Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Is the American Express Explorer credit card worth it?

This card has an annual fee of $395 but if you use the card’s benefits, there is over $500+ worth of value. I explain the different benefits you can get access to below.

A p p l y n o w

American Express Explorer Credit Card

Card benefits.

Annual Fee: $395/ year

Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the preceding 18 month period are ineligible for this introductory bonus offer. Previous and existing bank-issued American Express companion cardholders are eligible for this offer.

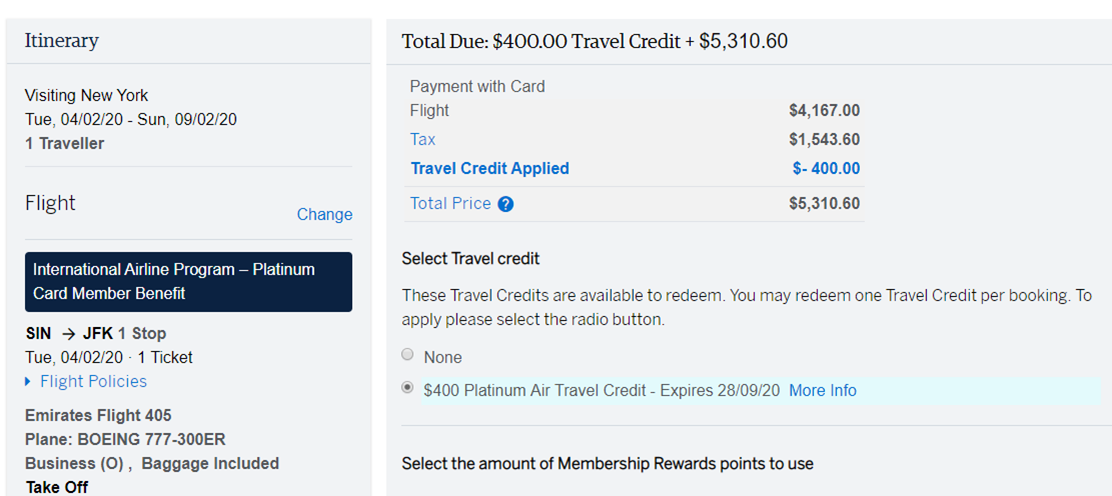

You will need to use your annual $400 Travel Credit on a single travel booking of $400 or more on your eligible Card, made through American Express Travel Online. Your booking will be charged in full to your American Express Explorer Credit Card and American Express will then credit $400 to your Account within 3 business days but may take up to 30 days. You will still receive your $400 Travel Credit each year, and your Travel Credit anniversary will remain the same.

We may receive a commission from the card issuer for each applicant of this card. You do not pay this amount. More about this in our credit guide .

So is the Amex Explorer card worth it?

The American Express explorer card has an annual fee of $395 but if you use the card’s benefits, you get your money’s worth with over $500+ worth of value.

There’s an interest free period of up to 55 days, so if you pay back the full balance owing each month before the interest free period, there no interest is charged on your account. You can read more frequently asked questions below.

Frequently asked questions

Do credit cards impact your credit score.

Paying off your full credit card balance each month on time may positively affect your credit score, but not paying back the full balance owing on time may negatively impact your credit score. That’s why it’s important to keep on top of your payments and try to pay off the balance in full and on time each month.

Do you need to pay interest on your credit card?

With every credit card, there’s usually an interest free period of up to 44 days or 55 days, whereby if you pay back the full balance owing on your statement before the interest free period, then no interest is charged.

However, if you don’t pay back the full balance owing before the interest free period, then interest will be charged on the balance owing on your statement. That’s why it’s important to keep on top of your credit card statements and try to pay back the full balance owing each month before the end of the interest free period.

What is American Express Explorer?

The American Express Explorer credit card is a credit card which has an annual fee of $395 offered by American Express in Australia. It is a rewards credit card that offers a range of benefits and features, including:

- Rewards program: The American Express Explorer credit card offers a rewards program that allows cardholders to earn Membership Rewards points for every dollar spent on eligible purchases. These points can be redeemed for a wide range of travel, shopping, and entertainment options.

- Travel insurance: The American Express Explorer credit card comes with complimentary travel insurance coverage for eligible trips taken using the card.

- Interest-free days: The card offers up to 55 interest-free days on purchases, allowing cardholders to pay off their balances without accruing interest charges.

- Other benefits: The American Express Explorer credit card also comes with a range of other benefits, including exclusive access to entertainment and dining experiences, offers and discounts, and a range of other travel-related benefits.

Overall, the American Express Explorer credit card is designed for people who are looking for a rewards credit card that offers a range of travel and lifestyle benefits, along with the ability to earn rewards on their everyday spending.

What is the minimum limit for Amex Explorer card?

The minimum limit for the American Express Explorer credit card in Australia is $3,000.

Keep in mind that the credit limit on a credit card is determined by the lender and is based on a number of factors, including your credit history, income, and spending habits.

What is the highest card from American Express?

American Express offers a range of credit cards with varying levels of benefits and features, and the “highest” card can vary depending on one’s specific needs and preferences. However, some of the most premium credit cards offered by American Express include:

- American Express Platinum: This is a premium travel rewards card that offers a wide range of benefits, including travel insurance, lounge access, hotel benefits, and more.

- American Express Centurion: Also known as the “Black Card,” the Centurion is American Express’s invitation-only, ultra-premium credit card that offers a range of exclusive benefits and experiences.

- American Express Business Platinum: This is a premium business rewards card that offers a range of benefits for business owners, including rewards points for business expenses, travel insurance, and access to a range of business-related services.

It’s important to note that the specific benefits and features of each card can vary based on the country in which they are offered, and the information provided above is specific to the American Express cards offered in Australia. To determine the highest American Express card for your needs, I would suggest reaching out to American Express directly or visiting their website for more information.

- Privacy Policy

- Terms & Conditions

This information is general in nature and does not take into account your personal financial circumstances. It is for educational purposes only, and does not constitute financial advice or any other professional advice. You should always do your own research and seek professional advice that is tailored to your specific needs and circumstances.

Queenie Tan and Marquetable Group PTY LTD (ABN 85 635 225 259) are authorised representatives (1301362 and 001301337 respectively) of Money Sherpa PTY LTD ABN 321649 27708 AFSL 451289.

Marquetable Group PTY LTD (ABN 85 635 225 259) are corporate authorised credit representatives (Number: 542464) of Moneysherpa Pty Ltd ABN 32 164 927 708 (Australian Credit License: 451289)

Read our financial services guide

Read our credit guide

- Budget Spreadsheet Template

- Investing Cheat Sheet

- First Home Buyer Ebook

- 90 Day Goals Template

- Net Worth Tracker

- Stock Research Checklist

- FIRE Calculator

- Property Research

- AMEX Essential Rewards

- AMEX Explorer Card

- AMEX Velocity Platinum

- No Annual Fee Credit Cards

- Free Budget Spreadsheet Template

- Investing Course

Hey, I’m Queenie.

I’m a licensed personal finance content creator. My mission is to help your money go further and I do this by creating educational videos to help inspire you to create a better financial future for yourself and your community.

Social Links

Welcome Bonus: 50,000 Bonus Points

American Express Explorer

Receive 50,000 Bonus Membership Rewards Points when you apply online, are approved, and spend $4,000 on eligible purchases on your new Card within the first 3 months. T&Cs apply. New Card Members only.

Membership Rewards

$400 each year you hold the card

50,000 Bonus Points

Here’s why I love the Amex Explorer Credit Card

Receive 50,000 bonus Membership Rewards points when you apply, are approved and spend $4,000 on your new Card within the first 3 months. T&Cs apply. New Card Members only. This translates into 35,000 frequent flyer points when you transfer to the most important programs such as KrisFlyer, Asia Miles, Etihad Guest or Emirates Skywards. Second up is the generous earn rate, 2 points on (almost) everything including utility bills, telco bills etc. And last but not least is the $400 travel credit you get every year, basically it wipes out the $395 card fee so in any case, you’re always $5 up. Travel credit can be spent on flights, hotels, car rentals etc. If you can’t use it…give it to a friend!

Rewards Details

Points program:

American Express Membership Rewards

Points earned per dollar Government/ATO:

Points earned per dollar everywhere else:

Points Cap:

Sign Up Bonus:

50,000 Points

Airline Transfer Rates

American Express Explorer transfers to a range of airline frequent flyer programs, which is a very valuable feature as it gives more flexibility when it comes to redeeming your points.

2 Membership Rewards points =

1 Asia Miles

3 Membership Rewards points =

1 Skyward Mile

1 Etihad Guest Mile

1 Enrich Mile

1 Kris Flyer Mile

1 Royal Orchid Plus Mile

1 Velocity Frequent Flyer Point

200 Membership Rewards points =

1 Airpoint Dollar

1 Qatar Airways Avios

1 HawaiianMile

Hotel Transfer Rates

American Express Explorer members can also transfer their points to the following hotel loyalty programs:

1 Hilton Honors point

2 Marriott Bonvoy points

Ready to Apply?

The Power Of A Flexible Reward Program

In the world of frequent flyer points, flexibility is power! The Membership Rewards program by American Express is a perfect example of this, why restrict yourself to 1 airline reward program when you can have 6 or more? When it comes to finding business or first class award tickets, it pays to have flexibility and plenty of options to chose from. Even if you’re an avid Qantas fan, consider this example: Asia Miles which is the reward program run by Cathay Pacific, (A One World airline, just like Qantas) allows you to use their points to book Qantas flights, sometimes for fewer points than it would cost using Qantas’s own frequent flyer points! The Kris Flyer program by Singapore Airlines is by far my favourite transfer partner, not only do they have some of the best business and first class seats in the sky, the taxes and points required for flights to Europe or Asia are much cheaper than what you could get with the local airline programs such as Velocity Frequent Flyer or Qantas Frequent Flyer. Amex Explorer lets you earn 1 frequent flyer mile on pretty much everything. This ads up fast throughout the year!

Amex Explorer Offer Details

American Express

$395 (Keep in mind you get $400 travel credit)

Additional cardholder fee

Interest rate on purchases

23.99% p.a. (or 0% when you pay your balance in full and on time)

Minimum Credit Limit

Interest-free days on purchases

International transaction fee

3% of the converted amount

Airport lounge access

If you’re in Sydney or travel through Sydney airport, this one can come in handy. The Amex Explorer gives you 2 access passes per year to The Centurion Lounge in SYD airport and the new Melbourne lounge. Passes are valued at $55 so it’s a pretty sweet deal if you end up using them.

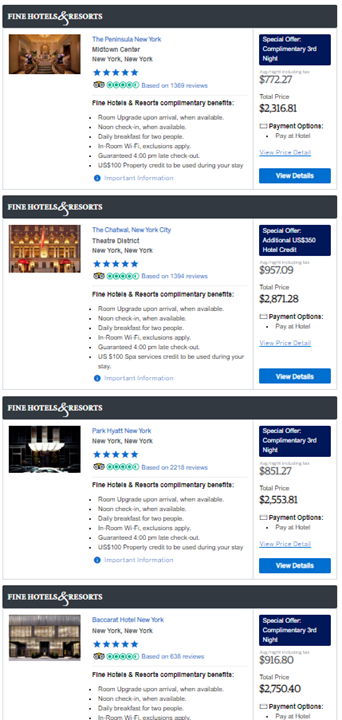

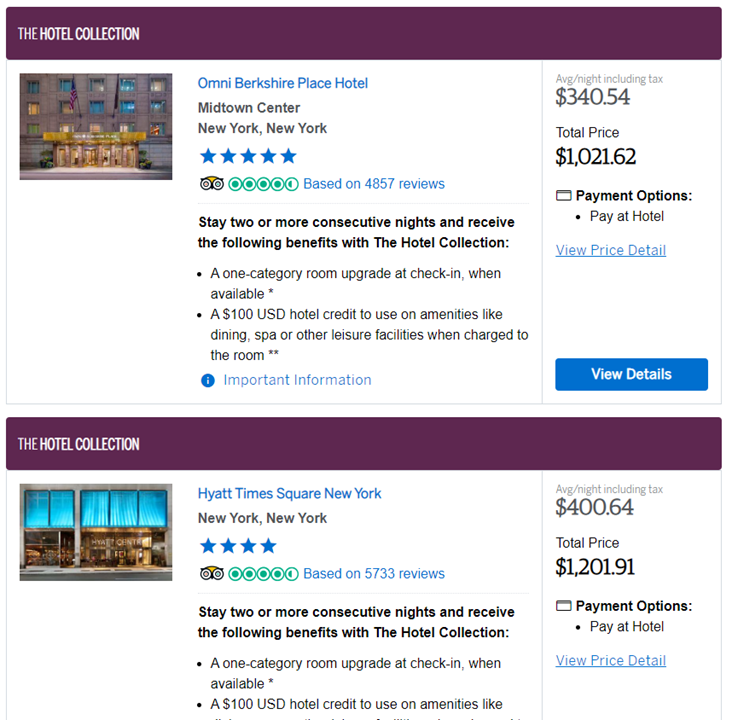

The Hotel Collection

The Amex Explorer now has access to The Hotel Collection, it’s similar to Amex Fine Hotels & Resorts where you get extra perks by booking through the site. For most properties participating this is a US$100 hotel credit which you can then use on food, drinks or even a spa treatment. In addition, some properties also offer upgrades as part of the deal. Explorer Card Members can get extra perks at participating Hotels Collection properties every time they book two consecutive nights stay using their American Express Explorer Card. To see all the participating hotels, you can check out the official directory here: https://hcdigitaldirectory.com To book your hotel through The Hotel Collection website click here. Or simply log-in to your Amex account and book through American Express Online Travel. You may be able to use Membership Rewards points and/or the Travel Credit on the American Express Travel website as payment towards The Hotel Collection, if the selected hotel and room type provides you the option to prepay in advance. Via this method, you can also use your annual travel credit to book and pay for The Hotel Collection participating hotels online.

Smartphone Screen Cover

Now, this is a killer perk! Who hasn’t dropped their phone and accidentally cracked the screen? With the Amex Explorer, even if you’re super careful, you can smash your screen twice per year! The best thing is, excess is limited to 10% of the repair cost so in most cases $20-30 will be all you end up paying. I’m always super careful with my phone but… the inevitable happened. Luckily I had been paying my phone plan with my Explorer so if you’ve been doing this for at least 30 days (that’s the waiting period) you can make a claim! The insurance claims underwriter is Chubb on behalf of American Express. I’ve written about my Amex Explorer screen insurance claim in a seperate post (hint: it was very easy, painless and straightforward. Some words we generally don’t associate with insurance companies) Read all about it here: learn more about my successful insurance claim The Smartphone Screen Cover is activated as soon as you start paying your phone plan with the Explorer or if you purchase the phone outright with the card. Card Members can still access the cover if they switch their monthly payment method to their Amex Explorer Card, however there is a 30 day waiting period which commences after the date of the first monthly payment made by the Amex Explorer.

Travel Insurance

Like most premium credit cards Amex Explorer comes with travel insurance, it’s pretty comprehensive and just like the expensive Platinum Charge it includes rental car “loss damage waiver” capped at 100k car value.

$400 Travel Credit

A great benefit of the Explorer it the $400 travel credit (which completely offsets the annual fee). It’s available in your account and can be used for all travel-related services offered via the Amex Travel Portal within your online account. Best of all, when booking flights through Amex Travel, you won’t be paying any card surcharges typically added on by the majority of airlines when booking direct. It’s worth noting that you need to use it all in one go. For example, you can’t split it up for multiple transactions and most importantly if the total falls under $400 you are forfeiting the difference. The best use for the credit, in my opinion, is flights and hotels. Both these categories are usually more than $400 so it’s easy to find a great use for your credit. The travel credit resets yearly so this card is definitely worthwhile to keep around. You can find the portal to book your travel here: http://americanexpress.com.au/travel

How The Travel Credit Works

If your card has a Travel Credit benefit, the Primary Card Member is eligible for an annual Travel Credit. The Travel Credit can be redeemed through American Express Travel Online on a single eligible travel booking by selecting the Travel Credit when you checkout. To redeem the Travel Credit, the full value of the Travel Credit (or more) must be charged to the eligible Primary Card. Eligible travel includes flights, hotels and car hire when you prepay in advance. The Travel Credit can be used for 365 days from the benefit anniversary date and cannot be used past the expiration date. To check the expiration date of your Travel Credit if you have not already redeemed it, please visit americanexpress.com.au/travel; log in and click ‘Travel Credit’. If your booking is cancelled, and your Travel Credit has already been used and associated statement credit applied to your account, you will forfeit your annual Travel Credit benefit and American Express may reverse the statement credits issued. You need to be able to spend on the Card to access the Travel Credit benefit and it should be credited to your Card Account within 3 business days but may take up to 30 days. Your account must be in good standing and you must have paid the annual fee and minimum payment by the due date. If you cancel your Card, change your rewards program or Card type, you will no longer be eligible for the Travel Credit.

Buyer’s Advantage Cover

Extends your manufacturer’s warranty by up to 12 months on eligible items purchased with your American Express Explorer Credit Card

Card Purchase Cover

Stay protected with Card Purchase Cover providing cover should your new items be stolen or damaged. Refund Protection is also available should a store refuse to accept the return of a recent, unused purchase.

Fraud Prevention

Online Fraud Protection Guarantee means you won’t be held responsible for any unauthorised charges made without your knowledge

Am I eligible for the 50,00 points sign up bonus?

If you were holding a bank-issued Amex such as Westpac, Commbank, ANZ or NAB in the past, you are eligible to get the bonus points on cards issued by American Express themself. Card Members who currently hold or who have previously held any Card product issued by American Express in the preceding 18 month period are ineligible for this offer.

Amex Explorer In Conclusion

Is this the best American Express card? Yes! In my humble opinion, this is the best all-round credit card and it does deserve a prime position in your wallet. Sure it’s expensive but never forget what perks you’re getting in return and the yearly travel credit makes it totally worth it.

Amex Travel Credits: How to get the most value

Save money on your next trip using your american express travel credits on flights, hotels, car rentals and more..

In this guide

How do American Express Travel credits work?

What is the difference between a complimentary flight and a travel credit, how to use your american express travel credit, pros and cons of the american express travel credits.

Several American Express credit cards offer yearly travel credits, which you can use to pay for flights, accommodation or car rentals. They usually offset the cost of the annual fee – as long as you use them, that is.

Depending on the card, the value of these travel credits ranges from $200 to $450. Here's how they work and how to make the most of them.

American Express Credit Card Offer

American Express Platinum Edge Credit Card

$0 annual fee for the first year.

Eligibility criteria, terms and conditions, fees and charges apply

Save with a $0 annual fee in the first year. Plus, $200 Travel Credit every year.

- $0 annual fee in the first year ($195 p.a. after that)

- $200 American Express Travel Credit each year

- Earn 3 points per $1 spent at major supermarkets and petrol stations, 2/$1 spent overseas and 1/$1 on other eligible purchases

Usually, you'll need to book through American Express Travel to use your travel credit. Depending on your Amex card, you could use the credit to book flights, hotel stays, and/or car rentals.

But there's a few terms and conditions to be aware of:

- You can only use your American Express Travel credit once, in a single booking, so you can’t spread it out over multiple bookings.

- If you have more than one Amex Travel credit, you can’t pool the value of multiple credits to cover the cost.

- Your booking must be valued at more than the credit value. eg you can purchase a $432 flight with a $400 flight credit, but not a $372 flight.

- You can book cruises through American Express Travel, although you can't redeem your travel credits to cover cruise costs.

If you get an Amex card with a complimentary flight, you can book an eligible flight for free.

For example, the American Express Velocity Platinum Card offers a complimentary return domestic flight between select cities with Virgin Australia. Meanwhile, the Qantas American Express Ultimate Card offers a $450 travel credit towards either a domestic or international booking with Qantas.

In comparison, the American Express Platinum Edge offers a $200 travel credit you can use for flights, hotels, car hire and more.

Do Amex travel credits expire?

Your travel credits last for 12 months, so keep this in mind when you’re planning to use them. Once your travel credits expire, they can’t be redeemed.

If your card offers an American Express Travel credit, you need to pay the annual fee and make the minimum payment by the due date in order you can access those credits. Then, you can redeem the credits with the following steps:

- Log in to the American Express Travel website and select the card with the travel credits you’re going to use. You’ll see the travel credits in the right-hand corner of your Amex Travel homepage once you’re logged in.

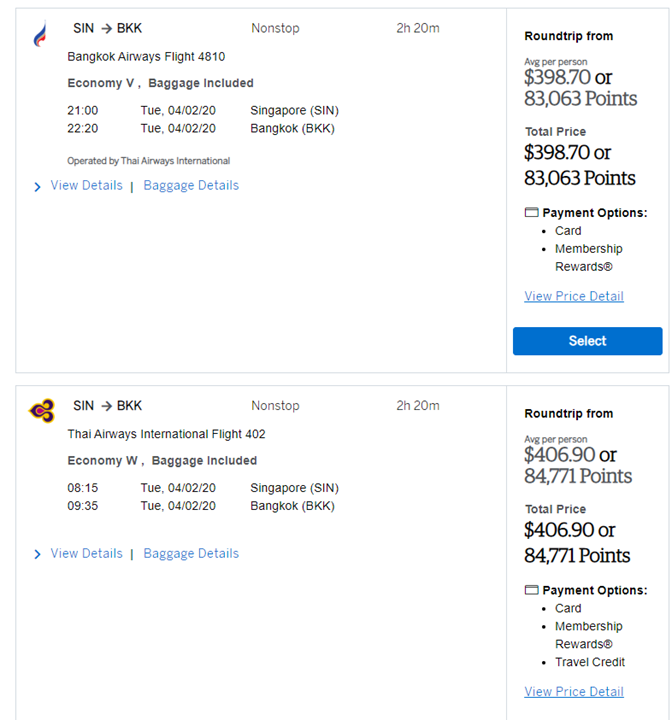

- Select what you want to book (flight, hotel or car hire) and filter your decisions by destination, travel dates, airline carrier and more.

- When you’ve picked an option that costs more than the value of your travel credits, you’ll see the total amount in dollars (which you can cover in your travel credits) or Membership Rewards points.

- Click on the “Use travel credit” button to redeem your credits. The value of the credits will be deducted from your total price and then you can pay for the remainder using your American Express card or Membership Rewards points.

- Finally, review and confirm your booking. You can’t get refunds on redeemed travel credits, so make sure you're 100% certain before you confirm your payment.

Want to redeem a flight with the Velocity American Express Platinum?

The complimentary flight offer on American Express Velocity Platinum Card is available after your first card spend each year. To redeem it go to velocityfrequentflyer.com and log in with your Velocity Frequent Flyer membership details.

- Cancels out annual fee. Some American Express credit cards offer travel credits that can offset the full cost of the annual fee, which can help justify getting the card.

- Cut travel costs. It’s an easy way to save between $200 and $400 on a trip (keeping in mind, the annual fee is still payable).

- Easy to use. The American Express Travel website is simple to use and it’s easy to access your travel credits once you’ve logged in.

- Less competitive prices. The cost of hotels, car rentals and flights booked through American Express Travel can be less competitive than if you were to book directly, as they often don't offer the same sales and deals as airlines offer direct.

- No points earned. In contrast to paying with your Amex card, you can't earn points on travel costs paid for with your travel credits.

- Expiration. You can use your travel credits within exactly 12 months from the issue date. After that they will expire and can’t be redeemed.

American Express Travel credits can be a great way to get extra value from your credit card. However, considering the restrictions and the terms and conditions, it’s good to understand how they work and whether you’re actually going to use the credits before you apply for the card.

Pictures: Shutterstock

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

More guides on Finder

Offers triple Qantas Points on eligible flights and 1.5 points per $1 dollar spent with no pre-set spending limit and with up to 51 interest-free days on purchases.

This corporate card offers up to 1.5 points per $1 dollar spent, points for ATO payments and no pre-set spending limit. It also includes complimentary domestic and international travel insurance covers.

The American Express Qantas Business Rewards Card offers 170,000 bonus Qantas Points, no pre-set spending limit and perks including complimentary insurance.

Compare the features of this no annual fee frequent flyer credit card, including a high earn rate of up to 1.75 Velocity Points per $1 spent.

The American Express Velocity Business Card earns points per $1 spent and offers complimentary travel insurance and two complimentary Virgin Australia lounge passes each year.

The American Express Velocity Platinum Card offers a range of frequent flyer benefits including a complimentary domestic return flight with Virgin Australia, airport lounge access and points per $1 spent.

From Membership Rewards Points to savings on first, business and premium economy class flights, this charge card is packed with features to help you manage business spending.

How does the huge bonus points offer, $450 annual travel credit and other platinum perks stack up against the Amex Platinum card’s annual fee?

Compare the fees and features of this charge card, including complimentary travel insurance cover for business trips, compatibility with MYOB, additional cardholders and the option of earning Membership Rewards.

The Qantas American Express Ultimate Card earns up to 2.25 Qantas Points per $1 spent, a yearly $450 travel credit and additional premium travel features.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Credit Card Annual Travel Credits Work

Chanelle Bessette is a personal finance writer at NerdWallet covering banking. She previously worked at Fortune, Forbes and the Reno Gazette-Journal. Her expertise has appeared in The New York Times, Vox and Apartment Therapy.

Paul Soucy has led the Credit Cards content team at NerdWallet since 2015 and the Travel Rewards team since 2023. He was an editor with USA Today, The Des Moines Register and the Meredith/Better Homes and Gardens family of magazines for more than 20 years. He also built a successful freelance writing and editing practice with a focus on business and personal finance. He was editor of the USA Today Weekly International Edition for six years and received the highest award from ACES: The Society for Editing. He has a bachelor's degree in journalism and a Master of Business Administration. He lives in Des Moines, Iowa, with his wife, Sarah; his two sons; and a dog named Sam.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Annual travel credits have become a common feature on premium credit cards with high annual fees. Because these credits erase hundreds of dollars' worth of expenses, they can take much of the sting out of annual fees of $450 or more.

Here’s how these credits work and how you can use them to your advantage.

» MORE: NerdWallet's best travel credit cards

What are annual travel credits?

Annual travel credits are reimbursements for certain travel expenses. They take the form of credits on the cardholder's statement.

The Chase Sapphire Reserve® , for example, offers $300 per year in travel credit. When a cardholder uses the card to pay for travel — either by booking through Chase or making a purchase from a travel-related merchant — the issuer automatically credits the account. Once a cardholder exceeds $300 in travel spending, the credit is used up for the year.

Say your first travel expense of the year is a $250 plane ticket. You buy the ticket with your Chase Sapphire Reserve® , and you later see on your statement that the $250 has been reimbursed. Now you have $50 worth of credit. If you pay for a $160 hotel stay, Chase will reimburse $50, leaving the last $110 as your obligation. At this point, you're out of credit until next year.

Assuming you use them, travel credits substantially reduce the cost of carrying a premium credit card. The Chase Sapphire Reserve® has an annual fee of $550 . If you get $300 back in travel credit, that knocks the annual cost down to $250.

» MORE: How to choose a travel credit card

A sampling of cards with travel credits

What expenses are eligible for travel credits.

Each card has its own rules about which expenses can be reimbursed through travel credits. Some cards limit the credits to spending on flights, while others apply them more broadly, including spending on hotels, cruises and travel agency bookings. Other cards even extend the credits to local transportation costs — including taxis, Uber and Lyft — and spending on tolls and parking fees.

Card issuers commonly identify purchases for reimbursement by looking at the merchant category code, or MCC, of the business where you made the purchase. Payment networks, such as Visa and Mastercard, assign businesses these codes to define their industry. Your card agreement should identify the types of purchases, as defined by MCC, that qualify for travel credits. Once your purchase appears on your statement, the issuer will begin the reimbursement process.

Keep in mind that some issuers are quicker than others to apply credits. Some do so in a day or two, while others can take one or more billing cycles — so you may have to make a payment while you wait for reimbursement. Other cards require extra effort: Users of the Ritz-Carlton® Rewards Credit Card have to call the issuer after they’ve made a qualifying purchase.

» MORE: How your credit card can help you save on travel

Information related to the Ritz-Carlton® Rewards Credit Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of these cards.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

How To Use Your Amex Statement Credits [2024]

Former Senior Content Contributor

485 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3271 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![american express $400 travel credit How To Use Your Amex Statement Credits [2024]](https://upgradedpoints.com/wp-content/uploads/2018/10/Amex-Gold-Upgraded-Points-LLC-09-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Prepaid hotel credit, clear plus credit, digital entertainment credit, equinox credits, walmart+ credit, adobe credit, indeed credit, wireless credit, fedex, grubhub, and office supply store credit, summary of available amex credit card statement credits in 2024, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

American Express, one of the world’s most recognizable brands, has traditionally appealed to the luxury segment, and around a third of its cardholders’ spending is typically on travel or entertainment.

All of this started plummeting at the onset of the COVID-19 pandemic, and American Express identified that consumer spending patterns were beginning to shift dramatically. As a result, it introduced a slew of valuable statement credits and benefits , mostly to help offset annual fees and to continue to retain customers.

In this guide, we’ll examine the statement credits and benefits that are still valid in 2024. We’ll start with a broad overview of the specific statement credit or benefit, discuss the terms and conditions, and then highlight which cards are eligible for it. We’ll also show you how you can make the most out of each new offer.

Note that terms may apply and enrollment may be required through your American Express account.

Cardholders of The Platinum Card ® from American Express will get up to $200 back in statement credits each year on prepaid Fine Hotels & Resorts (FHR) or The Hotel Collection reservations made through AmexTravel.com .

Bookings through The Hotel Collection receive premium benefits on stays of at least 2 nights at select properties across the globe.

When booking through Fine Hotels & Resorts , you’ll receive elite benefits and perks at over 1,000 luxury hotels worldwide, but with no minimum stay requirement .

CLEAR is an expedited security program available at select U.S. airports and stadiums.

Cardholders of the Amex Platinum card, The Business Platinum Card ® from American Express , and the American Express ® Green Card now receive an annual statement credit of up to $189 for a CLEAR Plus membership.

Once you enroll for the CLEAR Plus membership, get in the CLEAR lane at available airports. Check-in using an iris scan, then proceed through the TSA checkpoint as normal.

If you love to read the news online, watch TV, or listen to audiobooks or satellite radio, your purchases may now be eligible for a new statement credit.

Amex Platinum cardholders can receive up to $240 in annual statement credits for digital entertainment ($20 per month) on eligible purchases or subscriptions for Disney+, The Disney Bundle , ESPN+, Hulu , The New York Times, Peacock , and The Wall Street Journal (enrollment required).

New or existing subscribers can pay for the monthly digital subscription with an Amex Platinum card and enjoy the credit.

Amex Platinum cardholders can receive up to $300 in Equinox credits per year on eligible Equinox memberships when they pay with their card (enrollment required). Users can take classes using their at-home SoulCycle bike, follow workout videos, relax with PURE Yoga, and more.

Visit a club for membership details or start your monthly digital subscription using the Equinox+ Amex landing page and pay with your eligible Amex card.

Walmart+ is Walmart’s subscription service that offers free shipping with no order minimums, discounts at the pharmacy, gas discounts, free delivery, and more.

Amex Platinum cardholders receive a monthly statement credit for the monthly Walmart+ membership ($12.95 plus applicable taxes). The American Express ® Business Gold Card is also eligible for a Walmart+ credit.

If you’re a big shopper at Walmart, it’s easy to get great use out of this. Just shop at Walmart and utilize your extra benefits, whether you’re shopping in-person or online. You can also take advantage of the gas discounts available. Walmart+ members can save 10¢ per gallon on fuel at Walmart, Murphy, Exxon, and Mobil stations.

Adobe is one of the world’s largest software companies in the world, offering a host of marketing and document management software, including Adobe Acrobat and Creative Cloud.

Currently, those who have the Amex Business Platinum card are eligible for up to $150 in statement credits per year on annual prepaid subscriptions for Creative Cloud All Apps or Single Apps for Teams or Acrobat Pro DC with E-Sign or advanced E-Sign for Teams.

The best way to maximize this credit is to pick the subscription option that fits your business’s needs. Remember, monthly plans do not qualify, only annual prepaid plans.

Indeed is an online employment website where you can post jobs as an employer.

With the Amex Business Platinum card , you can get up to $90 back per quarter (up to $360 per year) for purchases with Indeed.

One of the statement credits introduced at the beginning of the COVID-19 pandemic was for wireless statement credits , and Amex has decided to make this a permanent perk available to Amex Business Platinum cardholders .

In total, you can get up to $120 in statement credits every year for wireless telephone service purchases made directly from a wireless provider in the U.S. It’s split into monthly statement credits of up to $10 each. Enrollment is required.

The best way to qualify for this credit is to charge your wireless telephone bill to the card.

What doesn’t count are:

- Bundled services

- Cellular repair services

- Electronics purchases

- Hardware purchases

- Purchases from authorized retailers, resellers, or third-party sellers

- VoIP services

Cardholders of the Amex Business Gold card can enroll to receive up to $240 back annually ($20 a month) for eligible purchases at FedEx, Grubhub, and office supply stores .

It’s important to note that you won’t receive a $20 statement credit for each type of purchase but rather for each month. So if you’ve received a $20 statement credit for FedEx for the month of March, for instance, you won’t receive a separate $20 statement credit for Grubhub for that month.

Let’s take a look at the full gamut of statement credits that renew annually for Amex cardholders. We’ve included credits that are an automatic benefit of the cards and not those that require a certain threshold of spending.

*All information about these cards has been collected independently by Upgraded Points.

The statement credits that American Express has continued to offer are a nice addition to its already popular lineup of credit card perks.

Whether it’s using Amex Offers to maximize value on Walmart+ purchases, wireless providers, or Adobe subscriptions, or up-leveling your fitness membership game, you’ll likely be able to extract solid value from these statement credits each year.

The information regarding the American Express ® Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the Blue Cash Preferred ® Card from American Express, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here . For rates and fees of the American Express ® Business Gold Card, click here .

Frequently Asked Questions

What is a statement credit.

A statement credit is essentially the opposite of a payment. It behaves a lot like a refund, but you’re not actually returning anything. It’s basically free money!

Learn more with our ultimate guide to credit card statement credits .

How does an Amex statement credit work?

In order to use a statement credit, you need to use your card. Before that, you might need to activate a statement credit. Sometimes, however, the statement credit is automatic. In that case, all you need to do is pay for a qualifying purchase using the card to get a statement credit. It may take up to 12 weeks for statement credits to post.

What is a $200 statement credit?

A $200 statement credit is simply a statement credit for a maximum of $200. This means that if you make a qualifying purchase, you’ll get up to $200 back.

For example, if your purchase is $250, you’ll get $200 back and pay only $50 out of pocket. If your purchase if $150, you’ll get the entire $150 back and usually still have $50 left over for a future qualifying purchase.

Is an American Express card worth it?

American Express forms one of the cornerstones of credit card rewards. It has so many amazing credit cards , so it is absolutely worth it to get an Amex card.

Was this page helpful?

About Stephen Au

Stephen is an established voice in the credit card space, with over 70 to his name. His work has been in publications like The Washington Post, and his Au Points and Awards Consulting Services is used by hundreds of clients.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Partner Offers

The Platinum Card ® from American Express

Chase Sapphire Preferred ® Card

The Business Platinum Card ® from American Express

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

How to use the AMEX Platinum Charge’s S$800 hotel & airline credit

Using your S$800 travel credit is key to getting the most out of the AMEX Platinum Charge's annual fee. Here's how to use it.

The AMEX Platinum Charge has a hefty S$1,712 annual fee, but comes with an S$800 annual travel credit to defray some of the cost ( among other things ). This is split into a S$400 hotel credit and a S$400 airline credit.

Sign up for the AMEX Platinum Charge and get 40K bonus MR points

To use the credit, you’ll have to book your travel with American Express, either online or through the concierge.

Cardholders will receive a S$400 hotel voucher and a S$400 airfare voucher in their welcome and renewal pack. You’ll need the code on this voucher if you want to book through the concierge, but otherwise you can do it yourself online without the voucher.

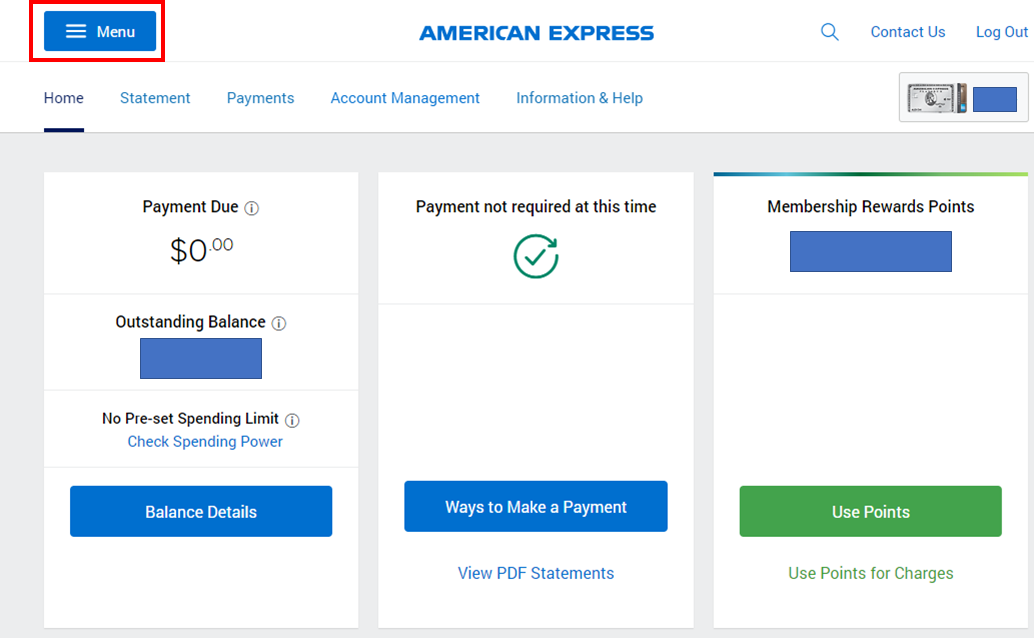

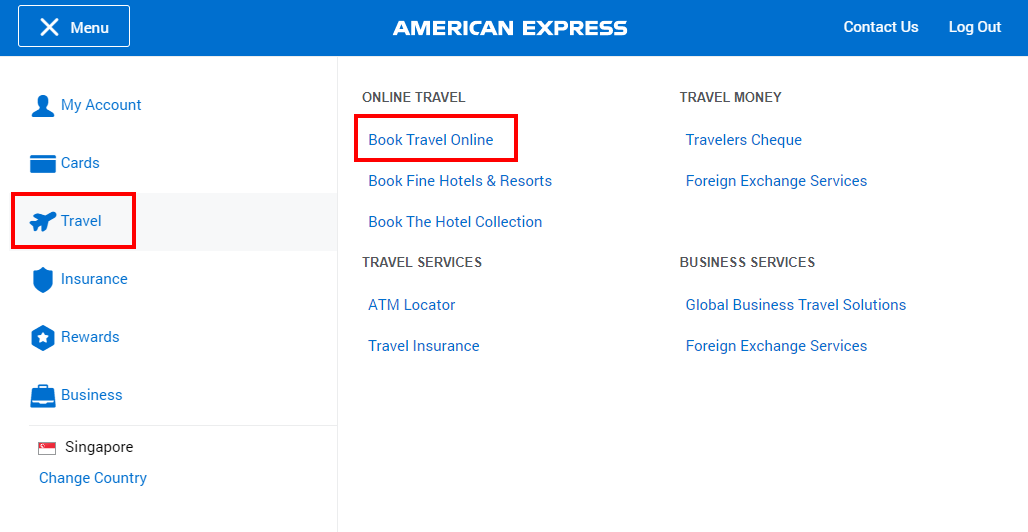

Getting to the AMEX Travel Portal

The first step is to navigate to the AMEX Travel Portal. Login to your AMEX online account and click the Menu button at the top left.

Click on Travel, then Book Travel Online

If you hold more than one AMEX card, you’ll be prompted to select the one you wish to use. Choose the AMEX Platinum Card option (you’ll see your S$400 Platinum Air Travel and Platinum Hotel Travel Credit reflected if it’s available).

You’ll be sent to the AMEX Travel homepage, which looks just like a regular OTA search engine.

Using the S$400 Hotel Credit

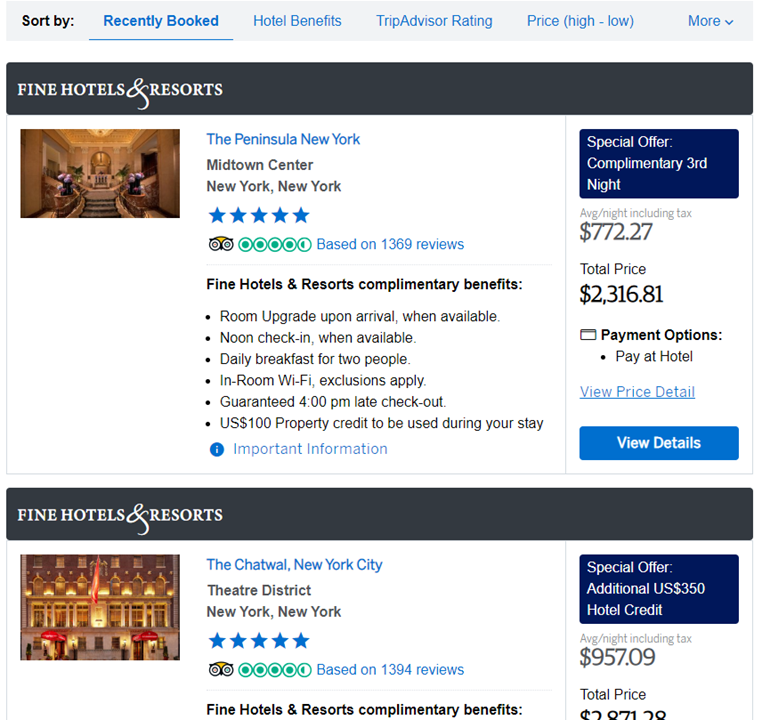

To look for hotels, go to the “Hotel” tab and enter your travel details. You’ll be presented with a list of options (all prices on the AMEX Travel Portal will default to SGD).

You’ll notice some of these hotels have a Fine Hotels & Resorts (FHR) banner. These rates are eligible for the following benefits:

- Room upgrade upon availability

- Noon check-in, where available

- Guaranteed 4 p.m late checkout

- US$100 property credit

- Complimentary breakfast for 2

- Complimentary Wi-Fi

On top of this, you may see certain properties offering additional promotions like the 3rd/4th/5th night free, or bonus hotel credits.

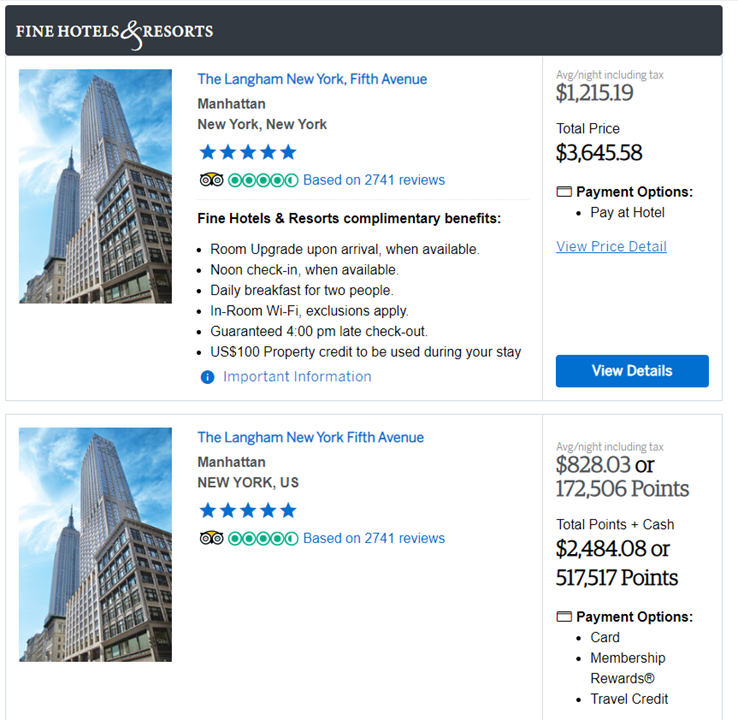

Here’s the thing though: you won’t be able to use your S$400 hotel credit on FHR rates. This used to be possible, but was cut sometime in mid-2019.

Similarly, you won’t be able to use your S$400 hotel credit with The Hotel Collection (THC) rates. THC is the little sister of FHR, for not-quite-superstar properties. Standard benefits include:

This means that your S$400 hotel credit is only usable at hotels without any banner on their listing. You can also look at the Payment Options header to see if “Travel Credit” appears.

Do note that it’s possible for a hotel to appear two times- once under the FHR/THC banner, and once without. All this means is that you can use your hotel credit on that particular hotel, but only if you book a non-FHR/THC rate.

For example, below we see The Langham New York, Fifth Avenue appear once with the FHR rate (S$1.2K per night), and again under the regular rate (S$828 per night). As valuable as the FHR benefits are, they’re probably not worth S$400 a night, so the choice here is pretty clear.

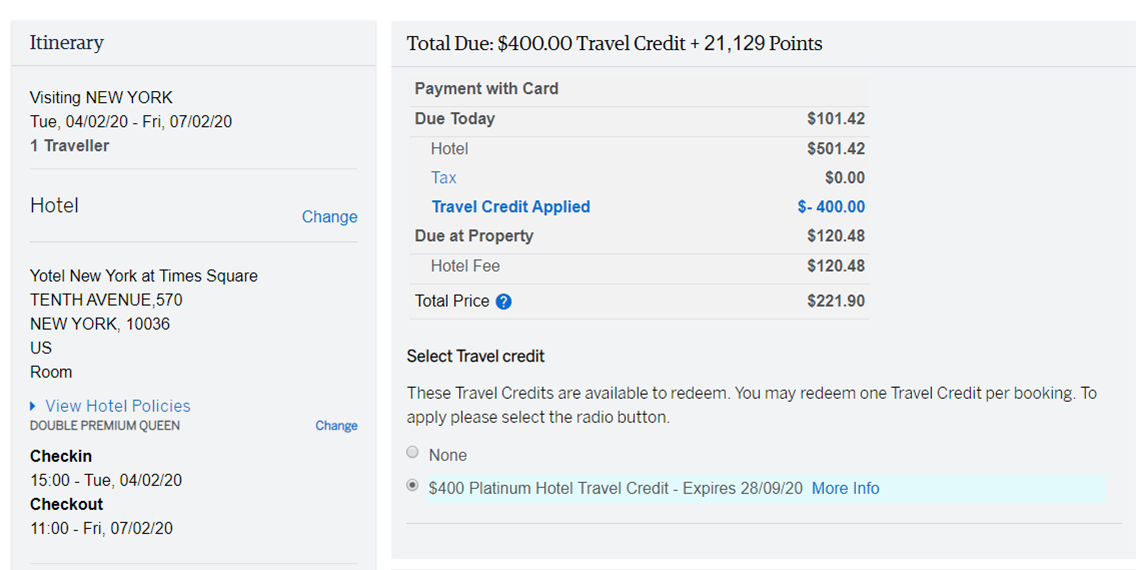

Once you’ve found a property you like and takes hotel credit, proceed to enter your details. At checkout you’ll see the option to apply your S$400 credit. This option will not appear if your total bill is less than S$400.

Selected rates will also be eligible for payment with points, but the rate offered is poor- you can expect a value of about 0.48 cents per point. If you redeemed points for miles, you’d get more than double the value, so don’t take that option.

How do AMEX rates compare?

It’s hardly scientific, but I took a sample of hotels in New York and the rates on the AMEX portal and compared them to the hotel’s official site and third party OTAs.

The results strongly suggest you comparison shop, because sometimes the AMEX portal may offer an FHR rate that’s on par with the official site (in which case it’s a no brainer to book), or slightly higher (in which case you need to carefully weigh the benefits).

Sometimes you’ll see discounted rates on the AMEX portal which are even lower than the hotel’s official site, although sadly you can’t use these to file a BRG claim because the AMEX portal is not considered a “public site”.

Do these rates earn elite status points/credit?

FHR and THC rates generally earn elite status credit and points, and elite members should receive their usual benefits on top of the FHR/THC entitlements.

However, if you book a regular AMEX portal rate, it counts as a third party booking and you won’t be eligible to earn any status credit or points, or enjoy any elite benefits. So keep that in mind when using your S$400 credit- it’s generally better saved for non-chain hotels.

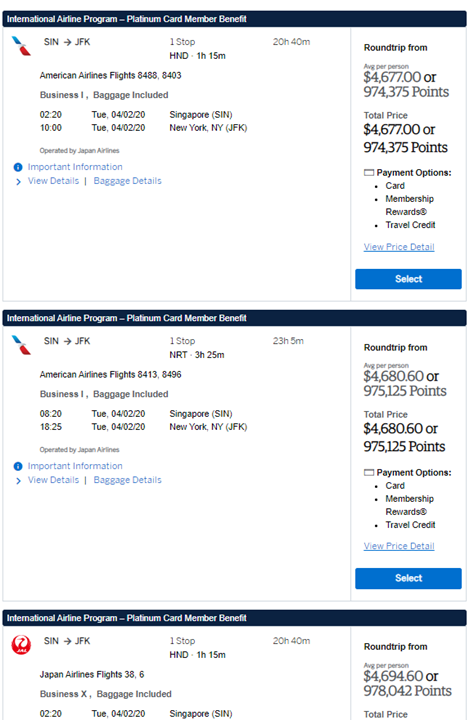

Using the S$400 Airline Credit

Go to the “Air” tab on the travel portal and enter your travel details. You’ll be shown a list of options, all priced in SGD.

You’ll notice that some flights have an “ International Airline Program ” (IAP) banner. These are special rates that AMEX has negotiated for premium cabin travel on the following carriers:

- Singapore Airlines

- American Airlines

- British Airways

- Etihad Airways

- Japan Airlines

- Qatar Airways

IAP fares are available if the following conditions are met:

- Your journey must start and end in Singapore

- The Platinum cardholder must be one of the travelers

- Available for Premium Economy, Business and First Class bookings only

The good news is that unlike FHR/THC rates, IAP fares can be paid for with the S$400 airline credit. Navigate to the final screen and you’ll see the option to apply it.

IAP rates are cheaper than the airline’s official website, but they still aren’t cheap (it’s premium travel, after all). If you’re ok with flying Economy, then the good news is your travel credit can also be applied here.

Do note that the option to use your S$400 travel credit won’t appear unless the flight costs S$400 or more. Also, you won’t find budget carrier options listed on the AMEX travel portal.

Airfares booked through the AMEX portal, whether they’re IAP or not, will be eligible to accrue miles and elite status credit as per their ticket class.

Although there are some restrictions to its use (no budget carriers, no stacking with FHR/THC rates), the S$800 travel credit will be as good as cash to most people. Using it properly is key to offsetting the S$1,712 annual fee, so don’t leave it until the last minute to book.

- american express

- credit cards

- platinum charge

Similar Articles

Dbs cards offering extra $100 cashback on dining, shopping & travel, hsbc revolution nerfs 4 mpd for contactless payments and travel transactions.

What are points and miles worth? TPG’s June 2024 monthly valuations

Editor's Note

One of the questions people often ask us is, "How much is a point or mile worth?"

The true answer varies from point to point and person to person. It also depends on your travel goals and how much you maximize a particular loyalty currency. Still, some rewards credit cards are worth more than others, and our goal is to give you a sense of how they stack up.

Historically, TPG has valued points and miles based on a combination of factors: the price at which we would purchase the miles, award costs in the program (factoring in availability and fees) and our expertise in the inner workings of the programs. However, we now use extensive data for the top six U.S. airline loyalty programs to better estimate the value you should aim to get from your rewards. Read our explainer post on our data-driven valuations for a full methodology breakdown.

Note: These valuations are not provided by card issuers.

What are credit card points and miles worth?

The information for the Citi Premier card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What are airline points and miles worth?

*Calculated using TPG's data-backed valuations methodology launched in September 2023.

The information for the Avianca and Qatar cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What are hotel points worth?

Points and miles news.

The welcome offers for the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® is 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Based on this month's valuation of Chase Ultimate Rewards points, we value the welcome bonus offered by each of these cards at $1,230.

With so many Ultimate Rewards points on offer through these welcome bonuses, you may wonder how best to use them. We value Ultimate Rewards highly for a few reasons. First, you can redeem them in many different ways, whether you're looking to travel in luxury halfway around the world or want to save money on your everyday purchases.

Secondly, these points are hugely flexible. You're not locked into one specific way of using them; you can chop and change as often as you want, whenever you want. You might want to keep them in your Ultimate Rewards account until a juicy transfer bonus comes around or redeem a welcome bonus as soon as you earn it—the choice is yours.

With so many ways to use Ultimate Rewards, we have prepared a list of easy ways to redeem Chase points that's perfect for beginners and casual points and miles collectors. TPG's points and miles experts explain how to get the maximum value from their Ultimate Rewards ; not to mention, TPG let three staffers redeem 75,000 Ultimate Rewards points for last-minute trips that included a couples getaway to Mexico , a trip to Greece and a business-class flight to New Zealand .

Related: Chase Sapphire Preferred vs. Sapphire Reserve: Should you go mid-tier or premium?

Travel credit card offers

There is no shortage of cards offering great welcome bonuses ; here are a few of our favorites this month.

Chase Sapphire Preferred Card

We discussed this card above, but it's so great that we'll cover its benefits in more detail here. After all, the Chase Sapphire Preferred® Card is currently offering 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening. Per our valuations, that's worth $1,230 when you leverage transfer partners or $750 if you redeem through Chase Travel℠ at 1.25 cents per point.

The card comes with a $95 annual fee, travel protections and additional perks — like a $50 annual hotel credit for reservations made through Chase Travel and a 10% anniversary points bonus based on your previous year's spending. For more details, check out our Chase Sapphire Preferred Card review .

Of course, you may want to spring for the Chase Sapphire Reserve® instead. While the card has a higher $550 annual fee, it includes perks like Priority Pass lounge access , a $300 annual travel credit and a Global Entry or TSA PreCheck credit .

Official application link: Chase Sapphire Preferred Card

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is one of the market's most exciting travel credit cards due to its great earning rates and included perks.

The card currently offers a welcome bonus of 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. Due to the value you can get when redeeming with Capital One's excellent airline and hotel transfer partners , our valuations peg the value of this welcome bonus at $1,388.

Check out our Capital One Venture X card review for more details.

Official application link: Capital One Venture X Rewards Credit Card

Capital One Venture Rewards Credit Card

The standard Capital One Venture Rewards Credit Card offers the same welcome bonus as the Venture X. You can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. Like the Venture X, the Venture card earns at least 2 miles per dollar on every purchase.

Check out our Capital One Venture card review for more details.

Official application link: Capital One Venture Rewards Credit Card

The Platinum Card from American Express

With the current welcome offer on The Platinum Card® from American Express , you'll earn 80,000 Membership Rewards points after you spend $8,000 on purchases in the first six months of card membership. Although, you may be targeted for a higher offer through the CardMatch tool . (This offer is subject to change at any time.)

The Amex Platinum Card is packed with benefits like airport lounge access and hotel elite status . The card has a $695 annual fee (see rates and fees ). Enrollment is required for select benefits.

For more details, check out our Amex Platinum review .

Official application link: The Platinum Card from American Express

American Express Gold Card

One of the most popular cards with TPG staffers, the American Express® Gold Card offers 60,000 Membership Rewards points after you spend $6,000 on eligible purchases on your new card within the first six months of card membership. Based on our valuations, this welcome offer is worth $1,200, but be sure to check the CardMatch tool to see if you're targeted for an even higher offer. (This offer is subject to change at any time.)

The Amex Gold Card is great for many everyday purchases. You'll earn 4 points per dollar on groceries at U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar) and 4 points per dollar on dining at restaurants. The card has a $250 annual fee (see rates and fees ).

For more details, check out our Amex Gold review .

Official application link: American Express Gold Card

The Business Platinum Card from American Express

The Business Platinum Card® from American Express offers 150,000 Membership Rewards points after you spend $20,000 on eligible purchases with your card in the first three months of card membership. Per our valuations, this welcome offer is worth at least $3,000, but you can get even more value when redeeming for high-end airfare.

You'll find many lesser-known Amex Business Platinum perks similar to (but slightly different from) the personal version. Check out our comparison of the Amex Platinum and the Business Platinum to see which card better fits your wallet.

For more details, check out our Amex Business Platinum review .

Official application link: The Business Platinum Card from American Express

Capital One Venture X Business

The Capital One Venture X Business card launched in September 2023. The card offers a welcome bonus of 150,000 miles after spending $30,000 in the first three months from account opening. While that's a large spending requirement, those rewards can go a long way toward your next trip.

The Venture X Business features perks that are nearly identical to those on the personal version of the card — including a $300 annual credit for bookings through Capital One Travel , extensive airport lounge access and 10,000 bonus miles each year after your cardholder anniversary.

For more details, check out our Capital One Venture X Business review .

Official application link: Capital One Venture X Business

Ink Business Preferred Credit Card

The Ink Business Preferred® Credit Card offers a generous welcome bonus of 100,000 Ultimate Rewards points after you spend $8,000 in the first three months after card opening. Based on our current valuation, this welcome bonus is worth more than $2,000. It could be a great option for business owners looking to benefit from a six-figure welcome bonus who might not reach the higher spending requirements of the Capital One Venture X Business welcome offer .

The Ink Business Preferred also offers 3 points per dollar on the first $150,000 in combined purchases each year on travel, shipping, internet, cable and phone services as well as advertising purchases made with social media sites and search engines.

For more details, check out our Ink Business Preferred Credit Card review .

Official application link: Ink Business Preferred Credit Card

For rates and fees of the Amex Platinum Card, click here . For rates and fees of the Amex Gold Card, click here .

COMMENTS

1. Visit the American Express Travel Online website to book flights, hotels, and car hire. 2. Make a booking to the full value of your Travel Credit or more and select the Travel Credit at checkout. 3. Pay for your booking using your eligible American Express Card and we will credit the amount to your Account within 3 business days.

So, when the American Express Explorer Credit Card is offering an annual Travel Credit of $400 to spend on things like flights, accommodation and car hire through American Express Travel, it certainly becomes worth a look. As the $400 Amex Travel Credit is provided each year, it could effectively offset the $395 annual card fee.

The Amex Platinum airline fee credit is a credit up to $200 that comes as a benefit of The Platinum Card® from American Express for one select airline. The credit applies as statement credits ...

Here's how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got: The Platinum Card® from American Express credit: $200. Property ...

To modify a reservation, you can cancel and rebook your reservation on amextravel.com or by calling a representative of amextravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking.

AMEX Platinum Charge Card: $300 travel credit. AMEX Explorer credit card: $400 travel credit. AMEX Platinum Reserve credit card (free with the Platinum Charge): a further $400 travel credit. Qantas AMEX Ultimate Card: $450 Qantas Travel Credit. On many of these cards, the included travel credit negates the cost of the annual fee, particularly ...

The Hilton Honors American Express Aspire Card has several annual credits geared toward travelers: $200 for airfare purchases. $400 Hilton resort statement credit. $100 Hilton on-property credit ...

$400 American Express Travel Credit: How it works. The annual $400 Travel Credit is awarded to the primary American Express Explorer Credit Card Member each card anniversary, and it's valid for 12 months from the date of issue. The Travel Credit can be spent online at American Express Travel, for travel, car hire, or accommodation in ...

A $450 travel credit each year which can be used on eligible flights, hotels and car hire 1. Access to 1,400+ airport lounges in over 650 cities across 140 countries and counting 2. Complimentary benefits averaging $800 of included value with FINE HOTELS + RESORTS 3. Complimentary Accor Plus membership valued at $399 per year 4.

How to use your Travel Credit online with American Express Travel. Step 1: ... The Reserve comes with a travel credit of $400, which when added to the credit associated with the Platinum Charge, totals $700, going a bit further towards offsetting the $1200 annual fee. Note the same restrictions apply to it as you mentioned (i.e. you have to use ...

American Express is offering 50,000 bonus Membership Rewards Points for new American Express Card Members who apply for the Explorer Card. Includes $400 Travel Credit each year as a regular benefit, plus free access to The Centurion® Lounge at Sydney and Melbourne airports along with a range of insurances and high points earn rates on spend.

American Express Travel makes it easy for Amex cardholders. Select Region United States. ... fourth or fifth complimentary night or even up to a $400 property credit, which you can see on the FHR ...

A new Amex Offer and a great credit on the Amex Platinum Card means you can save $400 off an upcoming hotel stay of $850 or more! ... Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. ... Nick has been quoted as an expert in credit cards and travel rewards in stories ...

In the world of travel credit cards, paying big annual fees can get you big perks. That's certainly true with The Platinum Card® from American Express, the *amex gold*, and the *Amex Green Card* travel credits issued each calendar year.. These Amex travel credits help offset the cost of annual fees - $150 for the Green Card (see rates & fees), $250 for the Gold card (see rates & fees), and ...

You will need to use your annual $400 Travel Credit on a single travel booking of $400 or more on your eligible Card, made through American Express Travel Online. Your booking will be charged in full to your American Express Explorer Credit Card and American Express will then credit $400 to your Account within 3 business days but may take up to ...

Here's why I love the Amex Explorer Credit Card. Receive 50,000 bonus Membership Rewards points when you apply, are approved and spend $4,000 on your new Card within the first 3 months. T&Cs apply. New Card Members only. This translates into 35,000 frequent flyer points when you transfer to the most important programs such as KrisFlyer, Asia ...

If your American Express credit card has a Travel Credit, you have 12 months to use it. ... Your booking must be valued at more than the credit value. eg you can purchase a $432 flight with a $400 ...

Meanwhile, the Hilton Aspire card's annual credit is the largest at $250 a year. The *amex gold card* previously got $100 a year in airline credits, though that ended in 2022. All of these travel credits reset each calendar year, not based on the month you opened your account. So you can use up the credits from Jan. 1 through Dec. 31.

Member, you are eligible for one $400 travel credit (Travel Credit) each anniversary year. Additional or Supplementary Card Members do not receive a Travel Credit. ... Reserve Card and American Express will then credit $400 to your Account within 3 business days but may take up to 30 days. 11. The Travel Credit must be used in good faith and cannot

If you get $300 back in travel credit, that knocks the annual cost down to $250. ... American Express® Gold Card. ... $400. Automatically applied on qualifying purchases ...

American Express Card: Statement Credit: ... Up to $400 Dell Credit: ... travel information and ancillary information concerning travel and credit cards. The information provided is for informational purposes only and should not be considered financial, tax or legal advice.

The card also offers several yearly statement credits for business-related purchases that include up to $400 per year ($200 between January and June and $200 between July and December) for U.S. purchases with Dell. ... Best premium travel credit cards. American Express® Gold Card - Best travel card for dining;

3%. 3% Cash Back at U.S. gas stations. 1%. 1% Cash Back on other purchases. Why We Chose It. The Blue Cash Preferred Card is one of the best cash-back credit cards on the market. You'll get a great return across a wide range of bonus categories, a solid welcome bonus and a low annual fee.

The AMEX Platinum Charge has a hefty S$1,712 annual fee, but comes with an S$800 annual travel credit to defray some of the cost (among other things).This is split into a S$400 hotel credit and a S$400 airline credit. Sign up for the AMEX Platinum Charge and get 40K bonus MR points. To use the credit, you'll have to book your travel with American Express, either online or through the concierge.

$400 Statement Credit Shop Dell Technologies. Up to $400 back (up to $200 semi-annually) on U.S. purchases with Dell Technologies through 12/31/24. Enrollment required. ... When you book through American Express Travel, you'll receive an average total value of $600 ...

Program June 2024 valuation (cents) Latest news; American Express Membership Rewards: 2.0: The Platinum Card® from American Express has turned 40 and has offers with selected retailers to celebrate.Your Amex Platinum's up to $50 Saks credit resets July 1. U.S. Open ticket presale for American Express cardholders has begun.: Bilt Rewards