Anti-fraud measures

A new safety measure is coming to the Android version of the HSBC Malaysia Mobile Banking app. To protect yourself, don't visit unknown links or download apps from unknown sources. Don't share your credentials, account details or authentication codes with unknown websites or apps either. Learn more

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

HSBC TravelOne Credit Card

Instant reward redemption with an extensive selection of airline and hotel partners.

Find out more via your eWelcome pack

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Apply online today and enjoy our exclusive sign-up offer

Open up a world of elevated travel.

Instant redemption

Earn accelerated points

Travel privileges

Split flexibly

Spend, earn, and go further, earn points and redeem them instantly.

Be spoilt for choice when you redeem instant miles and hotel points with an extensive range of airline and hotel partners such as Malaysia Airlines, airasia, Singapore Airlines, Marriott Bonvoy and more[@credit-cards-travelone-reward-programme-tncs].

- 8× Reward points on all foreign currency spend

- 5× Reward points on local travel spend (hotels, airlines and travel agencies)

- 5× Reward points on local dining spend

- 1× Reward points on all other eligible spend

- Find out how to redeem

Travel in style

- Airport lounge access[@credit-cards-plaza-premium-lounge-tncs]: You and your supplementary cardholder can enjoy a combined 6 complimentary visits per year at selected Plaza Premium airport lounge for international flights – terms and conditions apply

- Travel offers: Enjoy exclusive travel discounts on Agoda – learn more on the Agoda website

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers

- Travel rewards: shop at key destinations around the world and enjoy cashback offers and discounts from both in-store and online merchants across over 25 countries – Find out more

Put your mind at ease

- Travel insurance: Register to enjoy complimentary travel insurance coverage (including COVID-19)[@credit-cards-travelone-travel-insurance-tncs] of up to USD250,000 for you and your family when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card – Mastercard T&Cs apply

- ID Theft Protection™: Enjoy peace of mind when surfing and shopping online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Online enrolment is required – find out more on the Mastercard website

- Complimentary E-Commerce Purchase Protection: Rest easier when you shop online with up to USD1,000 coverage – find out more on the Mastercard website

More card benefits

- 1% contribution on charity spending For every charitable donation you make with your HSBC TravelOne Credit Card, we'll contribute 1% of your charity spending – up to RM500,000 per year – to our supported charities[@credit-cards-travelone-charity-donations].

- Blind notch Designed to increase accessibility and demonstrate our commitment to inclusivity. The notch signals the correct end of the card to insert into card readers and ATMs

- We're finding ways to reduce plastic waste. Your HSBC TravelOne Credit Card is made from 100% recycled plastic.

Enjoy 50% off green fees at 42 golf clubs and golf lessons at 1 participating golf academy in Singapore – Book now . Terms & Conditions apply.

Valid until: 15 January 2025

Who can apply?

- A minimum annual income of RM60,000 p.a. is required

- Primary cardholder must be at least 21 years of age; supplementary cardholder must be at least 18 years old

What you'll need

Salaried employee .

If you're working for a multinational, public-listed, government or semi-government company or office, you'll need:

Photocopy of MyKad (both sides) AND any 1 from below:

- EPF statement - latest original PDF copy of non-password protected statement downloaded from KWSP website/App OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit OR

- Letter of confirmation from employer or latest month salary slip if employed less than 3 months OR

- Latest Income Tax Return Form (Form BE with tax receipt) OR

For all other companies, you'll need:

Photocopy of MyKad (both sides) AND any 2 from below:

- EPF statement - latest original PDF copy of non-password protected statement (latest 2 years EPF statement if contribution less than 6 months) downloaded from KWSP website/App AND/OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit AND/OR

- Latest 3 months salary slip AND/OR

- Latest Income Tax Return Form (Form BE with tax receipt) AND/OR

Self-employed

If you're self-employed , you'll need:

Photocopy of MyKad (both sides) AND Photocopy of Business Registration Form (established minimum 3 years) AND any 1 from below:

- Bank statement - latest 6 months original PDF copy of non-password protected statement downloaded from online banking website/App AND/OR

- Latest Income Tax Return Form (EPF Statement or Form B with payment receipts or CP02 attached)

Foreign passport holders

If you hold a foreign passport , you must be working for a multinational, public-listed, government or semi-government company or office, or HSBC corporate lending employer. You'll also need:

Copy of passport showing personal details and work permit (must be valid for at least one year) AND

Letter of confirmation from employer stating position, remuneration and duration of employment AND any 1 from below:

- Latest month salary slip

(Minimum RM10k income per month AND working for multinational/public listed companies/government/semi-government/HSBC corporate lending employers only)

Important documents

- Product disclosure sheet (PDF) (EN)

- Product disclosure sheet (PDF) (BM)

Apply online in 10 minutes or less.

You might also be interested in

Cash instalment plan , balance transfer instalment , cash advance , more about credit cards , important notes, connect with us.

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

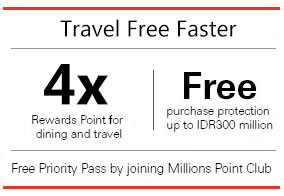

HSBC Elite Credit Card

Unlimited rewards points with no expiration.

Earn 50,000 Rewards Bonus Points worth $750 in airfare – when booked online through HSBC Travel from Rewards – after spending $4,000 in the first 3 months of account opening 1

You’ll earn 3× Rewards Points on new travel purchases – including airline, hotels, and car rentals

2× dining Points

You’ll earn 2× Points on new dining purchases

1× Points on all other purchases

You’ll earn 1× Points on all other purchases

- Add authorized users for $65 each 2

No Foreign Transaction Fees

- Competitive, variable APR of 21.24% to 25.24% † 2 on Purchases and Balance Transfers

Redeem your points for rewards

Redemption options.

- Redeem Points for flights, hotel reservations and car rentals using our online travel site 3

- Book your own airline travel, and receive a statement credit to reimburse the cost 3

- Transfer your Points to air miles with participating airline partner 3

Cash Rewards

- Reward yourself with cash back 4

- Direct deposit to your HSBC bank account

- Statement credits can be applied to your HSBC card account

- More than 100 brands in variable denominations 3

- Find the perfect fit across dining, travel, shopping, and entertainment 3

- Macy's, Starbucks, Home Depot®, Amazon.com, and Best Buy® are a few of the most popular in this vast collection 3

Merchandise

- A collection of over 3,000 items with new ones added every week 3

- Shop categories from luggage to electronics, kitchenware to fashion, and everything in-between 3

- Find top brands including Bose, Apple, Tumi, Dyson, Kate Spade New York, and many more 3

Explore this card

Travel benefits, everyday values and experiences, peace of mind.

$400 in Travel Credits

Up to $400 per year for all airfare, hotels and car rentals booked through HSBC Travel.

Unlimited Lounge Access

You and one guest get complimentary, unlimited access to 1,000+ airport lounges provided by LoungeKey™.

Mastercard Travel Rewards

Get exclusive offers from top brands in over 15 countries outside the U.S. including France, Hong Kong, U.K. and more when you use your HSBC Elite or Premier Credit Card. 3

Rewards For Miles

Transfer your Points into any of the Rewards for Miles partners’ loyalty programs. We have expanded the program to now include 11 airlines and 2 hotel partners.

- How to use How to use Modal link

View more travel benefits

There are no added costs when using your card to make purchases in a foreign country.

Trusted Traveler

You are eligible for either one Global Entry® Application Fee Statement Credit, up to a maximum of $100, or one TSA Precheck Application Fee Statement Credit, up to a maximum of $85, every 54 months 8 .

MasterRental TM Coverage Provides protection for physical damage and theft to most rental vehicles 5 .

Mastercard Travel & Lifestyle Services TM Connects you with access to luxury travel benefits, amenities and upgrades at some of the most sought-after travel destinations either by phone, email or a personalized online platform 5 .

Travel Accident Insurance Receive accidental death or dismemberment coverage of up to $1,000,000 when traveling 5 .

Trip Cancelation Insurance Reimburses you for your prepaid, non-refundable expenses in case you have to cancel your trip for a covered reason 5 .

Hotel and Motel Burglary Insurance Get reimbursed up to $1,500 per claim for personal property stolen or damaged from your hotel or motel room as a result of burglary by forcible entry 5 .

Lost Luggage Insurance Get reimbursed up to $1,500 per claim for checked or carry-on luggage that is lost or damaged while traveling on a common carrier 5 .

Baggage Delay Insurance Get reimbursed up to $250 per claim for the cost of essential items such as clothing and toiletries if your luggage is delayed in getting to your scheduled destination 5 .

Mastercard ® Airport Concierge Enjoy a 15% savings on Airport Meet and Greet services. Arrange for a personal, dedicated Meet and Greet agent to escort you through the airport on departure, arrival or any connecting flights at over 450 destinations worldwide 6 .

World Elite Concierge Service Enjoy complimentary, 24/7 concierge service that acts like a personal assistant. Receive help with all your tasks, big and small: from travel planning, dining reservations, sporting events and show ticket reservations 6 .

Priceless Golf®

Discounted access to select golf courses, complimentary grounds passes for PGA Tournaments, Priceless Lessons with PGA Tour professional and much more.

Priceless Experiences

Get exclusive, once in a lifetime experiences in the cities where you live, shop and travel.

Complimentary ShopRunner membership for unlimited, free 2-day shipping and free return shipping at over 140 online stores.

Take 3 rides per month and receive a $5 Lyft App credit 5 .

Mastercard ID Theft Protection TM

If your identity is compromised, you’ll receive one-on-one support until your claim is resolved 5

Identity Fraud Expense Reimbursement

Provides expense reimbursement in the event your identity is compromised through identity fraud 5

Cellular Wireless Telephone Protection

Provides reimbursements up to $800 per claim if your cellphone is stolen or damaged 5

More peace of mind

Purchase Assurance Covers most purchases from damage or theft within 90 days of purchase up to $1,000 5

Tap & Go® with any HSBC Credit Card

Tap & Go® contactless payments are faster than swiping or inserting your card for payment.

- Place – Simply place your HSBC Credit Card close to a contactless payment terminal

- Hold – Briefly hold your card close to the terminal until it confirms the payment with a green light or beep,

- Done – Follow the prompts, and you're done!

Thousands of merchants accept contactless payments – use your card wherever you see the contactless symbol.

† Summary of Terms can be accessed here

HSBC Elite World Elite Mastercard credit card Rewards & Benefits and Mastercard Guide to Benefits brochure can be accessed here .

How to apply

To apply for an HSBC Elite Credit Card, you must have a qualifying Premier or Private Bank relationship 7 .

New to HSBC

To apply for an HSBC Elite Mastercard credit card 7 , you must have an existing U.S. HSBC Premier checking account relationship. Explore the benefits today.

Existing HSBC Customer

Log on to Personal Internet Banking to apply for an HSBC Elite Mastercard credit card.

For Private Bank relationships, please see your Relationship Manager.

Phone Contact our 24/7 Premier Customer Relationship Center.

888.662.4722 (HSBC)

If you’re calling from outside the US or Canada, call

716.841.6866

Find the Wealth Center closest to you to apply in person.

- Wealth Center locator

- Fraud Protection

As an HSBC customer, you’re automatically enrolled in our fraud alert program.

- FICO®

See your FICO® score for free, along with key score factors, on your monthly statement.

- Mobile Pay

All HSBC credit cards are compatible with Apple Pay®, Google Pay TM , Fitbit Pay TM , Garmin Pay TM and Samsung Pay TM .

1 The 50,000 Rewards Bonus Points offer applies when you open a new HSBC Elite World Elite Mastercard credit card and charge the qualifying amount or more in new purchases (minus returns, credits and adjustments) within the first three (3) months from Account opening (“Promotional Period”). The 50,000 Bonus Points offer does not apply to account upgrades, account transfers, balance transfers, credit card checks, cash advances or overdrafts. Your HSBC Elite World Elite Mastercard credit card must be open and in good standing at the time of Bonus Points fulfillment. Allow 4-6 weeks after the Promotional Period has ended for the Bonus Points to post to your Account. Customers who have opened the same credit card product within the last 36 months are not eligible to receive the Rewards Program Bonus Points offer.

2 The information about the costs and benefits of the card described is accurate as of {{currentDate}}. The information may have changed after that date. To find out what may have changed, call 888.662.4722 (HSBC). A variable Purchase APR applies to credit card purchases and will be 21.24% to 25.24%, depending on your credit worthiness. A variable Balance Transfer APR applies to balance transfers and will be 21.24% to 25.24%, depending on your credit worthiness, for the HSBC Elite World Elite Mastercard credit card . The variable Cash APR applies to cash advances and is 30.24%. These APRs will vary with the market based on the Prime Rate. For each billing cycle, variable APRs are calculated by adding a specified amount (“Spread”) to the U.S. Prime Rate published in the Money Rates table of The Wall Street Journal that is in effect on the last day of the month (“Prime Rate”). If the Prime Rate changes, the new APRs will take effect on the first day of your billing cycle beginning in the next month. The Minimum Interest Charge is $1.00. A Balance Transfer Fee of either $10 or 4%, whichever is greater, will apply on each balance transfer. A check fee of either $10 or 4%, whichever is greater, will apply on each check written for purposes other than Balance Transfer. A Cash Advance Fee of either $10 or 5%, whichever is greater, will apply on each cash advance transaction. There is no Foreign Transaction Fee. The Annual Fee for the HSBC Elite World Elite Mastercard credit card is $395 plus $65 for each authorized user; the Annual Fee is waived ($0) for customers who hold a U.S. HSBC Premier Elite customer status (qualification required)* or Private Bank relationship. See Summary of Terms for details .

* For more information regarding U.S. HSBC Premier Elite customer status eligibility requirements please visit https://www.us.hsbc.com/checking-accounts/products/premier/ or speak with your Relationship Manager.

3 As an HSBC Elite or HSBC Premier credit cardholder, you do not need to enroll or register for the Mastercard Travel Rewards program. This program is available to you automatically, at no additional cost. Merchants may provide to eligible HSBC Elite and HSBC Premier Mastercard credit cardholders (“cardholder”) certain discounts, rebates or other benefits on the purchases of goods and services ("Offers") that will be available on the Mastercard Site. Merchants may also have different payment acceptance criteria for online purchases (e.g., debit or prepaid cards may not be accepted). Such Offers are subject to certain Terms & Conditions and may change at any time without notice to you. Payment acceptance criteria is determined by the merchant in its discretion and may be visible on the Merchant website. HSBC or Mastercard will not be liable for any loss or damage incurred as a result of any interaction between you and a merchant with respect to such Offers. Except as set forth herein, all matters, including but not limited to delivery of goods and services, returns, and warranties are solely and strictly between you and the applicable merchants. You acknowledge that HSBC or Mastercard does not endorse or warrant the merchants that are accessible through the Mastercard Site nor the Offers that they provide. If applicable, all offer redemption is dependent on merchant shipping policies and availability to cardholder's shipping address. For all offers that are specified as “unlock additional online offers” cashback is not earned on shipping, handling, tax or the purchase and/or use of gift vouchers, which for avoidance of doubt, includes gift cards, gift certificates, or any other similar cash equivalents. Terms and conditions apply, see https://www.us.hsbc.com/credit-card-resource-center/premier/#rewards for additional information. All third party-trademarks are the property of the respective owners.

4 Customers can choose to receive cash back redemptions as a direct deposit into their HSBC Bank USA, N.A. Checking or Savings Account, or as a statement credit on their HSBC Credit Card. For complete eligibility details, refer to the HSBC Elite World Elite Mastercard credit card Guide to Benefits brochure.

5 Certain restrictions, limits and exclusions apply. Visit https://www.lyft.com/mastercard for a full list of current merchant offers and applicable terms & conditions.

6 The Mastercard® Concierge Service is provided by Aspire Lifestyles. Certain restrictions, limitations and exclusions may apply. This service is administered by a company not affiliated with HSBC Bank USA, N.A

7 HSBC Elite World Elite Mastercard® requires a qualifying Premier or Private Bank relationship. For a complete list of HSBC Premier Relationship eligibility requirements please visit https://www.us.hsbc.com/checking-accounts/products/premier/ or speak with your Relationship Manager.

8 Certain restrictions, limits and exclusions apply. Benefits may not be offered in every state. Coverage may be underwritten and managed by companies that are not affiliated with Mastercard, or HSBC Bank USA, N.A. Please see your HSBC Elite World Elite Mastercard credit card Rewards & Benefits and Mastercard Guide to Benefits brochure for full details.

How you earn Rewards Points or Cash Rewards : You earn Points or Cash Rewards when you use your card to make new purchases (minus returns, credits and adjustments).

HSBC credit cards are issued by HSBC Bank USA, N.A., subject to credit approval and require a U.S. HSBC checking account relationship. To learn more, speak with an HSBC representative.

Deposit products offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.

Mastercard®, Tap & Go and the circles design are registered trademarks of Mastercard International Incorporated.

Mastercard® and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC.

Apple Pay works with iPhone 6 and later in stores, apps, and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2, and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105 .

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac, Safari, and Touch ID are trademarks of Apple, Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

Samsung, Samsung Pay, Galaxy S7 and Samsung Knox are trademarks or registered trademarks of Samsung Electronics Co., Ltd. Other company and product names mentioned may be trademarks of their respective owners. Screen images are simulated; actual appearance may vary. Samsung Pay is available on select Samsung devices.

Fitbit, Fitbit Pay and the Fitbit Logo are trademarks, service marks and/or registered trademarks of Fitbit, Inc. in the Unites States and in other countries.

Garmin and Garmin logo are trademarks of Garmin, Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Connect with us

HSBC credit cards complimentary travel insurance

Hsbc credit cards that offer complimentary travel insurance can help you save on the cost of overseas trips – so how much cover can you get.

In this guide

Which HSBC credit cards have complimentary travel insurance?

What's covered by hsbc complimentary international travel insurance, what do i need to do to use hsbc's credit card international travel insurance, pre-existing medical conditions, how to make a claim through your hsbc credit card complimentary international travel insurance policy, other types of hsbc complimentary credit card travel insurance, hsbc credit card complimentary insurance for shopping, other hsbc cards with complimentary insurance options, frequently asked questions.

HSBC offers complimentary insurance across its range of credit cards, including domestic and international travel insurance on HSBC Platinum and World Mastercard credit cards. The actual policies are underwritten by Allianz Insurance Australia (Allianz) and can be different based on the HSBC credit card you choose.

Like any insurance policy, there are terms and conditions you need to meet to get the cover and have your claims approved. The insurance policy booklet has complete details, so it's always good to keep that handy. But if you just want a quick guide of the cover you'll get, including what's available in a pandemic, we've got the key details here.

Have a question or need to make a claim right now? Call Allianz Insurance on 1800 648 093 (from Australia) or +617 3305 7499 (from overseas).

HSBC offers complimentary travel insurance to people with platinum and World Mastercard credit cards, as well as other types of insurance on other cards. Here are the key details for HSBC cards currently on the market.

Have an HSBC credit card that's not on this list? Check the terms and conditions available on the HSBC website to see if your card is eligible.

HSBC credit card travel insurance can give you cover for overseas trips of up to 4 months if you need to go to hospital overseas, miss flights because of delays, have your luggage stolen and for other situations that can leave you out of pocket.

The actual cover is broken down into "benefits" based on what you can and can't claim. Some claims also have an excess you need to pay before you'll get any money if a claim is approved.

Does HSBC complimentary credit card travel insurance cover pandemics?

Yes, some cover is available for COVID-19 and other pandemics or epidemics, including for cancellation and overseas emergency medical claims. There are very specific conditions you need to meet to make a claim, so it’s important to read the HSBC complimentary insurance policy document or call Allianz on 1800 648 093.

If you want more details about COVID-19 travel insurance, Finder also has a whole guide covering questions about pandemic and travel insurance .

Here, we've broken down the different types of claims, with an example of a situation when you might use the cover. But remember: You should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover with an HSBC credit card

Hsbc complimentary international travel insurance for cancellation, delays, accommodation and transport, luggage and personal items cover offered with hsbc credit card complimentary insurance, personal liability cover offered with hsbc complimentary credit card travel insurance, hsbc credit card complimentary international travel insurance for death and funerals, what's not covered.

Every insurance policy has details of when you will and won't get cover. These details can be very specific, which is why it is important to always check your insurance policy documents.

- Pre-existing medical conditions (unless you have got written confirmation from Allianz that your condition will be covered before you leave)

- Issues related to drinking alcohol or taking non-prescription drugs

- If you don't follow advice from any government, official body or mass media announcements

- Travel that's for the purpose of medical treatment

- If you're a crew member or pilot working on any of the transport

- Dangerous activities including rock climbing (with equipment), white water rafting, bungy jumping, off-piste snowboarding or skiing and quad or motorbike riding on a vehicle that has an engine capacity of 200cc or more

If you need cover for a skiing trip, bungy jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions. Got a pre-existing health condition? Check out travel insurance policies that offer cover for conditions including asthma, high blood pressure and physical disabilities.

If you're planning a trip and want cover through your HSBC credit card, you'll need to meet the following requirements:

- Travel bookings. You need to use your eligible HSBC credit card to pay for at least $500 of your travel costs before the start of the trip. A simple way to meet this requirement is to pay for your airfares, cruise or hotel stays with the card. You also need a return ticket before you go.

- Australian residency. You need to permanently live in Australia.

Does HSBC credit card travel insurance cover family members?

Yes, if you meet the eligibility requirements for cover on an upcoming trip, your spouse and dependants (children) can get cover under this policy when they're travelling with you for at least half of your trip and meet the following requirements:

- They need to permanently live in Australia.

- At least $500 of their pre-paid travel costs have been paid for with your eligible HSBC credit card and they have a return ticket to Australia.

- They need to be travelling with you for at least 50% of your trip.

They also need to meet all the other conditions of the insurance policy.

Need written confirmation of cover? Call Allianz on 1800 648 093.

This complimentary international travel insurance doesn't typically cover pre-existing medical conditions.

In simple terms, that means you won't get cover if you've seen a doctor or other qualified professional about a condition that causes issues overseas. It's the same if you're aware of a physical, medical, mental or dental condition before you travel.

There are some exceptions if you're pregnant, though:

- You can get cover for pregnancy complications that arise from injury or sickness when you're travelling and meet the other eligibility requirements.

- If you were eligible for the travel insurance before you became pregnant, you'll be entitled to available cover.

If you have a pre-existing condition you want covered, follow these steps:

- Call Allianz Global Assistance on 1800 648 093. You'll then go through an assessment process.

- Answer all the questions honestly and give them any extra information they ask for.

If your pre-existing medical condition is approved for cover, you will need to pay an administration fee. This fee is non-refundable and the cost is not detailed in the insurance policy booklet, so make sure you ask how much it will be when you call Allianz.

If you follow these steps and get approved, Allianz will send you written confirmation of cover for your pre-existing medical condition.

Pre-existing medical condition definition for HSBC credit card insurance

As well as the summary above, we have included the definition that's in the current HSBC card insurance policy document for HSBC Platinum Cards and Premier World Mastercard accounts.

These are effective from 14 October 2022.

a condition of which a reasonable person in the circumstances, should have been aware at the time eligibility for the cover available was met, including:

- Any dental condition; or

- Any physical condition; or

- Pregnancy; or

- Any lifelong illness; or

- Any chronic illness; or

- Any mental illness; or

- Any current or previously treated cancer, or

Any condition which, in the last two years:

- Was treated by surgery (including day surgery); or

- Required regular medication; or

- Required on-going treatment; or

- Was referred to a specialist medical adviser; or

- Had regular reviews or check-ups; or

- Caused admission to hospital; or

- Was treated at a hospital emergency department or out-patient clinic.

If you think you will need to make a claim, contact Allianz Global Assistance as soon as possible so that they can give you specific information.

You can do this by calling +617 3305 7499 from overseas (a reverse charge number) or 1800 648 093 in Australia.

There are 2 main ways you can submit your claim:

Allianz will review your claim and ask for any further details before giving you an outcome.

What to include in your claim

With insurance claims, it's always good to include as much detail and supporting documentation as possible. It makes it easier for the insurer to look at the claim and your eligibility for a payout.

- A referral or letter from a doctor or other professional you see in relation to a claim

- Official medical reports

- Police reports

- Photos of damaged items

- Emails or letters from airlines that relate to a claim

- Receipts or other proof of purchase

Transit accident insurance

- What is it? Cover for accidents that happen when you're travelling overseas on a plane, train, cruise ship, bus or other eligible vehicle. You also get cover for related accidents that happen when you're boarding or leaving the transport.

- When can I use it? You are eligible for cover if you have paid for the entire trip with your eligible HSBC credit card before you leave. If your partner or dependants are permanent residents of Australia and travelling with you, they'll also get cover.

- Is there an excess cost? No, you don't need to pay an excess for any claims but there are limits to how much you can get paid out. For example, the loss of one hand or one foot has a maximum benefit limit of $100,000 for the cardholder, $50,000 for a spouse and $12,000 for a dependant.

Domestic travel insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia for up to 14 days. This can include costs relating to cancelled return flights, flight delays of 4 hours or more, delayed or lost luggage and rental vehicle excess insurance costs if you hire a vehicle.

- When can I use it? If you have used your eligible HSBC credit card to pay for the entire flight or at least $250 of your flights and accommodation before you leave. If your partner or dependants are travelling with you for at least 50% of the trip and meet these requirements, they'll also get cover.

- Is there an excess cost? Yes, $200 per claim for cover relating to cancellation or luggage.

Rental vehicle excess insurance in Australia

- What is it? Cover for damage or theft of a car or other vehicle you have hired in Australia, up to a maximum of $6,000.

- When can I use it? You are eligible for cover if you have paid for the hire car (or vehicle) using your eligible HSBC credit card. The vehicle hire agreement also has to include details of how much you need to pay if the vehicle is damaged or stolen.

- Is there an excess cost? Yes, $200 per claim.

HSBC credit cards give you access to other types of insurance, also provided by Allianz. Below is a snapshot of the different types.

Purchase protection insurance

- What is it? Cover for the cost of a new item that is stolen, accidentally damaged or lost. It covers most household and personal items such as laptops, shoes, jewellery and glasses. Exclusions include second-hand items, perishables, cash, computer software, vehicles and items you've accidentally left in a hotel after checking out.

- When can I use it? If you use your eligible HSBC credit card to pay for covered items, this insurance will apply for the first 90 days from when you get them. This cover is available for personal items bought anywhere in the world, and for gifts you have bought and given to someone who is a permanent Australian resident.

- How can I make a claim? You need to show proof that you own the item and report the loss, theft or damage to the local police or relevant authorities (such as the office of a transport company). You also need to show proof of the report, such as written confirmation for the authorities involved. Then, call Allianz on 1800 648 093.

- Is there an excess cost? Yes, $100 per claim. There are also maximum claim amounts depending on the item.

Extended warranty insurance

- What is it? Cover that doubles the manufacturer's warranty for items bought in Australia, up to a maximum period of 12 months. For example, if you bought a laptop with a 12-month manufacturer's warranty and it stopped working for no reason after 12 months, you could make a claim under this cover.

- When can I use it? If you used your eligible HSBC credit card to pay for an item and it came with an Australian manufacturer's warranty of between 7 days and 5 years. You can make a claim if something happens after the original warranty period has ended.

- How can I make a claim? Call Allianz on 1800 648 093 and give them as much information as possible.

- Is there an excess cost? Yes, $200 per claim. There is a total maximum claim limit of $10,000 per year.

Don't have complimentary insurance on your credit card yet? Compare HSBC credit cards or other cards that offer insurance .

HSBC also offers different types of travel insurance on the following cards:

- HSBC Corporate Card . If you're looking at getting a card account for your business, the HSBC Corporate Card offers travel insurance and corporate liability against deliberate misuse by cardholders.

How do I activate my HSBC travel insurance?

If you have an eligible HSBC credit card, you'll get international travel insurance when you pay for at least 90% of your return travel ticket before the start of your trip.

Does HSBC credit card travel insurance cover cruises?

Yes, the international travel insurance policy would cover you for eligible issues that come up when you're on a cruise.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

More guides on Finder

The HSBC Star Alliance Credit Card offers points and perks with partners including Singapore Airlines, Air New Zealand and United. Is it right for you?

This card offers 0% interest on balance transfers for 12 months, a first-year annual fee waiver and platinum benefits including airport lounge passes and complimentary insurance covers.

The HSBC Corporate Card offers expense management, flexible spending controls, liability protection and worldwide acceptance through the Mastercard network.

Designed for premium HSBC customers, the HSBC Premier World Mastercard offers points, complimentary insurance, airport lounge access and more.

The HSBC Platinum Qantas Credit Card is a premium option that earns frequent flyer points per $1 spent and offers complimentary insurance.

With HSBC credit card rewards program, cardholders get the ability to earn points on a one point to one dollar ratio that can be used for a vast array of rewards and extra points with HSBC partners.

The HSBC Low Rate Credit Card has a 0% balance transfer offer and a low ongoing interest rate for purchases – here's what else you need to know.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

This is unsupported browser notification banner that is being show to users that visit the site with older IE browsers. Link to download newer version of IE.

- Personal Internet Banking

- Internet Credit Card Service

HSBC credit card travel insurance

With the travel protection offered by HSBC credit cards, you will have complete peace of mind when travelling abroad

- Travel insurance coverage

- Free airport transfers

- Free parking at international airports

- Dedicated travel advisory services

- Roadside assistance

Products and services

Promotional period: 1 July 2023 to 30 June 2024

During the promotional period, use your HSBC (Taiwan) credit card to pay for more than 80% of your package tour charges or the full amount of airfare * to enjoy all-round protection through our high-coverage travel insurance packages. Rest assured you'll be well protected in the event of flight delays or baggage problems.

- Travel insurance: high-coverage protection for your time spent abroad, en-route in travel and while taking public transportation

- Travel inconvenience insurance: compensation for actual losses incurred due to flight and baggage delays, losses or damage

* Please refer to 'service details' for details and amendments related to the Insurance Act, as well as attachments for filing claims.

*Remark: The payment for airline ticket cannot be offset entirely (e.g. mileage redemption, gift voucher, free voucher) or partially (including mileage redemption, discount voucher or coupon), or only pay for airport tax or war risk additional surcharge. No protection of credit card insurance will be provided for any airline ticket acquired by prize and award won by chance

If you're not an existing HSBC credit cardholder, apply now.

Use your HSBC (Taiwan) credit card to pay for the full amount of travel-related transport expenses (such as commercial planes*, trains and ships) or more than 80% of the package tour charges (including travel-related transport expenses) for yourself or your family (your spouse or dependent and unmarried children below 25) , and you'll enjoy all-round protection through our high-coverage travel insurance packages. However, if the transaction related to the afore-mentioned commercial airfare or package tour charges is cancelled by the insured party, the company will not be responsible for handling the claims thereon. Pertaining to the actual insurance content and other matters not covered here, the terms of the insurance contract shall prevail.

※ Free plane tickets are not covered by these insurance packages .

"Travel-related transport" refers to

- flights licensed by the government and operating on fixed routes;

- any means of transportation for which any traveller can purchase a ticket to ride on. To enjoy the insurance coverage, a cardholder has to use his/her valid credit card (with the insurance package) to pay for the full amount of public transport expenses or more than 80% of package tour charges during the insured period.

* The following flights are covered by the travel insurance policy: scheduled flights, referring to flights flying between certain designated airports, and listed on an airline's flight schedule and price list; charter flights or extra flights, referring to commercial flights not listed on an airline's flight schedule and price list, but that are chartered by a tour company on a regular basis to attract potential tour members, and that are operating on certain fixed routes licensed by the local government, as well as extra flights added to an existing route. Free air tickets are not covered by this travel insurance policy .

The following types of travel-related transport are not covered under the travel insurance policy:

- Airplane for government and private enterprise purpose.

- Tourism purpose instead of usual usage.

- Domestic mass MRT, public car and cable car solely paid by credit card.

Travel insurance

Insurance coverage for travel-related transportation

Scope of coverage and definitions :

Under the circumstances that a cardholder becomes disabled or dies due to accidental injury while taking travel-related transport as a passenger, the insurance pay-out will be based on the sum insured as stipulated in the relevant provisions:

- When the insured is taking a commercial flight: During the time period when the insured is travelling in a vehicle to and from the airport prior to the original flight departure time or within 5 hours upon arriving at the destination airport; waiting to board at an airport; or travelling in, boarding or alighting from a commercial airplane.

- If the insured is taking travel-related transport other than the afore-mentioned, the time period during which the insured is travelling in, boarding or alighting.

Compensation items :

Death benefit (Note 1), disability insurance

- Travel-related transport insurance with rider on injury medical insurance

Under the circumstances that a cardholder suffers from an accidental injury while taking travel-related transport as a passenger, and undergoes treatment at a registered and qualified hospital or clinic within 180 days of the incident, the insurance company will pay out the difference between the actual medical expenses incurred and the portion covered under National Health Insurance .

- When the insured is taking a commercial flight: During the time period when the insured is travelling in a vehicle to and from the airport prior to the original flight departure time or within 5 hours upon arrival at the destination airport; waiting to board at an airport; or travelling in, boarding or alighting from a commercial airplane.

- If the insured is taking travel-related transport other than the afore-mentioned, the coverage is limited only to the time period during which the insured is travelling in, boarding or alighting from the specific means of transportation.

If the insured receives treatment not as a member of the National Health Insurance plan; or if he/she goes to a hospital not covered under National Health Insurance for treatment, and as a result, the expenses incurred are not covered under the National Health Insurance, the insurance company will pay out 70% of the actual expenses incurred .

The total pay-out for the afore-mentioned injury cannot exceed the maximum pay-out per injury under medical insurance as listed in the insurance policy .

- Overseas travel insurance

If a cardholder uses his/her credit card to pay for all public transport expenses or 80% of the expenses of a tour organised by a travel agency during an overseas trip, and is injured in an accident during the trip, resulting in bodily damage and as a result, dies or is disabled, compensation will be paid out by the insurance company. The duration of the afore-mentioned trip cannot exceed 30 days .

- Overseas travel insurance with rider on injury medical insurance (based on actual expenses incurred)

Insurance scope and definitions :

During an overseas trip as afore-mentioned, if a cardholder is injured in an accident, and undergoes treatment at a registered and qualified hospital or clinic within 180 days after the accidental injury, the insurance company will pay out the difference between the actual medical expenses incurred and the portion covered under National Health Insurance .

The duration of the afore-mentioned trip cannot exceed 30 days.

If the insured receives treatment not as a member of the National Health Insurance plan; or if he/she goes to a hospital not covered under National Health Insurance for treatment, and as a result, the expenses incurred are not covered under National Health Insurance, the insurance company will pay out 70% of the actual expenses incurred .

Injury medical insurance

Special Declarations :

- If a cardholder is disabled or dies due to an accident, and the compensation pay-out can be claimed under both overseas travel insurance and travel-related transport insurance coverage under the overall travel insurance policy, the cardholder can only select 1 of the 2 options.

- If a cardholder suffers from an accidental injury, and the compensation pay-out can be claimed under both overseas travel insurance and travel-related transport insurance under the overall travel insurance policy policy, the cardholder can only select 1 of the 2 options.

Travel inconvenience insurance

Flight delay expenses (based on actual expenses incurred)

- The flight that the insured is taking is delayed for more than 4 hours

- The flight that the insured is taking is cancelled or is cancelled due to overbooking, and the insured cannot switch to another flight within 4 hours

- The insured misses a connecting flight because the previous flight is delayed, and the insured cannot switch to another connecting flight within 4 hours

- Delays or cancellations of flights originating from the insured's home countries/territories are not included if the delay or cancellation is confirmed before the insured checks in at the airport

- The insurance company will not be responsible for any compensation pay-out if the traveller cancels the transactions related to the payment for the tour package or the flight booking

The insured will be compensated for the following expenses incurred during the time when the flight is delayed and before the airline arranges the next available flight for the insured. The original receipts or invoices must be presented for verification (compensation will be paid out based on the actual expenses incurred instead of making a lump sum payment). However, the insurance does not cover expenses incurred in the insured's place of residence :

- Reasonable and essential dining and accommodation expenses: (up to NTD2,000/person/meal, the stipulated insured amount will apply in the case of Taiwan and the main island)

- Transportation expenses incurred while travelling between the airport and the accommodation location: Limited to transportation expenses incurred while travelling between the airport of the delayed flight and the accommodation location ; transportation expenses incurred while going to a dining location or any other locations (such as a pier or railway station, or to visit a friend) are not included in the scope of coverage.

- If the insured needs accommodation due to flight delays, and his/her baggage has been checked in, expenses incurred while buying daily necessities will be compensated only if 1. accommodation is required AND the insured's baggage has been checked in (luggage tag is required for checking) 2. the daily necessities purchased are items essential for an overnight stay (Note 2) .

- Expenses incurred while making international calls: Limited to expenses incurred while making international calls during the time period of the flight delay. Relevant phone bills have to be presented.

Deadline for filing claims :

File your claims with the insurance company within 30 days from the date of the incident.

Baggage delays, losses and damage expenses (based on actual expenses incurred)

Due to the airline's improper handling, the insured's checked-in baggage is not delivered more than 6 hours and less than 24 hours after arriving at the destination airport (original departing location or the insured's place of residence are excluded) .

Actual expenses incurred by the insured in purchasing daily necessities for emergency use prior to retrieving his/her baggage (Note 2), but only limited to such expenses incurred by the insured within 24 hours upon arriving at the destination.

- Loss of baggage expenses (based on actual expenses incurred)

Due to the airline's improper handling, the insured's checked-in baggage is lost, or is not delivered 24 hours or more after arriving at the destination airport (original departing location or the insured's place of residence are excluded) .

Actual expenses incurred by the insured in buying daily necessities for emergency use prior to retrieving his/her baggage (Note 2), but only limited to such expenses incurred by the insured within 120 hours upon arriving at the destination .

If the insurance company has already made a pay-out to the insured based on provisions under the afore-mentioned baggage delays, losses and damage expenses, the insurance company's liability under this coverage plan will be the difference between the total pay-out under this package and the amount already paid out under the coverage for baggage delays, losses and damage expenses.

Other important notes :

- Items purchased after the insured is being updated, and the baggage is delivered to the designated location are not covered.

- Items purchased before the insured realises about the lost or delayed baggage are not covered. For example, this includes items purchased at Duty Free shops at the airport prior to going through immigration checks.

- Retain the baggage receipt or ask the airline or delivery company to provide proof of the date and time of delivery.

File your claims with the insurance company within 30 days from the date of the incident.

- Hijacking insurance

During the insured period, if the plane on which the cardholder is travelling is seized by an individual or organisation not controlled or commanded by a legitimate government or judiciary through the use of force, coercion or other illegal means, hindering the plane's normal operations or limiting the passengers' freedom of action.

Compensation will be paid out based on a daily lump sum during the hijacking period, calculated based on the number of days multiplied by the daily hijacking compensation amount, up to a maximum of 30 days; if the hijacking period is less than 1 day, it will be counted as 1 day.

Related information

- Claims application (pdf) (Chinese only) Claims application (pdf) (Chinese only) Download link

- Insurance contract details (pdf) (Chinese only) Insurance contract details (pdf) (Chinese only) Download link

Supporting documents for claims

Travel insurance

Submit the completed claims application together with the following documents to the insurance company:

- Copy of the credit card voucher (the credit card linked with the insurance plan) related to the cardholder's ticket purchase, showing the authorisation code, and a copy of the agency receipt.

- Ticket stubs of the transportation vehicle and copies of the reservation documents.

- Copy of the statement of travel records.

- If you're filing a death benefit claim, please include the original autopsy report or the original death certificate, and the cancelled household registration transcript of the insured.

- If you're filing a claim for disability insurance, include the original disability diagnostic report. The insurance company will need to conduct a physical examination of the insured, and with the consent of the beneficiary, go through the insured's medical records if necessary. The related expenses will be borne by the insurance company.

- If you're filing a claim for medical insurance, include the original diagnostic report or hospitalisation record, original medical expenses record or medical reports. In the event of overseas consultations, include the National Health Insurance Administration's expenses reimbursement form.

- If necessary, the insurance company may request supporting documents for the incident resulting in the accidental injury (such as documental proof of the accident from the tour guide).

- The beneficiary's identification documents

- If you're filing a death benefit or disability claim for the cardholder, his/her spouse or children, please include copies of relevant identification documents.

Travel inconvenience insurance

※ Required documents for all items

- Copy of the credit card statement showing the purchase of the plane ticket or the tour package.

- Copy of the travel agency receipt.

- Original ticket or electronic ticket of the original flight and the original boarding pass for the switched flight.

- Copy of the cover of the applicant's (insured's) bank book (if the wire transfer option is chosen).

- Copies of both sides of the applicant's identification documents, and a copy of the household certificate when a claim is filed for expenses related to the cardholder's children.

※ Required documents for individual items

I. Filing a claim for flight delay expenses:

- Original receipts and vouchers for the expenses incurred by the insured due to flight delays.

- Original certificate issued by the airline proving the flight delay/missed flight/denied boarding situation.

- Please include the luggage tag if daily necessities have been purchased due to checked-in baggage and the need for accommodation.

- If you're filing a claim for the expenses incurred due to a missed flight, provide details on the timing of the original connecting flight, the destination of the connecting flight, and the number of delayed hours.

II. Filing a claim for baggage delays, losses or damage expenses:

- Original receipts and vouchers for the expenses incurred by the insured due to baggage delays, losses or damage.

- Original certificate issued by the airline or airport proving the baggage delay, loss or damage.

- Original certificate showing the timing of the retrieval of the delayed baggage and the original luggage tag.

III. Filing a claim for hijacking insurance:

- Original certificate proving the hijacking incident.

Claim application method (Chinese only)

國泰世紀產物保險股份有限公司

- 申請方式:請以掛號方式郵寄至下列地址

- 申請書郵寄地址:40341台中市西區民權路239號8樓B2室 (國泰產險信用卡理賠中心收)

- 聯絡電話: 0800-212-880 請撥打此專線 由國泰產險客服人員為您說明

- 台灣免付費服務電話: 0800-212-880 (限市話撥打)

This product is underwritten by Cathay Century Insurance. For the content of the insurance coverage and other matters not mentioned herein, refer to the terms and conditions described in the insurance contract signed between HSBC (Taiwan) and the insurance company for details.

In the event of any discrepancy or inconsistency between the English version and the Chinese version of these terms and conditions, the Chinese version shall apply and prevail.

Cathay Century Insurance

Toll-free service number: 0800-036-599

Important notes

Insurance act amendments .

In line with amendments in the Insurance Act, effective 15 June 2018, Cathay Century Insurance has made adjustments to a number of terms, including "handicap" and "disability". Details are as follows:

I. In accordance with Hua Zong Yiyi Zi document no. 10700062351, additional Article 107-1, and amendments in Articles 107, 125, 128, 131, 133, 135 and 138-2.

II. In accordance with the previous presidential order, to be in line with the spirit of the 'Convention on the Rights of Persons with Disabilities' (CRPD), Cathay Century Insurance will make adjustments to the terms used in the insurance contracts. However, such adjustments will not affect the actual content of the product or the interests of the insured.

III. For insurance contracts (attachments), effective 15 June 2018 (inclusive), if the names of the insurance products, the terms and conditions in the insurance policies, the attached proposals, supplementary terms and conditions, endorsements, and other agreements contain original terms listed in the table below, 'Endorsements Regarding Changes in Wordings in Cathay Century Insurance Policies', and 'Endorsements Regarding Changes in Wordings in Cathay Century Insurance Policies (applicable to property insurance products)' will apply. Such endorsements will form part of the insurance contract (attachment), and if any part of the insurance contract (attachment) is in conflict with such endorsements, such part will not be valid. Terms used in insurance contracts (attachments) related to the afore-mentioned endorsements are adjusted as follows:

If original terms used in the above table are used in sales materials and the company's official website, the new terms will also apply in these channels.

IV. Insurance contracts (attachments) effective prior to 15 June 2018 will be executed in accordance with the policy wordings in the insurance contracts. The interest of the insured will not be affected by the wording adjustments listed in the table above.

- In accordance with the revision of Article 107 in the Insurance Act, effective 1 April 2010, changes in the rights and benefits related to the travel insurance protection offered by the bank are as follows (if there are changes in Article 107 of the Insurance Act, the latest provisions shall prevail):

Death benefit :

If the insured person is a minor aged below 15, the pay-out of the death benefit thereof will become effective on the day the insured turns 15. If the insured person is under an order of guardianship that has not been revoked, the death benefit thereof will be changed to funeral expenses insurance. The total amount of the afore-mentioned funeral expenses coverage purchased by the insured on or after 3 February 2010 cannot exceed 50% of the deduction for funeral expenses as stipulated under Article 17 of the Estate and Gift Tax Act.

Disability insurance :

If the insured person is a minor aged below 15, the maximum pay-out of the disability insurance is NTD2 million . If the insured person is under an order of guardianship that has not been revoked, the pay-out of the disability insurance cannot exceed 50% of the deduction for funeral expenses as stipulated under Article 17 of the Estate and Gift Tax Act.

Exclusions

I. Liability resulting from wars, warlike operations (whether war is declared or not), enemy invasions, acts of foreign enemies, rebellions, civil disorder, forcible seizure, or expropriation, except otherwise stipulated in the insurance contract.

II. Liability resulting from nuclear fission or radiation.

III. Liability resulting from an intentional act carried out by the insured.

IV. Liability resulting from items being seized, confiscated, quarantined or destroyed by fire by any government or customs office.

V. Promotional activities for which the company's prior written consent to underwrite the coverage thereon has not been obtained.

VI. Terrorist activities.

VII. Free air tickets.

Important notes

Note 1: The beneficiary for death benefit is the statutory successor of the insured. Changes in the beneficiary are not accepted.

Note 2: "Daily necessities" mentioned above refer to underwear, pyjamas, and other necessary clothing, toiletries and sanitary supplies purchased during the flight delay period. Details are as follows:

- Items that are required or may be required during the flight delay period or prior to the cardholder retrieving his/her baggage (for example, under and outer garments, under and outer pants, socks, and warm clothing required under general circumstances).

- Items that are not required or may not be required (for example, large, thick jackets or snow garments purchased in the summer), or items for which the quantity purchased exceeds the potential requirement (for example, items purchased in advance in expectation of a delay in baggage delivery, or purchasing a dozen underwear for a day's delay in baggage delivery) are not covered.

- Toiletries are limited to essential basic toiletry products (such as facial cleansers, shampoo, body wash, tooth paste, tooth brushes, lotion, and shavers). Serum, eye cream, face masks, makeup (makeup removers), styling products, electric shavers, electric tooth brushes, and medication are not covered.

- Other items that are not generally required for daily use, such as hand luggage, suitcases, handbags, watches, decorative items, and books are not covered.

Please manage your finances carefully and value your credit . Interest on revolving credit and cash advance 5.68% to 15.00%. Service Charges for cash advance NT$100 + the amount of cash advance * 3.5%. Base date of interest on revolving credit: September 1 2015.

Connect with us

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Single Trip Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How single trip travel insurance works

How to choose between travel insurance companies, best plans for single trip travel insurance, other tips for travel insurance for a single trip, travel cards that come with complimentary travel insurance, single travel insurance for a trip recapped.

There are many types of travel insurance, including plans that’ll reimburse you for emergency medical expenses or unexpected travel delays. Along with coverage types, there are also different durations of travel insurance.

Single trip travel insurance will cover you during one vacation, while multitrip or annual travel insurance can last for multiple outings. Let’s take a look at single trip travel insurance, what kind of coverage you can expect and how to choose a plan that works for you.

Purchasing a travel insurance plan is fairly simple, as is making a claim. It generally goes like this:

You gather a few quotes from travel insurance companies.

You pick a plan that suits your needs and customize it to your liking.

You purchase your plan and include a date for it to start.

You go on your trip.

If something happens (such as a flight delay), keep the proof.

You make a claim with your travel insurance company.

The travel insurance company reimburses you.

There are a few variations in how this can work (for instance, some travel insurance plans can pay a medical provider directly), but for the most part, this is how the process will go. This is the case whether you have one-trip travel insurance or multitrip travel insurance.

» Learn more: How to find the best travel insurance

There are several travel insurance companies out there, which can make choosing a plan difficult.

NerdWallet analysis found that some travel insurance providers rise above the rest in terms of breadth and depth of coverage, cost, customizability, and overall customer satisfaction. Jump to see our findings on the bets plans for single trip travel insurance.

However, before choosing a company and purchasing a plan, consider these questions:

How much am I willing to pay?

Do I want trip protection, emergency medical coverage or both?

Do I already have coverage somewhere?

How much customizability does my plan need?

Do I need coverage for preexisting conditions?

Will I be doing any sort of adventure activities?

Once you’ve answered these questions, do your due diligence and get quotes from multiple sources. Different providers will offer differing levels of coverage at varying prices, so it’s in your best interest to generate as many quotes as possible and read the fine print.

To make it simple, travel insurance aggregators such as Squaremouth (a NerdWallet partner) will provide you with multiple quotes at a time.

» Learn more: The best travel credit cards right now

We considered a wide variety of factors when it comes to selecting the best insurance for your trip. These factors include cost, customizability, coverage maximums, whether preexisting conditions are included and the type of coverage the policy offers.

World Nomads

World Nomads is great for active travelers because of its standard coverage of adventure activities. With just two plans from which to choose, it’s also simple to decide which one you’d like.

Covers 200-plus activities as standard.

Simple plan options.

Emergency medical coverage included.

Only two choices for policies.

Riskier activities are covered only by the more expensive Explorer plan.

Fixed-rate reimbursement for trip protection.

» Learn more: Read our full review of World Nomads

With eight plans on offer, Tin Leg has a policy for every type of traveler. Along with standard trip protections, Tin Leg also offers Cancel For Any Reason (CFAR) add-ons.

Plenty of plans from which to choose.

Preexisting conditions included in most plans.

Primary and secondary medical coverage options.

Cheapest plan doesn’t cover preexisting medical conditions.

Rental car coverage add-on available only on Luxury plan.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

Seven Corners

Seven Corners is an excellent option for those who really want to customize their plans. Whether you’re looking for medical-only insurance or a more comprehensive policy, Seven Corners has options available.

Preexisting condition coverage available.

Medical-only plans on offer.

Covers missed tours and cruise connections.

Inexpensive plan offers secondary medical insurance.

Event ticket registration coverage only for expensive plan.

» Learn more: Is Seven Corners coverage worth the cost?

Our last company on the list is unique in that it covers those who use travel rewards, like purchasing flights or hotels with points and miles . This is fairly uncommon among travel insurance providers and can be really helpful when things go awry during award travel.

Plan options include accidental death and dismemberment (AD&D) travel life insurance.

Covers up to $300 in frequent traveler reward costs.

Worldwide travel assistance included on every policy.

Cancel For Any Reason insurance available only on most expensive plan.

Just $35,000 in emergency medical for basic plan (low compared to similar policies at other companies).

» Learn more: Our full TravelSafe review

If you’re interested in getting travel insurance, do yourself a favor and consider these tips before making any purchases:

Consult your medical insurance provider to see whether it offers coverage out of country .

Consider an annual plan to save money if you make multiple trips per year.

Check your credit card for complimentary travel insurance . Many offer this benefit, and if its limits are satisfactory, you can book your travels with it and avoid buying a separate policy out-of-pocket altogether. More on this in the next section.

If you're looking to get coverage for a one-off trip, among your best options is to simply pay for your travel with a card that includes travel insurance as a benefit.

Most travel cards will include coverage for things like trip interruption , trip delays and lost luggage .

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

If you’re in the market for single trip travel insurance, there are plenty of options available to you. Before purchasing a plan, grab quotes from multiple companies because the types of coverage and costs are going to vary.

Beyond this, be sure to check whether your credit card offers complimentary travel insurance and reach out to your medical insurance provider to see what type of coverage it offers overseas.

American Express insurance disclosures

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

- HSBC EveryMile Credit Card

Receive up to $1,000 RewardCash (or 20,000 miles) when you apply and spend with an HSBC EveryMile Card. T&Cs apply.

Earn miles faster and spend them the way you want.

Earn unlimited miles at a rate as low as HKD2 = 1 mile, and enjoy a wide range of complimentary travel perks.

- Up to $800 RewardCash (or 16,000 miles)[@cards-welcomeoffer]