- Business Services Explore Topic

- Things To Do Explore Topic

- Getting Around Explore Topic

- Government Explore Topic

Travel Policy

Before you go.

Review the City travel procedures.

- Employee Travel Procedures - Local

- Employee Travel Procedures - Overnight

- Car Rental Procedures

- Contact your Department Travel Coordinator for help with determining the cost of the trip.

- For overnight travel complete Travel Authorization Form .

- For travel pre-paid by the City, have your Department Travel Coordinator book the travel on the City Travel Card.

- For travel that is not pre-paid by the City, use an incorporated travel agency or secured internet site and use your personal credit card. You may also book travel directly with a reputable travel provider by telephone, using your personal credit card. Obtain a printed receipt for use when seeking reimbursement through the travel expense report.

- Travel advances are strongly discouraged. However, if you are unable to travel without a travel advance, you may request authorization from your department head. You will need to complete and sign a Travel Advance Request. Requests should be made two weeks prior to departure and submitted to Finance Accounting staff. Checks will be given out the Friday prior to departure. Travel Advance Request Form .

- Leave phone numbers where you can be reached, while away from the City.

- Review the policies and resources.

- Per Diem Rates

- Employee Travel Policy - Local

- Employee Travel Policy - Overnight

- Contractor Travel Reimbursement Conditions (City-paid Travel by Non-Employees)

While you're away

- Use the city phone number (1-800-348-MPLS) to call your office. These calls are considerably cheaper than calling collect or with a calling card.

- Save all the receipts required for your travel expense reimbursement request.

- Get a hotel receipt showing payment when you check out. Express check out slips are not valid receipts and you will have to wait for your credit card statement, canceled check, or for the hotel to mail you a receipt, before you can file your travel expense reimbursement request.

- Save your conference agenda. This will verify attendance and will list meals you need to deduct from the maximum allowable for meals & misc., for your Travel Expense Reimbursement Request form.

- Save the last page (passenger copy) in your airfare booklet.

When you return

- Travel Expense Request Reimbursement form

- Travel Expense Approvals

- Forms must be turned in to Finance – Payroll within 45 days from return of travel. The reimbursement will be made on a subsequent payroll disbursement.

- If you have questions, please contact us .

Traveling on City business

Learn how to plan your travel and submit reimbursement forms.

Christopher Fittipaldi

Finance Manager Internal Control & Financial Risk Manager

Email Christopher Fittipaldi

612-673-2004

Last updated on September 12, 2023

Need help? We're here for you.

Ask 311 about City services or report non-emergency issues. You can access 311 in many ways, including:

- Texting service

- 311 mobile app

- TTY/TDD service

- Report an issue

NRMC | Find the answer here

Destinations unknown: how to create travel and transport policies that balance safety and flexibility.

By Melanie Lockwood Herman

If you haven’t updated your travel and transportation policies lately, they may be out of sync with your current reality. This article explores a pragmatic approach to creating new or updated travel and transport policies that will help you get out in the community where your mission comes to life.

Make Traveler and Community Safety Top of Mind

Three years of managing through a global pandemic reminded nonprofit leaders that personal safety is key to mission success. In the pre-pandemic era, many nonprofit travel policies focused on the twin pillars of cost and compliance. Such policies reminded employees to always choose the most economical mode of travel, while imposing strict requirements for use of organization credit cards and completion of expense reimbursement forms.

While cost and compliance remain valid considerations, in today’s new reality, safe travel practices should headline travel communications. Staff whose travel choices put cost ahead of safety cannot be effective mission ambassadors. Remember that negative experiences leave a deeper imprint than positive ones. You’re more likely to remember the one time an airline lost your suitcase than the dozens of times your bag arrived safely. One business traveler we spoke with for this story explains: “We were required to stay in a dumpy hotel to save a few bucks; next time I’m asked to travel, I’m going to find an excuse not to. It was impossible to sleep with the noise happening in the rooms on either side of mine.”

Heather Chadwick, Director of Risk & Policy at Teach For America (TFA), told me that TFA now prohibits staff from using “any home-sharing services (Airbnb, VRBO, HomeAway, etc.) for lodging, since laws for such services vary for each state and these services may create greater safety, security and harassment risks compared to hotels offered through our centralized travel booking site. We are aware that home-sharing can sometimes be more economical, but we do not allow exceptions because of our concern for the safety of the TFA team.” TFA also keeps safety top-of-mind for vehicle rentals. Heather reports that TFA staff may “not use any peer-to-peer car rental services (Getaround, Turo, Maven, etc.) for transportation since laws for these services vary for each state and these services may create greater safety or security risks.”

Tip: When you read your travel and travel reimbursement policies, does your commitment to safe travel leap off the page? Or is it buried in dense narrative about submitting timely expense reports and getting advance approval before booking trips?

Provide Important Information in an Accessible Format

A common experience for frequent travelers is landing in a distant city and struggling to remember the name and address of your destination. I’ve taken a few trips where I wound up sitting in the baggage claim area to recharge my phone so I could look up the name and address of my hotel. To avoid that scenario, I write down that important info on a small piece of paper and keep it tucked in a pocket. Working outlets on a plane are nice, but not always available!

A colleague I consulted about this topic told me that at his company they have taken that small piece of paper one step further: they provide a handy, business-sized card to all travelers. The card lists the services and points of contact the traveler might need in an emergency. The company also requires that travelers post their full itineraries on calendars available to the team.

Tip: Before printing up handy cards for travelers, ask your team what numbers, services, providers, web addresses and other information they would find most valuable on a small, printed card. Set a reminder to review the printed cards at least twice annually to make sure they remain up-to-date. With a plethora of providers offering low-cost printing for business cards, the small expense to create a travel safety card will pay off the first time a traveler relies on the information. And the peace of mind a printed card offers is priceless.

Revisit Dollar Limits and Per Diems

While a growing number of nonprofits simply ask travelers to use discretion and judgment in booking reasonably priced accommodations, others continue to use per diem rates. If you’ve been part of the wave of people traveling for pleasure and business after three years of staying close to home, you’ve probably noticed that travel costs are much higher this year. According to NerdWallet, “…the overall cost of travel is up 16% compared with May 2019…” although airfare ticked downward in 2023 after hitting record levels in mid-2022.

One of my colleagues in the insurance industry told me his company has increased per diem amounts for all travel categories across the board, and has set separate per diem rates for each meal of the day and by type of location. The company’s policies don’t have city-specific rates, but rates are higher for major metropolitan areas. The Federal government’s FY 2023 per diem rate for lodging is incredibly low at $98, but 316 non-standard areas in the US have higher per diem rates. And the Federal Travel Regulation allows for actual reimbursement when the per diem rate is insufficient.

Another colleague, who leads operations for an international nonprofit, told me her organization has changed its travel policies to permit staff to book refundable fares and provide a per diem of 100% of meals and incidentals expense, instead of the prior practice of providing 50 or 75%. She added that the nonprofit is now more generous in covering airplane seat upgrades, day rooms for long layovers, and contributing to lounge memberships.

Tip: If you have chosen the dollar limit or per diem route, consider whether you’re requiring travelers to spend endless hours (time = money) finding safe, suitable accommodations instead of focusing their attention on your mission and their critical work tasks.

Ask, Don’t Assume, That Staff Are Available to Travel

One senior nonprofit leader I interviewed for this article told me that “A trend we’re seeing is an overall decrease in some employees’ desire to travel for work, or for as long or often.” If you’re a member of the Gen X or Baby Boomer generation, you may recall a time when you were told, not asked, about an upcoming business trip. And that was long before business travel expectations were added to position descriptions!

Keep in mind that a staff member’s availability and interest in travel will likely change during the course of their employment at your nonprofit. Following an intense period of caring for an elderly parent or after the kids have finally left the nest, a team member may be eager to resume travel. Check in with team members regularly to inquire about availability to travel; don’t assume the employee’s preference last year remains true today.

Tip: If a high-performing employee tells you they are unable to travel outside the area, refrain from questions that simply satisfy your curiosity about why. Accept the employee at their word, encourage them to reach out if that preference changes, and ask if it would be ok to revisit the topic in a year’s time.

You Can’t Go Back: Recognize the Staying Power of Remote Work

Heather Chadwick shared that Teach For America’s business travel practices have changed significantly in recent years, but while business travel has increased some, she doesn’t expect it will ever return to pre-pandemic levels. She adds, “We continue to balance budget constraints with org-wide needs and we recognize the impact that in-person work can have so we are trying to be intentional about when in-person work happens.”

Tip: Convene your team to talk about remote versus in-person meetings. What circumstances truly warrant the inconvenience and cost associated with business travel? At NRMC we believe site visits for Risk Assessments are very helpful when the mission of the nonprofit includes delivering diverse programs from multiple facilities. If a client’s team mostly works remotely, we conduct the entire Risk Assessment without ever getting on an airplane or on the road.

Be Proactive: Just Because It Hasn’t Happened Doesn’t Mean It Can’t or Won’t

A senior risk leader from an international nonprofit told me that “From supervision, and housing policies and protocols, to insurance coverage (travel-related, medical, repatriation, etc.), travel crisis communications plans, medical/health considerations/assessment, to general travel safety provisions, we take proactive steps to help ensure the health and safety of everyone who travels under our auspices.”

Being proactive and prepared are key to building organizational resilience. No nonprofit mission can afford to be stalled or waylaid because of an incident leaders believed could never happen. Advance preparation to equip travelers with tools and a safety mindset will reduce the likelihood of mishaps, and ensure that travelers know what to do and who to call if something does happen.

If you’re relying on providers that offer emergency assistance, seek assurances that those services will be available when you and your travelers need them. One senior nonprofit leader told me her organization has grown concerned about the performance of emergency evacuation providers who may be overtaxed and unable to live up to their promise of immediate and potentially life-saving services.

Tip: Risk readiness requires thinking of disruptive events and circumstances that have never happened. Invite your team to brainstorm potentially disruptive events that could impact staff travel. Ask: what can we do now to ensure resilience should that ‘what if’ event occur?

It’s a New Day: Refresh Your Travel and Transportation Policies

Each of the people I reached out to for this article offered insights into some of the most relevant trends and developments that will guide future decisions about staff travel as well as valuable recommendations to colleagues updating travel policies. These insights and recommendations included:

- “Approach your policies in a way that addresses business needs and realities, yet leaves room to reasonably accommodate, when possible, the increased overall travel health and safety concerns and needs some individuals may have coming out of the pandemic.”

- “Communicate, don’t assume! If you don’t have a travel policy, develop one.”

- “The most important thing we did was to emphasize that staff are not required to travel if they are uncomfortable traveling—no questions asked. While we emphasized it initially due to different tolerances/circumstances with the pandemic, we are also referring to it in other contexts, such as in connection with travel to countries with anti-LGBTQ laws.”

- “Make sure you’re looking at your policies through an equity lens. For example, our organization has added additional benefits for parents with small children.”

With respect to policies concerning the transport of clients and participants, remember to:

- Ensure all drivers have been screened and deemed eligible to drive on your behalf.

- Institute checks to verify that vehicles your nonprofit owns are properly maintained and checked to ensure safety features are working as intended; these checks should be more frequent than the safety inspections required by your state.

- Properly train drivers and require them to sign a pledge agreeing to safe driving practices.

- Carefully review telematic devices and other tech tools available from your automobile insurer, and use those that have more advantages than disadvantages for your nonprofit.

- Regularly review accident and incident reports to identify root causes and follow-up items.

In the Disney/Pixar film “Up,” the globetrotting, profound Charles F. Muntz says, “Adventure is out there.” When I’m asked how I cope with the drudgery of business travel, I sometimes reply: “I love traveling because that’s where the people are!” Personally, every flight delay or cancellation, every disappointing hotel stay, and every moment of utter exhaustion has been well worth it. Without traveling to the places where nonprofits serve people and communities, my appreciation for the incredible work and impact of our sector would be a teeny fraction of the vast whole.

An up-to-date travel policy grounded in simple safety messages should be a resource, not a burden, to staff who travel to support your mission. And a practical, clearly-written transportation policy should inspire pride among those who drive on your behalf. You owe it to your mission and your traveling ambassadors and passengers to right-size and streamline these polices without delay. The world around you is waiting: are you ready?

Melanie Lockwood Herman is Executive Director of the Nonprofit Risk Management Center. She has always loved to travel, and is grateful anytime an airline delays takeoff to address maintenance and mechanical issues. Whenever possible, she sits in the window seat of the exit row. She welcomes your questions about any topic in this article or your tips for finding low-cost, last minute trips anywhere, at [email protected] or 703-777-3504.

What is annual travel insurance?

Coverage options in annual travel insurance plans, how much does annual travel insurance cost, purchasing annual travel insurance, annual travel insurance frequently asked questions, how annual travel insurance works.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Annual travel insurance offers multi-trip coverage for travelers taking several trips over a year.

- Annual travel insurance can be cheaper and more convenient but is less flexible than single trip insurance.

- A 30-year-old US resident can expect to pay between $125 to $700 for annual travel insurance.

The more you travel, the higher your chances are that something goes wrong. Fortunately, coverage is available that can soften the financial blow if you get sick, lose your luggage, or experience some other hiccup while abroad.

While single trip travel insurance can cover one-off trips, frequently travelers may want annual travel insurance, which covers all your trips throughout a year. Read on to learn what annual travel insurance covers, how much you can expect to pay, and when you should buy.

Annual travel insurance, also called multi-trip insurance, is a type of insurance policy that protects you from potential losses on all trips in a 12-month period.

An annual travel insurance plans is more expensive than one single trip policy, but annual travel insurance becomes increasingly cost-effective as you take more trips. Buying annual travel insurance is also more convenient than shopping for travel insurance every time you take a trip. As such, these policies are particularly good for people who travel for work.

While annual travel insurance offers more convenience over single trip policies, you forfeit some flexibility offered in single trip travel insurance. For one, annual travel insurance limits the maximum number of days it will cover in one trip . This threshold varies from provider to provider, but generally it's up to a maximum of 90 days.

"During the coverage period, a traveler can move between countries and remain covered on the same insurance policy," says Rajeev Shrivastava , chief executive officer at VisitorsCoverage , a travel insurance marketplace. "With 30-day coverage, the plan is no longer valid on day 31. The traveler needs to return to their home country, resetting the 30 days and allowing them to resume travel."

Additionally, some annual travel insurance policies only cover trips a certain distance (say, 100 miles) from your residence or farther. Make sure to note these limitations before purchasing your policy — particularly if most of your travel is domestic.

Annual travel insurance coverage varies by plan and provider, but it is generally less comprehensive than a single trip policy.

Annual policies typically include coverage for emergency medical care, medical evacuations, trip delays, and lost or stolen baggage. Most basic plans do not cover trip cancellations (though a few more comprehensive ones do). If you're looking for cancellation reimbursement, you may want to purchase a single-trip plan with cancel for any reason coverage.

Here are just a few things a basic annual travel insurance plan might include:

- Trip cancellation for covered reasons

- Trip interruption

- Trip delays

- Missed connections

- Lost or stolen baggage

- Baggage delay

- Rental car damage or theft

- Emergency medical treatment

- Emergency medical evacuation

- Accidental death and dismemberment

- Repatriation of mortal remains

Limitations and exclusions to annual travel insurance

As we mentioned earlier, annual travel insurance plans are less flexible compared to single trip plans. While this affects how many days are covered in one trip, it'll also limit what you can cover. For one, coverage limits are usually lower throughout the policy.

Most notably, annual travel insurance plans do not offer cancel for any reason coverage . To receive reimbursement for a canceled trip, you must have canceled for a covered reason, such as illness or a disaster at your travel destination.

Depending on your provider, you may be able to add coverage for adventure sports injuries or purchase an adventure sports-specific policy, as these are not covered by standard travel insurance.

"Annual travel insurance doesn't cover losses that arise from expected or reasonably foreseeable events," says Daniel Durazo, director of external communications at Allianz Travel Insurance . "If your trips involve high-risk adventure — like skydiving, caving, mountain climbing, or participating in any athletic competition — your annual policy may not cover medical care if you sustain injuries."

Your age, the number of trips you plan to take, where you live, and other factors will figure into the cost of your coverage. For a 30-year-old US resident taking an estimated eight trips per year, all for fewer than 30 days each, annual travel insurance plans cost roughly between $125 and $700 , according to an analysis of plans on travel insurance comparison platform SquareMouth.

For example, under Seven Corner's travel insurance , one of the companies listed in our guide on the best international travel insurance companies for its long-term coverage, a 30-year-old US resident taking trips to eight destinations (including the US) would pay $375.50 for the annual plan with the lowest annual cancellation limit ($2,500) and $648 for the highest ($10,000).

"The per-trip length of coverage is usually a determining factor of the cost," Shrivastava says. "The longer the trip duration, the more expensive the policy can be."

Since annual travel insurance plans cover you for a full year, consider purchasing your policy right before your first trip. Strategic purchase dates could help you stretch your coverage period to cover more travels, but don't ignore the drawbacks of this approach.

First, you could forget. A lot goes into preparing for a trip, so leaving your travel insurance until the last minute could cause it to fall through the cracks. If you do opt to wait, make sure you set an alarm or calendar reminder.

Additionally, if you wait too long, your policy may not cover any pre-existing medical conditions. Some travel insurance companies will only cover pre-existing conditions if you buy your policy within 14 days of making your first trip payment.

As Durazo puts it, "Whether you're choosing an individual or annual policy, the best time to purchase insurance is always at the same time as you book your travel."

Assess your travel needs

Annual travel insurance isn't right for everyone, but if you travel often, it might be a good fit. Before you take out your policy, have an idea of what travels you'll take in the next year, and use the following chart to help guide your decision.

"These plans are ideal for frequent travelers such as business travelers, digital nomads, or other avid travelers," Shrivastava says. "They aren't a fit for travelers who are only taking one or two trips per year or someone looking for a more comprehensive range of benefits."

Yes, many policies include an option to add family members when you buy your policy, though. However, terms will vary depending on the insurance provider.

Some insurers allow you to automatically renew your annual travel insurance when it expires, though you can also wait until you're going on another trip to re-purchase. You can cancel annual travel insurance at any time, but you will only receive a refund if you cancel within your policy's money-back guarantee period and your trip hasn't started yet.

Pre-existing conditions can be covered under an annual travel insurance plan as long as you meet certain requirements. Policies often require that you buy travel insurance within a certain number of days from when you placed a deposit on your trip, usually two to three weeks. Additionally, many travel insurance providers require that your condition is stable.

- Real estate

- Main content

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- class="ssr-key" Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

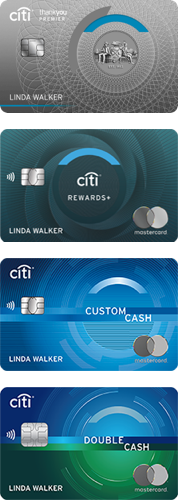

10x the fun with citi strata premier℠.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 You will earn 10 ThankYou Points for each $1 spent on hotels, car rentals, and attractions when you use your Citi Strata Premier Card to book them through the Citi Travel site via CitiTravel.com or 1-833-737-1288 (TTY: 711). For bookings made with a combination of points and your Citi Strata Premier Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

- 1.32.11.1.1 Background

- 1.32.11.1.2 Authorities

- 1.32.11.1.3.1 Approving Officials

- 1.32.11.1.3.2 Employees

- 1.32.11.1.3.3 Commissioner

- 1.32.11.1.3.4 CFO and Deputy CFO

- 1.32.11.1.3.5 Senior Associate CFO Financial Management

- 1.32.11.1.3.6 Travel Management

- 1.32.11.1.3.7 Travel Policy and Review

- 1.32.11.1.3.8 Travel Services

- 1.32.11.1.3.9 Travel Operations

- 1.32.11.1.4.1 Program Reports

- 1.32.11.1.4.2 Program Effectiveness

- 1.32.11.1.5 Program Controls

- 1.32.11.1.6 Terms/Definitions

- 1.32.11.1.7 Acronyms

- 1.32.11.1.8 Related Resources

- 1.32.11.2 General Rules

- 1.32.11.3 Travel Guidance for Year End and/or Beginning of New Fiscal Year

- 1.32.11.4 Travel During Periods Covered by Continuing Resolution Authority

- 1.32.11.5.1.1.1 Unused ticket(s) or Refund Application

- 1.32.11.5.1.2 Train Accommodations

- 1.32.11.5.1.3 Government Owned Vehicle (GOV)

- 1.32.11.5.1.4 Rental Car

- 1.32.11.5.1.5 Privately Owned Vehicle (POV)

- 1.32.11.5.1.6.1 Taxis, TNCs, Innovative Mobility Technology Companies, Shuttle Services or Other Courtesy Transportation

- 1.32.11.5.1.6.2 Limousine and Executive Car Services

- 1.32.11.5.2.1 Reduced Per Diem

- 1.32.11.5.2.2 Actual Expenses

- 1.32.11.5.2.3.1 Temporary Return to Residence or Official Station

- 1.32.11.5.2.3.2 Travel to Another TDY Location

- 1.32.11.5.2.3.3 Temporary Duty Beginning on Monday

- 1.32.11.5.2.3.4 Completion of TDY Assignment on Friday

- 1.32.11.5.2.3.5 Leave of Absence

- 1.32.11.5.3 Miscellaneous Expenses

- 1.32.11.5.4.1 Travel of an Employee with Special Needs

- 1.32.11.5.4.2 Travel of a Threatened Law Enforcement/Investigative Employee

- 1.32.11.5.4.3 Pre-Employment Interview Travel

- 1.32.11.5.4.4 Employees Detailed Beyond Six Months

- 1.32.11.5.4.5 Emergency Travel

- 1.32.11.5.5 Foreign Travel

- 1.32.11.5.6 Invitational Travel

- 1.32.11.5.7 Training Travel

- 1.32.11.5.8 Official IRS Representation at Funerals

- 1.32.11.6.1 Long-Term Taxable Travel Away From Home

- 1.32.11.6.2 Extended TDY Tax Reimbursement Allowance

- 1.32.11.7.1.1 Personal and Official Travel Combined

- 1.32.11.7.2 Fees

- 1.32.11.7.3 Profiles

- 1.32.11.7.4 Paying Travel Expenses Using the Government Travel Card

- 1.32.11.7.5 Paying for Common Carrier Transportation Expenses

- 1.32.11.7.6 Travel Advances

- 1.32.11.7.7 Claiming Reimbursements

- 1.32.11.8 Using Promotional Materials and Frequent Traveler Programs

- 1.32.11.9 Death of Employee While in Travel Status

- 1.32.11.10 Travel Payments from Other Federal Agencies

- 1.32.11.11 Payment of Travel Expenses from a Non-Federal Source

- 1.32.11.12 Travel Forms

- 1.32.11.13 Delegation Orders (DO)

Part 1. Organization, Finance, and Management

Chapter 32. servicewide travel policies and procedures, section 11. irs city-to-city travel guide, 1.32.11 irs city-to-city travel guide, manual transmittal.

March 28, 2023

(1) This transmits revised IRM 1.32.11, Servicewide Travel Policies and Procedures, IRS City-to-City Travel Guide.

Material Changes

(1) 1.32.11.1(5), Program Scope and Objectives - added approving officials.

(2) 1.32.11.1.3.7(f), Travel Policy and Review - changed travelers to employees for consistency and added timeframe, within twelve months, for clarification.

(3) 1.32.11.1.4.2(1), Program Effectiveness -Subsistence Allowances Claimed for Lodging (a) - added Lodging was booked in ETS or with TMC unless an exception to booking in ETS or with TMC is documented.

(4) 1.32.11.1.4.2(1), Program Effectiveness - Subsistence Allowances Claimed for Lodging (f) - corrected for clarification - Receipt from lodging facility and DTI invoice is uploaded into ETS.

(5) 1.32.11.1.4.2(1)(c), Program Effectiveness - Miscellaneous Items Claimed - added requirement for laundry receipt or notation of coin-operated facility used.

(6) 1.32.11.1.4.2(1)(e), Program Effectiveness - Miscellaneous Items Claimed - added Ensure receipts are provided for parking expenses in excess of $25.

(7) 1.32.11.1.4.2(1), Program Effectiveness - Miscellaneous Items Claimed - updated for clarity - d) Laundry expenses for Non-Foreign (Outside Continental United States) OCONUS and territories and all foreign OCONUS travel are not reimbursable.

(8) 1.32.11.1.4.2(1), Program Effectiveness - Transportation Expenses Claimed for Airfare/Train Transportation (c) added premium economy class.

(9) 1.32.11.1.4.2(1), Program Effectiveness - Labor/Employee Relations and Negotiations - corrected due to organization name change from Labor Relations to Labor/Employee Relations and Negotiations and updated to read: Employees’ audit errors with 1) two or more repeated violations of the Federal Travel Regulations (FTR) and/or mandatory IRS travel policy, or 2) potential fraudulent transactions (within 12 months), will be put into the Alerts system and referred to Labor Employee Relations and Negotiations for further determination of disciplinary action.

(10) 1.32.11.1.5(1), Program Controls - Lodging Cost - added DTI invoice to verify CGE reservation fees incurred.

(11) 1.32.11.1.6(2)(aa), Terms/Definitions - Local Travel - updated definition - Travel within a 50-mile radius of the employees official assigned duty station which is completed within one day and does not require any air, rail or lodging expenses.

(12) 1.32.11.1.6(2)(ac), Terms/Definitions - Non-Conventional Lodging - added recreational vehicle (RV) for clarification.

(13) 1.32.11.1.6(2)(ad), Terms/Definitions - Official Station - updated definition - An area defined by the agency that includes the location where the employee regularly performs his or her duties or an invitational traveler's home or regular place of business (see § 301-1.2). The area may be a mileage radius around a particular point, a geographic boundary, or any other definite domain, provided no part of the area is more than 50 miles from where the employee regularly performs his or her duties or from an invitational traveler's home or regular place of business. If the employee's work involves recurring travel or varies on a recurring basis, the location where the work activities of the employee's position of record are based is considered the regular place of work

(14) 1.32.11.1.6(2)(ae), Terms/Definitions - changed Official work location to Official Assigned Duty Station/Post of Duty (POD) - the specific building address of record the employee is permanently assigned.

(15) 1.32.11.2(12)(a), General Rules - revised to read premium class travel to include economy plus, business-class and first-class travel.

(16) 1.32.11.2(12)(b), General Rules - added Non-US flag carrier (See IRM 1.32.11.5.5(14), Foreign Travel).

(17) 1.32.11.2(12)(j), General Rules - added requirement for approval for booking reservations outside of ETS and/or TMC.

(18) 1.32.11.2(12)(m), General Rules - added All other expenses incurred that are a violation of the FTR or agency travel policies.

(19) 1.32.11.3, Travel Guidance for Year End and/or Beginning of New Fiscal Year - added information for travel that crosses fiscal years and obligating funds through September 30.

(20) 1.32.11.4, Travel Guidance During a Continuing Resolution Authority (CR) - added information for travel that extends beyond the end of a CR expiration date.

(21) 1.32.11.5.1, Transportation Expenses - rearranged in order of precedence per 1.32.11.5.1(3).

(22) 1.32.11.5.1(3), Transportation Expenses - added (3)(a)(b)(c) & (d) for clarification of FTR requirements for most advantageous methods of transportation by order of precedence.

(23) 1.32.11.5.1.1(4), Airline Accommodations - (c) added premium economy class.

(24) 1.32.11.5.1.1(8), Airline Accommodations - added premium economy class accommodation requirements.

(25) 1.32.11.5.1.1(11), Airline Accommodations - add criteria for premium economy class accommodations.

(26) 1.32.11.5.1.1(16), Airline Accommodations - changed business class premium economy or other premium class accommodation.

(27) 1.32.11.5.1.2(2), Train Accommodations - removed reference to cost comparison.

(28) 1.32.11.5.1.2(3), Train Accommodations - updated to simplify (3) The requirements for requesting premium accommodations including premium economy, business-class and first-class train accommodations are the same as those for airlines. See IRM 1.32.11.5.1.1, Airline Accommodations.

(29) 1.32.11.5.1.4(1), Rental Cars - added for official travel only

(30) 1.32.11.5.1.4(2), Rental Cars - added requirement for approving officials to notate reason rental car is authorized at the TDY location.

(31) 1.32.11.5.1.5(5) & (6), Privately Owned Vehicle (POV) - slightly reworded for clarification only. Added Uber/Lyft and rental car facility along with separating parking for clarification.

(32) 1.32.11.5.1.6.1(1)(a)(b)&(c), Taxis, TNCs, Innovative Mobility Technoligy Companies, Shuttle Services or Other Courtesy Transportation - updated for clarification adding a, b & c.

(33) 1.32.11.5.1.6.1(2), Taxis, TNCs, Innovative Mobility Technology Companies, Shuttle services or Other Courtesy Transportation - added Employees are not authorized the use of luxury or executive type vehicle services offered by Uber or Lyft (e.g., Uber Black, Uber Premier, Lyft Lux, etc.).

(34) 1.32.11.5.2.1(5), Reduced Per Diem - updated per interim guidance (IG) CFO-01-0222-0001, dated March 10, 2022.

(35) 1.32.11.5.2.3.1(1), Temporary Return to Residence or Official Station - added extended CONUS or non-foreign (Alaska, Hawaii and other US territories) for clarification.

(36) 1.32.11.5.2.3.1(4), Temporary Return to Residence or Official Station, added Authorized return home does not apply to foreign travel assignments. Periodic returns home from a foreign assignment would not be a costs savings once you factor in expenses and loss of productivity, for clarification.

(37) 1.32.11.5.3(6), Miscellaneous Expenses - added If a coin operated laundry facility is used, employees must notate in comments coin operated laundry facility used.

(38) 1.32.11.5.3(7), Miscellaneous Expenses - changed 2% to 2.5% due to change in Citibank terms.

(39) 1.32.11.5.3.(8)(g), Miscellaneous Expenses - added (cost of an office visit not reimbursable, only the cost of a required test if not covered).

(40) 1.32.11.5.4.1, Travel of an Employee with Special Needs - added reasonable accommodation for clarification, reference to premium economy and reformatted section.

(41) 1.32.11.5.5(12), Foreign Travel - added If flight time is over 8 hours and premium economy seating has been authorized by the CFO for Financial Management, no rest period may be authorized

(42) 1.32.11.5.5(13), Foreign Travel - added In limited circumstances (e.g., no available flights) a rest period of more than 24 hours may be authorized.

(43) 1.32.5.5(14), Foreign Travel - added Employees whose travel includes a non-US flag carrier transportation on a common carrier that does not meet the Fly America Act (49 U.S.C. 40188) requirements or have an Open Skies Agreement, must receive prior approval from Director of Travel Management before traveling. Employees must complete Form XXXXX and submit prior to travel to the *[email protected] mailbox for review and submission for approval.

(44) 1.32.11.6, Taxable Travel Reimbursement - added Note for clarification - all expenses incurred as part of the lodging receipt to include taxes, fees, parking, etc.

(45) 1.32.11.7.1(2), Arranging for Travel Services - updated for clarification - If an employee fails to use ETS or TMC, the employee will become responsible for any additional costs such as outside vendors’ transaction fees, electronic ticketing fees, delivery fees or cancellation fees. Request to claim any travel expenses incurred by arranging travel outside of the ETS or TMC (including nightly lodging rate), requires approval from the director of Travel Management. Employees must submit Form 15299, Travel Approval Request, to the [email protected] before claiming the expense. In addition, the approving official may take appropriate disciplinary actions as stated in the IRS Guide to Penalty Determinations, Failure to Observe Written Regulations, Orders, Rules or the IRS Procedures. An audit may result in referral to Labor/Employee Relations and Negotiations for further determination of disciplinary action for failure to comply with official travel policy.

(46) 1.32.11.7.1(4), Arranging for Travel Services - added (f) Unable to find a hotel at or below per diem in ETS for the specific TDY location.

(47) 1.32.11.7.1(6), Arranging for Travel Services - added (a), (b), (c) and Note for clarification.

(48) 1.32.11.7.1(7), Arranging for Travel Services - added and TDY assignment is for 30 days or more.

(49) 1.32.11.7.1.1 (1), Personal and Official Travel Combined - added for clarification (1) Official travel becomes personal when an employee travels to or from a destination other than their official assigned duty station or authorized TDY location. Example: Employee’s official assigned duty station is Dallas, TX and they have been directed to travel to Washington, DC; however, the employee already has a personal trip planned the week before the scheduled trip to DC in Orlando, FL. Employee travels from Orlando, FL to DC rather than Dallas, TX to DC, the leg from Orlando, FL to DC is a personal leg and must be purchased on a personal credit/debit card and the employee is not allowed to use government city pair contract fare for this leg of the trip.

(50) 1.32.11.7.7(9)(a)-(f), Claiming Reimbursement - added DTI invoice indicating CGE reservations fees incurred and form of payment.

(51) 1.32.11.7.7(9)(g), Claiming Reimbursement - added Parking receipts in excess of $25.

(52) 1.32.11.7.7(9)(k), Claiming Reimbursement - added Laundry expenses regardless of dollar amount as per IRM 1.32.11.5.3(6) which states receipts for laundry expenses requires a receipt regardless of dollar amount. If a coin operated laundry facility is used, employees must notate in comments coin operated laundry facility used.

(53) 1.32.11.12(17), Forms - added Form 15402, Justification Certificate for Use of a Foreign-Flag Air Carrier or Vessel.

(54) This revision includes changes throughout the document for the following:

Updated the CFO office names and responsibilities;

Per Executive Order 13988, references to him, her and his were updated;

Added minor editorial changes to include grammar, spelling and minor changes for clarification purposes;

Updated links throughout the IRM; and

Corrected references throughout the IRM.

Effect on Other Documents

Effective date.

Teresa R. Hunter Chief Financial Officer

Program Scope and Objectives

Purpose: This IRM provides the IRS policies and procedures for city-to-city travel, including domestic, foreign, invitational and emergency travel. It uses the term city-to-city and temporary duty travel (TDY) interchangeably.

Audience: All business units

Policy Owner: CFO, Financial Management

Program Owner: The CFO, Financial Management, Travel Management develops and maintains this IRM.

Primary Stakeholders: The primary stakeholders are employees who perform or approve city-to-city travel, including domestic, foreign, invitational and emergency travel in the interest of the government for the IRS.

Program Goal: The goal of this IRM is to ensure that IRS employees comply with the IRS policy for city-to-city travel, including domestic, foreign, invitational and emergency travel.

The General Services Administration (GSA) is responsible for establishing governmentwide temporary duty travel (TDY) policies and procedures through the Federal Travel Regulation (FTR). The FTR is the governing document for temporary duty travel and transportation allowances for all IRS employees. This IRM supplements the FTR by providing IRS specific policies and procedures where needed.

Local and relocation travel is not covered in this IRM. The IRS policy regarding local travel and relocation are covered in IRM 1.32.1, IRS Local Travel Guide and IRM 1.32.12, IRS Relocation Travel Guide. In 2010, GSA amended the FTR to clarify that it covers only temporary duty travel, not local travel.

Authorities

5 U.S. Code Section 5707, Regulations and Reports

5 U.S. Code Section 5738, Regulations

31 U.S. Code Section 901, Establishment of agency Chief Financial Officers

31 U.S. Code 902, Authority and Functions of agency Chief Financial Officers

31 U.S. Code Section 903, Establishment of agency Deputy Chief Financial Officers

31 U.S. Code Section 3711, Collection and Compromise

31 U.S. Code Section 3726, Payment for Transportation

49 U.S. Code Section 40118, Government-Financed Air Transportation

Title 41, CFR Chapters 300-304, Federal Travel Regulation

Department of Treasury Directives

Revenue Ruling 93-86

5 U.S. Code Section 4101, Definitions

Responsibilities

This section provides responsibilities for the following:

Approving Officials

Commissioner, cfo and deputy cfo, senior associate cfo financial management, travel management, travel policy and review, travel services, travel operations.

The approving official is responsible for:

Completing mandatory travel policy training every two years.

Providing employees with access and the opportunity to review the material in this guide and any other travel regulations prior to traveling.

Answering questions that an employee may have about the content of this guide or related travel matters.

Providing employees who are expected to travel with information on how to apply for a government travel card.

Planning travel to ensure that employees' time and travel funds are used in the most efficient and economical manner.

Directing employees' attention to possible travel savings.

Planning travel so employees do not incur personal expenses for properly authorized travel.

Reviewing and approving travel authorizations and vouchers to ensure expenses and accounting information are correct.

Verifying the approval of any special travel requirements (such as first-class or business-class travel) before approving an authorization or a voucher.

Approving travel authorizations at least four business days prior to the actual travel dates.

Ensuring travel expenses are authorized under travel policy. The IRS cannot reimburse an employee for inappropriate expenses incurred from having received incorrect guidance.

Ensuring required receipts and supporting documentation are scanned or faxed into Electronic Travel System (ETS) or attached to the manual vouchers.

Reconciling receipts and supporting documentation against the expenses claimed on the voucher before approving.

Maintaining copies of approved travel authorizations and supporting documentation for manual vouchers in compliance with General Records Schedule (GRS) 1.1, item 010 Financial Transaction Records Related to Procuring Goods and Services, Paying Bills, Collecting Debts, and Accounting, for records retention authorized disposition.

Reviewing advances to ensure that they are appropriate for expected travel requirements.

Ensuring that employees who are either transferring or separating have repaid outstanding travel advances.

Ensuring that travelers submit travel vouchers within five working days after completing their travel.

Approving or returning a travel voucher within seven calendar days of submission (to ensure payment within 30 calendar days of submission).

Ensuring that advances are liquidated on the vouchers.

Verifying that employees who request use of a non-contract carrier qualify to do so under the FTR.

Ensuring that employees do not claim any unauthorized expenses, such as resorts, villas, spas, country clubs and time shares.

Ensuring reporting instructions are attached if purpose code "T" is used, when applicable.

Delegation Order 1-30, Authorization and Approval of Official Travel within the United States, identifies the appropriate IRS officials with the delegated authority to direct travel. This authority has been delegated to managers and may be redelegated to a level no lower than management official. However, all executives that report directly to the Commissioner must have their travel authorizations and vouchers routed to Executive Services for approval.

The employee is responsible for:

Performing official travel within the guidance of travel policies, regulations and procedures.

Requesting clarification on any travel policies, regulations and procedures that are not understood.

Planning travel to minimize travel cost to the IRS.

Exercising the same prudence and economy when incurring expenses in the performance of official travel that a prudent person would exercise if traveling on personal business.

Submitting a travel authorization at least five business days before traveling and incurring travel expenses.

Paying all charges and fees associated with the government travel card by the due date on the invoice. Employees are liable for all charges and will not be reimbursed above maximum levels prescribed by law.

Using the mode of transportation that results in the greatest overall advantage to the government.

Using the government travel card for official travel including transportation expenses (bus, streetcar, transit system), automobile rentals and other major travel-related expenses to include fuel for privately owned vehicle (POV).

Canceling unused travel authorizations.

Submitting a travel voucher within five working days after completing travel and ensuring claimed travel expenses are correct. IRS cannot reimburse an employee for inappropriate expenses incurred from having received incorrect guidance.

Liquidating a travel advance on a voucher or submitting a check to Travel Operations.

Accounting for travel advances received and repaying any advances that are not liquidated by travel expenses. Employees are indebted to the government for advances.

Paying additional expenses resulting from scheduling travel for personal convenience and charging excess travel time against leave.

Not delaying the performance of official travel for personal reasons.

Not claiming personal expenses on travel vouchers.

Ensuring required receipts and supporting documentation are scanned, faxed or uploaded into the ETS or attached to your manual voucher.

Ensuring any outstanding advances are repaid if you are separating from the service.

Ensuring approval is obtained prior to incurring any expenses that require advance approval. For example: non-contract carriers, premium-class travel, non-conventional lodging, etc.

Not claiming any unauthorized expenses, such as resorts, villas, spas, country clubs or time shares.

Acknowledge that they have read and understand the following truth and accuracy statement before signing their voucher: “I certify that this voucher is true and correct to the best of my knowledge and belief, and that payment or credit has not been received by me.”

The Commissioner is responsible for:

Reviewing travel reports during periods of restricted travel due to national emergencies, pandemics, etc.

Reviewing, denying and approving first-class travel requests.

The CFO and Deputy CFO are responsible for:

Overseeing policies, procedures, standards, and controls for the IRS financial processes and systems.

Ensuring the IRS financial management activities are compliant with laws and regulations.

Reviewing, denying and approving business-class travel requests.

Reviewing and submitting first-class travel requests to Commissioner for denial or approval of requests.

The Senior Associate CFO Financial Management is responsible for:

Establishing, maintaining, and ensuring compliance with temporary duty travel policy and procedures for internal accounting operations and financial reporting.

Approving premium-class seating.

Travel Management is responsible for:

Developing and issuing IRS temporary duty travel policy

Approving exemptions to using (ETS).

Reviewing financial policies and procedures for compliance with financial laws and regulations.

Approving reduced per diem rates.

Approving exceptions to the required distance traveled for receiving per diem.

Reviewing and submitting business-class travel requests to CFO for denial or approval of requests.

Travel Policy and Review is responsible for:

Educating customers on travel policy, FTR, ETS and travel procedures.

Reviewing travel course materials used when Travel Services conducts travel workshops and customer outreach to ensure traveler compliance with regulations and travel policy.

Authoring travel IRMs, delegation orders, travel guidance, and travel forms.

Developing, administering and managing mandatory travel training in Integrated Talent Management (ITM).

Developing travel communications.

Performing travel compliance reviews on travel documents and referring employees with two or more repeated violations, within twelve months, of the FTR and/or IRS travel policies or potential fraudulent transactions to Labor Relations for further determination of disciplinary action.

Performing 100% review of all vouchers and receipts related to gainsharing awards, F13631-A, IRS Travel Savings, before award processing.

Conducting quarterly analysis on audit findings and creating scorecards for each business unit.

Performing eTravel post audit reviews of executive travel vouchers.

Monitoring and conducting quarterly reviews of travel in excess of 30 days to ensure per diem reduction and long-Term Taxable Travel (LTTT) for all travelers to determine if travel is to a single location. Review to determine if there appears to be excessive travel to a single location and should be reported as LTTT and reviewing executive travel for potential LTTT.

Managing the Travel Management Center (TMC) contract.

Travel Services is responsible for:

Providing help desk services for users and authorizing officials.

Administering the ETS, a web-based end-to-end travel system.

Interpreting federal policies and procedures.

Communicating travel related information.

Serving as the Federal Agency Travel Administrator (FATA).

Updating training material to conduct quarterly travel workshops to continue travel education.

Performing eTravel post audit reviews of local travel vouchers.

Travel Operations is responsible for:

Reviewing and processing manual travel authorizations and vouchers.

Processing Extended TDY Tax Reimbursement Allowance (ETTRA) reimbursement.

Processing travel reclassifications identified by Travel Policy and Review.

Performing eTravel post audit reviews of city-to-city and foreign travel vouchers.

Educating travelers on established travel policy, Federal Travel Regulations (FTR) and travel procedures.

Providing customer service for vouchers reviews.

Program Management and Review

The CFO is required to report all travel and transportation payments of more than $5 million during the fiscal year to GSA.

The travel reports include a list of data elements and report formats provided by GSA. The data must be submitted to GSA by November 30 and GSA must issue a government-wide report by January 31 to OMB and Congress to be available to the public.

Program Reports

The IRS completes the following reports and submits them to the Department of the Treasury annually:

Premium-class travel.

Travel Reporting Information Profile (TRIP) report.

Acceptance of Travel from a Non-Federal Source (submitted every 6 months).

Travel by Senior Federal and non-Federal Travelers on Government Aircraft.

Program Effectiveness

The IRS ensures program effectiveness for travel authorizations and vouchers through this process:

LTTT Reviews-Current Process

Quarterly Potential LTTT review for both executives and non-executives to determine if travel is to a single location.

In-depth review and analysis for travelers that appear to be traveling excessively to a single location and possibly should be filing their travel as LTTT.

Review all executives travel for potential LTTT and 75 nights or more of travel when asked by the CFO.

Program Controls

The following chart below describes internal controls in place for the city-to-city travel program:

Terms/Definitions

This section provides the IRS terms to supplement the FTR, Chapter 300, Part 300-3, Glossary of Terms

The following terms and definitions apply to this program:

Accounting Label -- The short name for the IRS’s ETS accounting codes.

Approving Official -- The manager or management official authorized to approve travel authorizations and vouchers in accordance with Servicewide travel-related Delegation Orders. The approving official should be a grade level equal to or higher than those whose documents they are approving.

Attendant -- An individual who provides personal care and travels with an authorized IRS traveler who has a disability or special need.

Automatic Teller Machine (ATM) Travel Advance -- Cash from an ATM that is only authorized for expenses while on official IRS travel status that cannot be charged to the government travel card.

Centrally Billed Account (CBA) -- A corporate travel card account set up for IRS travelers and invitational travelers who do not have an individually billed travel card to use for official IRS travel expenses (airline and train tickets).

City-to-City -- A form of travel to a place, away from an employee's official station, to which the employee is authorized to travel, which may involve an overnight stay or lodging expense.

Commuting area -- For per diem purposes only, is defined as the area within a 50 mile radius of the employee’s residence and official station.

Conditional Routing -- The electronic routing of the IRS's ETS authorizations that require special approval by an appropriate IRS official.

Concur Government Edition Reservation Fee (CGE) -- A vendor fee that will auto-populate in a document when reservations are booked through Concur or by contacting the TMC directly.

Concur Government Edition Voucher Fee (CGE) -- The charge or fee assessed for processing a travel voucher in ETS.

Contract City-Pair Fare -- An airline transportation fare negotiated under contract by GSA. The fare is fully refundable and exchangeable and reserved for government travel.

Constructive Cost -- The estimated cost of travel by an alternate mode that is compared to the standard or authorized mode of travel to determine the best way for travel to be performed. When a traveler chooses a mode of travel other than the standard or authorized mode, the traveler is reimbursed for the constructive cost of travel or the actual cost, whichever is less.

Digital Signature -- An electronic "signature" used to indicate that an individual has certified or approved the information on the document.

Electronic Travel System (ETS) -- A government-contracted computer application and database that provides IRS travelers with automated travel planning and reimbursement capabilities. The ETS includes authorization, reservation and vouchering capabilities for domestic and foreign city-to-city and local travel.

Employee -- An individual serving in the IRS in the usually accepted employer-employee relationship. Under limited circumstances and authority, employee also refers to individuals employed as experts or consultants paid on a daily when-actually-employed (WAE) basis or serve without pay or are paid $1 a year. Such persons are not considered to have a ‘‘permanent duty station” or “official assigned duty station”: within the general meaning of that term, but they are entitled to travel and transportation expenses while away from their homes or regular places of business.

E-ticket -- An electronic ticket allowing travel without a paper ticket.

Extended TDY Income Tax Reimbursement Allowance (ETTRA) -- An allowance designed to reimburse employees for federal, state, and local income taxes incurred because of an extended temporary duty (TDY) assignment at one location and long-term assignments.

Federal Agency Travel Administrator (FATA) -- The individual responsible for managing ETS at the organization level. A FATA may serve as a systems administrator, a resource manager, or an administrator responsible for loading, updating, and maintaining the ETS tables.

Federal Insurance Contributions Act (FICA) Tax -- A payroll tax or employment tax imposed by the federal government on both employees and employers to fund Social Security and Medicare.

First Level Executive -- The lowest level executive within a business unit or operating division.

Government travel card -- A government contractor-issued card used by employees to pay for official travel expenses such as transportation, lodging, meals, baggage fees, rental cars and rental car fuel/oils, for which the contractor bills the employee.

Government Owned Vehicle (GOV) -- An automobile (or light truck, including vans and pickup trucks) that is: 1. Owned by an agency, 2. Assigned or dispatched to an agency from the GSA Interagency Fleet Management System, or 3. Leased by the government for a period of 60 days or longer from a commercial source.

Head of office -- Any of the following IRS officials: Commissioner; Deputy Commissioners; Division Commissioners; Chiefs; Chief Counsel; directors reporting directly to the Commissioner or a Deputy Commissioner; and National Taxpayer Advocate and their deputies.

Innovative mobility technology company -- An organization, including a corporation, limited liability company, partnership, sole proprietorship or any other entity, that applies technology to expand and enhance available transportation choices, better manages demand for transportation services, or provides alternatives to driving alone. Examples: Car2Go, Lime or Bird.

Invitational traveler -- Travel performed by non-Federal Government employees, including contractors, who are acting in a capacity directly related to official activities of the IRS. Reimbursement for travel by non-Federal Government employees is subject to the same regulations as travel by IRS employees.

Line of Accounting (LOA) -- A set of accounting codes that determines the fiscal year, appropriation code, activity, cost center, source code, functional area, fund, purpose, program/project field, and internal order used to finance travel.

Local travel -- Travel within a 50-mile radius of the employee’s officially assigned duty station which is completed within one day and does not require any air, rail or lodging expenses.

Management official -- An IRS employee with duties and responsibilities requiring or authorizing the individual to formulate, determine, or influence IRS policies. In addition, the individual must be a non-bargaining employee and performing commitments under Form 12450A, Manager Performance Agreement, Form 12450B, Management Official Performance Agreement or Form 12450D Management Program Analyst Performance Agreement.

Non-conventional lodging -- Any lodging that is not a traditional hotel/motel type facility which includes but is not limited to home-sharing rentals, Vacation Rental By Owner (VRBO), Airbnb, long term apartment, condominium, private home or recreational vehicle (RV).

Official station -- An area defined by the agency that includes the location where the employee regularly performs his or her duties or an invitational traveler's home or regular place of business (see § 301-1.2 ). The area may be a mileage radius around a particular point, a geographic boundary, or any other definite domain, provided no part of the area is more than 50 miles from where the employee regularly performs his or her duties or from an invitational traveler's home or regular place of business. If the employee's work involves recurring travel or varies on a recurring basis, the location where the work activities of the employee's position of record are based is considered the regular place of work.

Official assigned duty station/Post of Duty (POD) -- the specific building address of record the employee is permanently assigned.

Per Diem Allowance -- The per diem allowance (also referred to as subsistence allowance) is a daily payment instead of reimbursement for actual expenses for lodging, meals, and related incidental expenses. The per diem allowance is separate from transportation expenses and other miscellaneous expenses. The per diem allowance covers all charges and services, including any service charges where applicable. Lodging taxes in the United States are excluded from the per diem allowance and are reimbursed as a miscellaneous expense. In foreign locations, lodging taxes are part of the per diem allowance and are not a miscellaneous expense. The per diem allowance covers the following: 1. Lodging - Includes expenses, except lodging taxes in the United States, for overnight sleeping facilities, baths, personal use of the room during daytime, telephone access fee, and service charges for fans, air conditioners, heaters and fire extinguishers furnished in the room when such charges are not included in the room rate. 2. Meals - Expenses for breakfast, lunch, dinner and related tips and taxes (specifically excluded are alcoholic beverage and entertainment expenses, and any expenses incurred for other persons). 3. Incidental expenses - Fees and tips given to porters, baggage carriers, hotel staff, staff on ships and transportation to/from meals.

Pre-trip vouchers -- A pre-trip voucher is used to obtain reimbursement for common carrier fare charges and CGE fees ONLY (when incurred far in advance of a scheduled trip departure).

Privately owned vehicle (POV) -- Any vehicle (such as an automobile, motorcycle, aircraft, or boat) that is not owned or leased by a government agency, and is not commercially leased or rented by an employee under a government rental agreement for use in connection with official government business.

Residence -- The home in which an employee lives in the vicinity of the official station to and from which an employee commutes on a daily basis to the official station.

Supplemental Voucher -- A document used to reimburse employees for travel expenses omitted from a previously paid travel voucher.

Taxi -- A hired car that carries passengers to a destination for a fare based upon the distance traveled, time spent in the vehicle, other metric or a flat rate to and from one point to another (a flat rate from downtown to a common carrier terminal).

Temporary Duty (TDY) Location -- A place, away from an employee's official station, to which the employee is authorized to travel.

Texting or text messaging -- Reading from or entering data into any handheld or other electronic device.

Transportation network company (TNC) -- A corporation, partnership, sole proprietorship, or other entity, that uses a digital network to connect riders to drivers affiliated with the entity in order for the driver to transport the rider using a vehicle owned, leased, or otherwise authorized for use by the driver to a point chosen by the rider. Examples: Uber and Lyft.

Travel authorization -- An electronic or written document submitted for approval to authorize official travel. The travel authorization obligates funds and must be submitted and approved before traveling, except in emergency situations.

Travel Cost Comparison worksheet -- The form(s) used to compare the authorized official travel costs to the actual travel costs that the employee incurred by taking a different method of transportation other than the authorized method, when employee voluntarily returns home during a TDY assignment, when an employee travels indirectly to or from a TDY location and when using a POV as the method of transportation.

Travel Management Center (TMC) -- The travel agency operating under GSA contract that provides transportation, lodging and rental car services to the IRS.

YUP Fares -- In the airline industry, coach fares that offer an immediate upgrade to first or business class, usually at a slight premium to regular coach fares but at a substantial discount from the higher fares.

The following acronyms apply to this program:

Related Resources