How Much Does a Doctor Visit Cost With and Without Insurance?

Without insurance, medical care can get pricy fast. Where you live, what doctor you’re going to, and what tests you need will all figure into your doctor’s visit bill. In this article, we’ll break down those costs and give you some tips for saving money.

What Goes into the Cost of a Doctor’s Visit?

Geography is one of the biggest factors in the price of a doctor’s visit. Most medical facilities pass some of their overhead expenses onto their patients. If you live somewhere with a higher cost of living, like California or New York City, you’ll likely pay more for doctors’ visits. The practice has to pay more for utilities and rent, and those costs show up in your bill. For example, Mayo Clinic’s Patient Estimates tool quotes $846 for a 60-minute office visit in Jacksonville, Florida, but $605 for the same visit in Wisconsin.

Like the cost of living, supplies and equipment will also end up on your tab. Say you need a strep test, blood draw, or Pap smear. The supplies needed for the test plus the cost of the lab fees will all figure into the price.

Bills for the same exams and procedures can also vary depending on what kind of facility you’re going to. Smaller practices and public health centers are often a lot cheaper than university or private hospital systems. This is due in part to their buildings being smaller and their overhead fees being lower.

Price of Out-of-Pocket Doctors’ Visits

The cost of a doctor’s office visit also depends on what kind of doctor and the procedure you need to have done. For example, an in-office general wellness checkup will be cheaper than a specialist procedure. If you have an emergency, an urgent care center will be much more affordable than the emergency room.

Primary Care Physician — Physical Exam

Physicals usually include blood pressure readings, cholesterol measurements, and vaccines. Prostate exams for men and Pap smears and breast exams for women are also often included. Pediatric physicals focus on the growth milestones for your child’s age. Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools.

The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Primary Care Physician — Procedures

On top of the base cost for physical exams, you may have extra charges for any specific tests or procedures you need. According to the Cardiometabolic Health blog, the most common procedures in primary care medicine include bloodwork, electrocardiograms, and vaccines/injections.

Bloodwork is one of the biggest cost wild cards. Certain tests can run you from as little as $10 to as much as $10,000 . Large national labs like Labcorp offer pricing on their website, so you know what to expect going in. For example, Labcorp’s General Health Blood Test , which includes a metabolic panel, complete blood count (CBC), and urinalysis, costs $78.

Electrocardiograms or EKGs check your heart health and can find cardi ac issues. This quick procedure involves monitoring your heartbeat through electrodes placed on your skin. While it’s a painless and accurate way to detect heart conditions, the costs can add up without insurance. Expect to pay as little as $410 or as much as $1700 for this procedure, depending on local prices.

Vaccines are often required before sending your kids to school. The CDC publishes a vaccination price list annually to give you an idea of what to expect. For example, they quote $19-$132 for DTaP, $21 for Hepatitis A, and $13-$65 for Hepatitis B. The COVID-19 vaccine, however, is free of cost, regardless of insurance status.

Urgent Care Visit

If you have an emergency but are stable, urgent care is much cheaper than the emergency room. According to Scripps , most urgent care centers and walk-in clinics can at least treat dehydration, cuts or simple fractures, fever, flu, strep, and UTIs. Note that if you have chest pain, a serious injury, seizures, a stroke, or pregnancy complications, you should go straight to the ER .

For a base exam at an urgent care facility, expect to pay between $100-$150 . That price will go up depending on what else you need. For example, Advanced Urgent Care in Denver quotes $80 for an X-Ray, $50 for an EKG, $135 for stitches, and $5 for a urinalysis. In comparison, expect to pay $1,000-$1,300 for the same procedures in the emergency room.

How to Lower Your Out-of-Pocket Medical Costs

Healthcare expenses may seem overwhelming without insurance. Luckily, there are many resources available to help you cover the costs.

Free & Low-Cost Immunization and Wellness Clinics

For standard vaccines and checkups, look for local free or low-cost clinics. Check out The National Association of Free and Charitable Clinics’ search tool to find a location near you. Your city’s public health department should also offer free or low-cost vaccines and basic medical care services.

Certain large vaccine manufacturers also offer vaccine programs. For example, Merck’s patient assistance program offers 37 vaccines and medicines free to eligible patients. The program includes albuterol inhalers and vaccines for Hepatitis A, Hepatitis B, MMR, and HPV.

Cash Negotiations

Most health systems offer lower rates for patients paying cash. Some even have free programs for low-income families. For example, Heritage UPC in North Carolina has a yearly membership for low-cost preventative care. In Northern California, the Sutter Health medical system offers full coverage for patients earning 400% or less of the Federal Poverty Income Guideline .

As of January 1, 2021, all hospitals in the United States now have to follow the Hospital Price Transparency Rule . That means they have to list procedure prices clearly on their website. You can also call medical billing before your appointment to discuss cash pay options.

Federal Medical Payment Support

If all else fails, there are federal programs to help you cover the cost of medical bills.

Organizations like The United Way and United for Alice offer grants for ALICE (asset-limited, income-constrained, employed) patients. These are people living above the poverty level, making them ineligible for other government programs but below the basic cost-of-living threshold.

Medicaid is available for children, pregnant women, and adults under a certain income threshold. If your income is too high to qualify for Medicaid but you can’t afford private insurance for your children, you may be eligible for the Children’s Health Insurance Program (CHIP) to cover your children’s medical care.

Use Compare.com for the Best Doctors’ Visit Prices

Navigating bills for a doctor’s visit can feel overwhelming, but Compare.com is here to help. With our price comparison tool, you can search all clinic and doctors’ office prices in your area. Compare makes sure you’re prepared for the cost of your checkup long before you schedule your appointment.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

Cost of doctor visit by state

The following estimated costs are based on cash prices that providers have historically charged on average for doctor visit and will vary depending on where the service is done. The prices do not include the anesthesia, imaging, and other doctor visit fees that normally accompany doctor visit.

What happens at a doctor's visit?

People go to the doctor for routine physical exams as well as acute care when they get sick or injured. Visits to the doctor are important for preventing disease and managing any health problems. During your doctor’s visit, the physician checks your blood pressure, temperature, and heart rate.

Your doctor may listen to your heart, check your ears, nose, and mouth, and perform a physical exam. They may also ask you about your medical history and the medications you take. Your doctor may want you to have blood drawn for laboratory testing during your doctor’s visit.

How long should a doctor’s visit last?

It’s common for your entire visit to the doctor to take a long time. From start to finish, your appointment may take well over an hour . Many patients sit in the waiting room before being called back for examination.

How long you’ll wait depends on your specific doctor’s office and how busy they are. Once you’re in the exam room, the visit with your doctor will go quickly. On average, patients spend about 20 minutes in the exam room with their doctor.

Why are doctor visits so expensive?

Doctor's visits are expensive for several reasons, including their offices’ administrative responsibilities and the cost of medical services. Your doctor’s office has to work with different insurance companies and pay administrative staff trained in medical billing. Your doctor charges for their services, lab work, or imaging they run and may charge facility fees as well.

How much does a doctor visit cost without insurance?

Without insurance, your doctor’s visit can cost hundreds of dollars. On average, people in the U.S. pay just under $400 for their annual physical exam at a doctor’s office if they don’t have insurance. These costs include the provider fee for seeing the doctor and costs for any blood work or imaging that’s needed.

What are the signs of a bad doctor?

Know the warning signs of a bad doctor so you can avoid problems and get better medical care. One sign is if your doctor doesn’t listen to you or take your concerns into account during your visit. Another is if your doctor rushes through your appointment, not giving you the time needed to deal with your concerns.

A third warning sign is if your doctor doesn’t explain why certain tests or treatments are needed in a way you can understand.

What should you not tell your doctor?

Your doctor doesn’t need to know every detail about your life to provide proper care. But they do need you to be truthful about your health. You should never lie about the symptoms you’re experiencing or the medications you’re taking. If you aren’t taking medications as prescribed, your doctor needs to know. You don’t need to tell them health details they already know or give them any of your financial information.

Costs vary by specialty

The cost of a doctor visit could vary depending on the specialty. To see the cash prices for a specialist visit, type is a specialty.

* Savings estimate based on a study of more than 1 billion claims comparing self-pay (or cash pay) prices of a frequency-weighted market basket of procedures to insurer-negotiated rates for the same. Claims were collected between July 2017 and July 2019. R.Lawrence Van Horn, Arthur Laffer, Robert L.Metcalf. 2019. The Transformative Potential for Price Transparency in Healthcare: Benefits for Consumers and Providers. Health Management Policy and Innovation, Volume 4, Issue 3.

Sidecar Health offers and administers a variety of plans including ACA compliant and excepted benefit plans. Coverage and plan options may vary or may not be available in all states.

Your actual costs may be higher or lower than these cost estimates. Check with your provider and health plan details to confirm the costs that you may be charged for a service or procedure.You are responsible for costs that are not covered and for getting any pre-authorizations or referrals required by your health plan. Neither payments nor benefits are guaranteed. Provider data, including price data, provided in part by Turquoise Health.

The site is not a substitute for medical or healthcare advice and does not serve as a recommendation for a particular provider or type of medical or healthcare.

What common medical visits cost in Florida - and how they compare to nearby states

In the patchwork of health care providers in the United States, determining what a medical visit might cost can be confusing at best and life-altering at worst. The vast majority of patients who arrive at the hospital for a service recommended by their doctor do so without knowing the cost of that treatment. The price tag on most medical visits is so high for the uninsured, a full one-third of all money raised on GoFundMe is for health care costs.

A raft of legislation in nearly every state is set on tackling some of these endemic issues, with energy aimed squarely at lowering costs and expanding access. Some of this legislation is grand in scope, notably in states like New York where legislators are looking to put a public option on the table for residents there. Other states are taking a narrower approach, requiring providers to release price lists so patients are aware of what their care will cost.

Stacker analyzed cost data released on June 8, 2021, from the Centers for Medicare & Medicaid Services , common provider data from Verywell Health , and state zip codes from Simplemaps to find the average out-of-pocket cost for three typical medical visits in each state .

- Most common family practice visit costs --- Medicare recipients: $103.76 for established patients ($90.25 for new patients) --- Other insurance holders: $25.94 for established patients ($22.56 for new patients) - Most common internal medicine visit costs --- Medicare recipients: $103.76 for established patients ($135.26 for new patients) --- Other insurance holders: $25.94 for established patients ($33.82 for new patients) - Most common pediatric medicine visit costs --- Medicare recipients: $103.76 for established patients ($90.25 for new patients) --- Other insurance holders: $25.94 for established patients ($22.56 for new patients)

Florida is currently experiencing one of the worst COVID-19 outbreaks in the nation, and soon, patients in the state will have to start covering the cost of their own care. Many insurers have indicated that they will no longer cover COVID-19 care for their patients, including Blue Cross Blue Shield (Florida Blue), the state's largest provider.

Some trends held steady across most states. For family practice and pediatric visits, new patients often pay less than established patients. For internal medicine visits, new patients frequently pay more than established patients. Both of these trends exist regardless of insurance type.

Transparency is increasingly paramount in American health care. Keep reading for a look at what common medical visits cost in neighboring states and the state-level factors that may influence these costs.

- Most common family practice visit costs --- Medicare recipients: $99.34 for established patients ($85.95 for new patients) --- Other insurance holders: $24.83 for established patients ($21.49 for new patients) - Most common internal medicine visit costs --- Medicare recipients: $99.34 for established patients ($129.06 for new patients) --- Other insurance holders: $24.83 for established patients ($32.26 for new patients) - Most common pediatric medicine visit costs --- Medicare recipients: $99.34 for established patients ($85.95 for new patients) --- Other insurance holders: $24.83 for established patients ($21.49 for new patients)

One of Alabama's most serious medical issues sending patients to doctors and hospitals alike is prescription drug abuse. State legislature cracked down on so-called "doctor shopping" in 2021 with legislation that may decrease some of these case numbers. New legislation requires doctors to submit prescription information to a centralized database to prohibit abuse.

- Most common family practice visit costs --- Medicare recipients: $98.79 for established patients ($85.46 for new patients) --- Other insurance holders: $24.70 for established patients ($21.36 for new patients) - Most common internal medicine visit costs --- Medicare recipients: $98.79 for established patients ($128.38 for new patients) --- Other insurance holders: $24.70 for established patients ($32.09 for new patients) - Most common pediatric medicine visit costs --- Medicare recipients: $98.79 for established patients ($85.46 for new patients) --- Other insurance holders: $24.70 for established patients ($21.36 for new patients)

Georgia is one of a minority of states that have resisted Medicaid expansion. These states, largely in the Republican South, have broadly declined to expand Medicaid on ideological grounds. Much of the state, including its leading newspaper , is calling on the government to use funds from the American Rescue Plan to expand coverage for a half-million Georgian families who make about $17,900 a year.

Explore by Metro

Gainesville, homosassa springs, jacksonville, panama city, port st. lucie, punta gorda, tallahassee, the villages, west palm beach, trending now, 50 most meaningful jobs in america.

50 best crime TV shows of all time

Top 100 country songs of all time

100 best films of the 21st century, according to critics

Thanks for visiting! GoodRx is not available outside of the United States. If you are trying to access this site from the United States and believe you have received this message in error, please reach out to [email protected] and let us know.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

How to pick a health insurance plan

Your total costs for health care: premium, deductible & out-of-pocket costs, think about a plan's deductible and copays, not just the premium.

The amount you pay for your health insurance every month. In addition to your premium, you usually have to pay other costs for your health care, including a deductible, copayments, and coinsurance. If you have a Marketplace health plan, you may be able to lower your costs with a premium tax credit.

Refer to glossary for more details.

Your expenses for medical care that aren't reimbursed by insurance. Out-of-pocket costs include deductibles, coinsurance, and copayments for covered services plus all costs for services that aren't covered.

- Monthly premium x 12 months: The amount you pay to your insurance company each month to have health insurance.

- Deductible : How much you have to spend for covered health services before your insurance company pays anything (except free preventive services)

- Copayments and coinsurance : Payments you make to your health care provider each time you get care, like $20 for a doctor visit or 30% of hospital charges.

- Out-of-pocket maximum : The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Estimate the health and drug services you’ll use

Get estimated total yearly costs when you preview plans & prices.

- Enter some basic information (like ZIP code, household size, and income) when asked. Then, select View plans .

- Select Add yearly cost on any of the plans listed.

- Pick the level of care you expect to use this year— low, medium, or high use.

- Select Save and continue to get your Estimated total yearly costs for each plan listed.

Pick a health plan category that works for you

- If you don’t expect to use regular medical services and don’t take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

A discount that lowers the amount you have to pay for deductibles, copayments, and coinsurance. In the Health Insurance Marketplace®, cost-sharing reductions are often called “extra savings.” If you qualify, you must enroll in a plan in the Silver category to get the extra savings.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Consider plans with easy pricing

- Doctor and specialist visits, including mental health

- Urgent care

- Physical, speech, and occupational therapy

- Generic and most preferred drugs

- Deductibles

- Out-of-pocket maximums

- Copayments/coinsurance

Compare only plans with easy pricing when you shop for coverage

- When viewing plans, select Add filters .

- Pick a Health plan category (Bronze, Silver, Gold, or Platinum). Then, select with easy pricing .

Health Spending

- Quality of Care

Access & Affordability

- Health & Wellbeing

- Price Transparency

- Affordability

- Prescription Drugs

How costly are common health services in the United States?

By Daniel McDermott , Julie Hudman , Dustin Cotliar, Gary Claxton , Cynthia Cox Twitter , and Matthew Rae Twitter

November 4, 2020

Stay Connected

Get the best of the Health System Tracker delivered to your inbox.

It is well documented that the U.S. is an outlier among peer countries when it comes to health spending, and recent Peterson-KFF analysis finds that the cost of inpatient and outpatient care is the primary driver behind this gap in health expenditures. In addition, countless news articles have highlighted extremely high medical bills sent to patients, often resulting from balance billing from out-of-network providers. However, the actual costs of specific healthcare services in the U.S. are often hard to track down and can vary widely between plans and across the country.

In this analysis, we explore the average cost of several common healthcare services in the U.S. We analyzed data from a sample of the IBM MarketScan Commercial Claims and Encounters Database, which includes health claims from non-elderly people enrolled in large employer plans. When possible, we show how these costs have changed over time and how they vary geographically.

The charts in this analysis show average allowed amounts large employer health plans agree to pay for in-network and out-of-network care. We refer to “cost” as the weighted average total expenditures made towards a given admission or service, including the portion paid by the health plan and any out-of-pocket costs paid by enrollees under the plan’s cost sharing. However, the charts do not include any balance bills (“surprise bills”) that out-of-network providers may send directly to patients.

This collection demonstrates that the costs associated with many common health services have risen more rapidly than general economic inflation, and that there are large geographic variations in the cost of the same health services across the United States. For example:

- The average cost of a hospital admission among large employer plans increased by roughly $10,000 (68%) from 2008 to 2018

- Over the same period, the average cost for a laparoscopic appendectomy increased nearly five times faster than inflation

- The average cost for a lower back MRI is nearly three times higher in the Houston, TX area ($1,106) than in the Las Vegas, NV area ($404)

Related Content:

Charges for emails with doctors and other healthcare providers

How financially vulnerable are people with medical debt?

There is wide variation in the cost of inpatient hospital admissions depending on the type of admission.

The average cost of an inpatient hospital admission for people with large employer coverage was $24,680 in 2018. The cost of a hospitalization varies widely, depending on the reason for the admission. Maternity and newborn admissions, for example, average $14,952, while the cost of a surgical admission is much higher, averaging $47,345. For the purposes of this analysis, the cost of an inpatient admission includes the cost of professional services provided by physicians or hospital staff as well as any drugs that may have been administered during the hospital stay.

The cost of inpatient hospital admissions for surgical and medical care nearly doubled from 2008 to 2018

Among people with large employer coverage, the average cost of inpatient hospital admissions has increased by nearly $10,000 (68%) since 2008. Inpatient admissions for surgical care experienced the steepest cost increases, rising by $22,291 (89%) over the decade. General medical admission costs also rose steeply, by $9,850, or 85%, over the decade. Psychiatric and substance use admissions also increased in cost by $6,139 (82%). For reference, inflation increased 17% over the same period.

The cost of an inpatient admission varied by location in 2008 and 2018

The cost of an inpatient admission has increased across all regions since 2008. The chart above shows the average cost of an inpatient admission across the 25 Metropolitan Statistical Areas (MSAs) with the highest number of inpatient admissions among large employer plans in 2018.

On average, inpatient hospital admissions were most expensive in the San Diego, CA, area in both 2008 and 2018. The least expensive areas for an inpatient stay also remained constant over that period – St. Louis, MO and the Louisville area in KY and IN.

The average cost of full knee or hip replacements varies considerably across markets

This figure shows the average cost of an inpatient admission for a full knee or hip replacement in most populous MSAs with more than 125 procedures in 2018. There is considerable geographic variation in the average cost paid by large employer plans and their enrollees for these surgeries. For instance, the average cost of a full knee or hip replacement in the New York City area is $56,739, which is 127% higher than the average cost in the Baltimore area ($25,044) and 61% higher than the national average ($35,263).

The average cost of a full knee or hip replacement has increased faster than other prices in the economy

The average cost of an inpatient admission for a full knee or hip replacement increased 38% (or $9,662) from 2008 to 2018, compared to a 17% increase in inflation over the same period (as measured by the GDP deflator).

The average cost of a laparoscopic appendectomy procedure has increased far faster than general inflation

Among large employer plans, the average cost of an inpatient admission for a laparoscopic appendectomy was $23,385 in 2018. The average cost for a laparoscopic appendectomy nearly doubled from 2008 to 2018 (increase of $11,456 or 96%), growing much faster than inflation over the same period (17%).

The average cost of laparoscopic gallbladder removal surgery has increased more than four times faster than general inflation.

A laparoscopic cholecystectomy involves the surgical removal of the gallbladder. The cost of an inpatient admission for this surgery nearly doubled from $15,900 in 2008 to $28,233 in 2018 – an increase of 78% over ten years, which was more than four times faster than inflation (17%).

The burden of medical debt in the United States

Health Cost and Affordability Policy Issues and Trends to Watch in 2024

The average cost of an inpatient admission that includes a heart attack costs more than twice as much in the new york city area than in the baltimore area.

There is considerable geographic variation in the average cost paid among large employer plans for an inpatient hospitalization that includes a heart attack. For instance, the average cost of a hospital stay that includes a heart attack in the New York area is $65,138, which is 37% higher than the national average ($47,666) and 137% higher than the average cost in the Baltimore area ($27,434).

The Baltimore area has lower-than-average costs for many inpatient admissions, including the lowest average cost for knee or hip replacements and inpatient admissions related to a heart attack. These lower inpatient prices may be due in part to Maryland’s all payer rate setting program .

Inpatient admissions for cardiac problems that require invasive surgical procedures can be much more expensive

Coronary artery disease— the buildup of plaque leading to reduced blood flow to the heart— forms the pathogenic basis for heart disease and heart attacks, the leading cause of death in the United States and a major driver of health spending.

Common treatments for these conditions aim to circumvent blockages in the arteries, and include cardiac catheterization and coronary artery bypass graft surgery (bypass surgery). Cardiac catheterization involves injecting a dye into the blood vessel to diagnose a blockage, and placement of a stent if appropriate. Bypass surgery involves grafting one or more blood vessels from other parts of the body with the coronary arteries to restore blood flow to the heart.

The average cost of an inpatient admission that included bypass surgery with catheterization (with or without a stent) and major complications was nearly $117,000 in 2018. An admission for a bypass surgery that did not involve catheterization or complications was $75,688 on average.

The average cost of an inpatient admission for an abdominal hysterectomy varies by surgical method

Hysterectomy costs vary based on the surgical method used and how much of the uterus and surrounding organs are removed. Most inpatient hysterectomies performed are ‘abdominal’ meaning the surgeon removes the uterus through a larger incision over the belly. This is in contrast to ‘laparoscopic’ and ‘vaginal’ approaches, which refer to performing the operation through smaller incisions in the abdomen or through the vagina, respectively.

Most inpatient hysterectomies are considered total hysterectomies, in which the surgeon removes the whole uterus and cervix. Other kinds include subtotal hysterectomies (removal of only a portion of the uterus leaving the cervix intact) and radical hysterectomies (removal of the whole uterus, the cervix, and the top part of the vagina). Any of these types of hysterectomies could also include the surgical removal of one or both of the fallopian tubes and/or ovaries.

Among large employer plans, the average cost of an inpatient admission for a total abdominal hysterectomy was $20,937 in 2018. Inpatient admissions for abdominal radical hysterectomies were substantially more costly at $36,485 on average, possibly because they are more invasive and because radical hysterectomies are often associated with malignancy and more complex conditions. The following chart shows costs for laparoscopic hysterectomies.

Total and subtotal hysterectomies performed laparoscopically on an outpatient basis are slightly less costly than inpatient abdominal hysterectomies

Laparoscopic hysterectomies are more common in outpatient settings and the cost of these procedures varies less dramatically than inpatient abdominal hysterectomies. On an outpatient basis, the average cost of a subtotal laparoscopic hysterectomy ($16,790) is just $343 less than the average cost of a total laparoscopic hysterectomy ($17,133). Laparoscopic hysterectomies are less invasive and, in most cases, require less recovery time than abdominal hysterectomies. Radical hysterectomies are also less commonly performed in outpatient settings.

There is considerable variation in the cost of outpatient visits depending on the severity and complexity of the visit

Outpatient physician visits with the highest level of acuity (the most severe and most complex) are coded as Level 5, whereas visits for straightforward, minor conditions are coded as Level 1. Physician visits for the most complex cases (Level 5) cost an average of $182 per visit, while compared to $46 for the simplest visits. The most common physician visits are coded as Level 3, which average $90 per visit. Overall, the average cost of an outpatient visit was $105 in 2018.

The following chart shows how the cost of an office visit has changed over time for each level.

Costs have increased over the past 10 years for all levels of outpatient visits

Average costs have increased for each of the five levels of office visits. From 2008 to 2018, the average cost of Level 1 office visits increased by $15 (or 52%) and the average cost of Level 5 office visits increased by $49 (or 37%). The average cost of Level 3 office visits, by far the most commonly coded severity, rose by $20 (or 29%) over the same period.

The average cost of outpatient visits varies considerably across markets

This chart shows the variation in the cost of Level 3 outpatient office visits across the largest MSAs with more than 10,000 visits in 2018. As an example, the average office visit in the Minneapolis and St. Paul area ($144) is more than double the average cost in the Louisville area ($68) and 60% higher than the national average ($90).

The average price of lower back MRIs has increased slower than inflation

Not all services have experienced rapid increases in prices. In 2018, the average price of an outpatient lower back MRI was $861, up from $784 in 2008. This represents a 9% price increase over 10 years, which was lower than general price inflation over the same period (17%). The prices here include the cost of the MRI itself and the professional cost of the radiologist interpretation.

The average price of lower back MRIs varies considerably by location

While the average price of a lower back MRI did not substantial increase from 2008 to 2018, there is large variation in the price of this procedure across the country. The highest average price for a lower back MRI is in the Houston, TX area ($1,106), which is nearly triple the average price in the Las Vegas area ($404), and 32% higher than the national average ($861).

The cost of outpatient surgery to repair torn knee cartilage varies considerably across the country.

Meniscus repair is an outpatient surgical procedure to repair torn knee cartilage. The national average cost for this procedure is $7,595, but there is considerable variation across MSAs. For example, the highest average cost for outpatient meniscus repair surgery is in the NYC area ($11,219), more than double the cost in the Detroit area ($4,655), and 48% higher than the national average.

There is considerable variation in the price of an allergy test across the country

The national average cost of an allergy test is $424, but there is a considerable range in prices across geographic areas. The highest average price for an allergy test is in the Cambridge, MA area ($575), which is 76% higher more than the average price in the Detroit area ($326).

Although recent policies have attempted to improve the transparency of health prices, a general lack of transparency makes it difficult for enrollees to know the total cost of a procedure or visit in advance, and even more difficult for them to know what their own liability may be. Additionally, many patients inadvertently receive treatment from out-of-network providers, putting them at risk for surprise medical bills . While this analysis examines average costs paid by insurers and enrollees for a number of common services, it also highlights the significant costs people may face for out-of-network providers.

The high cost of inpatient and outpatient care is the primary driver of the difference in health spending between the U.S. and similarly large and wealthy countries. As this analysis shows, even within the U.S., the cost of common health services can vary considerably from city to city (and a related analysis shows how these costs can even vary widely within cities). In some cases, this variation may be due to differences in severity of illness or complexity of service, but in other cases, this variation highlights extremely high and questionable prices set for care.

This analysis also shows that the cost of several health services has increased at a rate faster than general economic inflation – in some cases, many times faster. These rapidly rising costs of health services underlie growing premiums and deductibles for people with employer health insurance. Over the last decade, the amount employees have paid toward their premiums and out-of-pocket costs has exceeded wages , meaning that health care costs – and other expenses – have become harder to afford, even for those with relatively generous health coverage.

We analyzed a sample of claims obtained from the Truven Health Analytics MarketScan Commercial Claims and Encounters Database (MarketScan). The database has claims provided by large employers (those with more than 1,000 employees). This analysis only includes costs for services covered by large employer plans. We used a subset of claims from the years 2008 through 2018. In 2018, there were claims for almost 18 million people representing about 22% of the 82 million people in the large group market.

Weights were applied to match counts in the Current Population Survey for large group enrollees by sex, age, state and whether the enrollee was a policy holder or dependent. People 65 and over were excluded. We also limited claims to fee-for-service claims (excluding claims collected on an encounter basis). For all inpatient admissions, we excluded the top 0.5% of claims and claims that fall below either $5,000 or 10% of the average total price off the service, whichever is lower. For outpatient services or procedures, we also exclude the top 0.5% of claims and, unless otherwise specified below, claims that fall below either $5 or 10% of the average total price of the service, whichever is lower.

When showing the cost of a common service over time, we use the GDP deflator to benchmark the change in the price of the specific service against the change of prices in the general economy. The GDP deflator is a measure of inflation that captures the prices of all new, domestically produced goods and services. For charts depicting variation in the cost of a common service across Metropolitan Statistical Areas (MSAs), we select the 25 most populous MSAs with more than 125 procedures (unless otherwise specified in the text).

Midway through 2015, MarketScan claims transitioned from ICD-9 to ICD-10. While both systems classify procedures, they do not precisely crosswalk. Below is a summary of which codes we included:

- The cost of an inpatient admission for total knee or hip replacements are the cost of all services associated with an inpatient admission in which the principal procedure was ICD-9 code 81.54 or any of the subsequent procedures under the ICD-10 headings 0SRD and 0SRC. In addition, admissions without a principal procedure but in which the claim includes CPT code 27447 are included.

- The cost of an inpatient admission for a laparoscopic appendectomy is the cost of all services associated with an inpatient admission in which the principal procedure was ICD-9 code 47.01 or ICD-10 code 0DTJ4ZZ.

- The cost of an inpatient admission for a laparoscopic cholecystectomy is the cost of all services associated with an inpatient admission in which the principal procedure was ICD-9 codes 51.21- 51.24, or ICD-10 codes 0FB44ZZ, 0FT44ZZ, 0FT40ZZ, or 0FB40ZZ.

- The cost of an inpatient admission that include a heart attack is the cost of all services associated with an inpatient admission where the patient received one of the following ICD-10 codes: I2101, I2102, I2109, I2111, I2119, I2121, I2129, I213, I214, I220, I221, I222, I228 or I229.

- The cost of an inpatient admission for Coronary Artery Bypass Graft (CABG) surgery is the cost of all services associated with an inpatient admission where the associated diagnosis-related group (DRG) was 233, 235, or 236.

- The cost of an inpatient admission for an abdominal hysterectomy is the cost of all services associated with an inpatient admission where the admission includes CPT code 58150, 58152, 58180, or 58210.

- The cost of outpatient meniscus repair is the cost of all services on a day that contains the following: a diagnosis code under the ICD-10 headings S83.2 or M23 (meniscus injury), CPT code 29880 or 29881 (arthroscopy on knee), CPT code 01400 (anesthesia for knee surgery), and occurred in an ambulatory surgical center or in a hospital on an outpatient basis.

- The cost of an outpatient laparoscopic hysterectomy is the cost of all services on a day in which the primary procedure was CPT code 58570-58575 (total) or 58541-58544 (subtotal).

- The cost of outpatient lower lumbar MRIs includes the cost of outpatient claims with a CPT code of 72148. In addition to claims for professional services, some claims include facility fees. In cases in which no other professional services are provided on the date of service, facility fees were included in the cost of the MRI. In order to ensure that we are capturing the cost of performing the MRI and not associated services, claims in which all the cost in a day have a procedure modifier 26 are excluded.

- The cost of an outpatient office visit is the weighted average of the cost of CPT codes 99211, 99212, 99213, 99214 and 99215. These visit codes are for established patients but vary in complexity and duration. Claims with a total cost less than $5 were excluded.

- The cost of an allergy test is the weighted average cost of CPT codes corresponding with common skin tests: 95024, 95004, 95018, 95027, 95017, 95028, and 83520. Claims with a total cost less than $5 were excluded.

About this site

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.

More from Health System Tracker

How do health expenditures vary across the population?

Looking for more data?

Find out more details about U.S. healthcare from our updated dashboard.

A Partnership Of

Share health system tracker.

How much does Doctor On Demand cost?

Doctor On Demand is a covered benefit for over 98 million Americans, which means your visit will cost $0. If not a covered benefit, prices start at $89.

Here's how to find out:

- Download the app

- Register and create your account

- Add your insurance information

- Your cost will show before your visit

We partner with leading health plans and employers to serve millions of members around the country. Your telehealth visit may be as low as $0 /visit.

With Insurance

Without insurance.

See if we take your plan in just a few seconds:

Great news! Doctor On Demand works with INSURANCE_PROVIDER! Please create your account to find available doctors.

We also partner with hundreds of leading employers to offer $0 virtual care services, or you can take a visit at the prices listed below. Create a free account to learn more.

Board Certified Clinician

- $89 for a 15 min consultation

Psychologist

- $134* for a 25 min consultation

- $184* for a 50 min consultation

Psychiatrist

- $299 for initial 45 min consultation

- $129 for 15 min follow-up

Your estimated cost might change as we learn more details about your coverage, such as your specific benefits, or whether you’ve met your deductible. Register or log in to see your actual cost. We will always share the cost of your visit before you book your appointment.

We partner with these leading health plans and many more to serve millions of members around the country. This means your visit may be completely covered at no cost to you. To find out, register for Doctor On Demand and enter your plan information.

Register in the app and be ready to see a doctor, therapist or psychiatrist anytime, anywhere. Available for iPhone and Android.

What we treat

Urgent care.

- Cold and flu

- Sinus infections

- Skin rashes

- Asthma and allergies

- Urinary tract infections

- Headaches and migraines

- See all Urgent Care

Behavioral Health

- Anxiety and depression

- Trauma and loss

- Bipolar disorder

- Relationship issues

- Mental health screenings

- See all Behavioral Health

Virtual Primary Care

- Wellness visits

- Lab and screenings

- Chronic conditions

- Diet and nutrition

- RX management

- Specialist referrals

- Family medicine

- Men’s and women’s health

Chat-based Coaching

- Healthy habits

- Trouble sleeping

- Work stress

- Motivation to change

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

How Much Does Healthcare Cost in the USA?

What you need to know about healthcare costs in the united states.

People often warn visitors to America to purchase a health insurance plan before their trip because of horror stories about healthcare costs in the USA. They talk about outrageous bills for the uninsured party who finds themselves in trouble. But these dramatic stories don't really reflect the cost of healthcare in the United States - or do they? Here’s what you need to know about the cost of healthcare in the U.S. to make the best choices for your trip.

Despite its mixed reputation, healthcare in the United States performs exceptionally well in many regards. For instance, it has the best outcomes in the world for surviving a heart attack or stroke. However, it does not do well when it comes to chronic conditions like diabetes and asthma.

Waiting times, a concern in many countries with advanced health care systems, are less of a problem in the United States. Preventative health care spending is only slightly lower than in other industrialized nations. Overall, the standard of healthcare in the United States is very high. But so is the average cost of healthcare in the U.S.

US Health Insurance Plans Coverage and Costs of Insurance in the USA

If you reside in the US and your parents are planning a visit, consider one of the three travel insurance plans for parents visiting the USA .

What Is the Cost of Healthcare in the US Without Medical Insurance?

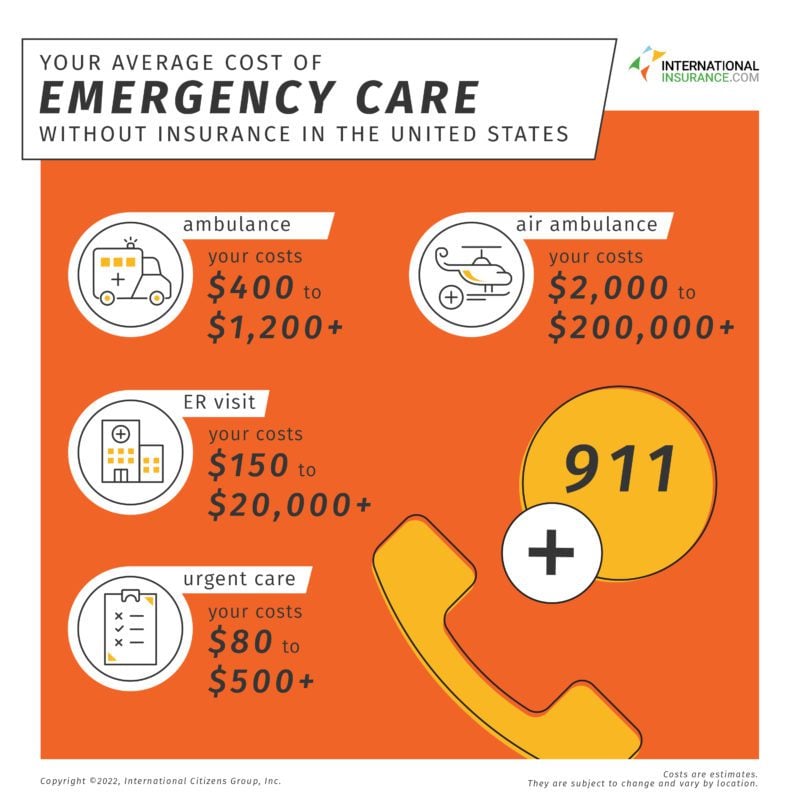

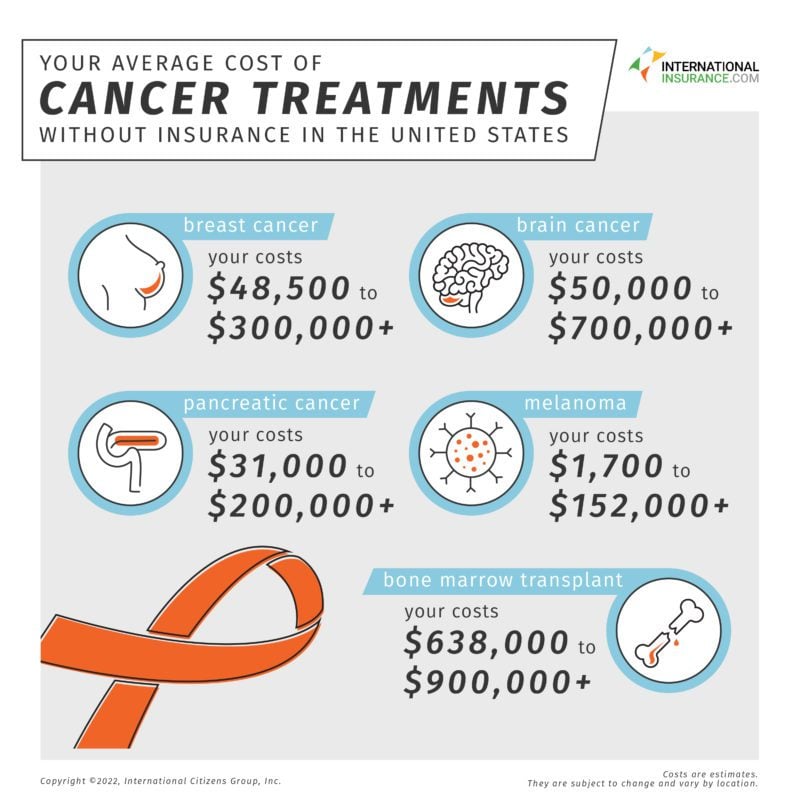

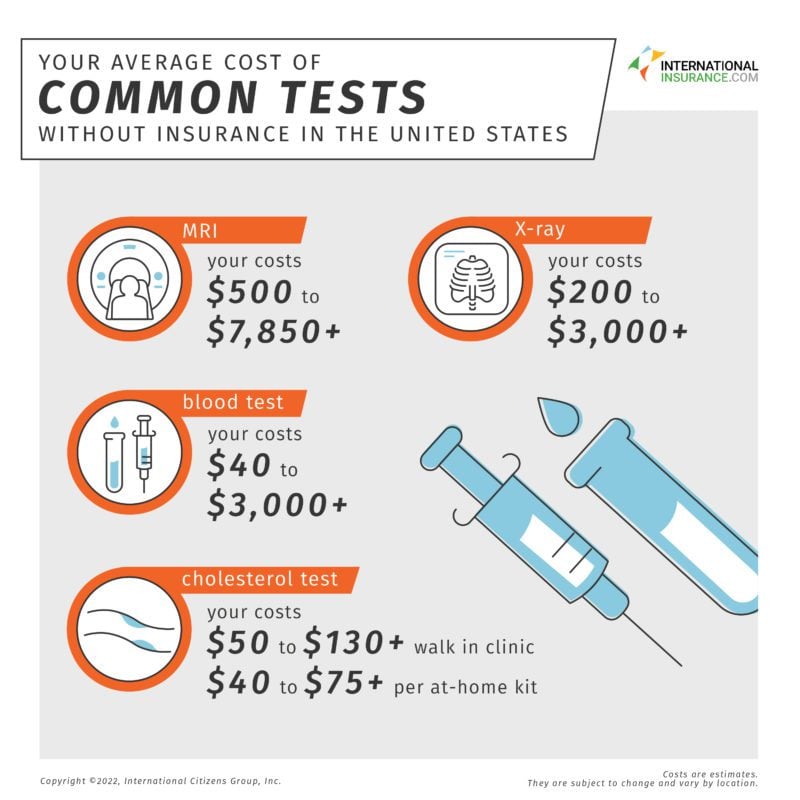

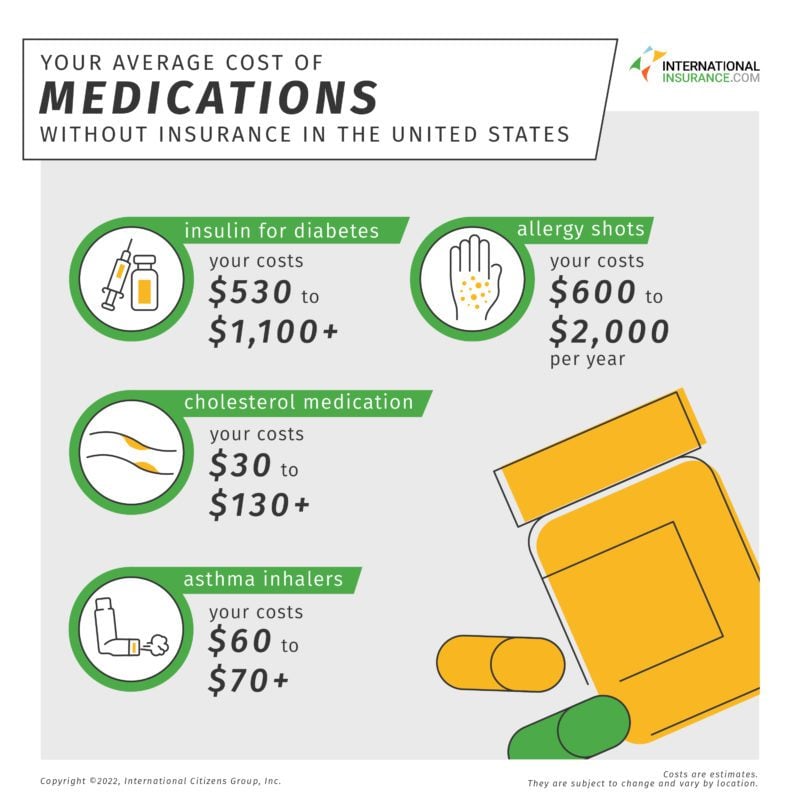

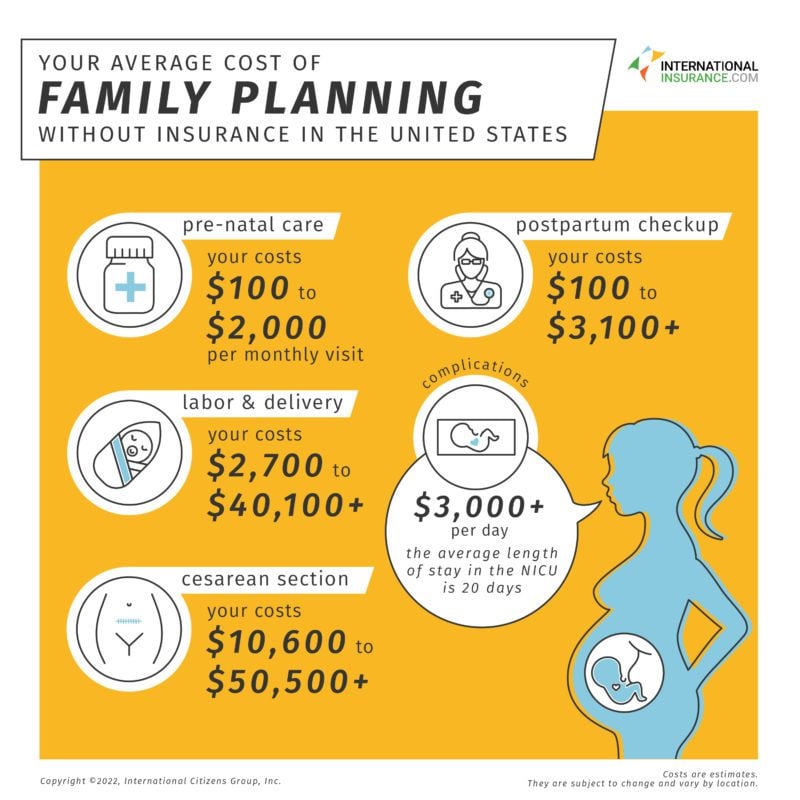

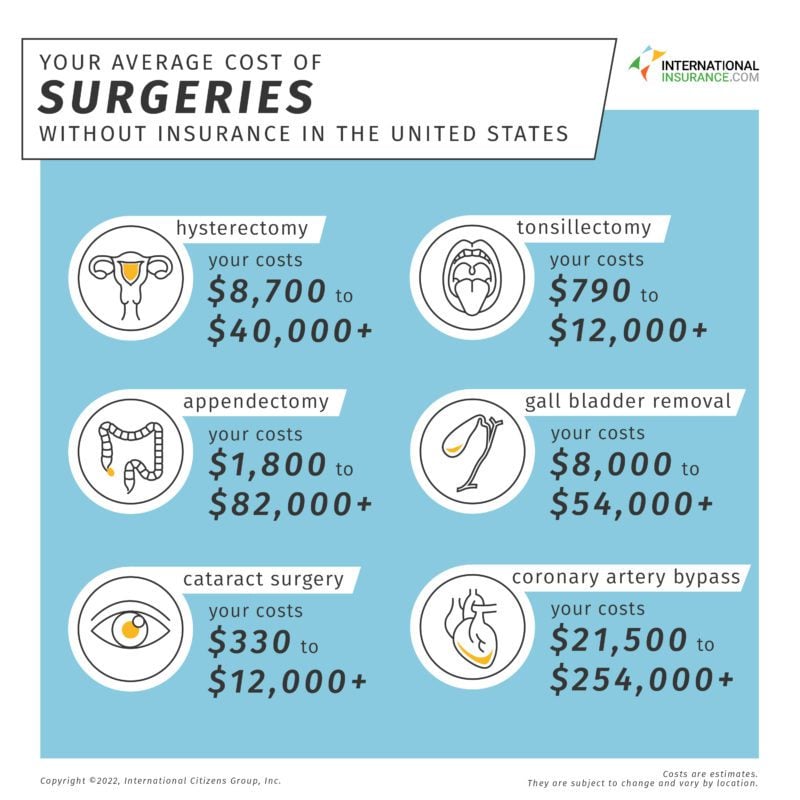

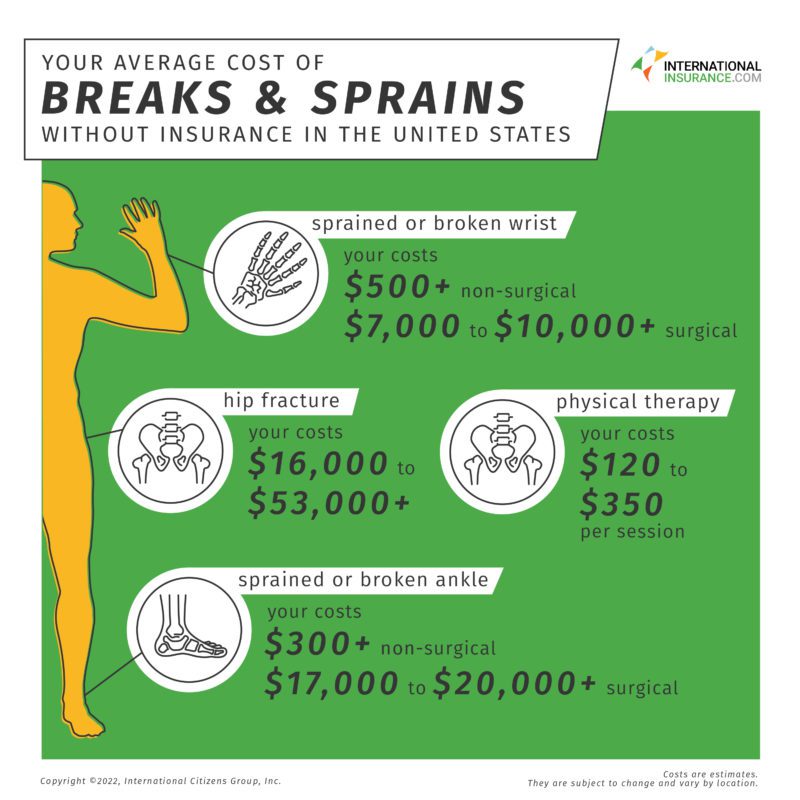

Below are average American healthcare prices for common procedures and services. These are estimates. The actual costs will vary depending on the healthcare facility providing the services. The infographics below will give you a good overview of the costs you may incur when visiting a doctor or hospital without insurance. These are the prices a visitor to the USA may face if they do not have a travel insurance plan or international health insurance plan .

These infographics list some of the typical, routine or unforeseen medical services that people require, along with their average costs. Much of this data comes directly from U.S. hospitals, which are required to list the cost of 300 of the most common medical procedures. As you will see, the cost of a doctor's visit or the average cost of a hospital stay in the U.S. varies widely depending on the services you need.

What Is the Cost of an Emergency Room Visit?

If you become ill and in need of emergency care, American healthcare prices will start adding up right away. An ambulance to take you to the hospital will start at $400. If you need tests, typical additional costs are $100 - $500. Should you need to spend the night, an additional charge of $5,000 might be added to your bill. With medications to treat your illness, the total cost of an emergency room or ER visit could be $6,000 or more!

What Is the Cost of Cancer Treatment Without Insurance?

Having cancer is enough to make anyone feel anxious about the uncertain road ahead. So any unwelcome medical costs will only add to those stress levels if you are uninsured. And, unfortunately, the costs for treatments in the U.S. \come with a high price tag. Nearly breaking the million-dollar mark is a bone marrow transplant. It could cost more than an eye-watering $900,000+. Prices start at a still pretty extortionate $638,000.

Brain cancer treatment costs anything from $50,000 to a lofty $700,000+, while breast cancer costs range from $48,500 through to $300,000+. The price it takes to tackle pancreatic cancer starts from $31,000 through to $200,000+. And melanoma treatment can be anywhere from $1,700 to $152,000+.

What Are the Costs of Common Lab Tests Without Insurance?

If a doctor is trying to diagnose your medical problem, common lab tests are important. But this is another area where the cost of healthcare in the US is high. An MRI scan will cost from $500 and up to, if not beyond, a costly $7,850+. A blood test, one of the most frequent lab tests, could be a seemingly low $40 but can ramp up to a staggering $3,000+. A cholesterol test at a walk-in clinic can be $50 to $130+ and $40 to $75+ for an at-home kit. An X-ray can cost between $200 but might also creep up to $3,000+ or more, depending on the circumstances.

What Could Prescription Drugs Cost?

American healthcare prices are also high when it comes to prescription medication. If you have diabetes and need insulin, you could be facing a cost of $530 to more than $1,100+. A year’s worth of allergy shots will set you back $600 to $2,000+. If you require cholesterol medication, you could see a $30 to $130 bill. Asthma inhalers cost between $60 and $70+. Prescription drugs can become a big part of a patient's budget.

What Is the Cost of Family Planning Without Insurance?

If you require pre-natal care, the average cost of a doctor's visit is between $100 and $2,000+. This adds up to a big total throughout even a single pregnancy. Should you go into labor and need assistance delivering your baby, this will cost anything from $2,700 up to and over $40,100.

Surgery in the form of a cesarean section costs between $10,600 and $50,500+. A postpartum check-up costs between $100 and $3,100+. If you have any birth complications, this tends to cost $3,000+ per day. And the average length of stay in the NICU is 20 days, meaning that you could potentially face a $60,000+ bill at the end of all your troubles.

What Does It Cost to Have Surgery Without Insurance in the USA?

Surgical procedures without a doubt save lives and improve outcomes. With health care costs in the USA, there's a high price to pay for the privilege. That's why we have broken down the ramifications for you. As you can see, the wide range of fees makes the average cost of a hospital stay in the U.S. hard to pin down. Coming in as the most expensive surgical procedure is the coronary artery bypass, which costs, at a minimum, $21,500 up to an astronomical $254,000+ or more.

Appendicitis attacks tend to come on quickly and require urgent attention, and that emergency appendectomy costs anywhere between $1,800 and $82,000+. Gallbladder removal costs between $8,000 to or even above $54,000. A hysterectomy starts at $8,700 but can shoot up to $40,000+. Cataract surgery is between $330 and $12,000+. That's the same as the uppermost cost of a tonsillectomy, where the lowest prices are a more reserved $790.

What Is the Cost of a Broken Bone or Sprain?

It could be an innocent tumble on the sidewalk, right through to a dramatic sporting injury. Whatever the scenario, breaks and sprains happen all the time and they are expensive for the uninsured.

A hip fracture starts at $16,000 for treatment, and goes up to $53,000+. A sprained or broken ankle could cost $300+ if surgery is not needed. But it soon jumps to a rather more unpalatable $17,000 to $20,000+ if a trip to the operating room is involved. A sprained or broken wrist costs $500+ on a non-surgical basis and leaps to $7,000 to $10,000+ if surgery is required. The resulting physical therapy will also cost you, coming in at $120 to $350 per session.

How Much is a Doctor's Visit in the United States?

A visit to the doctor's office is relatively affordable. However, if you are ill, additional costs will become expensive quickly. An initial consultation with a doctor will cost around $100 - $200. Visits to specialists are typically more expensive depending on their specialty and the nature of your visit. On average, specialists will charge $250 or more for a consultation.

What Is Behind Healthcare Costs in the USA? Why Are Medical Prices So Expensive?

Whether you are a local or a traveler, you cannot deny that the average cost of healthcare in the U.S. is expensive. According to USA Today : “The total costs for a typical family of four insured by the most common health plan offered by employers will average $28,166.” In terms of real dollars and earnings, these prices are keenly felt by the average person.

The cost of deductibles and premiums has grown at a faster rate than income. Deductibles (the amount you pay before your insurance starts to pay for covered services) grew 68.4% from 2011 to 2021, to an average $1,669, according to a report from the Kaiser Family Foundation . In addition, insured people are even more likely to have deductibles in their plans – 85% versus 74% in 2011. On top of that, premiums grew by 47% while worker earnings grew by only 31%. These figures alone prove how expensive healthcare in the USA has become and why even residents have a hard time paying for hospital bills.

The high average cost of healthcare in the U.S. is not the result of one particular challenge but rather a combination of factors that all contribute to increasing the bottom line. As CNBC noted ; “...drugs are more expensive. Doctors get paid more. Hospital services and diagnostic tests cost more. And a lot more money goes to planning, regulating, and managing medical services at the administrative level.” These factors, when put together, create a situation that makes it hard for the ordinary person to pay for medical care, especially when they do not have any health insurance in America to cover their expenses.

The Cost of Medical Care in America With Insurance

If you never go to the doctor, you won't experience these high costs. Some people feel comfortable taking that risk. But for the majority, the risks are too high.

For an expat or visitor in the USA, the best way to offset that risk is to purchase an international health insurance plan. Although a plan requires you to pay a fixed amount even if you never go to the doctor, it will cover your costs for the services detailed in the policy. A high-quality health insurance plan will cover all your costs, minus a deductible , excess, and/or co-pay (the fixed amount you pay for a covered service such as a doctor's office visit - even after you've met your deductible). Plans with higher deductibles and co-pays tend to have lower monthly fees, and vice-versa.

Depending on the plan you choose, all your costs could be covered without limit. But there are certain plans that will put a cap on how much they will pay for your medical expenses. This is called a medical maximum .

Choosing a health insurance plan in the USA with a lower medical maximum will lower your monthly premiums but you will take on additional risks in exchange. If your medical bills exceed the maximum, any additional costs will be your responsibility.

Due to all these factors, the cost of health insurance in America will vary. The cost of an international health insurance plan will be much greater than the cost of a travel medical insurance plan because the former offers more comprehensive coverage. Typically, our clients pay an average of $500 per month for comprehensive global medical health insurance. Compared to paying a $10,000 medical bill out of your own pocket, you can deduce that these premiums are reasonable.

Read: How Much Insurance Do Foreigners Need in the USA ?

Cigna Global Insurance Plan

- The flexibility to tailor a plan to suit your individual needs

- Access to Cigna Global’s trusted network of hospitals and doctors

- The convenience and confidence of 24/7/365 customer service

Common Costs in the USA Compared To Other Countries

How do the high average cost of healthcare in the U.S. impact the price of common medical procedures and treatments? Let’s look at the cost of an MRI, a frequently used diagnostic tool. All costs listed are from the most recent survey by International Federation of Health Plans , done in 2017. It's important to note that the costs listed below are lower than current U.S. prices; as noted earlier in this article, United States healthcare costs have gone up significantly since 2017.

The average cost of an MRI in the United States, according to the 2017 report, is $1,430. In Holland it's $190 while in New Zealand the price falls in the middle at $750.

The average cost of an angioplasty, which inserts a stent in a blocked blood vessel, was $32,200 in the United States at the time of the report. Meanwhile, in Switzerland, famous for both its high cost of living and its near-perfect health care standards, it's only $7,400.

When you take all of these into account, a common malady among travelers like abdominal pain suddenly becomes very costly. It will require diagnostic imaging and 24 hours of observation, which as discussed above is astronomically expensive. This is just for the diagnosis. Add in treatment and care, and the price goes up further. You can see why the average cost of a hospital stay in the U.S. is so high.

If that abdominal pain is found to be caused by an inflamed appendix that requires immediate surgery , it will cost you an average of $15,200 in the United States, according to the 2017 report. If you are in cost-friendly South Africa, it will be a meager $3,200. On the other hand, things will be a bit more expensive in the UK at $5,100 - that is still over $10,000 less expensive than getting the same treatment in the United States!

On the more dramatic end of the scale, both in terms of pricing and health risks, a bypass operation costs an average of $78,100 in the United States. In The Netherlands, it will cost only $11,700, according to the 2017 report. Either way, the cost of the operation is still far too expensive than what the average person can afford. Getting treated in The Netherlands, however, will be far less likely to cause medical bankruptcy compared to when you undergo the same procedure in the USA.

How Can You Cover Your Medical Costs in the USA?

So what can a frugal traveler or expat do? How do you reduce the cost of receiving proper health care without sacrificing quality or convenience?

Firstly, reassure yourself that common over-the-counter medications and first aid supplies are widely available and very affordable in the United States. Headache medication, mild heartburn medication, muscle cream, sinus decongestant pills, and skin ointments are all available for under $25; sometimes they're as cheap as $5.

A chat with a pharmacist is always free and they can provide sound recommendations for treating non-urgent, minor conditions. A bad cold is no more costly in the United States than it is in most other countries.

Secondly, make sure that you have health insurance in the USA. As you've seen up above, if you are traveling and fall ill, a relatively uncomplicated problem like an inflamed appendix can cost several times more than the trip itself. For non-residents, there is health insurance in the USA for foreigners that can greatly reduce costs of medical services, especially when you need them.

You do not need to face a life-threatening problem and then get slammed with sanity-threatening costs after. There is a wide variety of insurance products and packages designed for travelers. They range from the extremely comprehensive and inclusive to the more streamlined option, with a focus on coverage for the most serious and expensive of emergencies.

There is also health insurance for non-residents that can provide basic coverage for the most common ailments. This could be very helpful since healthcare in the USA is some of the most expensive in the world.

A medical emergency is stressful enough when you are traveling. You do not want it to ruin your life as well as your trip. Get health insurance in the USA to avoid headaches and astronomic costs.

If you're moving or planning to move abroad or going on an international trip and require insurance, then please consider choosing us . Here at International Citizens Insurance, we provide consumers with a resource to research, compare and purchase plans for their relocation abroad or international trip.

Through our website, we can offer some of the very best international health insurance , travel medical insurance , group insurance , and travel insurance policies to people from all around the world.

Xplorer Worldwide Medical Plan

- Premium Benefits, Coverage and Service

- Define your deductible and prescription benefits

- For Foreigners in the US or US citizens abroad

*Disclaimer: the information shown in these infographics is directional to help decision-making. Medical costs and charges are subject to change at any time and vary greatly from one geographic location to another and from one insurance plan to another.

Author: Joe Cronin , Founder and President of International Citizens Insurance . Mr. Cronin, a former expat, is an authority in the areas of international travel, and global health, life, and travel insurance, with expertise in advising individuals and groups on benefits for today's global workforce. Follow him on LinkedIn or Twitter .

Expat Insurance: Health, Life, and Travel Insurance

US Citizens Living Overseas: Insurance For US Expats

Visitors Insurance Coverage

US Health Insurance for Non-Citizens

America: Safety and Travel Insurance for the USA

Get a fast, free, international insurance quote., global medical plans, specialty coverage, company info, customer service.

UnitedHealthcare Individual & Family ACA Marketplace plans

Let's help you find your personalized Individual & Family ACA Marketplace plan. Enter your ZIP code to view and enroll in 2024 plans.

Which county are you in? UnitedHealthcare Individual & Family ACA plans are not available in your area. But we can still help. No results found near you

Your ZIP code and county determine which ACA plans are available.

We couldn’t find UnitedHealthcare Individual & Family ACA plans in your area. But you can call a UnitedHealthcare licensed insurance agent to get help finding an ACA plan that’s available near you — or go to HealthMarkets to see ACA plans from other companies online.

Call 1-877-732-0569

We couldn't find UnitedHealthcare Individual & Family ACA plans in your area. ACA plans from another company may be available through New York State of Health.

Questions? Talk with a licensed insurance agent at: 1-800-557-6718 , TTY 711

See ACA Marketplace plans

Find your personalized aca marketplace plan, aca marketplace plans with benefits that fit your needs.

unlimited primary care

Virtual urgent care 1

or less prescription drugs 2

in rewards for health 3

The affordable Marketplace plan options you've been looking for

We offer a variety of Individual & Family ACA Marketplace plans that are classified into 5 plan categories. Within these categories, “metal” levels tell you how costs are divided between you and UnitedHealthcare.

Essential High-deductible plans with basic coverage for serious illness or injury. Pay a low $0 4 monthly premium, but more when you get care.

What to know.

This is our lowest-cost plan. Your monthly premium could be as low as $0, but you'll pay more when you get care, compared to our other plans. Essential plans are available at the Bronze metal level only.

It's a good fit if

You rarely see your doctor. You want a low-cost way to protect yourself from worst-case medical scenarios, like serious illness or injury.

The UnitedHealthcare Essential Plan

Video transcript

[UnitedHealthcare logo]

ON-SCREEN TEXT: Individual & Family ACA Marketplace health plans

UnitedHealthcare Essential Plan

ON-SCREEN TEXT: Essential Plan

Your budget + Coverage that fits your needs

fits your budget and your health needs. It’s a great choice if you rarely see a doctor or want protection from serious illness or injury.

ON-SCREEN TEXT: Premiums as low as $0 1

Your monthly premium could be as low as zero dollars but you’ll pay more for care compared to our other plans.

ON-SCREEN TEXT: $0 virtual urgent care 2

You’ll get benefits like zero dollar virtual urgent care,

ON-SCREEN TEXT: $5 or less prescription drugs 2

low cost prescription drugs

ON-SCREEN TEXT: $100 in rewards 2

and up to $100 in rewards.

ON-SCREEN TEXT: Prescription delivery at no additional cost 3

Plus, extras like no cost delivery for prescriptions,

ON-SCREEN TEXT: 20% off Walgreens branded products 3

discounts on Walgreens health and wellness products,

ON-SCREEN TEXT: On-demand fitness classes 3

and on-demand fitness classes.

ON-SCREEN TEXT: In-network providers

And remember, UnitedHealthcare plans give you access to a huge selection of in-network providers

ON-SCREEN TEXT: In-network pharmacies

and over 40,000 in-network pharmacies.

ON-SCREEN TEXT: Enroll in an Individual & Family ACA Marketplace plan today

Essential Plan

Get no-cost 1-on-1 help to enroll in a plan today.

DISCLAIMERS:

1 To qualify for a $0 monthly premium, you must meet household income requirements for Advanced Premium Tax Credits.

2 The benefits described may not be offered in all plans or in all states. Some plans may require copayments, deductibles and/or coinsurance for these benefits. This policy has exclusions, limitations, reductions of benefits, and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, review your plan documents, call or write your insurance agent or the company, whichever is applicable. Plan specifics and benefits vary by coverage area and by plan category. Please review plan details to learn more. By responding to this offer, you agree that a representative may contact you.

3 UnitedHealthcare Internal Analysis, June 2023

UnitedHealthcare Individual & Family plans medical plan coverage offered by: UnitedHealthcare of Arizona, Inc.; Rocky Mountain Health Maintenance Organization Incorporated in CO; UnitedHealthcare of Florida, Inc.; UnitedHealthcare of Georgia, Inc; UnitedHealthcare of Illinois, Inc.; UnitedHealthcare Insurance Company in AL, KS, LA, MO, NJ, and TN; Optimum Choice, Inc. in MD and VA; UnitedHealthcare Community Plan, Inc. in MI; UnitedHealthcare of Mississippi, Inc.; UnitedHealthcare of New Mexico, Inc.; UnitedHealthcare of North Carolina, Inc.; UnitedHealthcare of Ohio, Inc.; UnitedHealthcare of Oklahoma, Inc.; UnitedHealthcare of South Carolina, Inc.; UnitedHealthcare of Texas, Inc.; UnitedHealthcare of Oregon, Inc. in WA; and UnitedHealthcare of Wisconsin, Inc. Administrative services provided by United HealthCare Services, Inc. or its affiliates.

Virtual Plans 5 Convenient, low-premium plans with unlimited 24/7 access to $0 5 virtual primary, urgent and specialty care. No copays. No coinsurance. Just quality virtual care through Galileo from your smartphone or tablet.

Built with flexibility and convenience on the go, this plan offers unlimited 24/7 $0 virtual care through the Galileo mobile app. Your 24/7 access to virtual care lets you interact with your doctor on your own schedule, when it’s most convenient for you. The Galileo mobile app will be your first stop for all your care needs, from everyday to urgent - including virtual primary and virtual specialty care. Virtual First and Virtual Access plans are available at the Bronze, Silver and Gold metal levels.

You like the convenience to text or have a video visit with a doctor instead of heading to the clinic.

Looking for a Spanish-speaking option?

This may be the plan for you. It offers the option to get your Galileo communications in Spanish and connect with a Spanish-speaking Galileo doctor right away.

The UnitedHealthcare Virtual First plan

Virtual First Plan

Your digital lifestyle + Benefits at your fingertips

The UnitedHealthcare Virtual First plan fits your digital lifestyle with care at your fingertips.

It’s a great choice if you prefer to talk, text or have a video visit with a doctor instead of going to the clinic.

ON-SCREEN TEXT:

Virtual First health care plans include zero-dollar unlimited virtual care.

ON-SCREEN TEXT: 24/7 access to care with Galileo app

Primary care

Specialty care

Urgent care

Using the Galileo app, you’ll have 24/7 access to primary, specialty and urgent care. Including care from Spanish-speaking doctors.

ON-SCREEN TEXT: $5 or less prescription drugs 1

You’ll also get benefits like prescription drugs for five dollars or less

ON-SCREEN TEXT: Network pharmacies

from thousands of in-network pharmacies

ON-SCREEN TEXT: Prescriptions delivered at no additional cost

and no-cost prescription delivery.

ON-SCREEN TEXT: Earn $100 in rewards 1

20% off Walgreens brand products 1

Digital fitness classes on-demand

Plus, extras like rewards, discounts at Walgreens and on-demand digital fitness classes.

Get no-cost one-on-one help today.

1 The benefits described may not be offered in all plans or in all states. Some plans may require copayments, deductibles and/or coinsurance for these benefits. This policy has exclusions, limitations, reductions of benefits, and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, review your plan documents, call or write your insurance agent or the company, whichever is applicable. Plan specifics and benefits vary by coverage area and by plan category. Please review plan details to learn more. By responding to this offer, you agree that a representative may contact you.

Value Plans with additional benefits, like $0 doctor visits from the first day of coverage as well as a Health Savings Account (HSA) option.

This plan isn’t as low-cost as Essential, but it’s close. It offers low-copay primary care visits with your doctor, and an HSA option. Like our other plans, this plan also has the option for virtual care. Value plans are available at the Bronze, Silver and Gold metal levels.

You regularly see your doctor and want something with a few more benefits than the basic Essential plan, without paying a lot for it.

The UnitedHealthcare Value Plan

Your budget + Coverage that fits

The UnitedHealthcare Value Plan offers a balance of coverage that fits your budget and needs.

It’s a great choice if you see your doctor regularly but don’t want to break your budget.

ON-SCREEN TEXT: Low-cost primary care

Value plans offer primary care at low or no cost.

ON-SCREEN TEXT: $0 unlimited virtual urgent care 1

$5 or less prescription drugs 1

You’ll also get benefits like zero-dollar virtual urgent care and prescription drugs at five dollars or less.

ON-SCREEN TEXT: Health Savings Account

Some Value plans also offer a Health Savings Account option.

With extras like a hundred dollars in rewards, Walgreens discounts, and on-demand digital fitness classes, the Value Plan keeps you covered at a price that fits your budget.

ON-SCREEN TEXT: Network providers

Network pharmacies

And remember, UnitedHealthcare plans give you access to a huge selection of in-network providers and over 40,000 in-network pharmacies.

Advantage Low or $0 deductible plans with extras, like adult vision and dental benefits. 6 Pay slightly higher monthly premium and lower costs when you get care.

This is our richest plan with the most coverage. It could be a good fit if you’re used to having lots of coverage and perks (like embedded adult vision and dental benefits). Advantage plans are available at the Silver and Gold metal levels.

You see your doctor often. You’re typically willing to pay a little more each month in order to pay less (usually copays) when you get care.

The UnitedHealthcare Advantage Plan

Advantage Plan

Your health needs + Coverage and benefits that fit

The UnitedHealthcare Advantage Plan gives you lots of benefits that fit your health needs.

This plan is a great choice if you see your doctor often and want a plan with lots of extras.

ON-SCREEN TEXT: $0 primary care 1

You’ll get lots of benefits like zero-dollar primary care,

ON-SCREEN TEXT: $0 virtual urgent care 1

and zero-dollar virtual urgent care,

prescription drugs at five dollars or less,

and up to one hundred dollars in rewards.

ON-SCREEN TEXT: $0 dental preventive visits 1

You’ll also get zero-dollar dental preventive visits

ON-SCREEN TEXT: $0 routine vision exams 1

and zero dollar routine vision exams.

ON-SCREEN TEXT: Prescription delivery at no additional cost

$0 gym membership 1

With extras like no cost delivery for prescriptions, Walgreens discounts, zero dollar memberships at in-network gyms, and on-demand digital fitness classes, the Advantage Plan helps you feel confident your needs are covered.

Copay Focus 7 $0 medical deductible plans with flat copays for most services. Know what you pay before you see your doctor.

With a $0 deductible, you won't have to worry about paying out-of-pocket costs before your plan kicks in. You'll pay defined copays, like $15 or $30, for most services starting the first day of your plan. Copay Focus plans are available at the Bronze, Silver and Gold metal levels.

You like greater cost transparency. You’re typically willing to pay a little more each month in order to pay lower, defined copays when you get care.

The UnitedHealthcare Copay Focus Plan

ON-SCREEN TEXT: Copay Focus Plan

The UnitedHealthcare Copay Focus Plan gives you predictable costs while fitting your health needs.

It’s a great choice if you want to know how much your care costs before you see a doctor.

ON-SCREEN TEXT: $0 medical deductible 1

With $0 medical deductible, you won’t have to worry about paying out of pocket to reach a deductible before your plan kicks in.

$100 in rewards 1

You’ll get benefits like low-cost virtual care, low-cost prescription drugs and up to a hundred dollars in rewards.

ON-SCREEN TEXT: No-cost prescription delivery 1

Digital fitness classes on-demand 1