Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

MasterCard Guide to Benefits

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

Are you sure you want to sign off?

Enroll in Paperless Statements and Letters

To enroll in paperless for your account, start by reading the terms and conditions below. You are agreeing to receive your statements electronically only and some of your legal notices electronically only. If you do not wish to enroll, choose Cancel and deselect the Paperless Statements and Letters checkbox.

Enrollment in Credit Card Paperless Statements and E-Communications

We send cardholders various types of legal notices, including notices of increases or decreases in credit lines, privacy notices, account updates and statements. Currently, we can provide some of these legal notices, including statements, electronically. We are working towards being able to provide all of these legal notices electronically. When we are able to provide all legal notices electronically, we will notify you by email. In the meantime, if you choose to receive legal notices electronically, you will need to monitor both your U.S. postal mailbox and your email inbox for legal notices. To receive your legal notices electronically, your computer must be capable of printing or storing email, web pages and documents in PDF format and your browser must meet minimum system requirements.

Minimum System Requirements

Your privacy and security are important to us. That is why we require you to use a browser with 128-bit security encryption to proceed with your application. This protection helps to ensure that the information you send and receive will remain confidential.

Getting Paper Copies

If you choose to receive legal notices and statements electronically and then want a paper notice, call us at the number on the back of your card and we will mail it to you.

Cancelling Paperless Statements and E-Communications

You may cancel through account online or by calling us at the number on the back of your card.

Updating Email Address

We will send notifications regarding the availability of your statement online and legal notices to the email address you provided to us until you contact us to change it. It is your responsibility to update promptly any changes in this information. If your email address changes, please update it through Account Online or call us at the number on the back of your card.

Credit Card Paperless Statements and E-Communications Authorization

I agree to receive my billing statements and other legal notices electronically as available. I understand that when I receive an electronic notice it will replace a paper copy. I also understand that I will need to check both my U.S. postal mailbox and email inbox for legal notices until you let me know by email that all legal notices will be sent electronically.

You will receive paperless notifications at the email address currently associated with your account.

Paperless Statements and Letters

To enroll in paperless for your account, start by reading the terms and conditions below. You are agreeing to receive your statements electronically only and some of your legal notices electronically only. Enrollment in Credit Card Paperless Statements and Other Communications We send cardholders various types of legal notices, including notices of increases or decreases in credit lines, privacy notices, account updates and statements. Currently, we can provide some of these legal notices, including statements, electronically. We are working towards being able to provide all of these legal notices electronically. When we are able to provide all legal notices electronically, we will notify you by email. In the meantime, if you choose to receive legal notices electronically, you will need to monitor both your U.S. postal mailbox and your email inbox for legal notices. Minimum System Requirements To receive your legal notices electronically, your device must be capable of printing or storing email, web pages and documents in PDF format, and you must use a browser with at least 128-bit security encryption to enroll. Getting Paper Copies If you choose to receive legal notices and statements electronically and want a paper notice, call us at the number on your statement or the back of your card and we will mail it to you. Cancelling Paperless Statements and Other Communications You may cancel by updating your settings on the Paperless Settings page of your account online or by calling us at the number on your statement or the back of your card. Updating Email Address We will send notifications regarding the availability of your statement and legal notices online to the email address you provide to us until you contact us to change it. It is your responsibility to update promptly any changes in this information. If your email address changes, please update it through Account Online or call us at the number on your statement or the back of your card. Credit Card Paperless Statements and Other Communications Authorization I agree to receive my billing statements and other legal notices electronically as available. I understand that when I receive an electronic notice it will replace a paper copy. I also understand that I will need to check both my U.S. postal mailbox and email inbox for legal notices until you let me know by email that all legal notices will be sent electronically. If I later let you know that I wish to receive either my statements or other legal notices in paper form, these terms will not apply to those documents. You will receive paperless notifications at the email address currently associated with your account(s).

Your Session Is About to Time Out

If you remain inactive, we will sign you out to protect your information.

Welcome to Virtual Guide

Can we help you today, if you have experienced financial hardship as a result of covid-19, log in to send us a secure message by selecting the topic “covid-19 payment waiver request”, are you sure you want to quit, access this page from your home screen..

Tap your browser's share button to ‘Add to Home Screen.’

User ID and Password Guidelines

For enhanced security, your Password, User ID and the Security Word you provided when you applied for your card should be different from each other.

User ID guidelines

A unique User ID helps safeguard your account and secure personal information.

User ID requirements

- Must be 5 to 50 characters

User ID restrictions

- Don’t use more than three consecutive or sequential digits (for example, 1111 or 1234) unless your User ID is an email address.

- Don’t use your Password or the Security Word you provided when you applied for your card as your User ID.

Password guidelines

Password requirements.

- Between 8-64 characters

- At least 1 number

- At least 1 uppercase letter

- At least 1 lowercase letter

- At least 1 special character or space: . ? * $ ! { } - _ + % ^ @ [ ]

Password restrictions

- Don’t use your name or User ID as your Password.

- Don’t use more than 2 consecutive identical characters, including spaces.

- Don’t use existing or the last 6 passwords.

Password tips

- Passwords are case sensitive.

- Choose a meaningful phrase with 6-8 words and numbers, and then include a special character. For example, “We bought our home 9 years ago!” can become “Wboh9ya!”

- Insert two digits into a word. For example, “Decem51ber?”

- Replace vowels or other letters in a short phrase with numbers or other characters. For example, “Sh0rt3n!”

- Don’t use characters that are next to each other on the keyboard (for example, hjkl;).

Your Upgrade is Right this Way

What to expect with your new upgrade.

We’ll keep you in the loop with notifications if there are any next steps on your end.

Device Requirements

We can electronically provide you the To get these electronically your device must be capable of printing or storing web pages and/or PDFs and your browser must have 128-bit security. If you want to request a paper copy of these disclosures you can call Citi Cards at and we will mail them to you at no charge.

You Are Leaving a Citibank Website and Going to {{:domainName}}.

That site may have a privacy policy and security that is different from this Citibank, N.A. Website. Citibank, N.A. and its affiliates are not responsible for the products, services, and content on {{:domainName}}.

Do you want to continue to {{:domainName}}?

Email Address Policy

Email privacy.

At Citi Cards, we are dedicated to protecting your privacy. We want you to feel comfortable about giving us your email address. The following Email Policy was developed to help you understand how we use email and what your choices are.

How We Use Email

When you give us your email address, we may then send you emails on a variety of subjects, such as: • General notices or important news about your account (rest assured your account number would never be included) • Updates on special deals and offers that might interest you • Opportunities to provide feedback or complete online surveys, so you can tell us what you think.

Your Choices

We believe you should be able to choose what kinds of information you receive. Thus, if you do not want to receive marketing material by email, just indicate your preference on your email profile. If you do so, please note that you could continue to receive some marketing information until your request is processed.

Important Note:

Please keep in mind that Citi reserves the right to continue to notify you by email regarding your account.

Welcome to Your New Online Account.

Introducing a whole new experience built to give you more control over your card and your time.

Congratulations. Your account setup is complete. Now discover a whole new online account, built to give you more control over your card and your time.

- Get around faster in an intuitive, clutter-free environment.

- Log in from anywhere with a design optimized for any device.

- Manage your account your way with all the features you enjoyed before—and more.

- Take advantage of your new online account by managing your alert settings, downloading statements or enrolling in autopay.

- Take advantage of your new online account by managing your alert settings, downloading statements or enrolling in autopay and paperless.

Note: If your browser has an ad blocker installed, you may want to turn it off now to enjoy the full site.

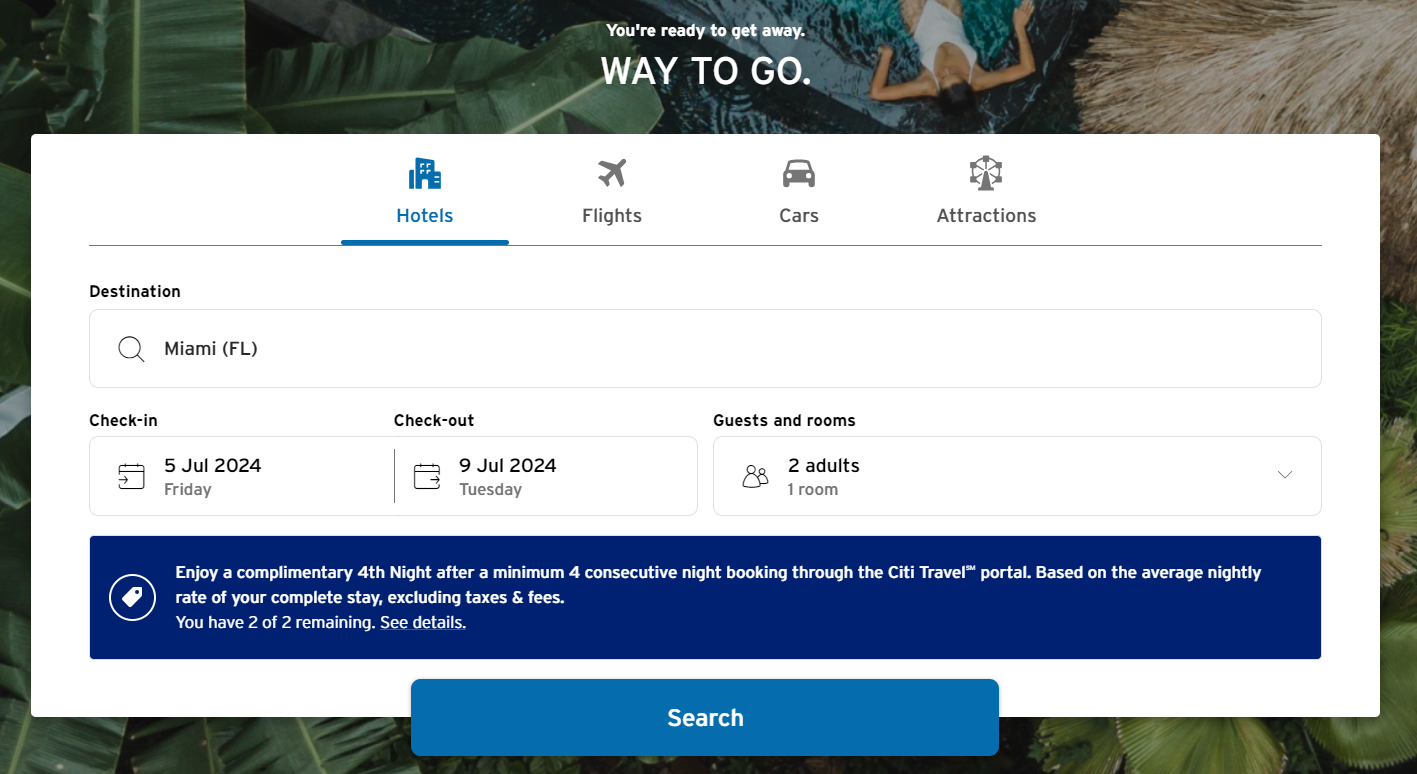

Ultimate guide to the Citi travel portal

fCiti is a TPG advertising partner.

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Strata Premier℠ Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

With the Citi Strata Premier℠ Card , you can earn 10 points per dollar on reservations for hotels, rental cars and eligible attractions.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants)

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel. Once you select a card, you're ready to start booking travel.

How to book flights using the Citi travel portal

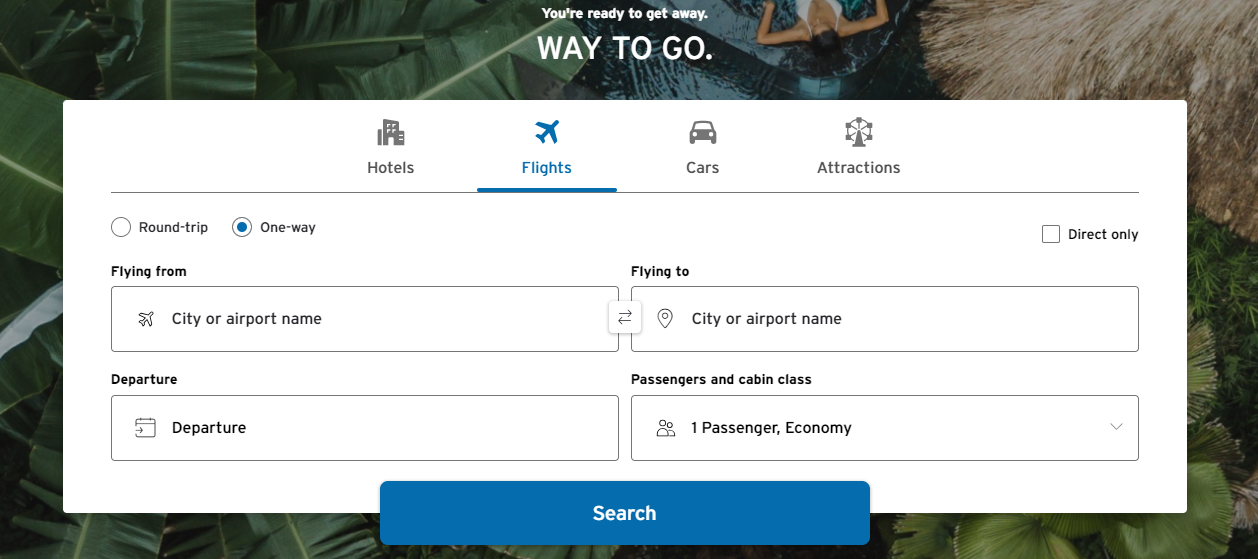

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

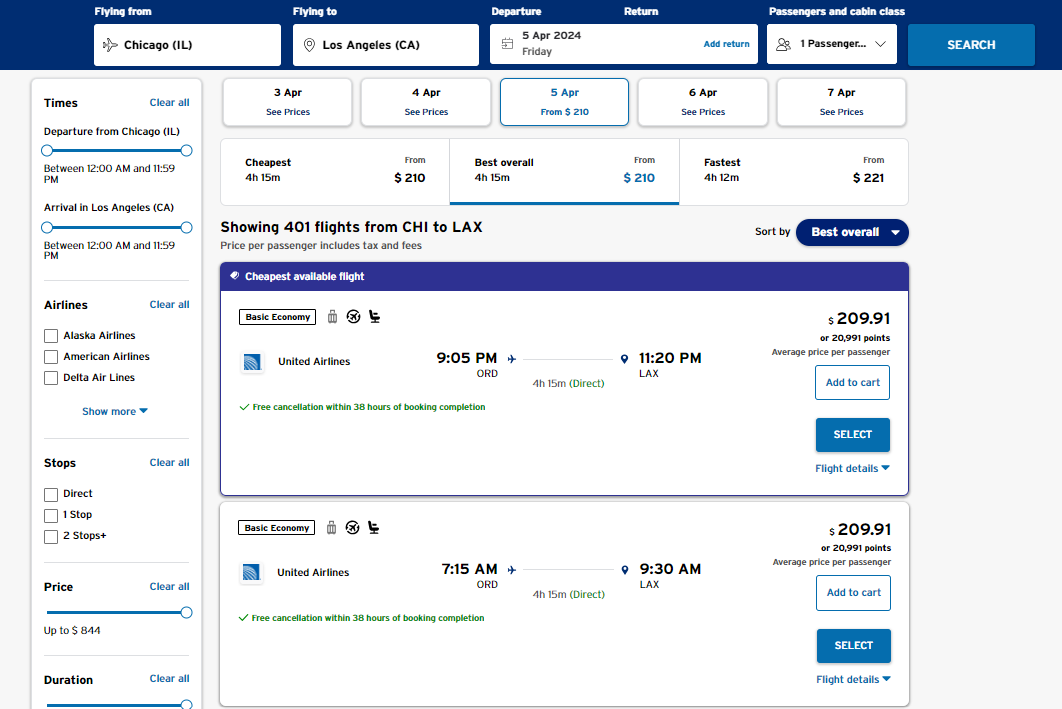

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

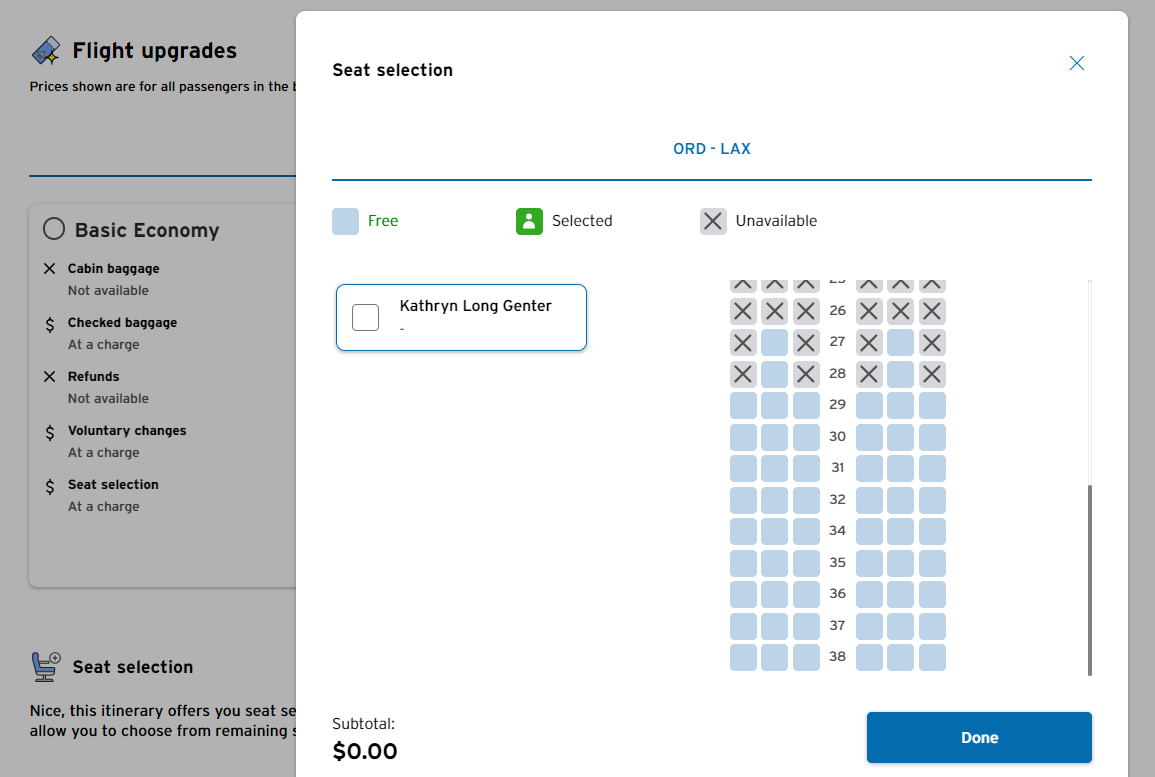

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

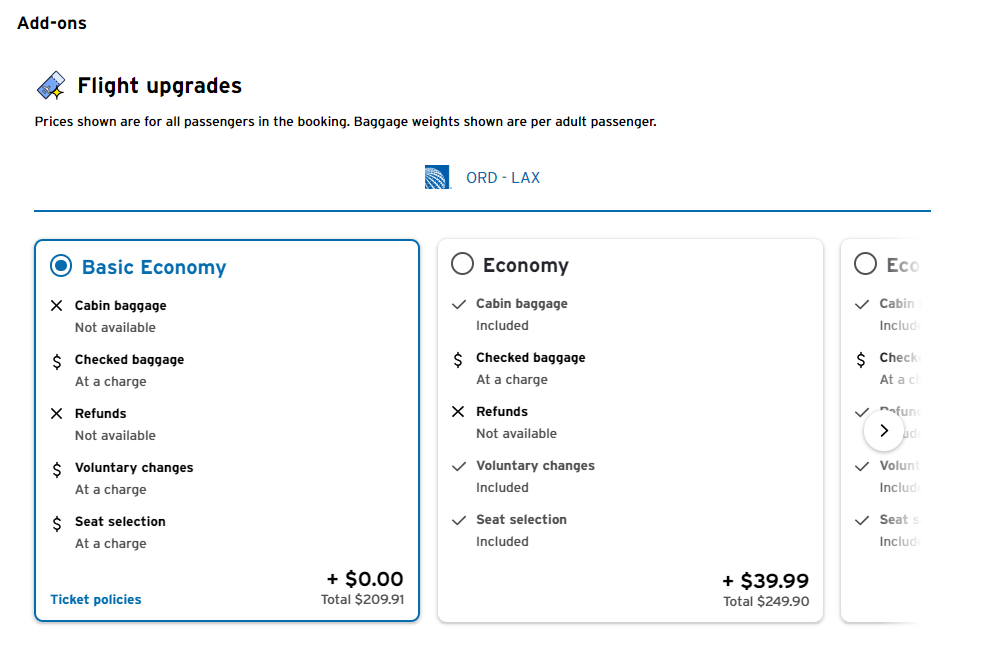

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

And if your fare class lets you select a seat, you can do so before heading to the payment page.

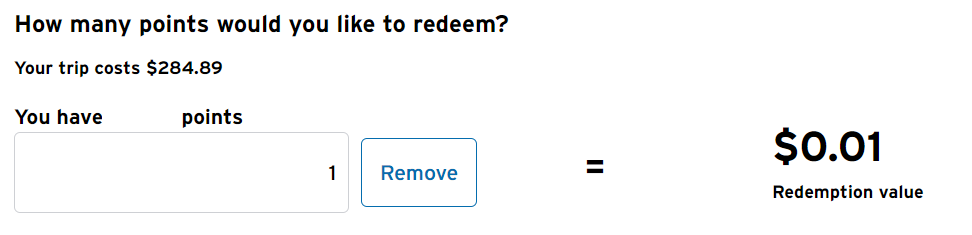

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

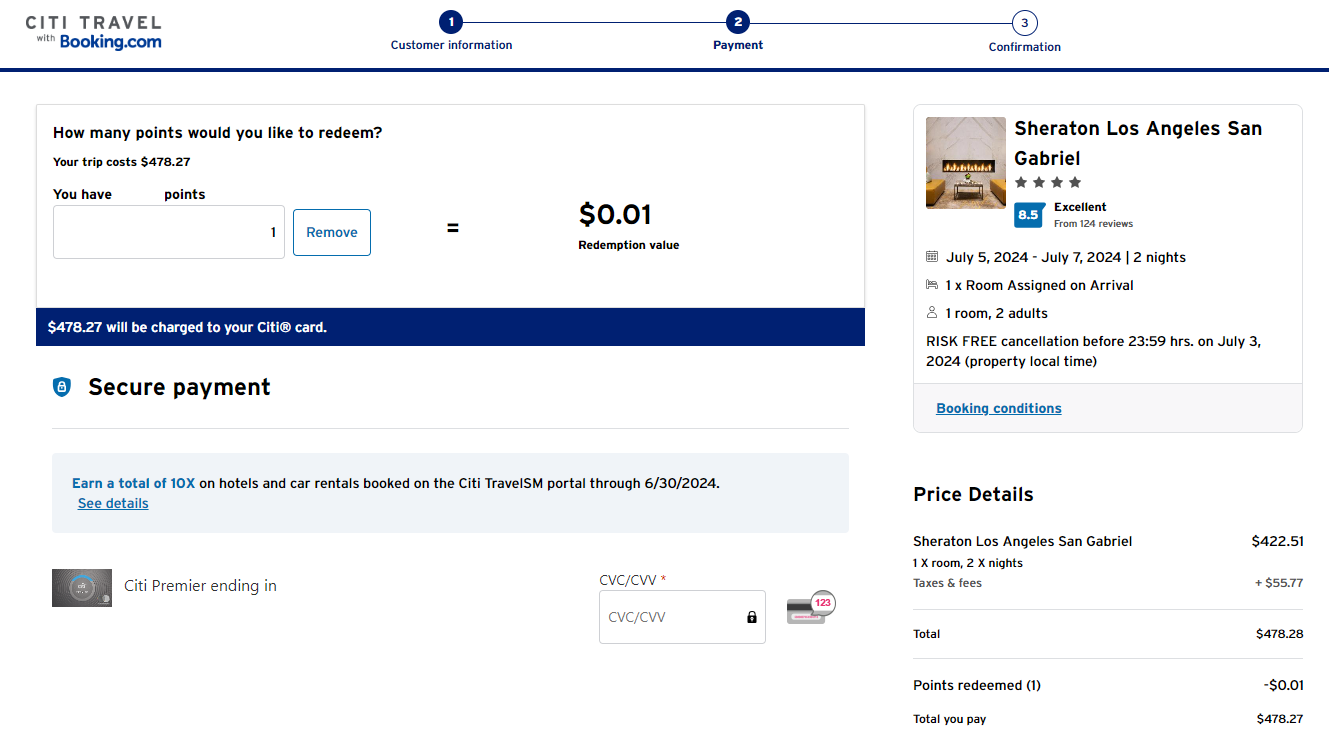

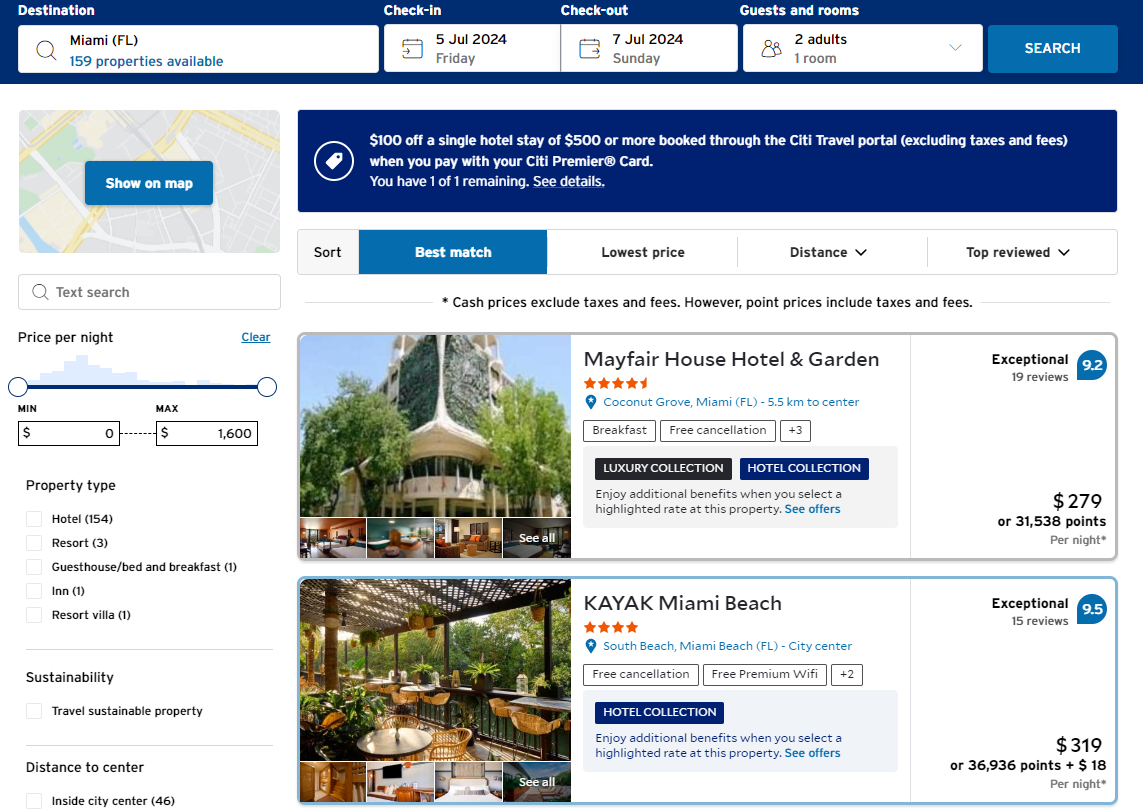

How to book hotels using the Citi travel portal

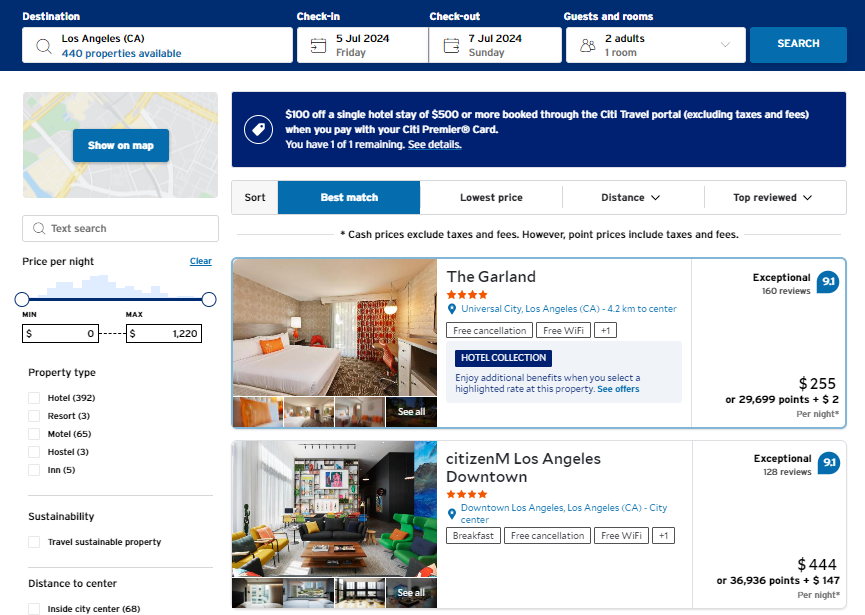

Booking hotels will feel familiar to those who have used other portals.

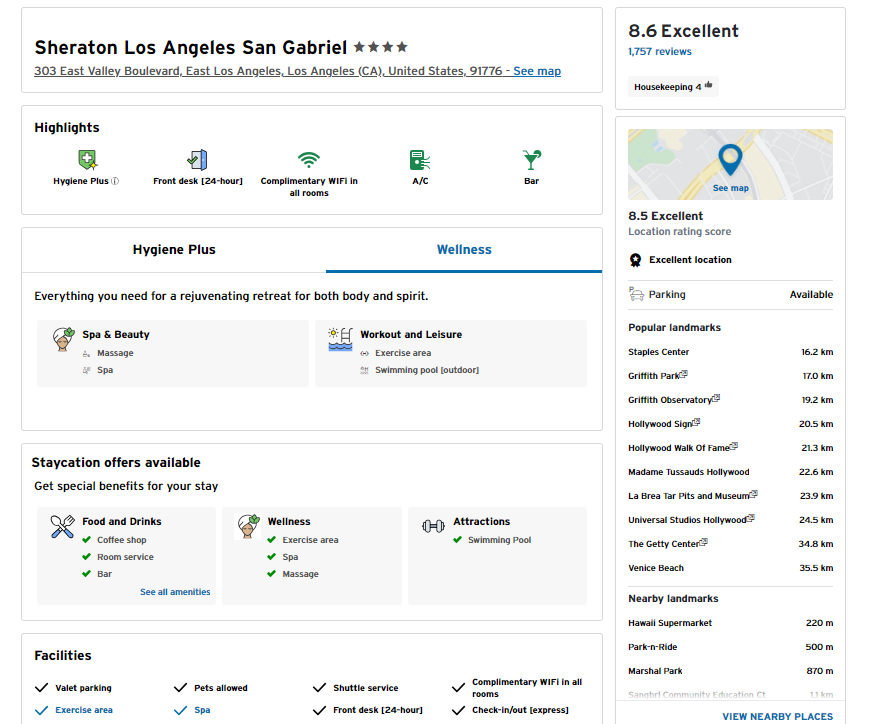

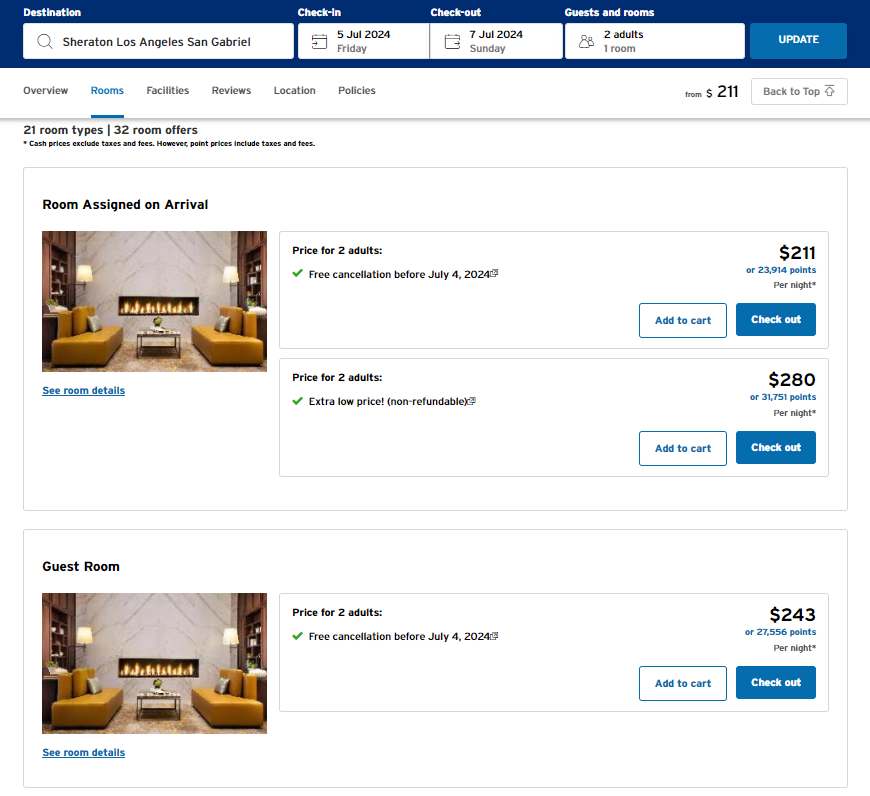

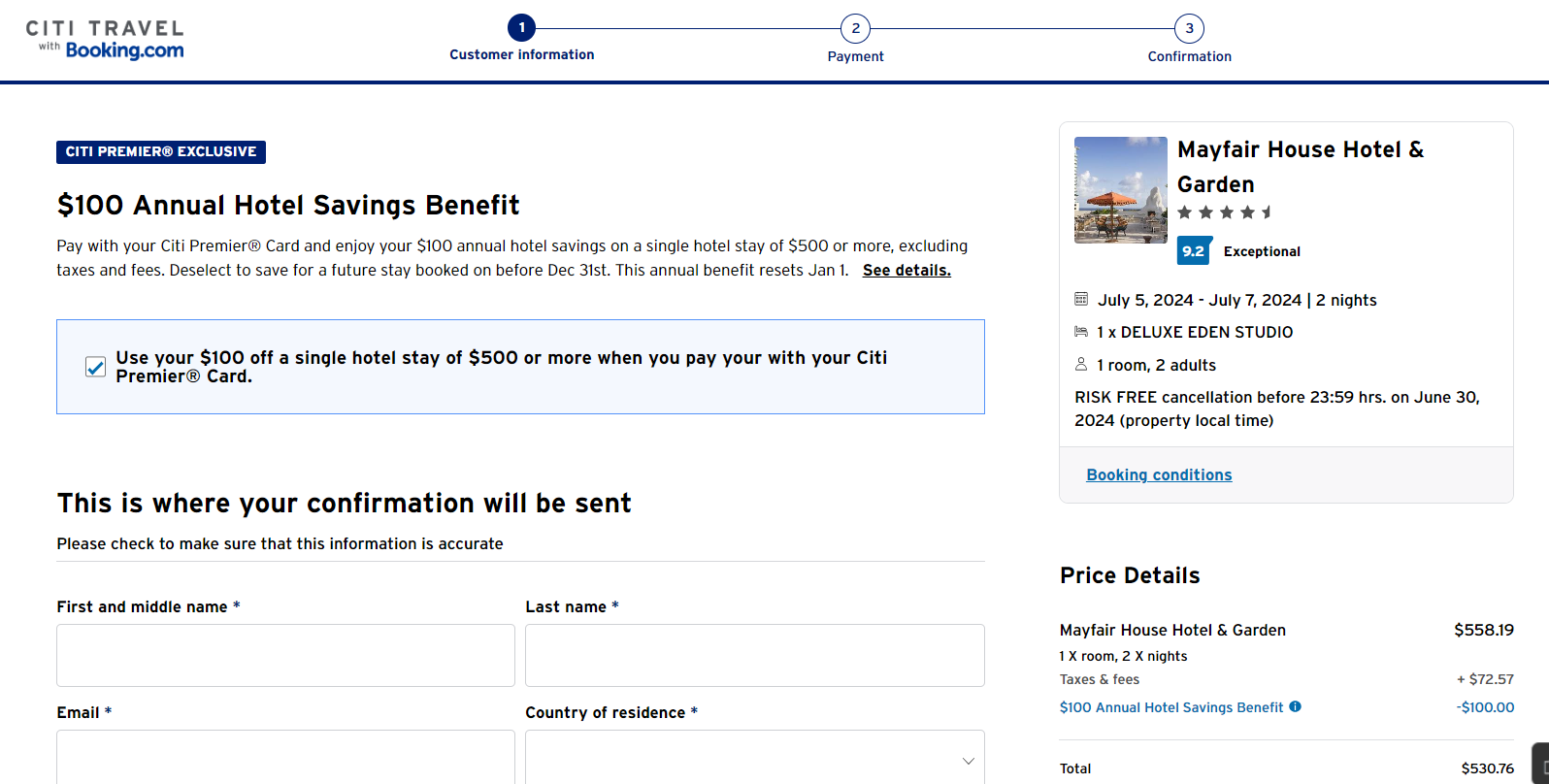

You should choose your Citi Strata Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Strata Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

Once you pick a property, you'll see details on its amenities and features.

Then, you can select your desired room.

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Strata Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

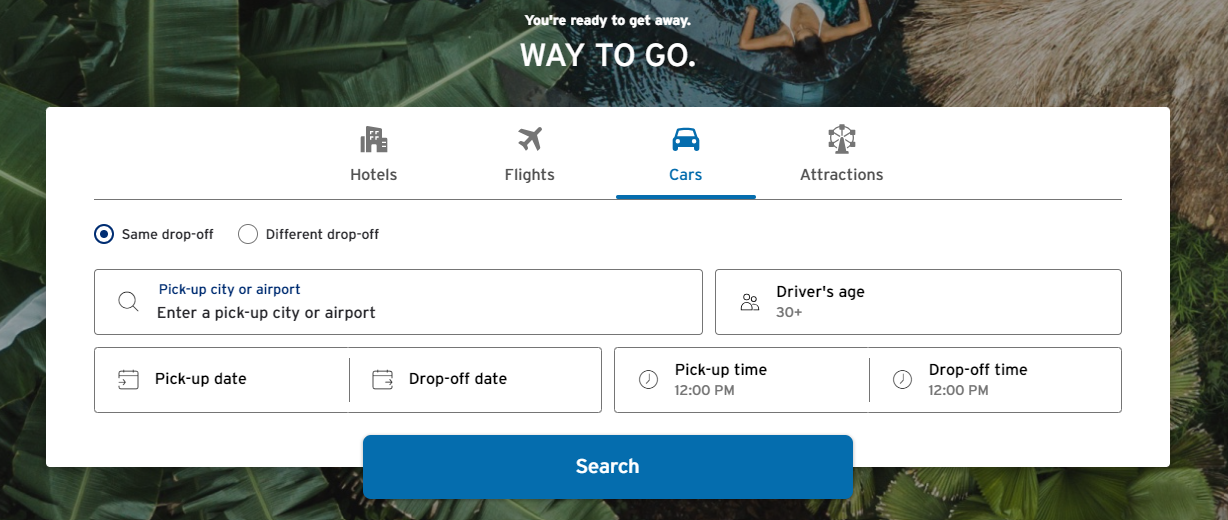

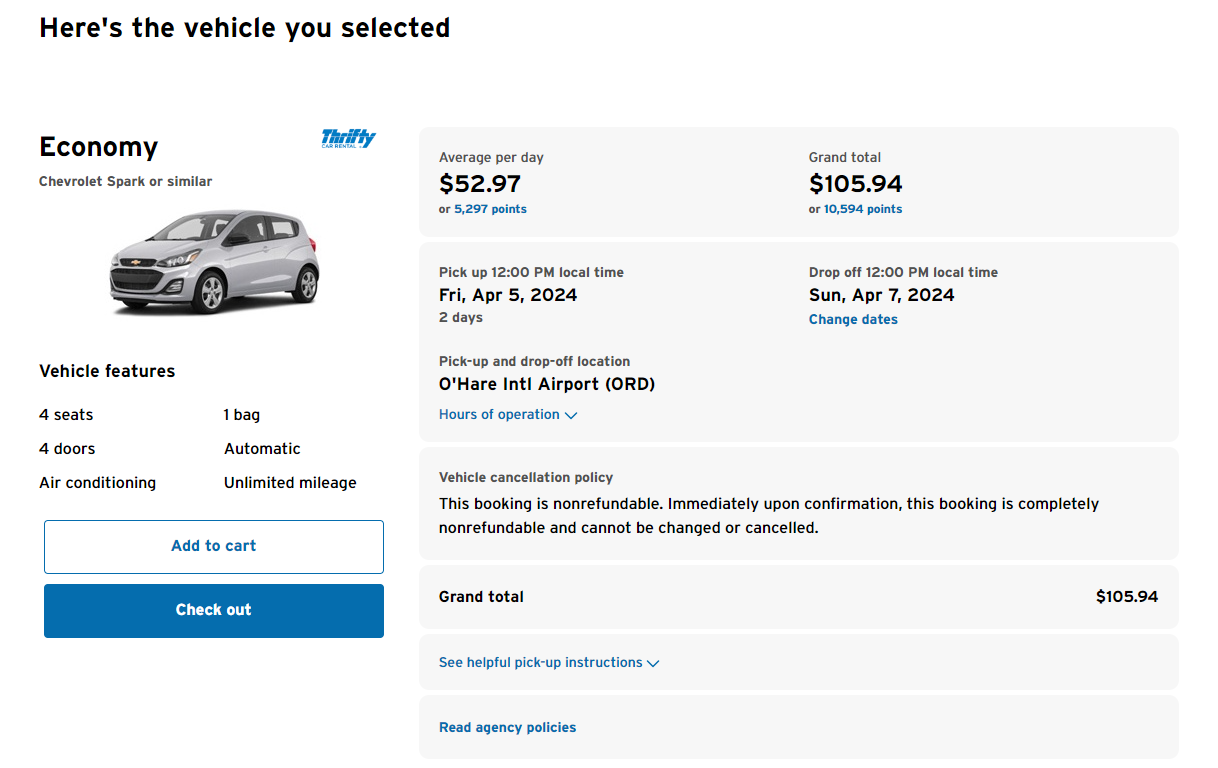

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

How to book attractions using the Citi travel portal

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

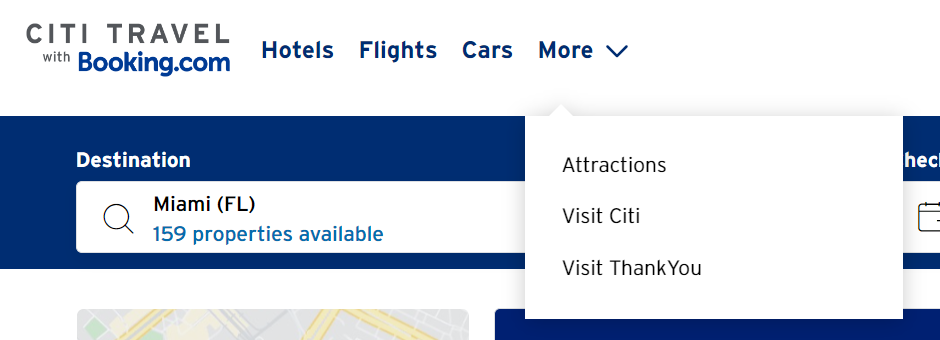

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

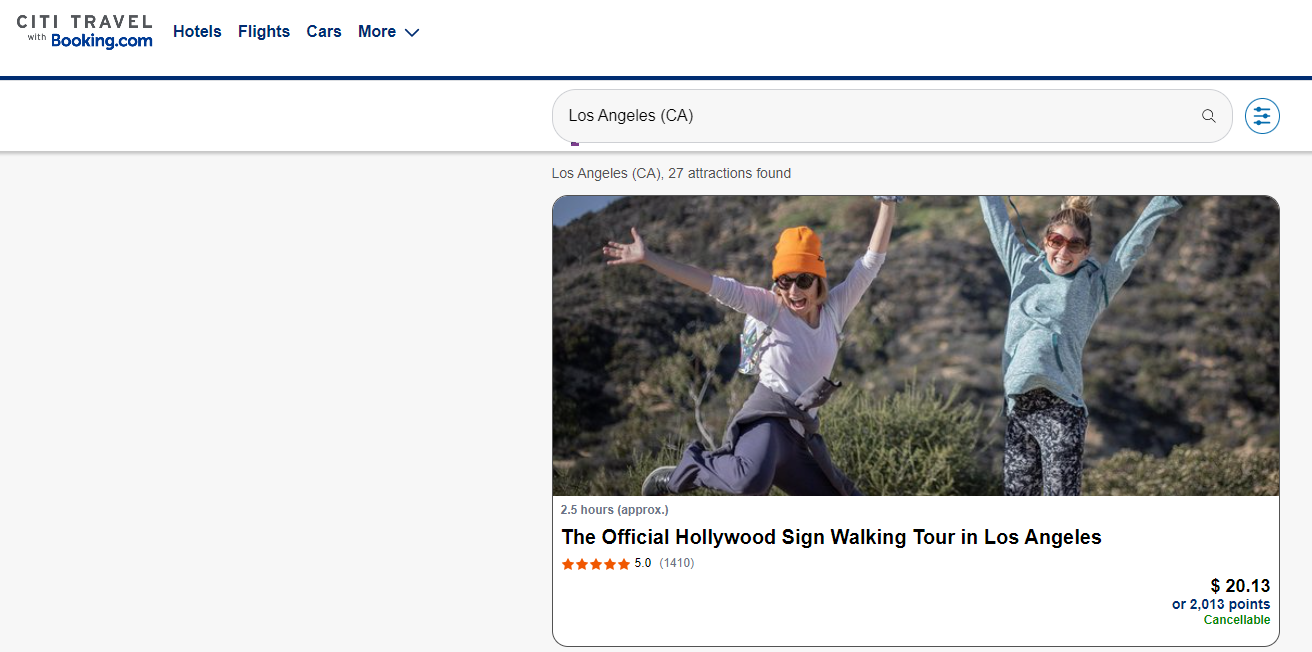

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

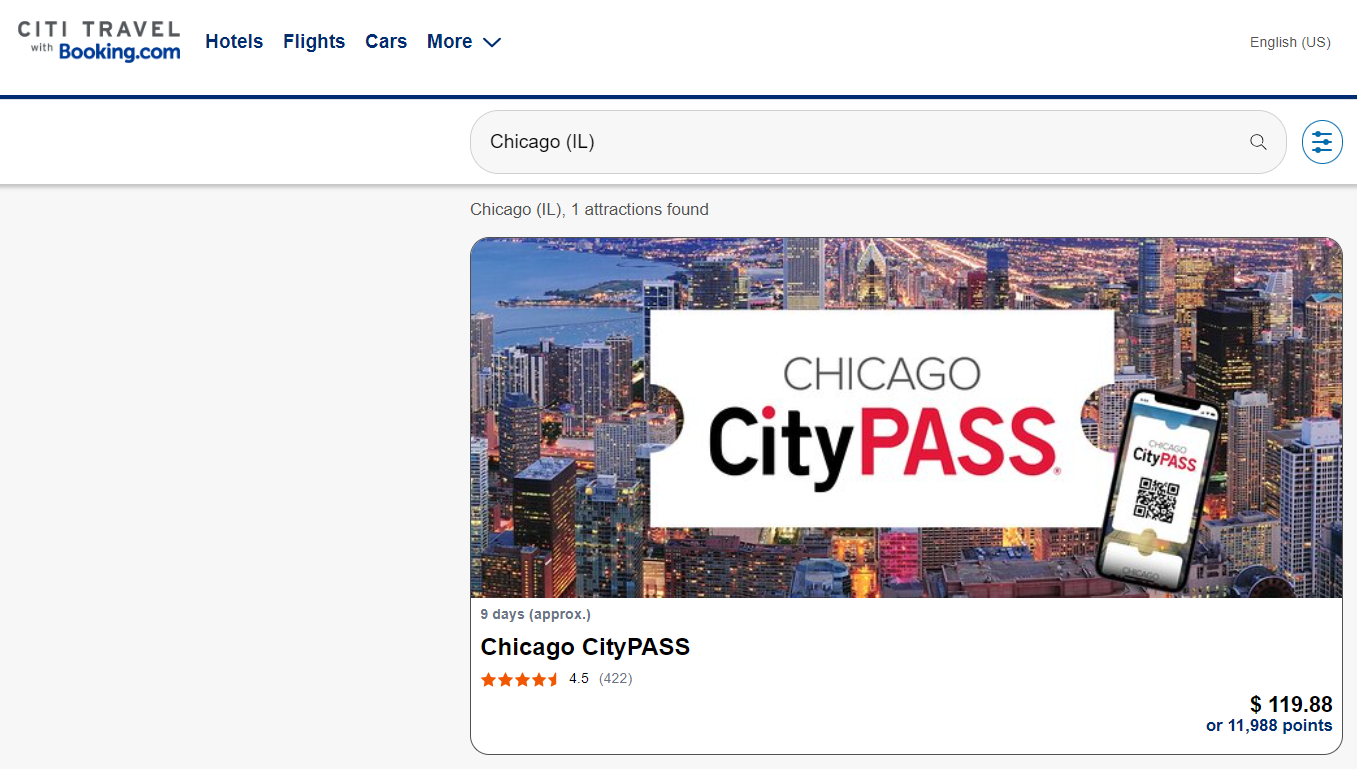

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Strata Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Strata Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

- Help Center

- 1-866-921-7925

Start Searching

- Packages

- Hotels

- Cruises

- Rental Cars

* Indicates required fields

Rental Period:

pickUpDate - dropOffDate

Pick-Up: pickUpTime - Drop-Off: dropOffTime

Pick-Up Location:

pickUpAddress

pickUpAgencyName

pickUpAgencyAddress

Drop-Off Location:

Same as Pick-Up Location

dropOffAddress

dropOffAgencyName

dropOffAgencyAddress

Coupon Override

Please call.

For drivers under the age of 25, additional fees and/or restrictions may apply.

For information and assistance in completing your reservation, please call:

We're unable to find your location.

Alaska Cruise Tours:

A cruise tour is a voyage and land tour combination, with the land tour occurring before or after the voyage. Unless otherwise noted, optional services such as airfare, airport transfers, shore excursions, land tour excursions, etc. are not included and are available for an additional cost.

Make your travels even more rewarding

From trips to the gas station to trips around the world, you can earn on all your travels with the Costco Anywhere Visa® Cards by Citi. Enjoy no foreign transaction fees* anywhere Visa® is accepted and no annual fee* with your paid Costco membership.

Whether for work or play, there's a card for you

Costco Anywhere Visa® Card by Citi

Earn cash back rewards anywhere on the things you buy everyday.

See Pricing and Information Below

TTY Use Relay Service

Costco Anywhere Visa® Business Card by Citi

Reach your business goals and earn cash back along the way.

Commence your rewards journey

Map out a road trip.

Earn 4% on eligible gas and EV charging for the first $7,000 per year and then 1% thereafter and 3% at restaurants and eligible travel purchases.

Get More as an Executive Member

Earn 3% cash back rewards on Costco Travel purchases when you use the Costco Anywhere Visa® Cards by Citi in addition to your annual 2% cash back from your Executive Membership.

Explore with Ease

Enjoy no foreign transaction fees* with your Costco Anywhere Visa® Cards by Citi no matter where life takes you.

See what cardmembers are saying:

Rated 5 out of 5 Stars

"The 3% cash back on travel and 4% on gas are unbeatable!"

Ronzam, Costco Anywhere Visa® Cardmember

"I love my Costco Citi card when we dine out. Definitely for gas and great travel coverage and peace of mind when you book tickets for any travel with this card. Finally, superb customer service."

Busy B, Costco Anywhere Visa® Cardmember

"The cash back on this card is the best we have found for everyday purchases. We have tripled our annual cash back from our previous credit card thanks to the extra cash back on gas, Costco and travel."

DuHaas, Costco Anywhere Visa® Cardmember

Rated 4 out of 5 Stars

"Widely accepted everywhere I like cash back especially on gas and restaurants. Costco cash back adds up."

Jk, Costco Anywhere Visa® Cardmember

Earn cash back rewards anywhere on the things you buy every day.

¹Costco Anywhere Visa® Card by Citi and Costco Anywhere Visa® Business Card by Citi – Pricing Details

Costco anywhere visa card by citi.

The variable APR for purchases and balance transfers is 20.49%. For Citi Flex Plans subject to an APR, the variable APR is 20.49%. For Citi Flex Pay Plans subject to a Plan Fee, a monthly fee of up to 1.72% will apply, based on the Citi Flex Plan duration, the APR that would otherwise apply to the Transaction, and other factors. The variable APR for cash advances is 29.99%. Variable penalty APR is up to 29.99% and applies if you pay late or your payment is returned. Minimum interest charge - $0.50. Fee for foreign purchases — None. Cash advance fee is either $10 or 5% of the amount of each cash advance whichever is greater. Balance transfer fee is either $5 or 5% of the amount of each transfer whichever is greater. No annual fee with paid Costco membership. Subject to credit approval. Additional limitations, terms and conditions apply. New card members only. You will be given further information when you apply. Variable rates shown above are based on the 8.50% Prime Rate as of 09/01/2024.

Costco Anywhere Visa Business Card by Citi

The variable APR for purchases is 20.49%. For Citi Flex Plans subject to an APR, the variable APR is 20.49%. For Citi Flex Pay Plans subject to a Plan Fee, a monthly fee of up to 1.72% will apply, based on the Citi Flex Plan duration, the APR that would otherwise apply to the Transaction, and other factors. The variable APR for cash advances is 29.99%. Variable penalty APR up to 29.99% and applies if you pay late or your payment is returned. Minimum interest charge - $0.50. Fee for foreign purchases - None. Cash advance fee - either $10 or 5% of the amount of each cash advance, whichever is greater. No annual fee with paid Costco membership. New cardmembers only. Subject to credit approval. Additional limitations, terms and conditions apply. You will be given further information when you apply. Variable rates shown above are based on the 8.50% Prime Rate as of 09/01/2024.

© 2023 Citibank, N.A. Citi and Citi with Arc Design are registered service marks of Citigroup Inc.

We are processing your payment.

Do not refresh your browser or exit this page.

IMAGES

VIDEO

COMMENTS

Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password. After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.) Confirm your booking and choose whether you ...

Visa Guide to Benefits. In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits. Travel Tips. For more information on your Citi Department of Defense Travel Card, please read What to do Before, During ...

Manage your Citi accounts online with ease and security. View balances, transfer funds, pay bills, and more. Login or enroll now.

Please Login to CitiManager: home.cards.citidirect.comhome.cards.citidirect.com

Skip to Content

Travel Notice Citi is by your side when you travel. We're continually monitoring your account for suspicious activity; our goal is to create a hassle-free experience for you when you use your card while traveling. ... For more information, please login or call Citi Customer Service at 1-800-950-5114 (For TTY: Use 711 or other Relay Service ...

Explore exclusive travel benefits and rewards with Citi Travel, offering convenient management of flights, hotels, car rentals, and attractions.

Citi Commercial Cards login. Enter username and password. You are authorized to use this System for approved business purposes only.

Skip to Content. ATM / BRANCH

Yes. Earn Costco cash back rewards with the Costco Anywhere Visa ® Card anywhere Visa ® is accepted, with the Costco Anywhere Visa® Card by Citi. Earn 4% cash back rewards on eligible gas and EV charging for the first $7,000 per year, and then 1% thereafter. Earn 3% on restaurants and eligible travel. Earn 2% on all other purchases from ...

<meta http-equiv="refresh" content="0; url=https://online.citibank.com/US/JPS/portal/Index.do">

Association Guide to Benefits. In addition to the card benefits provided by Citi, Visa and Mastercard provide card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the appropriate Guide to Benefits below. MasterCard Guide to Benefits.

Take advantage of your new online account by managing your alert settings, downloading statements or enrolling in autopay and paperless. Get around faster in an intuitive, clutter-free environment. Log in from anywhere with a design optimized for any device. Manage your account your way with all the features you enjoyed before—and more.

Purchase Rate: % -% Variable APR based on your creditworthiness. 1 American Airlines AAdvantage ® bonus miles are not available if you have received a new account bonus for a Citi ® / AAdvantage ® Platinum Select ® account in the past 48 months. The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding ...

The Citi Government Travel Card is accepted at 45 million merchant locations and 2.6 million ATMs worldwide. Exceptional dedicated customer services, wherever you are. Our Customer Service Center is committed to satisfying the needs of all Citi Government Travel Cardholders. Inside the U.S., simply call us toll-free at 1-800-790-7206, 24 hours ...

Welcome to Citi ® Commercial Cards! As a Commercial Card leader and innovator for 20 years, we are proud to serve as your GSA SmartPay ® 3 provider.. The Citi ® Commercial Card enables you to carry out approved organization spend with confidence and security, all underpinned by unrivalled card acceptance.. Please sign, complete card receipt verification, and set your PIN as soon as you ...

Citi Commercial Cards. You are accessing this computer system in order to service the U.S. General Services Administration Federal Government commercial cards program. This system is "FOR OFFICIAL USE ONLY," and is subject to monitoring and recording to the extent permitted by law and/or regulation. Therefore, no expectation of privacy is to be ...

Citi® Online Support. 1-800-347-4934. Outside of the United States, Call Citi collect at: 605-335-2222. (TTY: We accept 711 or other Relay Service) 24 hours a day, 7 days a week. We also recommend you download the Citi Mobile ® App to monitor your transactions on the go. To download the Citi Mobile app, text "APP35" to MYCITI (692484).

Citibank offers multiple banking services that help you find the right credit cards, open a bank account for checking, & savings, or apply for mortgage & personal loans.

Bottom line. Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card.

Costco Anywhere Visa Business Card by Citi. The variable APR for purchases is 20.49%. For Citi Flex Plans subject to an APR, the variable APR is 20.49%. For Citi Flex Pay Plans subject to a Plan Fee, a monthly fee of up to 1.72% will apply, based on the Citi Flex Plan duration, the APR that would otherwise apply to the Transaction, and other ...

CitiManager® is a fast, easy way to manage accounts. Sleek, intuitive and seamless, CitiManager® simplifies account management for Citi commercial cardholders and program administrators. Streamlined navigation provides direct access to tasks, tools and information. Learn more.

Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025. 2. Earn 2 ThankYou ® Points per $1 spent at supermarkets and gas stations for the first $6,000 spent per year. Earn 1 ThankYou ® Point per $1 spent on all other purchases. Round up to the nearest 10 points on every purchase. 2

Costco Anywhere Visa ® Business Card by Citi. Pricing & Information Benefit Terms & Conditions. APPLY NOW. Call to Apply 1-800-970-3019 TTY Use Relay Service. on eligible gas and EV charging for the first $7,000 per year and then 1% thereafter. on restaurants and eligible travel. on all other purchases from Costco and Costco.com.