- The Art of Enterprise

- Founder Stories

- The Generalist

- Business Deep Dive

- Brand Story

- Future List

- Brand Partnership

- Content Marketing

- Newsletter Sponsorship

- The Making of Intelligent Machines, Artificial Intelligence, and Rough Edges of… July 4, 2023

- Life’s Work: Kazi Faisal Bin Seraj, Country Representative, The Asia Foundation Bangladesh July 11, 2023

- Interview: IFA Consultancy Co-founder Mufti Yousuf Sultan on Islamic finance, venture… June 2, 2022

Go Zayaan Launches Travel Loan

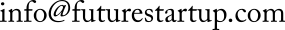

Go Zayaan, one of the fast-growing OTAs in the country, introduced a new travel loan product yesterday, a personal loan that can be used for travel purposes, in collaboration with IPDC Finance.

From now on, travelers can finance their trips and purchase travel-related services using Go Zayaan Travel Loan. The loan can be repaid in equal installment between 3 to 18 months using the salary account of the recipient. If a traveler repays the loan within 6 months, no interest will be charged on the loan. Currently, a traveler can avail up to BDT 2,00,000 as a travel loan. The loan remains valid for three months from the date of issuance, which means one can use the loan any time within three months from the issuance date.

Anyone who has been working for minimum one year with a monthly salary of minimum 20,000 can apply for the loan. Go Zayaan has partnered with IPDC EZ to launch the loan product. The loan could essentially make the lives of travelers in Bangladesh easier.

“As a data-driven company we always analyze data and in the process, we noticed that people within the age of 21-25 browse our website the most, even though the purchases are made mostly above that age range. We have launched this loan to cater to those young people and make their dream of traveling a reality,`` Says the founder and CEO of Go Zayaan, Ridwan Hafiz. “This will aid young travelers and corporates who don't have a credit card or enough credit limit to travel. And for frequent travelers like me, it can help free up my credit card for using abroad.”

The company says the process for availing the loan is simple and quick. In the existing process, it takes about three working days to approve a loan. Once someone applies for the loan, IPDC verifies and then approves the loan. Once the loan is approved, Go Zayaan reaches out to the customer and assists on purchases of travel products like tour packages, flights, and hotels. The loan will be activated once the purchase has been made. Multiple purchases can be made with this loan within 3 months from the issuance date.

Why this matters: From a consumer perspective, this loan can help young travelers and corporates who don't own a credit or don't have enough credit in their cards to travel with convenience. For a lot of frequent travelers, saving credit card limits for using abroad when they are traveling is very important. This loan can ease those challenges and provide more opportunities for traveling.

From an industry perspective, the move is a testament to the rising interest in travel and adventure in Bangladesh. With the loan product, Go Zayaan expands its market and solidifies its position as a travel brand that encourages traveling and empowers and enables travelers. It is also an indication that digital travel brands have a lot more scope to flex their influence beyond a certain vertical. If the product sees traction, it will validate the growing assumption of the unbundling of the financial services in the market.

There are many benefits for Go Zayaan in launching the travel loan, albeit for the first time in Bangladesh. One, it helps the company expand its market and attract more customers. Although EMI and similar facilities have always been available to customers in the past, travel loan is a first for Bangladesh and helps position Go Zayaan as an innovative travel tech brand. Three, it can open new doors for growth and future product direction for Go Zayaan.

For IPDC, the deal is simple. The NBFI gets an opportunity to play in a market that is growing pretty fast. At the same time, the collaboration allows IPDC to expand its IPDC EZ product beyond traditional verticals.

Go Zayaan, which was founded in 2017 as a travel aggregator platform, has been actively trying to position itself differently in an increasingly crowded, albeit of limited scale, OTA market in Bangladesh. The company, in the past, has introduced multiple innovative products new to the OTA industry. With the travel loan, it seems the company moves to untested water for the first time.

In-depth business & tech coverage from Dhaka

Powered by: Probaho

IPDC AT A GLANCE

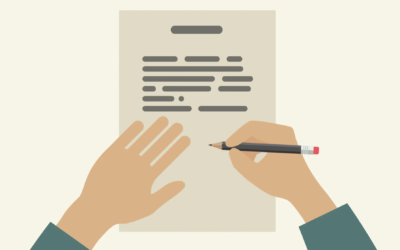

Mission, vision & values, shareholders, investor relations, citizen’s charter, bhalo basha loan, ipdc home loan, ipdc auto loan, ipdc personal loan, ipdc deposit schemes, ipdc saving schemes.

- ONGOING CAMPAIGNS

- FINANCIAL LITERACY

- SIGNATURE EVENTS

Exceptional Service

Some investments are meant to be very special for your very own purposes. We go that extra mile to ensure the freedom of your own investment. Thus, our personal loan is equipped to finance maximum amount for your convenience.

- Attractive interest rate

- No hidden charges

- Faster processing time

- Maximum loan amount

- No guarantee required

AM I ELIGIBLE?

You can apply for IPDC Personal Loan if you are:

- Salaried employed can apply for personal loan

- Age must be minimum 21 years and maximum 65 years or retirement (whichever is lower)

- Your verifiable minimum monthly income - 30,000 /-

- Your minimum working experience - 1 year

Live Unbound

Reject complacency.

To find your interest rate now

TRY OUR LOAN CALCULATOR

Documents required.

- Application form (Filled and signed)

Identity Document:

- Copy of NID or Passport (applicant’s and guarantors)

- Photographs (applicant’s and guarantors)

- Utility bill copy

Income Document:

- Salary / income slips

- Bank Statements

- Other income related documents

Loan Term and Amount

- Amount: IPDC offers personal loan up to BDT 20 lacs

- Term: Personal loan can be availed for 6 months to 5 years

Any purpose loan. You can avail the loan from IPDC and spend as per your requirement.

- APPLY ONLINE

- Our Branches

FDR with Simple Interest

Lost your password? Please enter your email address. You will receive a link to create a new password.

E-mail Error message here!

Back to log-in

Central Customer Service & Complaints Management Cell

Investors relation department, information booth, key contact.

- Highlight Links

- Inverted Colors

- Dyslexia Friendly

- Reading Guide

- Internet Banking

- Priority Banking

- Card Services

Privileges & Offers

- Health & Beauty Care

- Hotel & Resort

Travel & Tourism

- Vehicle & Accessories

- Entrepreneurship Development Services

BCL Aviation

Travel to Know

Us-Bangla Airlines

Wander Woman

CONTACT INFO

- Eastern Bank PLC. 100 Gulshan Avenue Dhaka-1212.

- + 88 09612316230

- [email protected]

- Swift Code: EBLDBDDH

BUSINESS HOURS

- Sunday - Thursday 10:00 AM � 3:30 PM

Copyright ©2024 Eastern Bank PLC.

- Uttara eWallet

- Warning against illegal forex trading/dealing

- National Integrity Strategy

- " id="top_home">National Integrity Strategy

- Security Features of Bank Note

- Sanchayapatra

- Unclaimed Deposit List

- " id="top_home">Quick Response Team

- Postponement of EGM and AGM of UBL

- Opened Branch List

- Quick Response Team

- "> Eligible Capital

- " id="top_home">Investor Relations

- Financial Literacy

- Unclaimed Dividend

- FDI Help Desk

- " id="top_home">Citizen's Charter

- Citizen's Charter

- National Mourning Day 2023

- downloads/Uttara-QRT.pdf" id="top_home">Quick Response Team

- Bank at a Glance

- History of Uttara Bank PLC.

- Board of Directors

- Executive Committee

- Audit Committee

- Risk Management Committee

- Senior Management

- Shareholding Structure

- Government Securities Investment Window

Deposit Scheme

- Uttaran Small Business Loan (USBL)

- Nari Swanirbor Rin Prokalpo (NSRP)

- Uttaran SME Sector Development Project Loan (USSDPL)

- House Hold Durables

- Uttaran House Repairing / Renovation Loan

- Green Financing

Loan for Foreign Employment

- Doctor’s Loan

- Education Loan

- Marriage Loan

- Travel Loan

- House Finance for Freedom Fighters

- Uttaran Home Loan

- Car/Motorcycle Loan

- Trade Finance

- Working Capital Loan

- Agricultural Credit

- Lease Finance

- Fixed Term Loan to Enterprise

- Savings Bank Account (Clients)

- Uttaran Kotipoti Deposit Scheme

- Savings Bank Account (School Banking)

- Savings Bank Account (Garments Workers)

- Double Benefit Deposit Scheme

- Savings Bank Account (Farmers)

- Savings Bank Account (Leather Factory Workers)

- Uttaran Millionaire Deposit Scheme

- Uttaran Lakhpoti Deposit Scheme

- Special Notice Deposit

- Bank Account (Non Privileged Farmers, Woman & Young Entrepreneurs)

- Fixed Deposit Receipt Account

- Uttaran Physically Challenged Persons SB A/C

- Uttaran Street Urchin and Working Children SB A/C

- Current Account (Non-Individual)

- Under Privileged SB A/C

- Monthly Deposit Scheme (MDS)

- Current Account (Individual)

- Uttaran Swapnapuran Sanchaya Prokolpa

- Uttaran Bibaha Sanchaya Prokolpa

- Mashik Munafa Prokalpa

- Uttaran Shikksha Sanchaya Prokolpa

- Uttaran Taka 10 SB Account

- Uttaran Footwear and Leather Products Workers SB A/C

- National Service Programme SB A/C

- The inhabitants of earlier enclaves taka 10 SB A/C

- Uttaran Five Million Deposit Scheme

- International Division

- International Trade Services

- Risk Management Department

- Treasury Service

- AD Branches

- Foreign Currency Account

- NFCD Account

- RFCD Account

- Standard Settlement Instruction

- Off - Shore Banking Unit

- Exchange Rate

- Annual Reports

- 1st Quarter Statement

- Half Yearly Statement

- 3rd Quarter Statement

- Credit Rating

- Disclosures on Risk Based Capital

- Disclosures on Green Banking

- Important Disclosure

- Inland Transaction

- Foreign Exchange Transaction

- Photo Gallery

- Video Gallery

- Useful Link

- "> Currency Converter

- "> EMI Calculator

- "> Deposit Calculator

- Complain Form

- Interest Rate

- Eligible Capital

- Security Feature of Bank Notes-->

- Tax Return Notice

- Code of Conduct

- Cautionary Notice

- YOU ARE HERE:

- Loan Product

UTTARA BANK AT A GLANCE

Remittance is the major contributor to the Economy of Bangladesh. In our country there are huge surplus manpower maximum of which are semi-skilled and less-skilled. Local employment cannot absorb them. This huge volume of workforce has good opportunity to engage in Foreign Employment. But major obstacle here is that many of them are incapable to meet the initial expenses for this purposes. For contributing to the economy of the country, Uttara Bank PLC. will finance in this sector which may help to reduce the unemployment problem of the country.

Purpose: To meet the Financial Expenses for going abroad for employment purpose of son/daughter or any other dependant.

Eligibility:

- Age: Minimum age 20 years ( At the time of application), Maximum age at loan maturity up to 45 years (At the end of Loan Tenor)

- Minimum Yearly income (Net BDT): Three times of the proposed limit ( to be calculated on the basis of the contract with the foreign company)

- Borrower must reside for at least 6 month in the same address.

Loan Size: Minimum BDT 25000.00 (Taka Twenty Five Thousand) only. Maximum BDT 2.00 Lac (Taka Two Lac)

Loan to Value Ratio: 70% of the cost of the quoted expenditure to be paid by the borrower.

Security/Collaterals Requirement

- Two Personal Guarantees with net worth declaration.

- Personal Guarantee of spouse/parents

- Post dated cheques for all instalments.

- One undated cheque covering total amount of all instalments

Tenor: Minimum 1 year,Maximum 5 Years

Repayment method : Equal Monthly Instalment

Disbursement Mode: By Crediting directly to the SB account of the Borrower

First repayment date: 1 st repayment will be started at the end of one month from the date of disbursement.

Documents Requirement

- Recent Passport size photographs of applicant(s) and guarantor (s).

- Photocopy of NID/Passport of applicant (s) and guarantor (s)

- Latest Utility Bill (Gas/Water/Electricity)

- Business Card/Office ID of applicant (s) and guarantor (s), if any.

- Latest Tax Certificate / E-TIN

- Personal Net Worth statements of applicant (s) and guarantor (s).

- Copy of all academic & experience certificates

- Copy of Air Tickets with the confirmed date of journey as endorsed by the BMET

- Details of expenditure

- Copy of Visa and Labour Contract provided from the concerned office of consulate /high commission / embassy.

Interest Rate: 12.00% per annum with quarterly rest. The rate of interest will remain fixed throught the tenure of the Loan.

Availability Period : Maximum 6 months from the date of sanction advice.

Prepayment : Loan to be prepaid on payment of 2% breakage cost on prepayment amount

*condition will apply

Transaction Tracker

Simply enter your 16-digit X-PIN number to know the status of your money transfer in an instant.

- Cover Focus

- Leadership Lens

- Fast Forward

- Word of Mouth

- February 13, 2020

Go Zayaan Launches Travel Loan

ICE Business Times

Go Zayaan, a leading Online Travel Aggregator in the country introduced a whole new product on 10th February. Named as travel loan, it is a personal loan which can be used for travel purposes; the venture was initiated in collaboration with IPDC Finance.

Using Go Zayaan Travel Loan, travellers can now finance their trips and other services. The loan is to be repaid in equal instalment between 3 to 18 months using the salary account of the recipient. If repaid within 6 months, no interest will be charged on the loan. A traveller can avail up to BDT 2,00,000 of travel loan. The loan remains valid for three months from the date of issuance, which means one can use the loan any time within three months from the issuance date.

Eligibility: Anyone, working for minimum one year with a monthly salary of minimum 20,000 can apply for the loan. Go Zayaan has partnered with IPDC EZ to launch the loan product. The loan intends to financially make the stories of travellers in Bangladesh simpler.

“As a data-driven company we always analyze data and in the process, we noticed that people within the age of 21-25 browse our website the most, even though the purchases are made mostly above that age range. We have launched this loan to cater to those young people and make their dream of travelling a reality, Says the founder and CEO of Go Zayaan, Mr. Ridwan Hafiz. “This will aid young travellers and corporates who don’t have a credit card or enough credit limits to travel. And for frequent travellers like me, it can help free up my credit card for using abroad.”

As per the company, the process for availing the loan is fast and simple. It takes about three working days to approve a loan in the existing process. Once someone applies for the loan, IPDC verifies and then approves the loan. Once the loan is approved, Go Zayaan reaches out to the customer and assists on purchases of travel products like tour packages, flights and hotels. Once the purchase is made, the loan will be activated. Multiple purchases can be made with this loan within 3 months from the issuance date.

From a consumer perspective, this loan can help young travellers who don’t own a credit or don’t have enough credit in their cards to travel with ease. For other frequent travellers, it is very important to save credit card limit for using abroad when they are travelling. This loan intends to ease all those challenges for travelling.

From an industry perspective, this initiative is a testament to the rising interest in travel and adventure in Bangladesh. With the loan product, Go Zayaan expands its market and clarifies its position as a travel brand that encourages travelling and enables travellers. It also indicates a broader scope that digital travel brands have to flex their influence beyond a certain vertical. If the product sees traction, it will validate the growing assumption of the unbundling of the financial services in the market.

There are many underlying benefits for Go Zayaan in launching the travel loan, albeit for the first time in Bangladesh. First, it helps the company expand its market and attract more customers. Second, although EMI and similar facilities have always been available to customers in the past, travel loan is a first for Bangladesh and helps Go Zayaan to thrive as an innovative travel tech brand. Third, it can open new doors for growth and future product direction for Go Zayaan.

For IPDC, the deal is simple. The NBFI gets an opportunity to play in a market which is growing pretty fast. At the same time, the collaboration allows IPDC to expand its IPDC EZ product beyond traditional verticals.

Related Posts

COMPUTE, CREATE, CELEBRATE

An overview of a four-day computer science event organised by AIUB Computer Club. AIUB CS Fest 2024, presented by the Office of Student Affairs and

LOOKS SO REAL

The exciting possibilities of OpenAI’s text-to-video AI model, Sora. Just a year ago, an AI-generated video featuring a grotesquely deformed approximation of Will Smith enthusiastically

HUMBLE LEGACY

For over 170 years, the legacy firms that make up PricewaterhouseCoopers International Limited, a multinational professional service brand of firms, operating as partnerships under the

LEADERSHIP LESSONS FROM A CXO

As a CXO, you are at a level where you have tough contenders and practical challenges. What could separate you from the rest? Here are

DON SUMDANY HOSTED MASTERCLASS 2024 ON LEADERSHIP, PRODUCTIVITY AND PERSONAL MASTERY AT SHERATON DHAKA

Don Sumdany Facilitation and Consultancy proudly presented their premium public training event for the 3rd consecutive year, ‘Masterclass with Ghulam Sumdany Don 2024,’ held on

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Global Markets

- Corporate Sustainability

- ATM/Branch locator

- Retail Banking

- HSBC Select

- Corporate Employee Privilege Scheme

- Lifestyle Benefits

- HSBC My Calendar

- Citizen’s Charter Corner

- Financial Literacy

- Retail Banking

- HSBC Select

Loan products

Avail HSBC personal loans to meet your everyday needs: travel, education, wedding, lifestyle or any other emergency needs.

Personal Unsecured Loan

- No personal guarantee or cash security required

- Maximum loan amount of BDT 1 million with competitive interest rate

- Loan tenure: 12 months/24 months/36 months/48 months and/or 60 months

- Joint application is possible

Personal Secured Loan

- Avail loans against the following securities

- Your HSBC term deposit account

- Wage earners’ development bond, and

- USD investment bond / premium bond

- Loan tenure: minimum 12 months, maximum 60 months

Personal Secured Credit

Privacy and Security | Terms of Use | Hyperlink Policy © Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, Bangladesh (HSBC Bangladesh). Incorporated in Hong Kong SAR with limited liability. All rights reserved.

Retail Loan Products

Personal banking, to avail retail loan facility click ↓↓, apply for loan.

To calculate your EMI click → EMI Calculator

CREDIT FACILITY FROM DEBIT CARD enjoy credit facility directly from your debit card. Get access to the money in your own account as well as extra money when you need it, even at ATMs

Personal loan products no cash security or personal guarantee needed, secured credit products flexible facility with minimum security, personal loan details (please check with branch for changes).

Car Loan Details (please check with branch for changes)

Home Loan Details (please check with branch for changes)

Frequently Asked Questions(FAQ)

To purchase various consumer durables, to meet medical, education, marriage, travelling, festival etc. to decorate or renovate houses, financing to professionals’ for purchasing equipment, tools, machineries, office decorations items or any other personal requirement.

• Salaried Individuals • Professionals (Doctor, Engineer, Architect, FCA, CA etc) • Landlord/Landlady • Businessperson (having existing mortgage security with DBBL)

BDT 50,000.00

BDT 20, 00,000.00

Up to 60 months

70 years or retirement age whichever comes first at the time of loan completion.

For Salaried Individuals: 1-2 years For Government, Semi-Government and Autonomous Bodies: 6 months For Businessmen: 2 years For Professionals: 6 months of service/ practice in the profession

For Professionals BDT 30,000/- For Landlord/Landlady BDT 30,000/- For Business Individuals BDT 50,000/-

Maximum 0.50% as per the schedule of charges of DBBL.

Yes. Partial payment can be made anytime.

0.50% of the adjusted amount.

0.50% of the settled amount.

Through Equated Monthly Instalment (EMI).

Yes. With Family Members Only (Father, Mother, Brother, Sister, Spouse, Son & Daughter only).

General Documents: • Loan Application duly completed and signed by the applicant • Colour Photograph • NID/ Smart Card • Bank Statement • Visiting Card • Copy of utility bill • e-TIN/ TIN certificate/ copy of income Tax acknowledgement • Personal Guarantee along with Colour Photograph, NID, Visiting Card/Office ID/Business Card of the personal guarantor(s). • Other documents or information as deemed necessary For Salaried Individuals: • Letter of Introduction (LOI) from employer regarding employment details/ Pay Slip/ Copy of Salary Certificate/ Copy of Increment/ Appointment letter etc. Or any other certificate issued by the employer. • Office ID For Businessperson: • Valid Trade Licence copy, copy of Memorandum & Articles of Association etc for Business person For Landlord/Landlady: • Rent or Lease Agreement of house / property

*Conditions Apply

• To buy new or old house/ flat • To construct / extend of house/ apartment • To renovate/ alteration of existing house/ flat • Taking over of the existing housing loan from other Bank/ Financial Institution • Refinance of an own availed flat/house (date of purchase /handover/ completion of construction will be no later than 2 years)

• Salaried Individuals • Professionals (Doctor, Engineer, Architect, FCA, CA etc) • Landlord/Landlady • Businessperson

BDT 200,000.00

Up to 25 years

• Maximum age of applicant: At the end of loan tenure, 70 Years for Sole/1st Applicant • No age limit for co-applicant

BDT 30,000.00

Maximum 0.50% or TK 15,000/- whichever is lower for Loan amount up to Tk. 50 Lac. Maximum 0.30% or TK. 20,000/- whichever is lower for Loan amount above Tk. 50 lac as per the schedule of charges of DBBL.

Through equated monthly instalment (EMI).

For Construction / Renovation: The loan will be disbursed one-time or in installments or by phases. For Flat/House Purchase: Loan to be disbursed directly to customer’s account and subsequently Payment Order to be made in favor of respective Developer/ Seller.

Maximum 12 months excluding the tenor of the loan.

Identification and Income Documents • NID/ Smart Card • Utility Bill Copy • Color Photograph • Office ID /Business card • Letter of Introduction (LOI) from employer regarding employment details/ Pay Slip/ Copy of Salary certificate/ copy of Increment/ appointment letter etc. or any other certificate issued by the employer. • Rent or Lease Agreement of house / property • e-Tin/TIN certificate / Copy of Income tax acknowledgement etc. • Copy of Trade Licence, Memorandum & Articles of Association etc. • Bank Statement / Income Statement etc. Property related Documents • Photocopy of original title deed. • C.S, S.A, R.S, DCR, Mutation and latest math Porcha • Mutation Khatian duly certified by AC Land. • Photocopy of Mouza Map • Photocopy of bia deeds. • Registered partition deed, in case of ajmali land. • Name of the land owner(s) along with their particulars mentioning age, qualification and detailed profession. • Up to date Non-Encumbrance Certificate. • Up to date ground rent receipt. • No Objection Certificate (NOC) from the concerned authority for mortgaging property. • Allotment letter of concerned authority for housing plot. • Layout plan of the building duly approved by the competent authority i.e. RAJUK/CDA/KDA/RDA/ Chairman, Pourashava/TNO/Union Parishad Chairman • Forwarding letter of the approved layout plan of the building by the competent authority. • A copy of Agreement between land owner & developer • A copy of Agreement between land owner/developer & Purchaser. • Any others documents / papers, if required as advised by the Bank’s legal advisor but not mentioned here.

• Purchase of new and reconditioned vehicles for personal use only. • Refinance of an own availed car (Date of purchase no later than 1 year)

50:50 where Bank will finance 50% of the car value or BDT 4,000,000.00 whichever is lower.

BDT 100,000.00

BDT 4,000,000.00 or 50% of the car value whichever is lower

70 years at the time of loan completion.

• Salaried Executives Minimum 6 (Six) months regular/contractual employment with present employer. • Professionals Doctors, Architects, Engineers, Chartered Accountants, and Teachers etc.: Minimum 6 (six) months of service/ practice in the profession. • Land Lord/ Land lady Rental income from the house with RCC and semi-pacca structure may be considered. • Businessman: Minimum 1 (One) year of business establishment

For Salaried Individuals: BDT 25,000.00 For Professionals BDT 40,000.00 For Landlord/Landlady BDT 50,000.00 For Business Individuals BDT 50,000.00

Disbursement of Loan amount is done in customer account and afterwards pay order is issued in name of Car Vendor.

Car registration with BRTA is required before disbursement of Car Loan.

1st Party comprehensive insurance (1st year only) is required before disbursement of car Loan.

Maximum 0.50% or TK 15,000/- whichever is lower as per the Schedule of Charges of DBBL.

Yes. Family Members Only (Father, Mother, Brother, Sister, Spouse, Son & Daughter only).

General Documents for all: • Loan Application duly completed and signed by the applicant • Colour Photograph • NID/ Smart Card • Bank Statement • Policy of first party comprehensive insurance • Car Quotation • Visiting Card • Copy of utility bill • e-TIN/ TIN certificate/ IT 88/ copy of income Tax acknowledgement • Personal Guarantee along with Colour Photograph, NID, Visiting Card/Office ID/Business Card of the personal guarantor(s). • Other documents or information as deemed necessary For Salaried Individuals: • Letter of Introduction (LOI) from employer regarding employment details/ Pay Slip/ Copy of Salary Certificate/ Copy of Increment/ Appointment letter etc. Or any other certificate issued by the employer. • Office ID For Businessperson: • Valid Trade Licence copy, copy of Memorandum & Articles of Association etc for Business person For Landlord/Landlady: • Rent or Lease Agreement of house / property

FOR INDIVIDUAL

- Premium Banking

- Priority Banking

- Islamic Banking

FOR BUSINESS

- Business Banking

- Corporate & Institutional

- Employee Banking

- Digital Banking

- Brunei Darussalam

- Cote d'Ivoire

- Falkland Islands

- Philippines

- Sierra Leone

- South Africa

- South Korea

- United Arab Emirates

- United Kingdom

- United States

Takeover Home Loan – More Life per Square Feet

Avail 8.49% Interest if you transfer your existing Home Loan from another Bank / Financial institute to us. Get a new lease of life.

- Apply Now Apply Now

loan amount up to BDT 20 million

enjoy loan amount up to 70% of property value

flexibility to repay the loan in up to 300 monthly instalments

Features of Standard Chartered Home Loan

You can avail home loan for renovation or extension of your existing home.

MortgageOne is a unique home loan linked to a deposit account, with which you can save on interest expense.

Top up your existing home loan at Standard Chartered Bank and avail additional funds for home renovation or extension.

Transfer your home loan from other financial institutions to Standard Chartered Bank at Zero processing fee!

Enjoy competitive variable interest rate. Processing fee up to BDT 20,000, without any hidden charges.

Mortgage Calculator

Please fill in the following information for an estimation of your repayment amount. The Approximate Monthly Repayment figure for Standard Chartered’s Personal Loan is indicative and is not meant to be final or binding on the Bank. The Bank reserves the right to determine the final interest rate in accordance with applicable laws and amount that can be borrowed.

Amount you want to borrow

Please enter an amount between BDT 2,000,000 and BDT 20,000,000

Loan Tenure

Please enter a Tenure less than 20 years.

The Approximate Monthly Repayment figure for mortgage is indicative and is not meant to be final or binding on the Bank. The Bank reserves the right to determine the final interest rate in accordance with applicable laws and amount that can be borrowed.

Eligibility & Documents

Age of applicant.

- Minimum age at the time of loan application: 25 years

- Maximum age at end of loan tenure: 70 years (depends on client segment)

Eligible client segments

- Salaried executives

- Business persons

- Self-employed professionals

Applicants must have a steady source of income from employment / business / self-employment activity.

Applicants must have aggregate 3 years of experience.

However, only for Employee Banking clients, 1 year experience will suffice if customer has proven loan / credit card repayment track of at least 12 months, and applies for the loan along with a co-borrower who has an independent income source.

Customer location

- Dhaka (including Narayanganj)

- Other areas with Standard Chartered Branch coverage may be considered

Property location

- Sylhet (Home renovation / extension loan only)

(Adjacent areas included)

Minimum net monthly net income: BDT 78,000

Mandatory documents for all clients.

- National ID Card

- Passport size photograph

- e-TIN Certificate

Income documents for salaried clients

- Original Letter of Introduction (salary certificate)

- Latest 6 months’ bank statement with salary reflections.

Documents for Businessman / Self employed clients

- Updated Trade License with proof of last 3 years business experience

- Partnership Deed /RJF certified with form1

- RJSC certified certificate of incorporation, MOA / AOA, form X / XII / 117 (as applicable)

- Business supporting documents like work orders

* Bank may ask for additional supporting documents if deemed necessary.

Maximum loan tenure

- Businesspersons: 120 months

- All other segments: 300 months

- Salaried executives with a valid work permit.

Co-applicant is mandatory for financing Non-Resident Bangladeshis (NRB). Where co-applicant is also a NRB, a local guarantor will be required for managing any post disbursement activities including collection, insurance renewal, security documentation, etc. The guarantor must be an immediate family member (father, mother, brother, son, daughter, spouse). The guarantor/local co-applicant must be located in Dhaka or Chattogram.

- UAE, India, Bahrain, Qatar, Jordan, Oman, Singapore, Malaysia, Indonesia, Hong Kong, Vietnam & South Korea

The property must be in the name of the non-resident or in joint name with the non-resident applicant.

Minimum net monthly net income: USD 3,500 (or equivalent)

Mandatory documents.

- Valid work permit

- Letter of Introduction (Salary certificate)

- 6 months bank statement as proof of salary relationship.

The following documents will need to be collected for providing the loan. The documents will need to be verified by concerned Embassy/High Commission of Bangladesh in the country of the non resident, and duly attested by foreign Embassy.

- Salaried segment: 180 months

Co-borrowers for the home loan can only be from your family i.e. spouse, father, mother and son only.

Co-Applicant is mandatory for all home loan applications.

However, if Primary applicant is both the “Property owner” & “Financially eligible person”, and there is no co-applicant, then primary applicant needs to provide 2 personal guarantors (1 immediate family member and another from anyone meeting guarantor criteria). However, if client is an Employee Banking Client / Doctor, then 1 personal guarantor from immediate family member is required.

Variable interest rate is a type of pricing where the interest rate is revised at pre-determined intervals based on movement of a market benchmark rate till the end of the loan tenure. During disbursement, the Home Loan interest rate is linked to the average rate of 182-Day Government Treasury Bill. The Home Loan interest rate will be reviewed (i.e. decreased or increased) every 6-months from the date of disbursement, based on the movement of the average rate of 182-Day Government Treasury Bills. During re-pricing, the new interest rate will be within the minimum and maximum interest rate range applicable for mortgage finance that is published in the bank’s interest rate matrix and also reported to Bangladesh Bank.

To apply for a home loan, please contact your nearest branch of Standard Chartered Bank, or call our 24 hour client care centre at +8802 8332272 , or 16233 (from mobile).

You can also speak directly to any of our Home Loan Sales Team Managers at the following numbers:

- +88 01711244654 (Md. Jafar Ullah)

- +88 01841706693 (Md Mesbah Uddin)

- +88 01711549073 (Washu Bin Mohsin)

- +88 01919930880 (For Chattogram – Ashim Chowdhury)

- +8801716582223 (Md. Sharek Chowdhury)

- +8801926669333 (AKShafiqur RahmanShirazee)

- +8801971686868 ( Mohammad Sharfin Ullah)

This information is neither an offer to sell, purchase or subscribe nor a solicitation of such an offer. This information is general and does not take into account a person’s individual circumstances, objectives or needs. Please visit any of our branches or contact your relationship manager to make an appointment.

Related Links

Personal Loan

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/bd and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/bd

Click to display the search engine

When Others Hushed Found My Voice!

Discover the path to finding your voice and enjoy the best of life with our personal loan that offers…

Low Interest Rates

- Offer for any legitimate financial purpose

- Attractive variable interest rate

- Competitive Processing Fees & Early Settlement Fees

- Flexible loan tenor (Maximum 05 Years)

- Maximum loan amount BDT 20 Lac

- Loan repayment with Equal Monthly Installment (EMI)

- Life insurance facility

- Takeover facility with Zero processing fees

- Convenience loan processing (Time & Location)

Eligibility

- Age must be between 22-65 years

Requirements

- If You Are a Jobholder or Self-employed

- If You Are a Landlord

- Personal Guarantor: Minimum: 01

- Recent passport size color photographs of applicant and guarantor(s)

- Copy of NID/passport of applicant and guarantor (s)

- Copy of Latest utility bill (gas/water/electricity/municipal tax)

- Quotation of purchased item/ Customer Declaration for cost purpose

- Business card/copy of office ID of applicant and guarantor(s), if any

- Copy of Latest tax clearance certificate/E-TIN

- Original Salary Certificate/Letter of Introduction (LOI)

- Copy of Pay-slip

- Offer letter/Release letter from previous employer to prove service experience

- Professional certificate issued by concerned authority

- Latest 06 months bank statement

- Copy of property title deed and latest mutations

- Copy of valid rental deed with tenants

- Copy of latest ground rent receipts and municipal tax receipts

Know Your EMI

Bank with ease.

Do Your Banking Online, Anytime

Check your balance, make fund transfer, pay bills & do more with our online banking solution MyPrime

Your First Step with Us, Starts Here

Today? Tomorrow? Why not right now! Start your journey with us right away with PrimePlus

For further assistance, feel free to…

Give us a call at 16218

Give us a knock at messenger!

Personal Loan

To meet financial requirement of salaried person, self employed or business person not exceeding 55 years

- Loan amount ranging from Tk. 50 thousand to Tk. 10 lac

- Loan tenor 12 to 72 months

- Competitive interest rate

Processing Fee

- 1% processing fee on any loan amount

Eligibility

- Age Limit: 21 to 60 years

- Salaried Executive (Govt. Service): Must be confirmed employee

- Salaried Executive (Private Service): Service length must be 02 years as a confirmed service holder.

- Salaried Executive (Govt. Service): Minimum Gross Salary Tk.18,000 per month

- Salaried Executive (Private Service): Minimum Gross Salary Tk.25,000 per month

instant smart loan

Hassle-free, Paperless, Cashless, Easy, Faster and More Transparent Way to Get Loan Anywhere in Bangladesh.

To be a Leading and Diverse Non-Bank Financial Loan Platform in Bangladesh.

To Support Businesses and Families Achieve More Financial Freedom.

eVerification

Contact No:

+8801708000660 +8801847220062

[email protected] [email protected]

How to take Foreign loans in Bangladesh in 2023 | How to effectively process Overseas Financing for Bangladeshi Companies | Pioneering Bangladesh

How to take foreign loans in bangladesh in 2023 | step by step process of getting loan from foreign entities.

11 Jan 2023

Tahmidur Rahman , Director and Senior Associate

This post will explain in details about Overseas Financing & Foreign loans for Bangladeshi Companies- How to take foreign loans in Bangladesh in 2023 . Here in this post we explain the Procedure & Guidelines for the required approval of foreign loans by Bangladeshi Companies.

Table of Contents

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

Overseas Financing by Bangladeshi Companies

Over the last decade, obtaining a foreign loan by Bangladeshi entities or companies , have increasingly become a routine occurrence. Bangladeshi companies choose international loans for a variety of reasons, including lower interest rates and the ability to borrow a big sum from a single lender.

The Government of Bangladesh has been enabling foreign borrowing legally approved by the Scrutiny Committee in order to attract foreign investment in the private sector through simpler long-term financing of industrial projects at lower cost of funds and to relieve strain on foreign currency reserves.

Obtaining foreign Loans in Bangladesh in 2023

In 2023 , Short-term loans from parent corporations and shareholders are now available to foreign-owned service companies as operating capital. Overseas-owned enterprises operating in Bangladesh now have more flexibility in receiving foreign loans according to the Bangladesh Bank.

According to a notice released by the central bank’s Foreign Exchange Policy Department , foreign-owned service companies can now obtain short-term loans as working capital from their parent companies and shareholders for essential business needs (FEPD) .

Previously, such loans were exclusively available to foreign-owned industrial businesses that participated in manufacturing. Such loans were not available to service or trading enterprises. However, service businesses can now take out such loans as well.

The central bank further stated that such a loan might be available in convertible foreign currencies for a maximum of six years from the start of manufacturing and/or service output operations, with the opportunity to renew or extend the term during that time. Borrowing businesses may pay interest at a maximum of 3% per year until additional instructions are issued, with all other relevant transaction directions remaining intact.

What are the usual requirements to borrow?

Though each foreign lender has its unique set of criteria, the following is a summary of some of the most frequent requirements that a company may be expected to meet before acquiring the foreign loan.

- Borrower possesses the necessary licences and permits to operate its business.

- The borrower’s business records are up to date.

- Borrower is a firm that is conscious about the environment.

- All industry standard certifications have been obtained by the borrower (e.g. ISO certification ).

- Borrower is a company that follows all labour laws.

- The borrower or the project has proper insurance.

Step by Step requirements and all the possible documents that you may need

When the documents are issued, they will be thoroughly reviewed by the BIDA Inter-Ministerial Committee . When the committee is content with the verification then they may give the approval or can obtain additional documentation. Hence it is important to carefully prepare the papers.

- The Company’s Board of Directors approval for the proposed foreign loan.

- Copy of the most recent BIDA registration form, duly attested by a First Class Gazette officer;

- Original copy of the parties’ Loan Agreement; (For the lender, a copy of the detailed repayment schedule; original copy of the grade period;)

- CIB Inquiry Forms 1&2 duly completed, as well as an undertaking from its Sponsors or Directors;

- Sponsors’ or directors’ credentials;

- The company’s and its sponsors’ CIB certificates;

- Record of previous foreign loans/deferred payments (if available);

- Audited previous year’s balance sheet;

- Utilization Certificate from nominated bank;

- Latest company credit rating report;

- Latest financial analysis

- Updated feasibility report of the proposed project in detail;

- Form-X, Form-XII and Form-XV from RJSC&F;

- Certificate of Incorporation of commencement;

- Memorandum & Articles of Association;

- Proforma Invoice or Price Quotation (where applicable);

- Original copy of the Bank Solvency Certificate;

- Descriptive statement of the use of the loan;

“Tahmidur Rahman Remura Wahid is Considered as one of the leading firms in Company Law in Dhaka, Bangladesh”

Bdlawfirms & Carpe Noctem Bangladesh

Criteria for foreign borrowing

Foreign lenders typically conduct extensive due diligence on the borrower. Financial due diligence is typically performed by the lender; however, for technical, environmental, and legal due diligence, the lender may hire external consultants. The borrower will be responsible for the costs of these consultants.

The lender may require the borrower to appoint a process agent in the country of its choosing, an auditor affiliated with an international auditing firm; and a compliance manager . The auditor and compliance manager may require a timely report to be submitted directly to the lender following disbursement.

Other Relevant Criterias for Foreign Loans

I. debt-to-equity ratio: the debt-to-equity ratio based on anticipated borrowing should be kept to a bearable level. while relatively higher debt levels may be warranted for long gestation infrastructure projects, total debt including the proposed borrowing should not breach 70:30 debt equity ratio even for these projects;, ii. liabilities to the government: there should be absolutely no liability to the government, either in taka or in foreclosed property..

iii. Status of implementation and utilization report of authorized foreign borrowing: On a semi-annual basis, the borrowing firm must submit to the BOI the status of implementation and utilization report of the approved loan in the specified format.

iv) If capital machinery and equipment to be bought: Quality, price, and economic life; The capital machinery and equipment to be procured with the proposed borrowing should either be brand new or, if refurbished, have a sufficient useful life as specified by the Government’s Import Policy Order.

v) Validity of the approval: The Scrutiny Committee’s approval of foreign borrowing is valid for 6 (six) months from the date of the BOI’s permission letter.

Vi) Common Terms: a) The borrowing firm must follow Bangladesh Bank’s laws and regulations on the use and repayment of the loan, as well as the interest thereon.

What are the due dilligence you may expect from your foreign lenders?

The lender may require the borrower to appoint a process agent in the country of its choosing, an auditor affiliated with an international auditing firm; and a compliance manager. The auditor and compliance manager may require a timely report to be submitted directly to the lender following disbursement.

How to get the BIDA Clearance for Foreign Loan in Bangladesh

After obtaining the prescribed application from BIDA , the applicant must submit the aforementioned documents, along with the applicable licence fee, to the Security Committee of Bangladesh Bank for review. If the committee grants clearance after reviewing the submitted documents, BIDA will grant the loan in accordance with their recommendation.

The official time limit for such a process will be entirely dependent on the Borrower for document collection and, to a lesser extent, on the Scrutiny Committee to conduct the meeting, and the fee schedule for approval will be tentatively between BDT 5k and BDT 100k depending on the amount of lending.

How to get a Trade License in Bangladesh?

Click here and go to the post, Tahmidur Rahman speaks in details about Trade License in Bangladesh | Fees, Processing and Renewal!

Regulatory Permissions from Bangladesh Bank and Board of Investment (BOI) .

Foreign loans with a term of less than a year require Bangladesh Bank’s prior authorization. The Board of Investment must authorize all other foreign loans (including supplier credits, financial loans from institutions or individuals, and debt issuance in international capital markets) (BOI).

Borrowers in special economic zones, such as the EPZs , are eligible for certain concessions (Export Processing Zone).

It normally takes three to six months for the BOI to approve the application. The loan must be applied for using a stipulated application form, which, along with accompanying documentation, must clearly state the loan’s purpose and planned usage by the borrower, as well as the repayment schedule with dates and amounts, and interest payment dates and amounts.

The following documents must be supplied with the application as supporting documentation:

- The term sheet, facility agreement , and security documents are all part of the loan documentation. These may be submitted in draft form:

- The borrower’s corporate documents, such as the memorandum and articles of association; resolutions of the borrower’s Board of Directors approving the foreign loan on the terms and conditions reflected in the loan documentation and the application;

- If the loan is to be used to import any equipment, a pro-forma invoice for that equipment;

- Report covering key financial and commercial matters in in respect of the loan and related project.

Foreign loans from Multilateral Development Banks

Each of the major Multilateral Development Banks, including the Asian Development Bank and the World Bank, has a Commercial Liaison Office run by the Commercial Service.

These financial organizations lend billions of dollars to initiatives in developing nations like Bangladesh that aim to boost economic growth and social development by decreasing poverty and inequality, increasing health and education, and expanding infrastructure development.

The Commercial Liaison Offices assist American firms in learning how to participate in bank-financed projects and lobby on their behalf.

General Questions that people ask about Foreign Loans in Bangladesh

Is it possible to receive international venture capital funding to launch a business in bangladesh.

IFC and IDLC funding helped Chaldaal, a food e-commerce firm, raise US$ 5.5 million. This is a positive indicator since if the business thrives, additional financial institutions may be willing to invest in it. Sindabad, a B2B e-commerce, received US$ 4.2 million from Aavishkaar, an Indian Impact Fund. Handy Mama, C-work, Gaze, and Beatles are among the four start-ups that BD Venture has invested in. They joined other Angel Investors in a second round investment in Esoshikhi, an educational technology. The government has set aside Tk 1 billion in the budget for new business ventures. However, the specifics of how that cash will be used have yet to be determined. The cabinet recently approved the ICT Ministry's initiative to establish a venture capital business.

Can I take loan from foreign bank in Bangladesh?

A company can obtain a soft loan in one of two ways: automatically or through the government: The automatic method allows a borrower to get a loan from a foreign firm without first obtaining clearance from Bangladesh's Central Bank. The loan arrangement must, however, be recorded with the BIDA in this case.

How to determine the existing indebtedness structure and creditworthiness of the borrowing company?

(a) CIB report: A CIB report will be needed for all proposals to be processed. The CIB report will be collected by BOI from Bangladesh Bank. (a) Bank certificate: Existing indebtedness structure and creditworthiness of the sponsors involved, duly confirmed by their bankers, will be required for foreign borrowing permission. The chosen bank will submit to BOI the required inquiry papers as well as an undertaking from the borrowing company's Sponsor Directors.

What are the funding programs for Bangladeshi Entrepreneurs?

Robi, a mobile telecom business, has overhauled its Accelerator program. They broadened the scope by allowing applications from anybody in Robi payroll. They expanded its coverage to include all of Bangladesh. They got almost 2200 applications, of which 56 were chosen for pitching. Finally, eight funds and incubation facilities were given. These programs were aired on television in order to raise awareness and encourage people about the notion of entrepreneurship. Grameenphone has renamed its Accelerator program GP Accelerator 2.0, which is divided into two parts: Pre-Accelerator and Accelerator. Pre-Accelerator is an 8-week program that provides training and coaching to assist verify their concept and get it to market. The accelerator is a 4.5-month program for teams with a Minimum Viable Product (MVP).

How to determine the Quality & Commercial viability of the project for Foreign Loan?

The following financial analyses are necessary to verify the quality/commercial viability of the project feasibility study;

a) The project's internal rate of return (IRR) b) The payback period c) The break-even point at what capacity and what time of year d) A sensitivity analysis in terms of IRR d) Ratio of Debt Service Coverage (DSCR)

What are the challenges regarding overseas financing in Bangladesh?

Globally, governments that backed startups saw an increase in their GDP. In the fourth industrial revolution period, creativity and technology assistance are critical for competing in global marketplaces. As a result, startups should be at the top of everyone's priority list. It is a priority for our government, but it should be represented at all levels of policy making. Our entrepreneurs have difficulties in obtaining trade licenses, intellectual property rights, and other business licenses and permissions. Foreign investors are hesitant to invest in a company that lacks all necessary legal documentation. Foreign investors are likewise unconvinced about the ease with which they might abandon their investments. Regional centers such as Singapore and China have vast amounts of money to invest, yet we are unable to entice them to engage in our enterprises.

Can an individual from Bangladesh take loan in foreign currency?

Provided, however, that for sufficient reasons, the Central Bank may permit a person resident in Bangladesh to borrow or lend in foreign exchange from or to a person resident in or outside Bangladesh, and/or permit a person resident in Bangladesh to borrow or lend in BDT from or to a person resident outside Bangladesh.

Can a foreign director give loan to Bangladeshi company?

Yes, it is permitted. But bear in mind, a company cannot lend to a director without paying taxes, while a director can lend to a company.

How do I record a loan repayment?

When your company records a loan payment, you debit the loan account to remove the liability from your books and credit the cash account. Repayments on an amortized loan are made over time to meet interest expenditures and principle reduction.

What are the 3 classification of loans in Bangladesh?

A loan is a sum of money borrowed from a lender by an individual or a business. It is divided into three types: unsecured and secured loans, conventional loans, and open-end and closed-end loans. Before any money crosses hands, the beneficiary and the lender must agree on the conditions of the loan. In some situations, the lender may compel the borrower to put up an asset as collateral, which will be specified in the loan agreement. Individuals, businesses, and governments can all get loans. The major reason for taking one out is to obtain funds to increase one's total money supply. The lender earns money by charging interest and fees.

Company Law practice in TR Barristers in Bangladesh

The Barristers, Advocates, and lawyers at TRW Law chamber in Gulshan, Dhaka, Bangladesh are highly experienced at assisting clients in dealing with and registering branch offices in Bangladesh. For queries or legal assistance to set up a branch office in Bangladesh , please reach us at:

E-mail: [email protected] Phone: +8801847220062 or +8801779127165 or +8801708080817 House 410 Road 29 Mohakhali DOHS

Want new articles before they get published? Subscribe to our Awesome Newsletter.

E-mail Address

How to get BGMEA Membership in Bangladesh

by Barrister Tahmidur Rahman | 16/05/2024 | BD Law , Law , Uncategorized | 0 Comments

Directorate of Textile Registration Permit in Banlgadesh

by Barrister Tahmidur Rahman | 16/05/2024 | BD Law , Business Law , Uncategorized | 0 Comments

Partnership Deed Registration in Bangladesh in 2023

by Barrister Tahmidur Rahman | 16/05/2024 | BD Law , Company Law , Uncategorized | 0 Comments

দেওয়ানী কার্যবিধির আদেশ সমূহ

by Barrister Tahmidur Rahman | 13/05/2024 | 2023 , BD Law , Uncategorized | 0 Comments

Registering a trademark in Bangladesh

by Barrister Tahmidur Rahman | 12/05/2024 | 2023 , BD Law , Business Law , Company Law , Uncategorized | 0 Comments

Top Divorce Lawyers Dhaka

by Barrister Tahmidur Rahman | 08/05/2024 | 2023 , BD Law , Divorce , Family , Uncategorized | 0 Comments

চেক ডিজঅনার মামলার নতুন নিয়ম ২০২8

by Barrister Tahmidur Rahman | 29/04/2024 | 2023 , 2024 , Banking Law , BD Law , Business Law , Cheque Dishonour , Uncategorized | 0 Comments

Cheque Dishounor and Legal Remedies in Bangladesh in 2024

by Barrister Tahmidur Rahman | 07/04/2024 | 2023 , Agreement , Banking Law , BD Law , Business Law , Cheque Dishonour , Commercial , Company Law , Uncategorized | 0 Comments

Issue Management for IPO in Bangladesh

by Barrister Tahmidur Rahman | 19/03/2024 | 2023 , Banking Law , BD Law , Capital Market Law , Company Law , Finance Law , Investment Law , Mergers and Acquisitions | 0 Comments

Ad valorem court fee in Bangladesh

by Barrister Tahmidur Rahman | 05/03/2024 | 2023 , Banking Law , jurisprudence , Law | 0 Comments

Contract Under Bangladeshi Law

by Barrister Tahmidur Rahman | May 19, 2024 | Uncategorized

The 6 Essential Elements of a Contract Under Bangladeshi Law As in many other jurisdictions, a Contract Under Bangladeshi Law is considered legally enforceable when it incorporates six essential elements: Offer, Acceptance, Awareness (also known as Consensus Ad Idem...

Setting up a new factory in Bangladesh

by Barrister Tahmidur Rahman | May 17, 2024 | Commercial , Company Law , Factory , Uncategorized

Setting up a new factory in Bangladesh in 2024 Are you considering expanding your manufacturing operations to Bangladesh? With its growing economy, strategic location, and favorable investment climate, Bangladesh has become an attractive destination for setting up new...

Comprehensive guide on Foreign Company Registration in Bangladesh

by Barrister Tahmidur Rahman | May 16, 2024 | Uncategorized

Foreign Company Registration in Bangladesh Bangladesh has emerged as a top alternative for international investors seeking to establish a foreign company due to its booming economy and large local clientele base. The implementation of several policies aimed at...

by Barrister Tahmidur Rahman | May 16, 2024 | BD Law , Law , Uncategorized

BGMEA Membership in Bangladesh The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) stands as a cornerstone of the country's textile and garment industry, representing the interests of manufacturers and exporters. Membership in BGMEA is highly sought...

by Barrister Tahmidur Rahman | May 16, 2024 | BD Law , Business Law , Uncategorized

Directorate of Textile Registration Permit in 2024 In Bangladesh, the textile industry stands as a cornerstone of the nation's economy, contributing significantly to its GDP and providing employment opportunities to millions. With the sector's rapid growth and...

VAT registration certificate in Bangladesh

by Barrister Tahmidur Rahman | May 16, 2024 | Finance Law , Tax Law , Uncategorized

How to get VAT registration certificate in Bangladesh Every business in Bangladesh must have a unique Business Identification Number (BIN). To obtain that, each firm must acquire a VAT registration certificate. VAT registration and a Business Identification Number are...

Other posts you might like

- Logout Login

- Adventure Holidays

- Weekend Getaways

- Driving Holidays

- Travel News

Top Searches

Ladakh Summer Treks

India Abandoned Places

UAE Visa Update

UAE Golden Visa

India Wildlife Adventure

Cyclonic storm 'Remal': Odisha, West Bengal and Bangladesh on high alert

Times of India TIMESOFINDIA.COM / TRAVEL NEWS , WEST BENGAL / Created : May 25, 2024, 20:44 IST

You're Reading

IMD issues alert for cyclonic storm 'Remal' intensifying over Bay of Bengal, set to make landfall on West Bengal and Bangladesh coasts by May 26 midnight, impacting multiple regions with heavy rain and strong winds.

IMD issues alert for cyclonic storm 'Remal' intensifying over Bay of Bengal, set to make landfall on West Bengal and Bangladesh coasts by May 26 midnight, impacting multiple regions with heavy rain and strong winds. Read less

14 most travelled countries and their single most unique attractions

More from travel news.

Comments (0)

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive . Let's work together to keep the conversation civil.

Comments ( ) Sort: Newest UpVoted Oldest Discussed Down Voted closecomments

SIGN IN WITH

Or post without registration.

Visual Stories

Popular Galleries

7 places in India that are perfect for motorcycle expeditions TRAVEL TRENDS , INDIA

7 coolest off-season wildlife adventures in India TRAVEL TRENDS , INDIA

Char Dham Yatra: Hill stations to avoid on weekends in summer TRAVEL TRENDS

Trending stories.

- Is Kalpa the prettiest village in India?

7 places in India that are perfect for motorcycle expeditions

- Chase offbeat waterfalls in Goa this monsoon season

Increased tourist footfall in Srinagar; book a month in advance for houseboat rides

- 1 Cyclonic storm 'Remal': Odisha, West Bengal and Bangladesh on high alert

- 2 Increased tourist footfall in Srinagar; may have to book a month in advance for houseboat rides!

- 3 Travel advisory: Heatwave alert declared in these parts of India

- 4 Goa heatwave: Tourists flock to Goa ahead of monsoon season; 5 lesser-known beaches to explore

- 5 Paris’ Champs Elysees to host massive picnic to draw tourists to the iconic boulevard

THE DEFINITIVE GUIDE TO DESTINATIONS, ITINERARIES, THINGS TO DO, RESTAURANTS, NIGHTLIFE and LOTS MORE!

FOLLOW US ON

Places to visit.

- Places to visit in Bangalore

- Places to visit in Mumbai

- Places to visit in Delhi

- Places to visit in Goa

- Hotels in Goa

- Hotels in Jaipur

- Hotels in Shimla

- Hotels in Mumbai

Things To do

- Things to do in Goa

- Things to do in Mumbai

- Things to do in Bangalore

- Things to do in Delhi

Travel Inspiration

- Visa on arrival for Indians

- Honeymoon Places in india

- Hill Stations in India

- Weekend getaways in Mumbai

- Weather in Delhi

- Weather in Chennai

- Weather in Bangalore

- Weather in Mumbai

Best Beaches

- Goa Beaches

- Mumbai Beaches

- Pondicherry Beaches

- Kerala Beaches

- Restaurants in Bangalore

- Restaurants in Chennai

- Restaurants in Pune

- Restaurants in Jaipur

- Hill Station near Delhi

- Winter trip to Ladakh

- Places to visit in Kerala

- Winter Honeymoon Destinations

- UK visa guide for Indians

- Winter Trip to Manali

- Vaishno Devi Yatra

- Special Train Ticket Booking

- HP inter-state Bus

- Honeymoon Destinations India

Latest News

- Travel advisory: Heatwave alert declared in these parts of India

- Increased tourist footfall in Srinagar; may have to book a month in advance for houseboat rides!

- Rock carvings found in Goa’s Mauxi village 20 years ago belong from neolithic age; ASI confirms

Congratulations!

You have been successfully added to the mailing list of Times of India Travel. To complete the subscription process, kindly open your inbox and click on the confirmation link which has been emailed to you.

Share with friends

Thank You for sharing! Your friend will receive the article link on email mentioned.

- (For more than one recipient, type addresses separated by commas)

IMD issues alert for cyclonic storm 'Remal' intensifying over Bay of Bengal, set to make landfall on West Bengal and Bangladesh coasts by May 26 midnight, impacting multiple regions with heavy rain an...

- Investigative Stories

- Entertainment

- Life & Living

- Tech & Startup

- Rising Star

- Star Literature

- Daily Star Books

- Roundtables

- Star Holiday

- weekend read

- Environment

- Supplements

- Brand Stories

- Law & Our Rights

Most Viewed

Afif exposing BCB’s bitter truth

2 MRT lines may miss deadline

Deep depression likely to intensify by this afternoon

Pakistan announce T20 World Cup squad

Lending through agent banking rises 41%

Loan disbursement through agent banking outlets rose by a massive 41.27 percent year-on-year as of March this year mainly thanks to the easy processing system, low transaction cost and comparatively lower interest rates.

The country's 15,835 agents handed over Tk 16,482.5 crore agent banking loans as of March this year, up from Tk 11,667 crore in March last year, according to Bangladesh Bank's January-March quarterly report on agent banking.

For all latest news, follow The Daily Star's Google News channel.

Mohd Ziaul H Molla, deputy managing director of Bank Asia, a leader in agent banking in Bangladesh, credited the growth in agent banking loan disbursement to its easy, customer-convenient and cost-effective process.

"To avail a loan from an agent banking outlet, customers do not need to visit a bank branch which is far away from their home," said Molla, who is also the head of channel banking and chief anti money laundering compliance officer of Bank Asia.

The alternate delivery channel of banking services introduced by Bangladesh Bank in 2013 is also gaining popularity as agent banking deposits posted a 16.52 percent year-on-year growth as of March this year, he told The Daily Star.

Deposits through the 2.2 crore agent banking accounts, around four-fifths of which belong to people in rural areas, hit Tk 36,810 crore at the end of the third month of 2024, up from around Tk 31,641.5 crore in March 2023.

"People love to use agent banking as they can withdraw money by using just their fingerprint on a biometric machine at the outlets," Molla said.

Depositing money has also been made safe as they receive a printed copy and a text message against every deposit, he added.

Meanwhile, agent banking accounts received Tk 149,916 crore worth of inward remittance as of March this year, posting growth of 23 percent year-on-year, and around 90.22 percent of the total went to the rural population.

In the January-March quarter, the amount of inward remittance rose by 4.75 percent over the December 2023 quarter.

This increase in inward remittances through agent banking is supposed to be a positive outcome of the government's initiative of providing 2.5 percent cash incentive on inward remittances, the report read.

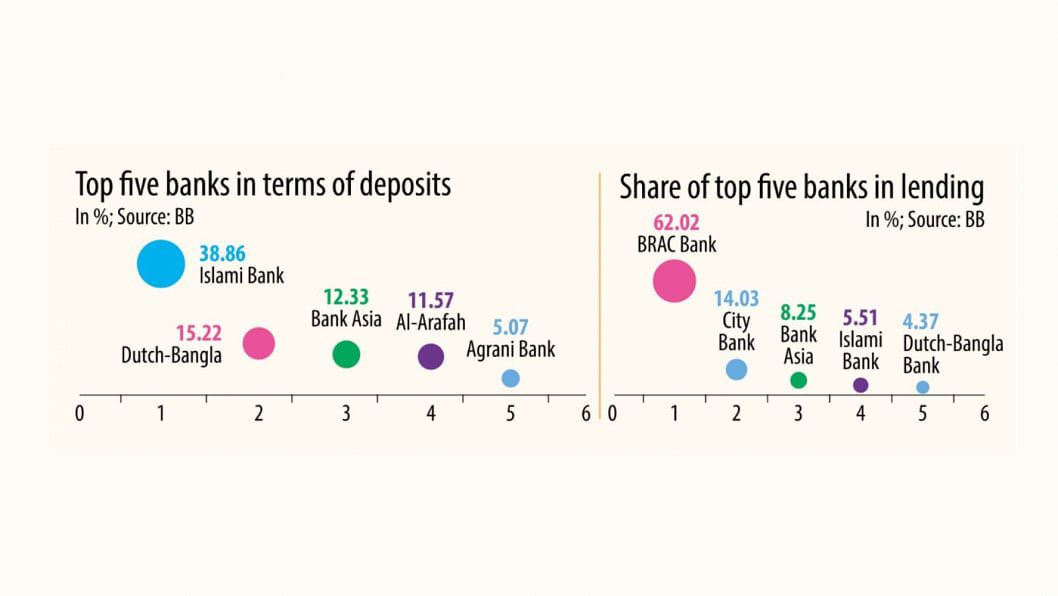

Islami Bank Bangladesh PLC received the highest amount of inward remittance, accounting for 52.94 percent of the total.

The top five banks have established 73.44 percent of the total agent outlets as of March 2024, with Dutch-Bangla Bank PLC having the highest number with 6,057 outlets.

Bank Asia PLC has the highest number of agent banking accounts, occupying 29.66 percent of the total.

Around 38.86 percent of the agent banking deposits were made in Islami Bank Bangladesh PLC, the highest among all banks.

In case of lending through agent banking, BRAC Bank PLC topped the list, disbursing 62.02 percent of the loans out of the combined Tk 16,482.5 crore.

Meanwhile, the agent banking outlets' loan to deposit ratio -- the percentage of loans an outlet gave in comparison to the deposits it received from customers -- has also seen a spike.

The loan to deposit ratio in agent banking was only 44.7 percent in the January-March quarter of 2024, up from the previous quarter's 42.38 percent.

An increase in loan to deposit ratio compared to the last quarter indicates that investment through agent outlets is gradually gaining momentum, the central bank report read.

However, the ratio is still low, according to industry insiders.

In the first three months of this year, only 22 banks out of 31 distributed loans through agent banking.

The low lending to deposit ratio indicates that the agent banking window is serving banks' purpose more on deposit collection than lending.

Again, the loan to deposit ratio in rural area was 36.79 percent, which indicates that rural people are still getting less loan facilities against their deposits compared to those in urban areas, the report read.

The coverage of agent banking operations in terms of the number of agents and outlets has increased remarkably.

As of March 2024, the number of agent banking outlets reached 21,613 and over four-fifths of them are located in rural areas.

Both the numbers of agents and outlets have been growing at a steady rate, Bangladesh Bank said.

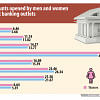

Of the agent banking accounts, around 49.71 percent belong to female customers, who have continued to surpass their male counterparts (49.06 percent) in account opening.

Some 1.1 crore of the accounts belong to female customers and 1.09 crore to males.

As of this March, around 57.61 percent of the deposits were made in male customers' agent banking accounts and 35.71 percent female.

The Bangladesh Bank report said the decrease in deposits from women has widened the gap between the volume of deposits by male and female customers.

Related News

Agent banking: the largest alternate delivery channel for banking the unbanked

Agent banking losing steam with banks opening more sub-branches

Women hold majority of accounts opened thru’ agent banking

Female participation through agent banking rising

ঘূর্ণিঝড়ে রূপ নিয়েছে গভীর নিম্নচাপ, বাড়ল সংকেত

তিন নম্বর স্থানীয় সতর্ক সংকেত নামিয়ে মোংলা ও পায়রা সমুদ্রবন্দরকে সাত নম্বর এবং চট্টগ্রাম ও কক্সবাজার সমুদ্রবন্দরকে ছয় নম্বর বিপদ সংকেত দেখাতে বলা হয়েছে।

হঠাৎ বন্ধ মেট্রোরেল, দেড় ঘণ্টা পর চালু

- Ground Reports

- 50-Word Edit

- National Interest

- Campus Voice

- Security Code

- Off The Cuff

- Democracy Wall

- Around Town

- PastForward

- In Pictures

- Last Laughs

- ThePrint Essential

Pune (Maharashtra) [India], May 25: Bajaj Markets, a digital financial marketplace, provides access to loans and credit cards from a wide network of financial institutions. These instruments can provide individuals with the financial flexibility required to explore the world. People planning a vacation should make the most of the financial solutions that are available on Bajaj Markets.

Turn Dream Vacations into Reality with Personal Loans

For those yearning for a getaway but short on immediate funds, a personal loan can bridge the gap. Bajaj Market’s wide range of network can definitely provide a solution:

* Fixed Rates and EMIs: Personal loans come with fixed interest rates and equated monthly installments (EMIs), allowing for easy budgeting and financial planning for repayments

* Substantial Loan Amounts: One can access substantial loan amounts of up to Rs. 50 Lakhs to cover various vacation expenses, from flights and accommodation to travel experiences and activities.

* Quick Disbursal: Bajaj Markets facilitates a faster loan disbursal, so you can book your trip without delay.

* Preserve Savings: A personal loan helps safeguard your emergency fund while financing your vacation, ensuring financial security upon your return.

Maximize Rewards and Flexibility with Credit Cards

Bajaj Markets also offers a curated selection of travel-friendly credit cards which may offer benefits like:

* Travel Rewards: Many travel credit cards offer reward points or miles on travel-related spending, which can be redeemed for future trips or travel upgrades.

* Exclusive Travel Benefits: Several cards provide access to airport lounge privileges, travel insurance, and other benefits that enhance your travel experience.

* Managing Expenses: Credit cards allow for easy expense tracking and convenient bill payments, simplifying post-vacation finances.

Bajaj Markets streamlines the process of finding the right financial product for your travel needs.

* Wide Network: Choose from a diverse range of personal loans and credit cards offered by the trusted network of Bajaj Markets.

* Convenient Comparison: Easily compare interest rates, fees, and features to select the most suitable option for your budget.

* Seamless Application Process: The online application process is quick and hassle-free, allowing you to focus on planning your dream vacation.

Whether one prefers the predictability of a personal loan or the flexibility of a credit card, Bajaj Markets empowers them to turn their travel aspirations into reality. Visit Bajaj Markets today and find the perfect financial tool to unlock the next adventure!

Bajaj Finserv Direct, a subsidiary of Bajaj Finserv, is one of the fastest-growing fintech companies in India. It has two primary arms, Bajaj Markets, a financial marketplace, and Bajaj Technology Services, a techfin service provider.

Bajaj Markets is a marketplace that offers multiple financial products across all categories – Loans, Cards, Insurance, Investments, Payments, Pocket Insurance, and VAS. Bajaj Markets has partnered with trusted financial brands to offer “India ka Financial Supermarket”. A one-stop destination where its customers can explore a host of products that can help them achieve their financial life goals.

Having started its journey as a fintech, Bajaj Finserv Direct has also built a very strong business as a techfin. Through Bajaj Technology Services it offers a wide gamut of digital technology services which span Custom Applications, Enterprise Applications, Data & Analytics, Gen AI, Cloud Services and Digital Agency.

Visit the Bajaj Markets website or download the Bajaj Markets’ app from the Play Store or App Store to experience “India ka Financial Supermarket”.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.

Subscribe to our channels on YouTube , Telegram & WhatsApp

Support Our Journalism

India needs fair, non-hyphenated and questioning journalism, packed with on-ground reporting. ThePrint – with exceptional reporters, columnists and editors – is doing just that.

Sustaining this needs support from wonderful readers like you.

Whether you live in India or overseas, you can take a paid subscription by clicking here .

LEAVE A REPLY Cancel

Save my name, email, and website in this browser for the next time I comment.

Most Popular

‘fraud on power’ — calcutta hc order scrapping nearly 5 lakh obc certificates issued in bengal, pune porsche case wouldn’t have taken a u-turn for the rich family if not for public outrage, anti-incumbency, ‘poor’ candidate choice, caste factor — nda depends on modi’s ‘magic’ in bihar.

Required fields are marked *

Copyright © 2024 Printline Media Pvt. Ltd. All rights reserved.

- Terms of Use

- Privacy Policy

- Subscribe Digital Print

- depopulation

- Latest News

- Deep Dive Podcast

Today's print edition

Home Delivery

- Crime & Legal

- Science & Health

- More sports

- CLIMATE CHANGE

- SUSTAINABILITY

- EARTH SCIENCE

- Food & Drink

- Style & Design

- TV & Streaming

- Entertainment news

Foreign student numbers in Japan grew in 2023

After a sharp decline during the pandemic, the number of foreign students in Japan experienced a recovery in 2023, though it remains below prepandemic levels, a public survey found.

The survey results, released by the Japan Student Services Organization (JASSO) on Friday , show a 20.8% increase in the number of foreign students — 279,274 — as of May 2023 compared with a year earlier. Over the same period, the number of foreign students enrolled in Japanese-language schools nearly doubled to an all-time high of 90,719.

JASSO is a quasi-autonomous agency responsible for scholarships and student loans.

In contrast, the number of foreign students enrolled in higher education institutions, which grew from 181,741 in 2022 to 188,555 in 2023, experienced a much slower increase. The latest figure represents just a little over 80% of the prepandemic level.

The number of foreign students enrolled in bachelor’s and associate degree programs even dropped by 2.4% compared with 2022.

In terms of origins, students from China continued to make up the largest proportion, at 115,493. But the number of students from Nepal, Myanmar, Bangladesh and the United States surpassed the figure in 2019, a year before the COVID-19 pandemic crippled transnational travel.