ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Office determination TD 2024/3 sets out reasonable allowances for the 2024-25 financial year. See details below .

2021, 2022, 2023 and 2024 rates and earlier years are also set out below.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2024-25

The full document in PDF format: 2024-25 Determination TD 2024/3 (pdf).

The 2024-25 reasonable amount for overtime meal expenses is $37.65.

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $30.35

- lunch $34.65

- dinner $59.75

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document.

2024-25 Domestic Travel

Table 1:Salary $143,650 or less

Table 2: Salary $143,651 to $255,670

Table 3: Salary $255,671 or more

Table 4: High cost country centres accommodation expenses

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2024-25 Overseas Travel

Table 6: Salary $143,650 or less

Table 7: Salary $143,651 to $255,670

Table 8: Salary $255,671 or more

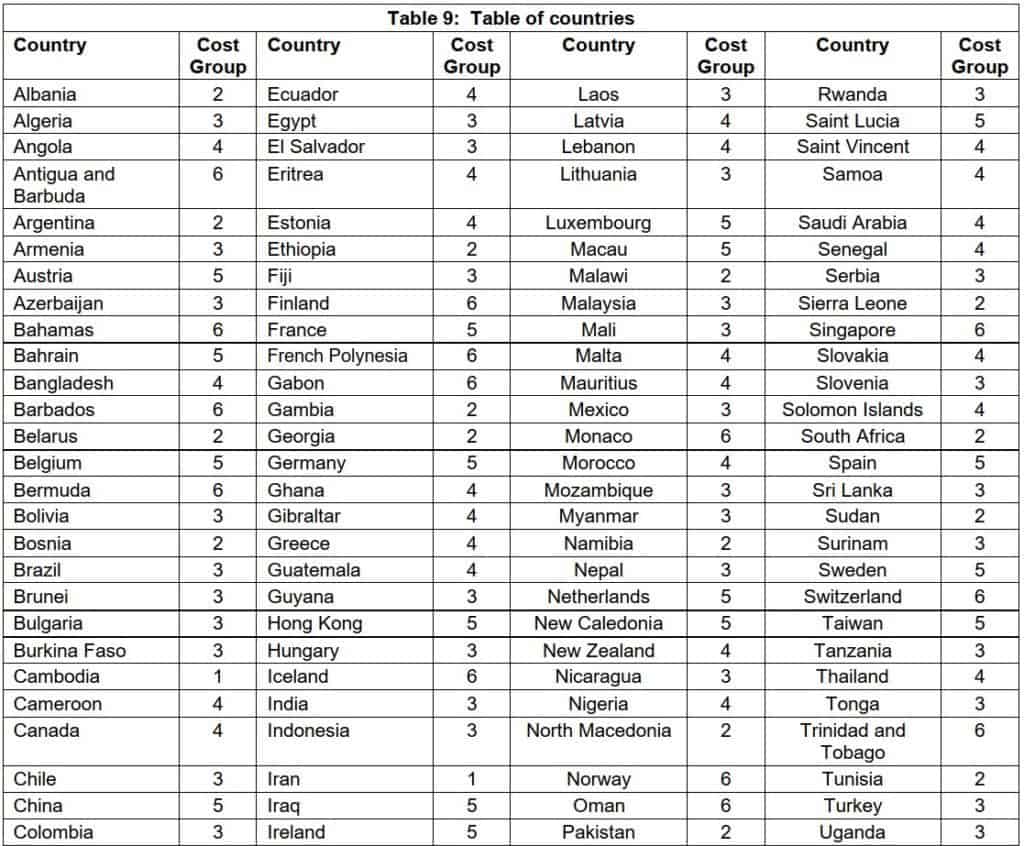

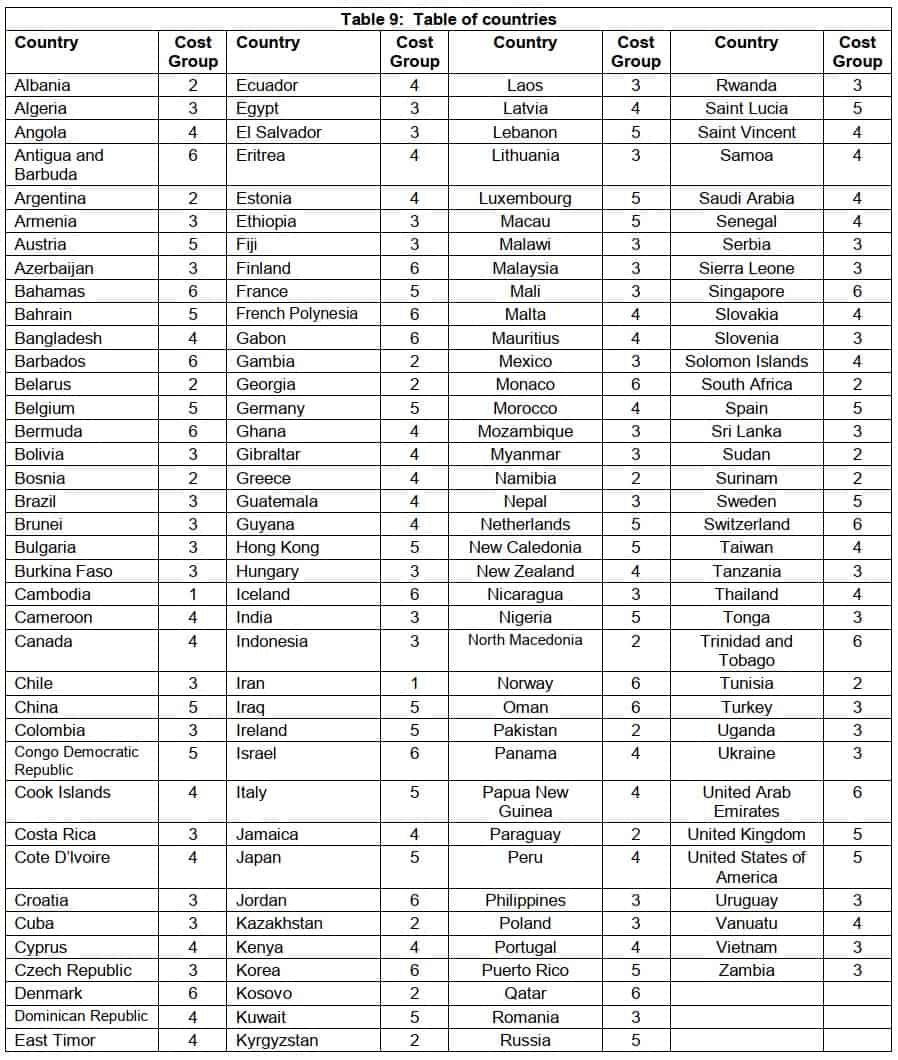

Table 9: Table of countries

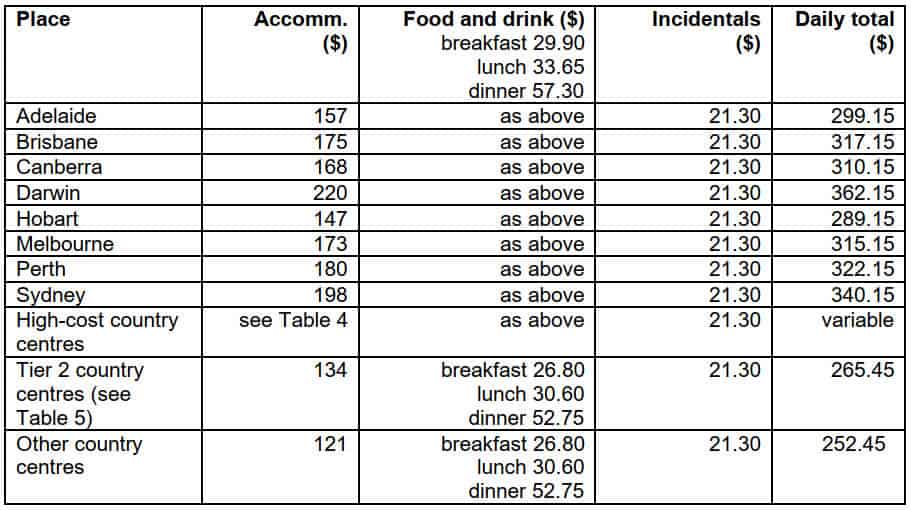

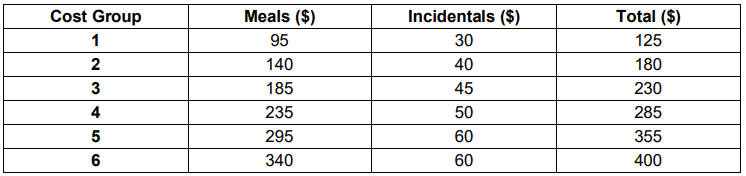

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $143,650 or less

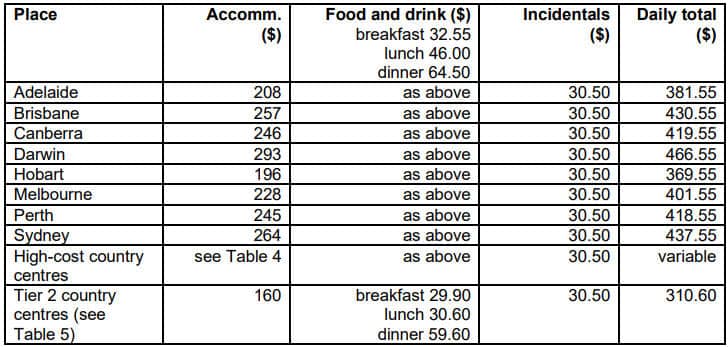

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $143,651 to $255,670

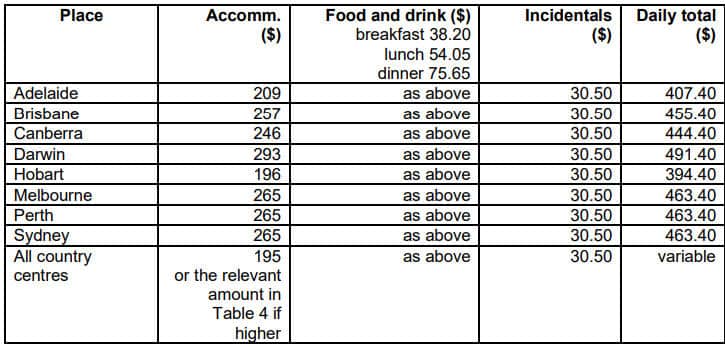

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $255,671 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

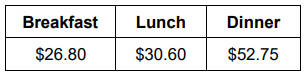

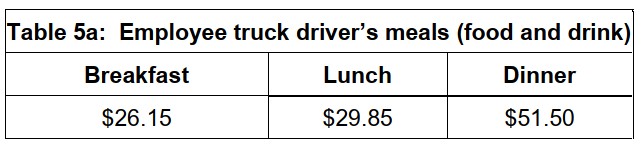

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $143,650 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $143,651 to $255,670

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $255,671 or more

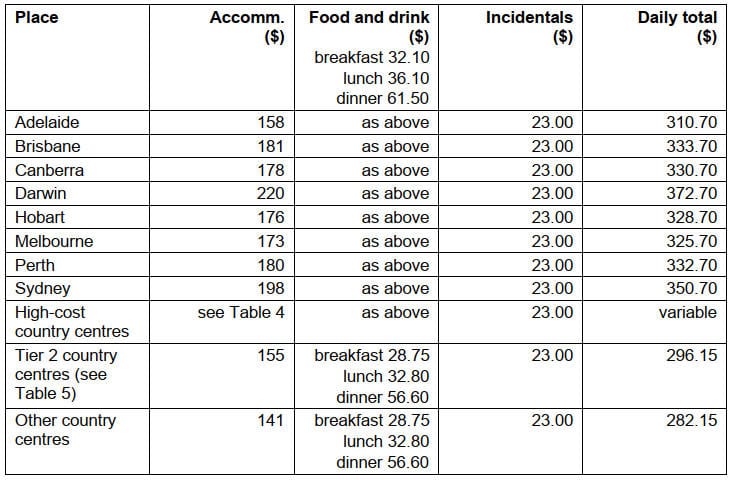

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

2023-24 Domestic Travel

Table 1:Salary $138,790 or less

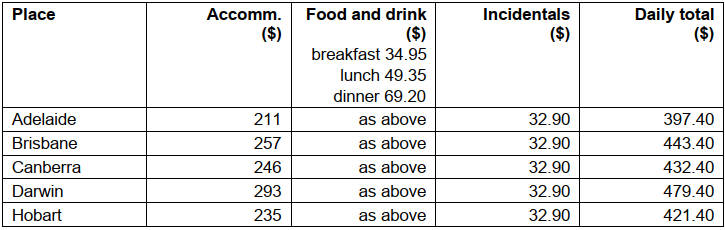

Table 2: Salary $138,791 to $247,020

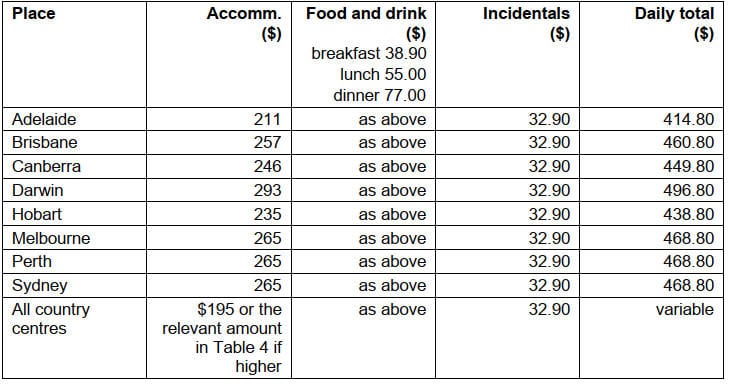

Table 3: Salary $247,021 or more

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

Table 7: Salary $138,791 to $247,020

Table 8: Salary $247,021 or more

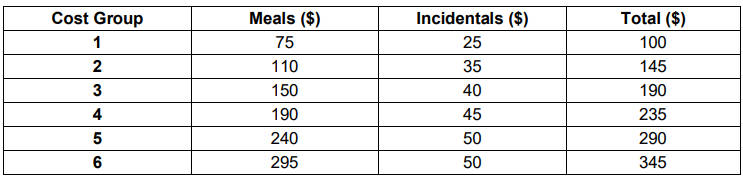

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

2022-23 Domestic Travel

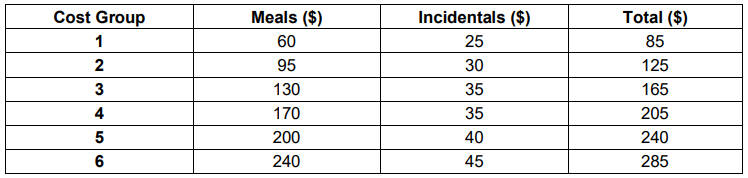

Table 1: Salary $133,450 and below

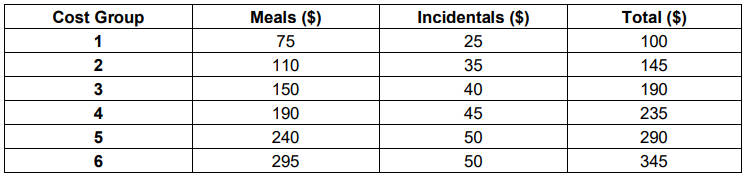

Table 2: Salary $133,451 to $237,520

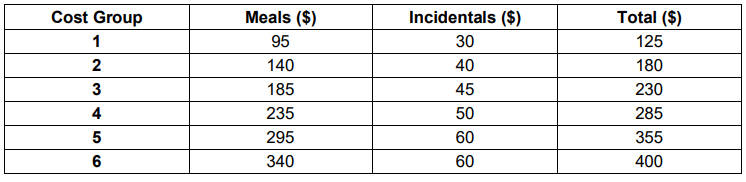

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

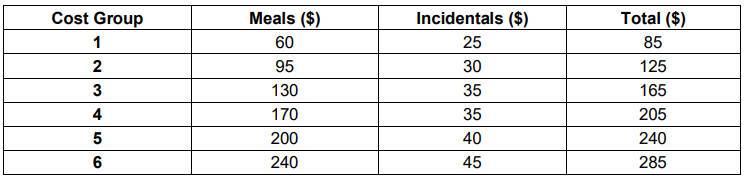

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

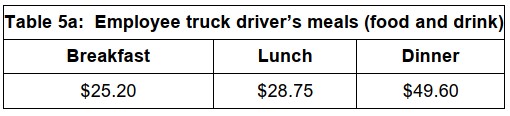

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

Table 1: Salary $129,250 and below

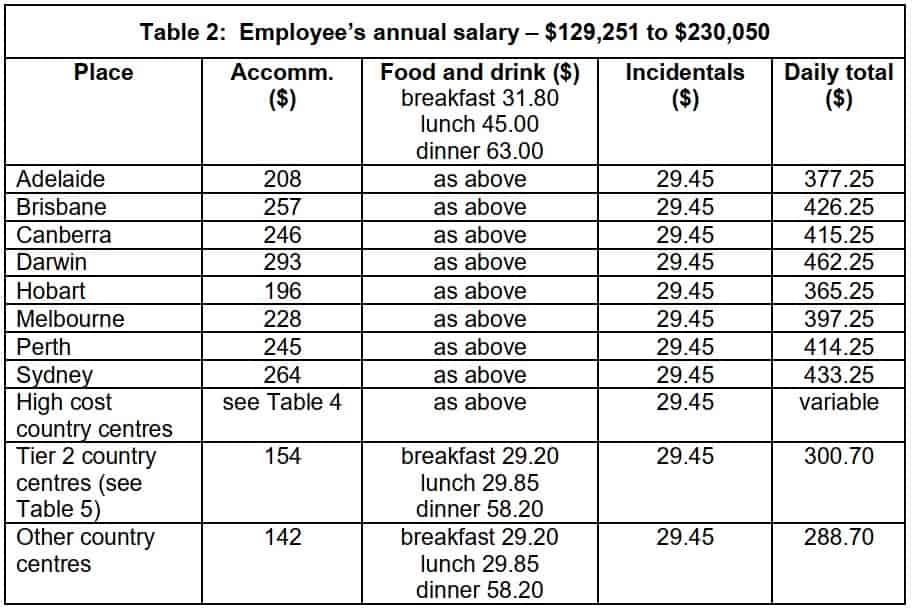

Table 2: Salary $129,251 to $230,050

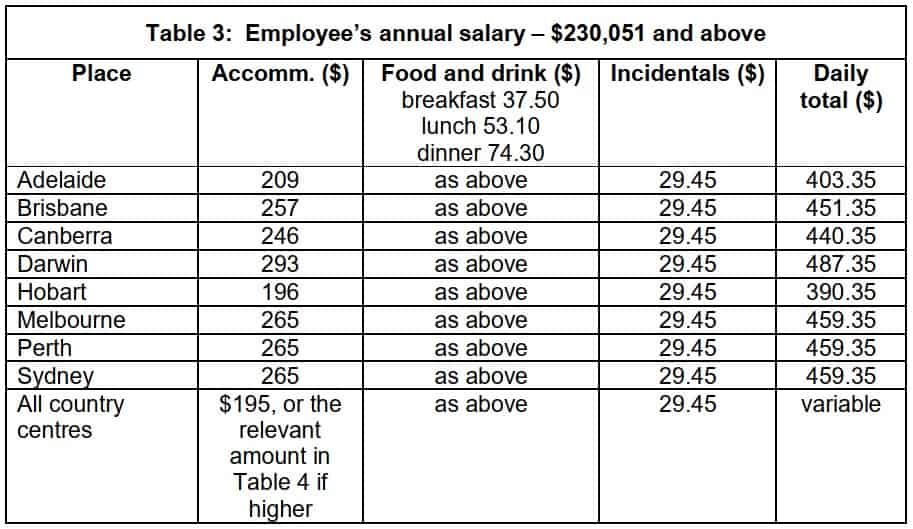

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

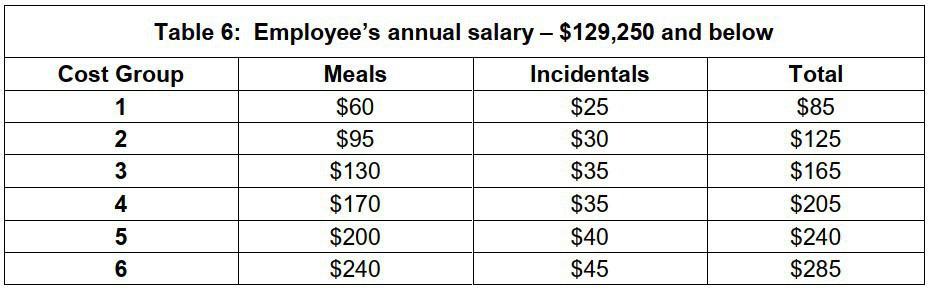

Table 6: Salary $129,250 and below

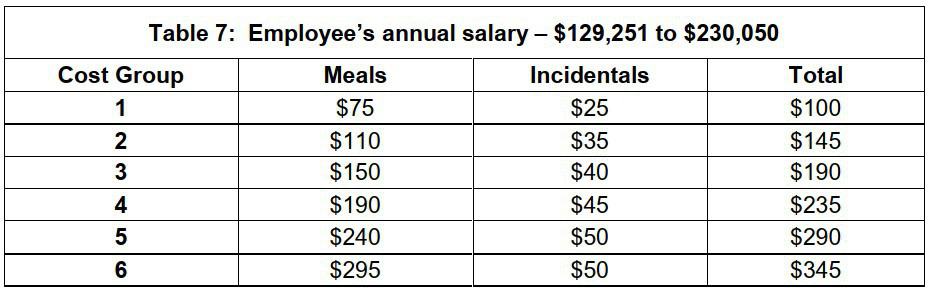

Table 7: Salary – $129,251 to $230,050

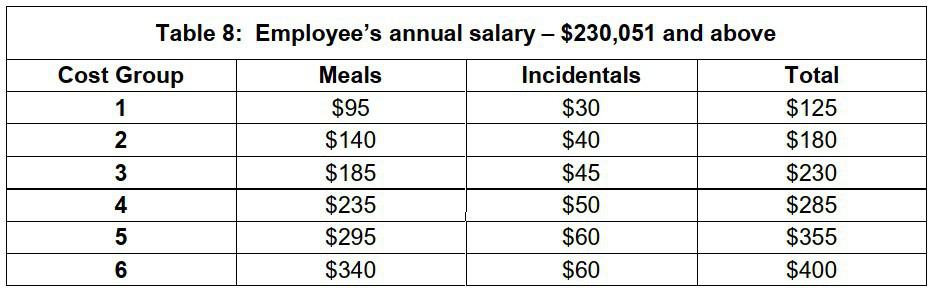

Table 8: Salary – $230,051 and above

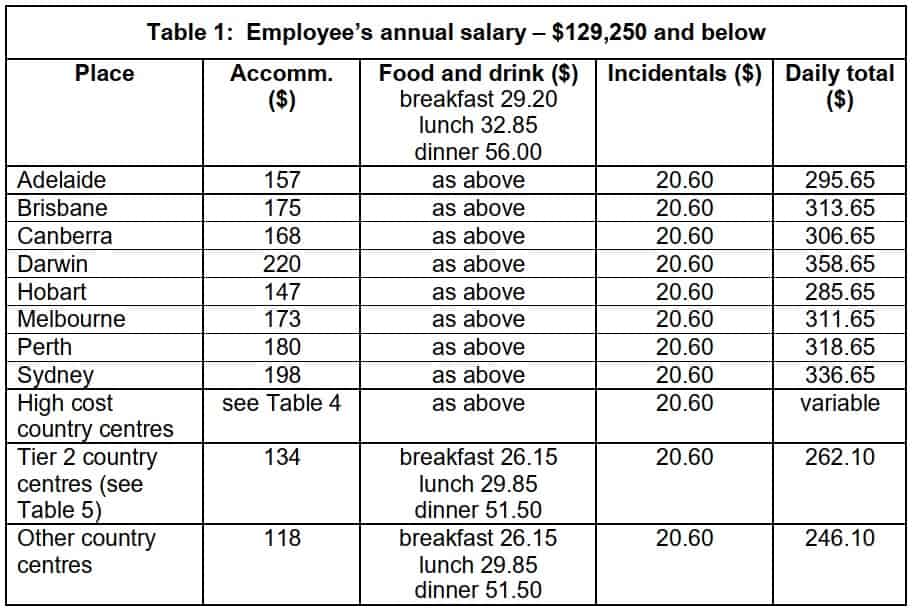

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

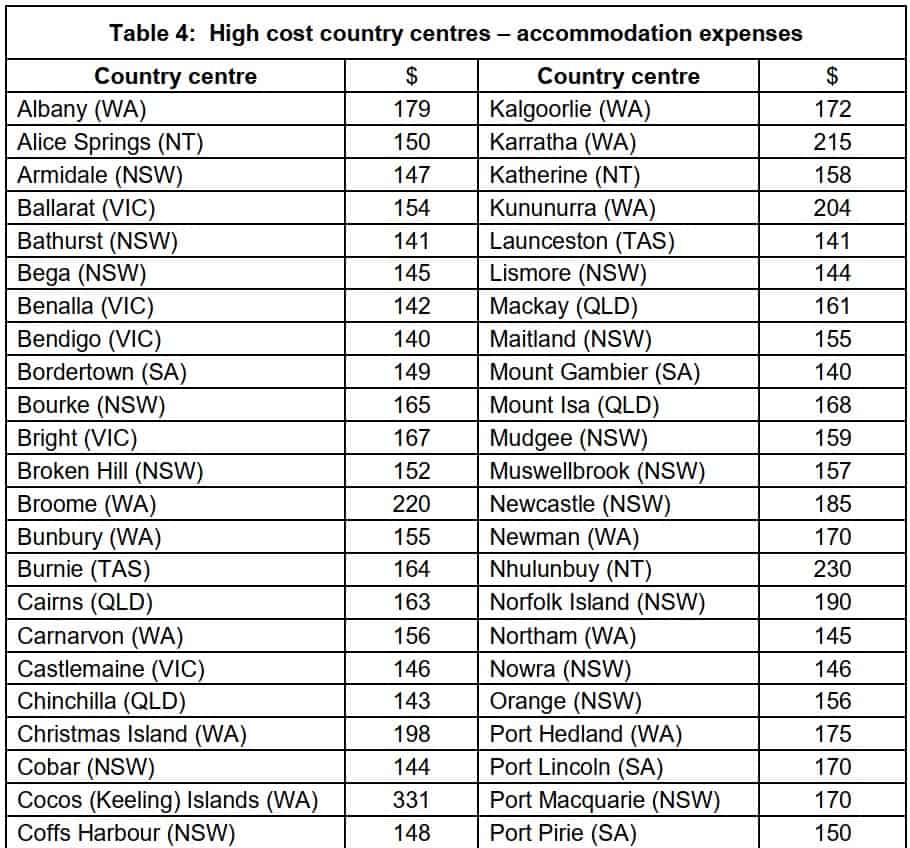

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

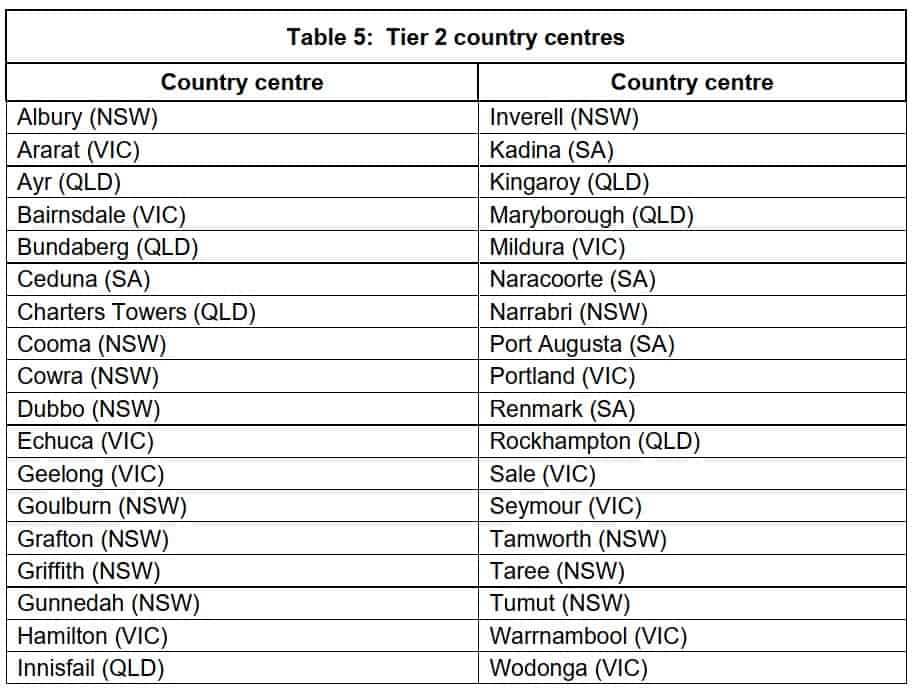

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

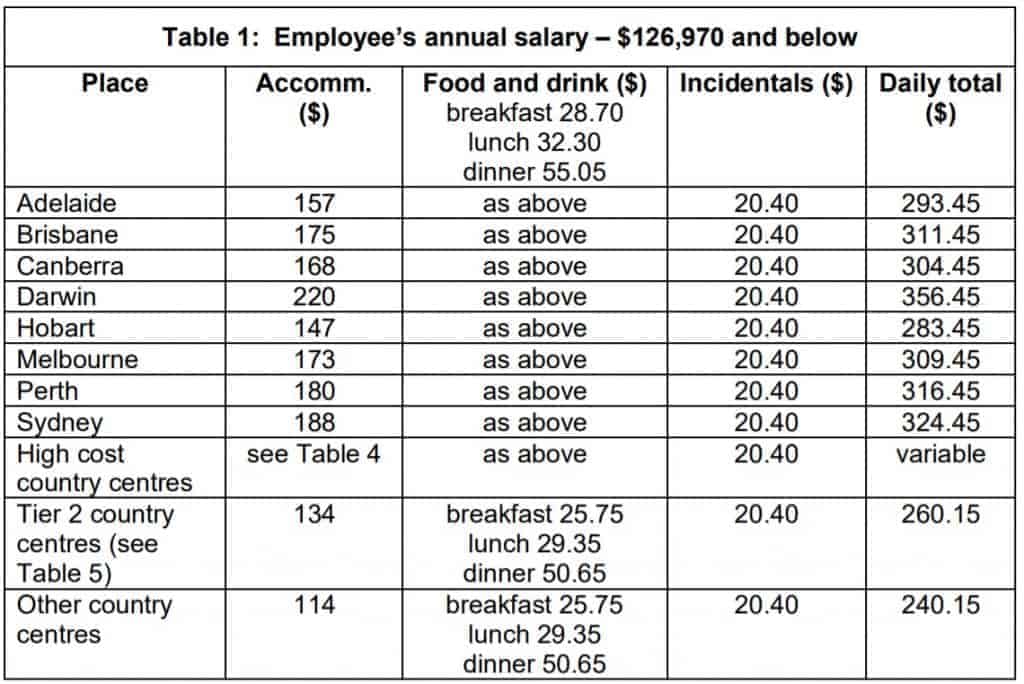

Table 1: Salary $126,970 and below

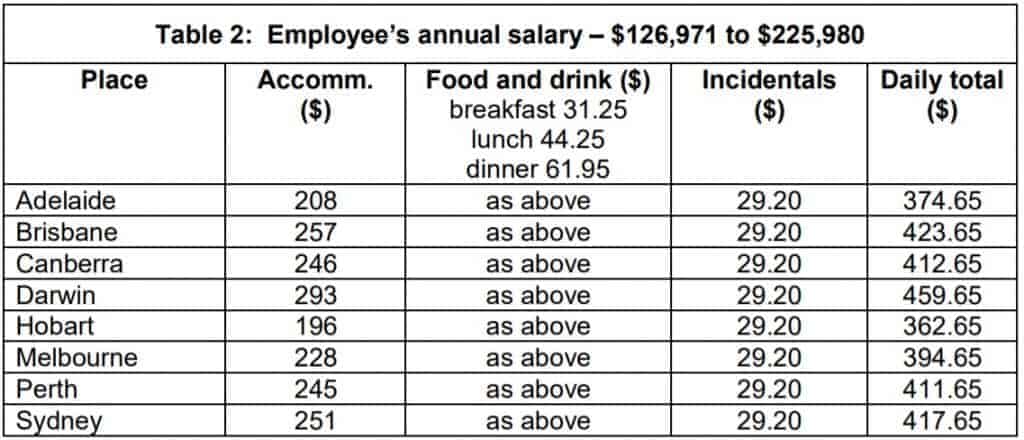

Table 2: Salary $126,971 to $225,980

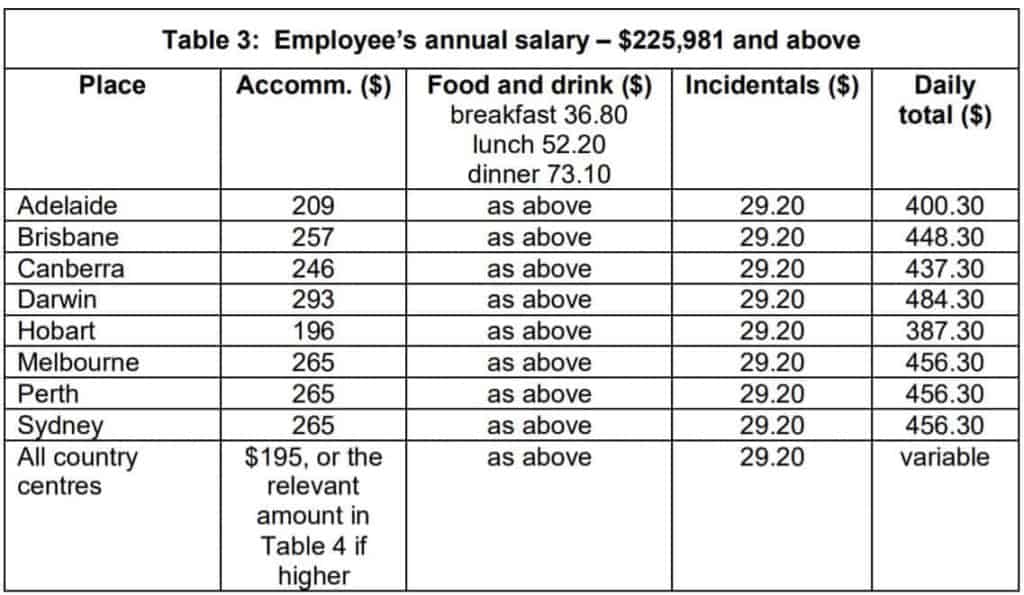

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

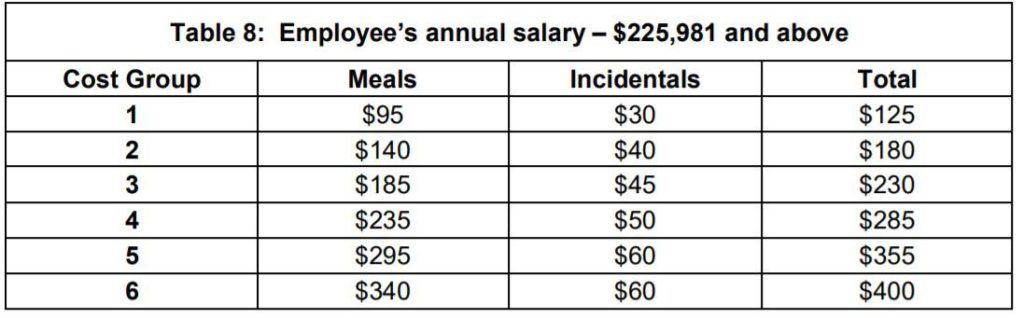

Table 8: Salary – $225,981 and above

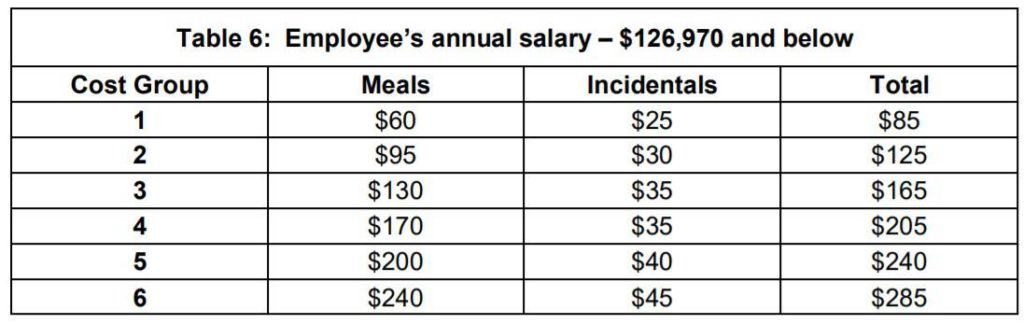

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

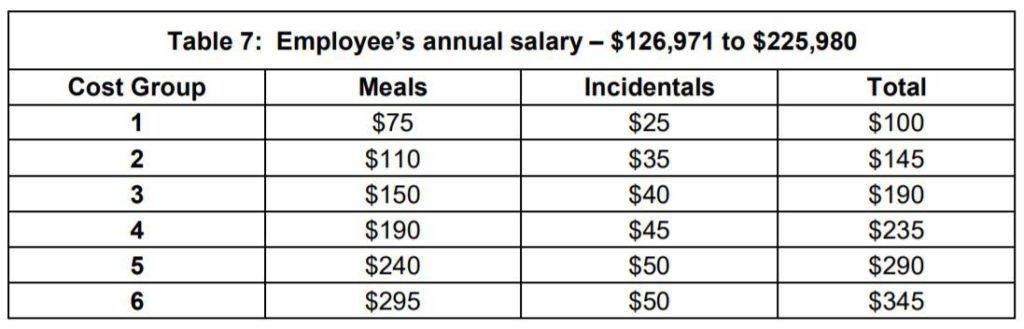

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

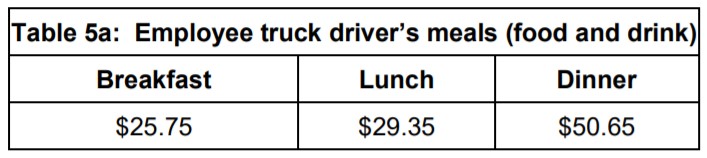

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

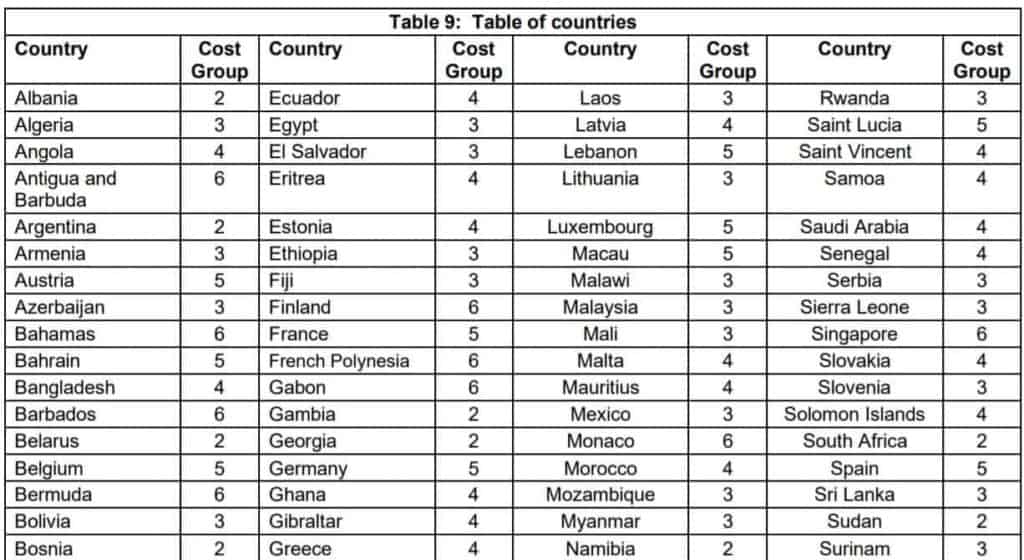

2020-21 Overseas Table 9: Table of countries

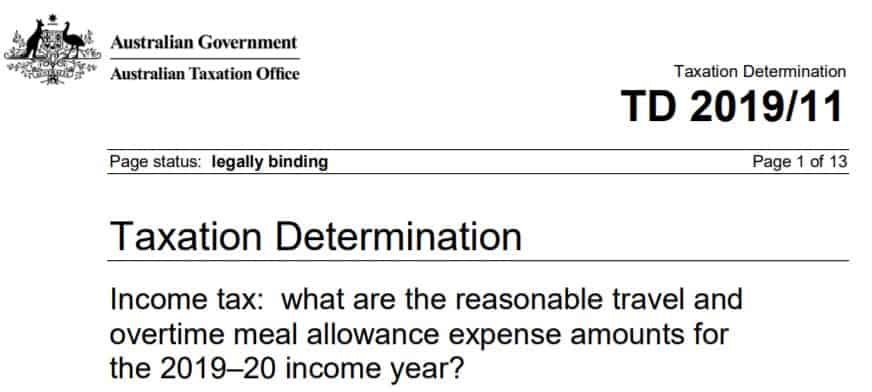

Allowances for 2019-20

The determination in sections:

Domestic Travel

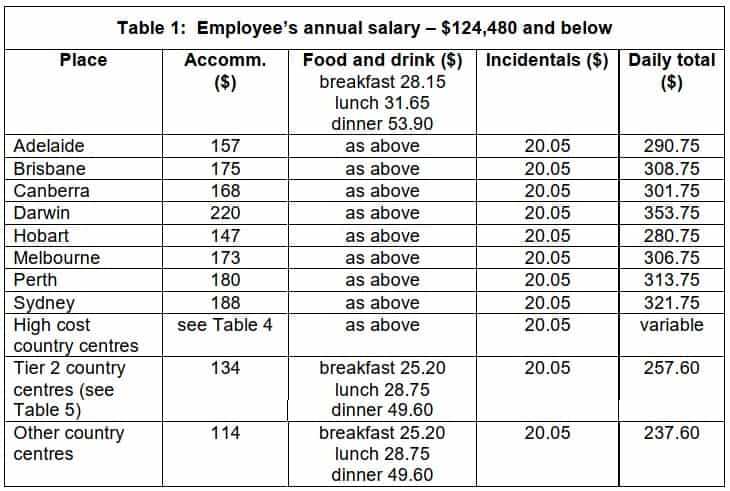

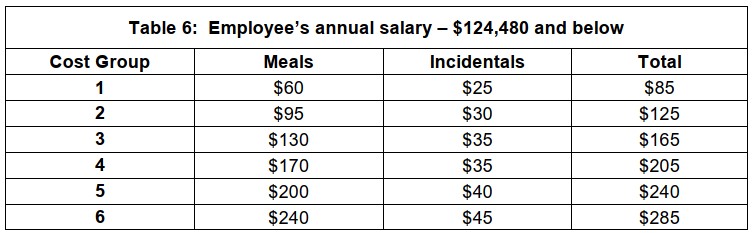

Table 1: Employee’s annual salary – $124,480 and below

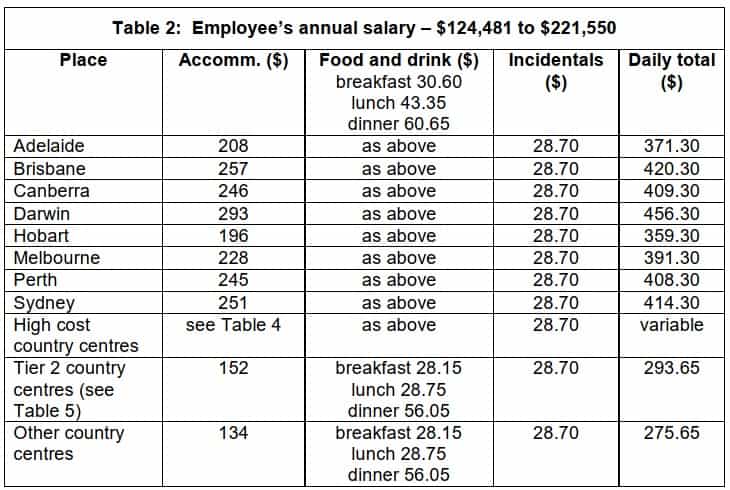

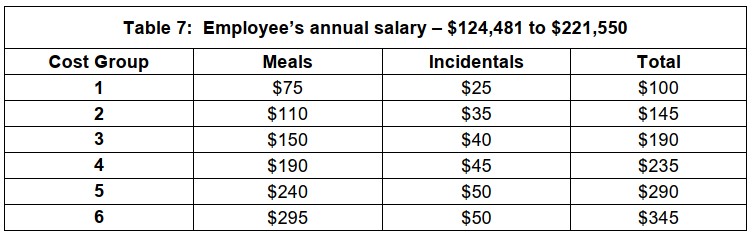

Table 2: Employee’s annual salary – $124,481 to $221,550

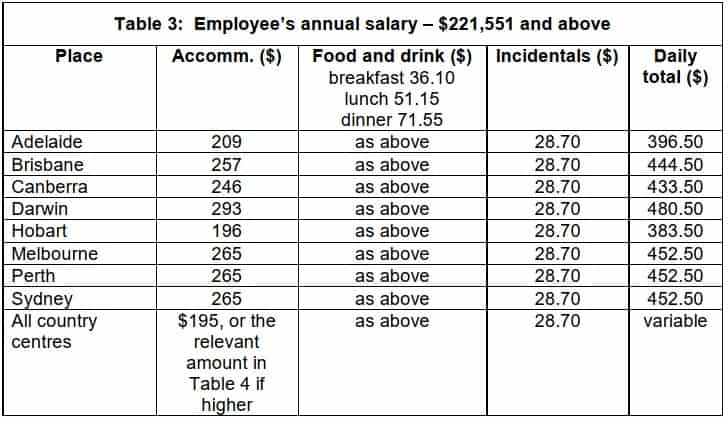

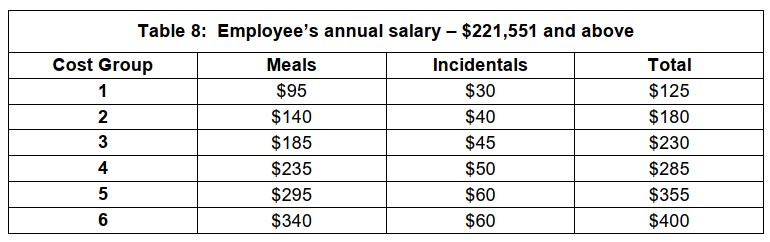

Table 3: Employee’s annual salary – $221,551 and above

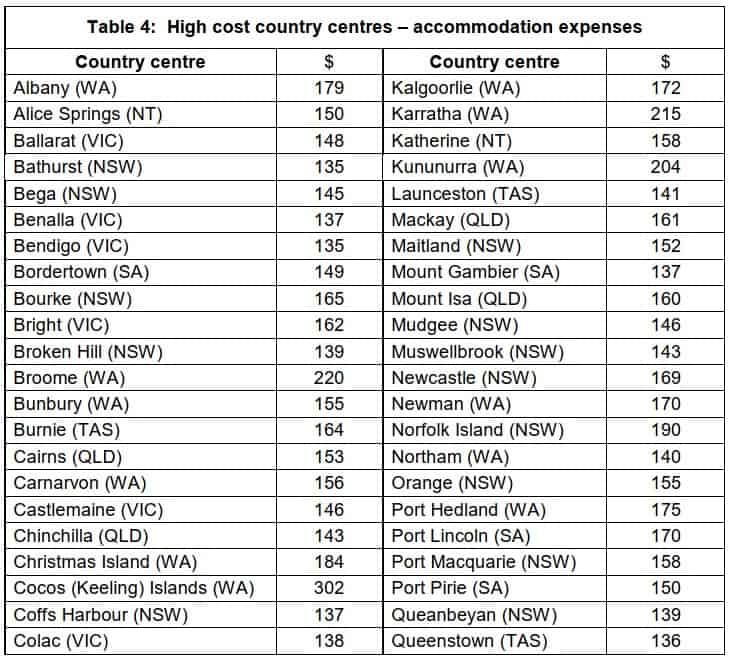

Table 4: High cost country centres – accommodation expenses

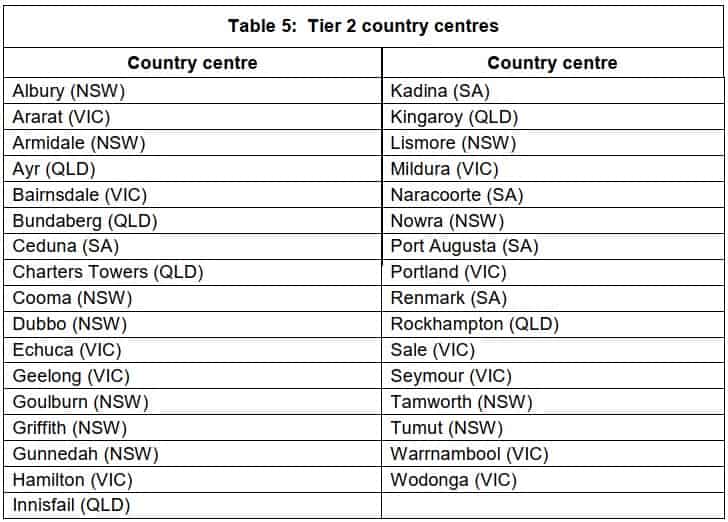

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

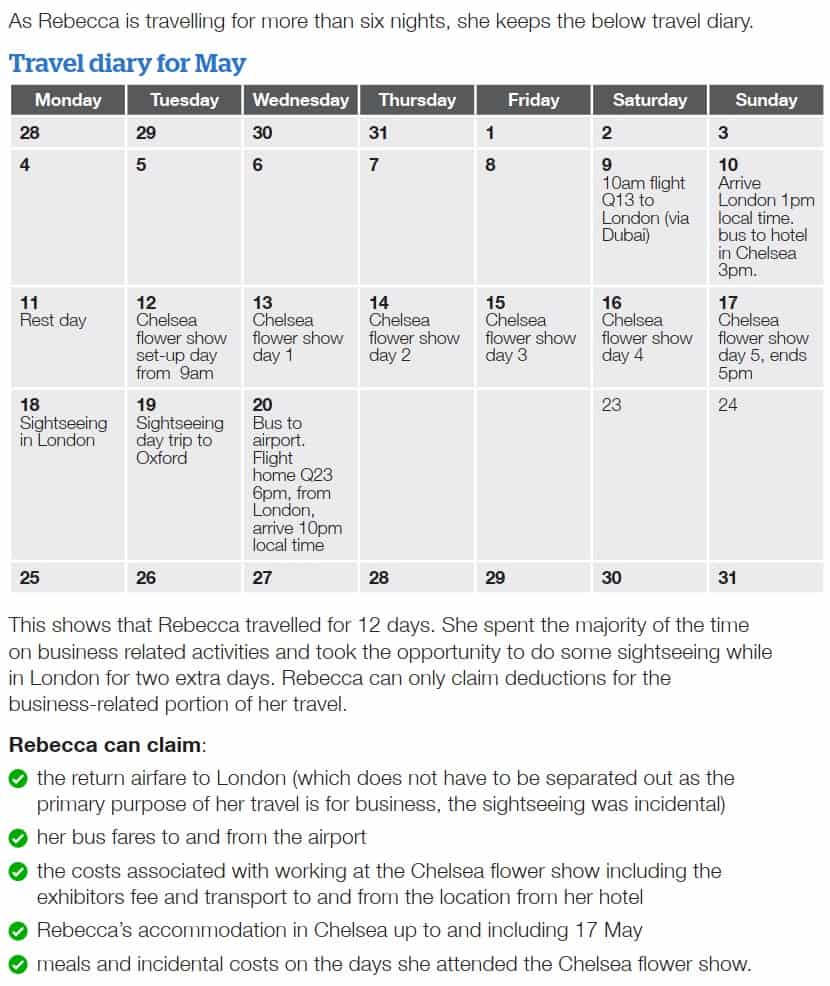

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2024-06-26

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Cents per kilometre method

Check how sole traders and some partnerships can use the cents per kilometre method for car-related business expenses.

Last updated 3 July 2024

This method

Only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a car .

The cents per kilometre method:

- uses a set rate for each kilometre travelled for business

- allows you to claim a maximum of 5,000 business kilometres per car, per year

- doesn't require written evidence to show exactly how many kilometres you travelled (but we may ask you to show how you worked out your business kilometres, for example diary records)

- uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account.

Rates are reviewed regularly. The rate is:

- 88 cents per kilometre for 2024–25

- 85 cents per kilometre for 2023–24

- 78 cents per kilometre for 2022–23

- 72 cents per kilometre for 2020–21 and 2021–22

- 68 cents per kilometre for 2018–19 and 2019–20

- 66 cents per kilometre for 2017–18.

How you use this method

To work out how much you can claim, multiply the total business kilometres you travelled by the rate.

You also need to apportion for private and business use , understand the expenses you can claim and keep the right records .

- About Us About Us collapsed link

- Law & Policies Law & Policies collapsed link

- Services Services collapsed link

- Procurement Procurement collapsed link

- Facilities Facilities collapsed link

DTMB Careers

- Inclusion and Diversity

- Work Life Balance

DTMB Executives

- Administrative Guide

- Boards and Commissions

- Reports to the Legislature

- State Administrative Board

- IT Policies, Standards & Procedures

- Strategy & Governance

The Administrative Guide to State Government presents what an informed person should know about the major processes of state government .

DTMB has multiple Boards and Commissions for which they have administrative oversight.

DTMB Reports to the Michigan legislature organized by fiscal year

The State Administrative Board has general supervisory control over the administrative activities of all state departments and agencies.

- Committees and Committee Documents

Information technology (IT) Policies document the DTMB's authority to establish Standards and Procedures in the specified areas.

At the heart of the DTMB organization are the fundamental governance elements that define the department's authorities, processes, and procedures

- The Management and Budget Act

- Electronic Recording Commission

- DTMB Strategic Plan

- CMIC Grant Program

- Archives of Michigan

- Cybersecurity

- Maps | Geographic Information Systems (GIS)

- ID Mail and Delivery Services

- Mailing Services

- Printing Services

- Real Estate Services

- Records Management Services

- Risk Management

- Shop Surplus!

The Archives of Michigan is responsible for preserving the records of Michigan government and other public institutions. The collections also include documents, maps, photographs and film from private individuals and organizations.

Cybersecurity information for the state of Michigan and resources for the public. Featuring educational and support information for local government, schools and more.

- CSO Kitchen Cabinet

- Cyber Disruption Response Plan

- Cyber Partnerships

- Michigan Cyber Civilian Corps (MiC3)

- Michigan Cyber Partners

- Michigan Secure

- Cybersecurity Resource Hub

The State of Michigan Geographic Information Systems (GIS) and Mapping Site provides access to GIS data, and information across the GIS community in Michigan.

DTMB Delivery Services provides comprehensive transport services tailored to the needs of each customer as well as ID Mail and moving services.

DTMB Mail and Delivery Services offers a full range of automated and manual mail handling and delivery services.

Innovative solutions to your state printing needs.

The DTMB Real Estate Division provides real estate and occupancy services for State of Michigan agency needs.

Information and services for local government agencies about managing records and data in the most effective, cost efficient, and legally compliant manner.

- Retention and Disposal Schedules

- Services for Local Governments

- Records Management Guidance

- Records Management Training

The State of Michigan’s Enterprise Risk Management (ERM) section is responsible for insuring and protecting the people, property, and activities of state government.

- Report a Vehicle Accident Involving State Employees

- Request Insurance

- Other Risk Management Services

Details on state surplus property, auctions, and eligibility for federal surplus programs.

- Project, Program, Portfolio Management Methodology

- Systems Engineering Methodology

- Investment Management Methodology

- SUITE Templates

- EPMO Quarterly Report

- Information Technology (IT) Investment Fund Portfolio Report

Information for state employees and vendors, including hotel listings, travel rates, forms, and regulations.

- Design & Construction Division

- Contract Connect

Design & Construction Information

The Contract Connect website provides info to vendors interested in doing business with the State of Michigan. Contract Connect is managed by State of Michigan Procurement.

- Let's Do Business

- How to Register as a Vendor

- Bid Proposals

- Commodity Codes

- Community Rehabilitation Organization Committee

- Contract List

- Presentations & Videos

- Programs & Policies

- Vendor Innovation Portal

- Vendor Opportunity Dashboard

- Contact State of Michigan Procurement

- Building and Parking Services

- Design and Construction Division

- Law & Policies

- Procurement

Search is currently unavailable. Please try again later.

Popular on michigan.gov

- Agriculture and Rural Development

- Civil Rights

- Environment

- Health and Human Services

- Natural Resources

- Secretary of State

How Do I...

- Register to Vote

- Renew My License Plate

- View assistance programs

The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

- Google Chrome

- Microsoft Edge

- Travel Arrangements

Learn about the policies and standards of travel and vehicle use for State employees. More information is available within the Inside Michigan portal.

- doc doc State of Michigan Hotel Listing Application (for use by hotels)

- Submit a Review of your Hotel Stay

Travel Security

Michigan Alerts Residents to be Aware of Legionellosis

State Department International Travel Alerts and Warnings

Department Travel Contacts If you can't find the answer to your question, ask your department travel contact.

Transportation Security Administration (TSA) Comprehensive travel guide for the flying public from the TSA with the latest on acceptable identification, permitted and prohibited items, and more.

Regulations and Policies

- Standardized Travel Regulations Revised and Adopted for travel on or after January 1 - 2023

- POLICY 0420 Travel

- Policy 0420.01 Standardized Travel Regulations

- SOM Travel Policy Summary and Responsibilities

- Complaint on a State Operated Vehicle

- Quick Vehicle Information

- State Vehicle Registrations

Travel Rates and Select Cities

- Travel Rates FY2025 and High Cost Cities effective 10-1-2024

- Travel Rates FY2024 and High Cost Cities effective 1-1-2024

- Travel Rates FY2024 and High Cost Cities Effective 10-1-2023

- Travel Rates FY2023 and High Cost Cities, effective 1-1-2023

- Travel Rates FY2023 and High Cost Cities effective 10-1-2022

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

IRS Raises Standard Mileage Rate for 2022

Business mileage rate will be 58.5 cents per mile, up from 56 cents

E ffective Jan. 1, 2022, the optional standard mileage rate used in deducting the costs of operating an automobile for business purposes will be 58.5 cents per mile , the IRS announced in Notice 2022-03 on Dec. 17, 2021.

Employers often use the standard mileage rate—also called the safe harbor rate—to pay tax-free reimbursements to employees who use their own vehicles for business.

Changes for 2022

For 2022, standard mileage rates for the use of cars, vans, pickups or panel trucks will be:

- 58.5 cents per mile driven for business use, up 2.5 cents from 2021. This ties the highest safe harbor rate the IRS has ever published, which was a midyear increase in July 2008.

- 18 cents per mile driven for medical care and for moving purposes for active-duty members of the Armed Forces, up 2 cents from the rate for 2021.

- 14 cents per mile driven in service of charitable organizations, which remains unchanged.

For cars employees use for business, the portion of the standard mileage rate treated as depreciation will be 26 cents per mile for 2022, unchanged from 2021.

While the standard mileage rates for business, medical and moving purposes are based on annual changes in the costs of operating an automobile, the charitable rate is set by statute.

[SHRM members-only HR Q&A: Do we have to reimburse personal auto mileage for business-related trips? ]

Using FAVR Plans

The IRS rate is optimal for low-mileage drivers, such as those who travel fewer than 5,000 business miles per year, according to benefits advisors.

Alternatively, Notice 2022-03 provides maximum vehicle expenses when using a Fixed and Variable Rate (FAVR) allowance plan , in which employees who drive their own vehicles can receive tax-free reimbursements from their employers for fixed vehicle costs (such as insurance, taxes and registration fees) and variable vehicle expenses (such as fuel, tires, and routine maintenance and repairs), instead of the standard mileage rate.

Under a FAVR plan, the cost of the vehicle may not exceed a maximum amount set by the IRS each year. For 2022, vehicle costs may not exceed $56,100 for automobiles, trucks and vans, up from $51,100 in 2021.

Revenue Procedure 2019-46 , which updated the rules for using standard mileage rates in computing the deductible costs of operating a car for business, stated that an employer may provide a FAVR allowance only to an employee who can provide adequate records showing at least 5,000 miles driven during the calendar year in performing services as an employee or, if greater, 80 percent of the annual business mileage of that FAVR allowance.

If the employee is covered by the FAVR allowance for less than the entire calendar year, the employer may prorate these limits on a monthly basis.

"Two years into the pandemic has showcased volatility and fluctuations across vehicle costs," said Motus CEO Craig Powell. Business leaders, he explained, are focusing on "managing these costs in a more accurate and fair way" for workers using their own cars to conduct business, including remote workers.

Motus calculates that organizations have saved more than $1.4 billion using FAVR reimbursement compared to the IRS business mileage standard since 2011. In part that's because the standard mileage rate doesn't account for driving costs that fluctuate based on geography and time of year, so businesses that rely on the rate to reimburse mid- and high-mileage workers may be giving reimbursements that do not reflect actual driving costs.

According to payroll, benefits and compliance firm Justworks in New York City, an advantage of using a FAVR plan to reimburse employees is that "in locations with higher automobile operating costs, the FAVR allowance may be more than the standard mileage rate ." However, "the disadvantage is that the employer must recalculate the FAVR allowance at least once every three months," as payments to employees must be made at least quarterly.

Flat Car Allowances

Another way for employers to reimburse employees for their business-driving expenses is a flat car allowance, which is a set amount provided to employees over a given period to cover the costs of using their own car for business purposes—such as $400 per month for the cost of fuel, wear and tear, tires, and more. Employers can also pay expenses using a variable rate for different locations.

While a car allowance is relatively easy to administer, payments are taxable to employees unless handled within an " accountable plan " that requires substantiation through adequate records and the return of excess amounts in a reasonable time.

Related Content

Why AI+HI Is Essential to Compliance

HR must always include human intelligence and oversight of AI in decision-making in hiring and firing, a legal expert said at SHRM24. She added that HR can ensure compliance by meeting the strictest AI standards, which will be in Colorado’s upcoming AI law.

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

News, trends, analysis and breaking news alerts to help HR professionals do their jobs better each business day.

Success title

Success caption

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

IRS raises per diem standard rates for business travel

- Individual Income Taxation

- Personal Financial Planning

- Employee & Business Owner Planning

The special per diem rates by which taxpayers may substantiate ordinary and necessary business expenses of travel away from home will be slightly higher starting Oct. 1, the IRS provided Monday in Notice 2022-44 .

Generally, in lieu of actual lodging, meal, and incidental expenses incurred, a payer may consider substantiated for federal tax purposes an employee's expenses incurred for employment-related travel in an amount up to or equaling the federal per diem rate for the locality of travel. The high-low substantiation method applies a higher rate to designated high-cost localities and a lower rate to all other localities.

The annual update includes the per diem rate under the high-low substantiation method for travel within the continental United States (CONUS), which for non-high-cost localities will be $204. The rate for travel to high-cost localities within CONUS, which are listed in the notice, is $297. Those current rates for the period Oct. 1, 2021, to Sept. 30, 2022 are, respectively, $202 and $296. The portion of the rates treated as paid for meals for purposes of Sec. 274(n) is $74 for high-cost CONUS localities and $64 for all other CONUS localities, both the same as currently.

The notice also revises the list of high-cost localities for the upcoming new annual period (Oct. 1, 2022, to Sept. 30, 2023) for which the new rates are in effect. High-cost localities have a federal per-diem rate of $250 or more.

Notice 2022-44 also provides the special rates for taxpayers in the transportation industry. The meals and incidental expenses rates are $69 for any locality of travel within CONUS and $74 for localities of travel outside CONUS, both the same as currently.

The incidental-expenses only rate remains $5 per day as currently, for travel both in and outside CONUS.

— To comment on this article or to suggest an idea for another article, contact Paul Bonner at [email protected] .

Where to find September’s digital edition

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

4 questions to drive your audit technology strategy

Discover how AI can revolutionize the audit landscape. Our report tackles the biggest challenges in auditing and shows how AI's data-driven approach can provide solutions.

FEATURED ARTICLE

Single-owner firms: The thrill of flying solo

CPAs piloting their own accounting practices share their challenges, successes, and lessons learned.

- Search Search Please fill out this field.

- Personal Finance News

IRS Announces Standard Mileage Rates for 2022

58.5 cents/mile for business purposes starting Jan. 1

:max_bytes(150000):strip_icc():format(webp)/jp_profileinv__jim_probasco-5bfc262746e0fb005118b333.jpg)

The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they own or lease. These rates set IRS allowances for the deductible part of the cost of driving for business and for charitable, medical, and moving purposes. The rates are adjusted on an annual basis (except for charitable-organization driving, which is set by statute) and depend on whether the vehicle is used for business, medical, or charitable purposes.

Key Takeaways

- The IRS annually publishes three standard rates used to calculate deductions for mileage driven for business, medical/moving, and charitable purposes

- The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving.

- Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA.

- The charitable rate is set by statute and does not necessarily change each year.

- Additional rates and valuations for 2022 include the taxable value of an employer-provided vehicle used for personal purposes.

Under the Tax Cuts and Jobs Act (TCJA) , taxpayers can no longer claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. In addition, moving-expense deductions are only available to members of the Armed Forces on active duty moving under orders to a permanent change of station.

Standard Optional Mileage Rates for 2022

For 2022, the business mileage rate is 58.5 cents per mile; medical and moving expenses driving is 18 cents per mile; and charitable driving is 14 cents per mile, the same as last year. The mileage rates are considered optional because taxpayers can always calculate the actual cost of using their vehicle instead of based on mileage.

- The 2022 business use allowance of 58.5 cents per mile driven is up 2.5 cents from 2021;

- The medical and moving expense rate of 18 cents per mile driven in 2022 has been raised 2 cents from 2021; and

- The 2022 rate of 14 cents per mile driven in service of charitable organizations, is set by statute and remains unchanged from last year.

Special Rules for Claiming Standard Mileage

When using the standard mileage rate for tax purposes, you must follow rules established by the IRS in order to claim a deduction:

- You can only claim standard mileage for a vehicle you own or lease.

- You must log the mileage for each deductible use; total mileage for the year; and the date, destination, and purpose of each trip.

- In order to use the standard mileage rate, taxpayers must use it the first year their vehicle is available for business use.

- In later years you can choose between the standard mileage rate and actual expenses.

- Leased vehicles must use the standard mileage rate for the entire lease period including lease renewals if the standard mileage rate is chosen in the first year.

How Mileage Rates and Vehicle Valuation Are Determined

The IRS uses an independent contractor to conduct an annual study of the fixed and variable costs of operating an automobile to set the standard mileage rates for business, medical, and military moving deductions. As previously noted, the standard mileage rate for charitable use is set by statute.

If you are provided a vehicle by your employer that you also use for personal use, regulations determine the amount that must be included in your income and wages. This is typically based on the vehicle's Fair Market Value (FMV). One of two special valuation rules, the fleet-average valuation rule or the vehicle cents-per-mile valuation rule, may also be used. These valuations are subject to limitations and, for 2022, may not exceed $56,100.

Additional IRS Vehicle Rates and Valuations for 2022

Included in the publication of standard mileage rates for 2022 are several additional updated rates and costs for the tax year 2022.

2022 Basis Reduction Amount

For automobiles a taxpayer uses for business purposes, the portion of the business standard mileage rate treated as depreciation is 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, 26 cents per mile for 2021, and 26 cents per mile for 2022.

Maximum Standard Automobile Cost for 2022

For purposes of computing the allowance under a fixed and variable rate (FAVR) plan, the standard automobile cost may not exceed $56,100 for automobiles (including trucks and vans).

Maximum Value of Vehicles First Made Available in 2022

For purposes of the fleet-average valuation rule and the vehicle cents-per-mile valuation rule, the maximum FMV of automobiles (including trucks and vans) first made available to employees in calendar year 2022 is $56,100.

Internal Revenue Service. " IRS issues standard mileage rates for 2022 ."

Internal Revenue Service. " Pub. 463: Travel, Gift, and Car Expenses ."

Internal Revenue Service. " Notice 2022-03: 2022 Standard Mileage Rates ."

:max_bytes(150000):strip_icc():format(webp)/5FRI-boggy22-69f6442284ce4e0fbb49ef77a65d8869.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Standard mileage rates

More in tax pros.

- Enrolled agents

- Annual Filing Season Program participants

- Enrolled retirement plan agents

- Certified Professional Employer Organization (CPEO)

- Enrolled actuaries

- E-file providers

- Modernized e-File

If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose.

2023 mileage rates

The standard mileage rates for 2023 are:

- Self-employed and business: 65.5 cents/mile

- Charities: 14 cents/mile

- Medical: 22 cents/mile

- Moving ( military only ): 22 cents/mile

Find out when you can deduct vehicle mileage

Mileage rates for all years (cents/mile)

Tax professionals topics.

IR-2021-251, Standard Mileage Rates for 2022

News essentials.

News Releases

IRS - The Basics

IRS Guidance

Media Contacts

Facts & Figures

Around The Nation

e-News Subscriptions

The Newsroom Topics

Multimedia Center

Noticias en Español

The Tax Gap

Fact Sheets

IRS Tax Tips

Armed Forces

Latest News Home

IRS Resources

Compliance & Enforcement

Contact My Local Office

Filing Options

Forms & Instructions

Frequently Asked Questions

Taxpayer Advocate

Where to File

IRS Social Media

Issue Number: IR-2021-251

Inside this issue.

IRS issues standard mileage rates for 2022

IR-2021-251, Dec. 17, 2021

WASHINGTON — The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021,

- 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2021.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 22-03 , contains the optional 2022 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2022 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

Back to Top

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe .

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the Administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

City Pair Program (CPP)

The OMB-designated Best-in-Class City Pair Program procures and manages discounted air passenger transportation services for federal government travelers. At its inception in 1980 this service covered only 11 markets, and now covers over 14,000 markets. Today, CPP offers four different contract fares. Please go to Government airfare types to learn more.

Fare finder

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

Contract Awards CSV

Download the FY24 City Pair Contract Awards [CSV - 1 MB] and FY25 City Pair Contract Awards [CSV - 2 MB] to have them available offline. The files update after 11:59 pm Eastern Time on standard business days. Previous fiscal year contract awards can be found on the Fiscal documents and information page . To read more about the contract award highlights, please see our Award highlights .

Instructions for the FY24 & FY25 CSV files

All fares are listed one-way and are valid in either direction. In the CSV file, Origin and Destination are in alphabetical order regardless of travel direction. The Origin is the airport code (domestic travel) or city code (international travel) that comes first alphabetically and the Destination is the airport or city code that comes second alphabetically.

For example, you are traveling from Washington, DC to London, England. You know the city codes are WAS and LON respectively. The city code LON comes first alphabetically and WAS comes second alphabetically. To find the contract fares, you filter:

City Pair Program benefits and info

CPP offers government travelers extra features and flexibility when planning official travel, in addition to maintaining deep program discounts. These include:

- Fully refundable tickets

- No advance purchase required

- No change fees or cancelation penalties

- Stable prices which enables accurate travel budgeting

- No blackout dates

- Fares priced on one-way routes, permitting agencies to plan multiple destinations

CPP is a mandatory use, governmentwide program, designated as a Best-In-Class procurement by OMB. The program delivers best value airfares, and ensures federal agencies effectively and efficiently meet their mission.

CPP saves the federal government time and money by maintaining one governmentwide air program. At the acquisition level CPP delivers data analysis, compliance, and uses strategic sourcing to optimize its service.

CPSearch Data 2023 [CSV - 1 MB]

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2022 and 09/30/2025.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

IMAGES

COMMENTS

FY 2025 per diem rates now available. Please note! The FY 2025 rates are NOT the default rates until October 1, 2024. You must follow these instructions to view the FY 2025 rates. Select FY 2025 from the drop-down box above the "Search By City, State, or ZIP Code" or "Search by State" map. Otherwise, the search box returns current FY ...

The IRS normally updates the mileage rates once a year in the fall for the next calendar year. For travel from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03 PDF. "The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices," said IRS Commissioner Chuck Rettig.

There are almost 400 destinations across the United States for which a special per-diem rate has been specified. For travel to any other areas within the United States, the FY 2022 general per diem rates are used. Read more about how Per-diems work here. FY 2022 General Rates: $96.00 per night lodging $59.00

Per diem rates are listed by the federal government's fiscal year, which runs from October 1 to September 30. You can choose to use the rates from the 2022 fiscal year per diem tables or the rates from the 2023 fiscal year tables, but you must consistently use the same tables for all travel you are reporting on your income tax return for the year.

2021, 2022, 2023 and 2024 rates and earlier years are also set out below. ... 2022-23 Domestic Travel. Table 1: Reasonable amounts for domestic travel expenses - employee's annual salary $133,450 and below. Table 2: Reasonable amounts for domestic travel expenses - employee's annual salary $133,451 to $237,520 ...

Rates are reviewed regularly. The rate is: 88 cents per kilometre for 2024-25. 85 cents per kilometre for 2023-24. 78 cents per kilometre for 2022-23. 72 cents per kilometre for 2020-21 and 2021-22. 68 cents per kilometre for 2018-19 and 2019-20. 66 cents per kilometre for 2017-18.

August 13, 2021. WASHINGTON — Today, the U.S. General Services Administration (GSA) released the fiscal year (FY) 2022 travel per diem rates for the lower 48 continental United States (CONUS) and the District of Columbia, which will take effect on October 1, 2021. GSA bases the maximum lodging allowances on historical average daily rate (ADR ...

Travel Rates FY2024 and High Cost Cities Effective 10-1-2023. Travel Rates FY2023 and High Cost Cities, effective 1-1-2023. Travel Rates FY2023 and High Cost Cities effective 10-1-2022. Travel Rates FY2022 and High Cost Cities, effective 7-1-2022. Travel Rates FY2022 and High Cost Cities, Effective 1-1-2022. Information for state employees and ...

Per diem rates look-up Allowances for lodging, meal and incidental costs while on official government travel. Mileage reimbursement rates Reimbursement rates for the use of your own vehicle while on official government travel. Technology ... Rates are available between 10/1/2022 and 09/30/2025.

Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for ...

Oct. 2021-Sept. 2022 (POV mileage rate Jan. 2022-Dec. 2022) ... 2020-2021 black & white map of rates by county; 2020-2021 per diem rate tables; Travel resources. These resources help state agencies fulfill travel requirements in Chapter 10 of the State Administrative & Accounting Manual (SAAM). Frequently used travel internet sites [PDF]

This annual notice provides the 2022-2023 special per diem rates for taxpayers to. use in substantiating the amount of ordinary and necessary business expenses incurred. while traveling away from home, specifically (1) the special transportation industry meal. and incidental expenses (M&IE) rates, (2) the rate for the incidental expenses only.

Separately, market research firm Destination Analysts' November 2021 survey of more than 1,200 Americans determined that the average American's leisure travel budget for 2022 is $3,797. Even ...

Effective July 1 through Dec. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate effective at the start of the year.

The special per diem rates by which taxpayers may substantiate ordinary and necessary business expenses of travel away from home will be slightly higher starting Oct. 1, the IRS provided Monday in Notice 2022-44.. Generally, in lieu of actual lodging, meal, and incidental expenses incurred, a payer may consider substantiated for federal tax purposes an employee's expenses incurred for ...

N-2021-52. 2021-2022 Special Per Diem Rates. Notice 2021-52. SECTION 1. PURPOSE. This annual notice provides the 2021-2022 special per diem rates for taxpayers to. use in substantiating the amount of ordinary and necessary business expenses incurred. while traveling away from home, specifically (1) the special transportation industry meal.

The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. Deductions for unreimbursed employee travel ...

2023 mileage rates. The standard mileage rates for 2023 are: Self-employed and business: 65.5 cents/mile. Charities: 14 cents/mile. Medical: 22 cents/mile. Moving (military only): 22 cents/mile. Find out when you can deduct vehicle mileage.

Beginning on Jan. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for ...

Contact Travel Programs. 888-472-5585. [email protected]. CPSearch Data 2023 [CSV - 1 MB] Print Page Email Page. Last updated: Aug 19, 2024. Find information on the OMB designated Best in Class City Pair Program (CPP), which allows government travelers savings and flexibility in planning official travel.