- Home ›

- Travel Money ›

Get the best US dollar exchange rate

Compare the latest US dollar exchange rates from the UK's best currency providers

Best US dollar exchange rate

It may come as no surprise that the US dollar is the most popular and widely-traded currency in the world. According to the Bank for International Settlements, nearly 90% of all foreign exchange trades involve the US dollar on one side of the transaction, and it's estimated that more than 60% of all the cash reserves held by central banks around the world are stored in US dollars.

If you're travelling to the USA, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best US dollar exchange rate by comparing a wide range of UK travel money suppliers who have US dollars in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best US dollar exchange rate right now is 1.2642 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of US dollars for home delivery.

The best US dollar exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

US dollar rate trend

Over the past 30 days, the US dollar rate is up 0.24% from 1.2642 on 3 May to 1.2672 today. This means one pound will buy more US dollars today than it would have a month ago. Right now, £750 is worth approximately $950.40 which is $2.25 more than you'd have got on 3 May.

These are the average US dollar rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to US dollar currency chart .

Timing is key if you want to maximise your US dollars, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the US dollar rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the US dollar rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their US dollars as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your US dollars sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better US dollar rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your US dollars first before you collect them from the store so you benefit from the supplier's better online rate.

US dollar banknotes and coins

US dollars are governed and issued by the central bank of the United States, the Federal Reserve, while the physical production of US dollar banknotes and coins is managed by the Department of the Treasury. Banknotes are printed by the Bureau of Engraving and Printing in Washington D.C., and coins are minted by the United States Mint which has facilities in various US cities including Philadelphia, Denver and San Francisco.

One US dollar ($) can be subdivided into 100 cents (¢). There are seven denominations of US dollar banknotes in circulation: $1, $5, $10, $20, $50 and $100 which are frequently used, plus a rarer $2 bill which is not as widely circulated but is still printed and is legal tender.

All US dollar banknotes feature two insignias that are intended to represent different aspects of American culture and history. The first insignia, known as the Great Seal, depicts a bald eagle with a shield on its chest, holding an olive branch and arrows in its talons. Above the eagle's head is a banner with the Latin phrase "E Pluribus Unum" which means "Out of Many, One", and a constellation of 13 stars representing the original 13 American colonies. The second insignia is the seal of the Federal Reserve System. The front of the seal features an eagle holding a key which represents the Fed's role in controlling the money supply, and a scroll which represents the Fed's responsibility to regulate and oversee banks.

There are four US dollar coins in frequent circulation: 1¢, 5¢ (nickel), 10¢ (dime) and 25¢ (quarter). 50¢ and $1 coins are also minted but are not as widely used.

Dollars are colloquially referred to as 'bucks'. The name was originally used as slang term in 19th century poker games, where a 'buck' was a buck-handled knife that was passed from player to player to indicate whose turn it was to deal. If a player didn't want the responsibility of dealing, they could 'pass the buck' to another player. Over time, the term 'buck' came to be used more broadly to refer to a bet or a wager; eventually becoming synonymous with dollars.

There's no evidence to suggest that you'll get a better deal if you buy your US dollars in the USA. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your US dollars in the USA:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy US dollars when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in the USA

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Tips for saving money while visiting the USA

The USA has a high standard of living, and prices are generally comparable to the UK for things like accommodation, food and transport. Hawaii, New York and California are generally considered to be the expensive states to visit, while Kentucky, Mississippi and Arkansas are among the cheapest.

- Research your accommodation: One of the best ways to save money is by opting for budget accommodation. Hostels, guest houses and AirBnB can be much more affordable than hotels, especially if you rent a room instead of an entire apartment. Hostel chains like Hostelling International, Freehand Hostels and Selina operate modern, budget-friendly accommodation in most large US cities.

- Use public transport: Private taxis and rental cars are an expensive way to get around, so make the most of busses, trains and metros wherever possible. Look out for discounted travel passes like CityPASS and Go Card to save even more on standard fares.

- Eat like a local: The USA is synonymous with fast food restaurants, but diners are another major staple of American dining which offer large portions of classic American dishes at affordable prices. Or, for a healthier option, consider shopping in local grocery stores and cooking your own meals if your accommodation has a kitchen.

- Plan your itinerary: Research free attractions in whatever city you're staying in and plan your itinerary around these. Many museums, botanical gardens and historical sites offer free entry, and there are over 60 National Parks across the US, many of which are free to enter such as Great Smoky Mountains in Tennessee, Olympic National Park in Washington D.C. and Acadia in Maine.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or US dollars - always choose US dollars. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Sign in

Foreign Currency Exchange

Foreign currency ordering—convenient and secure.

Exchange rates fluctuate, at times significantly, and you acknowledge and accept all risks that may result from such fluctuations. If we assign an exchange rate to your foreign exchange transaction, that exchange rate will be determined by us in our sole discretion based upon such factors as we determine relevant, including without limitation, market conditions, exchange rates charged by other parties, our desired rate of return, market risk, credit risk and other market, economic and business factors, and is subject to change at any time without notice. You acknowledge that exchange rates for retail and commercial transactions, and for transactions effected after regular business hours and on weekends, are different from the exchange rates for large inter-bank transactions effected during the business day, as may be reported in The Wall Street Journal or elsewhere. Exchange rates offered by other dealers or shown at other sources by us or other dealers (including online sources) may be different from our exchange rates. The exchange rate you are offered may be different from, and likely inferior to, the rate paid by us to acquire the underlying currency.

We provide all-in pricing for exchange rates. The price provided may include profit, fees, costs, charges or other mark ups as determined by us in our sole discretion. The level of the fee or markup may differ for each customer and may differ for the same customer depending on the method or venue used for transaction execution.

In connection with our market making and other activities, we may engage in hedging, including pre-hedging, to mitigate our risk, facilitate customer transactions and hedge any associated exposure. Such activities may include trading ahead of order execution. These transactions will be designed to be reasonable in relation to the risks associated with the potential transaction with you. These transactions may affect the price of the underlying currency, and consequently, your cost or proceeds. You acknowledge that we bear no liability for these potential price movements. When our pre-hedging and hedging activity is completed at prices that are superior to the agreed upon execution price or benchmark, we will keep the positive difference as a profit in connection with the transactions. You will have no interest in any profits.

We also may take proprietary positions in certain currencies. You should assume we have an economic incentive to be a counterparty to any transaction with you. Again, you have no interest in any profit associated with this activity and those profits are solely for our account.

You acknowledge that the parties to these exchange rate transactions engaged in arm’s-length negotiations. You are a customer and these transactions do not establish a principal/agent relationship or any other relationship that may create a heightened duty for us.

We do not accept any liability for our exchange rates. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.).

Order foreign currency

Foreign currency FAQs

Foreign currency ordering details

- Orders placed Mon.-Fri. before 2 p.m. local time of your address of record (on the account you’re using to pay for the order) will ship the same day.

- Orders placed Mon.-Fri. after 2 p.m. local time of your address of record (on the account you’re using to pay for the order) will ship the next day.

- We do not ship orders on Saturdays, Sundays or holidays

- Delivery is made to either a financial center or the address of record on the account used to pay for the order

- Delivery to U.S. addresses only; no P.O. boxes

- Standard delivery (1-3 business days): $7.50 (standard delivery is free for orders $1,000 and up)

- Overnight delivery (order by 2 p.m.): $20

- Because we do not stock inventories of foreign currency at financial centers, delivery charges apply to orders picked up at a financial center as well as to orders (under USD$1,000) sent to your account address.

- It is $1,000 or more in U.S. dollars

- You are a new customer (less than 30 days)

- Your address changed in the last 30 days

Are you planning a trip overseas?

Receiving an international wire transfer.

Best US Dollars Exchange Rates

Make sure to get the best rates by comparing prices on pounds to US dollars

Delivery Options

Established since 2010. Home delivery is free above £700 with a postal charge of £5 for orders below £700. Payment for your currency can be made via Visa, Mastercard, Apple Pay or Google Pay but using these services incurs a 0.1% additional fee. There are no charges if you pay using the “pay by bank app” or for make a manual bank transfer.

Currency Online Group

Established in 2006. Home delivery is free above £750 with a postal charge of £5 for orders below £750. “Click and collect” is available in 2 London locations.

Established in 1972. Home delivery is free above £700 with a postal charges of £6 for orders below £700. “Click and collect is available via their London W2 office.

The Currency Club

Established since 2010. Home delivery and payment via bank transfer is free. Payments via debit card incur a fee of 0.29%. There is no “click & collect” service available.

Covent Garden FX

Established in 2001. Home delivery is free above £750 with a postal charge of £6 for orders below £750. “Click & collect” is available from their London store and they also deliver to offices in the City of London.

NM Travel Money

Established in 2018 and part of the NM Money Group which includes eurochange. Home delivery is free above £500 with postal charges of £5 for orders below £500. Has access to the 192 eurochange “click and collect” outlets

Established in 1975. Home delivery free above £500 with postal charges of £5 for orders below £500. Has 192 “click and collect” outlets throughout the UK.

Provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with a postal charge of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and “click & collect” is available at a selected number of stores -check to see if there is one near you.

Part of the John Lewis partnership and provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with postal charges of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and ‘click & collect’ is available at a selected number of these stores -check to see if there is one near you.

First Choice

Provided by TUI Travel Money. Home delivery is free above £600 with postal charges of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

Part of the TUI Travel Agent Group. Home delivery is free above £600 with a postal charge of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

Travel money services offered in conjunction with Travelex. Home delivery is free above £500 with a postal charge of £3.95 for orders below £500. Asda has over 500 stores throughout the UK – check to see if the “click and collect” service is available at a store near you.

Tesco provide travel money services in conjunction with Travelex. Home delivery is free above £500 with postal charges of £4.99 for orders below £149 and £3.95 for orders below £500. Tesco has over 2,500 stores throughout the UK. Check to see if ‘click & collect’ is available at a store near you.

Rapid Travel Money

Powered by the Currency Club and part of the Sterling Consortium that was established in 1972.Home delivery is free over £1500 with a postal charges of £8.99 for orders below £1500. There is no ‘click & collect’ service available

Sainsbury’s have offered a travel money service as part of their bank offering since the late nineties. Home delivery is free above £400 with a postal charge of £4.99 for orders below this amount. ‘Click & collect’ is available in Sainsbury’s stores throughout the UK. Check to see if this service is available at a store near you

Established in 1976. Home delivery is free above £600 with postal charges applied on a tiered basis, ranging from £2.99 to £7.49 depending on the amount purchased. ‘Click & collect’ service available. Many of their outlets are at airports and transport hubs -check to see if there is a location convenient to you.

The Post Office

Post Office has provided travel money services in conjunction with First Rate Exchange Services since 1994. Home delivery is free above £500 with a postal charge of £4.99 for orders below £500. “Click and collect” is available at 100’s of Post Offices throughout the UK. Check to see if this service is available near you.

ABTA Travel Money

ABTA – The Travel Association knows travel, having been a recognised and reassuring source of advice, guidance and support to travellers for over 70 years. ABTA is now bringing you one of the essentials when travelling abroad – a foreign exchange service, ABTA Travel Money.

With competitive rates on over 60 currencies. Order Online for Click & Collect in just 60 seconds later (depending on branch opening hours and stock availability) from over 190 locations or order before 2:30pm for next working day home delivery.

Currency Exchange Corp

- Established in 1999.

- Home delivery is Free above £800 but postal charges of £6.95 apply to orders below £800

- There is a ‘Click & Collect’ service available in some 16 stores in London & surrounding area but check this service is available at a store convenient to you.

No1 currency - Home Delivery

Established over 20 years ago and part of the Fexco Group. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. Has 180 “click and collect” outlets throughout the UK.

Established since 2007 and part of the Equals Money Group. Requires you to register for an account before ordering currency. Home delivery is free above £750 with postal charges of £7.50 for orders below £500 & £5 for orders between £500 & £750. “Click and collect” is available in a store in London.

Established since 2018. Home delivery is free above £750 with a postal charge of £7.50 for orders below £750. Available for “click and collect” from their office in Slough.

Thomas Exchange

Established in 1993. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. “Click and collect” is available in 9 outlets throughout London.

Linkfx Home Delivery

Linkfx Home Delivery was established in 1995. Home delivery is free above £750 with a postal charge of £5 for orders below £750. There is no ‘Click & Collect’ service available.

The travel money service is only available to HSBC, First Direct and Marks and Spencer Account holders. Offers free delivery by post or to HSBC branches

All orders must be paid for with a Barclays debit card or a Barclaycard. Travel money can be collected from Barclays branches or delivered free to your home address. Minimum order £50.

Currency Commentary

The US dollar is the most widely used currency in international transactions, as well as the one considered to be the safest. The US dollar is the most traded currency in the world and is often called the worlds ‘reserve currency’ (so for instance crude oil is always denominated in US dollars).

This also means that in many other places in the world, but typically developing countries many shops and restaurants (and tour guides and taxis) will also accept US dollars. In fact, in some countries such as Argentina the dollar goes a lot further than the peso.

Countries that you can use the US dollars include Puerto Rico, Ecuador, British Virgin Islands, Turks and Caicos Islands, although many of the countries in the Caribbean also accept US dollars.

Citizens of counties often give their currency nick names and the US is no different calling the dollar ‘bucks’. This probably comes from the trading of deer skins in the 1700’s, which then over time became the name for the US dollar.

How to get the best deal on your travel money

How do you get the best exchange rate for US dollars?

If you are buying US dollars to get the best exchange rate you should always use a travel money comparison website, they are easy to use and provide a simple way of finding the best price. You don’t have to choose the best rate, so for example if you would prefer a well-known brand which maybe costs more, you can do so but at least you understand the difference in cost. The difference in cost between the best and worst rate can be significant, up to £20 on a currency purchase of £750.

How do you get the best on-line exchange rate for US dollars?

If you want to order and buy your US dollars on-line, then to get the best on-line exchange rate always use a comparison website. You will be provided with a list of travel money suppliers usually in order of the best price first. If you want a larger number of US dollars, say above £500 the best price will almost certainly be a small direct supplier with a less well-known brand. You then have a choice as to whether you would prefer to have the money delivered to your home or to collect the money from a local store on the ‘High St’.

How do you get the best exchange rate for US dollars for home delivery?

If you would like the money delivered to your home, when you are choosing the provider make sure that you understand the postal delivery charges, particularly for amounts below £500 as any additional postal costs will effectively mean that you are receiving less US dollars for the £sterling you pay. That is why at besttravelmoney.com we include postal charges for the specific amount of US dollars requested within the rate you are shown. So, what you see is the cost to you.

There are some practical considerations when choosing home delivery, like making sure the travel money supplier you have chosen for US dollars delivers to where you live. Some of the smaller suppliers with the best rates will only deliver to a small geographical area. Also, remember this is ‘cash’ you are having delivered, so you need to be at home when your US dollars arrive.

How do you get the best exchange rate for US dollars on the High St?

If you only require a small number of US dollars or would prefer the convenience of collecting your US dollars from a local store, we would still recommend you use a travel money comparison website. Choose the travel money provider which you consider having the best combination of rate and convenience for you. Check the supplier you have chosen (whether for example it is Tesco, Sainsbury’s or eurochange) really does have a collection point near you as not all stores will have the facility.

We still recommend that you order on-line going from the comparison website to your chosen provider website to ensure you get the best deal. You will almost certainly getter a better rate via ‘click & collect’ than just walking into a store and purchasing your US dollars.

Keep in mind our FAQ's to make sure your holiday money goes further

Always understand the charges for debit and credit cards.

Many of the costs that you incur while abroad are driven by your UK bank account or credit card, so understanding the costs for your debit or credit cards abroad is important.

Whilst using your debit card in the UK is usually free, using your card abroad often incurs extra charges. Apart from most European holiday destinations the major banks charge a fixed fee every time you use your debit card. There is also a foreign exchange fee (typically 2.99%) on the amount you spend when using your debit card. The newer banks tend to offer better deals. Starling bank and Revolut being two of the better examples.

We have put a table together of debit card charges for most UK banks within the Debit Card FAQ section .

Most credit cards don’t charge a fixed fee for using the card but still charge a percentage on any transaction that you make in a shop or restaurant. Also be careful using your credit card for cash from an ATM as it may be considered a cash advance and incur interest immediately. One of the better credit cards to use abroad is the Halifax Clarity card .

We have put a table together of credit card charges for the major UK card providers within the Credit Card FAQ section .

Always select the local currency in a shop or at an ATM

Something that is becoming more frequent when you go abroad is at an ATM or in shops and restaurants, you may be offered the option to pay in pounds sterling or local currency. Always choose the local currency otherwise you will get a very poor exchange rate and the cost to you can be surprisingly high.

This tiktok we saw explains it well for ATM transactions.

Check overseas ATM charges before pressing 'enter'

Understanding the differing charges applied by ATMs abroad is not easy. In theory ATMs are required to explain their charges before you press enter. Apart from any charges applied by your bank or credit card provider the local ATM owners may have differing exchange rates or local charges. Don’t be afraid to check out several local ATMs and see which offers the best deal.

Simpler options can be to take more local currency with you or use an ATM from a big local bank. ATMs from banks tend to charge less than independent local operators sited in stores or garages for example.

Our travel guides provide the names of the major banks in some different countries

Our travel money guide to the US plus a few others you may be interested in

United states, check out our blog posts.

All you need to know about cash and cards on a Caribbean cruise

Holidaymakers miss out on over £150m a year by not shopping around for currency

All you need to know about cash and cards when travelling to New Zealand

3 Easy Ways to Boost your Holiday Spending Power

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

- GBP to USD exchange rate

Pounds GBP to US dollars USD exchange rate

Seeing stars (and stripes)? Get your holiday cash from Post Office

Buy travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

- Order US dollars online and pick up in as little as 2 hours

- The more you buy the better the rate

- Have your US dollars delivered to your home or pick up in branch

America awaits. Get your holiday money here

The Golden Gate Bridge, Jeff Bridges, Bridges of Madison County, Madison Square Gardens, the Garden State…even in a game of word association, the USA has too many iconic landmarks to list. And in a country so enormous and diverse, you’re going to need your holiday money to hand.

Whether that’s in cash or on a Travel Money Card (or both), get your travel money with us. You can order online before 2pm Monday to Friday and pick up your US dollars at a participating branch in as little as 2 hours.

And if you come back with a few banknotes left over, we’ll even buy them back from you. We’ll refund you every cent within 28 days of purchase* if your holiday gets cancelled. Plus, don’t forget your travel insurance , available here too.

Today’s online rates

Rate correct as of 02/06/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Get your US dollars with Post Office

Voted ‘Best Foreign Exchange/Travel Money Retailer’ by the UK public at the British Travel Awards 2022

Pick up US dollars within 2 hours of ordering

Order online for our best rates and get better rates the more you buy

Delivery is free on orders of £500 or more, or pay just £4.99 for deliveries of less

Use our refund guarantee if your holiday is cancelled within 28 days of purchase. T&Cs apply

Or you can sell us back any currency notes you don’t spend

Get a Travel Money Card for cashless payments

And use our travel app to top it up, buy travel insurance and much more

Click and collect in branch

Order online by 2pm and pick up the same working day from your nearest participating branch.

Home delivery

Want to stay home? Order by 3pm and get your US dollars delivered the next working day.

Go digital in the USA

Get our Travel Money Card and top up with US dollars. Accepted anywhere you see the Mastercard® symbol.

What do things cost in the USA?

Our Post Office Travel Money Holiday Money Report looks at prices from some popular destinations, including Orlando, Florida.

Cup of coffee

£2.33

£6.81

Family meal

£65.02

Costs are for Orlando in the USA and based on prices at the time of our last Holiday Money Report in 2023.

How far will your US dollars go?

The United States is vast and it’s common for specific tax laws to be decided at a federal level. That means pricing for individual items might differ by state

Destinations that are popular with tourists might see prices inflated compared to other areas, but this isn’t always the case

Remember that travel insurance – particularly with good medical cover – is vital if you’re going to the USA. We’ve lots of information on what to expect in America

Some common questions

Where can i get us dollars.

Buying USD from a Post Office branch is simple. You can simply go into one of our branches that sells foreign currency. There are thousands, just use our branch finder to find your most convenient. You can order online for collection or delivery. Or you can load US dollars onto a Travel Money Card .

It’s very simple, and the US dollar is one of two currencies (the other being the euro) with the option to collect your travel cash in branch two hours after you’ve ordered it.

What is the US dollar?

The US dollar is the formal currency of the USA as well as the de facto currency of numerous other states and regions. It is the most traded currency in the world, as well as the currency most held in reserve.

The US dollar is a relatively stable currency, which has meant that some countries have introduced it at times when their own currency is volatile. Some countries, such as Lebanon, unofficially use US dollars in conjunction with their own tender. Other territories – for instance the British Turks and Caicos Islands – officially use the US dollar on the exchange too.

What countries use the US dollar?

Officially, the countries and territories that use the US dollar are: United States of America, American Samoa, British Virgin Islands, Ecuador, El Salvador, Guam, East Timor, Marshall Islands, Federated States of Micronesia, Palau, Northern Mariana Islands, Puerto Rico, Turks and Caicos, US Virgin Islands, Spanish Virgin Islands, British Indian Ocean Territory, Bonaire, Saint Eustatius and Saba.

There are also many more countries whose currencies are fixed to the US dollar, meaning that they can use US dollars in everyday transactions and on the exchange.

Please note, though, that if you have a Post Office Travel Money Card and load it with US dollars, it will only be accepted within the USA itself. It can’t be used to pay in US dollars in other territories that use them as either an official or unofficial currency.

What denominations does the US dollar come in?

Each US dollar is divided into 100 cents. Coins come in 1 cent, 5 cent, 10 cent and 25 cent. These are called penny, nickel, dime and quarter respectively. Fifty-cent coins and one-dollar coins are still minted, however are seldom used in day-to-day tender.

Notes come in 1, 2, 5, 10, 20, 50 and 100. A 20-dollar coin is minted but – like a 50-cent coin – not in popular circulation. Like with many currencies, higher-value banknotes are occasionally minted but not submitted into circulation.

What are some words for dollars?

The USA has a colourful slang around its currency, and it can help to know some if you’re going. The most common is, of course, ‘buck’ – a reference to the deer (buck) skin trading that once underpinned the fledgling American economy. A single US dollar is very occasionally referred to as a ‘simoleon’, while banknotes in general can be called ‘greenbacks’. Both of these uses are fairly arcane.

A penny is the same as it is in the UK, a ‘nickel’ is a 5-cent coin, a ‘dime’ is a 10-cent coin and a ‘quarter’ is a 25-cent coin. A $100 bill is occasionally called a ‘Benjamin’ owing to the image of Benjamin Franklin on them.

- Read all travel money FAQs

Popular currencies

Visiting several countries on the same trip or as part of future travel plans? These other currencies might be of interest.

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

Travel money sale now on!

Click & Collect sale on euro, US dollar and Turkish lira available until 4 June.

Click & Collect available on selected currencies from selected stores. £150 minimum order, cancellation fee and full T&Cs apply. Exchange rates will still fluctuate daily during the sale period, but you'll receive the best rate applicable on the date the order is placed. Rates shown when placing your order are sale rates. Sale T&Cs apply.

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

M&S Travel Money Click & Collect Sale Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Buy US Dollars

Buy US Dollars online or instore before you visit the USA with Sainsbury’s Bank.

Exchange your Pounds to US Dollars with Sainsbury's Bank

Wherever you’re headed in the USA, buy Dollars before setting off. Whether it’s the sunny beaches and wineries of California, or the skyscrapers of Manhattan or the vast Colorado wilderness, exchanging Pounds to Dollars before your trip saves you time and avoids any inconvenience. We can help you change your Pounds into Dollars. Find out how here.

Why buy US Dollars from us?

- Better rates for Nectar members*

- 0% commission on all foreign currencies

- Order online for collection at an instore bureau

- FREE home delivery on cash orders of £400 or more**

How to buy US Dollars

Order online.

Buy US Dollars online when it suits you, whether you’re at home, at work or on the go.

Order by telephone

You can also buy US Dollars by phone. Give us a call on 0345 355 2463 to order Dollars and pay over the phone for home delivery. Alternatively, you can order to pay and collect instore.

Buy US Dollars at any of our instore travel money bureaux across the UK.

Nectar members get better rates

If you're a Nectar member, you can get an even better exchange rate when you buy Dollars from us*.

All you have to do is tell us your Nectar card number when you order. Rates may vary depending on whether you buy instore, online or by phone.

Not a Nectar member? Just download the Nectar app or register at nectar.com

Don’t fancy carrying cash? Use our travel card

Our travel money card makes spending, withdrawing, and managing your money while abroad easy. Transfer from Pounds to Dollars online or using the app. You can add your travel money all at once or top up your card on the go.

You can use our travel money card in the following ways:

- Contactless

- Chip and pin

- Swipe and sign

- Withdraw cash at ATMs.

You can store up to 15 currencies in your digital wallet and convert it back or swap between currencies if you don’t spend it.

Want to exchange leftover Dollars to Pounds?

If you have cash left over after your trip, we can exchange Dollars to Pounds. Just bring any unused Dollar notes into one of our travel money bureaux and we’ll exchange them for sterling. We buy back most foreign currency notes in denominations we sell (buy back rates vary daily). We don't buy or sell foreign currency coins

How much will I get when I convert my Pounds to Dollars?

To find out exactly what you’ll get when you convert Pounds to Dollars, use our currency converter .

Rates may vary depending on whether you exchange instore, online or by phone.

USA currency costs and attractions

Facts and figures about us dollars.

- The US Dollar is the official currency in lots of countries besides the USA, including Ecuador and El Salvador. It’s also used in various US and British territories, like Puerto Rico and the British Virgin Islands.

- Many other countries accept the US dollar alongside their own local currency, including the Bahamas, Barbados, Belize, Costa Rica, Nicaragua, Panama, and Cambodia.

- The currency code for the US Dollar is USD and the currency symbol is $.

- US Dollar notes come in $1, $2, $5, $10, $20, $50, $100 denominations and there are 100 cents to every $1^.

- US coins currently in circulation are the penny (1 cent), nickel (5 cents), dime (10 cents) and quarter (25 cents). Half dollars and $1 coins are produced as collectables, but can also be used as legal tender^.

^ Please note we don't buy or sell foreign currency coins.

Using your travel money card in the USA

Using a card in the USA can work slightly differently than in the UK. We’ve answered common questions below.

Can I use my card in the USA?

Yes, you can use your travel money card in the USA. You will be able to pay for goods and services with your travel money card or withdraw cash from an ATM. ATMs are readily available throughout the USA, with 24/7 access at many places like banks, shopping centres and airports. You may be charged for ATM withdrawals, so always check before withdrawing cash.

Is contactless payment available in the USA?

In the USA some payment systems differ from those in the UK. Contactless and chip and pin are available in some retailers, but it’s a much less common way to pay in the USA. You may be required to swipe and sign instead.

Do I need cash in the USA?

Although you will be able to use card payment in many places in the USA, you may need to pay for some things with cash. It’s a good idea to buy some Dollars before you travel, so you’ve got cash available from the moment you arrive in the country. You can buy Dollars online or instore with Sainsbury’s Bank.

After another currency?

We sell over 50 different currencies from all corners of the world, with great rates and 0% commission.

Travel tools and guides

Holiday planning

Need a hand preparing for your trip? We’ve pulled together a range of tips and checklists to help get you holiday ready

Flying with children

Check out our top tips for a stress-free trip when flying with little ones

Solo travel

Travelling on your own can be both fun and rewarding. Our guide is full of hacks to help you make the most of your adventure

For additional travel tips and information, as well as help getting your travel money sorted, take a look at travel guides and tools page .

Have questions?

Have a look at our FAQs , where you’ll find our answers to customers’ most common travel money questions.

Terms and conditions

*Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy instore, online or by phone. You need to tell us your Nectar card number at the time of your transaction.

**You can order currency for a secure home delivery by 1pm on the day of your choice by Royal Mail (Mon- Sat). For next day delivery your order needs to be confirmed before 2pm (Mon- Fri). Please note that whilst Royal Mail make every effort to delivery on schedule, we cannot guarantee this as it is beyond our control. Highlands and Islands (including Channel Islands) are not guaranteed next day delivery. Delivery is free on all cash orders £400 or more (£4.99 for orders between £100 and £399.99). The minimum order for home delivery is £100. The delivery day quoted is dependent on the order day being a working day; if one of those days is a public holiday then additional day(s) will be added accordingly. All home delivery orders are sent via Royal Mail Special Delivery, unless we advise you otherwise, to your billing address, and a signature will be required upon delivery. A valid telephone number is required for home delivery.

Sainsbury's Bank Travel Money Card™ is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

US Dollars (USD)

Whatever you have planned for your trip to the United States, you can check the Pound to Dollar exchange rate and buy Dollars online before you fly.

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Purchase instantly Purchase instantly

Conveniently purchase currency or prepaid travel money cards in-store at Tesco.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Buy your Dollars online and collect them from selected Tesco stores

Travelling to the states pick up your dollars with the weekly shop..

If you need to buy Dollars for your next trip, why not give Click & Collect a try?

We offer next day collection for many currencies if you order before 2pm. You'll get a choice of collection dates when you place your order and these can vary depending on the store. So it's worth checking nearby alternatives if you don't see a date that suits.

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

How far your US Dollars could go

- Mid-range three-course meal for two: $72.50

- Cappuccino: $4.31

- 0.5 litre of beer: $6.00

- Soft drink: $2.02

- Loaf of fresh white bread (500g): $3.13

- Taxi Start (Normal Tariff): $3.25

- Taxi 1km (Normal Tariff): $1.68

- One-way ticket on local transport: $2.50

- Litre of petrol: $0.72

Information sourced from Numbeo.com, March 2021.

- Mid-range three-course meal for two: $67.50

- Cappuccino: $4.46

- Soft drink: $1.89

- Loaf of fresh white bread (500g): $2.67

- Taxi Start (Normal Tariff): $3.50

- Taxi 1km (Normal Tariff): $1.79

- One-way ticket on local transport: $2.00

- Litre of petrol: $0.70

San Francisco

- Mid-range three-course meal for two: $80.00

- Cappuccino: $4.83

- 0.5 litre of beer: $8.00

- Soft drink: $2.49

- Loaf of fresh white bread (500g): $3.80

- Taxi 1km (Normal Tariff): $1.86

- One-way ticket on local transport: $3.00

- Litre of petrol: $0.95

- Mid-range three-course meal for two: $50.00

- Cappuccino: $4.38

- 0.5 litre of beer: $4.50

- Loaf of fresh white bread (500g): $2.88

- Taxi Start (Normal Tariff): $2.75

- Taxi 1km (Normal Tariff): $1.49

- Litre of petrol: $0.55

- Mid-range three-course meal for two: $100.00

- Cappuccino: $4.96

- 0.5 litre of beer: $7.00

- Soft drink: $2.05

- Loaf of fresh white bread (500g): $3.96

- One-way ticket on local transport: $2.75

Buy before you fly

Benefits of planning ahead.

It's a good idea to exchange your Pounds for Dollars before you leave, so you can pay for travel essentials like food, drink, tips and transport when you arrive.

Buying your Dollars before you head off means you won’t need to worry about finding an ATM while you’re away. You’ll also be able to avoid any additional withdrawal charges.

It’s worth remembering that foreign exchange rates can go up and down. When you buy your Dollars in advance, you can be sure of the rate you are going to get. If you withdraw cash when you arrive in the United States, you may not get the same exchange rate.

Get your currency when it’s convenient for you

You can use Click & Collect to arrange a time to pick up your US Dollars as part of your weekly shop, either from a Tesco Travel Money bureau or customer service desks. You can also use our home delivery service, which is free for online orders of £500 or more.

Exchange rates can change throughout the day and may vary depending on whether you buy in-store, online, or over the phone.

Some common questions about the US Dollar

The US Dollar is the currency used in the United States. It is used in other states, regions, and countries too, including Ecuador, Puerto Rico and the British Virgin Islands. Thanks to the size of America and the number of other places that use and accept US Dollars, it is the most commonly used currency in the world.

There are also 65 countries that don’t use the US Dollar as their official currency, but they do peg their own currencies to it. This means the national government or central bank of those countries sets a fixed exchange rate for its currency and the US Dollar.

There are many countries that use the US Dollar as their official currency, including:

- The United States of America The United States of America

- Commonwealth of Puerto Rico Commonwealth of Puerto Rico

- Ecuador Ecuador

- Republic of El Salvador Republic of El Salvador

- Republic of Zimbabwe Republic of Zimbabwe

- The Virgin Islands of the United States The Virgin Islands of the United States

- The British Virgin Islands The British Virgin Islands

- Democratic Republic of Timor-Leste Democratic Republic of Timor-Leste

- Bonaire Bonaire

- American Samoa American Samoa

- Commonwealth of the Northern Mariana Islands Commonwealth of the Northern Mariana Islands

- Federated States of Micronesia Federated States of Micronesia

- Republic of Palau Republic of Palau

- Marshall Islands Marshall Islands

- Panama Panama

- Turks and Caicos Turks and Caicos

Some countries don’t officially use the US Dollar, but they will accept it alongside their own currency. When you’re visiting places like Canada and Mexico, you will usually be able to pay in US Dollars. The same is true for the Bahamas, Barbados, Bermuda, the Cayman Islands, Belize, Nicaragua, Sint Maarten, St Kitts and Nevis, as well as the ABC Islands of Aruba, Bonaire, Curacao, and the BES Islands including Bonaire, Sint Eustatius, and Saba.

Notes come in 1, 2, 5, 10, 20, 50 and 100 Dollars. Coins come in 1 Cent, 5 Cent, 10 Cent and 25 Cent pieces, but are referred to as a Penny, Nickel, Dime and Quarter respectively.

Looking for a different currency?

We sell over 50 currencies. Order online for home delivery or collect from selected Tesco stores.

Important information

Buying foreign currency using a credit or debit card.

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Other customers have been asking:

If you've got a problem or query on your order, get in touch with us. We're here to help.

- Money Transfer

- Rate Alerts

1 GBP to USD - Convert British Pounds to US Dollars

Xe Currency Converter

1.00 British Pound =

1.27 39202 US Dollars

1 USD = 0.784979 GBP

Convert British Pound to US Dollar

Convert us dollar to british pound, gbp to usd chart.

1 GBP = 0 USD

1 British Pound to US Dollar stats

Currency information, gbp - british pound.

Our currency rankings show that the most popular British Pound exchange rate is the GBP to USD rate. The currency code for British Pounds is GBP. The currency symbol is £.

USD - US Dollar

Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. The currency code for US Dollars is USD. The currency symbol is $.

Popular British Pound (GBP) Currency Pairings

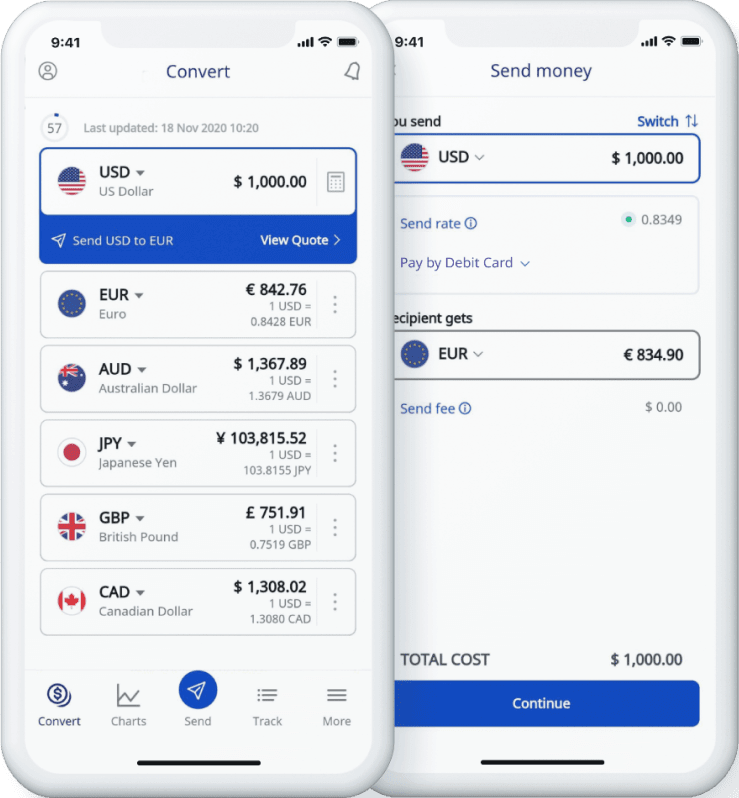

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Personal Finance

5 best ways to exchange foreign currency.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Cashless transactions are becoming more commonplace worldwide as consumers increasingly use debit and credit cards, mobile payment apps, and other types of digital payments for everyday spending. Still, you might want to exchange some U.S. dollars for foreign currency when traveling abroad—either because cash is still king at your destination or you prefer globetrotting with at least a little cash in your pocket.

There are multiple ways to exchange currency, but the goal is to get the best exchange rate with the lowest fees—something easier said than done. To help point you in the right direction, here are our tips for exchanging currency and finding the best deals.

5 ways to exchange foreign currency

1. get cash at your bank or credit union before and after your trip.

Many banks and credit unions sell foreign currencies without charging a fee beyond the exchange rate. You can order currency by phone, online, or in person at your local branch and arrange to pick it up or get it delivered.

Some currencies will be "in stock" and available to exchange immediately, while others may require a few days to process. Once you return from your trip, you can convert any unused currency back to dollars—or stash it somewhere safe for your next adventure.

2. Withdraw cash from your bank's in-network ATMs

Once you reach your destination, an Automatic Teller Machine (ATM) is the best way to get currency to spend locally. ATMs generally offer competitive exchange rates, and you can avoid (or at least limit) fees by using ATMs in your bank's network. You can save on fees by withdrawing larger amounts of cash once or twice rather than making frequent, smaller withdrawals. Check with your bank to find out your daily and per-transaction ATM limits, and request an increase if you plan to access more cash.

3. Use a money transfer app

Money transfer apps let you send money to friends, family, and merchants worldwide. Most transfers are completed within minutes. The apps are free to use (though you'll generally pay a fee if you use a credit card instead of a linked bank account to fund the transfer). You may also pay a fee if the cash needs to change currencies.

4. Online currency converters

Another option is to order cash through an online currency converter. However, you may get a poor exchange rate. Also, the pick-up and delivery fees could be higher than the amount your local bank charges, depending on how much currency you exchange.

5. Airport kiosks and currency exchange counters

Airport kiosks, hotels, and tourist centers are convenient ways to exchange currency. However, the high fees and poor exchange rates mean less cash in your pocket. If you can plan ahead, you'll get a better deal exchanging currency at your local bank or credit union.

More about foreign currency

How does currency exchange work.

Currency exchange lets you swap one currency for another, such as trading U.S. dollars (USD) for euros. Because currency values continuously fluctuate, the exchange rate you receive depends on what's happening in the global markets at any given moment. It's rarely a 1:1 ratio. Instead, one USD might buy, for example, 0.93 euros, 16.32 Mexican pesos, or 151.83 Japanese yen.

Banks that exchange foreign currency for free

Many banks let you exchange USD for foreign currencies (and vice versa) for free, but you may need to be a customer—or have a premium bank account plan. Still, remember that the exchange rate you receive may include the bank's profit, fees, costs, charges, or other markups in the spread—meaning you're still paying for the exchange. Check with your bank for details.

Where to get foreign currency internationally

ATMs are often your best bet for getting foreign currency while traveling internationally. ATMs generally offer competitive exchange rates, and if you use ATMs in your bank's network, you can limit fees. Remember that the ATM (or its affiliate bank) may also charge a fee of several dollars or more. ATMs in touristy areas sometimes have higher fees than those in non-touristy parts of town.

Places to avoid exchanging currency

You won't have to go out of your way to trade in your dollars at airport kiosks, hotels, or tourist centers, but they are some of the worst places to exchange currency; the high service fees and poor exchange rates mean you'll get less bang for your buck. (Of course, it's best to avoid currency exchange shops in remote or sketchy areas—not only because of excessive fees and unfavorable exchange rates but also because of the security risks.)

Still, you can try negotiating for a better rate or lower fees—but you'll need to know the current exchange rate going into the transaction. A quick Google search will display real-time exchange rates. For example, a "USD to EUR" search shows that $1 buys 0.93 euros (as of May 5, 2024). You can also use an online currency converter like Oanda or Xe to view live exchange rates.

Alternatives to exchanging currency

Credit and debit cards are simple alternatives to exchanging currency. Many credit cards—and some premium debit cards—offer travel rewards and protection benefits, making them an even more attractive option. Still, there are a few things to keep in mind when using your card internationally:

- Credit and debit cards aren't accepted everywhere.

- Some merchants don't accept certain credit card networks, even if they accept others. Of the four main U.S. payment networks (Visa, Mastercard, Discover, and American Express), Visa and Mastercard are the most widely accepted cards globally.

- Many card issuers impose a foreign transaction fee that can add about 3% to your total costs—or $30 on a $1,000 hotel bill, for example. If you're a frequent traveler, consider getting a travel credit card with zero foreign transaction fees.

- Your card issuer may temporarily freeze your card or contact you if they see overseas card activity. To avoid inconvenience, set up a travel notification.

- Merchants may offer the option to pay in USD or the local currency (called dynamic currency conversion). Paying in USD might seem the better choice; however, you'll almost always get a better rate by choosing the local currency (even if the merchant tells you otherwise).

- Credit card cash advances are an expensive way to get currency and should be considered a last resort.

- A banking app can help you monitor your account activity in real-time and alert you of unauthorized transactions.

TIME Stamp: Know your options before you travel

Before you travel internationally, find out if the areas you’ll be visiting accept credit cards. If so, you may not need any foreign currency (unless the idea of traveling without cash makes you uncomfortable). Consider charging larger purchases, like hotels and organized tours, and getting cash at an in-network ATM for everyday expenses like coffee, street vendors, and tips.

Frequently asked questions (FAQs)

Can i exchange foreign currency at a bank.

You can exchange many—but not all—foreign currencies at a bank. Stable currencies, like dollars, euros, and British pounds, are generally easily exchanged worldwide. However, illiquid or heavily regulated currencies may be difficult (or impossible) to exchange in many parts of the world.

How do I exchange foreign currency without a fee?

Currency exchange isn't free. You’ll pay for the service through a fee or a spread on the exchange rate (or both). Still, an ATM withdrawal can be a low-fee option when using an in-network ATM. (Check your bank's app to find an ATM near you.) Before your trip, consider asking your bank to increase your daily and per-transaction withdrawal limits. That way, you can make fewer trips to the ATM and save money on fees.

What is needed to exchange foreign currency?

One of the easiest ways to get foreign currency is via an ATM withdrawal; you only need your ATM card and PIN. If you exchange currency anywhere else, you'll need a valid government-issued ID, such as a driver's license or passport. Depending on the exchange service and the amount of currency you exchange, you may also need proof of your address or other documentation.

What is the procedure for foreign currency exchange?

Before your trip, you can order foreign currency from your bank or credit union to pick up at your local branch. (You may also be able to have it delivered, although there may be a delivery fee.)

Another option is an online currency converter that delivers cash to your home address, but the rate will likely be less favorable than your bank offers. Once out of the country, your best option is to use your bank's ATM network.

Whether heading out of the country or returning from a trip, it's generally best to avoid exchanging currency at airport kiosks, hotels, and tourist centers; skip the high fees and poor exchange rates and keep more money in your pocket for your next adventure.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

Understanding currency, how to get most bang for your buck when traveling internationally

Traveling internationally can come with a lot of additional fees that quickly add up on your vacation. From foreign transaction fees to currency conversion fees, there are so many things to look out for.

When traveling abroad, knowing exactly what your dollar is worth and how to avoid unnecessary fees can keep a lot of money in your pocket. Learning the basics of currency and how it works can be a powerful tool when traveling to another country.

The following is information on common currencies, exchange rates and tips for international travel that will save you cash in the long run.

SMART SHOPPING EXPERT GIVES TIPS FOR VACATIONING WITHOUT BREAKING THE BANK

- What are the most common currencies?

- What is the definition of currency?

- Which currencies are the most powerful?

- How can I convert currency in real time?

- How do I get the most for my money when traveling internationally?

When people talk about the most common currencies, they are often referring to those that are used the most frequently in terms of trading .