KPMG Personalization

Tourism Tax Policy and Amendments to Service Tax Policy

- Home ›

- Insights ›

Useful resources

- MyTTx Portal – TTx Policy No. 1/2021

- MySST Portal – Service Tax Policy

The Royal Malaysian Customs Department (“RMCD”) has uploaded a Tourism Tax Policy to recap the exemption of Tourism Tax announced by the Government earlier as well as amendments to two Service Tax Policies on its official portal. Please click on the above header links for a copy each of the policies.

Set out below are the salient points:-

Tourism Tax Policy No. 1/2021

- The exemption of Tourism Tax for the period from 1 July 2020 to 30 June 2021 has been further extended until 31 December 2021.

- Accommodation operators are still liable to submit TTx-03 Return to account and pay the Tourism Tax received from foreign tourists for accommodation provided before the exemption period or any Tourism Tax where payment has not been received from tourists within twelve calendar months that become due in the taxable period.

- The amount of Tourism Tax exempted must be stated in Column 7 of the TTx-03 Return i.e. the amount exempted for each night per room.

- During the exemption period, Tourism Tax should be recorded as “exempt” or “NIL” or “RM0.00” in the invoice issued to foreign tourists.

Amendment (No.2) to Service Tax Policy No. 9/2020

- Registered accommodation premise operators are exempted from charging Service Tax from 1 March 2020 to 31 December 2021.

- Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022.

Amendment to Service Tax Policy No. 2/2019

- Subject to meeting conditions, Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021.

Our highlights are intended to provide a general overview of the key proposed tax changes and should not be used or relied upon as a substitute for detailed advice or as a basis for formulating business decisions.

Should you have any questions or require further clarification, please do not hesitate to email or contact any of our Executive Directors, Directors, Associate Directors or Managers whom you are accustomed to dealing with or who are responsible for the tax affairs of your organization.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

- August 2021

Tax Exemption for Domestic Tourism Activities Gazetted

26 August 2021

- a ‘ qualifying person ’ is a company resident in Malaysia which is licensed under the Tourism Industry Act 1992 to carry out a tour operating business and which carries on a qualifying activity;

- a ‘ qualifying activity ’ is a tour operating business which provides a domestic tour package for travel within Malaysia utilised by local tourist and foreign tourist, including transportation by air, land or sea and accommodation;

- a ‘ tour operating business ’ has the same meaning assigned to it in the Tourism Industry Act 1992, that is any business of providing all or any of the following services:

- arranging for sale or commission any transportation, accommodation, tour services or any other incidental services for tourists within or outside Malaysia;

- organising or conducting for sale or commission inbound or outbound tours;

- providing conveyances for hire to tourists; and

- any other services incidental to any of the services enumerated above;

- the total number of local tourists and foreign tourists for a qualifying activity shall be verified in writing by an authorised officer of the Ministry of Tourism, Arts and Culture Malaysia.

- Proud to be a member of

- ©1963 - 2024 SKRINE. ALL RIGHTS RESERVED

- PDPA Notice

- connect with us

- -->

Tourism Tax (TTx) Policy No. 2/2021 – Extension of Tourism Tax Exemption

- April 21, 2022

- 2017年旅游税条例 , 2017年旅游税法令 , Tourism Tax , Tourism Tax Act 2017 , Tourism Tax Regulations 2017 , TTx-03 , 旅游税

1. On 27 December 2021, The Royal Malaysian Customs Department (RMCD) issued Tourism Tax Policy No. 2/2021 to provide guidance and clarification on the extension of the Tourism Tax (TTx) exemption until 31 December 2022, as revealed in the Budget 2022 speech.

2. Despite the exemption from TTx, registered accommodation operators are still required to comply with the Tourism Tax Act 2017 and the Tourism Tax Regulations 2017 by submitting the TTx-03 return per their taxable periods, as stipulated in the policy.

3. Join our Telegram – https://t.me/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻 1. 2021年12月27日,马来西亚皇家关税局 (RMCD) 发布了第2/2021号旅游税政策,为2022年财政预算案提呈时所透露的旅游税 (TTx) 豁免延长至2022年12月31日提供指导和澄清。

2. 尽管旅游税豁免了,但注册住宿经营者仍需遵守《2017年旅游税法令》和《2017年旅游税条例》,按照政策规定,在每个应税期 [Taxable Periods] 提交 TTx-03 报表。

3. 加入 Telegram 群 – https://t.me/YourAuditor 🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

Related Posts

Digital Certificates in e-Invoicing: Ensuring Authenticity, Integrity, and Non-Repudiation

Income Tax (Exemption) (No. 8) Order 2021 (Amendment) Order 2024

Income Tax (Exemption) (No. 7) Order 2021 (Amendment) Order 2024

Income Tax (Exemption) (No. 5) Order 2021 (Amendment) Order 2024

Get updates and stay connected.

Auditor | Tax Agent | BUsiness Advisor

A trusted, award-winning accounting firm that delivers measurable, sustainable results for our clients and communities.

Contact Information

- 03 9058 8313

- 03 9056 1160

- 03 9057 1160

- [email protected]

- No 38-1, Jalan Radin Anum, Bandar Baru Seri Petaling, 57000 Kuala Lumpur

- YourAuditor

CCS & CO PLT 202206000043 (LLP0033899-LCA) & AF 1538 was registered on 29th December 2022.

With effect from that date, CCS & CO (AF 1538), a conventional partnership, was converted to a limited liability partnership.

©2019 – 2024 by CCS . All rights reserved.

Tax Reliefs

Year of Assessment 2023 (Last updated on 6th November 2023)

Year of Assessment 2022

Year of Assessment 2021

Year of Assessment 2020

Year of Assessment 2019

Year of Assessment 2018

Year of Assessment 2017

Year of Assessment 2016

Year of Assessment 2014 & 2015

KUALA LUMPUR (March 17): The government has introduced new initiatives and extended existing ones for tourism, retail and other sectors that are affected by Covid-19 under the PEMERKASA stimulus package announced by Prime Minister Tan Sri Muhyiddin Yassin today.

To further encourage domestic tourism, the government has extended the exemption for tourism tax and services tax for hotel accommodation until Dec 31, 2021.

It has also announced entertainment duty exemption for entrance fees into entertainment premises including theme parks, stage performances, sports events and movie screenings within Federal Territories. However, the details on the period was not stated.

Individuals who purchase tourism packages from tour agents that are registered with the Ministry of Tourism, Arts and Culture (MOTAC) are also eligible for tax relief of up to RM1,000.

To support cash flow, companies in the tourism sector and selected sectors such as cinema operators and spa operators are allowed to delay their payment for monthly income tax for the period from April 1 until Dec 31, 2021.

Similarly, the Human Resources Development Fund (HRDF) levy is exempted for affected tourism and retail sector companies up until June 2021.

Another RM700 million was allocated to extend the Wage Subsidy Programme 3.0 for additional three months for companies involved in tourism, retail and wholesale trade, as well as businesses that were closed during the Movement Control Order (MCO) such as gymnasium and spa. This is expected to benefit 400,000 employees and 37,000 employers, Muhyiddin said.

The government also announced a one-off Special Assistance Grant of RM3,000 for 5,000 tour agencies registered with MOTAC, as well as one-off cash assistance of RM600 for 4,000 homestay operators registered with MOTAC.

Meanwhile, the existing special electricity bill discount of 10% for hoteliers, theme parks, convention centres, shopping malls, local airline offices and tour and travel agencies is now extended for three more months until June 30, 2021.

Concurrently, Bank Negara Malaysia has allocated an additional RM2 billion for its Targeted Relief and Recovery Facility (TRRF), which is provided for affected small and medium enterprises (SMEs).

PEMERKASA, announced today, comprises 20 key initiatives across four key focuses, namely to control the Covid-19 outbreak, to steer economic recovery, to strengthen the nation’s competitiveness, and to ensure the inclusivity agenda.

Muhyiddin said the PEMERKASA package is valued at RM20 billion, which includes a fresh fiscal injection of RM11 billion from the government.

Read also: Putrajaya allocates RM3.2b from USP Fund to improve broadband connectivity More cash assistance, subsidies for individuals under PEMERKASA PM announces stock market-related measures under PEMERKASA package PEMERKASA: Additional RM500m allocation for SME, micro business financing Allocation for National Immunisation Programme raised to RM5b Highlights of M'sian govt's additional stimulus measures to drive growth

Copyright © 1999-2023 The Edge Communications Sdn. Bhd. 199301012242 (266980-X). All rights reserved

- Legal Update

Malaysia | Updates on Tourism Tax - March 2021

Tourism tax.

The following Orders have been gazetted on 16 March 2021 and will come into operation on 1 July 2021:

- Tourism Tax (Rate of Digital Platform Service Provider Tax) Order 2021 ;

- Tourism Tax (Digital Platform Service Provider) (Exemption) Order 2021 .

Get in touch

Foong Pui Chi

Related news.

Tax Exemption For Domestic Tourism Activities Gazetted

Contributor.

The Income Tax (Exemption) (No. 9) Order 2021 [P.U.(A) 344/2021] (‘ E.O. No. 9 ') was gazetted on 23 August 2021. E.O. No. 9 has effect from the year of assessment 2021 until the year of assessment 2022.

E.O. No. 9 exempts a qualifying person from the payment of income tax in a basis period for a year of assessment in respect of the statutory income derived from a qualifying activity. The exemption under E.O. No. 9 only applies the total number of local tourists for a qualifying activity is not less than 200 persons in a basis period for a year of assessment.

For the purposes of E.O. No. 9:

- a ‘ qualifying person ' is a company resident in Malaysia which is licensed under the Tourism Industry Act 1992 to carry out a tour operating business and which carries on a qualifying activity;

- a ‘ qualifying activity ' is a tour operating business which provides a domestic tour package for travel within Malaysia utilised by local tourist and foreign tourist, including transportation by air, land or sea and accommodation;

- arranging for sale or commission any transportation, accommodation, tour services or any other incidental services for tourists within or outside Malaysia;

- organising or conducting for sale or commission inbound or outbound tours;

- providing conveyances for hire to tourists; and

- any other services incidental to any of the services enumerated above;

Notwithstanding the definition of ‘ tour operating business ', it must be noted that exemption under E.O. No. 9 only applies to statutory income of a tour operating business that is derived from the qualifying activity, that is domestic tour packages for travel within Malaysia which are utilised by local and foreign tourists.

- the total number of local tourists and foreign tourists for a qualifying activity shall be verified in writing by an authorised officer of the Ministry of Tourism, Arts and Culture Malaysia.

Where a qualifying person carries on a qualifying activity and an activity other than a qualifying activity, each activity shall be treated as a separate and distinct source of that qualifying person. A qualifying person who is granted an exemption from income tax under E.O. No. 9 shall maintain a separate account for the income derived from each of the aforesaid activities in the basis period for each year of assessment.

While it is doubtful that licensed domestic tour operators will derive much benefit from the tax exemption under E.O. No. 9 for the earlier part of this year due to the various movement control measures imposed over many parts of Malaysia, the gradual relaxation of these measure in the near future could result in a boom in the local tourism industry due to the release of pent-up demand for domestic travel.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

- Asia Investment Research

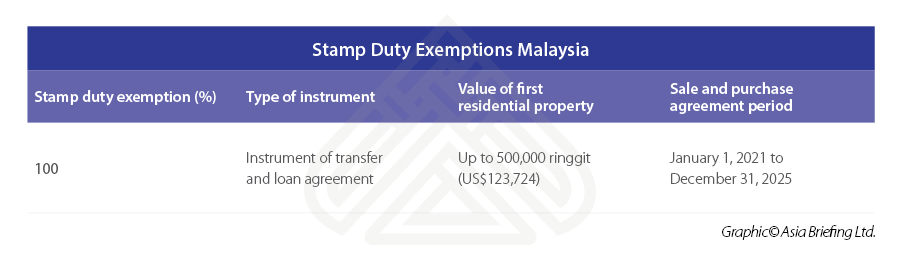

Indirect Tax and Stamp Duty Measures in Malaysia for 2021

- Malaysia has introduced a variety of indirect tax and stamp duty measures that businesses should be aware of in 2021.

- First time homeowners are now exempt from certain stamp duty charges on certain property prices and there is an extension on the sales tax exemption of locally assembled buses until December 2022.

As part of the 2021 national budget, Malaysia has issued various new incentives and measures in relation to indirect tax and stamp duty.

First time homeowners are now exempt from certain stamp duty charges if the property is valued at no more than 500,000 ringgit (US$123,724), and from July 2021, a tourism tax of 10 ringgit (US$2.47) per night will be levied on non-Malaysian tourists.

The government has allocated 322 billion ringgit (US$79.6 billion), or 20 percent of the GDP, in its latest national budget, considered to be the largest in the nation’s history. There are a variety of tax incentives for businesses and individuals in the form of reliefs and tax holidays aimed at mitigating the economic impact caused by the pandemic for the coming year.

Indirect tax

Increase of annual sales threshold for activities in the fiz and lmw.

At present, approval for any value-added/additional activities carried out in Free Industrial Zones (FIZ) and Licensed Manufacturing Warehouses (LMW) are subject to the condition that the value-added activities do not exceed 10 percent of the company’s annual sales turnover.

The government has increased the 10 percent annual sales value threshold to 40 percent of the company’s annual sales turnover. This relaxation gives companies more flexibility to diversify their operations and restructure their supply in response to the current dynamic business environment.

Expansion of tourism tax

From July 2021, tourism tax will be implemented and expanded to include accommodation reserved through online platforms. Under the PENJANA stimulus package, the tourism tax is fully exempt until June 2021.

The tax of 10 ringgit (US$2.47) per night usually levied on non-Malaysian and non-permanent resident tourists, staying in registered accommodation.

Proposal to broaden the AEO facility status

An Authorized Economic Operator (AEO) status is normally given to importers, exporters, manufacturers, and traders in Malaysia.

Obtaining this status means a business can enjoy the fast clearance of goods from customs control, deferred payment of import and export duties, and sales tax. The government has proposed broadening the AEO facility to include approved logistics service providers and warehouse operators.

This, in turn, will lower the cost of doing business for more sectors in the country. Investors should be aware that an implementation date has yet to be announced for this facility.

Exemption of sales tax on locally assembled buses

The government has extended the sales tax exemption of locally assembled buses until December 31, 2022.

The exemption also includes the purchase of bus components, such as air conditioners and chassis.

New excise duty on electronic and non-electronic smoking devices

Effective from January 1, 2021, there is a 10 percent excise duty on all electronic and non-electronic smoking devices, including vape. The liquid used in electronic cigarettes will be levied at the rate of 40 cents/ml (US$0.09)

Tougher controls on cigarette imports

With Malaysia annually losing some 5 billion ringgit (US$1.2 billion) in indirect taxes due to illegal imports, the government has decided to impose tougher controls for the import of cigarettes.

The new control measures, effective from January 1, 2021, are:

- All new import license applications to be frozen;

- Renewal of cigarette import licenses to be tightly reviewed, such as through the imposition of an import quota;

- Cigarettes imported for the purpose of transshipment to be subject to duties;

- Exports of cigarettes using local crafts are banned; and

- Cigarettes and tobacco products imported to duty free islands to be subject to duties.

Exemptions on stamp duty for first residential property

In order to receive full stamp duty exemption on the instrument of transfer and loan agreement for the purchase of a residential property in Malaysia, the property must be valued up to 500,000 ringgit (US$123,724).

This is only available for Malaysian citizens and is eligible on the purchase of the first residential property.

Extension of stamp duty exemptions for abandoned housing projects

Contractors and developers involved in reviving abandoned housing projects are eligible for stamp duty exemption on loan agreements and instruments of transfer. The abandoned housing project must be first approved by the Ministry of Housing and Local Government.

This incentive has been extended until December 31, 2025.

Stamp duty extension for Exchange Traded Fund

The stamp duty exemption for the Exchange Traded Fund (ETF) has been extended until December 31, 2025.

ETFs are securities traded on an exchange (in this case, Bursa Malaysia). Investors can buy or sell ETFs through licensed stockbrokers.

ASEAN Briefing is produced by Dezan Shira & Associates . The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore , Hanoi , Ho Chi Minh City , and Da Nang in Vietnam, Munich , and Esen in Germany, Boston , and Salt Lake City in the United States, Milan , Conegliano , and Udine in Italy, in addition to Jakarta , and Batam in Indonesia. We also have partner firms in Malaysia , Bangladesh , the Philippines , and Thailand as well as our practices in China and India . Please contact us at [email protected] or visit our website at www.dezshira.com .

- Previous Article Individual Income Tax Amendments in Malaysia for 2021

- Next Article Philippines Launches FIST Act to Protect Banks and Financial Institutions

Our free webinars are packed full of useful information for doing business in ASEAN.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly ASEAN Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for India business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly ASEAN Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

We broke our monthly GMV record by 200% in March 2021 despite pandemic !

Easy-to-use front desk system that facilitates day-to-day hotel operations

Get more direct bookings. Commissions free. Local payment gateways

Self-servicing hotel check-in, check-out and walk-in guest reservation

Probably the most affordable Channel Manager that you have come across

User-friendly website content management system built for hotelier

Try Our Free Trial

Unlock More Value with Softinn today!

Customer Success Stories

You would love to hear how have our customers made a significant difference after using Softinn

Suitable For

Road to automation, reduce unnecessary operational hassle and generate more revenues

Stand out from the other competitors, build a strong online presence

Manage your hotel branches & franchises systematically regardless of the number of properties

All tools and reports that you need to manage properties owned by others

E-book & Offers

More that just an e-book. Tips, tricks and trends are included for knowledge enhancement

One-stop knowledge center for Softinn users from beginners to expert

New to Softinn? Book your slot to join our live training session

We create and curate useful contents about the topics that hoteliers are looking for

We constantly innovate. Read more on our latest product releases & feature updates

Hello from Softinn!

We are hotel technology service provider with a mission to make hoteliers work easier

We do what we do best, make I.T easy for hoteliers

We work and integrate with other amazing companies

Let’s get connected. We are more than happy to talk to you

Be part of our story. We are looking for passionate candidates

- Free Trial

- Login

- Property Management System

- Booking Engine

- Hotel Channel Manager

- Hotel Website CMS

- Hybrid Hotel Kiosk

- Independent & Boutique Hotel

- Hotel Groups

- Resort & Luxury Villa

- Bnb Management

- Knowledge Base

- Blog & Article

- Product Update

- Product Training

- Why Softinn

- Partner & Integration

Malaysia Tourism Tax (TTX) 2023: What You Need to Know

In line with the announcement made by the Malaysian government regarding the Tourism Tax , I will talk about a series of questions that are commonly asked by hotel owners or operators, thus helping all of you to find the answers that are related to it.

1. What is a Tourism Tax?

Tourism Tax (TTx) is referred to as a tax charged for all foreign passport holders at accommodations premises collected by the operators effective from 1st September 2017 in Malaysia. It is charged at a fixed rate of RM10.00 per room per night. However, during the Covid-19 pandemic, The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022. Now, the Malaysian government has announced that the Tourism Tax will resume back starting from 1st January 2023.

2. How is the RM10 per room per night applied?

Assuming one room is booked for one night by John (who is a Filipino), the TTx charged to John will be RM10.00 x 1 room x 1 night = RM10.00 In the 2nd Scenario, assuming two rooms were booked by Dianne (who is an Indonesian) for three nights, so the TTx charged to Dianne will be RM10.00 x 2 rooms x 3 nights = RM60.00

3. How is this new to the travel industry starting January 2023?

Since September 2017, a guest who is a foreigner is subject to paying Tourism Tax when staying at any “accommodation premises” in Malaysia; this tax is collected by the operator at the accommodation premises upon check-in, regardless if the booking was made online or walk-in. However, starting from 1st January 2023. For any bookings made through digital platforms that provide reservation services such as booking.com, Agoda, and Expedia, the platform is the one to collect the Tourism Tax directly from the foreign guests when the guest made the booking and payment online through the platform. The digital platform provider shall remit the tax collected to the RMCD. Whereas, for booking that was made online through the platform but payment only upon arrival at the accommodation premises, the TTx shall be collected by the accommodation operator upon guest arrival. The responsibility of remitting the tax collected for this booking shall be by the accommodation operator instead.

We have just received the update that currently, only AGODA will collect the TTx directly from the guest together with the room charges if they made the payment online. Whereas, for other OTAs like Expedia, Booking.com & Traveloka, the TTx will be collected upon check-in by the property operator, UNTIL FURTHER NOTICE.

4. What if the booking has been made before 1st January 2023 for the check-in date after on or 1st January 2023?

If a foreign traveller has made a booking on a digital platform before 1st January 2023, for check-in on or after 1st of January 2023, the Tourism Tax must be collected by the accommodation operator upon guest arrival and the accommodation operator is required to remit the tax to the RMCD.

5. What if my property did not register for TTx?

We advise you to further consult with your business advisor or check with RMCD if you have not registered as a Tourism Tax registrant. Generally, if you are operating accommodation premises of 5 rooms or more, you are liable to be registered. You may also check this website https://www.myttx.customs.gov.my/ to further understand the registration.

6. If a Malaysian with his foreign friend both check into the same room and the booking was made and paid by the Malaysian, is TTx chargeable?

In this case, it is not subject to Tourism Tax because a local stayed and paid for the stay. However, the Tourism Tax is chargeable in the event that the foreigner stays and pays for the stay.

7. If the reservation has been made with full payment together with the TTx for the booking made via OTAs, then the guest request for the cancellation on a non-refundable policy, will the TTx will be refunded?

Unfortunately, we are unsure of this. Do let us know in the comment section if you have more information regarding this. What I can say is, you may refer to the T&C directly from the OTAs.

8. Will TTx subject to SST too?

No. The operator is not allowed to charge SST on the Tourism Tax.

9. Is day use chargeable to TTx?

No, if the day use charge is not equal to the room rate per night.

10. Is a Digital Platform provider compulsory to collect private data such as passport no. or ID no. to ensure nationality?

Yes. The Digital Platform provider should make an appropriate adjustment in its system to capture the information that is to identify the citizenship of the tourists.

11. John makes an accommodation booking online and provides inaccurate information which resulted in TTx not being collec ted. Who wi ll be responsible?

If due diligence has been done to obtain the information required from the tourists, the Digital Platform provider will not be responsible for any inaccurate information provided by the tourist, which may result in the under-collection of TTx.

Check out this video where we answer a frequently asked question regarding the Tourism Tax

That’s all 11 common questions that we heard so far regarding the Malaysia Tourism Tax. Please share this article if you find it useful and drop any questions in the comment sections if you think there are more questions that should be answered.

You're reading a blog compiled by Softinn. We're a hotel-technology company with the mission to make hotelier work easier. Do subscribe if you enjoy reading our blog or you may interact with us on our Facebook Page .

Get Monthly Updates

Other topics, ebooks & resources.

We won't spam your inbox. We promise to send a curated list of posts to your inbox once a month, nothing more.

Start your free trial now

No credit card required

Make hotelier work easier

Softinn builds the next-generation hotel management system for boutique hotels in Asia Pacific.

Term & Services | Privacy Policy

- Hotel Kiosk

- Softinn API

- Hotel Groups & Chains

- BnB Management

- Customer Success Story

- Blog and Articles

- Product Training (Basic)

- Product Training (Advanced)

- Pricing & Plan

© 2013-2023 Softinn Solutions Sdn. Bhd. (1029363-M) All rights reserved. Made with ♥ in Malacca, Malaysia.

COMMENTS

Bulletin Board Latest Announcements See more [31/05/2024] Extension of Deadline for Tax Payment under Voluntary Disclosure Programme (VDP) [19/04/2024] Notice of Scheduled Downtime for MyTTx System [21/04/2024, 12:00AM - 6:00AM] [19/04/2024] Notice of Scheduled Downtime for MyTTx System [20/04/2024, 12:00AM - 4:00AM] [03/06/2023] Implementation of Voluntary Disclosure Programme (VDP) [18 ...

The exemption of Tourism Tax for the period from 1 July 2020 to 30 June 2021 has been further extended until 31 December 2021.

Earlier, YAB Prime Minister has announced the Short-Term Economic Recovery Plan (PENJANA) on 5 June 2020. There is an initiative on Tourism Tax, namely tourism tax exemption for foreign tourist staying in registered premises from 1 July 2020 to 30 June 2021.

Q6: Currently, there is an exemption from collecting tourism tax and registration given to certain accommodation premise operators such as operator of a homestay / kampungstay operator, operator with 4 accommodation rooms or less and other operators as listed under item 3, Tourism Tax (Exemption) Order 2017.

Wednesday, 17 Mar 2021 8:24 PM MYT. KUALA LUMPUR, Mar 17 — The government will extend the tourism and service tax exemption for all hoteliers until December 2021 under the Pemerkasa programe to revitalise the economy. It will also extend tax incentives for all tourism firms until 2022, defer income tax deductions for cinema and spa operators ...

While it is doubtful that licensed domestic tour operators will derive much benefit from the tax exemption under E.O. No. 9 for the earlier part of this year due to the various movement control measures imposed over many parts of Malaysia, the gradual relaxation of these measure in the near future could result in a boom in the local tourism industry due to the release of pent-up demand for ...

1. On 27 December 2021, The Royal Malaysian Customs Department (RMCD) issued Tourism Tax Policy No. 2/2021 to provide guidance and clarification on the extension of the Tourism Tax (TTx) exemption until 31 December 2022, as revealed in the Budget 2022 speech.

Saturday, 30 Oct 2021 3:16 PM MYT. KUALA LUMPUR, Oct 30 — The extension for tourism tax exemption until December 31 through the presentation of Budget 2022 in the Dewan Rakyat yesterday will help revive the tourism industry in the three Federal Territories. Federal Territories Minister Datuk Seri Shahidan Kassim said the exemption of ...

If you had booked a hotel or visited a tourist attraction in Malaysia during 2021, you could be eligible for an income tax relief of up to RM1,000 on the expenses. As you may recall, the special tourism tax relief that was announced under the Economic Stimulus Package 2020 - originally for March to August 2020 - had been extended up until December 2021 (and again until end of 2022 ).

Imposition Of Penalties And Increases Of Tax. Cancellation Of Disposal / Sales Transaction. Pegangan Dan Remitan Wang Oleh Pemeroleh (Available in Malay Language Only) Shares In Real Property Company (RPC) Procedures For Submission Of Real Porperty Gains Tax Form.

• Tourism tax will be imposed on accommodation premises booked via an online platform operator with effect from 1 July 2021, to align with the treatment for bookings made directly with the registered accommodation premise operators.

[30/12/2022] Re-Imposition Of Tourism Tax By Registered Operator Of Accommodation Premise Effective From 1st January 2023

Comment: Currently, a relief of up to RM1,000 is given for amount expended on hotel accommodation and entrance fee to tourist attraction from 1 March 2020 to 31 December 2021.

To further encourage domestic tourism, the government has extended the exemption for tourism tax and services tax for hotel accommodation until Dec 31, 2021.

Tourism taxThe following Orders have been gazetted on 16 March 2021 and will come into operation on 1st July 2021:Tourism Tax (Rate of Digital Platform Service Provider Tax) Order 2021;Tourism Tax (Digital Platform Service Provider) (Exemption) Order 2021.

An obligation to charge Malaysia's tourism tax (TTx) and remit the tax to the tax authorities currently is scheduled to apply as from 1 January 2022 to digital platform service providers (DPSPs) that provide online booking services for accommodations in Malaysia, regardless of whether the DPSP is a resident of Malaysia or a nonresident. A ...

Authors. The Income Tax (Exemption) (No. 9) Order 2021 [P.U. (A) 344/2021] (' E.O. No. 9 ') was gazetted on 23 August 2021. E.O. No. 9 has effect from the year of assessment 2021 until the year of assessment 2022. E.O. No. 9 exempts a qualifying person from the payment of income tax in a basis period for a year of assessment in respect of the ...

The tourism tax exemption has been extended until 31 December 2021 as announced by the YAB Prime Minister on 17 March 2021 under the People and Economic Strategic Empowerment Programme (PEMERKASA).

As part of the 2021 national budget, Malaysia has issued various new incentives and measures in relation to indirect tax and stamp duty. First time homeowners are now exempt from certain stamp duty charges if the property is valued at no more than 500,000 ringgit (US$123,724), and from July 2021, a tourism tax of 10 ringgit (US$2.47) per night ...

However, during the Covid-19 pandemic, The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022.

New rules requiring digital platform service providers that facilitate the online booking of accommodations in Malaysia ("online travel platform operators") to collect tourism tax (TTx) and remit the tax to the Royal Malaysian Customs Department (RMCD) were scheduled to apply as from 1 January 2023; however, through a concession effective from 1 January 2023 to 31 March 2023, the RMCD ...

The General Guide on Tourism Tax may be withdrawn, either wholly or in part, by publication of a new guide.

In February 2022, the Road Transport Department (RTD) announced the incentive offer of full road tax exemption for EV vehicles from January 1, 2022 to December 31, 2025.