Cyprus Profile

- Country Overview

- Government & Politics

- Cyprus at a Glance

- Visiting Cyprus

- Country & People

- Living in Cyprus

- Cyprus Country Report 2023

- Economy Overview

- International Trade

- Foreign Direct Investment

- Headquartering

- Government Action Plan

- Agriculture & Food

- Film Production

- Maritime & Shipping

- Research & Development

- Capital Markets

- Technology & Start-ups

- Construction & Real Estate

- International Financial Services

- Transport & Logistics

- Investment Funds

- Energy: Oil & Gas

- Manufacturing & Industry

- Telecoms & Satellite Communications

- Energy: RES

- Corporate Business Structures

- Business Costs

- Business Culture & Etiquette

- Human Resources

- ICT & Communications

- Exporting to Cyprus

- Financial Services

- Business Incentives

- Legal & Regulatory Framework

- Access to Markets

- Professional Services

- Commercial & Residential Property

- Business and Investment

- Travel and Lifestyle

- Videos from our Partners

- Publications

- Advertising

- Terms of Use

The New Age of Tourism

Efforts to upgrade and diversify Cyprus’ tourism product have paid dividends as the country has seen record-breaking tourism figures and attracted millions in infrastructure and hotel investment over the last few years. Despite the current global clampdown on tourism, Cyprus opened up early after successfully containing its exposure to the coronavirus pandemic and launching industry incentives and support measures to welcome visitors.

Kostas Koumis

Deputy minister of tourism.

Amidst stiff competition from other destinations, Cyprus must leverage its inherent advantages to cement its position as a prime tourism i ...

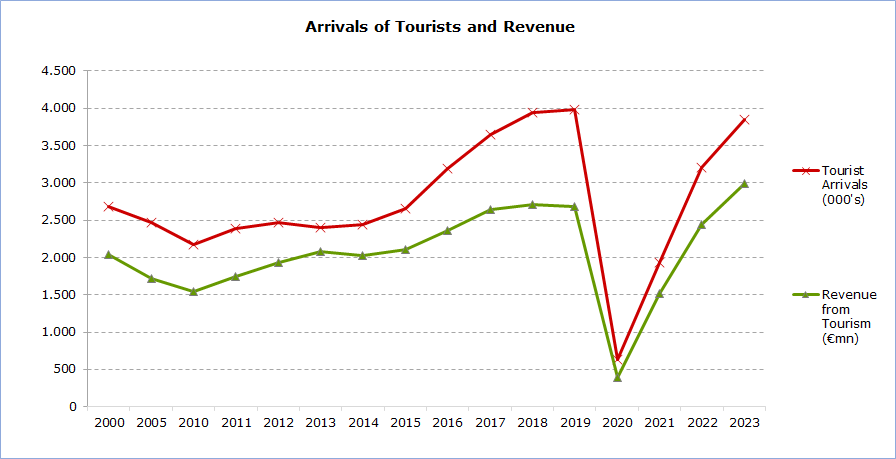

Tourism has been one of Cyprus’ top economic performers for decades, and the last five years have been record breaking in both the number of arrivals and revenue thanks to reforms and upgrades. In 2019 the country welcomed almost 4 million visitors with total revenue estimated at €2.7 billion, proving the long-standing appeal of Cyprus as a top European holiday destination.

Over the last few years, the country has focused on diversifying its traditional beach holiday image to show the world it has a lot more to offer than just the sun and sea. By extending its season with the aim to welcome tourists all year round, Cyprus is promoting its mild and green winters with snow-capped peaks and its other lesser known attractions such as forests and mountain regions, its wine country and agritourism, as well as its many historical and religious sites. Following global trends, a key part of the strategy is to develop and refine niche segments like health and wellness tourism, sports, nautical and cultural tourism, which all represent more diversified thematic areas that also foster investment opportunities in the tourism and hospitality sector.

As well as growing numbers of visitors, Cyprus has attracted millions in FDI into tourism-related projects. World-renowned hotel chains like Radisson and Sofitel are establishing themselves on the island, luxurious yacht marinas are beginning to spring up in every coastal region, and in 2021 Cyprus will be home to Europe’s largest integrated casino resort led by entertainment giant Melco. Income from tourism accounts for more than 20% directly and indirectly of the country’s GDP, but according to latest estimates the sector has the long-term potential to contribute around 25% to the country’s economy – making tourism a key pillar of the economy with vast potential for further sustainable development.

Covid-19 Impact

Though Cyprus had high expectations for its tourism sector in 2020, its ambitions were cut short when the dangers surrounding the pandemic became truly evident. Cyprus acted swiftly, closing its borders as it prioritised the health of its citizens. With air traffic a fraction of what it used to be, the island managed to use its decisiveness to its favour. Hailed as one of the safest countries in the world in its handling of the pandemic, the government felt confident it would reap the rewards of its tough and fast measures.

By June 2020, when the borders reopened after almost three months of lockdown, travel agents had already classed the island as a safe destination with many countries eyeing Cyprus as a corona-free holiday haven. Meanwhile, Cyprus ensured only countries with similar epidemiological data could have flights to the island, thus balancing tourism and the overall health and safety of citizens, hospitality workers and visitors alike. The list of approved countries will be updated regularly based on how the coronavirus situation evolves.

The year started off well with an annual increase of 2% in tourist arrivals for the first two months, but a sharp drop was recorded in March 2020 due to the lockdown and entry ban. Cyprus has shown strong leadership in its handling of the pandemic, but it will be hard to judge what the long-term impact on tourism will be with so many other countries – and crucially countries like the UK that constitute key markets for Cyprus – still struggling to manage their infection rates.

Cyprus has had to revise its high expectations for 2020 and has set a new target of attracting at least 20-25% of the 2019 arrival figures, which translates to bringing roughly 0.8-1 million tourists. To achieve this target, the government has taken a proactive approach by targeting several European countries to promote Cyprus as an ideal travel destination this year. To secure its safe-haven status the government introduced rigorous travel and health protocols for anyone looking to visit the island. All these measures are constantly assessed and updated based on global developments.

Support Measures and Incentives

With the harsh realities of the global pandemic continuing until the foreseeable future, Cyprus has sprung into action to support its tourism industry. In early June 2020, the country launched a new scheme to support aviation to stimulate passenger traffic by providing incentives for airlines to conduct flights even with low occupancy rates. The scheme, which will run for six months with a budget of €6.3 million, will see the government subsidising airlines based on their occupancy rate index, with sums to be pumped out for flights conducted with occupancy rates between 40% and 70%. The goal is to promote direct connectivity between Cyprus and other countries and motivate airlines to operate flights to the island until the end of the year.

In this new post-corona reality discounting is going to be the prime factor for people determining their choice of holiday destinations, and tourism experts predict the lower price tags will result in a significant increase in travel and tourism. With the Cyprus government subsidy assuring a large part of a flight’s capacity, airlines would be able to offer substantial discounts to other passengers to fill up the plane. In addition, Cyprus reduced the value-added tax (VAT) rate for tourism accommodation and catering sector services from 9% to 5% for the period from July 1 to January 10, 2021, and the government is doubling its air and sea connectivity resources to €15.7 million by the end of the year.

Diverse Offering

Although Cyprus is rebranding its image, there is no doubt a key element of Cyprus’ appeal remains its ideal weather of 340 days of sunshine and its pristine beaches – which are consistently ranked as some of the best in Europe for their high environmental and quality standards. Cyprus has 66 Blue Flag beaches and one Blue Flag Marina, renowned eco-labels awarded to beaches and marinas across the globe that meet specific standards. In 2019, Cyprus was lauded with the title of having the best bathing water quality in the EU, according to the European Commission and the European Environment Agency (EEA). Over the years, the island has consistently ranked at the top of this list for excellent water quality.

The Mediterranean lifestyle and expanding tourism offering of Cyprus have strengthened its status in the global tourism market as a destination of choice for travellers of all budgets – with accommodation ranging from rustic retreats and vast Airbnb options to bespoke hotels and luxury resorts. With further development of its niche segments, Cyprus is set to also attract a more diverse demographic of tourists interested in experiencing authentic island life and exploring the country’s gastronomy and history. Cyprus boasts world-renowned archaeological sites, such as the ruins of the ancient city-kingdom of Kourion and the famous Paphos mosaics. In 2018, the Cyprus antiquities department announced that it would be collaborating with the Getty Conservation Institute in Los Angeles to look at better conservation management of the World Heritage sites of Nea Pafos and the Tombs of the Kings, and to find ways of improving the visitor experience at these sites – a move that has been welcomed by both tourism officials and tourists.

Cyprus has also long been a popular winter training venue for international sports groups and athletes, as well as a destination for various sports events, ranging from rallies to cycling and sailing. The island attracts thousands of athletes and hundreds of teams every year – mainly in the winter season – proving that this niche area of tourism still has considerable growth potential if developed properly. The country’s Tourism Ministry has identified sports as an integral part of Cyprus’ tourism product and is currently drafting new incentive schemes to attract more events, teams and athletes to the island. An estimated 50,000 divers visit the island each year, many attracted by the opportunity to discover one of the top five dive sites in the world, the Swedish cargo vessel Zenobia, which sank off the coast of Larnaca in 1980. The island is creating more artificial diving reefs off the coasts of major tourist areas across the island to attract more divers. In addition, golf tourism is growing steadily thanks to the island’s year-round good weather and four 18-hole international standard courses and exceptional facilities.

Love and Wellbeing

Renowned as the mythical birthplace of Aphrodite, the goddess of love, Cyprus has become a popular destination for wedding tourism, which contributes up to €100 million a year to the economy. The number of destination weddings to Cyprus is around 8,000 per year, of which the majority are from the UK market, followed by neighbouring Israel and Lebanon. Russia, Poland, Ukraine and the UAE/MEA countries constitute growing markets and efforts are underway to also promote Cyprus as the ideal location for destination weddings and events not just to the above-mentioned existing and growing markets, but also to new markets such as India and the Far East. The growing appeal of tying the knot in Cyprus is largely due to the availability of civil marriages, making it an attractive wedding venue for mixed-faith and secular couples. Cyprus is also looking at opening new inroads into the billion-dollar global market of honeymoon tourism, renewal of vows, celebrations, romantic and special events.

Capitalising on its ideal climate and clean waters, health and wellbeing holidays to Cyprus are also on the rise. The recent creation of several exclusive spa retreats to pamper the visitor, as well as a number of large-scale projects open for investment in the fields of rehabilitation and other wellness services, have all driven interest in this niche area. The wellness segment has been identified as one of the key growth areas and FDI targets by the government. These plans are perfectly aligned with global trends, as the wellness market has seen tremendous growth of over 6% annually. Medical tourism is also experiencing some growth due to Cyprus’ world-class reputation for high-quality private healthcare in a technologically advanced environment. Cosmetic surgery, diagnostic tests and fertility treatment top the list as the most popular procedures for medical tourists from the UK, Germany, the Netherlands, Middle East and Russia.

Expanding Connectivity

With continuous efforts to open new markets, connectivity is a key aspect of ensuring growth in this sector. In the long-term and in a bid to decrease its dependency on a handful of traditional markets, like the UK, Russia and Germany, Cyprus is focused on diversifying and opening new markets, such as the Middle East and other central and northern European countries. Another target is to attract visitors from long-distance destinations such as the US, Canada, Korea, Japan and China, who are likely to travel in the wider region visiting more than one country during their holiday.

Over 80 airlines fly from Cyprus to around 40 countries and 120 destinations, and the two international airports handle around 11 million passengers annually. Cyprus has managed to improve its connectivity to the rest of Europe even amidst the corona crisis with Hungary’s Wizz Air announcing its plans to make Larnaca its 28th base from July 2020 and to launch 11 new destinations to seven European countries from Larnaca. Stationing two Airbus A320 aircraft will provide one million seats on sale from Larnaca this year, underlining the fact that the airline sees the potential and the demand for low-cost travel in Cyprus as a rapidly developing tourist destination.

Ideal Port of Call & Homeporting Hub

Prior to the pandemic, Cyprus was gaining a steady momentum in reviving its status as an attractive port of call for cruise ships exploring the Eastern Mediterranean region. Evidence of this was the fact that cruise line companies have been increasing the capacity and frequency of their calls to the island and Cyprus has regained its position in their East Med itinerary planning. Moreover, a British operator TUI (Marella Cruises) has implemented its winter 2020 plans for homeporting from Limassol Port to 13 destinations, a factor which has contributed to the boost of tourism numbers. Although many of the cruises follow the familiar Mediterranean formula, more exotic routes were also launched such as a sail from Barbados to Limassol. To strengthen Cyprus’ maritime tourism, a new passenger terminal was inaugurated in 2018 by port operator DP World Limassol, with plans to increase passenger traffic of the port by 35%. Naturally, the coronavirus pandemic has grounded cruise liner traffic to a halt and expectations are that cruise visits will not resume before 2021. Of the 123 cruise ship arrivals that were expected in 2020 to the Ports of Limassol, Paphos and Larnaca, more than half have been cancelled or rescheduled for the end of the year.

Despite the current difficulties in the cruise sector, the decision of a leading international cruise company to anchor its liners in Cyprus has come as a welcome boost. Six advanced passenger ships of cruise operator Carnival are laying up with crew on board in Moni anchorage, east of Limassol, for the duration of the Covid-19 imposed restrictions that have halted cruises worldwide. The ships include Bahamas-flagged Seabourn Encore and the brand-new Sky Princess flying the Bermuda flag. This followed an official announcement by the Cyprus shipping authorities in May offering facilities for cruise ships to dock in its ports for refuelling, with operators and shipowners also allowed to bring their vessels to the island for a ‘hot lay-up’, which means the vessel is idle but can be mobilised back into service at short notice. The decision by Carnival presents significant financial benefits for the country, and other cruise operators have also expressed an interest to follow suit.

Focus on the Future

Cyprus is actively targeting new markets and reassessing existing ones with a sharp focus on creating a richer holiday experience emphasising culture, nature and indigenous heritage. The country has honed a high-quality hospitality industry which has been reinforced by the fact that for decades tourism has consistently been one of the most formidable economic sectors. Current efforts to upgrade the country’s image and further develop various niche areas, such as rural, health and wellbeing, maritime, cultural, conference, sports and wedding tourism, are paving the way towards a more sustainable future. And these efforts have not gone unnoticed beyond its borders. FDI has been pouring in over the last five years with foreign investors closing multimillion-euro deals – cementing the fact that tourism-related real estate and infrastructure continues to be one of the most attractive investment opportunities in Cyprus. Due to the interest, the country’s investment promotion authority Invest Cyprus has set up a dedicated and specialised unit, TourInvest, to promote investment opportunities in the tourism and hospitality sector. In cooperation with the Deputy Ministry of Tourism and other stakeholders, the unit focuses on attracting multi-million investment into large-scale infrastructure projects that exist in diversified thematic areas.

Cyprus’ vision is to reposition itself in the global holiday market to provide a more diversified and ultimately more sustainable product. The new 2030 National Strategy for Tourism – which represents the most comprehensive restructuring of the sector since 1960 – is certain to bring profound results in diversification and to keep the sector on its growth trajectory for the next decades. The goal is to reach 5.15 million visitor arrivals and 4.4 billion euros revenue from tourism (including domestic tourism). Additionally, the strategy aims to improve seasonality and the regional distribution of tourists, with the objective of reaching 39% of overnights during November-April and tripling overnights in rural areas, by 2030. As the current global pandemic crisis has revealed, external shocks can cause severe delays in plans, but Cyprus has proven its resilience and ability to adapt and is well placed to achieve its targets and turn its vision into a reality.

For more information, contact Cyprus' investment promotion agency, Invest Cyprus .

All rights reserved. The material on this site may not be reproduced, distributed, transmitted, cached, or otherwise used, except with the prior written permission of The Profiler Group.

Related Articles & Insights

Articles | 06 june 2024, cyprus expecting approximately 1.3 million british tourists in 2024.

Cyprus’ Deputy Minister of Tourism Kostas Koumis visited London this week, where he held a series of meetings with major tourism organisations and ai ...

articles | 19 April 2024

Cyprus and bahrain discuss tourism ties, air connectivity.

Deputy Minister of Tourism Kostas Koumis and Ambassador Khaled Yusuf Ahmed Al Jalahma from the Kingdom of Bahrain, who is based in Tel Aviv, held a m ...

articles | 24 February 2024

Cyprus tourism ministry announces plan to improve beaches.

Cyprus’ tourism ministry this week unveiled an incentive plan aimed at the qualitative and aesthetic improvement of beaches for the year 2024, with l ...

Insights | 16 December 2023 | Deputy Ministry of Tourism

Kostas koumis, deputy minister of tourism.

Amidst stiff competition from other destinations, Cyprus must leverage its inherent advantages to cement its position as a prime tourism investment h ...

Become a Contributor

Related publications, december 2023 | the profiler group ltd., 2023 cyprus country report, doing business in cyprus (uk edition), doing business in cyprus (india edition), upcoming events, 11 october 2024 - 11 october 2024, 10th international compliance forum, 20 november 2024 - 20 november 2024, the 22nd leadership and human resource, cyprus connect.

Cooperation Partners

INVEST IN CYPRUS

The cyprus tourism industry.

Built around unique and diverse experiences, Cyprus’ tourism sector has always been a major player for the country’ s economy, which is in itself experiencing healthy growth, outperforming forecasts and maintaining its solid outlook.

The tourism market is one of the largest economic sectors in Cyprus and has experienced substantial growth over the last five years with breaking records in both arrivals and revenues, steadily increasing in winter months (Nov-April) with 100% increase in tourism arrivals from 2014 to 2019.

The year 2019 recorded the highest numbers reaching a peak of 4 million of tourists from 2.4 million in 2014, accounting for 13,1% of nominal GDP. Revenues grew to €2.68 billion in 2019, while the country was reported to have the largest growth in ground and port infrastructure in the worldwide travel and tourism index published by the World Economic Forum. According to latest estimates, the sector could contribute around 25% to the country’ s economy by 2030.

National Tourism Strategy 2030

Through a clearly-defined Vision and Strategy to launch the full rebranding of Cyprus and establish the island as a quality, all-year destination, tourism can strengthen its place and be one of the top economic performers by 2030, not only through direct revenues, but also through the major multiplier effects that tourism has on the local economy. The vision of the new Cyprus Tourism Strategy is to develop Cyprus in a sustainable way, which positively impacts our economy, society and the environment, improving seasonality, with the objective of reaching 39% of overnights during November-April and quadrupling overnight stays in the rural areas from 100,000 in 2018 to 400,000 by 2030.

The Tourism Strategy also aims at diversifying into other local and cultural experiences while attracting multi-million investment into large-scale infrastructure projects.

Efforts are focusing on diversifying, enriching and improving the quality of the touristic product and therefore, investment opportunities into thematic areas, such as luxury and lifestyle tourism, nautical tourism, cultural tourism, sports, conference, health and wellness, and agro-tourism.

Infrastructure Boost

The tourism and hospitality industry has seen significant investment, with luxury marinas in all coastal cities, golf courses, leisure & theme parks, high-end resorts being developed across the island. The Ayia Napa Marina with an estimated investment of €220 million, is currently under construction and expected to be fully completed in 2022, while a number of multiple multi-million developments are in the planning stage including the Paralimni, Paphos and Larnaca Marinas, expected to exceed €1 billion in total investments.

As a marker of success, is the decision by the Hong Kong-based Melco International Resorts and Entertainment to choose Cyprus for expanding its flagship brand name outside Asia for the first time, investing more than €600 million for Europe’s largest integrated casino resort, which is expected to attract an 1 million visitors per year.

Tourism-related construction activity is highly indicative of the shift towards large scale, high value developments, further strengthening the already strong hospitality industry. Hotels represented the 16,4% of the total value of building permits in 2019, while the total value of new hotel developments was estimated at €610 million.

Today, investors like NCH Capital and Invel Real Estate Partners and leading hotel chain groups like Radisson, Hilton, Marriott, Fattal, Grand Hyatt are expanding their investment projects in Cyprus, investing both into city hotels and sea-side resorts.

OPPORTUNITIES FOR INVESTMENT IN CYPRUS

VIEW PROJECTS

Statistics about tourism in Cyprus: tourist arrivals, purpose of travel, accommodation, tourist expenses, trips of residents of Cyprus.

Predefined tables, publications, infographics.

- Latest News

Tourism Statistics

Tourist arrivals and returns of residents of cyprus from trips abroad - tourist arrivals 0,3% and returns of residents of cyprus 13,8%, revenue from tourism - revenue from tourism 15,5%, tourist arrivals and returns of residents of cyprus from trips abroad - tourist arrivals -2,7% and returns of residents of cyprus -2,1%, revenue from tourism - revenue from tourism 15,0%, survey on the trips of residents, revenue from tourism, tourist arrivals and returns of residents of cyprus from trips abroad, methodology.

Methodological Information - Tourism

Survey Questionnaires - Tourism

Quality / Metadata Reports - Tourism

Related Content

EUROSTAT - Statistics Explained - Tourism

EUROSTAT - Tourism Statistics

Contact Details

No spam. We promise.

Cyprus Travel & Tourism Economic Impact Factsheet

Discover the total economic contribution that the Travel & Tourism sector brings to Cyprus and the world in this data-rich, two-page factsheet.

Discover the total economic contribution that the Travel & Tourism sector brings to the Cyprus’s economies and to the world in this data-rich, two-page factsheet.

Create an account for free or login to download

Over the next few weeks we will be releasing the newest Economic Impact Research factsheets for a wide range of economies and regions. If the factsheet you're interested in is not yet available, sign up to be notified via the form on this page .

Factsheet details

This factsheet highlights the importance of Travel & Tourism to Cyprus across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment

- Comparisons between 2019 and 2023

- Forecasts for 2024 and 2034

- International and domestic visitor spending

- Proportion of leisure vs business spending

- Top 5 inbound and outbound markets

This factsheet highlights the importance of Travel & Tourism to the Cyprus across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the group and globally

- Contribution of the sector to overall GDP and employment in the region and globally

This factsheet highlights the importance of T&T to this city across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the city

- Comparisons between 2019, 2020 and 2021, plus 2022 forecast

- Proportion of the T&T at city level towards overall T&T contribution at a country level

- Top 5 inbound source markets

Report sponsors

Research support partners.

Other factsheets you may like

Johannesburg Fact Sheet

Muscat fact sheet, tajikistan fact sheet.

- Previous Article

Selected Issues

Tourism Sector in Cyprus

The global pandemic shock has caused an unprecedented shock to the tourism industry, severely impacting tourism-dependent economies such as Cyprus. This chapter seeks to examine the recent developments in the tourism sector in Cyprus. It further examines the outlook for recovery prospects and outlines some policy priorities given the economic vulnerability to the tourism shock and the need to minimize scarring and protect the vulnerable workers .

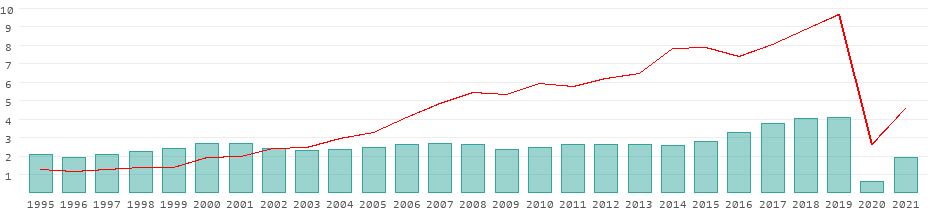

- A. Recent Trends in the Tourism Sector

1. Global tourism has suffered the worst year on record in 2020 following the unprecedented fall in demand and widespread travel restrictions . According to UNWTO (2021) , international arrivals dropped by 74 percent in 2020 (1 billion fewer arrivals) than in 2019. The collapse in international travel represented an estimated loss of USD 1.3 trillion in export revenues, more than 11 times the loss recorded during the 2009 global economic crisis. The loss in tourism translated into an economic loss of USD 2 trillion in direct tourism GDP (more than 2 percent of the world’s GDP). Europe recorded a 70 percent drop in tourist arrivals in 2020, and the region suffered the largest drop in absolute terms with over 500 million fewer international tourists. By comparison, during the 2009 global financial crisis, international tourist arrivals fell by 4 percent in the world and 10 percent in Europe, with a much smaller economic impact and swift recovery afterwards. Based on a simple event analysis, tourism slumps associated with major terrorist attacks, epidemics, and political crises, showed, on average, 20 to 30 percent declines in tourist arrivals ( Salas, et. al, 2020 ). For instance, tourist arrivals dropped by 5 to 31 percent after terrorist attacks (USA, France, Belgium, Turkey, Egypt) and recovered in one to five years. Tourist arrivals dropped, on average, by above 30 percent and recovered in one year or less in the SARS and MERS epidemics (Hong Kong, Taiwan, Singapore, South Korea).

International Tourist Arrivals

(Percent Change)

Citation: IMF Staff Country Reports 2021, 126; 10.5089/9781513587844.002.A001

- Download Figure

- Download figure as PowerPoint slide

Foreign Tourist Arrivals During Selected Crisis Events

(Index: Average number of arrivals one year before the crisis=100)

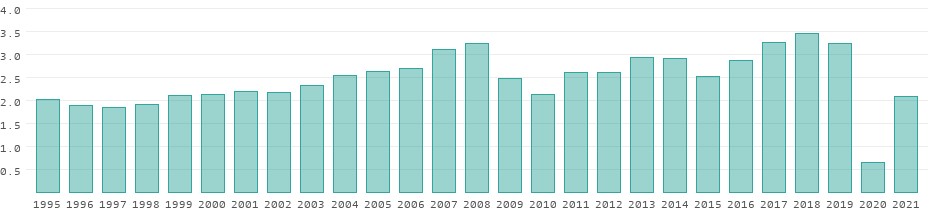

2. Tourism in Cyprus has been hard hit by the Covid-19 shock, among the most severe in Europe . Tourist arrivals experienced an unprecedented collapse since the pandemic. In 2020, tourist arrivals decreased by 84 percent, while tourism revenue decreased by 85 percent, compared to 2019. Travel restrictions led to a significant decrease in tourist demand from the major markets such as the United Kingdom (UK) and Russia. While travel restrictions were lifted in early June for arrivals from a limited number of countries, Cyprus still experienced the most severe decline of tourist arrivals for the year when compared with other European countries.

Cyprus: Tourist Arrivals

Growth of Tourist Arrivals, 2020

(Y-O-Y Percent Growth Relative to 2019)

(Thousand persons)

Cyprus: Tourism Revenue

(Millions of euro)

3. Employment has been largely protected in the tourism sector, but hours worked declined much more severely than during the previous crises . While tourism employment has declined more than in the rest of the economy, with the temporary employment support measures, this decline has been contained so far. The number of workers in Trade, Travel & Food Services decreased by 13 percent in 2020:Q2 and 9 percent in 2020:H2 compared with the previous year. This trend also held for self-employed workers. Nonetheless, hours of work in Trade, Travel & Food Services decreased more significantly in the second, third and fourth quarters of 2020 by 20 percent, 15 percent, and 18 percent, respectively, compared to the previous year.

Number of Workers: Cyprus

(Year on year growth, percent)

Hours Worked: Cyprus

4. The pandemic shock has had a significant impact on exports of services and on GDP growth . The adverse impact on the economy was large since tourism is a key sector for Cyprus. Services exports decreased by around 27 percent in the second and third quarters of 2020 compared to the same periods of 2019, mainly reflecting the fall in demand for tourism. The overall economy also showed a deep recession in 2020, with real GDP declining by around 8 percent in the second and third quarters of 2020.

The Impact of Covid-19 Pandemic on Tourism and GDP

- B. Vulnerability of the Cypriot Economy to the Tourism Sector

5. The Cypriot economy has a high dependence on tourism, which makes it more vulnerable to the impact of the Covid-19 shock . Tourism receipts accounted for more than 18 percent of Cyprus’s total exports in 2019. Tourism expenditure balance (inbound minus outbound) reached around 8 percent of GDP in 2019. Tourism also has large spillover effects to related industries outside of hotels (food services, retail, transport, construction, other services). Cyprus’s economy has a very high dependence on tourism related industries, with the total of direct and indirect contribution accounting for nearly 14 percent of GDP in 2019, which was higher than in many other European countries. 1 Tourism and related services also provided a large contribution (around 13 percent) to total employment.

Travel Service Exports

(Percent of Total Exports)

Contribution of Tourism Related Industries, 2019

(Percent of GDP)

6. High exposure of the Cypriot banking system to the tourism sector also increases the risk of a macro-financial feedback loop . Loans to accommodation and food services was 46 percent of tier 1 capital, one of the highest in the euro area (IMFa, 2020) 2 . The sectors of trade, hotel, restaurant, and transportation accounted for the largest shares of total loans and non- performing loans in Cyprus. These sectors were hit harder by the pandemic with more negative growth rates of gross value added than other sectors. However, the moratorium on loan repayments have helped alleviate the negative impact of the pandemic on the financial sector. The take-up rate of the loan repayment moratorium, at over 90 percent, was particularly high for non-financial corporations involved in tourism related activities, including accommodation and food, arts, entertainment and recreation, and construction. But with the expiry of the moratorium, there are risks of loan distress as the repayments become due. A heatmap table capturing these economic and financial sector exposures placed Cyprus among the highest quintile of countries vulnerable to the tourism sector in the EU 3 .

Loans to Highly Affected Sectors

(Percent of Tier 1 capital)

Macroeconomic Indicators

- C. Characteristics of the Tourism Sector Affecting the Recovery Prospects

7. The tourism sector in Cyprus is highly reliant on foreign/inbound tourism, which puts Cyprus in a less favorable position regarding the prospects for a near-term recovery . Foreign tourist arrivals reached around 5 times of domestic tourist arrivals in 2019, and the tourism expenditure balance (inbound minus outbound tourism expenditure) was around 8 percent of GDP in 2019, higher than most other European countries. The European Travel Commission (2021) estimated that European international travel declined by 69 percent in 2020, compared to a 35 percent decline for domestic travel. The high reliance of Cyprus’s tourism on international arrivals indicates a slower near-term recovery prospect as international travel restrictions will be eased at a slower pace than domestic tourism, and the smaller share of domestic tourism also reflects its relatively minor contribution from its rebound to offset the drop in international arrivals. In addition, the full dependence on air travel also makes it highly susceptible to travel restrictions.

Ratio of Foreign to Domestic Tourist Arrivals

Tourism Expenditure Balance

8. High reliance on hotel accommodation makes Cyprus more vulnerable to the Covid-19 shock, while concentration of stays away from cities presents a more favorable outlook . Given the fall in attractiveness of hotels with the pandemic shock, there is potential for non-hotel accommodations to attract tourists, which benefits countries that can provide a greater variety of accommodations. However, in the case of Cyprus, almost all tourists stay in hotels and similar accommodations. On the other hand, the location of overnight stays in Cyprus is more diverse, with more stays in towns and suburbs and rural areas and relatively low ratio of stays in cities. The relatively large size of non-urban tourism is helpful for Cyprus to cope with the pandemic, as rural tourism is likely to increase and could partly offset the decline in urban tourism.

Tourist Arrivals by Type of Accomodation, 2019

Overnight Stays by Degree of Urbanization, 2019

9. Cyprus’s lower dependency on business travel and good progress on vaccination in source countries are more favorable for recovery prospects . When evaluating travel exports by type, Cyprus has a very high ratio of personal travel and low reliance on business travel. This trend could suggest a quicker rebound of tourism since business tourism may be more severely affected post-Covid-19. In addition, the major tourist market countries of Cyprus have made good progress on vaccinations. Two of the top three source countries (UK and Israel) are advanced in vaccinating their population, with around 60 percent and 110 percent of population having completed vaccinations by mid-April. Another positive factor is that two of the top three markets (Russia and Israel) are expecting a faster recovery to pre-pandemic growth rates in 2021. The concentration of tourist sources from Europe also increases the likelihood of travel as travel restrictions ease within Europe and travelers prefer short-haul flights.

Travel Exports By Type

(Percent of Share)

Cyprus: Sanitary and Recovery Indicators of Tourism-Source Countries 1/

10. Furthermore, the relatively good health conditions of Cyprus would help to attract tourists once travel restrictions are lifted . Cyprus has so far ranked relatively well in terms of health conditions. When compared with other European countries, Cyprus has relatively fewer reported cases of Covid-19 per million people, suggesting the relatively high degree of safety of sanitary situation in Cyprus. Cyprus has also conducted more Covid-19 tests per million people than most of the other European countries which could help contain the pandemic. Nonetheless, the health situation remains highly uncertain given the ongoing wave of infections.

11. Based on a Heatmap Analysis of the overall tourism characteristics and sanitary situation, Cyprus is placed in the fourth and third quintile of EU countries in terms of the risks to the prospect of tourism recovery . As shown in the text table, Cyprus has a score of 3.4 using the tourism indicators 4 , mainly reflecting the large dependence on foreign tourism and air travel. Cyprus fares relatively well in terms of sanitary/health indicators, placing it in the middle quintile with a score of 2.8. This reflects the lower number of cases and high testing rates which is partly offset by the high stringency score on mobility restrictions that deter the attractiveness for travel.

12. Looking ahead, Cyprus fares relatively well in terms of prospects for recovery given the tourism characteristics, sanitary indicators, and recovery in the main source countries . Using the quantile distribution of countries (combining indicators in the heatmaps), with 1 indicating the least vulnerable and 5 being the most vulnerable, we estimate the speed of recovery for countries assuming each broad category has the same weight. Based on the results, Cyprus should have a relatively faster recovery rate.

Speed of Recovery: Country Rankings

- D. Outlook for Tourism

13. The decline in tourism is expected to be partially reversed in 2021 with a full recovery to pre-pandemic levels expected only in the medium term . Eurocontrol forecasts (Nov 2020) shows that air traffic in Europe would only return to 2019 levels by 2024 in the most optimistic scenario, assuming vaccine is made widely available for travelers by summer 2021, while air traffic in 2024 would be at 92 percent of the 2019 level in their second scenario (vaccine widely available in 2022) and 75 percent in their third scenario (vaccine not effective). According to the UNWTO (2021) , the recovery outlook for 2021 remains subdued amid high uncertainty, with half of the respondents expecting a rebound in 2021 and the other half only in 2022. The extended UNWTO scenarios for 2021 –2024 indicate that it could take between 2½ and 4 years (mid-2023 – end 2024) for international tourism to return to 2019 levels. Based on European Travel Commission (2021) , which conducts global tourism forecast using the Global Travel Service model, inbound visitor growth rates of Southern and Mediterranean Europe are projected to be -72 percent in 2020, 132 percent in 2021, 34 percent in 2022, and 16 percent in 2023.

Cyprus: Eurocontrol’s Forecast on Instrument Flight Rules (IFR) Movements

(Thousands)

International Tourist Arrivals: Recovery to Return to 2019 Levels, Scenarios for 2021–2024

14. The slow recovery is also consistent with recent high frequency indicators . Decline in flights to Cyprus was among the highest in Europe. Flights continue to decline in early 2021, which does not bode well for Cyprus’s tourism given its full reliance on air travel. Based on anecdotal evidence, hotel occupancy remains low at around 10 to 15 percent compared to the 50 to 55 percent in 2019, consistent with Southern European peers such as Portugal and Greece. EU business confidence surveys also show continued underperformance of tourism industries although forward-looking expectations have improved slightly since July 2020.

Total Number of Flights: Europe

(Percent change, weekly relative to 2019 baseline)

Europe: Hotel Rooms Occupancy Rate

(Occupied rooms as percent of total available rooms)

15. The recovery of tourism will be determined by the pace of the vaccination rollout, the coordination among countries on travel procedures and the economic situation . New infection waves and protracted containment measures could further delay the recovery of tourism sector. On the other hand, vaccine developments help to shift the balance of risks and elevate the upside potential. For Cyprus, based on the current pace of vaccine rollout in the country as well as the main source countries, staff has projected that a recovery of 30 percent, on average, of the 2019 level is expected in 2021 with full recovery taking place by 2024.

Cyprus: Expected Demand Over Next Three Months

(Percent Balance)

Cyprus: Estimated Recovery of Tourist Arrivals

(Share of total tourist arrivals)

- E. Policy Priorities

16. Cyprus has adopted various measures to support the economy and tourism sector . Main policy measures 5 include: 1) Income tax measures and VAT reductions; 2) support for bank lending; 3) a Suspended Operations Plan for businesses that decided to suspend their operations or suffered high losses and unemployment allowance; 4) Small Business Support Plan to provide funds and subsidy of employee salaries; 5) Granting of “sickness benefit” and residence allowance for students abroad. More targeted measures for the tourism sector include: 6) a co-promotional program of EUR10 million with tourist agents for the projection of Cyprus as a safe destination for tourists, and additional appropriations of EUR 11 million to support tourism between June and September 2020, in cooperation with airlines and travel operators, as well as actions to boost tourist attraction during the period from October 2020 to March 2021; 7) covering the health cost of travelers who test positive while in Cyprus; 8) allowing vaccinated travelers to avoid quarantine and negative coronavirus test restrictions from March 2021; 9) “Extraordinary Plan for the Support of Domestic Tourism” which offers hotel discounts to permanent residents to support local businesses.

17. Continued targeted support measures to the tourism sector are warranted in the short term given their systemic importance to the economy . Measures will need to consider solvency support given the high risk of insolvency among tourism sector firms as shown by simulations of corporates in the Euro Area ( IMF, 2020b ) 6 . Liquidity-type support, such as guaranteed loans or lending rate subsidies, etc. could be considered. These measures would allow public support to benefit from a viability assessment by banks. Since many tourism-related businesses would fall under SMEs, increased access to SME restructuring tools would help avoid costly bankruptcies. For larger, strategic businesses, equity-type support—with potential upside for the government down the road as the economy recovers—could also be considered. Since the tourism sector is more likely to suffer for an extended period, these measures could mitigate long-term scarring while ensuring scarce public resources are extended to viable businesses. The length of the support, if fiscal space allows, could last until the end of the crisis, and should reduce as tourism picks up. Other targeted polices such as promoting marketing for tourism, could also boost tourism revenues.

Euro Area: Increase in the Share of Insolvent Firms

(Percentage points from pre-pandemic levels; simple averages)

18. Policy design measures should also take into account that tourism sector workforce is among the most vulnerable . Workers in the hotel industry tend to fall disproportionately in the lowest income quintile compared with other industry groups. Given low teleworkability of this industry, these workers are more susceptible to unemployment and income loss. Policies should thus ensure continued income replacement or wage subsidies to maintain employment ties. Workers in this sector appear to be more gender balanced, although women are represented more than in other sectors. At the same time, this sector has a higher reliance on foreign workers in Cyprus. Support measures should appropriately target these populations in terms of safety net support and to facilitate easier transition back into the workforce as the recovery takes hold.

Likelihood of Being in the Top and Bottom Income Quintile by Industry’s Teleworkability

Cyprus: Employment Shares, 2019

(Share of total employment; Share of employment in Accommodation/Food Sector)

19. The longer-term policy challenge is to steer the sector from mass tourism to sustainable tourism, given the impact of the pandemic and environmental concerns . Mass tourism tries to maximize revenues through demand anticipation and capacity management, notably in airlines, hotels, and rental cars. Risks of future pandemics, overcrowding, and environmental policies may have long-term impacts on international travel and make mass-tourism business model less viable. Sustainable tourism could be a potential alternative which focuses on smaller-scale, regionally more diverse, and higher-end tourism; more strongly based on environmental sustainability, quality of services, and non-price competitiveness. Based on the Travel and Tourism Competitiveness Index by World Economic Forum (WEF), Cyprus has similar competitiveness scores as the average of Euro Area countries. Cyprus also ranks among the most improved (from 55 th to 42 nd ); nevertheless, further improvements will need to focus on environmental sustainability and diversification to different types of markets such as cultural resources. Cyprus has made progress in diversifying the source markets of tourism, although the share of its top three markets (UK, Russia, Israel) remains very high, making it vulnerable to developments in these countries. More diversification of tourist market would help Cyprus to cope with shocks.

Travel and Tourism Competitiveness Index

(Score, 1-7 (best))

Tourism Arrivals

(Percent Share of arrivals from the top 3 market)

- F. Conclusion

20. Global tourism has suffered the worst year on record in 2020 . The impact on tourism in Cyprus has been among the most severe in Europe, which in turn had a significant impact on exports of services and on GDP growth. Nevertheless, employment has been largely protected in the tourism sector, due to large support packages that were rolled out.

21. Looking ahead, near-term challenges to the tourism sector remain significant . The decline in tourism is expected to be only partially reversed in 2021 with a full recovery to pre-pandemic levels only expected in the medium term, raising risks of scarring. The Cypriot economy remains vulnerable to the COVID-19 shock given its high dependence on tourism. High exposure of the Cypriot banking system to the tourism sector also increases risks of a macro-financial feedback loop. At the same time, Cyprus fares relatively well in terms of prospects for recovery, given its tourism characteristics, sanitary indicators and recovery in the main source countries, once travel restrictions are eased. While uncertainty remains high, the recovery of tourism will be determined by the pace of the vaccination rollout, the coordination among countries on travel procedures and the economic situation.

22. In this context, continued targeted support measures to the tourism sector are warranted in the short term given their systemic importance to the economy. Policy design measures should also take into account that the tourism sector workforce is among the most vulnerable. The longer-term policy challenge is to steer the sector towards sustainable tourism, given the impact of the pandemic and environmental concerns.

European Travel Commission (ETC) , ( 2021 ), “ European Tourism: Trends & Prospects ”, Quarterly Report for 2020:Q4, published February 2021 .

- Search Google Scholar

- Export Citation

Eurocontrol ( 2020 ), “ Eurocontrol Five-Year Forecast 2020–2024 ”, published November 4, 2020 .

International Monetary Fund ( 2020a ), “ Euro Area: 2020 Article IV Consultation ,” December 2020, IMF Country Report No. 20/324 , International Monetary Fund , Washington, D.C .

International Monetary Fund ( 2020b ), “ Regional Economic Outlook: Europe ,” European Department, International Monetary Fund , Washington, D. C. , ( October 2020 ).

International Monetary Fund (forthcoming), “ Tourism in Southern Europe: Development and Prospects under the COVID-19 Pandemic ,” European Department, International Monetary Fund , Washington, D.C .

Salas , J. , J. Lee , and W. Oman ( 2020 ), “ Tourism in Europe After the COVID-19 Shock: Impact, Prospects, and Policies ,” Unpublished slides , European Department, International Monetary Fund .

World Tourism Organization (UNWTO) ( 2021 ), “ UNWTO World Tourism Barometer ”, January 2021 .

World Economic Forum (WEF) ( 2019 ), “ The Travel & Tourism Competitiveness Report 2019 ”.

WTTC/Oxford Economics ( 2020 ), “ Travel and Tourism Economic Impact Research Methodology ,” May 2020 .

Based on the World Travel and Tourism (WWTC) database, the direct contribution of travel & tourism to GDP is calculated to be consistent with the output of tourism-characteristic sectors such as hotels, airlines, airports, travel agents, and leisure & recreation services that deal directly with tourists. The total contribution of travel & tourism includes its wider impacts on the economy (i.e. the indirect and induced impacts), in addition to the direct impacts. The indirect contribution includes the GDP and jobs supported by: travel & tourism investment spending; government 'collective' spending which helps travel & tourism activity; and domestic (non-imported) supply chain purchases of goods and services by the sectors dealing directly with tourists. The induced contribution measures the GDP and jobs supported by the spending of those who are directly and indirectly employed by the travel & tourism sector ( WTTC/Oxford Economics 2020 ).

Based on IMF (forthcoming) , “ The Impact of COVID19 on European Banks ,” EUR Departmental Paper.

Based on Salas, et. al. (2020), “ Tourism in Europe After the COVID-19 Shock: Impact, Prospects, and Policies .” Unpublished slides, European Department, International Monetary Fund.

The Heatmap Analysis based on indicators include: relative size of urban (vs. rural) tourism, relative size of foreign (vs. domestic) tourism, inbound (vs. outbound) tourism spending, share of business (vs. personal) travel, share of hotel stays (vs. other accommodations) and share of tourism by air (vs. other modes). Each indicator is scored in a range between 1–5 with a higher score indicating a higher vulnerability ( Salas, et. al., 2020 ). The relative ranking should however be treated with caution given the missing values in some variables. A similar heatmap for the health/sanitary indicators uses number of COVID-19 cases, vaccination rate, number of COVID-19 tests and stringency of the mobility restrictions (see IMF (forthcoming) ,” Tourism in Southern Europe: Development and Prospects under the COVID-19 Pandemic ,” EUR Departmental Paper).

Based on UNWTO compilation of country policy measures to support travel and tourism.

Based on simulations using firm-level data (ORBIS database) in 13 euro area countries and October 2020 WEO projections and announced policies, the authors find that the share of firms deemed insolvent would rise by 8 percentage points, on average, given high leverage levels and limited scope for equity financing among SMEs. See IMF (2020b) , “Corporate Liquidity and Solvency in Europe During the COVID-19 Pandemic: The Role of Policies,” Chapter 3, Regional Economic Outlook (October) for further details.

Table of Contents

- Front Matter

- Cyprus: Selected Issues

- View raw image

- Download Powerpoint Slide

International Monetary Fund Copyright © 2010-2021. All Rights Reserved.

- [66.249.64.20|185.147.128.134]

- 185.147.128.134

Character limit 500 /500

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

- Market Overview

- Market Challenges

- Market Opportunities

- Market Entry Strategy

- Information Communication Technology (ICT)

- Renewable Energy Sources (RES)

- Oil and Gas Exploration & Exploitation

- Distressed Assets

- Travel and Tourism

- Trade Barriers

- Import Tariffs

- Import Requirements & Documentation

- Labeling and Marking Requirements

- U.S. Export Controls

- Temporary Entry

- Prohibited & Restricted Imports

- Customs Regulations

- Standards for Trade

- Trade Agreements

- Licensing Requirements for Professional Services

- Distribution & Sales Channels

- Selling Factors & Techniques

- Trade Financing

- Protecting Intellectual Property

- Selling to the Public Sector

- Business Travel

- Investment Climate Statement

Republic of Cyprus

Travel and tourism-related activities generate approximately 20 percent of ROC GDP. Tourist arrivals and tourism-related revenue are gradually returning to pre-COVID-19 numbers. Projects involving U.S. hotel brands not currently in the Cyprus market are expected to proceed as planned, some through U.S. investment funds. The most recent U.S. addition to the hospitality sector was Ramada by Wyndham. Tourism infrastructure is being upgraded and the Deputy Ministry of Tourism is re-evaluating the country’s tourism strategy to pursue new markets. An integrated resort casino - Europe’s largest – opened its doors in July 2023. A $1.2 billion Larnaca marina and port redevelopment is currently under construction. Although primarily a “sun and sea” destination, Cypriot government and tourism industry officials seek to diversify investment into new sectors such as medical, sports, or wellness tourism. Cyprus offers many advantages in this area, including a strategic location, expanding air connectivity, mild Mediterranean climate, existing high-standard hospitals, clinics with internationally educated doctors, and near-universal use of the English language.

Leading Sub-Sectors and Opportunities

Construction of greenfield tourism projects:.

In addition to acquiring existing tourism infrastructure, investors should consider prospects in constructing large, greenfield tourism projects in the following sub-sectors: seafront tourist developments, theme parks, retirement and rehabilitation centers, athletic tourism, medical and wellness tourism, agrotourism, cultural and religious tourism, wedding destination tourism, conventions, and golf courses combined with residential developments. Non-EU entities interested in constructing large greenfield development projects in Cyprus must be properly licensed in their country of origin.

Republic of Cyprus Statistical Service data on tourism

Association of Large Investment Projects

Tourism in Cyprus

Development of the tourism sector in cyprus from 1995 to 2021.

Revenues from tourism

All data for Cyprus in detail

Cyprus Tourism Forecast to Remain Strong in 2024 Despite Ongoing Conflicts

Despite ongoing conflicts in Gaza and Ukraine, Cyprus expects to welcome a steady flow of tourists in 2024, according to hotel industry leaders.

Arrivals to Remain Stable Despite Uncertainties

“The number of foreign visitors should remain very similar, if not higher, than 2023,” said Thanos Michaelides, president of the Cyprus Hotel Association (Pasyxe) .

He cautioned, however, that all predictions depend on global events that can rapidly change.

The conflict between Israel and Palestine has direct impacts on Cyprus’ second-largest tourism market.

“We cannot really predict Israeli visitor numbers this year due to geopolitics,” Michaelides said.

At the same time, many European countries like France , Germany , and Poland sent growing numbers of tourists in 2023. These trends are expected to continue.

Visitors from Russia remain uncertain due to continuing European Union (EU) sanctions over Ukraine.

“As long as sanctions remain, we foresee no change for Russian tourists,” Michaelides said.

Despite losing Russian and Ukrainian visitors, Cyprus welcomed over 3.7 million tourists from January to November 2023 — a 20.4% increase over 2022.

Revenues topped €2.8 billion, jumping 22.6% year-over-year.

Extending Season and Markets Remain Key

The tourism chief stressed the importance of diversifying markets and lengthening the visitor season.

Paphos saw exceptional tourist activity in November 2023, for example.

“The best outcome for 2024 is matching 2023’s success. We expect to replace lost Israeli tourists with gains elsewhere,” he said.

Ongoing concerns include flight insurance costs, which should be clarified by February.

However, the island nation has shown its resilience, absorbing a 25% drop in Russian and Ukrainian tourists while still exceeding 2019 arrival levels.

“As conflicts continue, the coming year remains unpredictable,” Michaelides said. “But current trends point toward stability or moderate growth for Cyprus tourism in 2024.”

ETIAS Waivers Still Set for 2025 Launch

The conflict does not impact plans for the upcoming European Travel Information and Authorization System (ETIAS) , set to launch in May 2025.

Once implemented, the ETIAS will require travelers from over 60 countries to obtain special waivers before visiting EU nations.

Cyprus remains on track to join the Schengen Area in 2025 as well.

These developments should facilitate tourism and immigration from both EU and non-EU regions.

ETIAS waivers will enable more long-term stays for non-EU families, investors, digital nomads, and students.

EU Policy Adjustments Remain Possible

Broader EU immigration policies have not changed due to geopolitical conflicts.

However, member states retain power to adjust restrictions based on security risks and economic needs.

Cyprus continues pushing for more flexibility regarding non-EU students and high-skilled talent.

As an island economy dependent on tourism, immigration policy holds major implications.

EU officials may revisit regulations if existing rules curb post-pandemic growth.

Tourism Remains Bedrock of Cyprus Economy

Despite uncertainties posed by conflict and sanctions, Cyprus continues to rely on tourism as an economic foundation.

If 2024 matches or exceeds the banner results of this past year, it will further cement this vital sector.

The island's travel industry has shown durable strength with nimble pivoting to new markets and savvy responses to global shocks.

As the new year unfolds, challenges surely loom ahead.

However, Cyprus tourism has demonstrated an ability to roll with the punches while still landing on its feet.

This flexibility and resilience will remain indispensable tools for weathering future storms.

This site uses cookies only for analytics purposes. Opt-out on the cookie policy page. Or agree and continue

Cyprus Moves On Without Russian Tourists

Dawit Habtemariam , Skift

February 2nd, 2023 at 1:00 PM EST

Seems like the loss of the Russian tourist segment made Cyrpus' transition to a more sustainable approach to tourism easier.

Dawit Habtemariam

Cyprus has been diversifying its visitor base and marketing approach as it fills the huge void left by the loss of Russians and Ukrainian tourists.

The island was hit by a double whammy — the pandemic and the loss of Russian and Ukrainian tourists. Like other European Union countries, Cyprus banned Russian flights to the island in response to the Ukraine War.

Russia has historically been a top market for Cyprus. Around 22 percent of the country’s tourist arrivals were from the Russian and Ukrainian market, and now it’s zero, according to Cyprus Deputy Tourism Minister Savvas Perdios. It was estimated to cost the country 600 million euros ($655 million today) in January 2022. Those tourists are now going to Turkey , Cyprus’ competitor in the region. In 2019, Cyprus had 3.9 million tourists, a record for the country.

The loss of the Russian market accelerated Cyprus’ pre-pandemic plans to pivot to a more sustainable approach and diversify its markets. Russian visitation was reaching its peak in 2019 and it was time to go after other markets, said the deputy minister.

After meetings with the industry in 2019, the ministry also decided the sun and sea focus wasn’t sustainable for the environment or the industry. While overtourism was not a problem yet, it was heading in that direction.“The more we continue with this approach, at some point, there’s not going to be anything left,” Perdios said. Plans, however, weren’t put on hold when the pandemic struck.

The country isn’t focused on increasing visitation anymore. It wants to develop its tourism sector in a more sustainable way, which includes developing and promote agrotourism, nature and cultural experiences on the island and sharing the benefits of tourism to locals all year-round.

@visitcypruscom An astounding melting pot of cultures, sites and sounds! 📷created by @atlasova.world #imaginebeinghere #LoveCyprus #VisitCyprus #foryou #travel ♬ original sound – visitcypruscom

Coming out of the pandemic, many destinations pivoted away from quantity-based tourism . A common pattern among them is to drive tourists to spend money and time around the destination and reduce pressure on local resources.

Cyprus tourism has historically been centered around its beaches. “Being an island, in the past most of the development had been focused on the beach resorts and the beach areas,” Perdios said. About 70 percent of visitors came from holiday package tours.

Beaches and resorts were popular with the banned Russian segment, which now goes to Turkey to enjoy such attractions.

Pivoting away from sun and sand can be formidable, especially for an island. One obstacle is the established public image , as noted by Frank Haas, president of Marketing Management, a hospitality marketing consultancy.

Part of its pivot includes promoting visitation to its overlooked villages and supporting their product development. The ministry now has a “Colorful Villages” certification where lesser known villages are labeled for their sustainability, authenticity, natural beauty and other attributes. Perdios said villages like Laneia, Arsos and Vouni have seen increased visitation.

Over 50 percent of all tourist arrivals are now individual tourists. These types of tourists tend to explore the destination more, travel more year-round and disperse their spending and they also incentivize airlines to add more flights, said the minister. The growth of such individual tourists reinforces th e Skift megatrend of the emergence of the anywhere traveler looking for less obvious destinations.

Cyprus has also been courting airlines to expand air connectivity in the island these past few years. Wizzair and Ryanair both opened new bases and have been adding routes, capacity and flight frequency from Europe to the island to Europe. In November, Wizz Air announced plans to increase flight frequency from the base to Athens, Prague and Tel Aviv.

The increase in air connectivity no doubt helped Cyprus to replace the missing Russian segment. A greater share of tourist arrivals are coming from Germany, Poland, Hungary, France, Austria, Italy, Israel and Switzerland, according to Perdios. The country finished 2022 at around 90 percent of revenues compared to 2019 and 3.2 million visitors last year . The average stay in Cyprus rose to 10 days, up one day from 2019.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: cyprus , destination marketing , russia , turkey , Ukraine War

Travel & Tourism - Cyprus

- Cyprus is expected to see a significant increase in revenue in the Travel & Tourism market, with projections indicating a rise to US$172.10m by 2024.

- This growth is expected to continue with a Compound Annual Growth Rate (CAGR) of 6.25% from 2024 to 2028, resulting in a projected market volume of US$219.30m by 2028.

- The largest market within this market is the Hotels market, with a projected market volume of US$76.03m in 2024.

- By 2028, the number of users in Hotels is expected to reach 261.50k users.

- The user penetration rate is expected to increase from 36.4% in 2024 to 40.6% by 2028.

- The projected Average Revenue Per User (ARPU) is US$372.40.

- By 2028, online sales are expected to account for 78% of total revenue in the Travel & Tourism market.

- It is worth noting that in comparison to other countries, United States is projected to generate the highest revenue in this market, with a total of US$199bn in 2024.

- Cyprus' travel and tourism market is rebounding with a focus on sustainable tourism, cultural heritage, and outdoor activities.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

Cyprus, known for its beautiful beaches and rich history, has seen a steady growth in its Travel & Tourism market in recent years. Customer preferences: Travelers in Cyprus are increasingly seeking unique and authentic experiences, moving away from traditional tourist hotspots to explore lesser-known destinations. They are also showing a growing interest in sustainable and eco-friendly travel options, supporting local businesses and initiatives that promote responsible tourism. Trends in the market: One notable trend in the Cyprus Travel & Tourism market is the rise of experiential travel, with travelers looking to immerse themselves in the local culture, cuisine, and traditions. This shift has led to an increase in demand for personalized and off-the-beaten-path experiences, driving growth in niche tourism sectors such as agrotourism and cultural tourism. Additionally, the growing popularity of wellness tourism is evident, with an emphasis on health and relaxation experiences. Local special circumstances: Cyprus's unique geographical location at the crossroads of Europe, Asia, and Africa gives it a diverse cultural heritage and a wealth of historical sites, making it a compelling destination for travelers seeking enriching experiences. The island's Mediterranean climate, with long summers and mild winters, also contributes to its appeal as a year-round tourist destination. Underlying macroeconomic factors: The steady economic growth and stability in Cyprus, coupled with government initiatives to promote tourism, have played a significant role in driving the expansion of the Travel & Tourism market. Infrastructure developments, such as new luxury hotels and improved transportation networks, have enhanced the overall tourism experience, attracting a broader range of visitors to the island. Additionally, strategic marketing efforts to promote Cyprus as a premium travel destination have helped boost international arrivals and tourism revenue.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Travel Behavior

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Get immediate access to all Market Insights, reports & statistics

- Download data in multiple formats for collaborative research

- Includes usage & publication rights for sharing data externally

- GREEK EDITION

Cyprus tourism faces headwinds in 2024

Decline in tourist traffic anticipated, efforts to stabilize the situation underway.

According to an article by Maria Eracleous published in Kathimerini's Oikonomiki, the tourism sector in Cyprus is grappling with a challenging start to 2024, primarily attributed to the ongoing conflict in Israel and heightened price sensitivity impacting travel demand. The situation is exacerbated by operational issues and fleet changes within the airline industry, potentially leading to a reduction in passenger seats for Cyprus.

According to current data, a 4% decrease in available airline seats is expected in 2024 compared to the previous year, translating to 500,000 fewer passenger seats. This decline is influenced by technical problems and fleet replacements in three major airlines. Concurrently, 10 other airlines, including TUI, Ryanair, Jet2, and Easyjet, are increasing seat capacities at Cypriot airports.

The loss of inbound passengers is estimated at around 250,000, primarily from the British market, where reduced frequency to destinations like Luton and Gatwick is noted. The remainder of the decline is spread across other European and Middle Eastern markets. However, it is anticipated that passengers may seek alternative flights with existing airlines, potentially increasing load factors.

In response to these challenges, Cyprus authorities are implementing a new package of targeted measures, including the extension of excise duty reduction on motor fuels, one-time support to qualifying households, increased budget for supporting large families interested in electric cars, and enhancements for refugees.

Hermes Airport's senior marketing director, Maria Kouroupi, assured that the current situation is not a cause for panic. She emphasized the airlines' intentions to address the challenges and the company's commitment to filling gaps. The decline is attributed to dynamic factors, and Kouroupi highlighted the potential for data changes by year-end.

Costas Koumis, Deputy Minister of Tourism, acknowledged the global problem affecting Cyprus and reassured that steps have been taken to minimize losses. He emphasized efforts to compensate for any losses through new routes and increased seat capacities from specific countries.

While 2024 is expected to witness a slight decrease in tourist traffic compared to the record year of 2023, authorities are working towards stabilizing the situation and mitigating potential impacts on the country's economy and tourism sector. The true impact will become clearer during the summer tourist season.

In summary, industry experts emphasize a three-year stabilization period in tourism numbers, with a focus on minimizing the impact of the current challenges on the Cyprus tourism sector.

- Cyprus tourism braces for challenges in 2024

- Nicosia's boutique hotel scene flourishes amid tourism surge

- Airbnb soars in Cyprus as over 6,700 properties embrace the trend

- Pancyprian Amateur Theatre Festival returns to Cyprus this October | 16:00

- Visually impaired paralympian blocked from competing due to UK guide dog policy | 14:00

- A cat's journey through 14 years of Prime Ministers | 12:00

- Windcraft Music Fest reflects on 10 years of music | 10:00

- Afghan mother's son kidnapped by Turkish father in occupied Cyprus | 19:16

- LATEST NEWS

Windcraft Music Fest reflects on 10 years of music

A cat's journey through 14 years of prime ministers, visually impaired paralympian blocked from competing due to uk guide dog policy, pancyprian amateur theatre festival returns to cyprus this october, business: latest articles.

Monthly car auction returns to Larnaca, featuring Bank of Cyprus vehicles

Top Cypriot producers honored for their culinary excellence

Houses for sale by AstroBank

Paphos-Polis road project faces uncertain future

Cyprus ship registry grows amid global tensions

DSV and UNICEF announce partnership to increase access to essential supplies for children worldwide

Heatwave halts deliveries, stores see orders plunge by up to 80%

Mandatory malpractice insurance now required for all doctors in Cyprus

Major shareholders of Bank of Cyprus seek to sell 15% stake

Real estate investment opportunities by Astrobank

The $10 billion plan to rebuild Cyprus's ghost town

Ministry probes public works tenders from 10 years ago

Cyprus sees surge in air travel as summer season takes off

Wizz Air increases number of flights from Larnaca, Cluj and Varna

US sanctions target Russian-Cypriot connections

CBC chief warns: Tax on big profits could hurt economy

Eurobank increases stake in Hellenic Bank to 55.48%

EU to impose up to 25% tax on imported Chinese EVs

Cyprus faces market uncertainties as exit plans delayed again

Eurobank boosts stake in Hellenic Bank with over 500,000 shares

Alphamega Hypermarkets ''Play Ball'' giving away gifts for the Euro 2024

Cyprus trade deficit shrinks by €708 million

Fitch upgrades Cyprus to 'BBB+'

Passenger traffic up at Larnaca and Paphos airports amid drop in hotel bookings

Eurobank's 'egg - enter grow go' wins top EBAN award for 2024

Work halted from 12pm - 4pm due to heatwave

Enjoy summer savings: Up to 50% off with Wolt+ weeks

EU Court upholds 'Halloumi' PDO registration

Christodoulides unveils €60M relief package amid rising prices

KPMG Personalization

Transport, Leisure & Tourism sector

Maximise new opportunities and meet challenges head in the Transport, Leisure & Tourism sector.

- Home ›

- Industries ›

- Transport, Leisure & Tourism sector

As one of the top tourism destinations, Cyprus is an appealing island known for its natural beauty and historical sites, presenting significant opportunities for investment in the hospitality sector. Cyprus’ Mediterranean climate, picturesque scenery, beautiful beaches, numerous historical and cultural attractions, traditional hospitality, and vibrant cuisine all provide an excellent foundation for further enhancing the industry.

Additionally, Cyprus’ geographical location, situated between three continents, offers opportunities for visitors from a wide range of nationalities.

International, regional, and local competitive pressures, along with the general economic environment, create both opportunities and risks in the Travel, Leisure, and Tourism industry. Many companies in the hospitality sector are seeking innovative and sustainable methods to attract new business, improve operating efficiency, and increase profitability.