International tourism, receipts (current US$)

All Countries and Economies

Country Most Recent Year Most Recent Value ( Thousands )

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

UN Tourism | Bringing the world closer

Tourism statistics database.

- 145 Key Tourism Statistics

- Economic Contribution and the SDGs

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Economic Contribution and SDG

As UN custodian, the UNWTO Department of Statistics compiles data on the Sustainable Development Goals indicators 8.9.1 and 12.b.1, included in the Global Indicator Framework . Data collection started in 2019 and provides data from 2008 onwards, the latest update took place on 29 April 2024.

Tourism direct GDP as a proportion of total GDP (indicator 8.9.1)

Indicator 8.9.1 on Tourism Direct GDP helps to monitor Target 8.9 which calls on countries “to promote sustainable tourism” under Goal 8 on decent Work and Economic Growth.

* Source : Data compiled from countries by UNWTO through annual statistical questionnaires. ** The boundaries and names shown and the designations used on this map do not imply official endorsement or acceptance by the UNWTO.

Implementation of standards accounting tools to monitor the economic and environmental aspects of tourism sustainability (indicator 12.b.1)

Indicator 12.b.1 shows the preparedness of countries to “develop and implement tools to monitor sustainable development impacts for sustainable tourism” called for in target 12.b under Goal 12 on Sustainable Consumption and Production. More specifically, it tracks the implementation of the most relevant Tourism Satellite Account (TSA) and System of Environmental Economic Accounting (SEEA) tables.

In the past, the UNWTO has conducted studies on the implementation of the TSA:RMF 2008, the latest being available here .

An official website of the United States government

The Journal of the U.S. Bureau of Economic Analysis

- Articles by Date

- Articles by Subject

- Infographics

- Research Spotlights

U.S. Travel and Tourism Satellite Account for 2017–2021

By Sarah Osborne | February 9, 2023

Download PDF

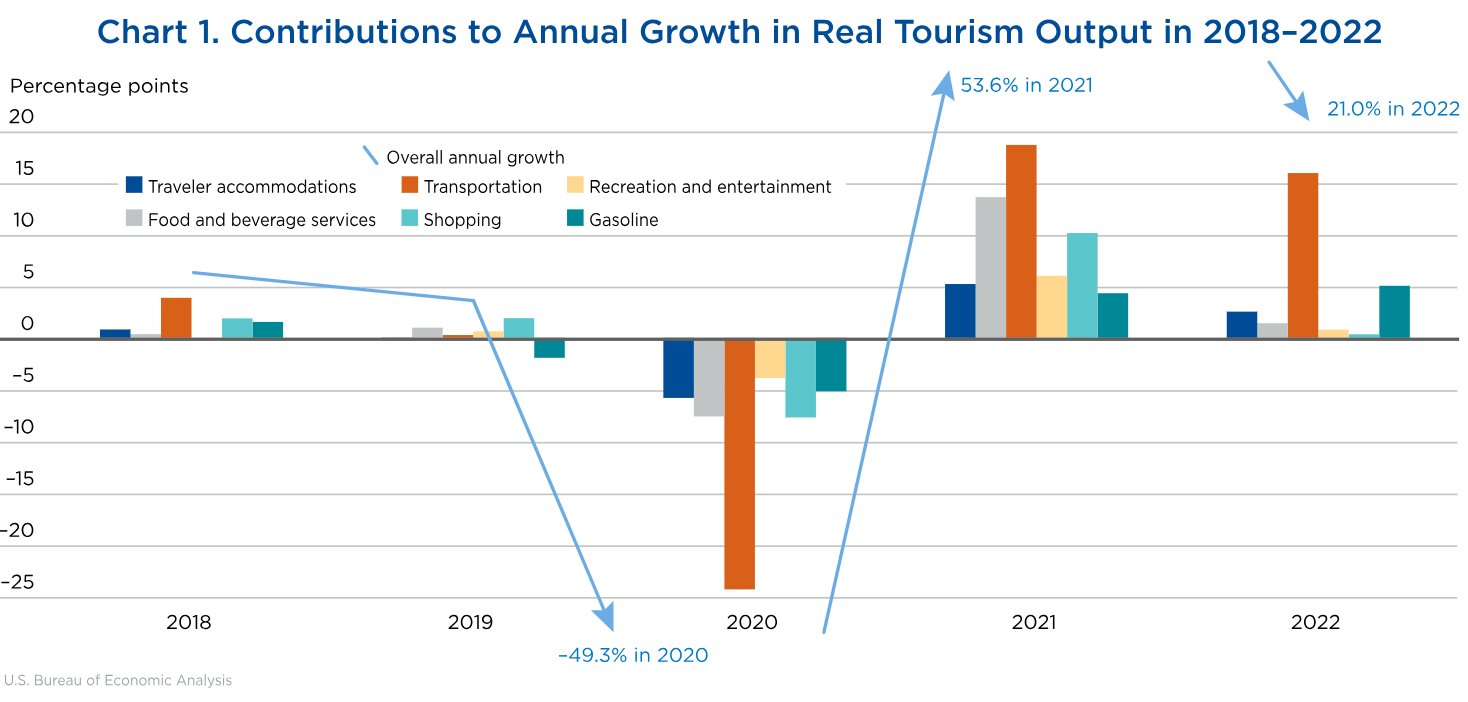

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 64.4 percent in 2021 after decreasing 50.7 percent in 2020, according to the most recent statistics from the Travel and Tourism Satellite Account (TTSA) of the U.S. Bureau of Economic Analysis (BEA). 1 By comparison, the broader economy, as measured by real gross domestic product (GDP), increased 5.9 percent in 2021 after decreasing 2.8 percent in 2020. Revised statistics on travel and tourism reflect the incorporation of the annual update of the National Economic Accounts, which was released on September 29, 2022. The 2022 Annual Update of the National Economic Accounts ,” Survey of Current Business 102 (November 2022)."> 2

Highlights from the TTSA include the following:

- As the industry entered the recovery period of the COVID–19 pandemic, travel and tourism's share of GDP increased from 1.54 percent in 2020 to 2.15 percent in 2021 ( table A ).

- The travel and tourism industry's real output increased $362.0 billion in 2021 but has not fully recovered from the pandemic. Travel and tourism’s real output for 2021 was 81.1 percent of its 2019 level ( table B ).

- The increase in 2021 is the largest expansion in real output since BEA began measuring these statistics in 1998.

- In 2021, real output increased for 21 of 24 commodities. The largest contributors to the increase were food and beverage services and shopping.

- Prices for travel and tourism goods and services increased 7.7 percent in 2021 after decreasing 5.0 percent in 2020. The largest contributors to the increase were gasoline, traveler accommodations, and automotive rental and leasing ( table C ).

- The TTSA is available on the BEA website; see the box “ Data Availability .”

The remainder of this article includes a discussion of trends in travel and tourism output, prices, value added, and employment.

Trends in Output and Prices

Real output.

Travel and tourism real output increased 64.4 percent in 2021. The largest contributors were food and beverage services, shopping, domestic passenger air transportation services, and traveler accommodations (table B and chart 1).

The upturn in real output (from a decrease of 50.7 percent in 2020 to an increase 64.4 percent in 2021) was led by upturns in food and beverage services, shopping, domestic passenger air transportation service, and traveler accommodations.

[View larger chart]

Travel and tourism prices turned up in 2021, increasing 7.7 percent after decreasing 5.0 percent in 2020, with prices of 21 of 24 commodities contributing to the increase (table C and chart 2). The upturn was led by upturns in gasoline, traveler accommodations, and automotive rental and leasing and a smaller decrease in domestic passenger air transportation.

Total output

Total tourism-related current-dollar, or nominal, output increased to $1.70 trillion in 2021, up from $952.0 billion in 2020. In 2021, total output consisted of $987.7 billion in direct tourism output and $716.3 billion in indirect tourism output. The 1.73 ratio of total output to direct output in 2021 means that every dollar of direct tourism output requires an additional 73 cents of indirect tourism output (chart 3).

Direct tourism output includes goods and services sold directly to visitors, such as passenger air travel. Indirect tourism output includes sales of all goods and services used to produce that direct output, such as jet fuel to fly the plane and catering services for longer flights.

Tourism Value Added and Employment

Value added.

A sector's value added measures its share of gross domestic product. The travel and tourism industry's share of GDP was 2.15 percent in 2021, 1.54 percent in 2020, and 2.99 in 2019 (table A). This pattern indicates that travel and tourism industries contracted and expanded disproportionately to non-travel and tourism industries during the COVID–19 pandemic.

Direct employment

Direct tourism employment refers to jobs that are directly related to visitor spending on goods and services. Airline pilots, hotel clerks, and travel agents are examples of such employees. Overall, direct employment increased by 1.3 million jobs in 2021 after decreasing by 2.9 million jobs in 2020. The largest contributors to the 2021 increase were food services and drinking places, which gained 730,000 jobs in 2021; shopping, which gained 206,000 jobs; and participant sports, which gained 86,000 jobs (chart 4 and table D).

Total employment

Total tourism-related employment (the sum of direct and indirect jobs) increased to 7.4 million jobs in 2021 from 5.5 million jobs in 2020. The 7.4 million jobs consisted of 4.8 million direct tourism jobs and 2.6 million indirect tourism jobs (chart 5). While direct tourism employment includes jobs that produce direct tourism output, such as airline pilots, indirect tourism employment is generated by the businesses that supply goods and services to the tourism sector, such as refinery workers producing jet fuel. Data for 2021 indicate that for every 100 jobs supported directly by the travel and tourism industry, an additional 53 indirect tourism jobs are also required.

- All measures of travel and tourism activity not identified as being in “real,” inflation-adjusted terms are current-dollar, or nominal, estimates.

- For more information see “ The 2022 Annual Update of the National Economic Accounts ,” Survey of Current Business 102 (November 2022).

Subscribe to the SCB

The Survey of Current Business is published by the U.S. Bureau of Economic Analysis. Guidelines for citing BEA information.

Survey of Current Business

bea.gov/scb [email protected]

By: Bastian Herre , Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

North America Travel & Tourism Sector GDP Expected to Grow an Average of Nearly 4% Annually Over Next Decade

Sector expected to create over nine million jobs over next 10 years

Travel & Tourism GDP could reach 2019 levels by 2023 across North America

Dallas, U.S. (May 16, 2022) – The World Travel & Tourism Council’s ( WTTC ) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth rate for the regional economy and reaching an impressive $3.1 trillion in 2032.

Published in partnership with Oxford Economics, WTTC’s latest EIR also forecasts that Travel & Tourism in North America is expected to create a staggering 9.5 million new jobs between 2022 and 2032, with an average annual growth rate of 3.7%.

The global tourism body projects that this year the recovery will continue to pick up speed, with the sector’s contribution to GDP growing 38.2% to reach $2.1 trillion, with jobs rising 19%.

The report from WTTC also shows that the economic recovery for the sector is on track to reach pre-pandemic heights by 2023. Employment prosperity is not far behind, with expectations of reaching pre-pandemic levels by 2024.

Julia Simpson, WTTC President & CEO, said: “The pandemic cost North America’s Travel & Tourism sector a staggering 8.85 million jobs and nearly $1.1 trillion in GDP in 2020.

“The U.S. travel and tourism business is showing a strong recovery. While we respect CDC’s tough decisions during the pandemic, the science indicates that the antigen test for returning US citizens and visitors is redundant. Other economies have scrapped all restrictions, the current antigen test is slowing the U.S. recovery’

In 2021, Travel & Tourism GDP remained 33.7% below 2019 levels at $1.5 trillion, in part due to the impact of the omicron variant and countries reinstating severe travel restrictions.

U.S. and Mexico led inbound arrivals and outbound departures last year, respectively, fuelling the resurgence of the Travel & Tourism sector for North America.

Pre-pandemic, North America’s Travel & Tourism sector contribution to the total economy was 8.9% ($2.3 trillion) in 2019, falling to 5% ($1.25 trillion) in 2020 due to steep drops in international and domestic visitor spending when the pandemic was at its height. Employment took a similarly devastating hit, with job contributions dropping nearly 35% between 2019 and 2020.

Regardless of these setbacks, the 2022 EIR projects a positive tide change for the Travel & Tourism sector in North America that is seeing strong momentum and growth as it emerges from the broader challenges and restrictions faced by travel during the peak of the pandemic.

Download press release

China’s Travel & Tourism Sector Set to Recover by More Than 60% This Year, Reveals WTTC

Portugal’s Travel & Tourism Sector Faces Job Shortfall of 85,000 This Year, Says WTTC Report

UK Travel & Tourism Sector Sees a Massive Job Shortfall of More Than 200,000 This Year, Says WTTC Report

- Tourism GDP

Related topics

- Innovation and Technology

Tourism direct GDP corresponds to the part of GDP generated by all industries directly in contact with visitors. This indicator is measured as a percentage of total GDP or a percentage of GVA.

Latest publication

- Industrial production

- Tourism receipts and spending

- Tourism employment

- Tourism flows

Tourism GDP Source: Key tourism indicators

- Selected data only (.csv)

- Full indicator data (.csv)

- Add this view

- Go to pinboard

©OECD · Terms & Conditions

Perspectives

Compare variables

Highlight countries

Find a country by name

Currently highlighted

Select background.

- European Union

Show baseline: OECD

latest data available

Definition of Tourism GDP

Last published in.

Please cite this indicator as follows:

Related publications

Source database, further indicators related to industry, further publications related to industry.

Your selection for sharing:

- Snapshot of data for a fixed period (data will not change even if updated on the site)

- Latest available data for a fixed period,

- Latest available data,

Sharing options

Permanent url.

Copy the URL to open this chart with all your selections.

Use this code to embed the visualisation into your website.

Width: px Preview Embedding

Australian National Accounts: Tourism Satellite Account

Estimates of tourism’s direct contribution to the economy including GDP, value added, employment and consumption by product and industry

- Australian National Accounts: Tourism Satellite Account Reference Period 2021-22 financial year

- Australian National Accounts: Tourism Satellite Account Reference Period 2020-21 financial year

- Australian National Accounts: Tourism Satellite Account Reference Period 2019-20 financial year

- View all releases

Key statistics

- Tourism gross domestic product (GDP) rose 60.1% to $57.1b in chain volume terms in 2022-23 but remains below the 2018-19 peak of $63.4b.

- Tourism's contribution to economy GDP rose to 2.5% in 2022-23 but remains below the 2018-19 level of 3.1%.

- Domestic tourism consumption rose by $34.9b to $124.9b in 2022-23 while international tourism rose by $17.7b to $23.6b in chain volume terms.

- Tourism filled jobs rose to 626,400 in 2022-23 but remains below the 2018-19 peak of 700,900 filled jobs.

- Download table as CSV

- Download table as XLSX

- Download graph as PNG image

- Download graph as JPG image

- Download graph as SVG Vector image

(a) As the reference period for chain volume measures is 2021-22, chain volume measures and current prices are identical in 2021-22.

Direct tourism

All references to "tourism" are referring to "direct tourism" unless otherwise specified. A direct tourism impact occurs where there is a direct (physical and economic) relationship between the visitor and producer of a good or service. For more information, refer to the Methodology section.

Gross Domestic product

- In current price terms, tourism GDP rose 76.6% to $63.0b in 2022-23 to be above the 2018-19 level of $60.3b. Of this, tourism GVA was $57.2b and tourism net taxes on products $5.7b.

- In chain volume terms, tourism GDP rose 60.1% in 2022-23 but stands at 90.1% of its 2018-19 level.

Consumption

- In purchasers' price terms, domestic consumption increased 53.7% to $138.4b in 2022-23, the highest level in the time series.

- In chain volume terms , domestic consumption increased 38.8% to $124.9b in 2022-23, the highest level in the time series.

- In purchasers' price terms, international consumption increased from $5.9b to $26.1b in 2022-23 but remains well below the 2018-19 level of $39.3b.

- In chain volume terms, international consumption increased from $5.9b to $23.6b in 2022-23 but remains well below the 2018-19 level of $42.5b.

Industry gross value added, current prices

- The accommodation industry's GVA increased to $7.7b in 2022-23 which is 25.5% higher than the 2018-19 level of $6.2b.

- The cafes, restaurants and takeaway food services industry's GVA increased to $7.0b which is 17.6% higher than the 2018-19 level of $5.9b.

- The travel agency and information centre services industry's GVA increased to $6.1b which is 7.8% higher than the 2018-19 level of $5.7b.

- The air, water and other transport industry's GVA increased to $7.1b but remains 9.2% below the 2018-19 level of $7.9b.

- The education and training industry's GVA increased from $1.2b to $3.2b but remains 47.9% below the 2018-19 level of $6.1b.

Tourism employment

- Tourism accounted for 4.1% of the filled jobs in the whole economy in 2022-23 but this is still lower than the 5.1% of filled jobs in 2018-19.

- The greatest increases in filled jobs in 2022-23 occurred in cafes, restaurants and takeaway food services (up 58,100 jobs), retail trade (up 32,500 jobs), accommodation (up 22,900 jobs) and education and training (up 19,600 jobs).

- Increases were recorded in both full-time filled jobs (up 46.0% to 317,600 jobs) and part-time filled jobs (up 37.2% to 308,800 jobs) in 2022-23.

- In 2022-23, filled jobs worked by females increased more than those filled by males with increases of 42.9% to 345,500 jobs and 39.9% to 280,900 jobs respectively.

Key considerations in data interpretation

Tourism estimates.

The International Visitor Survey (IVS) data sourced from Tourism Research Australia (TRA) is one of the key inputs to this account. Due to the COIVD-19 pandemic, IVS interviews were paused from June quarter 2020 to June quarter 2022 and data were imputed. Full sampling interviewing returned from March quarter 2023. Following a review by the TRA of the imputation method and changes to ABS Overseas Arrivals and Departures data used for IVS benchmarking, data for 2021-22 has been revised.

For more information see International Visitor Survey Methodology and Overseas Arrivals and Departures .

Changes in this issue

New process to derive economic measures.

This publication includes a methodological update. This update was undertaken to modernise the processing system and enhance the methodology. Consequently, the estimates for the 2019-20, 2020-21 and 2021-22 periods, which were previously published, have been revised. For an overview of the updated methodology, please refer to the Methodology page.

Status in employment

The term ‘status in employment’ has been changed to full-time and part-time employment to be consistent with Labour Force, Australia .

Updated job distribution in transport

The jobs that were previously reported under rail transport are now included in the air, water, and other transport industry.

Analysis of results

The contribution of tourism to the Australian economy has been measured using the demand generated by visitors and the supply of tourism products by domestic producers.

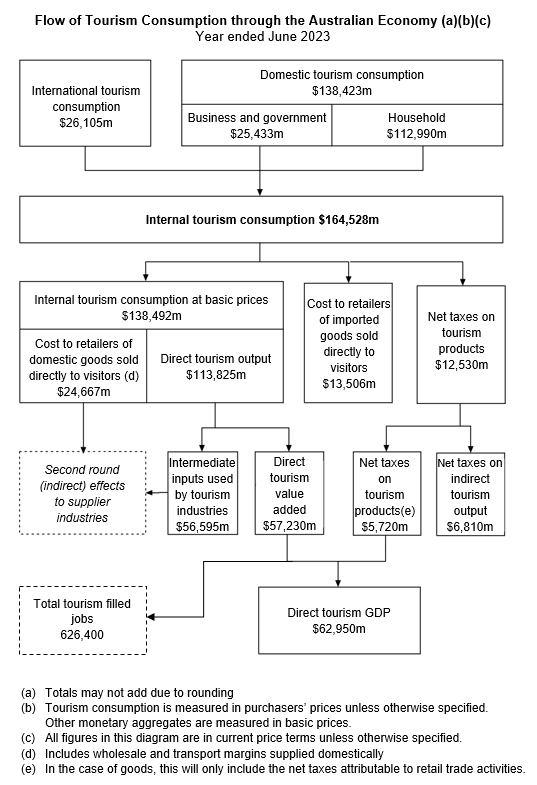

The diagram below provides a graphical depiction of the flow of tourism consumption through the Australian economy in 2022-23. What the diagram highlights is that, unlike traditional ANZSIC industries in the Australian National Accounts, tourism is not measured by the output of a single industry, but rather from the demand side i.e. the activities of visitors. It is the products that visitors consume that define what the tourism economy produces. The diagram shows how the value of internal tourism consumption (as measured by the sum of international and domestic tourism consumption in purchaser's prices, i.e. the price the visitor pays) is disaggregated to either form part of tourism GVA/tourism GDP, is excluded as it forms part of the "second round" indirect effects of tourism, or is output that was not domestically produced.

Flow of tourism consumption through the Australian Economy (a)(b)(c)

A flow chart representing the flow of tourism consumption through the Australian economy, year ending June 2023. Note, totals may not add due to rounding; tourism consumption is measured in purchasers’ prices unless otherwise specified. Other monetary aggregates are measured in basic prices; all figures in this diagram are in current price terms unless otherwise specified. Domestic tourist consumption to the value of $138,423 million is comprised of business and government, to the value of $25,433 million, and household, to the value of $112,990 million. International tourism consumption, to the value of $26,105 million, combines with domestic tourist consumption to create internal tourism consumption, to the value of $164,528 million. Internal tourism consumption splits into three values; internal tourism consumption at basic prices, to the value of $138,492 million; cost to retailers of imported goods sold directly to visitors, to the value of $13,506 million, and net taxes on tourism products to the value of $12,530 million. Internal tourism consumption at basic prices is comprised of cost to retailers of domestic goods sold directly to visitors, including wholesale and transport margins supplied domestically, to the value of $24,667 million; and direct tourism output, to the value of $113,825 million. Direct tourism output flows into two values; intermediate inputs used by tourism industries, to the value of $56,595 million; and direct tourism value added, to the value of $57,230 million. Cost to retailers of domestic goods sold directly to visitors and intermediate inputs used by tourism industries connect to second round (indirect) effects to supplier industries. Net taxes on tourism products flows into two values; net taxes on tourism products (in the case of goods, this will only include the net taxes attributable to retail trade activities), to the value of $5,720 million; and net taxes on indirect tourism output to the value of $6,810 million. Direct tourism value added and net taxes on tourism products combine to create direct tourism GDP, to the value of $62,950 million. Direct tourism value added is used to estimate total tourism employed persons, to the value of 626,400 tourism filled jobs.

Revisions are a necessary and expected part of accounts compilation as data sources are updated and improved over time. This issue includes revisions to tourism aggregates from 2019-20 to 2021-22. Revisions in the 2022-23 release include:

- Revisions to both domestic and international tourism expenditure as a result of the TSA annual balancing and confrontation process. This is particularly the case for tourism products where the estimates have been modelled using a range of source data.

- Replacing modelled 2021-22 net taxes, imports and margins data with the latest issue of Australian National Accounts: Supply Use Tables (available on a T-1 basis) for 2021-22.

- Revisions related to the new process to derive economic measures.

- Revisions to international tourism consumption due to the incorporation of updated 2021-22 data from Tourism Research Australia and updated data from the Survey of International Trade in Services for 2020-21 and 2021-22.

Please note, the revisions to the chain volume level estimates across the time series are an expected part of re-referencing the indexes to 100 in the reference year.

Data downloads

Australian national accounts: tourism satellite account, create your own tables and visualisations.

ABS provide access to a number of other datasets for you to create your own tables and make visualisations. See what's available in Data Explorer .

Caution: Data in Data Explorer is currently released after the 11:30am release on the ABS website. Please check the reference period when using Data Explorer. For information on Data Explorer and how it works, see the Data Explorer user guide .

For further information about these and related statistics, please contact the Customer Assistance Service via the ABS website Contact Us page. The ABS Privacy Policy outlines how the ABS will handle any personal information that you provide to us.

Previous catalogue number

This release previously used catalogue number 5249.0.

Methodology

Do you need more detailed statistics, request data.

We can provide customised data to meet your requirements

Microdata and TableBuilder

We can provide access to detailed, customisable data on selected topics

Australia Will Have Record Tourism Economic Impact in 2024

The World Travel & Tourism Council forecasts that Australia’s travel and tourism sector will contribute a record $265.5 billion to the economy in 2024, with expectations to surpass $345 billion by 2034.

- LinkedIn icon

- facebook icon

The World Travel & Tourism Council’s 2024 Economic Impact Research forecasted Travel & Tourism will contribute more to Australia’s economy in 2024 than any previous year on record. WTTC said the sector is poised to surpass the previous peak with a projected economic contribution of $265.5 billion, representing 10% of the Australian economy. They expect the sector to exceed $345 billion in contribution by 2034. Total spending by domestic visitors this year is expected to reach nearly $148 billion while spending by overseas visitors could be $35 billion this year.

Intercontinental Hotels & Resorts plans to continue to accelerate its expansion in the Chinese market because of a positive outlook on the business opportunities from inbound tourism and the development of the franchise model. IHG plans to drive the development of its Chinese projects with a dual approach of both management delegation and franchising. The expansion speed of opening 100 hotels will be shortened from the initial 24 years to five, four or even one and a half years.

IHG’s expansion in Vietnam is continuing with the announcement of the debut of its Vignette Collection brand in the country through a partnership with Hoi An Pearl Joint Stock Company . Moire Hoi An , part of the Vignette Collection, will become part of IHG’s Luxury & Lifestyle portfolio. The property, formerly known as Bay Resort Hoi An , has undergone extensive refurbishment and conversion. The hotel will have 128 guest rooms, including pool villas and suites. The property features two restaurants and a bar, swimming pool, fitness center, boutique spa and unique meeting facilities designed as a living room café. This expand IHG’s presence in Vietnam with the hotel chain expecting to double its current portfolio from the current 18 to around 44 hotels within the next three years.

Lead Real Estate Co. announced plans to build the ENT Terrace brand’s first “Premium Series” hotel, ENT Terrace Ginza Premium in Tokyo , Japan . The facility will have seven floors and six guest rooms, launching stays beginning in December 2024. Lead Real Estate is a Japanese developer of luxury residential properties, including single-family homes and condominiums across Tokyo, Kanagawa prefecture, and Sapporo . The company also operates hotels in Tokyo and leases apartment building units to individual customers in Japan and Dallas , Texas .

Brookfield has signed on JM Financial and Bank of America as investment bankers, exploring the idea of a landmark hospitality IPO with the Leela Palaces, Hotels and Resorts . Brookfield is aiming for a valuation of at least Rs 21,000 crore (US$2.5 billion) in the initial public offering. This would be the largest IPO in India’s hospitality sector. Brookfield intends to sell a 15% stake initially with another 10% of their stake being sold over the next three years. Brookfield acquire the luxury hotel chain in 2019 during bankruptcy proceedings for Rs 3,950 crore.

Marriott International’s Courtyard by Marriott unit announced the opening of Courtyard by Marriott Goa Colva , marking the debut of the Courtyard brand in the state. The hotel has 91 rooms and is Marriott’s 10th property in Goa , located a 40 minute drive from Dabolim Airport . Some of the 91 rooms feature private balconies. The hotel includes an all-day dining restaurant and grab and go deli. Rounding out the F&B amenities is the poolside Solario bar.

Bharat Agri Fert & Realty Ltd said it will develop India’s first 7-star resort on the outskirts of Mumbai with an investment of about Rs 55 crore. The company plans to launch an additional 170 rooms, along with a banquet hall and enhanced amenities by 2025-2026 on the banks of a river within the 120-acre freehold land. The new 7-Star resort project will operate under the Anchaviyo brand, India’s first premier unique theme-based resort. This will be an expansion on the surplus freehold land at the existing Anchaviyo resort. The company currently operates 80 luxurious theme-based resorts. Besides this expansion, Bharat Agri Fert & Realty said a joint venture with a prominent hotel chain is on the horizon.

OYO announced the opening of its first luxury hotel in Dubai , Palette Royal Reflections Hotel and Spa . They expect the number of Indian tourists to grow significantly in 2024 after Dubai relaxed the visa policy for them earlier this year. OYO has over 700 properties in the UAE , including over 200 in Dubai alone. India is the biggest source country for Dubai tourism.

Indian Hotels Company announced its expansion into Bhutan in South Asia with the signing of an 83-key hotel in Thimphu . The new property will be rebranded as part of the IHCL SeleQtions portfolio. The hotel will feature a variety of dining options, including an all-day dining restaurant and bar, a rooftop restaurant along with wellness facilities including a gym, indoor heated swimming pool and a spa. The project is a collaboration with owner Yarkay Group . IHCL also announced the singing of a Taj hotel in Anjuna , North Goa . The beachfront resort is a greenfield project. The hotel is a collaboration with Bharat Realty Venture Pvt Ltd . and includes 170 rooms across 17 acres. There is a variety of culinary offerings and wellness amenities at the J Wellness Circle , offering spa and rejuvenation treatments. The resort has the largest banquet hall and outdoor lawns in North Goa. With the additions, IHCL will have 16 hotels across Taj, SeleQtions, Vivanta and Ginger brands in Goa including five under development.

PH Resorts Group disputed reports that their deal with Okada Manila operator Tiger Resort, Leisure and Entertainment to sell off its stalled Cebu resort Emerald Bay in the Philippines is close to falling through. It is not like Dennis Uy has not said this same thing about all the past deals that fell through. InsidePH.com had reported talks between the two companies were close to collapsing due to an alleged disagreement on commercial terms with the belief that Tiger Resort believes Uy has set unrealistic terms, asking for a premium for his remaining stake in the project as well as repurchase rights.

Companies: IHG Hotels & Resorts , Anchaviyo , Brookfield , Courtyard by Marriott , Ginger , Marriott International , OYO Hotels , PH Resorts Group Holdings , SeleQtions , Taj , The Indian Hotels Company Ltd , The Leela Palaces Hotels and Resorts , Vignette Collection , Vivanta

Locations: Australia , Bhutan , Cebu , China , Dubai , Goa , Hoi An , Mumbai , Sapporo , Tokyo

Hilton Promises Increased China Investment

Hilton will increase investment in China, continuing rapid expansion as their fastest-growing international market with 671 hotels and a strong pipeline of new properties.

Full Tourism Recovery in APAC Forecast for Early 2025

Fitch Ratings projects China outbound tourism to the Asia Pacific region will recover to 86% of pre-Covid levels in 2024, with full APAC tourism recovery expected by the first half of 2025.

Hilton Garden Inn to Expand in China

Hilton plans to open around two dozen new Hilton Garden Inn hotels in China over the next year, including locations in Beijing, Nanjing, Chengdu, Chengde, and Jinan.

Vietnam’s Hotels Increasingly Face Financial Difficulties

Despite a rebound in tourism, many Vietnamese hotels face financial troubles and are being auctioned.

Hilton Expands in Southeast Asia With 11 New Hotels

Hilton announced the signing of 11 new properties in Thailand, Indonesia, and Vietnam, including the debut of the Tapestry Collection by Hilton in Southeast Asia.

It’s been a record-setting year for global travel – here’s how we make tourism inclusive and sustainable

Inclusive and sustainable travel and tourism includes supporting micro-, small- and medium-sized businesses. Image: Unsplash/Michael Barón

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Nicola Villa

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved .chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} with our crowdsourced digital platform to deliver impact at scale

- The global travel sector is experiencing a robust recovery, with tourists increasingly spending more on travel.

- Despite the overall positive outlook, some destinations struggle with operational challenges, including workforce issues and resource management amid rising tourist numbers and environmental concerns.

- The travel and tourism sector’s potential for advancing socio-economic prosperity is particularly impactful through the support of micro-, small-, and medium-sized enterprises.

The global travel sector forecast is in and it's sunny skies ahead. Through March 2024, consumer spending on travel remains strong, and passenger traffic has soared. Empowered by a strong labour market worldwide, tourists will be on the roads, air and seas once again, with more of people’s budgets on travel.

The latest report from the Mastercard Economics Institute, Travel Trends 2024: Breaking Boundaries , reveals that 2024 has already witnessed multiple record-setting days as consumer spending on leisure travel remains strong. The data shows that post-pandemic travellers continue to seek unique experiences rooted in local cultures while increasingly prioritizing spending on memorable events across sports, music and festivals.

The Mastercard Economics Institute’s analysis reveals that travellers also seek opportunities to extend their stays, prioritizing leisure for longer. For the first 12 months between March 2019 and February 2020, a trip’s average length of stay was about four days. As of March 2024, the average length of a leisure trip has edged closer to five days, which translates into an economic boost for the destinations and communities hosting them.

Have you read?

These are the top 10 countries for travel and tourism, what is travel and tourism’s role in future global prosperity, travel & tourism development index 2024, tackling tourism’s challenges.

Yet, while the overall outlook for travellers looks bright, that’s not the case for all destinations. Some tourism hotspots and lesser-known locales are facing growing challenges around operating conditions. The World Economic Forum’s Travel & Tourism Development Index (TTDI) 2024 highlights the ongoing constraints facing the global travel and tourism sector – including the lack of investment in skilled and resilient workforces and issues around resource management – cultural and natural – as destinations grapple with higher tourist visitor numbers and rising environmental concerns.

The report offers travel and tourism decision-makers recommendations around how the sector can take a more active role in tackling social challenges across socio-economic prosperity, peace and cultural exchange. As the industry accounts for approximately one-tenth of global gross domestic product and employment , the public and private sectors must work together to ensure future tourism development is, first and foremost, inclusive and sustainable.

Supporting the backbone of travel and tourism

As the TTDI 2024 notes, one area where the sector’s potential in advancing socio-economic prosperity can be particularly impactful is in the economic empowerment of micro-, small- and medium-sized enterprises (MSMEs). According to the World Travel & Tourism Council, more than 80% of travel and tourism businesses fall under this category.

Policies and investments promoting the adoption of digital solutions and enhancing digital skills development while improving access to credit can provide a major boost to tourism-focused MSMEs.

In Costa Rica, the Instituto Costariccense de Turismo, a member of Mastercard’s Tourism Innovation Hub , is championing such an approach to ensure increased tourist traffic results in better opportunities for MSMEs. Last year, the institute launched Tico Treasures , a platform facilitating tourist connections with Costa Rica’s Crafts with Identity programme, a group of 17 artisan collectives across the country. The platform allows visitors to discover local Costa Rican products, learn about artisan communities and then purchase and ship the goods back to their home country – all through one experience.

The programme is an example of public-private collaboration, including backing from Correos de Costa Rica, Banco de Costa Rica and the Instituto Costariccense de Turismo. Its objectives are multifold: delivering more authentic experiences for tourists, expanding citizens’ access to the digital economy and contributing to MSME resilience.

Protecting future environments

There are also novel approaches to solving destinations’ sustainability challenges underway. A key role of the Travel Foundation , a global non-government organization, is to facilitate innovative public-private collaborations in tourism that accelerate and scale sustainable solutions. One notable example is in Scotland, where the national tourism organization VisitScotland is partnering with the Travel Corporation, a global tour operator, to help decarbonize the destination supply chain. Both organizations are pooling their insights, data and expertise to support local businesses, develop new ideas for reducing carbon footprints and identify barriers to a green transition.

The learnings from this and other projects led by the Travel Foundation will be shared to influence future policy, investment and product development decisions at national and global levels. By combining public sector resources and capabilities with private sector technological expertise, travel and tourism decision-makers can enact policies and programmes that balance tourism growth with environmental protection, providing a nuanced approach that works for unique destinations.

It’s an important time for the sector – to leverage travel and tourism’s robust recovery and advance socio-economic prosperity, fuelling a more inclusive future for our treasured destinations. By accelerating collaboration between governments, destination management organizations and technology companies, we can ensure destinations, the communities that power them and the environments they inhabit are at the heart of all future tourism development.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} Weekly

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Trade and Investment .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

New report details global trade challenges - and other international trade stories to read this month

Khalid Alaamer

June 21, 2024

How an affordable cross-border delivery service will unlock the promise of millions of SMEs in Southeast Asia

Pete Chareonwongsak

June 17, 2024

IDEA: Investing in the Digital Economy of Azerbaijan

Digitalization is disrupting global trade – here's how AI can help customs and businesses to respond

Sebastian Klotz, Steve Barr and Jimena Sotelo

June 6, 2024

TradeTech is revolutionizing global trade

June 5, 2024

US hikes tariffs on Chinese imports, and other global trade stories to read this month

Guillaume Dabré

May 24, 2024

Travel, Tourism & Hospitality

- Tourism contribution to GDP in the U.S. 2019-2022

Total contribution of travel and tourism to the gross domestic product (GDP) in the United States in 2019 and 2022 (in trillion U.S. dollars)

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

United States

2019 and 2022

Figures have been rounded.

Other statistics on the topic Travel and tourism in the U.S.

Accommodation

- ADR of hotels in the U.S. 2001-2022

Parks & Outdoors

- Most visited amusement and theme parks worldwide 2019-2022

- Occupancy rate of the U.S. hotel industry 2001-2022

- Most visited states in the U.S. 2022

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in the U.S. "

- Total travel expenditures in the U.S. 2019-2026

- Direct travel spending in the U.S. 2019-2022, by traveler type

- Countries that visited the U.S. the most 2019-2022

- Leading outbound travel markets in the U.S. 2019-2022, country

- Contribution of travel and tourism to employment in the U.S. 2019-2022

- Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

- Number of aggregated downloads of leading travel apps in the U.S. 2023

- Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

- American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

- U.S. hotel and motel industry market size 2012-2022

- Number of hotel jobs in the U.S. 2019-2022

- Revenue per available room of the U.S. hotel industry 2001-2022

- Change in monthly number of hotel bookings in the U.S. 2020-2023

- YoY monthly change in number of online hotel searches in the U.S. 2020-2023

- Leading museums by highest attendance worldwide 2019-2022

- U.S. amusement park industry market size 2011-2022

- Landmarks most recommended visitors in the U.S. 2022

- City destinations with the highest direct travel and tourism GDP worldwide 2022

- World's highest-priced business travel destinations Q4 2022

- Selected cities with the highest hotel rates in the U.S. as of September 2023

- Most affordable cities for backpacking in the U.S. 2024, by daily price

- Average price per night of Airbnb listings in selected U.S. cities 2024

- Number of Airbnb listings in selected U.S. cities 2024

- Travelers who find sustainable travel important in the U.S. 2022

- Share of travelers that plan to make sustainable travel choices in the U.S. 2022

- How much more travelers would pay to make a trip more sustainable in the U.S. 2022

- U.S. consumers who have paid extra for sustainable travel in the past two years 2022

- U.S. consumers willing to pay extra for a sustainable travel provider 2022

- Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

- Reasons travelers were against staying in sustainable hotels in the U.S. 2022

- Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

- Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

- Trust in travel and hospitality brands in the U.S. 2023, by brand type

- American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

Other statistics that may interest you Travel and tourism in the U.S.

Industry overview

- Basic Statistic Tourism contribution to GDP in the U.S. 2019-2022

- Premium Statistic Total travel expenditures in the U.S. 2019-2026

- Premium Statistic Direct travel spending in the U.S. 2019-2022, by traveler type

- Basic Statistic Countries that visited the U.S. the most 2019-2022

- Basic Statistic Leading outbound travel markets in the U.S. 2019-2022, country

- Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022

- Premium Statistic Most visited states in the U.S. 2022

Key players

- Premium Statistic Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

- Premium Statistic Number of aggregated downloads of leading travel apps in the U.S. 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Basic Statistic American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

- Premium Statistic American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

- Premium Statistic U.S. hotel and motel industry market size 2012-2022

- Premium Statistic Number of hotel jobs in the U.S. 2019-2022

- Premium Statistic ADR of hotels in the U.S. 2001-2022

- Premium Statistic Occupancy rate of the U.S. hotel industry 2001-2022

- Premium Statistic Revenue per available room of the U.S. hotel industry 2001-2022

- Premium Statistic Change in monthly number of hotel bookings in the U.S. 2020-2023

- Premium Statistic YoY monthly change in number of online hotel searches in the U.S. 2020-2023

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Premium Statistic U.S. amusement park industry market size 2011-2022

- Premium Statistic Landmarks most recommended visitors in the U.S. 2022

City tourism

- Basic Statistic City destinations with the highest direct travel and tourism GDP worldwide 2022

- Premium Statistic World's highest-priced business travel destinations Q4 2022

- Basic Statistic Selected cities with the highest hotel rates in the U.S. as of September 2023

- Basic Statistic Most affordable cities for backpacking in the U.S. 2024, by daily price

- Premium Statistic Average price per night of Airbnb listings in selected U.S. cities 2024

- Premium Statistic Number of Airbnb listings in selected U.S. cities 2024

Sustainable tourism

- Premium Statistic Travelers who find sustainable travel important in the U.S. 2022

- Premium Statistic Share of travelers that plan to make sustainable travel choices in the U.S. 2022

- Premium Statistic How much more travelers would pay to make a trip more sustainable in the U.S. 2022

- Premium Statistic U.S. consumers who have paid extra for sustainable travel in the past two years 2022

- Premium Statistic U.S. consumers willing to pay extra for a sustainable travel provider 2022

- Premium Statistic Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

- Premium Statistic Reasons travelers were against staying in sustainable hotels in the U.S. 2022

- Premium Statistic Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

- Premium Statistic Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

- Premium Statistic Trust in travel and hospitality brands in the U.S. 2023, by brand type

- Premium Statistic American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

Further related statistics

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic National park visitor spending in the U.S. 2012-2022, by trip type

- Premium Statistic Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

- Premium Statistic Economic contribution of national park visitor spending in the U.S. 2012-2022

- Premium Statistic Number of international tourist arrivals APAC 2019, by country or region

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Camping expenditures for food, beverages and entertainment in North America 2014

- Premium Statistic Passenger traffic at Dubai Airports from 2010 to 2020*

- Basic Statistic Importance of BRICS countries to UK tourism businesses 2011

Further Content: You might find this interesting as well

- Contribution of China's travel and tourism industry to GDP 2014-2023

- National park visitor spending in the U.S. 2012-2022, by trip type

- Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Growth of inbound spending in the U.S. using foreign visa credit cards

- Economic contribution of national park visitor spending in the U.S. 2012-2022

- Number of international tourist arrivals APAC 2019, by country or region

- Middle Eastern countries with the largest international tourism receipts 2018

- Camping expenditures for food, beverages and entertainment in North America 2014

- Passenger traffic at Dubai Airports from 2010 to 2020*

- Importance of BRICS countries to UK tourism businesses 2011

Illustration: Chen Xia/GT

Multiple major cities across China recently announced the elimination of advance ticket reservation requirements for tourist attractions, aiming ...

As the traditional Dragon Boat Festival draws near, new options represented by "new Chinese-style travel" and outbound tourism ...

Businesses in the Hong Kong Special Administrative Region (HKSAR) expect more individual visitors from the Chinese mainland, where ...

IMAGES

COMMENTS

WTTC's latest annual research shows: In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

Total contribution of travel and tourism to GDP worldwide 2019-2034. Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2023, with a forecast for 2024 ...

r year of strong performance in 2023. Travel & Tourism GDP is set to grow by 23.3%. reaching 9.2% of the global economy. The sector's value is forecast to grow to $9.5 t. illion, only 5% behind the 2019 peak. This will be partly fuelled by the reopening of China, while Latin and North America are expected to.

In 2023, the share of travel and tourism's total contribution to global gross domestic product (GDP) showed a decline of 1.3 percentage points compared to 2019, the year before the COVID-19 ...

International Tourism and COVID-19. Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels. The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period. Go to Dashboard.

The account requires an annual contract and will renew after one year to the regular list price. ... Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

International tourism, receipts (% of total exports) International tourism, expenditures for passenger transport items (current US$) International tourism, expenditures (% of total imports)

New York, USA, 21 May 2024 - International tourist arrivals and the travel and tourism sector's contribution to global GDP are expected to return to pre-pandemic levels this year, driven by the lifting of COVID-19-related travel restrictions and strong pent-up demand, as per the new World Economic Forum travel and tourism study, released ...

Economic Contribution and SDG. As UN custodian, the UNWTO Department of Statistics compiles data on the Sustainable Development Goals indicators 8.9.1 and 12.b.1, included in the Global Indicator Framework . Data collection started in 2019 and provides data from 2008 onwards, the latest update took place on 29 April 2024.

The Travel & Tourism Development Index (TTDI) 2024 is the second edition of an index that evolved from the Travel & Tourism Competitiveness Index (TTCI) series, a flagship index of the World Economic Forum that has been in production since 2007. The TTDI is part of the Forum's broader work with industry and government stakeholders to build a ...

Notes: Destinations with available Tourism Gross Domestic Product data for 2018, 2017 or 2016, where Tourism GDP is 5% or more of total GDP. When Tourism GDP was not available, "tourism gross value added (TGVA)" or "tourism internal consumption" was used. 1 Data for Spain corresponds to both direct and indirect contribution.

Charts. Air passengers. Air passengers per fatality. Average length of stay of international visitors. Employment in food and beverage serving activities per 1,000 people. Employment in tourism-related industries per 1,000 people. Fatal airliner accidents and hijacking incidents. Fatal airliner accidents per million commercial flights.

Revised statistics on travel and tourism reflect the incorporation of the annual update of the National Economic Accounts, which was released on September 29, 2022. 2. ... Gross domestic product (GDP) Tourism value added Tourism value added as a share of GDP; 2017: 19,477: 565: 2.90: 2018: 20,533: 595: 2.90: 2019: 21,381: 640: 2.99: 2020: 20 ...

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...

Travel and Tourism GDP. During the decade prior to 2020, travel and tourism's share of U.S. GDP steadily increased from 2.6% in 2010 to 2.9% in 2019. In 2019, the $625 billion in travel and tourism GDP was greater than the GDP of insurance industry, the hospital industry, the chemical manufacturing industry and the utility industry (see Chart 3).

Travel and Tourism Satellite Account for 2018-2022 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Sate.

g or international tourism receipts).Domestic travel spending is expected to rise by 7.5%. pa to USD3,115.4bn from 2023 to 2033.Visitor exports are expected to rise by 12. % pa to USD821.0bn from 2023 to 2033.The Travel & Tourism industry contributes to GDP and employme.

Travel & Tourism GDP could reach 2019 levels by 2023 across North America. Dallas, U.S. (May 16, 2022) - The World Travel & Tourism Council's ( WTTC) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth ...

Tourism direct GDP corresponds to the part of GDP generated by all industries directly in contact with visitors. This indicator is measured as a percentage of total GDP or a percentage of GVA. ... Gross domestic product (GDP) Indicator. Further publications related to Industry. Entrepreneurship at a Glance Publication (2017) Financing SMEs and ...

Tourism gross domestic product (GDP) rose 60.1% to $57.1b in chain volume terms in 2022-23 but remains below the 2018-19 peak of $63.4b. ... Revisions to both domestic and international tourism expenditure as a result of the TSA annual balancing and confrontation process. This is particularly the case for tourism products where the estimates ...

The World Travel & Tourism Council's 2024 Economic Impact Research forecasted Travel & Tourism will contribute more to Australia's economy in 2024 than any previous year on record.WTTC said the sector is poised to surpass the previous peak with a projected economic contribution of $265.5 billion, representing 10% of the Australian economy.They expect the sector to exceed $345 billion in ...

As the TTDI 2024 notes, one area where the sector's potential in advancing socio-economic prosperity can be particularly impactful is in the economic empowerment of micro-, small- and medium-sized enterprises (MSMEs). According to the World Travel & Tourism Council, more than 80% of travel and tourism businesses fall under this category.

GDP continues to recover thanks to strong stayover tourism and the reconstruction. Domestic imbalances have closed, with inflation declining towards 2 percent and the fiscal balance returning to a surplus in 2023, but the current account deficit remains high. An immediate solution is needed to resolve load shedding and, in the medium term, investments in renewable energy are strongly encouraged.

An unprecedented tourism boom in southern Europe is turbocharging growth in places that had become bywords for economic stagnation. But some economists think it could end badly.

The world's best tourism countries: The US has come in first place on the World Economic Forum's annual list for 2024.Click through to see who else made the cut.

Tourism posted the highest growth in 2023 contributing 8.6% to the country's Gross Domestic Product (GDP), data from the Philippine Statistics Authority (PSA) showed.

In 2022, the gross domestic product (GDP) of the travel and tourism sector in the United States amounted to approximately 2.02 trillion U.S. dollars. This figure remained below the pre-pandemic ...

The travel and tourism sector has been identified as a major driver of China's GDP growth, with policymakers orchestrating fresh pushes to develop tourism infrastructure, upgrade catering ...

The baseline forecast is for the world economy to continue growing at 3.2 percent during 2024 and 2025, at the same pace as in 2023. A slight acceleration for advanced economies—where growth is expected to rise from 1.6 percent in 2023 to 1.7 percent in 2024 and 1.8 percent in 2025—will be offset by a modest slowdown in emerging market and developing economies from 4.3 percent in 2023 to 4 ...