Complete Overview of the 5 Sectors in the Tourism Industry

Overview of the sectors in tourism

The interplay of sectors in tourism, impact of each sector on the tourism industry, challenges and opportunities in each sector.

The tourism industry is one of the most dynamic landscapes . That’s primarily because it consists of several unique sectors. Each one of these sectors goes through comprehensive changes and is subject to many factors.

Nevertheless, understanding these sectors is quite essential! Why? Because it can help you make informed business decisions, identify valuable growth opportunities, future-proof your travel brand, and, ultimately, set it up for success.

Below you can find an in-depth analysis of the different sectors in tourism, how they affect each other, and the industry as a whole. Finally, you will discover unique challenges and opportunities for each sector.

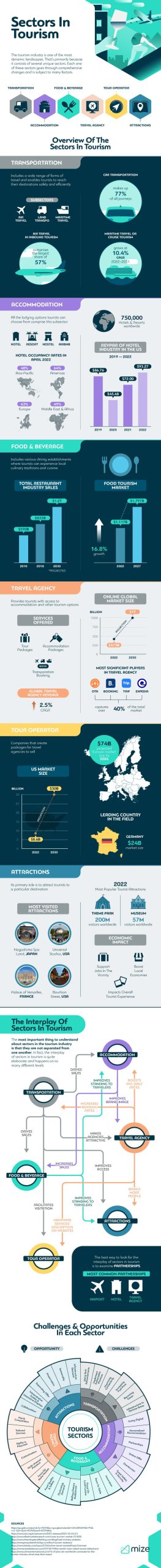

The tourism vertical is quite extensive. It consists of six sectors, making it one of the most diverse industries. These sectors are transportation, accommodation, food and beverage, travel agencies, and attractions. Let’s take a closer look at the sectors, their sizes, and their economic impact.

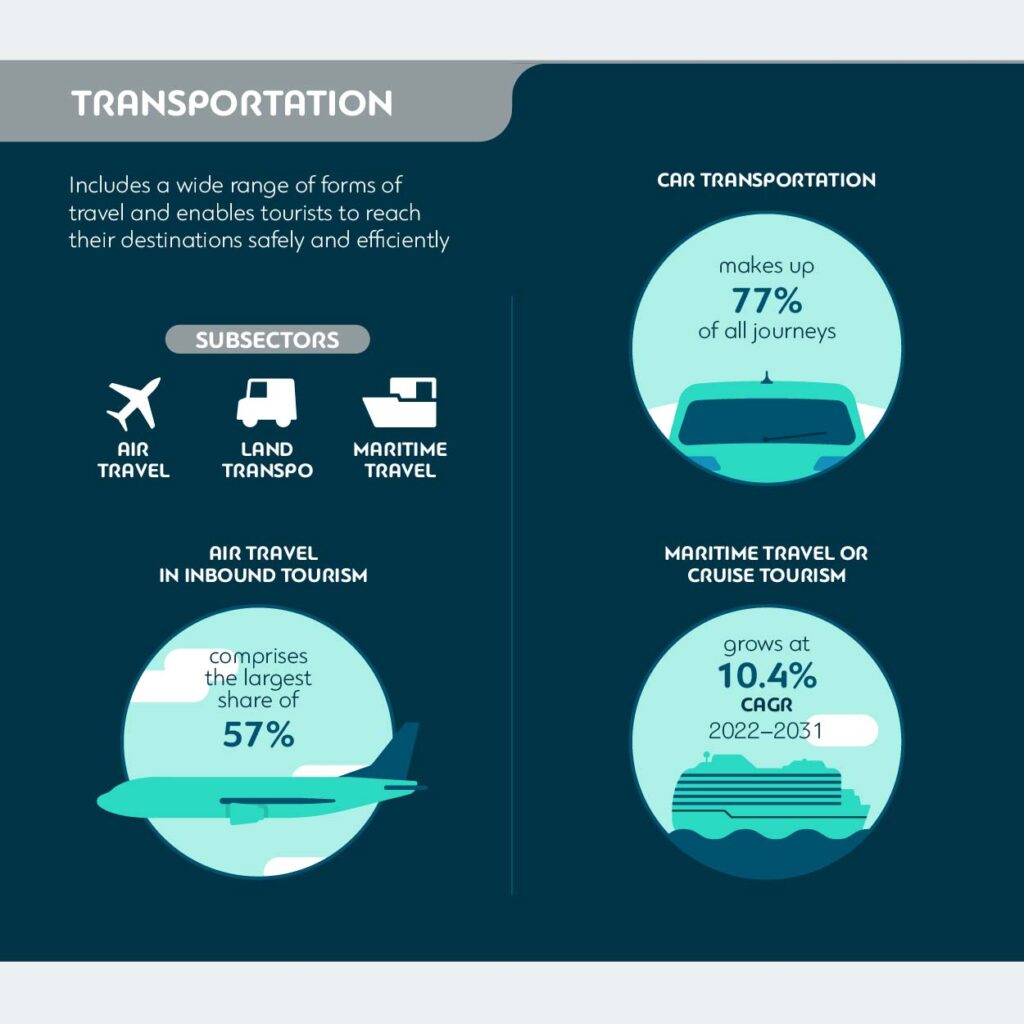

Transportation in Tourism

Transportation in tourism is a big sector. It encompasses a wide range of forms of travel and enables tourists to reach their destinations safely and efficiently. The sub-sectors include air travel, land transportation, and maritime travel.

When it comes to inbound tourism, air travel comprises the largest share, 57% . Travelers trying to reach faraway destinations often choose from various travel options. One can actually gauge the momentum of the tourism sector recuperation after the COVID-19 pandemic by looking at air transportation trends. The latest report states that total air traffic is up by 52% compared to 2022 .

Land transportation for tourists has been increasing in recent years. A recent study reveals that car transportation makes up 77% of all journeys . The reasons that explain this trend are flexibility, price, and independence.

Maritime travel or cruise tourism is also experiencing steady growth. This subsector is estimated to continue to grow at a CAGR of 10.4% from 2022 to 2031 .

Transportation is one of the pillars of the tourism industry, and as such, it has a tremendous economic impact on the vertical – its efficient functioning is critical for not only attracting tourists to destinations but also enabling them to reach their desired locations . It allows companies to generate revenue through ticket sales. However, by enabling tourists to reach their destinations, it also drives economic activity in hospitality.

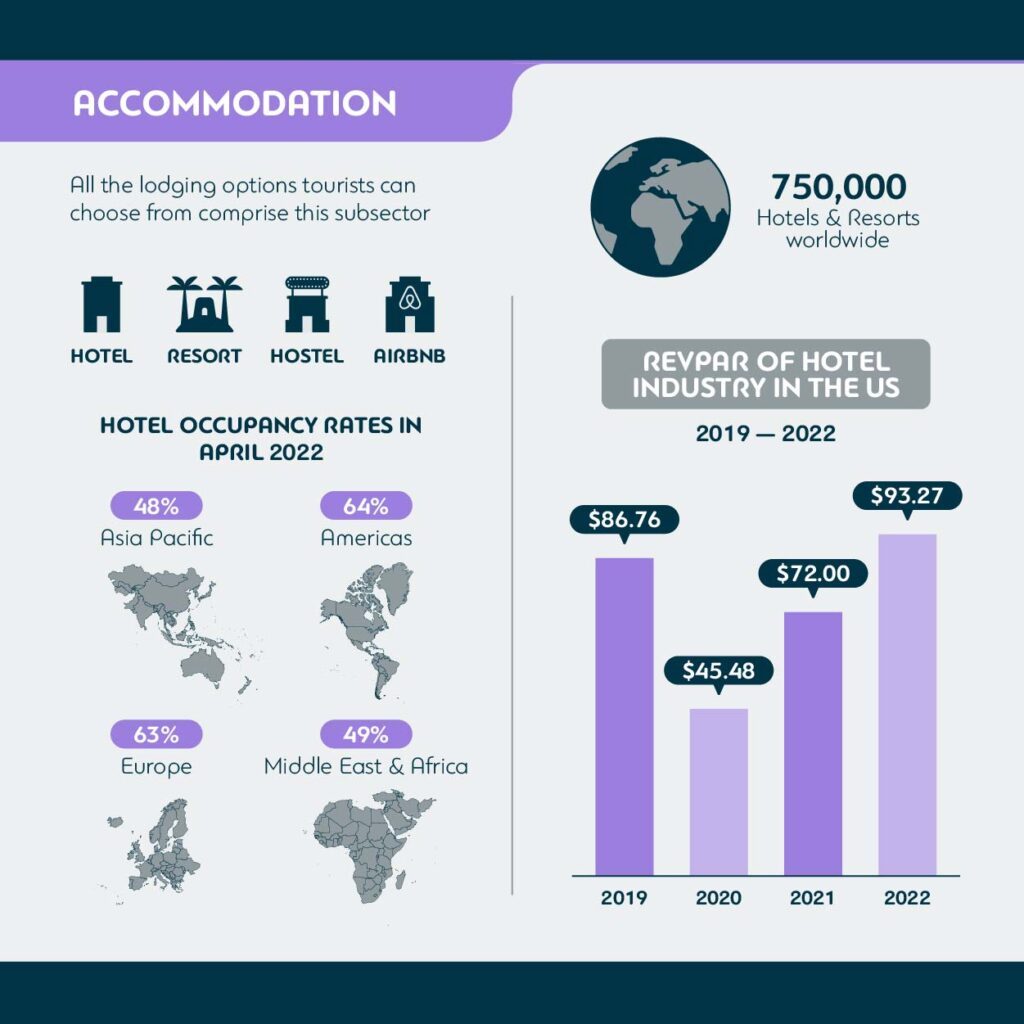

Accommodation in Tourism

All the lodging options tourists can choose from comprise the accommodation subsector of the tourism industry. It includes hotels, resorts, hostels, vacation rentals, Airbnb, and more.

The hotel occupancy rates metric is the best one to keep track of the developments in this subsector simply because there are almost 750,000 hotels and resorts worldwide . In April 2022, hotel occupancy rates were highest in the Americas, reaching 64% . Europe was in second place with the hotel occupancy rates at 63%, followed by the Middle East and Africa at 49% and the Asia Pacific at 48%.

When it comes to the economic impact, the best metric to track is revenue per available room or RevPAR. The RevPar reached $93.27 in 2022, an 8.1% increase compared to 2019 . The average daily rate is up by 13.6%, which makes $148.83 for the same period. Occupancy rates are still not at the pre-pandemic level, but with only a 4.9% difference, they are getting there.

The revenue this sector generates has a tremendous impact. The money is used toward creating new jobs, developing infrastructure, and boosting local economies. Local communities and governments also benefit from the taxes and fees collected from accommodation providers.

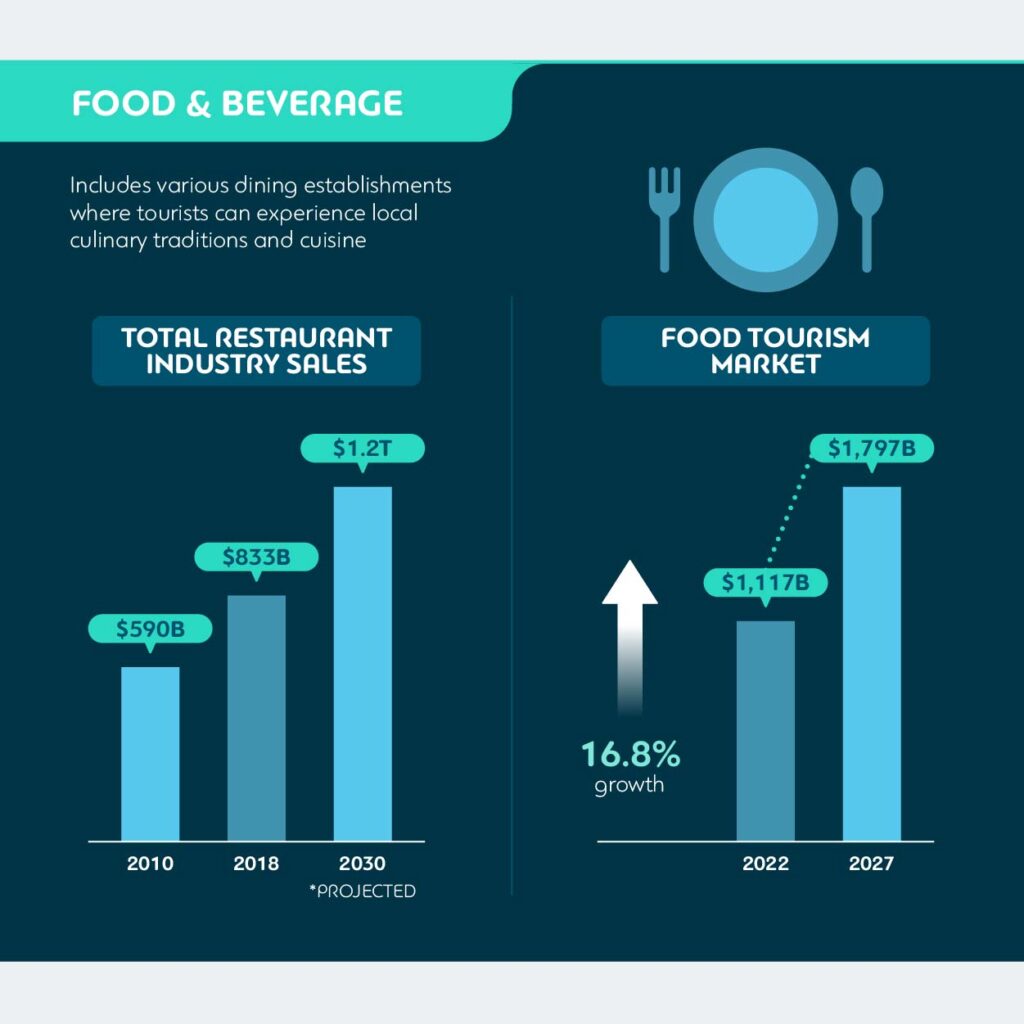

Food and Beverage in Tourism

The food and beverage tourism sector is quite diverse and doesn’t just include restaurants and cafes. It also encompasses various dining establishments where tourists can experience local culinary traditions and cuisine.

According to the National Restaurant Association research, the sales in the fine dining segment to travelers and visitors went down by 41% . However, total restaurant industry sales are projected to reach $.1.2 trillion by 2030 , and traveler purchases will significantly contribute to this positive development. The food tourism market is projected to reach $1,796.5 billion by 2027 in size, which is a 16.8% growth given that its size in 2022 is $1,116.7 billion.

One of the most extensive studies done recently encompassed the data from over 50,000 travelers to conclude that 64% of travelers base their traveling decisions on the food and drink options available at their destination.

There are two sides to the economic impact of food and beverage in tourism. First, it helps generate more direct revenue, and second, it fosters culinary entrepreneurship and can significantly boost agricultural and food production sectors. It can also help create more job opportunities.

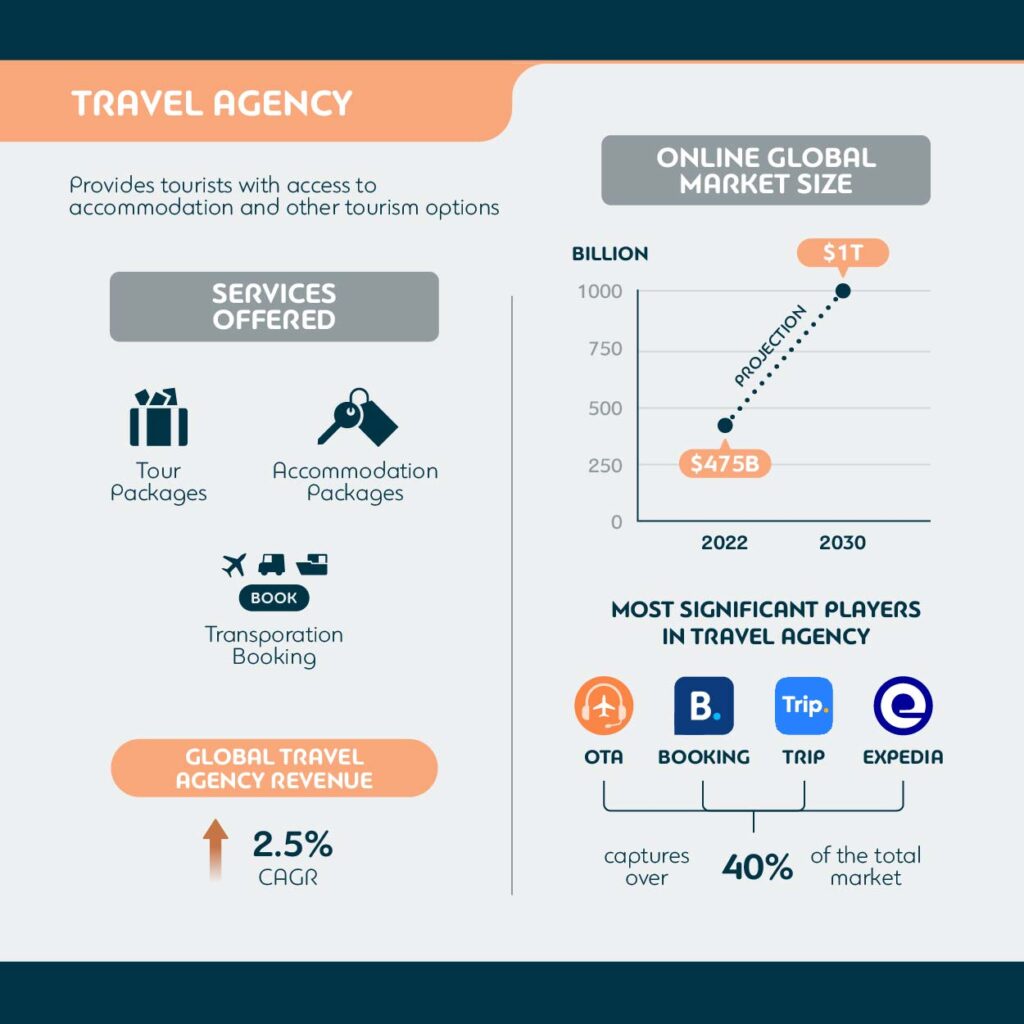

Travel Agencies and Tour Operators

Travel agencies are travel brands that specialize as intermediaries. They provide tourists with access to accommodation and other tourism options. Travel agencies can also offer various services, such as tour packages, accommodation reservations, and transportation booking .

Online travel agencies or OTAs are currently dominating this space. In 2022, the online global travel market size reached $475 billion and is projected to reach over one trillion US dollars by 2030. OTAs, including the most significant players such as Booking.com, Trip.com, and Expedia, captured over 40% of the total market .

While travel agencies continue to generate revenue, it’s important to note that global travel agency revenue is growing at a CAGR of 2.5% .

Travel agencies, both offline and online, are vital parts of the entire travel ecosystem. They both contribute to the whole sector and facilitate tourism overall. Travel agencies stimulate economic activity through other sectors as they are responsible for actually funneling tourists to destinations. They also help create new jobs, improve travel satisfaction, and ensure repeat business.

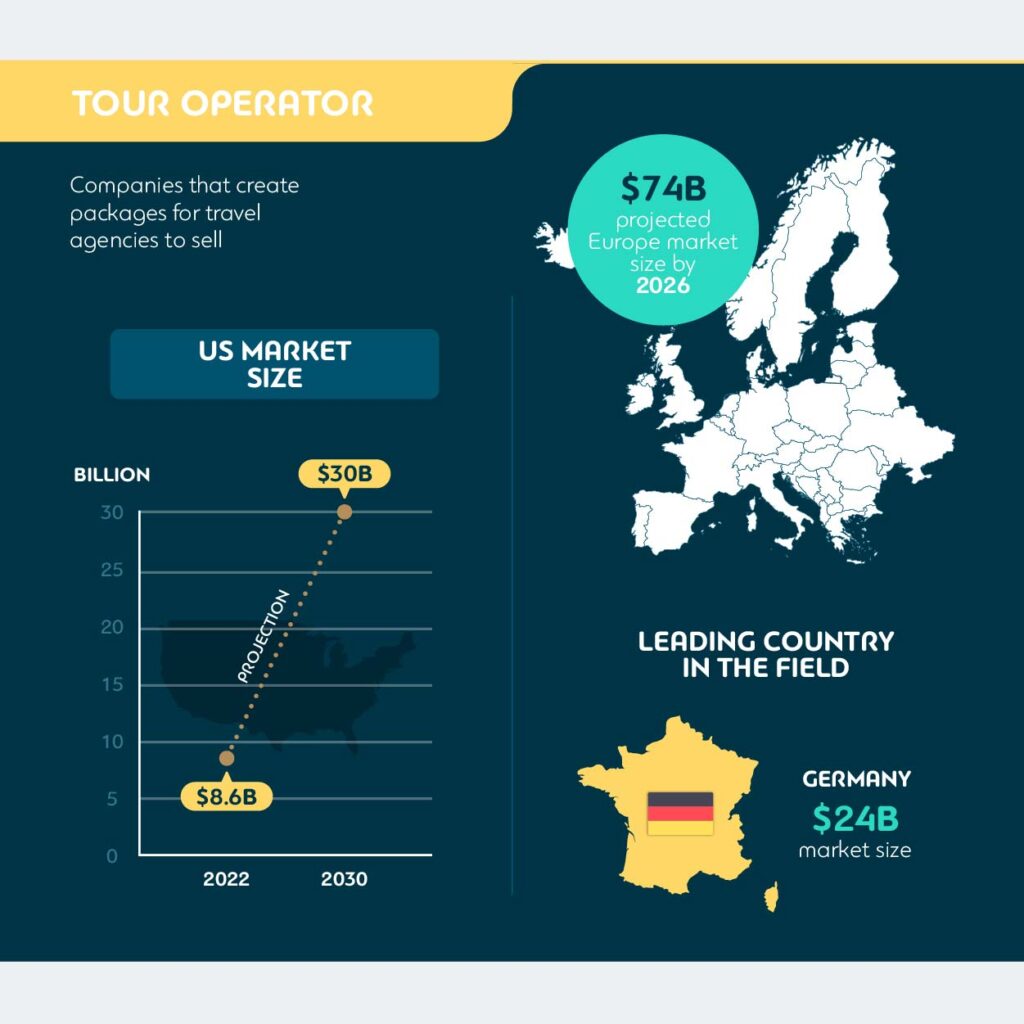

Tour operators, the companies that create packages for travel agencies to sell, also make up a sizable sub-sector. The market size of the tour operators industry in the US in 2022 was $8.6 billion . The US market will continue to grow at a CAGR of 17% to reach $30 billion in size by 2023 . Across the ocean, we have Europe, with its tour operator market size projected to reach $74 billion by 2026 , with Germany as the leader in the field with a market size of $24 billion.

Tourism Attractions

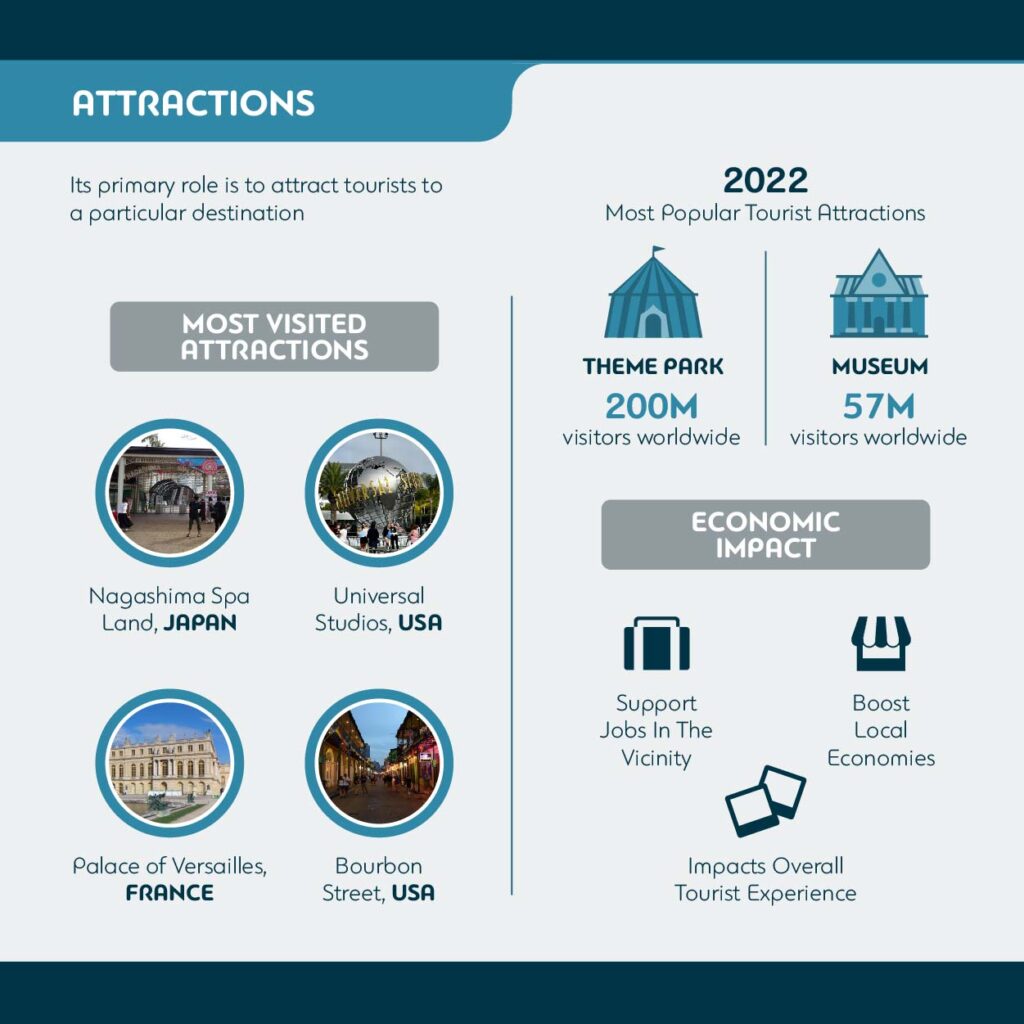

Tourism attraction is a place of interest. Generally speaking, tourism attractions’ primary role is to attract tourists to a particular destination. It can be anything from natural wonders and historical sites to museums and cultural landmarks.

According to the latest data , the most visited attractions are spread across the globe. These include Nagashima Spa Land, Japan; Universal Studio, USA; Palace of Versailles, France; and Bourbon Street, USA.

Theme parks are also among the most popular tourist attractions. In 2022, these parks attracted almost 200 million visitors . The museums are right behind theme parks, with an attendance of 57 million.

Tourism attractions also have a significant economic impact. They support jobs in the vicinity, boost local economies, and positively impact the overall tourist experience. They are also the number one factor that often drives visitation.

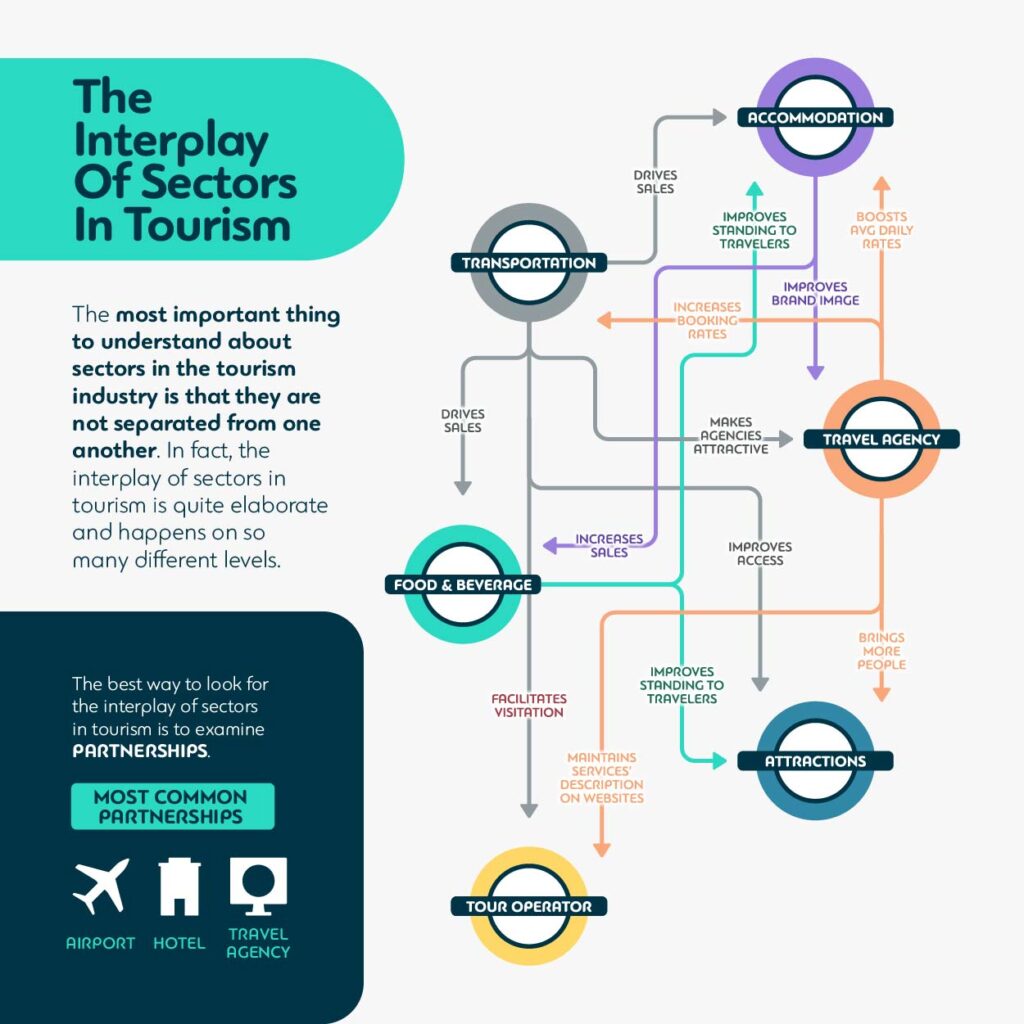

The most important thing to understand about sectors in the tourism industry is that they are not separated from one another. In fact, the interplay of sectors in tourism is quite elaborate and happens on so many different levels.

Let’s start with transportation. The affordable, dependable, and reliable means of transportation can facilitate visitation. Transportation is also responsible for the tourist experience. It can improve access to tourism attractions, make tourism agencies more attractive, and drive sales in the accommodation and food and beverage sectors.

Accommodation in tourism often interplays with travel agencies. It can help improve the brand image of a travel agency by enhancing the stay experience. It can also lead to increased food and beverage sales if the hotel or a resort has its own facilities, such as a restaurant or bar. In return, the food and beverage sector can improve the standing of accommodations and destinations in the eyes of travelers.

Travel agencies interplay with all of the sectors. The services they offer have to live up to the descriptions found on the websites. They can help boost the average daily rates for accommodation providers, increase booking rates at transportation companies, and bring more people to attractions.

The best way to look for the interplay of sectors in tourism is to closely examine partnerships. The transportation, accommodation, and other various travel brands have recognized the value of the interplay and decided to partner up to reap even more benefits.

The most common are partnerships between airlines, hotels, and travel agencies. It enables airlines to remain competitive while helping hotels and travel agencies maintain high customer satisfaction and enhanced travel experience.

The real-world example that comes to mind is Wilderness Safaris’ partnership with Qatar Airways . The big hospitality brand wanted its guests to arrive well-fed & rested, ready to engage in adventures in the great outdoors. Given that Qatar Airways received high marks in the catering and business class areas, it was the perfect pick for Wilderness Safaris.

Another real-world example is AEGAN’s partnership with Booking.com. Here, we have a transportation company and OTA joining forces together to reap unique benefits. AEGAN, an airline brand, wanted its customers to be able to conveniently check hotel availability in real-time, book accommodation at competitive prices, and benefit from friendly cancellation policies.

To encourage travelers to choose AEGAN services through Booking.com, the company also launched the Frequent Flyer Program and awarded consumers extra miles with every hotel booking using AEGAN transportation services.

As one of the largest industries, the tourism vertical contributes 10% of all jobs or 333 million . All sectors contribute to job creation and the global tourism market size of $2.4 trillion .

Accommodation and food and beverage sectors have a significant impact on the tourism industry as well. In terms of GDP, these sectors contributed 3.3% , a significant growth, given that the US average is 2.87% .

In raw numbers, it looks like the following. Global accommodation in tourism generates $903 billion . Almost half of it, 49%, comes from the USA sector. Europe, APAC, Middle East, and Africa contribute with their shares of 25%, 22%, 3%, and 2%, respectively. The global hotel and resort industry currently employs approximately 10.5 million people .

The global travel agency services industry’s revenue has reached $475 in 2023 . Travel agencies in the US employ 402,835 people. Over the last 5 years, the number of people working in the travel agency sector went up by 12%. On a global scale, travel agencies employ approximately 2 million people .

While every industry and sub-sector is unique, they all share a few things in common. In each one of them, you can find a couple of opportunities and encounter a few challenges. Let’s see what challenges and opportunities there are in each sector.

Transportation in tourism

Challenges:

- Ever-increasing prices of fuel – to remain profitable, airlines need to manage operational costs, and one of the enormous costs is fuel;

- Becoming green – transportation companies need to reduce carbon emissions and adopt sustainable travel practices, which can be challenging and costly;

- Infrastructure in remote destinations – building roads and developing infrastructure can be pretty challenging in remote destinations with tremendous tourism potential.

Opportunities:

- Using technological advancements – transportation technologies can help improve customer experience and improve operational efficiencies;

- Implementing sustainable practices – becoming eco-friendly can help brands attract environmentally conscious travelers;

- Improving connectivity – with connectivity expansion, transportation brands can help local economies and create new tourism opportunities.

Accommodation in tourism

- Online offer – as more and more competitors join online marketplaces, accommodation providers need to embrace a new paradigm;

- Overtourism – limited accommodation capacity is a massive problem in destinations where over-tourism is a norm;

- Guest safety and security – in some situations and locations, accommodation providers can struggle with ensuring guest safety and security.

- Going digital – embracing cutting-edge technologies can help enhance guest experience and ensure longer and repeat stays;

- Personalized accommodation – offering boutique and experiential lodging can help accommodation providers cater to modern travelers;

- Partnerships – aligning with relevant companies and local brands can help providers attract more travelers.

Food and beverage in tourism

- Quality and safety of food – upholding the highest food quality and safety standards can be challenging;

- Fluctuating demand – seasonal destinations can struggle with handling fluctuating food and beverage demand;

- Shifting dietary preferences – guests may have diverse dietary preferences, which require planning and management.

- Innovation – innovative dishes and fusion cuisines can attract guests who feel more adventurous;

- Farm-to-table – cooperating with local farmers can help bring fresh ingredients to restaurants;

- Focus on local cuisine – bringing local dishes into the spotlight can help attract people interested in authentic cuisine.

Travel agencies

- Harsh competition – travel agencies have to compete against hundreds of online travel booking platforms;

- Tailored services – many travelers look for personalized experiences, which can prove hard to provide if you are a small agency;

- Agility is required – getting ready for a wide range of disruptions is costly and hard to sustain at scale.

- Customization – offering unique packages can help generate more bookings;

- Multi-channel presence – being present across online and offline channels is paramount;

- Focus on a niche market – staying focused on a specific travel niche can help you truly cater to the needs of your target customers.

Tourism attractions

- Preservation – sustainable management of tourism attractions can be challenging;

- Seasonality – if traction generates the majority of the revenue through seasonal visitors, it can be a problem;

- Infrastructure demand – a growing number of visitors can cause infrastructure strain.

- Collaboration – partnerships can help create a better ecosystem;

- Interpretive guides and interactive displays – interpretive experiences can delight a wide range of visitors;

- Expanding offer – You can offer new activities to make the offer more attractive.

As you can see, the tourism industry landscape is quite comprehensive, with a lot of moving pieces on the board, and the best way to understand the vertical is to take a look at its subsectors.

Hopefully, now you understand transportation, accommodation, food and beverage, travel agencies, and tourism attraction sectors better. They are all intertwined, with many interplay activities. While the tourism sector comes with its fair share of challenges, there are also many opportunities. The current stats and projections tell us that all subsectors are prosperous and expected to grow in the foreseeable future.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Marc Truyols has a degree in Tourism from the University of the Balearic Islands. Marc has extensive experience in the leisure, travel and tourism industry. His skills in negotiation, hotel management, customer service, sales and hotel management make him a strong business development professional in the travel industry.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

What Is a Tourist Flow? 6 Characteristics

4 min. In recent decades, tourism has experienced a remarkable growth from an elitist activity to a mass phenomenon. According to the UNWTO, the turnover of tourism today equals, or even exceeds, exports of oil, automobiles or food products. It is a continuous flow of travellers that has become a key element in the socio-economic […]

From Screening to Hiring: A Guide to Effective Recruitment in the Travel Industry

6 min. The recruitment process of new employees is not based on a paradigm that applies across industries, instead, it revolves around best practices. The same goes for travel companies, including travel tech brands. We are talking about a very profitable market that reached $10.0 billion in 2023, attracting entrepreneurs and numerous workers. It simply […]

Unveiling the 13 Hottest Travel Trends of 2024

13 min. No one knows better than you how dynamic the realm of travel is. Dynamic shifts brought by technological strides, ever-changing traveler priorities, and global events are the new normal in 2024. How do you navigate this landscape that keeps transforming? You should familiarize yourself with the very travel trends that shape the world […]

What Are the 8 Sectors of Tourism Industry?

By Robert Palmer

Tourism is one of the most significant industries worldwide, generating income and creating job opportunities for millions of people. It is a dynamic and ever-evolving industry, with many different sectors that contribute to its success. In this article, we will explore the eight sectors of the tourism industry.

1. Accommodation

Accommodation is a crucial sector of the tourism industry, as it provides travelers with a place to stay during their trip. This sector includes hotels, motels, resorts, hostels, and vacation rentals. These accommodations can range from budget-friendly to luxury options.

2. Food and Beverage

The food and beverage sector is an integral part of tourism as it provides travelers with dining options during their trip. This sector includes restaurants, cafes, bars, food trucks, and other food establishments.

3. Transportation

Transportation is another critical sector of the tourism industry as it allows travelers to move around during their trip. This sector includes airlines, trains, buses, taxis, rental cars, and other modes of transportation.

4. Travel Trade

Travel trade involves tour operators and travel agents who provide services such as booking flights and accommodations for travelers. They also create packages that include various activities such as sightseeing tours or adventure excursions.

5. Attractions

The attractions sector includes all tourist destinations such as museums, art galleries, theme parks, historical sites or landmarks that attract visitors from around the world.

6. Events and Conferences

Events and conferences are another significant aspect of the tourism industry that brings people together for business or leisure purposes. This sector includes trade shows, exhibitions or conventions.

7. Adventure Tourism

Adventure tourism provides thrill-seeking travelers with activities like hiking, rock climbing, bungee jumping, scuba diving and other outdoor adventures.

8. Tourism Services

Tourism services refer to the support services that travelers need during their trip. This sector includes things like travel insurance, currency exchange, language translation services and more.

10 Related Question Answers Found

What are the eight sectors of tourism industry, what are the 8 sectors of tourism, what are the 8 tourism sectors, what are the main sectors of tourism industry, what are the sectors of tourism industry, what are the 8 types of tourism, what are the 8 tourism categories, what are topics in tourism industry, what is the main focus of tourism industry, what is the main element of tourism industry, backpacking - budget travel - business travel - cruise ship - vacation - tourism - resort - cruise - road trip - destination wedding - tourist destination - best places, london - madrid - paris - prague - dubai - barcelona - rome.

© 2024 LuxuryTraveldiva

The Tourism Industry: An Overview

- First Online: 30 September 2017

Cite this chapter

- Mark Anthony Camilleri 2

Part of the book series: Tourism, Hospitality & Event Management ((THEM))

101k Accesses

79 Citations

5 Altmetric

This chapter introduces its readers to the concept of tourism. It sheds light on the rationale for tourism, as it explains the tourists’ inherent motivations to travel. It also describes different aspects that together make up the tourism industry. Tourists travel to destinations that are accessible to them. They require accommodation if they are visiting a place for more than 24 h. Leisure and business travellers may also visit attractions, and engage themselves in recreational activities. Hence, the tourist destinations should have the right amenities and facilities. In this light, this chapter clarifies how destinations may offer different products to satisfy a wide array of tourists. Tourism products can include; urban (or city) tourism, seaside tourism , rural tourism , ecotourism , wine tourism , culinary tourism , health tourism, medical tourism , religious tourism , cultural (or heritage) tourism , sports tourism , educational tourism , business tourism (including meetings, incentives, conferences and events), among others. In conclusion, this chapter lists major points of interest in North America to clarify how diverse destinations may be appealing to different tourists, for many reasons.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Author information

Authors and affiliations.

Department of Corporate Communication, University of Malta, Msida, Malta

Mark Anthony Camilleri

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Mark Anthony Camilleri .

Rights and permissions

Reprints and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Camilleri, M.A. (2018). The Tourism Industry: An Overview. In: Travel Marketing, Tourism Economics and the Airline Product. Tourism, Hospitality & Event Management. Springer, Cham. https://doi.org/10.1007/978-3-319-49849-2_1

Download citation

DOI : https://doi.org/10.1007/978-3-319-49849-2_1

Published : 30 September 2017

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-49848-5

Online ISBN : 978-3-319-49849-2

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

What are Sectors of Tourism? Accommodation, Transportation, Intermediaries

- Post last modified: 28 August 2021

- Reading time: 15 mins read

- Post category: Tourism

What are Sectors of Tourism?

Tourism is an economic, environmental, and socio-cultural phenomenon. It reaches various sectors of the economy and society and it involves many different forms, such as leisure tourism, sports tourism, cultural tourism, business tourism, conference, and exhibition tourism, tourism for religious reasons, and Eco-tourism.

Table of Content

- 1 What are Sectors of Tourism?

- 2 Sectors of Tourism

- 3.1 Resort Hotel

- 3.2 Airport Hotel

- 3.3 Bed & Breakfast (B&B)

- 4.1 Transport by Air

- 4.2 Transport by Sea or Water

- 4.3 Road Transport

- 4.4 Rail Transport

- 5.1 Types of Intermediaries

- 5.2 Travel Agencies

- 5.3 Tour Operators

- 5.4 Corporate client travel agencies

- 5.5 Sightseeing tour companies

- 6 Merits of using Intermediaries (Travel Agency)

The broad nature of tourism makes it quite difficult to be defined and there is no universally accepted definition of it As tourism development has both positive and negative effects on the tourist location, the study will also discuss what are the factors reducing the positive effects of tourism and then what strategies should be adopted in order to reduce the negative effects and maximize the positive.

Sectors of Tourism

These are some various sectors of the tourism industry:

Accommodation

- Transportation

- Intermediaries

Accommodation is a temporary home for travelers. It ranges from simple sleeping places to deluxe suites for eating, entertainment, and sleeping. Travelers can stay overnight in any kind of lodging from an African treehouse to a castle in Europe.

The accommodation industry is made up of hotels, motels (motor hotels), resort hotels, campgrounds, hostels, and guesthouses. Hotels are classified in various ways. One of the most common ways is by location, such as resort, city center, airport, suburban, or highway.

Types of Hotels:

Resort Hotel

Airport hotel, bed & breakfast (b&b).

A resort hotel can be considered as a destination itself. It offers a full range of services and amenities for the guests to enjoy their vacations within the property. Typical features of a resort hotel include restaurants, shops, sporting facilities, pools, spas, casinos, and even private beaches.

Examples: 1. Hong Kong Gold Coast Hotel , 2. Mission Hills Resort Shenzhen in China .

Airport hotels are located in or near airports. This type of accommodation is selected by travelers for necessity. A major feature of airport properties is convenient for early morning departures or late evening arrivals. It is mainly for airline crew members and passengers with overnight layovers r canceled flights.

Example: Hong Kong Regal Airport Hotel .

B&B is a guest house or private house providing clean, attractive accommodation and breakfast. The B&Bs offer a home-like atmosphere. The owner of the B&B usually lives on the premises and provides all the necessary labor. Community breakfasts with other lodgers and hosts enhance this atmosphere.

The other way of classification is rating (grading), for example, five-star, four-star, three-star, two-star hotels. This grading system is commonly used in China.

Types of Transportation

There are a number of different types of transportation modes: air, water, road and rail. The various types of transport modes can be subdivided into:

Transport by Air

Transport by sea or water, road transport, rail transport.

Air Transport First-class travelers enjoy the privacy of their own private cabin area with seats that can be converted into 6’6″ flatbeds. Plenty of good food, in-flight entertainment, and a personal video screen is provided.

They are also welcome to use the arrivals lounge. Business-class travelers have wide comfortable seats with plenty of legroom. They can also enjoy good food, free drinks, and complimentary newspapers. Economy-class travelers though have narrower seats, still are provided with suitable services and meals.

In general, most of the airlines provide different classes on board; they are first, business and economy class. Some airlines nowadays introduced ‘premium economy class’. This class of service offers better individual service (e.g. more comfortable seat) to passengers at a lower price comparing with business-class service.

What is a cruise? A cruise is a vacation trip by ship. This definition excludes traveling by water for primarily transportation purposes. It offers the passengers a chance to relax in comfortable surroundings, with attentive service, good food, and a liner that changes the scenery from time to time.

Despite the potential positive impact of cruise tourism to the local economy, there is also a danger the local tourism industry faces is that cruise tourism can displace other forms of tourism as hotels and tours fill with cruise passengers, reducing the capacity for other tourists.

Cruise ships are basically self-contained destinations where guests live, eat, are entertained, and travel. Cruises are voyages taken for pleasure and not only for the purpose of transport. Most cruises start and end at the same port. A cruise with all-inclusive fare nowadays may combine:

Transportation costs such as airfare between cruise passengers’ point of origin and the destination port. Sometimes the cost of accommodation at the destination port is included in the all-inclusive fare.

Traveling by road is the most flexible and economical form of mass transportation. Modern motorway networks have made major cities easily accessible.

Coach Services

- Local Service.

- Regional – between Hong Kong and Shenzhen.

- International express services – services between Canada and United States in North America.

- Tour and sightseeing operations.

- Shuttle buses for airport transfers.

Car Services

Car travelers have greater freedom in choosing their route, destination, and timing of their journey. Examples are Private cars for rental, Taxis, Private cars.

Business and vacation travelers book car rentals for different reasons. Business travelers are looking for a convenient and reliable form of ground transportation to get them from point A to point B with the minimum amount of fuss and bother.

Vacation travelers are looking for a comfortable form of transportation to places where they plan to visit but these places are not easily accessible by public transportation.

The importance of rail travel has given way to private cars and air travel, but is picking up now since a number of services have been designed specifically for the tourist trade on a local and international level.

Examples include “Orient Express” in Europe and “Indian-Pacific” across Australia. Others include the “Trans-Siberian Railway” and the “Bullet Train” of Japan.

Examples of Other Rail Transport: Underground train services in a most urban city, Airport express train service; and Scenic rails.

One of the world’s eminent traveling experiences is to travel on a luxury train. Traversing the world’s varied landscapes along alternative train routes, the train combines all the comfort and luxury of a five-star hotel with a globally unparalleled journey.

Intermediaries in Tourism

Intermediaries are “Middle-Men”, acting as a link between the customer and the supplier. In the travel business, the suppliers consist of airlines, cruise and ferry companies, coach/bus companies, railways, hotels and motels, and car rental agencies.

The customers include holidaymakers, business travelers, and those visiting friends and relatives.

Tourism and the Structure of the Tourism Industry Travel agencies, in their role as “middlemen,” combine tourism activities originally carried out on an unconnected, individual basis, linking customers with tourism service suppliers and thereby promoting the development of the tourism industry.

Tourism service suppliers include airlines, hotels, restaurants, car hire companies, and companies that operate reception services at destinations.

Types of Intermediaries

Types of Intermediaries are chiefly divided into two categories:

Travel Agencies

Tour operators.

Appointed representatives such as tourism service suppliers or wholesalers are authorized to sell customers a series of tourism-related products and services such as airline tickets, cruise liner berths, hotel rooms, car rentals, and train tickets, etc.

Their role is to provide guests with relevant tourism consultant services, book travel products on behalf of customers, and provide special services for customers in accordance with their needs, etc. Their income is mainly derived from agency commissions.

- Wholesalers.

- Inbound travel agencies/outbound travel agencies.

Wholesalers buy large volumes of products at a relatively low price from tourism service suppliers such as transport companies, hotels, and tourist attractions, and then sell them to tourism retailers that then sell to the retail market.

They won’t normally sell travel products directly to the general public. However, some powerful travel agencies will also establish retail departments to sell these products directly to customers.

There are also some wholesalers that are operated by a number of airlines and chain hotels and promote package tours put together from their own products.

Retailers order large volumes of various different types of travel products from tourism service suppliers or wholesalers such as transport companies, hotel, and tourist attraction products and services, then design and combine these individual products and add in their own services such as tour guide services, etc., turning them into packaged travel products, which are then sold to customers.

Outbound tour groups will take locals to another city or country and provide travel products such as transport, accommodation, and tickets to tourist attractions. Generally speaking.

This type of intermediary will regularly organize groups to take people from Hong Kong all over the world, wherein they will be accompanied by a group leader or tour guide from the very start.

Corporate client travel agencies

Sightseeing tour companies, merits of using intermediaries (travel agency), please share this share this content.

- Opens in a new window X

- Opens in a new window Facebook

- Opens in a new window Pinterest

- Opens in a new window LinkedIn

- Opens in a new window Reddit

- Opens in a new window WhatsApp

You Might Also Like

Tourist places to visit in telangana (2024), medical tourism in india: challenges, growth, scope, suggestions to develop, what is travel trade history, travel agency, tour operators, adventure tourism: history, advantages, disadvantages, destinations in india, tourist places to visit in punjab (2024), types of tourism: based on nationality, duration, number of tourists & classification, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism’s Importance for Growth Highlighted in World Economic Outlook Report

- All Regions

- 10 Nov 2023

Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector’s rapid recovery will have on certain economies worldwide.

According to the World Economic Outlook (WEO) Report , the global economy will grow an estimated 3.0% in 2023 and 2.9% in 2024. While this is higher than previous forecasts, it is nevertheless below the 3.5% rate of growth recorded in 2022, pointing to the continued impacts of the pandemic and Russia's invasion of Ukraine, and from the cost-of-living crisis.

Tourism key sector for growth

The WEO report analyses economic growth in every global region, connecting performance with key sectors, including tourism. Notably, those economies with "large travel and tourism sectors" show strong economic resilience and robust levels of economic activity. More specifically, countries where tourism represents a high percentage of GDP have recorded faster recovery from the impacts of the pandemic in comparison to economies where tourism is not a significant sector.

As the report Foreword notes: "Strong demand for services has supported service-oriented economies—including important tourism destinations such as France and Spain".

Looking Ahead

The latest outlook from the IMF comes on the back of UNWTO's most recent analysis of the prospects for tourism, at the global and regional levels. Pending the release of the November 2023 World Tourism Barometer , international tourism is on track to reach 80% to 95% of pre-pandemic levels in 2023. Prospects for September-December 2023 point to continued recovery, driven by the still pent-up demand and increased air connectivity particularly in Asia and the Pacific where recovery is still subdued.

Related links

- Download the News Release on PDF

- UNWTO World Tourism Barometer

- IMF World Economic Outlook

Category tags

Related content, international tourism reached 97% of pre-pandemic level..., international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., international tourism swiftly overcoming pandemic downturn.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 1. History and Overview

1.1 What is Tourism?

Before engaging in a study of tourism , let’s have a closer look at what this term means.

Definition of Tourism

There are a number of ways tourism can be defined, and for this reason, the United Nations World Tourism Organization (UNWTO) embarked on a project from 2005 to 2007 to create a common glossary of terms for tourism. It defines tourism as follows:

Tourism is a social, cultural and economic phenomenon which entails the movement of people to countries or places outside their usual environment for personal or business/professional purposes. These people are called visitors (which may be either tourists or excursionists; residents or non-residents) and tourism has to do with their activities, some of which imply tourism expenditure (United Nations World Tourism Organization, 2008).

Using this definition, we can see that tourism is not just the movement of people for a number of purposes (whether business or pleasure), but the overall agglomeration of activities, services, and involved sectors that make up the unique tourist experience.

Tourism, Travel, and Hospitality: What are the Differences?

It is common to confuse the terms tourism , travel , and hospitality or to define them as the same thing. While tourism is the all-encompassing umbrella term for the activities and industry that create the tourist experience, the UNWTO (2020) defines travel as the activity of moving between different locations often for any purpose but more so for leisure and recreation (Hall & Page, 2006). On the other hand, hospitality can be defined as “the business of helping people to feel welcome and relaxed and to enjoy themselves” (Discover Hospitality, 2015, p. 3). Simply put, the hospitality industry is the combination of the accommodation and food and beverage groupings, collectively making up the largest segment of the industry (Go2HR, 2020). You’ll learn more about accommodations and F & B in Chapter 3 and Chapter 4 , respectively.

Definition of Tourist and Excursionist

Building on the definition of tourism, a commonly accepted description of a tourist is “someone who travels at least 80 km from his or her home for at least 24 hours, for business or leisure or other reasons” (LinkBC, 2008, p.8). The United Nations World Tourism Organization (1995) helps us break down this definition further by stating tourists can be:

- Domestic (residents of a given country travelling only within that country)

- Inbound (non-residents travelling in a given country)

- Outbound (residents of one country travelling in another country)

Excursionists on the other hand are considered same-day visitors (UNWTO, 2020). Sometimes referred to as “day trippers.” Understandably, not every visitor stays in a destination overnight. It is common for travellers to spend a few hours or less to do sightseeing, visit attractions, dine at a local restaurant, then leave at the end of the day.

The scope of tourism, therefore, is broad and encompasses a number of activities and sectors.

Spotlight On: United Nations World Tourism Organization (UNWTO)

UNWTO is the United Nations agency responsible “for the promotion of responsible, sustainable and universally accessible tourism” (UNWTO, 2014b). Its membership includes 159 countries and over 500 affiliates such as private companies, research and educational institutions, and non-governmental organizations. It promotes tourism as a way of developing communities while encouraging ethical behaviour to mitigate negative impacts. For more information, visit the UNWTO website .

NAICS: The North American Industry Classification System

Given the sheer size of the tourism industry, it can be helpful to break it down into broad industry groups using a common classification system. The North American Industry Classification System (NAICS) was jointly created by the Canadian, US, and Mexican governments to ensure common analysis across all three countries (British Columbia Ministry of Jobs, Tourism and Skills Training, 2013a). The tourism-related groupings created using NAICS are (in alphabetical order):

- Accommodation

- Food and beverage services (commonly known as “F & B”)

- Recreation and entertainment

- Transportation

- Travel services

These industry groups (also commonly known as sectors) are based on the similarity of the “labour processes and inputs” used for each (Government of Canada, 2013). For instance, the types of employees and resources required to run an accommodation business whether it be a hotel, motel, or even a campground are quite similar. All these businesses need staff to check in guests, provide housekeeping, employ maintenance workers, and provide a place for people to sleep. As such, they can be grouped together under the heading of accommodation. The same is true of the other four groupings, and the rest of this text explores these industry groups, and other aspects of tourism, in more detail.

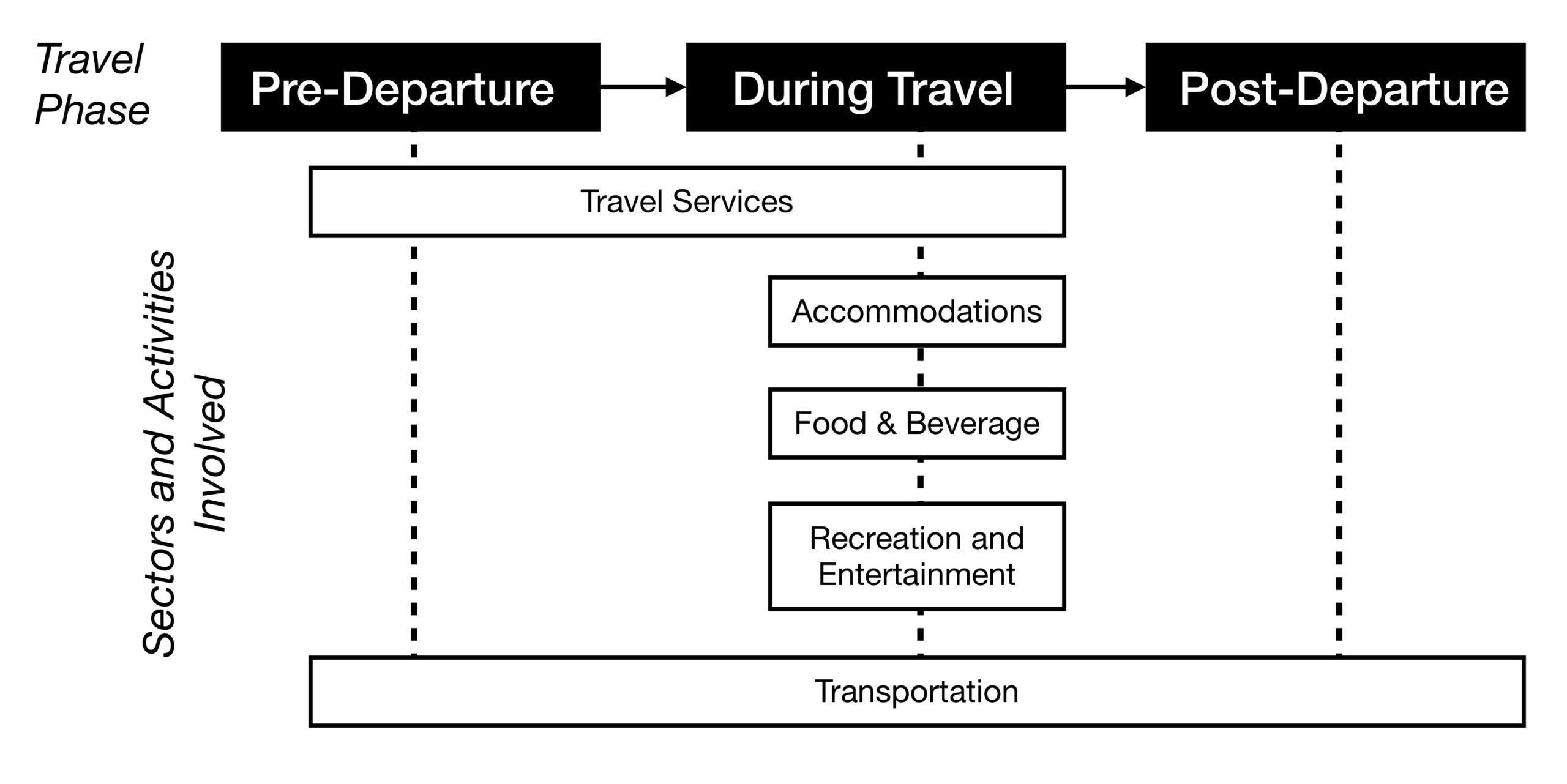

It is typical for the entire tourist experience to involve more than one sector. The combination of sectors that supply and distribute the needed tourism products, services, and activities within the tourism system is called the Tourism Supply Chain. Often, these chains of sectors and activities are dependent upon each other’s delivery of products and services. Let’s look at a simple example below that describes the involved and sometimes overlapping sectoral chains in the tourism experience:

Before we seek to understand the five tourism sectors in more detail, it’s important to have an overview of the history and impacts of tourism to date.

Long Descriptions

Figure 1.2 long description: Diagram showing the tourism supply chain. This includes the phases of travel and the sectors and activities involved during each phase.

There are three travel phases: pre-departure, during travel, and post-departure.

Pre-departure, tourists use the travel services and transportation sectors.

During travel, tourists use the travel services, accommodations, food and beverage, recreation and entertainment, and transportation sectors.

Post-departure, tourists use the transportation sector.

[Return to Figure 1.2]

Media Attributions

- Front Desk by Staying LEVEL is licensed under a CC BY-NC 4.0 Licence .

Tourism according the the UNWTO is a social, cultural and economic phenomenon which entails the movement of people to countries or places outside their usual environment for personal or business/professional purposes.

UN agency responsible for promoting responsible, sustainable, and universally accessible tourism worldwide.

Moving between different locations for leisure and recreation.

The accommodations and food and beverage industry groupings.

someone who travels at least 80 km from his or her home for at least 24 hours, for business or leisure or other reasons

A same-day visitor to a destination. Their trip typically ends on the same day when they leave the destination.

A way to group tourism activities based on similarities in business practices, primarily used for statistical analysis.

Introduction to Tourism and Hospitality in BC - 2nd Edition Copyright © 2015, 2020, 2021 by Morgan Westcott and Wendy Anderson, Eds is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Further recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Sustainable tourism

Related sdgs, promote sustained, inclusive and sustainable ....

Description

Publications.

Tourism is one of the world's fastest growing industries and an important source of foreign exchange and employment, while being closely linked to the social, economic, and environmental well-being of many countries, especially developing countries. Maritime or ocean-related tourism, as well as coastal tourism, are for example vital sectors of the economy in small island developing States (SIDS) and coastal least developed countries (LDCs) (see also: The Potential of the Blue Economy report as well as the Community of Ocean Action on sustainable blue economy).

The World Tourism Organization defines sustainable tourism as “tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities".

Based on General assembly resolution 70/193, 2017 was declared as the International Year of Sustainable Tourism for Development.

In the 2030 Agenda for Sustainable Development SDG target 8.9, aims to “by 2030, devise and implement policies to promote sustainable tourism that creates jobs and promotes local culture and products”. The importance of sustainable tourism is also highlighted in SDG target 12.b. which aims to “develop and implement tools to monitor sustainable development impacts for sustainable tourism that creates jobs and promotes local culture and products”.

Tourism is also identified as one of the tools to “by 2030, increase the economic benefits to Small Island developing States and least developed countries” as comprised in SDG target 14.7.

In the Rio+20 outcome document The Future We want, sustainable tourism is defined by paragraph 130 as a significant contributor “to the three dimensions of sustainable development” thanks to its close linkages to other sectors and its ability to create decent jobs and generate trade opportunities. Therefore, Member States recognize “the need to support sustainable tourism activities and relevant capacity-building that promote environmental awareness, conserve and protect the environment, respect wildlife, flora, biodiversity, ecosystems and cultural diversity, and improve the welfare and livelihoods of local communities by supporting their local economies and the human and natural environment as a whole. ” In paragraph 130, Member States also “call for enhanced support for sustainable tourism activities and relevant capacity-building in developing countries in order to contribute to the achievement of sustainable development”.

In paragraph 131, Member States “encourage the promotion of investment in sustainable tourism, including eco-tourism and cultural tourism, which may include creating small- and medium-sized enterprises and facilitating access to finance, including through microcredit initiatives for the poor, indigenous peoples and local communities in areas with high eco-tourism potential”. In this regard, Member States also “underline the importance of establishing, where necessary, appropriate guidelines and regulations in accordance with national priorities and legislation for promoting and supporting sustainable tourism”.

In 2002, the World Summit on Sustainable Development in Johannesburg called for the promotion of sustainable tourism development, including non-consumptive and eco-tourism, in Chapter IV, paragraph 43 of the Johannesburg Plan of Implementation.

At the Johannesburg Summit, the launch of the “Sustainable Tourism – Eliminating Poverty (ST-EP) initiative was announced. The initiative was inaugurated by the World Tourism Organization, in collaboration with UNCTAD, in order to develop sustainable tourism as a force for poverty alleviation.

The UN Commission on Sustainable Development (CSD) last reviewed the issue of sustainable tourism in 2001, when it was acting as the Preparatory Committee for the Johannesburg Summit.

The importance of sustainable tourism was also mentioned in Agenda 21.

For more information and documents on this topic, please visit this link

UNWTO Annual Report 2016

In December 2015, the United Nations General Assembly declared 2017 as the International Year of Sustainable Tourism for Development. This is a unique opportunity to devote a year to activities that promote the transformational power of tourism to help us reach a better future. This important cele...

UNWTO Annual Report 2015

2015 was a landmark year for the global community. In September, the 70th Session of the United Nations General Assembly adopted the Sustainable Development Goals (SDGs), a universal agenda for planet and people. Among the 17 SDGs and 169 associated targets, tourism is explicitly featured in Goa...

Emerging Issues for Small Island Developing States

The 2012 UNEP Foresight Process on Emerging Global Environmental Issues primarily identified emerging environmental issues and possible solutions on a global scale and perspective. In 2013, UNEP carried out a similar exercise to identify priority emerging environmental issues that are of concern to ...

Transforming our World: The 2030 Agenda for Sustainable Development

This Agenda is a plan of action for people, planet and prosperity. It also seeks to strengthen universal peace in larger freedom, We recognize that eradicating poverty in all its forms and dimensions, including extreme poverty, is the greatest global challenge and an indispensable requirement for su...

Status and Trends of Caribbean Coral Reefs: 1970-2012

Previous Caribbean assessments lumped data together into a single database regardless of geographic location, reef environment, depth, oceanographic conditions, etc. Data from shallow lagoons and back reef environments were combined with data from deep fore-reef environments and atolls. Geographic c...

15 Years of the UNWTO World Tourism Network on Child Protection: A Compilation of Good Practices

Although it is widely recognized that tourism is not the cause of child exploitation, it can aggravate the problem when parts of its infrastructure, such as transport networks and accommodation facilities, are exploited by child abusers for nefarious ends. Additionally, many other factors that contr...

Towards Measuring the Economic Value of Wildlife Watching Tourism in Africa

Set against the backdrop of the ongoing poaching crisis driven by a dramatic increase in the illicit trade in wildlife products, this briefing paper intends to support the ongoing efforts of African governments and the broader international community in the fight against poaching. Specifically, this...

Natural Resources Forum: Special Issue Tourism

The journal considers papers on all topics relevant to sustainable development. In addition, it dedicates series, issues and special sections to specific themes that are relevant to the current discussions of the United Nations Commission on Sustainable Development (CSD)....

Thailand: Supporting Sustainable Development in Thailand: A Geographic Clusters Approach

Market forces and government policies, including the Tenth National Development Plan (2007-2012), are moving Thailand toward a more geographically specialized economy. There is a growing consensus that Thailand’s comparative and competitive advantages lie in amenity services that have high reliance...

Natural Resources Forum, a United Nations Sustainable Development Journal (NRF)

Natural Resources Forum, a United Nations Sustainable Development Journal, seeks to address gaps in current knowledge and stimulate relevant policy discussions, leading to the implementation of the sustainable development agenda and the achievement of the Sustainable...

Road Map on Building a Green Economy for Sustainable Development in Carriacou and Petite Martinique, Grenada

This publication is the product of an international study led by the Division for Sustainable Development (DSD) of the United Nations Department of Economic and Social Affairs (UNDESA) in cooperation with the Ministry of Carriacou and Petite Martinique Affairs and the Ministry of Environment, Foreig...

UN Ocean Conference 2025

Our Ocean, Our Future, Our Responsibility “The ocean is fundamental to life on our planet and to our future. The ocean is an important source of the planet’s biodiversity and plays a vital role in the climate system and water cycle. The ocean provides a range of ecosystem services, supplies us with

UN Ocean Conference 2022

The UN Ocean Conference 2022, co-hosted by the Governments of Kenya and Portugal, came at a critical time as the world was strengthening its efforts to mobilize, create and drive solutions to realize the 17 Sustainable Development Goals by 2030.

58th Session of the Commission for Social Development – CSocD58

22nd general assembly of the united nations world tourism organization, world tourism day 2017 official celebration.

This year’s World Tourism Day, held on 27 September, will be focused on Sustainable Tourism – a Tool for Development. Celebrated in line with the 2017 International Year of Sustainable Tourism for Development, the Day will be dedicated to exploring the contribution of tourism to the Sustainable Deve

World Tourism Day 2016 Official Celebration

Accessible Tourism for all is about the creation of environments that can cater for the needs of all of us, whether we are traveling or staying at home. May that be due to a disability, even temporary, families with small children, or the ageing population, at some point in our lives, sooner or late

4th Global Summit on City Tourism

The World Tourism Organisation (UNWTO) and the Regional Council for Tourism of Marrakesh with support of the Government of Morroco are organizing the 4th Global Summit on City Tourism in Marrakesh, Morroco (9-10 December 2015). International experts in city tourism, representatives of city DMOs, of

2nd Euro-Asian Mountain Resorts Conference

The World Tourism Organisation (UNWTO) and Ulsan Metropolitan City with support of the Government of the Republic of Korea are organizing the 2nd Euro-Asian Mountain Resorts Conference, in Ulsan, Republic of Korea (14 - 16 October 2015). Under the title “Paving the Way for a Bright Future for Mounta

21st General Assembly of the United Nations World Tourism Organization

Unwto regional conference enhancing brand africa - fostering tourism development.

Tourism is one of the Africa’s most promising sectors in terms of development, and represents a major opportunity to foster inclusive development, increase the region’s participation in the global economy and generate revenues for investment in other activities, including environmental preservation.

- January 2017 International Year of Tourism In the context of the universal 2030 Agenda for Sustainable Development and the Sustainable Development Goals (SDGs), the International Year aims to support a change in policies, business practices and consumer behavior towards a more sustainable tourism sector that can contribute to the SDGs.

- January 2015 Targets 8.9, 12 b,14.7 The 2030 Agenda for Sustainable Development commits Member States, through Sustainable Development Goal Target 8.9 to “devise and implement policies to promote sustainable tourism that creates jobs and promotes local culture and products”. The importance of sustainable tourism, as a driver for jobs creation and the promotion of local culture and products, is also highlighted in Sustainable Development Goal target 12.b. Tourism is also identified as one of the tools to “increase [by 2030] the economic benefits to Small Island developing States and least developed countries”, through Sustainable Development Goals Target 14.7.

- January 2012 Future We Want (Para 130-131) Sustainable tourism is defined as a significant contributor “to the three dimensions of sustainable development” thanks to its close linkages to other sectors and its ability to create decent jobs and generate trade opportunities. Therefore, Member States recognize “the need to support sustainable tourism activities and relevant capacity-building that promote environmental awareness, conserve and protect the environment, respect wildlife, flora, biodiversity, ecosystems and cultural diversity, and improve the welfare and livelihoods of local communities” as well as to “encourage the promotion of investment in sustainable tourism, including eco-tourism and cultural tourism, which may include creating small and medium sized enterprises and facilitating access to finance, including through microcredit initiatives for the poor, indigenous peoples and local communities in areas with high eco-tourism potential”.

- January 2009 Roadmap for Recovery UNWTO announced in March 2009 the elaboration of a Roadmap for Recovery to be finalized by UNWTO’s General Assembly, based on seven action points. The Roadmap includes a set of 15 recommendations based on three interlocking action areas: resilience, stimulus, green economy aimed at supporting the tourism sector and the global economy.

- January 2008 Global Sustainable Tourism Criteria The Global Sustainable Tourism Criteria represent the minimum requirements any tourism business should observe in order to ensure preservation and respect of the natural and cultural resources and make sure at the same time that tourism potential as tool for poverty alleviation is enforced. The Criteria are 41 and distributed into four different categories: 1) sustainability management, 2) social and economic 3) cultural 4) environmental.

- January 2003 1st Int. Conf. on Climate Change and Tourism The conference was organized in order to gather tourism authorities, organizations, businesses and scientists to discuss on the impact that climate change can have on the tourist sector. The event took place from 9 till 11 April 2003 in Djerba, Tunisia.

- January 2003 WTO becomes a UN specialized body By Resolution 453 (XV), the Assembly agreed on the transformation of the WTO into a United Nations specialized body. Such transformation was later ratified by the United Nations General Assembly with the adoption of Resolution A/RES/58/232.

- January 2002 World Ecotourism Summit Held in May 2002, in Quebec City, Canada, the Summit represented the most important event in the framework of the International Year of Ecosystem. The Summit identified as main themes: ecotourism policy and planning, regulation of ecotourism, product development, marketing and promotion of ecotourism and monitoring costs and benefits of ecotourism.

- January 1985 Tourism Bill of Rights and Tourist Code At the World Tourism Organization Sixth Assembly held in Sofia in 1985, the Tourism Bill of Rights and Tourist Code were adopted, setting out the rights and duties of tourists and host populations and formulating policies and action for implementation by states and the tourist industry.

- January 1982 Acapulco Document Adopted in 1982, the Acapulco Document acknowledges the new dimension and role of tourism as a positive instrument towards the improvement of the quality of life for all peoples, as well as a significant force for peace and international understanding. The Acapulco Document also urges Member States to elaborate their policies, plans and programmes on tourism, in accordance with their national priorities and within the framework of the programme of work of the World Tourism Organization.

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).