- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best SEO Services (2024 Rankings)

- Best Mass Texting Services 2024

- Best SEO Software 2024

- Best Email Marketing Software 2024

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (June 2024)

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

5 Best Backpacker Travel Insurance Companies of 2024

Explore our top picks for travel insurance for backpacking trips and compare options to find the right coverage below.

in under 2 minutes

with our comparison partner, Squaremouth

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

The best travel insurance for backpacking trips is Travelex due to its affordable coverage for mult-destination trips. Travelex offers three plan options and a Travel America plan for backpackers making their way across the states.

From beachfront hostels in Thailand to campgrounds in Europe, a backpacker insurance policy can help you enjoy your adventure with peace of mind. Whether you’re traveling as a digital nomad or launching into adventure sports like trekking or scuba diving, travel insurance can cover the cost of unforeseen events or accidents during short or long-term backpacking trips.

Key Features To Look For in Backpacker Travel Insurance

Backpacker travel insurance is subject to your individual needs. According to the U.S. Department of State, the government does not cover medical bills overseas. Therefore, the agency recommends travel medical emergency insurance, especially if you’re participating in adventure activities. However, not all travel insurance companies cover adventure sports.

Trip interruption insurance can help you prepare for potential cancellations and flight delays, offering reimbursement of prepaid costs if interruptions occur for a covered reason. Emergency evacuation coverage is important in the event of natural disasters or civil unrest, especially if you plan on adventuring in rural areas. Ensuring your policy offers baggage and personal effects coverage also offers a financial safety net for lost or stolen belongings, including sporting gear.

While you may be able to find basic travel insurance with these features, the benefit limits may vary. It’s also important to note that not all policies cover adventure sports gear or medical expenses. Make sure to look for a plan with this coverage if you plan on adding sporting events to your backpacking trip.

Top 5 Travel Insurance Providers for Backpackers

Here is our list of travel insurance plans and providers to suit backpackers:

- Travelex Insurance : Our pick for families

- AIG Travel Guard : Our pick for families

- IMG Travel Insurance : Our pick for medical coverage

- Allianz Global Assistance: Our pick for concierge services

- World Nomads: Our pick for adventure travelers

Compare Backpacking Travel Insurance Companies

We requested online quotes for our top travel insurance providers so you can see how much coverage costs . The chart below includes estimates for a 25-year-old backpacker from New York taking a three-week trip to Mexico, with a total trip cost of $2,500. Quotes are for basic plans with travel medical insurance, trip cancellation coverage and more. We also included unique coverage options, including cancel for any reason or CFAR coverage.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros & Cons

You can choose from three plans with Travelex Insurance: Travel Basic, Travel Select and Travel America. Travel Basic is a budget-friendly option for backpackers with sufficient coverage. Five optional upgrades are available with the more comprehensive Travel Select Plan, with a $50,000 limit for emergency medical costs.

If you are planning to backpack around the U.S., the Travel America plan provides emergency medical expenses and reimbursement for canceled events, such as ski resort closures.

Coverage & Cost

Add-On Options

Travelex offers a variety of add-on options, depending on the plan you choose. Upgrades include:

- CFAR coverage

- Car rental collision

- Adventure sports coverage

- Additional medical coverage

- Flight accidental death and dismemberment

Based on our quote process, the Travel Basic Plan costs $87 for a 25-year-old traveler on a 20-day trip to Spain worth $3,000.

If you’re looking for a travel insurance policy for backpacking as a family, AIG Travel Guard plans include coverage for one child under age 17 with the rate for a paying adult. The Deluxe Plan offers high-level medical evacuation and healthcare coverage up to $100,000, while

the Preferred Plan features up to $50,000 for travel medical costs.

If you are on a budget during long-term backpacking trips, the Essential Plan covers the basics, with 24/7 emergency assistance and medical care coverage up to $15,000. The Pack N’ Go Plan is available if you plan a trip last minute and don’t need cancellation coverage.

AIG Travel Guard provides a range of add-ons depending on your chosen plan. Some examples include:

- Cancel for any reason (CFAR) coverage

- Rental vehicle damage coverage

- Security evacuations and interruptions bundle

- Adventure sports bundle

- Medical bundle

- Wedding bundle

- Baggage bundle

Based on the quote we requested for a 25-year-old backpacker traveling to Spain for 20 days on a $3,000 trip, the Essential Plan would cost $134.

*AM Best ratings are accurate as of June 2023.

From rafting to skydiving and bungee jumping, extreme sports fans can take advantage of IMG’s iTravelInsured Travel Sport Plan. It includes sports equipment rental reimbursement and natural disaster evacuation coverage.

For long backpacking trips, the most affordable option is the iTravelInsured Travel Lite Plan, which includes benefits for trip cancellation, travel delays and emergency medical assistance. You can also opt for more comprehensive options with the iTravelInsured Travel SE and iTravelInsured Travel LX plans.

IMG offers the following add-ons with the iTravelInsured Travel LX plan:

- Interrupt for any reason (IFAR) coverage (up to 75% of trip costs)

- CFAR coverage (up to 75% of the trip costs)

Based on our quote, the iTravelInsured Travel Lite Plan would cost $83 for a 25-year-old traveler backpacking around Spain for a 20-day trip worth $3,000.

Allianz offers a range of affordable plans for backpackers, including the AllTrips Basic Plan, a multi-trip policy with year-long protection. Or, if you’re primarily looking for health insurance and have a flexible itinerary with minimal prepaid expenses, you can save money with the OneTrip Emergency Medical Plan. It only covers post-departure benefits, including unexpected events after your trip begins.

While Allianz also provides comprehensive insurance policies, budget travelers may prefer the OneTrip Basic plan for affordable, all-around coverage.

Allianz Global provides the following add-on options, which you can add depending on your plan:

- OneTrip Rental Car Protector

- Terrorism Extension cover

- Required to Work cover

Based on our quote, the OneTrip Basic Plan would cost $91 for a 25-year-old backpacker taking a 20-day trip to Spain for $3,000.

Whether you love Alpine skiing or rock climbing, World Nomads is a popular choice for adventurous backpackers. Its two policies, the Standard Plan and Explorer Plan, cover over 200 adventure activities and sports. The main difference between the plans is the Explorer Plan offers higher coverage limits.

World Nomads offers rental car damage coverage with the Explorer Plan.

We pulled quotes for both plans for a 25-year-old backpacker taking a 20-day trip to Spain. You could expect to pay $96 for the Standard Plan and $180 for the Explorer Plan.

Factors To Consider When Choosing the Backpacking Insurance

Everyone’s different, so choosing the best insurance for your backpacking trip means considering your personal needs. Ask yourself the following questions as you consider travel insurance policies:

- Does the travel insurance cover all the destinations you want to visit?

- How long is your backpacking trip and if needed, does the policy suit long-term travel?

- Does the policy include sufficient medical coverage for potential health issues or participation in sports?

- Are there adequate coverage limits for baggage, gear and high-value equipment?

- Does the policy sufficiently cover missed activities and flight cancellations ?

- Do you require coverage for a pre-existing conditio n and if so, does the policy include a waiver?

If you are planning a long-term backpacking trip, pay attention to the duration of your travel insurance policy. For example, if you apply for a multi-trip plan with six months versus a year of coverage. And if you plan to trek around the globe, make sure your policy includes your intended destinations.

It also helps to check the coverage you already have before purchasing a policy. For example, your credit card may include rental car coverage or other forms of travel insurance.

What Does Travel Insurance Not Cover?

Most travel insurance plans cover medical emergencies, trip cancellations and delays , and baggage loss or theft. However, most policies don’t cover the following:

- Alcohol and drug-related incidents

- Extreme sports such as cliff diving

- Non-emergency medical treatment

- Flexibility in trip cancelation, such as changing your mind about flights or destinations

- Incidents due to negligence

Some providers may offer add-on coverage for extreme sports, non-emergency medical treatment and cancellation flexibility (CFAR coverage).

Travel Tips for Comparing Backpacker Insurance

Before buying travel insurance, it’s important to shop around, compare prices and read customer reviews. We suggest obtaining online quotes from at least three providers before selecting a policy.

Once you’ve found a few options that suit your coverage needs and budget, read the policy documents to ensure the coverage is right for you. Look for any exclusions or limits that may impact your coverage, such as a lack of adventure sports protection. If you don’t understand something, speak to the provider directly before making your decision.

Is Backpacking Travel Insurance Worth It?

Backpacking is often an adventure of a lifetime, but it is also an investment. Safeguarding your prepaid and nonrefundable costs, along with having financial safety nets for unforeseen medical emergencies, can help you enjoy a stress-free journey.

Ultimately, it is up to you to decide if backpacking travel insurance is worth it . If you’re planning to launch into adventure activities, top providers such as World Nomads, IMG and Travelex offer extra coverage. You can also opt for a basic plan from Allianz or choose AIG Travel Guard if you need coverage for a child. Regardless of your choice, each of our top providers can provide affordable options with sufficient coverage for backpackers.

Frequently Asked Questions About Travel Insurance for Backpacking Trips

Should i purchase travel insurance for a backpacking trip.

While your need for travel insurance is up to you, purchasing a policy can be worth it. Travel insurance for backpacking can cover medical costs in an emergency. Policies can also safeguard you against financial loss by providing reimbursements if your trip is canceled or delayed or your baggage or gear gets stolen. Some providers offer add-ons to cover rental car damage, highly valuable items and more.

What type of insurance do you need for backpacking?

The type of insurance you need depends on your destination, the duration of your trip and the activities you plan to do. At a minimum, backpackers should consider a policy with the following coverage:

- Trip cancellation , interruption and delay

- Emergency medical expenses

- Emergency evacuation and repatriation

- Lost or stolen baggage

Consider policies with adequate add-on coverage, like if you plan on participating in adventure sports or need a rental car.

What is the difference between backpacking insurance and travel insurance?

Backpacking insurance is simply a type of travel insurance with coverage tailored to backpackers. While some providers offer adventure-specific policies, you may find that a standard travel insurance plan suits your backpacking trip. Researching policy options can help you find coverage for your unique needs, including annual multi-trip plans for long-term trips.

Methodology: Our System for Ranking the Best Travel Insurance Companies for Backpacking Trips

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Health insurance for visitors to usa

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

More Resources:

The Best Backpacker Travel Insurance – 17 Options Compared

In this guide to the best backpacker travel insurance we compared the 17 most popular providers – you’ll be surprised which was the best!

Do you really need to get travel insurance?

It’s probably a familiar question. It’s certainly one I ask before every single trip.

Even as a cyclist, hiker, climber, traveller and general accident-prone backpacker, travel insurance is something I’ve always been dubious of. I don’t like insurance companies and the concept of paying for something you may never use has always seemed alien.

Then, at some point or another, you have a personal experience where travel insurance quite literally saves your life.

Whether it’s lying in a hospital bed in Indonesia with Dengue Fever, filing for a stolen bag in Barcelona, having a bot fly cut from your head in Panama or needing to return home to visit ill family… there comes a point in every trip I realise yes, yes you definitely do need travel insurance (and, yes, they are all things I’ve had to claim for).

Unfortunately, it’s not that easy finding the right policy and travel insurance companies don’t make it any simpler. There are SO many different options, so many different prices and the small print is too often clouded behind technical jargon. Altogether it can be very hard to know what you’re getting and which policy is best for you.

Should you pay an extra £50 and get added cover?

Is it worth paying for a lower excess?

What even is liability insurance?

In this guide to backpacker travel insurance, we’ll explain all the jargon and the nitty-gritty stuff you need to consider when finding a policy. We’ve also compared 17 of the most popular backpacker insurance policies to see which is the best – y ou’ll be happy to know it’s not always the most expensive!

In this article, you’ll find:

- What is the difference between backpacker and travel insurance

- Why you should never travel without it

- Insurance terminology explained

- Things to look out for when finding a policy

- Picking the best travel insurance for YOU

- Travel insurance activity packs

- When to buy backpacker insurance

- How to make an insurance claim abroad

- 17 popular backpacker insurance options compared

- The best insurance policies in detail

What is the difference between backpacker and travel insurance?

First things first, backpacker travel insurance is specifically designed for backpackers going to multiple destinations over a longer period of time. It is also sometimes under the same umbrella as long-term travel insurance.

Compared to regular travel insurance policies, backpacker insurance can be used for trips ranging from 3-18 months (sometimes more). It covers a wider range of activities like hiking , diving, skiing, working with animals etc and has extra precautions for things more likely to occur on a backpacking trip.

The best travel insurance policies will include:

- Medical and dental cover ranging from small prescriptions to major surgery

- Baggage, electrical and documents cover also covering things like bicycles, outdoors or camera equipment

- Legal cover and advice paying for lawyers’ fees to political support if there is civil unrest

- Cover if you cancel or change your trip also includes transport delays

- Home visits if you need to return home during your trip

- Hostage cover everything from ransom fees to paying for negotiators

- Natural disaster cover hurricanes, tsunamis, earthquakes, wildfires etc

- A good level of sports and activities this is often included in the price rather than an additional cost

Note. most of the insurance policies in this article require you to be currently in the UK and not already travelling

Do you even need backpacker travel insurance?

The simple answer is, yes.

Whether you’re a disaster-prone adventurer cycling from England to India, a couple planning on Interrailing through Europe or you’re going to be backpacking Asia on a gap year, insurance is a no brainer.

These are just some things which could easily happen to anyone on any journey

- You lose your passport and need a replacement

- You get sick or injured during your trip

- You miss a train and end up stranded

- There is political unrest and you need legal support

- A family member becomes ill and you have to return home

Many of these things could be out of your control when you’re travelling and an accident might be no fault of your own. Overseas legal or medical fees are outstandingly high so having insurance as a safety net can be life-saving. It can also protect you from the crippling financial hardship you’ll face after paying fees from your own pocket.

And, if you’re a renegade thinking “I’ll be fine” then think of your friends and family. If you need emergency medical treatment it will likely be them having to pay for it. Ask many backpackers around the world and they’ll likely have a number of tales where travel insurance has saved their skin!

Why we’ll never travel without backpacking travel insurance again

At some point during all of my backpacking trips, I’ve needed some kind of medical attention, police support or legal advice. However, during our year in Vietnam 3 things happened which made me realise I’d never travel without comprehensive insurance again.

- We met a friend who had developed a serious leg infection whilst hiking in China. This infection had him hospitalised, close to the point of a leg amputation and nearly death. He did have cheap backpacker insurance but it didn’t cover hiking. His family had to pay tens of thousands of pounds and start a crowdfunding campaign to get him medically transferred to a Thai hospital and then back to his home in Ireland. With the right insurance policy, this would have been covered.

- Whilst living in Hanoi there were constant stories of travellers and expats having fatal motorbike accidents. Without insurance, it can cost friends and family more than £10,000 to have the body sent home. Morbid I know, but a game-changer for us.

- The thing which really hit home was when my mum became extremely ill during our time living in Hanoi. We had very little money but we were able to immediately return to the UK and claim for our flights and possessions left in Vietnam. Mum is much better now!

Bottom line is, you might have dozens of trips without needing to make a claim but it’s worth the money for the one trip you do. Need some more convincing? Check out these travel horror stories !

The Best Backpacker Insurance Buyer’s Guide and Tips

As mentioned there are many different types of policy options, some which might be useful to you, others which might not. In this section, we’ll go through all of the things you need to look out for to find the right policy.

1. What does it all mean? Travel insurance terminology

Before we get into things it’s probably best to go over some travel insurance terminology. It can be seriously confusing reading through the small print and policy wordings so this should help explain some of the confusing parts.

Baggage cover

This generally covers the baggage and belongings you take with you, including travel documents and bank cards. This sometimes covers electronics and outdoors equipment too but you will need to check the small print.

Cancellation

Cover if you have to cancel your trip before you travel.

Cooling off period

The length of time you have to cancel your policy.

Curtailment

Cover if your travels are changed or disrupted during your trip. This often includes travel delays, like missed transport or travel changes due to injury, illness or from returning home.

Deductible or excess fees

The amount of money you will need to pay before your travel insurance starts to make payment. This may be shown as “Baggage cover – £3,000 (£50 excess)”.

Cover for any legal costs resulting from accidents with other people or their possessions.

Personal accident

This is a compensation payment made if you have an accident, resulting in death, loss of limbs, loss of sight etc.

Repatriation

The costs of sending an ill or deceased person to their home country.

Single trip Vs. Multi-trip insurance

Most travel insurance policies cover you from when you leave the country to the point you return home. Multi-trip travel insurance covers you for multiple trips taken over a certain period of time. This may be useful for business people with a number of trips in the space of a few months but is less useful for backpackers.

Single trip vs. long-term vs. backpackers travel insurance

Single trip insurance is often available for shorter trips and won’t cover as many activities. Long-term insurance is regularly aimed at travellers visiting one country for a longer period of time whilst backpacking insurance is for multiple countries, varying lengths of time and with additional cover for activities.

Sometimes the terms backpacker and long-term are actually given to very similar policies so you need to check to see what they provide.

Single article limit

The most you’re covered for a single item e.g. if your single article limit is £500 and you have a £1,000 camera stolen your insurance provider will only pay up to £500.

Any other terms you found confusing when you were looking for insurance? Tell us in the comments so we can add it in for other readers 🙂

2. What to look for when buying travel insurance

- Medical, cancellation and curtailment, legal, liability and repatriation are the most important aspects – find the policy that has the best cover

- Always read the policy wording and small print so you know what is included

- Check you’re covered for any existing medical conditions you may have

- Make sure you’re covered for all the destinations you’re visiting and the activities you’re doing (sometimes they’re an add-on)

- Check all of your baggage is covered and that gadgets cover isn’t additional

- If you’re travelling with expensive gear or equipment make sure the single article limit is high enough

- A 24-hour emergency helpline is very useful to have

- If hiking or climbing make sure you don’t go above the altitude you’re covered for, for campers check your baggage is covered whilst in the tent

- Find out how much cash you are covered for and try not to carry more than that on you

- See what the excess is and decide what you would be able to pay

- Some insurance policies won’t cover periods of voluntary or paid work – check the policy

- Age restrictions may apply and if you have pre-existing medical conditions then make sure you state them

- It’s great having the option to return home – some providers include this

Things which are generally not covered – cruises and winter sports, alcohol or drug-related accidents, failure to declare medical conditions, stolen items which weren’t reported.

3. What’s the best travel insurance policy for backpackers?

Everyone’s travel plans are different – if you’re planning on hiking the Dolomites your activities will be very different to someone city hopping, for example. T hink of what type of trip you’re going on and what is most important for you.

As an example, we no longer take flights and instead cycle so curtailment cover isn’t very useful. We do a lot of outdoor activities and travel with expensive camera equipment so it’s important we have good medical and baggage cover.

Think of the where you’re going, what you’re going to be taking and what you’ll be doing. If you’re planning a city trip then having adventure activities covered probably isn’t a necessity. If you’re going to be hiking Everest Base Camp then check to see if you’re covered.

4. Travel insurance activity packs

If you know you’ll be doing lots of potentially ‘hazardous’ activities (climbing, hiking, rafting, skiing, bungee jumping, sky diving, cage diving, martial arts training etc.) then it’s especially important to find a fitting policy. Commonly these will be covered in different ‘activity packs’ for you to choose from.

Typically, insurance providers have a base range of activities which are automatically covered, with backpacker insurance being more comprehensive than other insurance types. Take a read through the policy to see what’s included and works for your trip.

If you’re not covered with the base activities then you’ll normally have two options depending on the company.

Firstly , with some policies, you can buy an add-on pack which will include a larger range of more serious outdoor activities. For things like hiking and climbing, this may cover you for higher altitudes or diving for deeper water.

Secondly , other policies have the option to pay for each activity as an add-on which may be cheaper than upgrading a whole pack. If you are planning something deemed as potentially very hazardous you may need to get an individual quote from the provider. This may include technical climbing, alpine hiking, adventure races etc.

5. When to buy your backpacking travel insurance – IMPORTANT!

As soon as you make a payment towards the trip.

If you’ve booked accommodation, tours or transport and your plans change then your insurance can cover it, even if you’ve not left the country yet. Many providers will actually require you to buy insurance within a certain window of making your first travel payment.

6. How to make a travel insurance claim whilst you’re abroad

It’s very important to keep a copy of your insurance policy with you when you travel as each provider will have different claiming procedures . Keep a hard copy and one backed-up online just to be safe.

When making a claim for any policy you should…

- Get a police statement if it’s relevant – if you have items stolen or broken, have been assaulted and need medical treatment etc. then make sure you have a police statement to confirm it

- Contact your insurer to see what they advise and to check what’s covered in your policy

- Try and collect evidence this may be receipts for bought items, travel tours, transport or medical bills etc. to give to your insurance provider

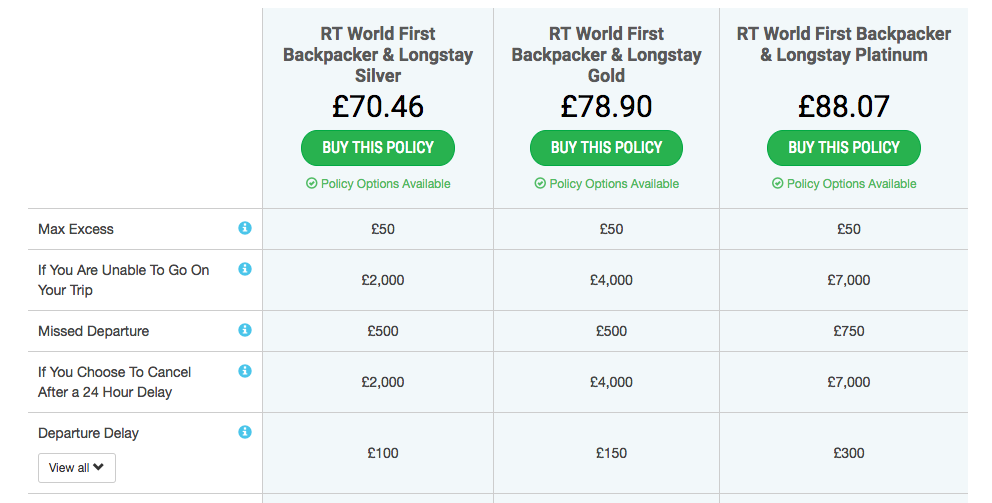

Backpacker Travel Insurance Comparison – 17 Popular Options

There are hundreds of insurance options out there, many with similar policies but very different prices. Finding out which is the best can be tough work so we’ve put it all into one place for you to compare.

We looked at the 17 most popular options to see how they faired against each other. For the best options, you’ll also find a more detailed breakdown at the bottom so you can decide which one is best for you.

What we searched for

To find these policies we looked for the best-rated backpacker and long-term travel insurance options in the UK on public review sites like Trust Pilot and Feefo . We also collected suggestions from Google, travel agents, insurance comparison sites and user reviews.

All details were taken directly from the provider’s official website, searching with exactly the same details for the same trip.

This is what we searched for:

- 12 months of cover

- Leaving Saturday 27th July 2019

- For one 28-year-old male

- From the UK

- Not already travelling

- Travelling as an individual

- On a single trip

- Travelling worldwide

- With no pre-existing medical conditions

- No cruise, winter sports or business trip options added

No discount codes were added and if there were multiple choices from one provider the middle tier was chosen.

Note this information was taken directly from insurers’ websites but may be subject to change. I have not personally used all of these services but have displayed their policies without bias or opinion in the table below. Some of the options may contain affiliate links, meaning if you purchase the insurance through a link on this page it will be of no extra cost to you but we will receive a small commission. This commission enables Veggie Vagabonds to run and grow!

The best travel insurance for backpackers… and some of the worst!

Below you’ll find all of the results, user reviews and policy wordings where possible. As mentioned above, make sure you read the policy wording before making a purchase so you can be sure what’s included.

There were other options which aren’t shown below due to them being either a) pretty rubbish or b) excessively expensive.

Backpacker insurance from the Post Office cost a whopping £1,038, £838 from Flexicover and Voyager, Leisure Guard and Sports Cover Direct also had very high prices. Interestingly, none of these providers offered competitive policies despite costing more than double their competitors…

Keep reading below the table to see a detailed breakdown of some of the better options!

In some more detail…

World nomads, true traveller, world first & sta 🙁.

Despite these options being by far the most expensive (and often the most widely recommended) they really don’t offer competitive policies, particularly with STA travel insurance or World Nomads. Admittedly for my first long-term trip, I did go with STA gap year travel insurance, but this was 10 years ago before I was aware of other options. Take a look at other policies and save your money, no matter what other travel bloggers might be telling you!

If you have used one of these providers and had good experiences then we’d be interested to hear from you in the comments below

Alpha 100 Longstay – £180 🙂

Considering this is the cheapest option reviewed it is very competitive and you’re getting a very similar coverage to many providers double the price. Their options are easy to understand and you have the choice to pay more for a lower excess or less for a higher excess.

The medical coverage includes dental treatment and there are good levels of baggage, legal and cancellations protection. I like that extra gadget coverage isn’t too expensive, as well as cheap additional activity coverage. On top of this, it’s also got cracking backpacking insurance reviews.

Go Walkabout Traveller Plus – £251 🙂

An option I have personally used for a year in Latin America and thought was very professional. I didn’t need to make any major claims besides a few prescriptions but it was all reimbursed very easily.

Go Walkabout has good levels of cover where it’s most needed without breaking the bank. £10 million medical cover is competitive whilst also having cover for dental services. There’s also up to £500 covered for personal money (higher than many more expensive competitors) and £500 for kidnap, hijack and detention situations. Again Go Walkabout has good reviews online which I can personally vouch for.

Cover for you Gold £307 😀

Cover for You has no excess charges and £15 million medical cover, that’s the highest medical cover out of all the insurance policies reviewed (and £10 million more than World Nomads travel insurance!). £3,000 is higher than average for cancellation and curtailment and they offer to pay for funeral expenses abroad. There are higher tiers which are more comprehensive and they offer one return flight home. This is an option we also considered before leaving for our current cycle tour.

Holiday Safe Backpacker and Longstay Plus £381.64 😀

Yes, this is slightly more expensive than the others we’ve picked but we think it’s worth it. It’s actually the insurance policy we’re using right now, and I’ll tell you why we went for it…

The medical (£10 million) and legal (£2 million) cover are competitive with other more expensive policies but the possessions (£2,500) and cancellation (£3,000) are higher than average.

The extra things which sold us are the return journey home, which could make it useful for gap year insurance or new travellers, and Interrailling ticket cover of up to £500. We’re not Interrailing but it’s a nice extra. There is also up to £2,500 for clothes which is especially important if you’re doing outdoor activities with technical clothing.

It’s also recommended for backpackers with gadgets, as there is £1,000 gadget cover, being one of the only providers to have it included without upgrading. It covers phones, laptops and computers and you are given one return journey home per policy.

I don’t know if it works but if you go for this policy and use this link (at no extra cost to you) we’ll be entered into a prize draw to win… an Amazon voucher!!!

Got your insurance? Here’s some other things to think about

Visa – many countries require a visa to visit, find out if you need one here

Vaccinations – your insurance won’t cover you if you don’t have the right vaccinations – you can check to see vaccine requirements here

Accommodation – find cheap deals and a variety of accommodation at Hostel World , Booking.com or Airbnb ( £35 off your first booking with this code) . You can also use TripAdvisor to see what other travellers think!

Do you know any other great backpackers travel insurance options or tips? Maybe you have some extra questions? Drop us a comment below!

A Guide to the Best Backpacker Travel Insurance

A pretty extensive guide with all the tips needed to help you find the best backpacker insurance. I think we can all agree that finding the right policy is seriously important AND it’s nice to know you can get a great deal without blowing the bank.

If you’ve used other insurance providers and had a good experience then let us know and we can add them to this article. Alternately if you had a bad experience, tell us in the comments so we can warn other travellers to steer clear!

Keep exploring…

The Best Debit Cards to Use Abroad

10 Super Easy Tips to Planning a Trip

All the Best Budget Travel Tips

There I thought I might find a few new options as we’re currently travelling without insurance… No such luck as your parameters are all different (and wrong for us). That’s always the issue with such recommendations or affiliate post: what fits for one won’t even apply to the next. We’re both 64 years of age (where some policies become very expensive), Australians (limited choices of offerings), travelling full-time (we have left already – years ago), and we don’t need cover for missed flights or lost/stolen technology (we’re travelling in a motorhome, driving instead of flying, and I can’t see the benefit of insuring our old computers, which are usually locked away safely). There simply isn’t a “one size fits all”. We absolutely don’t want to go back to WorldNomads; in 5 years we only had unpaid claims, none was accepted – waste of our time and money! I keep searching.

Hey Juergen, thanks for your comment! Sorry none of them are fitting, we searched based on the general readers for the blog to show a rough idea of what each company provided, but yes won’t be suited to everyone.

Frustrating they become more expensive but I think a few of the options are available for Australians. If they’re not directly I remember some of them having partner companies based in Australia.

We also don’t need cover for flights as we cycle but unfortunately could only find provides with this included. We also looked at getting everything individually (medical, legal, baggage etc) to avoid paying for unneeded flight cover but this worked out more expensive.

Does insurance change dramatically for RVs? We’ve never actually looked into it – though we do hope to get an RV at some point in the future.

Completely agree about World Nomads, I was surprised how little cover they offered considering their high fees. Hope you can find the right policy soon! Where are you currently travelling?

Thanks for the wonderful post!

It’s silly just putting up a load of prices and say “Choose the cheapest”. The reason why people like Nomads and TT have a lot of mentions everywhere is that they do pay claims quickly. Nomads were bought out a few years ago and they have gone a little bit downhill.

The only way to see about these companies is to go onto TrustPilot and just read their 1 star reviews. Holidaysafe has hundreds of 1 star reviews – most of them are about them not paying claims.

We haven’t actually said choose the cheapest, we’ve said that cheaper can sometimes be better. Something both Sarah and I can confirm, having used cheaper and more expensive insurance options.

We haven’t used World Nomads or TT but their coverage is far worse than cheaper companies we have used who have paid claims without any issues. It’s also frustrating to know that Nomads particularly are generally recommended online by bloggers who are trying to make money through affiliate sales and may not be giving completely honest opinions.

We’re yet to make a claim with Holidaysafe but will make sure to update the article if there are any issues.

Which insurance policies have you used in the past? Are there any others you would recommend?

It’s great food for thought which is what you are trying to achieve and sorry you got such unnecessarily unpleasant criticism from people who clearly know all the answers already; I don’t so it helped me! I’ll research further myself but you have saved me a lot of time by removing the first step of my research. Thanks Mark

Hey there Mark! Ahh, you’ve got to take the positive with the negative, ey 🙂 Glad it could be useful to you, are you planning a trip somewhere nice?

Leave a Reply

Your email address will not be published. Required fields are marked *

What is the best Affordable Travel Insurance for Backpackers? The 3 Best Backpacker Travel Insurance Companies Compared

Here’s the complete guide to backpacker travel insurance, why you need it, and what it should cover. You’ll find a detailed comparison of the 3 best insurance companies that offer specific policies and travel insurance for backpackers to help you choose the most suitable policy for your trip.

So you’ve packed your bag, you’re ready to embrace the life of a backpacker, and are headed off on a new adventure!

However, before you leave, no matter where your chosen destination may be, there’s no better way to protect yourself on your trip than purchasing backpacker travel insurance.

The number of insurance providers out there can be overwhelming but no need to worry, this guide has you covered!

Disclaimer: This posts might contain affiliate links, meaning that if you make a purchase through these links, I may earn an affiliate commission. Thank you for helping to support this website!

TABLE OF CONTENTS

1. What is backpacker travel insurance?

You might ask yourself, what exactly is backpacker travel insurance and how does it differ from regular travel insurance?

Backpacker travel insurance is a type of insurance specifically designed for people traveling long-term and/or on a budget and living the wanderlust dream.

Not only does it protect you from canceled flights, lost luggage, and emergency visits to the hospital whilst overseas, it’s more flexible than regular travel insurance and will usually cover a broader range of countries alongside more adventurous activities .

Long-term travelers will often have a lower budget and often look for cheap backpacker travel insurance deals to cover a more extended trip. Because of this, backpacker travel insurance tends to be less expensive and more affordable than traditional travel insurance.

2. Why do you need backpacker travel insurance?

Backpacking is a lifestyle of traveling that brings with it the unknown, excitement, and risks that you probably wouldn’t find yourself taking in your everyday life back at home.

It’s so essential that you have travel insurance to protect you in all unforeseen situations, including any accidents and emergencies you may find yourself involved in.

Covering yourself with a comprehensive travel insurance policy can save you from spending thousands of dollars on medical expenses.

Not only that, if you happen to miss an important flight or if some of your belongings are stolen, having insurance gives you peace of mind knowing that these things will all be covered.

16 Things to Prepare for a Long-Term Trip – International Travel Checklist

3. What to look for when buying travel insurance

There are a few essentials that all travel insurance policies should cover:

- medical emergencies and protection (medicine, emergency evacuation, hospital fees)

- stolen, lost or damaged belongings (including documents and luggage)

- flight delays and cancellations

- trip cancellations (plus curtailment cover so that you can get home quickly if there is a death in the family)

- access to a 24-hour helpline

- Repatriation for you to get home (if you become ill, it covers the flight back home)

Other factors to look out for that could be really beneficial for you when included in your policy are:

- being able to extend your policy if you choose to stay longer than you originally intended

- a very high limit for medical expenses

- cover for any legal expenses whilst overseas

- a policy that covers most countries in the world

- high personal liability insurance (in case you cause any damage to someone else’s property or injure them)

It’s really worth doing the research and choosing a policy that is going to be relevant for the type of traveling and adventuring that you choose to partake in.

Read the small print and make sure that the policy covers everything that you need it to!

It’s worth paying extra for the peace of mind of knowing if something were to happen, your travel insurance is there to serve you properly.

What you need to know before you quit your job and travel the world indefinitely

4. What travel insurance for backpackers doesn’t cover

It’s also very useful to know and worth noting what many backpacker travel insurance policies do NOT cover.

This will differ slightly with each policy, however, there are a few common things that you won’t be able to get cover for.

Generally speaking, these are:

- any drug or alcohol-related incidents or accidents

- injuries or accidents sustained whilst participating in some extreme sports/high adrenaline activities which in some cases can include hill walking, so make sure that the policy you’re looking at covers you appropriately for the activities you will be doing

- Pre-existing medical conditions are sometimes not covered

- any stolen money

- traveling to areas that have been deemed dangerous (natural disaster zones, or places with armed conflicts

- any flights bought with airline miles

- medical tourism (facial/body aesthetic operations )

- breakdowns due to poor mental health

The Ultimate List of Countries with Digital Nomad Visas

5. Useful tips before heading off on your trip

Once you have organized and purchased your travel insurance, a smart tip is to make a note of the company’s helpline number along with the number of your policy. Keep it somewhere easy to find with your other travel documents.

On previous trips, I found myself printing out parts of my policy so that I had the important information close at hand alongside my passport.

Make an extra copy, or email a copy to your parents or friends at home just in case you happen to need assistance and end up in a sticky situation where you can’t advocate for yourself.

Another handy tip is to document EVERYTHING.

For example, if you’re planning on buying and taking some expensive kit with you i.e a camera, laptop, smartphone or any other pricey gadget, make sure to keep ALL of the receipts.

It’s helpful for the insurance company to see that you actually have proof of purchase for these items and in the event of any of these devices being stolen or damaged you may have an easier time claiming back your money.

What’s in my Camera Bag: Cameras for Travel Photography and Essentials

6. If you need to make a claim whilst abroad

If you find yourself in a position where you need to make a claim whilst on your travels, it’s helpful to organize all of your necessary documents with time to spare.

Include any/all receipts, emails, documentation of hospital or doctor appointments, any purchases, take photos and images of everything that you think is relevant and include them in your claim.

As I mentioned above, by saving ALL of the appropriate documents, you can better support your claim.

It’s also important to be aware that insurance companies can take some time to pay out and patience is a good thing to keep in mind.

7. What are the best travel insurance providers for backpackers?

There are literally hundreds of companies out there offering cheap backpacker travel insurance.

Whilst budget is an important factor for most backpackers, especially for people looking for student backpacking travel insurance, it’s vital that you purchase a policy that provides you with the protection that suits the nature of your trip.

There’s getting a ‘good deal’ and then there’s buying travel insurance for backpacking that doesn’t give you any cover for any of the activities you want to do whilst away and the relevant countries that you plan on visiting.

If you need to make a claim, you could end up thousands of dollars out of pocket instead of just paying that little bit extra at the start.

To head off WITHOUT travel insurance could prove to be a big mistake and according to statistics , if you plan on traveling for a long period of time, something is bound to happen.

I am not being pessimistic when I say this, it’s from my own experience and the advice of many other seasoned travelers and backpackers.

Bags will be lost, belongings may be stolen or damaged, you may become unwell and require medical care. At the end of the day, it’s just not worth the gamble.

If you have zero clue about where to start when it comes to buying backpacker travel insurance, please know that you’re not alone and that this guide is here to help.

I’ve gathered and researched for you my pick of the three best companies offering backpacker insurance policies and laid it out plain and simple for you to understand in order to make the right decision for your trip.

The top two travel insurance companies who I believe offer the best backpacker travel insurance cover are:

- IATI Backpacker

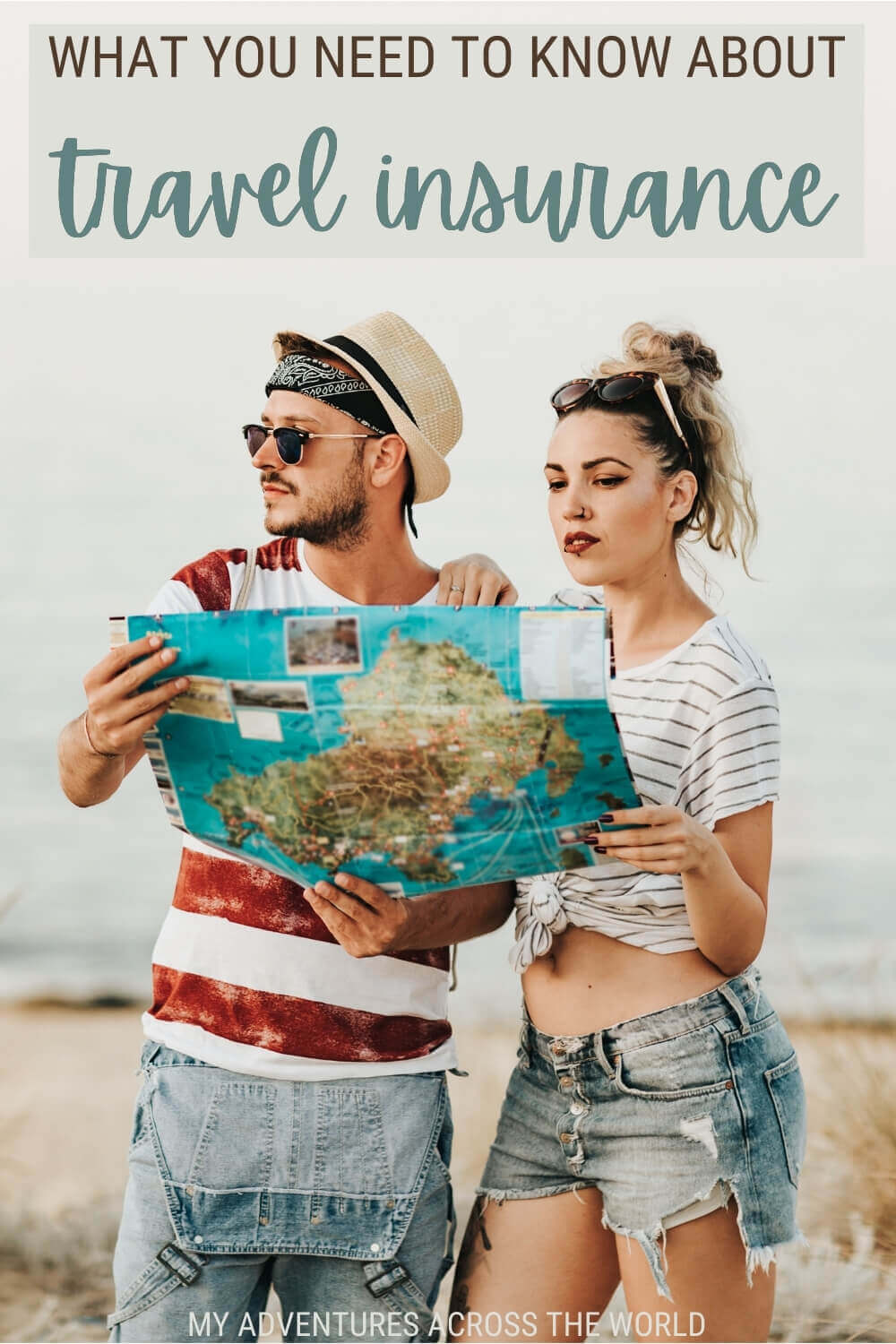

1) SafetyWing

SafetyWing is my first recommended travel insurance company.

Their Nomad Insurance has been specially created for backpackers, digital nomads, and long-term travelers.

They haven’t been around very long in comparison to other companies, however, they are quickly becoming a firm favorite in the backpacking community.

Not only are their plans affordable, with cover starting at $2 per day for short trips, they also offer long-term annual travel insurance plans for frequent travelers which is ideal if you travel regularly.

Unlike most policies on offer by other companies, SafetyWing doesn’t require you to provide a home address or a list of the countries that you plan on visiting which gives you the ultimate freedom to change your mind about your next destination.

They also offer a completely comprehensive travel medical insurance policy for full-time travelers and remote workers which is called ‘ Remote Health ’.

This plan covers any healthcare or medical care that you may require when traveling on a trip or if living and working abroad. It covers everything from giving birth to treatment for all kinds of illnesses, it also covers you for repatriation or evacuation too.

If you need it, you can add on dental cover, just in case you needed some work on your teeth whilst away.

The Nomad Plan is an ideal choice of travel insurance for backpackers who are already abroad because you can buy it or renew a policy during your trip at any point making it perfect for those spontaneous trips and life changes.

2) IATI BAckpacker

I only recently discovered IATI but I’m already a fan! That’s why it’s my third recommended company offering backpacker travel insurance.

IATI offers seven (!!) levels of cover, depending on your needs and the preferred way in which you like to travel.

They offer a wide range of different coverage for short holidays, destinations with high medical costs, long-term travelers, adventure travelers, families, and students alike.

Their IATI Backpacker policy covers you highly for any medical expenses and also gives you a high amount of personal liability. They cover you for all sorts of sports and adventurous activities, including scuba diving, rock climbing, trekking at altitudes up to 5400 meters and bungee jumping.

They also cover dental expenses, repatriation, travel and accommodation of a relative if you have to stay in hospital for more than 5 days, theft, damaged or lost luggage, travel delays, search and rescue and much more.

They are one of the few companies that offer backpacking travel insurance and cover any claims brought against you if you are held liable for any injuries or damage you involuntarily caused to third parties.

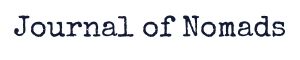

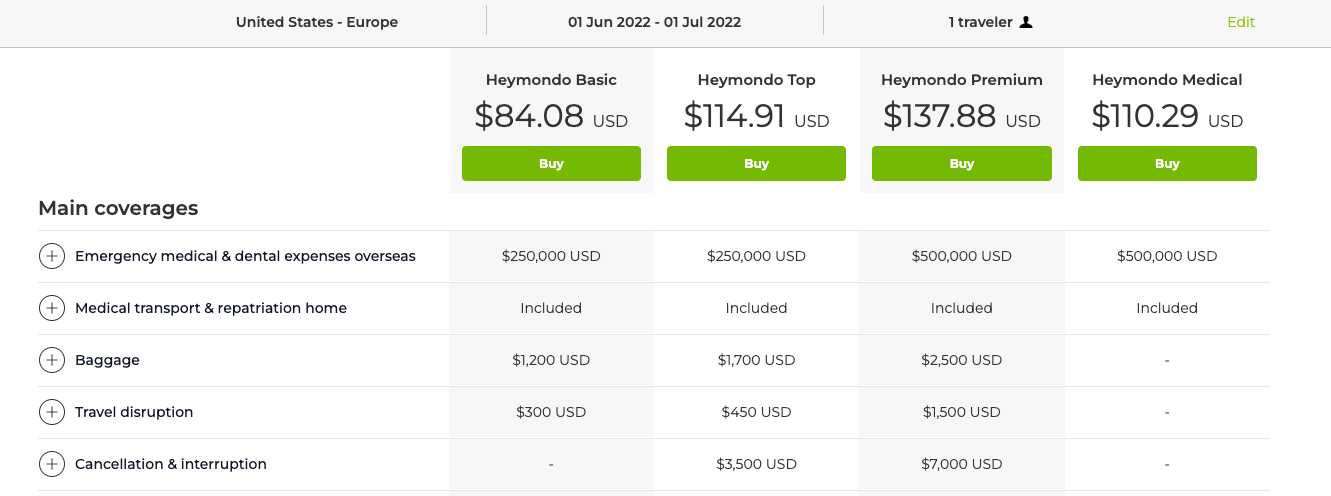

3) Heymondo

Heymondo is one of the latest top travel insurance providers for backpackers and long-term travelers.

Their policies are accessible and easy to understand and they offer a range of different coverage for short trips , annual multi-trips and flexible long-term trips . You can easily personalize your insurance to your type of trip and budget.

Their travel insurance plans already cover numerous outdoor activities and you can add Adventure Sports that will cover extreme activities from white-water rafting and trekking up to 5,000 meters altitude to bungee jumping and rock climbing.

Another benefit they offer is the ability to edit or extend your policy on the go which could come in handy for someone living the life of a backpacker.

8. Cover during a Pandemic (Covid 19)

A global pandemic isn’t something that many, if any travel insurance companies, would have probably ever covered you for pre-2019.

However, nearly three years on, here we are, the world a changed place for the foreseeable, and Covid 19 continues to affect people across the world. After numerous lockdowns, it’s natural that some people may be feeling anxious about the thought of being able to travel again.

Although numerous countries’ borders still remain closed, there are plenty of countries that are ready to welcome tourists and travelers back, in order to help rebuild their damaged economies.

We have all learned to adapt the way we live our lives around Covid 19 and travel insurance providers have had to change and adapt their policy offerings to support this.

The three companies that I mention in this article each have different components within their policies that state what you are covered and not covered for when taking Covid 19 into consideration.

Therefore, it’s important that you read through all of the information carefully and find out exactly what applies to you and what your specific policy covers you before you leave on your trip. If you’re unsure about something, phone the helpline and discuss the specifics with someone.

All three travel insurance companies state that they will NOT provide you with any cover if you decide to travel against the advice of the Foreign, Commonwealth, and Development Office including any travel restrictions enforced by the government in relation to Covid 19. This would be, for example, if your country were to be in lockdown. As I said before, I know it’s a brand new world…

Heymondo states that their insurance plans cover all emergencies related to Covid. These include trip delays or interruptions, emergency medical expenses and cancellation charges.

If you were to contract Covid and become sick and require emergency medical care, any expenses in this instance would be covered by your policy just like any other illness.

Their trip cancellation even covers you if you test positive or if a close relative gets seriously ill or dies due to COVID-19 and you’ll be able to get a reimbursement for your pre-paid, non-refundable expenses related to your trip.

SafetyWing now offers coverage for Covid 19 under their Nomad insurance policy, which means you would be covered if you become sick and need medical care.

You would receive $50 per day for up to 10 days if you were to test positive for Covid if your policy was at least 28 days or longer. They will now cover you for lockdowns as well as quarantine coverage which is a more comprehensive type of Covid cover than other plans.

And with their Annual Nomad Plan , you can cancel it at any time. If you were to enter a country that went into ‘lockdown’ due to Covid, you’re not tied into a plan when you can’t actually travel.

All IATI ‘s policy plans offer coverage for coronavirus during the trip. This coverage includes diagnostic tests (PCR) prescribed by health professionals in case of symptoms compatible with the disease, medical assistance, medical transport, hospitalization, quarantine and repatriation.

A 10-day quarantine in a hotel is contemplated with the convalescence coverage included in all their plans.

9. The 3 best backpacker travel insurance companies compared

So I’ve briefly mentioned a little about my top three choices for backpacker travel insurance. Now let’s go into more detail about what each of these companies actually offers you and compare these backpacker travel insurance policies.

I want to help you get the best insurance deal that will cover you fully for your exciting adventures abroad.

1) Safety Wing

Safety Wing uses a monthly payment scheme that is subscription-based meaning that if you need to, you can stop or pause your cover when not using it.

It’s flexible because you can organize coverage for a specific date, monthly or annually until the end of your trip with their auto-renewal service. This is ideal if you’re not totally certain about the length of time you will be traveling for.

Safety Wing lists what activities and adventures are not covered on their website in a really clear and simple way which is really refreshing in comparison to trawling through the fine print of some other companies’ policies.

However, unlike World Nomads, Safety Wing does NOT cover any electronics . I would suggest that if you choose their backpacker insurance cover, insure your tech through a secondary insurance company such as a Gadget Cover .

Safety Wing also does NOT provide cover for any pre-existing medical conditions with the exception of cover for Acute Onset of a Pre-existing Condition – see here for more details on this .

Their Nomad Insurance Policy includes:

- $250,000 in emergency medical coverage

- $100,000 in medical evacuation

- $5,000 for trip interruption

Their policy also includes:

- coverage up to the age of 69 years old

- coverage from 5 days – 1 year

- great value for money at $42 USD per month

- cover for a huge list of activities and sports but NOT many adventurous activities such as paragliding, white water rafting or skiing off piste for eg. See the full list here .

- covers travel anywhere in the world (except for Cuba, Iran, Syria and North Korea)

- They offer home country coverage, including the USA

- You can include up to 2 kids under age 10 per family at no extra cost

- 24/7 assistance

Safety Wing – Is this the best travel insurance for long-term travelers?

2) IATI BAckpacker insurance

IATI offers seven different types of insurance plans, depending on your budget, type of travel and the duration of your trip.

The IATI Backpacker Insurance is specially designed for backpackers who are setting off to see the world without knowing exactly which countries they will visit or how long the trip will take. You can also purchase this travel insurance if your trip has already started.

However, it’s important to know that if you’re not a Spanish citizen (this insurance company is located in Spain), you can only take out insurance for trips up to 4 months.

Their monthly policies start at €127 covering nearly all destinations in the world. They offer 24/7 customer care.

This policy combines high medical coverage of €500,000 with and other specific upgrades such as adventure sport, search and rescue, and computer equipment in your luggage. You can also take out a new policy when you arrive if you decide to extend your trip.

The IATI Backpacker Plan includes:

- €500,000 in emergency medical coverage

- 100% coverage in medical evacuation and repatriation (including natural disasters)

- €1,500 for stolen or lost baggage

- up to €500 in trip delays

- €15,000 in search and rescue expenses

- €60,000 in personal civil liability

- €2,000 in cancellation costs, provided that you cancel before the trip starts and for one of the reasons set out in the policy

This policy also includes:

- emergency medical and dental coverage

- personal injury in motor vehicle accidents

- travel/accommodation of a relative in case you need to stay more than 5 days in hospital

- coverage up to age of 69 years old

- convalescense in a hotel

- sending medication abroad

- stolen passports & tech gear

- delayed departure and delivery of luggage, and missed connections

- extended trip costs if you’re stuck somewhere due to bad weather, natural disaster, political problems

- cover for a huge list of activities and sports. See the full list here.

- covers travel anywhere in the world

3) HeyMondo Travel Insurance

Heymondo offers three different types of insurance plans with policies starting at 65 EURO per month for European Citizens and 116 USD per month for USA Citizens.

Heymondo also offers an app service which comes with a 24/7 medical chat, free worldwide emergency assistance calls, extra lodging expenses due to medical quarantine, coverage of non-refundable expenses in case of serious illness and simple claims management options.

The Heymondo Medical Plan includes:

- $500,000 in emergency medical and dental expenses

- $500,000 in medical evacuation and repatriation

The Heymondo Top includes:

- Up to $1,700 for lost or stolen baggage.

- Up to $450 for travel disruption and $3500 for cancellation and interruption due to serious illness

Their policies also include:

- Natural disasters

- Medical transportation

- Personal liability

- Compensation for death or permanent disability as a result of an accident that takes place during the trip.

- Cover for over 140 countries

- You can add-on cover for expensive belongings and adventure sports.

The Heymondo Premium includes:

- Up to $2,500 for lost or stolen baggage.

- Up to $1500 for travel disruption and $7000 for cancellation and interruption due to serious illness

- Search and rescue

- Natural disaster

- Rental car access

- You can add-on cover for expensive belongings, adventure sports and cruises.

10. Which is now the best backpacker travel insurance?

You must think properly about all the things you’d like your policy to cover you for when comparing travel insurance.

Shop around and do some research first and then be sure to read through the terms and conditions carefully before purchasing your policy.

However, I wholeheartedly want to say that it is equally just as important that we keep our minds open to traveling and keep dreaming and planning epic adventures.

Backpacking can be absolutely life-changing and provide you with so much joy and give you a new thirst for life, meeting new people, exploring new places, and pushing the boundaries of your comfort zones.

Regarding the BEST backpacker travel insurance, my top pick depends on the duration of my trip and the type of activities I plan on doing.

Every summer, I travel for 3 to 4 months to Central Asia to guide my adventure tours and to go trekking in the mountains.

These activities sometimes include heights over 4000 meters, so I take out IATI Backpacker Insurance . This insurance policy covers everything I need and so much more for “only” €127 per month.

If something happens to me in the mountains or I get stuck due to natural disasters, pandemics or political issues (nowadays we never know what’s coming…), at least I know I’m fully covered with the IAT I B a c k p a c k e r P l a n .

If I’m going on a trip longer than 4 months or on a shorter trip that doesn’t include me doing extreme activities or hiking above 4000 meter, I take out the Nomad Insurance Policy by Safety Wing .

Their plans are very affordable, and their unique subscription service also offers you a modern and ultimately a more flexible way to insure yourself whilst away compared to other types of cover on the market.

With rates starting at $42 per month (28 days) and covering you for most of the basics , they are a fantastic option for anyone working with a tight budget. Not only do they offer great travel insurance for backpackers, but they are also a good option for any digital nomads out there too.

I hope this guide helped you understand what backpacker travel insurance is and what to look out for when purchasing one.

Even if you choose not to go with any of the companies mentioned in this article, please don’t travel without insurance.

Make sure that you’re covered, even if you don’t end up needing to claim whilst away, knowing that you’re covered (just in case) is totally worth it!

You might also want to read:

The Ultimate List of 23 Countries with Digital Nomad Visas (for remote workers)

Travel and volunteer abroad for free with these 4 work exchange programs

The Complete Guide to Teach English Online with 37 Online Teaching schools and Platforms

4 Realistic and Best Ways to Find Free Accommodation for Travellers

How to Make Money While Traveling the World including the 12 Best Travel Jobs

16 Things to Prepare for a Long trip – International Travel Checklist

2 thoughts on “what is the best affordable travel insurance for backpackers the 3 best backpacker travel insurance companies compared”.

I read your long post and realised than none of your three companies would insure me as a 64 year old long time backpacker. Shocking? Back to World Nomads I suppose as they insure backpackers till 70. What will I do then though?

Hey Linda, I’m sorry to hear that they all put an age limit for long-term travelers… I double-checked and indeed, they only insure long term until a certain age…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

What’s the Best Backpacker Travel Insurance?

Explore the world with peace of mind; select backpacker insurance that prioritizes comprehensive medical coverage and flexibility for spontaneous travel plans.

When I was a backpacker, my low-budget lifestyle often took me off the beaten path, and rarely did I follow a fixed itinerary. Anything could happen, and that was the whole point.

In that same vein, it’s important that backpacker travel insurance coverage fits a lower budget yet is flexible enough to work with changing plans.

Within my fourteen years of travel, I’ve cashed in a travel insurance policy more than a few times. And while the industry has certainly changed in that time, general policy and coverage needs haven’t.

Based on years of travel, first-hand experience, extensive industry knowledge and deep research, I believe the following five companies offer the best insurance for backpackers because they are both flexible and affordable.

- Best Backpacker Travel Insurance Overall: Heymondo

- Best Long-Term Backpacker Travel Insurance: Safety Wing

- Most User-Friendly Backpacker Travel Insurance: Faye

- Best International Backpacker Travel Insurance: Tin Leg

- Best Medical Coverage: Seven Corners

Heymondo : Best Backpacker Travel Insurance Overall

The word “insurance” can be intimidating, and it’s easy to assume that buying insurance for your trip will be a frustrating process that will leave your head (and wallet) aching.

Fortunately, there are more and more companies out there trying to create a more user-friendly approach to travel insurance. Heymondo is a modern travel insurance provider that has a straightforward process to buy a plan, and their insurance policies are very affordable.

Plus, their coverage is great. The lowest level plan pays up to $100,000 for emergency medical bills and $250,000 in medical evacuation coverage. That’s better than most companies’ upper-tier plans which cost much more!

In addition to emergency evacuation and medical costs, you also get protection for trip cancellations, missed flights, lost baggage, electronic equipment, and more. Heymondo also includes several benefits that many travel insurance companies don’t cover (or charge you extra for) like coverage for adventure sports and pre-existing conditions.

I also love that Heymondo has an easy-to-use app that lets you manage your plan and submit claims straight from your phone. It’s much easier to deal with than waiting for hours to speak to an agent on the phone. I’m a big fan of anything that streamlines and simplifies my travel experience.

Heymondo also has a medical-only plan that doesn’t include coverage for canceled trips, baggage loss, flight delays, or the other trip protection benefits. This plan is extremely affordable and is a great way to get the most important protection for your health if you don’t need or want anything else.

Heymondo doesn’t offer a ton of customization options, but their base plans are great and much less expensive than most competitors. That’s awesome for us backpackers who are pinching pennies to save up for our next flight!

- Pros & Cons

- Great standard coverage for medical and trip protection

- Very affordable rates

- Included protection for adventure sports and pre-existing conditions

- Plans for trips of up to six months

- Skiing and snowboarding aren’t covered activities (even with the adventure sports add-on)

- No Cancel For Any Reason coverage

- Will only cover travelers up to 68 years old

Safety Wing : Best Long-Term Backpacker Travel Insurance

As one of the newest names in the insurance biz, Safety Wing is an excellent option for long-term travel insurance. Safety Wing is a bit different from most backpacker insurance providers in that they don’t offer policies for single trips. Instead, they have “nomad insurance” that has no fixed start and end dates. It uses a monthly subscription model, meaning you can travel as long as you want and still have insurance for medical emergencies.

SafetyWing’s plans range from emergency medical coverage while traveling outside your home country to full-blown health insurance for remote workers and digital nomads. Their goal is to create a global financial safety net by providing affordable insurance for anyone around the world. That also makes for great backpacking travel insurance.

Plus Safety Wing is one of the most affordable companies on this list. They have budget-friendly options that still offer good coverage for medical expenses, travel delays, and more.

All of this makes Safety Wing a fantastic insurance policy for anyone looking to travel for an extended period of time. Their coverage for medical expenses is fantastic, and they also include good protection for trip delay, lost luggage, and more.

So is this a perfect option for everyone? Well, no. Safety Wing doesn’t offer single-trip policies, so it really works best for folks traveling long-term. Also, medical protection limits drop if you’re over 65, and adventure sports and pre-existing medical conditions aren’t covered. Lastly, there is no coverage for canceled trips.

Click here to read our full Safety Wing review , or check out our Safety Wing vs World Nomads comparison.

- Flexible travel insurance for long-term travel

- Your plan automatically renews until you decide to cancel

- Trip delay coverage and trip interruption coverage are included

- Offers medical insurance that has you fully covered, even in your home country

- Just a single standard plan to purchase (no customization)

- No trip cancellation coverage

- No protection for electronics

- Doesn’t offer coverage for single trips

- No home country insurance for US residents

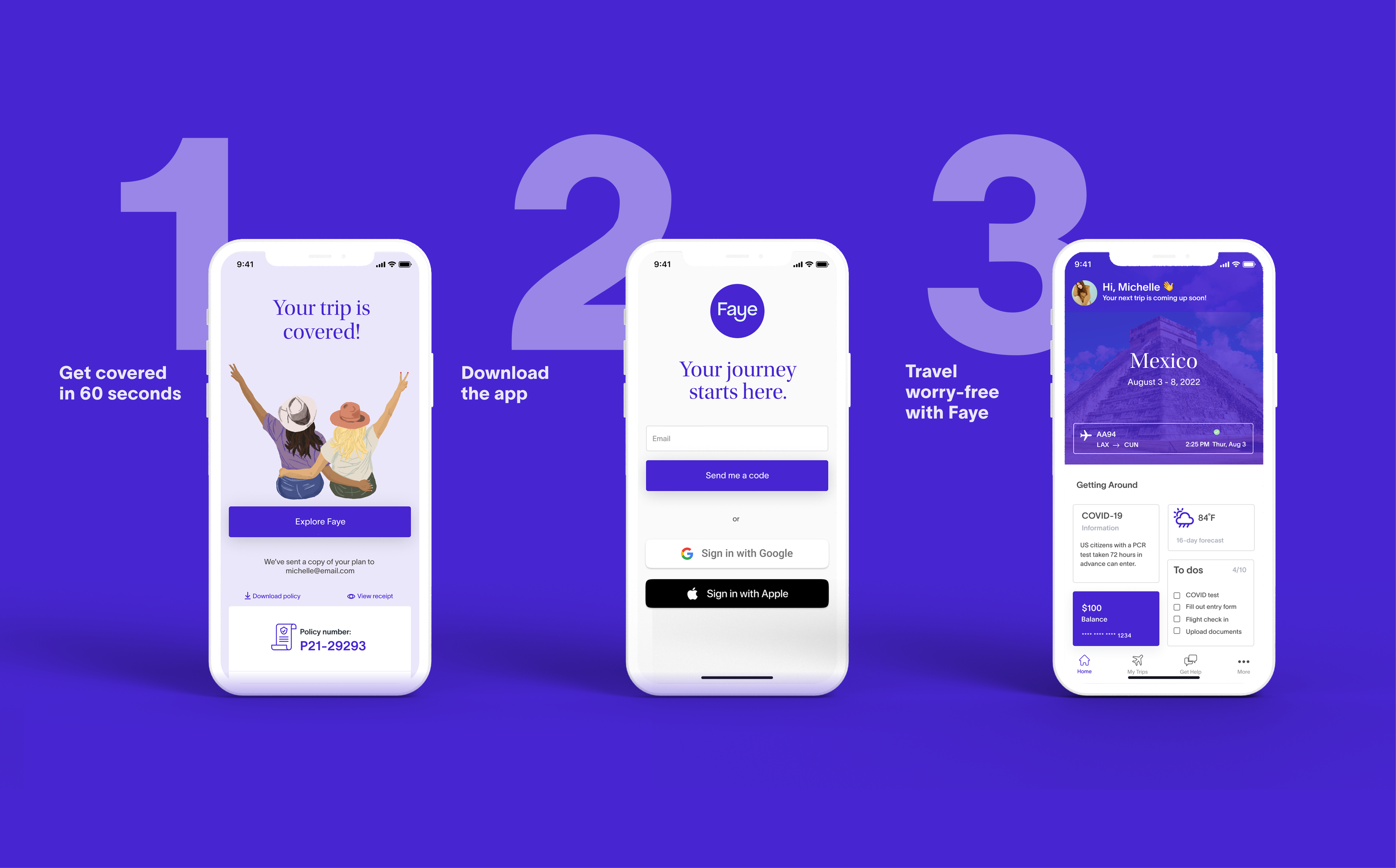

Faye : Most User-Friendly Backpacker Travel Insurance

When you’re out backpacking around the world, you probably don’t want to spend any extra time waiting on phone calls or filing claims. Unfortunately, many travel insurance providers aren’t known for being easy to deal with.

It doesn’t have to be that way though.

Faye is a newer insurance company on the market that offers a refreshing take on backpacker insurance policies with an app-based interface that makes it much easier to manage your plan or file claims. Sick of dealing with stuffy, difficult-to-navigate insurance? Faye might be a good option.

In addition to their easy user interface, I also love that Faye has a lot more customization options than other insurance providers. Going skydiving? You can add adventure sports coverage. Renting a car? They can insure that and will pay for rental car damage. Worried about taking care of your pet if your return home is delayed? They have an option that will pay for kennelling until you make it back.

There’s a lot to love, but (there’s always a but, isn’t there) Faye definitely isn’t the cheapest option on this list. They have great protection for medical costs, canceled flights, and more, but budget travelers will be able to get a better bang for your buck with Heymondo or SafetyWing .

- Super easy app-based system

- Included coverage for pre-existing conditions

- Covers flight cancellations

- Lots of add-ons to customize your policy, including Cancel For Any Reason

- Telemedicine feature gives you access to thousands of medical providers wherever you are

- Limited lost/damaged item coverage

- Not the cheapest option

Tin Leg : Best International Backpacker Travel Insurance