Your browser is not supported for this experience. We recommend using Chrome, Firefox, Edge, or Safari.

Take a 360° Tour

Welcome to the Modern West

Fort Worth is the 12th-largest city in the United States, known for Texas hospitality and a dozen remarkable districts full of culture and fun. The Historic Stockyards features western heritage with the world’s only twice-daily cattle drive , Billy Bob’s Texas , the world’s largest honky-tonk and the new Mule Alley . Explore a connected downtown with the 37-block Sundance Square entertainment district. Experience the stunning museums of the Cultural District , the Botanic Garden and nearby Fort Worth Zoo .

Navigating Fort Worth

Download a visitor guide, fort worth itineraries, things to do, food & drink, plan your stay, read up on all of the must-see fort worth spots while you're here , free things to do in fort worth.

Want to enjoy Fort Worth without spending a lot of money? Choose from a variety of free and nearly…

First Timer's Guide to Fort Worth

Here is a rundown of everything you need to consider adding to your trip itinerary.

Year-round Patios in Fort Worth

Patios perfect for any weather...

Discover Diverse Fort Worth

We invite you to visit Fort Worth, learn about the history and discover the Modern West.

Transportation Accessibility

Taxpayers to foot bill for majority of Jill Biden's Paris-Delaware trips for Hunter Biden trial

Dr. Biden made a round trip from Paris to Wilmington for an estimated $223,000.

Taxpayers will front the majority of first lady Dr. Jill Biden's travel between Paris, France, and Wilmington, Delaware, last week when she broke away early after D-Day commemorations to attend Hunter Biden’s trial , only to return to Paris a day later.

When officials travel, they fly on military planes, which are paid for by the government. But for personal, unofficial travel, they must reimburse the government for “the full coach fare for all flights,” according to U.S. Code.

According to the National Taxpayers Union Foundation, the cost of the one-way trip from the airport in Paris to the airport in Wilmington, Delaware, is about $111,500, based on an eight-hour flight and the Air Force's hourly reimbursement rate charged to other federal agencies for use of a Boeing C-32 (the type of plane Dr. Biden usually flies in, for security reasons). Dr. Biden made a round trip from Paris to Wilmington for an estimated $223,000.

MORE: Exclusive: Biden tells Muir he wouldn't pardon son Hunter, says Trump got 'fair trial'

The Air Force lists the reimbursable rate for use of this aircraft at $13,816 per hour. It is unclear what percentage of the total cost would be covered by the reimbursable rate that the Air Force charges other federal agencies for the use of the aircraft.

The Democratic National Committee will reimburse the value of two first-class tickets for the two trips she made in between the two cities, according to a DNC spokesperson, although when asked by ABC News, they did not specify how much that would be.

The DNC spokesperson did tell ABC News what they will pay is in line with what they are supposed to by law at the "specified rate."

MORE: New Jersey's Division of Alcoholic Beverage Control reviewing liquor licenses held by Trump's golf courses

The cost of a first-class ticket from Paris to Wilmington is $6,655, per a search on Google flights which would suggest the DNC will pay $13,310 instead of the full $223,000. That leaves an outstanding balance of around $209,690 to be paid for out of taxpayer funds.

Dr. Biden has been in the courtroom for most of Hunter Biden’s trial , missing only one day to commemorate the 80th anniversary of D-Day in Normandy last Thursday. That night she flew back to Wilmington to be at her son's trial on Friday. She flew back to Paris in time for a state visit on Saturday. President Biden remained in France for the 80th anniversary commemoration.

The White House and the First Lady's office did not respond to a request for comment.

Related Topics

Trending reader picks.

Texas doctor charged with taking private patient information on transgender care

- Jun 18, 12:47 PM

Japan, New Zealand agree on intel sharing pact

- Jun 19, 12:46 PM

Dog helps rescue owner after car crash in ravine

- Jun 10, 8:11 PM

Dutch leader Mark Rutte clears a big hurdle to becoming NATO chief after Hungary lifts objections

- Jun 18, 11:41 AM

A fire at a hospital in Iran's north kills 9 patients

- Jun 18, 4:04 AM

ABC News Live

24/7 coverage of breaking news and live events

Fort Worth Travel Guide

Courtesy of Jeremy Woodhouse | Getty Images

14 Best Things To Do in Fort Worth

Updated Dec. 22, 2022

If you're looking for a big dose of cowboy culture, head to the Fort Worth Stockyards for a self-guided tour. In addition to twice-daily cattle drives, this one-of-a-kind National Historic District is also home to Billy Bob's Texas , a

- All Things To Do

Fort Worth Stockyards Fort Worth Stockyards free

If you only have a day in Fort Worth, head straight to the Fort Worth Stockyards National Historic District. This living museum pays tribute to Fort Worth's Wild West heyday with daily cattle drives and plenty of restaurants serving up cowboy cuisine like beef tenderloin and rabbit-rattlesnake sausage. Start your visit at Stockyards Station, which sits at the heart of this historic neighborhood – from here, you can join a guided walking or Segway tour or hop on a stage coach. If you're interested in the district's history, pay a visit to the Stockyards Museum, which is housed in the former Livestock Exchange building and now contains an extensive collection of documents and artifacts from Fort Worth's Old West era. Meanwhile, the Texas Cowboy Hall of Fame and the Texas Trail of Fame will also offer insight into the people who made an impact on the sport and business of rodeo, and the western lifestyle in Texas. If you have kids in tow, take a twirl through the Cowtown Cattlepen Maze or a ride on the Grapevine Vintage Railroad.

Recent visitors strongly recommend visiting the Stockyards on a Friday or Saturday night for the Championship Rodeo. Starting at 7:30 p.m., talented cowboys will show off their riding, roping and racing skills in the Cowtown Coliseum. Afterward, you can test your dancing skills at Billy Bob's Texas – at 3 acres, Billy Bob's claims to be the world's largest honky-tonk. While many reviewers said this was a great activity for first-time visitors, they also cautioned that it is quite touristy.

Sundance Square Sundance Square free

To get a sense of historic Fort Worth, pair your visit to the Stockyards with an afternoon at Sundance Square, which is located in the heart of the city. Named for the Sundance Kid – partner to the infamous Butch Cassidy – this 35-block district has been entertaining Fort Worth visitors since the city's Wild West days. During the 1800s, cowboys following the Chisholm Trail would stop here in town to linger in the saloons, gambling parlors and dance halls. Today, the area's red-brick buildings house a variety of shops, restaurants and bars. Sundance Square's pedestrian plaza (located along Main Street between Third and Fourth streets) also features several fountains – the jetted fountains being the most popular. Bring your bathing suit for an afternoon of ducking and diving beneath the spray of 216 jets, or bring your camera in the evening when the fountain is lit by underwater LED light fixtures.

Recent visitors to Sundance Square enjoyed their time, describing the ambiance as quaint and the dining options as varied and plentiful. Many say it's much more fun when there are events going on, which liven up the scene even more. Others were particularly impressed with the area's holiday displays.

Fort Worth Zoo Fort Worth Zoo

Since it opened in 1909, this Texas zoo has been exposing Fort Worth residents and visitors to wildlife from around the world. When it first opened, the Fort Worth Zoo housed one lion, two bear cubs, a coyote, a peacock, an alligator and some rabbits; now, it's a full menagerie with exhibits showcasing everything from jaguars to flamingos. Make your way to the Australian Outback to observe Aussie residents like kangaroos, or visit the African Savanna for views of the Southern black rhinos. Recent visitors also highly recommend spending time in the Museum of Living Art, an award-winning facility that houses some 5,700 birds, reptiles and amphibians who live among hand-painted murals.

Those who have visited the zoo find plenty of aspects to praise, including the well-shaded pathways (lined with water misters primed to keep you cool on hot summer days) and the option to bring your own food and beverages. But heed the advice from these travelers to not ignore the other pastimes found on zoo grounds. For example, spend some time in Texas Wild!, a model Wild West village complete with a petting corral and a laser shooting gallery, as well as several snack options. Other attractions include a carousel, a 25-foot rock climbing wall and a 14,000-square-foot splash area complete with slides, a dump tower and water cannons.

Popular Tours

Stockyards History Tour Fort Worth Pub Crawl

(162 reviews)

from $ 45.00

Cow Town Ghost Tour: Hauntings of the Wild West

(39 reviews)

from $ 24.00

The Train Heist Adventure Escape Room

(34 reviews)

from $ 32.48

Kimbell Art Museum Kimbell Art Museum free

The Kimbell Art Museum has earned a reputation as one of the top small museums in the world. The facility itself is a work of art, complete with vaults and skylights and a sculpture garden designed by prominent Japanese-American artist, Isamu Noguchi. And despite its modest size, this museum is a must-see for any art buff: the permanent collection houses works that span history and features artists ranging from El Greco and Rembrandt to Monet and Picasso. Other collections include Egyptian and classical antiquities, Asian, Mesoamerican and African art.

Although art aficionados were already impressed by the original Louis Kahn building, which was constructed in 1972, the addition of the Piano Pavilion (named for Italian architect Renzo Piano, who helped design Paris ' famous Centre Pompidou ) in 2013 has made the Kimbell feel less cramped, recent visitors say. Many reviewers call this one of the best-kept secrets in Fort Worth, and one that is not to be missed.

Fort Worth Botanic Garden Fort Worth Botanic Garden

Visitors to the Fort Worth Botanic Garden can explore 120 acres of gardens, horticultural displays and exhibits. Dating back to 1934, the garden is the oldest of its kind in the state, and houses more than 2,500 species of plants. It is composed of 23 distinct gardens, including the renowned rose and Japanese gardens, the latter of which features koi-filled ponds and cascading waterfalls.

Recent visitors were blown away by the beauty of the gardens. Notably, for an outdoor attraction, many travelers say this destination is worth a visit during any month of the year. It's also a family-friendly attraction, although some note upkeep could be improved.

Amon Carter Museum of American Art Amon Carter Museum of American Art free

Can't get enough of Fort Worth's Cultural District? Art buffs should not miss the Amon Carter Museum of American Art. Visitors will find quintessential artists like Grant Wood, Georgia O'Keeffe and Jacob Lawrence featured at this museum, and may discover a new contemporary favorite, too. The museum exhibits American art from the 18th century to the present day represented across a variety of different mediums, including paintings, sculptures, photographs and works on paper.

Recent visitors raved about the collections, particularly the locally-relevant cowboy artworks. The museum is widely considered a must-see, and many noted that it is conveniently located near two other major art museums in the neighborhood (the Modern Art Museum of Fort Worth and the Kimbell Art Museum ).

Billy Bob's Texas Billy Bob's Texas

Billy Bob's Texas is a spacious honky-tonk, featuring an enormous dance floor (that can accommodate up to 6,000 people), pro bull riding and a stage graced by stars like ZZ Top. There are nearly three dozen bar stations in the neon-lit 1910 building – which was originally an open-air barn. Anyone looking for a quintessential Texas good time will find something to enjoy at this massive, 100,000-square-foot venue.

Recent visitors enjoyed the endless array of sights at Billy Bob's Texas. Nearly everyone notes the Texas-sized space, and many appreciated the live music and memorabilia on display. Several travelers mentioned that there is a $3 entry charge, including during the day.

Fort Worth Water Gardens Fort Worth Water Gardens free

The Fort Worth Water Gardens are a downtown "oasis" designed by famed 20th-century architect Philip Johnson. Spanning more than 5 acres, the site contains three "pools," including a Quiet Pool, an Aerated and an Active Pool. The Active Pool, which features a canyon of concrete terraces over which water flows to a basin 38 feet below, is perhaps the most visually striking. The Quiet Pool, which is surrounded by bald cypress trees, offers an ideal meditative spot. This shady urban paradise can be experienced year-round; an evening visit offers the chance to view the pools' dramatic architectural lighting. Note that though they are called "pools," swimming and wading is not allowed at the Fort Worth Water Gardens.

Recent visitors called this spot a hidden gem, especially in the summertime. It can be peaceful or quite lively, depending on the weather. Reviewers noted that following posted safety instructions is important, as ignoring them to enter the fast-moving waters is dangerous.

Pedal Saloon Fort Worth West 7th 2 Hour Private Tour

(265 reviews)

from $ 410.00

Billy Bob's Texas Honky Tonk Dinner and Photo Package

(55 reviews)

from $ 51.00

Fort Worth Stockyards Food And Puzzle Tour

(10 reviews)

from $ 117.00

Bass Performance Hall Bass Performance Hall free

Whether you love live music, theater or architecture, the Bass Performance Hall is not to be missed. Inspired by European opera houses, the building, which opened in 1998, fuses a historicizing exterior with a decidedly modern – but no less spectacular – interior. Architectural highlights include two 48-foot-tall limestone angels on the hall's exterior and an interior dome that measures 80 feet in diameter and features paintings by two Fort Worth artists. After you've gawked at the architecture, step inside for shows ranging from Broadway tours, to concerts, to stand-up comedy.

Recent visitors praised the acoustics of the Bass Performance Hall, as well as its beautiful design. However, some reviewers found the security measures and staff less than welcoming.

Fort Worth Museum of Science and History Fort Worth Museum of Science and History

Kids and adults alike will enjoy the Fort Worth Museum of Science and History. This interactive museum includes popular traditional exhibits featuring dinosaurs and Plains cultures, but also offers many opportunities for visitors to touch and experiment. For example, "DinoDig" replicates a field site with mock fossils, allowing visitors to become amateur archaeologists. Meanwhile, "Innovation Studios" allow kids to make memories – literally – with its focus on drawing, inventing and designing. The "Children's Museum" exhibit features a kid-sized grocery store, resources to design a building or train station, and a variety of age-appropriate play spaces. There is also a playground, a planetarium and the separate Cattle Raisers Museum on site, which features exhibits on the history and science of the cattle industry.

Recent visitors note that the museum is small, although it packs a lot of exhibits into the space. Some say it is best for young children and adults, though others found that toddlers to early teens alike enjoyed the outing for hours.

National Cowgirl Museum and Hall of Fame National Cowgirl Museum and Hall of Fame

The National Cowgirl Museum and Hall of Fame celebrates the women who helped shape the American West. The 33,000-square-foot museum features interactive galleries, theaters and archives that house thousands of artifacts that serve to tell the stories of more than 750 women. Artifacts include Annie Oakley's handwritten letters, her wedding ring and one of her shotguns. But it's not all ranchers and rodeo winners here; Laura Ingalls Wilder, Sacagawea and even Associate Justice Sandra Day O'Connor are honored in the museum's hall of fame. Among the museum's exhibits are some high-tech, interactive features, including the opportunity to create your own digital boot, shirt or horse projection, as well as the ability to superimpose yourself riding a bucking bronco in a digital rodeo.

Recent visitors enjoyed their stop here. Many noted that this is a unique museum experience and that there is a substantial variety of artifacts to reward a visit. Many were impressed with Annie Oakley hologram.

Modern Art Museum of Fort Worth Modern Art Museum of Fort Worth

Modernists will not want to miss this museum in the city's Cultural District. The museum showcases art from the 1940s to the present day and is housed in a striking concrete, glass and steel building that features 40-foot transparent walls and an exterior reflecting pool. Inside, there are paintings by Rothko, prints by Andy Warhol and sculptures by Jenny Holzer. There is a cafe on site, and special events take place regularly, including film screenings, musical performances and drawing programs for children, teens and adults.

Recent visitors raved about this museum. Aside from the excellent collection, travelers also complimented the knowledgeable staff, cafe offerings and modern building. Exhibits rotate, so it is a good idea to make sure many are open for your visit, as occasionally a floor is closed for installation.

Sid Richardson Museum Sid Richardson Museum free

The Sid Richardson Museum is an art museum located in Sundance Square that showcases paintings of the American West. It exhibits the art collection of oilman and philanthropist Sid Williams Richardson. Exhibits seek to bring new context and depth to depictions of the West by artists, such as Frederic Remington and Charles M. Russell.

Recent visitors recommend adding this museum to your itinerary if you have an interest in art depicting the American West. Reviewers praised the knowledgeable docents and many appreciated the artful landscapes. Some called this a "hidden gem" in Sundance Square.

Murder Mystery Dinner and Show

from $ 66.00

Fort Worth Stockyards Booze and Boos Ghost Walking Tour

(29 reviews)

from $ 38.72

Bikes and BBQ: Electric Bike Tour of Fort Worth

(50 reviews)

from $ 140.00

Trinity Park Trinity Park free

Dedicated in 1892, Trinity Park is a spacious, 252-acre outdoor space that's equipped with a variety of amenities, including a basketball court, a playground and water features. This municipal park, which sits along the Trinity River, was the first parkland in the city. It includes walking and bike paths that connect to a 100-plus mile paved trail network known as the Trinity River Trails. Amenities like restrooms, water fountains and picnic areas make it easy to pass an entire afternoon here.

Recent visitors praise the park for its safe and clean atmosphere and grounds. According to reviewers, the park is very family friendly. Others applaud the number of activities it offers. Cyclists, in particular, love the many trails found here.

Things to Do in Fort Worth FAQs

Explore more of fort worth.

Best Hotels

When To Visit

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

Recommended

The 28 Best Water Parks in the U.S. for 2024

Holly Johnson|Timothy J. Forster May 8, 2024

The 18 Best Napa Valley Wineries to Visit in 2024

Lyn Mettler|Sharael Kolberg April 23, 2024

The 25 Best Beaches on the East Coast for 2024

Timothy J. Forster|Sharael Kolberg April 19, 2024

The 50 Best Hotels in the USA 2024

Christina Maggitas February 6, 2024

The 32 Most Famous Landmarks in the World

Gwen Pratesi|Timothy J. Forster February 1, 2024

9 Top All-Inclusive Resorts in Florida for 2024

Gwen Pratesi|Amanda Norcross January 5, 2024

24 Top All-Inclusive Resorts in the U.S. for 2024

Erin Evans January 4, 2024

26 Top Adults-Only All-Inclusive Resorts for 2024

Zach Watson December 28, 2023

Solo Vacations: The 36 Best Places to Travel Alone in 2024

Lyn Mettler|Erin Vasta December 22, 2023

26 Cheap Beach Vacations for Travelers on a Budget

Kyle McCarthy|Sharael Kolberg December 4, 2023

- Arts, History & Culture

- Attractions & Family Fun

- Texas Beaches

- Food & Drink

- Music & Film

- Outdoor Adventure

- Texas Road Trips

- The Western Experience

- Texas Cities

- Big Bend Country

- Hill Country

- Panhandle Plains

- Piney Woods

- Prairies & Lakes

- South Texas Plains

- Texas Travel Guide

- Hotels, Resorts and B&Bs

- Campgrounds

- Guest Ranches

- The Great Texas Eclipse

- Where to Stay in the Prairies & Lakes

- Getting Outdoors in the Prairies & Lakes

- Online Travel Guide

The Perfect Dallas/Fort Worth Outdoor Itinerary

Whether you're a local or just got to Texas as fast as you could, I've mapped out the perfect Dallas/Fort Worth outdoor itinerary, chock-full of fun activities. Remember to travel safely. Wear a mask, stay home if you feel unwell and keep your distance. Get more information on traveling safely through Texas .

As a native of Dallas, I'm very proud to call this city home. We have a surprisingly diverse landscape of activities, shopping, nightlife, art, culture and entertainment. But what's so often forgotten is that there are many outdoor options in and near the DFW metroplex. Whether you're wanting to get your heart pumping with a bike ride or a hike, leisurely gaze at the funky art scene, explore a historical neighborhood or capture an Instagram shot of the beautiful skyline, it's easy to keep yourself busy. The Dallas/Fort Worth area has 232 days of sunshine year-round! So you'll surely find a day that's perfect to enjoy outdoors.

Dallas/Fort Worth Itinerary at a Glance

Day 1 – See the best of Dallas! We'll spend a full day in Dallas exploring the best this historic city has to offer.

Day 2 – Dallas and Fort Worth. We'll start our day in Dallas, get some fun activities in along the way, then finish off in Fort Worth.

This is a jam-packed schedule of fun and outdoor adventures for any age. Too many things to do? Feel free to take a few things off the daily itineraries.

Day 1 Outdoor Activities in Dallas

While Dallas has plenty of high-end things to do, those often come with a price tag. There are plenty of totally free outdoor activities in Dallas waiting for you. One of my favorite things about my hometown is that it welcomes everyone outside to enjoy the warm Texas weather, even in the heart of the city and no matter the time of year. Even better, exploring Dallas outdoors is an activity that can be done without spending a dime.

Morning at White Rock Lake

White Rock Lake is my favorite park in Dallas. It's beautiful, accessible and provides lots of activities. The 9.5-mile loop allows you to run, bike or walk. With 1,015 acres, you can easily go for a picnic, take photos of the skyline or even go stand-up paddleboarding.

It’s hard to believe you can go fishing, kayaking or sailing so close to downtown, but that’s what makes this park so special. Head to the park during early morning to snap photos of the sunrise against the Dallas skyline. Don't forget, you can also bring your dog to the dog park here or take a stroll around the lake.

Dallas Arboretum and Botanical Garden

Located on White Rock Lake, you'll find the lovely 66-acre Dallas Arboretum . Filled with beautiful flowers, botanical plants and unique vegetation, this is a great place for all ages. Different seasons and holidays offer new decor, so you might even want to opt for a season pass to see all the different offerings. This is one of the most-visited botanical gardens in the country!

Afternoon at Deep Ellum Murals

The funky and cool area of Deep Ellum is one of the best areas of Dallas to see art for free. There are dozens of murals painted on buildings. You'll see everything from Texas and Dallas history, along with artist's renditions of people, places and influences. The rich cultural ties and artistic roots make Deep Ellum a haven for street art. If you're looking for a great Instagram shot, don't miss Deep Ellum. See the most Instagram-worthy spots in Dallas here.

Klyde Warren Park

A park above the freeway? Yes! And it's meticulously landscaped along with unique features to photograph. Klyde Warren Park is located directly between the downtown and uptown districts. The 5.2 acres of play space for kids and adults is actually constructed above the Woodall Rodgers Freeway, offering a unique escape from the traffic that inevitably comes with city living. Here you can grab a bite to eat at the food trucks, walk your dog or enjoy a different view of Dallas.

Evening at Highland Park Village

This is one of the prettiest areas of Dallas. You can drive around to see the homes and stroll around Highland Park Village , or go window shopping. It's one of the oldest open-air shopping centers in the country, which adds a bit of culture to your shopping adventure. Here, you’ll find names like Chanel, Fendi, Ralph Lauren and Jimmy Choo, as well as younger, trendier names like Anthropologie and Rag & Bone. This is also a great place to grab a coffee or see the historical movie theater.

Trinity Skyline Trail

We're ending day one in Dallas with the perfect view of the skyline and our newish Margaret Hunt Hill Bridge . This 4.6-mile recreational trail is perfect for hikers & bikers, or those that just want a great view. Here, you can see the Trinity River in the Dallas Floodway. Another great place to take a walk in this west Dallas area is the Ronald Kirk Pedestrian Bridge , right next to Trinity Groves , which is a mecca for outdoor patio restaurants.

Day 2 In and Around Dallas/Fort Worth

Morning at dallas farmers market.

Dating back to 1941 and founded on downtown’s east side, this market is one of the largest in Texas. It features more than 150 stalls, selling everything from honey, local produce and eggs to artisanal foods, Mexican imports and T-shirts. It’s easy to spend a big chunk of your day shopping and dining in the Dallas Farmers Market , and possibly even longer if you visit during a live musical performance or special event.

Cedar Ridge Preserve

A quick 20-minute drive from Dallas, and on your way to Fort Worth, the Cedar Ridge Preserve covers 600 acres with nine miles of trails, a butterfly garden and lush trees and wildflowers. Dallas is home to a shocking number of mountain biking paths. DORBA (Dallas Off-Road Bicycle Association) shares many great spots for mountain biking trails in the Dallas/Fort Worth area.

Don't want to venture too far from the heart of Dallas? Check out the Katy Trail . This former rail line is a beacon for walkers and joggers near the Uptown and Downtown neighborhoods. This 3.5-mile trail is also near many of Dallas' must-see districts and restaurants.

Afternoon at the Fort Worth Botanic Garden

Just because Dallas has a great botanical garden, doesn't mean Fort Worth doesn't have an equally great one. Started in 1934, this is the oldest major botanical garden in Texas. The beautiful garden is focused on beauty, education and research, as well as the opportunity to observe and admire nature in the 110-acre space. My favorite is the Japanese Garden . Get ticket prices and more information for the Fort Worth Botanic Garden .

Midday at the Fort Worth Stockyards

If you really want to feel like a Texan, head to the stockyards . This is a historic district in Fort Worth, and twice a day, there's a cattle drive that's a must-see! In addition, you can see the historic buildings and walk the Texas Trail of Fame , where the Chisholm Trail began.

Evening at the Drive-In Movie Theater

You've had a busy past two days! Check out the Coyote Drive-In Theater in Fort Worth. This outdoor theater features a big, covered concession area serving local beers and snacks, plus there's a playground.

Now, you've really seen some of the best things to do in Dallas/Fort Worth!

This post is sponsored by Travel Texas. All opinions expressed are my own.

Helene Sula

Helene Sula is a Dallas native who has traveled the world with her husband and two dogs. After living in Germany for the past three years, she's back in Texas to continue blogging, writing a book, and experiencing America in an RV. Helene has a passion for photography and capturing the moment. A former social media marketer, Helene grew her blog and Instagram to become a full-time content creator and has helped 1,000s of other bloggers build and grow their brand through tried and tested strategies. You can find more from Helene here.

We use cookies to improve your experience and to analyze the use of our website. By continuing to use our site, you agree to our Privacy Policy .

- Travel & Meeting Pros

- Accessibility

- Privacy Policy & Terms Of Use

All Material © 2024 Office of the Governor, Economic Development and Tourism. All Rights Reserved. Reproduction in whole or in part is prohibited without the written permission of the publisher. Office of the Governor, Economic Development & Tourism 1100 San Jacinto, Austin, Texas 78701, (512) 463-2000

- Skip to main content

- Skip to footer

- 888-438-3294

- [email protected]

The beginning of an exciting vacation experience

Sunny Fort Lauderdale getaway starting at $99

- Resort accommodations

- Additional nights available

Offer Expires in:

Book by phone: 888-438-3294.

Let our expert vacation specialists help you save even more.

Visit Fort Lauderdale

Collegians of the 1960s returning to Fort Lauderdale would be hard-pressed to recognize the onetime “Sun and Suds Spring Break Capital of the Universe.” Back then, Fort Lauderdale’s beachfront was lined with T-shirt shops, and downtown consisted of a lone office tower and dilapidated buildings waiting to be razed. Not anymore! What was once a hotbed of dive bars, diners, and all-day beach parties is now a more upscale destination with a deeper focus on quality in the pursuit of leisure. The city’s elevated personality has paved the way for creative organizations, notable eateries, and premium entertainment options to stake their claims and has attracted a menagerie of world-class hotel brands and condo developments. Fortunately, the upscaling is generally guided by an understated interpretation of luxury that doesn’t follow Miami’s over-the-top lead. Fort Lauderdale is still a place where flip-flops are acceptable, if not encouraged.

Along The Strip and west to the Intracoastal, many of the mid-century-modern boutique properties are trying to preserve the neighborhood’s vintage design aesthetic. Somehow, Greater Fort Lauderdale gracefully melds disparate eras into nouveau nirvana, seasoned with a lot of sand. This could be the result of its massive territory: Broward County encompasses more than 1,100 square miles of land—ranging from dense residential enclaves to agricultural farms and subtropical wilds. But it’s the county’s beautiful beaches and some 3,000 hours of sunshine each year that make all this possible.

Fort Lauderdale was named for Major William Lauderdale, who built a fort in 1838 during the Second Seminole War. It was incorporated in 1911 with only 175 residents, but it grew quickly during the Florida boom of the 1920s, and it became a popular spring break destination in the 1960s. Today’s population is more than 176,000, and the suburbs continue to grow. Of Broward County’s 31 municipalities and unincorporated areas, Fort Lauderdale is the largest. And now, showstopping hotels, a hot food scene, and a burgeoning cultural platform accompany the classic beach lifestyle.

Top things to do in Fort Lauderdale

- Las Olas Boulevard – Diverse restaurants, three museums, 10 international art galleries and 65 retail options line Las Olas Boulevard, with recent visitors saying it’s the perfect place for a stroll, if not a shopping spree. But while casual walkers and window shoppers enjoy soaking in the Floridian atmosphere and overall aesthetic of the boulevard, the more intent consumer may not find this commercial street as appealing due to the high price tags. However, travelers recommended grabbing a bite above all else, as many were impressed with the quality of food and the amount alfresco dining options available. Our advice would be to make a stop here if you’re planning to visit the nearby Stranahan House, Riverwalk or Museum of Art.

- Fort Lauderdale Beach – Want a beautiful Florida beach without a crazy party scene? Fort Lauderdale Beach may be just what you’re looking for. Here you’ll find a calmer and less chaotic version of Miami Beach — but with the same sugary sands and crystal clear water. There are still parties, but you’re more likely to find families relaxing or leisurely walking the waterline than raucous groups of college kids. Backing the shoreline, the palm tree-lined promenade bustles with visitors looking to shop and dine in the many establishments along it. There are also water sport and beach chair rentals near the shore.

- Sawgrass Recreation Park – Take an airboat tour of the Florida Everglades at the Sawgrass Recreation Park, home to a huge range of flora and fauna, including a variety of birds, fish and alligators. And prepare to be amazed (or scared) by the close-up vistas of gators and other creatures. You can even reserve an airboat tour for nighttime runs to see nocturnal animals in their natural state. Visitors can also arrange for private tours, which are longer than the normal 30-minute runs.

- Hugh Taylor Birch State Park – Located less than 2 miles north of the Bonnet House, Hugh Taylor Birch State Park is situated between the Intracoastal Waterway and the Atlantic Ocean and boasts fun activities for all types of travelers. Those looking to get a little wet can canoe or kayak in the largest of the park’s coastal dune lakes. Adventurers who want to get their adrenaline pumping can bike along the nearly 2-mile paved park drive. Meanwhile, visitors who prefer to explore by foot can hike the Coastal Hammock Trail, which snakes through a native maritime tropical hardwood hammock ecosystem, one of the last of its kind in the county. Fisherman can make a catch at the seawall while bird-watchers can have fun trying to spot any one of the 250 species that live in and regularly grace the park. There are also free ranger-guided walks that take travelers through sensitive habitats, along the beach and even to Hugh Taylor Birch’s old residence, for which the park is named.

- Stranahan House Museum – The oldest residence in Fort Lauderdale is now a living monument to Floridian life in the 1900s. Frank Stranahan originally constructed the house located off Las Olas Boulevard, as a trading post before making it a home for him and his wife Ivy, the city’s first schoolteacher. From this spot, he met and did business with Seminole Indians who were in the area. After Ivy Stranahan’s death in 1971, the building was purchased by the Fort Lauderdale Historical Society and is now a museum that provides guided tours three times a day.

- Bonnet House – This house sitting in the middle of the city has a long romantic history. In 1919, a wealthy settler gave the 35-acre property (named after the bonnet lily flower that grew on the grounds) as a wedding gift to his daughter Helen and her husband Frederic. In 1920, the newlyeds began construction of Bonnet House, hoping to build a winter getaway where Frederic could pursue his art and Helen could work on her music and poetry. But construction soon stopped when Helen unexpectedly died in 1925. Frederic didn’t resume property renovations until 1931 when he married Evelyn Fortune Lilly. The new couple continued decorating the house until Frederic’s death. Several decades later in 1983, Evelyn donated the house to the state’s Trust for Historic Preservation, opening it to visitors for guided tours.

- Museum of Discovery and Science – If it’s a rainy day and you need an indoor activity that appeal to the kids, take them to the Museum of Discovery and Science. The museum’s Ecodiscovery Center is filled with so many activities, animals and exhibits your kids may never want to leave. Get introduced to river otters, take a simulated airboat ride along the Everglades or learn more about Florida weather patterns at the Storm Center. There’s also an aviation station, where kids can climb into the cockpit of a DC-9 commercial airliner, and rea dinosaur bones at the Fishy Fossils exhibit. If that’s not enough, guests can venture into the 7-D capsule theater that takes visitors on a flight through the sky to learn more about the mechanics of aviation. There’s also a 300-seat Imax theater showcasing documentaries and major motion pictures.

- NSU Art Museum Fort Lauderdale – Las Olas Boulevard’s NSU Art Museum Fort Lauderdale is a great spot to escape the hot or rainy weather, according to recent visitors. The modern art museum features more than 6,000 works from a variety of artists in its permanent collection, including the largest holding in the country of post-war and avant-garde works from CoBrA (stands for Copenhagen, Brussels and Amsterdam) artists in the country. There is also a significant amount of work from various Latin and Latin-American artists, as well as art from African, Native American and Oceanic Tribal Arts. The museum has rotating exhibits, previous of which have included the likes of Frida Kahlo and Pablo Picasso. Along with an extensive art collection, the more than 50-year-old museum also works in conjunction with Nova Southeastern University to provide art classes for visitors.

Book Online

We are committed to providing the best vacation experience possible. In order to meet this promise, we vow to only hire friendly, positive people that have a passion for helping others.

- Vacation Specials

- Free Travel Guides

- Customer Reviews

Destination

- Orlando Vacations

- Gatlinburg Vacations

- Las Vegas Vacations

- Miami Vacations

- Best Price Guarantee

- Privacy Policy

- Terms and Conditions

- 5300 Old Pineville Rd Ste 150 Charlotte, NC 28217

- Phone : 888-438-3294

- Mail : [email protected]

©2019 2fntravel.com | Terms & Conditions | Privacy | Contact Us

THIS ADVERTISING MATERIAL IS BEING USED FOR THE PURPOSE OF SOLICITING SALES OF TIMESHARE INTERESTS OR PLANS. Complete details of participation in offering provided by sponsor.

Locations and travel dates are subject to package availability and reservation requests are confirmed on a first come, first served basis. Package price covers accommodations and specifically does not cover costs associated with travel and additional expenses that might be incurred. Price does not include tax. The offer may not be coupled together with another promotional discount or coupon. This promotional offer is void where prohibited by law. Package and Extra Night Pricing is based in U.S. Dollars (USD).

Forth 2 live

Frequencies Forth 2

Edinburgh: 1548 AM

Related Podcasts

Address:

Telephone:

E-mail:

Social networks

Discover radio stations by genre

Filter radio by location.

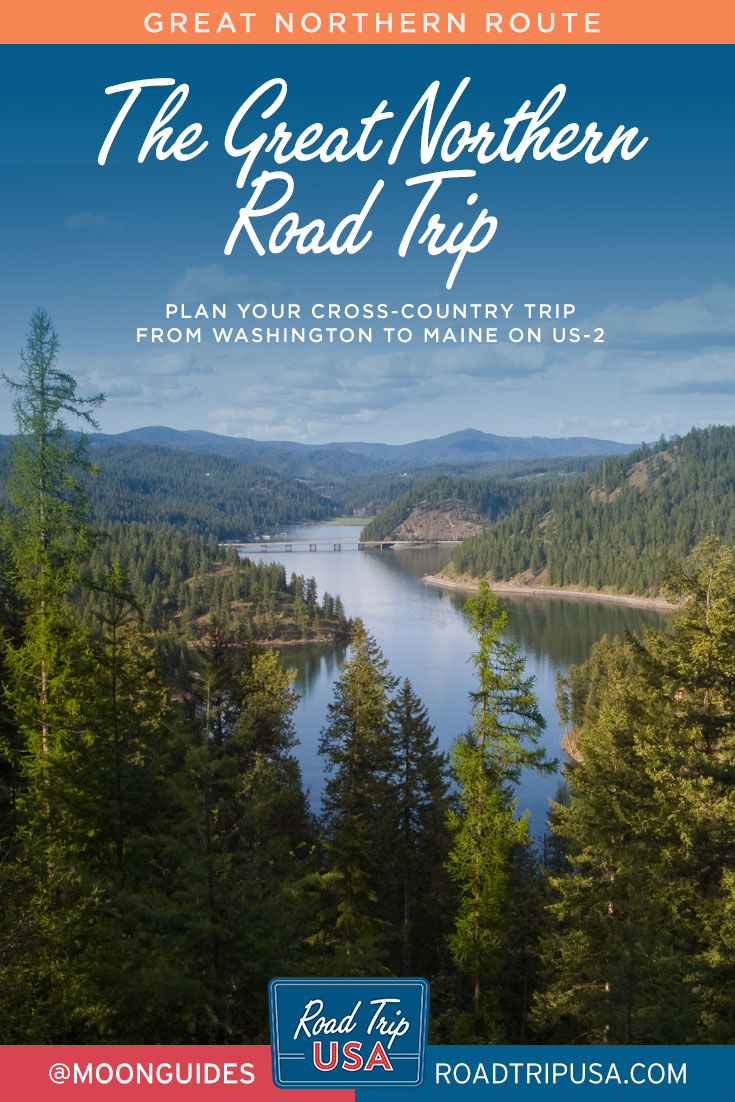

Are you ready for a Road Trip? Explore these eleven incredible cross-country road trip routes across the U.S.!

Pacific Coast

Border to Border

The Road to Nowhere

The Great River Road

Appalachian Trail

Atlantic Coast

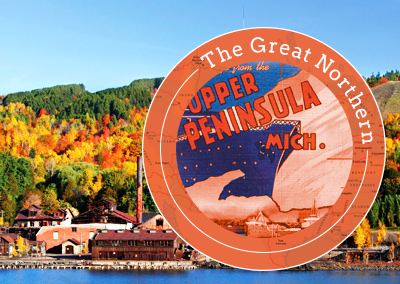

The Great Northern

The Oregon Trail

The Loneliest Road

Southern Pacific

Home / The Great Northern

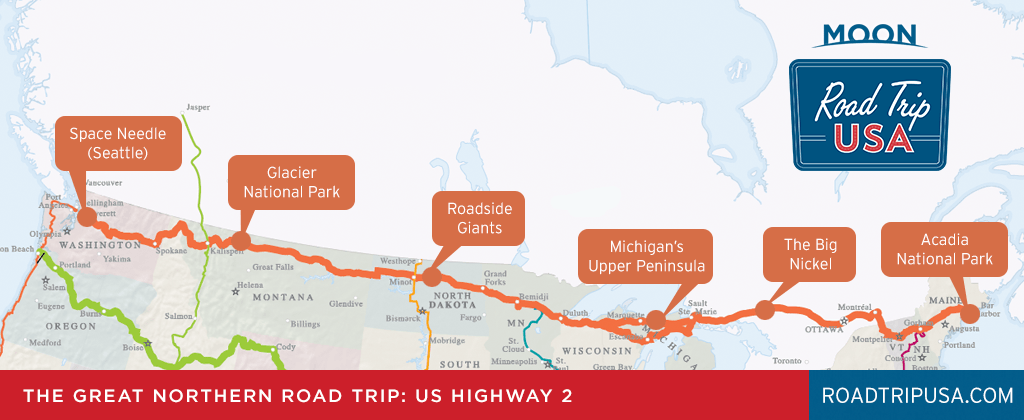

The Great Northern Road Trip: US Highway 2

Though many come close, no other cross-country route takes in the variety and extremity of landscape that US Highway 2 does. Dubbed the Great Northern in memory of the pioneer railroad that parallels the western half of the route, US-2 is truly the most stunning and unforgettable, not to mention longest, of all the great transcontinental road trips.

Starting in the west near the beautiful Pacific port city of Seattle, US-2 runs steeply up and over the volcanic Cascade Range, climbing from sea level to alpine splendor in around an hour. From the crest, the road drops down onto the otherworldly Columbia Plateau, a naturally arid region reclaimed from sagebrush into fertile farmland by New Deal public works projects like the great Grand Coulee Dam, one of the largest pieces of civil engineering on the planet. From Washington, US-2 bends north, clipping across the top of the Idaho Panhandle before climbing into western Montana, a land of forests, rivers, and wildlife that culminates in the bold granite spectacle of Glacier National Park.

On the eastern flank of the Rockies, the route drops suddenly to the windswept prairies of the northern Great Plains. Though empty to look at—especially when you’re midway along the 1,000-mile beeline across Montana and North Dakota, wondering how long it will be until you see the next tree or peak—this is a land rich in history, where the buffalo once roamed freely, where Plains peoples like the Shoshone, Blackfeet, Sioux, and Cheyenne reigned supreme, and where the Lewis and Clark expedition followed the Missouri River upstream in search of a way west to the Pacific.

Midway across the continent, the Great Plains give way to the Great Northwoods country of Minnesota —birthplace of both Paul Bunyan and Judy Garland—and then to the rugged lumber and mining country of Wisconsin and Michigan’s Upper Peninsula. Continuing due east, the route crosses the border into Ontario, Canada, running through the francophone environs of Montreal before returning to the United States near lovely Lake Champlain in upstate New York.

From there, US-2 passes through the hardwood forests of Vermont’s Green Mountains and the rugged granite peaks of New Hampshire’s White Mountains, two very different ranges, though only 50 mi (81 km) apart. The route winds down to the coast of Maine, reaching the Atlantic Ocean at Bar Harbor and Acadia National Park.

Landscapes, rather than cities and towns, play the starring roles on this route. After a few days spent following US-2 through small towns and wide-open spaces, you’ll probably consider Duluth bustling and fast-paced; driving even a short stretch of the Great Northern highway is guaranteed to bring new meaning to the expression “getting away from it all.”

Sights along a US Highway 2 Road Trip

For more insight into each stop along the Great Northern road trip, our content is arranged by state. Here are some major sights along US Highway 2 where travelers aiming to follow only a section of the full cross-country route may wish to use to plan their drive:

- Seattle, Washington – An engaging and energetic combination of scenic beauty, blue-collar grit, and high-tech panache

- Glacier National Park, Montana – Offering incredible scenic beauty and innumerable options for outdoor recreation

- Devils Lake, North Dakota – Home to historic Fort Totten, one of the country’s best-preserved 19th-century military forts

- Duluth, Minnesota – One of the most beautiful and underappreciated travel destinations in the Midwest

- Apostle Islands National Lakeshore, Wisconsin – Take a detour on our favorite summer drive and follow Highway 13 along the picturesque shore of Lake Superior

- Mackinac Island, Michigan – No cars allowed! Park your ride and ferry over to one of the top draws in the Midwest

- Ottawa, Ontario – Canada’s national capital is one of the most peaceable and pleasant of the world’s capitals

- Montreal, Quebec – Charming and cosmopolitan, Montreal is easily the most European city in North America

- Burlington, Vermont – Best known these days as the home of Senator Bernie Sanders and countercultural icons Ben & Jerry’s

- Jefferson, New Hampshire – Featuring one of the state’s biggest tourist draws: Santa’s Village

- Acadia National Park – Explore the natural glory of Mount Desert Island and be sure to get out of the car and head inland on foot on the park’s many hiking trails

Related Travel Guides

- Barnes & Noble

- Books-A-Million

- Indigo (Canada)

- Powell's Books

- Apple Books

Great Northern Route Travel Maps

Pin it for Later

Jill Biden takes 7,200-mile round trip in private jet from D-Day event in France to Delaware for Hunter's trial

F irst Lady Jill Biden made a 7,200-mile trip from the D-Day commemorative event in France to Delaware for her stepson Hunter's federal firearms trial on Friday.

After attending a D-Day anniversary event in Normandy, France, where President Joe Biden spoke about the current threats to democracy mirroring those faced during World War II, she quickly returned to her home state.

Despite having a state dinner back in France on Saturday, she's chosen to make the 7,200-mile round trip to be present in court.

READ MORE: Hunter Biden branded stepmom Jill Biden a 'vindictive moron' in vicious texts

READ MORE: Joe Biden sparks concern as onlookers fear he 'pooped his pants' after he 'can't figure out' how to sit down

Hunter Biden , the president's only surviving son, is currently on trial facing three federal charges related to the alleged purchase of a firearm while addicted to drugs. These charges include making a false statement in the purchase of a firearm, providing false information required by a federal firearms licensed dealer, and possession of a firearm by an unlawful user of or addicted to a controlled substance.

If found guilty on all counts, he could face up to 25 years in prison and fines exceeding $750,000. However, it's highly unlikely that he will receive the maximum sentence if convicted, reports the Express US .

Given the First Lady 's unexpected visit and extensive travel, there's speculation that she may testify as a defense witness in her stepson's case. The first defense witness called to the stand today was the owner of the gun store.

The situation follows the recent verdict in former President Donald Trump 's hush money trial in New York last Friday, where he was found guilty on all 34 counts related to his payment to adult film star Stormy Daniels to suppress the story of his extramarital affair before the 2016 election.

Click here to follow the Mirror US on Google News to stay up to date with all the latest news, sport and entertainment stories.

Attention has now turned to the president's 54-year-old son who faces three charges of illegal firearm possession, allegedly obtained without properly disclosing his crack cocaine addiction on the federal background check form.

While President Biden is not directly involved in the case, the trial is likely to attract unwanted attention and be used against him in his re-election campaign, including the upcoming first debate with Trump later this month, where the two leading candidates are expected to engage in a heated exchange.

Forth 1 Traffic and Travel

Get live traffic and travel information for your area. See the latest incidents, engineering works, and road closures.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Best Days to Fly Around the Fourth of July in 2024

Sally French is a travel rewards expert who joined NerdWallet in 2020. She previously wrote about travel and credit cards for The New York Times and its sibling site, Wirecutter.

Outside of work, she loves fitness, and she competes in both powerlifting and weightlifting (she can deadlift more than triple bodyweight). Naturally, her travels always involve a fitness component, including a week of cycling up the coastline of Vietnam and a camping trip to the Arctic Circle, where she biked over the sea ice. Other adventures have included hiking 25 miles in one day through Italy's Cinque Terre and climbing the 1,260 steps to Tiger Cave Temple in Krabi, Thailand.

She lives in San Francisco.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

The best and worst days to fly July Fourth weekend

How this year’s thursday holiday might impact long weekends, the smarter, cheaper fourth of july travel itinerary in 2024, what about driving on fourth of july.

For folks planning July Fourth vacations, prepare for crowds. The Transportation Security Administration (TSA) screened a record number of passengers in 2023, and those records are likely to be broken in 2024. In fact, in the first two months of 2024, travel volumes were roughly 6% higher than the same period in 2023, according to the TSA.

With the expected big crowds in mind, are some days better for air travel than others?

In 2024, July Fourth falls on a Thursday, which puts a wrench in predicting travel crowds. Will folks take the Friday after off to enjoy the long weekend? Or will they decide their vacation time is best used for another holiday?

Here’s some guidance around booking July Fourth weekend air travel in 2024, how you might be able to avoid the crowds — and potentially save money on airfare .

Are airports busy on July Fourth? NerdWallet analyzed TSA data showing the number of passengers screened at its U.S. checkpoints over the past three years, homing in on the seven days before and after July Fourth, to find the busiest days to fly.

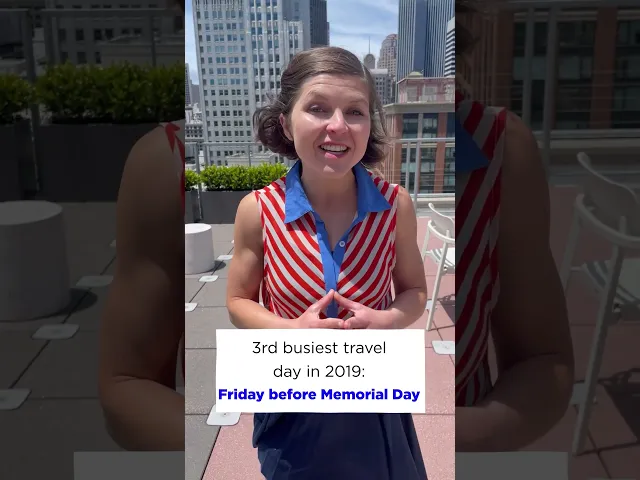

The worst days to fly: To avoid crowds, don’t fly the Friday before July Fourth. In each of the past three years, the Friday before July Fourth was the busiest travel day before the Fourth of July weekend.

For post-holiday travel, the Sunday after ranks as the busiest day to fly.

The best days to fly: Typically, July Fourth is the least busy day to fly. On July Fourth of last year, airport crowds averaged just 70% of what they were relative to the busiest travel day, which was the Friday before July Fourth (June 30, 2023).

But if you’d rather spend July Fourth celebrating — and not in an airport — turn to Tuesday. The Tuesdays before and after the holiday rank among the least busy days to fly during July Fourth week.

The rankings of best and worst days to fly for July Fourth follow year-round travel patterns. No matter when you’re traveling, Fridays are, on average, the busiest day to fly, and Tuesdays are, on average, the least busy days to fly.

July Fourth falls on a Thursday, so people intending to travel for the holiday will likely take the next day, Friday, off and make it a long weekend. But given how few people are willing to travel on Independence Day, when will people actually fly?

The last time July Fourth fell on a Thursday was in 2019. Here’s a look at travel crowds by day in 2019, ranked from most to least crowded:

Sunday after, July 7 (most crowded).

Monday after, July 8.

Friday before, June 28.

Thursday before, June 27.

Sunday before, June 30.

Thursday after, July 11.

Wednesday before, July 3.

Wednesday after, July 10.

Tuesday after, July 9.

Monday before, July 1.

Saturday before, June 29.

Tuesday before, July 2.

Saturday after, July 6.

Friday after, July 5.

Thursday, July Fourth (least crowded).

In 2019, the July Fourth holiday was the least busy day to fly. Meanwhile, July 5, the day after the holiday, wasn’t busy either. That bucks the usual trend of Friday being the busiest travel day of the week. When it comes to July Fourth weekend travel, most people are already set in their locations by Friday.

But there’s one day that people are definitely crowding airports, and that’s the Sunday after July Fourth. Flying this day will cost you, too. According to travel booking app Hopper’s 2024 Travel Booking Hacks report, Sunday is the most expensive day to fly in the U.S., with airfares averaging 15% more than midweek departures.

Following typical July Fourth holiday travel patterns could mean costs in terms of airfare and time spent waiting in line at the airport. Deviate from that schedule to find lighter crowds and perhaps better July Fourth flight deals, too. Try these travel days instead:

Fly on July Fourth

If you don’t mind traveling on the holiday, you’re looking at the single emptiest air travel day of the period analyzed.

Do one better by flying early on the holiday. Hopper’s spring 2023 Flight Disruption Outlook found that flights that depart from 5 a.m. to 8 a.m. are half as likely to be delayed as flights with scheduled departure times after 9 a.m.

Plus, a morning flight improves your odds of catching the fireworks at your final destination.

Embrace Saturday travel

Rather than rush out from work on the Friday afternoon before the holiday to jump on a flight, relax at home that evening and depart Saturday morning before instead. Simply shifting your trip by one day could likely result in going from one of the busiest to lightest travel days of the July Fourth travel period.

The same goes for returning home. While it can be tempting to extend your trip as long as possible before you have to get back to work on Monday, skip the Sunday flight and fly home on Saturday instead. Bonus: You’ll have a day at home to rest and recover before the new workweek. How responsible of you.

Fly on July 5

Though Friday is typically one of the most expensive days to fly year-round, that’s unlikely to be the case this particular week.

So another option is to fly home on July 5. This allows you to still spend the holiday in your destination of choice. By returning on Friday, you’ll still have the full weekend at home to take a vacation from your vacation before Monday.

While airports will be packed, the roads probably won't be much better.

That's true of most U.S. holidays. According to American Automobile Association's projections for Memorial Day weekend , nearly 38 million people will travel by car over the holiday weekend, more than 10 times the number of air travelers. These projections are 4% higher compared to last year's estimates for the same period, which could be a signal that Fourth of July in 2024 will be busier than 2023 as well.

If you are driving and are seeking to save money on gas , use gas price apps and pay with a gas credit card so you earn bonus points at gas stations.

If you're driving a car that you expect to book from a rental car agency, be prepared to pay up. The average cost of a car rental today is significantly higher than the same month in 2019 pre-pandemic, according to NerdWallet's travel price tracker , which is based on data from the U.S. Bureau of Labor Statistics.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Forth Bridge 2

Ideal cruising for a family or two couples., forth bridge 2 dimensions: 11.58m x 3.66m (38ft x 12ft).

3 Cabins (3 double and 1 single or 2 double and 2 single and quarter berth midship suitable for child 3-11 years

Up to 7 people, pet friendly*, please note: this boat will only pass under potter heigham bridge, when tides are lower than normal..

Dual steering

Bow thruster for ease of handling

Dual steering from stateroom or flying bridge

2 shower/WCs, 1 ensuite

240v socket for mobile phone and camcorder

12v socket for mobile phones etc (12v car leads required)

GPS speed log

Warm air heating

Galley including cooker, fridge and kettle

Travel hairdryer on request

Bed linen and duvets

All our boats include;

Fouled propeller insurance

Open air parking

Sorry, none of the boats will operate electrical appliances for medical reasons (e.g. a nebuliser to aid breathing).

Early and late season cruising is available on some boats, please ask for details., group bookings may be subject to restrictions..

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

When it comes to government planes and political trips, who pays for a president’s campaign travel?

FILE - President Joe Biden boards Air Force One, March 11, 2024, at Andrews Air Force Base, Md. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Luis M. Alvarez, File)

FILE - President Joe Biden, center right, and first lady Jill Biden, center left, walk off Air Force One, March 29, 2024, at Andrews Air Force Base, Md. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Alex Brandon, File)

FILE - President Joe Biden boards Air Force One at Dallas Fort Worth International Airport, March 21, 2024, in Dallas, en route to Houston. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Jacquelyn Martin, File)

FILE - President Joe Biden boards Air Force One, March 13, 2024, at Andrews Air Force Base, Md. en route to Milwaukee. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Jacquelyn Martin, File)

FILE - President Joe Biden boards Air Force One at Andrews Air Force Base, Md., March 11, 2024, to travel to Manchester, N.H. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Andrew Harnik, File)

FILE - President Joe Biden boards Air Force One at Andrews Air Force Base, Md., April 12, 2024, enroute to New Castle, Del. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Pablo Martinez Monsivais, File)

FILE - President Joe Biden, second from left, boards Air Force One, March 28, 2024, at Andrews Air Force Base, Md. Biden is headed to New York for a fundraiser. The White House and the Democratic National Committee are splitting the cost of Biden’s travel while he runs for a second term. It’s part of a longstanding arrangement that prevents taxpayers from being stuck with the full bill for political trips. (AP Photo/Alex Brandon, File)

- Copy Link copied

WASHINGTON (AP) — It’s no simple matter to move the commander in chief from point A to B, and it’s even more complicated when the president is seeking a second term.

President Joe Biden recently spent three days in Pennsylvania , a pivotal state in the 2024 campaign, and he plans to be in Virginia and Florida this coming week. The Democratic incumbent is seeking an edge over Republican Donald Trump as he ramps up his travels around the country.

Here’s a look at how much it costs and who pays the bill during the campaign season.

HOW MUCH DOES IT COST?

It’s not cheap to fly the president’s fleet.

The White House uses Sikorsky helicopters known as Marine One when the president is aboard, as well as custom Boeing 747s that are immediately recognizable as the iconic humpback Air Force One. (Sometimes the president uses a more modest modified 757 if his destination is nearby or if a runway isn’t long enough to accommodate the bigger plane.)

Marine One costs between $16,700 and almost $20,000 per hour to operate, according to Pentagon data for the 2022 budget year. Air Force One is even more expensive: roughly $200,000 per hour.

But those figures only scratch the surface of the real cost. There also are military cargo planes that travel ahead of the president to make sure his armored limousines are in place, not to mention the enormous security apparatus that follows the president everywhere.

What to know about the 2024 Election

- Democracy: American democracy has overcome big stress tests since 2020. More challenges lie ahead in 2024.

- AP’s Role: The Associated Press is the most trusted source of information on election night, with a history of accuracy dating to 1848. Learn more.

- Read the latest: Follow AP’s complete coverage of this year’s election.

New aircraft are in the works because the current versions are decades old. Sikorsky is producing 23 updated helicopters to serve as Marine One. Boeing is building two new Air Force One planes , and they are scheduled to be finished by 2028. According to the Pentagon, the planes will come with all enhancements, including “a mission communication system,” a “self-defense system” and even “autonomous baggage loading.”

WHO PAYS FOR THE TRAVEL?

When the president flies for political purposes, the campaign is supposed to pay the bill. But during an election year, the line between governing and campaigning can be fuzzy.

For example, Biden held an official event Wednesday in Pittsburgh, where he announced his proposal for higher tariffs on steel imported from China. The event, however, was a not-so-subtle opportunity for the president to rub shoulders with union members who are critical to his reelection, and he jabbed at Trump in his remarks. (At one point Biden joked that the former president was “busy right now,” a reference to the hush money trial that recently got underway in New York.)

It’s up to the White House counsel’s office to figure out what percentage of the president’s travels are campaign related. That determines how much the federal government should be reimbursed by the Biden campaign. Sometimes the calculations aren’t straightforward, such as when the White House adds an official event to an otherwise political trip.

Norm Eisen, a White House ethics lawyer under President Barack Obama, said both Republicans and Democrats have usually hewed closely to regulations.

“We had a set of rules on how to do the allocations,” he said. “They’re intricate, and we stuck to them.”

No matter what, taxpayers end up on the hook for most of the cost. Campaigns do not pay for all the Secret Service agents and the rest of the security apparatus. In fact, they usually only cover the cost of Air Force One passengers who are flying for explicitly political purposes — sort of like buying a ticket on a particularly exclusive private jet.

President Joe Biden, second from left, boards Air Force One, March 28, 2024, at Andrews Air Force Base, Md. (AP Photo/Alex Brandon, File)

HOW MUCH HAS BIDEN PAID?

Biden’s campaign and his joint fundraising committee have been stockpiling travel cash in an escrow account maintained by the Democratic National Committee. From January 2023 until the end of last month, they deposited nearly $6.5 million.

Some of that money goes to general campaign logistics, such as staff expenses and advance work. The account is also used to reimburse the federal government for official aircraft used to transport the president, the first lady, the vice president and the second gentleman when they travel for the reelection effort.

So far, not much money has found its way back to the U.S. Treasury. As of the latest data available, just $300,000 has been provided.

It’s safe to assume that Biden’s campaign will end up forking over much more than that once the campaign is over. Trump’s team reimbursed the federal government nearly $4.7 million for travel expenses during the 2020 race.

But Biden probably won’t have trouble covering his bills. His campaign and the DNC had more than $192 million in cash on hand at the end of March.

AP White House Correspondent Zeke Miller contributed to this report.

- Share full article

Advertisement

Supported by

Why Is Biden Going to Europe Twice in a Week?

President Biden made two back-to-back round trips to Europe, separated by about 60 hours on the ground at home.

By David E. Sanger

David E. Sanger has covered five presidencies.

Air Force One is plenty comfortable if you are its most privileged frequent flier, with a comfortable bedroom and a spacious office.

Still, most American presidents will try to avoid making two back-to-back round trips to Europe, separated by about 60 hours on the ground at home. Yet that is what President Biden is pulling off this week.

“The president’s schedule is jam-packed. It is,” said Karine Jean-Pierre, the White House press secretary. “There is a lot to be done on behalf of the American people.”

Mr. Biden left the United States for D-Day celebrations in France last Wednesday, June 5; stayed the weekend for a state dinner in Paris; and returned to his home in Delaware late Sunday. He left Washington again early Wednesday, June 12, to fly to the southeast coast of Italy for the annual gathering the Group of 7, the traditional summit of leaders of Britain, Canada, France, Germany, Italy and Japan.

When Mr. Biden looks back at those two round trips — roughly a day and a half of flying, all told — he may remember only what happened in between: the conviction of his only living son, Hunter Biden, on charges of lying to obtain a gun permit.

But the two round trips raise the question: Why didn’t he just stay in Europe for a couple days, play a round of golf, visit some American troops, maybe huddle with a foreign leader or two? He is, after all, 81, and some of his aides who are half his age were complaining about lost sleep cycles.

The White House’s explanation for four trans-Atlantic crossings in nine days was simply that Mr. Biden had commitments in Washington. But by presidential standards, his public schedule looked light: a lunch with Vice President Kamala Harris, a Juneteenth concert and a speech to a gun-safety group.

Hunter Biden’s trial also loomed over the planning, though it was impossible to know when these trips were planned that the case would go to the jury and a verdict would be rendered in the three days between the D-Day trip and the G7 meeting. As it turned out, Mr. Biden shuttled back to Delaware on Tuesday afternoon to be with his son before taking off again in the morning.

But privately, some aides said there were election-year optics to be considered. There was no urgent reason to stay in Europe, and a few down days “might not look right,” one of Mr. Biden’s advisers conceded, though the aide quickly added that Mr. Biden never really took a down day. In any case, no one wanted images of the president on what his political opponents might cast as a European holiday, at least while he is running for re-election. A long weekend in Rehoboth, the Delaware town where he and his wife, Jill, have a beach house, might be one thing; a few days in France or Italy have an entirely different look.

The presidency, of course, is the ultimate work-from-anywhere job. There are instant communications (a White House van, bristling with antennas, travels in every motorcade) and a staff of hundreds ready to cater to every contingency, whether that involves sending off a thank-you note or launching a retaliatory nuclear strike.

The intolerance for seeing presidents abroad, save for work, has a long history. Franklin D. Roosevelt loved to camp at Campobello Island, in Canada, though as president he kept the visits brief. When Harry S. Truman went to Potsdam, Germany, to negotiate with Joseph Stalin and Winston Churchill about what post-World War II Europe would look like, he stayed for more than two weeks. There were days off from the negotiations, but not for long, and the nearest big city, Berlin, was a bombed wreck. And there was a reminder of the risks of being out of town: Churchill’s party lost to Labour during the conference, and he got booted out of office while it was still going on.

David E. Sanger covers the Biden administration and national security. He has been a Times journalist for more than four decades and has written several books on challenges to American national security. More about David E. Sanger

Inside the Biden Administration

Here’s the latest news and analysis from washington..

Immigration: President Biden announced sweeping new protections for undocumented immigrants who are married to U.S. citizens. The new policy will give some 500,000 people a pathway to citizenship.

Social Media Warning Labels: Dr. Vivek Murthy, the U.S. surgeon general, said he would urge Congress to require a warning label on social media platforms advising parents that using the platforms might damage adolescents’ mental health.

Title IX Rules: A federal judge blocked the Biden administration’s new Title IX regulations in six more states as Republicans and conservative groups try to overturn a policy that expanded protections for L.G.B.T.Q. students.

Merrick Garland: The Justice Department said it would not prosecute the attorney general for not complying with a congressional subpoena for recordings of Biden’s interview by a special counsel. The decision was expected because the president had invoked executive privilege.

Questionable Titanium: The F.A.A. is investigating how titanium that was sold using fake documentation got into recently manufactured Boeing and Airbus jets.

Quick Links

Who uses travelmath.

Companies like United Airlines, Southwest Airlines, and Ryanair use Travelmath to re-route passengers and plan new flight paths.

Celebrities love Travelmath!

"Travelmath is the one app I couldn't live without - it calculates all your journey timings and because I travel a lot, it's essential. Whoever invented Travelmath, I love you! " – Drew Barrymore

"There's a website called Travelmath, it's really good if you're into flight times. " – Blake Griffin

Dirtiest Public Transit

See the research from our Travelmath study on public transportation hygiene. How does the New York subway rank against Chicago, DC, SF, and Boston? Read the full study!

Germiest Hotel Rooms

See even more research from our Travelmath study on hotel hygiene. Spoiler alert: Don't turn on the TV... Read the full study!

Travel Tools

What is travelmath.

Travelmath is an online trip calculator that helps you find answers quickly. If you're planning a trip, you can measure things like travel distance and travel time . To keep your budget under control, use the travel cost tools.

You can also browse information on flights including the distance and flight time. Or use the section on driving to compare the distance by car, or the length of your road trip.

Type in any location to search for your exact destination .

Quick Calculator

How do i search.

To get started, enter your starting point and destination into the boxes above. If you want an airport , it's best to enter the 3-letter IATA code if you know it. For cities , include the state or country if possible.

You can also enter more general locations like a state or province , country, island , zip code, or even some landmarks by name.

Check Prices

Home · About · Terms · Privacy

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

How to Protect Yourself and Others

CDC’s Respiratory Virus Guidance provides strategies you can use to help protect yourself and others from health risks caused by COVID-19 and other respiratory viruses. These actions can help you lower the risk of COVID-19 transmission (spreading or catching COVID-19) and lower the risk of severe illness if you get sick.

Core Prevention Strategies

CDC recommends that all people use core prevention strategies to protect themselves and others from COVID-19:

- Although vaccinated people sometimes get infected with the virus that causes COVID-19, staying up to date on COVID-19 vaccines significantly lowers the risk of getting very sick, being hospitalized, or dying from COVID-19.

- Practice good hygiene (practices that improve cleanliness)

- Take steps for cleaner air

When you are sick:

- Learn when you can go back to your normal activities .

- Seek health care promptly for testing and/or treatment if you have risk factors for severe illness . Treatment may help lower your risk of severe illness, but it needs to be started within a few days of when your symptoms begin.

Additional Prevention Strategies

In addition, there are other prevention strategies that you can choose to further protect yourself and others.

- Wearing a mask and putting distance between yourself and others can help lower the risk of COVID-19 transmission.

- Testing for COVID-19 can help you decide what to do next, like getting treatment to reduce your risk of severe illness and taking steps to lower your chances of spreading COVID-19 to others.

Key Times for Prevention

Using these prevention strategies can be especially helpful when:

- Respiratory viruses, such as COVID-19, flu, and RSV, are causing a lot of illness in your community

- You or those around you have risk factors for severe illness