Do Cruise Ship Crew Pay Taxes?

You’re on the other side of the world, sailing in international waters, and so far from home you don’t even know which way around the world would be faster to fly to get there. You’re still working though and most places in the world income tax income. So, how does that work? Do cruise ship crew pay taxes?

There are so many questions floating around about cruise ship crew and a big one seems to be about whether or not cruise ship crew have to pay income taxes. Let’s talk about that.

First Off – Big Disclosure: I am not a lawyer, solicitor, tax advisor, or accountant. The information that follows is for general information purposes only. This information is based off of my experience, those experiences of people I know, and research. You should always ensure that you are paying the proper taxes for your home country/state/district. If you are unsure whether taxes are taken out of your pay talk to the cruise company you work, if you are unsure about how to go about paying/filing your taxes in your home country, speak to a licensed accountant.

Do Cruise Ship Crew Pay Taxes on their Wages?

Why yes, of course…

Actually, it’s more complicated than that (isn’t everything?). Cruise ships have crew members from all around the world. On any given cruise ship you will likely find crew members from 40+ countries. That’s not an exaggeration either, on the bigger ships you are likely to find even more than that. Keeping track of the tax requirements for employees from 40+ countries (just on one ship) would be incredibly challenging.

Just like in the rest of society, people are responsible for making sure they have paid their required taxes. While cruise ships are part of giant corporations, the crew members, those people working so hard to ensure that passengers have a great vacation – aren’t any different than people living in regular society. At the end of the day each crew member is responsible for making sure that they pay the appropriate taxes for their country/state/district.

Still though, it’s not quite as simple as that.

Do Cruise Lines Take Any Taxes Out Of Your Paycheck?

That answer is different depending on which cruise line you work for, where you are from, and even what contract type you have. Do cruise ship employees pay taxes? It’s about as complicated as Avril Lavigne was in the early 2000’s.

There Are Different Types of Contracts

Did you know that cruise ship employees aren’t always hired by the cruise line? There are a few different types of contracts out there. Primarily there are contracts where you are hired directly from the cruise line and those where you are hired through a recruitment agency or brand partner of some sort. Whether or not taxes get directly taken out isn’t entirely dependent on what contract type your on, but it can play a role in it. What country you are from can also play a role both in your contract type and in whether or not taxes are taken out. Confused yet?

If You’re From the US Working for a US Cruise Line

A lot of questions about whether or not cruise ship employees pay taxes come from people from the United States. I can’t speak for all cruise lines, but I worked for a cruise line that was a part of one of the biggest cruise corporations in the world. The company had headquarters in the United States and I am a US citizen. I was also hired directly by the cruise line and not a recruitment agency or brand partner.

In the United States when you file taxes you have to file a federal tax return and a state tax return (for most states, a few states do not have income taxes). When working for the cruise line they would withhold any federal taxes that I owed but not any state taxes. So, out of each paycheck there would be the typical federal deductions – including things like social security, but, there would be no state tax taken out.

As I am from Vermont – a state that taxes income – and the cruise line did not take any money out of my paycheck for state taxes, I am still responsible for paying my fair share as a Vermont resident. While working on the ship if I had moved and become a legal resident in a state that didn’t tax income I wouldn’t have owed additional money, but that wasn’t the case in my particular situation. At the end of the year I would get my W-2 from the cruise line and when I filed my taxes I would owe money to the state of Vermont.

So, while in this instance the cruise line is taking out some taxes from my paycheck, as with all crew members, as with all adults, I am still responsible for making sure I have paid my required taxes.

If You’re Not From the Same Country Your Company Is And You’re Hired Directly By Them

There is no one size fits all for how cruise ship workers pay their taxes. Most of the time if you are working onboard, are hired directly by the company, but aren’t from the same country that your company is headquartered out of you will have to handle paying all of your taxes and they will not withhold any towards your taxes.

This is not always strictly the case though as if your company has another branch or headquarters in another country you may be hired by that branch (still directly through the cruise line, but the side of the company that is the same country as you). In that case most likely they will withhold tax on each paycheck.

Most of the time though nothing will be withheld from your paycheck towards taxes though. At the end of each pay period you would be issued a pay-stub (of sorts, it may be a full page print out) detailing your earnings. You would then use this information when you file/report your income for the purpose of taxes with your government.

Important to Note: Many crew members are paid through direct deposit (the money is transferred directly into their bank account). There are some positions and contract types that are paid in cash. Yes, you read that correctly – they are paid in cold hard cash. Most people in these positions will find places like Western Union ashore to then transfer the money home. Bank Cards : In recent years cruise companies have partnered with various banks to have bank cards ( Brightwell is currently a popular choice) issued to crew members that their pay is loaded onto.

What If You’re On One of Those Other Contract Types?

All those other contract types – well, let’s say 99/100 times – you will not have any taxes withheld from your paycheck. So do cruise ship workers pay taxes? Each crew member is responsible for paying the taxes in their own country.

Interestingly, you can have people doing the same job that are on different contract types. One may have been hired through a recruitment agency (and from a country where the cruise line uses that recruitment agency), whereas another may have been hired directly through the cruise line (and most likely not from a country that has an agreement with a recruitment agency).

** As an Amazon Affiliate I may earn a commission on eligible purchases.

Does The Cruise Line Enforce Crew to Pay Their Taxes?

Not anymore than any other corporation enforces their employees to pay taxes. If you hire a contractor, say they are going to replace the roof on your house. You are employing them – they’re offering a service that you’re paying for – do you then make sure they file their taxes? No, you trust that they will pay the necessary taxes.

Crew members are kind of like the contractor fixing your roof. They do a job, the cruise line pays them for it, then the cruise ship workers pay the taxes on it. As members of society in general we assume that if people don’t pay their taxes then their respective governments will handle it. This is pretty much how it is for cruise line employees.

But, I’ve Heard About Crew Saying They Don’t Have to Pay Income Taxes So Is Working on a Cruise Ship Tax Free?

There are some countries where if you are outside of the country for more than half of the year you are not required to pay tax on your income.

Most people that work on cruise ships are away from their home country for half the year. For many that is literally one contract.

There are also some countries that don’t tax any income earned outside of the country (any foreign income).

Let’s strongly clarify something though:

Do you pay tax working on a cruise ship? You are responsible to file your taxes. Even if you live in a place that doesn’t require you to pay income tax if you are out of the country for a certain amount of time each year, and even if you are out of the country for more than that amount of time each year – even if you are from a country that doesn’t require you to pay tax on any foreign earned income –

You are still liable and responsible to properly report and file your taxes with your government.

You don’t get to determine that you aren’t required to pay your taxes, it’s the government that determines that when you file your taxes. If you don’t have to pay income taxes that particular year it really means that when you file your taxes the government says, “nope, you’re good, you aren’t required to pay X,Y, or Z”.

When this happens you get excited – thank the accountant you’re working with for filing everything correctly – and maybe enjoy an extra pint at the pub.

Want a bit more info on cruise ship pay? Check out this article from cruiseshipjobs.com .

Do Cruise Ship Crew Pay *Income* Taxes?

Yes, but it mostly depends on where you are from. Whether it is withheld out of their paycheck depends on where they are from; whether cruise ship workers have to pay taxes on their income earned while at sea depends on where they are from.

And, just like adults around the rest of the world – they’re responsible for filing their taxes and if what they owe hasn’t been withheld throughout the year then they’re responsible for paying.

Wondering about working on a cruise ship with a kid ? Here’s a run down of how that works.

Similar Posts

Accountability: February 2022

February has come to an end and what a month it has been. Have you ever had a time when you get lots of good news but it’s all really on the cusp of good news and you have to wait a bit for it to come to fruition? Well, that was February. I am…

Accountability: September 2021

Ahh, September. What a magical month. It’s the beginning of fall foliage (aka lots of tourists in Vermont, but it’s also beautiful), the changing of seasons, and this time around going from pretty close to 24 hours a day with my husband to 111 days apart. Oh, it is the life we lead. Call it…

Leave a Reply Cancel reply

Cruise Ship Salary, Wages, Banking & Savings

Each crew member has an employment contract that specifies their salary, but how do you really get paid when you work on board a cruise ship? What are the taxes and deductions for cruise ship crew? How do you get your salary from the ship to your bank account and is it possible to save money while working on a cruise ship? Here are some answers.

Cruise Ship Employee Contract and Agreements

Each crew member must sign an employment agreement or an employment contract before starting each contract. They may do this before they leave home or once onboard their ship. The contract lists the crewmember’s position, the length of the employment agreement and how much they will be paid.

The employee’s employment contract also states the expected hours that will be worked. For example an employment agreement may state that you can expect to work an average of 11 hours per day, seven days per week. Alternatively, the contract may state that the employee may work up to 70 hours per week, seven days per week.

Some contracts may pay overtime. In the case of Royal Caribbean, their Getting Onboard Employee Handbook states, “You may be required to work more than 70 hours per week, or overtime. If so, non-management employees will be paid for the overtime hours worked.” Check with your recruiter if overtime is paid and at what number of hours is considered overtime.

Cruise Ship Jobs Salary

Not all employees that work in the same department and in the same position make the same salary. Each employment contract is different depending on crewmember’s nationality. For example, a youth counsellor from the Philippines makes less than a youth counsellor from Canada. This also explains why some cruise lines hire a limited amount of counsellors from North America. Each employee must sign their employment agreement, agreeing to the specified salary.

How Are Tips Paid?

Cruise lines generally do not make any promises as to how much tips or gratuities will actually be paid. Some all-inclusive cruise lines (where tips are included on cruise fare for passenger) pay a higher wage for cabin stewards and waiters because there is no tip pool. Alternatively, many cruise lines pay a lower wage because passengers do pay tips.

Generally speaking, during each cruise on each ship, passengers pay gratuities which go into a “pool” that is divided between the crewmembers that are part of the hotel and dining pool. For many cruise lines, the gratuities are automatically deducted from the passenger’s onboard account to be paid out to the crew at the end of the month.

Taxes on Cruise Ship Employment Income

Crew members are responsible for any taxes due to their country of origin. Only United States citizens or employees that reside in the USA will have US federal taxes deducted from their pay. Depending on your employment contract and the country where you are a citizen will determine how you are paid onboard also.

Some countries do not require their citizens to pay taxes on employment income if they are a seafarer. On the other hand if you are a citizen of a country that requires you to report your worldwide income on your tax return, you may have to pay taxes when you file your tax return at the end of the year. The bottom line is that taxes will not be deducted from your payroll, but some nationalities will be responsible to remit taxes at the end of the year.

Seafarers need to educate themselves about their own countries tax rules. Here two useful links:

- UK’s HR Revenue and Customs Website- Seafarer’s Earnings Deduction and Nationa l Insurance for Mariners

- Canadian Seafarers – Canadian Seafarer Blog and Canadian Seafarer and Taxes

How Cruise Ship Crew Members Get Paid

Crew members are paid on a monthly basis at the end of each month. Depending on your nationality and what you have organized with your hiring partner or human resource recruiter will determine what currency you will be paid in, if you will be paid in cash, or if you will be paid by direct deposit.

If the crew member starts their contract halfway through the month they may have to wait until the end of the next full month to be paid. This depends on the cruise line you work for and your employment agreement.

Many cruise lines have a direct deposit option for their employees working on cruise ships. This is typically set up before the crewmember even leaves home. Crew members may also choose to wire transfer money to their land-based bank account for a fee. Make sure to bring a void check and a bank statement that shows the bank account number and the name on the account. Alternatively, crew members can obtain a crew safety deposit box onboard some cruise ships to keep their money secure.

Be aware of how much cash you want to travel with on your way home. Most countries make you declare how much currency you have in your possession. Plus, you may not to want to make any large one lump sum once you get to your home bank. Most banks must report single deposits in excess of $10,000.

The Crew Office

The Crew Office on a cruise ship is managed by the Crew Purser or Crew Administrator. This office looks after the crew payroll including the payment of gratuities. They also collect crew expenses (ie. bar bills) at the end of each month. While working onboard, the crew office is your link to head office and all correspondence about payroll issues need to be sent through the crew office.

How to Save Money Working on a Cruise Ship

The best way to save money is to not have the cash on board. By either direct deposit or wiring your money home, having no access to the cash virtually eliminates the temptation to spend it. You have very few expenses working onboard since your normal monthly expenses (like rent, food, etc.) are covered or inexpensive. If you want to end your contract with a large amount of savings, you’ll need to learn to resist shopping in the ports and in the shops on board.

We use cookies to ensure that we give you the best experience on our website.

This is the announcement bar for Poornima to test the Close Button. It will expire May 31 2024.

- Pre-Cruise FAQ

- Onboard FAQ

- Post-Cruise FAQ

- Cruisetours FAQ

- Special Offers Sign Up

- Cruise Deals

You have been logged out

Your window will update in 5 secs

Onboard Employment FAQ

Are you interested in joining the thousands of worldwide employees who are proud to be part of the Princess Cruises family? We are committed to being an employer of choice and understand that our Consummate Hosts need to be supported, empowered, and recognized.

We also understand that working at sea can be a challenging new opportunity. Here are answers to some essential questions you might have when considering cruise ship employment.

- What are the requirements to work onboard?

What is a C1/D visa?

How do i get a medical certificate, which ship will i be assigned to, how do i get to and from the ship i am assigned to, do i need travel insurance, how long will i be onboard, can i get off and go home during the contract, will i have my own room, what is the power voltage in my cabin, can i drink alcohol onboard, is there a drug policy, is there a curfew, can i bring a family member or friend onboard, will i have access to guest areas and amenities during my time off, once onboard, how do i stay in touch with my friends and family back home, can i have mail delivered to the ship, is there an atm onboard to use, will i have to pay taxes, can i send money home from onboard, how do i pay for items onboard, how do i do laundry, what if i miss the ship in port, what happens if i get sick while working onboard, can i visit the ports while working onboard, how do i apply to work onboard, what are the requirements for onboard employment.

While specific position requirements depend on the job you are interested in, there are some essential requirements that all crew must meet to work onboard:

- Be 21 years of age or older

- Be able to pass a criminal background check

- Hold a valid passport

- Have a US C1/D visa (if you are not a Canadian or US citizen/resident)

- Have a Princess-specific pre-employment medical exam certificate

- Meet the English fluency requirements relevant to your position

Also known as a seaman's visa, some nationalities need this to work onboard a ship and travel to certain countries. This visa normally lasts between two and five years. You will be required to make an appointment at your nearest US Embassy to gain this visa; all paperwork for the appointment will be supplied by your manning agency.

This extensive examination is at the employee's expense and can be conducted through one of Princess's recommended medical facilities—you'll be advised which one is closest to you. Once this is completed and approved by our corporate Medical department, you are cleared to travel and work onboard.

Shipboard employees are scheduled to vessels based on operational need. This means you could be assigned to any one of our vessels in the fleet depending on where a position is open at the time you are travel-ready. After your first assignment, we will be able to provide details about the next assignment after your leave period.

At the beginning of each contract Princess Cruises will provide flights from your designated airport to your assigned ship. At the completion of your contract, Princess will arrange for your travel back home as well. It is your responsibility to get to the airport from your home, but from there we will provide any necessary accommodations and/or transportation to and from the ship.

While you are covered medically in Los Angeles and onboard the vessel, we suggest you purchase basic travel insurance to cover the cost of lost luggage or injuries that could result from shoreside activities.

Contract lengths vary by position but range between four and ten months. After each contract you will receive approximately 60 days of vacation before your next assignment. Your daily work schedule while onboard will depend on your particular position, but you can expect to work seven days a week and anywhere between 10-13 hours per day.

Time off during the contract is not permitted. In case of family emergencies, Princess Cruises does understand that additional time at home may be needed and does accommodate these requests on a case-by-case basis.

Accommodations vary depending on the ship and position. Those in non-management positions generally share a cabin with one to three other roommates whereas those in most management positions are entitled to a single cabin. Cabins include a storage space, TV, and DVD player.

All vessels have 120v US power and some vessels also have 220v European power.

Yes, alcohol is available for purchase during time off. However, Princess Cruises has a strict alcohol limit and at no time can a crew member be intoxicated.

Princess has a zero-tolerance drug policy. All crew are subject to random and reasonable-suspicion drug testing. Violation of these policies will result in termination.

There is no set curfew. However, crew who are out late should be respectful of other crew members and guests nearby.

Crew members who meet specific length-of-service criteria have the option of requesting "relatives travel," a benefit that allows family members to sail onboard for a limited period of time. Some restrictions may apply.

While some officer-level positions do allow restricted access to guest areas, most facilities are for guests only. However, we have a variety of crew-only facilities, such as a crew pool, whirlpool, gym, bar, and Crew Club, which is a communal room where you can gather to watch movies, play games, sing karaoke, and much more!

Postal mail services are available while onboard. You will also have access to computers in the crew training areas. Wi-fi Internet is also available in the crew areas if you choose to bring your own laptop or tablet. Princess offers discounted rates for phone and Internet cards so you can stay in touch with those at home. But remember that satellite capabilities are sometimes limited while the ship is at sea.

You will be provided with mailing addresses for ports where mail can best be delivered.

There is an ATM in the guest areas; an ATM charge will apply. You can also cash checks in the Crew Office onboard to get cash.

US citizens will have federal taxes automatically deducted and may be required to pay state taxes, if applicable. All other nationalities are responsible for filing their own tax forms upon returning to their home countries (as they are self-employed).

You can wire money via the Crew Purser's office. Details are available onboard and rates may vary.

You will be provided with a bar account number, which is your personal number for the duration of your contract onboard each ship. As the entire vessel is cashless, even for guests, you will provide your account number at the bars, salon, and shops in guest areas. In the Crew Bar you can purchase a CrewCard and add money onto it for purchases. At the end of every month you will be required to settle your account.

There are crew laundry facilities where the washers and dryers are free of charge—you just provide the soap. You can also use the dry cleaning onboard, but there is a nominal cost.

Crew members who miss the ship should contact the ship's Agent who will be at the port (the address and phone number are always in the Princess Patter, a daily newsletter for our guests). The Port Agent will arrange transportation to the ship's next port of call. However, it is the responsibility of crew to pay these transportation costs. Crew may be disciplined for the offense and could be terminated. Depending on the port all crew members are required to be back onboard half an hour to an hour prior to sailing time.

While onboard, all crew are medically covered and can visit the Medical Clinic for health concerns. If you need to be medically disembarked during your contract, Princess will provide transportation to a land-based medical facility and repatriate you back home.

If you are not scheduled to work during the time the ship is in port, you can disembark the ship with your supervisor’s approval. Occasionally, there are crew-specific activities or tours to participate in.

Safety requirements dictate that a certain number of crew members be present on each vessel at all times. As such, there may occasionally be times when, although not scheduled to work, you will be required to remain onboard while the ship is in port.

Princess Cruises recruits globally through authorized hiring partners. Find a hiring partner located near you.

Once you contact the authorized hiring partner, you can get answers to questions regarding the application process and which positions are currently open in your region.

Impartial training and careers advice

Call us: +441983 280 641

+441983 280 641

- Is working on a cruise ship tax free?

Have you recently finished school and are unsure what step to take next? Or perhaps you are about to graduate and are looking for a varied and exciting career?

Or maybe you just feel like you’re in the wrong job and are after a change. Whatever your reason for considering working on a cruise ship, you’ve probably got a number of questions buzzing in your brain, from where to begin your job search to what type of positions are available and even if you need to pay tax when you work on the ocean.

Well, if you’ve got questions, we’ve got the answers – so read on to discover our answers to your ultimate financial questions about life on board a cruise ship.

Is working on a cruise ship right for me?

First things first, you might be wondering whether or not working on a cruise ship is right for you. Well, if you want to travel to amazing places, meet awesome people, and get paid for doing so, then working on a cruise ship could be perfect for you.

Working on a cruise ship is great fun, and it also provides the opportunity to pick up a whole host of transferable skills for your future. Plus, with so many different types of jobs available on board, whatever you’re interested in, you’re sure to find a role that works for you. But what about tax?

Your questions about tax whilst working on a cruise ship answered

So, do I have to pay tax?

“ Do you pay tax when working at sea ?” is one of the questions we are asked the most here at Flying Fish. And we’re happy to say that as a general rule of thumb, the answer is, no. When you work onboard a ship, you are actually exempt from paying UK income tax, as long as you meet the qualifying criteria and fill in your tax return correctly!

When you work as a seafarer, you are paid without any tax or national insurance being deducted. This is because cruise ships and other vessels employ their crew from all over the world, so it is up to each individual seafarer to declare their income to their country.

So, whilst you most likely won’t have to pay any tax due to a legislation known as the Seafarers’ Earning Deduction (more on that below!), HMRC will still expect you to declare your income by completing a seafarers’ self-assessment tax return .

What is a seafarers’ self-assessment tax return?

When you work on board a cruise ship – or any other vessel – you will be classed as a seafarer and will need to complete a seafarers’ tax return in order to declare your income to HMRC so they can calculate the amount of tax you owe (if any!).

Although the Seafarers’ Earning Deduction means your earnings will most likely be exempt from income tax, you must still complete your tax return if you’re going to avoid any nasty penalties. Discover how to complete your tax return in this helpful blog .

Am I eligible for SED if I work on a cruise ship?

If you work on board a cruise ship, are employed by the vessel, and are a resident of the UK, you may not need to pay tax on your earnings.

The three basic rules to qualify for SED are that you must have spent more than 183 days outside of the UK during a 365-day period, your qualifying period has at least one voyage that begins and ends at a foreign port, and that you are employed to work on a ship. You won’t qualify for the deduction if you are a Crown employee (for example, a Royal Navy sailor), not a UK resident, or if you are self-employed.

Find out everything you need to know about the Seafarers’ Earning Deduction and how to claim it in this ultimate guide to SED .

What do I need to apply for SED?

In order to complete your seafarers’ self-assessment tax return and apply for SED, you’ll need to submit the following records to HMRC:

- Photocopy from your discharge book

- If not shown in your discharge book, proof of a foreign port

- Boarding cards if you flew out to join your vessel earlier than the date shown in your discharge book, the same with returning back to the UK

- Details of any courses or holidays abroad, such as flight tickets, boarding cards, accommodation receipts, or visa/credit cards receipts

- P60/P45 from any PAYE employment during the tax year

- Wage slips or bank statements showing the gross amounts received

- Employment contract

How can Flying Fish help with my tax?

If you’re worried about completing your seafarers tax return or are confused with all the information out there, we can take the weight off your shoulders. The Flying Fish seafarers’ tax service is available for just £210, and we’ll complete and file your tax return for you – so you can enjoy your career at sea, completely stress free!

Get ready to sail away into the sunset with Flying Fish

We hope that answers all your questions on paying tax when you work on a cruise ship!

In addition to tax advice, here at Flying Fish we also offer a range of specialist courses to help you set sail into your dream job.

The SCTW Basic Safety Training Course is a requirement for all crew who want to work at sea on all commercial vessels, including cruise ships, ferries, and Superyachts – so be sure to sign up for our six-day training course and kick-start your cruise ship career here .

Related articles

- Seafarers Tax

5 ways to ensure your SED claim is rock solid

The Seafarers’ Earnings Deduction, often referred to as the SED, is a tax legislation that enables seafarers to claim back their UK income tax. It a...

Do I need to pay off my Student loan if I work on a Superyacht?

Good question! First, let me say that the information below is aimed at people who have studied in the UK and took out a Student Loan to cover course ...

Have I got the right experience to work in yachting?

If you’re thinking about working on board a Superyacht, we share the skills and experience you need and how to get into the yachting industry in thi...

- Cruise News

Fact Check: Do Cruise Lines Pay US Taxes?

Ashley Kosciolek

- June 15, 2020

As many states prepare to reopen after three months of self-isolation and social distancing, cruisers are finding the travel itch a bit difficult to scratch.

Whether or not cruise lines will return to service this summer is still up in the air, but as the mainstream media’s cruise line finger-pointing dies down, we’d like to continue dispelling some of the wild misreporting that’s been happening since February.

This second installment of Cruise Radio’s “Fact Check” series will address whether cruise lines — which largely source customers from North America — do, in fact, pay taxes in the United States and, if so, how much and to whom.

Do Cruise Lines Pay Taxes in the U.S.?

The short answer is yes, but there’s a bit more to it. Provisions under the U.S. Internal Revenue Code allow foreign corporations — like cruise lines — to do business in America without being taxed federally, as long as they are registered in countries that have reciprocal agreements with the U.S.

A big misunderstanding is the manner in which international shipping is handled under the tax code is not a “tax shelter.” It is how international shipping – long before there was a cruise industry – has been taxed. It is memorialized in numerous treaties that the U.S. has with other countries. Countries have not been able to find an equitable way to tax shipping that traverses international boundaries constantly.

READ MORE: How Much Are Port Fees and Taxes?

So to put it simply, the agreement is, “You don’t tax our ships and we won’t tax yours.”

It’s a mutual policy that equally benefits U.S. corporations that are, in return, able to do business internationally without being taxed in those countries.

Carnival Corp. — which operates Carnival Cruise Line, Princess Cruises, Holland America Line, Costa Cruises, Cunard Line and Seabourn Cruises — is registered in Panama; Royal Caribbean Cruises, Ltd. — operating Royal Caribbean International, Celebrity Cruises, Azamara Cruises and Silversea Cruises — is registered in Liberia; and Norwegian Cruise Line Holdings — which comprises Norwegian Cruise Line, Regent Seven Seas Cruises and Oceania Cruises — is registered in Bermuda.

A representative from Carnival Corp. told Cruise Radio that, in addition to the taxes it paid to the U.S. Federal Government in 2019, the corporation shelled out an additional $600 million in port taxes and fees directly to port cities in the United States.

According to the Internal Revenue Service (IRS), Panama, Liberia and Bermuda are all countries that have reciprocal tax agreements with the U.S. , so none of the aforementioned cruise lines pay federal taxes in the U.S.

However, they do pay docking fees to the U.S. ports they visit. They also pay per-passenger head taxes that range from about $5 to $15 per person in certain ports; on a midsize ship carrying 3,000 passengers, that amounts to between $15,000 and $45,000 per port call.

Further, cruise lines are subject to state income taxes, as well as various other taxes, such as a 33% tax on all gambling revenue generated while in Alaska waters.

Additionally, more than 420,000 U.S.-based employees or people associated with cruise industry pay federal and state income taxes.

How much do cruise lines pay in taxes?

In 2019, Carnival Corp. paid $71 million in taxes on $3.06 billion in income. In the same year, Royal Caribbean Cruises, Ltd. paid $25.5 million in taxes on $1.8 billion in income , and Norwegian Cruise Line Holdings paid $18.9 million in taxes on more than $911 million in income.

That works out to a tax rate of 2.32% for Carnival Corp., 1.4% for Royal Caribbean Cruises, Ltd . and 2.07% for Norwegian Cruise Line Holdings.

According to PricewaterhouseCoopers , the federal tax rate for foreign corporations that are not tax-exempt is 21%; when combined with state and local taxes, that rate goes up to 25.75% for non-tax-exempt foreign corporations.

Did cruise lines ask for a bailout from the U.S. Federal Government?

No. Despite many media outlets’ gleeful announcements that the cruise industry was excluded from U.S. bailouts, what they haven’t mentioned is that the cruise lines never asked to be included in the first place.

According to the Cruise Lines International Association (CLIA), the organization that collectively represents passenger cruise lines, the lines and their parent companies did not request federal assistance.

Although all three of the major cruise line parent companies were able to secure enough non-government funding to sustain themselves for the short term, they all imposed some variation of layoffs, furloughs and/or salary cuts on their employees .

It’s also important to recognize that cruise lines aren’t the only ones benefitting from U.S. tax law loopholes.

Many profitable Fortune 500 companies — including International Business Machines (IBM), Amazon, Molson Coors, Netflix, Apple and even General Motors, which did receive a government bailout in 2008 — also avoid paying federal taxes, according to a 2019 report by the Institute on Taxation and Economic Policy (ITEP).

Want more cruise line fact-checking?

Take a peek at our first installment, which addresses cleanliness standards on cruise ships , and stay tuned to Cruise Radio for additional coverage.

Recent Posts

Disney cruise ship passenger arrested at port everglades, world cruise delayed again by failed inspection, passengers left waiting, juneau, alaska strikes deal with cruise lines on passenger limits, norwegian joy 2024 review + cruise news [podcast], share this post, related posts.

140 Cruise Passengers Evacuated During European River Flood

Couple’s Dream Wedding Shattered by Cruise Line Shutdown

Bringing you 15 years of cruise industry experience. Cruise Radio prioritizes well-balanced cruise news coverage and accurate reporting, paired with ship reviews and tips.

Quick links

Cruise Radio, LLC © Copyright 2009-2024 | Website Designed By Insider Perks, Inc

- Career Advice

- Salary Guide

- Dockwalk Presents

- Digital Dockwalk

Crew Compensation: What to Know for Your U.S. Taxes

This tax advice is not intended, and cannot be used, to avoid any penalties as a result of taking any position from this column. Thomas Andrews is a CPA and a principal of AvMar Accounting Services. +1 954 764 0404; www.avmaraccounting.com

As a crewmember on a foreign-flagged vessel, you are probably being paid in one of three ways:

- You’re issued a W-2 with taxes withheld.

- You’re working as a “contractor” and receive a 1099 at the end of the year.

- The employer is simply depositing funds to your bank account without providing a W-2 or 1099.

The purpose of this column is not to opine on the proper payroll procedures of your employer and whether or not the employer is compliant with United States payroll tax law. Compliance is a discussion between your employer and their attorney/accountant. It’s important to stress just how important it is for the taxpayer to understand their relationship with the vessel.

It’s important to stress just how important it is for the taxpayer to understand their relationship with the vessel.

You should be asking yourself if you are an employee or contractor — the difference between the two will affect how much tax you ultimately owe. In most cases, your crew contract will clarify the nature of your services as employee or contractor. However, there are instances in which the contract is vague or you don’t have a contract. If it’s unclear whether you’re an employee or contractor, you may refer to www.irs.gov for guidance on the criteria that the IRS uses to make this determination.

Another layer to crew compensation occurs when you’re a crewmember of a foreign-flagged vessel employed by a foreign entity. Under these circumstances, you MIGHT not be required to pay Social Security and Medicare taxes. The exemption from Social Security tax is attributed to a section of the Internal Revenue Code that addresses American crew of foreign-flagged vessels. The dilemma occurs when you’re trying to prove your status, as you will want to be able to provide documentation supporting your claims.

Assuming that you have properly filed your tax returns, there are situations in which you must prove that you were in fact a crewmember of a foreign-flagged vessel. These situations include, but are not limited to, an IRS audit, state employment tax audit, or income verification as part of a home loan. If you’re ever faced with having to prove you were crew on a foreign-flagged vessel it will probably occur after you have left the employment of that vessel. Trying to track down documents after you have left a vessel can be difficult and should be acquired prior to leaving the vessel. These documents include but are not limited to the following: Vessel Certificate of Registry, crew manifest on vessel letterhead, and a letter from the employer confirming status as a crewmember of a foreign-flagged vessel.

Employment in the yachting industry is not a traditional career. Sometimes outsiders will not understand the differences between this industry and mainstream employment, which makes having supporting documentation all the more important when dealing with individuals who are tasked with understanding the nature of your employment.

This article originally ran in the October 2020 issue of Dockwalk.

More from Dockwalk

Most popular on dockwalk.

- Follow us on Facebook

- Follow us on Twitter

- Follow us on YouTube

- Follow us on Pinterest

- Connect with us on LinkedIn

- Subscribe to our blog

- Cool and Unique Jobs (Check them out!)

- Take a Gap Year!

- Alaska Fishing Industry

- On-Demand Delivery Jobs

- Wine Industry Jobs

- Nursing Jobs (High Demand)

- Truck Driving Jobs (High Demand)

- Security Mercenary Jobs

- Becoming a Male Model

- Drone Operator Jobs

- Jobs in the Renewable Energy Industry

- On-Demand Odd Jobs

- Distillery Jobs

- Beach Resort Jobs

- Tour / Travel Gigs

- Pet Sitting Jobs

- Land Tour Section

- Animal Jobs Section

- Working Abroad

- Shared Economy Jobs Section

- Cicerone, Beer Sommelier Jobs

- Teaching / Tutoring / Coaching Gigs

- Backpacking Trip Leader Jobs

Cruise Line Employee Pay, Benefits, and other Compensation

Pay is a big factor for cruise ship employees. If you’ve found yourself wondering how much you can earn and how much you can save while working on a cruise ship, you’re not alone. Here we discuss in greater detail some of the earning potential and pay-related issues that cruise ship employees commonly ask about.

The pay you can earn by working on a cruise ship is largely determined by your position. There are, however, a number of other factors that can contribute to your earnings. The size of the ship, the type of ship, the clientele, the cruise liner, tips earned and your job experience will all affect your earning potential. How much you earn will also depend on whether or not your pay is salary or commission-based. Each of these factors should be taken into account when trying to forecast the money you can earn or save by working in the cruise industry.

As a paid cruise ship employee you will have to pay all the income taxes you would normally pay working at a land-based job. Keep in mind though, that there are some big differences to land-based jobs. For example, in most cases, on a cruise ship, your cabin is free. Additionally, for the duration of your contract you will likely have no grocery bills, and in many cases, uniforms are provided by the cruise line. Some companies will even pay laundry expenses. This means that it is possible to bank nearly all your earnings, especially if you don’t have too many land-based expenses.

“I would have saved virtually everything, but I had a lot of shore -based bills, like a car and student loan payments. Before you go, definitely get rid of expenses you don’t need while on board, like car and rent payments. Practically everything was paid for, we really didn’t have any living worries at all. No cooking, no laundry, and our rooms were cleaned for us every day; we even got free dry-cleaning. We did have to pay our room steward ten dollars per week, and that was pretty much it. Of course, alcohol and restaurant stuff is really expensive on the ship. For instance, a beer cost almost four bucks, so if you go over your bar allowance (which I always did), it can cost you a lot.”

A gift shop employee offers this insight:

“I managed to save some money during my six-month contract since I had no expenses and my commissions [tips] started adding up. I could have saved a lot more, though, if I hadn’t done so much shopping in the different ports of call that I went to. Unfortunately, we visited Hawaii right before the end of my contract, and I really spent a lot of money there. I knew someone who worked in a gift shop on a ship and came back after ten months with $12,000 in the bank, but most people don’t make close to this much. Commissions varied a lot, and the most I ever got was $800 a month. A lot of it depends on what kind of passengers you have. Our line was kind of a budget one that offered lower prices. We jokingly called it ‘K-Mart Cruises.’ The passengers tended to be cheap, but that’s not true on all lines. Some of them are really upscale.”

It is true that compensation can vary greatly from cruise line to cruise line. However, on large lines, staff and entry-level positions such as aerobics instructors, youth counselors, junior purser , disc jockeys, and hosts, will receive an industry-standard wage around $1,200-$1,500 per month. Casino workers, waiters, and bartenders depend heavily on tips, which can sometimes double salaries.

Positions such as these tend to be in high demand because of the increased earning potential, and not surprisingly, are harder to procure.

Raises are relatively rare for people who remain the cruise staff, although wages will increase with experience on some ships. Wages increase dramatically when a staff member takes on a new position like that of a cruise director or assistant cruise director. In positions like these, cruise ship employees can make as much as $4,500 a month. Keep in mind though, that these positions are very competitive. One of the top-earning positions onboard is that of a cruise director, a position that can command as much as $80,000 per year! Although, the average cruise ship director salary is $50,000 annually. Of course, competition for these positions can be fierce, with many qualified applicants competing for only two or three positions per ship.

So what can you expect to make? The majority of positions are based on an hourly wage and most employment opportunities on a cruise ship earn $1,200-$1,500 a month. There are though, a large number of positions that can make as much as $2,500 a month equating to $13 an hour. Because work weeks on a cruise ship are typically longer than your typical work week, a cruise ship employee can expect to work over 45 hours in a week on average. Some cruise ship employees will work closer to 60. While this may seem long and arduous, the earning potential of all those hours worked is an excellent payoff.

Again, earnings will vary depending on the cruise line you are contracted with, but in general, you can expect to at least secure a comfortable existence while on board, and have money in your pocket when you depart. Most cruise ship employees do.

Almost every cruise line offers a cruise discount for employees who have been with the company for over a year. Taking your family on a cruise for as little as $15 a day can add up to thousands of dollars in saved vacation expenses, and give your family the chance to see places they might not be able to otherwise experience. While you probably won’t become a million by going to sea , it is possible to enrich your life with a healthy sum of money, and, perhaps more importantly, fond memories.

- Subcribe to our blog

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Follow Cruise Jobs on Facebook

- Follow Cruise Jobs on Instagram

Free emails with tips and advice on how to get a job on-board a cruise ship.

Tax Free Income

- Connie Motz

- 26 September 2010

The allure of the tax free income offered by cruise line employment is almost too much for job seekers to resist. But before you get too excited, it might 'pay' to conduct a little research into your country of residence and any maritime laws that may apply in regards to income.

In most cases, it's the responsibility of the individual worker to report any monies earned as income to their respective governments as declared by law. But in many cases, when a cruise ship employee works outside of his or her own country onboard a vessel where the employment contract is six months or more in duration, any income earned by that employee is not taxable by their country of origin.

Here are some examples of tax free income laws:

If you are an Australian citizen, you are required by law to pay tax on any foreign income earned. The Australian Government does provide an Exempt Foreign Employment Income policy (23AG), however, strict conditions apply regarding the type of employment and the policy does not generally apply to cruise line employment.

Canadian citizens are required to report all of their income regardless of the country of origin of that income and are expected to pay income tax accordingly. Technically, there is an Overseas Employment Tax Credit (IT-497R4) available, however, this tax credit only applies if the employee is working for a Canadian company overseas and within certain industries specified.

United Kingdom

When a person receives an income above the provided personal allowance, and is a resident of the UK or is based in the country for tax purposes, he or she is required to pay tax regardless of whether a part of that work is carried out abroad or overseas, such as the case of cruise ship employees.

Read more about UK Income Tax for employees on-board cruise ships .

United States of America

All U.S. citizens working for a U.S. based cruise line such as Norwegian Cruise Lines or Carnival Cruise Lines, will automatically have income tax deducted from their paychecks as per federal and state laws. Depending on individual circumstances, regulations within the Internal Revenue Service (IRS) Foreign Earned Income and Housing Exclusions/Deductions (Publication 54) may apply.

If you're concerned about whether or not you'll be able to earn tax free income while working onboard a cruise ship and since laws can be confusing, it's best to consult a professional certified accountant who will provide you with tax advice and an interpretation of the law in regards to your own specific overseas employment situation.

Do cruise ship employees pay US taxes?

Faqs about taxes for cruise ship employees:, 1. are there any tax benefits for cruise ship employees, 2. how much income can i exclude using the feie, 3. what is the fica tax, 4. who qualifies for fica tax exemptions, 5. do non-us citizens working on cruise ships pay us taxes, 6. can i claim deductions for expenses related to my work on a cruise ship, 7. how do i file my us tax return as a cruise ship employee, 8. can i receive a tax refund as a cruise ship employee, 9. are there any penalties for not paying taxes as a cruise ship employee, 10. can i still contribute to social security while working on a cruise ship, 11. can i deduct my travel expenses to and from the cruise ship, 12. how can i ensure i am compliant with us tax laws as a cruise ship employee.

Yes, cruise ship employees do pay US taxes. However, the taxation process for cruise ship employees can be quite complex and can vary depending on a range of factors, including the individual’s citizenship, the cruise line they work for, and the duration of their employment. In general, if you are a US citizen or a permanent resident, you are required to pay taxes on your worldwide income, including earnings from working on a cruise ship.

The Internal Revenue Service (IRS) considers cruise ship employees as working abroad, and therefore, they may qualify for certain tax benefits, such as the Foreign Earned Income Exclusion (FEIE) or the Foreign Housing Exclusion (FHE). These exclusions allow individuals to exclude a certain amount of their foreign earned income from being taxed. For the tax year 2021, the FEIE amount is $108,700.

Additionally, cruise ship employees may also have to pay Social Security and Medicare taxes, known as the Federal Insurance Contributions Act (FICA) taxes. However, there are certain exceptions and exemptions available for individuals who perform services on foreign-flagged vessels, which may reduce their FICA tax liability.

It is important for cruise ship employees to consult with a tax professional or seek guidance from the IRS to ensure they meet their tax obligations and take advantage of any available deductions or credits.

Yes, cruise ship employees may qualify for tax benefits such as the Foreign Earned Income Exclusion (FEIE) or the Foreign Housing Exclusion (FHE). These exclusions allow individuals to exclude a certain amount of their foreign earned income from being taxed.

For the tax year 2021, the FEIE amount is $108,700. This means you can exclude up to $108,700 of your foreign earned income from being taxed.

The Federal Insurance Contributions Act (FICA) tax consists of Social Security and Medicare taxes. Cruise ship employees may have to pay FICA taxes, unless they qualify for certain exceptions and exemptions.

Cruise ship employees who perform services on foreign-flagged vessels may qualify for FICA tax exemptions. It is important to understand the specific rules and conditions for these exemptions, as they can vary depending on the individual’s situation.

Non-US citizens working on cruise ships may still be subject to US taxes, depending on various factors such as the country they are from, the cruise line they work for, and the length of their employment. It is advisable for non-US citizens to consult with a tax professional to determine their specific tax obligations.

Yes, as a cruise ship employee, you may be eligible to claim deductions for certain work-related expenses, such as uniforms, equipment, or travel expenses. It is recommended to keep detailed records of these expenses and consult with a tax professional to ensure you are claiming all eligible deductions.

Cruise ship employees can file their US tax return using Form 1040 or Form 1040NR, depending on their residency status. It is recommended to seek guidance from a tax professional or use tax preparation software specifically designed for international workers.

Yes, it is possible for cruise ship employees to receive a tax refund if they have paid more in taxes than their actual tax liability. This typically happens if they qualify for certain deductions, credits, or exclusions.

Failure to pay taxes or comply with tax obligations can result in penalties imposed by the IRS. It is important to fulfill all tax obligations and seek professional advice if you are unsure about the requirements.

Cruise ship employees may still be required to contribute to Social Security, depending on their employment contract and the cruise line they work for. However, there may be exceptions and exemptions available for individuals who perform services on foreign-flagged vessels.

Depending on your specific circumstances, you may be eligible to deduct travel expenses related to your work on a cruise ship. It is recommended to consult with a tax professional to understand the rules and requirements for claiming such deductions.

To ensure compliance with US tax laws, it is advisable for cruise ship employees to seek guidance from tax professionals who specialize in international taxation. They can assist in understanding your tax obligations, maximizing deductions, and filing accurate tax returns. Additionally, keeping detailed records of income and expenses related to your work on a cruise ship can help support your compliance efforts.

Please note that tax laws and regulations can change, and it is essential to keep abreast of any updates or changes that may affect your specific tax situation.

About The Author

Kevin Johnson

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Port Overview

- Transportation to the Port

- Uber & Lyft to the Port

- Dropping Off at the Port

- Cruise Parking

- Cruise Hotels

- Hotels with Parking Deals

- Uber & Lyft to the Ports

- Things to Do

- Cozumel Taxi Rates

- Free Things to Do

- Restaurants Near the Cruise Port

- Hotels & Resorts With Day Passes

- Closest Beaches to the Cruise Port

- Tips For Visiting

- Shore Excursions

- Cruise Parking Discounts

- Hotels with Shuttles

- Which Airport Should I Use?

- Transportation to the Ports

- Dropping Off at the Ports

- Fort Lauderdale Airport to Miami

- Inexpensive Hotels

- Hotels near the Port

- Hotels With Shuttles

- Budget Hotels

- Carnival Tips

- Drink Packages

- Specialty Restaurants

- Faster to the Fun

- More Articles

- CocoCay Tips

- Norwegian Tips

- Great Stirrup Cay

- Harvest Caye

- How to Get the Best Cruise Deal

- Best Time to Book a Cruise

- Best Websites to Book a Cruise

- Cruises Under $300

- Cruises Under $500

- Spring Break Cruise Deals

- Summer Cruise Deals

- Alaskan Cruise Deals

- 107 Cruise Secrets & Tips

- Tips for First-Time Cruisers

- What to Pack for a Cruise

- What to Pack (Alaska)

- Packing Checklist

- Cruising with Kids

- Passports & Birth Certificates

- Bringing Alcohol

- Cruising with a Disability

- Duty-Free Shopping

- Cruise Travel Insurance

- Things to Do on a Cruise Ship

- What Not to Do on a Ship

- News & Articles

Answered: How Much Money Do Crew Members on a Cruise Earn?

If you’re like many passengers, no matter what the crew members aboard a cruise ship earn, you still might not think it’s enough. One constant in cruising is an overall appreciation for the hard work that crew do to provide passengers with a great vacation.

The crew that you encounter on the cruise — such as the cabin stewards, dining staff and more — have jobs that are unlike what many of us have ever experienced.

For one, crew members work lengthy shifts. It’s not unusual, for instance, to see your cabin steward making his or her first rounds early in the morning and then doing another round to tidy up rooms late in the evening. And this pace happens day in and day out across all sorts of positions.

Not only is the work hard, but the crew is also doing it far from home. You’ll notice that large portions of the crew are from places like the Philippines, India, and China, among many other countries. Often, they are literally from places halfway around the world while families and friends are still back home.

And that distance isn’t just a factor for a few weeks. Crew operate under contracts that last for months. That means they can often stay and work on the ships for six months at a time before returning home.

To be sure, working on a cruise ship isn’t for everyone. Yet many do it for the opportunity to earn a living making more than what they would back home while also seeing parts of the world that many others never get the chance to visit.

So exactly how much do workers on a cruise ship earn?

“Median Employee” Earning Disclosure Required

First, there is no set rate that every person working on a cruise ship earns. Different positions on the ship will make different amounts. And on a modern cruise ship there are dozens if not hundreds of different roles, from the captain of the ship to kitchen staff.

That means there is no set compensation list for every cruise line that shows what different positions make (at least publicly).

But we do have the next best thing…

Major cruise lines like Carnival, Princess, Royal Caribbean, Celebrity, and Norwegian are actually part of larger public companies that trade on major stock exchanges. As a result, the parent companies are subject to certain SEC filing requirements.

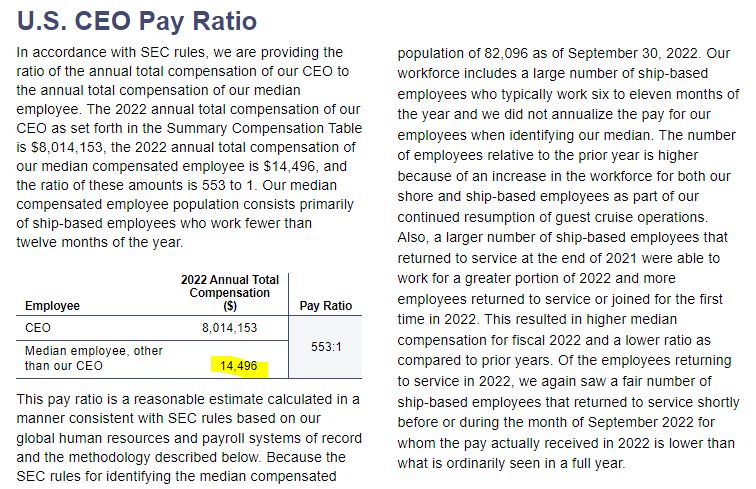

Along with quarterly and annual reports, part of that requirement is a “Pay Ratio Disclosure” as part of the Dodd-Frank reform. Here, a company must detail the ratio of pay for a company CEO compared to the “median employee.”

That gives us not only a glimpse into how much the top brass at the company makes in total, but also what those who work on the ship earn as well.

How Much the Crew Makes on a Cruise

There are three major cruise companies that trade on public exchanges: Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings. Each shares the “median employee” wages via the CEO Pay Ratio disclosure in its filings.

Carnival Corporation includes lines like Carnival, Princess, Costa, and others. In 2022, the cruise company reported that its median employee earned $14,496 in total compensation. With a CEO total compensation of over $8 million, that comes to a pay ratio of 553:1.

Royal Caribbean Group includes names like Royal Caribbean, Celebrity, and more. In 2022, the company stated that its median employee earned $15,264 . Given total compensation to the CEO of $10.7 million, the pay ratio comes in at 705:1.

Finally, Norwegian Cruise Line Holdings , which includes NCL, Oceania and Regent Seven Seas filed that its total compensation for 2022 was $24,484 . Meanwhile, that company’s CEO took home compensation of more than $21 million. That is a pay ratio of 866:1.

For comparison, hotel company Hilton Worldwide Holdings reports a median employee compensation of $43,702 compared to over $23.5 million in compensation for the CEO. That’s a ratio of 539:1.

And according to the Economic Policy Institute, the average CEO-to-worker ratio reached 399:1 in 2021 , a new high.

Some More Things to Know About The Crew’s Compensation

There is little argument that if you want to get rich, then working on a cruise ship likely isn’t the path. That said, there is some context with these figures that bears mentioning.

First, as mentioned, the crew are internationally sourced, often from places where the cost of living is significantly lower than what we see in the United States. That can make the earnings — though low by American standards — more attractive.

Second, this compensation figure is based on what the “median employee” was paid over the course of the year. However, many employees do not work the entire year . According to Carnival Corporation’s disclosure, “our workforce includes a large number of ship-based employees who typically work six to eleven months of the year and we did not annualize the pay for our employees when identifying our median.”

Finally, when working on the ship, cruise crew are also provided with some benefits like room and board that aren’t usually included in regular jobs. As Norwegian stated, “our shipboard employees receive certain accommodations that are not typically provided to shoreside employees including housing and meals while on the ship and medical care for any injuries or illnesses that occur while in the service of the ship. These accommodations are free of cost to each shipboard employee.”

Even with that, however, there’s no doubt that by American standards, shipboard crew work extremely hard and for wages that many of us would not be willing to take.

And while the cruise lines make clear that this compensation figure includes wages and gratuities billed to passengers, they do not include any extra money paid to crew directly by guests . So the next time you’re feeling generous on a cruise, the crew would likely be happy to accept any extra gratuity.

Popular: 39 Useful Things to Pack (17 You Wouldn't Think Of)

Read next: park & cruise hotels for every port in america, popular: 107 best cruise tips, secrets, tricks, and freebies.

This is a typical crap article from cruise ship apologists. So really most people don’t get a good wage and saying maybe Americans won’t work for this, but they do. Relying on tips is a cop out. These hardworking people should be paid for every hour they work. I wouldn’t trust a metric 400-600:1! ; it’s a nonsense number. They pick overseas workers as they know they will just do the work.

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Everything to Know About Interior Cruise Cabins (Read Before Booking)

5 easy ways to get to the los angeles and long beach cruise ports, carnival is taking over an entire cruise line to grow even larger, hotels with cruise shuttles for every major port in america, 107 best cruise tips, tricks, secrets, and freebies, 39 useful things to pack for your cruise (including 17 you’d never think of).

- Privacy Policy

- Terms & Conditions

Access Leading Tax Experts And Technology In Our Global Digital Marketplace

Please select an option from dropdown.

Please enter your input in search field.

We Are Proven Connectors Worldwide >>> Ask Our Executive Search Services Division

Airline and cruise ship employees: how income earned in international waters may lead to double taxation for (only) americans abroad.

Oliver Wagner, CPA and John Richardson – January 16, 2022

Americans abroad and the presumption of double taxation

Prologue: For whom the bell tolls …

Whether a US citizen lives in (and is a tax resident of) Mexico and works on a ship in international waters

International waters are not a foreign country. https://t.co/hnhfCddLb1 — John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) January 15, 2022

Or Whether A US citizen lives in (and is a tax resident of) Holland and is an airline pilot …

OMG imagine if @Ronald77171496 had known that he was a US citizen while he was flying planes across the Atlantic! Read this article which describes the nightmare imposed on "US citizen" airline pilots who have @taxresidency in other countries. (Applies to cruise ship people too!) https://t.co/gW8G30W9Vq — John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) January 17, 2022

That US citizen, because and only because of the combination of US citizenship-based taxation coupled with living outside the United States, is likely to be subject to double taxation. The following discussion explains why.

Part A: Introduction – About Citizenship-based Taxation Part B: How the Internal Revenue Code is designed to mitigate the effects of double taxation in certain circumstances Part C: Determining what is “foreign source” income Part D: The problem of international waters … Part E: The effect of sourcing to the US income earned in international waters by dual tax residents Part F: Deducting “foreign taxes” paid – although income from international waters may not be foreign, it is still subject to the payment of “foreign taxes” Part G: Can a US citizen living abroad be saved by a tax treaty? Maybe if he/she lives in Canada **** Part H: Conclusion and the need for “Pure Residence-Based Taxation”

Part A: Introduction – About Citizenship-based Taxation

Whether they live in Mexico, France, Canada, Brazil or even on a yacht, US citizens are taxable on their worldwide income. Worldwide income means income of all kinds, from all sources and wherever earned. US citizens are taxable an ALL income sources. It doesn’t matter whether the income has a source in Mexico, France, Canada, Brazil or even on a yacht. For example, a US citizen living in France who has ONLY French source income is required to treat that income as taxable in the United States. The fact that the income is also taxable in France is irrelevant!

The Internal Revenue Code is based on a presumption of double taxation. The presumption of “double taxation” is reinforced by the “ saving clause ” in US tax treaties where the treaty partner country agrees that the US retains the right to tax US citizens regardless of the tax treaty. The treaties themselves typically contain a small number of specified exceptions that mitigate against the effects of double taxation in certain narrow circumstances.

Relief from double taxation is available either domestically under the Internal Revenue Code or through provisions in international tax treaties (or possibly both). Each avenue of mitigation will be considered separately.

Part B: How the Internal Revenue Code is designed to mitigate the effects of double taxation in certain circumstances

It is commonly understood that the Internal Revenue Code provides for two distinct mechanisms to mitigate the effects of double taxation.

First – S. 911 – EXCLUDING Foreign Earned Income

US Taxation of Americans Abroad: Does the FEIE (Foreign Earned Income Exclusion Work)? – Sometimes yes and sometimes no https://t.co/jyphB9sz4T — John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) January 17, 2022

This is referred to as the FEIE and allows US citizens (and Green Card holders in treaty partner countries) to exclude up to $107,000 USD of “foreign SOURCE” earned income. There are a number of rules and it is more complicated than meets the eye. The key point is that only “foreign SOURCE” “earned” income is eligible for the exclusion. The FEIE exclusion is generally considered to be less advantageous for Americans abroad than using the foreign tax credit rules.

Second – S. 901 – INCLUDING Foreign Earned Income And Paying The US Tax By Taking Credit For Foreign Taxes Paid On Foreign Income

US Taxation of Americans Abroad: Do The Foreign Tax Credit Rules Work? – Sometimes yes and sometimes no https://t.co/HPkGH3st9Q — John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) January 17, 2022

This is referred to as the FTC “Foreign Tax Credit Rule”. The foreign tax credit rules continue to evolve in their complexity.

The Internal Revenue Code grants relief from double taxation only with respect to “foreign source” income

Relief from either the FEIE option or the FTC option is dependent on having foreign source income!!

Part C: Determining what is “foreign source” income

The “source rules” are found in § 861 – § 865 of the Internal Revenue Code . § 861 prescribes income sources that are sourced to the United States and over which the US has primary taxing rights. § 862 prescribes income sources that are foreign to the United States where the foreign country has primary taxing rights. § 863 prescribes special rules for determining source including income earned in international waters.

(d)Source rules for space and certain ocean activities (1)In general Except as provided in regulations, any income derived from a space or ocean activity— (A)if derived by a United States person, shall be sourced in the United States, and (B)if derived by a person other than a United States person, shall be sourced outside the United States.

Since income earned by a US citizen in “international waters” is not foreign, it follows that neither the FEIE nor the FTC rules can be used to offset double taxation. In other words, in the absence of treaty relief, income earned by a US citizen in international waters will be subject to taxation by both the United States and any other country of tax residence.

Of course American citizens who live in the United States are subject to tax by ONLY the United States and are not subject to double taxation. Americans citizens living abroad are tax residents of both the United States and their country of actual residence and are subject to double taxation.

Part D: The problem of international waters …

Q. What is meant by the term “international waters”?

A. According to Wikipedia …

“International waters” is not a defined term in international law. It is an informal term, which most often refers to waters beyond the “territorial sea” of any country.[2] In other words, “international waters” is often used as an informal synonym for the more formal term high seas or, in Latin, mare liberum (meaning free sea). International waters (high seas) do not belong to any state’s jurisdiction, known under the doctrine of ‘mare liberum’. States have the right to fishing, navigation, overflight, laying cables and pipelines, as well as scientific research.

The article goes on to suggest that “international waters” begin approximately 370 km (200 miles) from the shoreline of a country:

The Convention on the High Seas was used as a foundation for the United Nations Convention on the Law of the Sea (UNCLOS), signed in 1982, which recognized exclusive economic zones extending 200 nautical miles (230 mi; 370 km) from the baseline, where coastal States have sovereign rights to the water column and sea floor as well as the natural resources found there.[4]

The claim of tax jurisdiction over international waters (a specific location) – ridiculous

NO country should be able to claim tax jurisdiction over “international waters”. Presumably, no country could justifiably claim that income earned in “international waters” could/should be sourced to any one country.

The claim of tax jurisdiction over individuals who are tax residents – the international standard

All countries may claim tax jurisdiction over their tax residents . Therefore, countries which follow the “residence-based taxation” model would impose taxation on the income earned by their residents in international waters. For example, all Canadian tax residents who earn income in “international waters” are taxable on that income. The US employs “citizenship-based taxation”. Therefore, All US citizens earning income in “international waters” are taxable on that income, etc.

The Internal Revenue Code and international waters

While retaining tax jurisdiction over US tax residents, the US goes one step further and claims tax jurisdiction over income earned in international waters, to the extent that the income is earned by US citizens. Rather than simply presume that income earned in international waters is taxable income to US tax residents (under IRS S. 61 or other sections), the Internal Revenue Code specifically defines income earned in international waters as:

– US source income if earned by “United States persons”*; and

– NOT US source income if earned by a person other than a “United States person”.**

Part E: The effect of sourcing to the US income earned in international waters by dual tax residents

Q. What is the effect of deeming income earned by US citizens in international waters as US source income?

A. The effect is that if a US citizen earns income in international waters that income is NOT foreign source income and therefore cannot be excluded under the 911 FEIE or be treated as foreign under the 901 FTC rules. In other words, US citizens who are tax residents of other countries will get NO RELIEF (under the Internal Revenue Code) from double taxation!

The significance of this was explored in the 2004 case of Francisco, John A. v. Cmsnr IRS, No. 03-1210 (D.C. Cir. 2004) ***

US Citizen Airline Pilots And Cruise Ship Employees Living Outside The USA – What percent of the work takes place in “international waters”?

It’s obvious that some work time is spent in “international waters” and some is spent in “non-US AKA foreign countries”.

The income attributable to work in the foreign (“non-US”) country is eligible for either the FEIE or FTC.

The income attributable to “international waters” is NOT eligible for the either the FEIE or FTC rules!

Think of the record keeping and compliance burden!

Part F: Deducting “foreign taxes” paid – although income from international waters may not be foreign, it is still subject to the payment of “foreign taxes”

Internal Revenue Code § 164 allows for the deduction of “foreign taxes” as an itemized deduction.

(a)General rule Except as otherwise provided in this section, the following taxes shall be allowed as a deduction for the taxable year within which paid or accrued: (1)State and local, and foreign, real property taxes. (2)State and local personal property taxes. (3)State and local, and foreign, income, war profits, and excess profits taxes.

Although not perfect, this may be helpful to certain individuals. This provision converts “foreign taxes” into a deduction for US tax purposes. The following IRS commentary is helpful:

Choice Applies to All Qualified Foreign Taxes As a general rule, you must choose to take either a credit or a deduction for all qualified foreign taxes. If you choose to take a credit for qualified foreign taxes, you must take the credit for all of them. You cannot deduct any of them. Conversely, if you choose to deduct qualified foreign taxes, you must deduct all of them. You cannot take a credit for any of them. Why Choose the Credit? The foreign tax credit is intended to relieve you of the double tax burden when your foreign source income is taxed by both the United States and the foreign country. The foreign tax credit can only reduce U.S. taxes on foreign source income; it cannot reduce U.S. taxes on U.S. source income. It is generally better to take a credit for qualified foreign taxes than to deduct them as an itemized deduction. This is because: A credit reduces your actual U.S. income tax on a dollar-for-dollar basis, while a deduction reduces only your income subject to tax; You can choose to take the foreign tax credit even if you do not itemize your deductions. You then are allowed the standard deduction in addition to the credit; and If you choose to take the foreign tax credit, and the taxes paid or accrued exceed the credit limit for the tax year, you may be able to carry over or carry back the excess to another tax year.

https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit-choosing-to-take-credit-or-deduction

In summary:

While a foreign tax credit is not possible to offset the tax arising from US-sourced income, another benefit is available.