ARE YOU A NURSE ?

Fall in love with your next travel assignment.

Our Vision We believe in rehumanizing the way healthcare staffing is done.

Our mission to provide healing in places where patients and facilities need support while protecting the nation’s future healthcare workforce., learn more about travel healthcare, contact form fill out this quick form to learn more and get in touch with a recruiter, traveler resources new to travel or looking for more resources we've got you covered., meet the team meet the team members that make marvel medical so marvelous, at marvel medical staffing - we have travel jobs all across the country, and we are with you every step of the way., looking for your next assignment, we've got the perfect match for you..

Marvel Medical Staffing is a medical staffing agency with facilities all over the country looking to connect with marvelous travelers just like YOU!

We’ve created an easy and transparent process to find the perfect match for you. Click below to see what we have available!

Adventure Awaits

Your travel therapy and nursing advocates.

There is no greater freedom than traveling to a new place, exploring a new culture and embracing all of the new adventures waiting for you. And there is no greater joy than diving into this wonderful life.

Meet the Woman Behind Marvel Medical Staffing

Any worries, questions, or concerns? Get in touch with us and we’ll get back to you.

323.977.4437

Employee Verification

A signed release and if there are any documents to complete, please send to [email protected]

Social Media

Keep up to date with marvel medical staffing want more travel, therapy, and nursing.

Marvel Medical Staffing Acquires Alliance Healthcare Solutions, Joining Forces to Rehumanize Healthcare Staffing

The Pros and Cons of Being a Traveling Respiratory Therapist

Pros of Being a Travel Radiology Tech

Extend or Explore? A Travel Medical Pro’s Guide to Contract Decisions

Privacy overview.

Username or email *

Password *

- Login / Register

Shopping cart

- Find location

- Group Testing Offers

- Lab Partner

- Medical And Research

- Fox Medical

- Pentecostal

- Ocean Drive

- Happy to Health

- Laundromart

- Oakland Park Blvd #3

- Oakland Park Blvd #2

- Oakland Park Blvd #1

- W Broward Blvd

- Deerfield Beach

- Chingon LLC

- Corpus Christi Miami

Book Your COVID Test

Your personal data will be used to process your order, support your experience throughout this website, and for other purposes described in our privacy policy.

RT-PCR TESTS FOR TRAVEL AGENCIES

Enhance customer experience for free! Your guests get tests & we take care of the logistics.

Want to earn $$$ with Alliance Health?

Free to join in 4 easy steps.

Sign up in no time! Partner with Alliance to offer your traveling customers RT-PCR COVID-19 tests of the highest standard.

Register for free online to receive a call from Alliance.

Schedule Mobile Tests

Coordinate with us to set up COVID-19 testing in or outside your Travel Agency.

Offer PCR COVID Tests

Offer your clients PCR tests with free creative assets sent by Alliance.

Build Customer Loyalty

Increase the value of your service & build customer loyalty.

Brands We Partner With

COVID Testing You Can Promote

Alliance offers 2 different RT-PCR tests—both approved for travel. Offer clients PCR results in as little as 30 Minutes!

Same-day RT-PCR Approved for International Travel

Results Guaranteed within 24 Hours

Our standard PCR test delivers quick & reliable results affordably. We guarantee results within 24 hours but most patients get them within just 6-8, on the very same day.

Rapid Results RT-PCR Approved for International Travel

Results in 30 Mins

The CDC mandates a negative PCR result 3 days before international flights. Perfect for travelers, this rapid option delivers RT-PCR results in just 30 minutes!

COVID-19 Testing Mobile Service in your City

Save your time we come to you to get you tested!

Live Photos From Locations

Sign up in no time! Partner with a company that values you

Start Offering More with alliance.health

Join us in the partnership effort to expand access to quick & convenient COVID-19 testing in Florida & New York.

Partnership Benefits

Alliance is with you every step of the way, helping you provide travelers with quick & reliable COVID-19 PCR results.

Mobile Testing

Partners can schedule Mobile COVID-19 Testing with Alliance Health by their area of the airport—scheduled at a date and time that works for you.

Dedicated Team

You’ll have access to our team of Lab Techs at alliance.health, with an open line of communication to answer any questions or troubleshoot any concerns.

Convenient for Customers

Enhance your customer service by offering a convenient option for clients who need PCR results quickly for travel, business, or personal reasons.

Promotional Materials

Receive branded creative assets from us, making it effortless to offer RT-PCR COVID-19 tests to guests at your Travel Agency.

Who Can Partner With Alliance ?

If you provide dining or accommodation, especially to tourists or travelers, partnering with Alliance will help customers feel safe.

Restaurants

Private Jet & Yacht Charters

Camps & Schools

Travel Agencies

Esthetic Med Spa

Visit our shop.

Abbott BinaxNow POC 40-pack (kits)

Celltrion DiaTrust POC 25-pack (kits)

Abbott BinaxNOW At-Home Test 2pk

AccessBio CareStart OTC Test 2-pack

iHealth OTC 2-pack

FACE RESPIRATOR HF BOX 50PCS

FACE RESPIRATOR M98 ZIP 50PCS

ABIFARM “Herbal Protect”, Protective Masks 50 PCS

FACE RESPIRATOR BC ZIP 50 PCS

FACE RESPIRATOR M100 ZIP 50 PCS

Our locations.

Do you serve travelers in Florida or New York? With our testing centers & testing areas, we may very well have a location nearby where your customers can quickly get the negative PCR result they need.

Frequently Asked Questions

It’s a way for businesses to partner with Alliance Health & offer convenient COVID-19 tests to customers. With international travel returning to pre-pandemic numbers, hotel guests need PCR test results to get on their returning flights!

As a partner, you can schedule Mobile testing with Alliance in your hotel parking lot! You’ll also get promotional materials from Alliance to offer guests quick & convenient RT-PCR tests at a nearby Alliance Testing Center.

With readily available PCR tests and results in just 30 minutes, you’ll enhance the value of your service to guests—especially travelers!

Who is eligible to join the Alliance Partners Program?

Any company serving clients with a demand for COVID-19 tests is free to join.

It’s especially helpful for businesses where customers prioritize speed & convenience when choosing which COVID-19 test to take, such as tourists or business travelers.

Can Alliance Health also come test clients at my hotel?

Yes! At no cost to you, we’ll conduct mobile testing in the hotel parking lot or set up a testing area inside—whichever you prefer.

Schedule Now!

Need quick COVID-19 / STD&UTI / IV Therapy / Wound Results? Get tested today and receive immediate results

One Provider for Global Health Insurance and Benefits

International health insurance for you and your family.

Consistent cover for your employees

We understand that in today's globalized world, businesses often have employees spread across different regions. With our regional plans, you can ensure consistent and reliable coverage for your employees worldwide. Our Summit plans are designed to meet the unique healthcare needs of each region, while also ensuring compliance with local regulations. We provide administration services, cover for insurance risks, or a combination of both.

GET A QUOTE

Health Services included with your cover

Next Generation Healthcare

Solutions for a healthier future -, our mission is to make access to quality healthcare easier, giving you peace of mind and confidence in tomorrow. , why choose us, looking for something else.

This is your toolbox, with many resources you might need, whether you're an insured member, an employer, an intermediary or a healthcare provider.

VIEW OUR RESOURCES

Browse the topics below to find the answers for the most frequently asked questions.

ANSWER YOUR QUESTION

If you're interested in getting international health insurance for you and your family, we'd be delighted to speak with you by phone or email. You can also arrange for us to call you at the time it suits you best.

EMAIL US NOW +353 1 514 8480

Olympic & Paralympic Movements

Allianz is proud to be the worldwide insurance partner of the olympic and paralympic movements from 2021-2028. , latest news & services, new gut health nutrition hub.

Allianz Partners reports record 2023 performance with growth in all business segments

Allianz partners names ariane koelbli as new global head of people and culture.

External Content cannot be shown without accepting cookies

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers, top credit cards with travel insurance, methodology, best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

Here is the list of travel cards offered by Chase that include various forms of travel insurance.

Having one of these in your wallet is a good start to protecting your travel investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 12 hours.

• Car rentals: Theft and collision damage for most cars in the U.S. and abroad.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Travel insurance

Find the right travel insurance policy with allianz assistance.

AWP Assistance UK Ltd , trading as Allianz Assistance and Allianz Global Assistance , is a subsidiary company of Allianz Partners SAS. AWP Assistance UK Ltd is authorised and regulated by the Financial Conduct Authority in the United Kingdom to provide insurance products and services.

Please note that, whilst AWP and Allianz Insurance are part of the global Allianz SE group of companies, AWP and Allianz insurance are separate companies and not part of the same group of companies in the UK. Any communications regarding Allianz Assistance services should therefore be addressed to AWP .

A range of cover options are available including single and multi-trip, 24/7 medical cover, backpacker, winter sports and more.

Whatever type of trip you're taking, Allianz Assistance will help you find a plan that covers the "what ifs?".

Extended Car Warranty

Allianz Assistance is the trusted car warranty provider for ten of the UK’s leading car brands. Find out more on Allianz Assistance about the three levels of car warranty that are available.

Not what you were looking for?

Pet insurance, musical insurance, home insurance.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Top Travel Insurances For Russia You Should Know in 2024

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

The world's largest country, Russia is known for its history and cultural heritage, with landmarks such as the Red Square, St. Petersburg, and the Hermitage Museum. Although travelling to Russia can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Russia and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Russia Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Russia:

Best Travel Insurances for Russia

- 01. Do I need travel insurance for Russia? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to Russia scroll down

Heading to Russia soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Is Travel Insurance Mandatory in Russia?

No, there's currently no legal requirement to take out travel insurance for travel to or through Russia.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Russia or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Russia:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to Russia, no matter whether you're planning to ice skate in Gorky Park in the winter or sunbathe in Sochi in the summer.

VisitorsCoverage lets you choose between various plans tailored to meet the specific needs of your trip to Russia, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies, and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Russia:

- Policy Names: Varies

- Medical Coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip Coverage: Excellent - but only available for US residents.

- Customer Support: FAQ, live chat and phone support

- Pricing Range: USD 25 to USD 150 /traveller /month

- Insurance Underwriter: Lloyd's, Petersen, and others

- Best For: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option for Russia, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy Names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical Coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip Coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer Support: FAQ, live chat, phone support

- Pricing Range: USD 80 to USD 420 /traveller /month

- Insurance Underwriter: David Shield Insurance Company Ltd.

- Best For: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads in Russia because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy Names: Nomad Insurance, Remote Health

- Medical Coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip Coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing Range: USD 45 to USD 160 /traveller /month

- Insurance Underwriter: Tokyo Marine HCC

- Best For: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Russia? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to Russia

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for Russia. However, we strongly encourage you to do so anyway, because the cost of healthcare in Russia can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Healthcare in Moscow

This guide was written prior to Russia's 2022 invasion of Ukraine and is therefore not reflective of the current situation. Travel to Russia is currently not advisable due to the area's volatile political situation.

Healthcare in Moscow is organised by the Moscow Health Department. While public healthcare facilities are available, most expats seek out private healthcare at international medical centres. Expats are advised to take out private medical insurance if it is not provided to them by their company.

Subsidised healthcare is provided to everyone living in the country, paid for by the state and the mandatory health insurance system. That said, professionals in the state system are likely to speak little to no English.

There are several private medical centres in Moscow where English is spoken and where the healthcare is on par with expat standards. These clinics are generally very expensive, so it is highly recommended that expats take out private medical insurance to cover medical costs in Moscow. Most insurance coverage plans will also include evacuation cover for emergencies or life-threatening situations.

Recommended hospitals in Moscow

Alliance medicale.

www.alliancemedicale.ru Address: Kutuzovsky Ave, 1/7

Intermed Center American Clinic

www.en.intac.ru Address: 4 Monetchikovsky Lane, 1/6, Building 3

International Clinic MEDSI

www.medsi.ru Address: 26 Prospekt Mira, Building 6

European Medical Center

www.emcmos.ru Address: 5 Spiridon'yevskiy Pereulok, Building 1

Further reading

►For more on the Russian healthcare system see our Healthcare in Russia page.

Expat Interviews " The standard is high, but health insurance is essential − both international and local cover tend to be adequate and similar for routine things." Read more about Stephen, a British expat, and his experience living in Moscow .

Are you an expat living in Moscow?

Expat Arrivals is looking for locals to contribute to this guide, and answer forum questions from others planning their move to Moscow. Please contact us if you'd like to contribute.

Expat Health Insurance

Cigna Global Health Insurance. Moving your family abroad can be intimidating, but learning about medical options such as family health insurance early on can help you settle successfully. Comprehensive Family coverage, wherever you go Paediatric coverage for well-child visits & immunizations Access to dental and orthodontic care 24/7 multilingual Customer Service Get a quote from Cigna Global (10% off family health plans in June)

Aetna Aetna International, offering comprehensive global medical coverage, has a network of 1.3 million medical providers worldwide. You will have the flexibility to choose from six areas of coverage, including worldwide, multiple levels of benefits to choose from, plus various optional benefits to meet your needs. Get your free no-obligation quotes now!

Moving Internationally?

International Movers. Get Quotes. Compare Prices. Sirelo has a network of more than 500 international removal companies that can move your furniture and possessions to your new home. By filling in a form, you’ll get up to 5 quotes from recommended movers. This service is free of charge and will help you select an international moving company that suits your needs and budget. Get your free no-obligation quotes from select removal companies now!

Free Moving Quotes ReloAdvisor is an independent online quote service for international moves. They work with hundreds of qualified international moving and relocation companies to match your individual requirements. Get up to 5 free quotes from moving companies that match your needs. Get your free no-obligation quotes now!

Advertisement

Supported by

Countries Fail to Agree on Treaty to Prepare the World for the Next Pandemic

Negotiators plan to ask for more time. Among the sticking points are equitable access to vaccines and financing to set up surveillance systems.

- Share full article

By Apoorva Mandavilli

Countries around the globe have failed to reach consensus on the terms of a treaty that would unify the world in a strategy against the inevitable next pandemic, trumping the nationalist ethos that emerged during Covid-19.

The deliberations, which were scheduled to be a central item at the weeklong meeting of the World Health Assembly beginning Monday in Geneva, aimed to correct the inequities in access to vaccines and treatments between wealthier nations and poorer ones that became glaringly apparent during the Covid pandemic.

Although much of the urgency around Covid has faded since the treaty negotiations began two years ago, public health experts are still acutely aware of the pandemic potential of emerging pathogens, familiar threats like bird flu and mpox, and once-vanquished diseases like smallpox.

“Those of us in public health recognize that another pandemic really could be around the corner,” said Loyce Pace, an assistant secretary at the Department of Health and Human Services, who oversees the negotiations in her role as the United States liaison to the World Health Organization.

Negotiators had hoped to adopt the treaty next week. But canceled meetings and fractious debates — sometimes over a single word — stalled agreement on key sections, including equitable access to vaccines.

The negotiating body plans to ask for more time to continue the discussions.

“I’m still optimistic,” said Dr. Jean Kaseya, director general of Africa Centers for Disease Control and Prevention. “I think the continent wants this agreement. I think the world wants this agreement.”

Once adopted, the treaty would set legally binding policies for member countries of the W.H.O., including the United States, on surveillance of pathogens, rapid sharing of outbreak data, and local manufacturing and supply chains for vaccines and treatments, among others.

Contrary to rhetoric from some politicians in the United States and Britain , it would not enable the W.H.O. to dictate national policies on masking, or use armed troops to enforce lockdowns and vaccine mandates.

Next week’s deadline was self-imposed, and some public health experts have said it was far too ambitious — most treaties take many years — for such a complex endeavor. But negotiators were scrambling to ratify the treaty before elections in the United States and multiple European countries.

“Donald Trump is in the room,” said Lawrence Gostin, director of the W.H.O. Center on Global Health Law, who has helped to draft and negotiate the treaty.

“If Trump is elected, he will likely torpedo the negotiations and even withdraw from W.H.O.,” Mr. Gostin said.

During his tenure as president, Mr. Trump severed ties with the W.H.O. , and he has recently signaled that, if re-elected, he might shutter the White House pandemic preparedness office.

Among the biggest bones of contention in the draft treaty is a section called Pathogen Access and Benefits Sharing, under which countries would be required to swiftly share genetic sequences and samples of emerging pathogens. This information is crucial for rapid development of diagnostic tests, vaccines and treatments.

Low-income nations, including those in Africa, want to be compensated for the information with quick and equitable access to the developed tests, vaccines and treatments. They have also asked that pharmaceutical manufacturers share information that would allow local companies to manufacture the products at low cost.

“We don’t want to see Western countries coming to collect pathogens, going with pathogens, making medicines, making vaccines, without sending back to us these benefits,” Dr. Kaseya said.

Member countries have only ever agreed to one other health treaty, the 2003 Framework Convention on Tobacco Control , which strengthened control of the tobacco industry and decreased smoking rates in participating countries. But they were jolted by the devastation of the Covid pandemic and the inequities it reinforced to embark on a second.

The countries are also working on bolstering the W.H.O.’s International Health Regulations, which were last revised in 2005 and set detailed rules for countries to follow in the event of an outbreak that may breach borders.

In May 2021, an independent review of the global reaction to Covid-19 “found weak links at every point in the chain of preparedness and response.”

The pandemic also deepened mistrust between wealthier nations and poorer ones. By the end of 2021, more than 90 percent of people in some high-income countries had received two doses of Covid vaccines, compared with less than 2 percent in low-income nations. The lack of access to vaccines is thought to have caused more than a million deaths in low-income nations.

The treaty would be an acknowledgment of sorts that an outbreak anywhere threatens the entire globe, and that providing vaccines and other resources is beneficial to everyone. Variants of the coronavirus that emerged in countries with large unvaccinated populations swiftly swept across the world.

“Nearly half of U.S. deaths came from variants, so it’s in everybody’s interest to have a strong accord,” said Peter Maybarduk, who directs Public Citizen’s Access to Medicines program.

In December 2021, the W.H.O. established a group of negotiators to develop a legally binding treaty that would enable every country to prevent, detect and control epidemics, and allow for equitable allocation of vaccines and drugs.

More than two years into the negotiations, negotiators have agreed, at least in principle, on some sections of the draft.

But much of the good will generated during Covid has evaporated, and national interests have returned to the fore. Countries like Switzerland and the United States have been reluctant to accept terms that may affect the pharmaceutical industry; others like Argentina have fought against strict regulations on meat exports.

“It’s evident that people have very short memories,” said Dr. Sharon Lewin, director of the Cumming Global Center for Pandemic Therapeutics in Melbourne.

“But it can happen again, and it can happen with a pathogen that is far trickier to deal with than Covid was,” she warned.

One proposal for the Pathogen Access and Benefits Sharing section would require manufacturers to set aside 10 percent of vaccines to be donated, and another 10 percent to be provided at cost to the W.H.O. for distribution to low-income nations.

But that idea proved to be too complicated, said Roland Driece, who is one of the leaders of the negotiations. “We found along the way that that was too ambitious in the time frame.”

Instead, a working group established by the World Health Assembly will be tasked with hammering out the details of that section by May 2026, Mr. Driece said.

The terms of the proposed agreement have generated some confusion. In Britain, Nigel Farage, the conservative broadcaster and populist politician, and some other conservative politicians have claimed that the W.H.O. would force richer countries to give away 20 percent of their vaccines.

But that is an incorrect reading of the proposed agreement, Mr. Driece said. “It’s not the countries that have to come up with those vaccines, it’s the companies,” he said. Pharmaceutical companies would commit to the system in exchange for guaranteed access to data and samples needed to make their products.

Britain will not sign the treaty unless “it is firmly in the U.K. national interest and respects national sovereignty,” a spokesperson for the country’s health department told Reuters earlier this month.

In the United States, Republican senators have demanded that the Biden administration reject the treaty because it would “potentially weaken U.S. sovereignty.”

Dr. Tedros Adhanom Ghebreyesus, W.H.O.’s director general, has roundly criticized what he called the “the litany of lies and conspiracy theories,” noting that the organization does not have the authority to dictate national public health policies, nor does it seek such power.

The secrecy surrounding the negotiations has made it difficult to counter misinformation, said James Love, director of Knowledge Ecology International, one of the few nonprofits with a window into the negotiations.

Having more people allowed into the discussion rooms or to see the drafts as they evolve would help clarify complicated aspects of the treaty, Mr. Love said.

“Also, the public could relax a bit if they’re actually reading the actual agreement on a regular basis,” he said.

Some proposals in the draft treaty would require massive investments, another sticking point in the negotiations.

To monitor emerging pathogens, wealthier nations endorse a so-called One Health strategy, which recognizes the interconnections between people, animals, plants and their shared environment. They want low-income countries to regulate live animal markets and limit trade in animal products — a big economic blow for some nations.

Last month, the Biden administration released its own strategy for global health security , with a focus on bilateral partnerships aimed at helping 50 countries bolster their pandemic response systems. The administration hopes to expand the list to 100 countries by the end of the year.

American support would help the countries, most of which are in Asia and Africa, strengthen their One Health systems and better manage outbreaks.

The U.S. strategy is meant to be complementary to the global treaty, and cannot serve as an alternative, public health experts said.

“In my view, this is the most important moment in global health since W.H.O. was founded in 1948,” Mr. Gostin said. “It would just be an unforgivable tragedy if we let this slip away after all the suffering of Covid.”

Apoorva Mandavilli is a reporter focused on science and global health. She was a part of the team that won the 2021 Pulitzer Prize for Public Service for coverage of the pandemic. More about Apoorva Mandavilli

Destigmatizing mental illness and promoting equitable communities.

The Wellness Recovery Action Plan® or WRAP®, is a self-designed prevention and wellness process that anyone can use to get well, stay well and make their life the way they want it to be.

Alliance House

Alliance House is located in Moscow, ID and provides a supported living environment for up to 6 adults diagnosed with severe and persistent mental illness who have had difficulty with living independently in the past.

Education, Outreach & Advocacy

LAMI offers community outreach amd free QPR Suicide Prevention Training to small groups. Contact us at [email protected] for more information and to schedule a training.

See What's Happening!

"I just don't like training": Capitals' Alex Ovechkin opens up about offseason training regimen

Washington Capitals captain Alex Ovechkin on Thursday talked about his offseason training routine. In an interview with Sports.ru, he shared his go-to travel meal at different times during the year.

Ovechkin talked about his approach to nutrition during the regular season, saying:

"There is [dieting] during training, but when the regular season starts, that's it. No diet. More calories. Some people go on a diet during the season. Some don't eat pasta, some don't eat meat or chicken. But I eat whatever I want."

On being asked if his preferred Subway sandwich and Flamin Hot Cheetos were impacting his performance during the regular season, he said:

"It doesn't."

Despite his relaxed approach to in-season dieting, Ovechkin is no stranger to rigorous training.

"I hate prep. I hate it," Ovechkin said. "I just don't like training. Before the season, that's the hardest part. Can you imagine, after vacation, you arrive, you're tan, everything's fine, happy, and your coach calls you and says, 'Well Sasha, tomorrow we start training.' And it starts, you go to training, then rest, then another training. I hate it, I can't stand it."

Currently, back in Moscow, Alex Ovechkin is likely focusing on balancing his training regimen with his comfort.

Alex Ovechkin's pursuit of Wayne Gretzky's 894 goals

The Washington Capitals made it to the playoffs this season but got swept off 4-0 by the New York Rangers . Alex Ovechkin initially suffered in the beginning, but in the later part of the season, his performance allowed the Capitals to qualify for the playoffs. Ovechkin scored 31 goals this season amid his subpar performance.

There were discussions before the season about whether he would break Wayne Gretzky 's goal record of 894, and many put their faith in him. His performance initially hinted that he would need two more seasons to do that. But his late-season form helped him reach 853 career goals.

Ovechkin is now just 41 goals short of achieving the milestone. He could surpass Gretzky if he gets an average performance season in 2024-25.

One more thing that stood out this season was Ovechkin's shot speed. He had 68 shots clocked between 90-100 mph, according to NHL Edge. The average for other NHL forwards is just one shot in this range per season.

Coronavirus (COVID-19) Update For Inland Orthopaedic Surgery Patients

About inland orthopaedics.

Inland Orthopaedic Surgery and Sports Medicine Clinic has been providing orthopaedic care on the Palouse since 1990. We provide a wide range of services including sports medicine, joint replacement, arthroscopic shoulder, knee and hip procedures, fracture care and general orthopaedics. Our surgeons are certified by The American Board of Orthopaedic Surgeons and are committed to being the orthopedic practice of choice for people seeking a personal approach to orthopedic care. It is important for us to encourage patients to play an active role in their treatment. We strive to serve our patients with compassion and integrity by providing exceptional patient-centered care through our knowledge, commitment, and attention to detail, giving each patient optimal potential to return to an active lifestyle. We take great pride in treating patients like family and providing specialized, high-quality care in a warm and friendly atmosphere.

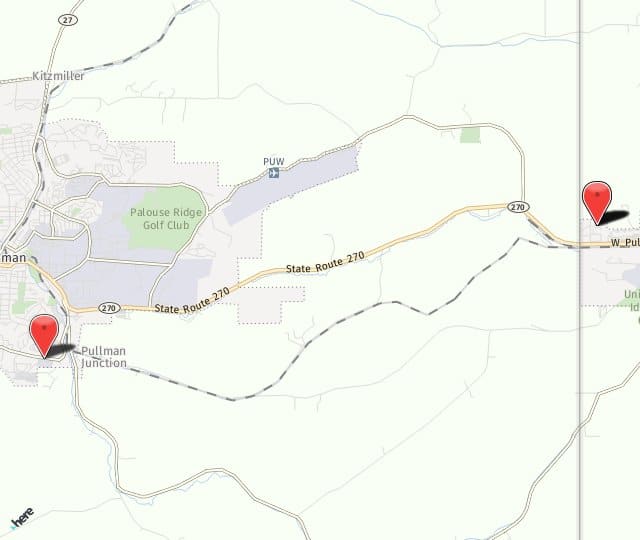

Office Addresses & Directions

Moscow office.