Your complete guide to Apple Pay

Update : Some offers mentioned below are no longer available. View the current offers here .

Apple Pay launched in 2014 as the first of the mobile wallets that enabled people to connect credit cards, debit cards and bank accounts to their personal devices in order to send and receive money. Of the major mobile wallet services – Google Pay (formerly Android Pay), Samsung Pay and Apple Pay – Apple's service remains the largest. In fact, 507 million iPhone users had Apple Pay as of 2020, according to Statista .

Apple Pay represents a secure and sanitary payment option, since the app uses Near Field Communications (NFC) to transmit an encrypted virtual account number to the point-of-sale (POS) payment terminal. When you use Apple Pay in stores, no money changes hands, and you don't even have to touch the POS terminal to complete the transaction or sign for it.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner's guide .

You can also use Apple Pay to send and receive money to and from family and friends, pay at thousands of brick-and-mortar stores as well as paying online and through many common app-based services. In this article, we will dig into everything you want to know about Apple Pay.

Related: Here's how the pandemic is completely changing how we pay

Which banks support Apple Pay?

Apple Pay can link to thousands of banks and credit unions across the world, with more being added all the time. More than 60 countries now have access to Apple Pay, and all major U.S. credit card providers support the payment system.

That means you can link credit cards from the following providers to your Apple Pay account to pay easily and securely through the platform:

- American Express

- Bank of America

- Barclaycard

- Capital One

- Synchrony Bank

- Wells Fargo

Smaller banks and credit unions that issue credit cards also support the service, including USAA, PNC Bank, HSBC, Fifth Third Bank, Navy Federal Credit Union, Huntington Bank, Regions Bank, Beneficial Bank, Citizens Bank, KeyBank, SunTrust, PenFed Credit Union and Alliant Credit Union.

Where can I use Apple Pay?

You can use Apple Pay for in-app purchases on your iPhone and to pay for Apple services from the App Store, the iTunes store, Apple Music, Books, Apple News+, Apple TV+ and iCloud.

In stores, you can use Apple Pay anywhere you see the NFC logo or the Apple Pay logo at a point-of-sale location. This includes millions of stores, restaurants, and entertainment venues worldwide, from ACE Hardware and Albertsons grocery stores to Walt Disney World and Whole Foods. Apple Pay is currently accepted at more than 85% of retailers in the U.S.

You can also use Apple Pay on popular apps and online services, including Lyft, Fandango, Airbnb, GrubHub and Groupon.

Related: Dirty money: Could ditching cash keep you healthier?

Finally, use Apple Pay with the following metropolitan area transit provider apps:

- MTA Metro-North and Long Island Railroads (LIRR)

- Ventra (CTA, Pace, and Metra)

If you're riding Ventra in the Chicago metro area or are using the Hop Fastpass for TriMet, C-TRAN, and Portland Streetcar rides in the Portland and Vancouver metropolitan area, you don't need to download the transit provider app. You can use Apple Pay to tap and pay with your mobile phone instead.

Related: Best travel credit cards for travel purchases

How many cards can I add to Apple Pay?

Users with an Apple iPhone 8, 8 Plus or later, or an Apple Watch Series 3 or later can add up to 12 cards on any one device. Users with earlier versions of iPhone or Apple Watch can only add 8 cards to each device. If you have more than one mobile device, you need to add the cards to each device separately.

In certain countries, including the U.S., you can also add retail and restaurant loyalty cards , boarding passes, movie tickets , coupons and student ID cards to your Apple Wallet.

Related: The best credit cards for entertainment spending

What popular credit cards Can I use with Apple Pay?

With a limit of 12 credit cards, you can probably load all your cards into your Apple Wallet for easy access through your iPhone. But which one should you set as your default payment method? Which are the best credit cards to use with Apple Pay?

Since Apple Pay supports nearly every credit card in the U.S., you have plenty of choices. Some of the best cash-back credit cards and travel rewards cards are also some of the best cards to use with Apple Pay. Let's look at a few of them, which also happen to be among the best contactless credit cards available, below.

Chase Freedom Unlimited

An unsung hero when it comes to cash-back rewards credit cards, the Chase Freedom Unlimited has a lucrative rewards structure. You'll earn 5% on travel purchased through Chase Ultimate Rewards, 3% on dining and drugstores (including takeout and eligible delivery service) and 1.5% on all other purchases. Unlike the Chase Freedom Flex card, you don't need to keep track of rotating categories.

Related: Chase Freedom Unlimited review

It's a great card to use as your default in Apple Pay because you know wherever you shop and whatever you buy, you'll net a neat 1.5% cash back, at least. There's no annual fee, and you'll enjoy benefits such as 120-day purchase protection and extended warranty protection to extend certain manufacturers' warranties by up to a year.

The Freedom Unlimited also has a sign-up bonus of an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back! If you transfer those Freedom Unlimited rewards to a Chase Ultimate Rewards credit card, such as the Chase Sapphire Preferred Card or Chase Sapphire Reserve, you can effectively double their value, based on TPG's latest valuations , since they become fully transferable Ultimate Rewards points.

Related: How to maximize your Chase Ultimate Rewards points

Chase Sapphire Preferred Card

If you're interested in more than cash back and want to delve into the Chase Ultimate Rewards universe, the Chase Sapphire Preferred credit card is a great choice to load into your Apple Wallet so you can earn 5 points per dollar on Lyft (through March 2022), 5 points per dollar on all travel when book through the Chase Ultimate Rewards portal, 3x points per dollar select streaming services, 3 points per dollar on online grocery purchases(excluding Walmart and Target, 3x points per dollar on dining, 2 points per dollar on travel and 1x point per dollar on all other purchases. The annual fee is $95.

Related: Chase Sapphire Preferred review

The sign-up bonus from Sapphire Preferred isn't exactly small potatoes, either. Earn 60,000 in bonus points, worth $750 in travel through Chase Ultimate Rewards (or $1,200 in general based on TPG valuations ), when you spend $4,000 on purchases in the first three months from account opening.

Chase Sapphire Reserve

Big spenders may find they can make their rewards go even further with a Chase Sapphire Reserve credit card. The card carries a $550 annual fee, plus $75 for each authorized user. But, you get up to $300 in annual travel credit, and earn 10 points per dollar on Lyft (through March 2025), 3x points per dollar on travel and dining worldwide and 1x point per dollar on all other purchases.

Related: Chase Sapphire Reserve review

Under the card's current terms, you'll earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening – as long as this is your only Sapphire card at the moment and you haven't received a new cardmember bonus for holding a Sapphire card in the past 48 months. Those bonus points are worth $1,200, based on current TPG valuations .

If you're opening a new card to link to Apple Pay, you'll want to choose carefully. Chase's 5/24 rule could prevent you from qualifying for any Chase credit card if you've opened more than five credit cards across all banks in the past 24 months.

American Express® Gold Card

If you're looking outside the Chase family of credit cards for a great rewards card to use with Apple Pay, consider the classic American Express Gold Card.

Related: Amex Gold review

A favorite rewards card for many people, the Amex Gold offers a generous rewards program that includes 4x points per dollar on dining at restaurants and U.S. supermarkets on up to $25,000 per calendar year in purchases (then 1x), 3x points per dollar on flights booked through Amex Travel or directly with the airlines and 1x per dollar on other purchases.

Related: Choosing the best American Express credit card for you

With Apple Pay accepted at so many restaurants nationwide, it pays to load your Amex Gold in your Apple Wallet, because you'll receive an up to $120 dining credit annually ($10 in monthly statement credits) when you use Amex Gold at eateries such as The Cheesecake Factory, Ruth's Chris Steak House and participating Shake Shack locations. The offer applies to food services such as Grubhub, too. You'll also get up to $120 Uber Cash ($10 each month) for U.S. Uber rides and Uber Eats orders. Card must be added to Uber account before receiving the Uber Cash benefit. Enrollment required for select benefits.

Related: Best credit cards for food delivery services

The Amex Gold carries an annual fee of $250 (see rates and fees).

Do I earn rewards with Apple Pay?

Apple Pay itself does not deliver any rewards to users. However, you can load loyalty rewards cards from your favorite stores into the program, making it easier to earn extra points or cash back without fumbling for a key fob, hunting in your wallet, or providing your phone number or email address at the payment terminal.

Of course, when you use Apple Pay linked to a rewards credit card, you'll earn whatever points, miles or cash back you are entitled to for using that credit card, just like with old-fashioned purchases.

Related: How do mobile wallets code for credit card bonus categories?

How do I set up Apple Pay?

Setting up Apple Pay is easy and intuitive. Most iPhone and Apple Watch users will find it pre-loaded on their device. Just click the "Wallet" icon, hit the plus sign in the right-hand corner and start adding your favorite credit cards by positioning your card in your camera's view frame. You can also add a card manually by entering the name, account number, expiration date and CVV code on the back of the card.

Along with credit cards, you can store concert tickets , travel documents, such as boarding passes, and more in your Apple Wallet by downloading the corresponding app through the App Store.

Which countries support Apple Pay?

Apple Pay is accepted in nearly 60 countries around the globe. It can be used throughout the European Economic Area, and also in the U.S., Canada, the U.K., Australia, Brazil, the United Arab Emirates, Saudi Arabia, Russia, Kazakhstan, New Zealand, Singapore, and other countries and territories.

Is it secure?

Apple Pay utilizes Near Field Communications (NFC) to carry out transactions. NFC technology has been deemed one of the safest ways to make payments as it's immune to credit card skimming technology (where cyber thieves can collect your account number when you swipe your credit card) and uses sophisticated encryption to protect your account data.

Related: Are mobile wallets safe?

When you enter your credit card into Apple Pay, the data goes through a series of encryption steps, called tokenization. Ultimately, a virtual account number is stored on your phone within the most secure portion of the iPhone's memory banks. Only your phone has the capability to decrypt the number and process a transaction.

Add the touch ID, facial recognition and passcodes that protect your phone, and Apple Pay is probably safer than most other payment methods. Plus, Apple's "Find my iPhone" service enables you to wipe your phone of all its data if it's ever lost or stolen.

Is there a fee?

If you use Apple Pay at the register in stores or restaurants, Apple does not charge any fees. Since merchants consider this a "card present" sale, however, the merchant may charge additional fees , just like they would for physical credit card users. Merchants who offer "cash discounts" may not extend that discount to Apple Pay customers, so be sure to read the signage around the register carefully before you decide how you want to pay.

If you pay with Apple Pay using a debit card, there are no additional fees.

Finally, if you transfer money to another Apple Pay user from a debit card linked to Apple Pay, there is no fee. But you will pay a 3% fee if you transfer money to an individual using a credit card linked to Apple Pay.

Bottom line

With the ability to link to practically any credit card you're likely to carry, there's a reason Apple Pay is the most widely used mobile wallet app available today. iPhone and Apple Watch, in particular, users may want to consider making Apple Pay their main payment method going forward since it can help maintain social distancing from cashiers and its contactless operation means it might be more sanitary than other payment options.

Additional reporting by Stella Shon.

For rates and fees of the Amex Gold, please click here.

Ride transit with Pay Apple Pay in AR. 1 Open this page using Safari on your iPhone.

Experience Pay Apple Pay in AR. 1

Now arriving in New York.

Traveling around NYC is fast and easy with Express Mode for Apple Pay. 2 Just tap your iPhone or Apple Watch and ride — no need to use Face ID or Touch ID.

Ride transit with Pay.

Apple Pay is accepted on trains and buses throughout NYC. 3 With your credit or debit card in Wallet, you can easily get where you need to go with just your iPhone or Apple Watch.

How to set up Apple Pay in the Wallet app.

Open Apple Wallet and tap the plus icon .

Select Debit or Credit Card and follow onscreen instructions.

Done. Tap and ride.

Using Express Mode with Apple Pay.

Express Mode is automatically enabled on your Apple device, so there’s no setup required.

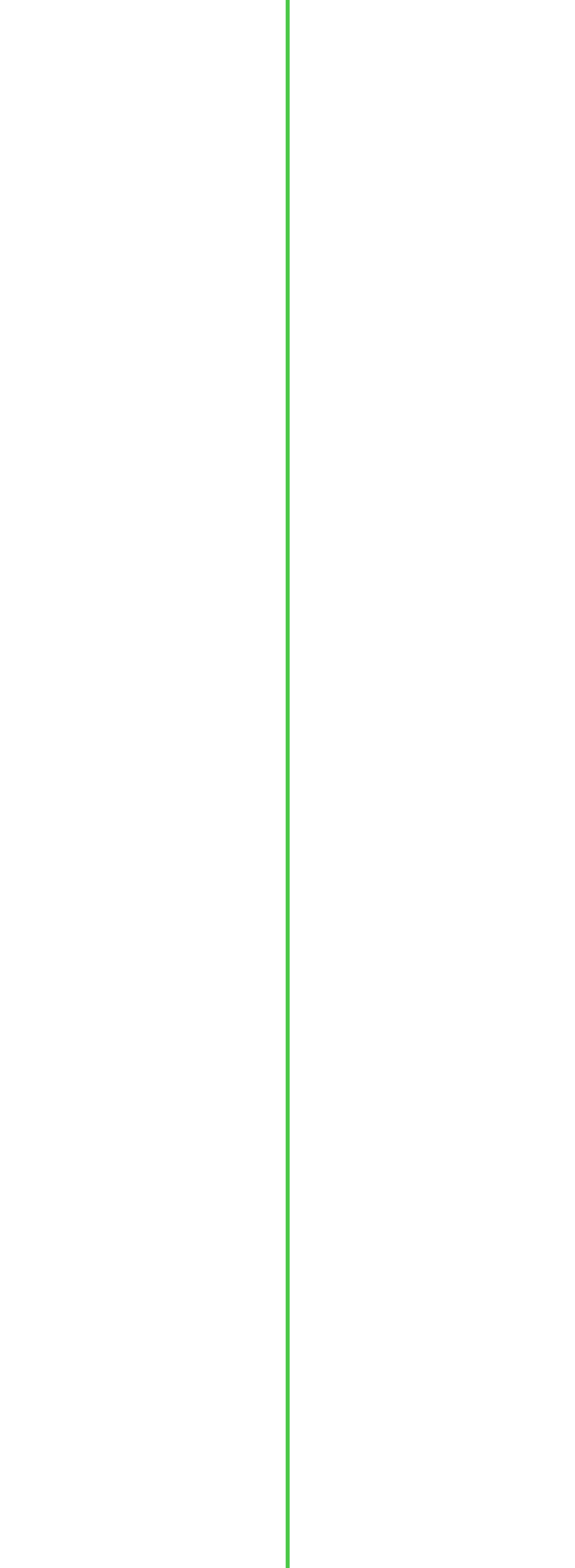

If you have more than one debit or credit card in Wallet, you can easily make sure your preferred payment card is selected for Express Mode.

- Open Wallet and select a payment card.

- Tap Express Transit Settings and confirm your preferred card.

Take a virtual trip with Pay.

Open this page using Safari on your iPhone.

Make sure you’re on the latest version of iOS.

A fast way to travel across NYC.

Use your iPhone or Apple Watch at the OMNY readers in all subway stations, buses, and the Staten Island Railway.

Your iPhone is now your ticket.

Just tap and ride, no cards or tickets necessary. No need to open an app, or even wake or unlock your device.

Find it all in Apple Wallet.

Keep your credit and debit cards, tickets, keys, and more all in one place.

Questions answered.

You will need an iPhone 8 or later with iOS 13.6 or later, or an Apple Watch Series 3 or later with watchOS 6.2.8 or later.

Yes. Just make sure that you have added a payment card to your iPhone and Apple Watch. You can add a card to Apple Watch with the Apple Watch app on your iPhone.

No. Express Mode can only be used with OMNY readers at MTA bus and subway stations. Face ID, Touch ID, or passcode will still be required when using Apple Pay at other locations.

No. You can only pay for single rides.

This is called card clash. To ensure that only your chosen payment method is charged, always keep your physical MetroCard separate from your Apple devices when paying at an OMNY reader.

For more questions about OMNY, visit the OMNY website. For more questions about Apple Pay, visit the Apple Support website.

- OMNY website

- Apple Support website

- AR requires an iOS or iPadOS device with iOS 11 and an A9 processor or later.

- To use Express Transit in New York, you need a debit or credit card set up in the Wallet app and set as your Express Transit card on an iPhone 6s, iPhone 6s Plus, iPhone SE (2016), or later running the latest version of iOS, or an Apple Watch Series 1 or later running the latest version of watchOS.

- Not accepted on AirTrain JFK, Access-A-Ride, or for onboard fare payment on LIRR or Metro-North.

- Sign in

Apple Pay ® FAQs

Get the mobile banking app, get it on the app store.

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically.

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Or we can send you a link by email

Get it on google play.

Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd.

Our mobile app isn't available for all devices

If you don't see an app for your device, you may still be able to access our mobile website by typing bankofamerica.com in your mobile web browser.

Get the mobile banking app

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices.

Continue Go back to Bank of America

We've sent you a download link

We sent an email with the download link to

We sent a text message with the download link to

We couldn't send the link

To add an eligible card to your compatible Apple device from the Bank of America ® Mobile Banking app

- Log in to the app

- Tap the Menu option in the navigation bar

- Tap Manage Debit/Credit Card

- On your desired card, tap Digital Wallets

- In the Add to Wallet section, select Add on the Apple Pay option

You may also add a card using the Wallet app or within the Wallet & Apple Pay settings of your compatible device.

Currently, the following cards are eligible:

- Bank of America ® consumer credit cards and debit cards (excludes ATM-only cards)

- Merrill Lynch ® consumer credit cards

- U.S. Trust ® consumer credit cards and debit cards

- Small Business debit cards (excludes ATM-only, deposit-only and employee-only cards)

Please note: Due to card network limitations, cards issued in Puerto Rico and U.S. Virgin Islands are not eligible at this time.

- Bank of America uses verification steps that may require you to enter a one-time Password that is sent to you when activating your card.

- Your virtual cards are covered by Bank of America's $0 Liability Guarantee.

- Most merchants will not have access to your physical card number; they will receive the unique virtual card number associated with your debit or credit card.

Virtual cards are the digital form of your eligible physical credit and debit cards. When you add your physical card to Apple Pay, it is stored as a virtual card. It will have a unique virtual card number that is only associated with Apple Pay.

Apple refers to the digital form of credit and debit cards as the Device Account Number. Bank of America uses the term virtual card number. Review the question “What is a virtual card?” for more info.

Please note: Due to card network limitations, cards issued to residents of Puerto Rico and U.S. Virgin Islands are not eligible at this time.

See a full list of compatible devices layer

Learn more about how to make purchases using Apple Pay layer

Apple Pay works in-store, in-app and online. Use Apple Pay wherever you see one of these symbols:

Apple Pay can be used in millions of locations including grocery stores, restaurants, vending machines and public transportation, as well as within apps and websites. See where you can use Apple Pay layer

No. The card image may not be an exact match. Keep in mind this doesn’t affect how your cards work with Apple Pay.

Apple Pay displays the last 10 Bank of America credit and debit card purchases you made within the Wallet on your iPhone, but it won't display all your purchase details. For a complete view of all your Bank of America transactions, log in to Online Banking or use our Mobile Banking App and select the appropriate account. Note: If you are unable to view your transactions in Apple Pay, you may need to delete and re-add your card.

If your device is lost or stolen, you can lock your card from being used for payments on that device through your Online Banking account or the Bank of America® Mobile Banking app. To lock your card through Online Banking:

- Log in to Online Banking

- Select Digital Wallets & Virtual Cards from the Profile & Settings menu

- Select Lock

To lock your card through the Bank of America ® Mobile Banking app:

- On your desired card, tap Digital Wallets and select Manage

- Swipe left and select Lock

Erasing the information on your iPhone will have no effect on your physical cards. You can continue to use your cards as you normally would. Erasing your iPhone will delete the virtual cards from Apple Pay and they can no longer be used. You can add your credit and debit cards back into Apple Pay at any time.

Related Links

- Learn more about Apple Pay

Bring on the benefits.

Daily cash that grows in a savings account. 1.

With Savings, you can choose to send your Daily Cash to a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). 2 And because it’s all built into the Wallet app, it’s simple to get started. All it takes is a few steps to open an account and you're in.

Get started with savings

Just remember 3, 2, and 1%.

No matter where you shop with Apple Card, you always get unlimited Daily Cash back. That's real cash 3 you get back every day. Use it right away 4 with Apple Pay, send it to a friend with Apple Cash, 5 or watch it grow in a high-yield Savings account. Buy anything from Apple — including services like Apple Music or Apple TV, games and apps from the App Store, even in-app purchases — and enjoy 3% cash back.

cash back with Apple and select merchants when you use Apple Card with Apple Pay. 6

Get 3% back on everything you buy from Apple and at select merchants when you use Apple Card with Apple Pay.

cash back when you use Apple Pay.

Use Apple Pay wherever you see one of these symbols.

cash back when you use the titanium card or your virtual card number wherever Mastercard is accepted.

Learn how to order your titanium card

Grow your Daily Cash in a Savings account. 1

Apple Card gives you up to 3% unlimited Daily Cash back on every purchase. That’s real cash you can use right away, to send to a friend or use wherever Apple Pay is accepted when you send Daily Cash to Apple Cash. And with Savings, you can choose to send your Daily Cash into a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). Add money from your bank account to Savings at any time, directly in the Wallet app. If you need to move money out, withdrawals to Apple Cash are typically instant, and usually take 1-3 business days with other bank accounts. 7 No minimum deposits, fees, or balances required. 8 And, you’re covered by FDIC insurance. 9

Open a Savings account

Enroll in Savings

Healthy finances. Family style.

Share the benefits of Apple Card with anyone in your Family Sharing group — whether it’s a partner, a child, or someone else you trust. 10 It’s a great way for everyone on the account to work toward healthy finances together. Add a Co-Owner 11 to build credit as equals 12 and manage the account together. You can also add kids and young adults as Participants. 13 And if a Participant is over 18, they can have the option to start building their own credit history. 14 Plus, everyone gets to enjoy their own unlimited Daily Cash back when they use Apple Card for their purchases. 15

Learn how to add someone to your Apple Card Family

Pay for new Apple products over time, interest-free. 16

Apple Card Monthly Installments lets you buy new Apple products, like iPhone, Mac, iPad, and more, and pay them off with interest-free monthly payments. You get 3% Daily Cash back, all up front. Simply choose Apple Card Monthly Installments as your payment option when you make your purchase at an Apple Store, in the Apple Store app, or on apple.com.

Learn more about Apple Card Monthly Installments

Accepted globally, with no foreign transaction fees. 17

Because Apple Card is part of the Mastercard network, it's accepted anywhere in the world. Plus, you have access to Mastercard benefits, like identity theft protection. And because Apple Card is designed to have no fees at all, you won't get charged any foreign transaction fees.

See all Mastercard benefits for Apple Card customers

Pocket-lint

How to use apple pay on the london underground.

We've got all the key details you need on how to use Apple Pay on the London Underground, including tips and tricks.

Key Takeaways

- Using Apple Pay on the London Underground is different than using it at other stores, but it's now much quicker with Express Mode.

- Enable Express Mode on your iPhone or use your Apple Watch to quickly tap and go through the turnstiles.

- Wear your Apple Watch on your right arm for an even quicker gate experience, and remember to always use the same device when tapping in and out.

Apple Pay has been around in the UK for ages now. You might have noticed that the average queue at your local Pret or pub features iPhone and Apple Watch owners thrusting their devices at store staff and payment machines. What you might not realise, however, is that using Apple Pay with a London Underground terminal is actually quite different - once a faff, it's now much, much quicker.

Fumbling and fiddling with a device might be acceptable in a sandwich shop, but you need to be nimble to avoid other commuters getting angry at you using your Apple tech to get through the gate. Thankfully, there's an Express Mode to make it easy to pay for your travel via your Watch or your iPhone.

Using Apple Pay on public transport in London is actually extremely easy - and it's important to know that it'll also work the exact same way on buses and the Overground network, too!

London's public transport revolves around a contactless system now, with entry points all featuring big yellow readers - this is the key to using Apple Pay.

On the Tube, you tap both in and out of your journey, while on a bus you only tap as you get on.

That means all you have to do is get your Apple Pay reader to go through the reader as you start your journey or end it on the Underground, and use the same card both times.

As you'll see below, though, there are some amazing ways to speed this up, with the biggest being Express Mode.

Apple Pay on the London Underground: Tips and tricks

If you're all set with the above steps and have Apple Pay ready to go on the Tube, you might want to check out our list of extra tips below, which could help you speed things up a good chunk.

1. Enable Express Travel Card Apple Pay on your iPhone

This trick is vital for whizzing through the turnstile quickly. Rather than wait until the turnstile prompts you to give Touch ID or Face ID authentication, you can enable Express Mode on a certain card in your Apple Wallet to work automatically without having to require authentication. Just tap and go.

Open Settings on your iPhone > Tap on Wallet & Apple Pay > Tap on Express Travel Card > Select the card you want to use as your Express Travel Card. If you've got an iPhone XS or later it will even work for 5 hours after the battery has run out.

2. Use your Apple Watch

If you have an Apple Watch you'll find it much quicker and easier to go through the turnstiles. If you've set up Express Mode, or Express Transit Mode as it's also known, simply place the watch face down on the yellow circle and you're through.

If you've got an Apple Watch Series 4 or later, it will work even when the battery has run out. Handy if you're out late.

3. Wear your Watch on your right arm

For an even quicker through-the-gate experience, wear your Apple Watch on your right wrist as almost all Tube system gate readers are on that side.

If your Watch is on your left arm, you could always do the tap and spin like we do. That way you end up facing the gates backwards as you spin through them as if you were a pro dancer.

4. Check your progress

Once you've tapped through with either your iPhone or your Watch, check your journey "tap in" status by going to the card you've used and viewing your logged journey data.

As Apple Pay logs the transaction as you go, it will let you see your journey history right then and there. Oyster card members only get to see that if they go to the TfL website and sign in. What a faff.

Open Settings on your iPhone > Tap on Wallet & Apple Pay > Tap on the card you are using for tapping in and out at the top > Select the Transactions tab.

5. Save money with a weekly travel card

It's not available to Oyster card users, but contactless and Apple Pay users can benefit from weekly travel card fares if they "tap in" across the week. TfL automatically works out the best cost according to your usage, and then charges you the best rate possible.

6. Always use the same device in and out

Because of the way Apple Pay works, if you tap into the system with your iPhone you have to tap out with the iPhone as well, otherwise you'll be charged the maximum fare.

If you change payment methods (like using your Watch on the way out), even if it's the same card via Apple Pay, it thinks you are a different user and will charge you accordingly.

7. They will let you out if your battery is dead

TfL isn't evil and that means that if your battery dies mid-journey you will be let out of the gates at the other end. Expect to have to grovel though.

You might have to prove it to the guard too. Of course, if you've got an iPhone XS or later, and or an Apple Watch Series 4 or later, then you'll be fine for around 5 hours after the phone dies.

8. Tourists can use it too but with caveats

Visitors from the US to London are able to use Apple Pay on the Underground and buses too, but TfL can't 100 per cent guarantee that it will work the first time.

Make sure you tell your bank you are travelling first so they don't decline the card when you tap in for the first time.

9. Change the card you use

If you've got multiple cards loaded into Apple Pay, simply swipe between them before you pay to make sure you've got the right one. Just remember to use the same one at the other end too.

10. Use it on buses and trams too

Apple Pay works on all of the Transport for London (TfL) network including the London Overground, DLR, River, TfL-Rail, Buses, Trams, and of course the Underground.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Travel Money Card Apple Pay

Pay anywhere you see the Apple Pay logo or contactless sign

Fully secure with Touch ID or Face ID

Compatible with all your Apple devices

Leave your wallet at home

Add your Travel Money Card to Apple Wallet to unlock a world of payment freedom. Here’s how.

Open the Post Office travel app

If you don’t have it, download the latest version for iOS for free.

Add your card to Apple Wallet

In the app, select the card you want and tap the “Add to Apple Wallet” option.

Pick a card

Open Apple Wallet to slide your preferred card to the front to make it your default payment card.

Shop simply and securely with Apple Pay

Pay safely and securely.

Use your phone or device to pay in shops, restaurants and online. Apple Pay doesn’t share any of your card details, so it’s highly secure.

Say goodbye to the £100 limit*

Unlike other contactless payments, Apple Pay isn’t capped. So, wherever you’re heading to, you can enjoy a bigger holiday splurge.

Use biometrics to pay

Your device will use your fingerprint with Touch ID or facial recognition with Face ID – and both are highly secure.

Don’t have a Travel Money Card yet?

Go cashless with our prepaid, contactless Mastercard®. You can load it with up to 22 currencies and manage everything with our travel app. Simple, secure holiday spending sorted.

Common questions

How many travel money cards can i add to apple wallet.

The travel app allows you to hold up to 3 active cards at any given time, and all 3 can be added to Apple Pay.

Can I use Apple Pay and my Travel Money Card to pay in any currency?

You can use it to pay in any of the currencies preloaded on your Travel Money Card.

In the same way that your Travel Money Card works, Apple Pay will use the currency of the country you are in, meaning you don’t have to select specific currencies whilst paying – it’s all done behind the scenes for you. For more information about this, please visit our Travel Money Card FAQs in your travel app or you can read the FAQs online .

What if I lose my phone or device?

If you’ve lost your iPhone, use Find my iPhone to put it into ‘lost mode’. This will prevent your phone from being able to be used. You can also log into your iCloud account and remove all of your cards for peace of mind.

If you don’t have access to the travel app you can also contact our card support team 24/7 on +4420 7937 0280.

What if I lose my Travel Money Card

If you’re concerned about your Travel Money Card, please log into your travel app where you can freeze the card quickly and easily. Follow the simple in-app steps below to do this. You can toggle between freezing and unfreezing your card at the tap of a button.

- Log in and tap ‘cards’. If you have several Travel Money Cards, select the card you wish to freeze

- Tap the cog icon, top right, to go to card settings

- Toggle the ‘freeze card’ function. Once you see the toggle has moved, your card is frozen until you unfreeze it, following the same instructions

Which Apple devices can I use Apple Pay on?

Virtually all of them. iPhones, iPads, Apple Watches and MacBooks are all Apple Pay enabled (though for some it may only be more recent versions).

If you’re adding your Travel Money Card via the travel app, you can only do this on iPhones and Apple Watches. But if you want to add your card in order to pay using the device’s in-built Apple Pay app, the next FAQ explains how.

Each device may have a slightly different method of payment. For MacBooks, it will only be for making purchases online and will use Touch ID. For Apple Watches, you need to double-tap the side button while holding the device near the reader.

Apple, Apple Pay, Apple Watch, iPad, iPhone, MacBook Pro, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

How do I add my Travel Money Card to my Apple Wallet using the Apple Wallet app?

For iPhone, open Apple Wallet and tap the plus sign (usually toward the top, right-hand corner), then follow the instructions. Once we've verified your card, you'll be able to start using Apple Pay with your Travel Money Card.

For Apple Watch, open the Apple Watch app on your iPhone, then tap ‘Wallet & Apple Pay’. Then choose ‘Add Card’. Once you tap ‘Next’, we'll verify your card, you can tap ‘Next’ again, and then you're off.

If you want to add Apple Pay to your Mac, you'll need a version of the computer with Touch ID. Go to ‘System Preferences’, then open ‘Wallet & Apple Pay’ and tap ‘Add Card’. Just follow the instructions after that.

Remember that after you've set up Apple Pay on your iPhone, you can allow the same card for that to be used for Apple Pay on your Mac. Just go to ‘Settings’ on your iPhone, then ‘Wallet & Apple Pay’, and turn on ‘Allow Payments on Mac’.

And finally, for your iPad, go to ‘Settings’ then ‘Wallet & Apple Pay’, then tap ‘Add Card’. Follow the instructions and once your card has been verified, tap ‘Next’ and you're ready to start using your Travel Money Card via your iPad.

*Apple Pay contactless limits can vary country to country; while there is no contactless cap within the UK please ensure you check any limits within the country you are visiting

Find out more information by reading the Post Office Travel multi-currency-terms-and-conditionsMoney Card terms and conditions.

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International.

First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

How to set up and use Apple Pay across your devices

- Apple Pay supports most major banks & credit/debit card providers, including federal payment cards.

- Apple Pay can be used at physical/online stores, apps, and public transit.

- Apple Pay offers secure tokenized backend infrastructure for payments, with no direct card details shared.

Apple Pay is a contactless payment technology that allows you to speed through the checkout line with a tap of your Apple Watch or finish an online shopping spree without getting up from your couch to dig out your wallet. It was designed to move consumers away from physical wallets into a world where your debit and credit cards are on your iPhone or Apple Watch , allowing you to pay using your device instead of a card. Tapping your iPhone or Apple Watch instead of digging out a debit or credit card can speed you through the line faster, and it's an even faster way to zip through the gate when taking public transit.

Apple Pay Later is now live but there's a huge catch

But while Apple Pay has been around since 2014, the growing prevalence of tap-to-pay devices everywhere from retail stores to gas stations has a number of traditional debit card users wondering exactly how Apple Pay works. This guide walks new users through Apple Pay, including how it works, how to set it up, which banks support it and where you can use it.

Which banks and cards support Apple Pay?

Most major banks are now supported.

Apple Pay supports most major credit and debit card providers, including Visa, MasterCard and American Express. Apple's Apple Card is also supported, unsurprisingly.

You do need to use a participating bank, but most major banks now support Apple Pay. You can find complete, updated lists of all the banks supported in each country from Apple's list of supported financial institutions .

Does Apple Pay work with US federal payment cards too?

Apple pay can be used with social security and veterans benefits.

Yes. Apple's mobile payment system does work with federal payment cards, including Social Security and veterans benefits that are paid through debit cards.

This includes the Direct Express payment network and government cards issued through GSA SmartPay. Apple Pay is also supported by transactions with the federal government, meaning you can use Apple Pay to buy tickets and gift shop items at national parks, etc.

Where can you use Apple Pay?

Apple pay can be used at physical stores, online stores, the app store, public transit, and to send money to friends.

Apple Pay works at any physical location that accepts contactless payments, as well as at many online stores. If you see the contactless payments symbol or the Apple Pay symbol near readers at the checkout, they will accept Apple Pay.

For physical retail stores, Apple Pay is supported by hundreds of thousands of stores and restaurants worldwide. In the UK, over 99 percent of retailers accept Apple Pay.

When online shopping, Apple Pay is supported by many e-commerce stores when you shop from a Safari browser.

With iOS 17.4, Apple added an option that allows users to pay with Apple Pay for an online purchase even at retailers that do not accept Apple Pay. How? Apple will generate a card number, expiration date, and CVC code connected to your Apple Pay account. You can type this information in just like you would type in the details of a credit card for an online purchase. You'll need to have a device running iOS 17.4 or later -- here's how to use Apple Pay on websites that don't support the platform.

Apple Pay can also be used to make purchases within iOS apps. For public transit, you can use Apple Pay to quickly buy your subway ticket using an Express Travel Card on Apple Pay . Finally, Apple Pay can also be used to send money to friends from Messages, a feature called Apple Cash . Apple Cash allows you to send the money, which is then deposited into their Apple Pay account for use anywhere Apple Pay is accepted.

Is there a limit on Apple Pay?

Not exactly, but you may need to use a pin or signature.

Unlike contactless card payments that limit you to a certain spending amount, there is no limit for Apple Pay. However, some countries will require a pin or signature for transactions over a certain amount . For example, in the US, you'll need to sign for any purchases over $50.

Which apps support Apple Pay?

A growing number of apps support apple pay.

Numerous apps spanning travel, shopping, entertainment, and services all support Apple Pay.

Here are just a few of the apps that support Apple Pay: Adidas, Bloom & Wild, Starbucks, Deliveroo, Apple Store, Topshop, Zara, ASOS, Uber, British Airways, Booking.com, Emirates, StubHub, DesignMyNight, and Made.com.

How to order with DoorDash and what makes it better than GrubHub or Uber Eats

How to set apple pay up on an iphone or ipad, apple pay is set up using the settings app.

You need to use the Apple Wallet app to set up Apple Pay on your iPhone or iPad . The Apple Wallet will then store your credit cards and debit cards, pulling the data when you authenticate Apple Pay to pay for goods.

On your iPhone, open Wallet. On your iPad, go to Settings > Wallet & Apple Pay. Underneath Payment Cards, tap Add Card. On the next screen, select Debit or Credit Card. You can use your device's camera to capture the information on your credit, debit, or store card. Then fill in any additional information needed.

Your bank will verify your information. You may need to provide additional verification, which can mean you will have to call your bank, or you may receive a text message with a unique code that you'll need to enter. The process varies depending on your bank.

After your card is verified, tap Next, and then you can start using Apple Pay.

What is Apple Tap to Pay and how can iPhones use it to accept payments?

How to set up apple pay on apple watch, you'll need to enable apple pay on your watch from your iphone.

To set up Apple Pay on the Apple Watch, you'll first need to open the Watch app on your iPhone. Make sure you're in the My Watch tab (bottom left). Then, scroll down to Wallet & Apple Pay, then choose App Card.

Like on the iPhone, your bank will verify your information. You may need to provide additional verification again. You'll receive a notification on your Apple Watch that your card is ready for Apple Pay.

My 10 favorite Apple Watch Ultra tips and tricks

How to use apple pay at a store with an iphone, paying with apple pay at a store is a quick and simple process.

Apple Pay requires the Near Field Communication (NFC) antenna and Touch ID or Face ID on iPhone 6 and later. It will depend on which iPhone you have as to how you launch Apple Pay. Each transaction has to be authorized by either Touch ID, Face ID, or your passcode.

For iPhones with Touch ID , double tap the Touch ID home button and keep your finger on it until your screen says "Hold Near Reader." If your fingerprint isn't recognized, you can choose the "Pay with Passcode" option.

For iPhones with Face ID, double press the sleep/wake button on the right-hand side of your iPhone to launch Apple Pay. Authorization will then take place through Face ID, or you can choose the "Pay with Passcode" option if your face isn't recognized. Once authorized, your screen will again say "Hold Near Reader."

Once your iPhone says hold near reader, you can just place your iPhone near a contactless terminal and a subtle vibration -- or a ping if your phone isn't on silent -- confirms payment. A receipt is recorded in the Wallet app where you can see your latest transactions. There's no need to open an app or wake your iPhone's display to launch Apple Pay, no matter which iPhone model you have.

Apple's latest patent could finally bring Face ID to future MacBooks

How to use apple pay at a store with watch, a tap of your wrist can be used to pay at physical stores.

To launch Apple Pay on your Apple Watch, double-click the button next to the Digital Crown. Your default payment card will appear on your Apple Watch screen with "Hold Near Reader to Pay" below, after which you can place your watch up to the payment terminal and a pulse and beep will confirm that your payment has gone through.

Swiping right to left on your Apple Watch display will present any other cards you have registered.

How to use Apple Pay within Apps

Many ios apps support apple pay as well.

Apple iPhone apps also work with Apple Pay, meaning you will be able to select Apple Pay at checkout when ordering anything from an app. You also still need to place your finger on Touch ID, or use Face ID, when paying.

You can also use Apple Pay via the Safari browser. You can either use Touch ID if you have a supporting MacBook model or pay via your iOS device. To use Apple Pay on a Mac that doesn't have Touch ID and confirm the payment through your iPhone, head to Settings > Wallet & Apple Pay > Toggle on Allow Payments on Mac at the bottom of the display.

10 must-have apps I install first on any new iPhone

How to use apple pay from a mac or macbook, apple pay is only compatible on models with touch id.

Macs that have a touch ID or fingerprint sensor can also use Apple Pay for online shopping. Like with Apple Pay on an iPhone, you'll need to set it up first. From your Mac, Click on the Apple menu icon in the upper left, then select System Settings. Choose Wallet & Apple Pay from the left hand sidebar. Then, click Add Card.

Once set up, you can use Apple Pay at supported online retailers. You'll need to use a Safari browser to shop. At checkout, click on Apple Pay as the payment method, then use the Touch ID to verify your identity and check out.

5 features my Mac has that I can't live without

How to change your default card on apple pay, adjusting your card details is an easy swap in settings.

To change your default card on Apple Pay, head to the Settings app on your iPhone and scroll down to Wallet & Apple Pay. On this screen, you will see a list of settings under the header "Transaction Defaults."

The first setting is "Default Card." Click on this, and you can choose which card you want to select as your default Apple Pay card, though it is easy enough to switch between them when you launch Apple Pay.

iOS 17.4 adds virtual card numbers for Apple Cash. Here's how to use it

Where is apple pay available, apple pay is supported in a growing number of places.

Apple Pay is available in over 75 countries. These include the US, UK, Canada, Australia, the UAE, Russia, China, New Zealand, Singapore, Japan, Taiwan, Hong Kong, as well as numerous other countries.

You can view the full list of countries here .

Which devices work with Apple Pay?

Apple Pay works with the following Apple devices:

- Apple iPhone 6 or iPhone 6 Plus and newer models

- Apple iPad Pro, iPad Air 2 and iPad mini 3 and newer devices with Touch ID or Face ID

- Apple Watch Series 1 and newer (when paired with iPhone 5 or newer)

- MacBooks with Touch ID

- Macs with Apple Silicon and a Magic Keyboard with a Touch ID sensor

What is an Express Travel Card?

Ride the subway with apple pay.

Apple Pay offers an Express Travel Card feature , which allows you to select a card you have set up to work automatically when you are near a supported public transport reader.

Whichever card you choose will be used to pay for your travel without you having to double-tap the side button or home button on an iPhone or Apple Watch.

Is Apple Pay secure?

Apple uses a number of different methods to keep your payment information secure.

Yes. Apple doesn't save your transaction information or card numbers on its servers, though your most recent purchases are kept in the Wallet app.

Apple Pay, which has a tokenized backend infrastructure, makes card payments secure by creating a number or token that replaces your card details. More specifically, it creates a Device Account Number for each one of your cards.

According to Apple, the Device Account Number is assigned, encrypted, and securely stored in the Secure Element, a dedicated chip in the iPhone and Apple Watch. When a payment is initiated, the token is passed to the retailer or merchant. Therefore, the retailer or merchant never has direct access to your card details.

On an iPhone, you'll need to verify your identity when making a purchase by using Face ID, Touch ID or a passcode. On a Mac, you'll need to use Touch ID.

Best VPNs for Linux: Secure connection for your customized OS

What if you lose your iphone or watch, a new stolen device protection feature adds another layer of security.

Losing your iPhone or Watch is stressful enough, but with Apple Pay, the chances of that happening just got a lot more frightening. As every Apple Pay transaction has to be authorized by either your fingerprint, face, or passcode, whoever finds your iPhone won't be able to pay for anything unless they have your passcode. They will be able to see your billing address and the last four digits of your stored cards, but no more information than that.

In iOS 17, a new feature called Stolen Device Protection also adds another layer of security for Apple Pay users worried about losing their iPhone. The feature adds additional steps when changing vital information or applying for a new Apple Pay credit card when not at a familiar location, such as home or work. Activating the feature is a simple process in the Settings app for devices running iOS 17 or later.

Find My can be used from another iOS device to put your device in Lost Mode. This will lock everything and prevent others from accessing your content including Apple Pay or Wallet data. You can also use the Find My app to wipe your iPhone clean completely.

How to set up Find My Friends and track an iPhone

- a. Send us an email

- b. Anonymous form

- Buyer's Guide

- Upcoming Products

- Tips / Contact Us

- Podcast Instagram Facebook Twitter Mastodon YouTube Notifications RSS Newsletter

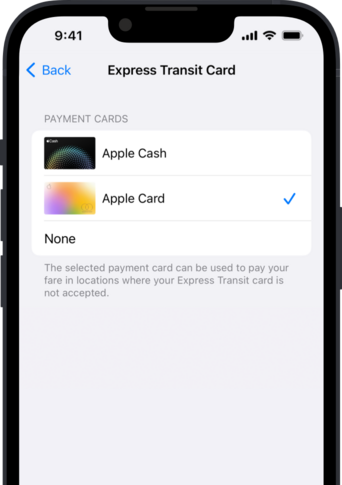

Apple Wallet App Gaining Support for Transit Cards in Paris and Toronto

Apple has announced that the Navigo transit card can be added to the Wallet app starting today, allowing iPhone and Apple Watch users to simply tap their devices to pay for rides on the metro, trains, buses, and more in the Paris, France area.

Apple also announced that real-time transit information for the Paris area will be available in Apple Maps starting this week. This feature will allow riders to view detailed schedules, live departure and arrival times, delays, outages, and any connections required to complete a trip across multiple transit systems.

In related news, it was recently announced that the PRESTO transit card in the Toronto, Canada area will soon support the Wallet app too.

Thanks, Apollo Zhao !

Get weekly top MacRumors stories in your inbox.

Popular Stories

5 Biggest Changes Rumored for iPhone 16 Pro Max

Apple Releases iOS 17.5.1 With Fix for Reappearing Photos Bug

iPhone SE 4 With Face ID Said to Be Priced Below $500

Microsoft Says New Surface Pro is Faster Than 15" M3 MacBook Air

iPhone 16 Pro Max to Feature New 48MP Wide and Ultra Wide Cameras

Top rated comments.

Too bad it won't happen in Montreal until 2045 at this rate. God damn you Quebec.

I have the Navigo card when I travel to Paris. When I try to add it while I'm at home in the States, it doesn't find it in the search even though I have the app on my phone. I must return to Paris to add it as a transit card it seems.

If the virtual Navigo card can get transferred to a new phone once you upgrade your device just like all other cards in Pay can then the initial 2 EUR deposit is negligible in the long run.

You can still use the app, but you won't be able to add your existing card to Wallet. Wallet allows you to buy (using Apple Pay only) the ticket or pass in that app and then creates a virtual card to use with your iPhone or Apple Watch. It seems designed more for irregular/tourist use.

Next Article

Our comprehensive guide highlighting every major new addition in iOS 17, plus how-tos that walk you through using the new features.

Apple News+ improvements, cross-platform tracker alerts, website app downloads for the EU, and more.

Get the most out your iPhone 15 with our complete guide to all the new features.

A deep dive into new features in macOS Sonoma, big and small.

Apple's annual Worldwide Developers Conference will kick off with a keynote on June 10.

Expected to see new AI-focused features and more. Preview coming at WWDC in June with public release in September.

AI-focused improvements, new features for Calculator and Notes, and more.

Action button expands to all models, new Capture button, camera improvements, and more.

Other Stories

1 hour ago by Juli Clover

2 days ago by Tim Hardwick

3 days ago by Tim Hardwick

Looks like no one’s replied in a while. To start the conversation again, simply ask a new question.

Apple Card and International Travel

I am traveling from USA to Spain in September. Do I need to notify Apple Card of my travels, so that the card/app works in Spain?

Posted on Jul 20, 2021 6:11 AM

Posted on Jul 20, 2021 6:16 AM

Hi, Goldman Sachs doesn’t have a specific requirement in regard to foreign travel. However, in my experience, it’s always a best practice to notify the bank. You can reach out to their support team using the chat feature in the Apple Card which is in the Wallet App on your iPhone. If you need more help, chat with an Apple Card specialist .

(877) 255-5923

The Apple Card is accepted at merchants that accept MasterCharge worldwide. Happy travels!

Similar questions

- I'm going to travel to another country and I am going to use my Apple Card, do I need to report this trip to be able to use it in another country? Thank you I'm going to travel to another country and I am going to use my Apple Card, do I need to report this trip to be able to use it in another country? Thank you 6534 7

- Apple card use when traveling Do I need to notify Mastercard/Goldman Sachs when traveling outside US? 784 1

- Travel I’m traveling to Brazil tomorrow. Do I need to notify Apple Card of my travel? 3534 3

Loading page content

Page content loaded

Jul 20, 2021 6:16 AM in response to rjb138

Identity verification for Apple Card or Apple Cash

To protect your account, you might be asked to verify your identity when using Apple Cash or applying for Apple Card.

How to verify your identity for Apple Card

If you're asked to scan your valid driver license or state ID when you apply for Apple Card , 1 follow these steps:

Scan the front of your photo ID and tap Continue.

Scan the back of your photo ID and tap Continue.

To rescan your photo ID, tap Scan Again.

If your Apple Card application was declined because your identification information couldn't be verified, learn what you can do .

How to verify your identity for Apple Cash

Go to your card info:

iPad: Open the Settings app, tap Wallet & Apple Pay, then tap your Apple Cash card.

Apple Watch: Open the Apple Watch app on your iPhone, tap Wallet & Apple Pay, then tap your Apple Cash card.

Tap Verify Identity.

Follow the onscreen steps. When capturing your driver license or state ID card, use these tips:

Place your card on a dark background.

Capture all four corners of your card.

Make sure that there's nothing between your device's camera and the card that would obscure it.

The first time that you verify your identity, you might be asked for this information:

Your full name

Your Social Security number

Your date of birth

Your home address 2

Answers to questions regarding your personal history

An image of your valid driver license or state ID card

To use all the features of Apple Cash 3 you must verify your identity.

If you enter the wrong information, try to verify your identity again. If you don't see the option to verify your identity, contact Apple Support .

When you'll be asked to verify your identity

You'll be asked to verify your identity based on how much you use Apple Cash. You may not add or receive $500 or more in total without verifying your identity. You might also be asked to verify your identity prior to this limit.

To protect your account and the security of your money, you might be asked to verify your identity when using Apple Cash, even if you have previously done so.

Identity verification for Apple Cash Family

If the family organizer hasn't already, they need to verify their identity when they set up Apple Cash Family .

Members of the Family Sharing group that are over 18 years old and take ownership of their Apple Cash account must verify their identity.

If you're under 18 years old, your family organizer can set up Apple Cash for you.

Why you'll be asked for your personal data

Apple Cash services are provided by Green Dot Bank, Member FDIC, a regulated financial institution. Green Dot Bank is required by federal law to verify the identity of its customers.

To verify your identity, Green Dot Bank will request Social Security numbers and other personal information to ensure that customers are eligible to use the service.

Where is your personal information going

Information that you provide will be sent to Green Dot Bank and their identity verification service provider. Your name and address is securely stored by the partner bank and Apple Payments Inc. If asked, Social Security number, date of birth, answers to questions (e.g. confirm street name you have previously lived on), or a copy of your government ID will be provided to Green Dot Bank and their identity service provider, and stored by Green Dot Bank as long as required by law. This additional information cannot be read by Apple.

Apple created Apple Payments Inc., a wholly owned subsidiary, to protect your privacy by storing and processing information separately from the rest of Apple and in a way that the rest of Apple doesn’t know.

What if you don't have the information that you need to verify your identity

If your identity is unable to be verified, you won't be able to use all of the features of Apple Cash, including sending and receiving money and adding money to your Apple Cash balance.

You can use the money in your Apple Cash account to make purchases with Apple Pay in stores, in apps, and on the web, and you can transfer money to your bank.

Learn about Apple Pay security and privacy .

Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch. Apple Card is available only in the United States.

You should enter a home address. If you enter a post office box, your account will be restricted. Contact us .

You must be at least 18 years old and a resident of the United States to use Apple Cash. If you're under 18 years old, your family organizer can set up Apple Cash for you as part of Apple Cash Family. Apple Cash services are provided by Green Dot Bank, Member FDIC. Learn more about the Terms and Conditions .

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.

Explore Apple Support Community

Find what’s been asked and answered by Apple customers.

Contact Apple Support

Need more help? Save time by starting your support request online and we'll connect you to an expert.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Changes from Visa mean Americans will carry fewer physical credit, debit cards in their wallets

FILE - A Visa sign is displayed on the front door of a local business, April 27, 2021, in Urbandale, Iowa. Visa has announced major changes to how its credit and debit cards will operate in the U.S. Features in the works will lead to Americans to carry fewer physical cards in their wallets and make the 16-digit credit or debit card number printed on every physical card increasingly irrelevant. The new features unveiled Wednesday, May 15, 2024 will be some of the biggest changes to how payments operate since the U.S. rolled out chip-embedded cards several years ago. (AP Photo/Charlie Neibergall, file)

- Copy Link copied

NEW YORK (AP) — Your wallet may soon be getting thinner.

Visa on Wednesday announced major changes to how credit and debit cards will operate in the U.S. in the coming months and years.

The new features could mean Americans will be carrying fewer physical cards in their wallets, and will make the 16-digit credit or debit card number printed on every card increasingly irrelevant.

They will be some of the biggest changes to how payments operate in the U.S. since the U.S. rolled out chip-embedded cards several years ago. They also come as Americans have many more options to pay for purchases beyond “credit or debit,” including buy now, pay later companies, peer-to-peer payment options, paying directly with a bank, or digital payment systems like Apple Pay.

“I think (with these features) we’re getting past the point where consumers may never need to manually enter an account number ever again,” said Mark Nelsen, Visa’s global head of consumer payments, in an interview.

The biggest change coming for Americans will be the ability for banks to issue one physical payment card that will be connected to multiple bank accounts. That means no more carrying, for example, a Bank of America or Chase debit card as well as their respective credit cards in a physical wallet. Americans will be able to set criteria with their bank — such as having all purchases below $100 or with a certain merchant applied to the debit card, while other purchases go on the credit card.

The feature, already being used in Asia, will be available this summer. Buy now, pay later company Affirm is the first of Visa’s customers to roll out the feature in the U.S.

Some of Visa’s new features are in response to online-payments fraud, which continues to increase as more countries adopt digital payments. The San Francisco-based company estimates that payment fraud happens roughly seven times more often online than it does in person, and there are now billions of stolen credit and debit card numbers available to criminals.

Other new elements are also in response to features that non-payments companies have rolled out in recent years. The Apple Card, which uses Mastercard as its payment network, does not come with a printed 16-digit account number and Apple Card users can request a fresh credit card number at any time without having to dispose of the physical card.

Visa executives see a future where banks will issue cards where the 16-digit account number, if the new cards come with them, is largely symbolic.

Among the other updates unveiled by Visa are changes to tap-to-pay features. Americans will be able to tap their credit or debit cards to their smartphones to add the card to mobile wallets, instead of using a smartphone’s camera to scan in a card’s information, or tap the card to their smartphones to approve a transaction online. Visa will also start implementing biometrics to approve transactions, similar to how Apple devices use a fingerprint or face scan to approve transactions.

The features will take time to filter down to the banks, which will decide when or what to implement for their customers. But since the banks and credit card companies are Visa’s customers, and issue cards with the Visa label, these are features that the financial institutions have been asking for.

Apple and Île-de-France Mobilités introduce Navigo card for iPhone and Apple Watch

Add a New Navigo Card to Apple Wallet and Buy a Transit Pass

Tap to Ride with Navigo Card in Apple Wallet

Security and Privacy

Real-Time Transit Updates in Apple Maps

Text of this article

May 21, 2024

PRESS RELEASE

Customers can add a Navigo card to Apple Wallet and simply tap their iPhone or Apple Watch to ride the metro, train, bus, and more in the Paris region

PARIS Apple and Île-de-France Mobilités today introduced an easy, secure, and private way for customers to add a new Navigo card to Apple Wallet and purchase passes to ride transit in the Paris region. Riders can buy passes from the Île-de-France Mobilités iOS app or directly from Apple Wallet, and use an iPhone or Apple Watch to tap and ride. Additionally, beginning this week, real-time transit information in Apple Maps is available in Paris to help users navigate their travels throughout the city.

“In the lead-up to what will surely be an amazing summer for the Paris region, we’re thrilled to bring Navigo cards to Apple Wallet and provide Parisians and visitors with an incredibly convenient and secure way to ride transit in Paris and explore the city,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Users will love the safety, security, and seamlessness of purchasing passes and riding with a Navigo card in Apple Wallet on iPhone and Apple Watch.”

Starting today, users can quickly and easily add a new Navigo card to Wallet by opening the Wallet app, tapping the Add (+) button, selecting “Transit Card,” and following the instructions. With a Navigo card in Apple Wallet, users no longer need to visit a ticket vending machine or reload a Navigo card at retailers, as they can purchase any pass from the Île-de-France Mobilités iOS app or select passes in Apple Wallet. Riders can purchase t+, t+ reduced price, OrlyBus, RoissyBus tickets, and Navigo Day passes in Apple Wallet by selecting their Navigo card of choice, tapping the More (…) button, and selecting “Buy Passes.”

Navigo cards in Apple Wallet allow for an easy and convenient commuting experience. Users can easily select their Navigo card from Apple Wallet and double-click the side button, or if they have Express Mode enabled, a user can simply hold their iPhone or Apple Watch near a reader to ride transit in Paris without having to unlock or wake up their device. 1 With power reserve on iPhone, if a customer’s device needs to be charged, they can still use it to ride transit. 2

Navigo cards in Apple Wallet take full advantage of the privacy and security built into iPhone and Apple Watch. Navigo cards stored in Apple Wallet are private and secure, and Apple never tracks users’ journeys. When customers add a Navigo card to Apple Wallet, the card information is encrypted and securely stored in the Secure Element, an industry-standard, certified chip designed to store the information safely on the device. If a user’s iPhone or Apple Watch is misplaced, the owner of the device can promptly use the Find My app to lock and help locate the device.

Also beginning this week, real-time transit information is available in Apple Maps for the Paris metro, RER, Paris tramway, RATP buses, and more. With real-time transit in Maps, users in Paris can see detailed schedules, live departure and arrival times, and system connections to help plan a journey. Apple Maps will now also offer users in Paris important real-time transit information such as outages and delays.

- Express Mode requires iPhone X R or later, or Apple Watch Series 6 or later. Only one Navigo card can be enabled with Express Mode at a time. Additional cards must be manually selected.

- Power reserve is available on iPhone X R or later. Express Mode becomes unavailable when the device is powered off.

Press Contacts

Kimberly Mai

Heather Norton

Apple Media Helpline

Images in this article

Deadline for $35 million settlement over Apple iPhone 7 issues approaching: How to join

The deadline to join or receive part of a $35 million settlement related to microphone or audio issues for Apple's iPhone 7 or 7 Plus is approaching.

The settlement was reached with Apple in a class action lawsuit alleging that the iPhone 7 and 7 Plus experienced audio issues related to the "audio IC" chip," according to the settlement website.

The settlement comes from a 2019 lawsuit from Joseph Casillas and De'Jhontai Banks, who claimed they began experiencing issues the year after purchasing iPhone 7 devices in 2017. In the settlement claim , Apple denies any wrongdoing and that any of the devices had those issues.

Here's what to know about the settlement and if you can get paid.

Who is eligible for part of the settlement?

You can be included in the settlement and receive a payment if you owned an iPhone 7 or 7 Plus between Sept. 16, 2016 and Jan. 3, 2023, and either complained to Apple regarding an issue covered by the settlement or paid Apple for a repair or replacement covered by the settlement.

More ways to save: Visit USA TODAY's coupons page for deals from thousands of vendors

When is the deadline to submit a claim?

The deadline to submit a claim is June 3, and you can do that via the settlement website .

How much can you get from the iPhone 7 settlement?

People who paid for repairs can receive a maximum of $349, and people who reported the issue but didn't pay for repairs can receive up to $125. The minimum pay for eligible claims is $50.

IMAGES

VIDEO

COMMENTS

You can select a different travel or payment card for Express Travel Mode on your Apple Watch: On your iPhone, open the Apple Watch app. In the My Watch tab, tap Wallet & Apple Pay. Then tap Express Travel Card, select a travel or payment card and authenticate on your Apple Watch with your passcode. Compatible cards, keys and passes

To enable the Express Travel Card feature on iPhone, follow these steps: Open Settings. Tap on Wallet & Apple Pay. Tap on Express Travel Card. Select the card you want to use to pay for public ...

Apple Pay launched in 2014 as the first of the mobile wallets that enabled people to connect credit cards, debit cards and bank accounts to their personal devices in order to send and receive money. Of the major mobile wallet services - Google Pay (formerly Android Pay), Samsung Pay and Apple Pay - Apple's service remains the largest. In fact, 507 million iPhone users had Apple Pay as of ...

Traveling around NYC is fast and easy with Express Mode for Apple Pay. 2 Just tap your iPhone or Apple Watch and ride — no need to use Face ID or Touch ID. Set up Apple Pay in the Wallet app. Ride transit. with Pay. Apple Pay is accepted on trains and buses throughout NYC. 3 With your credit or debit card in Wallet, you can easily get where ...

Launch the Settings app on your iPhone. Tap Wallet & Apple Pay. Tap Express Travel Card. Tap one of your cards in the list to use it with Express Transit. A tick will appear next to the card ...

To add an eligible card to your compatible Apple device from the Bank of America ® Mobile Banking app. Log in to the app. Tap the Menu option in the navigation bar. Tap Manage Debit/Credit Card. On your desired card, tap Digital Wallets. In the Add to Wallet section, select Add on the Apple Pay option. You may also add a card using the Wallet ...

3, 2, and 1%. No matter where you shop with Apple Card, you always get unlimited Daily Cash back. That's real cash 3 you get back every day. Use it right away 4 with Apple Pay, send it to a friend with Apple Cash, 5 or watch it grow in a high-yield Savings account. .

Open your Apple Wallet. Tap the + icon in the top right-hand corner. Choose Debit or Credit Card. If you previously used a card and want to re-add it, go to Previous Cards instead. The Apple Pay window will appear if you're adding a new card, and you'll need to hit the Continue button. Scan your the card you want to use for Apple Pay abroad.

Just tap and go. Open Settings on your iPhone > Tap on Wallet & Apple Pay > Tap on Express Travel Card > Select the card you want to use as your Express Travel Card. If you've got an iPhone XS or ...

For iPhone, open Apple Wallet and tap the plus sign (usually toward the top, right-hand corner), then follow the instructions. Once we've verified your card, you'll be able to start using Apple Pay with your Travel Money Card. For Apple Watch, open the Apple Watch app on your iPhone, then tap 'Wallet & Apple Pay'. Then choose 'Add Card'.

Apple Footer. On iPhone X S Max, iPhone X S, iPhone X R or newer iPhone models, you can use Express Transit card with power reserve for up to 5 hours when your iPhone battery is running low and needs to be charged. This feature does not apply if you actively switch off your phone. A Hong Kong-issued Visa, Mastercard or UnionPay credit or debit card, or a China mainland-issued UnionPay credit ...

Here's how to use it. Apple iPhone 6 or iPhone 6 Plus and newer models. Apple iPad Pro, iPad Air 2 and iPad mini 3 and newer devices with Touch ID or Face ID. Apple Watch Series 1 and newer (when ...

Wallet allows you to buy (using Apple Pay only) the ticket or pass in that app and then creates a virtual card to use with your iPhone or Apple Watch. It seems designed more for irregular/tourist use.

Wallet / Apple Pay Apple Vision Pro is now available in the U.S. Learn more > Join the conversation > Show more. Learn more > Join the conversation > Looks like no one's replied in a while. To start the conversation again, simply ask a new question. User profile for user: Torchyaa Torchyaa ...

See your Apple Pay transaction history. Check the latest transactions for the credit or debit cards that you use with Apple Pay. You might see any transactions made from your credit or debit card account, including transactions from all devices that you use with Apple Pay and your physical card. 1 However, depending on your bank or card issuer, you might see only transactions made with the ...

To add your license to your Apple Wallet: Select Driver's License or State ID. Select your state. Scan the front and back of your license. Follow the prompts to confirm your identity. Wait for ...

You can reach out to their support team using the chat feature in the Apple Card which is in the Wallet App on your iPhone. If you need more help, chat with an Apple Card specialist. (877) 255-5923. The Apple Card is accepted at merchants that accept MasterCharge worldwide. Happy travels! View in context. 1 reply.

iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button, then tap Card Details. iPad: Open the Settings app, tap Wallet & Apple Pay, then tap your Apple Cash card. Apple Watch: Open the Apple Watch app on your iPhone, tap Wallet & Apple Pay, then tap your Apple Cash card. Tap Verify Identity. Follow the onscreen steps.

FILE - A Visa sign is displayed on the front door of a local business, April 27, 2021, in Urbandale, Iowa. Visa has announced major changes to how its credit and debit cards will operate in the U.S. Features in the works will lead to Americans to carry fewer physical cards in their wallets and make the 16-digit credit or debit card number printed on every physical card increasingly irrelevant.