- Tata Steel share price

- 178.95 4.04%

- Wipro share price

- 484.45 5.09%

- ITC share price

- 439.10 0.76%

- State Bank Of India share price

- 829.90 1.59%

- Power Grid Corporation Of India share price

- 309.35 2.95%

- HDFC Bank Share Price

- Reliance Industries Share Price

- TCS Share Price

- Infosys Share Price

- HUL Share Price

Easy Trip Planners announces stock split and bonus issue; shares jump

Easy trip shares jumped more than 4% to ₹419 apiece on the bse in early deals.

Easy Trip Planners Ltd on Monday informed that its board has approved bonus issue of three shares for every one share held i.e., 3:1 ratio and also has given nod for the stock split in the ratio of 1:2. Shares of Easy Trip jumped more than 4% to ₹ 419 apiece on the BSE in early trading session.

“This is to inform that the board at its meeting held today i.e., 10th October, 2022, has inter-alia, considered and approved the following items subject to shareholder’s approval: Sub-division/Split of each existing equity share of face value of ₹ 2/- into 2 equity shares of face value of ₹ 1/- fully paid- up and the issue of three bonus equity shares for every one fully paid-up equity share," the company announced in an exchange filing today.

It added that bonus shares will be issued out of free reserves created out of profits of the company available as at March 31, 2022 and the estimated date by which such bonus shares would be credited/dispatched would be within 2 months from the date of board approval i.e. by December 8, 2022.

Explaining the rationale, it said that "the company and its subsidiaries have grown significantly, in terms of business and performance, over the years. This is reflected in the share price of the company. As and when the stock price rises further, it will be increasingly difficult for small potential shareholders to partake in the company's future. Keeping with the spirit of inclusion and in order to reward the shareholders. the Board of Directors at its meeting held today, approved and recommended the said corporate actions."

A stock split increases the number of shares that are outstanding by issuing more shares to the current shareholders. A company engages in stock split decision to make its stock more affordable if its price levels are very high, which in thus would lead to increase in liquidity in the stock. Meanwhile, bonus shares are fully paid additional shares issued by a company to its existing shareholders.

Further, the board has also increase in Authorised Share Capital from ₹ 75,00,00,000 to ₹ 200,00,00,000 and an alteration in Capital Clause of Memorandum of Association.

EaseMyTrip provides travel agents access to its website to book domestic travel airline tickets in order to cater to the offline travel market in India.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

3.6 Crore Indians visited in a single day choosing us as India's undisputed platform for General Election Results. Explore the latest updates here!

Get the best recommendations on Stocks, Mutual Funds and more based on your Risk profile !

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

Open Demat Account and Get Best Offers

Start Investing in Stocks, Mutual Funds, IPOs, and more

- Please enter valid name

- Please enter valid mobile number

- Please enter valid email

- Select Location

I'm interested in opening a Trading and Demat Account and am comfortable with the online account opening process. I'm open to receiving promotional messages through various channels, including calls, emails & SMS.

The team will get in touch with you shortly

- Business News

- Markets News

- Sensex News

- Explained: Why Easy Trip Planners' shares surged 20% today

Explained: Why Easy Trip Planners' shares surged 20% today

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

- Trending Stocks

- Heritage Foods INE978A01027, HERITGFOOD, 519552

- Rail Vikas INE415G01027, RVNL, 542649

- Canara Bank INE476A01022, CANBK, 532483

- IOC INE242A01010, IOC, 530965

- Vodafone Idea INE669E01016, IDEA, 532822

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Loans

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- REA Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- T20 WC 2024

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Travel Services

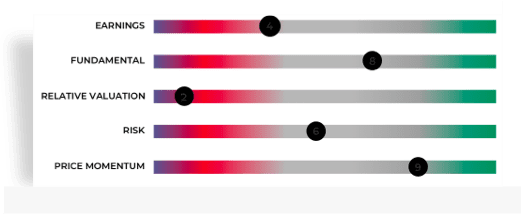

Samco Stock Rating

Easy Trip Planners Ltd.

As on 07 Jun, 2024 | 03:58

* BSE Market Depth (07 Jun 2024)

As on 07 Jun, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Stock with medium financial performance with average price momentum and val

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

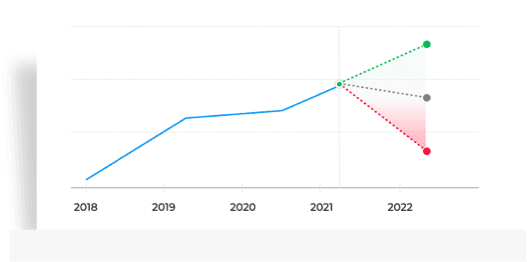

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 22.69% away from 52 week high

- Market Cap - Below industry Median

- Promoters holding remains unchanged at 64.30% in Mar 2024 qtr

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing ROE

Companies that are decreasing efficiency in utilisation of shareholders funds, rising profits, falling margins, companies that have grown their net profits but decreased net profit margins over the past 12 months, dii buying fii buying, list of companies in which diis and fiis have increased their holdings in last quarter.

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- Market Capitalization >250

- NetProfit>NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

- MarketCap>250

- FIIHolding >FIIHolding1QtrBack AND

- DIIHolding >DIIHolding1QtrBack AND

- MarketCap >250

Companies in which FIIs have increased holding QoQ

10x profit growth explosion, companies whose net profit have grown 10 times in 5 years, 5x premium to book value, companies trading at more than 5 times their book values.

- FIIHolding>FIIHolding1QtrBack AND

- MarketCap>500

- Market Capitalization >500 AND

- Profit growth 5Years >59 AND

- Profit growth >0

- Price to book value > 5 AND

- Book value >0 AND

- Market Capitalization >500

Sales Pioneers

3 yr sales cagr of 25% or higher, rising book value, book value of these companies rising over last 3 years.

- Sales3yrCAGR>25 AND

- SalesGrowth>25 AND

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

Price to Book Value Above Industry

Companies with price to book value above industry, premium to peers, companies trading at premium pe valuation as compared to their industry peers.

- Price to book value >Industry PBV AND

- Price to Earning >Industry PE AND

Profit Pioneers

Companies that are consistently generating 25% or higher profit growth for last 3 years, falling quarterly profits, companies that have shown a fall in qoq profits as per their latest results.

- NetProfit3yrCAGR>25 AND

- NetProfitGrowth>25 AND

- QuarterlyNetProfit<NetProfit1QtrBack AND

Increasing Institutional Interest

Companies in which diis and fiis have increased their holding in the latest quarter.

- DIIHolding>DIIHolding1QtrBack AND

Price and Volume

Community sentiments, data not available.

What's your call on today?

Read 3 investor views

Thank you for your vote

You are already voted!

this is worse stock ever View more

Posted by : Jaykumar21

Repost this message

this is worse stock ever

True. Also kangana became mp. She will kick out Chinese mmt plus old grudge with hruthik. Lakhpathi didi scheme to fly.. Stock will go rocket. View more

Posted by : Kori_BLR

True. Also kangana became mp. She will kick out Chinese mmt plus old grudge with hruthik. Lakhpathi didi scheme to fly.. Stock will go rocket.

suresh_visu1987

modi came to power tomorrow stock will fly like rocket be ready for rally View more

Posted by : suresh_visu1987

modi came to power tomorrow stock will fly like rocket be ready for rally

- Broker Research

ICICIdirect.com

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

WILSON HOLDINGS PRIVATE LIMITED

Nishant pitti.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

HRTI PRIVATE LIMITED

Minerva ventures fund.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Rikant pittie, nishant pitti.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Rikant Pittie & PACs Disposal

Nishant pitti & pacs disposal, nishant pitti disposal, prashant pitti acquisition, prashant pitti & pacs acquisition.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Easy Trip Planners Limited

Easy trip planners - announcement under regulation 30 (lodr)-press release / media release.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds holding remains unchanged at 0.06% in Mar 2024 qtr

- Number of MF schemes remains unchanged at 8 in Mar 2024 qtr

- FII/FPI have increased holdings from 2.18% to 2.78% in Mar 2024 qtr.

About the Company

Company overview, registered office.

223, FIE Patparganj Industrial Area, ,East Delhi,,

011-43131313

http://www.easemytrip.com

Selenium Tower B, Plot No. 31-32,,Gachibowli, Financial District, Nanakramguda,Seri

Hyderabad 500032

040-67161500, 67162222, 33211000

040-23420814, 23001153

http://www.kfintech.com

Designation

Chairman & CEO

Executive Director

Independent Director

Included In

INE07O001026

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Sector: Services

- Industry: Online Service/Marke...

Easy Trip Planners Share Price

- 41.75 0.46 ( 1.09 %)

- Volume: 83,55,858

- 41.79 0.50 ( 1.21 %)

- Volume: 5,73,074

- Last Updated On: 07 Jun, 2024, 03:58 PM IST

- Last Updated On: 07 Jun, 2024, 03:54 PM IST

Easy Trip Planners Shar...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Easy Trip Planners share price insights

Company has posted a loss of Rs 15.75 cr in 31 Mar, 2024 quarter after 3 consecutive quarter of profits. (Source: Consolidated Financials)

White Spinning Top was formed for Easy Trip Planners

Stock gave a 3 year return of 70.45% as compared to Nifty Midcap 100 which gave a return of 98.13%. (as of last trading session)

Company has spent 1.01% of its operating revenues towards interest expenses and 13.91% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

Easy Trip Planners Ltd. share price moved up by 1.09% from its previous close of Rs 41.30. Easy Trip Planners Ltd. stock last traded price is 41.75

Insights Easy Trip Planners

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 71.75

- EPS - TTM (₹) 0.58

- Dividend Yield (%) 0.00

- VWAP (₹) 41.65

- PB Ratio (x) 11.70

- MCap (₹ Cr.) 7,318.53

- Face Value (₹) 1.00

- BV/Share (₹) 3.53

- Sectoral MCap Rank 17

- 52W H/L (₹) 54.00 / 37.00

- MCap/Sales 12.87

- PE Ratio (x) 71.82

- MCap (₹ Cr.) 7,329.16

- Sectoral MCap Rank 16

- 52W H/L (₹) 54.00 / 37.01

Easy Trip Planners Share Price Returns

Et stock screeners top score companies.

Check whether Easy Trip Planners belongs to analysts' top-rated companies list?

Easy Trip Planners News & Analysis

Announcement under Regulation 30 (LODR)-Press Release / Media Release

Easy Trip Planners Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Easy Trip Planners Share Recommendations

Recent recos.

Mean Recos by 1 Analysts

That's all for Easy Trip Planners recommendations. Check out other stock recos.

Analyst Trends

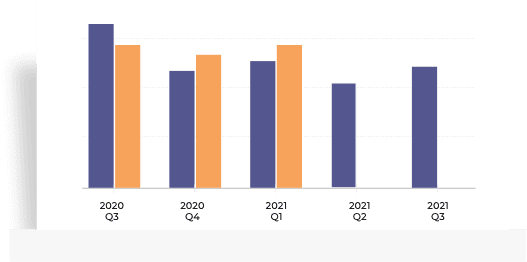

Easy trip planners financials.

- Income (P&L)

Balance Sheet

PAT: Slipping to Red

Employee & Interest Expense

All figures in Rs Cr, unless mentioned otherwise

Financial Insights Easy Trip Planners

Easy trip planners share price forecast, get multiple analysts’ prediction on easy trip planners.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Peer Comparison

Easy trip planners stock performance, ratio performance.

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

- There’s no suggested peer for this stock.

Peers Insights Easy Trip Planners

Easy trip planners shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, easy trip planners board meeting/agm, easy trip planners dividends, about easy trip planners.

Easy Trip Planners Ltd., incorporated in the year 2008, is a Small Cap company (having a market cap of Rs 7,398.27 Crore) operating in Services sector. Easy Trip Planners Ltd. key Products/Revenue Segments include Commission (Air Passage), Income From Advertisement, Other Services and Other Operating Revenue for the year ending 31-Mar-2023. For the quarter ended 31-03-2024, the company has reported a Consolidated Total Income of Rs 172.56 Crore, up 4.39 % from last quarter Total Income of Rs 165.31 Crore and up 42.85 % from last year same quarter Total Income of Rs 120.79 Crore. Company has reported net profit after tax of Rs -15.08 Crore in latest quarter. The company’s top management includes Mr.Nishant Pitti, Mr.Prashant Pitti, Mr.Rikant Pittie, Mr.Satya Prakash, Justice(Retd)Usha Mehra, Mr.Vinod Kumar Tripathi, Mr.Ashish Kumar Bansal, Ms.Nutan Gupta, Mr.Priyanka Tiwari. Company has S R Batliboi & Co. LLP as its auditors. As on 31-03-2024, the company has a total of 177.20 Crore shares outstanding. Show More

Nishant Pitti

Prashant Pitti

Rikant Pittie

Satya Prakash

Vinod Kumar Tripathi

Ashish Kumar Bansal

Nutan Gupta

Priyanka Tiwari

- S R Batliboi & Co. LLP S R Batliboi & Associates LLP

Online Service/Marketplace

Key Indices Listed on

Nifty 500, S&P BSE 500, S&P BSE 250 SmallCap Index, + 9 more

223, FIE Patparganj Industrial Area,East Delhi,Delhi, Delhi - 110092

http://www.easemytrip.com

More Details

- Easy Trip Planners Chairman's Speech

- Easy Trip Planners Company History

- Easy Trip Planners Directors Report

- Easy Trip Planners Background information

- Easy Trip Planners Company Management

- Easy Trip Planners Listing Information

- Easy Trip Planners Finished Products

FAQs about Easy Trip Planners share

- 1. What is Easy Trip Planners share price and what are the returns for Easy Trip Planners share? Easy Trip Planners share price was Rs 41.75 as on 07 Jun, 2024, 03:58 PM IST. Easy Trip Planners share price was up by 1.09% based on previous share price of Rs. 41.3. In last 1 Month, Easy Trip Planners share price moved down by 5.76%.

- 2. Who is the CEO of Easy Trip Planners? Nishant Pitti is the Chairman & CEO of Easy Trip Planners

- 3. What is Easy Trip Planners's 52 week high / low? 52 Week high of Easy Trip Planners share is Rs 54.00 while 52 week low is Rs 37.00

- 4. What is the PE & PB ratio of Easy Trip Planners? The PE ratio of Easy Trip Planners stands at 71.75, while the PB ratio is 11.84.

- 5. Who are peers to compare Easy Trip Planners share price? Within Services sector Easy Trip Planners, Just Dial Ltd., Infibeam Avenues Ltd., Nazara Technologies Ltd., CarTrade Tech Ltd., Yatra Online Ltd., Matrimony.com Ltd., IndiaMART InterMESH Ltd., One97 Communications Ltd., FSN E-Commerce Ventures Ltd. and PB Fintech Ltd. are usually compared together by investors for analysis.

- 6. What is the market cap of Easy Trip Planners? Market Capitalization of Easy Trip Planners stock is Rs 7,318.53 Cr.

- 1 analyst is recommending to Hold

- 1 analyst is recommending Strong Sell

- 8. What are the Easy Trip Planners quarterly results? Total Revenue and Earning for Easy Trip Planners for the year ending 2024-03-31 was Rs 609.08 Cr and Rs 103.11 Cr on Consolidated basis. Last Quarter 2024-03-31, Easy Trip Planners reported an income of Rs 172.56 Cr and loss of Rs -15.75 Cr.

- 9. Who's the chairman of Easy Trip Planners? Nishant Pitti is the Chairman & CEO of Easy Trip Planners

- 10. What is the CAGR of Easy Trip Planners? The CAGR of Easy Trip Planners is 53.38.

- Promoter holding have gone down from 71.3 (30 Jun 2023) to 64.3 (31 Mar 2024)

- Domestic Institutional Investors holding have gone down from 2.48 (30 Jun 2023) to 2.44 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 2.54 (30 Jun 2023) to 2.78 (31 Mar 2024)

- Other investor holding has gone up from 23.67 (30 Jun 2023) to 30.48 (31 Mar 2024)

- 1 Week: Easy Trip Planners share price moved down by 0.48%

- 1 Month: Easy Trip Planners share price moved down by 5.76%

- 3 Month: Easy Trip Planners share price moved down by 11.83%

- 6 Month: Easy Trip Planners share price moved up by 7.88%

- PE Ratio of Easy Trip Planners is 71.75

- Price/Sales ratio of Easy Trip Planners is 12.87

- Price to Book ratio of Easy Trip Planners is 11.70

- 14. What dividend is Easy Trip Planners giving? An equity Interim dividend of Rs 0.1 per share was declared by Easy Trip Planners Ltd. on 11 Dec 2023. So, company has declared a dividend of 10% on face value of Rs 1 per share. The ex dividend date was 19 Dec 2023.

Trending in Markets

- Bajaj Finance Housing

- F&O Stocks to Buy Today

- TBI Corn Share Price

- Stocks in News

- Sensex climbs 300 points

- Sensex Today

- F&O Stocks

Easy Trip Planners Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Election with BT

- Economic Indicators

- BT-TR GCC Listing

Easy Trip Planners soars 20% as stock goes ex-split, ex-bonus

Easy trip planners surged 19.93 per cent to hit a high of rs 57.15 on bse. it was later traded at rs 53 a piece, up 11.23 per cent.

- Updated Nov 21, 2022, 10:26 AM IST

Shares of Easy Trip Planners surged 20 per cent in Monday's trade, as the scrip turned ex-split and ex-bonus. The scrip went ex-split from face value of Rs 2 to Re 1 each. It also turned ex-bonus in the 3:1 ratio.

Following the development, the scrip soared 19.93 per cent to hit a high of Rs 57.15 on BSE. It was later traded at Rs 53 a piece, up 11.23 per cent. The stock hit an adjusted 52-week high of Rs 59.56 on May 24. In the last one month, it has traded largely in Rs 46.10-57.15 range.

Earlier on February 28, the same company went ex-bonus in 1:1 ratio. In a November 14 note, Edelweiss Wealth said Easy Trip Planners reported better-than-expected revenue in September quarter, even as margins were below its estimates on higher advertising expenses.

The company reported a standalone net profit of Rs 30.63 crore for the Septemeber quarter compared with Rs 27.28 crore in the year-ago quarter. Revenue for the company rose to Rs 104.32 crore from Rs 43.68 crore in the year-ago quarter.

The management claims to have gained market share in Q2FY23, it noted while adding that the robust pickup in air travel in domestic and international markets bodes well for the company.

"Moreover, the company is focusing on expanding its non-air verticals from FY23. It strategically pursued inorganic growth by acquiring innovative companies across diverse travel segments and by evolving into a complete travel ecosystem. Management guides to achieve GBR of Rs 6,500–7,000 crore in FY23, and expects to continue its strong growth momentum in the coming years with consistent profitability," it said.

Also Read: Five Star Business Finance lists at 5% discount to issue price, m-cap at Rs 13,110 crore

Also Read: Archean Chemical shares make decent debut, list at 10% premium to issue price

- #Easy Trip Planners

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

- Option Chain

- Daily Reports

- Press Releases

07-Jun-2024 15:30

14-Jun-2024 | 83.5000

07-Jun-2024 17:00

Lac Crs 420.14 | Tn $ 5.04

07-Jun-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Series : ( )

Announcements.

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %).

Click here for Block Deals

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, announcement xbrl details, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

EaseMyTrip board clears bonus shares and stock split — here's what it means for investors

Easy trip planners share price: the company — which owns and operates the easemytrip platform — announced bonus shares and a stock split after a board meeting on friday..

- Privacy Policy

- Historical Data

- Targets Short Term (Tomorrow, Weekly)

- Targets Long Term (Yearly)

Stocks To Watch Today - 1 May 2024: Piccadily Soars to All-Time High, Axis Bank Creates New 52-Week Peak & More

Stock To Watch Today - 30 Apr 2024: Piccadily Agro, Gallantt Metal, Mahindra & More!

Stocks To Watch Today (23 Apr 2024): Gallantt Metal Hits New All-Time High, TECHNOE Brews 52-Week High & More

Five Stocks to Watch Today (22 Apr 2024): TRIL, Gallantt, Berger, Winsome, and Bharat Road Witness Milestones

Hot Stocks To Watch Today (19 Apr 2024): TRIL, Gallantt, Berger Paints Hit Milestones Yesterday, Setting Stage for Market Surprises!

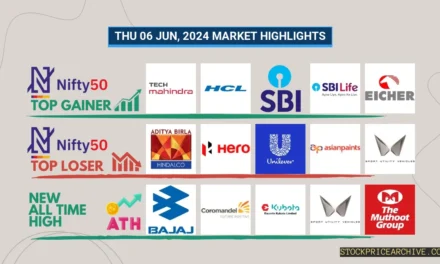

07 Jun 2024: Nifty 50 Closes at ₹23,265.25 (+1.94%), TCS & Procter & Gamble Show Bullish Trends, Nifty 500 Up 1.79%

06 Jun 2024: Nifty 50 closed at ₹22,620.34 (+3.36%), with Tech Mahindra and HCL leading the gains. GMM Pfaudler show bearish patterns.

05 Jun 2024: Nifty Closes at ₹22,568.3 (+3.12%) with Adani Ports & IndusInd Bank Leading Gains. Explore Top Performers & Stocks to Watch!

03 Jun 2024: Nifty 50 Surges to ₹23,302.34 (+3.42%), Adani Ports ₹1591 (10.68%) & NTPC ₹393 (9.47%) Lead the Charge!

31 May 2024: Nifty Closes at ₹22,530.69 (+0.18%), HDFC Bank Shows Bullish Pattern, ONGC on a Red Streak!

Select Page

Easy Trip Split History From 2021 to 2024

- 1: Easy Trip Split History Table From 2021 to 2024

- 2: How Many Times Easy Trip Share Split?

The most recent share split of Easy Trip occurred 2 years ago with ex-split date of Mon, 21 Nov 2022. Easy Trip has given split 1 times in the past, you can find its complete split history in below table.

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Join our WhatsApp group

Join our Telegram group

Your phone number will be HIDDEN to other users.

Easy Trip Split History Table From 2021 to 2024

How many times easy trip share split.

In the past 3 years, Easy Trip share has been split 1 times. If you had purchased 1 share in 2021 then by 2024 after 1 splits your 1 share would be converted to 2 shares.

- Easy Trip Share Price History

- Easy Trip Price Target Tomorrow

- Easy Trip Price Long Term Target

- Easy Trip Dividend History

- Easy Trip Bonus History

Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own research before making any investment.

Recent Posts

TYRE PARTNER

ASSOCIATE PARTNER

EaseMyTrip Board Approves Bonus Shares, Stock Split; Key Details Investors Must Know

Curated By : Aparna Deb

Last Updated: October 10, 2022, 14:23 IST

New Delhi, India

EaseMyTrip.com

Easy Trip Planners operates the popular ticketing platform EaseMyTrip.com

Easy Trip Planners Board Approves Stock Split: Easy Trip Planners Shares of online travel company Easy Trip Planners surged 6 per cent to Rs 428 on Monday after the company announced that its board has approved a stock split in the ratio of 1:2. The travel agency has also given its nod to the bonus issue of three shares for every one share held.

“This is to inform that the board at its meeting held today i.e., 10th October, 2022, has inter-alia, considered and approved the following items subject to shareholder’s approval: Sub-division/Split of each existing equity share of face value of Rs 2/- into 2 equity shares of face value of Rs 1/- fully paid- up and the issue of three bonus equity shares for every one fully paid-up equity share,” the company announced in an exchange filing today.

It added that bonus shares will be issued out of free reserves created out of profits of the company available as at March 31, 2022 and the estimated date by which such bonus shares would be credited/dispatched would be within 2 months from the date of board approval i.e. by December 8, 2022.

Why is Easy My Trip Going for a Stock Split?

A stock split increases the number of shares that are outstanding by issuing more shares to the current shareholders. A company engages in stock split decision to make its stock more affordable if its price levels are very high, which in thus would lead to increase in liquidity in the stock. Meanwhile, bonus shares are fully paid additional shares issued by a company to its existing shareholders.

Explaining the rationale, it said that “the company and its subsidiaries have grown significantly, in terms of business and performance, over the years. This is reflected in the share price of the company. As and when the stock price rises further, it will be increasingly difficult for small potential shareholders to partake in the company’s future. Keeping with the spirit of inclusion and in order to reward the shareholders. the Board of Directors at its meeting held today, approved and recommended the said corporate actions.”

Further, Easy Trip Planner’s board has also announced a hike in Authorised Share Capital from Rs 75,00,00,000 to Rs 200,00,00,000 and an alteration in Capital Clause of Memorandum of Association.

Meanwhile, the travel agency, launched in 2008, debuted on the bourses last year on March 19, 2021. Easy Trip Planners operates the popular ticketing platform EaseMyTrip.com. The company is enrolled in the business of booking services related to travel and tourism.

Read all the Latest Business News and Breaking News here

- EaseMyTrip IPO

- PRO Exclusives

- Free Newsletter

Easy Trip shares jump on bonus, stock split announcement

By Staff Writer

- 10 Oct 2022

Share article on

Alteria Capital ropes in offshore LP for $100-mn debt fund

Cureskin, Fasal backer ITI Group makes first close of second VC fund

Bottomline: Fullerton-backed Lendingkart's FY24 profit nearly halves; revenue, AUM up

Path to profitability key in Egyptian VC Beltone's deployment strategy

ADV Partners' Suresh Prabhala on deploying second fund, a possible third outing and more

Auxano Capital raises target corpus of angel fund, plans new outing

- Personal Finance

- Today's Paper

- T20 World Cup

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

Easy Trip Planners surges 8% on bonus issue, stock split plan

The board of directors of the company are scheduled to meet on monday, october 10, 2022, for considering the proposal for issue of bonus shares and/or sub-division/split of shares..

)

Easy Trip Planners hits record high on heavy vols; stock up 20% in 2 days

Bajaj finserv gains 4% as board to consider bonus, stock split plan, how to plan a holiday trip here's what you need to know before travelling, bajaj finserv trades ex-date for 1:5 split, 1:1 bonus; shares rally 6%, how will ey's split shake up the sector, review, gmp, valuations: should you subscribe to electronics mart ipo, 'offer for sale' mechanism to get mega boost as sebi relaxes norms, liberty shoes hits multi-yr high on strong outlook; stock up 104% in 1-mnth, m&m finance soars 10% as asset quality improves in september quarter, september's credit wipeout foretells even more pain in for us investors.

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 04 2022 | 10:46 AM IST

Explore News

Key stories on business-standard.com are available only to BS Premium subscribers.

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- ICC T20 World Cup 2024 Budget 2024 Lok Sabha Election 2024 Bharatiya Janata Party (BJP)

FREE Equity Delivery and MF Flat ₹20/trade Intra-day/F&O

- IPO Details

- Subscription

EaseMyTrip IPO is a book built issue of Rs 510.00 crores. The issue is entirely an offer for sale.

EaseMyTrip IPO bidding started from March 8, 2021 and ended on March 10, 2021. The allotment for EaseMyTrip IPO was finalized on Tuesday, March 16, 2021. The shares got listed on BSE, NSE on March 19, 2021.

EaseMyTrip IPO price band is set at ₹186 to ₹187 per share. The minimum lot size for an application is 80 Shares. The minimum amount of investment required by retail investors is ₹14,960.

Axis Capital Limited and Jm Financial Limited are the book running lead managers of the EaseMyTrip IPO, while Kfin Technologies Limited is the registrar for the issue.

Refer to EaseMyTrip IPO RHP for detailed information.

EaseMyTrip IPO Details

Easemytrip ipo reservation.

EaseMyTrip IPO offers 15,080,644 shares. 8,225,806 (54.55%) to QIB, 4,112,903 (27.27%) to NII, 2,741,935 (18.18%) to RII. 34,274 RIIs will receive minimum 80 shares and (sNII) and (bNII) will receive minimum 1,120 shares. (in case of oversubscription)

EaseMyTrip IPO Timeline (Tentative Schedule)

EaseMyTrip IPO opens on March 8, 2021, and closes on March 10, 2021.

EaseMyTrip IPO Lot Size

Investors can bid for a minimum of 80 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

EaseMyTrip IPO Promoter Holding

Mr. Nishant Pitti, Mr. Rikant Pittie, and Mr. Prashant Pitti are the company promoters.

About Easy Trip Planners Limited

Incorporated in 2008, Easy Trip Planners Ltd is the second largest online travel agency in India in terms of gross revenue. The online travel agency offers a range of travel products and services and end-to-end travel solutions including airline tickets, rail tickets, bus tickets, taxis, holiday packages, hotels, and other value-added services i.e. travel insurance, visa processing, etc.

Easy Trip offers a range of online traveling services through its website and Ease My Trip android and iOS mobile app. The company follows B2B2C (business to business to customer), B2C (business to customer), and B2E (business to enterprise) distribution channels to offers its services.

As of November 2019, the firm has served customers with more than 400 domestic and international airlines, and 1,096,400 hotels. As of March 2019, it had 49,494 registered travel agents across major cities of India.

Competitive strengths

- One of the leading online travel agencies in India.

- Strong brand name and distribution network.

- In-house advanced technology infrastructure.

- Consistent financial track record and operational performance.

Company Financials

Objects of the issue (easemytrip ipo objectives).

The IPO proceed to be used against the following purposes;

- To achieve share listing benefits.

- To sell up to [_] equity shares agggregating up to Rs. 5100 million.

EaseMyTrip IPO Review (May apply)

[Dilip Davda] Based on its financial data, the issue appears fully priced. Being the first mover in the online travel service segment with niche play, the company may attract fancy post listing. ETPL is operating an asset-light model of business with negligible borrowings. Rising trade receivables and trade payables coupled with declined bank deposits are the major concerns. Considering all these, investors may consider investing in this IPO with a long term perspective. Read detail review...

EaseMyTrip IPO Subscription Status (Bidding Detail)

The EaseMyTrip IPO is subscribed 159.33 times on March 10, 2021 5:00:00 AM. The public issue subscribed 70.40 times in the retail category, 77.53 times in the QIB category, and 382.21 times in the NII category. Check Day by Day Subscription Details (Live Status)

EaseMyTrip IPO Prospectus

- › EaseMyTrip IPO DRHP

- › EaseMyTrip IPO RHP

EaseMyTrip IPO Rating

Easemytrip ipo listing details.

Pre-Open Session - NSE Pre-Open Session - BSE

Listing Day Trading Information

Check IPO Performance…

Easy Trip Planners Limited Contact Details

Easy Trip Planners Limited 223, FIE Patparganj Industrial Area, East Delhi, Delhi – 110 092, India Phone : 91 11 4313 1313 Email : [email protected] Website : http://www.easemytrip.com/

EaseMyTrip IPO Registrar

Kfin Technologies Limited Phone : 04067162222, 04079611000 Email : [email protected] Website : https://kosmic.kfintech.com/ipostatus/

EaseMyTrip IPO - Buy or Not

EaseMyTrip IPO Recommendation Summary

Read All Reviews Post Your Review Manage Reviews

EaseMyTrip IPO Lead Manager(s)

- Axis Capital Limited ( Past IPO Performance )

- Jm Financial Limited ( Past IPO Performance )

Lead Manager Reports

- IPO Lead Manager Performance Summary

- IPO Lead Manager Performance Tracker

- EaseMyTrip IPO FAQs

What is EaseMyTrip IPO?

EaseMyTrip IPO is a main-board IPO of [.] equity shares of the face value of ₹2 aggregating up to ₹510.00 Crores. The issue is priced at ₹186 to ₹187 per share. The minimum order quantity is 80 Shares.

The IPO opens on March 8, 2021 , and closes on March 10, 2021 .

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

How to apply in EaseMyTrip IPO through Zerodha?

Zerodha customers can apply online in EaseMyTrip IPO using UPI as a payment gateway. Zerodha customers can apply in EaseMyTrip IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in EaseMyTrip IPO through Zerodha

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the 'EaseMyTrip IPO' row and click the 'Bid' button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Visit Zerodha IPO Application Process Review for more detail.

When EaseMyTrip IPO will open?

The EaseMyTrip IPO opens on March 8, 2021 and closes on March 10, 2021.

What is the lot size of EaseMyTrip IPO?

How to apply for easemytrip ipo.

You can apply in EaseMyTrip IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha , Upstox , 5Paisa , Nuvama , ICICI Bank , HDFC Bank and SBI Bank .

When is EaseMyTrip IPO allotment?

The finalization of Basis of Allotment for EaseMyTrip IPO will be done on Tuesday, March 16, 2021, and the allotted shares will be credited to your demat account by Thursday, March 18, 2021. Check the EaseMyTrip IPO allotment status .

When is EaseMyTrip IPO listing date?

EaseMyTrip IPO Message Board

28 comments.

Find EaseMyTrip IPO Latest Update

- EaseMyTrip IPO Review

- EaseMyTrip IPO Live Subscription

- EaseMyTrip IPO Live News

- EaseMyTrip IPO Allotment Status

- EaseMyTrip IPO Basis of Allotment Document

Useful Articles

- Top 10 Discount Brokers | Top 10 Full-Service Brokers

- 3 Easy steps to trade in F&O (Equity Future Derivatives) at BSE, NSE

- HUF Account Basics Explained (Bank, Demat and Trading Account)

- List of All Articles...

Compare IPOs with EaseMyTrip IPO

- Kalyan Jewellers IPO vs EaseMyTrip IPO

- Anupam Rasayan IPO vs EaseMyTrip IPO

- Laxmi Organic IPO vs EaseMyTrip IPO

- Craftsman Automation IPO vs EaseMyTrip IPO

- Nazara Technologies IPO vs EaseMyTrip IPO

- MTAR Technologies IPO vs EaseMyTrip IPO

- Heranba Industries IPO vs EaseMyTrip IPO

- Nureca limited IPO vs EaseMyTrip IPO

- Brookfield India REIT vs EaseMyTrip IPO

- Stove Kraft IPO vs EaseMyTrip IPO

Free Eq Delivery & MF Flat ₹20 Per Trade in F&O

Open Instant Account

Open FREE Demat Account

30 days brokerage free trading Free - Personal Trading Advisor

Open Account

FREE Intraday Trading (Eq, F&O) Flat ₹20 Per Trade in F&O

Open Online Demat Account

FREE Account Opening Flat ₹20 Per Trade

Enquire Now

Unlimited @ ₹899/month Rs 0 Demat AMC

Open FREE Account

Free Eq Delivery Trades Flat ₹20 Per Trade in F&O

Pay ₹0 brokerage for first 10 days

Flat ₹20 Per Trade

Open Instant Account Now!

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

- EASY TRIP PLANNERS LTD.

Easy Trip Planners Ltd. NSE: EASEMYTRIP | BSE: 543272

/100 Valuation Score : 12 /100 Momentum Score : 42 /100 "> Expensive Performer

Easy Trip Planners Ltd. Live Share Price Today, Share Analysis and Chart

41.75 0.45 ( 1.09 %)

52W Low on Aug 23, 2023

8.9M NSE+BSE Volume

NSE 07 Jun, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

SWOT Analysis

Easy Trip Planners Ltd. Live Price Chart

Earnings conference calls, investor presentations and annual reports, earnings calls, annual reports, investor presentation, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-earni…, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-analy…, easy trip planners ltd. results earnings call for q3fy24, easy trip planners results earnings call for q2fy24, easy trip planners results earnings call for q1fy24, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-inves…, easy trip planners ltd. faq, how is easy trip planners ltd. today, easy trip planners ltd. today is trading in the green, up by 1.09% at 41.75., how has easy trip planners ltd. performed historically, easy trip planners ltd. is currently trading up 1.09% on an intraday basis. in the past week the stock fell -0.48%. stock has been down -11.83% in the past quarter and fell -3.13% in the past year. you can view this in the overview section..

IMAGES

VIDEO

COMMENTS

Splits Summary. Easy Trip Planners had last split the face value of its shares from Rs 2 to Rs 1 in 2022. The share has been quoting on an ex-split basis from November 21, 2022.

The corporation has announced the record date for the 1:2 stock split and the 3:1 bonus shares. The company has said today in a stock exchange filing that "This is to inform you that pursuant to ...

"The Board at its meeting held today i.e., 10th October 2022, has inter-alia, considered and approved sub-division/split of each existing equity share of the face value of Rs 2 into two equity shares of the face value of Re 1 fully paid-up, and the issue of three bonus equity shares for every one fully paid-up equity share," the company said in a BSE filing.

Easy Trip Planners Ltd on Monday informed that its board has approved bonus issue of three shares for every one share held i.e., 3:1 ratio and also has given nod for the stock split in the ratio ...

Easy Trip Planners Split Information. BSE: 543272 | NSE: EASEMYTRIPEQ | IND: Online Service/Marketplace | ISIN code: INE07O001026 | SECT: Services. You can view the Split history of Easy Trip Planners Ltd. along its Announcement Dates, Ex-Split Dates, Old Face Value New Face Value.

Stock splits don't actually change the value of one's stock holdings, but multiply one's shares and divide the share price. A stock split increases the number of shares outstanding and ...

Easy Trip Share Price: Find the latest news on Easy Trip Stock Price. Get all the information on Easy Trip with historic price charts for NSE / BSE. Experts & Broker view also get the Easy Trip ...

Easy Trip Planners Share Price Today (07 Jun, 2024): Easy Trip Planners Stock Price (₹ 41.75) Live NSE/BSE updates on The Economic Times. ... Split: Old FV2.0| New FV:1.0: Bonus: Nov 21, 2022: Nov 22, 2022: ... discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking ...

Shares of Easy Trip Planners surged 20 per cent in Monday's trade, as the scrip turned ex-split and ex-bonus. The scrip went ex-split from face value of Rs 2 to Re 1 each.

Easy Trip Planners Limited Share Price Today, Live NSE Stock Price: Get the latest Easy Trip Planners Limited news, company updates, quotes, financial reports, 52 week high low, tips, historical charts, market performance etc at NSE India.

Get the latest Easy Trip Planners Ltd (EASEMYTRIP) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Easy Trip Planners share price: The company — which owns and operates the EaseMyTrip platform — announced bonus shares and a stock split after a board meeting on Friday. ... The company will complete the split on or before December 8, according to a regulatory filing.

EaseMyTrip Bonus, Split Record Date: EaseMyTrip or Easy Trip Planners is in focus today as the stock of the travel company turns ex-bons and ex-split date today.The counter zoomed more than 17 per cent as Street cheered the corporate actions. The stock opened at Rs 53 apiece after bonus and split adjustments.

Easy Trip Planners Ltd. has split the face value 1 time since Nov. 21, 2022. Easy Trip Planners Ltd. had last split the face value of its shares from ₹2 to ₹1 in 2022.The share has been quoting on an ex-split basis from Nov. 21, 2022. Ex-Date.

How Many Times Easy Trip Share Split? In the past 3 years, Easy Trip share has been split 1 times. If you had purchased 1 share in 2021 then by 2024 after 1 splits your 1 share would be converted to 2 shares. Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice.

Shares of Easy Trip Planners, which operates EaseMyTrip.com, soared 20 per cent to Rs 57.15 on the BSE in Monday's intra-day trade after they turned ex-date for 3:1 bonus issue, and 1:1 stock split. The stock of the tour and travel related services company was trading close to its 52-week high level of Rs 59.56 (adjusted to stock split and ...

Easy Trip Planners Board Approves Stock Split: Easy Trip Planners Shares of online travel company Easy Trip Planners surged 6 per cent to Rs 428 on Monday after the company announced that its board has approved a stock split in the ratio of 1:2.The travel agency has also given its nod to the bonus issue of three shares for every one share held.

Easy Trip shares jump on bonus, stock split announcement. Shares of travel agency Easy Trip Planners Ltd, on Monday traded with gains of 1.9% in mid-day trade at Rs 409.85 apiece on BSE after announcement of a bonus issue and stock split. The stock had risen to as much Rs 419 per share in early trade on Monday.

Easy Trip Planners surges 8% on bonus issue, stock split plan The board of directors of the company are scheduled to meet on Monday, October 10, 2022, for considering the proposal for issue of bonus shares and/or sub-division/split of shares.

Get EaseMyTrip IPO details. Find IPO Date, Price, Live Subscription, Allotment, Grey Market Premium GMP, Listing Date, Analysis and Review.

EaseMyTrip shares end 20% higher at ₹57.15 on the BSE. Shares of Easy Trip Planners, which operates EaseMyTrip - the second largest online travel agency in India in terms of gross revenue, hit the upper circuit limit of 20% on Monday after the travel company turned ex-date for a 3:1 bonus issue, and a 1:1 stock split.

Easy Trip Planners Ltd. live share price at 2:29 p.m. on Jun 7, 2024 is Rs 41.70. Explore financials, technicals, Deals, Corporate actions and more

Two household-name stocks could soon become more affordable for everyday investors. One is pretty much guaranteed to split its stock very soon, and the move would also fit the other company's ...

9 June 2024 (Sunday Mass) 10th Sunday in Ordinary Time Year B FAITH AS A CALL & JOURNEY TOWARDS INCLUSIVITY #OrdinaryTime #OrdinaryTimeYearB...