- Vacation packages

- Vacation rentals

- Things to do

- AARP Member Savings

- Create an Account

- List of Favorites

- Not ? Log in to your account

Create your free account

Sign in to your account, travel protection plans, expedia cancellation plan.

When plans change, there's help. Expedia Cancellation Plan from Berkely can cover your expenses if you need to cancel or change your flight. Don't leave home without it!

- Includes trip cancellation coverage

- Interruption coverage can provide reimbursement for airfare home

- Coverage for travel in the continental U.S. only

Booking a hotel along with your flight? Get broader coverage with the Expedia Package Protection Plan

Please see Terms and Conditions for full terms, including limitations and exclusions.

- Plan Coverage

- What's Not Covered

- Claim Instructions

- Terms Of Coverage

- Definitions

Stonebridge Casualty Insurance Company Policy Number MZ0911076H0000A

DESCRIPTION OF COVERAGE

- Schedule: Expedia, Inc Maximum Benefit Amount

PART A. TRAVEL ARRANGEMENT PROTECTION

- Trip Cancellation Up to Total Flight Cost

- Trip Interruption Up to Total Flight Cost

Trip Cancellation and Trip Interruption Benefits Pre-Departure Trip Cancellation

We will pay a Pre-Departure Trip Cancellation Benefit, up to the amount in the Schedule if you are prevented from taking your Covered Trip due to your, an Immediate Family Member's, Traveling Companion's, or Business Partner's Sickness, Injury or death or Other Covered Events as defined, that occur(s) before departure on your Covered Trip. The Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) require the examination and treatment by a Physician at the time the Covered Trip is cancelled; and c) in the written opinion of the treating Physician, be so disabling as to prevent you from taking your Covered Trip.

Pre-Departure Trip Cancellation Benefits

Post-departure trip interruption, post-departure trip interruption benefits.

- 1. the additional transportation expenses by the most direct route from the point you interrupted your Covered Trip: a) to the next scheduled destination where you can catch up to your Covered Trip; or (b) to the final destination of your Covered Trip;

- 2. the additional transportation expenses incurred by you by the most direct route to reach your original Covered Trip destination if you are delayed and leave after the Scheduled Departure Date. However, the benefit payable under (1) and (2) above will not exceed the cost of a one-way economy air fare by the most direct route less any refunds paid or payable for your unused original tickets.

- being directly involved in a documented traffic accident while en route to departure;

- being hijacked, Quarantined, required to serve on a jury, or required by a court order to appear as a witness in a legal action, provided you, an Immediate Family Member traveling with you or a Traveling Companion is not: 1) a party to the legal action, or 2) appearing as a law enforcement officer;

- having your Home made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- Your involuntary termination of employment or layoff which occurs after your effective date of coverage and was not under your control. You must have been continuously employed with the same employer for 1 year prior to the termination or layoff. This provision is not applicable to temporary employment, independent contractors or self-employed persons.

Contact Information

This program was designed and is administered by Aon Affinity Berkely Travel. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc.; (AR 244489); in CA, MN & OK , AIS Affinity Insurance Agency, Inc. (CA 0795465); in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY and NH, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. As an MGA we are acting on behalf of our carrier partner.

Please see Terms and Conditions for full details include plan terms, conditions and exclusions.

WE WILL NOT PAY FOR ANY LOSS CAUSED BY OR INCURRED RESULTING FROM:

- mental, nervous, or psychological disorders, except if hospitalized;

- being under the influence of drugs or intoxicants, unless prescribed by a Physician;

- normal pregnancy, except if hospitalized; or elective abortion;

- declared or undeclared war, or any act of war;

- service in the armed forces of any country;

- operating or learning to operate any aircraft, as pilot or crew;

- any unlawful acts, committed by you or a Traveling Companion (whether insured or not);

- any amount paid or payable under any Worker's Compensation, Disability Benefit or similar law;

- Elective Treatment and Procedures;

- medical treatment during or arising from a Covered Trip undertaken for the purpose or intent of securing medical treatment;

- business, contractual or educational obligations of you, an Immediate Family Member or Traveling Companion;

- failure of any tour operator, Common Carrier, or other travel supplier, person or agency to provide the bargained-for travel arrangements;

- a loss that results from an illness, disease, or other condition, event or circumstance which occurs at a time when the plan is not in effect for you.

Policy Number MZ0911076H0000A

- TRIP CANCELLATION CLAIMS: Contact Expedia, Inc. and Berkely IMMEDIATELY to notify them of your cancellation and to avoid any non-covered expenses due to late reporting. Berkely will then forward the appropriate claim form which must be completed by you AND THE ATTENDING PHYSICIAN, if applicable. If you are cancelling due to a death, a death certificate will be required.

- ALL OTHER CLAIMS: Report your claim as soon as possible to Berkely. Provide the policy number, your travel dates, and details describing the nature of your loss. Upon receipt of this information, Berkely will promptly forward you the appropriate claim form to complete. If you are interrupting due to a death, a death certificate will be required.

Online: www.travelclaim.com Phone: 1-877-718-4651 or 1-(516) 342-2720 Mail: Berkely 300 Jericho Quadrangle, P.O. Box 9022, Jericho, NY 11753 Office Hours: 8:00 am - 10:00 pm ET, Monday - Friday; 9:00 am - 5:00 pm ET, Saturday IMPORTANT: In order to facilitate prompt claims settlement upon your return, be sure to obtain as applicable: detailed medical statements from Physicians in attendance where the Accident or Sickness occurred. These statements should give complete diagnosis, stating that the Sickness or Injury prevented traveling on dates contracted. Provide all unused transportation tickets, official receipts, etc.

Claims Provisions

Payment of Claims Claims for benefits provided by the plan will be paid as soon as written proof is received. Benefits are paid directly to you, unless otherwise directed. Any accrued benefits unpaid at your death will be paid to your estate, or if no estate, to your beneficiary. If you have assigned your benefits, we will honor the assignment if a signed copy has been filed with us. We are not responsible for the validity of any assignment. Travel Insurance is underwritten by Stonebridge Casualty Insurance Company, a Transamerica company, Columbus, Ohio; NAIC # 10952 (all states except as otherwise noted) under Policy/Certificate Form series TAHC5000. In CA, HI, NE, NH, PA, TN and TX Policy/Certificate Form series TAHC5100 and TAHC5200. In IL, IN, KS, LA, OR, OH, VT, WA and WY Policy Form #’s TAHC5100IPS and TAHC5200IPS. Certain coverages are under series TAHC6000 and TAHC7000. This is a brief Description of Coverage which outlines benefits and amounts of coverage that may be available to you. If you are a resident of one of the following states (IL, IN, KS, LA, OH, OR, VT, WA, or WY), your Policy is provided on an individual form. You can request a copy of your Individual Policy or Group Policy for all other states by calling 1-800-453-4090. Your Individual Policy or Group Policy will govern the final interpretation of any provision or claim. Notice to California residents: This plan provides cancellation coverage for your trip and other insurance coverages that apply only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. If you have any questions about your current coverage, call your insurer, insurance agent or broker. The purchase of this plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. Unless individually licensed as an insurance agent, your travel agent is not qualified or authorized to answer your technical questions about the benefits, exclusions or conditions of this plan or to evaluate the adequacy of any existing insurance coverage you may have. Questions should be directed to the plan administrator at the toll-free number provided.

For questions or claims, please contact Berkely. Call: 1-800-453-4079 Email: [email protected] Office Hours: 8:00 AM to 10:00 PM EST Mon-Fri, 9:00 AM to 5:00 PM EST Sat.

- the date the Covered Trip is completed;

- the Scheduled Return Date;

- your arrival at the return destination on a round-trip, or the destination on a one-way trip;

- cancellation of the Covered Trip covered by the plan.

In the certificate, "you", "your" and "yours" refer to the Insured. "We", "us" and "our" refer to the company providing the coverage. In addition certain words and phrases are defined as follows: Accident means a sudden, unexpected, unintended and external event, which causes Injury. Business Partner means an individual who is involved, as a partner, with you in a legal general partnership and shares in the management of the business. Covered Trip means a period of travel away from Home to a destination outside your city of residence; the purpose of the Trip is business or pleasure and is not to obtain health care or treatment of any kind; the Trip has defined departure and return dates specified when the Insured enrolls; and the Trip does not exceed 31 consecutive days in length. Common Carrier means any land, water or air conveyance operated under a license for the transportation of passengers for hire. Domestic Partner means a person who is at least eighteen years of age and you can show: 1) evidence of financial interdependence, such as joint bank accounts or credit cards, jointly owned property, and mutual life insurance or pension beneficiary designations; 2) evidence of cohabitation for at least the previous 6 months; and 3) an affidavit of domestic partnership if recognized by the jurisdiction within which they reside. Flight means a scheduled trip for which coverage has been elected and the plan payment paid and all travel arrangements are arranged by Expedia, Inc. prior to the Scheduled Departure Date of the trip. Home means your primary or secondary residence. Hospital means an institution, which meets all of the following requirements

- it must be operated according to law;

- it must give 24 hour medical care, diagnosis and treatment to the sick or injured on an inpatient basis;

- it must provide diagnostic and surgical facilities supervised by Physicians;

- registered nurses must be on 24 hour call or duty; and

- the care must be given either on the hospital's premises or in facilities available to the hospital on a pre-arranged basis.

Why should I purchase Expedia Cancellation Plan? You've saved, you've waited, and now you're all set to go on the trip of your life. Preparing for your trip should include covering yourself against unfortunate occurrences that may interfere with even your best-laid plans. By purchasing Expedia Cancellation Plan, you may be reimbursed for covered cancellation or interruption penalties. Unexpected situations can happen to anyone, even immediate family members that are not traveling with you, and provide you with a reason you might need to cancel or interrupt your trip. Did you know that Expedia Cancellation Plan can reimburse covered expenses if:

- You become ill and can't travel.

- Someone in your immediate family has an illness or injury and you must cancel or interrupt your trip, even if he or she is not scheduled to travel with you.

- Involuntary job loss

- Your house becomes uninhabitable due to a hurricane.

- An immediate family member back home passes away and you must return from your trip early.

- You are injured and must visit a doctor while traveling.

- Many other unforeseeable events as listed in the Description of Coverage.

What does Expedia Cancellation Plan cover? Expedia Cancellation Plan includes coverage for Trip Cancellations and Trip Interruptions. If you must cancel or interrupt your trip for a covered reason, the plan provides coverage for covered penalties and expenses up to the cost of your originally booked flight. In the event of an interruption, covered benefits include the new airfare paid, less the value of an unused return travel ticket, to return home or rejoin your trip (up to a maximum of the cost of the originally booked flight). Covered reasons include illness, injury or death to you, a traveling companion or an immediate family member. Additional covered reasons for cancellation include jury duty, the issuance of a subpoena for court or administrative hearing, involuntary job loss, having a home made uninhabitable by a natural disaster, hijacking, quarantine, and being involved in a documented traffic accident en route to departure. Please refer to the Description of Coverage for full details. There is no Pre-existing Condition Exclusion in Expedia Cancellation Plan. Will my current home, renters, or credit card policies cover me during my trip? Most people don't have any insurance coverage at all for penalties incurred when they need to cancel their flight. It is not a typical coverage found in homeowners and renters policies. Likewise, most credit cards do not offer trip cancellation coverage; however, check your documentation carefully to see if yours might. Who can I contact for more information? You may call Berkely, the plan administrator, with any questions regarding Expedia Cancellation Plan. Their CustomerCare representatives will be happy to assist you. Hide Via email: [email protected] Via phone: 1-877-718-4651 or 516-342-2720 Via mail: Berkely P.O. Box 9022 300 Jericho Quadrangle Jericho, NY 11753 Office Hours:8AM-10PM (EST), Monday-Friday 9AM-5PM (EST), Saturday This program was designed and is administered by Aon Affinity Berkely Travel. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc.; (AR 244489); in CA, MN & OK, AIS Affinity Insurance Agency, Inc. (CA 0795465); in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY and NH, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. As an MGA we are acting on behalf of our carrier partner. ` When is payment for the plan due? The plan must be purchased when your flight is purchased. How do I enroll in Expedia Cancellation Plan? The option to enroll is presented to you while booking your ticket. If you would like to purchase Expedia Cancellation Plan, simply select it and the cost of the plan is automatically included in the total amount due for your trip. Simply pay the amount indicated to purchase the plan. When does coverage go into effect and will it cover me for the entire length of my trip? The Trip Cancellation coverage takes effect upon receipt of the required plan cost by Expedia. The Trip Interruption Coverage takes effect at 12:01 AM on your scheduled departure date and location. The plan will cover you for the entire length of your Expedia-booked ticket. I am not a resident of the U.S. or Canada. Can I purchase the plan? Expedia Cancellation Plan is available only to U.S. residents and non-U.S. residents traveling to the U.S. who book their travel arrangements with Expedia. What happens if I need to cancel my trip? Please contact Expedia and Berkely as soon as possible in the event of a claim, as the insurer will not reimburse you for any additional charges incurred due to a delay in notifying Expedia of your cancellation. Berkely will then forward you the appropriate claim form in order to file a claim. How do I file a claim? You may request a claim form online via www.travelclaim.com or alternatively, call Berkely, the plan administrator, at 1-877-718-4651 from 8:00 am to 10:00 pm EST Mon-Fri or 9:00 am to 5:00 pm EST Sat. Please note that you may want to have a copy of your Expedia invoice handy as there are some details that will be needed in order to initiate your claim. This information includes your travel dates, date of cancellation, booking number, and some brief information regarding your reason for cancellation or interruption. Important: Be sure to also contact Expedia to notify them of cancellations, as well as to avoid additional expenses due to late reporting. Who is considered an "Immediate Family" member under the plan? Our definition of "Immediate Family" is quite broad. It's not just the family members who reside with you. "Immediate Family" includes: parents, spouses, domestic partners, grandparents, siblings, siblings-in-law, children, grandchildren, aunts, uncles, nieces, nephews, and business partners. See the Definitions section of the Description of Coverage for a full listing. Are there exclusions? Certain restrictions do apply. For example, the coverage in the plan does not provide duplicate payments if there are other sources of reimbursement available. Please see the Terms and Conditions for a full list of exclusions. Is there a Pre-Existing Condition exclusion? Expedia Cancellation Plan does not have a pre-existing condition exclusion.

Expedia Flight Cancellation & Insurance (7 Important Facts)

If you want to cancel a flight that you booked through Expedia, you need to know 7 things so that you don’t get frustrated and get every penny you owe from Expedia or your airlines.

This article also talks in-depth about Expedia travel insurance. The information outlined here will help you save money on your next trip.

Can Expedia Flights be Canceled?

The US Department of Transportation requires every airline to provide a 24-hour free cancellation option upon booking an airline ticket. Expedia honors this law.

It doesn’t matter whatever type of plane ticket you purchase from Expedia; your flight can be freely canceled within 24 hours of your ticket purchase, and you can get a full refund without any fees.

However, once the 24 window passes, Expedia will apply the airline ticket cancellation policy.

If you bought a refundable ticket, airlines would allow you to cancel your flights and refund you, but they would cut the cancellation fee from your refund money.

Budget airlines such as RyanAir, Frontier, and Spirit handle all the cancellation by themselves, and most of the time, they sell non-refundable tickets. Therefore, contact your airline directly if you want to cancel these tickets.

Sometimes, they can cancel a non-refundable ticket and give you travel credits which you can use at a future date with the same airline. However, they will not refund your full money; they will charge you a cancellation fee.

Can You Get a Refund from Expedia if Your Flight is Canceled?

Expedia offers two types of airlines on its platform for booking.

- Low-Cost Airlines

- Full Service Airlines

RyanAir, Frontier, AirAsia, Spirit, EasyJet, or Jetstar are low-cost airlines. If you hold tickets from any of these airlines and it gets canceled, you have to talk to the airlines for a refund or future alternatives directly. Expedia can’t help you get a refund with these airlines.

However, if the full-service airline cancels your flight, Expedia will handle all the refunds, and you don’t have to call the airline. Expedia will refund your money in original form to your bank or credit card. It may take up to 7 days to process the refund.

Related : 8 Reasons Why Expedia Is So Cheap (In-Depth Explanation)

Does Expedia Travel Insurance Cover Cancellation?

The Expedia travel insurance will not cover your flight cancellation either by you or your airline carrier. Travel insurance has strict claim guidelines, which we discussed below.

There are two types of Expedia flight insurance:

- Flight cancellation plan

- Flight protection plan

The flight cancellation plan is for domestic flights within the USA except for Alaska and Hawaii. The flight protection plan is for international flights, including Alaska and Hawaii.

Expedia doesn’t give these insurances. A third-party company named “AIG” provides this insurance. It’s similar to the car’s extended warranty that auto dealers sell. It costs a lot of money but isn’t that helpful.

Both of these travel insurance will refund your flight cancellation money if and only if the following criteria are met:

- You or your travel companion becomes seriously sick or injured and needs hospitalization. If the Physician says that your or your travel companion’s injury is life-threatening and you can’t travel, you can file a claim with AIG. However, you must submit a certified paper from your Physician when you file a claim. AIG will call your Physician to find the authenticity of your claim. Your claim will be denied if your hospital or Physician doesn’t receive the call.

- You or your travel companion receive a jury duty subpoena, or you are required to visit court as a witness in legal action.

- If you lose your job and were employed with the same employer for the last 12 months.

- You get into an accident while going to the airport and need medical attention. When filing your claim, you must submit a police report and certified hospitalization paper.

- You lose your passport. You must submit a police report with your claim.

As you can see, the travel insurance will refund you if and only if any of these things happen to you.

Expedia flight insurance will not refund your money if you cancel for any other reason.

However, please remember that criterion 4 and 5 doesn’t apply to all state residents. For example, for Indiana residents, these two criteria don’t apply. Therefore, if you lose your passport, AIG will not refund you.

Read the flight insurance policy from AIG here .

Related : Expedia Refunds (8 Things You Must Know For Quick Refund)

Is Expedia Cancellation Plan Worth It?

The Expedia flight cancellation plan does very little to protect a consumer. The claim criteria are ridiculously challenging and apply to almost no one. For most airline passengers, the cancellation plan is a waste of money.

In five rare circumstances, Expedia travel insurance will refund your money. Those circumstances are not only rare, but you will also have a hard time filing your claim successfully because of paperwork and verification.

It is not only an expensive plan, but it’s also useless.

We highly recommend you not buy the cancellation plan because AIG will usually deny your claim outright. This is how these insurances work.

The Expedia cancellation plan isn’t worth your hard-earned money.

Is Expedia Free Cancellation Really Free?

Expedia, on their website, advertises that they offer free cancellation. However, these cancellations aren’t really free.

Expedia is saying that they don’t charge the customer for cancellation. But the airlines or hotels might charge you a cancellation fee. If they do, Expedia will pass the cancellation fee to you.

Why Did Expedia Cancel My Flight?

Airline cancellation is common due to bad weather, pilot shortage, airline maintenance, or other reasons.

Expedia doesn’t cancel flights; airlines do. If you get your flight cancellation email or notification, call Expedia immediately.

Even though you have booked your flight through Expedia, it’s better to contact the airlines and ask for a refund. Or ask them to give you another ticket for your trip.

Sometimes Expedia proactively will book another flight for you.

Remember that Expedia will not reimburse you if you need to stay extra a few days in a hotel, nor will they refund you any money if you must leave early due to flight schedule changes.

If you need hotel accommodations due to flight cancellations, you have to talk to airline customer support.

If either Expedia or your airlines refuse to give you another flight ticket or refuse you a full refund, call your credit card company and put a chargeback claim. It’s because Expedia failed to provide you with a service for which they took the money.

How to Cancel Expedia Flight Insurance?

If you purchased the flight insurance, you have 15 days to cancel it to get a full refund of your insurance premium. However, if you already filed a claim with the insurance, you can’t cancel it.

To cancel the flight insurance, follow the steps outlined below:

- Go to My Trips on the Expedia website.

- Select Cancel insurance and follow the instructions.

You can also call Expedia to cancel your flight insurance.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Protect Your Travel Plans: Trip Cancellation Insurance Explained and the 5 Best Policies

Jessica Merritt

Editor & Content Contributor

93 Published Articles 508 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

156 Published Articles 776 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3254 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

The 5 best trip cancellation insurance policies, what is trip cancellation insurance, how trip cancellation insurance works, is trip cancellation insurance worth it, what trip cancellation insurance costs, choosing trip cancellation insurance , final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

You’ve booked your flight, hotel, and tours and are ready to go on your trip — but what happens if you can’t make it? Unexpected circumstances can pop up that force you to cancel your trip, such as illness or natural disasters. If you can’t get refunds from travel suppliers, trip cancellation insurance can help.

Let’s look at what trip cancellation covers, whether you need a trip cancellation policy, and what you should know before shopping for a plan.

You’ll have plenty of options if you want a cheap, standalone trip cancellation policy, comprehensive travel coverage, or Cancel for Any Reason (CFAR) coverage.

Consider these trip cancellation insurance policies that offer good value and coverage, quoted for a 35-year-old visiting Mexico on a $1,500 trip in September 2023:

Best Cheap Trip Cancellation Insurance: battleface

We were quoted just $20 for a battleface Discovery Plan with trip cancellation benefits up to $1,500. But that’s all it offers — you won’t get trip interruption coverage, medical coverage, evacuation, loss or delay, or other benefits offered by comprehensive travel insurance plans.

Best Extensive Trip Cancellation Reasons: IMG

IMG’s iTravelnsured Travel Essential plan isn’t CFAR coverage, but it has multiple covered reasons for cancellation. You’re covered for foreign and domestic terrorism, financial default, medical reasons, and accommodations made uninhabitable. Our $35.92 quote offered up to 100% of the total trip cost for trip cancellation and 125% for trip interruption.

Best Comprehensive Trip Cancellation Coverage: TinLeg

TinLeg’s Basic travel insurance plan covers up to 100% of your total trip cost for trip cancellation , but you’ll also get other major travel insurance coverages. This plan we were quoted $41 for offers trip interruption, travel delay, baggage delay, emergency medical, evacuation and repatriation, and more.

Best Layoff Protection: Aegis

Like the battleface plan, Aegis Go Ready Trip Cancellation insurance covers up to 100% of your trip cost if you need to cancel — but not much else. But a big value-add is employment layoff coverage , which allows you to get reimbursed if you need to cancel your trip due to involuntary layoff or termination of employment. We were quoted $45 for this plan.

Best Cancel for Any Reason: Seven Corners

The Seven Corners Trip Protection Basic plan offers optional CFAR coverage, which reimburses up to 75% of your trip cost for reasons not otherwise covered by your policy. Regular trip cancellation and interruption coverage offer reimbursement of up to 100% of your trip cost. Our quoted cost for this plan came to $58.

Trip cancellation insurance is a type of travel insurance. With trip cancellation coverage, you can get reimbursement for nonrefundable prepaid travel expenses if you need to cancel your trip before departure. Trip cancellation is one of the main coverage areas for travel insurance, the other being medical emergency coverage.

Many comprehensive travel insurance policies offer trip cancellation coverage; standalone trip cancellation insurance is less common than comprehensive travel policies. Travel credit cards may offer trip cancellation coverage as a cardholder benefit, as well.

Trip cancellation insurance kicks in if you must cancel your trip due to unforeseen circumstances such as an illness, injury, or other covered reasons. You can get reimbursed for nonrefundable expenses if you have travel cancellation insurance and need to cancel your trip.

Covered nonrefundable expenses typically include:

- Hotels and vacation rentals

- Rental cars

Travel insurance policies with trip cancellation coverage often include trip interruption benefits. Similar to trip cancellation coverage, trip interruption benefits can help you recoup your costs if you need to delay or cut your trip short due to covered reasons.

When To Buy Trip Cancellation Insurance

You can usually purchase trip cancellation insurance up to the day before your scheduled departure. Still, you’ll get more value if you purchase insurance as soon as you make your first trip deposit . That way, your travel plans are covered from the start.

Trip Cancellation Insurance Covered Reasons

Unless you opt for Cancel for Any Reason travel insurance, trip cancellation insurance only applies to covered cancellation reasons. For example, you can’t use trip cancellation insurance to cancel your trip for a refund because there’s rain forecasted for your beach vacation. But, you could get reimbursement if a named hurricane forms after you purchased your policy.

Common reasons covered by trip cancellation insurance include:

- Death, including the death of a family member or traveling companion

- Government travel warnings or evacuation orders for your destination

- Home damage or burglary

- Illness, injury, or quarantine that makes you or a covered travel companion unfit to travel

- Legal obligations such as jury duty or subpoena

- Natural disasters such as hurricanes, earthquakes, or floods affect travel operations at your destination

- Terrorist incidents at home or your destination

- Travel supplier cancellation

- Unexpected military duty

- Unexpected pregnancy complications

- Unexpected work obligations

These are common covered reasons for trip cancellation insurance, but policies vary in coverage . Reviewing the terms and conditions of your trip cancellation insurance is a good idea so you understand what’s covered.

You should also understand what’s explicitly not covered. For example, changing your mind is not a covered reason on a standard trip cancellation insurance policy. And trip cancellation insurance typically doesn’t cover foreseeable events, routine health treatments, substance abuse, sporting events, mental health, acts of war, self-harm, or dangerous activities such as skydiving.

Cancel for Any Reason Trip Cancellation Coverage

Need to expand your list of covered cancellation reasons? Cancel for Any Reason trip cancellation insurance is an option.

You can use CFAR to cancel your trip for reasons not covered by trip cancellation insurance, such as changing your mind, fear of travel, unexpected obligations, weather, or budget concerns.

The catch? You’ll pay more for CFAR coverage , and it only reimburses up to 50% to 75% of your nonrefundable travel expenses. Generally, trip cancellation insurance offers 100% reimbursement for covered expenses.

The other main stipulation is that you’ll need to purchase your coverage within a specified period , usually within 10 to 21 days of your first trip deposit. And to get reimbursement under CFAR, you must cancel your travel within the cancellation timeframe, usually at least 48 hours from your scheduled departure.

Annual Travel Insurance

Most annual travel insurance policies, also known as multi-trip policies, cover trip cancellation for multiple trips taken within the policy period, usually 12 months. You’ll also typically get coverage for medical expenses.

Trip Cancellation vs. Trip Interruption

Trip cancellation insurance covers your nonrefundable travel expenses if you have to cancel before departure, while trip interruption covers your trip costs after departure . For example, trip interruption coverage kicks in if you get injured while traveling and have to go home early.

Trip cancellation insurance can be worth it if you have nonrefundable travel expenses and there’s a risk you’ll have to cancel your travel due to unforeseen events. It offers financial protection if you’re traveling to a destination with potential risks such as natural disasters or political instability — or if you have risk factors at home, such as unpredictable work commitments or family members with health conditions that could interfere with travel.

If you plan an expensive trip with nonrefundable bookings or deposits, trip cancellation is probably worth it. But if your travel is inexpensive, or most of your travel expenses are refundable, you might not need trip cancellation insurance.

Consider the cost of insurance, the likelihood you’ll need to cancel, and the cost of nonrefundable travel at stake when you decide if trip cancellation is worth it.

A basic travel insurance policy with trip cancellation coverage generally costs between 5% to 10% of your trip costs . So a travel insurance policy for a $5,000 trip would cost $250 to $500. Your costs will be higher if you opt for CFAR coverage.

Factors that influence how much your trip cancellation insurance costs include traveler age, trip expenses, trip length, coverage options, and how many people you need to cover.

A comprehensive travel insurance policy with emergency medical or lost baggage coverage and trip cancellation coverage can offer additional value.

If you’re mainly concerned with trip cancellation coverage, look for cheap travel insurance policies that still offer this coverage, but have either nonexistent or low coverage limits for other coverage areas, such as lost baggage or medical evacuation .

Credit Cards With Trip Cancellation Insurance

You might not have to pay for trip cancellation insurance if you have the right credit card. Some credit cards offer trip cancellation and interruption coverage as a cardholder benefit.

Credit cards with trip cancellation coverage generally provide between $2,000 to $10,000 per person in trip cancellation benefits, often covering trip interruption.

For example, the Capital One Venture X Rewards Credit Card offers cardholders $2,000 in trip cancellation or interruption benefits per person. With the Chase Sapphire Reserve ® , cardholders get up to $10,000 per person in trip cancellation coverage with a maximum of $20,000 per trip and a $40,000 limit per 12-month period.

If your nonrefundable travel costs exceed the covered benefit offered by your credit card, you may prefer to purchase separate trip cancellation insurance.

If you only need trip cancellation and interruption coverage, your credit card may have adequate protection benefits.

Consider these factors as you shop for a trip cancellation insurance policy:

- Cost: Compare policy premiums and consider how the cost fits into your overall travel budget.

- Coverage Amount: Your trip cancellation coverage should cover all of your nonrefundable prepaid trip expenses. But a policy with too much coverage could be more costly than necessary.

- Policy Limits: Know the policy’s limits, including deductibles, exclusions, and limitations.

- Covered Reasons: A policy that offers a variety of covered cancellation reasons offers the most protection.

- CFAR Coverage: Understand whether CFAR coverage is included in the policy and its additional cost.

- Reputation and Customer Service: Read travel insurance reviews to learn about the experiences policyholders have had, whether they’re good or bad.

- Refund Policies: Understand what happens if you cancel your policy before the trip.

Travel insurance comparison sites such as Squaremouth make it easy to enter your trip details and get quotes from multiple insurance providers.

Trip cancellation coverage can provide valuable peace of mind if you’re concerned about losing nonrefundable prepaid travel expenses. It can be worth it if there’s a chance you’ll have to cancel your travel plans, and you’ll lose money on nonrefundable costs. Before you choose a trip cancellation policy, consider factors including cost, coverage, and cancellation reasons, and look at what’s covered with any credit cards you hold.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What is trip cancellation insurance for.

Trip cancellation coverage offers financial protection if you need to cancel or interrupt your trip due to unexpected circumstances. You can get reimbursement for nonrefundable prepaid expenses related to covered travel if you have to cancel your trip.

Is trip cancellation covered in travel insurance?

Most travel insurance policies cover trip cancellation coverage. Other common coverage areas include trip interruption and medical emergencies.

Does trip insurance cover cancellation for any reason?

Travel insurance can offer CFAR coverage, usually as an optional add-on. You can select a CFAR policy if you want more flexibility in canceling your trip and receiving reimbursement.

When should I buy trip cancellation insurance?

It’s best to purchase trip cancellation as soon as you have any money at risk on your trip, usually as soon as you book travel. Buying trip cancellation insurance after booking covers you for unexpected circumstances that could cause you to cancel your trip.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Things to do

- Groups & meetings

- List your property

Explore > New Destinations > Expedia Quick Guide to Cancelling a Flight or Hotel

Expedia Quick Guide to Cancelling a Flight or Hotel

If you’re looking to cancel an upcoming trip due to COVID-19, we understand and are here to help. Knowing your options and the right steps can sometimes require reading a lot of fine print, so we’ve taken the guesswork out of it and created a quick guide that tackles some of the most common questions customers have when cancelling their flight or hotel on Expedia.

Use the flowcharts below to find out what options and resources will be the most applicable to your specific travel plans.

More Customer Resources

For the most up-to-date traveller advisories and information on cancellations and refunds from Expedia, visit the customer service portal.

- Customer Service Portal

For answers to some of the most asked COVID-19 traveller questions including steps you should take to plan future trips, visit the Expedia FAQ page.

- Coronavirus Travel Advice

More Articles With New Destinations

Abu Dhabi is more than just the capital of the UAE; it’s an ultra-modern city where big desert, epic adventure, and next-level luxury come together to offer the perfect getaway. Looking for fine dining? You’ll find it on helipads, in revolving restaurants, and beneath a blanket of a million twinkling stars. Searching for the perfect… Continue reading Spend A Winter You’ll Never Forget In Abu Dhabi

La période des Fêtes approche à grands pas et de nombreux voyageurs ont déjà des plans et des aspirations de voyage. L’année 2022 nous a démontré que voyager n’est pas toujours facile puisqu’il faut parfois composer avec des imprévus, que ce soit des retards, des annulations ou même des hausses de prix des billets d’avion.… Continue reading Rapport d’Expedia sur les astuces de voyage en avion pour 2023 : il est conseillé aux voyageurs canadiens de réserver leurs billets d’avion dès maintenant pour économiser et éviter les retards de vols

We know the world can’t wait to see you again, and we can’t wait to get back out there either. So, we rounded up 18 locals-only secrets in some of the world’s most beloved cities to help you feel like an insider, no matter where your travels take you. New York City – It’s estimated… Continue reading 18 insider tips about the world’s favourite cities

The singer, songwriter and actor reveals his favourite destinations along with where to stay and what you can’t miss when you get there. Ever wanted to travel like a rock star? We caught up with singer, songwriter, actor, and avid traveller Joe Jonas to get his shortlist of his favourite hotels and things to do… Continue reading Joe Jonas shares his top travel picks

Entering what is hopefully the twilight of the pandemic in Montreal, there is reason to believe a sense of normalcy is on the horizon and optimism for the future. Expedia has teamed up with LNDMRK to create its ‘Helping Hand’ mural. Located in the heart of Montreal’s Plateau neighbourhood at 4411 Rue Berri, Montreal (QC)… Continue reading This Montreal street art will give you all the feels to inspire your next trip

- Skip to main content

- Skip to header right navigation

- Skip to site footer

milepro | travel like a pro!

travel smarter....travel like a pro!

Expedia Cancellation Policy: How to get a Refund from Expedia

Booking travel with expedia, expedia cancellation policies, how to cancel a flight you booked with expedia, expedia flight cancellation within 24 hours of booking, changing flights, expedia flight refund: how long before expedia issues my flight refund, are all flights reservations subject to refunds, steps to cancel or change an expedia hotel booking, non-refundable hotel bookings, will i get charged for canceling or changing a hotel room, expedia rental car cancellation & refund policy, expedia vacation package cancellation policy, priceline cancellation policy: how to cancel & get a refund from priceline, american airlines refund policy: how to get a refund on aa.com, united airlines refund policy: how to get a refund from united, delta airlines refund policy: how to get a refund from delta, how to get a refund from spirit airlines.

These days, with the help of online travel agencies (OTA’s) like Expedia, Orbitz, and Priceline , the process of booking tickets and coming up with a vacation plan is not so complicated. With just a few clicks, you can easily book the vacation of your dreams.

But what happens if you have to cancel? How does that work? Can you still get a refund, or is your money lost forever? Many travelers are unsure of the specific rules and regulations regarding cancelations, changes, and refunds when booking with an online travel agent.

In this article, we’ll take an in-depth look at the Expedia cancellation policy for all types of travel, including its terms and conditions, fees, and how to make changes or cancel your reservation. Whether you’re planning a trip or have already made a booking, this guide will help you navigate Expedia’s cancelation policy with ease.

For those of you who aren’t that familiar with Expedia , it’s an online travel agency used to book airline tickets, hotel reservations, car rentals, cruise ships, vacation packages, and more.

Expedia provides travelers with a convenient way to find the best deals on flights, hotels, cruises, and vacation packages. With Expedia, you can quickly search and book travel, often at lower prices than when booking direct with the travel provider.

On top of that, you can earn Expedia Rewards points, buy travel insurance, and even spread your payments out over a longer time period with a payment plan. There are a lot of positives when booking with Expedia.

However, booking with any third-party site has its drawbacks, and Expedia’s cancellation policy is one of them. Not because of a policy Expedia created. Rather, canceling or making changes to any itinerary booked with a third party involves a lot of back and forth regarding who you have your booking relationship with.

Airlines and hotels, in particular, will tell you that they cannot help you with your reservation, cancellation, or refund. You will have to go back to the party that booked your travel.

Here’s a detailed guide on Expedia’s cancellation and refund policy for each type of travel you can book with them. This includes airfare, hotels, rental cars, cruises, and vacation packages.

Expedia has different policies depending on the type of vacation service you get with them. Some require signing in to your account and canceling the service from there (hotels, flights, and rental cars) while others require getting in touch with someone from their customer service department (cruises and travel packages).

Expedia Flight Cancellation & Refund Policy

The cancellation process with a flight reservation with Expedia is very straightforward. Below I will walk you through the steps to process your Expedia flight cancellation along with screenshots.

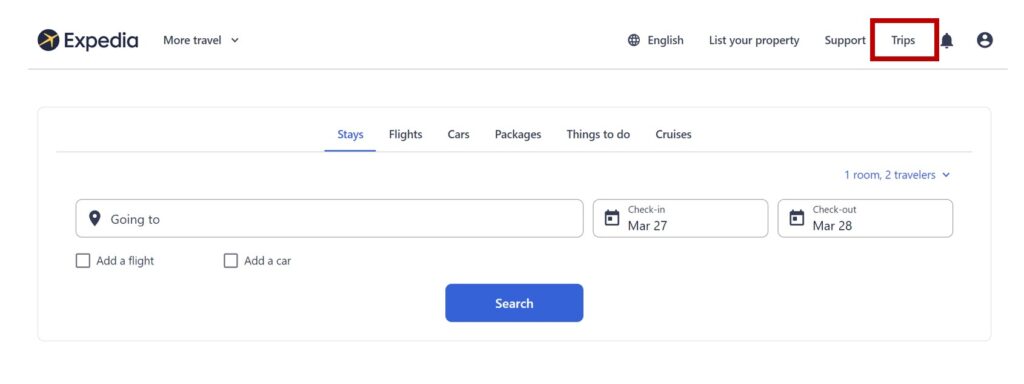

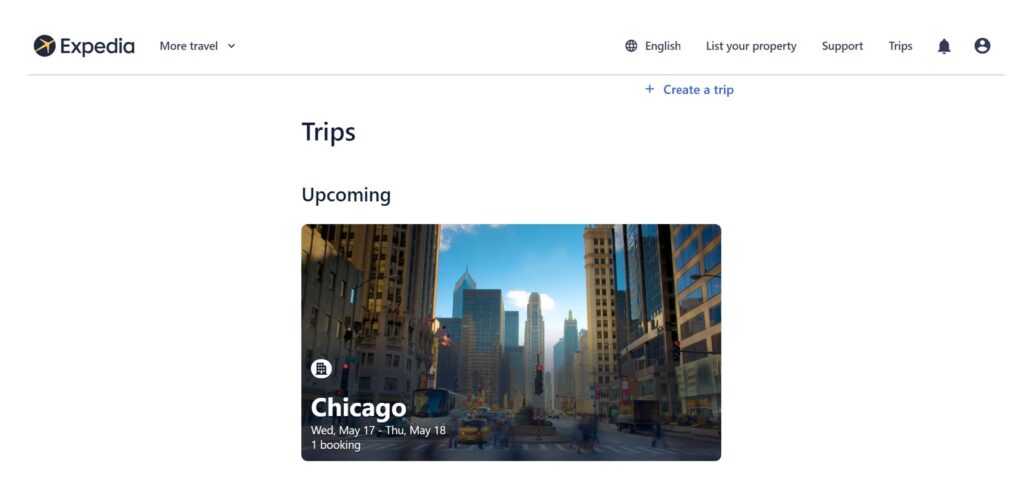

1. Go to expedia.com on your web browser and sign in to your account. On you are signed in, select the Trips button at the top right corner of the page.

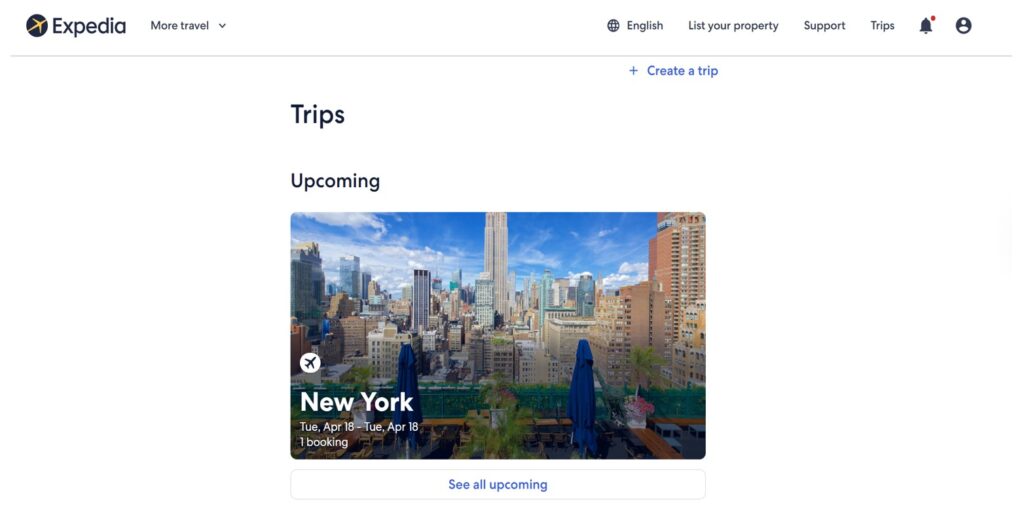

2. Click on the itinerary that contains the flight reservation you want to cancel from your list of upcoming trips.

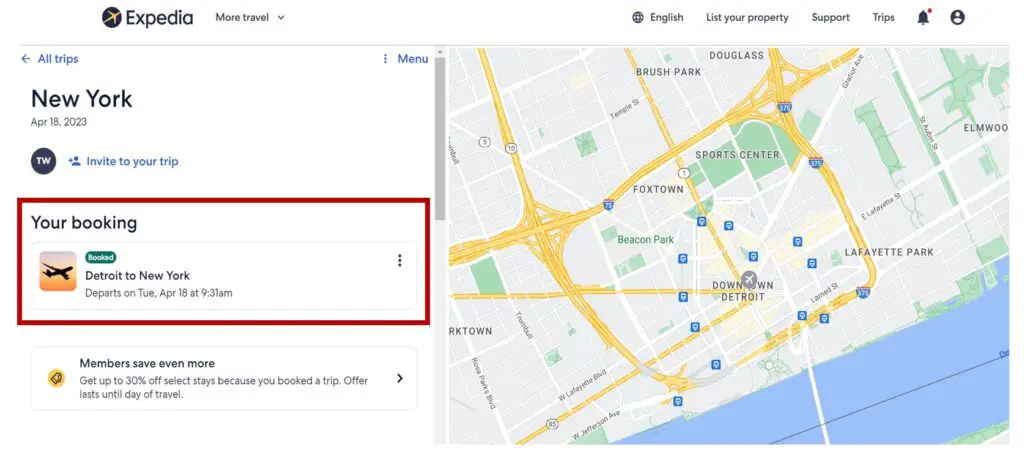

3. Select the booking you want to cancel

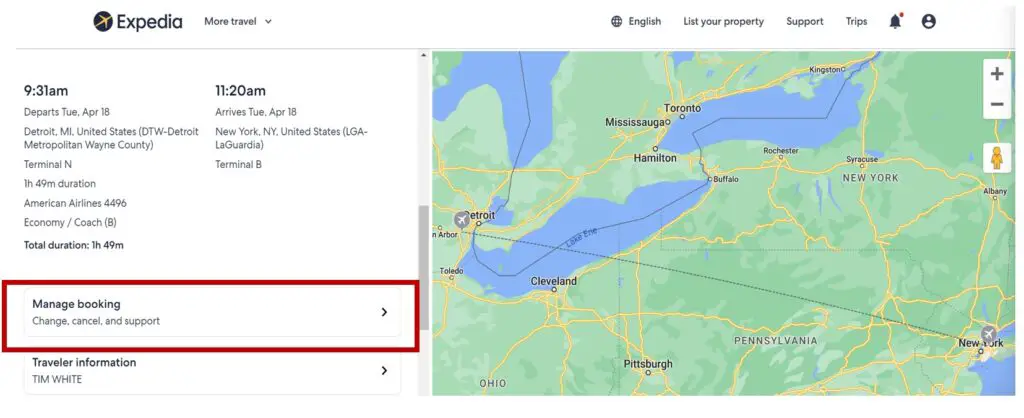

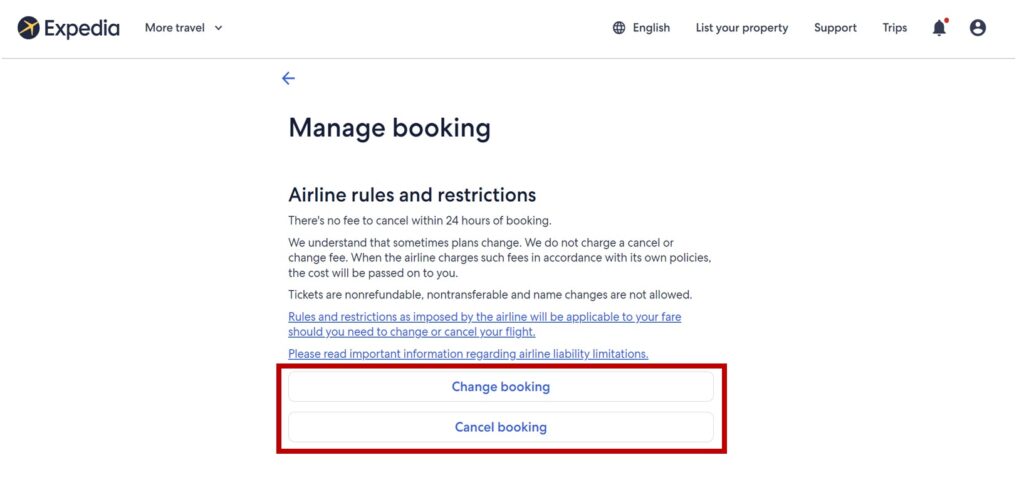

4. Click Manage Booking .

5. Click Cancel Booking .

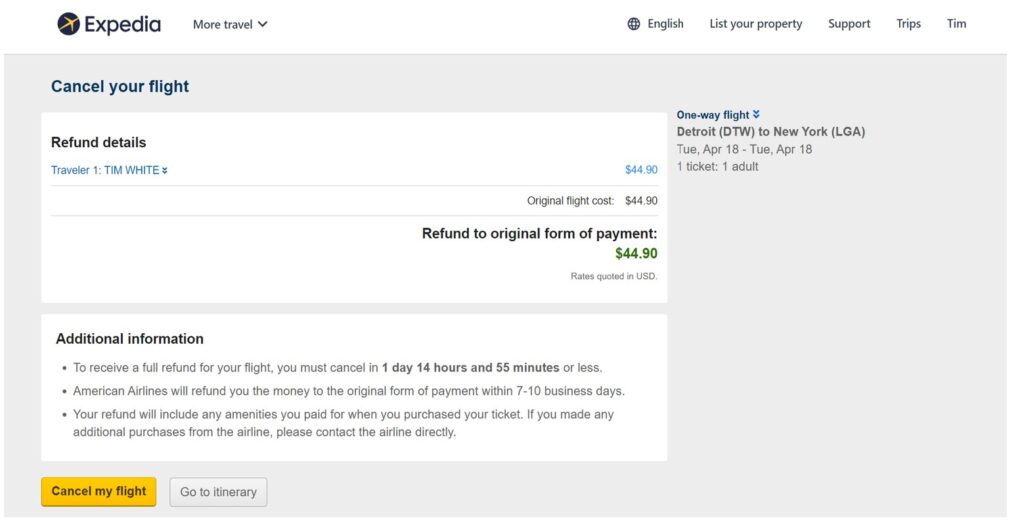

6. Review the refund details and the amount to be refunded. (In this example the flight is canceled within 24 hours of booking so a full refund will be applied).

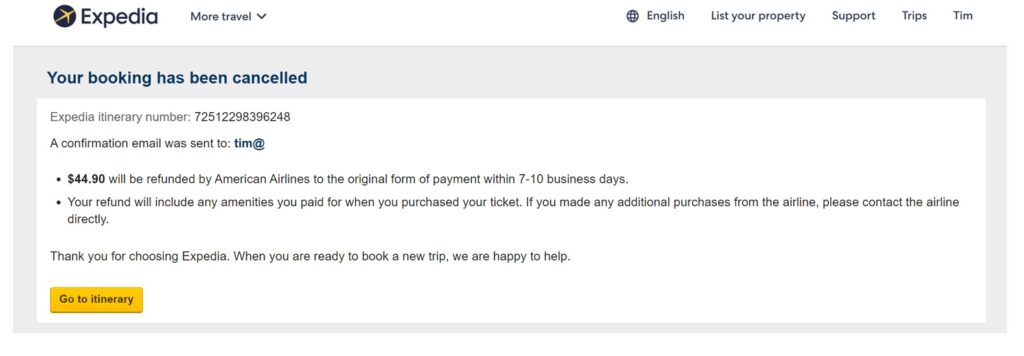

After you select the “cancel my flight” button, you will receive a confirmation summary that will be sent to you via email.

If you cancel a flight booked through Expedia within 24 hours of booking that flight, you will be eligible to get a full refund. This is a rule mandated by the Department of Transportation .

If you booked the wrong flight or decide to change flights, you may still end up getting charged by the airline. Airlines may also have other rules and restrictions in place, such as requiring you to book a new ticket on the same airline and paying the difference in ticket costs if the cost of the new flight is more expensive than that of the old one.

Many, but not all, airlines have made “no change fees” a part of their policy since COVID-19. However, the “no change policy” usually doesn’t apply to bargain fares, such as Basic Economy or Saver fares. They also typically apply to domestic travel only and not international travel.

Expedia tries to do its best to get any refund owed to you as soon as it can. Nevertheless, while they are the ones who process your cancellation, acting as the mediator between you and their travel partners (e.g. airlines, hotels, cruise ships), it’s still up to the travel partners to process your refund.

For flight cancellations, most refunds are issued within 3-6 weeks. Depending on the airline, however, some refunds may take longer, especially with the high volume of cancellations due to COVID-19.

However, if you cancel your flight within 24 hours, you will get your refund within 7 business days if paid by credit card, and within 20 days if paid by cash or check.

Even if you cancel your flight within 24 hours of buying it or even several days or weeks before your trip, some flights aren’t subject to refunds—even a partial one. Before you book the flight through Expedia, it’s best to check the terms and conditions of the itinerary so you can find out if it’s subject to a refund or not.

Some flights, though they aren’t subject to a refund, have other options so that, even if you cancel, you aren’t at a complete loss. Instead of getting a full or partial refund, you may be able to receive credit for a future flight from the same airline. If you have to cancel your flight, it’s best to cancel as soon as possible so you can still get a refund or travel credit.

For future trips, you may want to apply the “Free Cancellation” and “No change fee filters” when you’re looking to book flights, hotel accommodations, or other trip packages.

Expedia Hotel Cancellation & Refund Policy

The cancellation process with a hotel booking is very straightforward and very similar to canceling a flight with Expedia. Below I will walk you through the steps to cancel along with screenshots.

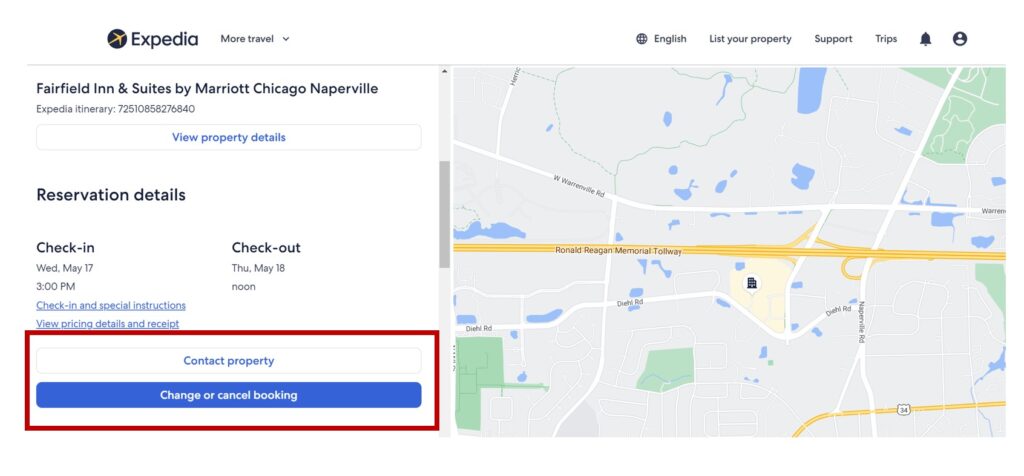

1. Go to expedia.com on your web browser and sign into your account. Then click on the trips button in the upper right-hand corner to find all of your open trips and bookings.

2. Select the trip you want to cancel or change

3. Go to the reservation details and click on the “Change or cancel hotel booking” button

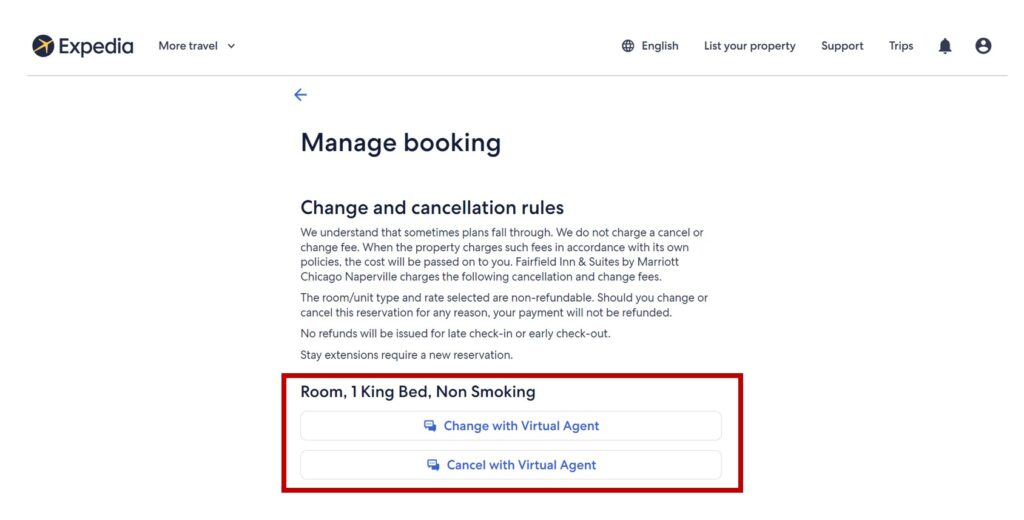

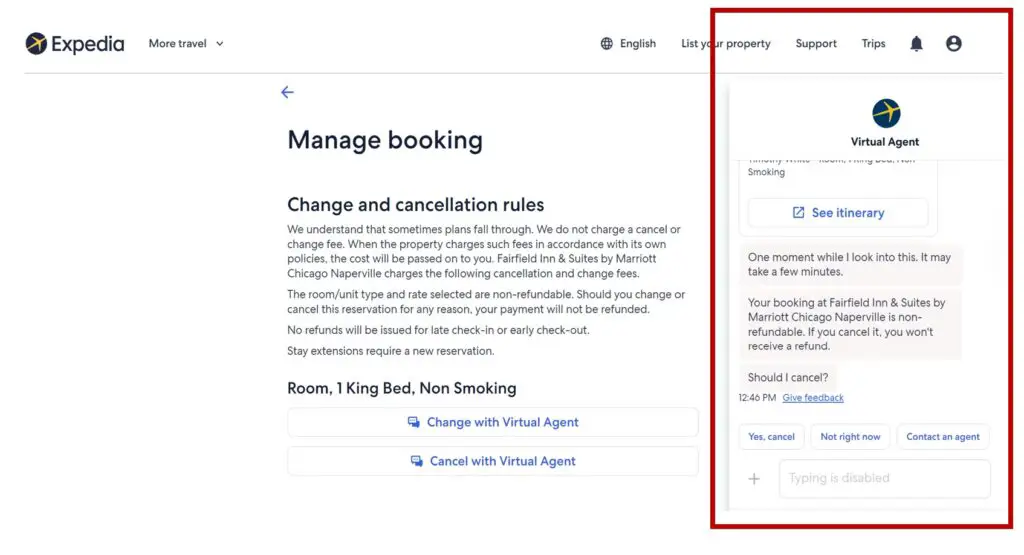

4. In the “Manage Booking” section you will find 2 buttons. One to change your hotel booking and one to cancel the hotel booking. Either way, you will be directed to a chatbot to work with a virtual agent.

5. The virtual agent will communicate with you in a chat box and help you make the change or cancellation. If you have a non-refundable hotel booking, this is when you will find out you cannot cancel. If the reservation is fully refundable they will finalize the cancellation.

Expedia Hotel Cancellations: The Fine Print

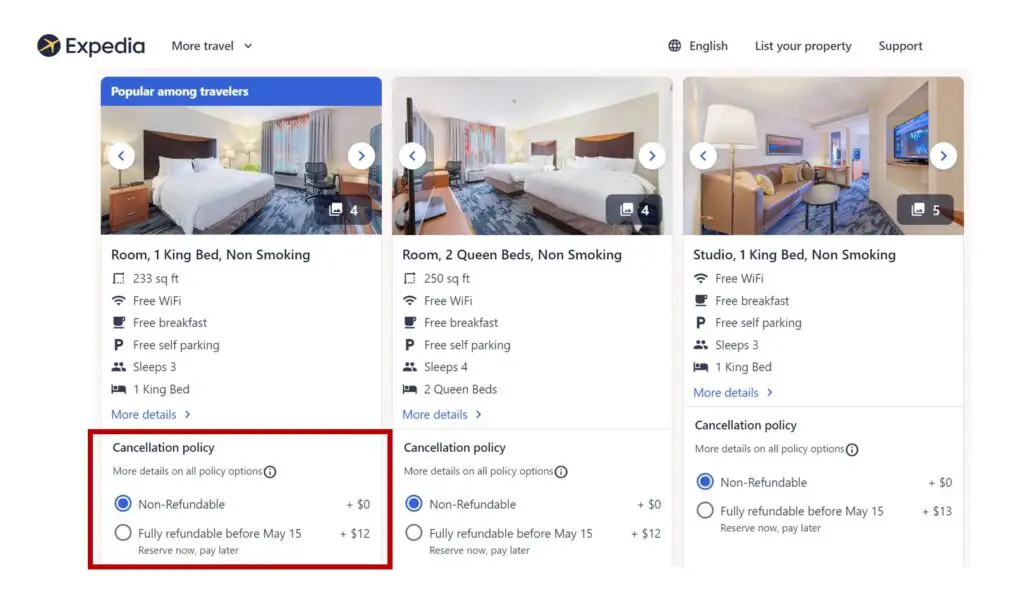

Most of the time, whether or not you can get a refund for a canceled hotel room depends on the rules and restrictions of the hotel. This may also depend on the specific room or type of room you booked. Before booking, it’s always best to read the fine print of your bookings and itinerary and know if your rate is refundable or non-refundable.

One of the biggest problems you can run into when trying to cancel a hotel reservation is if you booked a non-refundable room rate. In an effort to show the lowest price first, Expedia will default to the non-refundable room reservation. If you’re not paying attention, you can book a non-refundable room reservation and not even know it. (Trust me, I have done it before…)

If you accidentally (or intentionally) book a non-refundable room reservation, don’t plan on getting a refund. Hotels are very strict on this policy and very rarely will they even consider the option of a refund when you have a non-refundable reservation.

Expedia will not charge you any money for changing or canceling a hotel room. Some hotels, however, may do so, depending on their rules and regulations. Some hotels might charge a fee for changing or canceling your booking any time between the moment you booked it to within 48 hours of checking in. If you know you plan to cancel, it’s best to act as soon as possible, so you don’t have to pay for all those extra fees.

While most hotels will allow you to change several things free of charge, some changes, including the type of room, the new date of stay, the number of guests, and even check-in and check-out dates, may end up with the hotel charging you additional fees.

The process for canceling rental car reservations is similar to canceling a flight or hotel. You will log into your account, go to “my trips” and manage it from there. Below are the steps you need to follow.

How to Cancel a Rental Car on Expedia

- Go to expedia.com on your web browser.

- Sign in to your account.

- On the menu, click on My Trips .

- Click on the travel itinerary with the car reservation you wish to cancel.

- Click Manage Booking .

- Click Cancel this Car .

Canceling Your Car Reservation Any Time

Unlike flights and hotel room reservations, most rental car reservations allow you to cancel at any time, and they won’t charge you an extra fee or enforce some sort of penalty. However, if you need to make some changes to the car reservation you booked, you will not be able to do so. Instead, you can cancel it and book a new reservation.

In order to cancel an entire vacation package, you will need to contact the customer service department directly at 1-800-551-2534. These trips cannot be canceled online. For canceling or changing individual parts of your vacation, see the sections above.

Expedia will not charge a fee to cancel a hotel, rental car, or activity as part of a vacation package. However, the companies that provide these services may charge you fees to change or cancel them, as per their rules and restrictions (which you can read in your itinerary). These fees are applied on a per-item basis, rather than on the whole general itinerary, so keep that in mind.

Expedia Cruise Cancellation and Refund Policy

Canceling a cruise booked with Expedia is a little more complicated than a flight, hotel, or rental car booking, so you cannot cancel online like you can with those bookings.

If you want to cancel an Expedia cruise, you will have to call the cruise division’s customer support department. Their phone number is 1-888-249-3978. You may also want to contact the specific cruise line that you’re booked with directly since it is ultimately their cancelation policy that will drive the decisions.

When you cancel a cruise, you may have to pay fees for canceling, depending on how far in advance you cancel, what kind of reservation you have, and which cruise line you booked with. You can check the specific cruise lines’ cancellation policies in your itinerary on Expedia.com.

Here is a summary of the cancellation policies for all of the cruise lines that work with Expedia:

AmaWaterways

- For the most up-to-date information on suspended sailings click here .

- If the recent advisory or relaxed policies do not cover your cruise please refer to these Cancelation Policies and General Conditions, Rules & Regulations .

Avalon Waterways

Carnival Cruise Lines

Celebrity Cruises

Costa Cruise Lines

Crystal Cruises

Disney Cruise Line

Emerald Waterways

Holland America Line

MSC Cruises

Norwegian Cruise Line

- If the recent advisory or relaxed policies do not cover your cruise please refer to these Cancelation Policies and General Conditions, Rules & Regulations .

Oceania Cruises

- Please refer to these Cancelation Policies and General Conditions, Rules & Regulations .

Princess Cruises

Regent Seven Seas Cruises

Royal Caribbean International

Seabourn Cruise Line

Uniworld River Cruises

Viking Ocean Cruises

Viking River Cruises

Summing Up: Expedia’s Cancellation and Refund Policies

When it comes to canceling or changing trips, Expedia’s policies are pretty straightforward. It’s easy to book with them, and it’s also easy to cancel in case you can’t push through with your trip. If you have an account, you can navigate to the itineraries you’ve booked and change or cancel them accordingly. If all else fails, contact their customer service to have things straightened out.

Frequently Asked Questions

Unfortunately, it doesn’t work that way. If you booked a vacation package, canceling the whole package requires canceling your flight and hotel reservation and everything else you booked separately.

If you don’t have an account, you can use the itinerary or confirmation number in your order. You will find this in the email you received when you booked your trip.

No, “Unpublished Rate” hotel rooms can never be changed or canceled.

For hotel accommodations, car rentals, and activities, it may take up to 48 hours to receive your refund. If the hotel is the one that processed the charge, the refund timeline is up to them. For complete vacation packages, since you need to cancel each item separately, each part of the vacation package is also processed separately. Expect the refund to take a little longer than usual.

No. When you book travel with Expedia, you will have to work with them throughout the process including changes and cancellations. The travel provider will just refer you back to Expedia.

Related Content:

Tim is a business road warrior and avid leisure traveler who has flown over two million miles in the air and spent well over a thousand nights in hotels. He enjoys sharing tips, tricks, and hacks to help readers get the most out of their travel experience and learn how to “travel like a pro”!

Reader Interactions

May 14, 2024 at 9:38 am

I booked a 4 night stay in Marrakech through Expedia. Property was advertised as non-smoking and non-refundable. Upon arrival, I was affronted by smoke everywhere. I’ve asked the riad (4+ rating) for a refund, which was refused. I have requested a refund with Expedia, given the circumstances and given that we needed to book other accommodations as I am allergic to smoke (at a vastly increase in $), and have been told by Expedia that they are unable and unwilling to help. Can you suggest another recourse? This laisser-faire attitude on behalf of both parties is unacceptable! Would appreciate any suggestions you can provide.

May 15, 2024 at 8:25 am

Sorry to hear about your experience. There is nothing worse than the smell of smoke in a hotel. One other option you may have is via the credit card you used to book the hotel. If you use a Chase Sapphire card or an AMEX Platinum or another travel credit card, they are generally very good about working with the provider to get a refund. What card did you use?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Enter your ZIP Code!

Get a quote today., expedia travel insurance: plans, costs, reputation, & services.

Expedia markets itself as “the world’s travel platform.”

In business since 1996, the company has grown to be one of the biggest travel insurance providers in the world.

It has several plans with different coverage levels suitable for a variety of travelers, helping keep its spot as a leading travel insurance company in the industry.

Expedia’s plans can be customized with a variety of add-ons and extra benefits that let travelers make sure they get the best travel insurance for their needs and budget.

Travelers can find out more about the costs of an Expedia travel insurance plan by visiting its website and inputting their personal information, with the details of their planned trip.

The company routinely provides flights and hotels, bundling travel insurance as part of this main offering.

Expedia’s travel insurance is only available for purchase when you book your trip and accommodation with the company.

Aon Affinity Travel Practice, who administers Expedia’s travel insurance policies, has a rating of A+ from the Better Business Bureau (BBB).

This is an indicator of the efficient way this company deals with complaints that are filed against it.

While it had 49 logged complaints within the last 12 months, according to the BBB, the company’s prompt response time is reflected in its A+ rating.

Expedia provides a mobile app which gives its customers the ability to file a claim from anywhere in the world.

It also offers 24/7 telephone support.

While this is a pretty standard offering in the travel insurance industry, it’s a great relief knowing that if you need to talk to your travel insurance provider from a different time zone, you’ll be able to.

An insurance company’s financial stability is regularly overlooked by potential customers, but can often be just as important as analyzing travel insurance reviews.

Expedia’s underwriting company, Stonebridge Casualty, has received a rating of “A” by A. M. Best through its parent organization Transamerica Casualty.

Financial stability should always be something to consider when you’re looking at travel insurance providers .

Expedia Travel Insurance Coverage & Plans

Expedia travel insurance offers a wide variety of coverage plans to ensure protection across a variety of situations.

Each offering has several available levels of coverage, so there’s a big chance you can find something that’s right for you to protect you when you’re away from home.

Expedia travel insurance provides the following types of coverage:

- Comprehensive

- Trip Cancellation/ Interruption

- Accidental Death

Expedia Package Protection

This plan provides trip cancellation and interruption coverage.

It also includes reimbursement for any expenses incurred if your travel is delayed due to mechanical failure, strike, or adverse weather conditions.

This plan also protects you in the event of medical emergencies and can help with the costs of medical expenses and medical transportation.

Baggage and personal property is covered, so any lost, stolen, or damaged items during travel can be replaced.

If a hurricane warning has been issued and you need to change the specifics of your trip, the company may waive cancellation fees and liaise with its partnering companies to waive its associated fees as well.

You can also receive assistance with re-booking the entirety of your trip, including your flight and any activities you may have booked.

Though Expedia only offers one travel insurance plan, the company has a wide range of add-ons.

These include coverage for lost passport and document assistance, emergency cash, translation services, medical case management, and concierge services such as restaurant or event referrals and reservations.

While these add-ons may understandably increase the cost of your travel insurance, they also provide you with a greater degree of protection and offer added value.

Expedia Travel Insurance Costs

Travel insurance generally costs between 4 and 8 percent of the total trip.

While this is the industry standard, the actual costs of your travel insurance usually depend on the level of coverage you select and how comprehensive your plan is.

Travel insurance companies base their actuarial math on several factors.

The length of the trip is a significant determiner, as the longer you’re traveling, the more likely adverse calamities could occur. Destination dramatically impacts the price as well.

If you’re visiting an area with a high crime rates, political unrest, or poor infrastructure, to name just a few, insurance providers may view you as a higher risk. The age of the policyholder can also influence the price of the premium.

Generally, consumers aged 70 or over can expect to pay considerably more for their travel insurance.

The price of travel insurance is calculated based on risk, and the older you are, the more your risk increases in the eyes of the insurance providers.

Travelers can get a quote from Expedia by visiting its website and providing precise details of the trip that they plan on making.

Expedia doesn’t have annual options available, so it may not be possible to get a standard rate year in year out.

There’s no minimum age limit for insuring children via this company, though dependents are covered under their parents’ policy.

Expedia only refunds policies purchased ten days before the trip, provided no claims have been made.

Customer Reviews & Reputation

Before purchasing any travel insurance policy, it’s important to look at the insurer’s reviews, to gain insight into the company should you need its services on your trip.

Expedia (through Aon Affinity) has been awarded the Better Business Bureau’s highest rating of A+.

Though this rating is not uncommon, it is noteworthy that Aon Affinity has closed 49 complaints in the past 12 months.

This high volume of complaints can be attributed to the fact that this company is quite a large insurance provider.

Customer Assistance Services

When you take out a travel insurance plan with Expedia, you benefit from 24/7 support and access to its mobile app, with paperless claim filing available.

Choosing a travel insurance company that has modern interfaces is always a good choice, as instant access can significantly reduce your stress should something go wrong on your trip.

Another critical aspect to consider, and one which may not initially cross your mind, is whether the insurance company you choose has 24/7 support available.

This is particularly important for travel to far removed time zones from your own.

Expedia also provides additional concierge services such as ground transportation, up to the minute travel advice, and event or restaurant referrals and bookings.

Expedia Travel Insurance Financial Stability

Financial stability is an essential factor to consider when choosing an insurance company.

Dedicated credit rating agencies such as A.M Best, Standard and Poor’s, and Moody’s analyze insurance companies and report their findings, publishing results regularly.

Good ratings with any of these are generally indicative of a company’s ability to meet its obligations.

Expedia is underwritten by Stonebridge Casualty, a subsidiary of Transamerica Casualty, which has received a rating of A from A. M. Best.

This high rating shows that the backing company can meet its ongoing insurance obligations.

If there were any concerns with the quality of the coverage offered by this company, or of its ability to make good on claims, A. M. Best would have a lower rating.

Expedia Travel Insurance Phone Number & Contact Information

- Homepage URL : https://www.expedia.com/

- Provider Phone : (877) 227-7481

- Headquarters Address : 333 108th Ave NE Ste 300, Bellevue, WA 98004-5736

- Year Founded : 1996

Best Alternatives to Expedia Travel Insurance

Not satisfied with what Expedia has to offer? These companies provide great travel insurance alternatives:

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

- Things to do

Explore > Company > News > Got questions about your travel plans? Here’s what you should know if you’re changing or canceling a trip due to COVID-19

Got questions about your travel plans? Here’s what you should know if you’re changing or canceling a trip due to COVID-19

We’re here to help answer your questions about making changes to your existing travel plans due to the ongoing COVID-19 pandemic. Please read the latest updates below and visit our Customer Service Portal for online tools to help you change or cancel travel plans.

Latest Updates

We will keep this page regularly updated to ensure we are providing the latest guidance, travel suggestions, and links to pertinent coronavirus information.

June 26, 2020

Interstate Travel Quarantines:

- The travel quarantine announced on June 24, 2020 by the Governor of New York means travelers returning to New York, New Jersey or Connecticut from 8 U.S. states will be required to self-quarantine for 14 days. Those states are: Alabama, Arkansas, Florida, North Carolina, South Carolina, Utah and Texas.

- Governor of Hawaii announced on June 24, 2020 that all travelers arriving in Hawaii from out-of-state will be required to get a valid COVID-19 test prior to their arrival, and to show proof of a negative test result, to avoid the 14-day quarantine. The pre-travel testing program begins August 1.

- Customers who wish to change or modify travel plans due to these travel quarantines should review the terms and conditions of their air and/or hotel bookings to see what they are eligible for.

- Many airlines are allowing customers to cancel without penalty one time per ticket and receive a flight credit or change the date of their travel. Customers can cancel and view their airline’s policies by heading to their My Trips page and using self-service links in their itineraries.

- In some cases, customers with non-refundable hotel bookings may be eligible for a voucher (based on the property’s policies). Refundable bookings can be canceled in My Trips .

July Travel Dates:

- Customers with air travel booked for the month of July who wish to cancel may be eligible to cancel without penalty and receive a flight credit. Most customers with July travel would have received an email allowing them to cancel for a credit. Travelers can also cancel themselves using self-service tools in My Trips .

- For hotels, many of our travel partners continue to review and update their policies. Check My Trips to see if your reservation qualifies for free cancellation. If your reservation does not qualify, you can still cancel your reservation, but standard cancellation policies will apply.

May 27, 2020

June Travel Dates:

- Customers with international lodging bookings, as well as those with lodging bookings at select domestic properties, who are scheduled to begin their stay on or before June 30, 2020 and booked prior to March 19, 2020, will be eligible for a full refund or, in some cases, a voucher allowing them to rebook the original property at later dates. For options on how to manage your itinerary, head here: https://www.expedia.com/service

- Customers who booked a non-refundable rate for a stay scheduled to begin after June 30, 2020 , should continue to check our site for updates. As the situation evolves, we will continue working with travel partners as necessary to implement flexible policies.

May 8, 2020

Information for travelers that purchased travel insurance:

- The World Health Organization (WHO) has declared COVID-19 a global emergency and a pandemic. For more information on what may or may not be covered related to COVID-19, please click here for United States residents , and here for non-US residents .

If I intend to file a claim, do I still need to cancel my travel booking?

- Yes, if you are not planning to travel due to COVID-19, you should cancel your travel before your travel start date to ensure that you do not forfeit any refunds, vouchers, or credits offered by the travel suppliers. You can initiate cancellations and check booking status by logging in to your online itinerary at My Trips .

- If your travel is not immediate, please note that you may want to check back closer to your travel date as cancellation policies continue to evolve.

How do I submit a claim?

- Please visit the AIG website to submit a claim directly. Be sure to have your policy or itinerary number handy, as well as the last name the booking is under. Please note that AIG is currently processing insurance claims in order of trip date.

If you have any additional questions regarding your insurance policy, please connect with AIG .

Information for travelers that purchased Vacation Waiver:

- If you purchased Vacation Waiver we’ll reimburse you for any change or cancellation fees you are charged by a travel provider. If there are no change or cancellation fees involved in changing or cancelling your travel plans, then there is nothing additional for Vacation Waiver to provide.

April 24, 2020

May Travel Dates:

- If you are traveling between now and May 31, 2020, we have new options to cancel your trip online at Expedia.com/trips or you can submit our cancellation form at Expedia.com/travel-alert-refunds . If none of the above solutions worked, and your trip begins within the next 10 days, use the “Contact Us” button at the top of expedia.com/service to speak directly with an agent. There are still currently extremely high hold times, so please do not call if you are not departing in the next 10 days so that we can better support travelers with more imminent needs.

- Now that the impacts of COVID-19 on travel plans are more widely known, and our teams have worked hard to ensure customers are able to manage their bookings via robust self-service tools, we are putting some of our previous cancellation policies back into place. For example, if a lodging booking has a cancellation window in May, we expect travelers to abide by that cancellation window to avoid penalties.

- We will continue to notify customers as their cancellation window approaches. We encourage travelers to review their plans and let us know if they intend to travel or not.

Update for travelers with tickets booked on Qantas (travel before July 31):

- For those of you with bookings on Qantas, they have extended and simplified their flight credits for customers with impacted travel plans. If you’re due to travel on a Qantas flight before July 31, 2020 and wish to change your plans, you can cancel your booking and retain the full value as a flight credit. Change fees will also be waived when you are ready to re-book. Flight credits must be requested by April 30, 2020.

- Customers traveling beyond May 31, 2020 who are unable to self-service online—we will reach out to round-trip ticket holders directly via email to give you the option to cancel your flight for credit. Please be sure to keep an eye out and to check your spam/junk mail.

April 17, 2020

Update for travelers with tickets booked on United (June travel and beyond):

- For tickets issued on or before March 2, 2020 with travel scheduled for June 1-Dec 31, 2020, travelers must change or cancel by April 30, 2020 to ensure your change fees are waived and to receive two years to use the airline credit we will issue to you on their behalf. If you aren’t ready to re-book, no worries! Just make sure you cancel the flight for the credit. We’ll be sending out an email to you in the next few days to make it easy for you to do this, so please keep an eye out and check your junk mail. Alternatively, if you’ve already submitted your request to our Travel Alert Refund form , there’s nothing else you need to do as we’ll process that for you.