APIA Travel Insurance Review

An Aussie Insure summary of...

APIA Travel Insurance is an integral part of the APIA insurance company. The company specialises in providing specific travel cover including multi-trip and group excursions mainly aimed at Australia's senior citizens. APIA also have a selection of products for those who are planning a trip far afield or within Australia.

APIA offers excellent cover containing decent benefits that will suit most Australians planning a holiday, business trip or other trip. Their policies are priced quite reasonably and the protection they provide represents good value when comparing to other Aussie insurance brokers.

APIA Travel Membership

APIA Travel's membership has grown considerably during the past number of years. Their customers can choose from many types of cover from basic insurance policies to products that are furnished with several extra benefits.

Like most other travel insurance companies, when applying for a claim from APIA, there could well be a standard excess charge. But when financial experts analyse the average monthly premiums that are charged, most would say they are reasonably priced considering the quality of cover they provide.

APIA Travel Insurance Online

Purchasing an online policy from the APIA website is relatively easy. Click the link below and follow their step-by-step instructions and your personal quote will be calculated within a few moments.

APIA Travel Insurance Contact Details

Below you will find contact details for APIA Travel Insurance compiled by the Aussie Insure research team.

Website: APIA Travel Insurance

Telephone: 13 50 50

APIA Travel Insurance Notes

Please note that the information on this page concerning APIA Travel insurance is accurate at the time of publishing. However, details of insurance companies and brokers may change in the future. Although the team at Aussie Insure strive to keep company information up to date there will be occasions when some info may be out of date.

Best Performing Travel Insurance Companies

Here are the top performing travel insurance companies in Australia according to the latest expert, retailer and customer reviews.

Travel Insurance Companies

One Cover Travel Insurance

A1 Travel Insurance

AAMI Travel Insurance

ACE Travel Insurance

AHM Travel Insurance

AIG Travel Insurance

Alliance Travel Insurance

Allianz Travel Insurance

ANZ Travel Insurance

APIA Travel Insurance

Australian Unity Travel Insurance

Avant Travel Insurance

Bankwest Travel Insurance

BOQ Travel Insurance

Budget Direct Travel Insurance

Bupa Travel Insurance

Canstar Travel Insurance

CGU Travel Insurance

CHI Travel Insurance

Choice Travel Insurance

Chubb Travel Insurance

Columbus Travel Insurance

CommBank Travel Insurance

Cota Travel Insurance

Defence Health Travel Insurance

Easy Travel Insurance

Fast Cover Travel Insurance

GIO Travel Insurance

GMHBA Travel Insurance

Go Travel Insurance

Good To Go Travel Insurance

HCF Travel Insurance

HIF Travel Insurance

ICICI Travel Insurance

Insure & Go Travel Insurance

iTrek Travel Insurance

Lloyds Travel Insurance

Mastercard Travel Insurance

Mondial Travel Insurance

NIB Travel Insurance

NRMA Travel Insurance

Ouch Travel Insurance

Priceline Travel Insurance

Probus Travel Insurance

QBE Travel Insurance

RAA Travel Insurance

RACQ Travel Insurance

RACT Travel Insurance

RACV Travel Insurance

Real Travel Insurance

Seniors Travel Insurance

SGIO Travel Insurance

Southern Cross Travel Insurance

Southern Star Travel Insurance

Suncorp Travel Insurance

Suresave Travel Insurance

Surf Travel Insurance

Teachers Health Travel Insurance

Tick Travel Insurance

Vero Travel Insurance

Virgin Money Travel Insurance

World Care Travel Insurance

World Nomads Travel Insurance

Zurich Travel Insurance

Travel Insurance Advice

Best Travel Insurance Reviews

Insurance Brokers

Car Insurance

Life Insurance

Home Insurance

Travel Insurance

Business Insurance

Privacy Policy

- Business & Gov

- Residential

- White Pages >

- Australian Pensioners Insurance Agency

We won't use your number for marketing purposes.

This service is subject to our terms of use .

At Apia, we realise that the more you live life, the better you get at it. So it's only fair that the experience you've gained should count for something. That's why we reward people over 50 for their experience, with better insurance products and the service you deserve.

So if you're looking for home insurance , car insurance , caravan insurance , boat insurance , motorhome insurance , travel insurance , motorcycle insurance , funeral insurance and health insurance that rewards experience, then Apia is for you.

Home Insurance

- Home and Contents Insurance

- Apartment Insurance

- Village Insurance

- Landlord Insurance

- Assisted Living Insurance

Motor Insurance

- Car Insurance

- Third Party Car Insurance

- Caravan Insurance

- Motorhome Insurance

- Motorcycle Insurance

Other Insurance

- Health Insurance

- Boat Insurance

- Travel Insurance

- Funeral Insurance

Go to Facebook page

General Enquiries: 13 50 50 International: 61 2 4331 2024 Claims Enquiries: 13 50 50 Existing Customers: 13 50 50 Travel Insurance General Enquiries: 13 50 50 Emergency Assistance Overseas: 61 7 3305 7051 Travel Claims Enquiries: 13 50 50 Home Insurance Enquiries: 13 50 50 Website: www.apia.com.au

Building Insurance

Visit website

Contents Insurance

Marine Insurance

Motor Bikes, Scooters & Cycles

Motor Insurance

Apia Travel Insurance

Our verdict: apiatravel insurance is no longer available, but there are plenty of alternatives to choose from instead..

In this guide

Request travel insurance quotes and compare policies

Who is apia, when did apia stop offering travel insurance, why did apia stop offering travel insurance, frequently asked questions.

Destinations

Important Information

Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Apia is an Australian insurance company aimed specifically at people over 50. It offers a broad range of insurance products, including car and vehicle, home and property, CTP, health, and funeral insurance.

Apia is part of the Suncorp Group. It previously offered travel insurance but confirmed it would no longer do so in February 2021.

Apia announced it would be permanently ending its travel insurance offering in February 2021.

In 2021, Suncorp Group, the parent company of Apia, confirmed it was permanently stopping travel insurance across all brands.

"Suncorp Group announced we would permanently cease underwriting travel insurance under all brands in February 2021," a Suncorp representative told Finder. "This was part of our efforts to simplify our operations."

Can I still get an Apia travel insurance policy??

No. Apia stopped offering travel insurance in 2021 but you can compare alternative options using our travel insurance comparison tool .

Can I still get in touch with Apia?

Yes. You can call Apia on 13 50 50, Monday to Friday from 8am to 7pm AEDT or on Saturday and Sunday from 8am to 5pm AEDT. Alternatively you can use Apia online chat service or message Apia via facebook.

See travel insurance quotes and compare policies

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds. See full profile

More guides on Finder

The best travel insurance policies are different for each individual traveller.

Compare Travel Insurance Direct policies online to save time and money. Travel Insurance Direct offers various policies including Annual multi-trip, The Works, The Basics and Domestic travel.

If time is valuable to you, Travel Insuranz may be suitable for you. With its fast online processing process, Travel Insurance provides easy access to protecting yourself for travel. Read its policy online.

Compare Travel Insurance Saver with other policies to see if they are right for you.

Find out how travel insurance for trip disruption actually works and policies from Australian brands.

Find out how travel insurance covers accidental death and what will be paid from in the event of a claim.

Beware when swimming at Byron, Ballina, Bondi and Bells.

Learn more about travel insurance brokers, how they are paid and the way they can help you find comprehensive travel cover.

Is travel insurance a worthy investment? Find out why travel insurance is an invaluable travel item.

Guide to high-risk travel insurance: What is and isn't covered.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

39 Responses

I am insured with Apia Health. I have an extended stay in Malaysia at present. I wish to travel to Thailand, Vietnam, Cambodia, for maybe 3 weeks.The countries are requesting COVID cover Insurance. I have no pre exisiting health problem and am a fit 78 year old. What avenue do you suggest.

Hi Geraldine,

You can find more information in the policy documents issued at the time of your application with Apia Health, or you can contact the provider directly for clarification.

If you aren’t covered for COVID on your existing policy, you can find a list of some insurers that do offer this cover on our Travel insurance that covers COVID guide .

Since you’re already overseas, you will need to confirm that your chosen insurer covers you when you’ve already started your travels.

Best, James

In January 2019 I am flying from Brisbane to Perth. Then boarding a ship for 5days sailing from Fremantle to Albany, Esperance then back to Fremantle. Then taking the Indian Pacific train from Perth to Sydney then flight to Brisbane. What type of insurance can you offer for a senior?

Thanks for reaching out to us at Finder.

Use may use our travel insurance search tool to generate quotes for cruise cover from various brands. Simply enter your travel details on the form – destination, travel period and age then get quote.

Your cruise policy works much the same as any other travel insurance policy. You are covered for the regions listed on your policy for the dates that you have selected. Please note that most insurers recommended that you select Pacific or South Pacific as your region in order to be covered for emergency medical expenses.

Please feel free to message us anytime if you have further questions on this.

Best regards, Liezl

HOPE TO TRAVEL TO USA FOR 3 WEEKS MAY 2018 AGES 84 M 78 F HOW MUCH APPROX TRAVEL INSURANCE.

Thanks for your inquiry.

If you are looking to apply for APIA travel insurance, you may visit their official website to request a quotation or speak to their representative for further assistance.

Alternatively, you may refer to our list of travel insurance for the USA from Australia . On the page is a comparison table you can use to see which insurer suits you. If you would like to compare policies from different travel insurance brands in our panel , please enter your travel details like destination, age, and dates of the trip into the form. Once you have done you can click on ‘Go to site’ button to head over to the insurer’s website.

Please ensure you review the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Hope this information helps

Cheers, Arnold

Hi my husband had an angiogram about 18 months ago which was good showing no problems with his heart. He takes medication for high blood pressure and cholesterol which are controlled well. Would he be covered for any potential cardiac problems under your policy when we travel to Europe next month. He is 64years old

Thanks for your question.

Apia travel insurance will not automatically cover your husband for his pre-existing medical condition. Moreover, they’ll require you to fill out and submit a pre-existing medical form request and meet a medical practitioner for assessment. You may refer to the section on getting a cover with a pre-existing condition above for the procedure and conditions.

Generally, travel insurance brands consider cardiac or heart problems to be strong risk factors for travel and exclude them from their automatic cover. However, there are still some insurers that will cover people with pre-existing heart conditions although these brands will require medical assessment as well. You may check our list of brands covering heart problem and their terms and conditions. You might also find our guide on travel insurance for pre-existing medical conditions helpful.

I hope this has helped.

Cheers, Liezl

Thanks for your question,

If you are the owner of the land or building you are occupying during your travel date, and certain circumstances arise where your property has caused bodily injury or property damage to a third party during your trip, this is not covered by the policy.

I highly recommend you check your personal liability insurance options to ensure you are getting the right policy for you.

I hope this helps.

Cheers, Anndy

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

If you've been impacted by the recent weather, we're here to help. Find out more

Get a quote now

The go-to insurance for seniors, over 50s & retirees

Choose from our quality insurance options

Comprehensive Car Insurance

Lifetime guarantee on repair work authorised by us

Home & Contents Insurance

New for old repair or replacement of your contents

Funeral Cover

Funeral insurance could give you and your family peace of mind for the future

Apartment Insurance

Choose to pay by instalments or annually

Village Insurance

Cover tailored to retirement or Lifestyle villages

Assisted Living Insurance

Insurance for nursing home or other assisted living accommodation

Landlord Insurance

Cover for your rental property

- Motor Insurance

- Home Insurance

- Health Insurance

Funeral Insurance

- Contact Apia

- Code of Practice

- News & Media

- Cookie & Data Policy

- Online Terms & Conditions

- Get a quote

- Retrieve a quote

- Make a payment

- Make a claim

- Track a claim

- Find my policy

- Policy documents

- Ways to save

- Apia Good Life

- Severe Weather

- Identify scams

- Customer care

- Customer Relations & Complaints

Website Feedback

Cookie and Data Policy We use cookies and other related technologies to improve and tailor your website experience. See our Cookie and Data Policy . This policy provides information about how Apia collects and uses data related to your online activity, and how you can choose to remain anonymous.

AAI Limited Australian Pensioners Insurance Agency Pty Ltd (Apia) ABN 14 099 650 996 AR 239591 is an authorised representative of AAI Limited ABN 48 005 297 807 AFSL 230859 (AAI), the issuer of Home, Landlord, Car, Motorcycle, Caravan, Motorhome, Boat, Travel, Compulsory Third Party Personal Injury (CTP) Insurance and Motor Accident Injuries Insurance (MAI Insurance). Registered Office: Level 23, 80 Ann Street, Brisbane QLD 4000.

Any advice provided is general advice only and has been prepared without taking into account any person's particular objectives, financial situation or needs, consider whether it is appropriate for you before acting on it. Read the Product Disclosure Statement (and any related documents) before making a decision about general insurance. The Target Market Determination is also available

Health Insurance Apia Health Insurance is issued by nib health funds limited ABN 83 000 124 381 (nib), a registered private health insurer, and is marketed by Platform CoVentures Pty Ltd ABN 82 626 829 623 (PC), a Suncorp Group company. PC is an authorised agent of nib and receives commission from nib.

Life Products Any advice on this page in connection with the Life products is general in nature and is provided by Platform Ventures Pty Ltd ABN 35 626 745 177 AFS Representative Number 001266101 (PV). PV is part of the Suncorp Group and an authorised representative of TAL Direct Pty Limited ABN 39 084 666 017, AFSL 243260 (TAL Direct).

Apia Funeral Insurance is issued by TAL Life Limited ABN 70 050 109 450 AFSL 237848 (TAL Life) which is part of the TAL Dai-ichi Life Australia Pty Limited ABN 97 150 070 483 group of companies (TAL). TAL is not part of the Suncorp Group. TAL Life uses the Apia brand under licence from the Suncorp Group. The different entities of TAL and the Suncorp Group of companies are not responsible for, or liable in respect of, products and services provided by the other.

Any advice on this page in connection with the Life products is general in nature and is provided by Platform Ventures Pty Ltd ABN 35 626 745 177 AFS Representative Number 001266101 (PV). PV is part of the Suncorp Group and an authorised representative of TAL Direct Pty Limited ABN 39 084 666 017 AFSL 243260 (TAL Direct). General advice does not take into account your individual needs, objectives or financial situation. Before you decide to buy or to continue to hold a Life Product you must read the relevant Product Disclosure Statement . The Target Market Determination (TMD) for the product is also available.

TAL Life is proud to have adopted the Life Insurance Code of Practice (Code) . The Code has been developed voluntarily by the Life Insurance industry to promote high standards of service to consumers, provide a benchmark of consistency within the industry, and establish a framework for professional behaviour and responsibilities.

This content is current for Home and Contents, Home and Contents Extra, Village Style Residence, Apartment Style Residence, Assisted Living Residence, Landlord, Car Advantage, Motorcycle, Caravan, Motorhome and Boat Insurance policies commenced or renewed on or after 23 March 2021.

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for medical-only coverage

- Best for family coverage

- Best for long trips

- Why You Should Trust Us

Best International Travel Insurance for June 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best International Travel Insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the Best International Travel Insurance Companies

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allianz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue Travel Insurance offers policies that covers emergency medical treatments when you're abroad. While GeoBlue lacks trip cancellation coverage, that allows it to charge lower premiums than the other companies on this list.

GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs.

Read our GeoBlue Travel Insurance review here.

Best for family coverage: Travelex Travel Insurance

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex Travel Insurance review here.

Best for long trips: Seven Corners

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners Travel Insurance review here.

How to Find the Right International Travel Insurance Company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

Your needs for travel insurance will depend on the type of trip you're taking. You'll need to consider your destination and what you'll be doing there, either business, leisure, or adventure traveling. Policies covering adventure sports and activities will cost more. Longer, more expensive trips will also cost more.

Research the reputation of the company

When researching a company, you'll want to closely review the description of services. You'll want to see how claims are handled, any exceptions, and limitations.

You'll also want to look at the company's customer reviews on sites like Trustpilot, BBB, and Squaremouth, as this will provide insight on the quality of customer service and the claims process. You should also take note of whether companies respond to customer reviews.

Compare prices

You can get quotes through a company's website or travel insurance aggregators like InsureMyTrip and VisitorsCoverage. You'll need to be prepared to provide the following information about your trip:

- Trip destination(s)

- Travel dates

- Number of travelers

- Traveler(s) age/birthday

- State of residence

- Total trip cost

For companies that offer travel medical insurance, you'll also want to play around with the deductible options, as they can affect your policy premium.

Understanding International Travel Insurance Coverage Options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the Best Price for International Travel Insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

Why You Should Trust Us: How We Reviewed International Travel Insurance Companies

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

Read more about how Business Insider rates insurance products here.

International Travel Insurance FAQs

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

You should pay attention to any limitations regarding covered cancellations, pre-existing conditions, and adventure activities. For example, if you're worried you may have to cancel a trip for work reasons, ensure that you've worked at your company long enough to qualify for cancellation coverage, as that is a condition with some insurers. You should also see if your destination has any travel advisories, as that can affect your policy.

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

You should purchase travel insurance as soon as possible after making payment on your trip. This makes you eligible for add-ons like coverage for pre-existing conditions and CFAR. It also mitigates the chance of any losses in the days leading up to your trip.

- Main content

Get In Touch Today - AXA Travel Insurance Phone Number

Still have a question.

Be sure to get in touch with our expert travel team. Remember to have your policy number available when contacting us.

Emergency Assistance

24 hours / 7 days a week 855-327-1442 312-935-1719

Questions about your policy

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 1

Claims status

Monday-Friday from 7:30am-4pm CST 888-957-5015

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 2

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

Buildings & Contents

Caravan & trailer, contents for renters.

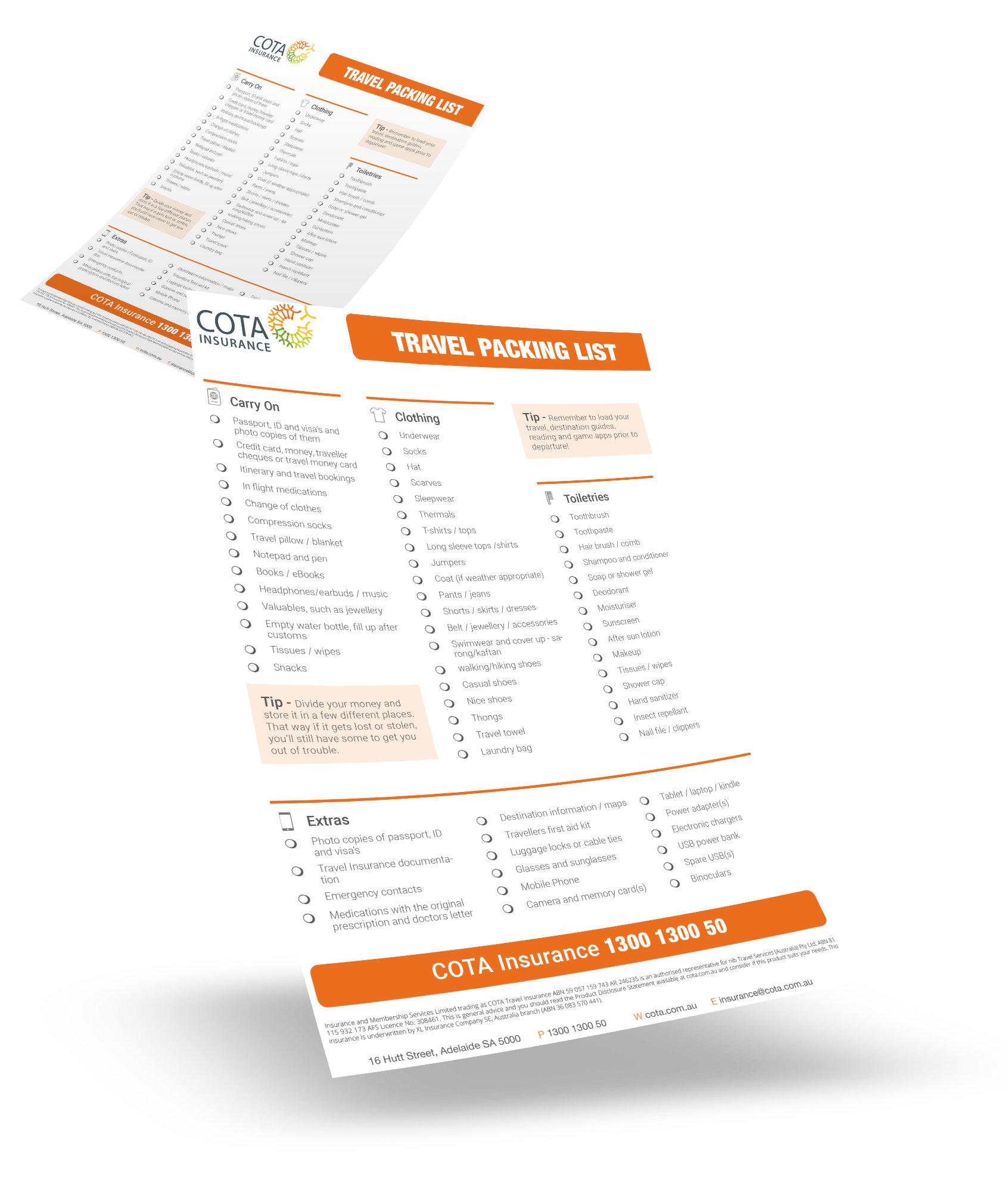

Subscribe to our COTA Connects newsletter & receive the COTA Insurance travel packing list

Travel insurance.

Coronavirus (COVID-19) continues to impact many travellers around the world. Before you buy, read the travel alerts and check travel advice and restrictions for your destination(s) as these may impact cover, or your ability to travel.

Travel – Comprehensive Overseas and Annual Multi Trip Plan

Standard inclusions, provide cover for....

Medical Expenses

Medical, hospital and ambulance costs incurred overseas following a sudden illness or serious injury. Emergency dental – expenses required to relieve sudden and acute pain to healthy, natural teeth following an infection or broken tooth. Sub-limits apply.

Medical evacuation

When agreed by us, medical evacuation to the nearest appropriate medical facility or repatriation home.

Extra Trip Costs

Additional expenses you incur following the death, sudden illness or serious injury of you or a member of your travelling party or where your travel is disrupted or delayed due to severe weather or accident.

Cancellation

Unforeseen cancellation of prepaid travel and accommodation arrangements.

Emergency Assistance

24 hr help with medical problems, locating medical facilities, embassies and communication home.

Loss of Income

Payment if you cannot return to your usual full-time permanent employment or full-time business following your accidental injury.

In-Hospital Allowance

A $50 per day allowance for incidental expenses such as television hire, magazines, food, when you are hospitalised overseas for more than 48 continuous hours.

Room Service Supplement

A $50 per day allowance for meals delivered to your overseas hotel room or cruise cabin if you’re confined for more than 48 hours for medical reasons.

Travel Delay

Meal and accommodation expenses due to lengthy delay of your scheduled transport. Sub limits apply.

Resumption of Trip

Transport costs to resume your travel if you had to return home early due to the hospitalisation or death of a close relative.

Special Events

If your trip is interrupted and you are unable to arrive at a one-off performance or function, tour or cruise on time we will reimburse you for using equivalent transport to arrive on time.

Accidental Death

A benefit that is payable to your estate if you die within 12 months of an injury that occurred during your trip.

Total Permanent Disability

Cover if you suffer an injury resulting in your permanent total loss of sight in one or both eyes or the permanent total loss of use of one or more limbs (excluding dependants).

Personal Liability

Injury to other people or damage to their property.

Extra benefits as standard:

Personal Effects

Loss or damage caused by theft, accidental damage or permanent loss of your possessions.

Luggage Cover

Theft, accidental damage or permanent loss or if your luggage is delayed.

Rental Vehicle Insurance Excess

Cover for the rental vehicle insurance excess you are required to pay.

Loss of Passport

Documentation fees you incur overseas for a replacement passport.

Optional extras

Extend your cover to include....

Specified Medical Conditions

Cover for certain illnesses/injuries you already have.

New for Old Luggage Cover

Increased cover for nominated individual items

Participating In Snow Sports

Cover for lift passes, equipment hire and ski school costs if sick or injured.

Travel – Essentials Plan

Optional extras, travel insurance – australian travel plan, provides cover for:, extend your cover to include:.

Specified Items

You can pay an extra premium to increase your cover to up to $4,000 per individual nominated item ($10,000 for all nominated items).

Read the Product Disclosure Statements

Read the Target Market Determination

Why choose COTA Travel Insurance

Excess options available on some plans, no age limit on the annual multi trip, comprehensive, australian travel, or cancellation and additional expenses plans, easy and friendly phone or online application, simple, over the phone, medical assessment, 24/7 emergency assistance anywhere in the world, choose from a domestic, overseas or multi trip (domestic & overseas) policy, dependant children and grandchildren can be covered at no extra cost, except for certain specified medical conditions.

Wherever you are in the world, if you have an emergency, call for Emergency Assistance 24 hours a day on Phone: +61 2 9234 3170 or +61 2 8256 1570 or within Australia 1300 555 019. You can even call reverse charges via the local operator and we will pick up the call cost. Not a worry in the world!

Need to make a Claim?

Click here for details on how to lodge a travel insurance claim.

Download a copy of our free travel packing list today!

*Plans with option to change excess are Comprehensive, Essentials and Annual Multi Trip Plans. An additional excess applies to claims related to specified medical conditions, which cannot be removed.

What are COTA Insurance’s emergency contact details?

If you have an emergency, you can call for emergency assistance at any time. Just dial either of the following two numbers 24 hours a day and nib International Assistance will help:

+61 3 8523 2800 or 1300 555 019 within Australia.

We even accept reverse call charges via the local operator, so you don’t have to worry.

Can I get a refund on my travel insurance if I return earlier than planned?

If you return to your home in Australia before the trip return date shown on your Certificate of Insurance, that’s when your cover ends. If you resume travelling, you must buy a new policy. No refund will be available for any unused days on the original policy.

Do you have a cooling-off period for my travel insurance policy?

If you aren’t satisfied with your policy purchase for any reason, you have a 21 day cooling-off period. This means you can cancel your policy within the first 21 days of purchase and receive a full refund, provided you haven’t started your journey and you’re not making any claims nor exercising any other right under the policy.

If you request to cancel outside the cooling-off period, we may, at our discretion, refund that part of your premium paid for the unused period of insurance.

When does my travel insurance cover start?

If you pay for your travel insurance online or over the phone by credit card before you depart on your trip, we’ll send you an immediate confirmation and Certificate of Insurance so you’re covered straight away. If you buy your policy after you have started travelling, policies are subject to a 72 hour waiting period.

Testimonials

Ms jones , unley.

I have a severe hearing disability and Paul handled this very well by being patient, articulate and unhurried. It was a positive experience for me.

I was recommended to your company by a friend and I wouldn’t use anyone else now. From the first contact, from my Greek hospital bed, I felt that you cared and were looking out for me. I got all the paperwork to you and you paid out the claim within a week.

Ms Badman ,

Very fast and helpful service! I got exactly what I needed and the staff were very friendly.

Write a Bucket List

Posted: September 4, 2019

Healthy Grieving

Anxiety Exposed

Get it done online

What type of policy do you have?

Select your policy and we’ll let you know how you can renew, make payments, access documents and more.

Car Insurance

NSW CTP Insurance

Workers compensation

Choose your product

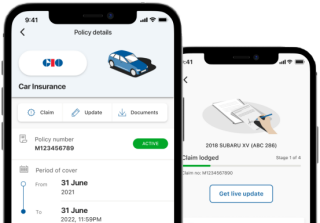

Contact us on the go

Manage your insurance in a touch

With the GIO App, you’ll know you can manage your insurance policies from your smartphone. Make and track claims, update personal details, renew policies, and more.

More about the GIO App

Ways to get in touch

Give us a call on.

FOR HOURS SELECT PRODUCT

Got a question?

Ask george, the gio virtual assistant..

Launch the Virtual Assistant

Launch Messenger

8am - 9pm, 7 days (except national public holidays)

9am - 5pm national public holidays

Message GIO at your own pace with the GIO App

GIO Messaging is a convenient way to get the support you need, without the hassle of waiting by the phone.

Get in the know

Tips on getting the most from your home and contents insurance, your guide to electric vehicles in australia in 2023, how to add another driver to your car insurance, using gio online services.

No, GIO does not charge any fees for credit card payments.

Insurance premiums can change from year to year, based on a range of factors. These include, for example:

- the increasing frequency and severity of weather events

- fluctuating repair costs

- improved data, and

- the number of claims made in a year.

You may also have received discounts or free coverage last year that no longer apply this year.

Being aware of your options and updating your policy to suit your needs and budget, can help you take control of your premium. At your next renewal, log in and check that your details are up to date. Making updates to your excess, amount covered, optional covers and other details can impact your premium.

You can make updates to your policy online. Just log in to My Account .

Most policies can be paid for online using your Credit or Debit card. Some can also be renewed using our online payment portal, except for the following:

- Life Insurance

- Bill Protect

- Funeral Insurance

- Accidental Injury

- Accidental Death

Payments for MAI Insurance in the ACT must be made to Access Canberra at the time of your registration renewal.

Renewals for Workers Compensation policies in NSW are managed by icare Workers Insurance .

For other GIO insurance products or to get information on any of these, please refer to our payments page .

GIO does not price match quotes from other companies.

GIO Online Services shows claims information for Home and Contents, Landlord, Car, Motorcycle, Boat and Caravan Insurance, allowing you to track claims for those policies.

If you’re uncertain whether the text or email is genuine, contact us immediately on:

- Suncorp – 13 11 55

- AAMI – 13 22 44

- GIO – 13 10 10

- Apia – 13 50 50

- Shannons – 13 46 46

See all FAQs here

Extra help and support

We understand that sometimes our customers need extra care and support at different points in their lives. We also know that everyone’s situation and needs will be different. We are committed to looking after your needs with sensitivity, dignity, respect and compassion. Find out more

- Insurance Fraud

- Financial Hardship Policy

- Service of Legal Documents

- General Insurance Code of Practice

- Domestic & Family Violence Policy

- Customer Relations and Complaints

Service of legal documents

GIO is a part of the Suncorp Group, and the contact details for service of legal documents (including writs, subpoenas, and garnishee orders) are the same across the Group.

Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

- GIO PRODUCTS

- Car Insurance Products

- CTP Green Slip

- MAI Insurance

- Home Insurance Products

- Business Insurance

- Agency Stores

- Sponsorships

- Accessibility

- Cookie & Data Policy

- MY GIO INSURANCE CENTRE

- Get a quote

- Retrieve a quote

- Make a payment

- View/manage policy

- Make or track a claim

- Find your policy

- Policy documents

- Our Repair Partners

- Ways to save

- Emergency Response

- Identify scams

- Customer Care

- Customer Relations & Complaints

Website Feedback

COOKIE AND DATA POLICY

We use cookies and other related technologies to improve and tailor your website experience. See our Cookie and Data Policy . This policy provides information about how GIO collects and uses data related to your online activity, and how you can choose to remain anonymous. This content is current for Home Building, Home Contents, Landlord, Strata, Car, Motorcycle, Caravan and Boat Insurance policies with a start or renewal date on or after 22 March 2021.

AAI LIMITED TRADING AS GIO

Insurance issued by AAI Limited ABN 48 005 297 807 trading as GIO. Registered Office, Level 23, 80 Ann Street, Brisbane QLD 4000. Any advice has been prepared without taking into account your particular objectives, financial situation or needs, so you should consider whether it is appropriate for you before acting on it. Please read the relevant Product Disclosure Statement before you make any decision regarding this product. The Target Market Determination is also available. In accessing the GIO site you agree to the Online Terms and Conditions .

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

IMAGES

VIDEO

COMMENTS

Contact Apia. Please select insurance category for relevant contact options. ... Home & Property; Funeral & Injury; Apia has permanently ceased selling travel insurance policies. The Insurance Council of Australia offers a free ... Life products is general in nature and is provided by Platform Ventures Pty Ltd ABN 35 626 745 177 AFS ...

RentalCover.com 4.6. Fast Cover Travel Insurance 4.6. Seniors Travel Insurance 4.6. Worldcare Travel Insurance 4.4. See more. 🏆 2024 Award. Ad. Visit Official Website. APIA Travel Insurance (Travel Insurance): 3.7 out of 5 stars from 3 genuine reviews on Australia's largest opinion site ProductReview.com.au.

Apia. 13,426 likes · 208 talking about this. Welcome to Apia's official home on Facebook. Whether you're after help with your insurance, or simply here to say 'hi', we're around 8am - 9pm AEDT Daily...

APIA Travel Insurance Contact Details . Below you will find contact details for APIA Travel Insurance compiled by the Aussie Insure research team. Website: APIA Travel Insurance . Telephone: 13 50 50 . APIA Travel Insurance Notes . Please note that the information on this page concerning APIA Travel insurance is accurate at the time of ...

At Apia, we realise that the more you live life, the better you get at it. So it's only fair that the experience you've gained should count for something. That's why we reward people over 50 for their experience, with better insurance products and the service you deserve. So if you're looking for home insurance , car insurance , caravan ...

APIA | Find an insurer. General Enquiries: 13 50 50. International: 61 2 4331 2024. Claims Enquiries: 13 50 50. Existing Customers: 13 50 50. Travel Insurance General Enquiries: 13 50 50. Emergency Assistance Overseas: 61 7 3305 7051. Travel Claims Enquiries: 13 50 50. Home Insurance Enquiries: 13 50 50.

Call Apria's Travel Department at 1.844.235.2738 at least 4 to 6 weeks before you plan on leaving (or as soon as possible). The time is needed to allow us to make arrangements, including ensuring that Apria branches are prepared to meet your specific needs. Apria's weekend hours vary by location.

No. Apia stopped offering travel insurance in 2021 but you can compare alternative options using our travel insurance comparison tool. Can I still get in touch with Apia? Yes. You can call Apia on ...

Find my policy number; Contact Us; Home; home; Insurance Quotes; Get a quote now. ... Car, Motorcycle, Caravan, Motorhome, Boat, Travel, Compulsory Third Party Personal Injury (CTP) Insurance and Motor Accident Injuries Insurance (MAI Insurance). Registered Office: Level 23, 80 Ann Street, Brisbane QLD 4000. ... Apia Funeral Insurance is issued ...

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.. You can select its budget-friendly ...

The insurer for travel insurance is Allianz Australia Insurance Limited ABN 15 000 122 850, AFSL 234708 (Allianz). Seniors Travel Insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177, AFSL 245631, trading as Allianz Global Assistance (AGA), acting as agent for Allianz. Terms, conditions, limits, and exclusions apply.

AboutAlaska Pacific Insurance Agency dba: APIA Insurance. Alaska Pacific Insurance Agency dba: APIA Insurance is located at 912 E 15th Ave #100 in Anchorage, Alaska 99501. Alaska Pacific Insurance Agency dba: APIA Insurance can be contacted via phone at 800-890-5563 for pricing, hours and directions.

We encourage you to search our Help Center to get quick answers to commonly asked questions. If you aren't able to find what you're looking for, please contact us. Customer Care. 1-877-771-1189. Emergency Travel Assistance. 1-866-509-7711 (toll-free in the U.S. and Canada) 1-603-328-1720 (collect outside of the U.S. and Canada) Back to ...

Get In Touch Today - AXA Travel Insurance Phone Number. Still have a question? Be sure to get in touch with our expert travel team. Remember to have your policy number available when contacting us. Emergency Assistance. 24 hours / 7 days a week 855-327-1442 312-935-1719.

Call Apria's Billing Department (866) 505-6365. Medicare Coverage. For questions about general Medicare coverage: (800) 633-4227. Visit Medicare Website . Insurance. For questions about your insurance coverage, contact your insurance plan's case management or authorization department.

For example, travel medical insurance is a common type of travel insurance for parents visiting the U.S. whose adult children live here. You also need travel medical insurance if you are a U.S ...

Wherever you are in the world, if you have an emergency, call for Emergency Assistance 24 hours a day on Phone: +61 2 9234 3170 or +61 2 8256 1570. or within Australia 1300 555 019. You can even call reverse charges via the local operator and we will pick up the call cost. Not a worry in the world!

Travel Guard. 3300 Business Park Drive. Stevens Point, WI 54482. *= Required. To help us expedite this process select one of the categories below: *. Call us at: 800-826-5248. Contact us for more information about purchasing a travel insurance plan, or for additional information on your existing plan. We can also help if you are currently on a ...

Apia Travel Medical Insurance for International Travelers - FAQs. Traveling to Apia puts you at risk for infectious, waterborne, food-borne, and other diseases. Even small symptoms like fever and diarrhea could be indicative of serious diseases. Hence, any medical complication in Apia could require a doctor's visit.

Read More. What do I do if I receive a text or email with a payment request for my policy? If you're uncertain whether the text or email is genuine, contact us immediately on: Suncorp - 13 11 55. AAMI - 13 22 44. GIO - 13 10 10. Apia - 13 50 50. Shannons - 13 46 46. See all FAQs here.

Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. ... Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]. Email customerservice ...