Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]

Christine Krzyszton

Senior Finance Contributor

328 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

49 Published Articles 3413 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![costco travel insurance for seniors The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

Why purchase travel insurance, what you need to know about age and travel insurance, best travel insurance options — ages 65 to 69, best travel insurance options — ages 70 to 79, best travel insurance options — age 80 and above, credit card travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Our senior years can be some of the most exciting years of our lives. If we’re fortunate, we’ll now have the time, and hopefully, the resources, to make our travel dreams come true.

As we age, however, traveling may pose some additional risks. We may be more likely to have health-related issues and therefore the need to seek medical attention during our journey. We may also have occasions where we need to cancel our plans due to health issues or the health of those around us.

Now, more than ever, we need to think seriously about purchasing travel insurance. The good news is that comprehensive travel insurance, regardless of your age, is widely available and relatively affordable. With that being said, chances are you could use a little help getting started with the process of finding and purchasing the right plan.

If you’re 65 years of age or older and thinking about purchasing travel insurance, don’t pull the trigger without reviewing the information in today’s article on travel insurance options for seniors.

Travel insurance can protect you from financial loss due to unforeseen events that can cause you to cancel your trip or disrupt your trip once it’s in progress. As we age and our health declines, we may be more likely to experience such an event.

Travel insurance can cover the following situations:

- You, a family member, or travel companion becomes seriously ill and you must cancel your trip

- You slip and fall while traveling abroad, require medical care, and are forced to stay in a foreign city until you can travel again

- You are on safari and break your ankle, requiring emergency evacuation to the nearest hospital

The types of coverage you can expect to find on travel insurance policies include the following:

- Emergency medical coverage

- Emergency evacuation

- Trip cancellation, trip interruption , and trip delay

- Baggage insurance and personal effects coverage

- Travel accident and accidental life insurance

You may also elect to add coverage such as cancel for any reason insurance (CFAR) , a waiver for preexisting conditions, or car rental insurance.

It’s possible to purchase travel insurance at just about any age. If you’re healthy enough to travel, you’ll generally be able to find coverage. You’ll normally be paying more to purchase coverage as you get older, however, and most policies may have preexisting health stipulations.

The Cost of Travel Insurance

As age increases, so does the cost of purchasing travel insurance . The good news, however, is that premiums tend to vary widely between companies who offer policies for older travelers, so it pays to compare.

The easiest way to compare policies is via insurance comparison sites such as SquareMouth , InsureMyTrip , or TravelInsurance.com . Travel comparison sites make it easy to compare travel insurance policy pricing and coverage options for all ages.

We’ve used these sites to find most of the comparison quotes provided in this article.

Preexisting Conditions

As we age, we’re more likely to have preexisting health conditions, which can be excluded from most travel insurance policies. Once again, the good news is that preexisting condition exclusions are generally limited to a specified timeframe previous to the effective date of your policy.

If you have shown symptoms or been treated within a specified time period before your trip, usually 90 to 120 days, your condition may not be covered for certain coverages such as trip interruption, cancellation, or emergency medical. Each company’s requirements may differ.

Also, on a positive note is that many insurers allow you to purchase a preexisting condition waiver when you purchase your policy.

Travel Insurance and Medicare

Health insurance may or may not cover medical costs abroad. And even if there is coverage, evacuation costs may not be included. The same scenario exists with Medicare.

Medicare will not cover medical expenses incurred abroad . There are very limited situations where Medicare may grant coverage, such as if you reside in the U.S. and a foreign hospital (such as a Canadian hospital) is closer to your residence than the U.S. hospital, or you’re traveling through Canada to reach another U.S. state or territory. Also, several terms and conditions apply.

There are Medicare supplement policies you can purchase that can cover you while traveling abroad. You’ll pay a standard $250 deductible, have coverage for 80% of eligible expenses beyond that amount, and have a lifetime cap of $50,000 in coverage.

So even if you have Medicare, a Medicare supplement, or other health insurance policy, there can still be plenty of gaps in coverage when you’re traveling abroad.

For this reason, and the need for additional coverage such as trip cancellation, interruption, delay, baggage coverage, and more, it’s prudent to purchase travel insurance.

Bottom Line: Medicare will generally not cover medical expenses when you’re traveling outside of the U.S. and its territories and Medicare supplement and Advantage policies provide limited coverage. Travel insurance is a wise choice for covering medical expenses and for other travel-related events that could cause you to cancel your trip or disrupt your journey in progress.

COVID-19 and Travel Insurance

As we advance in age, the chance we will need to cancel a trip due to health-related issues increases. Fortunately, most travel insurance policies cover trip cancellations due to illness. However, travel insurance policies do not cover voluntary cancellations such as canceling your trip due to the fear of getting sick.

Cancel for any reason insurance (CFAR), when added to a travel insurance policy, will allow you to cancel your trip for any reason you deem necessary. It will even cover you if you simply decide not to go.

While CFAR insurance allows you to cancel your trip for any reason, including COVID-19-related issues, the coverage will not reimburse 100% of your costs. The coverage can only be purchased when you purchase your travel insurance or for a short window following the purchase. CFAR insurance can also be expensive.

Our article on COVID-19-related trip cancellations goes into a lot more detail.

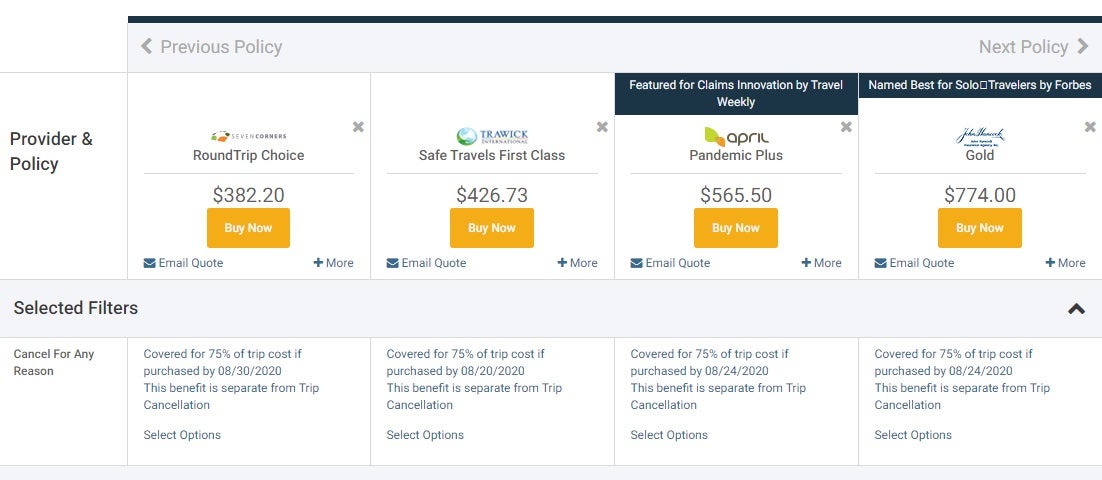

Priorities change as we change and as a result, we may have different insurance needs at age 65 than we do at age 80. Here are some examples of travel insurance plans that might be a fit for travelers age 65-69.

World Nomads — Best For Active Seniors

If you’re under age 70, you’ll find comprehensive travel insurance coverage with World Nomads . What sets World Nomads apart from other insurance providers is that they’re experts at insuring active travelers who participate in adventurous activities.

While World Nomads does not offer CFAR insurance, COVID-19 is not excluded as an illness for trip cancellation and emergency medical coverage.

World Nomads only insures those travelers under age 70 and refers older travelers to its partner TripAssure .

For a traveler 68 years of age, traveling to the Netherlands for 8 days, with a total trip cost of $3,000, here are some sample costs.

The main differences in these plans are that the Explorer Plan covers an expanded collection of over 200 covered adventurous activities, has higher limits for trip interruption/cancellation/delay and emergency evacuation, and includes rental car insurance.

Secure your own quote from World Nomads .

Allianz — Best for Annual Multi-Trip Policies

Allianz simplifies purchasing travel insurance with its offerings of travel insurance package policies. You can select from single trip policies with several levels of coverage options or annual multi-trip policies that cover every trip you make during the policy period, even ones you haven’t yet planned.

If you travel frequently, or even a few times each year, purchasing an annual, multi-trip plan could be a cost-effective way to protect all your trips.

To learn more about Allianz and its policy offerings , you’ll want to check out our review for details.

Hot Tip: Be sure to compare the price of an annual multi-trip travel insurance policy to a single-trip plan, even if you are only currently planning 1 trip. You may find a better value in the annual multi-trip policy and not have to purchase additional coverage if you should decide to travel again during the policy period.

Best for Covering COVID-19 Cancellations

Many policies will cover trip cancellation due to getting the virus, but none will cover cancellation due to the fear of getting the virus. To cover cancellations based on the fear of COVID-19, you’ll need a policy that allows you to add CFAR insurance .

The following are just a sampling of companies that offer this option on their policies.

- John Hancock

- Seven Corners

Please note that not every policy these companies offer allows you to add CFAR coverage.

For more information on travel insurance covering COVID-19 , we’ve put together an informative article.

There are a lot of reasons to embrace the wanderlust and travel in your 70s. By then, many have retired and perhaps have more money to spend on travel. There can also be a sense of urgency to travel while we’re still healthy.

As we’ve mentioned, however, as we age we are more apt to have health issues. Fortunately, this doesn’t mean we’ll be unable to purchase travel insurance. Even into our 70s, we’ll have plenty of travel insurance options, and coverage can still be affordable.

Best for Preexisting Conditions

Since travel insurance is meant to protect you from unforeseen events, having a preexisting health condition may rule out any chance of coverage for that issue. However, several companies allow you to purchase a waiver so that preexisting health conditions can be covered.

Here are just a few companies that offer this waiver:

- Travel Guard

- Travel Insured

Each company has its own requirements for adding a preexisting condition waiver to your policy. You must purchase the policy within a specific time period, such as within 14 to 30 days after making your first trip deposit payment. You may also be required to insure the entire cost of your trip and your health must be medically stable when purchasing the coverage.

As a senior, it becomes more and more likely that we will actually have to use our travel insurance coverage as we age. However, even at age 80 or beyond, you’ll still find travel insurance widely available and relatively affordable. Some companies are willing to insure older travelers but charge higher premiums , so it’s wise to compare the pricing of several providers.

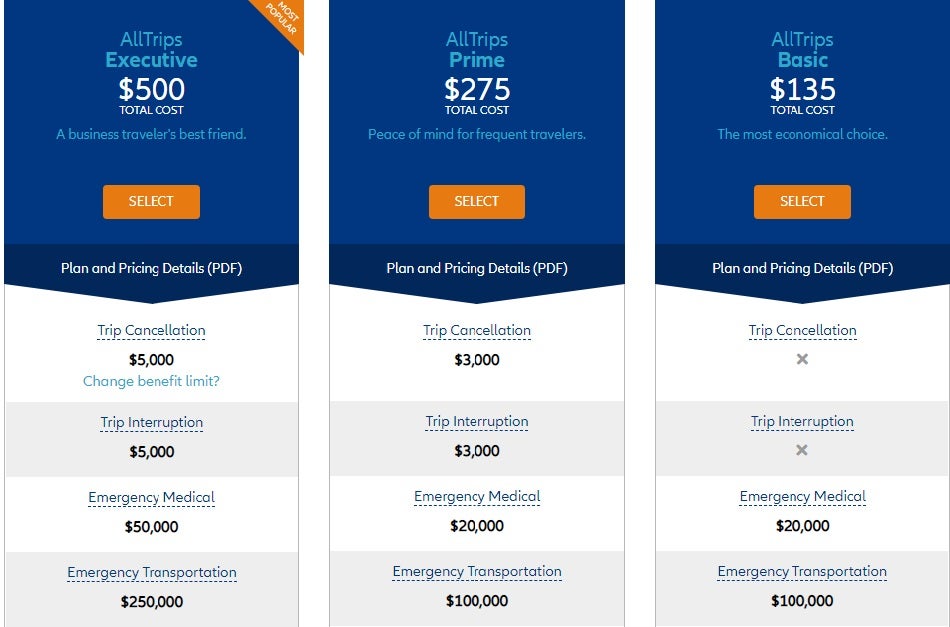

Above you’ll find a sampling of 4 SquareMouth quotes for single-trip travel insurance policies that include CFAR insurance for a traveler 80 years of age. The trip’s total cost was stated at $3,000 and was 8 days in length. Quotes ranged from $382 (Seven Corners) to well over $1,000 to insure the trip (not all quotes are shown). Coverage limits can also vary greatly, so it can be beneficial to compare policy limits.

If you’re looking to purchase travel insurance and you’re 80 years of age or older, it’s imperative to compare policies for the best pricing and coverage.

Hot Tip: Seniors ages 65 to 99 who are not interested in CFAR (cancel for any reason) insurance, may consider an annual multi-trip travel insurance plan. Allianz is a company that charges the same premium, regardless of age, for its annual plans for travelers ages 65 to 99 .

There is 1 type of travel insurance that will cover you, regardless of age . U.S.-issued credit cards come with various types of travel insurance coverages that apply to all primary cardholders.

Typical travel insurance coverage found on credit cards includes the following:

- Lost, stolen, or damaged luggage insurance

- Car rental insurance

- Roadside assistance

- Travel accident insurance

- Travel assistance hotline

Premium credit cards such as The Platinum Card ® from American Express and Chase Sapphire Reserve ® also come with valuable emergency evacuation coverage. The Amex Platinum card, unlike typical credit cards, allows you to carry a balance for certain charges, but not all. Additionally, the Chase Sapphire Preferred ® card is known for its comprehensive travel insurance benefits, including primary car rental insurance .

To learn more about which credit cards come with travel coverage, check out our article on the best credit cards for travel insurance benefits.

Bottom Line: The travel insurance benefits that come with U.S.-issued credit cards do not generally have age limits for coverage. However, many credit card travel benefits may be secondary to other insurance you might have. This means that you might first have to file a claim with your own insurance before the credit card insurance is valid.

As seniors, purchasing travel insurance should be a priority for protecting your investment and preventing losses you might incur due to unexpected medical expenses during your travels.

With wide availability, regardless of age, it’s not only a prudent economic move, but it’s also a move that delivers peace of mind before and during your trip.

Finally, always make sure to compare policies as coverages and prices vary widely between travel insurance providers.

You can learn more about the best travel insurance companies for travelers and the basics of travel insurance in our informative articles.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Senior Travel Insurance for 2024

Trawick International »

Allianz Travel Insurance »

AIG Travel Guard »

Nationwide Insurance »

WorldTrips »

GeoBlue »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Trawick International

- Allianz Travel Insurance

- AIG Travel Guard

Key takeaways

- Senior travelers can benefit from a plan that offers coverage for emergency medical expenses and emergency medical evacuation first and foremost.

- Other benefits to look for include coverage for lost or delayed baggage, trip delay protection, and coverage for trip cancellation and interruption.

- Older travelers may also want to look for travel insurance plans that cover preexisting medical conditions.

- Some plans for seniors let individuals add on cancel for any reason (CFAR) coverage that reimburses up to 80% of prepaid travel expenses when a trip is canceled for any reason at all.

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

U.S. News compared more than 20 of the top travel insurance companies to find the top plan options for seniors and retirees. This list does the heavy lifting for you as you search for the best senior travel insurance, so read on to learn about the top picks.

- Trawick International: Best Overall

- Allianz Travel Insurance: Best Cancel for Any Reason

- AIG Travel Guard: Best Annual

- Nationwide: Best for Cruises

- WorldTrips: Best Budget

- GeoBlue: Best Medical

Incredibly high limits for medical expenses and emergency evacuation

Customize plan with optional CFAR coverage

Coverage is for trips up to 30 days if you're ages 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- Up to $750 in emergency dental coverage

- Up to $2,000 in coverage for baggage and personal effects

- Up to $400 for baggage delays of 12-plus hours

SEE FULL REVIEW »

High reimbursement for CFAR coverage

Coverage for preexisting conditions is offered

Relatively low limits for baggage delays

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Trip change protector coverage up to $500

- Emergency medical coverage up to $50,000

- Emergency medical transportation coverage up to $500,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $300

- Travel delay coverage up to $800 ($200 daily limit)

- $100 per day in SmartBenefits coverage per person for fixed inconvenience payments

- 24-hour hotline for assistance

- Concierge services

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

Year-round comprehensive travel insurance coverage

Generous limits for medical and emergency medical evacuation

Does not include trip cancellation coverage

- Up to 100% of insured trip cost for trip interruptions (maximum of $2,500 per trip)

- Up to $1,500 for trip delays ($150 per day)

- Up to $500 for missed connections caused by delays of at least three hours

- Up to $2,500 for lost baggage

- Up to $1,000 for baggage delays of 12-plus hours

- Up to $50,000 for travel medical coverage ($500 dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 for accidental death and dismemberment (AD&D)

- Up to $100,000 for security evacuation coverage

Nationwide »

Cruise-specific coverages and benefits

High limits for medical expenses and emergency evacuation

May be expensive compared to other coverage options

- Trip cancellation coverage up to 100% of prepaid trip cost

- Trip interruption coverage up to 150% of prepaid trip cost

- Trip interruption for any reason (IFAR) coverage worth $1,000 if conditions are met

- Missed connection coverage up to $2,500 for delays of three-plus hours

- Trip delay coverage up to $1,000 for delays of six-plus hours

- Itinerary change coverage worth $250 to $1,000 (depending on reason for change)

- Emergency medical coverage up to $150,000 (secondary with $750 dental sublimit)

- Emergency medical evacuation coverage up to $1 million

- Up to $25,000 for AD&D

- Up to $2,500 in coverage for lost or stolen baggage ($1,000 maximum for special items and $500 limit per article)

- Baggage delay coverage up to $1,000 for delays of six-plus hours

- Nonmedical evacuation coverage up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

Medical-only coverage

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg – a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Costco Travel Insurance Worth It? A Detailed Review

Travel insurance can provide valuable protection when you’re on vacation. If something goes wrong, like a canceled flight or medical emergency, insurance helps cover your costs. But is Costco’s travel insurance worth buying?

Costco offers travel insurance policies throughCover-More, a division of Zurich Insurance Group. Policies are available for international trips, cruises, domestic U.S. vacations and rental cars.

Here’s what to know about Costco travel insurance and whether it’s worth it for your next vacation.

What Does Costco Travel Insurance Cover?

Costco offers a few different travel insurance options based on your trip type:

International travel: Covers vacations outside the U.S. Offers the highest coverage limits.

Cruise vacations: Protects the entire cruise vacation, not just time on the ship.

Domestic U.S. trips: For vacations within the United States. Lower coverage limits than international policies.

Rental cars: Primary insurance for rental vehicles to replace expensive rental company options.

The main coverages are similar across plans and include:

Trip cancellation: Up to 100% of trip costs if you have to cancel for a covered reason.

Trip interruption: Up to 150% of trip cost to get home if you have to cut your trip short.

Travel delay: Reimburses expenses like hotels and meals if your travel is delayed.

Baggage: Covers lost, damaged and stolen luggage. International and cruise plans offer higher limits.

Medical: Emergency medical and dental care if you’re injured or get sick on your trip.

Evacuation: Transportation to get you to adequate medical facilities in a medical emergency.

Some benefits are upgraded for international and cruise vacations like missed connections coverage. Rental car protection has more limited benefits focused just on the vehicle itself.

You can also add on cancel for any reason coverage and increased rental car damage coverage for extra fees.

How Much Does Costco Travel Insurance Cost?

Costco travel insurance rates are based on:

Trip cost: The dollar amount of your prepaid, nonrefundable trip.

Trip length: Longer trips may have higher premiums.

Destination: International trips often cost more than domestic.

Upgrade options: Cancel for any reason or rental car damage upgrades raise the price.

Here are some examples of Costco travel insurance cost:

- 7-day domestic trip costing $6,000: $270

- 10-day Spain trip costing $6,000: $300

- 30-day rental car: $170

In most cases, expect to pay about 4% to 10% of your total nonrefundable trip cost. Upgrading your policy raises the percentage.

Costco’s website makes it easy to get quotes. Just enter your trip details to see exact pricing. Members can buy policies online without contacting an agent.

Pros of Costco Travel Insurance

High coverage limits: Maximum coverages go up to $200,000 for medical care and $1 million for emergency evacuation.

Cancel for any reason upgrade: Unique upgrade reimburses 50% of trip costs if you cancel more than 48 hours before departure.

Easy online purchase: Quote and buy policies completely online without phone calls.

Good value: Competitive pricing compared to plans from other insurance providers.

Strong backing: Zurich Insurance Group backing provides security and stellar financial ratings.

Cons of Costco Travel Insurance

Pre-existing condition exclusion: Typical for travel insurance, but still problematic for travelers with health issues.

High-risk activities excluded: No coverage for things like scuba diving, mountain climbing or amateur racing.

Weather exclusions: Natural disasters like hurricanes often have special exclusions.

Rental car restrictions: Daily limits and excluded car models apply to rental coverage.

Limited plan options: Only one set of benefits and coverage amounts for each trip type.

What Credit CardsCover

Before buying a Costco policy, check what your credit card covers. Many travel credit cards include some protections:

- Trip cancellation/interruption insurance

- Baggage delay or loss coverage

- Rental car damage coverage

- Travel accident insurance

But credit card protections typically have lower limits, like $1,000 or $2,000. Costco travel insurance offers more robust coverage.

For a big trip or cruise, Costco insurance works well in addition to credit cards. Use the card’s coverage first, then Costco for anything else.

What’s Not Covered by Costco Travel Insurance

Like most insurance policies, Costco travel insurance excludes some things:

Pre-existing medical conditions: Unless you qualify for a waiver when you buy coverage shortly after your first trip payment.

High-risk activities: No coverage for things like extreme sports, racing or stunt flying.

Intentional acts: Injuries or illnesses caused by things like drug use or self-harm.

Natural disasters: Hurricanes, earthquakes and other major weather or events known when you purchase coverage.

Refundable reservations: Anything you can cancel for a full cash refund.

War: Injury or loss due to declared or undeclared war or civil unrest.

Pay attention to exclusions when choosing a travel insurance policy and reading the full terms.

Is Costco Travel Insurance Worth It?

Costco travel insurance can be worth it for the right kind of traveler and trip.

Good for big, expensive vacations: Policies with high coverage limits protect costly trips. Good for cruises, exotic locations or extended travel.

Nice upgrade over credit cards: More robust benefits than even the best travel credit cards. The cancel for any reason upgrade is hard to find.

Peace of mind for worriers: Comprehensive coverage lets anxious travelers relax. Insurance can seem worth it for the trip protection.

Not worth it for everyday trips: Lower cost domestic travel may not need big coverage limits or extra insurance cost. Credit cards work fine.

Is Costco Travel Insurance Right for You?

Think about your upcoming trip and how you handle travel risks. Ask yourself:

How expensive is this vacation? Higher cost trips get more value from insurance.

How worried will I be about potential issues? More nervous travelers appreciate the peace of mind.

Does my credit card already cover some risks like baggage or rental cars? If so, a big policy may not be necessary.

Are we doing risky activities excluded by insurance? Consider passing if you’ll have coverage gaps.

For many frequent travelers going on higher cost trips, Costco insurance can definitely be worth considering. It provides solid protection that goes beyond most credit card coverage. Just be sure to understand what is and isn’t covered before making your purchase.

The Bottom Line

Costco travel insurance provides good value at reasonable prices for members. For international vacations, cruises, and other big trips, it’s worth considering to supplement credit card protections. Make sure to evaluate your trip, risk factors, and existing coverage when deciding if you should buy a policy.

For the right person and the right vacation, Costco insurance can give useful trip coverage and peace of mind. Just know what you’re buying and make sure it fits your needs.

Costco Travel Insurance Review: Analyzing the Pros and Cons of Costco’s Travel Insurance Policy

What travel insurance company does Costco use?

Is Costco a good place to buy insurance?

What is the benefit of booking with Costco Travel?

Related posts:

- Does Homeowners Insurance Cover Well Going Dry?

- Does My Spouse Have to Be on My Car Insurance?

- Understanding Travelers Insurance Company’s NAIC Number

- How to Get Non-Owner SR-22 Insurance in Oregon

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Seniors in July 2024

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Traveling at any age can be a stress-inducing event, especially when you’re leaving the country. For that reason, many travelers opt to purchase travel insurance before they go.

Depending on your age, you may want to consider different types of coverage, whether that’s one oriented to emergency medical care or one refunding you in the event your plans change.

To make sure you’re covered, we’ve compiled a list of the best travel insurance for seniors. Here’s which companies made the cut:

Trawick International .

Nationwide .

Travel Insured International .

Factors we considered when picking a travel insurance policy

Choosing the right travel insurance plan can be overwhelming, especially when there are so many options. To whittle down the choices for top dog, we took a few factors into consideration:

Available policy types . Depending on the type of plan you’re interested in, not all insurance companies may work for you. Some won’t offer emergency medical coverage, while others provide only a fixed amount of reimbursement.

Policy coverage limit . Are you interested in comprehensive coverage or the bare minimum? If you’re heading out on a longer trip, a higher maximum may be more prudent.

Exclusions . Many travel insurance companies will exclude pre-existing conditions as well as coverage for risky activities.

Cost . With a huge range in costs, we focused on plans that provided value for money.

Website usability . Nothing is more frustrating than trying to make a claim through a clunky website, which is why we’ve included this.

Customization . Cancel For Any Reason, rental car, accidental death and dismemberment (AD&D), sports coverage, rented electronics coverage — the more customizations a plan offers, the better.

Of course, the most important thing is that you find a plan that suits your needs. If you’re not planning on taking a cruise, then choosing a plan with cruise coverage makes no sense.

What to know before you shop

No matter your age, you’ll want to make sure you compare a variety of plans before purchase. However, as an older adult, this advice is more pertinent than ever. As you’ll see below, coverage levels and costs can vary hugely between insurance companies.

Policy premiums can vary widely based on the length of coverage and your age. If you frequently travel, buying an annual policy instead of policies for each trip may make more sense. Additionally, your premiums may be much different as a new retiree at 65 compared with someone in their 70s or 80s.

A simple way to compare multiple quotes at once is through a travel insurance aggregator, such as Squaremouth. This website allows you to type in your details just once, then spits out plan options from multiple businesses so you can peruse them easily.

You may be able to save money on your travel insurance policy by taking advantage of credit card benefits. For example, many travel cards include trip cancellation, delay and interruption benefits, luggage protection and rental car coverage at no additional charge when using the card to book flights and rent cars.

» Learn more: How to find the best travel insurance

An overview of the best travel insurance for older adults

To find the best travel insurance for seniors, we generated quotes from a variety of companies. Our sample trip consisted of a 65-year-old from California heading to Spain for 10 days in August 2024. The total trip cost was $8,000.

Among our top companies, the average cost for a plan cost $389. However, that number is skewed slightly by Travelex Insurance Services, whose Travel Med program offers medical protection but is otherwise limited.

Here is the basic coverage cost, broken down by provider.

There are various coverage options and price points when comparing travel insurance policies for older adults. While the lowest-priced options in the chart are the most affordable, their policies offer different levels of coverage.

Comparing these coverage limits and exclusions when selecting a policy is important so you are satisfied when making a claim.

Top travel insurance options for older adults

Let's look at our six travel insurance policy recommendations for older adults.

1. Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

What makes Travelex great:

Plan is much cheaper than average.

Offers emergency medical insurance.

Medical coverage is primary.

Here’s a snippet from our Travelex review :

“Travelex’s primary goal is to provide travel insurance protection that’s personalized to the type of trip you’re taking and the style of traveler you are. And regardless of which plan you choose, you’ll always have 24/7 access to travel assistance.”

Since Medicare doesn't cover healthcare needs when traveling outside the United States, some travelers purchase healthcare-only policies such as this one from Travelex. However, keep in mind that its Travel Med plan doesn’t include trip cancellation insurance , and its policy limits are fixed rather than a percentage of what you’ve paid. This means you’ll get up to $1,000 for trip interruption and a maximum of $10,000 in emergency medical.

If you want insurance for things like baggage delay, you'll need to purchase a different plan.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

- Annual or single-trip policies are available.

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

What makes IMG great:

100% reimbursement for trip cancellation.

125% reimbursement for trip interruption.

Lower-than-average cost.

Here’s a snippet from our IMG review :

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

“More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

Be aware that IMG’s iTravelInsured Travel Essential plan, which we looked at, doesn’t include any emergency medical coverage , so you’ll want to make sure you’re protected elsewhere.

3. Trawick International

- Many different plan options.

- CFAR available as an add on.

- Specialty coverage for adventure sports (SafeTreker Basic).

- Reports of long resolution processes.

- Low customer service rating on SquareMouth.

What makes Trawick great:

Primary medical coverage.

High limit for medical evacuation .

Pre-existing conditions covered.

Here’s a snippet from our Trawick review :

“Trawick International has been in business for about 25 years and is a legitimate travel insurance provider. Trawick International reviews on Trustpilot and Squaremouth are generally good, with scores around 4.5/5 and 4.15/5, respectively.”

For those who aren’t familiar with these terms, primary coverage means this entity is the first one to pay out; secondary means the insurance will only cover costs not already paid for by other policies.

At the lower end of costs for our quote — though still above average — Trawick still provides a hefty $50,000 in primary medical coverage with its Safe Travels Defend plan.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

What makes AXA great:

$100,000 emergency medical limit.

Here’s a snippet from our AXA insurance review :

“The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.”

With $100,000 in primary medical coverage and the inclusion of pre-existing conditions , those who have ongoing health issues may want to opt for AXA Gold’s comprehensive coverage.

5. Nationwide

What makes Nationwide great:

Reimburses cruise excursion changes.

150% reimbursement for trip interruption.

Eligible sports and other activities covered.

Here’s a snippet from our Nationwide review :

“Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.”

Nationwide’s Cruise Choice plan includes comprehensive coverage for all your trip needs. However, it’s at its best for those who plan to cruise, since it offers unique insurance should problems arise. This even includes a payment for you if you’re inconvenienced by a ship breakdown.

» Learn more: Is cruise travel insurance worth the cost?

6. Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

What makes Travel Insured International great:

Multiple customizations available.

Offers a Cancel for Work Reasons upgrade option.

Rental car insurance is included in the quote, but is generally sold as an upgrade.

Here’s a snippet from our Travel Insured review :

“Plan benefits offered by Travel Insured International include trip cancellation or interruption, mileage or rewards reimbursement, Interrupt For Any Reason, travel delay, missed connection, change fee coverage, itinerary change, accident & sickness medical expense, baggage delay, rental car damage and more. Each plan is different and has the option for add-ons.”

Travel Insured International’s Worldwide Trip Protector Edge plan offers a great deal of flexibility. Along with full-scale trip protections and medical coverage, you can also choose to double your policy limit for medical care or add on Accidental Death and Dismemberment coverage for your flight.

Check your card for existing travel insurance

Many travel rewards cards, such as the Chase Sapphire Reserve® and The Platinum Card® from American Express , offer some kind of trip protection, see more on their benefits in the comparison module below. Terms apply.

Having one of these in your wallet is a good start to protecting your trip-related investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

» Learn more: The best travel credit cards right now

Best travel insurance for older adults recapped

We’ve done the work for you to figure out the best travel insurance for seniors, whether you’re looking to hop on a cruise or want comprehensive coverage for the trip you’re about to take.

American Express travel insurance disclosures

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Points + $300 Travel Credit Get up to $1,050 in Chase Travel℠ value. Earn 60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

672 Wine Club

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Ka La’I Wakiki Beach

- Kalamazoo Grill

- Raffles Hotels & Resorts

- Rocco Forte Hotels

- Tributary Idaho

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

65 or Older? Here Are The Best Travel Insurance Plans for Seniors

The top-rated plans all have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage., erica lamberg, erica lamberg's most recent stories.

- 5 Tips for Buying Travel Insurance

- Travel Insurance for Sports Equipment: Everything You Need to Know

- The Travel Insurance You Need for a Multi-Destination Vacation

- Share This Article

We may receive payment from affiliate links included within this content. Our affiliate partners do not influence our editorial opinions or analysis. To learn more, see our Advertiser Disclosure .

With more than a year of travel adventures lost, it’s time to consider how you’ll explore the world again. Whether you’re going across the country or around the world, travel insurance for seniors can provide a valuable safety net if a trip goes wrong. Here are the best senior travel insurance plans based on our ratings of two dozen travel insurance policies.

Related Stories

Silversea is planning to open the world’s southernmost hotel in chile next year, what it’s like to stay at maxx royal bodrum, a new resort on turkey’s glittering turquoise coast, despite risks, luxury cruise operators are sinking big money into submarine adventures.

All the winning travel insurance plans below include coverage for Covid in trip cancellation and travel medical benefits

Nationwide Cruise Choice Plan

Why we picked it: Nationwide Cruise Choice Plan offers superior benefits at excellent prices for senior travelers.

This plan provides $100,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation . You will also get non-medical evacuation coverage of $25,000 per person, which covers transportation if you have to move to a safe location due to a natural disaster or civil/political unrest.

Nationwide’s Cruise Choice Plan has top-notch baggage loss coverage of $2,500 per person. Other highlights include missed connection coverage of $1,500 per person after only a three hour wait and the option to add “cancel for any reason” coverage.

If you are looking for an upgrade, it’s worth taking a look at Nationwide’s Cruise Luxury plan.

Potential drawbacks: Travel delay coverage of $750 per person is low compared to top competitors.

Trawick International Safe Travels First Class Plan

Why we picked it: Trawick’s International Safe Travels First Class plan has excellent prices for seniors and a wide range of solid benefits.

The plan comes with $150,000 per person in emergency medical expenses and $1 million per person in medical evacuation coverage. You’ll also get $2,000 per person in baggage loss coverage and $1,000 per person for missed connections (cruises and tours only).

The plan has good travel delay coverage of $1,000 per person but only after a 12-hour delay. And if you’re the type of traveler who wants the ultimate flexibility, you can add “cancel for any reason” coverage to your policy.

Potential drawbacks: Baggage delays and travel delays are only reimbursed after a 12-hour delay. That’s a long time compared to some top competitors that require only six hours (or less).

Related: Best Senior Travel Insurance Plans Of 2021

AXA Assistance USA Gold Plan

Why we picked it: Great prices for senior travelers make AXA’s Gold plan an attractive option.

The plan comes with $100,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. You’ll also get non-medical evacuation coverage of $50,000 per person in case you need to move to safety because of a natural disaster or civil/political unrest.

AXA’s Gold plan has good baggage loss coverage of $1,500 per person. It has generous missed connection coverage of $1,000 per person if you miss your cruise or tour. The plan also includes concierge services.

Potential drawbacks: AXA’s Gold plan does not offer optional “cancel for any reason” coverage.

Cat 70 Travel Plan

Why we picked it: Superior coverage for medical expenses at very competitive prices for seniors makes the Cat 70 plan a solid choice for senior travelers.

Cat 70’s Travel plan pairs a whopping $500,000 per person in emergency medical expenses with $500,000 per person in emergency medical evacuation coverage. Travelers seeking trip cancellation flexibility can add “cancel for any reason” coverage.

Potential drawbacks: Compared to some top competitors, reimbursement is on the lower end for travel delay ($500 per person), lost baggage ($500 per person) and baggage delay ($200 per person after 24 hours).

HTH Worldwide TripProtector Classic Plan

Why we picked it: Excellent prices for seniors make the TripProtector Classic plan worthy of consideration.

TripProtector Classic comes with $250,000 per person in emergency medical expenses and $1 million per person in emergency medical evacuation coverage. The plan includes good travel delay benefits at $1,000 per person after a six-hour delay.

Senior travelers looking for even better benefits (at a higher cost) may want to upgrade to the Worldwide TripProtector Preferred plan.

Potential drawbacks: Baggage delay benefits might be insufficient at $200 per person after a 12-hour delay and you won’t have the option of adding “cancel for any reason” coverage.

Tin Leg Gold Plan

Why we picked it: Tin Leg’s Gold plan offers ample medical benefits at competitive prices for seniors.

With $500,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation coverage, Tin Leg’s Gold plan has some of the highest medical benefits among top competitors.

You will also have the option to add “cancel for any reason” coverage.

Potential drawbacks: Reimbursement is low compared to top competitors for travel delay ($500 per person), baggage delay ($200 per person after a 24-hour delay) and baggage loss ($500 per person).

USI Affinity Travel Insurance Services Ruby Plan

Why we picked it: USI Affinity’s Ruby plan has solid medical benefits and very competitive prices for seniors who are traveling.

The plan comes with $250,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. If you want the flexibility to cancel your trip, you’ll have the option to add “cancel for any reason” coverage.

Potential drawbacks: Baggage delay ($300 per person) and baggage and personal items loss ($1,000 per person) are lower than top competitors and might be insufficient for senior travelers looking for higher coverage amounts.

Tips for Seniors Buying Travel Insurance

Travel insurance can be essential for many types of trips, but seniors are particularly vulnerable to travel-related problems. Most notably, travelers age 65+ should consider a travel insurance policy with medical insurance and medical evacuation benefits.

Understand Insurance Needs When Traveling Abroad

With the vaccine rollout and countries relaxing border restrictions, you may be thinking about taking that river cruise to Portugal or a wine tour in France.

It’s important to know that when you travel outside the United States a domestic health insurance plan will not generally travel with you. This includes Medicare.

A key focus for seniors should be travel insurance with high limits of travel medical insurance, says Jeremy Murchland, president of travel insurance company Seven Corners. “Some plans on the market limit coverage to only $25,000 or $50,000,” he says. “Depending on the type of care needed, this may not be enough to cover the cost.”

“Most Medicare plans will not cover a person outside of the U.S. or U.S. territories,” explains Gail Manganite, lead customer advocate for InsureMyTrip, a travel insurance comparison provider. She notes that there are some Medigap and supplemental plans that offer health coverage outside the U.S., but deductibles and copayments will still apply.

Find out if your current health insurance includes emergency medical coverage outside the country and what restrictions apply. Then you’ll know how much travel medical insurance you need to fill the gap.

If you want top-notch coverage, look for travel insurance plans that offer $500,000 in medical coverage.

Get Medical Coverage for Pre-Existing Conditions

You don’t want a pre-existing condition to flare up during a trip, but in case it happens, have a travel insurance plan that covers it. You do this by getting a pre-existing medical condition exclusion waiver.

The availability of this important waiver is time-limited: You’ll have to add it to a travel insurance plan within a specified number of days from the date you make your first trip payment. For example, Seven Corners’ RoundTrip Choice plan covers pre-existing conditions if you buy it within 20 days of the date of your initial trip payment.

But your plan might have a window of only 14 days to get pre-existing conditions covered.

Plan for Medical Evacuation Coverage

If you require an emergency airlift back to the United States, it could easily cost $100,000 or more for private, emergency transport. Emergency medical evacuation insurance pays to move you to a medical facility with appropriate and necessary care if the facility where you are located is unable to provide the level of care needed for your medical condition, says Murchland.

You can find travel insurance plans with up to $1 million in coverage for emergency medical evacuation.

Be Aware of “Cancel for Any Reason” Coverage

“Cancel for any reason” coverage is an add-on that you can tack on to some travel insurance plans. It will add about 40% to your travel insurance cost but gives you the widest flexibility to cancel the trip for any reason and get some reimbursement (typically 50% or 75%).

Without it, you’ll receive trip cancellation reimbursement only if you cancel for a reason listed in the base policy, such as an illness or injury that forces you to abandon travel plans. “Cancel for any reason” coverage will give you the option to cancel for reasons like a sudden fear of flying or simply changing your mind.

Consider Customer Service Options

Murchland says to pick a travel insurance company that has services that match your comfort level.

“For example, Seven Corners has found that a higher percentage of seniors wish to discuss a travel insurance plan over the phone and, in some cases, want assistance selecting a plan and executing a purchase,” he says. “In today’s world of chat bots and email, this is an important consideration for seniors who would prefer to talk with a person.”

Stay on Top of Your Insurance Timeline

Buying a travel insurance plan early and taking the time to read it can pay off later. In addition, a travel insurance agent can help you understand what the policy covers and find plans that fit your travel insurance concerns. It’s wise to:

- Buy your plan early (shortly after you make your first trip deposit) so you don’t miss out on key benefits like pre-existing conditions coverage.

- Review your plan information well before your trip . Understand what reasons are covered for trip cancellation insurance claims. If you want broader coverage, consider adding “cancel for any reason” coverage, which also needs to be added shortly after your first trip payment.

- Feel comfortable asking questions to ensure you understand your plan and how it works.

- Keep in mind that travel insurance plans offer 24/7 travel assistance help . If you run into trouble during your trip, make use of the professional help available for language translation, finding a pharmacy and much more.

Methodology

Using data provided by Squaremouth, a travel insurance comparison provider, we evaluated 24 travel insurance plans that have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage. Scores were based on:

- Travel insurance rates (50% of score) for a range of travelers age 65 and older, for trips in a variety of lengths, destinations and costs.

- Coverage benefits (50% of score) including travel medical expenses, cancel for any reason availability, Covid coverage, medical evacuation, baggage delay, baggage loss, missed connection, non-medical evacuation, travel delay.

Erica Lamberg is a personal finance and travel writer based in suburban Philadelphia. She is a regular contributor to USA Today, and her writing credits include NBC News, U.S. News & World Report, Business Insider, Oprah Magazine and Creditcards.com .

Read More On:

- FBS Marketplace

More Travel

Scotland’s Gleneagles Hotel Just Opened a Luxe New Sporting Club. Here’s a Look Inside.

Meet the Wine Club That Thinks Differently.

Receive editor-curated reds from boutique California producers four times a year.

Give the Gift of Luxury

Latest Galleries in Travel

L’Observatoire Suite in Photos

We Cherrypicked the Best Elements of Luxury Resorts to Create the Ultimate Fantasy Hotel

More from our brands, madelyn cline wraps up in ‘easy breezy’ tommy hilfiger dress, madison bailey favors liquid looks and more cast at ‘outer banks’ season four red carpet, nfl reporter trotter settles retaliation lawsuit with league, lisa marie presley and riley keough’s ‘from here to the great unknown’ is a raw, thoroughly engrossing portrait of intergenerational sorrows: book review, activists cover picasso’s ‘motherhood’ painting with image of gazan mother and child, the best yoga mats for any practice, according to instructors.

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed.

Costco Travel Insurance Review and Pricing (2024)

Sarah Horvath is a finance writer and researcher based in New York City. She specializes in writing about home warranties, insurance and home financial protection.

Anna Douglas is a journalist and editor with over a decade of experience in newspapers and digital publishing.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

The worldwide budget travel provider Costco Travel partners with the Zurich Insurance Group to offer budget travel insurance to its members. Costco Travel offers lower-cost insurance policies to protect nonrefundable trip costs, plus exclusive vacation offers. Costco members can purchase a travel insurance policy and access lower rates on their vacation if they book using Costco Travel.

While Costco only offers one policy option for international travel, this plan includes competitive travel and baggage benefits. After extensive industry research, the MarketWatch Guides team awarded Costco Travel Insurance 4.3 out of 5 stars. We especially recommend Costco to older adult travelers looking for lower-cost coverage.

- Average plan cost: $219

- Emergency medical coverage: $200,000

- Trip cancellation coverage: 100%

- CFAR coverage: 50%

- Offers an affordable insurance option, with lower pricing than the national average

- Policies include several benefits, ranging from airfare reimbursement to non-emergency medical evacuation

- Features advantageous pricing for older travelers

- Missed connections benefits go into effect after just three hours

- Has a highly rated underwriter with an A+ score from the financial credit rating agency AM Best

- Premium pricing is only available for Costco members who buy one of the company’s travel packages

- Only offers one travel package for international trips

- Limits its CFAR upgrade to a 50% reimbursement, lower than competitors offering 70% or more

Our Thoughts on Costco Travel Insurance

Travel package shoppers who buy an insurance plan through Costco are eligible for a discounted policy issued and backed through the company’s partner, Zurich. While it only offers one plan choice for all international travelers, policy details are competitive with other industry providers we’ve reviewed.

Most travelers can access the International Travel Protection Plan, which extends coverage for travel expenses and medical emergency situations . It includes benefits for accidental death and dismemberment (AD&D), financial insolvency of the carrier and missed connections, which goes into effect after just a few hours. Pricing is set before asking for the traveler’s age — a benefit if you’re over 50 years old and worry your age may influence costs.

There are a few drawbacks to consider before selecting Costco as your travel insurance provider. First, you’ll only have one policy choice — leaving no flexibility to adjust costs by reducing coverages. To take advantage of the best pricing, you have to insure a Costco vacation offer, the cost of which can run upwards of $2,000 per traveler and requires a membership to purchase. Costco’s cancel for any reason (CFAR) benefits are also less comprehensive than competitors, with only up to 50% reimbursements compared to 70% or 80%.

Pros and Cons

How costco travel insurance scored in our methodology.

Overall, our team gave Costco’s travel insurance plans a score of 4.3 out of 5 stars . While members may only qualify for low-price protection if they book their trip through Costco Travel, eligible customers can access travel insurance with high coverage caps at competitive prices.

Rating is based off of MarketWatch Methodology Guidelines

Compare Costco Travel Insurance to the Competition

Comparing Costco’s travel insurance options to other companies can help you determine the best rate for the coverage you need. However, if you don’t have a Costco membership, you will have to find another provider to work with. Explore a few of our team’s top picks for travel insurance using the table below.

Costco vs. Nationwide

If you aren’t a Costco member but are looking for similar protections as those offered by the International Travel Protection Plan, consider Nationwide. Like Costco, Nationwide’s Single-Trip Prime plan includes benefits for baggage, medical considerations, emergency evacuations and baggage issues you might run into with an airfare provider. Plus, anyone can buy a plan, whether or not they have other Nationwide insurance products.

Nationwide can also offer a stronger choice for customers looking for more protection against travel interruptions. While Costco’s policy caps interruption benefits at 150%, Nationwide will reimburse up to 200% of eligible trip expenses. This insurance company also offers more generous CFAR reimbursements of up to 75% of travel expenses — 25% more than the available upgrade from Costco.

Read our team’s complete review of Nationwide travel insurance to learn more.

Costco Travel Insurance vs. Tin Leg

Customers looking for additional coverage options and more affordable prices compared to Costco may consider Tin Leg Travel Insurance. While Costco only offers one international plan, Tin Leg provides seven policy options, with multiple coverage tiers allowing you to more easily personalize coverage. Its prices are also more affordable than Costco on average and you don’t need a membership to enroll.

Read our complete review of Tin Leg Travel Insurance to learn more.

What Does Costco Travel Insurance Cover?

Costco travel insurance is not issued through the same retailer that maintains and provides Costco wholesale club locations. While Costco Travel sells travel insurance policies at an advantageous rate, the international insurance company Zurich Insurance Group services the plans. Zurich offers international travelers one policy option, which includes both medical and travel benefits.

Zurich offers one specialized travel insurance plan to Costco members who book their vacation through Costco Travel.

- International Travel Protection Plan: The only international coverage option issued for non-domestic travelers through Costco Travel. The plan offers standard trip insurance and more generous baggage benefits than many competitors. It also includes benefits for AD&D, service provider bankruptcy and emergency medical expenses.

You do not need to have a Costco membership to buy travel insurance through Zurich. However, standardized pricing only applies to Costco executive members who book their trip through the company’s travel branch and have a Costco Travel booking number. If you buy directly through Zurich to protect a trip other than a Costco vacation, different rates will apply.

The table below summarizes coverages found in the International Protection Plan.

Costco’s partnership with Zurich offers customers only one plan option. While our team found coverage pricing to be competitive with other service providers, you may prefer to compare pricing between providers with multiple plan options if you’re shopping on a budget.

Costco Optional Add-On Coverage

Costco travel insurance policies, administered by Zurich, also offer the following add-on options:

- CFAR coverage: Covers up to 50% of your total travel expenses if you cancel your trip for any reason, as long as you purchased insurance within 21 days of your initial trip payment. You must also be within 60 days of international travel to qualify for this coverage.

- Pre-existing conditions waiver : This coverage extends your plan’s medical expense benefits to include conditions you showed symptoms of before planning your trip. You must be within 21 days of your initial trip payment to qualify.

- Rental car coverage: Adds $50,000 worth of collision coverage to rental cars you use abroad. This add-on is not available in Ireland, Mexico, Jamaica and Costa Rica.

How Much Does Costco Travel Insurance Cost?

The International Travel Protection Plan is the only coverage option available at a discounted rate with a Costco travel offer. In our review, we found the average price of a travel insurance coverage plan through Costco is $219 . This is around the same cost of an average travel insurance policy ($221) our team found in our review of dozens of providers. The specific cost of your travel insurance policy will vary primarily depending on your trip value, number of travelers in your group and date of your initial trip payment. The table below summarizes sample pricing our team found when we requested pricing for sample trips with Costco.

Note: We collected the above quotes in 2024 directly through the policy provider ’s website for sample travelers living in Alabama.

Does Costco Travel Insurance Offer 24/7 Travel Assistance?

Yes, Costco travel insurance policies include access to its 24/7 travel assistance line, which can provide concierge services and assistance when booking emergency services. Some common uses of this coverage include replacing prescriptions, arranging emergency evacuation services, and connecting with local medical and evacuation service providers on your behalf.

How To Buy a Travel Policy From Costco

To purchase a travel insurance policy through Costco, start by visiting Costco Travel’s website and entering your trip details. You’ll need to have your trip itinerary, travel dates and budget per traveler available to claim a quote. Notably, when you purchase travel insurance through Costco, you don’t need to input your age — a potential benefit for older travelers.

After entering your trip information, you get redirected to Costco’s partner company, Zurich Insurance Group, the servicing company offering international travel insurance plans. In most instances, you’ll have access to only one plan, no matter if you’re traveling internationally or domestically. For international travelers, the International Travel Protection plan is the only offering. You can explore specific coverages and view a sample contract directly before purchase, making it easy to compare additional plans.

After exploring a sample contract, you can finalize your purchase through Zurich. You’ll need to have your Costco policy travel number handy when finalizing your policy pricing — so you can’t lock in coverage until you’ve settled on a travel offer. Overall, our team found the process of buying a travel insurance policy easy and straightforward, especially if you already have a Costco vacation planned.

Costco Travel Insurance Customer Reviews

Customer reviews are an important consideration when selecting any travel insurance policy. Our team looked at what previous policyholders had to say about their travel insurance experience with Costco and identified common likes and dislikes. Since Costco offers travel insurance through a partnership with Zurich, we referenced Zurich’s BBB and Trustpilot profiles for insights.

What Customers Like

- Helpful customer service agents: Most positive reviews of Zurich’s insurance products relate to its customer service representatives , whom policyholders said were eager and able to help.

- Comprehensive cruise benefits: Multiple customers praised the company’s cruise line assistance and claims process, which customers say was easy to use in accident-related cancellations.

- Prompt payments: Another common compliment among BBB customers is quick reimbursements — a benefit after an expensive cancellation or trip interruption.

What Customers Don’t Like

- Long hold times: Multiple BBB customers expressed frustration with waiting times when connecting with customer service, with some travelers being left on hold for more than 20 minutes. Customers who submitted messages via email also faced long wait times.

- Denied claims: From airport cancellations to rental car insurance claims , multiple customers reported that their claim was denied by Zurich.

- Poor claims settlements: For customers who were able to submit a successful claim, payouts were often less than expected. This made some travelers question the value of their coverage.

We reached out to Costco for comment on its lower ratings and negative customer reviews in relation to its partnership with Zurich but did not receive a response.

How To File a Travel Insurance Claim With Costco

Costco travel insurance, administered through Zurich, offers two methods customers can use to file a travel insurance claim. We’ve summarized each method below.

- Phone: To begin a claim by phone, call 844-799-0331 if you’re located in the U.S. or Canada. Call 416-945-9802 if you’re abroad when you need to file.

- Online filing: Zurich also allows you to file a claim online . For a speedier process, have details of your claim handy when you file.

According to customers who have filed a claim with Costco’s travel partner, Zurich, it is sometimes difficult to get claims approved. Multiple customer reviews indicate denied travel insurance claims or being asked for multiple rounds of documentation for expenses. Of customers who had a claim approved, some reported getting only a small percentage of eligible expenses reimbursed.

Is Costco Travel Insurance Worth It?

Costco’s option for travel insurance is comprehensive and affordable, offering more convenient benefits for members. For example, in addition to its standard trip cancellation and interruption benefits, Costco’s partner Zurich allows you to begin using benefits such as baggage delay and missed connections funds in as little as three hours. Policies are also convenient, providing an all-in-one choice for medical, flight, baggage and evacuation benefits.

There are a few notable drawbacks to consider before investing in a Costco travel insurance plan. While anyone can purchase insurance through Zurich, only Costco members can access its travel benefits and discounted pricing. Costco also limits its plan offerings to a single coverage choice, which may not benefit travelers looking for more coverage variety. Still, for the benefits provided, Costco offers an affordable and inclusive choice for travel insurance for its members.

Frequently Asked Questions About Costco Travel Insurance

How much does costco travel insurance cost.