- Travel Money Card

The Travelex Money Card is the quick, easy and secure way to spend abroad

- Top Up Card

- Our best rates

- No commission or hidden charges

- Free Click and Collect

- Next day home delivery

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

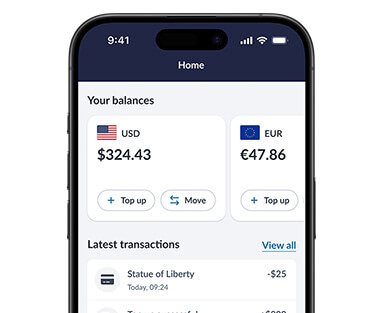

- Manage your balance 24/7 through the Travelex Money App

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Already have a card?

Travel money card benefits, safe & secure, find the right balance for your trip.

With our multi-currency prepaid card, you can reduce the amount of cash you need to carry on holiday and find the right balance for your trip. Plus, your card is not linked to your bank account, providing an extra layer of security against potential financial threats, and reducing the risk that comes with carrying cash.

Control at your fingertips

Manage your travel funds effortlessly with the Travelex Money App . Along with the essential features of freezing/unfreezing your card for enhanced security, the app provides seamless options to top up your card on-the-go. Always have secure access to your PIN and stay in full command of your travel money, ensuring a worry-free experience.

Peace of mind

Lock in your rates.

No more fluctuating exchange rates causing stress during your travels. With our multi-currency prepaid card, you can lock in your exchange rates 1 , shielding your budget from unexpected currency fluctuations.

Free and secure cash access

Forget about ATM fees eating into your travel budget. Our card provides free cash access with no overseas ATM charges 2 , allowing you to withdraw funds wherever you are. And in case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you. We aim to replace your card swiftly or provide emergency cash to keep your journey on track.

Easy to use

Effortless transactions.

Experience the ease of secure contactless payments – no signature or PIN required. Streamline your transactions and enjoy the convenience of a smooth payment process at millions of locations worldwide, wherever Mastercard Prepaid is accepted.

Easy money management

Enhance your travel experience with the flexibility to top up in 22 different currencies, including EUR, USD and AUD, and the convenience of transferring funds between your currency wallets in our app all through one versatile card, making international spending more seamless and efficient.

Seamless spending

You can easily add our card to your Apple Pay or Google Pay Wallet, making your payments smooth frictionless.

How does a Travelex Money Card work?

It’s fast and easy to get a Travelex Money Card.

1 | Order your Card

Order your Travelex Money Card online or in-store. Enjoy the flexibility of free delivery or convenient in-store collection.

2 | Register

Use the Travelex Money App to effortlessly register your card, granting you complete control over your account

Explore the world of hassle-free spending! Use your card at millions of locations globally, wherever Mastercard Prepaid is accepted.

Currencies and Rates

Explore the 22 currencies available to you on our prepaid travel card.

Fees and Limits

Free atm withdrawals worldwide.

Access your money without the hassle of ATM fees 2 , whether you're in the UK or exploring abroad.

Free Replacement Card

Enjoy peace of mind with our free replacement card service, available if your card is lost, stolen, or damaged while you're away or access to emergency cash.

Low Minimum Load/Top-up

Get started with a minimum load of just £50.00 GBP.

Generous Spending Limits:

Generous Spending Limits Spend up to £3,000.00 GBP at retailers and merchants within a 24-hour period

With our flexible fees and limits our Travelex Money Card is your perfect travel companion.

Download the Travelex Money App

- Top-up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

What our customers say

Find out why our community trust in Travelex

Common questions about the Travelex Money Card

What is a travel money card.

A travel money card (sometimes referred to as a prepaid currency card) is a global multi-currency card that’s not linked to a bank account. Like a debit or credit card, travel money cards can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling.

Do you get charged for using a travel money card?

Some providers may charge you for using your card abroad, but we do not charge spending fees 3 on our Travelex Money Card.

How do I get a Travel Money Card?

You can get a Travelex Money Card by purchasing currency online or in-store. Find our full list of stores here.

Where can I use my Travel Money Card?

You can use the Travelex Money Card in most countries across the world, wherever Mastercard Prepaid is accepted. Choose from 22 available currencies: British pounds, euros, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Swiss franc, UAE dirham, Mexican peso, Polish zloty, Czech koruna, Swedish krona, Japanese yen, Thai Baht, Hong Kong dollars, Singapore dollars, Danish kroner, Norwegian krone, Hungarian forint and Icelandic krona.

Can I withdraw money from my Travel Money Card?

Like most bank accounts, you can withdraw money from your travel money card at ATMs worldwide. The maximum withdrawal amount is 500.00 GBP within a 24-hour period. Please bear in mind Travelex does not charge ATM fees but some operators may do so, check before you withdraw cash. Travelex Money Card T&Cs can be found here.

Still have questions?

Explore our support categories for more help.

Basic information about the Travelex Money Card.

Getting started

Details on obtaining and eligibility for the card.

Managing your Travelex Money Card account.

Managing card

PIN, balance checks, and card management.

Using & topping up card

Card usage, currencies, and transaction limits.

Details about adding your card to an Apple Wallet.

Details about adding your card to a Google Wallet.

Fees and limits

Information on fees and limits.

Getting help

Support for lost/stolen cards and troubleshooting.

Previous cards

Information for Cash Passport customers.

- Travelex Money Card Terms & Conditions can be found here.

- 1 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

- 2 Although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. We advise to check with the ATM operator before using.

- 3 No charges when you spend abroad using an available balance of a local currency supported by the Travelex Money Card.

- Travelex Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International.

- PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

- Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Store Finder

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

- Prepaid Cards >

- Travel Prepaid Cards

Compare our best prepaid travel cards

Simplify your spending abroad with a prepaid travel card, find a prepaid travel card, what is a prepaid travel card.

A prepaid travel card , also known as a 'travel money card', is a debit card that you preload with money and take on holiday. It's a good way to stick to your holiday budget and avoid carrying a lot of cash.

Prepaid travel cards can be used at cashpoints, in shops and restaurants , or anywhere that accepts Mastercard or Visa debit or credit cards.

However, a prepaid travel card is not the same as a credit card for two key reasons:

You can only spend the amount you have put on the card; the pre-loaded limit prevents you overspending and getting into debt

You can choose which currency to preload your travel money card with depending on where you're going, which often means you can secure a better exchange rate

Pick a card with fees that suit how you plan to use it, e.g. choose one with no withdrawal fees if you'll be withdrawing cash often while travelling.”

What are the different types of prepaid travel cards?

Multi-currency prepaid cards.

These can be loaded with several different currencies , making them ideal for both frequent travellers and those taking trips to multiple destinations. For example, you holiday in Europe but often visit the US on business, you could use a prepaid travel card to cover your everyday spending wherever you are by topping it up with say £600 then exchanging £200 into euros and £200 into US dollars. The different currencies will then be stored in separate “wallets” , allowing you to switch currencies when you like.

Sterling prepaid cards

These can be used at home and abroad , making them even more flexible than the best travel cards offering multiple currencies. You don’t need to worry about setting up a wallet for the currency you want to use; the card provider simply converts your pounds to the required currency each time you make a purchase . However, this can make holiday budgeting harder and may increase your costs, depending on the charging structure.

Euro prepaid cards

As well as multi-currency cards, you can take out prepaid cards designed to hold a specific currency . This can work out excellently if you're trying to lock in a good rate now by loading your euro prepaid card, but if you then use the card to buy things in a country that isn't in the eurozone. That's because if you spend in a country that does not use the euro, it converts to the local currency each time you make a purchase, which can work out more expensive.

Prepaid US dollar cards

These keep your balance in dollars . If you spend in countries that use a different currency, the card will exchange your dollars to the local currency, and you might well be charged a fee. The currency exchange takes place as soon as you load your card . If the pound strengthens afterwards, you won’t be getting the best value for money, but it if weakens you'll do well.

How to get a prepaid travel card

Compare cards.

Use our table below to find prepaid travel card that offers the features you need with the lowest fees

Check your eligibility

Make sure you fit the eligibility criteria for your chosen travel money card and can provide the required proof of ID

Apply for the card

Click 'view deal' below and fill out the application form on the provider's website with your personal details

What are the eligibility requirements?

Anyone can get a prepaid travel card. There's no need to have a bank account, and no credit checks are required . Some providers have a minimum age of 18, but many will let you have a prepaid card from the age of 13 with parental consent.

Sometimes parents like to use travel money cards to give their children a set amount of holiday money , and to help teach them about budgeting and financial responsibility.

Pros and Cons

What exchange rate do you get.

Exchange rates vary over time depending on what is happening in the wider economy. That means the exchange rate you get on a US dollar travel card today, for example, might not be the same as you get tomorrow or next week.

What prepaid cards offer is the ability to lock in today's rate to use later on. That could see you better off if the pound weakens, but might also mean you get a poor deal if the pound strengthens.

That offers is certainty - you'll know exactly how many dollars, euros, lira or whichever currency you load onto the card you have to spend on holiday.

Today’s best exchange rates

At what point is the currency exchanged with prepaid travel cards.

Some prepaid travel cards hold the balance in pounds sterling. These convert the required amount to the local currency every time you spend on them .

The exchange rate isn’t fixed, so you’ll only know how many pounds you have on the card - not what it will buy you while overseas.

But the cards in our comparison table convert your money when you add it onto the card. This means you know the exchange rate used and your card's exact balance before you go away.

Compare the rates before you choose a prepaid card. Although rates can change several times a day, some travel cards will be more competitive than others.

Using a card with competitive exchange rates will mean you get more local currency for your pound.

You also need to watch out for fees as well as withdrawal limits when choosing a card, as these can vary between providers.

What are the alternatives to prepaid travel cards?

Travel credit card.

A travel credit card works just like a regular credit card, with which you can make purchases by borrowing money. The main difference is that travel credit cards don't charge foreign transaction fees for spending abroad.

Travel money

For many people, cash is the most comfortable form of payment when travelling. It's hassle-free and universally accepted. But it’s riskier, as you'll lose out if it’s lost or stolen and you’ll need to budget carefully to ensure your foreign currency lasts the length of your trip.

Travel debit card

These days, there are plenty of specialist banks and providers that offer bank accounts that don't charge foreign transaction fees when used abroad. This offers you a chance to take advantage of the best exchange rates. And if it's your main current account, you won't have to worry about topping up your account before you go.

What other costs or fees are there with prepaid travel cards?

As well as the exchange rate, you might have to pay several other charges on your prepaid travel card.

These could include:

A fee to buy the card

A monthly or annual fee for keeping the account open

Cash withdrawal fees

Transaction fees when you pay for anything on the card

Inactivity fees

Loading fees when you add money onto the card

Some cards also charge fees for withdrawing cash or making purchases inside the UK .

But some of the cards in this comparison do not charge fees in countries that use currencies loaded on the card - just make sure the right one is selected before spending on them.

Check carefully for fees before you pick one.

Read our full guide on how much it costs to use a travel prepaid card and how to choose one .

"With multi-currency cards, check you've selected the right currency before you arrive."

How long does it take to get a prepaid travel card?

You can apply online and get a decision immediately. However, it can take up to two weeks before your card arrives in the post.

Can I use any prepaid card abroad?

Yes, you can use prepaid Visa or Mastercard cards in most destinations worldwide. Travel prepaid cards are usually cheaper to use overseas than a standard credit or debit card.

Can I withdraw cash abroad?

Yes, you can use a travel money card in a cash machine outside the UK. Some cards charge fees for this, so always check if you want to use your prepaid travel card to make cash withdrawals.

What currencies can my card hold?

All the travel money cards in our comparison can hold a balance in popular currencies such as euros or dollars, while some support more than 50 different currencies.

Can I make international payments?

Yes, some providers let you send or receive money from abroad by logging into your online account, which works in the same way as standard internet banking.

Who sets the exchange rate?

This depends on the company that processes the transactions. Typically, it’s down to Visa or Mastercard , as well as your card provider, which may take an additional cut.

Can I use my prepaid card in the UK?

You can use prepaid cards to withdraw cash or buy things in the UK or online. However, you may pay fees or even an exchange rate if your card is loaded with a foreign currency.

Explore our prepaid card guides

About the author

Didn't find what you were looking for?

Our most popular prepaid card deals

Other products that you might need for your trip

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Best Prepaid Travel Money Cards

Matt Crabtree

Rebecca Goodman

Prepaid travel cards have various names, such as travel money cards or multi-currency prepaid cards, but they all work in the same way to make spending abroad easier.

Using your debit card or usual bank account on holiday can accrue fees, and spending more than you have may be tempting, like dipping into your overdraft or savings accounts.

With a prepaid card, you can stick to your budget and be aware of all the fees involved before spending.

In this article, I'll discuss everything you need to know about prepaid cards to use when you're abroad, and I've picked a list of the best prepaid travel cards on the market to help you decide.

What are multi-currency prepaid cards?

A prepaid card works much like a debit card in terms of how you use it to make purchases and withdraw cash from an ATM. The only difference is that a prepaid card isn't attached to a bank account; you must top it up to use it.

Anyone can sign up for a prepaid card and use it for travelling. There are no credit checks, so even if you’ve got a history of bad credit, you can still apply for a prepaid travel card.

A prepaid multi-currency card is like a gift card in the same way you top it up and use it. With multi-currency prepaid cards, you use them as an alternative to carrying cash or traveller's cheques when travelling . You top the card up in the currency of your choice and then use it as you need it.

You can top-up prepaid cards on the go, usually by an app, and you can use them in most places worldwide. You’ll have to check with your prepaid card provider to see what currencies you can use on the card and where you can use it.

The pros and cons

Like any financial product, there are benefits and drawbacks to using a prepaid card.

✔️ Budgeting: You can preload all of your spending money on the card, and as you can only spend what's there, it's much easier to stick with a budget and not overspend.

✔️ Safer than cash : If you lose your prepaid card, or if it's stolen, you can get a replacement card sent to you. A prepaid card isn’t attached to a bank account , so you don’t have to worry too much about anyone potentially accessing your everyday banking.

✔️ No foreign exchange fees: Most travel money cards are made for spending abroad, so there are usually no foreign exchange fees.

✔️ Accepted in most places: Most countries accept prepaid cards. Double-check with your prepaid card provider if your card is accepted before you fly out to your destination.

✔️ Different foreign currency: You can spend money in your chosen currency.

✔️ Top-up on the go: Most prepaid cards have an app that allows you to add money, exchange multiple currencies and view transaction history in one place.

✔️ Good credit not required: Anyone can apply and use a prepaid multi-currency card and there are no credit checks .

❌️ Fees to cash withdrawals: Some prepaid cards charge you for cash withdrawals.

❌️ Other fees: Fees will vary between prepaid card providers, but there may be administration fees, monthly charges or other additional fees.

❌️ Limits: Some travel prepaid cards limit how much money you can hold on your prepaid card, and some cards have a minimum amount to deposit to use the card.

Best prepaid travel cards

Here are the best prepaid travel money cards:

1. Wise: Digital and physical cards available

- Application fees: One-time fee of £7

- Conversion Fees: Fixed fee + 1.75% after free allowance

- Minimum loading amount: No limit

- Cash withdrawal fee: Fee-free cash withdrawals up to £200 monthly

With the Wise Travel Money Card, you can use it straight away as a digital card.

If you want a physical card, there is a £7 delivery fee, but you can use a digital card instantly with Google Pay or Apple Pay. You can create up to three free digital cards.

With the mid-market rate, you can top up your currency card from the Wise app . On the app, you can check your balance and transactions and receive spending notifications to see how much you spend to help you stay within your budget.

You can manage your Wise account from the mobile app or their website. You can exchange money for over 40 other currencies in real time. If you have leftover money from your holiday or your plans have changed, you can spend the money at home in the UK with a small conversion fee.

You can use your currency card to withdraw cash from over 3 million ATMs worldwide. You can use your currency card in more than 160 countries. The Wise prepaid travel money card is eco-friendly, biodegradable, reloadable, and has no subscription fee. There are no fees if you choose not to use the Wise travel card.

2. Asda Money Travel Money Card: Apply online or in store

- Application fees: None

- Conversion Fees: 5.75%

- Minimum loading amount: £50

- Cash withdrawal fee: Fee-free

You can apply for an Asda Money Travel Money Card online or in-store.

You can load up to 15 currencies and use your card contactless worldwide. You don't have to worry about cash withdrawal fees when you use this prepaid currency card; you can manage it on the go with the app. You can exchange 16 currencies with a fixed conversion fee.

You can top up via the app, online, or over the phone. You can top up while abroad, so you don't have to worry about running short of money. There are no fees when you spend in a currency preloaded to your card.

There is a £2 inactivity fee per month after 12 months. With this card, you can withdraw £500 a day, but the maximum it can hold is £5,000. This card has no link to your bank account for fraud protection.

Asda Travel Money Card is issued by PrePay Technologies Limited pursuant to a licence by Mastercard International. The Financial Conduct Authority authorises PrePay Technologies Limited under the Electronic Money Regulations 2011 .

3. Caxton Currency Card: Up to £12,000 on a card

- Conversion Fees: Live exchange rates

- Minimum loading amount: £10

- Cash withdrawal fee: Fee-free abroad, £1.50 for domestic ATM withdrawals and transactions

The daily cash withdrawal limit for the Caxton Currency Card is £300, and you can hold up to £12,000 on the prepaid card.

When you use this currency card abroad, you can make purchases fee-free with no worries. You can convert your money into 15 currencies with live exchange rates and hold multiple simultaneously.

You can use your Caxton prepaid card anywhere that accepts Mastercard; watch for the Mastercard Acceptance Mark. You can manage your finances from the mobile app as it allows you to check your card balance, top up, and block the card if you misplace it.

Caxton offers customer service that is live 24/7 to help with any of your issues or concerns. Caxton also runs an international trading online platform.

4. Easy FX Currency Card: Fee-free international cash withdrawals

- Conversion Fees: Exchange rate plus 1.8% for up to £1,000

- Cash withdrawal fee: International cash withdrawals are free

There are zero international fees when you use the EasyFX Personal Currency Card.

There is a £1.50 withdrawal fee for using a cash machine in the UK. You can benefit from highly competitive exchange rates and store multiple currencies on one account.

There are conversion fees with this currency card. However, the more money you convert, the lower the cost. You'll pay 1.8% on top of the exchange rate for conversion up to £1,000. The conversion fee lowers to 1.2% for up to £4,000.

As well as a currency card, you'll gain access to risk management tools provided by VFX Financial. You can manage your balances in real time on any device using the smart app or EasyFx website. If you don't use your card for 12 months, you'll be charged £2 monthly for inactivity.

5. Travelex Money Card: Use in millions of locations

- Application fees: One-time fee of £15

- Minimum loading amount: £50 in person and £100 online

- Cash withdrawal fee: None

The Travelex Travel Money Card allows you to use your card across millions of locations that accept Mastercard Prepaid. Look for the Mastercard International Incorporated logo when you're travelling, and you can use the Travelex Travel Money Card at those locations.

With the Travelex Money Card, you'll get free WiFi worldwide without worrying about roaming fees. There are no charges for withdrawing cash from an ATM overseas. You can exchange GBP into 15 other currencies with fixed exchange rates.

There is a monthly £2 inactivity fee. There is currently a giveaway running with Mastercard that's open until 30 September, where all you need to do is load £220 or more onto a Travelex Money Card. You'll enter into a prize draw to win a dream holiday.

6. Post Office Travel Money Card: No fee for spending abroad

- Cash withdrawal fee: Fees vary between locations

Carry up to 22 currencies with the Post Office Travel Money Card. Wherever you see the Mastercard Acceptance Mark , you can use this travel money card, including millions of shops, restaurants, and bars in over 200 countries.

There are cross-border fees of 3% when you use your currency in other countries than what the Post Office offers. There is also a load commission fee of 1.5%.

Use the Post Office accessible Travel app to top up, manage your prepaid card, transfer funds between currencies and more. You can connect your prepaid card to Apple Pay and Google Pay. If you return from your holiday with money left on your card in another currency, you can use the wallet-to-wallet feature and transfer it to a new currency you choose.

7. Sainsbury's Bank Prepaid Travel Money Card: Lower exchange rate for Nectar cardholders

You may get better exchange rates than a non-card holder if you're a Nectar cardholder and want to apply for Sainsbury's Prepaid Travel Money Card. If you hold a Nectar card, you can earn 500 bonus Nectar points when you load at least £250 onto your travel money card.

You can load money onto your card in 15 currencies at once. You can use your prepaid travel card to make purchases worldwide and withdraw cash without worrying about ATM fees.

You can check out all your transactions and load money onto the card with the Sainsbury's Bank travel money card app. There is no direct link to the prepaid card to your bank account, so you don't have to worry about security.

There is a 2% fee for loads and reloading into GBP purses. Additionally, if you don't use your card for 18 months, you may be charged a £2 inactivity fee.

8. FairFX Prepaid Card: Earn cashback in select retailers

- Application fees: Free

- Conversion Fees: 1.12%

- Cash withdrawal fee: £2 flat rate + 3.75% of the transaction amount

The FairFX Prepaid Card holds 20 major currencies, including GBP, Euros, US dollar, Japanese yen, Australian dollar, and more.

You can use this free multi-currency card in over 190 countries worldwide. You can top up on the go, either before you travel or whilst you're travelling.

Travel smarter with FairFX; when you become a customer, you can access offers and deals from partners to help your money take you further, for example, discounts on lounge access and more. You can earn 3.5% cashback in-store or online at select UK retailers.

If your car expires with a leftover balance, there will be a monthly £2 charge. Card renewal is free so that you can avoid expiration. There are no subscription fees or monthly fees.

Tips for looking after your money as you travel

Money is a massive element of travelling; it pays for your trips, food, and all the fun activities you get up to. A prepaid currency card can make your journey much more accessible.

We've compiled a list of further tips to help manage your finances a little more easily while you travel:

- Check the expiry date on the card: For any cards you take with you on your travels, ensure they're within the expiry date. Otherwise, you may be stuck without access to money. If your cards are close to expiring, consider contacting your provider and getting a new one sent out before you fly out.

- Travel insurance: Always travel with travel insurance to protect yourself and your belongings. Travel insurance can cover your medical costs if you become ill or have an accident.

- Check exchange rate: If you choose a prepaid card provider that uses live exchange rates, keep an eye on the exchange rates at specific types of the day.

- Top up your card online: If you're running low on holiday money, choose a prepaid travel card that allows you to top up online to add money to the card quickly.

- Check foreign exchange fee: Most prepaid travel cards offer minimum foreign exchange fees, but always check with the card provider for potential fees before you travel.

- Have card provider details at hand: If any issues occur, you should have the contact number or support team access to contact prepaid providers. If your card is stolen or you find fraudulent transactions on it, contact your provider, and it's worth alerting local police, too.

The verdict

A prepaid card is the ideal companion if you're someone who travels regularly and wants to be on control of tour cash.

They allow you to stay within budget, control your account from an app on your phone, and spend abroad without worrying too much about fees. With one of the prepaid currency cards from our best list, you can spend abroad securely and confidently.

Related Guides:

- 7 Cheapest Ways to Spend Money Abroad

- Best Avios Credit Cards

- Best Air Miles Credit Cards

- What Is Holiday Let Insurance?

Related posts:

- 7 Best International Banks for Expats: Pros & Cons in 2024

- Best Reward Current Accounts in 2024

- 6 Best Current Accounts UK With Cashback in 2024

- Tide Vs Starling Bank Full Review: Which is the #1 Choice?

- Revolut Vs Monzo – Which Is Best For You in 2024?

- Bank of England Base Rate Predictions for 2024

Is it Worth Getting a Prepaid Travel Card?

Using your debit card or usual bank account can accrue many travelling fees. With a prepaid card, you can stick to your budget with no credit options available and know all the fees involved before spending. You can spend without worrying about security, as your prepaid card has no direct link to your bank accounts. Prepaid cards are safer than cash and are accepted in most places. You can spend money in your chosen currency and top up on the go.

How Does a Prepaid Card Work?

You can top-up prepaid cards on the go, usually by an app, and you can use it in most places worldwide. It works similarly to a debit card, like how you use it to spend, but a prepaid card isn’t attached to a bank account, and anyone can use one.

What is the Best Travel Money Card?

The Wise Travel Money Card is at the top of our best travel money card list. There is no minimum loading fee; you make free monthly cash withdrawals of up to £200. While waiting for your card to be delivered, you can use your balance immediately as a digital card with Google Pay or Apple Pay. You can create up to three free digital cards. You can use your currency card to withdraw cash from over 3 million ATMs worldwide.

Related Articles

Mentioned Banks

Get Bank Deals & More

Sign up for our email updates on the best bank deals, money savings tips and more.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 07/09/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

We all look forward to our holidays. Unfortunately, though, more and more ...

From European hotspots to far-flung destinations, UK travellers are making ...

Travelling abroad? These tips will help you get sorted with your foreign ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

One of the joys of summer are the many music festivals playing across the ...

Our annual survey of European ski resorts compares local prices for adults and ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel money card

Planning a trip overseas? Our prepaid travel money card lets you load your chosen currency and lock in the current rate before you go. Spend safely abroad with a Sainsbury’s Bank Travel Money Card.

Wherever you go, we’ve got your back

With a Sainsbury's Bank Travel Money Card, spending money abroad has never been easier – or safer. Once you’ve experienced the benefits of a travel money card, it’ll be your first choice every time. Our prepaid money travel card allows you to:

Load up to 15 currencies at any one time. No more worrying if your currency will be in stock at the bureau de change

Make secure, contactless payments. Just look for the contactless symbol when eating out or shopping abroad. Contactless payment is subject to merchant acceptance, and there may be a maximum limit when paying this way

Manage your account on the go. Use the Sainsbury’s Bank travel money card app to manage your currency card wherever you are

Put security first. Travel with confidence knowing your card is chip and PIN protected and there’s no direct link to your bank account

Live like a local. Use your travel money card to withdraw local currencies at ATMs worldwide for free. Remember to check whether the ATMs charge their own fee

Enjoy rates you can rely on. Fix the exchange rate any time you load or move money between currencies

Enter a world of convenience. Whenever you use your travel card, it automatically knows where you are and which currency to use

It’s free to get. And it won’t cost you a penny – or a cent – to load with foreign currency

Your adventure awaits. To get your travel money card next day from your local instore bureau click 'order for collection'. Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days).

What is a travel money card?

Travel cards are a hassle-free alternative to taking cash on holiday. And a handy way of taking multiple currencies if you’re travelling to a few different destinations.

Use it like a debit card – without worrying about overseas bank fees when you spend in a currency loaded on the travel card. Pay contactless, pay with your PIN or withdraw at a local ATM. You can even use it to make online purchases.

Since it’s a prepaid travel money card, it’s also a great way to keep an eye on your holiday spending – just load your money before you jet off. And if you need a little extra you can even easily top up your card from the beach. Download the Sainsbury’s Bank travel money card app or find out more .

Which currencies can I load?

The world’s your oyster when you get a Sainsbury’s Bank Travel Money Card. Pick up to 15 currencies at any one time. Along with the Great British Pound, you can choose from:

- Euros

- US Dollars

- Australian Dollars

- NZ Dollars

- Canadian Dollars

- South African Rand

- Turkish Lira

- Swiss Francs

- UAE Dirham

- Mexican Peso

- Polish Zloty

- Czech Koruna

- Swedish Krona

- Japanese Yen

When you use your travel money card abroad, it will automatically pick up where you are and know which currency to use.

And as soon as you load money onto your prepaid travel money card, you’ll get a fixed exchange rate for the currency, or currencies loaded. So you know exactly how much you’ll have to spend even if rates change while you’re away.

Ready to get your travel money card?

It's easy. To get your travel money card next day from your local instore bureau click 'order for collection'.

Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days). When it arrives, remember to sign the back of the card.

To start using your card, simply load it with a minimum of £50. All that's left to do is decide where you’re going.

Fees, limits and terms and conditions

Get to know our Sainsbury’s Bank travel money card fees and limits. It’ll help you understand whether it’s the right option for you.

For a full description of fees, limits and terms and conditions, please click here .

± If the currency of your transaction does not match any of the currencies on your card, or there are insufficient funds on your card in a currency to cover the whole transaction, the (remainder of the) transaction amount will be exchanged to another currency (-ies) on the card in the order of priority, at an exchange rate determined by Mastercard® on the day the transaction is processed, increased by 5.75% (the foreign exchange fee).

‡ A foreign exchange rate will apply if transferring funds to another currency. The currency exchange rate is selected from the range of rates available in wholesale currency markets (which vary each day), together with a margin.

+ If, following the debit of any monthly inactivity fee, the card fund balance is less than the fee, we will waive the difference.

^^ The amount that can be loaded/reloaded will vary depending on which channel you choose, i.e. online, in store, telephone or internet banking.

^^^ If you’ve forgotten your travel money card PIN, you can contact us for a replacement.

Already got a card?

If you’ve already got a travel money card with us, login online or use the app to top up and manage your account.

Prefer to take foreign currency?

We can help with that too. With travel money bureaux all over the UK, it’s easy to find one near you . You can also order online for home delivery. There’s 0% commission, plus, if you’re a Nectar member, you’ll get better rates. ±

Travel tools and guides

Going on holiday.

Read our holiday checklist to help you create the perfect travel plan

Keeping your valuables safe abroad

Helpful tips on how to protect your valuables while you’re on holiday

Currency converter

Use our calculator to find out how much foreign currency you could get

Frequently Asked Questions

How does a sainsbury's bank travel money card work.

Sainsbury’s Bank Travel Money Card is a chip and PIN protected prepaid Mastercard® currency card.

You can load multiple currencies onto it before you travel and then use it in millions of ATMs around the world displaying the Mastercard Acceptance Mark, to access your money quickly and safely. You can also pay for goods and services online and in-store.

Where can I use a Sainsbury's Bank Travel Money Card?

Your Sainsbury’s Bank Travel Money Card can be used to withdraw money from ATMs worldwide~ displaying the Mastercard® Acceptance Mark. All you need to do is to find your nearest ATM.

Alternatively, you can use the card to pay online and in stores around the world~.

You can use your Sainsbury’s Bank Travel Money Card in countries or areas with a different currency to those on your Card. The system will automatically convert your stored currency (-ies) to the local one. Please note that for any transactions in a currency different from the Currencies loaded on your Card, the funds available on the Card will be used in the following order of priority: GBP, EUR, USD, AUD, CAD, NZD, ZAR, TRY, CHF, AED, MXN, PLN, CZK, SEK and JPY at an exchange rate determined by Mastercard on the day the transaction is processed, increased by a percentage determined by us (see the Fees and Limits section for more details).

How do I download the Sainsbury’s Bank Travel Money Card app?

Search Sainsbury’s Bank Travel Money Card app in the Apple App Store or on Google Play.

How do I top up my Sainsbury's Bank Travel Money Card?

Even with a zero balance, your card is still valid (up to the expiry date printed on the front of the card), and you can reload it any time before your next trip##.

For information on how to reload your Sainsbury’s Bank Travel Money Card, please see the 'top up' section.

## Until card expiry and subject to reload limits (see Fees and Limits section).

What if an ATM asks for a six-digit PIN?

In some countries, you may be asked for a six-digit PIN when using an ATM.

Sainsbury’s Travel Money Card uses a standard four-digit PIN, which will still be accepted as normal if the ATM has been set up correctly in compliance with Mastercard regulations.

If you need assistance with any PIN issues, please call Card Services.

Can I get cash back with my Sainsbury's Bank Travel Money Card?

No, cash back is not available on a Sainsbury’s Bank Travel Money Card.

Terms and conditions

Sainsbury’s Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

* Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy in store or online. You need to tell us your Nectar card number at the time of your transaction. We reserve the right to change or cancel this offer without notice.

Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Our website doesn't support your browser so please upgrade .

Global Money

Access the world with one account

Spend, send and manage your currencies in one place using the HSBC UK Mobile Banking app.

Join the many customers who are benefitting from HSBC UK's best exchange rates, and access to more than 200 countries and regions worldwide.

Spend money at home or abroad using your Global Money debit card, or simply add it to your digital wallet for spending free from HSBC fees. Non-HSBC fees may apply.

Your currency balances are protected by the Financial Services Compensation Scheme.

Available exclusively via the latest version of the HSBC Mobile Banking app.

Here's what you get with a Global Money Account

Send money internationally without any HSBC or intermediary fees

- Send money abroad via the HSBC UK Mobile Banking app with a Global Money Account with no HSBC or intermediary bank fees

- Send money free from HSBC fees in more than 50 currencies to 200 countries and regions with Global Money transfers. You can also hold up to 18 currencies securely to use at any time

- Live exchange rates during market hours so you know exactly how much you're sending

- Send up to GBP50,000 per day (or currency equivalent)

- See the estimated arrival time on screen when you send a payment

More than just a travel money card

- Order your Global Money multi-currency debit card when you apply at no extra cost and add it immediately to your digital wallet. It can be used at home, abroad and online

- With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines

- Use your card abroad and spend like a local. We'll debit the payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance

HSBC UK's best exchange rates

- Benefit straight away from our competitive live exchange rates

- You can view these rates in the HSBC UK Mobile Banking app before you convert

- You can add or convert currency at any time, storing it until you need it. Convert on the go or when the rate is right for you

- When you're using your card abroad and have the funds in the currency balance you are spending in, there won't be a conversion

- If there aren't enough funds in the right currency balance, but you have funds in GBP and spend in one of the currencies you can hold with us, the conversion will be done using the HSBC Global Money Exchange Rate. Any other currencies will be converted using the VISA exchange rate

Before you apply

Who can apply.

You can apply for an HSBC Global Money Account if you have:

- An active HSBC UK current account (excluding Basic Bank Account, Amanah, Appointee and MyAccount)

- A valid email address that's on our records

- A valid mobile number on our records

- The HSBC UK Mobile Banking app (Global Money is only available via the app)

Find out how to add or update your contact details .

You must also read the important documents.

Important documents

- HSBC Global Money Account Terms and Conditions (PDF, 582 KB) HSBC Global Money Account Terms and Conditions (PDF, 582 KB) Download

- HSBC Global Money Account fee information document (PDF, 181 KB) HSBC Global Money Account fee information document (PDF, 181 KB) Download

- UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) Download

- Privacy notice (PDF, 498 KB) Privacy notice (PDF, 498 KB) Download

Apply for a Global Money Account

Already an hsbc customer.

On your mobile and have our app?

New to HSBC?

If you're not yet an HSBC customer with an eligible current account, find out more about our current accounts and how to apply.

Not on your mobile?

Scan the code to get started.

Frequently asked questions

What is an hsbc global money account .

It's a digital account you can use to hold money in different currencies. It's also an easy-to-use instant payment service that lets you manage, send and spend money in different currencies securely. It's free from HSBC fees. Non-HSBC fees may apply. If a payment is sent to your Global Money Account in a non-GBP currency it will be received, but will be converted into GBP. In the future you’ll be able to receive foreign currency into your account without it being converted to GBP.

What currencies can I hold and use with an HSBC Global Money Account?

You can send and spend money in more than 50 currencies to 200 countries and regions. If you don't hold a balance in the currency you are spending in, simply ensure funds are available in your GBP wallet.

You can hold balances in these currencies:

- GBP - pound sterling

- USD - US dollar

- AUD - Australian dollar

- ZAR - South African rand

- PLN - Polish zloty

- CAD - Canadian dollar

- NZD - New Zealand dollar

- CHF - Swiss franc

- SEK - Swedish krona

- HKD - Hong Kong dollar

- AED - UAE dirham

- CZK - Czech koruna

- NOK - Norwegian krone

- DKK - Danish krone

- SGD - Singapore dollar

- JPY - Japanese yen

- CNY* - Chinese yuan renminbi

*Whilst you can hold a CNY balance, there are are regulatory restrictions that prevent you being able to send or spend inside or outside China. Chinese regulations only allow for payments in GBP, USD or EUR, so you will need to ensure you have funds available in these currencies.

How do I use my Global Money card?

Simply add GBP or any supported currency to your HSBC Global Money Account. Use your debit card as you would at home. We'll debit payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and not your USD balance.

Please bear in mind spending limits may apply.

Is a Global Money debit card the same as a travel money card?

Global Money is more than just a travel card. You can convert currency as and when you need to, even on the go. You can use your Global Money debit card like a local, at home or abroad with no HSBC fees including at cash machines. Non-HSBC fees may apply. We'll debit payments from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and NOT your USD balance.

Are my balances in Global Money protected?

Yes, they're covered up to £85,000 by the Financial Services Compensation Scheme. You can find the UK FSCS Information Sheet and Exclusions List under Important documents on this page where you can, view, print and download the document.

What exchange rate will I get when I use my Global Money Account?

The HSBC Global Money Exchange Rate is made up of the cost to HSBC and a foreign currency conversion margin that we include.

Sending money - international payments

The HSBC Global Money Exchange Rate is a live rate updated by the second during market hours. This means we can always offer our most up-to-date rate. This provides you with visibility and certainty of how much you're sending. The exchange rate will be displayed in the mobile app before you confirm your payment and will be valid for 40 seconds before refreshing. This rate is quoted to you before you complete any foreign currency transaction using Global Money.

Spending – card transactions.

If you have enough funds in the currency of the transaction, no exchange rate will apply. If the transaction is in one of the 17 currencies you can hold a balance in and you don't have enough funds in that currency to cover it, we'll convert available GBP funds using the HSBC Global Money Exchange Rate to cover the transaction. If the transaction is in a currency you can't hold a balance in, it'll be converted using the VISA exchange rate.

Is the Global Money debit card a prepaid debit card?

No, but you can convert currency before you go, and hold it in your currency balance ready to use at any time. This can help you control your budget by choosing how much you want to spend. Alternatively, you could choose to convert currency as and when you need it.

Are there any fees for using a Global Money Account?

You can send money internationally without any HSBC or Intermediary fees. However, other banks may charge to receive a payment.

With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines.

Winner at the 2024 Card and Payments Awards

Our Global Money Account was awarded 'Best Industry Innovation' for making everyday international banking easier.

- Find out more about the awards Find out more about the awards This link will open in a new window

You might also be interested in

Using your card abroad vs travel money , using your card outside the uk , starting a new journey , customer support.

Hays Travel Money Card

How would you like to WIN a £5,000 holiday of your choice? Whether it’s a tropical beach paradise, a multi-destination adventure or an epic city getaway you could be in with a chance to win! One lucky winner will win a £5,000 holiday AND £1,000 spending money on their Hays Travel Mastercard. PLUS, 10 runners up win £1,000 on their card. Sign up and load, or top up, your Hays Travel Mastercard with £500 or more before 30 September 2024 for a chance to win. T&Cs apply. No wonder we’re the Nation’s Favourite Foreign Exchange provider!

The Hays Travel Mastercard® is free to use in millions of locations worldwide where Mastercard® Prepaid is accepted when you spend in a currency loaded on the card: including restaurants, bars, and shops. This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals, and also 24/7 phone support. Take your currency card with you on every holiday, simply top up and go! Just call into your local Hays Travel branch today to purchase your Hays Travel Prepaid Travel Money Card. *The Hays Travel Mastercard is only available to UK residents aged 18 or over. A valid Passport or Drivers Licence must be presented in the branch at the time of purchase.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

- BUY IN BRANCH

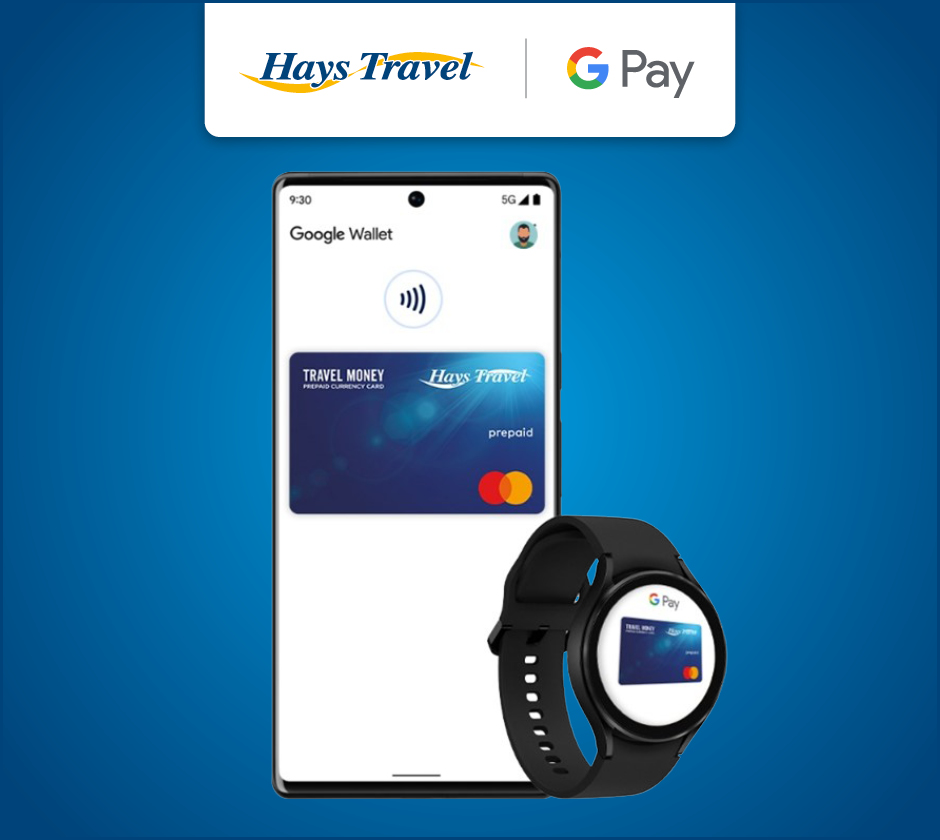

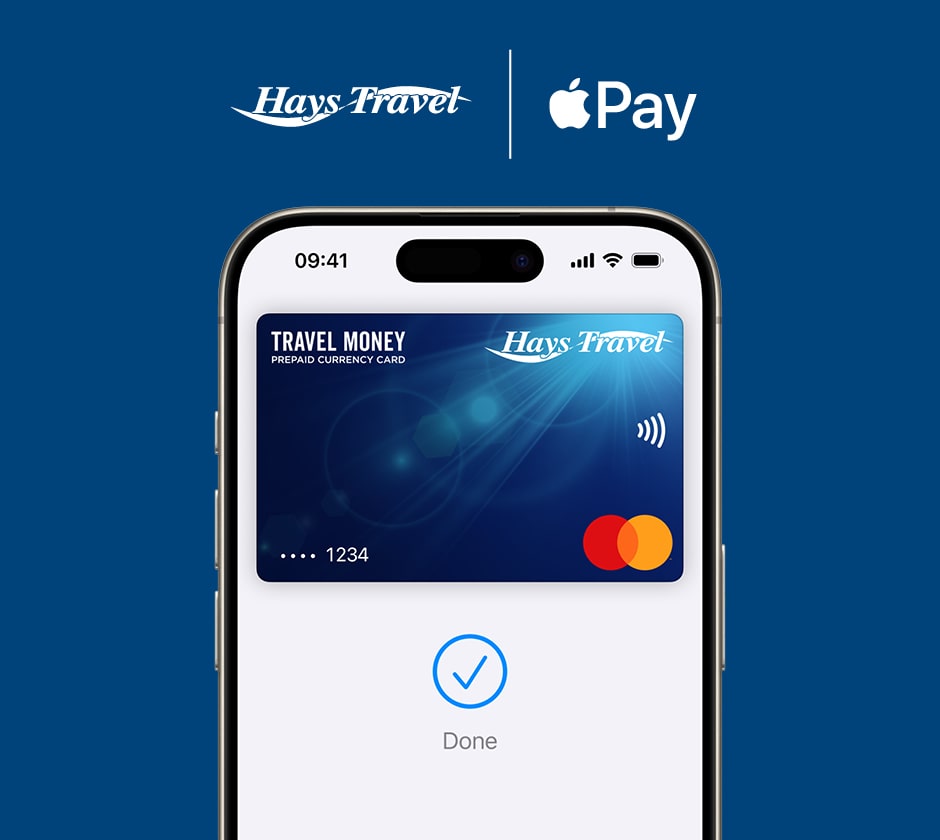

Connect to your Google Pay Wallet

You can now link your Hays Travel Mastercard® with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

Your iPhone is now your Hays Travel Mastercard®. With Apple Pay, you can pay quickly and easily with your Hays Travel Mastercard from your iPhone or Apple Watch.

Pay with just a tap.

Double-click. Face ID. Hold iPhone near reader. Done.

- Add your card today

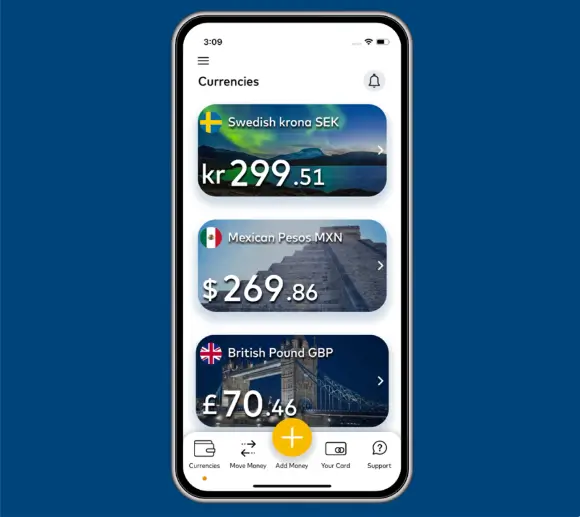

The Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad. The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

Download our app here

Manage the card on the go via Hays Travel Currency Card App

*Terms and conditions apply. View full T&C's HERE

My Account Portal

Available currencies.

Useful links

- Card Services Support Numbers

- Terms and Conditions

How to get airport lounge access

Far from the chaos of airport terminals, airport lounge access could be just the ticket to transform your travel experience

- Newsletter sign up Newsletter

Let’s face it – nobody loves the typical airport grind, so having airport lounge access can be a game-changer when you’re travelling.

Everyone loves a good break, and whether you’re jetting off on a cheap, last-minute holiday or travelling for work, the way you start your journey can set the tone for the whole trip. Instead of dealing with loud announcements, slow charging outlets, frenetic travellers and mediocre food, airport lounges can be a peaceful oasis.

If you’re a frequent flyer, with the right credit card or loyalty rewards membership, you may be able to get airport lounge access for a reduced fare – or even free.

- Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, not all airport lounges are created equal. Some provide luxurious five-star amenities, while others may be more no-frills. And it doesn’t always pay to go premium. A recent investigation by Which? into UK airport lounges revealed that despite charging upwards of £40, some lounges lack essentials like toilets, quiet zones or family areas. That’s why it’s essential to know how you get into the best airport lounges without breaking the bank. Here are five ways to get airport lounge access.

1. Credit card rewards

Credit cards can be your golden ticket to accessing airport lounges. Travel credit cards often come with lounge access as a perk, letting you enjoy a bit of pre-flight luxury for a small fee. Some services extend beyond lounges, where you also get discounts on restaurants that are within the airport terminal. But how exactly do you access this perk?

Here are a few ways you can use credit cards to their maximum potential when it comes to lounge access:

American Express lounges

American Express (Amex) credit cards regularly feature in our best cards to use for travel guide. For instance, with The Platinum Card from Amex, card members can access over 1,400 airport lounges across 650 cities in 140 countries.

This includes access to the Centurion Network, which is known as one of the flashiest lounges with top-quality service. They offer amenities from high-speed Wi-Fi to gourmet meals and cocktails, spa services and even conference rooms for business meetings. At the moment, there are 24 Centurion Lounges worldwide, including New York, London, Hong Kong, Mumbai and Sydney. This does come at a price, of course, the annual fee for the Platinum Card from American Express is £650.

You can get some free lounge passes if you’re an Amex Preferred Rewards Gold Credit Card member. With this, you can get four complimentary Priority Pass airport lounge visits per year. It’s a great deal if you’re not a frequent flyer.

Capital One lounges

If you hold a Capital One Venture X Rewards Credit Card , you can visit one of its all-inclusive lounges with unlimited complimentary access for you and two more guests per visit. It offers premium chef-inspired food, relaxation and fitness spaces and custom cocktail bars. You can visit one of their lounges in Washington (Dulles), Denver, New York and Las Vegas. Holders of the Venture X card also get a free Priority Pass membership with access to over 1,400 airport lounges in nearly 150 countries.

Chase lounges

In recent months, Chase – a MoneyWeek Readers' Choice favourite , has pulled some of its best savings deals due to a Bank of England interest rate cut. However, Chase Sapphire Reserve credit card holders are still in luck. You can take advantage of complimentary lounge access to 1,300+ airport lounges worldwide with up to two guests. If you hold a Priority Pass from another credit card, you can visit Chase lounges in the US once a year.

While the annual fee for the card is high ($550), you also receive up to $300 in annual travel credit and significant welcome bonuses, which can help justify the expenses.

2. Get a membership

For those who don’t think they will get their money’s worth out of a credit card, consider purchasing a membership to an airport lounge. Executive Lounges by Swissport offers a membership of £260 a year, though you’d need to use it at least 15 times to get your money’s worth.

Alternatively, a Priority Pass could be a better fit. This pass grants access to over 1,600 lounges worldwide, from JFK and Heathrow to Doha, Hong Kong and Sydney. You don’t need to be a business class flyer. Anyone can buy a membership, and you get services like spas, sleeping pods and fine dining to elevate your journey.

Many credit cards like the Amex Platinum, Chase Sapphire Reserve and the Capital One Venture X Rewards Credit Card also let cardholders register for Priority Pass Select memberships.

Here are the three different Priority Pass memberships depending on how frequently you travel:

If you’re not a frequent flyer, a lower-tier membership like DragonPass might be more beneficial. Starting at £68 for a Classic membership with an additional £24 for each guest, you get one free lounge visit included, and depending on your plan, up to eight free visits a year.

But if you’re going to use a lounge more than a handful of times a year, you might find better value in a credit card that offers lounge access, given the extra perks on top.

3. Fly premium

Your boarding pass can make all the difference. Many airlines offer VIP lounge access to first-class and business-class passengers, like the Admirals Clubs by American Airlines, Sky Clubs by Delta Air Lines and United Clubs by United Airlines. However, note that for domestic and short-haul flights, a business class ticket might not always grant lounge access – you often need to be flying internationally.

Some airlines really go the extra mile for their top-tier flyers. Cathay Pacific's The Wing, First, for example, is a first-class lounge with an à la carte menu, champagne bar, private workstations and luxurious cabanas with rain showers. Similarly, Air France’s La Première lounge offers fine dining, beauty and botanical treatments, and even a personal chauffeur who drops you off at the airport. But be prepared to splash out – this lounge can set you back around €800 (or £673) for access.

4. Have airline elite status

Airlines often reward their most loyal customers with an ‘elite status’. This is basically where you get a host of benefits depending on how frequently you fly with them, and the rewards can range from complimentary checked baggage to priority check-in and even free access to its lounges.

For example, British Airways extends complimentary lounge access to Emerald and Sapphire level members of any Oneworld airline frequent flyer programme on a flight operated by BA or a Oneworld partner. United Airlines provides United Club access to Premier Gold, Platinum and 1K members flying internationally on Star Alliance flights, with one guest allowed.

5. Tap into your packaged bank account perks

Packaged bank accounts , while they come for a monthly fee, can offer great value. From just around £15, you could get travel and home insurance , car breakdown cover , cashback, freebies and some of the best savings rates . In some cases, you can also get free access to airport lounges, which can be a great perk if you travel often.

The Barclays Travel Plus Pack , for instance, costs £22.50 per month and gives you six free airport lounge passes annually, valid at over 1,000 lounges. The NatWest Premier Reward Black account with a £36 monthly fee also offers lounge access, but not everyone is eligible. You need to pre-book your lounge entry for £5 per person via the DragonPass Premier Plus app, and it costs £24 to bring a guest.

How to get one-time airport lounge access

If you’re only after a one-off visit, a single lounge pass might be cheaper than buying food and drinks at the airport. Sites like Lounge Pass , LoungePair and Holiday Extras let you book these, or you can book directly through lounges such as No1 Lounges or Executive Lounges by Swissport .

Prices usually start around £20 but can vary depending on the lounge and its services. As a rule of thumb, it’s best to book in advance, as prices on the day of travel are typically more expensive.

If you’re unsure about which airport lounge you’re looking for, it’s a good idea to check directly with the airport you’re going to be visiting.

Can you get airport lounge access for free?

Sometimes. If you’re flying business or first-class, or have a credit card that includes lounge access (like the Platinum Card from American Express Gold), you could get in for free. Some lounge memberships also allow free entry for guests, and military members often enjoy complimentary access.

Ultimately, whether you’re looking to relax in style or just dodge the crowds, there’s an option out there to suit every traveller. Bon voyage!

Our team, led by award winning editors, is dedicated to delivering you the top news, analysis, and guides to help you manage your money, grow your investments and build wealth.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money. Oojal has an MA in international journalism from Cardiff University, and before joining MoneyWeek, she worked for Look After My Bills, a personal finance website, where she covered guides on household bills and money-saving deals. Her bylines can be found on Newsquest, Voice Wales, DIVA and Sony Music, and she has explored subjects ranging from luxury real estate to the cost of living, politics and LGBTQIA+ issues. Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

After years of decline, M&S seems to have turned a corner. But is this just a “dead cat bounce”?

By Dr Matthew Partridge Published 6 September 24

Professional investor Ken Wotton highlights British small caps that hit the sweet spot of the British equity market

By Ken Wotton Published 6 September 24

Useful links

- Get the MoneyWeek newsletter

- Latest Issue

- Financial glossary

- MoneyWeek Wealth Summit

- Money Masterclass

Most Popular

- Best savings accounts

- Where will house prices go?

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Moneyweek is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.

MORE SECTIONS

- Dear Deidre

MORE FROM THE SUN

- Newsletters

- Deliver my newspaper

- Sun Vouchers

- The Sun Digital Newspaper

- Racing Members Enclosure

- Fabulous Clothing

Full list of card providers charging up to £24 a year in ‘sneaky’ fees which eat away at your cash

- Sara Benwell

- Published : 8:10, 1 Sep 2024

- Updated : 9:43, 1 Sep 2024

- Published : Invalid Date,

IF you’ve got a prepaid card you haven’t used in a while, check the terms and conditions, as you could be stung by sneaky charges that eat away at your money.

Several providers charge ‘dormancy’, ‘inactivity’, or ‘account maintenance fees’ if you’ve not used your card for a set period - often a year.

This is particularly common among currency and prepaid cards, which is a problem because if you skipped your annual holiday thanks to the cost-of-living crisis, you might be losing cash without realising it.

Some companies even charge you if you have an unused balance on a card that has since expired.

Most providers charge around £2 a month until the balance is cleared after which you won’t pay any more fees.

If you have an inactive account, you can typically stop the charges by either topping up cash, withdrawing money , or spending on a transaction.

More on money

High street bank to start charging fees to use debit card abroad from next week

Thousands of shoppers are missing out on best high street loyalty scheme deals

The exact amount charged varies from bank to bank, but you can check by looking up the terms and conditions for your card.

We’ve rounded up a list of cards that charge dormancy or account management fees, how much it will cost each month, and what triggers the charges.

Asda travel money card

Asda says it charges an inactivity fee of £2 per month on its Travel Money Card.

The fee kicks in after a 12-month period where you have not topped up your card, paid for transactions or withdrawn money.

Most read in Money

Royal Mail to hike price of first class stamps in WEEKS

Major bargain chain with 600 locations to close ALL stores on Boxing Day

Supermarket tea bag named better than PG Tips or Tetley - it’s not Aldi or Lidl

Ideal date you should turn on heating to get best savings on energy bills

This still applies after your card has expired, but there is no fee if you have a zero balance.

Caxton Mastercard Prepaid Card

Caxton says that if there hasn’t been any activity on your card for 12 months or more, you will pay a £2 per month dormancy fee.

The dormancy fee will continue until either you re-activate the account, or the available balance is completely depleted.

You can stop the fees and reset the 12-month period at any time by:

- Loading your account

- Switching a balance

- Using your card for a payment

If your balance is at zero, you will not pay any fees.

Easy FX Currency Card

Easy FX says it charges a card dormancy fee of £2 per month if there have been no card transactions in the preceding 12 months.

FairFX Currency Card

FairFX doesn’t charge a dormancy fee, but it does charge a £2-per-month "expired card administration fee" on cards that still have balances.

This doesn’t apply to cards that have not expired.

Iceland Bonus Card

The Iceland Bonus card is designed to help shoppers save and gives you a £1 bonus for every £20 that you load.

But Iceland says it reserves the right to withdraw, decline, cancel or issue a new card at any time and without notice. If your account is cancelled, the remaining balance will be lost.

If you choose to cancel the account you must make sure that any savings or balances on your Bonus Card are redeemed, otherwise you’ll lose the money.

Iceland also says that your Bonus Card will automatically expire 24 months after the last time you used it. Any remaining balance, of any type, will be forfeited and will not be retrievable.

PayPal charges an inactivity fee of £9 each year, which it says is to cover the cost of maintaining inactive accounts.

To avoid the fee, you need to do one of the following:

- Log in to your account

- Pay with PayPal

- Send money to friends or family using your PayPal account

- Withdraw money from your PayPal account

- Donate to a charity using PayPal

This fee only impacts accounts that haven't been active within the past 12 months. Accounts with a zero balance aren’t charged and PayPal says the charge won’t result in any negative balances.

If an account remains inactive, PayPal says it may be closed.

Post Office Travel Money Card

The Post Office charges a monthly maintenance fee of £2 for Travel Money Cards that have expired and not been replaced, despite having a positive balance.

If, after the expiry of your current card, you would like to apply for a new one, you can contact customer services, and the balance will be transferred across.

The fee starts to be deducted from your balance 12 months after your card expires. All cards are valid for up to 3 years.

Sainsbury’s Bank Travel Money Card

If you don't use your card for 18 months, a £2 dormancy fee (also known as inactivity fee), will be taken off your balance each month.

If, following the debit of any monthly inactivity fee, the card fund balance is less than the fee, Sainsbury’s says it will waive the difference.

If the balance is £0, then you won’t be charged.

Travelex Money Card

Travelex says it charges a £2 per month fee after a 12-month period of you not using your card.

To prevent the charge, you need to either top up your card, pay for transactions or withdraw money.

The fee is still charged if your card has expired, but there is no fee if you have a zero balance