- Destinations

- Hotels & Homestays

- Food & Drink

- People & Culture

- Mindful Travel

- Readers' Travel Awards

- Escape to Rajasthan

- READERS TRAVEL AWARDS

- #LOVEGREATBRITAIN

- TAJ SAFARIS

- BOUTIQUE HOTELS

- CNT TOP RESTAURANT AWARDS

- DESTINATION WEDDING GUIDE

- DON’T TRAVEL WITHOUT IT

- #UNDISCOVERAUSTRALIA

- ESSENTIALLY RAJASTHAN

Will you have to pay 20% extra for international travel? New TCS rule explained

By Condé Nast Traveller

The Finance Ministry has introduced amended rules under the Foreign Exchange Management Act (FEMA), increasing the Tax Collected at Source (TCS) for international spending from 5% to 20%. This increased tax will apply from 1 July, and there are also new rules regarding international credit card transactions. Here’s a handy explainer on what the new 20% TCS rule means, and how things will change for you:

What is TCS?

Tax Collected at Source is a tax payable by a seller which he collects from the buyer at the time of sale of goods so that it can be deposited with the tax authorities.

What is the new 20% TCS rule?

Previously, the TCS on international spending was 5%. Starting 1 July, this will increase to 20%. This means that any travel bookings you make, July onwards, will cost 20% more upfront. Any international travel package, airline and accommodation bookings will be 20% higher in cost than before. “Suppose you’re booking a package that costs Rs100, it will now cost Rs120—with Rs20 being collected as tax,” says Aliasgar A Khumosi, a chartered accountant. This applies for all forms of payments.

What kind of transactions will attract the 20% TCS?

Any spending through a debit card, credit card or forex card outside of India will attract the 20% TCS. This includes meals at restaurants, Ubers, flight bookings, hotel bookings, shopping and more. However, the Ministry of Finance has issued a clarification stating that “any payments by an individual using their international Debit or Credit cards up to Rs7 lakh per financial year will be excluded from the LRS (Liberalized Remittance Scheme) limits and hence, will not attract any TCS”.

Can you book through a travel agent to save TCS?

The rule also applies to bookings made through a travel agency—you will pay 20% more to your travel agency for their services as a result of the new rule. Beyond foreign travel, the rule applies to money sent abroad as well as any other remittances.

Will a forex card save you the TCS?

No. Transactions on forex cards and debit cards will also attract the 20% TCS.

How does it affect international credit card transactions?

In consultation with the RBI, the Finance Ministry has omitted Rule 7 of the Foreign Exchange Management (Current Account Transactions) Rules, 2000. Under this rule, forex spending through international credit cards was exempted from the Liberalized Remittance Scheme (LRS). This scheme enables Indian residents to remit funds abroad for certain specified purposes up to a limit of $2,50,000 (Rs2 crore). Until now, the scheme only included debit cards, forex cards and bank transfers. Since international credit card transactions were not included, they were also exempt from the TCS levies that came under the scheme. With the new rule, transactions made with credit cards outside of India will also fall under the LRS. Until 1 July, the transactions will carry a 5% TCS levy, following which the TCS for transactions above Rs7 lakh (per financial year) will increase to 20%.

Are there any foreign expenses that are exempted from the 20% TCS?

Yes. There is no change in the TCS rate for remittances made for the purpose of any education or medical treatment abroad.

Can you claim the 20% TCS back?

“You can get your tax back once you file your returns. It’s essentially an advance tax paid by you,” says A Khumosi. While you will have to pay more for international travel upfront, you can claim the tax back through your Form 26AS—your annual tax statements—when you file your returns.

It just got (much) cheaper to visit Bhutan – start planning that dream trip

Aug 31, 2023 • 11 min read

Bhutan is a destination only lightly touched by tourism © Mark Paulda/Getty Images

Since tentatively opening up to tourism in 1974, the Himalayan kingdom of Bhutan has earned a reputation as one of the most pristine – and expensive – places to visit on the planet.

Tight controls on tourism and high daily tourist fees have helped to preserve a traditional Buddhist culture that is rapidly vanishing from other parts of the Himalayas. And in 2022, those fees climbed even higher, as Bhutan opened its borders to travelers following the pandemic.

Now, almost a year after this sudden price hike, the Bhutanese government has announced another shake-up to the daily tourist fees – but this time, fees are coming down significantly. For travelers deterred from visiting Bhutan’s ancient fortress monasteries and immaculate mountain valleys by the high price tag, this is welcome news, but what exactly are the new rules, and how do they affect travelers?

If Bhutan has long been on your bucket list and you’re ready to go, here’s what you need to know about the new fees, including what you will be charged for and where the money ends up.

What was the old system for visiting Bhutan?

Until 2022, tourists to Bhutan were charged a daily tourist fee of $250 ($200 in the low season) for every day spent in the country. This might sound expensive, but the fee covered food, accommodation, transport, guide fees and most of the other essentials tourists needed for a once-in-a-lifetime trip. Also included in the daily charge was a $65 Sustainable Development Fee, funding far-reaching social programs in a nation famed for measuring progress in terms of Gross National Happiness rather than Gross National Product.

In September 2022, Bhutan reopened to un-quarantined tourists for the first time since the start of the pandemic – but the Sustainable Development Fee increased to $200 per day, with additional charges for accommodation, food, transport, entry to sights and guides. Lower fees applied for tourists from neighboring India , but for most other visitors, the cost of travel to Bhutan doubled from an already high baseline.

For some, Bhutan was no longer a once-in-a-lifetime destination tantalizingly within reach, but an unattainable dream, particularly with the soaring cost of flights and the post-COVID-19 cost-of-living crisis. For a while, it seemed that Bhutan’s unique experiences would be reserved for the high-flying elite; Himalaya fans with smaller budgets folded away their maps of alpine valleys and prayer-flag-draped monasteries and looked elsewhere for their dose of mountain magic.

In fact, the blow was soon softened by a series of discounts offered to travelers staying more than four nights in Bhutan, with additional days exempt from the daily fee once visitors reached a certain threshold. But as of September 2023, cheaper – if not exactly cheap – travel to Bhutan is back in the cards. Here are the changes, and what they mean for travelers dreaming of Bhutan's pure mountain air and timeless Buddhist architecture.

Getting the best out of your trip to Bhutan

What is the new system starting in September 2023?

After increasing by 200% in 2022, the daily Sustainable Development Fee will be cut in half from September 1, 2023 to a more affordable US$100 per day. Children ages six to 12 will pay $50 per day, and there’s no fee for children age five or under. This is a significant price drop – but travelers will still have to budget for meals, transport, guide fees, entry charges at dzongs (fortress-monasteries) and museums, and hotels – which can cost anything from $40 per night for a budget hotel in the capital, Thimphu , to nearly $2000 per night for the lavish, palace-like Amankora Paro Lodge in Paro .

Then there are flights, with the trip from New York to Paro coming in at around $2000, transferring in either India or Nepal to a Bhutan-bound flight with Bhutan Airlines or Druk Air – the only airlines licensed to fly into the international airport at Paro. You should budget a minimum of $300 per day for a trip to Bhutan, and considerably more to stay in superior classes of hotel, in addition to the cost of your flights.

However, this high price tag gets you access to a destination only lightly touched by tourism. Only around 40,000 tourists visited Bhutan in the first six months after the country reopened following the pandemic, with more than half of these visitors coming from India. For comparison, Nepal received nearly 500,000 visitors over the same period, and India saw more than four million arrivals.

With the low visitor numbers, sights in Bhutan – such as the majestic dzongs in Paro, Thimphu and Punakha and the gravity-defying monastery at Taktshang – only become truly crowded when locals are gathering for one of the country’s colorful Buddhist festivals. While the influence of the modern world is creeping into Bhutan, particularly in Thimphu, your prevailing memories will be of peace, silence and clear mountain air scented by the aromatic resin of blue pines. For travelers seeking Shangri-La in real life, the experience is priceless.

Are there any changes for travelers from India, Bangladesh and Maldives?

Visitors from India, Bangladesh and Maldives are subject to different rules. Travelers from India, who make up 73% of all visitors to Bhutan, can visit with a special permit – available through the Bhutanese government’s visa portal – paying a low daily fee of ₹1200 (about $15). Bangladeshi and Maldivian citizens must apply for a visa, on top of the same special daily fee. No changes have been announced to this system.

In Bhutan, a historic Himalayan route opens to hikers for the first time in 60 years

What if I want to go trekking?

With its lofty Himalayan valleys and remote monasteries, Bhutan is a spectacular trekking destination, but the daily Sustainable Development Fee still applies. The most practical way to trek is to make arrangements through a Bhutanese tour operator, who will provide guides, support staff, pack animals, tent accommodation and meals for the duration of your trek.

With a support team to transport your bags and put up your tent and a hot breakfast waiting for you when you wake up every morning, the experience is more like glamping than wild camping, and the trails are delightfully uncrowded – particularly if you attempt more ambitious routes such as the 28-day Trans-Bhutan Trail . You’ll also get to meet local people following a traditional way of life, far from the tourist bustle.

What about my visa?

Applying for a visa for Bhutan is a little different from applying for a visa for most other countries. Visas are not issued by embassies overseas but are stamped into your passport on arrival, on production of a pre-approval letter confirming you have paid the daily tourist fees and the $40 visa-processing fee. The easiest way to obtain this letter is to make arrangements through an approved Bhutanese tour operator; you can also apply online via the government's visa portal (you’ll also need mandatory travel insurance for the duration of your trip).

Be aware that you will have to pay the Sustainable Development Fee for every day of your stay at the same time as you apply for your visa. Many travelers feel more comfortable applying through a tour agency, rather than making a payment of hundreds or even thousands of dollars via an online form. Using an agency will also allow you to talk through your itinerary with an experienced local expert. It’s the best way to ensure that you get maximum value from the daily fee (for instance, you don't want to squander $100 days backtracking to places you have already visited).

Why has this decision been made now?

When the daily fee was increased in 2022, the government announced that funds raised would be used to offset the carbon footprint of tourism, reduce fossil-fuel dependency, improve carbon-neutral infrastructure and up-skill workers in Bhutan’s tourism sector, supporting Bhutan’s recovery from the pandemic.

However, in the first few months following the reopening, international visitor numbers fell markedly compared to before COVID-19, attributed to the new fee structure, worldwide inflation and economic uncertainty linked to the war in Ukraine. Nearly 60,000 people visited Bhutan from January to August 2023, compared to 315,600 travelers for the whole of 2019. The economic foundation of Bhutan’s “high value, low volume” tourism model no longer seemed quite so secure.

According to a government statement, the new fee reduction announced in 2023 reflects the “important role of the tourism sector in generating employment; earning foreign exchange; realizing the potential for spillover benefits for ancillary industries; and in boosting overall economic growth.”

Commenting on the change, Dorji Dhradhul, director general of the Department of Tourism Bhutan, said: “ Amid the global recovery from the COVID-19 pandemic, ongoing European conflicts, and economic challenges affecting key markets, we’ve attentively considered feedback from our guests, industry peers and global travel partners."

"Consequently, we’ve decided to temporarily reduce our Sustainable Development Fee (SDF) to rejuvenate our tourism industry. This will not only make our nation more accessible to potential visitors but will also ensure sustained funding for the numerous projects supported by the SDF."

It’s a valid stance for the government to take. In 2019, the Sustainable Development Fee contributed nearly $89 million to the Bhutanese economy. During the eight months from January to August 2023, the Sustainable Development Fee delivered a more modest $13.5 million into the national coffers.

Another issue was the lack of warning provided by the authorities when Bhutan reopened to tourism after the pandemic. The government announced the doubling of the daily fee just weeks before the borders opened in September 2022 – for a destination where tourists typically spend up to six months planning a trip.

The current reduction in the daily fee has also been announced on short notice, but the lower rate will apply until August 31, 2027, giving tourists some certainty when planning ahead for a trip to Bhutan.

Escaping Thimphu: where to go to find Bhutan’s hidden treasures

Where will my money go?

Bhutan’s unique tourism model has delivered significant benefits for the people of this remote Himalayan kingdom. On top of free healthcare and education, the Sustainable Development Fee has funded everything from conservation to carbon-neutral infrastructure and organic farming. These projects have contributed to Bhutan becoming the first carbon-negative country on earth – actually absorbing more carbon dioxide than it produces.

What does sustainable development look like on the ground? With tourism reducing the pressure on agriculture to sustain the economy, Bhutan has managed to keep 71% of its territory under forest cover, compared to just 25% in Nepal and 11% in Bangladesh . Some 95% of Bhutan’s electricity is produced using hydropower, and almost 100% of the population has access to electricity and clean water.

In exchange for opening their mountain home to high-value, low-impact tourism, the Bhutanese have achieved a high standard of living compared to their neighbors. Bhutan spends nearly 40% more than Nepal on education, with half the unemployment rate and half as many people living under the poverty line. And the adult literacy rate is growing at 10% per year – not bad for a country where 61% of people live in remote mountain villages.

Bhutan is also famous for its Gross National Happiness – an innovative model for assessing the successes and achievements of Bhutan’s part-monarchy, part-clergy and part-elected government. Using such measures as job satisfaction, sense of community, psychological well-being and religious karma, Bhutan is rated as the happiest country in the world.

Know your gompas: a Lonely Planet guide to Tibetan Buddhist monasteries

So is Bhutan still worth visiting?

Of course! While visiting Bhutan will always be an expensive option, the lower daily fee makes travel here more affordable – just not quite as affordable as it was before the pandemic. In truth, Bhutan was always a plan-ahead-and-save-up kind of destination, and with the lower Sustainable Development Fee fixed until 2027, travelers have a clear target to aim for over the next four years.

Looking at things objectively, tourist fees are increasingly the future of travel. Barcelona has had a tourist tax since 2012, Thailand imposed a $9 tourist tax in 2022, Manchester introduced a daily tourist charge in 2023, and Venice and Valencia are poised to levy new tourist charges during the 2023–24 season. The primary difference in Bhutan is that you need slightly deeper pockets.

If the lower daily fee succeeds in luring more people to Bhutan, visitor numbers will still be small by international standards, and the government will have more funds for worthy social and environmental initiatives such as new hydropower projects and the electrification of public transport. In the future, that famously clean mountain air may become even cleaner and more keenly fragranced by the scent of glacial meltwater and blue pines.

This article was first published Aug 12, 2022 and updated Aug 31, 2023.

Explore related stories

Jan 5, 2024 • 20 min read

As the new year begins, here are 24 of the world’s most life-affirming journeys to consider for nurturing your path to self-discovery.

Jun 15, 2024 • 9 min read

Jun 14, 2024 • 6 min read

Jun 12, 2024 • 12 min read

Jun 11, 2024 • 9 min read

Jun 3, 2024 • 8 min read

May 31, 2024 • 6 min read

May 29, 2024 • 8 min read

May 28, 2024 • 9 min read

May 23, 2024 • 17 min read

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

- Buying Guides

For Indians, a summer holiday abroad now comes with a 20% tax

A leisurely trip abroad is about to get 20% costlier for Indian travellers.

Earlier this week (May 16), India’s finance ministry notified that using international credit cards will be taxed at 20% from July 1, up from 5% now. This applies to overseas tour packages and other remittances, too, but not educational and medical expenses.

A look back at BTS as it became the world's top-selling act

Your anxiety brings 4 distinct superpowers

Americans may have seen the last of big rent hikes

The government has also set a limit on the amount that can be sent out of India , including credit card usage during overseas travel, on hotel stays or tour packages. Under the Liberalised Remittance Scheme (LRS), individuals are allowed to remit only up to $250,000 every year without prior approval.

The government’s move has stirred up a debate and led to rollback calls from Indian citizens.

This new 20% TCS (Tax Collected at Source) on credit card spend in foreign currency in the name of catching tax offenders or stopping people from remitting more than LRS limit of US$ 250000/- per year seems ill conceived idea. Earlier TCS was 5% & credit card spend was exempted.… — Aveek Mitra (@aveekmitra) May 18, 2023

The hiked tax rate, in particular, is not sitting well with the travel industry that has sprung back to life only now following the covid-19 pandemic.

“The finance ministry is truly creating gaps and the business of travel and tourism is becoming a maze of tax collections,” Jyoti Mayal, president of Travel Agents Association of India, told The Economic Times .

Losing the game to global competition

In recent months, airfares and hotel room rates have surged due to the pent-up demand .

Indians spent $12.51 billion on overseas travel until February in the fiscal year 2023. This was 104% more than the expenditure in the same period last year. Outward remittance for travel in February alone stood at a little over $1 billion (pdf).

In March, several tour operators and local travel agents urged authorities to review the budget decision to the hiked tax on overseas tour packages. They have already lost business to global players like Expedia Group and Booking Holdings as customers looked for better pricing, and avoid paying the tax.

“Foreign companies are not charging GST (goods and services tax) on bookings. There are foreign companies that will take advantage of this move and will allow customers to pay on arrival, and there will be no revenue generation for the government,” Riaz Munshi, president of Outbound Tour Operators Association of India, told The Economic Times .

India’s outbound travel is only growing

India’s outbound travel has grown exponentially in recent months.

More than 18 million Indians travelled abroad between January and November 2022—this was around 70% of overall outbound visits in 2019, government data showed.

Meanwhile, foreign agents like Agoda, a subsidiary of Booking Holdings, are bullish on India’s domestic and international travel market, Mint reported in March. “I suspect that India will gradually become the number two market for outbound travellers to the world. People tend to think that the Indian traveller is not a big spender, but that’s not true,” Agoda CEO Omri Morgenshtern told the daily.

More from Quartz

The world’s biggest banknote printer said the demand for cash hit a two-decade low

Every fifth car sold worldwide this year will be electric

Sign up for Quartz's Newsletter. For the latest news, Facebook , Twitter and Instagram .

Click here to read the full article.

Recommended Stories

We finally know how many cybertrucks tesla has sold so far.

Tesla announced another recall for its Cybertruck, its fourth since its release in late last year, but within the recall notice is an interesting nugget on how many Cybertrucks are actually out in the wild.

Texas A&M baseball coach Jim Schlossnagle takes Texas job day after MCWS loss, adamant vow to 'never' leave

Schlossnagle lambasted a reporter for broaching the subject, then reportedly took the Texas job less than 24 hours later.

Rivian stock soars as Volkswagen says it will invest up to $5 billion in new joint venture

Rivian shares are surging in extended hours after the EV maker announced a joint venture deal with Volkswagen, crucially bringing fresh capital into Rivian’s coffers.

Pornhub to leave five more states over age-verification laws

Pornhub will block access to its site in five more states in the coming weeks.

Knicks' OG Anunoby declines player option, becomes unrestricted free agent: Report

New York Knicks forward OG Anunoby has declined his player option for the 2024-25 NBA season, choosing to enter unrestricted free agency as one of the most intriguing players on the market.

NHRA legend John Force hospitalized in ICU after fiery crash at Virginia Nationals

Force's engine exploded before his car hit two retaining walls.

With the future of college sports uncertain, one thing is clear: An official and permanent split of NCAA Division I is here

Division I has never been more fractured, and the split between the haves and have-nots in college athletics is becoming more real than ever.

Men's College World Series Finals: Tennessee holds on to beat Texas A&M and claim first national title

Tennessee closed out the College World Series with back-to-back wins over the Aggies to win the national championshp.

NFL offseason power rankings: No. 30 Denver Broncos are a mess Sean Payton signed up for

The Broncos are still reeling from the Russell Wilson trade.

Top RBs for fantasy football 2024, according to our experts

The Yahoo Fantasy football analysts reveal their first running back rankings for the 2024 NFL season.

Walking for weight loss: How to burn fat during walks

Trying to shed those last 10 pounds? Here's how to do it by walking every day.

Hockey Hall of Fame: Pavel Datsyuk, Jeremy Roenick, Shea Weber among 7-member class of 2024

Natalie Darwitz, Krissy Wendell-Pohl, Colin Campbell, and David Poile will also be inducted.

Cheat sheet: What you need to know about about the great car dealer software hack

After numerous dealerships across Canada and the US reported system outages, CDK Global revealed it had been the victim of a cyberattack. Here's what you need to know.

Mets broadcasters tell fan to 'grow a spine' after Cubs fans push him to throw back HR ball at Wrigley Field

A Mets fan might have taken Wrigley Field rules a little too seriously.

Toyota, Lexus issue stop-sale order for Grand Highlander and TX

Toyota and Lexus have issued a stop-sale order for the Grand Highlander and the TX because the driver-side curtain airbag might not deploy in a crash.

6 things to know from the weekend in MLB: Astros, Cardinals are climbing back into the mix, and don’t sleep on the Guardians

Also, Shohei Ohtani showed off against his former team, and Max Scherzer delivered in his season debut.

2025 Ford Expedition spy photos reveal major exterior overhaul

2025 Ford Expedition full-size SUV spy photos show a significantly changed exterior that takes cues from the recently updated F-150 pickup truck.

U.S. Olympic track and field trials: Athing Mu won't defend her 800 meters gold after stunning fall

Three years after her radiant smile and unparalleled speed made her one of the faces of the Tokyo Olympics, Mu crossed the Hayward Field finish line in tears on Monday night.

Countdown of NFL's offseason power rankings and 2024 season preview

Our Frank Schwab counts down his NFL power rankings, grades each team's offseason, solicits fantasy football advice and previews what the 2024 season might have in store for each team.

Raiders unveil new way to lose $20,000 in Las Vegas: A tailgating 'party shack'

Just split it with 20 friends and it's $1,000 each!

- Environment

- Road to Net Zero

- Art & Design

- Film & TV

- Music & On-stage

- Pop Culture

- Fashion & Beauty

- Home & Garden

- Things to do

- Combat Sports

- Horse Racing

- Beyond the Headlines

- Trending Middle East

- Business Extra

- Culture Bites

- Year of Elections

- Pocketful of Dirhams

- Books of My Life

- Iraq: 20 Years On

Seven new tourism taxes for 2022 that trip-planners need to know about

From thailand to venice, these are the places where you’ll have to pay a little more on a foreign holiday this year.

A number of countries are introducing tourist taxes in 2022. Photo: Unsplash / Danila Hamsterman

A new year means new travel plans and with the world slowly opening up for foreign jaunts, there’s never been a better time to start plotting your next trip – and that includes all the nitty-gritty.

Although tourist tax is nothing new, hardship from Covid-19 travel restrictions and an increased focus on sustainability have led governments and airlines around the world to announce additional fees for travellers.

Here, we round up the travel and tourism taxes landing in 2022, from Thailand to Venice , so that you can plan your next holiday without any nasty surprises.

1. Thailand – April 2022

Visitors to Thailand will have to fork out an extra 300 baht ($9) from April as the country introduces a foreign tourist fee.

Officials say the fee will be used to develop attractions and cover accident insurance for foreign travellers who are unable to pay the costs themselves. One of Asia’s most popular travel destinations, Thailand was hit badly during a pandemic-induced tourism slump, reporting about 20,000 arrivals in 2021, compared with nearly 40 million in 2019.

The latest fee adds to a list of requirements for foreign visitors, which includes prepayment for Covid-19 tests, pre-booked hotel accommodation or quarantine and having Covid-19 insurance with a minimum coverage of $50,000.

2. Venice, Italy – June 2022

In a quest to quash overcrowding, the Italian city of Venice is introducing a tourist tax of up to €10 ($11) a day to enter the lagoon city.

Authorities have long grappled with mass crowds swarming the narrow streets and iconic piazzas. The latest effort to preserve Venice’s fragile ecosystem aims to curb the overtourism it suffered in pre-pandemic years.

Access will be regulated by electronic turnstiles at entry points to the city, plus an online booking app, with fees from €3 and €10 depending on the season. Residents, students, commuters and overnight guests will be exempt from the tax, which is expected to come into effect in June.

3. The Netherlands and France – January 2022

It’s not only governments that are adding a surcharge to foreign travel in 2022. Air France-KLM introduced a hike to ticket prices earlier this month to help fund the extra cost of using sustainable aviation fuel.

The move will add between €1 and €12 to the cost of flights running from France or the Netherlands. The fee will depend on the distance travelled and the ticket class and is part of the airline’s drive to lower its carbon footprint.

The airline said the cost of using sustainable aviation fuel is four to eight times higher than that of fossil fuels and explained that coach-class tickets will rise by no more than €4. Business-class fares will cost up to €12 more. Meanwhile, low-cost arm Transavia will include an unitemised contribution in its ticket cost.

4. The EU – end of 2022

Travellers to the EU will soon have to cough up an extra €7 for the pleasure when a new travel tax comes into force this year.

Called the “European Travel Information and Authorisation System” – ETIAS for short – the new measure is intended to “increase security and help prevent health threats to the bloc”.

The new rule affects people who do not live permanently in an EU country or don’t need a visa to stay in one, including Americans, Australians, those from the UK and other travellers from outside the Schengen zone, although people under 18 or over 70 will be exempt.

5. The Maldives – January

If leaving the Maldives wasn’t already difficult enough, people are now going to be charged for the pleasure.

A new departure tax was introduced this month for all travellers leaving the islands, including local residents.

According to Raajje, a news outlet for the Maldives, the fee will depend on the passenger’s residency and the class they are flying, and starts from $12 for local travellers in economy class.

Non-residents will have to pay $30 when flying economy class, $60 in business class, and $90 if flying first class. There will be a $120 fee for those flying on private charter jets.

Passengers flying out of Velana International Airport will also be charged a $25 Airport Development Fee in addition to the new departure tax.

6. Bengaluru, India – April 2022

If you’re planning a trip to India’s Bengaluru, get set to add a little to your travel bill. Passengers flying out of Kempegowda International Airport will have to pay 350 rupees ($4.70) for domestic and 1,200 rupees for international flights, instead of the existing 184 rupees and 839 rupees, respectively.

The user development fee will come into play in April and will continue until March 2026 and is intended to boost the airport’s finances after a huge expansion project and lower footfall since the outbreak of the Covid-19 pandemic.

7. Norway – January 2022

With stunning fjords, spectacular ancient cities and magical northern lights, there are a million reasons to visit Norway, though booking in 2022 may cost you a touch more than in recent years.

In March 2020, the country’s Air Passenger Duty was temporarily abolished as a relief for airlines during the pandemic. After extending it several times, the government has now announced that it will reintroduce the tax in its 2022 national budget, at a rate of 80 Norwegian krone ($9) per passenger for flights with destinations in Europe and 214 Norwegian krone per passenger for other flights.

The rates correspond to what the fee was before the Covid-19 outbreak, but are adjusted to 2022 levels.

India Daily: Tour Operators Call For Tax Rollback to Revive Inbound Tourism

Amrita Ghosh , Skift

May 2nd, 2023 at 11:00 PM EDT

While tourism to India has still not recovered, losing business to global players will hurt the Indian travel industry. Will they be able to take advantage of the opportunity?

Amrita Ghosh

The Skift India Newsletter is your go-to platform for all news related to travel, tourism, airlines, and hospitality in India.

The Indian Association of Tour Operators has requested the government to restore duty cred it via the Service Export Incentive Scheme or introduce an alternative in the new foreign trade policy, as the country’s inbound tourism remains sluggish. The association also urged a rollback of the 5-20 percent tax — insisting that it be brought back to 5 percent or lower — which is collected at source on overseas tour packages announced in the Union Budget, effective July 2023 . The hike in tax would hit the Indian outbound tour operators hard, as travelers could bypass them and book outside the country, causing losses for both the government and operators. In a letter to the government, association President Rajiv Mehra highlighted how the pandemic severely affected the tourism industry, with only 30-40 percent of inbound tourism to India having returned since international flights and tourist visas were revived. He also highlighted the challenges of competing with other countries due to high goods and services tax rates , the withdrawal of marketing and promotion activities in foreign countries, and the lack of alternative benefits , indicative of the stress the sector is reeling under.

From five-star hospitality brands like Tata-Group owned Indian Hotels Company , Radisson and ITC Hotels to budget players such as potentially IPO-bound budget hotel operator and aggregator Oyo , companies are lining up to open new hotels in pilgrim city Ayodhya in the north Indian state of Uttar Pradesh . While Indian Hotels Company plans to open two greenfield properties with 100-room Vivanta and 120-room Ginger , Oyo also said it would add 50 properties in the city among which 25 will be homestays run by homeowners and another 25 will be small and medium hotels. Radisson Hotel Group is looking at launching two hotels in the city under their brands — Park Inn and Individuals . ITC Hotels is also exploring opportunities across its brands to bring them to Ayodhya to cater to the increased demand.

India showcased diverse tourism offerings and highlighted its commitment to sustainable tourism practices at Dubai’s Arabian Travel Market 2023 — a leading global event for the travel and tourism industry — to attract travelers from the Middle East and North Africa markets. Encouraging inbound travel, the country also showcased ‘ Incredible India! Visit India Year 2023 ’ campaign at the backdrop of India’s G20 Presidency to highlight unique tourism offerings of every state. Culture, heritage, adventure, and rural tourism along with niche tourism products such as cuisine, wellness, yoga, wildlife, and luxury were on display. More than 65 participants represented the India pavilion at the fair, including travel agents, tour operators, airlines, and hotels.

Tata-owned Air India is re-introducing its daily Mumbai-Coimbatore-Mumbai flight with effect from May 3 . The A320-Neo fleet flight will also offer quick connections to Heathrow in London and San Francisco out of India’s financial capital Mumbai, the airline said in a statement. Flight AI 609 will leave Mumbai at 6:30 hours and reach Coimbatore in the south Indian state of Tamil Nadu at 8:20 hours . The return flight AI 608 will leave Coimbatore at 9:00 hours and reach Mumbai at 11:00 hours . The airline recently announced that it would hire over 1,000 pilots , including captains and trainers, as it expands its fleet and network.

Amid the government looking to establish India’s capital as an international aviation hub , Delhi airport operator Delhi International Airport Limited has said the airport’s terminals will be able to handle 100 million passengers per annum once expansion work gets completed this year. With three terminals now, the airport handled around 65.33 million passengers, including 15.65 million international passengers, in the financial year 2023 . “The government has asked Delhi airport and some of the major airlines to examine the global best practices on scheduling to ensure that international and domestic operations complement each other and provide enhanced connectivity from Delhi airport, essential for setting up India’s first international aviation hub,” the operator said in a statement.

Mumbai-based luxury real estate development company AweSpace Estate is set to develop more than 350 villa estates and mansions across India’s key travel destinations over the next two years with a revenue target of $305.7 million . The firm will be developing these residential retreats in Goa , Alibaug , Lonavala , Shimla , Nainital and Coorg in its first phase and in the Maldives, Europe, Australia and the U.S. in the second phase. “The move into the real estate market represents a diversification of our investment strategy, with a focus on meeting the lucrative and growing demand for luxury vacation properties in popular tourist destinations in India and overseas locales,” said Vijay Naraayanan , co-founder and CEO of AweSpace Ventures.

Dubai ’s Department of Economy and Tourism has launched its latest summer campaign for the India market that captures the destination’s outdoor and indoor activities. “With the onboarding of outbound Indian travelers this summer, we aim to showcase unique offerings in the city, which will entice visitors from all age-groups making it an exciting destination for the summer break,” said Bader Ali Habib , head of South Asia at Dubai Department of Economy and Tourism. Earlier this year, travel site Tripadvisor ranked Dubai as the world’s most popular destination for holidaymakers in its 2023 Travellers’ Choice Awards for its luxury hotels, traditional souqs and family friendly attractions.

Guwahati-based airline Flybig has launched a direct daily Guwahati-Dibrugarh-Guwahati flight under the Assam Tourism Development Corp.’s viability gap funding to promote intra-state air connectivity . Under the viability gap funding, the state government will make up for the shortfall if the flights operate at less than 50 percent of their seating capacity to ensure the routes remain viable. The maximum price has been fixed at $49 and any additional prices will be borne by the state. Earlier in March this year, the Assam government had signed a memorandum of understanding with Big Charter Private Limited (or Flybig) under which daily flights would operate connecting Guwahati with Dibrugarh and Silchar in the northeast Indian state of Assam .

Skift India Report

India is booming. Discover the subcontinent’s most important travel news here every Tuesday-Thursday.

Have a confidential tip for Skift? Get in touch

Tags: air india , delhi airport , dubai , Dubai's Department of Economy and Tourism (DET) , india , Indian Hotels Company , itc hotels , oyo , radisson hotel group , skift india report , tour operators

Photo credit: The tax hike would hit the Indian outbound tour operators hard, as travelers could bypass them and book outside the country. Pictured are tour guides in India. Ziv Cohen / Flickr https://www.flickr.com/photos/guideofisrael/13314515634/ Ziv Cohen

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Budget 2024

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Economic Indicators

- BT-TR GCC Listing

Foreign travel to get expensive from July 1! Tax collected at source to jump from 5% to 20%

As per the announcement made in budget 2023, the tax collected at source (tcs) rate on foreign remittances, including bookings for tour packages, will rise sharply from 5 per cent to 20 per cent of the total transaction amount from july 1, 2023..

- Updated May 18, 2023, 7:41 PM IST

Due to the extended hiatus caused by Covid-19 and the desire to escape the scorching weather, travel bookings have surged by 30 per cent to 40 per cent this season. However, the surge can also be attributed to the impending increase in foreign travel expenses, which is set to take effect from July 1, 2023. As per the announcement made in Budget 2023, the Tax Collected at Source (TCS) rate on foreign remittances, including bookings for tour packages, will rise sharply from 5 per cent to 20 per cent of the total transaction amount from July 1, 2023. This means if the air travel costs Rs 50,000, the corresponding TCS amount would be Rs 10,000, which is equivalent to 20 per cent of the air travel cost.

Not only foreign tour packages but 20 per cent TCS rule also applies on credit cards on international transactions, which means even direct booking would come under the ambit of 20 per cent TCS, as per finance ministry circular issued on May 16. According to PTI report the ministry on May 16 notified the Foreign Exchange Management (Current Account Transactions) (Amendment) Rules, 2023, to include international credit card payments in the LRS.

Also WATCH: India’s automobile sector: Insights On Growth, CV & PV Sales, Hero Vs Honda, Maruti, Hyundai Vs Tata Motors, M&M & more

“The rate of TCS on LRS remittances including foreign travel bookings is all set to increase four-fold from 5 per cent to 20 per cent effective 1st July 2023. TCS at 5 per cent on LRS remittances was first introduced in October 2020, and it has already led to a significant loss of business for domestic travel and tour agents (DTAs) as customers now prefer booking overseas travel services with Global Travel Agents (GTAs), who have been escaping TCS compliance and hence can offer better pricing on their platforms. The proposed four-fold rate increase will widen the pricing gap as the upfront cost for travellers will increase further on DTAs, motivating them to book with GTAs," Mohit Kabra, Group CFO, MakeMyTrip told Business Today.

Investments and expenditures abroad are made by using the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI), which is available to all resident Indians. Through this scheme, an individual can remit up to $250,000 per financial year for such transactions. Once the rule comes into play Indian travellers will be subject to a 20 per cent tax collected at source by authorized banks or travel agents when making payments for international travel bookings, including airfare, hotel accommodations, or tour packages.

"The tax collected at source (TCS) shall be accumulated as an aspect of the payment and subsequently transmitted to the government. It is imperative for Indian travellers to take into account these supplementary financial obligations while strategizing their global adventures. The imposition of a 20 per cent TCS is likely to augment the overall expenditure incurred by individuals on their travel. However, the traveller can claim TCS credit while filing their tax return. So no overall impact will be seen," says Rikant Pittie, Co-founder, EaseMyTrip.

The new Tax Collected at Source (TCS) rules will also apply to transactions made with credit cards, added Pittie.

Undoubtedly, it is anticipated that foreign travel will incur greater expenses commencing July 1st, 2023, as a result of the enforcement of the 20 per cent TCS on foreign remittances for diverse objectives, including travel abroad. "It is mandatory for Indian globetrotters to take into account this supplementary financial obligation while devising their overseas excursions. The imposition of a 20 per cent TCS is likely to augment the immediate total expenditure incurred by individuals on their travel. However, there will be no difference in their travel costs as they can claim it while filing their return," says Pittie.

- #Foreign travel

- #Foreign travel expensive

- #TCS on foreign remittances

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

- SIMCards / eSIMS

Hotels, Resorts, Villas & Holiday Rentals

Bali's no. 1 Travel Guide

Don't Forget:

Things to Do in Bali

With our BaliCard, Bali's Digital Discount Card & Tourist Pass, you save 10% and more

What's on Bali

Events at W Bali Seminyak

Events at Desa Potato Head

Events at AYANA Bali

Events at MRS SIPPY

Bali Tourist Tax

For international travelers – all you need to know.

Don't miss our Digital Discount Card. Get discounts at +200 awesome partners! BaliCard

Beware of Scammer Websites, selling the Tourist Tax Registration. They are not representing the Balinese Government. ONLY use the official LoveBali Portal that we linked in our FAQ below

Bali tourist tax / bali tourist levy.

The Tourist Tax for international visitors to Bali is a tax charged by Bali’s provincial government. This is all you need to know to get ready to come to Bali. Make sure you are only using the links mentioned tha guide you to the official website of the Bali government.

Planning your trip to Bali?

In the FAQ Section below we will answer your questions about the tourist tax.

Equally important for your travel planning:

Don’t miss to check the updated Visa Regulations and general Travel Regulations to ensure a smooth arrival in Bali.

Want to rent a scooter?

International Driving License is Mandatory (online purchase)

More Essentials

Get your SIM and internet connection Book your Hotel / Villa Discounts and Things to do

Bali Tourist Tax Regulations and How to Pay the Bali Tourist Tax

Faq - must know about the tourist tax (levy), the tourist tax will have to be paid by international travelers coming to bali, the tax applies to foreigners coming to bali..

For arrivals to Bali from outside Indonesia and also if you arrive coming from another province to Bali.

The Bali Tourist Tax costs IDR 150,000 per person (ca. USD 10 and AUD 15). Regardless of the age of the traveler.

It seems, that for the online payment there is also a surcharge of Rp 4,500

Most probably you will not be checked (yet). The reason is, that the immigration officers and airport personnel is not responsible to check if you paid. And the Balinese government has not yet installed check points to control the payment (which might happen at some point).

Still you have to pay the tax and checks can happen at popular tourist destinations or then also at the airport and harbours upon entry.

You can pay the tax online on the official Bali Tourism Website ( ONLY use that website, don't pay the tax anywhere else, there might be websites run by scammers).

Official website to pay the bali tourist tax lovebali.baliprov.go.id/.

You will also be able to pay the tax upon arrival (airports and harbours). We strongly suggest however you pay already online before you arrive.

At times the Official Bali Tax Website might be offline.

Lovebali.baliprov.go.id/.

Don't pay the tax anywhere else! Keep trying and come back to the website. Worse case, you can arrive in Bali without paying for the tourist tax online in advance, and then pay at the lovebali-counters. The Balinese government is in the process of installing payment counters at the checkpoints at the airports and harbours.

Travelers with following Visas are exemption from paying the Bali Tourist Tax, without having to apply for the exemption online (automatic exemption)

- Holders of Diplomatic Visas and Official Visas

- Crew Members of Conveyances are exempted

- KITAS & KITAP Holders (Holders of Temporary and permanent stay permits)

- Family unification visa holders

- Student Visa Holders

Foreigners can apply for an exemption on the official website . Apply at least 5 days before your arrival

- Golden Visa Holders

- Any other Visa issued by the immigration office, that do not have the travel purpose tourism ,. In other words, travelers with any visas that is issued with the travel purpose "tourism" will have to pay the tax.

On the official website the government states:

We are not the government, so unfortunately we cannot help you with this issue.

First we would check the Spam / Junk Folder, to be sure you did not receive it.

You can also write a message to the support on

It seems that the official site from the Bali government still has problems from time to time. Since we are not representing the government and are not charging any taxes or fees, we cannot assist you in this matter. We suggest you keep trying opening the website. Worse case, you can pay the tourist tax upon arrival.

Only use the official Bali Tax Website:

The tourist tax (levy) is a local tax that the Bali administration is implementing, it is only related to Bali and not to Indonesia

The bali administration has issued following statement:, the levy is paid only 1 (one) time while traveling in bali, before the person leaves the territory of the republic of indonesia., how they will control this is not yet clear to us, but it seems that if you travel to bali, pay the tax, then go to lombok, return to bali, you would not have to pay the tourist tax again., the bali administration has announced that they want to use the income of the tourist tax for the following initiatives (official statement from the bali administration):, preserve heritage, protecting balinese customs, traditions, arts and local wisdom, ensuring the sustainable culture of bali island., nurture nature, contribute to the nobility and preservation of bali's unique culture and natural environment, making it an even more beautiful destination., elevate your experience, improve the quality of service and balinese cultural tourism management, promising you a safe and enjoyable travel adventure in bali., bali and the indonesian tourism officials have discussed over the last few years how they can protect the environment better, handle mass tourism, improve infrastructure and handle the growing trash problem, increase income for the local population who do not yet benefit from the growing tourism sector. they wish to encourage travelers to respect and participate the local culture more and overall have a better experience when they visit the island of gods., for the moment it seems, yes, but we expect the local administration to clarify at some point., 14th february 2024, essentials for your bali vacation.

- Digital Discount Card - The BaliCard

- SIMcards & e-Sims online (NEW)

- International Driving License (mandatory)

- Hotels, Resorts and Villas in Bali

- Trekking Tours & Sightseeing

- Car Rental with Driver (half- & full day)

- Airport Transfer DPS

- Bali Scooter & Motor Bike Rental

- Medical Travel Insurance (incl. Covid coverage)

- Golf Tee Time

People also search for love bali app love bali website bali tourist tax 2024 how to pay bali tourist tax love bali app download we love bali love bali system

- Visa & Regulations

- Things to Do

No products in the cart.

Return to shop

Digital Digital Discount Card

Discounts at 200+ experiences & venues.

Waterbom, LIGA.TENNIS & Padel, Sushimi, Villas, and many more.

–> click here and get our BaliCard 20% cheaper 😉

The discount will be applied directly in the shopping cart.

Username or email address *

Password *

Remember me Log in

Change Location

Find awesome listings near you.

Do you need to file ITR and disclose your foreign travel expenses?

- 3 minute read

GST Council may consider a modification to the GSTR-3B form for better ITC reporting

- Posted on May 24, 2022 May 24, 2022

- Annapoorna M

- Namita Shah

Share article

People are splurging on foreign travel as international travel opens up after two years of COVID-19 pandemic. After taking a mood booster, knowing the income tax compliances for travelling abroad is essential.

Where an individual incurs foreign travel expenses exceeding Rs 2 lakh during the year, he/she must disclose the amount of foreign travel expenses by filing the income tax return even if their income before deductions is below the basic exemption limit as per the Income Tax Act. The basic exemption limit is Rs 2.5 lakh for individual taxpayers, but as per the old tax regime, it is Rs 3 lakh for senior citizens and Rs 5 lakh for super senior citizens.

Let’s understand with an example. Suppose your total income during the Financial Year (FY) 2021-22 is Rs 1.8 lakh, and you have travelled to Singapore in June 2021 and spent Rs 3 lakh. In such a case, you are obliged to file an income tax return in India for the FY 2021-22 and disclose the amount of foreign travel expenses. If the expenditure would have been less than Rs 2 lakh, it is not necessary to file ITR.

It is important to understand that the requirement of filing ITR and disclosure of foreign travel details shall apply even if the amount is spent in foreign currency and is equivalent to Rs 2 lakh or more. The said Rs 2 lakh limit is the aggregate limit of the financial year. Hence, suppose your income is below the basic exemption limit, and you have spent Rs 60,000 for visiting Singapore, Rs 1.6 lakh for visiting Japan and Rs 40,000 for visiting Sri Lanka during the same financial year, you are required to file ITR and disclose such expenses since the total foreign expenses have crossed Rs 2 lakh limit.

Moreover, ITR filing applies even in cases where you have spent an amount on others for foreign travelling. For example, your income is below the basic exemption limit, but you have sponsored a foreign trip for your parents, and the expenditure for the same exceeds Rs 2 lakh. In such cases, too, you must disclose the said expenses and file ITR.

For ITR filing of FY 2021-22, below are the conditions as per the IT Act where the individuals/HUF must file ITR even if their income is below the basic exemption limit:

- If total deposits in one or more current accounts exceed Rs 1 crore during the financial year

- If total foreign travel expenses for self or any other person is Rs 2 lakh or more during the financial year

- If the total electricity bill payment is Rs 1 lakh or more during the financial year

- If total business sales/gross receipts during the financial year exceed Rs 60 lakh

- If total professional gross receipts exceed Rs 10 lakh during the financial year

- If the aggregate of TDS and TCS is Rs 25,000 or more during the financial year (In the case of senior citizens, and increased limit of Rs 50,000 shall apply)

- If total deposits in one or more savings bank accounts are Rs 50 lakh or more during the financial year

Hence, if you fall under any of the above conditions, you are required to file ITR mandatorily.

For any clarifications/feedback on the topic, please contact the writer at [email protected]

I’m a chartered accountant and a functional CA writer by profession. Reading and travelling in free time enhances my creativity in work. I enjoy exploring my creative side, and so I keep myself engaged in learning new skills.

You May Also Like

Taxation of dividend income received on or after 1 April 2020 (FY 2020-21)

- Sweta Dugar

- Posted on May 26, 2020 February 24, 2022

Know the taxation rules for income F&O trading

- Posted on February 15, 2022 July 14, 2022

Important Cash Transaction Limits and Penalties Under Income Tax That You Need to Know About

- Athena Rebello

- Posted on April 14, 2022 April 14, 2022

What is the TDS provision for rent paid by individuals above Rs 50,000?

- Posted on July 20, 2021 August 4, 2021

tourist tax

TOURIST TAX

Simplify GST: Adopting the KISS principle for reform

Sin taxes contradict growth policies like 'Make In India'. 5-star hotels create jobs and attract investment, impacting FDI. Taxing luxury items hampers economic growth and consumer spending.

Where is ‘fake Venice’ situated? Why did ‘Venice of China’ fail to attract tourists? Details here

China which had built its city mimicking the city of Venice in Italy has left its visitors with a lot to desire. The city with its incomplete projects, artificial products and ‘fakery’ has left the tourists disappointed.

Calangute village in Goa plans to collect entry tax from tourists

The village panchayat of Calangute in North Goa will require tourists to show proof of hotel reservations or pay an entry tax. This decision aims to maintain cleanliness and reduce traffic issues caused by tourists who litter the beach. The panchayat will adopt the resolution on Friday and seek approval from the district collector. If approved, the new rule will be implemented from the next tourist season starting in October. Local residents are exempt from this requirement.

Venice made $1 mn from the implementation of €5 Tourist Tax in April

Venice has responded to concerns about over-tourism by introducing a ticketing system for day visitors since last month. Reports indicate that nearly one million euros were collected within the first 11 days of implementing the tax. From April 25 to May 5, approximately 195,000 tickets were sold, generating €975,000, though this amount falls short of covering the expenses incurred in setting up the system. After the trial period, the daily fee is expected to increase to €10, with fines ranging from €50 to €300 for those without tickets.

Cambodia to begin direct flights to India from June 16

Cambodia Angkor Air to launch first-ever direct flights between Cambodia and India on June 16, operating four times a week. Round trip pricing from New Delhi to Phnom Penh approximately Rs 23,000. Ambassador optimistic about doubling tourist flow, citing direct flights and medical tourism demand. Pre-pandemic, India welcomed 75,000 visitors annually.

Paris, Milan become the new favourite shopping destinations for travellers after London's 'Tourist Tax'

After Brexit, the UK discontinued tax-free shopping incentives, leading thousands of tourists to redirect their shopping to Paris, Milan, and Madrid. Despite lobbying efforts, the UK remains steadfast in its decision. The shift has resulted in increased spending per person, particularly in France and Italy. While some argue the policy negatively impacts tourism, the UK government asserts it benefits public finances.

Venice begins charging tourists entry fee €5 as it looks to find ‘new balance’

Venice has launched a pilot program to charge day-trippers a 5-euro entry fee to manage overtourism. The initiative aims to discourage visitors on peak days and preserve the city for its residents. Despite protests and skepticism among locals, officials hope the fee will provide valuable data to manage tourism better. The fee applies during peak hours, with exemptions for residents and workers.

Milan is the latest European city to fight overtourism; may ban ice cream, pizzas post midnight

Milan tackles overtourism with late-night activity restrictions, while European cities like Venice and Amsterdam adopt measures such as tourist taxes, time slot systems, and new hotel development constraints to manage overwhelming tourist numbers.

After Venice, this popular Italian destination plans to charge a tourist fee

Como, inspired by Venice's move, is considering imposing a tourist fee to tackle overtourism. Mayor Rapinese mentioned discussions about this measure, signaling a proactive stance. Lake Como's popularity, drawing over a million tourists annually, prompts concerns for local residents. Venice has already announced a similar fee, effective from April 25, aiming to regulate visitor numbers during peak times.

'Go home': Anti-tourism movement gains momentum in Spain

Anti-tourism movements are multiplying in Spain, the world's second most visited country, prompting authorities to try and reconcile the interests of locals and the lucrative sector. - 'Go home' - Similar anti-tourism movements have sprung up elsewhere in Spain and are active on social media.

Standby Cruising: A new option for the frugal traveler

Barb McGowan from Naples, Florida, took a $343 seven-day cruise with short notice on Holland America Line to the Bahamas, Turks and Caicos, and the Dominican Republic, praising the food and entertainment.

View: We need to get our tourism game face on, especially for high-value customers, for job creation

India's tourism sector has immense potential for growth and job creation. By prioritizing cleanliness, connectivity, sustainability, and adopting innovative strategies, India can position itself as a global tourism hub and contribute significantly to the economy.

After Jakarta, IndiGo announces daily flights to Indonesia's Bali

IndiGo plans to launch daily direct flights from Bengaluru to Bali's Denpasar starting March 29. Bali will be the airline's second destination in Indonesia after Jakarta. Denpasar, the capital city of Bali, offers historical and cultural sites, lively markets, stunning temples, museums, and a new tourism tax.

Hawaii tourists need to pay climate tax? Here's what we know so far

Tourists travelling to Hawaii may soon have to pay climate tax as per a proposal to safeguard beaches there, according to a report.

Visa-free Thailand is now offering tourists up to $14,000 in medical coverage

Thailand's new initiative, the Thailand Traveller Safety scheme, offers up to $14,000 medical coverage for accidents. It aims to entice backpackers back amidst the Covid-19 pandemic and travel restrictions, addressing the issue of inadequate insurance coverage. The scheme does not cover accidents due to negligence, intent, illegal activities, or risky behavior.

Bali to impose $10 tourist fee starting this Valentine's Day

Bali will implement a new tourism tax from February 14, exempting seven visa categories from the IDR 150,000 fee. Visa holders must apply for an exemption online. The levy can be paid at the airport and port, but tourists may be asked to show their voucher.

Thailand cuts tax on booze and night clubs to boost tourism

Thailand also announced a visa waiver for travelers from India and Taiwan last year, effective from Nocember 2023 until May 2024.

Tourist tax & visa relaxations: Countries that made travel easy in 2023, and those that didn't

As the new year approaches, travelers heading to Schengen countries may face increased costs, with various European destinations implementing tourist taxes. In a contrasting move, many countries announced plans to cancel visa requirements for visitors.

Amsterdam's new tourist tax in 2024 could become 'Europe’s highest'

With expectations of over 20 million visitors this year, Amsterdam has grappled with challenges posed by a growing influx of tourists, particularly budget travelers impacting areas like the red-light district. The city is actively implementing comprehensive measures to manage and control tourism, including commitments to limit the total number of domestic and foreign visitors to 20 million.

France unveils plan to triple tourist tax in Paris next year

The government's plan to triple the tourist tax is part of its 2024 budget, set to be expedited through parliament without a vote before Christmas. The proposed increase, a 200-percent surge, is intended to contribute to funding public transport for the Olympic events.

Karnataka's Dasara gift to tourists: Outside transport vehicles to Mysuru exempt from taxes for 10 days

Mysuru Dasara festival 2023: The state government of Karnataka has exempted tourist vehicles from other states from paying road taxes during the nine-day Dasara celebrations. The exemption, applicable from Monday till October 24, is limited to Mysuru and Srirangapattana taluk. The delay in issuing the notification has been criticized by private transport operators.

South Korea plans to offer bigger tax refunds to foreign tourists

Currently, the maximum 500,000 won ($370) worth of a local purchase and 2.5 million won in total is applicable for tax refunds when foreign tourists leave the country.

Japan bullet rail pass gets expensive by 70 per cent for tourists

The prices of Japan's bullet train have increased by 70% from October, marking the first price hike in four decades. The 14-day unlimited travel pass now costs 80,000 yen, up from 47,250 yen. Children aged 6-11 still qualify for half-price tickets. The JR group of train operators argues that the previous fares were set when there were fewer bullet-train destinations and that the higher prices are justified due to services extending into northern regions

Your Iceland holiday is about to get more expensive, all thanks to a new tourism tax

Iceland, known as the "land of fire and ice," attracts travelers with its unique geological features, including lava flows, hot springs, geysers, and waterfalls. Moreover, its strategic location between Europe and North America makes it a busy air-travel hub.

Thailand eyes India to boost tourism recovery after waiving visa for China

Thai Prime Minister Srettha Thavisin is looking to attract tourists from India to boost the country's tourism industry. He plans to visit India and discuss increasing flight frequency between the two countries. Thailand may also consider offering tax exemptions on imported jewelry for Indian weddings held in Thailand. Additionally, the government recently approved temporary visa exemptions for Chinese and Kazakh tourists.

Tourist Tax: You will have to pay extra to enter these cities

Barcelona on April 1 announced that it will increase its municipal fee to €2.75. The tax will be increased over the next two years, they further announced. Since 2012, visitors have been paying both regional tourist tax and an extra city-wide surcharge. A second raise will happen next year on April 1, 2024 where the fee will rise to €3.25. The tax applies to visitors staying in official tourist accommodation. According to the council, money collected from this tax will be used to fund city’s infrastructure, including improvements to roads, bus services and escalators.

These European countries are imposing fines and restrictions amid tourist overcrowding

Several Schengen countries are taking various measures to address the social issues arising from over-tourism. Italy has introduced entrance fees, Venice now requires tourists to pay an entrance fee ranging from €3 to €10. Greece is implementing a time-slot system to limit daily visits and charge entry fees. Amsterdam has banned cruise ships from entering its main ports.

Rishi Sunak dampens hopes of reversal over axed UK tourist tax break

British Prime Minister Rishi Sunak said nearly all of the benefit of a now-abolished tax break for tourists went to a small area of central London, dampening the hopes of shops and businesses campaigning for it to be brought back. Sunak told LBC radio he avoided talking about tax policy because of the impact of any comments on markets.

Bali to impose $10 tourist e-tax from 2024 to preserve culture

More than two million tourists visited the island last year, according to official figures, as Bali rebounded from the Covid-19 pandemic after imposing a zero-tolerance policy on rule-breakers.

We're Listening

Feel free to message us your feedbacks and queries at [email protected] .

Provisions for GST Refunds to International Tourists

India will introduce a gst refund system for international tourists, enabling them to reclaim taxes on purchases, enhancing their travel experience and savings..

As global travel experiences become more accessible, India is stepping up its efforts to make tourism an even more rewarding experience by soon introducing a tax refund system. This will be in line with the policies in foreign countries that allow tax-free shopping for tourists. This blog post explores the provisions related to refund of GST for international tourists in India.

Understanding GST Refunds:

The Goods and Services Tax (GST) is a tax that applies to almost all goods and services in India. When it comes to international tourists, they are eligible for refunds of the GST paid on their purchases within the country upon departure.

Eligibility for refunds:

To qualify for a GST refund, you must meet certain criteria outlined in Section 15 of India’s IGST Act. Before we begin, let’s clarify what we mean by “tourist” in this context.

A ‘tourist’ is defined as an individual who enters India on a non-immigrant basis and stays for not more than six months with the intention of engaging in legitimate activities.

Section 15 states that “the integrated tax paid by tourist leaving India on any supply of goods taken out of India by him shall be refunded in such manner and subject to such conditions and safeguards as may be prescribed. ”

Note: It states “integrated tax” implying only IGST can be refunded. Section 8(1) clarifies that when suppliers in India sell goods to tourists who are leaving the country, these transactions are not treated as intra-state supplies. This implies that to qualify for refunds, suppliers must identify these tourists and charge only IGST and not CGST and SGST components.

Expected Inclusions and Exclusions in the Scheme This refund scheme shall benefit several categories of visitors to the country, including crew members of international conveyances, foreign diplomats on official duties, foreign athletes participating in tournaments or training, foreign journalists, camera crews, artists visiting for professional reasons, etc.

Although the government has not yet specified the procedures and eligibility for refunds for tourists, it is expected that these refund schemes will also have some exclusions. These exclusions are expected to apply to residents of India, diplomats on overseas deputations, etc. The government aims to streamline the GST refund process for visitors to the country to enhance their experience in India.

Streamlining the refund process:

The Indian government is currently developing a process for foreign tourists to get GST refunds on their purchases of goods and services in the country. The government’s focus is on creating an efficient and user-friendly process for tourists claiming GST refunds. This includes implementing online systems for easier claim submission, reducing paperwork, and enhancing transparency. By utilizing these channels, tourists will be able to claim their refunds seamlessly and effortlessly, making the most of their Indian experience.

Conclusion:

The introduction of the GST refund system for international tourists is going to be another step by the Indian government to enhance the travel experience and boost the country’s tourism industry. This policy will not only encourage more visitors but also help them save money, making India an even more appealing destination.

Share this post on: Facebook Twitter (X)

Tags: GST refunds India tourism international tourists tax-free shopping travel savings

CA Raj Kumar

I love blogging and studying taxation. I write articles related to Tax laws and common issues in handling taxation in India. Often, common but small mistakes make things complicated. I write and share them to save precious time of others.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Math Question: * 1 + 6 =

Recent Posts

Understanding Time of Supply of Goods & Services in GST

Decoding the gst composition scheme for small businesses, when e-way bill is not required: understanding exemptions and exceptions, the enforcers of gst: understanding officers and source of their powers under the cgst act.

India considering personal tax rate cuts to boost consumption, sources say

- Medium Text

Sign up here.

Reporting by Nikunj Ohri and Ira Dugal Editing by Bernadette Baum

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

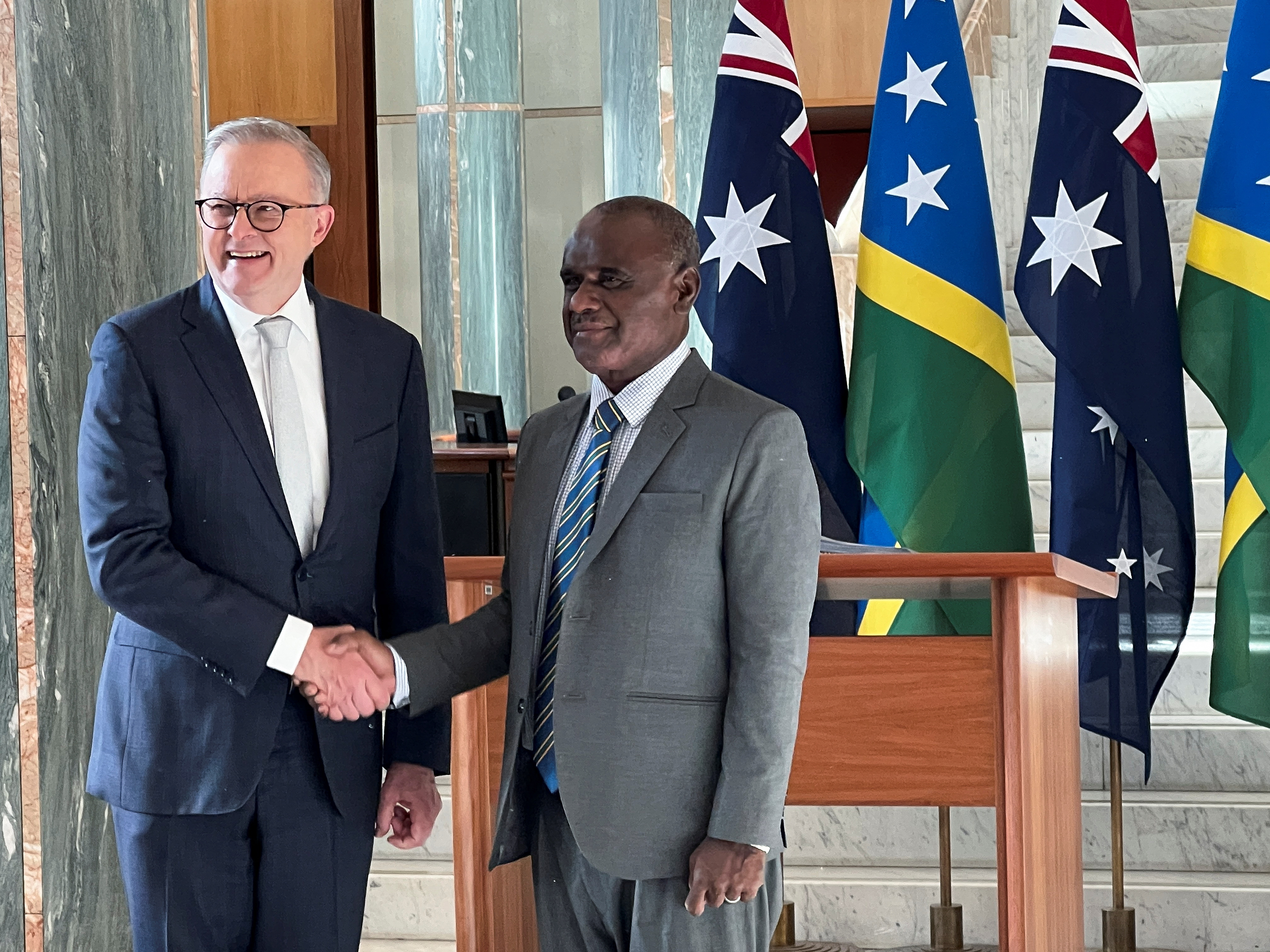

Solomon Islands Prime Minister Manele in Canberra to discuss ties

Solomon Islands Prime Minister Jeremiah Manele met Australian counterpart Anthony Albanese in Canberra on Wednesday to discuss security and development ties, as the United States and China vie for influence in the Pacific Islands region.

'Ache Din' For Taxpayers Soon? Govt Plans To Hike Income Tax Exemption Limit, Check Latest Details Here

Curated By : Namit Singh Sengar

Last Updated: June 19, 2024, 10:39 IST

New Delhi, India

A cut in personal tax could boost consumption in the economy and increase savings for the middle class. (Representative image)

The announcement is expected in the upcoming budget, likely to be presented in mid-July 2024.

There are reports that the centre government is considering raising the income tax exemption limit. The increase would likely be under the new tax regime, which offers lower tax rates but fewer deductions.

This move is intended to give more disposable income to individuals, especially those in the lower income bracket.

According to a report by Moneycontrol , the move is aimed at bolstering the country’s GDP growth by stimulating consumption amidst subdued spending levels among the middle class.

The government is planning to raise the income threshold for tax liability from the current Rs 3 lakh to Rs 5 lakh in the forthcoming budget.

This adjustment is intended exclusively for taxpayers under the new regime, aiming to increase disposable income, especially among lower-income groups.

‘Tax Exemption For Rs 15 Lakh Income’

Another report by news agency Reuters stated that the government is considering lowering personal tax rates for certain categories of individuals, which could help boost consumption in Asia’s third-largest economy.

A post-poll survey by Reuters showed that voters were worried about inflation, unemployment and decreasing incomes.

While the Indian economy grew at a world-beating 8.2% in 2023-24, consumption has grown at half that pace.

A cut in personal tax could boost consumption in the economy and increase savings for the middle class, the sources told Reuters .

The category of individuals that may see some tax relief are those earning over Rs 15 lakh annually, up to a certain amount which is yet to be determined, the first source said.

The changes could be made to a tax scheme introduced in 2020, where annual income up to Rs 15 lakh is taxed at 5%-20% while earnings over Rs 15 lakh are taxed at 30%.

The personal tax rate jumps six-fold when an individual’s income increases by five times from Rs 3 lakh to Rs 15 lakh, “which is quite steep,” the second source said.

The government may also explore lowering personal tax rates for annual incomes of Rs 10 lakh, said the first source, adding that a new threshold was being discussed for income taxed at the highest rate of 30% under the old tax system.

Any loss of tax income to the government through tax cuts could be partially offset by increased consumption from this category of income earners, the second source said.

The government is targeting a fiscal deficit of 5.1% of GDP in the financial year ending March 2025.

Strong tax collections amid a buoyant economy and a bumper dividend from the central bank will give the government flexibility in planning the first budget of its new term, Reuters reported earlier.

- income tax return

- personal finance

- Business News

- India Business News