RewardExpert.com is an independent website that is supported by advertising. RewardExpert.com may be compensated by credit card issuers whose offers appear on the site. Because we are paid by our advertising partners it may impact placement of products on the site, including the order in which they appear. Not all available credit card issuers or card offers are included on the site.

Guide to Travel Transfer Partners for Major Credit Card Programs

Transferable points are probably the most valuable points to earn with a credit card. They give more flexibility when you redeem them for travel: unlike airline or hotel points, which can only be used with a specific airline or hotel, transferable points can be transferred to multiple airline or hotel loyalty programs. Plus, points transfer is given in addition to other standard redemption options, including booking travel directly through the issuer without transferring points to loyalty programs.

Below we are reviewing five point transfer programs from big credit card issuers: American Express Membership Rewards®, Capital One Miles, Citi ThankYou Rewards, Chase Ultimate Rewards, Bilt Rewards. Each program has its own set of participating travel partners and some of them overlap giving you extra opportunities to maximize points earning.

American Express Membership Rewards®

The Membership Rewards program allows you to earn points with eligible American Express cards. Generally, Amex cardholders will earn at least 1 point per dollar on all eligible purchases, but some cards can offer higher rewards rates on select purchases, like restaurant purchases, travel purchases, and purchases at supermarkets to name a few. The easiest way to earn Membership Rewards points is with an Amex credit card enrolled in the Membership Rewards program. Cards can offer welcome bonuses, extra rewards in specific spending categories, and extra benefits. Plus, Amex card members can enroll in Amex Offers and refer friends to receive extra rewards. Here are American Express credit cards that earn Membership Rewards points:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express® Gold Card

- American Express® Business Gold Card

- American Express® Green Card

- Business Green Rewards Card

- Blue Business® Plus Credit Card

- Amex EveryDay® Credit Card

- Amex EveryDay® Preferred Credit Card

When it comes to redeeming Membership Rewards points, Amex card members can do it in several ways: pay with points at checkout, redeem for gift cards, use points like statement credits, book or upgrade travel, shop online with points, donate, or transfer points to travel partners. The last option is a firm favorite with avid travelers. The Membership Rewards program allows members to transfer points to more than 20 frequent flyer and hotel loyalty program partners.

Amex Membership Rewards Transfer Partners

Capital One Miles

Capital One miles are Capital One’s travel rewards currency that can be earned with select travel rewards credit cards from Capital One. Cardholders will earn at least 1 mile per dollar on purchases made with travel cards. Plus, Capital One offers opportunities to earn increased rewards on select purchases. For example, select purchases made at Capital One Travel earn from 5X to 10X miles, depending on the card you have. Here are Capital One travel rewards credit cards that earn miles:

- VentureOne Rewards for Good Credit

- VentureOne Rewards

- Venture Rewards

- Venture X Rewards

- Venture X Business

- Spark 2X Miles

- Spark 1.5X Miles Select

Capital One miles can be used in several ways and not only towards travel. Thus, if you do not want to redeem for travel, you can get gift cards, shop with miles, redeem miles with Capital One Entertainment, or even redeem for cash back. Travel redemptions also have several options: you can redeem miles on travel-related purchases, book travel with miles though Capital One Travel, or transfer miles to more than 15 travel loyalty programs.

Capital One Miles Transfer Partners

Citi thankyou® rewards.

ThankYou® Rewards is a program that lets you earn ThankYou® Points when you make purchases with eligible credit cards. ThankYou points can be combined under a single ThankYou Account, which means you can pool or share points with friends, family members or even total strangers provided they have a ThankYou account. Just keep in mind that shared points are valid for 90 days from the date they are received. Here are eligible Citi ThankYou® Rewards credit cards:

- Citi Rewards+® Credit Card

- Citi Double Cash® Card

- Citi Custom Cash® Card

- Citi Premier® Card

- AT&T Points Plus® Credit Card from Citi

There are various ways you can redeem ThankYou Points: from gift cards to cash, you can pay with points or share your points with other ThankYou members, or you can donate points to participating charities. However, transferring points to airline and hotel partners is probably the most interesting option, especially for frequent travelers. There are 14 airline partners and 4 hotel partners in the ThankYou Rewards program. Most transfers to participating loyalty programs are at a 1:1 ratio.

Citi ThankYou® Rewards Transfer Partners

*Transfer exchange rates vary depending on your card.

Chase Ultimate Rewards®

Chase Ultimate Rewards® is a credit card rewards program offered by Chase. The program allows consumers with eligible Chase credit cards to earn points on all everyday purchases, whether you shop at your favorite retailers, dine out with friends or travel around the world. Chase credit cards can offer a sign-up bonus, which you can earn by meeting certain spending requirements within a specified amount of time, or you can earn higher points per dollar spent in specific categories (such as gas stations, grocery stores, restaurants and more). Here are eligible Chase cards that earn Ultimate Rewards points:

- Chase Sapphire Preferred® Credit Card

- Chase Sapphire Reserve® Credit Card

- Chase Freedom Flex® Credit Card

- Chase Freedom Rise℠ Credit Card

- Chase Freedom Unlimited® Credit Card

- Ink Business Preferred® Credit Card

There are four main ways to redeem Ultimate Rewards points: book travel through the Chase Travel Portal, redeem for gift cards, redeem for cash back, or transfer points to a partner. To transfer points to Chase’s travel partners, log into the Chase Ultimate Rewards portal and choose the “Transfer to Travel Partners” section. There, you will see a list of airline and hotel partners to choose from. Also, you can see a full list of Chase’s travel partners below.

Chase Ultimate Rewards Transfer Partners

Bilt rewards.

Bilt Rewards is a loyalty program that lets you earn points on purchases, but more notably, you can earn Bilt points by paying your rent. You don’t have to have a Bilt credit card to earn Bilt points. You can simply become a Bilt Rewards member, link a debit or credit card to your Bilt account, and start earning points with Bilt Neighborhood Rewards or by paying your rent. However, earning can be easier with the Bilt Mastercard® credit card. Bilt Rewards members can redeem their points in various ways: use points towards rent, save points to use them towards a down payment on a home, shop with partners, redeem points on the Bilt Travel Portal, or transfer points to Bilt loyalty partners. Bilt members can transfer Bilt points at a 1:1 rate to all Bilt travel partners. Below are the loyalty programs you can transfer Bilt points to using the Bilt app.

Bilt Loyalty Partners

Bottom line.

Travel enthusiasts love point transfers as they have the potential to increase the value of earned points. When you master all ins and outs of credit card point transfers, you will see more opportunities to earn points or miles and can get more flexibility when redeeming them.

Editorial Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

UGC Disclosure: The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Points exchange with travel partners

Exchange your Hilton Honors Points for travel miles or, travel miles for Hilton Honors Points, with our global partners worldwide at Hilton.com/en/hilton-honors/guest/exchange-points/ .

All transactions must be done online and you must have the travel partner attached to your Hilton Honors account.

7 of the best cards to pair with the Amex Gold

The American Express® Gold Card is a card we can't live without .

It earns 4 points per dollar spent at U.S. supermarkets (up to $25,000 in purchases per calendar year; 1 point per dollar after) and dining at restaurants and 3 points per dollar on flights booked directly or through Amex Travel .

The card also comes with up to $10 in monthly dining credits on eligible purchases at participating restaurants and up to $120 in annual Uber Cash credits (which can be used for Uber or Uber Eats) for U.S. customers. The card must be added to Uber account to receive the Uber Cash benefit, and enrollment is required for select benefits.

But even though it's a great card on its own, it also pairs well with other rewards cards to build a more well-rounded card strategy.

Today, we're reviewing a few cards that pair well with the Amex Gold .

Supercharge your Membership Rewards balance

The first cards you should consider pairing with the Amex Gold are other Membership Rewards points-earning cards. Amex allows you to pool your points into one Membership Rewards account, meaning you can earn across multiple cards and cash in for one fantastic redemption.

The Platinum Card® from American Express

Welcome bonus: Earn 80,000 Membership Rewards Points after you spend $8,000 on purchases within the first six months of card membership.

Annual fee: $695 (see rates and fees )

Rewards rate: Earn 5 points per dollar on airfare purchased directly from the airline or through Amex Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar) and prepaid hotels booked through Amex Travel.

If you are a frequent traveler looking to upgrade your experiences, the Amex Platinum could be a great choice to add to your wallet alongside the Amex Gold. You'll earn more on eligible airfare and hotels and get a stellar lineup of travel perks , including lounge access , elite status with both Marriott and Hilton and hundreds of dollars in assorted statement credits. Enrollment is required for select benefits.

For more details, check out our full Amex Platinum review .

Apply here: Amex Platinum Card

Amex cash back options

There are plenty of good reasons to have a cash-back card in your wallet . Cash-back is the ultimate flexible rewards currency, and these options will help you earn bonus cash back in categories the Amex Gold misses.

Blue Cash Everyday® Card from American Express

Welcome bonus: Earn $200 back after you spend $2,000 on purchases within the first six months of card membership.

Annual fee: $0 (see rates and fees )

Rewards rate: Earn 3% cash back at on groceries at U.S. supermarkets (on up to $6,000 per year, then 1%), U.S. online shopping (on up to $6,000 per year, then 1%) and at U.S. gas stations (on up to $6,000 per year, then 1%) and 1% cash back on all other purchases.

The Blue Cash Everyday is a great option for frequent online shoppers as this card earns elevated cash back on websites that generally don't fall into bonus categories. The cash back this card earns can be redeemed as a statement credit.

For more details, check out our full review of the Blue Cash Everyday card .

Apply here: Amex Blue Cash Everyday

Blue Cash Preferred® Card from American Express

Welcome bonus: Earn a statement credit for $250 after you spend $3,000 in purchases on your new Card within the first 6 months of card membership.

Annual fee: $0 introductory annual fee, $95 after (see rates and fees )

Rewards rate: Earn 6% cash back at U.S. supermarkets (on up to $6,000 per year, then 1%) and select streaming services, 3% cash back on transit and U.S. gas stations and 1% cash back on all other purchases.

The Blue Cash Preferred often flies under the radar, but it's a solid cash back card, especially for grocery shopping and gas purchases. The cash back you earn with this card comes as reward dollars that can be applied as a statement credit.

For more details, check out our full review of the Blue Cash Preferred card .

Apply here: Amex Blue Cash Preferred

Rack up points or miles with an Amex travel partner

If you are loyal to one of the hotels or airlines that are a Membership Rewards transfer partner , like Delta SkyMiles or Hilton Honors , a cobranded card could be a great way to supplement your earning potential.

Delta SkyMiles® Gold American Express Card

Welcome bonus: Earn 70,000 Bonus Miles after you spend $3,000 in purchases on your new card in your first six months of card membership. Offer ends March 27.

Annual fee: $0 introductory annual fee for the first year, then $150 (see rates and fees )

Rewards rate: Earn 2 points per dollar on eligible Delta, restaurant and U.S. supermarket purchases and 1 point per dollar on all other purchases.

Those who live near a Delta hub or regularly fly with the airline might be interested in a Delta cobranded credit card that helps you earn bonus miles on flights and gives you some nice airline benefits. Delta is one of Amex's transfer partners, which makes using your Amex Gold to supplement your Delta earnings for redemptions easy.

The Delta SkyMiles Gold Amex is a great choice for casual flyers and those who don't want to add a high annual fee to their wallet. Still, Delta's other credit cards are also excellent choices for those who want help to hit elite status with the airline.

For more details, check out our full review of the Delta SkyMiles Gold .

Apply here: Delta SkyMiles Gold Amex Card

Hilton Honors American Express Surpass® Card

Welcome bonus: Earn 155,000 Hilton Honors points after you spend $3,000 in purchases on the card within the first six months of card membership. Offer ends April 17.

Annual fee: $150 annual fee (see rates and fees )

Rewards rate: Earn 12 points per dollar spent on eligible purchases at Hilton hotels; 6 points per dollar spent at U.S. restaurants, U.S. supermarkets, and U.S. gas stations; 4 points per dollar on U.S. online retail purchases; and 3 points per dollar spent on other eligible purchases.

If you are loyal to Hilton Hotels when you travel, having a Hilton credit card in your wallet may be a good idea. The card comes with complimentary Gold status (though you can earn Diamond status when you spend $40,000 on eligible purchases on your card in a calendar year), a free night award after spending $15,000 each calendar year and more. Enrollment required for select benefits.

It's a solid card to pair with your Amex Gold because it earns in one of the categories the Amex Gold misses — like Hilton hotel stays, online shopping and gas stations— and you can transfer Membership Rewards to Hilton Honors to help you top off your Hilton account for redemptions.

For more details, check out our full review of the Hilton Honors Surpass .

Apply here: Hilton Honors Surpass Credit Card

Stock up on other types of points

Of course, there is also value in having cards that earn entirely different currencies in your wallet to maximize your redemption options across the board. Here are some options to diversify the points and miles you're earning.

Chase Sapphire Preferred® Card

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Annual fee: $95

Rewards rate: Earn 3 points per dollar on dining purchases and 2 points per dollar on a generous definition of travel purchases. Earn 5 points per dollar on Lyft through March 2025 and 1 point per dollar on all other purchases.

At face value, you may wonder why the Chase Sapphire Preferred is a good card to pair with the Amex Gold, considering it earns 2 points per dollar on travel and 3 points on dining — two categories that overlap with the Amex Gold. But Chase defines travel broadly , which makes this card a great choice for travel spending that isn't flights booked directly through the airline or Amex Travel. Chase is also more generous than Amex in defining 'dining ,' which includes most bars.

And when it comes to earning diversified points, Amex and Chase both offer the most valuable flexible rewards currencies on the market. They also both come with a unique set of redemption options, so it makes sense to have both in your wallet.

For more details, check out our full review of the Chase Sapphire Preferred .

Apply here: Chase Sapphire Preferred Card

Capital One Venture Rewards Credit Card

Sign-up bonus: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

Annual fee: $95 (see rates and fees )

Rewards rate: Earn 2 miles per dollar spent on every purchase and 5 miles per dollar on hotels and car rentals booked through Capital One Travel .

If you want a catch-all card for your non-bonus spending, it doesn't get much better than the Capital One Venture. You'll earn 2 miles per dollar on every purchase, making it a great choice for purchases that don't earn bonus rewards on your Amex Gold.

When it comes time to redeem your miles, you can choose a simple fixed-value redemption option for broader travel purchases or transfer your miles to any of Capital One's 15-plus hotel and airline partners .

For more details, check out our full review of the Capital One Venture Card .

Apply here: Capital One Venture Rewards Credit Card

Bottom line

The Amex Gold is a solid card on its own — but it's even better as part of a complementary card pair. Choose from any of the options listed here or a different card that works well with your lifestyle and spending habits, like

And if you haven't added the Amex Gold to your wallet yet, now is a great time to apply and earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new card within the first six months of card membership.

Apply here: American Express Gold Card

For rates and fees of the Amex Blue Cash Everyday, click here .

For rates and fees of the Amex Blue Cash Preferred, click here .

For rates and fees of the Amex Gold card, click here .

For rates and fees of the Amex Platinum card, click here .

For rates and fees of the Delta SkyMiles Gold card, click here .

For rates and fees of the Hilton Surpass card, click here .

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

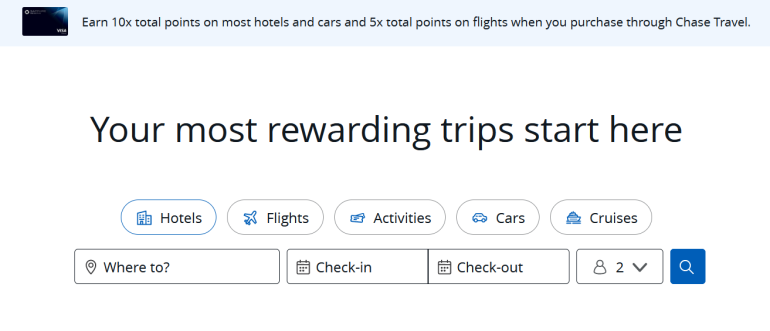

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card. c

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

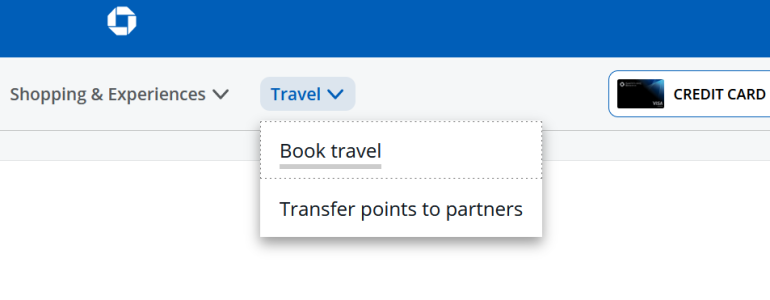

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

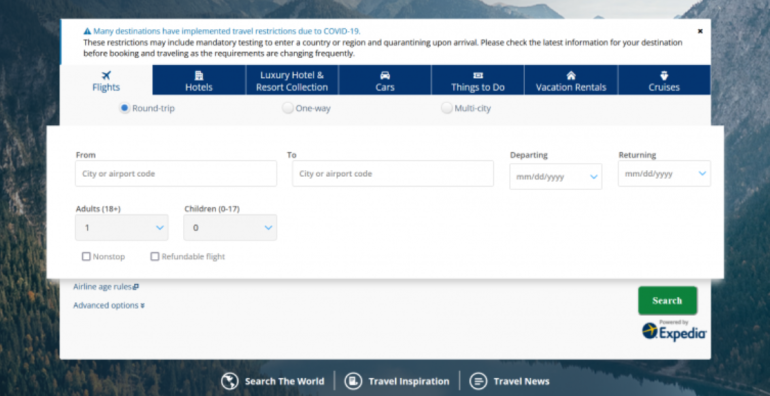

How to book award flights in Chase's travel portal

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

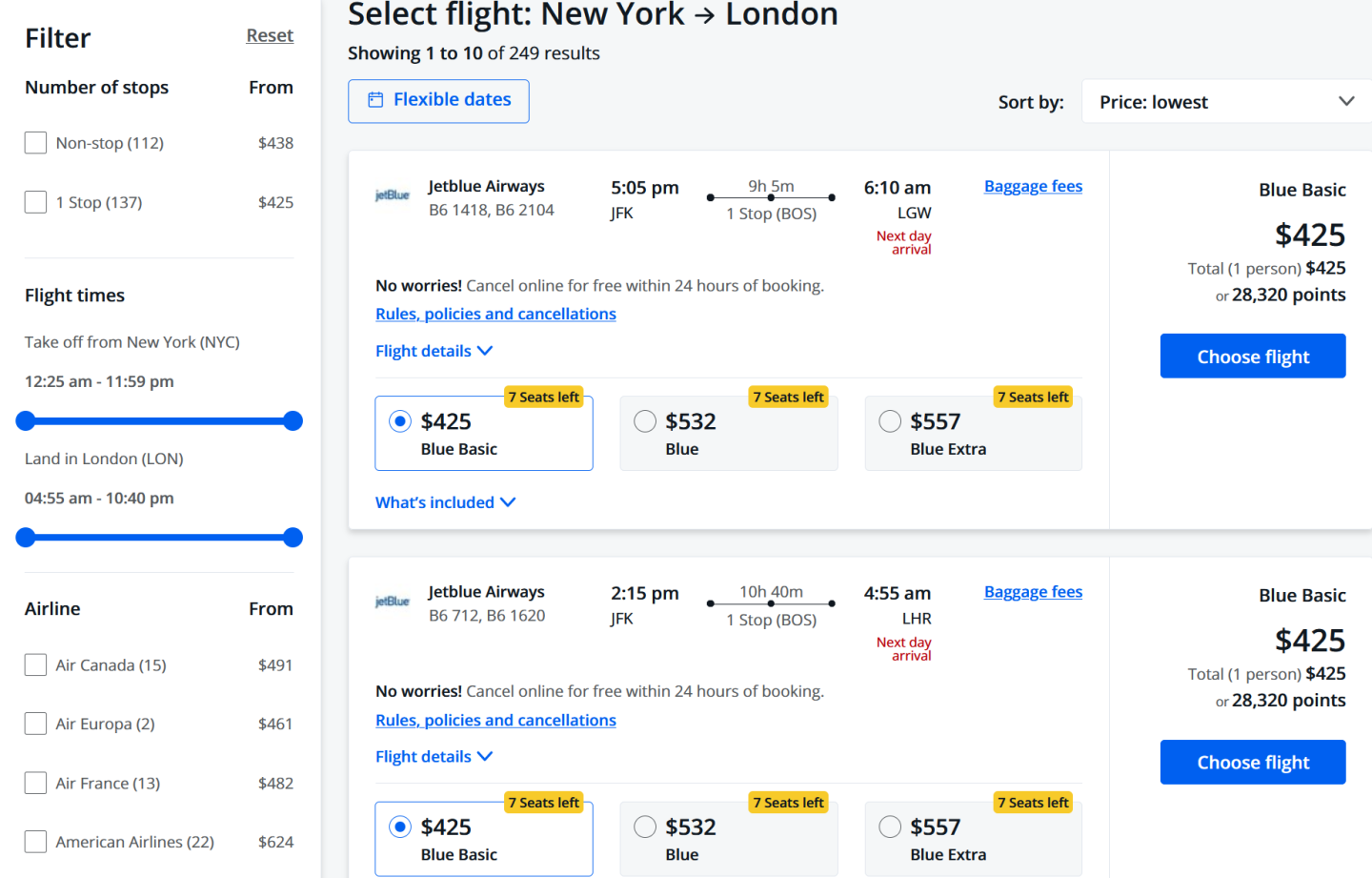

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

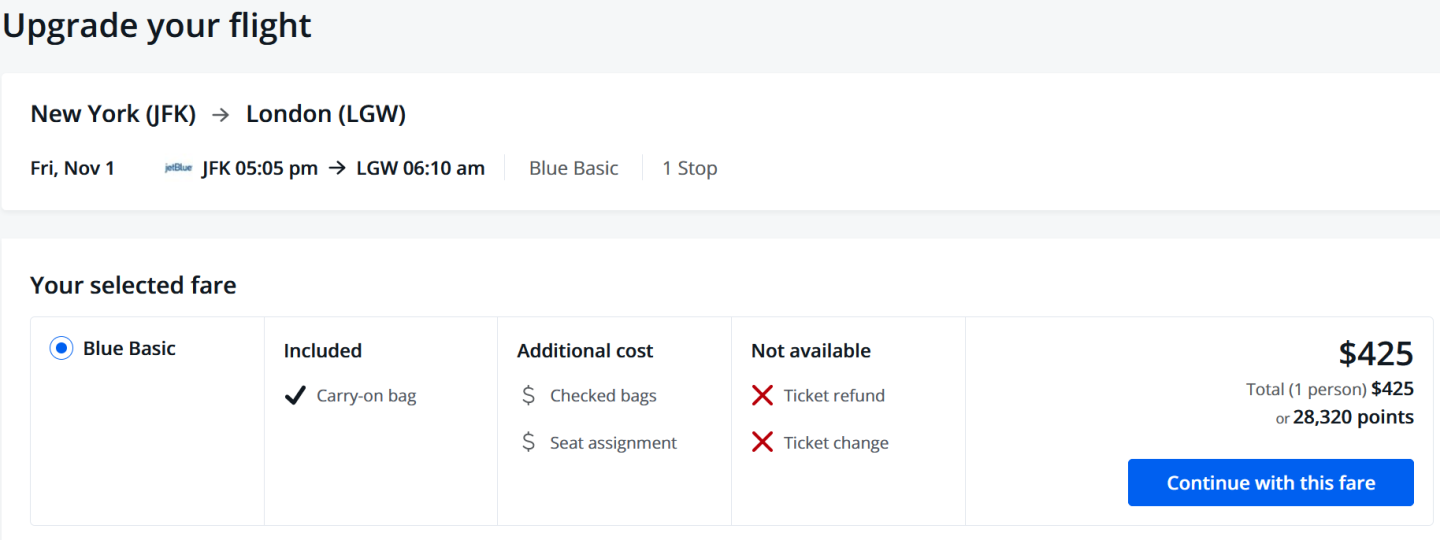

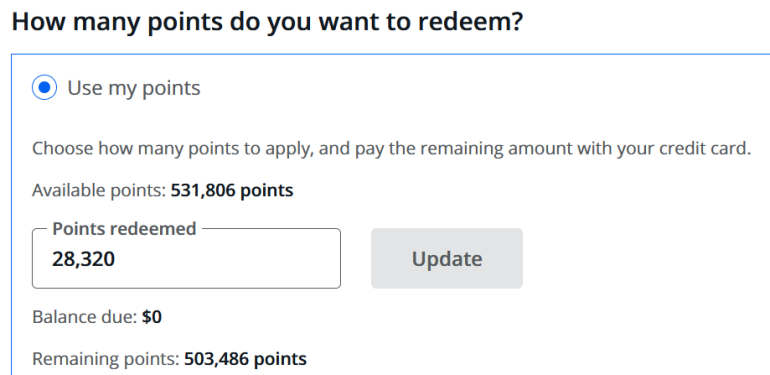

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

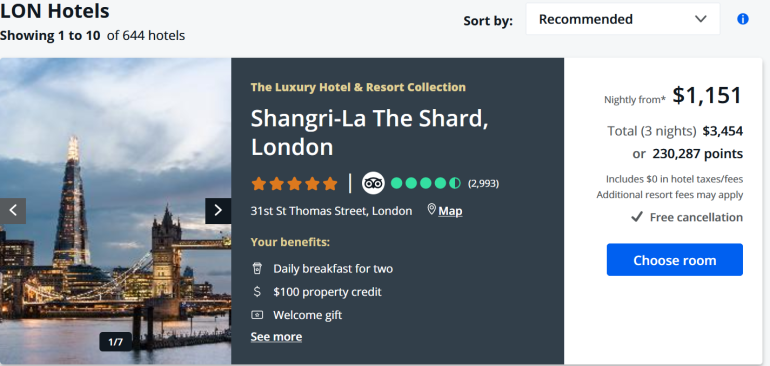

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

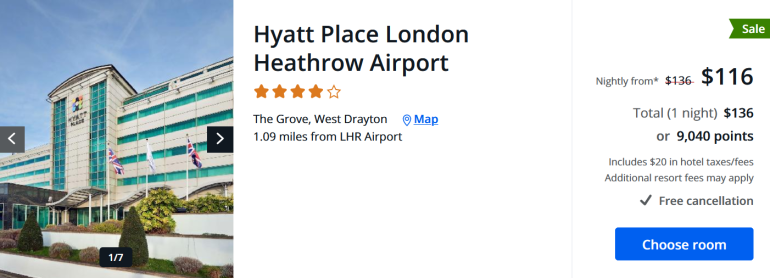

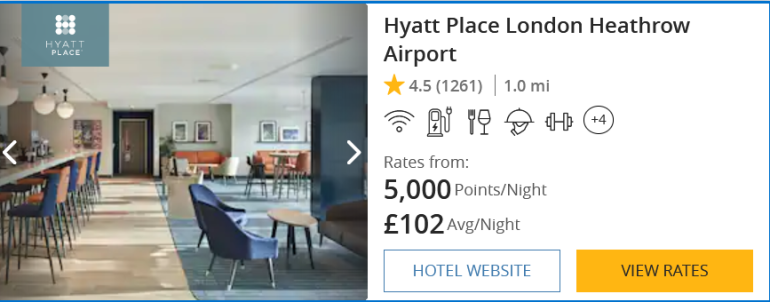

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

One of the booking tabs also leads to the Chase Luxury Hotel & Resort Collection . This subset of high-end hotels delivers bonus perks like free breakfast, a $100 hotel credit and room upgrades, depending on the property and other things.

You can book directly through Chase or redeem points and be eligible. It’s nice to have elite status-style perks at a hotel where you may not have status or that doesn't have a loyalty program.

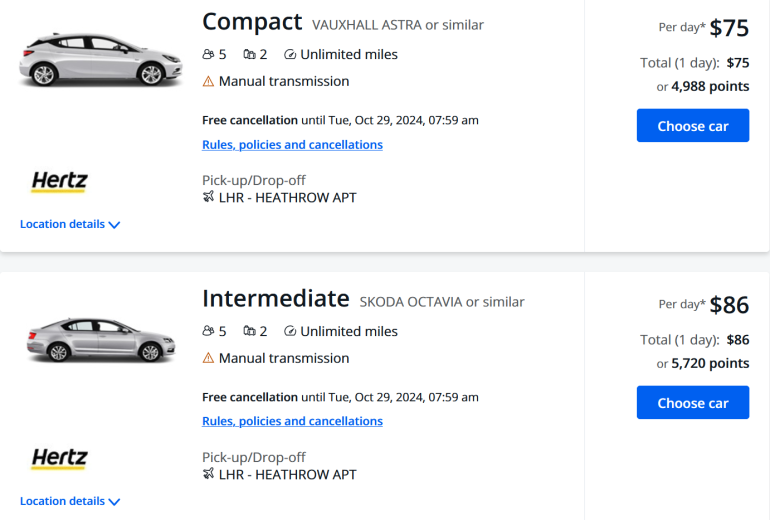

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

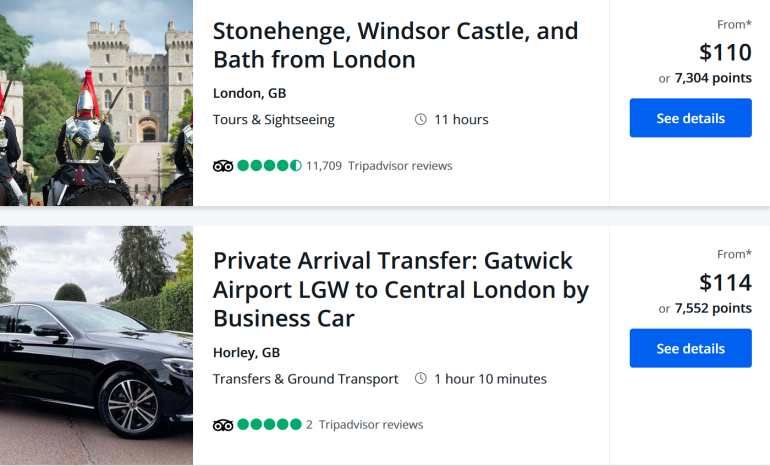

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Earn up to 8,000 bonus points or more

Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Haven’t traveled with us in a while? You may be eligible for an extra 2,000 bonus points.

Activate and book March 1 to May 31, 2024 for stays through the end of the year.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Citi strata premier card replaces citi premier: enjoy travel insurance and other new benefits, in addition to a new name, the card offers new travel protections and bonus rewards categories..

Citi is an advertising partner.

Citi has rebranded its popular mid-tier Citi Premier® travel credit card as the Citi Strata Premier ℠ Card . The new Strata Premier Card is nearly identical to the old Citi Premier except it has additional travel protections, bonus spending categories and a new limited-time welcome offer .

If you're interested in applying for this card, here's what you need to know about the card's benefits and how to qualify for the intro bonus .

Citi Strata Premier℠ Card

Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.; 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations; 1 Point per $1 spent on all other purchases

Welcome bonus

Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

Regular APR

21.24% - 29.24% variable

Balance transfer fee

5% of each balance transfer, $5 minimum

Foreign transaction fee

Credit needed.

Good/Excellent

See rates and fees . Terms apply.

Citi Strata Premier℠ Card details

The Citi Strata Premier ℠ Card earns transferrable Citi ThankYou points and earns them in bunches. It also currently offers a welcome bonus worth 70,000 points after spending $4,000 in the first three months of account opening.

This bonus is worth $700 in gift cards, cash back or travel (booked through thankyou.com ). To potentially get even greater value, you can also transfer these points to any Citi ThankYou travel partners , including Air France/KLM (Flying Blue), Avianca, Singapore Airlines and Virgin Atlantic. Having the option to transfer your points unlocks all sorts of opportunities.

For example, you could take advantage of the monthly Flying Blue promo rewards and use the bonus points to book two round-trip economy awards flights from the U.S. to Europe which can easily cost over $500 a person depending on your itinerary. Want to go somewhere a little more tropical? Transfer those 70,000 points to Avianca LifeMiles and you have enough to book two round-trip economy awards flights from the U.S. to the Caribbean .

New Citi Strata Premier Card benefits

Aside from a new name and some travel protections, the new Citi Strata Premier is mostly the same as the Premier card it replaces.

One change is that the Strata Premier is making permanent the old Premier's limited-time spending category bonus of 10X points on hotels, car rentals and attractions when booked through CitiTravel.com You're also now able to earn 3X at EV charging stations.

But the most notable changes with the Strata Premier are the new travel coverages, including:

- Trip cancellation/interruption

- Lost or damaged luggage

- MasterRental coverage (car rental insurance)

What's staying the same with the Citi Strata Premier Card?

The Citi Strata Premier's annual fee is staying at $95, and you'll continue to earn:

- 3X points on air travel

- 3X points on hotels (not booked through CitiTravel.com)

- 3X points at restaurants

- 3X points at supermarkets

- 3X points at gas stations

- 1X points on all other purchases

You'll still receive an annual hotel benefit valid for $100 off a single hotel stay of $500 or more that you book through CitiTravel.com. This card continues to have no foreign transaction fees and access to Citi Entertainment as well as all of the same Citi ThankYou transfer partners.

As before, if you have a Citi cash-back card, such as the Citi Double Cash® Card or the Citi Custom Cash® Card , you can pair it with the Citi Strata to convert your cash-back rewards into fully transferrable points.

Citi Double Cash® Card

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

0% for the first 18 months on balance transfers; N/A for purchases

19.24% - 29.24% variable

For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer ($5 minimum) applies; after that, a balance transfer fee of 5% of each transfer ($5 minimum) applies

Fair/Good/Excellent

Read our Citi Double Cash® Card review.

Citi Custom Cash® Card

Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025.

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back.

0% APR on balance transfers and purchases for first 15 months

5% of each balance transfer ($5 minimum)

Excellent, Good, Fair

Read our Citi Custom Cash ® Card review .

How to qualify for the Citi Strata Premier Card

You'll want a good-to- excellent credit score to have the best chance of being approved for the Citi Strata Premier. There is also an additional restriction for qualifying for this card's intro bonus. If you've received an intro bonus for the Strata Premier or the Premier card within the last 48 months, you can't earn the bonus again with a new Strata Premier Card.

It's important to note that this 48-month restriction applies to when you received the intro bonus points, not when you opened the account. If you opened a Citi Premier card in April of 2020 but didn't earn the intro bonus until early July 2020, you have to wait 48 months from July — not April — to be able to earn the Strata Premier's bonus.

Alternatives to the Citi Strata Premier Card

The Chase Sapphire Preferred® Card charges the same annual fee as the Strata Premier Card and offers similar benefits. It too earns transferrable travel rewards and has a long list of travel and purchase protections. But while the cards seem similar on the surface, dig a bit deeper and you'll find the Chase Sapphire Preferred Card has a few advantages over the Citi card.

The Chase Ultimate Rewards® airline and hotel transfer partners include programs such as World of Hyatt, Southwest Rapid Rewards and Air Canada Aeroplan, which help make Chase's network one of the best in the travel rewards space. The Sapphire Preferred also features more robust protections than the Strata Premier, including purchase protection and extended warranty protection on top of travel insurance.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

21.49% - 28.49% variable on purchases and balance transfers

Either $5 or 5% of the amount of each transfer, whichever is greater

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card (see rates and fees ) doesn't have the same long list of bonus spending categories you get with the Strata Premier. Instead, it earns at least 2X miles on every purchase, which makes it a strong option for everyday purchases outside of standard bonus categories. The Capital One Venture Rewards also allows you to transfer miles to a strong list of partner travel programs or keep things simple by offsetting travel purchases with miles at a rate of one cent each.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% variable

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Bottom line

The Citi Premier Card is now the Citi Strata Premier . With this renaming, a few of the benefits are changing, but it is largely the same card. However, the biggest weakness of the Citi Premier has been solved with this update, which includes the addition of travel insurance perks.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every personal finance article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of financial products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- How to use the Chase Sapphire Reserve travel credit Jason Stauffer

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

How to redeem Chase Ultimate Rewards points for maximum value

You can never have too many Chase Ultimate Rewards points .

This transferable points currency gives you access to some of the best hotel and airline transfer partners in the business, as well as the easy-to-use Chase Travel℠ portal , which allows you to cover a wide variety of different costs for your trip, including car rentals, hotels, flights, tours and activities, as well as some everyday expenses.

Despite increasing competition from American Express Membership Rewards , Citi ThankYou Rewards and Capital One miles , Chase Ultimate Rewards maintains its place as one of the most valuable points currencies on the planet. Plus, the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® card are both currently offering elevated welcome bonuses of 75,000 points after you spend $4,000 on purchases in the first three months from account opening. Therefore, this is a great time to consider applying for a Chase credit card and maximizing your rewards.

If you are new to redeeming Chase Ultimate Rewards points, this stress-free beginner guide will show you how to easily redeem 75,000 points.

However, if you're ready to get serious about traveling more for less, here's everything you need to know about Chase transfer partners and the best ways to redeem your Chase Ultimate Rewards points.

How much are Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents each, which is what you should aim for when redeeming them. The actual value you get from these points depends on how you redeem them.

How can I redeem Chase Ultimate Rewards?

If you redeem your points for cash back or statement credits at the lower-value end, each point is typically worth 1 cent.

A midvalue redemption option is to use your Chase points for virtually any kind of travel booking: Flights, hotels, cruises, tours and rental cars via Chase Travel. If you have the Chase Sapphire Preferred , your points are worth a fixed rate of 1.25 cents each. Meanwhile, cardholders of the Chase Sapphire Reserve get a higher valuation of 1.5 cents per point. This is an excellent redemption option for folks who don't want to deal with complicated award program rules.

If you want to maximize your Ultimate Rewards points, the most valuable option is often to transfer your points to one of 14 airline or hotel partners. From there, you can use them for premium travel bookings, such as premium cabin flights and luxury hotels.

What are the most valuable ways to redeem Chase points?

We've mentioned that transferring your Chase points to a travel partner is often your best bet if you want to get the most value out of your points. Here are some of the best ways to redeem Ultimate Rewards with airline and hotel transfer partners.

Air France-KLM Flying Blue

While Flying Blue prices its awards dynamically, the program has now standardized saver-level pricing for all one-way flights between the U.S. and Europe as follows, regardless of origin or destination, meaning you can connect at no extra cost:

- 20,000 miles in economy

- 35,000 miles in premium economy

- 50,000 miles in business class

Remember that these rates are only for the lowest saver-level seats, which are limited. Booking business class from anywhere in the U.S. to anywhere in Europe for 50,000 Flying Blue miles is a fantastic deal, so jump on this if you find this price on dates that work for you.

Additionally, you could spend a few days in Paris or Amsterdam using the free Flying Blue stopover program . This is a great way to visit another city without paying additional miles or cash. To book Flying Blue stopovers, you'll need to call Flying Blue at 800-375-8723.

Southwest Airlines Rapid Rewards

TPG values Southwest Rapid Rewards points at 1.35 cents each, which is a lot less than the 2.05 cents per-point value of Ultimate Rewards. So, transferring to Southwest isn't a great way to use your Chase Ultimate Rewards points.

However, there are a couple of scenarios where transferring points to a friendly carrier with no change or baggage fees makes sense. First, for inexpensive fares of $100 or less, Rapid Reward points can be worth as much as 1.7 cents per point, which beats the value you get when booking through the portal. Second, if you have a Southwest Companion Pass and are really getting two flights for the price of one award, then your points become worth as much as 3.4 cents per point for inexpensive fares.

Remember, too, that Southwest flights booked with Rapid Rewards points include free changes and cancellations , which gives you a ton of flexibility if the award rate drops after booking.

Singapore Airlines KrisFlyer

Singapore Airlines has several benefits as a potential airline transfer destination for your Ultimate Rewards. First, Singapore is one of the best airlines in the sky, with tremendous service and luxurious onboard products and experiences. The carrier's premium-class products are typically only available through the KrisFlyer program , not with its Star Alliance partners.

Second, Singapore's KrisFlyer program offers fantastic value, with reasonable award charts, low fuel surcharges, routing rules that allow stopovers and the ability to combine multiple partners in one award.

Finally, the online award booking tool is intuitive and easy to use — though be aware that transfers typically are not instantaneous.

Here are some of our favorite KrisFlyer redemptions when using Chase Ultimate Rewards:

- Fly from the mainland U.S. to Hawaii in economy class on United Airlines for 19,500 miles each way

- Fly Singapore Airlines from the U.S. to Europe from 25,000 miles (note: this may be discounted further thanks to KrisFlyer's monthly Spontaneous Escapes offers )

- Fly the world's longest flight in business class from New York to Singapore for 111,500 miles each way

- Fly first class from Los Angeles to Japan or South Korea from 120,500 miles each way

Related: It doesn't get much better than this: Singapore Airlines' A380 in business class from Frankfurt to New York

Iberia Plus

Spain's national carrier remains a mystery to many Chase cardholders despite the significant value Iberia Plus can offer U.S.-based flyers. The carrier offers cheap economy, premium economy and business-class transatlantic flights on its own metal.

Transatlantic business class is priced based on a distanced-based award formula. One-way flights from Miami to Madrid on off-peak dates start at just 21,250 Avios in economy and 42,500 Avios in business class, for instance. There can be less than $100 in surcharges, depending on the class of service you book.

However, prices get even more attractive for shorter routes (based on distance in miles). For example, off-peak flights from Boston to Madrid require only 17,000 Avios in economy, 25,500 in premium economy and 34,000 Avios in business each way, one of the best sweet spots of any airline program.

Related: A review of Iberia's new business-class suite on the A350-900 from Madrid to Mexico City

Virgin Atlantic Flying Club

There are multiple ways to use Virgin Atlantic's loyalty program to unlock value. Thanks to its own distance-based formula, you can redeem points to fly Delta domestic itineraries here in the U.S. starting at 7,500 points per segment, potentially saving you thousands of points compared to the number of miles Delta is asking for the same flight.

Delta One flights to Europe (excluding the United Kingdom) are a flat 50,000 points for nonstop itineraries — though availability tends to be very scant. Instead, consider booking Air France flights in business class. On off-peak dates, flights from the U.S. to most of Europe are just 48,500 points.

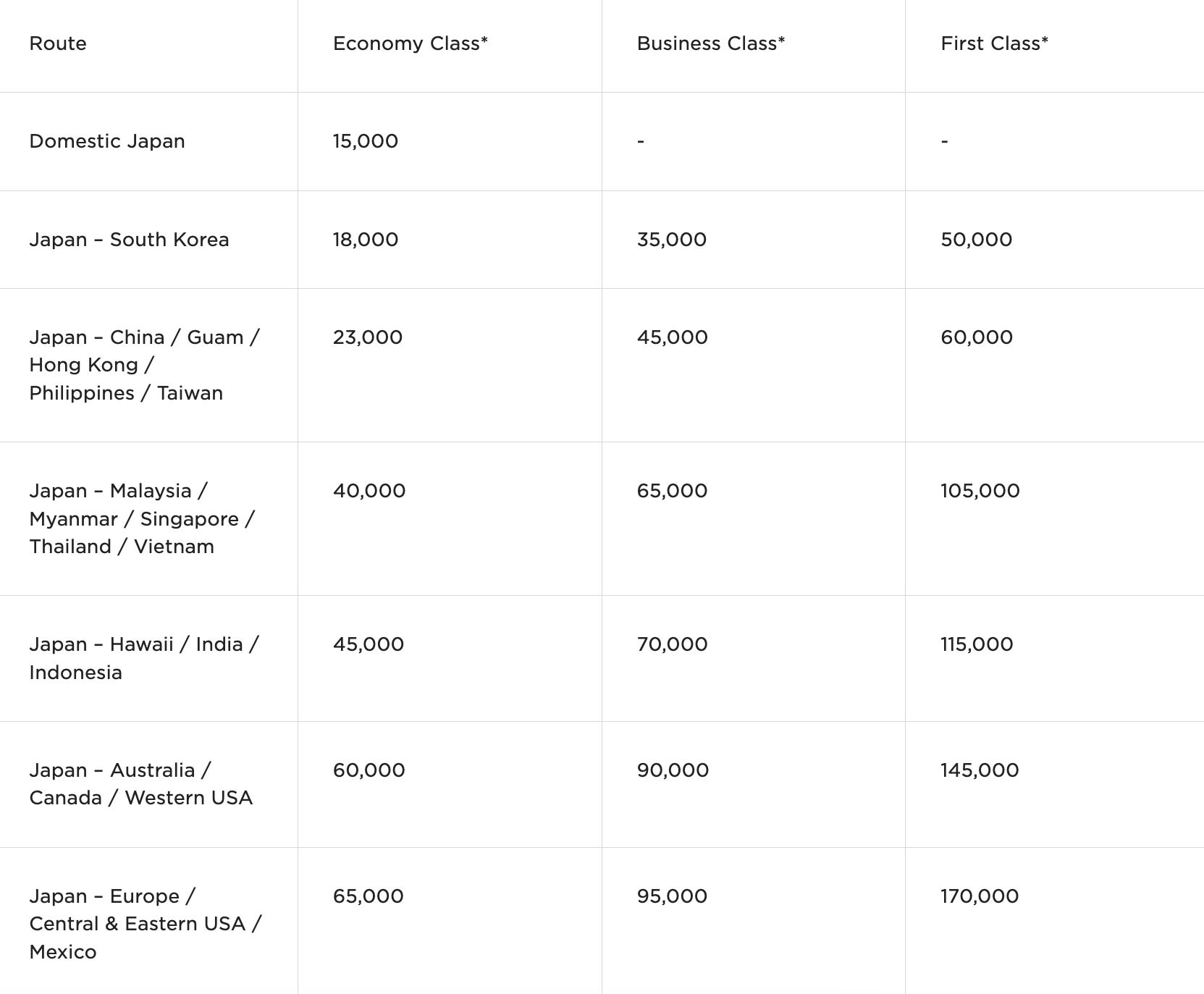

Other partners like All Nippon Airways have award charts so attractive they almost seem like a mistake. You can use just 90,000 Virgin points to fly ANA business class round trip from the West Coast to Japan and 95,000 miles from the central and eastern U.S. to Japan — or one-way for half these prices.

Here is Flying Club's award chart for ANA-operated flights:

Virgin Atlantic also offers attractive fares on flights between the U.S. and the U.K., though taxes on the return flight are quite high. A one-way economy-class flight from the East Coast is just 10,000 points.

Related: How 5,000 credit card points saved me over $650 on a flight to London

British Airways Executive Club

If you need a short-haul, nonstop flight on a Oneworld partner like American Airlines or Alaska Airlines, British Airways Avios can reward you with tremendous savings.

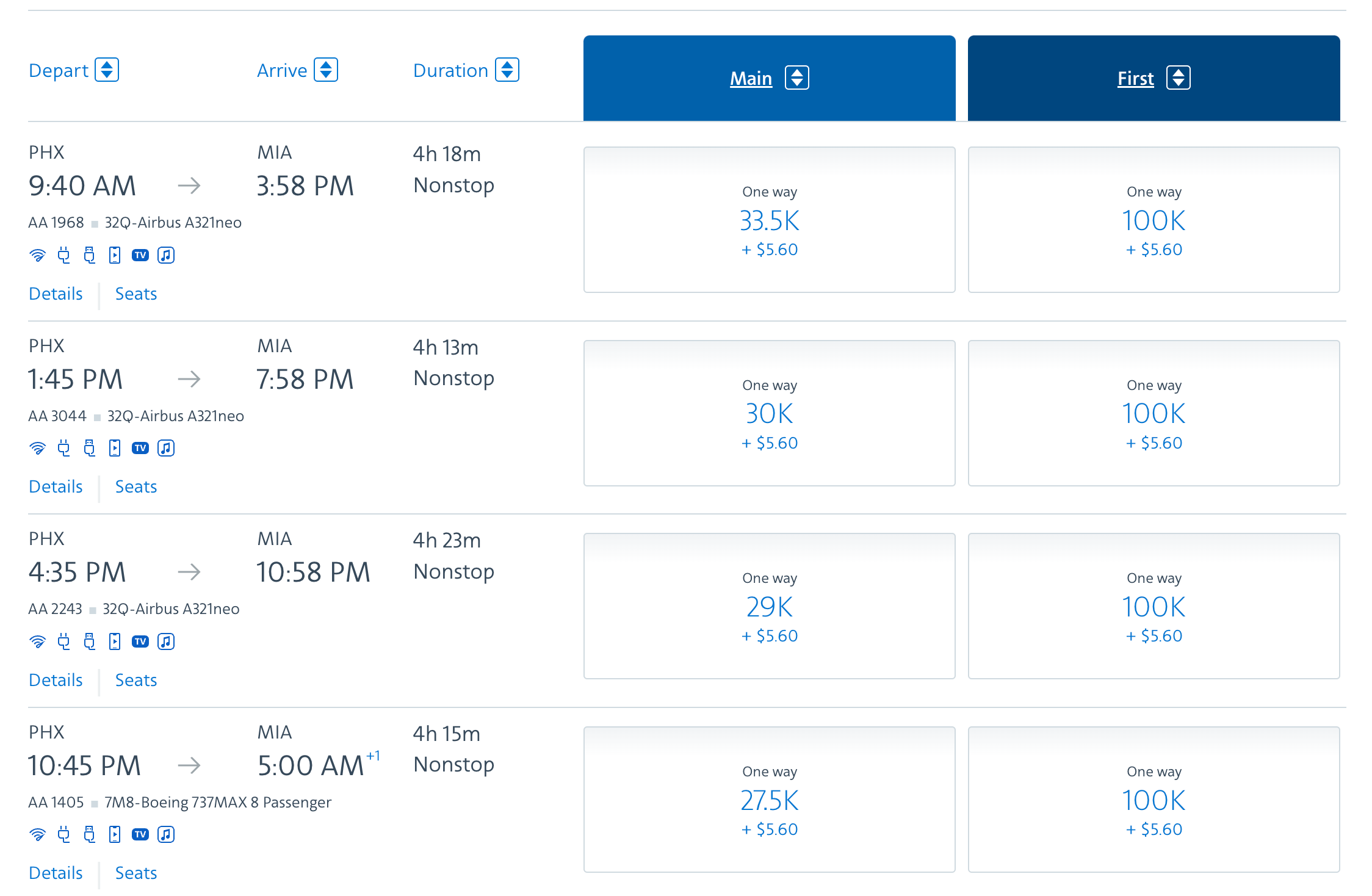

Short-haul flights start at 8,250 Avios for U.S. economy flights up to 650 miles in length, 11,000 Avios for flights 651 to 1,151 miles in length and 14,500 Avios for flights up to 2,000 miles in length. The latter would cover a flight from Phoenix Sky Harbor International Airport (PHX) to Miami International Airport (MIA).

This can be considerably cheaper than what American Airlines charges its American AAdvantage members for the same flights.

British Airways also lowered the cost of Qatar Airways awards when the Doha-based carrier adopted Avios as its own loyalty currency , giving another great option for transferring your Chase points for a valuable award ticket.

Related: British Airways Executive Club: Guide to Avios, elite status and transfer partners

World of Hyatt

One of the best ways to use Ultimate Rewards points is to transfer them to World of Hyatt for low- or high-category properties. Hyatt points are generally worth more than Marriott Bonvoy and IHG points, so Hyatt is often your best hotel transfer partner within Chase Ultimate Rewards.

World of Hyatt also offers an extremely reasonable award chart, with prices ranging from 3,500 to 45,000 points.

If you're looking at standard award nights, the program has value across the spectrum of properties. Category 1 to 5 properties , in particular, can offer some fantastic awards. Examples include the Grand Hyatt Washington (17,000 to 23,000 points), the Grand Hyatt Athens (9,000 to 15,000 points) and the Park Hyatt Mendoza (12,000 to 18,000 points).

Several Category 1 properties sell for over $100 a night (excluding taxes), so redeeming just 3,500 points for these off-peak dates is usually a good decision. An example is the Hyatt Place Tucson-Central, which is bookable for just 3,500 to 6,500 Hyatt points per night.

Higher-tier hotels also have substantial value. For example, redeeming 35,000 to 45,000 points per night at the ski-out Park Hyatt Beaver Creek or 25,000 to 35,000 points per night at the Park Hyatt St. Kitts or the Park Hyatt Maldives Hadahaa can make sense since rooms at these luxury properties routinely sell for over $1,000 a night.

Best cards to earn Chase Ultimate Rewards points

There are many ways to earn Ultimate Rewards points with Chase credit cards. Here is a summary of the best options:

- Chase Sapphire Preferred Card : Best for overall mid-tier cards

- Chase Sapphire Reserve : Best for frequent travelers, dining and travel insurance

- Ink Business Preferred® Credit Card : Best for business travelers

- Ink Business Cash® Credit Card : Best for office supplies and technology services

- Ink Business Unlimited® Credit Card : Best for no-annual-fee business card

- Chase Freedom Flex℠ : Best for earning 5% cash back (or 5 points per dollar) up to a quarterly maximum; activation required

- Chase Freedom Unlimited® : Best for simple rewards

The first three cards earn fully transferable Ultimate Rewards points, while the remaining four are technically billed as cash-back credit cards .

However, if you have an Ultimate Rewards-earning card, you can convert your Chase cash-back rewards to Ultimate Rewards points. For this reason, having more than one Chase card in the family can make sense to maximize your earning and redeeming potential.

Check out TPG's guide to transferring Chase points between accounts for complete details.

Bottom line

The above strategies sample the many redemptions available through the Ultimate Rewards program. If you have the Chase Sapphire Reserve , the Chase Sapphire Preferred Card or the Ink Business Preferred Credit Card , booking through the Chase Travel portal at a rate of 1.25 to 1.5 cents per point will be a solid baseline redemption for many travelers.

However, to really get maximum value, look to utilize Chase transfer partners to book flights and hotel rooms that might otherwise be beyond your means.

With the elevated 75,000 Ultimate Rewards points welcome bonuses available on the Chase Sapphire Preferred and the Chase Sapphire Reserve cards, now is a great time to start earning and redeeming Ultimate Rewards.

Yantar Hotel

View prices for your travel dates

- Excellent 0

- Very Good 0

- English ( 0 )

Own or manage this property? Claim your listing for free to respond to reviews, update your profile and much more.

Yantar Hotel - Reviews & Photos

THE 10 BEST Hotels in Elektrostal 2024

2. Apelsin Hotel

3. MTM Hostel Elektrostal

7. Hotel Djaz

8. park hotel bogorodsk.

Results Similar to Elektrostal

IMAGES

COMMENTS

The IHG loyalty program is good, but it's generally a weak Chase transfer partner. NerdWallet values IHG points at 0.8 cent each. But since Chase points transfer to IHG One Rewards at the same 1:1 ...

Ultimate Rewards points are the currency of most Chase-branded credit cards. You can earn Chase Ultimate Rewards points for everyday spending and then redeem them for a wide range of rewards.. Despite increasing competition from American Express Membership Rewards points, Citi ThankYou Rewards points and Capital One miles, Chase Ultimate Rewards points have maintained their place as one of the ...

Enjoy benefits such as 5x on travel purchased through Chase Travel SM, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel ...

Next, follow the below steps: Log into Ultimate Rewards and click the circle next to your points balance at the top of the page. Then choose "Transfer to Travel Partners." Choose the frequent partner program to which you want to transfer points. Enter the amount of points you want to transfer in increments of 1,000.

In the banner at the top, click on "Travel" and then "Transfer points to partners.". Choose your transfer airline or hotel partner. Click on the blue button near the bottom that says "Transfer Points.". If this is your first transfer with that partner, enter your airline or hotel loyalty member number.

Flexible points that can be transferred to 14 travel partners or redeemed through Chase Travel℠ at 1.25 cents each. $50 annual statement credit toward Chase Travel hotel bookings. Valuable ...

Chase Sapphire Preferred® Card: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. $95 annual fee.; Chase Sapphire Reserve®: Earn 60,000 ...

Hilton Honors has 26 airline partners and one resort partner to which you can transfer your Hilton points. However, note that Hilton Honors has less-than-ideal transfer ratios. For example, you can exchange 10,000 Hilton Honors points for a mere 1,000 United Airlines MileagePlus miles.

Every 2 Virgin Atlantic miles are worth 3 Hilton Honors Points. You must transfer in 10,000-mile increments. This makes 10,000 Flying Club miles worth 15,000 Hilton Honors points. That's an effective 1 Chase Ultimate Rewards to 1.5 Hilton Honors points transfer ratio. It can take up to 30 days for the transfer to complete.

Hilton's hotel loyalty program is called Hilton Honors.With a rich history dating back to 1987 and a gigantic portfolio of brands and hotels, chances are you'll eventually encounter Hilton in your travel planning, even if you don't currently seek its hotels out.. Most of us don't ever consider transferring points out of Hilton; in fact, most of us points enthusiasts ever only think ...

Here are the steps to take to transfer Ultimate Rewards points you've earned: Sign in to your account at chase.com. Choose the "Redeem Rewards" prompt within the dashboard. Select an option to transfer between eligible cards or travel partners. Points can be transferred in 1,000-point increments. Keep in mind that all points transfers are ...

Also, you can see a full list of Chase's travel partners below. Chase Ultimate Rewards Transfer Partners. Transfer Partner Type Transfer Ratio Estimated Transfer Time Minimum Transfer Amount; Aer Lingus AerClub: Airline: 1:1: Instant: 1,000 Chase Ultimate Rewards points: British Airways Executive Club: ... Hilton Honors: Hotel: 1:1: Within 24 ...

Redeeming Chase Ultimate Reward points. As a general rule of thumb, one point equates to $0.01 in redeemable value. This can fluctuate, however, depending on how you decide to redeem your points. When it comes to travel there are three main ways to redeem Ultimate Rewards points: Booking travel directly through the Chase travel portal.

Chase Ultimate Rewards points are among the most useful and valuable currencies you can collect.. You can choose from a wide range of redemption options, including some of the best airline and hotel transfer partners, the easy-to-use Chase Travel℠ portal, cash back and payment for everyday expenses.. With two of the most popular Ultimate Rewards-earning credit cards offering elevated welcome ...

Exchange your Hilton Honors Points for travel miles or, travel miles for Hilton Honors Points, ... All transactions must be done online and you must have the travel partner attached to your Hilton Honors account. Home; Your account; Hilton Honors; Reservations; Hotel information; Hilton Honors Points; Check-in / Check-out;

The Chase Sapphire Preferred card earns flexible Ultimate Rewards points, while the Hilton Surpass card earns valuable Hilton Honors points. A key attribute of these 2 rewards cards is earning well on travel-related purchases. In addition, both cards have several bonus-earning categories that include everyday purchases.

The Chase Sapphire Reserve® is loaded with luxury perks like airport lounge access, travel protections and the ability to earn transferrable travel rewards — but it also has a hefty $550 annual ...

Earn bonus points on select purchases and redeem for travel, gift cards, cash back and more. Earn 1-15 bonus points per $1 spent at 450+ stores with Shop through Chase. Turn your rewards into a statement credit or a direct deposit into most U.S. checking and savings accounts. Use your card and points to attend exclusive events curated around ...

Chase Ultimate Rewards points can be one of the most valuable transferable currencies you can earn. With 11 airline and three hotel transfer partners to choose from, many people start with an Ultimate Rewards-earning card when they first get into points and miles. That's also due to Chase's 5/24 rule and its restrictions on credit card ...

If you are loyal to Hilton Hotels when you travel, having a Hilton credit card in your wallet may be a good idea. The card comes with complimentary Gold status (though you can earn Diamond status ...

Chase Sapphire Preferred® Card: 866-331-0773. All other cards: 866-951-6592. Chase's travel portal can be lucrative. If you compare prices and consider the opportunity cost of using the portal ...

64 reviews. Location 4.2. Cleanliness 3.5. Service 3.7. Value 3.6. The sanatorium "Valuevo" is a historical health resort located in a unique location of the New Moscow on the territory of 30 hectares of the ancient noble estate of Count Musin-Pushkin with a perfectly preserved architectural ensemble and a landscape park, in an ecologically ...

Hotels near Electrostal History and Art Museum, Elektrostal on Tripadvisor: Find 1,362 traveler reviews, 1,954 candid photos, and prices for 62 hotels near Electrostal History and Art Museum in Elektrostal, Russia.

Earn up to 8,000 bonus points or more. Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Citi is an advertising partner. Citi has rebranded its popular mid-tier Citi Premier® travel credit card as the Citi Strata Premier ℠ Card. The new Strata Premier Card is nearly identical to ...

You can never have too many Chase Ultimate Rewards points.. This transferable points currency gives you access to some of the best hotel and airline transfer partners in the business, as well as the easy-to-use Chase Travel℠ portal, which allows you to cover a wide variety of different costs for your trip, including car rentals, hotels, flights, tours and activities, as well as some everyday ...

Yantar Hotel in Elektrostal, Russia: View Tripadvisor's unbiased reviews, photos, and special offers for Yantar Hotel.

Price trend information excludes taxes and fees and is based on base rates for a nightly stay for 2 adults found in the last 7 days on our site and averaged for commonly viewed hotels in Elektrostal.Select dates and complete search for nightly totals inclusive of taxes and fees.