JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Serving Macau since 1983, we are one of Macau's leading providers of personal and business insurance.

About AIG in Macau

AIG Macau is a branch of AIG Insurance Hong Kong Limited, a general insurance company incorporated in Hong Kong.

Launching of Macau:

AIG Macau became fully operational as of June 1, 2010 in place of the Macau branch of its affiliate company, American Home Assurance Company (AHAC Macau).

Drawing on almost three decades of local experience and AIG's international presence around the world by serving 88 million customers in 130 countries and jurisdictions worldwide, AIG in Macau offers a wide range of insurance products for individuals, families, small businesses and multinationals. No risk is too small or too big.

To ensure that all customers receive both maximum protection from potential risk and the best value from their investment, we take an integrated approach to risk management and constantly review and update products and services.

Whether the need involves insurance for a home, a car, an office block or a fleet of commercial vehicles, we are there with the right product at the right price.

Our Regional Presence

AIG Asia Pacific is one of the largest personal and business insurance specialist groups in the region. We are among the leaders in every market in which we operate.

Our network of operating companies reaches across many countries and jurisdictions in the Asia Pacific region, including Australia, China, Guam, Hong Kong, Indonesia, Japan, Macau, Malaysia, New Zealand, Philippines, Papua New Guinea, Saipan, Singapore, Taiwan, Thailand, and Vietnam.

Our clients include many of the region's largest and most respected listed corporations.

AIG is one of the world's leading property-casualty and general insurance organizations. Serving more than 88 million commercial and personal clients in more than 130 countries and jurisdictions, AIG has a 90-year history, one of the industry's most extensive ranges of products and services, and excellent financial strength, AIG enables its commercial and personal insurance clients alike to manage virtually any risk with confidence.

AIG is the marketing name for the worldwide property-casualty and general insurance operations of AIG Inc.

For additional information, please visit our website at http://www.aig.com .

Message from the President and CEO

AIG has maintained a continuous presence in Greater China since it first opened its doors in Shanghai 90 years ago. Today, we are one of the largest and most financially secure insurance organizations in the world, with more than 40,000 employees worldwide serving more than 88 million individual and business customers in more than 130 countries and jurisdictions.

In Macau we offer businesses and individuals a broad range of high-value general insurance products, all supported by superior AIG service and unmatched claims settlement.

We look forward to serving you in the months and years ahead under the AIG banner.

President and CEO AIG Insurance Hong Kong Limited

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Effective Date: Start Date

The departure date must be within 365 days starting from today.

*The promotion offer is subject to Terms and Conditions , please click here for further information.

| Asia | Australia, Brunei, Cambodia, China, India, Indonesia, Japan, South Korea, Laos, Macau, Malaysia, Myanmar, New Zealand, Philippines, Singapore, Taiwan, Thailand and Vietnam

| Worldwide | All destinations excluding : Cuba, Iran, Syria, North Korea, Crimea Region, Donetsk People’s Republic (DNR) Region or Luhansk People’s Republic (LNR) Region

Latest announcement: If you have already purchased “ TravelWise” Insurance Protection Plan, please click here for further information.

Please be advised that the military conflict between Russia and Ukraine may impact travel insurance coverages and benefits, and AIG Travel’s ability to provide certain travel-related assistance services, for travel to, from or within the affected areas.

Important Notice: COVID-19 is a foreseen or known event. For more details, please click here.

AIG TravelWise Insurance

AIG’s TravelWise travel insurance provides comprehensive protection for your journey and is one of the best travel insurance packages available in Hong Kong.

We cover your medical costs should you have an accident or suffer illness while on holiday worldwide, along with any losses arising from your trip being cancelled or your journey being delayed. AIG also covers loss of your baggage or personal belongings, as well as all other risks related to your travelling experience.

TravelWise holiday insurance comes with AIG Travel Assistance, our worldwide emergency service which gives you 24/7 access to a dedicated team of multi-lingual staff of doctors, nurses, medical professionals and security personnel, who can respond to your needs in the event of an emergency.

Flexible plans from HK$14.45 only

- Travel delay - 5 hours from stated departure or arrival

- Baggage delay - up to HK$2,000 maximum

- Baggage and personal effects

- Emergency medical expenses

- Personal accident - accident while in a common carrier up to HK$1.2M maximum

- Journey cancellation or interruption

- Loss of income benefits

- Compassionate visit

*All journeys must commence from Hong Kong

*The price is for reference only. You could get a quote here real time. # The above information is for reference only. For the full benefit table, please refer to our TravelWise brochure or click Buy Now .

Receive COVID-19 coverage of up to HK$1,200,000

AIG TravelWise insurance is now enhanced with COVID-19 coverage. Get the same existing protection, now with COVID-19 cover including emergency overseas medical expenses, journey cancellation, curtailment and quarantine allowance if you are diagnosed with COVID-19.

As you look to explore the world again, travel safely with TravelWise for greater peace of mind.

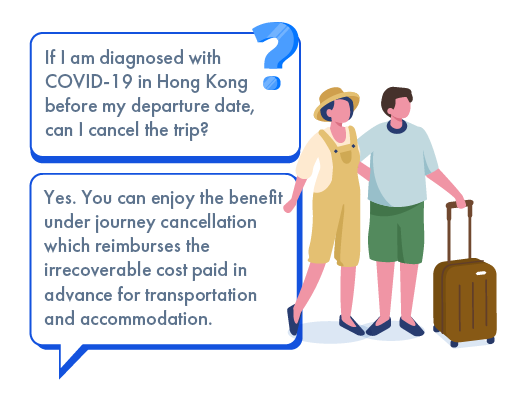

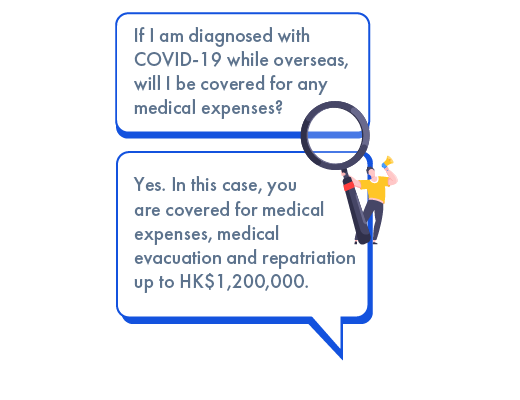

Journey cancellation cover if you are diagnosed with COVID-19 prior to departure from Hong Kong

Emergency overseas medical expenses cover, curtailment cover and quarantine allowance if you are diagnosed with COVID-19 while traveling overseas

*This is for reference only and is subject to policy terms and conditions. For the full benefit table, please click Buy Now .

Check out travel insurance plan with new COVID-19 cover

Click to compare plan coverage and benefits.

- Plan Benefits

- Coverage comparison

COVID-19 Coverage

Optional benefits.

*The above information is for reference only. For the full benefit table, please refer to our TravelWise brochure or click Buy Now .

We are here to support you in case you experience difficult situations during your journey

We understand that things can change quickly, and you might need extra support especially while abroad.

AIG offers a 24/7 toll-free travel emergency hotline to provide support if you feel unwell, or are banned from boarding your transport or from entering a country due to an emergency health condition.

Please note: Expenses incurred from third-party vendors as well as AIG administrative case fees for assistance services not covered as part of this insurance plan are the responsibility of the Policyholder.

When should I buy the travel insurance?

As soon as you have confirmed your travel route and destination, you should consider purchasing travel insurance. The policy must be purchased before your journey commencement (before you leave an immigration counter in Hong Kong), travel insurance purchased after you departed Hong Kong is considered invalid.

I purchased the annual plan of TravelWise insurance policy, will this policy cover all of my trips in this year?

TravelWise annual plan covers all of your trips during the year while trip must commence from Hong Kong with maximum 90 consecutive days per journey.

If I purchased TravelWise Deluxe single plan, will I be covered if I take hot air balloon ride?

Yes, TravelWise covers all amateur sporting activities.

I felt sick while I was travelling but I did not consult a doctor. I only saw a doctor when I came back to Hong Kong. Am I covered?

Unfortunately, your medical expenses incurred after your return to Hong Kong are not covered. Under your TravelWise single plan, we only pay for medical expenses incurred as follow-up treatment in Hong Kong if you have consulted a Legally Registered Medical Practitioner overseas for the same sickness during the insured trip.

Who is eligible to purchase?

Anyone age 70 or below on the commencement date of the policy. A policy may be purchased by an individual or a family for travel overseas for purpose of leisure and/or business, provided the trip is commences from Hong Kong.

Note : We do not cover any travel to Cuba, Iran, Syria, North Korea, the Crimea region, Donetsk People’s Republic (DNR) Region or Luhansk People’s Republic (LNR) Region.

How much premium do I have to pay?

Please press “ Buy Now ” above or refer to our TravelWise brochure for premium levels for each plan.

I travelled to Thailand for 4 days and purchased TravelWise single insurance plan. On the last day of the trip, I suffered from fibular fracture which caused me to stay 2 more days in Thailand. Will TravelWise Protection Plan cover my trip?

Yes. Cover will automatically be extended up to a maximum of 10 calendar days without paying any additional premium, in the event the journey is being unavoidably delayed. (e.g: Travel Delay and missed departure sections due to fibular fracture, and insured person can provide medical documentation to prove that he/she is not medically fit to travel)

How and when can I contact AIG Travel (emergency service team)?

You can call our emergency service team 24/7 at (852) 3516-8699

I am heading to an overseas exchange after which I will stay behind for my personal travelling. Can I only buy travel insurance only for my personal travel?

Yes, but you must purchase your Travel Insurance for the whole period (including exchange & leisure travel).

My flight will depart on 11:50pm on 1 Feb evening. When should be my policy inception date?

You must take 1 Feb as the inception date/ departure date of your Travel Insurance, and the protection will commence after the insured person passed the Hong Kong Immigration Department counter.

If I travel to multiple countries within the same trip, do I need to purchase a separate plan for each country?

If you are travelling to multiple destinations within the same trip, you can be covered under one policy. Please select the furthest region as listed under our area of coverage.

I will be travelling to Thailand this weekend, but a tsunami has just hit the tourist spot today. I want to cancel my trip. Am I covered?

If the Security Bureau issued a “Red or Black Alert” within 7 days of your journey departure date or during your journey, AIG shall reimburse you in accordance with the following “Journey Cancellation”, “Journey Curtailment” or “Journey Re-arrangement” coverage.

I originally planned to travel from Edinburgh to London then coming back to Hong Kong by air. Unfortunately the earthquake had halted the air traffic in Scotland. I chose the road transport instead to travel to London in order to catch the flight to Hong Kong. Can I claim the road transport costs?

Yes, we will reimburse you the additional road transport fares since earthquake is a natural disaster which has caused the delay or cancellation of your scheduled flight. Please ensure that you submit to us the letter from airline to prove the flight delay/ cancellation.

How can I make a claim?

In the event of loss, written notice of claim should be submitted to AIG Hong Kong within thirty (30) days after the occurrence , together with all relevant documents.

In order to help us to deal with your claims, you should provide all the supporting documents to substantiate your claim. Complete documentation will prevent any delay in your claim assessment as additional time may be required to obtain the requisite information.

Upon receipt of sufficient documents, we will assess your claim accordingly. The result of your claim submission will be sent to you shortly.

For detailed claims procedure, please check travel claims procedure .

- TravelWise Summary

- China Assist Card Hospital List

- TravelWise Policy Wording

- OTA Brochure

AIG’s 24/7 Chatbot is here to help

Travel Insurance Hotline

Online Enquiry

Leave us a message

Need Business Insurance?

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ® Direct

√ Up to $80 in eCapitaVouchers (Single Trip Plan)

√ Luggage & travel data (Annual Multi-Trip Plan)

√ Promo code AIGTGD

√ Promo till 30 June 2024

Make a claim

- Renew Annual Travel

- Make Changes to Your Travel Policy

- Request for Proof of Cover Letter

Current Promotion

June Travel Promotion

Use promo code: aigtgd for annual multi-trip and single trip plans .

Promotion is valid till 30 June 2024 . T&Cs apply.

AIG Travel Assistance Services

Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, with a team that is proficient in over 40 languages , providing comprehensive support for travel or medical emergencies abroad.

Top 3 reasons to buy Travel Guard® Direct

QUICK QUOTE

To get a quick quote, select the destination you are travelling to:.

SINGLE TRIP COVERAGE

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

Policy Type

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

- Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

- Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

Group/ Couple

Select this option if you have individuals travelling together on the same dates and to the same destination.

For Group/ Couple up to a maximum of 10 individual policies on the same transaction.

Region 2 Destinations

Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Vietnam

Argentina, Bahrain, Bangladesh, Belize, Bolivia, Brazil, Chile, China (excluding Tibet), Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Hong Kong SAR - China, India, Kuwait, Macau SAR - China, Maldives, Mexico, Mongolia, Nicaragua, Oman, Pakistan, Panama, Paraguay, Peru, Qatar, Sri Lanka, Suriname, Taiwan - China, Thailand, United Arab Emirates, Uruguay, Venezuela

Region 3 Destinations

Region 1, Region 2, Australia, Japan, South Korea, New Zealand, Nepal, Tibet - China and the rest of the world.

(Exclude Cuba, Iran, Syria, North Korea or the Crimea region)

Modal Message

Please select coverage type

travelCoverageType

We do not provide Annual Multi Trip for Group

travelPolicyType

Please select policy type

Please select destination(s)

Please select region of travel

Please provide start date

Please provide end date

Please select if you are going on a cruise

Please select if only 1 adult is travelling

Please provide age

less than or equal to

Please provide valid age

greater than or equal to

Please enter age of at least 2 travellers

Please select no of travellers

Key Benefits

Before you buy, travel alerts, testimonials.

COVID-19 Benefits & FAQ

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.AIG.sg or www.gia.org.sg or www.sdic.org.sg ).

Case Study Illustration

Learn more about AIG's Travel Guard Direct

- Policy Wording (issued on/after 24 September 2022)

- Policy Wording (issued on/before 23 September 2022)

Enquiries: 6419 3000 24-hour overseas emergency assistance hotline : 6733 2552 Travel claims : 6224 3698

Enquire online

Send an enquiry

Policy Changes

Make changes to your policy

You might like

AIG On the Go driving app

Score your driving performance and get up to 15% off your AIG vehicle insurance premium.

Travel Insurance Macau

Whether it is for work or leisure, taking a trip to a foreign country is always a new experience! And a country like Macau has a lot to offer in terms of business opportunities, thanks to its open market structure, as well as tourist activities, courtesy of the cultural heritage of the land!

The city is known for its Macanese and Chinese food and Chinese cuisine with hints of Portuguese ingredients. So what are you waiting for if all of this is something you want to be a part of? Get your Macau travel insurance and be on your way. Now, remember, as with any overseas place, the travel to Macau from India can be expensive. However, you can secure your Macau travel from India with a trusty travel policy. Afterall, it is only a good policy that can help you stay safe and keep you protected against a variety of emergencies.

And to ensure that your travel insurance safeguards you to the best of its ability, you can opt for a travel insurance policy from Tata AIG. With our comprehensive Macau travel insurance, you can be better prepared for your Macau trip. And to ensure that travel policy does not add much to your Macau trip cost from India, we offer affordable travel insurance premiums that you can choose from. Even if you’re travelling with your family, you can select a family travel insurance plan and get comprehensive protection for your loved ones on your Macau travel from India.

Key Benefits of Purchasing a Macau Travel Insurance

When on your trip to a foreign country, any kind of emergency can ruin the spirit of the vacation. But facing tough situations becomes much easier if you have some backup and travel insurance is that backup for you. So, whenever you are planning a trip abroad, always remember to get a travel policy:

Some benefits of having travel insurance when you travel to Macau from India are-

- Travel assistance on your trip.

- Coverage for flight hijacking.

- Coverage for baggage loss or delay.

- Personal liability cover in case of third-party damages on your trip.

- $5,00,000 in coverage against accidents, diseases, and COVID-19 care.

- Tata AIG travel insurance Macau plans may be purchased quickly and easily online.

- Buying travel insurance from India to Macau at only ₹45.5 per day.

- In the event of hospitalisation close to the plan's expiration date, your insurance coverage for Macau will be automatically extended for up to 60 days or until discharge, whichever comes first.

- Your travel insurance Macau policy is automatically extended for 7 days upon a flight cancellation or postponement.

Travel Insurance for Macau from India

Macau and Hong Kong successfully combine Western and Eastern cultures. Macau and Hong Kong are known for their western-style schooling, democratic political system, and status as important trading ports. Although the vast majority of the populace in both regions is Chinese, their long periods of colonial governance have produced an independent lifestyle from China.

Each year, many Indian tourists visit Macau and Hong Kong. If you're one of those who get to visit Hong Kong and Macau, make sure you have a travel policy. Many things might go wrong when travelling abroad, and you do not wish to be stranded without insurance. You could get sick or have an accident. You could also lose your luggage sometimes along the way. While vacationing in and around Macau, you might also misplace your passport. And being alone in an unfamiliar area, surrounded by strangers, is bound to make you feel anxious. Our insurance policy will come in handy in such situations! If you are travelling solo for business, you can purchase specialised business travel insurance to ensure your safety while on the road. You might want to be especially careful while travelling with family and get family travel insurance just to be extra safe. You do not want to be caught in a situation where you need help but do not know where to get it from.

Use a travel insurance premium calculator to see what kind of plan fits into your budget and how you can go about getting it. Many factors affect the Macau trip cost from India, and these are the same factors that affect your policy price. Entering the variables into your travel insurance premium calculator may help you estimate how much you need to pay.

Today getting travel insurance is easier than ever before, and you can complete the task in a few minutes with a few clicks of your mouse. So, when you have affordable rates and an easy application process, you should not let anything stop you from getting a travel policy.

Macau Travel Insurance: Why Is It Needed?

To travel is indeed a beautiful experience. We get to do things we have never done before, see things we have never seen before and sometimes even be a different person. Travelling gives a different perspective from the one we may be having as we get a chance to see how different people live, what they do and how they behave. It is a chance to experience true freedom outside the constraints of everyday life. It is a chance to relax and recuperate while also learning much about this world and its myriad of cultures. But to do all of this, we must be free from the stress of things that could go wrong.

To give ourselves the chance to let go and relax, we must secure our trips, especially international trips, with a reliable travel insurance policy. We know that we will be paying a large sum of money for our trip, so we may be constantly worried about things going wrong and have to pay an extra sum of money. This is not a concern we need to have if we use the right travel policy. We know that we will be taken care of and do not have to empty our pockets abroad in case of an emergency.

Another important thing to keep in mind when considering our Macau trip cost from India is healthcare. Healthcare can be really expensive abroad. So we need to be prepared in case we fall ill while in Macau and need assistance. Getting admitted to a hospital and having any procedure done can be expensive as a tourist, and you need to consider this contingency when planning your budget.

The wise thing to do is get health coverage with your travel insurance plan. Here, you end up paying only a little extra for your insurance, and your insurance takes care of the rest should you need medical assistance while in Macau. So, when planning your Macau travel from India, do not forget to get health coverage with your travel insurance.

Tata AIG's Macau Travel Insurance Plan: Benefits Offered

As stated above, you do not want to be caught in a situation while abroad where you need to pay extra or are stuck without any assistance. While going to a foreign land where you do not speak the language, do not make yourself vulnerable to situations where you may be honestly stuck without a way out. Always get travel insurance before leaving for a trip abroad. Also, take a look at the many benefits that Tata AIG offers, and you will no longer doubt why you need to buy travel insurance.

1. Baggage Coverage - If you lose your baggage or it is delayed at the airport, the Tata AIG luggage cover can offer unrivalled help. You can use this service to get a complete refund for all of the things in your checked bags upto the limit mentioned in the policy.

2. Travel Coverage - With Tata AIG Macau travel insurance, you'll have comprehensive protection for your trip to this foreign destination. It will cover you against things like losing your passport, travel delays or cancellations, and hotel cancellations, among other things.

3. Medical Support

The Tata AIG Macau travel insurance policies are intended to provide comprehensive coverage in the event of a sickness or injury while on vacation. This health coverage will compensate your expenses if you become sick or meet with an accident that needs you to be hospitalised. The best news is that you'll be covered for any COVID-19-related medical expenses you incur throughout your trip.

4. Additional Advantages

- Packages for travel insurance in Macau start at ₹45.5 per day.

- Purchase travel insurance in Macau through the Tata AIG portal without a complete medical examination.

- Payment of travel insurance rates is in Rupees and receipt of travel insurance policy in Macau are simple.

5. COVID-19 Cover

Coronavirus continues to be a concern for tourists and inhabitants in several Asian nations, with cases continually being reported. Any hospital stays or medical bills incurred as a result of the coronavirus, including isolation charges, hospitalisation, or non-refundable charges incurred due to the trip getting terminated, will be covered by travel insurance.

Macau Visa for Indians

There is a visa procedure that needs to be followed when you want to visit Macau and depending on the purpose of your visit, you can choose a type of visa that best suits your needs. The visa type and its validity will determine the duration of your stay and your restrictions with regard to your activities in Macau. A Macau visa for Indians has the unique advantage of allowing the individual to register for permission before travelling to the nation. These are the different types of Macau visa for Indians -

- Dependent Visa

- Tourist Visa

- Visa of up to 14 days

- Visa of more than 14 days

Indians who complete their Pre-arrival registration (PAR) online can enter Macau without a visa. The PAR application process is simple and free. If you intend to travel to Macau, you need to apply for a visitor's permit 4 to 6 weeks ahead of time. If you have a valid Indian passport for at least 6 months and intend to travel to Macau for less than 14 days, you can request it online. This PAR registration is effective for 6 months, and you can enter Macau as many times as you like as long as each visit is fewer than 14 days. Also, there are no India to Macau travel restrictions you need to worry about when getting your permit.

Travel to Macau from India: Documents Required

You cannot go to Macau if you do not have the following documents in place;

- A properly completed application form

- The latest image of the applicant must be attached to the application.

- A photocopy of the applicant's passport is required.

- A duplicate of the passenger's confirmation of financial circumstances, such as financial records, bank account passbooks, income tax receipts, or an employment document.

- Proof of the tour itinerary and hotel reservations.

- Proof of visit (receipt/itinerary for package tours).

- a photocopy of the sponsor's ID card (for a visa for more than 14 days).

- a copy of the sponsor's passport page with their photo (for a visa for more than 14 days)

The Indian Embassy in Macau

Unfortunately, there is no Indian Embassy in Macau, but if you ever find yourself in a situation where you need help, and your travel insurance is not enough to take care of your needs, you can always reach out to the Indian Embassy in Hong Kong. Remember, there are no India to Macau travel restrictions, so you should have no problems, but still, here is the contact information of the Indian Embassy in Hong Kong.

Macau Trip: Safety and Travel Tips

Some safety tips to keep in mind while travelling to Macau are-

- Keep your passport safe at all times.

- Avoid becoming involved in any local protests.

- Get to a safe area or shelter if you find yourself in the neighbourhood of any significant local gatherings or protests.

- Always keep up with local news and alter your vacation plans accordingly.

- Observe the local government's and officials' rules and regulations.

- Avoid engaging in any illegal actions and respect the integrity of public spaces.

- Travelling to unknown or isolated areas without adequate information is not recommended. Seek assistance from the local government.

- Always use legitimate and legal modes of transportation.

- Keep track of your visa status in Macau, and ensure you don't overstay your welcome.

- Safeguard your valuables and luggage, particularly in congested areas and tourist attractions.

- To provide enough financial assistance throughout your journey, choose the ideal Macau travel insurance plan.

Safety Recommendations for COVID-19

Keeping the ongoing pandemic in mind, there are several recommendations you must keep in mind to ensure your safety and that of others.

- When outside in a crowded place, use a non-surgical mask to shield your mouth and nose.

- Keep your social distance.

- When travelling, wash your hands frequently and use hand sanitiser.

- Maintain a healthy lifestyle, remain hydrated, and watch for COVID-19 signs. Self-isolate and get yourself tested as quickly as possible if you have any symptoms.

- Observe all local COVID-19 recommendations in collaboration with the local government making it possible for them to make Macau safe and secure.

- You can easily use your travel insurance to seek financial assistance if you experience COVID-19 indications or need emergency medical attention.

Major International Airports in Macau

Macau has one airport called the Macau International Airport.

Currency and Foreign Exchange

Macau has a currency of its own different from the one used in Mainland China and Hong Kong. The currency is called the Macau Pataca (MOP). You can check the conversion rate from INR to the Macau Pataca here.

https://www.xe.com/currencyconverter/convert/?Amount=1&From=INR&To=MOP

As with all international travel, it is always recommended that you carry some cash in the currency of the country you are visiting. There may always be some stores or counters that accept only cash, and you do not want to be caught in an awkward situation if you do not have some at hand.

A Few Must-Visit Places When in Macau

Macau is a true paradise for people who take time out to visit it and has something for everyone. Here are some places you must not leave Macau without visiting.

1.The Venetian - The Venetian, a Vegas-style hotel themed after Venice, is among Macau's more sophisticated tourist destinations and features one of the biggest casinos in the world. Known for its ultra-luxurious settings, exquisite décor, and lavish amenities, the resort is inspired by Venice, with its canals, limestone bridges, cobblestone alleys, and an artificial clear sky ceiling.

2. Macau Tower - The moment you step through the glass-fronted lifts you will be soaring to a breathtaking 223 metres above ground level in under 60 seconds. You can watch the landscape of Macau as you rise. When at the Macau Tower, enjoy a coffee or some delectable treats and take in the spectacular 360° sights from the Observation Room on floor 58!

3. Fisherman’s Wharf - Fisherman's Wharf is an exciting amusement park with themes dedicated to different port cities, including Amsterdam, Miami, Lisbon, Cape Town and Venice. The park comprises numerous shopping centres, eateries and several vibrant casinos and bustling pubs.

4. Ruins of St. Paul - Macau's most historically significant monument is the Ruins of St. Paul, which is situated within Senado Square. Many people visit this UNESCO World Heritage Site daily, which illustrates the experiences of a bygone era of Portuguese persecution.

5. Nam Van Lake - The effect created by 288 brightly coloured spotlights, controlled by computers and twirling over pristine water jets at this lake is undeniably beautiful. The famed Macau Tower can be seen from Nam Van Lake. When Macau organises a fireworks festival, Nam Van Lake is a great place to watch the show.

Best Time to Visit Macau

Macau is best if you visit between October and December. The dry and wet seasons in Hong Kong and Macau are distinct. So, if you really want to enjoy your trip to Macau, visit the country between the end of summer and the beginning of winter.

All the information mentioned above is well-researched and sourced from reliable sources. Since this information is subject to change, it is advisable to check the latest travel guidelines and other location-specific information before planning a trip to any location.

*Subject to change based on the nature and extent of the coverage.

Disclaimer / TnC

Your policy is subjected to terms and conditions & inclusions and exclusions mentioned in your policy wording. Please go through the documents carefully.

Related Articles

Going for a vacation. Here are five reasons you need travel insurance

5 Myths Travel Insurance

Why senior citizens travel insurance is must?

1. can i get travel insurance for macau for someone over 60 years of age.

Yes, you can get travel insurance plans for all people regardless of their age. But remember, the premium costs and some features may change depending on this.

2. Do I need to have COVID coverage on my insurance?

Yes, most places require tourists to have a travel insurance plan with Covid coverage to ensure that they are taken care of in case of contraction.

3. What is a personal liability cover in travel insurance?

If you are involved in an accident where another individual suffers personal harm or injuries, the personal liability feature covers these damages to the third-party. However, this feature or cover will not cover your travel companion or family members as it is meant for third-party liabilities.If you are involved in an accident where another individual suffers personal harm or injuries, the personal liability feature covers these damages to the third-party. However, this feature or cover will not cover your travel companion or family members as it is meant for third-party liabilities.

4. Do I receive reimbursement in case my flight is cancelled?

Yes, you receive flight cancellation insurance as part of your comprehensive travel insurance plan from Tata AIG.

5. How do I seek help while abroad if I am diagnosed with COVID-19?

For America's policies, you can call us at +1-833-440-1575 (Toll-free within the US and Canada) or write to us at [email protected]

For other policies, you can either call us at +91 – 022 68227600 (Call back facility available) or write to us at [email protected]

6. How does the trip cancellation cover my travel insurance work?

The trip cancellation feature in your travel insurance will protect you against financial losses in case an emergency causes you to cancel your trip and all the reservations and return to India. The losses covered include your unused travel and accommodation expenses that are non-refundable.

7. How do I calculate my Macau trip cost from India?

The amount of money you need to travel from Macau to India should include all the travelling expenses, including your flight tickets, visa costs (if the trip extends beyond 30 days), transportation by private vehicle or public transport, accommodation expenses and other costs depending on your itinerary. The cost of your trip will depend on the nature and duration of your trip and can differ from person to person.

Other Destinations

Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

2008, Tata AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CINNumber : U85110MH2000PLC128425. Registered with IRDA of India Regn. No. 108. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Best travel insurance companies of June 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 2:16 p.m. UTC June 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Elevate plan gets the top score in our rating because of the extensive coverage it provides for the price. It offers best-in-class emergency medical and evacuation benefits, as well as high limits for baggage insurance.

Best travel insurance of 2024

- WorldTrips : Best travel insurance.

- Travel Insured International : Best for emergency evacuation.

- TravelSafe : Best for missed connections.

- Aegis : Cheapest travel insurance.

- Travelex : Best for families.

- AIG : Best for add-on coverage options.

- Nationwide : Best for cruise itinerary changes.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best travel insurance companies

Best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel , WorldTrips’ Atlas Journey Elevate plan gives you $250,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

See our full WorldTrips travel insurance review .

Pros and cons

- $250,000 in primary medical coverage.

- $1 million per person in medical evacuation coverage.

- Primary damage or loss baggage coverage of $500 per item, up to $2,500.

- 5 optional upgrades, including pet care, adventure sports and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 428 reviews of policies purchased through the travel insurance comparison site since 2008.

Heidi’s expert take: “WorldTrips offers primary coverage for emergency medical expense and for baggage damage or loss. This means the insurer will pay for your claim first and then seek recovery from any responsible third party, such as your health insurance provider, airline or homeowners insurance company (if your belongings are stolen). Travel insurance with secondary medical coverage might be cheaper, but then you’d have to file claims with third parties yourself, before you could turn to your travel insurance for help.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “The Worldwide Trip Protector plan provides rare non-medical evacuation benefits of up to $150,000. If you’re traveling to an area at risk of a political, security or national disaster, this emergency evacuation coverage could help get you back to safety.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for missed connections

TravelSafe offers good travel insurance for missed connections , with $2,500 in missed connection coverage for each person on the plan.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you miss out on prepaid vacation plans because you didn’t make a connecting flight, you’ll be glad for the $2,500 missed connection coverage. Some policies only provide missed connection coverage for cruises and tours, but TravelSafe Classic doesn’t impose that restriction.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Cheapest travel insurance

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. This is based on the average cost of seven international trips of varying lengths and values for travelers of different ages.

See our full Aegis travel insurance review .

- Cheapest of our best trip insurance plans.

- Pet care benefit of $500 under travel delay benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Heidi’s expert take: “If you’re looking for a budget travel insurance policy , Go Ready Choice may fit the bill. It has comparably low coverage limits, but if you have health insurance that will cover you on your trip, its $50,000 in secondary medical coverage may be sufficient.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

See our full Travelex travel insurance review .

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you’re traveling with kids, a Travelex policy will cover them, too. The number of children you can add to your policy is unlimited and they’ll get travel protection at no additional cost.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review .

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Heidi’s expert take: “You can add riders to your AIG travel insurance policy to maximize your coverage. Choose from these bundles: adventure sports, medical, pet, quarantine, security and wedding. You may also want to add “cancel for any reason” coverage and rental vehicle damage coverage.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for cruise itinerary changes

Nationwide’s Choice Cruise is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Choice Cruise also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

See our full Nationwide travel insurance review .

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

Heidi’s expert take: “This plan has protections for cruisers when it comes to prepaid expenses. But its emergency medical coverage is secondary, which means you’d have to file medical claims with your health insurance company first. Since U.S. health insurance won’t help you at sea, you may want to look for cruise travel insurance with primary medical coverage instead.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Compare the best travel insurance plans

Via Compare Coverage’s website

Heidi’s expert take: “Here are my tips on how to buy travel insurance that gets you the most coverage for the lowest price: Buy early . Getting travel insurance within two weeks of making your first trip deposit may qualify you for coverage of pre-existing medical conditions, and it won’t cost you any extra. Look for primary emergency medical coverage . If you buy a plan with secondary coverage, you’ll have to file a claim with your health insurance first, even if you know it will be denied. Don’t overinsure . Calculate the value of only your prepaid, nonrefundable trip expenses that are not already covered by other insurance (like credit card travel insurance or health insurance, if your coverage extends to where you are traveling). Even if this value is $0, you can still buy travel insurance for the travel medical insurance benefits, and you’ll only be paying for the insurance you need. Understand exclusions . If you are planning to go scuba diving, for instance, make sure this adventure activity is not excluded from a policy’s coverage. If so, you may need to pay for a rider or shop for another plan that offers the coverage you need.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from April 28 to May 28, 2024.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

If you’d like to dig in deeper, head over to our travel insurance ratings methodology page.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Explore and Atlas Journey Elevate — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- 'Just a parade of incompetency': Spirit Airlines passengers with 'nightmare' stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise