- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is Airbnb Travel Insurance Worth It?

Ramsey is a freelance travel journalist covering business travel, loyalty programs and luxury travel. His work has appeared in Travel+Leisure, Condé Nast Traveler, Reader's Digest, AFAR, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Business Traveler, Fortune, Airways, TravelAge West, MSN.com, Bustle.com and AAA magazines. As someone who flies more than 450,000 miles per year and has been to 173 countries, he is well-versed in the intricacies of credit cards and how to maximize the associated perks and services.

Kevin Berry works as the content lead for multimedia production at NerdWallet including YouTube, podcasts and social media videos across all financial topics. Previously, he was the Lead Editor for the Travel Rewards team. Prior to NerdWallet, Kevin managed the content and social media teams at NBC Sports in Portland for eight years. His prior experience also includes time as a financial analyst (Comcast) and business system analyst (Nike).

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can protect you in the event of unforeseen delays or cancellations, but whether you should pay extra for it — or rely on what might already be included in the booking — is a perennial question.

We have some answers for you if you’re wondering, “Is Airbnb insurance worth it?”

Here’s the lowdown on what Airbnb insurance covers and what you’ll be on the hook for if you choose not pay extra for it.

What does travel insurance for an Airbnb rental cover?

This type of travel insurance protects the cost of your Airbnb rental if you encounter unexpected disruptions to your travel before or during your trip.

These policies are underwritten by Generali Global Assistance in the U.S. and Aon and Europ Assistance Group abroad. The insurance coverage is available in nine countries where Airbnb offers rentals and will cover up to 100% of your payment if you cancel for a covered reason.

Examples of covered reasons include a delayed flight that prevents you from arriving at your rental on time or having to cancel the trip because you got sick. Other obstacles might include your bags getting lost en route or a hurricane thwarting your plans. Travel insurance for an Airbnb rental would protect you in these situations.

These are some of the covered protections that come with Airbnb travel insurance:

Trip cancellation for a covered reason.

Flight cancellation due to weather.

Illness or injury.

Trip delay of more than 12 hours.

Loss of baggage.

Natural disasters.

Theft during the stay.

Stolen travel documents.

In the above instances, Airbnb travel insurance would reimburse you the non-refundable cost of the rental. Without insurance, if you had to cancel, you would be subject to the host’s cancellation rules — which could include forfeiting the entire cost of the rental.

» Learn more: How to book an Airbnb

Is Airbnb travel insurance worth it?

Since you can’t see into the future, this type of travel insurance can help protect expensive Airbnb rentals if you can’t make your trip as originally planned.

Remember that Airbnb travel insurance only covers the cost of the rental, not any other related expenses like airline tickets, car rentals or transportation to the property.

To determine if Airbnb travel insurance is worth it, it’s important to know what other types of insurance you already have. Do you have any travel protection through your credit card ? If so, that may be more than enough to cover your Airbnb rental, and purchasing an Airbnb travel insurance policy wouldn’t be necessary.

If you want to rely on another form of travel insurance, a comprehensive plan may offer more protection — like covering additional costs associated with travel disruptions — but it can also be more expensive than what Airbnb offers. A good place to check for the best travel insurance for Airbnb is NerdWallet’s list of best travel insurance companies , where you can compare different options.

» Learn more: What to know before you book an Airbnb

Don’t I already have this with Airbnb AirCover?

No. AirCover protects renters from issues that are within the host’s control, whereas travel insurance protects the renter from things outside of the host’s control, like flight disruptions or personal illness.

AirCover protects the renter if the rental doesn’t meet the advertised standards or if the host cancels at the last minute. It also covers operational issues like a broken heater or if the number of bedrooms didn’t match the listing.

Essentially, AirCover assures travelers that their rental is what was advertised. If any issues arise, Airbnb will help you find a comparable alternate rental within the same price point. Alternatively, if you’d prefer not to be rebooked, Airbnb may issue a full or partial refund.

» Learn more: Are Airbnbs more cost-effective than hotels?

How do you get Airbnb travel insurance and how much does it cost?

If you want to add Airbnb travel insurance to your reservation, it’s easy to do during the reservation process through the Airbnb booking platform. The cost will vary and is based on a percentage of the overall trip cost.

Remember, if you use a credit card with ample travel insurance, you might already be protected.

Can you cancel Airbnb travel insurance?

If you need to cancel travel insurance purchased through Airbnb, it’s possible to do so within 10 days of purchase. For residents of Indiana, you can cancel within 30 days of purchase. However, once the trip begins, you can’t cancel it.

» Learn more: How to get an Airbnb discount

Should I get Airbnb travel insurance?

Is Airbnb insurance worth it for guests? Yes and no. It depends on how you purchase your travel.

If you use a credit card with ample protections already, then you may be fine. Otherwise, a travel insurance policy can help you recoup the cost of your rental in the event of a travel disruption.

Ultimately, it will come down to your own personal risk tolerance, but it’s nice to have the option when booking with Airbnb.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Citibank's application

1%-5% Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

$200 Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

on Wells Fargo's website

2% Earn unlimited 2% cash rewards on purchases

$200 Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

1x-3x Earn unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans. Plus earn 1X points on other purchases.

20,000 Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

Airbnb Travel Insurance for Guests | What it is and How it Works

Traveling opens doors to new experiences and cultures, but unexpected events can disrupt even the best-laid plans. Trip cancellations, flight delays or medical emergencies can leave you scrambling for solutions and facing financial losses. This is where travel insurance steps in, offering a safety net for unforeseen circumstances.

Airbnb, recognizing this need, offers travel insurance as an add-on purchase for guests during the booking process. But how does it differ from the existing Airbnb Host Guarantee programs like AirCover for guests? Let's delve into the world of Airbnb travel insurance and understand how it can protect your next Airbnb adventure.

AirCover vs. Travel Insurance

It's important to distinguish between Airbnb travel insurance and AirCover for guests . AirCover is a free program offered by Airbnb. It acts as a safety net for situations directly related to the host or the listing itself.

Let's dissect what AirCover covers:

- Listing inaccuracy: Did the pool in the pictures turn out to be a kiddie inflatable? AirCover comes to the rescue if the listing significantly differs from reality and the host can't rectify it. Guests will be assisted in finding similar accommodation or offered a full or partial refund.

- Host cancellation within 30 days: Imagine booking your dream getaway only to have the host cancel last minute. AirCover ensures guests aren't left scrambling. It will help them find alternative accommodation or provide a full refund.

- Unable to check-In (host's fault): You arrived at your stay, but the host is nowhere to be found, or there's a problem with access? AirCover steps in, helping guests find a similar place or offering a full refund depending on the circumstances.

In these scenarios, Airbnb will help you find a similar place to stay or offer a full or partial refund.

Travel insurance

Travel insurance acts as a broader umbrella, shielding guests from a wider range of potential disruptions beyond the scope of AirCover.

Unlike AirCover, travel insurance is an optional add-on purchased during the booking process. It's provided by a third-party insurance company, currently Generali Global Assistance in the US and Europ Assistance Group in other parts of the world) and offers broader coverage for unforeseen circumstances outside the control of you and your host.

What does Airbnb travel insurance cover?

Airbnb travel insurance offers a safety net for various situations that could derail your trip. Here's a breakdown of some key coverages:

- Trip cancellation: If you need to cancel your trip entirely for a covered reason, you can be reimbursed for up to 100% of your non-refundable Airbnb booking cost. Covered reasons typically include illness, injury (to yourself or a travel companion), natural disasters at your destination or unexpected work obligations.

- Trip interruption: Imagine having to cut your Airbnb stay short (due to a covered reason). You can get reimbursed for the unused portion of your accommodation cost, potentially up to 150% (including the initial cancellation reimbursement). This additional 50% might cover some additional expenses incurred due to the disruption.

- Travel delay: Flight delays can wreak havoc on your itinerary. If your trip is delayed by 24 hours or more due to a covered reason (like bad weather or a mechanical issue), you might be reimbursed for expenses like meals, accommodation and local transportation incurred during the delay, up to a certain limit per person (typically $750).

- Emergency medical and evacuation: Accidents or sudden illness can occur anywhere. You get coverage for medical expenses and emergency medical evacuation (including repatriation) if needed during your trip.

- Baggage delay or loss: Misplaced luggage can throw a wrench in your travel plans. If your checked baggage is delayed or lost for 24 hours or more, you might be reimbursed for essential items like toiletries and clothing to tide you over until your luggage arrives.

What does Airbnb travel insurance NOT cover?

This depends on how the coverage is defined and the country of residence of the Airbnb traveler. For example, UK residents are not covered for travel costs such as flights, trains and ferries as well as pre-existing medical conditions.

Policy details relevant to each country including areas of coverage and key exclusions can be found here .

How Does Airbnb AirCover Work with Airbnb Travel Insurance?

Airbnb’s AirCover for guests and travel insurance are two different but complementary products that work well together. For example, if a guest arrives at their destination only to find the host has canceled the reservation at the last minute. Meanwhile, they are informed at the airport that their baggage is missing. While AirCover will help the guest find a new place to stay at no extra cost, they can file an insurance claim to get reimbursed for their missing baggage.

Key Considerations for Guests When Choosing Travel Insurance

While AirCover offers valuable protections related to Airbnb itself, Airbnb travel insurance provides a broader safety net for various trip disruptions.

By understanding the coverage details and comparing it to your specific needs and risk tolerance, you can decide if Airbnb travel insurance is a worthwhile addition to your Airbnb booking. Here are some additional tips:

- Compare costs: Don't just rely on the travel insurance offered during booking. Consider comparing it with independent travel insurance providers to see if you can find a better deal with similar coverage.

- Read reviews: Researching online reviews of Generali's travel insurance can give you insights into their claim settlement process and customer service.

- Consider trip protection on credit cards: Some credit cards offer trip cancellation or interruption insurance as a benefit. Check your credit card's benefits to see if it might already offer some coverage.

- Always review the full terms and conditions of any travel insurance policy before purchasing.

- File claims promptly according to the insurer's guidelines.

- Keep all documentation related to your trip cancellation or disruption, including receipts and communication with the host or airline.

By being prepared with Airbnb travel insurance, you can embark on your Airbnb adventure with greater confidence, knowing you have some financial protection if the unexpected arises. Now you can focus on creating lasting memories during your stay!

Who should consider Airbnb travel insurance?

Travel insurance can be a wise investment for:

- Those with non-refundable bookings: If you've booked an Airbnb with a strict cancellation policy , travel insurance can provide peace of mind in case unforeseen circumstances force you to cancel.

- Those booking expensive trips: For trips with a significant financial investment, travel insurance can help mitigate potential losses due to cancellations or interruptions.

Ready, Set, Go!

Airbnb travel insurance is more than just a step in creating new revenue streams. It’s also a means of providing added convenience to users inclined to purchase travel insurance while keeping them inside the Airbnb platform.

By incorporating this optional safety net, you can approach your Airbnb adventure with a sense of security, ready to embrace the possibilities and forge unforgettable memories. Remember, travel insurance provides a financial buffer, but prioritizing safety and well-being throughout your travels should always be your top priority. Now, bon voyage!

Ready to find out how Hostaway can transform your business?

Launched in 2015, Hostaway has helped thousands of vacation rental property managers regain their focus on growing their business. Hostaway takes pride in aligning itself with the needs of the fast evolving landscape and always provide reliable technology and great support. Sign up today!

Don't get stuck in a broken routine with poor software, manage your properties with Hostaway and experience a better business and life right away!

Home » Travel Insurance » Airbnb Travel Insurance: Is It Worth It? Your Ultimate Guide to Protecting Your Stay

- Travel Insurance

Airbnb Travel Insurance: Is It Worth It? Your Ultimate Guide to Protecting Your Stay

- Author | Alexa Erickson

- April 15, 2024

The Daily Navigator strives to help you make the best decisions in travel. While we produce content according with strict editorial integrity this post may contain references to partner products. Here’s a full explanation for how our team makes money .

- Understanding travel insurance coverage

- Factors to consider

- When travel insurance may not be necessary

- What may be excluded from travel insurance

- How to get travel insurance

What is travel insurance?

Travel insurance is a type of insurance coverage that provides financial protection against unexpected events or emergencies that may occur during your travels, such as trip cancellations, medical emergencies, lost baggage, or other unforeseen circumstances.

What are the main types of travel insurance?

- The main categories of travel insurance are typically based on the type of coverage they provide. Here are the main categories of travel insurance:

- Trip cancellation/interruption insurance: This covers expenses incurred if you need to cancel or interrupt your trip due to covered reasons such as illness, injury, death, natural disasters, or other unforeseen events.

- Medical insurance: This provides coverage for medical expenses incurred while traveling. It can include emergency medical treatment, hospital stays, doctor’s visits, medications, and medical evacuations.

- Baggage and personal belongings insurance: This type of travel insurance protects against loss, damage, or theft of your luggage, personal belongings, and valuables during your trip.

- Travel delay insurance: This covers additional expenses incurred due to unexpected delays, such as flight cancellations, missed connections, or severe weather conditions.

- Emergency evacuation insurance: This category assists with the cost of emergency evacuations, particularly in remote or medically inadequate areas.

- Accidental death and dismemberment insurance: This provides financial compensation in the event of accidental death, loss of limbs, or permanent disabilities resulting from accidents that occur during your trip.

How much does travel insurance cost?

The cost of travel insurance varies depending on several factors, including your destination, the length of your trip, your age, the coverage options you choose, and any pre-existing medical conditions. It is advisable to compare quotes from different insurance providers to find the best coverage at a competitive price.

Where can you buy travel insurance?

Travel insurance can be purchased from various sources, providing flexibility and options for travelers. Here are some common places where you can buy travel insurance:

- Insurance companies: Many insurance companies offer travel insurance policies. You can directly contact insurance providers to inquire about their offerings, receive quotes, and purchase a policy. These companies may have online platforms or local offices where you can access their services.

- Travel agencies: Travel agencies often offer travel insurance as part of their services. When booking your trip through a travel agency, they can provide you with options for travel insurance coverage and facilitate the purchase on your behalf.

- Online travel booking platforms: Online travel booking platforms, such as Expedia , Travelocity, or Kayak, often provide the option to purchase travel insurance during the booking process. These platforms may partner with insurance providers to offer a range of policies that you can select from.

- Credit card companies: Some credit card companies offer travel insurance as a benefit to their cardholders. If you have a credit card with travel-related perks, review the terms and benefits associated with your card to see if travel insurance coverage is included and how to access it.

- Comparison websites: There are online comparison websites that allow you to compare different travel insurance policies from multiple providers. These platforms provide a convenient way to review coverage options, prices, and customer reviews, helping you make an informed decision.

- Specialized travel insurance providers: There are companies that specialize in travel insurance, offering a wide range of policies tailored to different types of travelers and trips. These specialized providers may have additional coverage options or unique features that cater to specific needs, such as adventure travel or long-term travel.

With the rise of vacation rental platforms like Airbnb, travelers are increasingly seeking ways to protect their trips from unforeseen events. This is where Airbnb travel insurance comes into play.

Let’s take a detailed look at what Airbnb travel insurance is, its importance, who offers it, and whether you should consider purchasing it.

Read also: The Best Travel Insurance Companies of 2024

What is Airbnb travel insurance?

Airbnb travel insurance is designed to cover unexpected events that may affect your travel plans when booking accommodations through Airbnb. This type of insurance can cover a range of incidents, including trip cancellations, interruptions, medical emergencies, and even lost luggage. Essentially, it acts as a safety net, ensuring that travelers can recover some of their costs if their travel plans are disrupted by covered events.

Should you get Airbnb travel insurance?

The decision to purchase Airbnb travel insurance largely depends on your personal risk tolerance and the nature of your trip. If you are planning a costly vacation, or traveling to a location with volatile weather or political climates, travel insurance can be particularly valuable. It offers peace of mind by mitigating financial losses due to last-minute cancellations or medical emergencies.

Here are some scenarios where Airbnb travel insurance can be beneficial:

- High investment trips : If you’re spending a significant amount on your Airbnb bookings, flights, and other travel arrangements, insurance can protect that investment.

- International travel : For trips abroad, where unexpected medical costs and trip delays are more problematic, travel insurance is highly advisable.

- Traveling in uncertain times : During periods of global uncertainty, such as the COVID-19 pandemic, having travel insurance means you’re more likely to recoup costs if plans change unexpectedly.

Navigator Tip

One crucial tip for travelers considering Airbnb travel insurance is to purchase the insurance policy shortly after booking your trip. Many travel insurance policies offer the most comprehensive coverage options, including a “Cancel For Any Reason” benefit, only if the insurance is purchased within a specific time frame after making the initial trip deposit—often within 10 to 21 days.

Buying your insurance early not only maximizes the coverage available but also ensures that you’re protected right from the start of your trip planning. This early purchase is particularly important for trips planned during peak travel seasons or to areas prone to natural disasters, as it secures your investment against a broader range of potential disruptions.

Who offers Airbnb travel insurance?

Airbnb guests residing in the US have the option to purchase travel insurance and assistance services either at the time of checkout or after their booking is confirmed.

However, there are many third-party providers that offer policies for Airbnb customers as well. One reputable provider in this market is Squaremouth . Squaremouth is known for its transparent approach to selling travel insurance, providing a platform where travelers can compare policies from various insurers to find the best fit for their needs.

When choosing a policy, it’s important to read the fine print and understand what is and isn’t covered. Not all travel insurance policies are created equal, and coverage can vary significantly between providers.

Why consider Squaremouth for your Airbnb travel insurance?

Squaremouth stands out for several reasons:

- Comparison shopping : Squaremouth allows travelers to compare different travel insurance policies from top-rated insurers side by side.

- Customer reviews : The platform offers customer reviews and ratings for each policy, helping you make an informed decision based on other travelers’ experiences.

- Comprehensive coverage options : From trip cancellation to medical emergencies, Squaremouth offers a range of coverage options that cater to various travel needs.

Several insurance companies offer travel insurance policies that are suitable for Airbnb stays, including:

Tin Leg offers travel insurance that is suitable for Airbnb stays, featuring comprehensive coverage options. Their policies typically include benefits such as trip cancellation, interruption, emergency medical coverage, and baggage loss or delay.

Seven Corners

Seven Corners offers various travel insurance plans that can be tailored to include coverage for stays at rental properties like those booked through Airbnb. Their plans often cover medical expenses, trip cancellation, and interruptions.

Are there credit cards that offer travel insurance you can use for booking an Airbnb?

Yes, several credit cards offer travel insurance benefits that can be useful when booking an Airbnb stay. These benefits typically include trip cancellation and interruption insurance, travel accident insurance, baggage delay insurance, and sometimes even emergency medical and evacuation coverage. Here are a few key points to consider if you’re thinking of using a credit card’s travel insurance for your Airbnb booking:

Key features of credit card travel insurance

- Trip cancellation and interruption Insurance : This coverage can reimburse you for non-refundable travel expenses, including Airbnb stays, if your trip is canceled or cut short due to covered reasons such as sickness, severe weather, or other qualifying unforeseen events.

- Baggage delay insurance : If your bags are delayed, this insurance may cover the cost of essential items until your luggage arrives.

- Travel accident insurance : Provides coverage for accidental death or dismemberment that occurs while traveling.

- Emergency medical and evacuation : Some premium credit cards offer this coverage, which can be crucial, especially for international travel. It covers emergency medical expenses and, if necessary, medical evacuation.

Considerations when using credit card travel insurance for Airbnb

Coverage limits : Credit card travel insurance often has lower coverage limits and more exclusions compared to standalone travel insurance policies. It’s essential to review the terms and benefits to ensure they meet your needs.

Eligibility requirements : To activate these insurance benefits, you typically need to pay for a significant portion of your travel expenses with the credit card that offers the coverage. Ensure that your Airbnb booking is eligible.

Specific coverage details : The specifics of what is covered can vary greatly from one credit card to another. For example, some cards may exclude certain types of travel disruptions or reasons for cancellations that standalone travel insurance might cover.

Popular credit cards offering travel insurance

Chase sapphire reserve®.

Offers extensive travel insurance benefits, including trip cancellation and interruption insurance, baggage delay insurance, and emergency medical coverage.

60,000 Bonus Points

after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

Learn More –>

The Chase Sapphire Reserve® is a premium travel card that’s accessible to most travelers as it has a number of valuable and easy-to-use benefits. Its annual fee of $550, though still high, is quickly offset thanks to its $300 travel credit, large welcome bonus, strong spending categories, and premium perks like airport lounge access. It’s also great for those who don’t want to deal with transferring their points, as you’ll get big value when redeeming through Chase’s travel portal.

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel—which is more than the annual fee.

- The $300 travel credit covers anything travel related, whether thats an Airbnb, a taxi, a flight, or hotel, making it almost impossible not to lessen the dent the fee made.

- The points are worth 1.5 cents a piece when used directly on Chase’s Ultimate Rewards Portal, offering a simple but high value use for your points.

- Plenty of excellent transfer partners allow points to be maximized

- Some excellent partnerships with Doordash and Lyft add to its value.

- Priority Pass membership allows access to over 1,300+ airport lounges and restaurants.

- No complimentary elite hotel status, like that offered by the Amex Platinum.

- You won’t earn points on travel purchases until the $300 credit is used.

- It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Annual Fee: $550 | Terms Apply | Rates & Fees

The Platinum Card® from American Express

This luxury travel credit card offers a hefty welcome bonus, and an annual fee that more than pays for itself thanks to its plentiful perks. The card includes trip cancellation and interruption insurance, as well as travel accident insurance, with generous coverage limits.

80,000 Membership Rewards® Points

after you spend $8,000 on purchases in your first 6 months of card membership

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $695 worth it for some.

PROS

- The Amex Platinum’s typical intro bonus of 80,000 points is massive in itself. It’s worth $800 when spent directly through Amex’s travel portal on flights and hotels, which is already stellar. But when transferred to a partner, it’s very possible to squeeze over $1,600 or more in value.

- The Platinum has a slew of top-tier benefits, like Priority Pass, which gives the cardholder access to thousands of airport lounges and restaurants around the world, as well as Amex’s own Centurion lounges which are known for the high-quality (and free) food and cocktails. Other perks include up to $200 in Uber credits, up to $200 in airline fee credits (given in statement credits), up to $240 in digital streaming credits, up to $200 towards hotel bookings (given in statement credits) with Amex’s Fine Hotels and Resorts (2 night minimum stay required), and more. Enrollment is required for select benefits.

- A number of statement credits spanning multiple industries can build even more value into the card, including free stays when applied strategically.

- The Amex concierge is an underutilized benefit that can transform a trip by helping book hard-to-find dinner reservations or show tickets.

CONS

- The $695 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

- Points-earning rates are low unless spending directly on flights or with the Amex Portal.

- Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

Annual Fee: $695 | Terms Apply | Rates & Fees

For just a $95 annual fee, the Capital One Venture Rewards Credit Card gives you one of the loudest bangs for your buck. It also provides travel accident insurance and lost luggage reimbursement, among other benefits.

Capital One Venture Rewards Credit Card

75,000 Bonus Miles

after you spend $4,000 on purchases in the first 3 months of account opening.

The Capital One Venture is an excellent go-to card for any traveler, thanks to its easy to navigate 2 miles per dollar on every purchase. With no bonus categories to consider, a reasonable $95 annual fee, and a strong 75,000-mile intro offer worth over $1000, Alec Baldwin might be onto something.

- The Capital One Venture’s 75,000 mile intro bonus is worth $750 when spent on Capital One’s (recently revamped) travel portal or you can use your miles to cover your recent purchases. The bonus rises to well over $1000 when transferred to an airline or hotel partner.

- A steady 2 miles per dollar on all purchases makes earning simple and lucrative. You’ll also grab 5 miles per dollar when booking through Capital One’s travel portal.

- Its $95 annual fee is almost negligible, especially if the intro bonus is achieved Flexible miles allow for a wide array of redemption options

- You can enjoy a two free visits to a Capital One Lounge each year

- You’ll get up to a $100 credit for Global Entry or TSA PreCheck® membership which can help make airport security a breeze.

- Capital One lacks US-based airline and hotel transfer partners

- Not many major perks beyond its miles value

Annual Fee: $95 | Terms Apply | Rates & Fees

Airbnb travel insurance is a crucial consideration for travelers looking to protect their trips from unexpected disruptions. Whether facing trip cancellations, medical emergencies, or other unforeseen events, the right insurance policy can safeguard your travel investments and offer peace of mind. While third-party providers like Squaremouth provide a broad range of options to cover Airbnb stays, don’t overlook the benefits that may already be available through your credit card.

Many credit cards offer travel insurance benefits, including trip cancellation and interruption coverage, which can be applicable to Airbnb bookings. However, it’s important to understand the specifics of these benefits, as coverage limits, eligibility requirements, and covered reasons for cancellation can vary significantly.

Ultimately, whether you opt for a standalone travel insurance policy or utilize the benefits from your credit card, the key is to ensure that you have comprehensive coverage tailored to your specific travel needs. By carefully reviewing your options and understanding the coverage you choose, you can enjoy your Airbnb experience with greater confidence and security.

Read also: The Best Credit Cards for Travel Insurance Benefits

Editorial Disclaimer: Opinions expressed here are the author’s alone. This post contains references to products from one or more of our partners and we may receive compensation when you click on links to those products.

Our Top Travel Card Picks

Delta SkyMiles® Gold American Express Card

65,000 Bonus Miles

after you spend $3,000 in the first 6 months

LEARN MORE –>

after you spend $8,000 in the first 6 months

Chase Ink Business Preferred® Credit Card

100,000 bonus points

after you spend $8,000 on purchases in the first 3 months

Capital One Venture Rewards Credit Card

75,000 bonus miles

after you spend $4,000 in the first 3 months

Explore Top Travel Cards

Navigate the News Better

Take a five-minute trip through the news that matters most to travelers with our daily newsletter.

Related Stories

The Best Travel Insurance Companies of 2024

The Best Senior Travel Insurance Companies of 2024

Best CFAR (Cancel for Any Reason) Travel Insurance

- The Navigator

- Room Service

- Smart Points

- Advertising Policy

- Privacy Policy

- Terms Of Use

Work With Us

- Hotel/Airbnb Review

Built with by travelers, for travelers.

Stay in the know with The Navigator Newsletter

A five-minute trip through the news that matters most to travelers. Past Edition →

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. The relationship may impact how an offer is being presented. Our site doesn’t include all the offers available. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page .

Special Discounts for Our Members

Save big with perks.

Get $5,000+ in immediate travel savings with Perks. Unlock next level travel benefits, for life. Get discounts from the world’s best travel brands you won’t find anywhere else. No credit required.

Special Discount for Our Members

93% off lifetime access.

Save $1,200 and 10 hours of your time on every vacation. With Lifetime access to DFC Concierge, get fully customized trip itineraries to make every vacation unforgettable.

50% Off PREMIUM

You can save up to $500 on your next adventure without lifting a finger get email alerts when we find flights up to 90% off leaving your home airport. Just let us know your departure airport and we’ll do the rest.

The Navigator Commitment

The Daily Navigator is the cornerstone of the DFC Media family. Through each of our brands, we’re dedicated to helping our readers travel, spend, and live smarter.

With products dedicated to affordable travel, daily news, hospitality, and personal finance, we deliver the day’s essential content with none of the filler — all in a way that’s fast, easy, and fun to read. Every morning, over 2 Million travelers trust DFC to deliver the latest news and information so that they can make informed decisions faster. We hope you’ll join them.

We’re happy to have you here!

Airbnb Insurance: A Guide for Hosts and Guests

Airbnb’s aircover covers both hosts and guests for liability, property damages, and cancellations..

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Read Editorial Guidelines

Featured in

)

3+ years experience in insurance and personal finance editing

Katie uses her knowledge and expertise as a licensed property and casualty agent in Massachusetts to help readers understand the complexities of insurance shopping.

Updated March 27, 2024

)

At Insurify, our goal is to help customers compare insurance products and find the best policy for them. We strive to provide open, honest, and unbiased information about the insurance products and services we review. Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site.

We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site. That may impact which products we display and where they appear on our site. But it does not influence our meticulously researched editorial content, what we write about, or any reviews or recommendations we may make. We do not guarantee favorable reviews or any coverage at all in exchange for compensation.

Table of contents

- Understanding AirCover

- Standard vs. AirCover

- Rental property risks

- Filing a claim

- Guest insurance

Table of contents Compare quotes

If you own property and plan to rent it out on Airbnb, it’s important to have insurance coverage to protect you from liability and property damage caused by guests. Airbnb provides its own host liability insurance policy as well as damage protection insurance through AirCover. AirCover also provides insurance for guests that covers cancellations and issues your host can’t solve.

AirCover may not be the best option for everyone, so it’s important to compare home insurance rates from multiple companies. Here’s what you need to know about how Airbnb AirCover can protect you as a host or a guest during an Airbnb stay.

Shop for Home Insurance

Insurify partners with top insurers for real-time quotes

Understanding Airbnb insurance for hosts

AirCover for Hosts is Airbnb’s insurance policy for people renting their property through the app. It provides thorough protection, including $1 million in host liability coverage, $3 million in host damage protection, and $1 million in experiences liability insurance. It also includes things like guest identity verification, reservation screening, and a 24-hour safety line.

You don’t need to opt in, either. Airbnb will automatically enroll you. But it’s not mandatory in the U.S. You can opt out of Airbnb AirCover liability insurance, but you shouldn’t unless you have sufficient alternate coverage.

If you don’t want AirCover insurance for any reason, email Airbnb at [email protected] to request its removal from your account. [1] If you don’t reach anyone at that email address, you can also call Airbnb to speak with a representative.

Host liability insurance

Host liability insurance is a main part of AirCover. Airbnb hosts automatically have $1 million of host liability coverage, which protects you if a guest has an accident resulting in injury or has their property damaged or stolen while staying in your Airbnb. [2]

Here’s a breakdown of exactly what it covers:

Bodily injury to a guest

Theft or damage of a guest’s property

Damage caused by a guest to common areas like lobbies

It doesn’t cover the following:

Intentional damage or injury

Damages to property or belongings caused by a guest covered by host damage protection

)

Learn More: How Much Homeowners Insurance Do You Need?

Host damage protection.

Host damage protection is the other key component of AirCover. Hosts automatically have $3 million of coverage, which protects you if an Airbnb guest damages your property during their short-term vacation. It also covers cleaning fees in some instances. [3]

Damage to your property or belongings caused by guests

Damage to vehicles caused by guests

Loss of income due to necessary cancellations

Extra cleaning services resulting from guests’ actions

Normal wear and tear

Currency loss

Property damage or injury to guests

Acts of God or natural disasters

Check-out tasks such as cleaning and laundry

Limits of Airbnb insurance

In some cases, you may want to purchase an insurance policy for your short-term rental property in addition to the insurance provided by Airbnb. Though Airbnb has high coverage limits, you may want to look into other insurance products for more protection, depending on your situation.

Airbnb isn’t a traditional insurance company, so it may not be as reliable as more established insurers. Ask your home insurance company if it offers short-term rental insurance. This can provide an extra layer of coverage to protect your property and finances and provide peace of mind.

Does standard homeowners or renters insurance cover Airbnb properties?

No. Standard homeowners or renters insurance doesn’t cover Airbnb properties. Because renting your home out qualifies as a business activity, insurers won’t cover any damages resulting from guests like they would for your primary residence.

You may be able to get an Airbnb host insurance endorsement or a home-sharing endorsement from your current insurer for an additional cost, though not every company offers one.

You can also consider short-term rental insurance. It covers liability damage , property damage, theft, and burglary. However — like AirCover — it doesn’t cover intentional damages, your Airbnb guests’ personal property, or regular wear and tear.

)

Learn More: What Is Home Repair Insurance?

Risks of renting out your property.

Renting out your property increases the risk of damages and thus needing to file a claim. This is why insurance companies won’t cover home-sharing under standard homeowners insurance policies. Having coverage protects you from these additional risks, including:

Inconsiderate guests

Property damages

Misuse of appliances

Theft of personal belongings

Water damage and stains

How to file a claim with AirCover

To file a claim with AirCover, you’ll first need to document the subject of the claim with photos, videos, repair estimates, and any other relevant information. You’ll then need to file a reimbursement request through Airbnb’s online resolution center.

Your guest will then have one day to respond to the request. If they don’t pay for the damages, you can officially submit a reimbursement request for Airbnb to review.

Many hosts report that the process of filing a claim is straightforward but can be frustrating. They don’t always get the results they want and often the money from damages isn’t worth it because it results in guests leaving bad reviews, thus damaging their Airbnb ratings.

It’s up to you as the host to decide if the monetary damages are worth the risk of a difficult guest who might choose to leave a bad review.

Find Home Insurance

Compare quotes from top insurers

Does Airbnb have insurance for guests?

Yes. Airbnb has insurance for guests. AirCover is one of the automatic benefits Airbnb guests receive during booking, similar to AirCover for Hosts. This includes reservation insurance in some scenarios, host cancellations within 30 days, and falsely advertised conditions of an Airbnb rental property.

Airbnb insurance FAQs

Sharing your home with strangers can be stressful. Check out the answers to these commonly asked questions about Airbnb liability insurance to make sure you have the proper insurance for your home.

Does Airbnb insure against damage?

Yes. Airbnb insures against damage through its AirCover insurance. It offers host damage protection of up to $3 million if a guest damages your property or belongings.

What type of insurance do you need as an Airbnb host?

You don’t technically need to have insurance as an Airbnb host, but it’s typically a good idea to carry some. You can get liability and property damage insurance through AirCover, Airbnb’s insurance program, or you can just purchase short-term rental insurance through a traditional insurance company.

Does Airbnb automatically provide insurance?

Yes. Airbnb automatically provides insurance for both hosts and guests. If you want to, you can opt out of the coverage. But it’s risky for a property owner to rent out property without proper protection. Just like how landlords need landlord insurance, you should have protection for your property, whether you’re using it as a short or long-term vacation rental.

Can you add Airbnb travel insurance after booking?

Yes. You can add Airbnb travel insurance after booking. Generali US Branch underwrites Airbnb’s travel insurance policies.

Does Airbnb insurance pay out?

It depends. If you’re a host and experience damage, you can file a property damage claim with Airbnb. Your guest will have a chance to dispute your claim, and Airbnb needs to review it before paying you for any damages.

If you have a legitimate claim, you should receive a payout, per Airbnb’s contractual obligations laid out in the Host Guarantee Terms and Conditions. [4] But people renting out your home can leave a bad review, so weigh the costs of each outcome before filing a claim.

Related articles

- How to Find Your Home’s Protection Class and ISO Ratings

- Understanding Flood Zone X: What You Need to Know

- Can You Cancel a Home Insurance Claim?

- How to Get Anonymous Home Insurance Quotes Online the Easy Way

- Homeowners Insurance Canceled Because of the Roof? What’s Next

- Allstate Homeowners Insurance Dog Breed Restrictions

- How to Get Your Mortgage Company to Release Insurance Proceeds

Popular articles

- Wisconsin Homeowners Insurance Quotes

- Cheapest Arizona Homeowners Insurance Quotes

- Cheapest Dallas Homeowners Insurance Quotes

- Best New Mexico Homeowners Insurance Quotes

- Cheapest Colorado Homeowners Insurance Quotes

- Nevada Homeowners Insurance Quotes

- Best Oregon Homeowners Insurance Quotes

- Airbnb . " Getting protected through AirCover for Hosts ."

- Airbnb . " Host liability insurance ."

- Airbnb . " Host damage protection ."

- Airbnb . " Host Guarantee Terms and Conditions ."

)

Danny is a Brooklyn-based writer with a producer’s license for property and casualty insurance. A former editor at Insurify, he specializes in auto, home, and pet insurance. He works to translate his insurance expertise into digestible, easy-to-understand content for drivers, homeowners, and pet owners alike.

Compare Home Insurance Quotes Instantly

Latest articles.

)

Florida Regulators: Execs of Bankrupt Insurers Illegally Took New Roles

Executives of insolvent Florida insurance companies are breaking state law by taking similar roles with new firms. Now the state is reacting.

)

Compare Home Insurance Quotes (June 2024)

Looking to compare home insurance quotes? Discover your complete Insurify guide here to find the best policy for your needs.

)

5 Best Home Insurance Companies (2024)

State Farm, Stillwater, American Family, Farmers, and Nationwide offer top-notch insurance. Learn why they’re the best home insurance companies for many.

)

Cheapest Home Insurance Quotes (2024)

Compare the cheapest home insurance rates from companies like American Family, Travelers, and USAA.

)

Earthquake Insurance: A Complete Guide for Homeowners (2024)

Standard homeowners insurance doesn’t cover earthquake damage. You’ll need earthquake insurance to protect your home and belongings in the event of an earthquake.

)

What Manufactured and Mobile Home Insurance Covers (2024)

If you’re looking for mobile home insurance, learn why you need it, where to get it, and what it covers.

Airbnb Travel Insurance for Guests: Cost, details, limitations, differences with Aircover

Thibault Masson

Updated on: July 21, 2022

Airbnb is rolling out its guest travel insurance in the US, the UK, and 8 countries of the European Union . The company had been working on it for at least two years. Unlike its Aircover for guests program, which is free, this travel insurance is a paid product . Travelers can purchase it while completing their booking. Big insurance company names are behind the insurance program (e.g. Europ Assistance, Generali, AON). Let’s discover what Airbnb’s travel insurance exactly covers, when it can be used, and wha t impact it can have on existing host cancelation policies . We’ll also see why it is difficult to roll out a travel insurance offering globally.

Airbnb is not the first vacation rental listing platform to be offering travel insurance to its guests. Vrbo has been selling travel insurance products in the US created by Generali (formerly CSA Travel Protection) for years. At a time when online travel agents like Hopper are promising incremental revenues from FinTech products to their investors, it is also good for Airbnb to announce a way to make money on insurance products, after giving away host insurance liability for free, for instance.

Where is Airbnb’s travel insurance available?

Airbnb is launching its guest travel insurance in the following countries:

- the Netherlands,

- Austria,

Airbnb is planning on making its travel insurance available to guests in other countries in the future. Our guess is that Airbnb will then go after other markets in the European Union, such as France, as it already has set some insurance operations within the EU. Then, other countries with similar insurance industry setups such as Australia come could.

Rolling out insurance is really a matter of going at it country by country and even state by state in the US. Insurance regulations are very strong and differ from one country to another in the EU and one state to another in the US.

For countries in South America, parts of Asia, and Africa, things will probably take more time.

What does the Airbnb travel insurance cover and when can a guest make a claim? Disover this trip cancellation insurance which does not infringe existing host cancellation policies.

What the airbnb travel covers, for instance, in the us:.

In the US, the Airbnb travel insurance is powered by the Generali insurance company. The plan includes:

- Trip cancellation: Get reimbursed for up to 100% of your non-refunded Airbnb reservation cost if you cancel for a covered reason, such as: iIllness or injury, flight cancellations and delays due to weather, or mandatory evacuations due to weather.

- Travel delay: Get reimbursed for certain additional expenses you incur because your trip is delayed for 12 hours or more for a covered reason, such as: flight delays, passport theft, or adverse weather.

- Medical: Get reimbursed for doctor-ordered medical services during your trip, such as: hospital services, ambulance services, and prescription medicines.

- Baggage: Get reimbursed for lost, stolen, or damaged baggage, lost, stolen, or damaged travel documents, and unauthorized use of credit cards during your trip.

The plan also comes with other coverages and perks, like 24/7 emergency and travel assistance services. With just a phone call, you can get help with anything from a medical referral to a restaurant recommendation.

What does the Airbnb travel insurance mean for a host?

Airbnb’s travel insurance for guests promises a payment for up to 100% of their non-refunded Airbnb reservation costs if their trip is impacted by specific events, such as

- bad weather,

- stolen travel documents,

- or serious illness.

Airbnb’s travel insurance is more like a trip cancellation insurance that works under certain conditions than a cancel-for-any reason insurance product.

Basically, if a traveler has to cancel their trip:

- The existing host cancellation policy will apply.

- Let’s take the example of a booking made under the Airbnb Strict cancellation policy . It allows guests to receive a full refund if they cancel within 48 hours of booking and at least 14 days before a listing’s check-in time. In the event of a cancellation within 48 hours, the guest is only entitled to a 50% refund, regardless of how far out the check-in date is. S o, the host only pays back 50% of the Airbnb reservation cost.

- Now, if specific events listed and covered by the Airbnb travel insurance occur, then travel insurance can refund up to the remaining 50% .

- Note that, unlike with Aircover, the insurance provider will not seek to recover any money from the Host if a guest files a travel insurance claim

What exactly is the “Airbnb booking cost” that is covered?

To our understanding, the Airbnb booking cost is what the guest pays to the host. It may or may not include Airbnb’s service fee. Depending on the existing host cancellation policy, the travel insurance will pay the guest the part of the booking cost that the host got to keep as per the cancellation policy.

For example, if the Host refunds 50% of the Airbnb reservation cost based on their cancellation policy, travel insurance can refund up to the remaining 50% if the guest cancels for a covered reason.

How about COVID-19?

At Airbnb, for any booking made on or after May 31, 2022, being sick with COVID-19 will no longer be considered an extenuating circumstance. This is also the case on most online travel platforms such as Booking.com and Vrbo?

According to Airbnb, its guest travel insurance “could” cover costs related to COVID as it can cover “serious illness”: “If a guest purchases travel insurance, they could be covered should they become sick with COVID-19 (as diagnosed by a licensed doctor) and other policy terms are met. So, it may depend on where the guest booking is from, among other things.

If they are worried about having to cancel a trip due to COVID-related reasons, Airbnb recommends travelers buy travel insurance. So, it would make sense that Airbnb started selling such an insurance product to its guests.

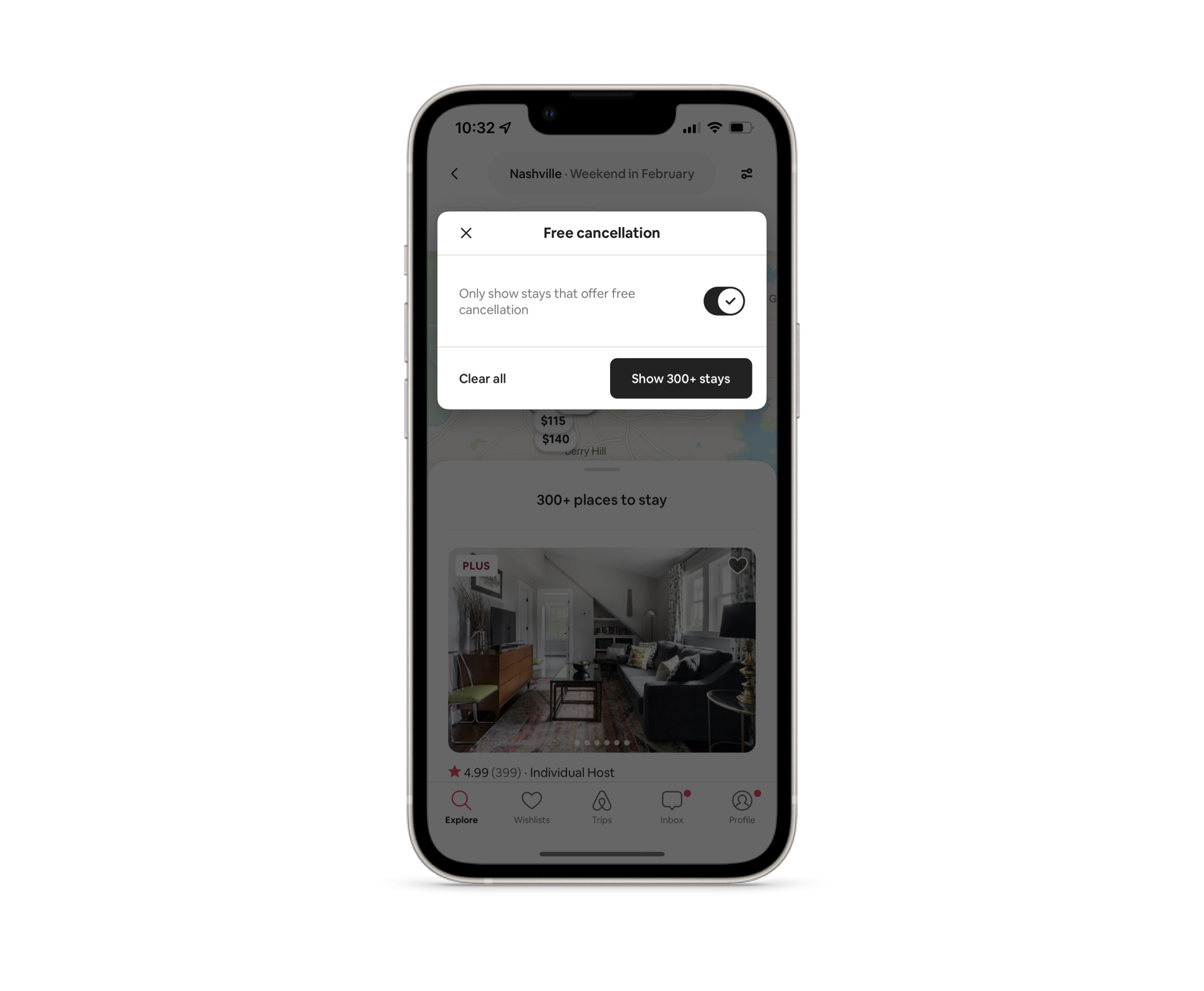

How can you buy guest travel insurance on Airbnb?

Guests get the option to purchase travel insurance during the booking process. The Airbnb guest travel insurance cannot be bought separately or after the booking has been made.

- During booking, guests are given the option to add travel insurance.

- Dedicated screens provide details about what the policy covers and key exclusions.

- If they’re interested, guests simply add travel insurance to their booking and check out.

- The guest’s travel insurance premium is a percentage of their total trip cost and will appear as a line item at checkout.

- After completing their reservation, guests who added travel insurance will receive an email confirmation with their policy’s details and information about how to file a claim

Is it free or paid?

The Airbnb travel insurance is not free, can be purchased at booking time and covers up to 100% of Airbnb booking cost

How much does the Airbnb guest travel insurance cost?

The cost of Airbnb’s travel insurance is not a fixed cost. It varies according to the total trip cost (as well as the location of the guest making the booking). The guest’s travel insurance premium is a percentage of their total trip cost and will appear as a line item at checkout.

What are the differences between Aircover for guests (free) vs Airbnb travel insurance (paid)?

So here are the main differences with Aircover for guests:

- Aircover for guests is free, while Airbnb’s travel insurance is a paid product.

- Aircover relies on a set of processes that force hosts to pay back guests in case of major issues (e.g. impossible to check-in, a major listing feature missing such as air conditioning)

- Airbnb’s travel insurance is underwritten by large insurance companies such as Generali.

- Aircover for guests is triggered when things do not go well due to issues on the host side, while the guest travel insurance covers trip cancellations due to bad weather or the guest falling sick.

- While Aircover for guests often gets down to hosts refunding money to guests, Airbnb’s travel insurance is money paid by the insurance company to the guests (no money is retrieved from the host on top of the existing host cancellation policy).

Aircover for guests is a set of protections that rely on hosts refunding money. It is no insurance, unlike the guest travel insurance product being introduced

Du ring its Summer 2022 Release event , Airbnb announced a program called “Aircover” which offers new booking protections for guests, for free. These are protections, not insurance. Basically, they rely on Airbnb’s ability to get money back from the host to the guest in case of a substantial breach in what the guest was expecting (e.g. Air conditioning or a swimming pool were listed by the host but they are not actually available at the property).

The protections offered to guests through Airbnb’s Aircover are presented as unique and ground-breaking. Yet, they look like a nice repackaging of existing services that companies such as Booking.com have been offering for years (e.g., helping find a place for the guest should the host cancel). Now, better packaging protections, giving them a name (Aircover), and merchandising them well on the website (Aircover is mentioned high on every listing page) make up good product marketing work. If competitors have been doing the same but have done a bad job at saying so, travelers will indeed have the impression that what Airbnb is offering for free is new and superior in terms of booking protections.

On the guest side, Aircover is no insurance product. It is more the sum of a series of policies and procedures imposed on the host, especially the recently updated and much-contested rebooking and refunding policy.

Aircover is about guaranteeing that Airbnb will either find a new place or refund the guest (e.g., Check-In Guarantee: If a guest can’t check in to a place and the host isn’t able to resolve the issue, Airbnb will find the guest a similar or better home for the length of their original stay at Airbnb’s expense, or we’ll refund them.

To deliver on its promises to guests, Airbnb needed to set the equivalent expectations upon hosts . This is why the company had previously informed its hosts that it was updating its Rebooking and Refund Policy . For instance, it has made it plain and clear to hosts that they may have to refund guests should the host cancel a booking or the guest find that something crucial promised in the listing was actually missing from the property. You will notice that this is the exact mirror of the protections offered to guests, and it makes sense: The money refunded to guests through Aircover actually comes from hosts having to refund them according to the updated rebooking and refund policy.

Why did Airbnb make its travel insurance a paid product, while Aircover for guests and Aircover for hosts are free?

If Airbnb were to offer free travel insurance, it would also have to pay an insurance premium to a professional insurer . Given the volume of Airbnb bookings, it would represent a lot of money and would dent Airbnb’s profitability.

First, Airbnb would not need to cover all its guests, as some already have their travel insurance. Also, unless a reservation is non-refundable, a guest may have a chance to get their money back by canceling their booking or asking their host for some flexibility. Hosts may not like to hear it, but, in a way, flexible cancellation policies are a form of travel insurance for guests.

Second, Airbnb seems to see travel insurance as a money-maker. After all, Vrbo has been flogging insurance products to guests and owners for years, probably making a lot of money from its insurance provider Generali.

- In August 2021, during a quarterly earnings call, a financial analyst asked Airbnb leaders whether the take rate, currently at 15% on average, would increase in the future. The answers were quite interesting.

- First, Airbnb mentioned, “opportunities (such as) guest travel insurance”. So, the take rate could increase from commissions on travel insurance that Airbnb would sell to guests.

Another reason why it could be a paid product for guests is Hopper’s success at selling its “cancel any time” and “price freeze” guarantees. It shows that consumers are ok to pay for an added service. Airbnb’s shareholders may be happy to hear that the company is trying to increase its margins, as Hopper is doing. With the launch of Hopper Homes, the competition between the two companies is increasing.

What’s the impact of Airbnb’s travel insurance on existing host cancellation policies?

There is no impact on a host’s cancellation polic y. If a guest cancels, they forfeit whatever money was due under the cancellation policy they had signed up for. The host gets to keep the deposit.

What the travel insurance brings about is that the guest can ask the insurance company to refund the money that the host has kept for themselves (as per the existing cancellation policy).

So, Airbnb has found a way to enforce host policies, while allowing guests to lower their risk through travel insurance. According to the company, if travelers who buy a policy cancel their booking for a covered reason, they’ll be able to file a claim to seek reimbursement for up to 100% of their non-refunded Airbnb booking cost. This may reduce the possibility of guests asking Hosts for a refund outside the terms of their Hosts’ cancellation policies.

The challenges of offering an insurance product on a global basis

When Airbnb first revealed that its $1,000,000 Host Guarantee had gone global ten years ago, the industry wondered how Airbnb had pulled it off. How can they have created and launched such an insurance product globally? The answer was that the company could, as this was no insurance. This was a guarantee, built on processes and tools such as the Resolution Center . In some iffy cases, Airbnb was probably also ready to spend some money of its own the solve the issue. So, no need to care about local insurance regulations across 130+ countries. No insurance, just a guarantee.

It is somewhat easier to roll out a liability insurance program for hosts ( as Booking.com just did ), as the risk is a bit more standard and as insurance companies have some existing products that can be used. This is why Aircover for Hosts has a real liability insurance product, while, on the damage protection side, Airbnb is still relying on the Resolution Center.

The Airbnb Guest Travel Insurance has been in the works for almost two years!

- On March 30, 2020, during an emergency live stream held with Airbnb hosts in the thick of the COVID crisis, B rian Chesky announced that the company was working on travel insurance ,

- In 2021, Airbnb discreetly launched its Travel Insurance page and started recommending guests purchased a travel insurance product at the end of its booking process. Airbnb here was merely redirecting travelers to third-party websites, such as the travel insurance aggregator InsureMyTrip in the US and insurance company Europ Assistance (part of the Generali Group) in Europe,

- In August 2021, during a quarterly earnings call, Airbnb mentioned working on opportunities such as “guest travel insurance”,

- On January 2, Brian Chesky confirmed in a tweet that the company was working on guest travel insurance

Who are the insurance companies behind Airbnb’s travel insurance?

It is always hard to pull off global coverage, as insurance is really more like a series of national businesses due to local regulations . Airbnb had to create subsidiaries that deal with insurance on local or regional levels, such as Airbnb Insurance Agency LLC in the US and Airbnb UK Services Limited in the UK.

Two partners with Aon + Europ Assistance Group (and its U.S. subsidiary, Generali Global Assistance), to introduce travel insurance for guests. Both AO

- For guests in the U.S., the travel insurance plan is offered by Airbnb Insurance Agency LLC , which is licensed as an insurance agency in all states of the U.S. and the District of Columbia, and underwritten by Generali US Branch of New York, N.Y.

- For guests in the U.K., travel insurance is underwritten by Europ Assistanc e SA. Travel insurance is arranged by Airbnb UK Services Limited . Airbnb UK Services Limited is an appointed representative of Aon UK Limited

- For guests in the EU, travel insurance is underwritten by Europ Assistance S.A., acting through its Irish Branch

Airbnb has been working on its guest travel insurance product for over two years and announced that it will be launching the product in Spring 2022. The COVID-19 pandemic has forced Airbnb to expedite the launch of this product. The company is launching its travel insurance as a paid product in 10 countries. More countries, at least within the European Union, should soon be covered.

Airbnb stacks this paid product on top of its free Aircover booking guarantees. This way, it wants to show that it is already offering a great level of protection but that money can buy guests something extra. It certainly does not hurt that insurance products have comfortable margins and that it is also a good move for Airbnb’s bottom line.

most recent

Industry News

Barcelona to ban short-term rentals by 2028.

EMBRACE ROMANCE: HOW FRENCH HOSTS BOOST OCCUPANCY WITH LOVE ROOMS

Exciting News: Rental Scale-Up Launches the Vacation Rental Scale-Up Podcast!

From Green to Gold: Achieving 90% Direct Bookings Through Sustainability

Cool to Be Kind: Building Lasting Partnerships in Property Management

Airbnb , Industry News

Airbnb’s new highlight system: top 1%, top 5%, and bottom 10% explained.

PH +1 000 000 0000

24 M Drive East Hampton, NY 11937

© 2024 INFO

Get the most important short-term rental news and insights straight to your inbox, for FREE.

Email address:

I have read the Rental Scale-Up Privacy Policy

Should you purchase travel insurance for your vacation rental?

Vacation rentals booked through Airbnb and its alternatives have become popular holiday destinations for all types of travelers, from extended families staying in large beachfront homes to couples vacationing in swanky city apartments.

But what happens if these rental properties, especially ones worth millions of dollars, get damaged before you arrive or if your plans unexpectedly change, causing you to need to cancel or shorten your stay?

While the exact outcome will depend on the situation, if you purchase travel insurance , you may find you're eligible for compensation.

So how do you know if it's worth the investment before your next trip? TPG dug into the details to determine what standard travel insurance policies may cover you for when staying at home rentals — and when you may want to purchase some additional coverage.

For more TPG news and tips delivered each morning to your inbox, subscribe to our daily newsletter .

What travel insurance covers for vacation rentals

Traditional travel insurance policies offer features that will cover you and your invested travel costs, whether you're staying at a hotel , friend's house or rental property. Although the exact benefits for vacation rentals may vary slightly depending on the policy you choose, there are a few situations that most will cover.

Your vacation is canceled due to sickness, injury or an emergency

Many hotels offer free cancellations until two or three days before arrival so long as you book your rooms with flexible rates. However, this is rarely the case for vacation rentals, which often have strict cancellation policies requiring 30 to 60 days of advance notice to cancel without penalty. Some even go so far as to have completely nonrefundable deposits, regardless of the cancellation circumstances.

Fortunately, there's a workaround to this conundrum if you find yourself in an unexpected situation involving your health or the health of someone close to you: trip cancellation coverage. If you have insurance with trip cancellation coverage and cannot complete your trip as planned due to select health-related issues, you'll be able to recoup up to 100% of your nonrefundable costs.

While the exact cases that are eligible for complete reimbursement vary by policy, know that many pertaining to health are covered. For example, World Nomads ' trip cancellation insurance policy will cover you in the event you need to cancel your vacation, including any stays at home rentals, due to illness, injury or a death in the family.

You have to cut your vacation short due to a medical reason or natural disaster

In addition to helping you out when you need to cancel your entire vacation, insurance can reimburse you for early departure fees when you find yourself needing to cut your vacation rental stay short. Know, though, that you'll need to have a policy offering trip interruption protection to be eligible for this perk.

Covered reasons for ending your stay early will vary from plan to plan, but typically, policyholders can expect reimbursement due to health-related issues and natural disasters like hurricanes, wildfires and blizzards. For instance, IMG's travel insurance covers sickness, injury and natural disaster evacuations when cutting vacation rental stays short.

You cannot stay at the rental due to it being uninhabitable

If you book a vacation rental that is not fit for human habitation, then the booking company or owner should refund all your costs. However, there are rare occasions when this does not happen, so it's important to have travel insurance as a backup.

To qualify for reimbursement from your travel insurance provider due to uninhabitable conditions, you'll need to read the fine print of your chosen policy. Allianz , for example, defines uninhabitable as "a natural disaster, fire, flood, burglary or vandalism that has caused enough damage (including extended loss of power, gas or water) to make a reasonable person find their home or destination inaccessible or unfit for use."

Other situations, such as having an unpleasant or dirty vacation rental , would not be enough to trigger this coverage.

Should you have to find another property or cancel your trip completely due to uninhabitable conditions at your original rental, your travel insurance plan will cover the added costs you incur.

Related: 13 mistakes to avoid on your next vacation home rental

What travel insurance won't cover for vacation rentals

As you may expect, there are some situations when travel insurance won't cover extra expenses related to stays at rental properties. To have a solid understanding of what to expect, be sure to read the fine print of any insurance product you choose. Only circumstances listed in the policy will be covered. The following are two key reasons why you wouldn't be covered.

You accidentally damage the property during a typical stay

Most travel insurance policies will not cover the costs of damage you incur at a rental property, even if it was done by accident. As a result, you must pay for a replacement or repair to any item you accidentally break or damage, such as a work of art, a garage door or wine glasses. Depending on the item in question, this can quickly add up.

If you have a homeowners or renters insurance policy, know that it may include protection beyond regular limits called "umbrella" coverage, which can help cover damage caused at a rental property. Keep in mind, though, that you'll have to pay your deductible first. Additionally, your home insurance rate may rise if you submit a claim for vacation rental damage.

Should you wish to stick with travel insurance, you may be able to add extra vacation rental coverage to a traditional policy to assist with accidental damage. Faye's travel insurance , for example, has an add-on feature that offers "coverage if you unintentionally damage the vacation rental property you're staying in or its contents, while in-trip." It costs about 10% of what you'll spend on the main policy itself.

You damage the property while hosting a party

Across the board, travel insurance policies are much more strict about damage caused during parties. If you host an unapproved party or event at a rental property and damage any part of the rental, you will be responsible for covering costs associated with repairs and replacements.

Even approved events are not entirely off the hook for any damage caused to the property. Should you decide to use a vacation rental for an approved event like a wedding or family reunion, expect the booking company or owner to require you to purchase an event-specific insurance policy that covers guest liability, home damage and other items that may be specific to the location.

Related: 6 truths and myths about 'cancel for any reason' travel insurance

Bottom line

Home rentals can be a great lodging solution when you're on vacation, especially if you're traveling with family or friends. However, the high cost of some vacation properties and the cancellation policies often in place mean you should probably purchase some kind of travel insurance to protect your investment.

Typical travel insurance policies will offer coverage for your vacation rental costs should your trip be canceled or delayed for events covered under the policy, but you may be on the hook for other scenarios. As a result, it's vital you pay careful attention to your policy's terms. Doing so will ensure you know what to expect should you face an unexpected situation while enjoying your temporary home away from home.

Related: 7 things to look out for when buying travel insurance, according to an expert

Is Airbnb Travel Insurance Worth It? Exploring the Pros and Cons

Planning a vacation can be an exciting experience, but it’s essential to consider all aspects of your trip, including travel insurance. While Airbnb offers its own travel insurance policy, you might be wondering, “Is Airbnb travel insurance worth it?” In this article, we’ll take a closer look at Airbnb’s insurance coverage, exploring its benefits and drawbacks to help you make an informed decision about protecting your trip.

Understanding Airbnb Travel Insurance:

Airbnb offers a built-in Host Protection Insurance program that provides coverage for property damage and liability claims up to a certain limit. However, this insurance primarily protects the hosts rather than the guests. To address this, Airbnb introduced a separate Guest Refund Policy and Host Guarantee to protect travelers from unexpected circumstances.

Pros of Airbnb Travel Insurance: