- About Settle In

- Help Center

- Multilingual Resource Library

- Kinyarwanda

At this point, the RSC will coordinate with the International Organization for Migration, or IOM, to schedule your flight to the United States. Your family is eligible to receive a loan to pay for your travel to the United States. Family members over 18 years of age each receive their own loan. Learn more about Traveling to the United States below.

You may download this page as a PDF, watch, or listen to this information in a podcast. Downloadable PDFs, podcasts, and videos provide the same information as the webpage in different formats.

Step 5: Travel

You should wait until your travel details are confirmed by IOM before selling your belongings, leaving your job, or leaving your home.

Regarding travel arrangements, you will receive the following assistance:

- Obtaining travel documents including exit permits, whenever possible, and transit and entry visas

- Pre-departure orientation:

In addition to the travel-related information provided in your Cultural Orientation training, you will receive additional information regarding flight schedules, airline regulations, customs requirements, and the specific assistance you should expect to receive in transit and when you arrive in the United States.

- Transportation to and assistance at embarkation airports:

You will be assisted with flight check-in, as well as customs and immigration formalities at the airport.

- Operational or medical escorts:

Passengers requiring special assistance during travel will be assisted as needed.

- Assistance in transit:

You will be helped with direction to connecting flights, any necessary booking adjustments, and meals and accommodation as needed during transit, by IOM or an IOM contracted service provider.

- Arrival assistance:

You will be met at your port of entry in the United States by IOM staff and assisted with entry formalities including onward connecting flights. At your final destination in the United States, you will be met by a representative of your Resettlement Agency.

Frequently Asked Questions

Prior to departure, you will sign a Promissory Note to promise to repay the cost of airfare for everyone on your case. After arriving in the United States, you will have 42 months to repay this interest-free loan. Repayment of the loan generally begins within six months after arrival. You should repay the loan in monthly payments set forth in the loan note. The monthly payments should be sent to the Resettlement Agency designated on the Promissory Note. The Resettlement Agency then reimburses IOM to make funds available for others seeking resettlement. Repaying the travel loan promptly contributes to sustaining the travel loan program and will help you to establish a good credit rating in the United States. If you have any problems paying your loan you should talk to your Resettlement Agency; in certain circumstances the loan payment amount can be reduced or the repayment terms extended. It is important that you communicate with your Resettlement Agency about your Promissory Note upon arrival.

Prior to departure, IOM will also provide information on baggage restrictions and items that may not be transported to the United States. Please note that baggage allowances are very strict and IOM cannot pay or otherwise take responsibility for excess baggage. If you have excess baggage, you may be required to dispose of many personal items at the airport in order to meet your baggage allowance.

In general, checked baggage is usually limited to two pieces of 23 kg or 50 lb each per ticketed passenger (with the exception of infants, who are not entitled to checked baggage). In some cases, checked baggage is limited by particular carriers to one piece only. Hand luggage or carry-on luggage is usually restricted to one piece per passenger. Traditional hand luggage or carry-ons, as well as other items such as laptop cases, musical instruments, and other similar items, are considered one piece of hand luggage.

IOM will ensure that you receive detailed information about the baggage allowances applicable to your travel to the United States prior to your departure.

Ready to test your knowledge?

Download the Settle In App

Get unlimited access to hundreds of lessons designed for all learners

Test your Knowledge

With short videos and interactive lessons, you can learn about a wide range of pre- and post-arrival resettlement topics like traveling to the U.S., housing, and looking for a job.

The content on this website is developed by the Cultural Orientation Resource Exchange (CORE), is in the public domain, and may be reproduced. The contents of this website were developed under an agreement financed by the Bureau of Population, Refugees, and Migration, United States Department of State, but do not necessarily represent the policy of that agency and should not assume endorsement by the Federal Government.

Travel Agency Loan Agreement

This Travel Agency Loan Agreement ("Agreement") is made effective as of [Month Day, Year] , by and between [Your Company Name] ("Borrower"), a licensed travel agency located at [Borrower's Address] , and [Financial Institution Name] ("Lender"), a financial institution located at [Lender's Address] . This Agreement outlines the terms and conditions under which the Lender agrees to loan a specified amount to the Borrower for the purposes stated herein, and under which the Borrower agrees to repay this loan in accordance with the terms set forth below.

1. Loan Amount and Disbursement

The agreement stipulates the following terms regarding the loan amount and its disbursement:

Loan Amount: The Lender agrees to provide a loan of [$Amount] to the Borrower. This amount ("Loan") is established to support the Borrower's strategic initiatives as specified in their business plan.

Purpose of Loan: The Loan is designated strictly for enhancing the operational capacity and business growth of the Borrower’s travel agency operations. The specific uses include but are not limited to upgrading technology, expanding service offerings, and entering new markets.

Disbursement Process: Upon the execution of this Agreement and the completion of all requisite formalities, such as the verification of documentation and final approval from the Lender, the Loan will be disbursed directly into the Borrower’s designated bank account.

Confirmation by Borrower: The Borrower is required to confirm that the Loan will be utilized exclusively for the purposes outlined, aligning with the business growth strategies detailed in the submitted business plan.

These provisions ensure that the loan is utilized effectively to achieve the intended enhancements in the Borrower's business operations, with a clear and accountable disbursement process.

2. Interest Rate

The terms of interest calculation and payment on the loan are as follows:

Interest Rate: The Loan will incur interest at a fixed annual rate of [X%] . This rate is locked in to provide consistency and predictability in financial planning for both the Borrower and the Lender.

Calculation of Interest: Interest is calculated on the principal balance of the Loan based on a 365-day year, accruing daily from the date of fund disbursement.

Payment of Interest: Interest accrued on the Loan is payable in alignment with the repayment schedule agreed upon in this Agreement. This ensures that the Borrower is aware of the cumulative financial commitment at any given time.

These interest terms are designed to provide clear guidelines on the cost of borrowing and to facilitate smooth financial management for the Borrower.

3. Repayment Terms

The Loan repayment is structured to provide an orderly schedule that aligns with the Borrower's cash flow projections:

Repayment Duration: The total Loan amount, along with the accrued interest, is to be repaid over a period of [Number of Years] years. This term is designed to balance the need for manageable monthly payments with the cost of borrowing.

Grace Period: A grace period of [Number of Months] months from the date of disbursement is provided before repayment commences. This period allows the Borrower to utilize the funds and begin realizing growth from the investment before starting the repayment.

Monthly Installments: Repayments will be made in equal monthly installments of principal and interest. These installments are due on the first day of each month, beginning after the grace period has ended.

Maturity Date: The final installment will be due on [Month Day, Year], which marks the end of the loan term.

4. Collateral

In order to secure the repayment of the Loan, the following collateral provisions are set forth:

Description of Collateral: The Borrower agrees to pledge [Specify Collateral] as security for the Loan. This may include assets such as real estate, equipment, inventory, or other valuable property owned by the Borrower.

Lien and Security Interest: The Lender will hold a first-priority lien on the pledged collateral. This lien grants the Lender a legal right to hold or sell the Borrower's collateral in the event of default, ensuring the security of the Loan.

Rights Upon Default: In the event the Borrower defaults on the Loan, the Lender retains the right to seize or liquidate the collateral. The process of seizure or liquidation will be conducted in accordance with the governing laws of [State], which may involve court proceedings or other legal processes to convert the collateral into cash to offset the unpaid loan balance.

Maintenance and Insurance of Collateral: The Borrower must maintain the collateral in good condition and insure it against risks, ensuring its value is preserved as a viable security against the Loan.

These collateral arrangements provide a safeguard for the Lender, securing the financial interests against potential losses that might arise from defaults on the Loan.

5. Late Payment and Default

The conditions regarding late payments and the consequences of a default are outlined as follows:

Late Payment Penalties: If the Borrower fails to make a scheduled payment within [Number of Days] days of its due date, a late fee of [X%] of the overdue amount will be charged. This fee is intended to compensate the Lender for the inconvenience and additional management required to handle overdue payments.

Default Conditions: If a payment is overdue for more than [Number of Days] days, or if there is any other breach of the terms of this Agreement (such as failing to maintain or insure the collateral properly), the Lender may declare the full amount of the Loan, plus accrued interest and any late fees, immediately due and payable. This action, often referred to as "acceleration," is at the discretion of the Lender and underscores the importance of maintaining timely payments and compliance with all loan terms.

Legal and Collection Fees: In the event of default, the Borrower will also be responsible for any legal and collection fees incurred by the Lender in the process of recovering the loan amount. These costs can include attorney fees, court costs, and other expenses related to the enforcement of the repayment.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of [State] . Both parties agree to submit to the jurisdiction of the courts of [State] for any actions relating to this Agreement.

IN WITNESS WHEREOF , he parties hereby enter into this Agreement willingly and affirm their commitment to fulfill the obligations specified herein.

Travel Agency Templates @ Template.net

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Personal & Family Loan Agreement

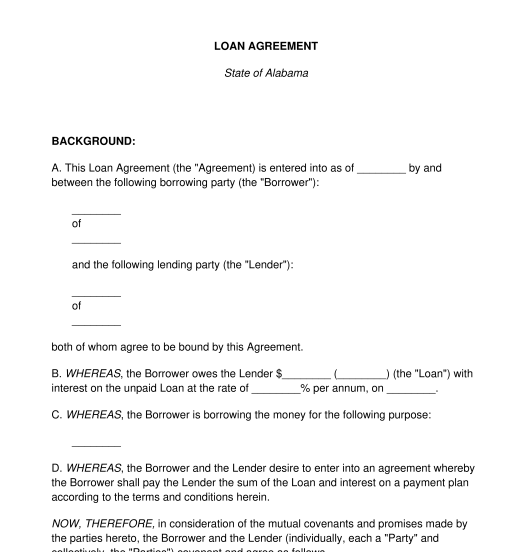

Loan Agreement Template

Use our loan agreement template to detail the terms of a loan.

Updated November 13, 2023 Written by Sara Hostelley | Reviewed by Brooke Davis

A loan agreement is a legally binding contract between a lender and a borrower that a court can enforce if one party doesn’t follow the arrangement. It establishes how much money the lender is loaning and sets other terms, including the repayment schedule and interest.

Types of Loans

Secured Loans: They require collateral as a precondition for borrowing, typically a home or vehicle.

- Auto Loans: Use to purchase a vehicle.

- Mortgage Loans: Use to buy a home.

- Personal Loans: Use to fulfill any personal needs you have.

Unsecured Loans: They don’t require collateral. A borrower promises to repay the amount via a contract.

Variable-Rate Loans: They have an interest rate that changes over time.

Fixed-Rate Loans: They have an interest rate that stays the same for their entire duration.

Payday Loans: They’re short-term and immediate loans with high interest rates.

Loan Agreements By Type

When to use a loan agreement, how to get a loan, how to notarize a loan agreement, loan agreement terms and conditions, how to write a loan agreement, loan agreement sample, frequently asked questions.

Business Loan

Payment Plan

Promissory Note

Release of Debt

Deed of Trust

Mortgage Deed

You should use a written loan agreement whenever you lend or borrow money. Here are some situations where you may need to create this document:

- Starting a business with a capital loan [1]

- Purchasing land or a home with a real estate loan

- Investing in a college education or repaying a student loan

- Buying a new car or boat

- Getting a paycheck advance from an employer

- Helping a friend or family member with a personal loan

When making a loan agreement contract between family members, you should be aware that there can be tax implications. For example, if you lend money without interest, the IRS may charge you tax because it would be below the minimum interest rate required for family loans. This amount is the Applicable Federal Rate (AFR) [2] .

Also, if you’re borrowing money from family or friends and don’t have to repay the loan, the IRS will consider this transaction a gift and charge you income tax [3] .

If you see an exorbitantly high interest rate on a potential loan agreement, you shouldn’t sign it without serious consideration. You may be a victim of a loan shark, which is a lender who preys on individuals and charges the highest legal interest rate possible.

Step 1 – Check Your Credit Score

Your credit score indicates how likely you are to repay a loan. Lenders consider this metric when assessing your loan application.

The higher your credit score, the better chance a lender will want to loan to you. You can obtain your credit score from one of the three major credit bureaus, which are Experian , Transunion , and Equifax .

Once you learn your current credit score, you can understand which interest rates you may qualify for.

Step 2 – Compare Lenders

Shop around for the best personal loan option. Research and compare lenders based on interest rates, fees, repayment terms, and customer reviews.

You have several options to find personal loans:

- Banks could be the best option if you have a good to excellent credit score. They offer low interest rates, few fees, and flexible repayment terms.

- Credit unions offer loans to their members. They tend to have lower interest rates and fees and can’t charge more than 18% APR (annual percentage rate) on personal loans [4] .

- Online lenders let you prequalify, apply for, and receive personal loans online, but they have higher APRs and fees than banks and credit unions.

Consider obtaining a loan from a family member or friend who has extra money to lend. Even if you know the lender well, it’s still a good idea to get a personal loan agreement in writing.

Step 3 – Gather Necessary Documents

Lenders may request several documents to verify your information. Gather them in advance so you can present them when lenders request them.

Examples of these documents include proof of identity (like a driver’s license or an affidavit of identity ), proof of income , bank statements, and rental or mortgage agreements.

Step 4 – Get Prequalified for a Loan

Many lenders offer a prequalification process involving a soft credit check that estimates the loan amount and interest rate you might qualify for. Thanks to prequalification, you can preview the potential offers you may get from lenders and narrow them down based on potential interest rates, fees, terms, and amounts.

Note that the prequalification process doesn’t guarantee you’ll get a loan. It also doesn’t require you to accept one.

Step 5 – Start the Application Process

If you’re satisfied with the prequalification terms, pick one that matches your needs and proceed with the formal loan application. Complete the lender’s application form with accurate information, finalize the documents, and accept the terms.

Step 6 – Accept the Loan

If you receive loan offers after applying, review them carefully. Pay attention to the loan amount, interest rate, repayment term, and associated fees, and read and understand the fine print. You can accept the offer and sign the loan agreement if all the details meet your needs.

While most jurisdictions don’t require witnesses to legitimize this document, you may consider getting a notary public to sign it. A notary public will ensure all parties sign the document as themselves and without coercion.

Follow these steps to notarize a loan agreement:

Step 1 – Find a Notary Public

You can find a certified notary public at a local accountant’s office, lawyer’s office, bank, or public library. You may also use free online services to connect with a notary public who isn’t in your area.

Schedule a meeting with them. The other party (whether they’re the borrower or lender) can be present, but they may also have their signature notarized at a different time.

Step 2 – Meet With the Notary Public

Meet with the notary public. Present a valid form of government-issued ID so they can confirm your identity.

Step 3 – Sign the Agreement

Sign the agreement in front of the notary public. Once you sign, they’ll add their seal to your document.

Step 4 – Pay the Associated Fee

Pay the nominal fee for the notary public’s services. Depending on where you live, you may expect to pay between a couple dollars and $10.

A loan contract contains basic details, including the principal amount and interest. Explore some other terms and conditions that you can include within this document:

Payback Options

This document can outline the desired payback option. For example, a lender may want the borrower to pay:

- In full on a certain date

- In installments of interest only (with the principal due at a later date)

- In installments of the principal and interest

Assignment refers to letting a lender sell their right to collect payments from a borrower. This option may be useful if the lender no longer wants to collect payments from the borrower.

A guaranty provision states that a cosigner will become responsible for the loan if the original borrower fails to repay the entire amount.

Acceleration

An acceleration clause explains whether the lender can increase the repayment date or make the borrower repay the loan immediately. Possible triggers for acceleration include:

- The borrower becomes bankrupt.

- The borrower fails to follow the agreed-upon payment schedule.

- The borrower wants to pay off the note early.

- The borrower sells off a significant or material portion of their assets.

An amendments clause can outline how either party can alter the original agreement.

A collateral provision is essential for a secured loan, as it defines what property the lender can keep if the borrower defaults.

A prepayment clause determines if the borrower can pay off the loan and interest early. If the lender permits, this clause may allow the borrower to receive a discount for early payment.

Late Charges

A late charges clause states that the borrower is responsible for paying penalty fees if they make late payments.

Joint and Several Liabilities

Joint and several liabilities state that all borrowers are individually responsible for the total loan amount.

Maturity Date

The maturity date defines when the borrower should repay the full amount.

Step 1 – Name the Parties

This agreement should detail the lender’s and borrower’s full legal names.

Step 2 – Write Down the Loan Amount

Provide the amount the borrower will be loaning from the lender. This amount is the principal sum. It doesn’t account for the total amount, including accrued interest.

Step 3 – Specify Repayment Details

This section is where you must provide the details of the borrower’s loan repayment. The options you choose will have to be mutually agreed upon. You can choose whether the borrower will repay the loan in regular payments or at once.

- Regular Payments: The borrower repays the lender in a set number of payments over a specific period.

- Single Payment: The borrower repays the lender all at once by the date specified by the lender OR “on-demand” by the lender. With a “Due on Demand” payment option, the borrower repays the loan upon the lender’s demand.

If you choose regular payments, you must specify the repayment schedule, which can be monthly, quarterly, semi-annual, or annual installments.

Step 4 – Choose How the Loan Will Be Secured (Optional)

If you want the loan secured, you can include the property the borrower has put up for collateral. Make sure to provide as many relevant details as possible. Both parties must mutually agree upon this collateral for it to be legally valid in court.

Step 5 – Provide a Guarantor (Optional)

A cosigner or guarantor is optional and protects the lender if the borrower defaults on the agreement. You may require a cosigner if the borrower is in questionable financial standing. The cosigner is someone who jointly signs the agreement with the borrower.

If the borrower defaults and cannot pay back the amount in full, the cosigner is responsible for paying you back the due amount. The cosigner is usually someone in good financial standing or has excellent credit.

Step 6 – Specify an Interest Rate

You should include the interest rate you will be charging the borrower in a percentage. This interest rate will apply to the principal amount of the loan, and the borrower must agree to this rate.

Step 7 – Include Late Fees (Optional)

As a lender, you can charge late fees if the borrower does not meet a payment in time. Including a late fee can motivate the borrower to make payments on the agreed dates.

Step 8 – Determine Options for Prepayment

You can include whether penalties or discounts will apply if the borrower decides to pay the loan amount ahead of schedule. Alternatively, you can explicitly state that the agreement does not allow prepayment of the loan.

A penalty can prevent the borrower from paying the loan early and encourage long-term payments. The loan would then accrue more interest, which can be a favorable arrangement for the lender.

Step 9 – Include Provisions for a Default

When the borrower cannot repay the loan as the loan agreement details, the borrower has entered into default. It would be best to clarify how the borrower will default in the document. An agreement can say missing one payment causes a default, but a lender may choose to be more lenient.

A default can give you the legal right to accelerate payment. In this scenario, you can make the total loan amount due immediately.

Step 10 – Add in Relevant Terms

Further terms make up the remainder of the agreement and serve to protect the rights of both parties, and they include any remaining provisions such as:

- The legal right of the lender to enforce the terms of the agreement

- The costs and expenses associated with taking the case to court

- The transferability of the agreement

- The capability of alterations to part of or the entire agreement

Step 11 – Specify How You Would Like To Communicate

You can establish communication methods so both parties are on the same page. This preparation can prevent either party from claiming they didn’t receive a notice.

Step 12 – Include the Governing Law

Indicate your resident state in the agreement so both parties know which jurisdiction’s laws they must follow.

Step 13 – Determine the Resolution Method for Disputes

Detail the procedure for how both parties can resolve disagreements. Choose from several options, including court litigation, mediation, and arbitration.

Pursuing court litigation will mean the party who lost the case must pay the other party any costs and fees related to the court process.

Step 14 – Include All Relevant Signatures

All involved parties in the agreement, including personal guarantors and cosigners, must sign the document.

Download a free loan agreement template as a PDF or Word file below.

What’s the difference between a loan agreement and a promissory note?

A loan agreement and a promissory note are legal documents individuals use when borrowing money from another party. However, promissory notes tend to be shorter and more straightforward. They focus on the borrower’s pledge to repay and contain basic elements like the parties’ names, the loan amount, and the terms.

Loa agreements are more comprehensive since they outline the loan’s terms and conditions in greater detail. They often give both parties more protections, including borrower representations, warranties, and covenants.

For more detailed information, read our article on the differences between a loan agreement and a promissory note .

Can you cancel a loan agreement?

You can cancel this agreement in certain instances. Refer to the original document for termination conditions. You may also be able to cancel the loan if both parties agree to it or if you’re within your jurisdiction’s cancellation period for your specific loan type.

Can I write a loan agreement with a family member?

Yes. Consider writing this agreement when borrowing money from or lending to a family member. This agreement can help keep matters objective if you disagree about the loan’s terms later.

What does it mean to consolidate your loans?

Consolidating your loans involves obtaining one sizable loan to pay off all your loans. This way, you only have to make one payment each month. Consolidation may be a reasonable option if you can secure a loan with a low interest rate.

Legal Templates uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial guidelines to learn more about how we keep our content accurate, reliable and trustworthy.

- Working Capital Loan. https://investinganswers.com/dictionary/w/working-capital-loan

- Applicable Federal Rates (AFRs) Rulings. https://www.irs.gov/applicable-federal-rates

- Gift Tax. https://www.irs.gov/businesses/small-businesses-self-employed/gift-tax

- National Credit Union Administration. Permissible Loan Interest Rate Ceiling Extended. https://ncua.gov/regulation-supervision/letters-credit-unions-other-guidance/permissible-loan-interest-rate-ceiling-extended-2#ftn_1

Related Documents

- Demand Letter for Payment : A formal, written document demanding payment of an outstanding debt.

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Purchase Agreement : A legally enforceable contract that documents the sale of a business.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Loan Agreement

Rating: 4.8 - 1,357 votes

A Loan Agreement is a written promise from a lender to loan money to someone in exchange for the borrower's promise to repay the money lent as described by the Agreement.

Its primary function is to serve as written evidence of the amount of a debt and the terms under which it will be repaid, including the rate of interest (if any). The note serves as a legal document that is enforceable in court creating obligations on the parts of both the borrower and the lender. Use this Loan Agreement template to lend or borrow money .

Though Loan Agreements are often referred to as IOUs or Promissory Notes, Loan Agreements are different than these documents in two key respects:

- First of all, Loan Agreements are binding on both the borrower and the lender ; and

- Secondly, Loan Agreements are much more detailed and include extensive provisions about when and how the borrower will repay the loan and what sorts of penalties will be incurred if the borrower does not follow through with repayment.

- Finally, Loan Agreements are usually used when large sums of money are involved , such as student loans, mortgages, car loans, and business loans. For smaller and/or more informal loans, such as those between family and friends, a Promissory Note should be used instead .

To find more information about whether a Promissory Note or Loan Agreement is more appropriate, please see the guide What is the Difference Between a Promissory Note and Loan Agreement?

This document can also be used in conjunction with a Guaranty Agreement , wherein a third party, known as a guarantor, agrees to repay the loan if the borrower defaults on repayments.

How to Use this Document

This Agreement sets out all of the terms and details of the loan, including the names and addresses of the borrower and lender, the amount of money being borrowed, how often payments will be made, the amount of the payments, and the signatures of the parties .

This document can be used for different types of loans including the following:

- Instalment Loan: The borrower pays off the loan, plus interest (if any), by making payments over a set period of time, such as annually, monthly, or weekly.

- Lump Sum Payment: The borrower pays off the money borrowed, plus interest (if any), in one single payment due on a pre-agreed upon date.

- Due on Demand: The borrower pays off the money borrowed, plus interest (if any), in a single payment due at the time the Lender requests it.

The document can also specify whether or not interest will accrue on the loan and, if so, the interest rate that will be used. There is also. the option of including provisions to govern early payments as well as an acceleration clause that would cause the entirety of the loan to come due in the event of late payments or non-payment according to the agreed upon payment plan schedule.

Once all of the provisions of the contract have been filled out, both the borrower and the lender should print out and sign the document , each saving a copy for their records in case of future misunderstanding or dispute. If the loan is being secured by real estate used as collateral, the borrower should be sure to property register this collateral according to the laws of the state in which it is located.

If the lender and the borrower decide to change the terms of the Loan Agreement, use an Amendment to Agreement form. Once the loan has been fully repaid, complete a Release of Loan Agreement form.

Applicable Law

Loan Agreements are governed by Article III of the Uniform Commercial Code (the "UCC") .

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Get your Debtor to Pay

- What is the Difference Between a Promissory Note and Loan Agreement?

- Mortgage Deed vs. Deed of Trust

- Should I Use a Promissory Note for a Friendly Loan?

Other names for the document:

IOU, Debt Agreement, Debtors Agreement, Lending Agreement, Lender Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

Should you use vacation loans to cover travel expenses?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Student loans

- • Student financial aid

- Get in contact with Raija Haughn via Email Email

- • Personal loans

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

A vacation is a fun and exciting way to relax, spend time with family and friends and let off some steam. It can also be expensive, depending on the trip you have in mind. 7.99 The average cost for one person to go on a week-long vacation in the U.S. is $1,982 . If you’re traveling with family or plan to leave the country, prices could be much higher. With inflation continuing to be a challenge, many Americans are struggling to pay for vacations this summer, with many scaling back and looking for ways to travel cheaper.

If you are planning a trip and are unsure if you will be able to pay for it, you do have the option to finance the trip with a vacation loan. While a vacation loan should be treated as a last resort and should only be applied for if you are certain you will be able to pay it back on time, it could be a decent option to help you pay for a once-in-a-lifetime trip or urgent travels. You should always try budgeting and saving before taking out a loan. If you think that taking out a vacation loan is the right move for you, there are plenty of reputable lenders out there to help.

Key statistics

- The National Travel and Tourism Office projects that inbound travel will return to pre-pandemic levels by 2025.

- Atlanta, Boston, Las Vegas, Los Angeles and Miami are the top destinations for U.S. domestic travelers in 2023.

- The average domestic traveler in the U.S. spends $1,982 per person on a week-long vacation, which translates to about $283 per day.

- Most Americans ( 20% ) plan to spend between $1,500 and $3,000 on travel in 2023, with 26% saying they’ll be spending more this year due to inflation.

- Despite having the lowest traveling budget, more than half of Gen Z adults and millennials ( 52% ) travel three times or more per year, compared to 41% of Gen Xers and 35% of baby boomers.

- When it comes to planning trips, roughly 62% of consumers think cost is the most important factor.

- Over 82% of U.S. travelers plan on financing at least a portion of their trip.

- More than a quarter of travelers say that traveling is worth going into debt for.

How has inflation affected travel costs?

The U.S. economy has been experiencing a difficult time in the last several months, as rising inflation and a looming recession have affected nearly every industry with travel as no exception. Airfare prices have risen by roughly 18 percent between last March to March 2023, according to the U.S. Bureau of Labor Statistics Consumer Price Index . Nevertheless, Americans are still traveling.

If you are planning a vacation this summer but are unsure of how inflation will factor into the overall cost, consider all the individual elements of the trip before making any decisions. This could include flights, hotels, car rentals and food costs.

Here is a breakdown of some of the common travel expenses and how rising inflation has impacted pricing:

Hotel and air travel prices dropped significantly during the peak of the COVID-19 pandemic a couple of years back, but prices have risen significantly in the face of inflation over the last year. Hotel prices have risen due to the increased demand for travel after a two-year period of reduced activity. The increase in price for car rentals, flights and food costs can be attributed to high fuel costs increasing overall transportation costs.

Average amount people spend on vacation by age

Despite having the smallest average travel budget , Gen Zers along with millennials travel more frequently than other generations. According to Morning Consult , 52 percent of Gen Z adults and millennials travel at least three or more times per year, compared to 41 percent of Gen Xers and 35 percent of boomers.

What is a vacation loan?

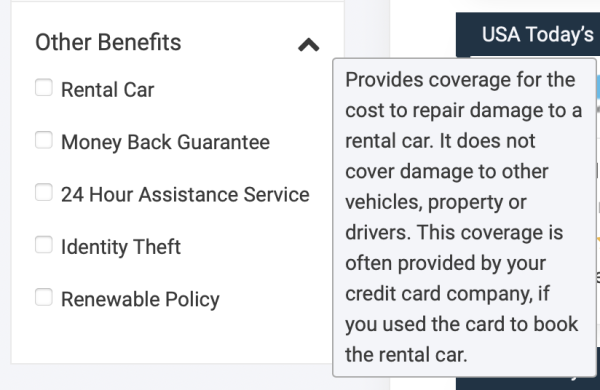

Vacation loans can be used to cover any and all travel expenses, including transportation, lodging, food and entertainment. You can get a vacation loan from any lender that offers personal loans, which include banks, credit unions and online lenders. That said, vacation loans should only be used for once-in-a-lifetime trips, special occasion trips like a honeymoon or emergency trips because of the effect they can have on your credit score and finances. Only take out a vacation loan if you are sure you will be able to pay it back on time.

What are the pros and cons of a vacation loan?

While vacation loans can help you take the trip of your dreams sooner rather than later, they should be considered a last resort unless the trip is an unavoidable emergency. Before considering a vacation loan, you should try to save up and budget for a trip so that you can afford it on your own. If you are considering taking out a vacation loan, consider the pros and cons first.

- Fixed monthly payments. Because payments are fixed, you will pay the same amount each month, making it easy to plan ahead.

- Potential for lower interest rate. Depending on your credit, personal loans often have lower interest rates than alternatives like credit cards. If you were planning to use a credit card to pay for your trip, a vacation loan could be a lower interest alternative.

- Help fund emergency travel (or higher cost travel). If you are taking a trip out of necessity rather than pleasure and it is time-sensitive, a vacation loan could be a great option to enable you to travel more quickly.

- Interest increases the cost of the trip. If you take out a loan, you will have to pay interest on top of the expenses of the trip itself.

- Fees can increase the cost of borrowing. Many lenders charge a variety of fees. Always look into the fees a lender charges before applying.

- Monthly payments. If you take out a vacation loan, you will be on the hook for monthly payments until it is paid off. This means that you could be paying off your trip months after the fact. Taking out a loan is a long term investment.,

- Can negatively impact your credit score if you don’t make the payments. If you are late making payments or end up having to defer them, your credit could take a serious hit.

How do you get a vacation loan?

If you decide to take out a vacation loan, there are several steps you will take.

Check your credit score

First, you should check your credit score. Different lenders have different minimum credit score requirements, but you generally need good to excellent credit to qualify for a lender’s lowest rates. Here’s a breakdown of FICO scores and their meanings:

Knowing your credit score is important because it informs what lenders you may qualify with and the terms you might be eligible to receive. If your credit is less than stellar, you may want to consider a lender that works with bad credit borrowers.

If you aren’t sure where your credit stands, you can always visit AnnualCreditReport.com to get a free copy of your report from all three major bureaus once every 12 months. Although these reports won’t show you your score, they will give you an idea of what needs to be improved. However, you can also visit the websites from each individual bureau (Experian, TransUnion and Equifax) to get a copy of your report, although some may charge a nominal fee in exchange for this.

Research lenders

Once you have reviewed your credit score and overall financial picture, start researching top lenders . When comparing lenders, consider the interest rates offered, fees charged, minimum and maximum loan amounts, repayment terms and any additional features offered by individual lenders.

Many lenders allow you to pre-qualify without hurting your credit. This lets you see the rates you will be eligible for without officially applying.

Submit your application

Once you have chosen a lender, you will submit a formal application, including identifying documents like your ID, W2s and pay stubs. If you are accepted, the next step is to sign off on the agreement, receive the funds and begin paying back the loan in monthly installments.

Should I apply for a vacation loan?

While taking out a vacation loan could be the right decision in certain circumstances, you should generally try to save up and budget for expenses that are not necessities rather than taking out a loan.

Because a vacation is a luxury, not a necessity, you should think carefully about taking out a vacation loan. If the trip is an emergency, a vacation loan may be a good idea. Other circumstances that warrant taking out a vacation loan include special occasion trips like a honeymoon or once-in-a-lifetime trips.

Essentially, if there is a sense of urgency and you don’t think you have time to save up, taking out a vacation loan could be the way to go. However, you should budget and save instead of taking on debt if it is at all possible. If you do decide to take out a vacation loan, make sure to search for the best rates and make sure that the loan fits your budget.

5 best vacation loan lenders

Discover: Discover vacation loans are available for as much as $40,000 with rates ranging from 7.99 percent to 24.99 percent. Funds can be acquired as quickly as the next business day after approval.

SoFi: SoFi offers as much as $100,000 for vacation loans with rates that start at 8.99 percent and go up to 29.49 percent. Loan funds can be dispersed as quickly as the same day of approval, and origination fees are not required.

Prosper: Prosper loans can be used for practically anything and offer rates as low as 8.99 percent. Loans are available from $2,000 to as much as $50,000. There are no prepayment penalties and you can get funds in as little as one business day.

Avant: You can borrow from $2,000 to $35,000 from Avant for vacations. APR rates range from 9.95 percent to 35.99 percent with loan terms from 12 to 60 months. There are fees with Avant loans to be aware of including late payment fees, administration fees, and dishonored payment fees.

LightStream: Rates on LightStream personal loans range from 7.49 percent to 25.49 percent, and there are no fees. Loans are available for as much as $100,000 and you can get your rate reduced as much as 0.50 percent by signing up for automatic payments. But prequalification isn’t an option with LightStream, so check your rates with other lenders first.

What are some alternatives to vacation loans?

Before taking out a vacation loan, consider the following alternatives.

- Budget. If you plan accordingly, there are many ways to save money on a trip. Spend time researching the cheapest travel and lodging options, as well as looking up tips and tricks for cheap travel in a certain area. Creating a budget and finding options that fit into that budget is the best way to save money while traveling.

- Travel cards and reward cards. Many credit card companies offer perks and reward programs for traveling. Find a credit card that lets you build up travel points as you spend. This could help you cut travel costs, with some cards even awarding airline miles as you spend and pay off the card.

- Saving. If you know you want to take a trip, it is always a good idea to start saving early. Set aside a predetermined amount from each paycheck to go toward a travel fund. Figuring out a travel budget will make it easier to figure out how much and for how long you will need to save.

- Traveling with a bigger group and splitting costs. Traveling with a group and sharing accommodations can help with travel costs significantly.

- Find discounts. There are often discounts available if you search for them. Do your research to find the cheapest flights, hotel rooms, etc. There are almost always deals to be found online.

- Choose a less costly vacation. If the vacation you’re planning is turning out to be too expensive, you might want to consider a smaller-scale trip, or changing your destination to a less costly area.

- Wait until the offseason. Prices are higher in certain areas during certain times. For example, it is more expensive to go to the Bahamas during the summer than it would be to go during the fall or winter. Consider visiting your chosen location during the offseason to take advantage of lower prices and less crowded destinations.

The bottom line

Despite rising costs, Americans are ready to travel after the pandemic. While rising inflation does make travel more difficult, there are still plenty of ways to reduce costs and keep your travel budget on track.

If you can’t wait to save up but are confident you will be able to pay back the loan, a vacation loan could be a great way to finance your upcoming trip. However, you should do your research and compare financing options before making that decision. Saving up and finding deals is always a better option than taking on debt.

Related Articles

Should you use a personal loan to invest and build wealth?

Should I pay off my student loans early?

Should you use savings or a personal loan to travel over the holidays?

8 last-minute ways to save for vacation

Should You Use Buy Now, Pay Later for Travel?

BNPL brings financial flexibility to travel bookings, but paying for travel in installments could be risky.

Should You Use BNPL for Travel?

Getty Images

Plan how you’ll make the payments before hopping onboard.

Buy now, pay later financing options offer a flexible alternative to traditional payment methods when you make a purchase – including travel purchases. Whether traveling for family obligations or jetting off on a fabulous vacation, BNPL may offer the option to book travel without making a full upfront payment. But while BNPL can offer flexibility, it isn’t without risk.

Read on to understand the benefits, drawbacks and factors you should consider before using BNPL to book travel.

What Is Buy Now, Pay Later?

BNPL is an alternative to credit cards and loans . It’s popular for travel expenses such as flights, hotels and vacation packages. BNPL can offer convenience and flexibility, particularly for costly trips that might be difficult to pay upfront, but you should exercise caution.

“Participating online and in-person retailers offer (BNPL) at checkout,” says Rod Griffin, senior director of public education and advocacy for credit bureau Experian. “You can think of BNPL similar to a layaway plan, where you pay a merchant for a purchase over time rather than immediately upfront. Unlike a layaway, though, with BNPL, you get your items right away.“

Using BNPL, you can make a purchase and spread your expense into installment payments . That allows you to buy products or services – such as travel – immediately without making a full payment. BNPL is often interest-free as long as you stay on top of installment payments.

How to Secure a $30,000 Personal Loan

Matthew Reitz July 28, 2023

How Buy Now, Pay Later Services Work

BNPL services are typically available at checkout when you book travel. For example, you might see the option to use BNPL when you book a flight instead of entering a credit card number .

At checkout, the BNPL service will provide loan information, including the number of payments, how much you’ll pay and your interest rate , if there is one. Some BNPL services use a credit check, but BNPL often doesn’t require a hard credit check unless you opt for extended terms or make a particularly large purchase.

You’ll make the first payment if approved, and your travel will be booked. The remaining balance will be split into equal installments. If you’ve opted for auto-pay, the installment amounts will be automatically charged to your payment method when each payment comes due.

Personal Loans for Debt Consolidation:

Factors to Consider Before Opting for Buy Now, Pay Later

Before you opt for BNPL, plan how you’ll make your payments. While BNPL can make paying for travel easier, installment payments could pressure other financial obligations. Can your budget handle the installment payments along with other commitments?

“The first thing to ask yourself is can you pay back the loan on time and in full?” says personal finance and travel expert Barry Choi. “Next, you should be aware that BNPL may encourage you to spend more because the entire balance isn't due right away.”

Some BNPL services offer interest-free installment plans, but you may have to pay interest or fees if you miss a payment.

“BNPL plans have widely varying payment structures, so it's important to read the terms carefully,” says Griffin. “Treat them like you would any loan agreement and look for information on payment terms, potential interest and late fees, and whether those payments or fees will be reported to the national credit reporting companies like Experian.”

Interest-Free Buy Now, Pay Later Installment Plans

An interest-free BNPL plan allows you to split your purchase into equal installments with no interest charges. BNPL installment plans may have no credit check . That can give you an alternative if you’re worried about getting approved for a credit card or loan to finance a travel purchase.

But there’s a catch: The repayment terms are often very short – for example, a down payment and three biweekly payments. Also, you might pay fees if it takes longer to repay the loan or if you miss a payment.

For example, you might be offered four interest-free payments, but if you opt to pay over six, 12 or 24 months instead, you’ll pay interest. It’s key to read the terms and conditions before signing the dotted line. And if you miss a scheduled installment payment, you should expect a late payment fee. You might also have to pay interest.

6 Best Loans for Moving or Relocating

Dawn Papandrea Aug. 8, 2023

Benefits and Drawbacks of Buy Now, Pay Later for Travel Expenses

- Payment flexibility: You can spread out travel costs in installments so it’s easier on your budget.

- Interest-free options: You may have the option of getting an interest-free installment plan.

- Quick approvals: BNPL applications and approvals are generally fast, so you can get approved and book your trip.

“The main benefit of BNPL is that you can pay for your purchases over time without potentially paying interest,” says Choi. “This can help people who are facing a temporary cash flow crunch.”

- Late fees and interest: If you miss a payment or extend the installment period, you might have to pay late fees or interest.

- Credit impact: Missing a payment or defaulting on BNPL could negatively impact your credit score if the account goes to collections. But BNPL generally doesn’t help you build credit as traditional credit cards or loans can.

- Overspending risk: Breaking payments into smaller installments might make you feel that you can afford to spend more than you can handle.

“Generally, consumers are better off avoiding BNPL services since it may encourage them to spend more or buy things they don't need,” says Choi. “That said, BNPL can be helpful in some situations. For example, you need to purchase something immediately for an emergency and don't have a credit card.”

Alternatives to Buy Now, Pay Later

- Savings: Setting aside money in a travel fund enables you to pay for your trip without using credit.

- Rewards credit cards : You could pay for travel with points and miles earned with a rewards credit card.

- Personal loans : If you have good credit, a personal loan might offer better terms than BNPL.

- Delaying purchases: If you can’t afford travel without debt, hold off until it’s in your budget.

“To responsibly use BNPL services, you should be prepared to make all your payments on time to avoid fees, keep enough funds in your bank to avoid overdraft payments and assess the cost of the purchase and your overall budget to avoid overextending,” says Griffin. “It can be very easy to take on multiple BNPL accounts. You can quickly find yourself with more debt than you realized you were taking on and difficulty repaying the debts you owe.“

6 Best Vacation Loans

Dawn Papandrea May 6, 2024

Tags: money , Travel , credit cards , loans

Personal Loan Articles

Personal Loans Advice

Personal Loan Categories

Personal Loan Lenders

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

You May Also Like

How to pay off a personal loan faster.

Jerry Brown May 22, 2024

What to Know About Financing Appliances

Mary Beth Eastman May 6, 2024

How Much Loan Can You Borrow?

Jerry Brown May 6, 2024

How to Refinance a Personal Loan

Rebecca Safier April 26, 2024

Is 0% Financing a Good Idea?

Geoff Williams and Chris Kissell April 26, 2024

U.S. Department of the Treasury

Loans to air carriers, eligible businesses, and national security businesses.

Established by the CARES Act, the 4003 Loan Program authorized the Treasury Department to make loans, loan guarantees, and other investments to provide liquidity to eligible businesses related to losses incurred due to the coronavirus pandemic. Under this program, the Treasury Department provided approximately $2.7 billion in loans to 35 eligible businesses, including passenger air carriers, repair station operators, ticket agents, cargo air carriers, and businesses critical to maintaining national security.

The 4003 Loan Program provided an emergency credit line for large and small businesses unable to obtain credit elsewhere during the height of the pandemic, thereby reducing COVID-19-driven bankruptcies, protecting pensions, and, together with the Payroll Support Program, avoiding long-term reductions in aviation capacity.

To the extent practicable, the CARES Act required borrowers to agree to maintain their March 24, 2020, employment levels between that date and September 30, 2020. In accordance with the statute, borrowers also were required to agree to certain employee compensation restrictions; agree not to repurchase stock; and agree not to pay dividends or make other capital distributions until 12 months after the loan is fully repaid to the Treasury Department.

Further, the CARES Act required that the Treasury Department receive certain financial protections in making a loan, in the form of a warrant or equity interest if the borrower is a public company, or a warrant, equity interest, or senior debt instrument if the borrower is a private company. As of February 2023, of the 35 loans that the Treasury Department executed, 21 large and small businesses owe a combined $985 million. Fourteen borrowers have fully repaid their loans for a combined $1.7 billion in principal prepayments. Borrowers have paid more than $97 million in cash interest payments.

DATA CURRENT AS OF 1/21/2021

air carriers, repair station operators, and ticket agents 1

National security businesses 1.

- Only certain categories of entities are eligible to receive loans under sections 4003(b)(1), (2), and (3) of the CARES Act. Under those provisions, a borrower must be a passenger air carrier; a business that is certified under 14 CFR part 145 and approved to perform inspection, repair, replace, or overhaul services; a ticket agent (as defined in 49 U.S.C. 40102); a cargo air carrier; or a business critical to maintaining national security. Additional information regarding eligibility is provided in the "Procedures and Minimum Requirements for Loans to Air Carriers and Eligible Businesses and National Security Businesses under Division A, Title IV, Subtitle A of the Coronavirus Aid, Relief, and Economic Security Act" (March 30, 2020), available here

- The location provided is the address included by borrowers in their applications and may not include all locations in which a borrower operates.

- Date of Loan Agreement: The date of the loan agreement is also the date of approval of the borrower’s application. For borrowers whose loan agreements have been amended, the date listed is the date of execution of the initial loan agreement.

- The transaction documentation provides information including the interest rate, conditions, and other material and financial terms of the transactions.

CARES Act Section 4026(b) Reports

4026(b)(1)(B) Loan Report (07/15/2020)

4026(b)(1)(B) Loan Report (10/02/2020)

4026(b)(1)(B) Loan Report (10/23/2020)

4026(b)(1)(B) Loan Report (10/30/2020)

4026(b)(1)(B) Loan Report (11/04/2020)

4026(b)(1)(B) Loan Report (11/12/2020)

4026(b)(1)(B) Loan Report (11/19/2020)

4026(b)(1)(B) Loan Report (11/25/2020)

4026(b)(1)(B) Loan Report (12/08/2020)

4026(b)(1)(B) Loan Report (12/15/2020)

4026(b)(1)(B) Loan Report (12/29/2020)

4026(b)(1)(C) Loan Report (08/07/2020)

4026(b)(1)(C) Loan Report (09/06/2020)

4206(b)(1)(C) Loan Report (10/05/2020)

4026(b)(1)(C) Loan Report (11/05/2020)

4026(b)(1)(C) Loan Report (12/05/2020)

4026(b)(1)(C) Loan Report (01/04/2021)

4026(b)(1)(C) Loan Report (02/03/2021)

4026(b)(1)(C) Loan Report (03/01/2021)

4026(b)(1)(C) Loan Report (04/01/2021)

4026(b)(1)(C) Loan Report (05/01/2021)

4026(b)(1)(C) Loan Report (06/01/2021)

4026(b)(1)(C) Loan Report (07/01/2021)

4026(b)(1)(C) Loan Report (08/01/2021)

4026(b)(1)(C) Loan Report (09/01/2021)

4026(b)(1)(C) Loan Report (10/01/2021)

4026(b)(1)(C) Loan Report (11/01/2021)

4026(b)(1)(C) Loan Report (12/01/2021)

4026(b)(1)(C) Loan Report (01/01/2022)

4026(b)(1)(C) Loan Report (02/01/2022)

4026(b)(1)(C) Loan Report (03/01/2022)

4026(b)(1)(C) Loan Report (04/01/2022)

4026(b)(1)(C) Loan Report (05/01/2022)

4026(b)(1)(C) Loan Report (06/01/2022)

4026(b)(1)(C) Loan Report (07/01/2022)

4026(b)(1)(C) Loan Report (08/01/2022)

4026(b)(1)(C) Loan Report (09/01/2022)

4026(b)(1)(C) Loan Report (10/01/2022)

4026(b)(1)(C) Loan Report (11/01/2022)

4026(b)(1)(C) Loan Report (12/01/2022)

4026(b)(1)(C) Loan Report (01/01/2023)

4026(b)(1)(C) Loan Report (02/01/2023)

4026(b)(1)(C) Loan Report (03/01/2023)

4026(b)(1)(C) Loan Report (03/15/2023)

4026(b)(1)(C) Loan Report (04/15/2023)

4026(b)(1)(C) Loan Report (05/01/2023)

4026(b)(1)(C) Loan Report (06/01/2023)

4026(b)(1)(C) Loan Report (07/01/2023)

4026(b)(1)(C) Loan Report (08/01/2023)

4026(b)(1)(C) Loan Report (09/01/2023)

4026(b)(1)(C) Loan Report (10/01/2023)

4026(b)(1)(C) Loan Report (11/01/2023)

4026(b)(1)(C) Loan Report (12/01/2023)

4026(b)(1)(C) Loan Report (01/01/2024)

4026(b)(1)(C) Loan Report (02/01/2024)

4026(b)(1)(C) Loan Report (03/01/2024)

4026(b)(1)(C) Loan Report (04/01/2024)

Travel Services Agreement

Jump to section, what is a travel services agreement.

A travel services agreement is a contract between a travel agency and a client that serves as a master document governing the business relationship. A few of the most important aspects of a travel services agreement include an agency's terms and conditions, travel advisories, and planning fee terms. Consolidating all of these pieces into one master document simplifies the relationship between the two parties, making the process easier and more palatable for everyone involved.

Perhaps the biggest benefit of signing a travel services agreement lies in the protections it offers. Travel agencies are reassured that their clients have a good understanding of how the relationship will work. Travelers, on the other hand, can count on having no surprises during their trip. If anything goes wrong on either end, a travel services agreement provides vital evidence to benefit the wronged party.

Common Sections in Travel Services Agreements

Below is a list of common sections included in Travel Services Agreements. These sections are linked to the below sample agreement for you to explore.

Travel Services Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.1 2 f8k101012_ex10z1.htm EXHIBIT 10.1 TRAVEL SERVICES AGREEMENT , Viewed August 13, 2022, View Source on SEC .

Who Helps With Travel Services Agreements?

Lawyers with backgrounds working on travel services agreements work with clients to help. Do you need help with a travel services agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate travel services agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Need help with a Travel Services Agreement?

Meet some of our travel services agreement lawyers.

Ralph graduated from University of Florida with his JD as well as an LLM in Comparative Law. He has a Master's in Law from Warsaw University , Poland (summa cum laude) and holds a diploma in English and European Law from Cambridge Board of Continuous Education. Ralph concentrates on business entity formation, both for profit and non profit and was trained in legal drafting. In his practice he primarily assists small to medium sized startups and writes tailor made contracts as he runs one of Florida disability non profits at the same time. T l Licensed. in Florida Massachusetts and Washington DC this attorney speaks Polish.

Experienced business and contract lawyer. Our firm specializes in commercial litigation and dispute resolution.

I'm an attorney available to help small businesses in Georgia get started with initial business set-up, required filings, tax strategies, etc. I'm also available to draft, review, and negotiate contracts. I can draft and file real estate quit claims as well. My experience areas include small business startups, information technology, technology innovation, real estate transactions, taxes, community associations, intellectual property, electrical engineering, the business of video game development, higher education, business requirements definition, technology consulting, program management, and the electric utility industry. I work part-time for a local law firm and part-time in my solo practice. I'm also an adjunct professor at Southern New Hampshire University teaching business innovation and business law. In addition, I'm part owner, legal counsel to, and a board member of a virtual reality video game development company. I am a member of the Georgia Bar Association. Please reach out if you need attorney, documentation or consulting help in any of those areas!

Stirk Law is a law firm based in London that advises on dispute resolution, commercial and corporate arrangements, employment and private wealth. We are experts in our areas and experienced in advising on complex and high value matters in the UK and internationally. We have extensive onshore and offshore experience across a variety of areas such as the administration of trusts together with complex fraud and trust disputes. Our expertise includes the conduct of significant and high-value cases valued at up to in excess of £1 billion over a combined 40 years of legal practice in England, Jersey and Guernsey. As well as having a large international network, we work closely with a corporate investigations and risk advisory business based in London and Vienna. Together we can deliver a holistic service for cases involving fraud, dissipation of assets or other illegal activity.

Talin has over a decade of focused experience in business and international law. She is fiercely dedicated to her clients, thorough, detail-oriented, and gets the job done.

Mr. LaRocco's focus is business law, corporate structuring, and contracts. He has a depth of experience working with entrepreneurs and startups, including some small public companies. As a result of his business background, he has not only acted as general counsel to companies, but has also been on the board of directors of several and been a business advisor and strategist. Some clients and projects I have recently done work for include hospitality consulting companies, web development/marketing agency, a governmental contractor, e-commerce consumer goods companies, an online apps, a music file-sharing company, a company that licenses its photos and graphic images, a video editing company, several SaaS companies, a merchant processing/services company, a financial services software company that earned a licensing and marketing contract with Thomson Reuters, manufacturing companies, and a real estate software company.

Stan provides legal services to small to medium-sized clients in the New England region, and throughout the U.S. and abroad. His clients are involved in a variety of business sectors, including software development, e-commerce, investment management and advising, health care, manufacturing, biotechnology, telecommunications, retailing, and consulting and other services. Stan focuses on the unique needs of each of his clients, and seeks to establish long term relationships with them by providing timely, highly professional services and practical business judgment. Each client's objectives, business and management styles are carefully considered to help him provide more focused and relevant services. Stan also acts as an outsourced general counsel for some of his clients for the general management of their legal function, including the establishment of budgets, creation of internal compliance procedures, and the oversight of litigation or other outside legal services.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Business lawyers by top cities

- Austin Business Lawyers

- Boston Business Lawyers

- Chicago Business Lawyers

- Dallas Business Lawyers

- Denver Business Lawyers

- Houston Business Lawyers

- Los Angeles Business Lawyers

- New York Business Lawyers

- Phoenix Business Lawyers

- San Diego Business Lawyers

- Tampa Business Lawyers

Travel Services Agreement lawyers by city

- Austin Travel Services Agreement Lawyers

- Boston Travel Services Agreement Lawyers

- Chicago Travel Services Agreement Lawyers

- Dallas Travel Services Agreement Lawyers

- Denver Travel Services Agreement Lawyers

- Houston Travel Services Agreement Lawyers

- Los Angeles Travel Services Agreement Lawyers

- New York Travel Services Agreement Lawyers

- Phoenix Travel Services Agreement Lawyers

- San Diego Travel Services Agreement Lawyers

- Tampa Travel Services Agreement Lawyers

ContractsCounsel User

Service Contract Needed for Customer Research Projects

Location: michigan, turnaround: a week, service: drafting, doc type: service agreement, number of bids: 4, bid range: $500 - $1,500, pesticide application contract, location: new york, turnaround: less than a week, number of bids: 7, bid range: $600 - $1,000, want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Travel Loan Agreement

Traveling is an experience that rejuvenates the soul and expands the horizon of our worldview. Whether it’s a backpacking trip through Southeast Asia or a luxurious cruise through the Caribbean, travel can be costly. But, with the help of a travel loan agreement, you can easily finance your dream vacation without any financial stress.

A travel loan agreement is a contract between a borrower and a lender that outlines the terms and conditions of a loan taken for travel purposes. It helps people access funds that they may not have readily available, enabling them to travel and make memories without breaking the bank.

When you decide to take out a travel loan, it’s important to carefully read and understand the agreement before signing on the dotted line. Here are some key things to look out for in a travel loan agreement:

1. Loan amount – This is the amount of money that the lender will give you to cover your travel expenses. It’s important to ensure that the loan amount covers all of your costs, including airfare, lodging, food, and other travel expenses.

2. Interest rate – The interest rate is the cost of borrowing the money, and it’s expressed as a percentage of the loan amount. It’s important to compare interest rates from different lenders to find the best deal.

3. Repayment terms – This includes the length of the loan and the frequency of payments. It’s important to ensure that the repayment terms are affordable and realistic, and that you are able to make payments on time.

4. Late fees – Late fees are charges that are imposed when payments are not made on time. It’s important to understand the late fees associated with the loan agreement, as they can add up quickly and make the loan more expensive.

5. Collateral – Some lenders require collateral to secure the loan, such as a car or house. It’s important to understand the collateral requirements and ensure that you are able to provide the necessary collateral.

In conclusion, a travel loan agreement can be a great tool to finance your dream vacation. It’s important to carefully read and understand the agreement before signing, ensuring that the loan amount, interest rate, repayment terms, late fees, and collateral requirements are all reasonable and realistic. With careful planning and consideration, a travel loan can help you create unforgettable travel experiences while staying financially responsible.

- Search for:

Recent Posts

- Tamiu Financial Responsibility Agreement

- Southern Cross Care Nsw Act Enterprise Agreement

- M&A Agreement

- Pip Mobility Agreement

- Collateral Assignment of Purchase Agreement

- Development Agreement Ohio

- Education Partnering Agreement Requirements

- Group Purchasing Organization Vendor Agreement

- Rental Agreement Sample Wi

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- December 2020

- November 2020

Loan Agreement Sample Philippines [Free Download]

![travel loan agreement Loan Agreement Sample Philippines [Free Download]](https://filipiknow.net/wp-content/uploads/2023/10/loan-agreement-sample-philippines-featured-image-1024x576.png)

Lending or borrowing money has turned many a relationship sour. This is why you don’t enter into a loan agreement without a legal document to support it.

It’s a good thing we’ve prepared loan agreement samples that you can easily download and fill out. Whether it’s a collateral (secured) or a non-collateral (unsecured) loan, our free sample templates will help you have legal proof to hold on to if the borrower defaults or the lender demands something that isn’t included in your original agreement.