- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

9 Best Nomad Travel Insurance Options

Elina Geller is a former NerdWallet travel writer specializing in airline and hotel loyalty programs and travel insurance. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Her work has been featured by AwardWallet. She is a certified public accountant with degrees from the London School of Economics and Fordham University.

Anya Kartashova is a freelance writer and full-time traveler based in Salt Lake City. She has written about travel rewards and personal finance for FrugalTravelGuy, Fodor's, FlyerTalk, 10xTravel and Reward Expert. Her goal is to visit every country in the world by offsetting the cost with points and miles.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. World Nomads

2. safetywing, 3. atlas travel insurance, 4. allianz global assistance, 5. insured nomads, 6. img global, 7. heymondo, 8. travelex insurance, 9. aig travel guard, nomad travel insurance recapped.

Travel insurance can safeguard your nonrefundable reservations and reimburse you for any unexpected emergency medical costs that you incur while traveling. However, the travel health insurance needs of those taking several short vacations per year will vary from those of digital nomads, who may spend significant portions of the year living and working from abroad.

Digital nomads may also return home less often, travel with equipment (e.g., laptop, camera, etc.), participate in adventurous activities and want access to health insurance, especially if they don’t have that coverage back home.

Given the prevalence of remote work and increasing options to live and work from abroad, here you'll find some of the most popular nomad travel insurance options .

World Nomads is a travel insurance provider that offers coverage for residents of many countries and also allows you to extend your coverage mid-trip. It is underwritten by Nationwide Insurance. Regardless of which plan you choose, the health insurance limits are fairly good.

Importantly, the provider does not have a pandemic exclusion, so COVID-related claims are covered. However, World Nomads specifically states that fear of travel is not a valid reason for trip cancellation. So if you’d like the option to cancel a trip at your discretion, you’ll want to consider plans that offer Cancel For Any Reason coverage .

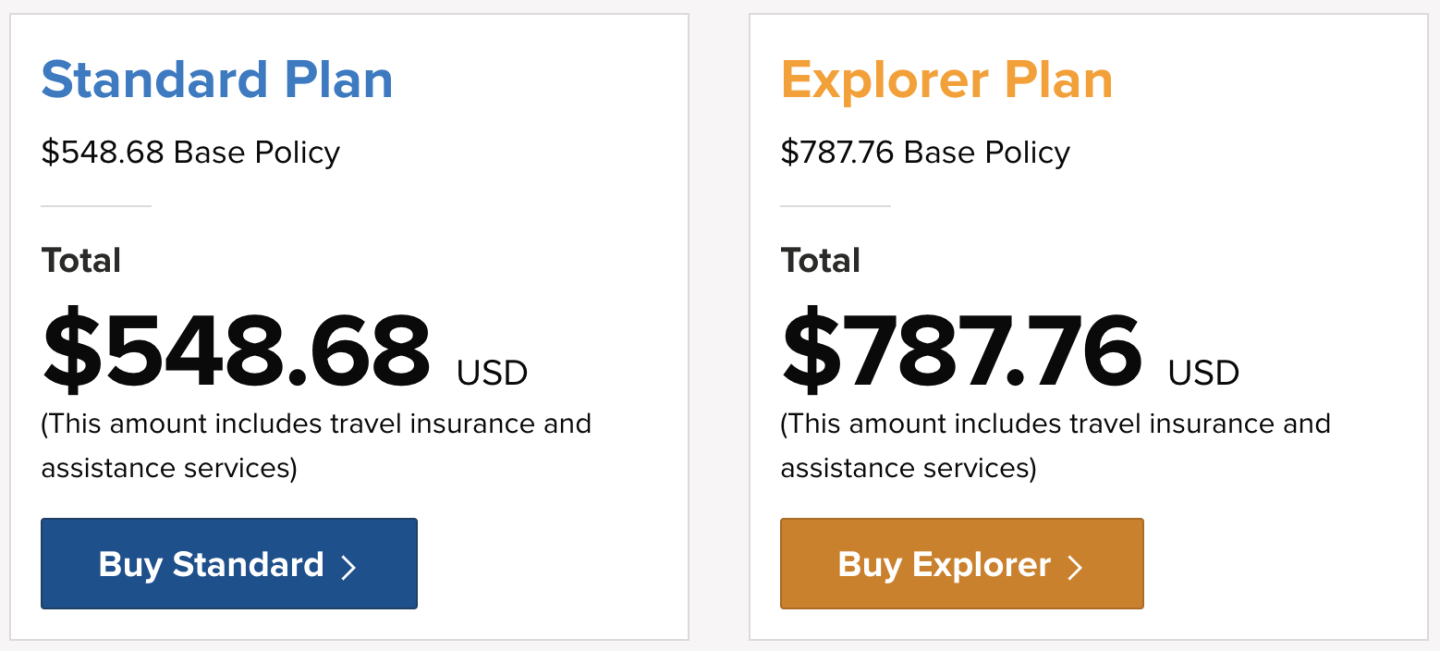

There are two trip insurance policies available from World Nomads: Standard and Explorer. The Standard Plan has lower coverage limits and includes more than 200 sports (including some adventure sports), while the Explorer Plan adds on 60 other activities and sports, including more dangerous ones such as shark cage diving, skydiving and paragliding.

The inclusion of athletic activities in both World Nomads plans is unique, since most traditional travel insurance plans exclude them.

Here's a list of what's included with World of Nomads coverage:

Trip cancellation, interruption and delay.

Emergency healthcare coverage, evacuation, repatriation and 24-hour assistance services.

Accidental death and dismemberment.

Nonmedical emergency transportation.

Baggage delay and loss.

Rental car damage (Explorer Plan only).

Adventure sports and activities.

And here are a few items of note that are excluded (not a comprehensive list):

Pre-existing conditions.

Self-harm or accidents occurring while intoxicated.

Finally, coverage can’t exceed 180 days, so if you’re traveling abroad longer than that, you’d have to renew your plan once the current coverage period ends.

To see how World Nomads compares to other travel health insurance providers, we considered a sample 180-day trip to multiple countries by a 30-year-old resident of Colorado.

Due to the lower limits and less coverage for adventure activities, the World Nomads Standard Plan is priced at $549, which is meaningfully cheaper than the $788 Explorer Plan.

It's important to note that if your nonrefundable prepaid trip costs are more than $2,500, the Standard Plan will cover you only up to $2,500 on trip cancellation. In this case, you’d want to consider the pricier Explorer Plan, which provides coverage up to $10,000 on trip cancellation. Notably, emergency accident & medical coverage is $100,000 on both plans, which offers a lot of assurance, especially if you’re abroad for a long time.

The most significant advantage of World Nomads is coverage for adventure activities. In this case, assessing the suitability of the plan has more to do with the type of coverage you’re looking for than price. Because of the multitude of advantages of World Nomads plans over various providers, we've named World Nomads as one of the best travel insurance companies out there. Check out our full rationale here: Best Travel Insurance Right Now .

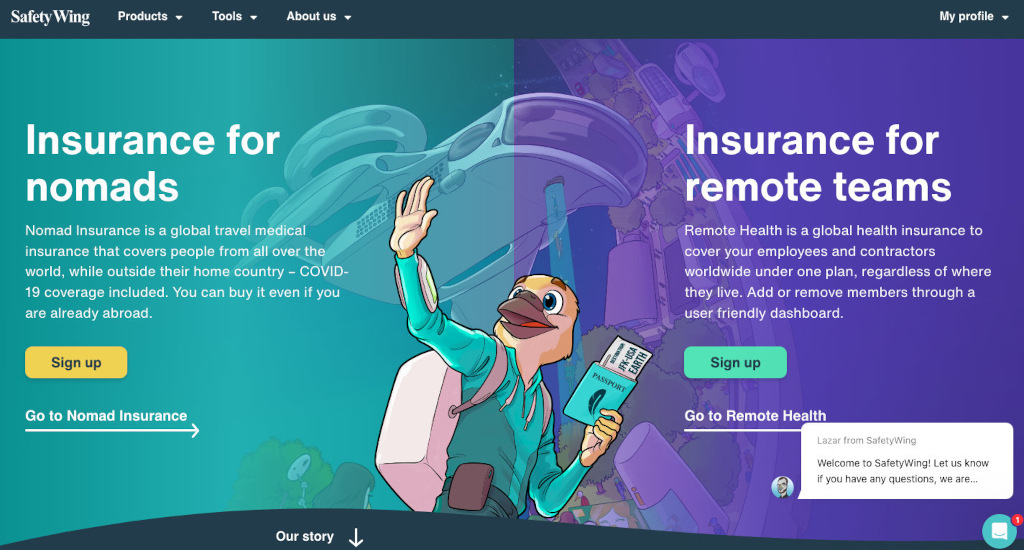

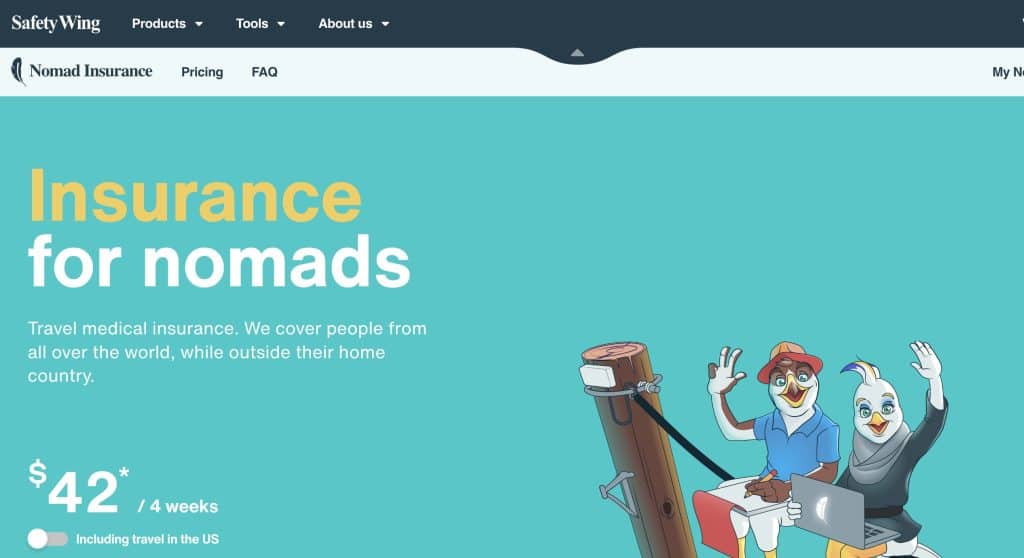

SafetyWing is another popular digital nomad travel health insurance option that also offers COVID coverage. You can purchase your policy while you’re abroad, which makes it easy for those who are already traveling and decide to get insurance coverage mid-trip.

Unless you are a resident of North Korea, Cuba or Iran, you can purchase a SafetyWing policy. The default length of coverage is 28 days, and the policy will continue to renew unless canceled (maximum policy length is 364 days).

SafetyWing also provides U.S. citizens with incidental coverage in the U.S. for up to 15 days out of every 90 days. Despite the U.S. coverage, SafetyWing is meant to provide medical and travel insurance coverage while you’re abroad; it does not meet the health insurance requirement under the Affordable Care Act.

Trip interruption and delay.

Emergency medical and dental expenses.

Emergency medical evacuation, repatriation of remains and accidental death.

Lost checked luggage and lost visa/travel documents.

Return of minor children and pets.

Political evacuation and border entry protection.

Excluded (not a comprehensive list):

Mental health disorders.

Intentional acts or damages sustained under the influence of drugs or alcohol.

The cost of a SafetyWing policy is based on your age and whether you’d like health insurance coverage while you’re in the U.S. For example, a four-week policy for someone aged 18 to 39 years old who doesn’t need health insurance coverage in the U.S. will cost $45. If you would like coverage while in the U.S., the policy cost jumps to $83.

A 180-day coverage comes out to $290 for a traveler between ages 10 and 39, but increases to $536 if you want to add on U.S. coverage. A deductible of $250 applies every time you start or renew a policy.

Overall, the options to purchase a plan mid-trip and receive health insurance coverage while in the U.S. are some of the main benefits of a SafetyWing policy.

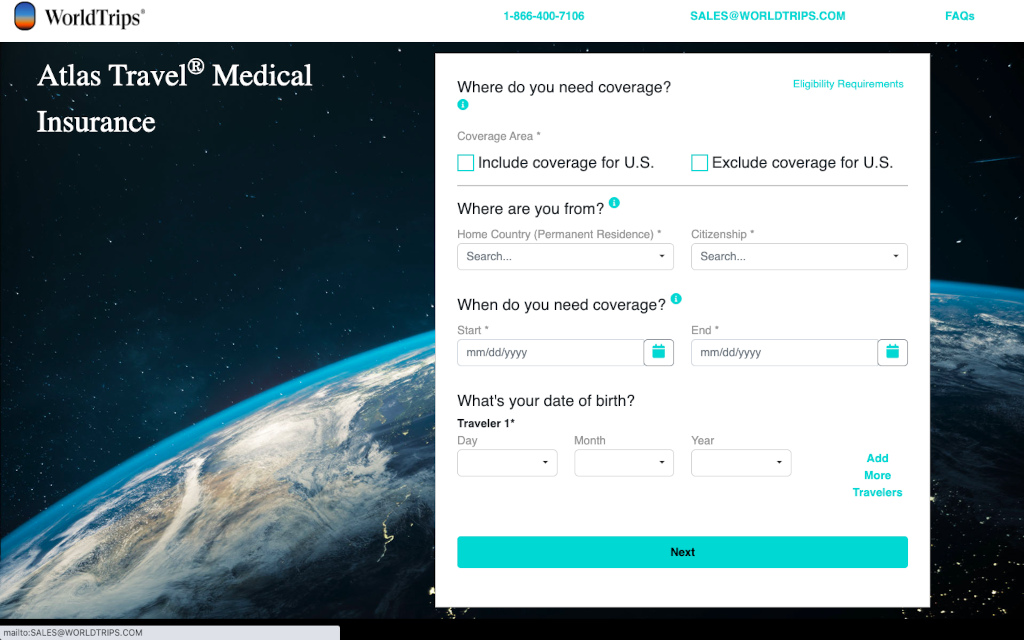

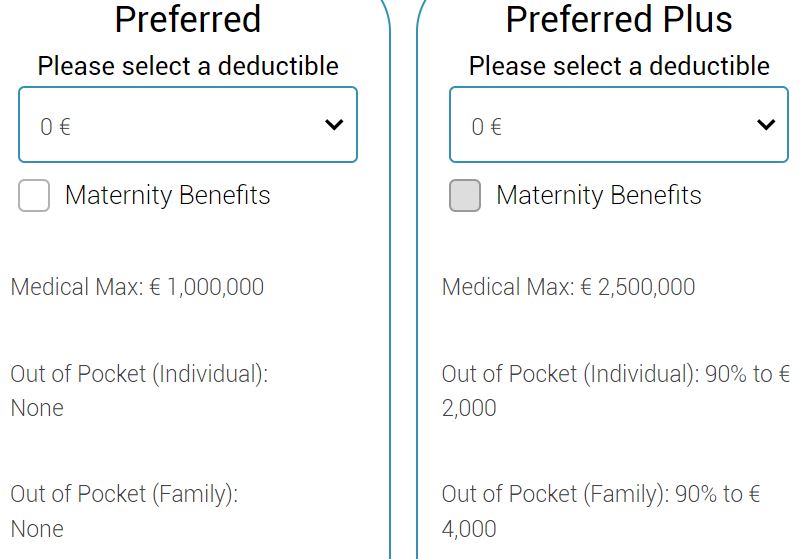

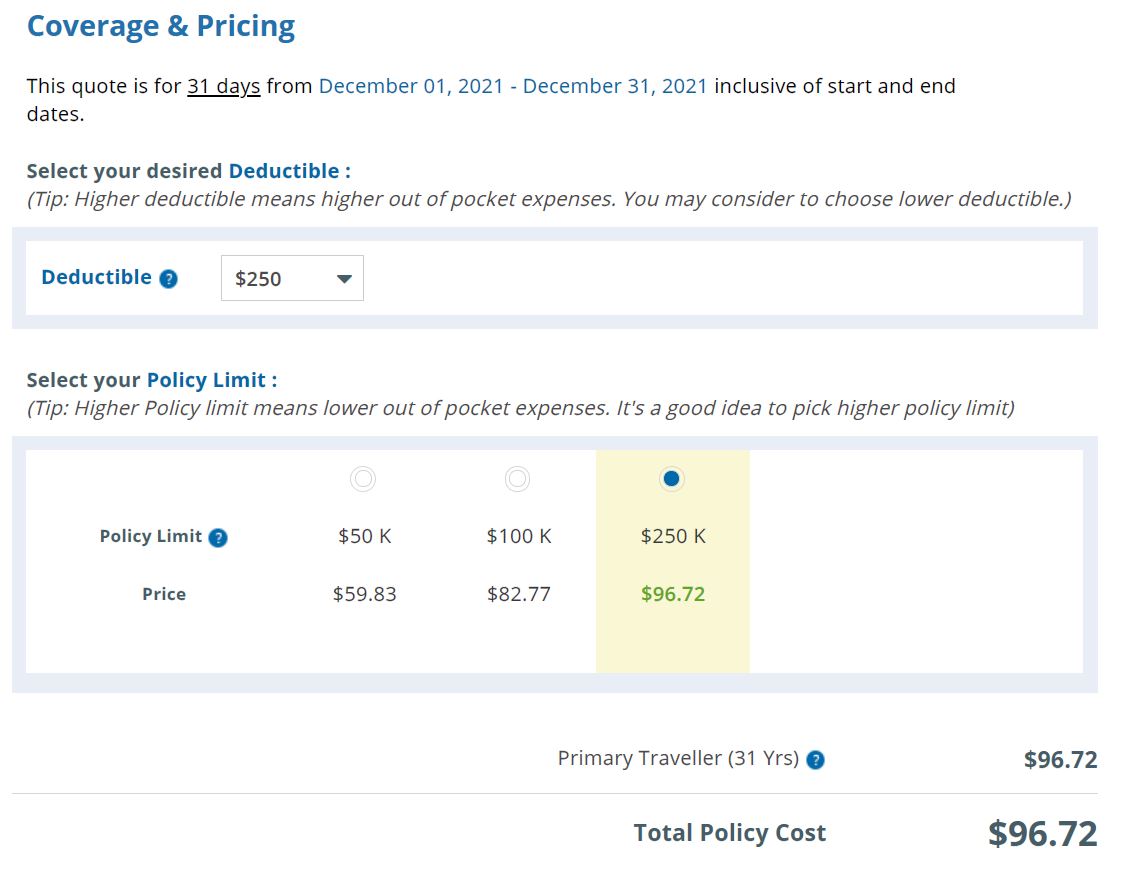

Atlas Travel Insurance offers health insurance plans for digital nomads and long-term travelers looking for medical coverage (including for COVID-19) and some supplemental trip benefits (e.g., trip interruption). When selecting a policy, you’ll need to specify if you’d like to include the U.S. within your coverage area. Coverage limits decrease with age, and the plans offer varying levels of deductibles.

Medical expenses and emergency dental.

Emergency medical and political evacuation.

Trip interruption; travel delay.

Lost checked luggage and stolen visa/passport.

Natural disaster and border entry protections.

Repatriation of remains; accidental death and dismemberment.

Many adventure sports.

Various diseases including cancer.

Self-inflicted injuries and those arising when under the influence of drugs or alcohol.

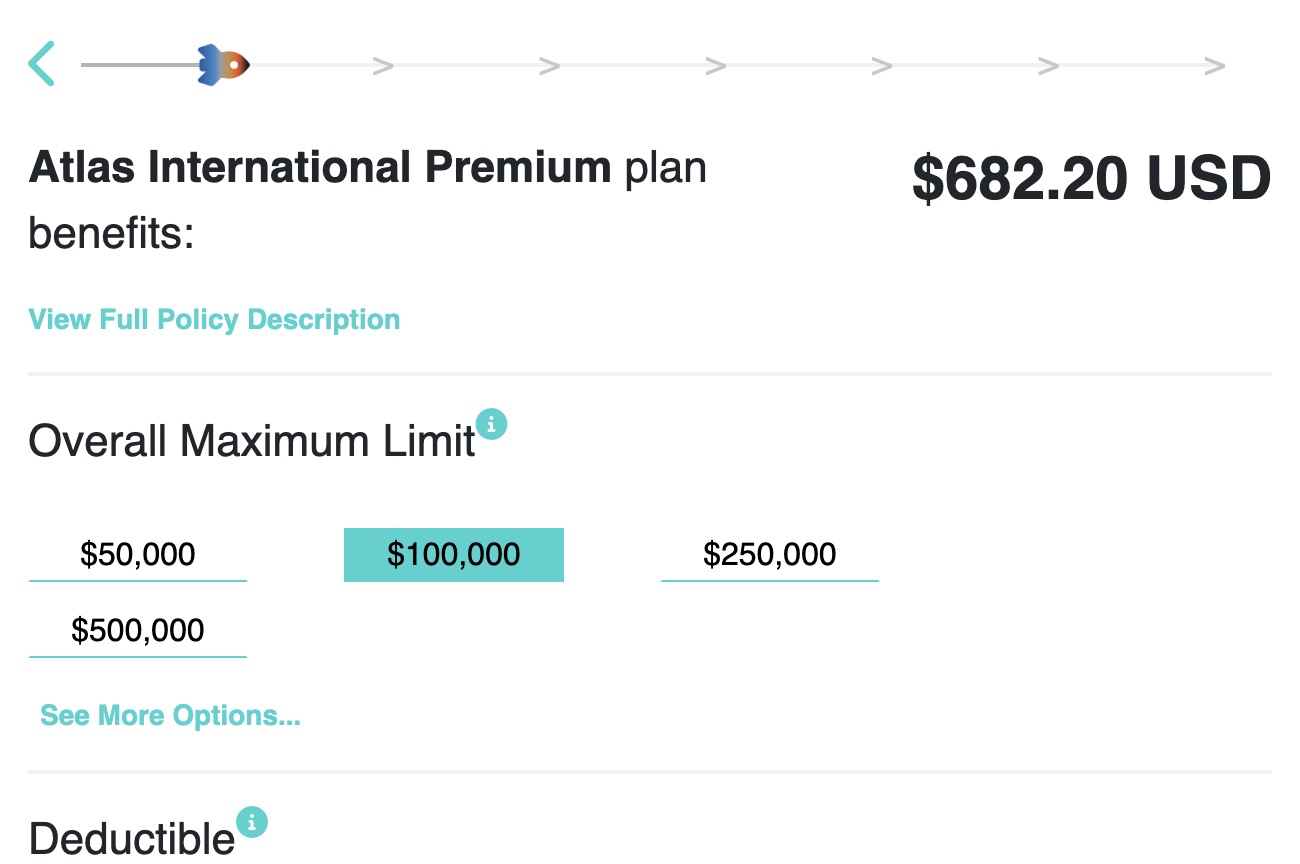

To compare these plans, we used the same parameters as the preceding example: a 180-day trip by a 30-year-old. Atlas offers two options to digital nomads: Atlas International and Atlas International Premium, which cost $274 and $682, respectively.

The main difference between these two Atlas plans is that the Premium option offers higher coverage limits.

It's also possible to customize the overall maximum limit and the deductible on both policies, so if you don’t want to go with the more Atlas International Premium plan, you can up the limits or change the deductible on the Atlas International plan.

Allianz Global Assistance offers affordable coverage for annual or multi-trip travel. It’s more cost-effective than purchasing coverage for separate trips individually. Allianz’s multi-trip policy covers trips up to 45 days in length.

Allianz is best for travelers who take multiple trips per year from their home base and not those who travel overseas for an extended period of time.

Covered illness.

Missed or delayed departures.

Baggage loss or delays.

A tropical storm (before it’s named).

Loss of passport.

Unforeseen pregnancy complications.

Losses that arise from foreseeable events.

War or civil unrest.

Participating in extreme or high-risk sports.

Flying an aircraft as pilot or crew.

Terrorist events.

Allianz plans limit or exclude coverage related to COVID-19 or resulting from Russia’s invasion of Ukraine.

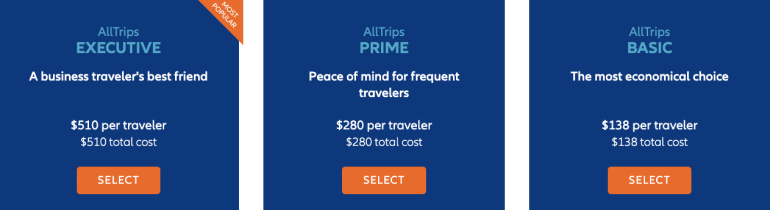

Allianz Global Assistance offers a few annual plan options to digital nomads. The plans last a full year, so keep that in mind when comparing costs with other nomad insurance providers. The plans are Basic, Prime and Executive, quoting $138, $280 and $510 per year, respectively.

The Basic insurance plan from Allianz is designed for medical emergencies and provides some travel coverage, but it doesn’t provide any trip cancellation or trip interruption coverage.

The Prime plan provides affordable trip protection and medical coverage abroad.

The Executive plan is designed for business travelers by providing higher coverage limits and rental car damage and equipment rentals. The Executive plan covers personal vacations in addition to business trips .

It's also possible to sign up for a Premier plan, which lasts up to 365 days but covers up to 90 days of consecutive travel.

Insured Nomads provides medical coverage, travel insurance and trip cancellation to digital nomads, remote workers and expats.

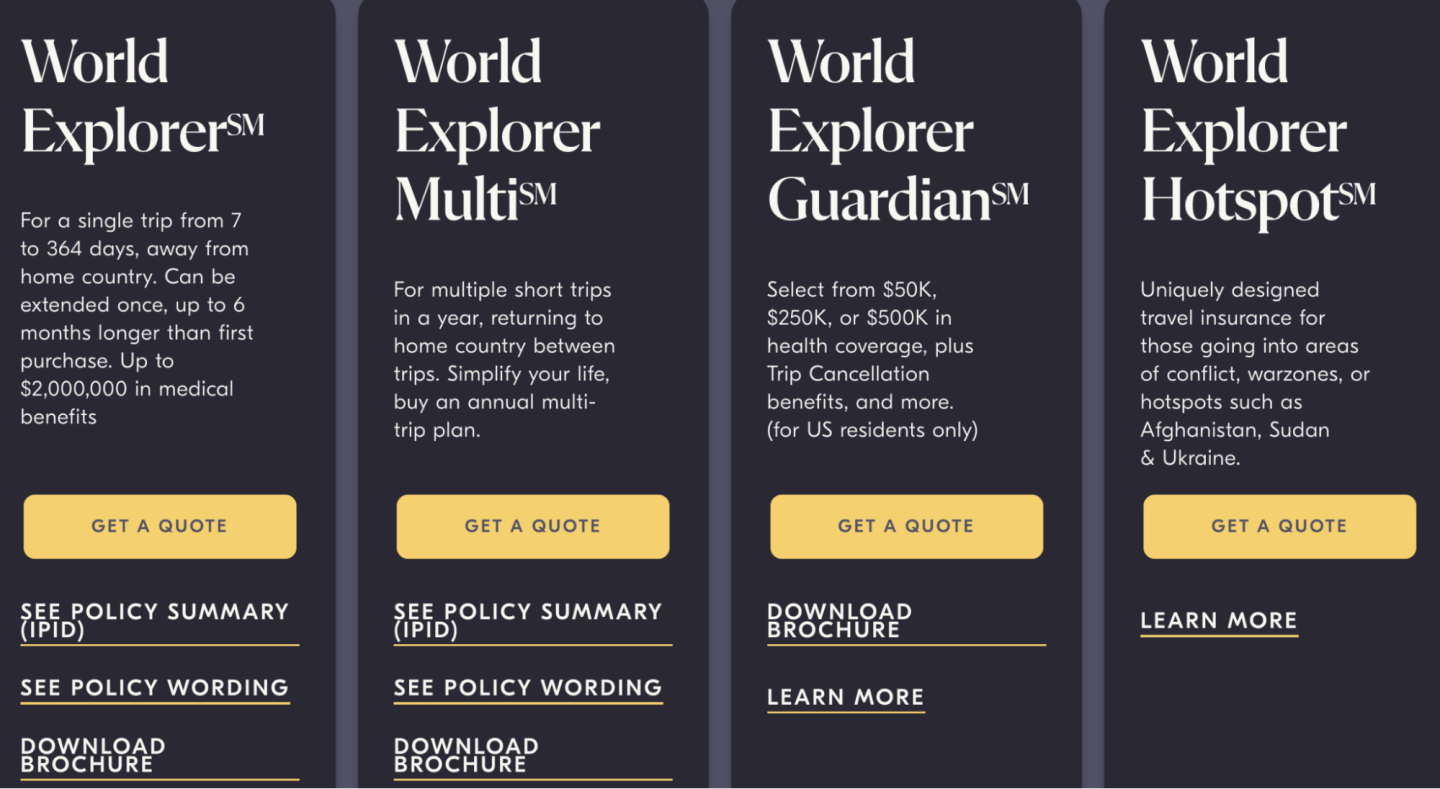

Insured Nomads offers four plans, and they all have their own function. For example, the World Explorer plan provides coverage for a single trip lasting between seven and 364 days away from home, and the World Explorer Multi offers coverage for multiple trips within a single year. Plans are available to citizens of any country, not just the U.S.

Depending on the plan, you’ll have the option to add adventure sports, pet insurance, accidental death and dismemberment and car rental insurance for an extra fee.

Medical benefits, including 24-hour emergency medical care.

COVID-19 coverage.

Acute onset of pre-existing condition.

Emergency dental treatment.

Local ambulance transport.

Natural disaster accommodations.

Evacuation and repatriation.

Airport lounge access for delayed flights.

Lost luggage.

War and terrorism.

Public health emergencies or natural disasters in countries deemed Level 4 by the U.S. Department of State.

Illegal acts.

Injuries sustained while under the influence of drugs or alcohol.

Extreme sports (unless an add-on was purchased).

The quote for a traveler between the ages of 30 and 39 looking to travel to Mexico for six months with the World Explorer plan costs $679. This plan has a medical benefit limit of $250,000 and a deductible of $100. Increasing the medical benefit maximum to $1,000,000 increases the premium to $830, and that’s without any of the additional benefits, such as adventure sports or marine activities.

» Learn more: How to find the best travel insurance

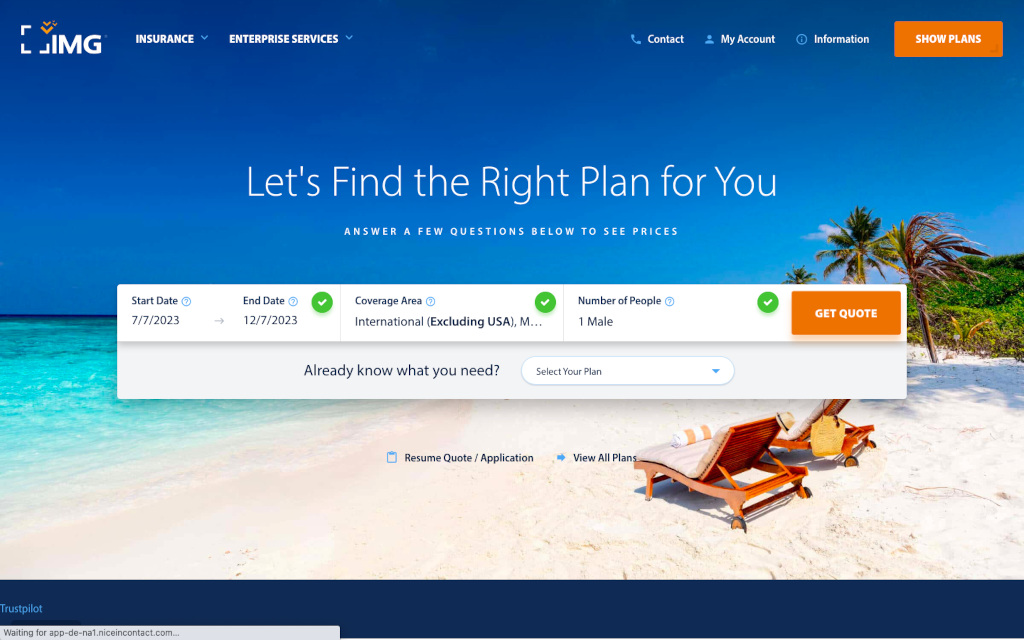

IMG Global offers an insurance plan just for expats and citizens of the world called Global Medical Insurance. It’s a medical-only plan that doesn’t offer trip protection, but offers medical coverage worldwide.

Several tiers of Global medical insurance from IMG Global are available: Bronze, Silver, Gold and Platinum. The more expensive the plan, the lower the deductible and the higher the policy maximum.

The following expat insurance rates are for a 30-year-old traveler whose primary travel destination is Spain.

The deductible amounts can be adjusted in every plan above to reduce the monthly payment. Additionally, the total coverage cost for the year can be reduced with an annual payment. An optional dental and vision rider is available for the policy you pick.

Undoubtedly, the cost is on the high end, but it does come with some noticeable extras, such as COVID-19 coverage , telemedicine and mental health professional counseling, that most travel insurance providers don’t cover.

It’s possible to purchase a World Explorer policy after you’ve left on your trip, and you can extend coverage by up to six months beyond the initial policy purchase.

In addition to the Global Medical Insurance, IMG Global offers the following plans to long-term travelers:

The Global Employer Option: Medical coverage for internationally assigned employees.

International Marine Medical Insurance: Health insurance for long-term (longer than one year) marine crew.

MP+ International: Group travel insurance for mission groups.

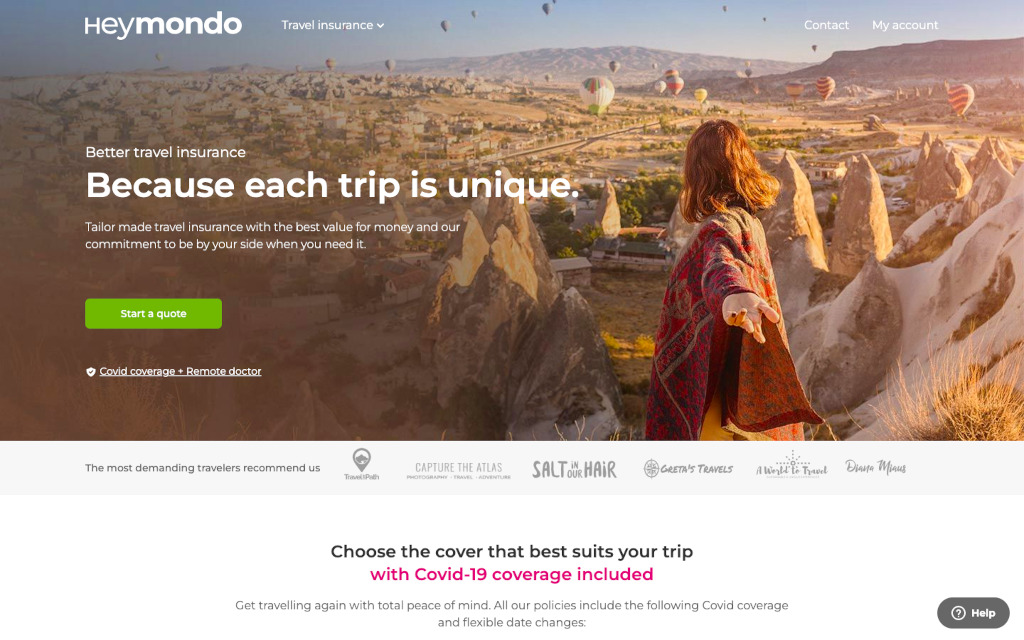

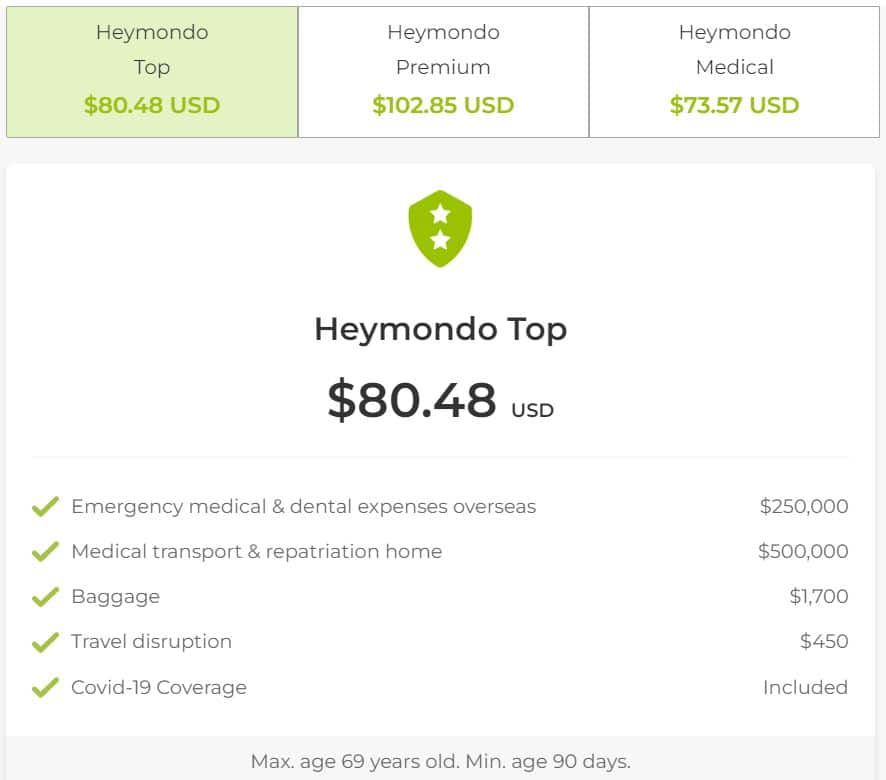

Heymondo offers comprehensive travel insurance plans to short-term and long-term travelers. Digital nomads and expats can purchase a Long Stay plan for trips longer than 90 days. The initial coverage is capped at 90 days, but you can renew if necessary. You can also add electronics and adventure sports riders to the Long Stay policy at an extra cost.

Coverage is available to travelers between 90 days old and 49 years old.

What’s included :

Emergency medical and dental coverage (with a $250 deductible).

Medical transport and repatriation home.

Baggage delay , theft and loss.

Travel delay or a missed connection.

Natural disaster.

Personal liability.

Accidental death or disability.

What’s not included (not a comprehensive list):

General medical check-ups.

Trips aimed at receiving medical treatment.

Burial, ceremony and coffin costs in the repatriation of remains.

Petty theft.

Damage caused by strikes, earthquakes or radioactivity.

Motor vehicles.

A 90-day global coverage that excludes travel to Canada and U.S. costs $257 upfront. You can renew coverage once it expires or prepay for additional coverage at the following prices:

30 days: $76.

120 days: $304.

180 days: $456.

275 days: $731.

Notably, medical coverage includes COVID-19, including medically prescribed PCR tests and extra lodging expenses when you’re prescribed a medical quarantine .

» Learn more: Best long-term travel insurance options

Travelex Insurance offers long-term nomad insurance with its Travel Select plan, which is one of the provider’s comprehensive travel insurance plans . This plan covers trips up to 364 days. You must select travel dates and provide the cost of your trip to get a quote.

A 30-year-old Colorado resident traveling to Italy for six months will pay $734 for a Travel Select plan from Travelex Insurance to cover a trip that costs $5,000. It comes with:

100% trip cancellation.

150% trip interruption.

$2,000 trip delay (with a $250 daily limit).

$1,000 baggage loss.

$200 baggage delay.

$50,000 emergency medical expense.

$500,000 emergency medical evacuation and repatriation.

$25,000 accidental death and dismemberment.

Pre-existing conditions waiver : available if purchase conditions are met (more on this below).

Add-ons to the Travel Select plan include double the medical expense, adventure sports rider, car rental collision protection , extra accidental death and dismemberment coverage and even Cancel for Any Reason coverage covering 75% of the insured trip's cost (though the covered trip cost maxes out at $10,000).

The good thing about this plan is it provides coverage for pre-existing conditions as long as you pay for insurance within 15 days of the initial trip deposit. Most annual policies notably exclude a pre-existing conditions waiver.

The bad thing is its high cost because of all the bells and whistles of a comprehensive plan.

AIG Travel Guard offers an annual plan that provides essential coverage to business and leisure travelers who are U.S. residents (not available for Washington state residents).

The Travel Guard Annual Plan is an option for travelers who take multiple trips within a single year (364 days), with a limit of 90 days per trip.

100% trip interruption.

Trip delay.

Missed connection.

Baggage loss or delay.

Medical expenses, including dental.

Emergency evacuation and repatriation of remains.

Non-flight accidental death or dismemberment.

Security evacuation.

War or acts of war.

Participation in a riot, civil disorder or insurrection.

Commission or an attempt to commit a felony.

Being under the influence of drugs or intoxicated above the legal limit.

Trips taken against a physician’s advice.

Release, escape or dispersal of nuclear or radioactive contamination, and pathogenic or poisonous biological or chemical materials.

A Travel Guard Annual Plan comes out to $242 for a Colorado resident, which is a pretty good deal considering all the inclusions — but remember that your trips cannot exceed 90 days each, so its usage is limited to remote workers taking shorter trips.

» Learn more: How much does travel insurance cost?

Expats and digital nomads have different travel health insurance needs than the average traveler, so choosing a policy that aligns with your travel style is advisable.

If you’re looking for adventure sports coverage, World Nomads, Insured Nomads, Heymondo and Travelex Insurance all have the option to add a rider to their policies.

However, if those benefits aren’t relevant to you and you’d instead prefer to have the option of medical coverage when you’re abroad (and to a certain degree while you’re in the U.S.), consider SafetyWing or Atlas, which offer this feature. For medical-only coverage, IMG Global provides some options, albeit pretty expensive ones.

Additionally, take into consideration your travel style. Are you taking one long trip or multiple shorter trips within one year? Because Allianz and AIG Travel Guard won’t work well if you plan to be abroad longer than the limit specified in the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 7 Best Travel & Health Insurance for Digital Nomads (By Nomads)

- December 4, 2023

FREE DOWNLOAD: 20 QUESTIONS THAT WILL CHANGE YOUR LIFE(STYLE)

A simple roadmap for setting up a life you don’t need to escape from.

- Digital Nomad

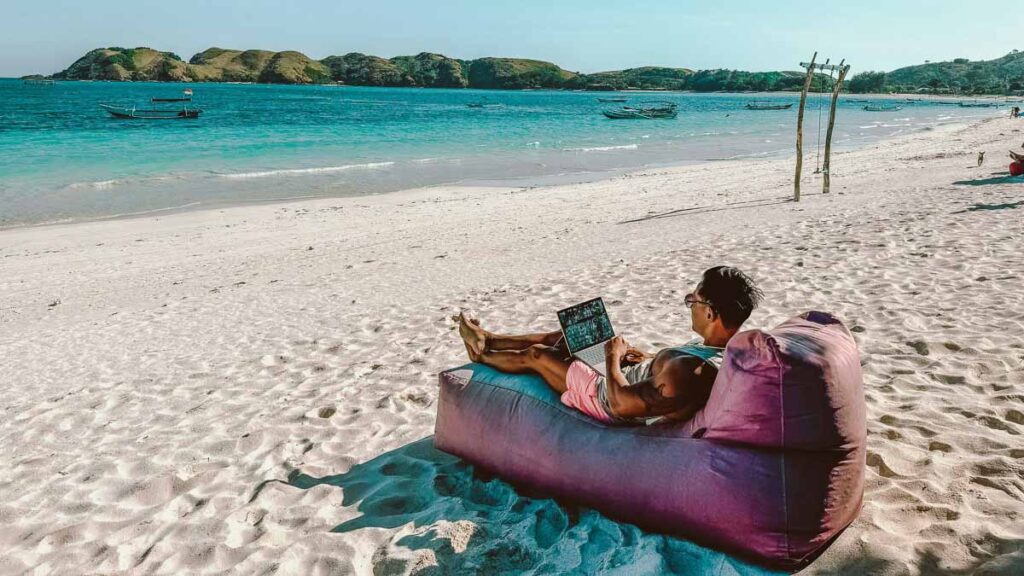

Ever wondered how to guard your health while gallivanting across the globe? As you navigate the labyrinth of worldly wanderings, ensuring your wellbeing is paramount. We delve into the best travel and health insurance solutions, tried, and tested by fellow nomads. An exploration of safety nets, tailored for those who trade skyscrapers for skylines and office blocks for breathtaking landscapes. Journey fearlessly, protected by the power of foresight and preparation.

Flâneur Life Team

The life of a digital nomad can be an exciting blend of work, travel, and adventure. While the freedom and flexibility of this lifestyle can be immensely rewarding, it also comes with its share of responsibilities—one of the most significant being health insurance.

As a digital nomad, your health is your most valuable asset, and safeguarding it should be a top priority. This comprehensive guide will delve into the crucial topic of health insurance for digital nomads. We’ll explore why it’s vital, what options are available, and how to choose the best policy for your unique lifestyle.

The world of health insurance may seem complex, but with the right information, you can make informed decisions that protect both your health and your finances as you journey around the globe.

So, let’s dive in and ensure that your nomadic adventures are covered, every step of the way.

Why the Need for Health Insurance as a Digital Nomad

Navigating health insurance options for digital nomads, safetywing nomad health insurance, world nomads travel insurance, genki nomad travel medical insurance, insured nomads travel insurance, passportcard nomads insurance, atlas travel insurance, img global travel insurance, global digital nomad travel insurance, digital nomad travel insurance: beyond health coverage, personal stories and experiences, frequently asked questions about digital nomad insurance, parting words.

Whether you’re diving into the turquoise waters of Bali or scaling the Andes in Peru, being a digital nomad often means embracing a lifestyle filled with adventure. This thrill, however, comes with its share of risks.

As a digital nomad, you might find yourself susceptible to a range of health issues, from commonplace illnesses and injuries to serious medical emergencies. Additionally, regular exposure to different environments and climates can take a toll on your health.

Take, for instance, all of these scenarios:

- Slip and fall accidents in unfamiliar environments

- Food poisoning or other food-related illnesses

- Injuries from outdoor activities like hiking or water sports

- Motor vehicle accidents, such as car or scooter crashes

- Heatstroke or sunburn from spending excessive time outdoors

- Altitude sickness when traveling to high-altitude destinations

- Animal bites or stings, particularly in rural or wildlife-rich areas

- Accidental consumption of contaminated water leading to waterborne diseases

- Travel-related diseases such as malaria or dengue in certain countries

- Unforeseen medical emergencies such as heart attacks, strokes, or appendicitis

- Injuries during workouts or physical exercises

- Mishaps during adventure sports like skydiving, bungee jumping, or scuba diving.

While many may believe that their standard health insurance is enough, this often isn’t the case.

The Issue With Traditional Insurance Policies

Traditional insurance policies usually provide coverage within your home country, with limited or no benefits when you are overseas. Furthermore, they might not cover routine checkups and preventive care, which are essential for those frequently on the move. This is why it’s important for digital nomads to invest in dedicated health insurance that’s designed to meet their unique needs, providing coverage across borders and peace of mind on their nomadic journey.

Navigating the world of health insurance as a digital nomad can feel like traversing a labyrinth, but understanding your options and key features can make the journey much smoother.

While the specifics of each plan may vary, there are certain common elements that should be at the forefront of your considerations:

- Flexibility: The life of a digital nomad is often unpredictable. So, the insurance plan should be flexible in terms of coverage duration, allowing for extensions if required.

- Global Coverage: As a digital nomad, you’re not just in one place. Hence, your health insurance should provide comprehensive coverage irrespective of your location. Look for plans that offer international coverage, excluding only a few high-risk countries.

- Coverage for Common Travel Accidents: The plan should cover accidents that are common during travel such as injuries from adventure sports, road accidents, or food and waterborne illnesses.

- Emergency Evacuation: It’s critical to have a plan that covers emergency medical evacuation, especially if you travel to remote areas. This feature covers the cost of transporting you to a medical facility in case of severe illness or injury.

- Routine Health Care: While it’s essential to be covered for emergencies, don’t overlook routine healthcare. Some plans offer coverage for regular check-ups, vaccinations, and preventive healthcare.

- Direct Billing: Direct billing can be a lifesaver in a medical emergency. This means the insurance company pays your medical bills directly, so you don’t have to worry about upfront costs.

As you sift through various health insurance options, keep these key features in mind. But remember, there’s no one-size-fits-all solution. Your choice should align with your travel itinerary, health condition, budget, and personal preferences.

Popular Digital Nomad Insurance Providers

Navigating the landscape of digital nomad insurance can seem daunting, but certain providers stand out for their dedicated services tailored to the needs of this unique community.

Here, we take a closer look at the prominent players:

Known as the ‘insurance for nomads, by nomads’, SafetyWing offers a comprehensive package catering specifically to the needs of digital nomads. Their coverage is flexible, allowing you to buy insurance while already traveling, with the option to choose your home country as a coverage area. They also provide coverage for unexpected illnesses or injuries, including eligible expenses for hospital, doctor, or prescription drugs. SafetyWing operates on a subscription model, which can be a handy feature for digital nomads with an unpredictable schedule. However, it’s important to carefully review their terms as there may be some location and activity exclusions.

Founded by a fellow traveler, World Nomads has been a trusted name in the travel insurance industry for years. It offers flexible and comprehensive coverage designed specifically for nomads and long-term travelers. From emergency medical expenses and evacuation to trip cancellation and gear protection, World Nomads aims to provide wide-ranging coverage. A standout feature of World Nomads is their coverage for a large number of adventure activities, which makes them a popular choice among adventurous nomads. They also have a strong online community and provide plenty of resources for travelers. As with all insurance, it’s crucial to understand what is and isn’t covered, especially regarding pre-existing conditions and high-value gear.

Tailored for digital nomads and remote workers, Genki Nomad Travel Medical Insurance provides coverage for a wide range of medical emergencies during your travels. Their packages are flexible and scalable to meet varying requirements. Genki Nomad stands out with their dedicated support for mental health, which is not commonly covered in travel insurance.

Insured Nomads offers a suite of insurance products designed with the nomadic lifestyle in mind. They provide a combination of travel and health insurance with various tiered plans. Their coverage includes medical expenses, trip interruption, and lost luggage. They also provide unique features like identity theft protection and benefits for accidental death or dismemberment.

PassportCard provides a real-time payment card for medical treatments, removing the need for out-of-pocket payments or claim forms. Their offerings are comprehensive, covering not just medical emergencies but also cancellation, interruption, and delay, as well as baggage loss or delay. They provide 24/7 global assistance, ensuring help is always a phone call away.

Atlas Travel Insurance, administered by Tokio Marine HCC – Medical Insurance Services Group, provides coverage for international travelers. This includes coverage for unexpected medical expenses, emergency medical evacuation, and complications of pregnancy. They also cover travel-related incidents like lost checked luggage and trip interruption. The company is known for its flexibility, offering insurance policies from 5 days up to 1 year.

International Medical Group (IMG) provides a comprehensive range of international medical insurance and travel insurance products for every insurance need. Whether you need individual coverage for a vacation, long-term coverage for a long-distance adventure, or group coverage for employees in locations around the world, IMG has a product to meet your needs. They provide a variety of plans so you can find the one that best fits your travel lifestyle.

Travel insurance is an essential part of any nomad’s travel checklist. Unlike traditional health insurance, travel insurance is designed to cover a variety of unexpected incidents that may occur while traveling, including but not limited to medical emergencies, trip cancellations, lost belongings, and more.

As a digital nomad, your lifestyle involves constant movement, and securing global coverage becomes pivotal. Not just for those worst-case scenarios of health emergencies, but also for minor hiccups on your journey that can otherwise cause considerable inconvenience.

Several insurance companies offer comprehensive global travel insurance plans tailored to the needs of digital nomads. These policies usually provide worldwide coverage and take into account the unique needs of individuals who work while traveling.

Here are a few popular global nomad travel insurance options to consider:

- Safety Wing Nomad Insurance: Safety Wing offers a flexible payment system with coverage in over 180 countries. It provides both travel and medical coverage, including coverage for COVID-19.

- World Nomads Travel Insurance : World Nomads is recognized for its comprehensive coverage, including adventure sports that many other insurers exclude. They also allow policy purchases when already traveling.

- Insured Nomads Travel Insurance: Insured Nomads offers comprehensive travel insurance, including benefits for interruption, delay, and lost baggage, alongside their health coverage.

- Atlas Travel Insurance: Atlas is known for its wide-ranging medical benefits, including hospitalization, outpatient treatment, emergency medical evacuation, and more.

- IMG Global Travel Insurance: IMG Global offers a range of plans to cater to different travel needs. Its policies include coverage for medical emergencies, trip interruption, and even political evacuation.

While these options have excellent reputations, always assess your personal needs and risks before selecting a plan. Consider factors like the length of your travel, destinations, planned activities, and your overall health condition. Always read the terms and conditions carefully, ensuring the coverage provided aligns with your lifestyle and work needs.

As a digital nomad, your travel insurance needs go beyond just health coverage. The life of a digital nomad, while full of adventures and excitement, is not devoid of unexpected challenges and obstacles. This is where travel insurance steps in, providing a safety net for issues that are not necessarily health-related but can still impact your journey significantly.

From trip cancellations and interruptions due to unforeseen circumstances to lost luggage or stolen equipment, these inconveniences can disrupt your schedule and work, not to mention potentially incurring substantial costs. Therefore, having a robust travel insurance policy that covers such eventualities is essential.

When choosing your travel insurance, you should consider:

- Coverage Scope: Ensure the policy covers not just medical emergencies but also other travel-related issues like trip cancellation, delay, lost or delayed baggage, and more.

- Equipment Coverage: As a digital nomad, your work equipment is crucial. Make sure your policy includes coverage for lost, stolen, or damaged equipment like laptops, cameras, etc.

- Adventure Activities: If you’re the adventurous type and plan on participating in extreme sports or activities, check that your policy covers these. Some insurance companies may exclude certain high-risk activities.

- Global Coverage: Since you’re likely to be hopping from one country to another, ensure that your travel insurance provides worldwide coverage.

- Flexibility: Look for a policy that allows you to extend or curtail the coverage period according to your travel plans.

Remember, each digital nomad’s needs are unique, and so should be their insurance coverage. Therefore, make sure you pick an insurance policy that aligns with your specific requirements, offering maximum coverage and peace of mind as you embark on your nomadic adventure.

Real-life experiences from fellow digital nomads provide invaluable insights, often shedding light on situations that you might not have considered while purchasing insurance.

In a recent poll conducted in our Facebook group, we found that a staggering 77% of participants that has coverage had needed to use their travel or health insurance at least once during their nomadic journey. This substantial figure underscores the crucial importance of insurance for those living the digital nomad lifestyle.

From the same survey, here are a personal stories that highlight the importance of having good insurance coverage:

- “I was in Bali when I met with a scooter accident. I ended up with a broken arm and a hefty medical bill. Thankfully, my insurance covered the hospital expenses, and I could focus on recovering without worrying about the financial strain.” (Alicia M)

- “While in Mexico, I contracted a severe stomach bug. My insurance provided coverage for the hospital stay and the necessary medications. It’s a relief knowing that you’re covered when you’re in a foreign country and feeling your worst.” (Jake M)

- “During a trip to Thailand, my laptop was stolen from my accommodation. It was a significant setback, both financially and work-wise. However, my travel insurance policy included coverage for stolen equipment, which helped me replace my laptop quickly and get back to work.” (Lily P)

- “I had planned a workcation in Portugal, but my flight got cancelled due to bad weather. The airline refused to compensate, but my travel insurance covered the costs of the cancelled flight. It saved me a lot of money and stress.” (Sam C)

These stories underscore the value of having insurance as a digital nomad. It’s a safety net that protects you from unforeseen expenses, allowing you to enjoy your nomadic lifestyle with peace of mind.

Whether it’s a health crisis, equipment loss, or trip cancellation, a good insurance policy ensures you’re covered, leaving you free to focus on your work and travel.

What is nomad insurance?

Nomad insurance is a type of travel insurance designed specifically for digital nomads and long-term travelers. It typically covers medical expenses, emergency evacuations, trip interruptions, and sometimes gear protection. Companies like SafetyWing and World Nomads specialize in such policies, which are designed to provide coverage for an extended period, often globally.

What is the alternative to SafetyWing Insurance?

An alternative to SafetyWing Insurance for digital nomads and long-term travelers is World Nomads. It offers similar coverage, including medical expenses, emergency evacuation, and trip interruption. Other alternatives include traditional travel insurance providers or international health insurance companies, depending on your specific needs.

Does travelers insurance still exist?

Yes, travel insurance still exists and is widely available. It’s a type of coverage that helps protect against unforeseen problems before or during a trip, such as cancellations, medical emergencies, or lost luggage. Providers include World Nomads, SafetyWing, and many traditional insurance companies. It’s recommended for international travel and trips with significant prepaid expenses.

How to extend World Nomads travel insurance?

To extend your World Nomads travel insurance, log in to your online account and navigate to your policy details. Look for an option to “extend” or “manage” your policy. If your current policy is still active, you should be able to purchase an extension. Remember to review the updated policy details and price before finalizing the extension.

As we wrap up this discussion on digital nomad health insurance, let’s remember that while our globe-trotting adventures can be full of unexpected joys, they can also bring unforeseen challenges. Ensuring your health is well-protected offers not just medical security but peace of mind. Investing in the right health and travel insurance allows you to focus on embracing the digital nomad lifestyle to its fullest, knowing you’re safeguarded against health-related hiccups.

We’d love to hear from you now. Have you had an experience where health or travel insurance saved the day? Or perhaps you have some tips to share on navigating the insurance landscape as a digital nomad? Share your thoughts and experiences in the comments below. Safe travels and stay healthy!

You might also like this related posts:

- Best Digital Nomad Books

- Best Digital Nomad Podcasts

- What is a Digital Nomad? (And How to Become One)

- Digital Nomad Packing List

- 85 Digital Nomad Locations Around the Globe

- Best Digital Nomad Blogs

Originally Published: July 7, 2023

Our website is supported by our users. We may earn a small commission when you make a purchase through links on our site at no additional cost to you.

Leave a Reply Cancel reply

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Let’s Connect

Blog CATEGORIES

MOST RECENT Posts

Gold LIRA: How to Buy Gold With a Locked-in Retirement Account

Where to buy gold in canada: a trusted buyer’s guide, gold tfsa: how to hold gold in your tax-free savings account, gold rrsp in canada: everything you need to know.

Ready to create your own freedom?

Kickstart your journey towards autonomy today.

To propel you forward, we’ve created a complimentary 7-day, 7-minute series – a daily challenge in Choose-Your-Own-Adventure style! Immerse yourself in the wealth of tools and tactics essential to crafting your own life of freedom, regardless of where you’re starting from.

Simply click the button below to sign up completely free!

- Related Posts

Cheapest Countries to Travel To: Guide to Affordable Adventuring

How to Choose a Country to Live in (For Digital Nomads and Expats)

How to Balance Work and Play While Traveling: A Nomad’s Guide

Best Travel Insurance for Digital Nomads (Pros & Cons)

What is the best travel insurance for digital nomads? Traveling since 2020 full-time we got asked that question many times.

We have done tons of research , not only for this blog post but also for ourselves. Because as a digital nomad travel insurance is very important.

Spending a long time away from home increases the chance that you will need travel insurance. But many travel insurance providers cater to holidaymakers and not long-term travelers.

So we went on a quest to find the best digital nomad travel and health insurance we could actually sign up for. We will share the best we came across in this blog post!

7 Factors to consider when purchasing travel insurance for digital nomads

The best travel insurance is the one that covers your individual needs as a digital nomad. Because as a digital nomad, you will have different needs than the average traveler. So read on to find out what to look out for when choosing!

#1 Flexibility

In my opinion, this is one of the most important factors you should take into account when looking for an insurance provider.

Traditional insurance providers always ask for a fixed start and end date for your travels. They also ask what countries you are going to visit.

This is often impossible for nomads to answer because you may be going to many countries at a time like us. Plus your plans could change so it’s hard to plan in advance.

This is why it is great to have a provider that will allow you to be flexible about what countries you will visit, how long you can sign up for, and when or how you can cancel your membership.

#2 Where you can sign up from

As a nomad, you may be away from your home country for months or years at a time. We both are! But some insurance providers will only allow you to sign up for a plan from your home country.

This can be extremely inconvenient so it is best to look for a provider that allows you to sign up from anywhere in the world.

#3 Deductibles

A deductible is an amount you have to pay before your insurance provider will start paying your bills.

An example : You have a $800 dollar hospital bill and your deductible is $250. You will have to pay $250 and your insurance provider will pay the rest.

Some insurance providers will offer zero deductibles but then you have to pay a higher monthly rate. While others will offer higher deductibles with lower monthly rates. This one is up to your preferences.

#4 Loss or theft of luggage covered

As a nomad, I think one of the crucial areas that you want to be covered for is the loss or theft of baggage. We don’t own anything else than our luggage so it’s very important to us.

Most of us also rely heavily on our laptops and other electronics to make a living so you want to make sure your insurance provider will cover you.

Many plans will only cover medical treatments so you need to read the terms to make sure loss, damage, or theft of personal possessions is covered if that’s of interest to you.

#5 Adventurous activities covered

If you are planning on doing sporty activities such as skydiving, bungee jumping, diving, rafting, and skiing then you want to make sure that your plan covers injuries arising from these activities.

Many travel insurances for digital nomads do not cover these activities and it could leave you with a very big hospital bill if you get in trouble in the wrong country.

Which activities you would like to have included is highly individual. So make sure to read the terms of each plan to see exactly what is covered.

#6 Ease of making a claim

Trying to make a claim is usually the worst part of dealing with insurance companies. They are usually quick to take your money and slow to give it back to you when you need it!

So you want to pick a provider that has a proven track record of paying out claims and not making you jump through thousands of bureaucratic hoops.

I have read through many reviews to assess how reliable the insurers are in paying out claims and to get an idea of what the best travel insurances for digital nomads are in practice.

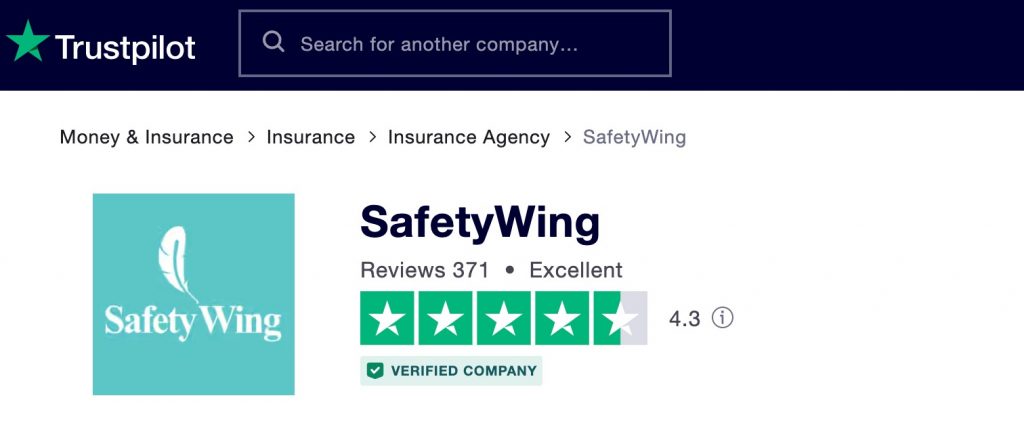

#7 Review Score

How can you know if the insurance is a good one? Read the reviews! Tons of reviews. Because the best way to judge a provider is by knowing what real customers are saying.

I went through hundreds of reviews to see if companies are reliable, keep their promises, and offer an overall good customer experience . Because if you need them it shouldn’t be an extra burden.

I mainly checked Trustpilot and if they were not on there I check other review sites. So with all the factors out of the way let’s check out my list of the best travel insurance for digital nomads.

1. SafetyWing (Overall best travel insurance for digital nomads)

SafetyWing is a newcomer to the insurance scene but has become very popular recently. We have chosen SafetyWing because it is one of the best travel insurance for digital nomads.

One of the best things about SafetyWing is that it was specifically made for digital nomads. This means that it is super flexible and you can sign up from anywhere in the world.

When you sign up you only pay for the first month . Your contract will then auto-renew every month and the payment will be taken from your bank account. That means you can cancel or pause anytime.

SafetyWing Pricing

Plans start at about $45 per month and cover you everywhere in the world excluding the US. You can get coverage for the US but it will almost double the price.

What is covered?

- Max medical coverage $250,000

- Emergency dental care up to $1,000

- Physical therapy and chiropractic care up to $50 per day

- Lost checked luggage up to $3,000

- Travel delays of up to $100 per day

SafetyWing Reviews & Our Experience

SafetyWing has a Trustpilot score of 4.2 . Some reviews complain that the claim process is slow and communication is not the best. But so far we only had a good experience.

We already filed a claim with SafetyWing nomad insurance and although it wasn’t the smoothest process we received compensation for our claim quickly.

We also had fast and friendly customer service via live chat on their website. A feature we both love – no exhausting email threads or phone lines!

SafetyWings sign-up process is also super easy and straightforward. No bureaucratic hoops to jump through or endless papers to fill out. You can get your digital nomad insurance in under 15 minutes.

- Can sign up from anywhere fast

- Super flexible with pausing and canceling

- Low monthly rate

- 24/7 live chat

- Made for digital nomads

- New Company

- People reported a hard time filing claims

- No coverage for lost, stolen, or damaged possessions

- Quite a high deductible $250

👉 Check out SafetyWing travel insurance for digital nomads here or calculate your price here 👇

2. Genki (Best cheap digital nomad health insurance)

Genki is another newcomer to the scene that has a very similar setup to SafetyWing. They have also been created for digital nomads and allow you to sign up at any time from anywhere in the world.

They are operating since March 2022 so they are a very new company. Genki was started by a group of young people working in tech so they realize the needs of digital nomads. Many of the team at Genki are themselves digital nomads which is another bonus.

With Genki nomad insurance, you can only receive medical coverage . So if you want coverage for things like trip delays or lost luggage SafetyWing is the better option.

But if you are looking for the best digital nomad health insurance then Genki may be a great and cheap option for you.

Genki Pricing

Genki has different monthly costs depending on your age. If you are aged 0-29 years then you will pay $40 a month. The next age bracket is 30-39 years where you will pay $55 euros a month.

Genki also has a fairly low deductible of $50 per case. But you will have to pay this deductible for every claim so if you make multiple claims it could add up.

- No cost limit for medical care

- Coverage for dental care up to $1,000

- Treatment for sports injuries unless they are listed under dangerous activities

Genki Reviews

Genki has a score of 4.3 on Trustpilot. There are a few negative reviews from people having trouble making claims. But since it is a brand new company there is room for improvement.

- Cheap monthly rate

- Flexible, can cancel anytime

- Low deductible

- Only covers medical expenses

- People reported that it is hard to file claims

- Very new company (2022)

👉 Check out Genki travel insurance for digital nomads here 👈

3. Heymondo (Best digital nomad medical insurance)

Heymondo is a well-established insurance provider that offers some of the best health insurance for digital nomads.

It is not quite as cheap or flexible as SafetyWing or Genki but it is still a great option. Heymondo has wider coverage options and a greater ability to customize your plan.

You can for example opt to cover yourself for loss, damage, or theft of your electronics. This will cost extra but will be of peace of mind to many digital nomads if they own expensive electronics.

Heymondo also offers a 24/7 medical chat for members. So as soon as you have a medical emergency you can contact them and they will direct you to the nearest appropriate medical facility. Handy!

Heymondo Pricing

Option 1: long trip plan.

The Long Trip Plan is the best plan for digital nomads on Heymondo and costs about $47 per month . If you include travel to the US this goes up to about $76 per month. You must book your insurance for a minimum of 90 days and then the plan renews as you like.

Option 2: Annual Multi-Trip

The Annual Multi-Trip is great if you plan to do lots of small trips from your home country. You can get worldwide coverage for as little as $240 per year.

This plan is only available to you if do not spend more than 60 days in a row outside your home country. So if you do a few trips per year it is a great plan with great benefits.

- Emergency medical and dental up to $2,500,000

- Lost or damaged baggage up to $1,200

- Up to $350 for costs incurred to travel disruptions such as missed or canceled transfers

- Natural disaster coverage up to $1,250

Heymondo Reviews

Heymondo has a score of 4.5 on Trustpilot from about 1,700 reviews. So it has a proven track record of being a reliable company.

- Well-established company, good reviews

- Coverage for theft, damage to baggage

- Potential to get coverage for electronics

- 24/7 medical chat for emergencies + app

- Wide range of sports covered, plus you can upgrade to cover adventure activities

- Not super flexible

- Quite a big deductible $250

- The minimum period is 90 days so not as convenient for shorter trips

👉 Check out Heymondo travel insurance for digital nomads here 👈

4. Atlas Travel Insurance by World Trips (Highly customizable)

Atlas Travel Insurance is a company that has been around for many years with a great reputation . They are not focused primarily on digital nomads but have plans that can be tailored to your needs.

They are suitable for digital nomads as their plans are available to citizens of most countries and you can sign up anywhere .

When signing up to Atlas you will have to select what countries you will be visiting. You will also have to select the time in which you are traveling.

So it is not super flexible in terms of signing up and canceling but you will have a broader range of coverage. For example, you will receive $100 for a lost passport and up to $10,000 to fly home when a close relative passes away.

You will not get these benefits on SafetyWing, Heymondo or Genki, so if you prefer these benefits over flexibility , then Atlas Travel Insurance may be for you.

Atlas Travel Insurance Pricing

When choosing a plan with Atlas the monthly price will depend on what choices you make. But when I selected different countries and deductible amounts it usually came to around $50 per month .

Considering the benefits you get from Atlas I think that this is a very reasonable price.

- You can choose from $50,000, $100,000, $250,000 or $500,000 max coverage

- Emergency dental up to $300

- Lost luggage $1,000

- Lost passport $100

- Up to $10,000 to return home after the death of a close relative

Atlas Travel Insurance Reviews

Atlas Travel Insurance has a score of 4.6 from over 2,000 reviews on InsureMyTrip. So they seem like a very reliable company with great customer service.

- Available to all nationalities

- Can sign up from anywhere

- A well-established company that has been around for many years

- The plan is very customizable

- You can choose to pay no deductible

- Not flexible, you have to choose countries you are visiting and travel time period

- Low dental coverage compared to other plans

👉 Check out Atlas travel insurance for digital nomads here 👈

5. IMG (Best nomad travel insurance with lot of coverage)

IMG is an international insurance provider that serves over 190 countries and has been operating for over 25 years. They offer a wide range of insurance options for all types of needs.

The two plans they offer that are the best for digital nomads are the Patriot International Lite and the Patriot International Platinum plans.

IMG Pricing

The Patriot International Lite Plan which will cover most digital nomads needs costs about $50 per month . The Patriot International Platinum Plan is about $72 per month.

The main difference between the plans is that the Lite Plan has a policy maximum limit ranging from $50,000 to $1,000,000. Whereas Platinum has maximum limits from $2,000,000 to $8,000,000.

The amount you pay will increase depending on what maximum limit you want for your insurance.

The Lite Plan can be extended up to 24 months whereas the Platinum Plan can be extended up to 36 months. So apart from the medical max limits and renewal period, the plans are quite similar.

- Medical maximum $50,000 to $8,000,000 depending on your plan

- Deductible $0 to $25,000 depending on what you choose

- Emergency Reunion with selected family member $100,000

- Return travel home for the death of a close relative $10,000

- Dental care $300. For emergency dental care coverage up to plan maximum

- Lost luggage $50 per item and $500 in total

There are also some optional coverage options such as cell phone coverage . For just $90 you can be covered for loss, damage, or theft of your cellphone.

IMG Reviews

IMG has a score of 4.6 on Trustpilot from over 7,000 reviews. So you can see that it is a reliable company with a large customer base.

- The company exists for a long time

- Available to citizens of all countries

- Can choose to have zero deductible

- Plans are customizable

- Not flexible, have to choose travel dates

- Can not pay by the month or pause plan

👉 Check out IMG travel insurance for digital nomads here 👈

6. True Traveller (Best travel insurance for digital nomads from UK and EU)

True Traveller is a trusted insurance provider with some of the best travel insurance for digital nomads if you are from the UK or the EU . Unfortunately is not available for citizens outside of these regions.

The insurance plans they offer are created by travelers for travelers and you can really see that in the options they offer.

For example, they offer plans for people taking gap years or doing working holidays in Canada. So it is not just great for digital nomads but all travelers in general.

What stood out to me was how customizable True Traveller’s plans are. You can choose to ensure yourself for winter sports, lost stolen possessions, trip delays, and more.

So if there is something particular that you want to be insured for then True Traveller is a good option.

True Traveller Pricing

The Basic Plan costs around $50 per month and will give you all the basic health care coverage you need. It comes with zero deductible so you will not have to pay anything if you make a claim.

True Traveller also has Plus plans which more comprehensive coverage for a slightly higher price.

There are three main plans available for digital nomads. The below table displays the main areas of coverage of the three plans. For a more detailed list of coverage, you will have to visit their website.

True Traveller Reviews

True Traveller has a 4.8 on Trustpilot from over 3,000 reviews. Which is a really good score considering the number of reviews.

Overall customers in the reviews seemed to be very happy with the claims process. So True Traveller seems like a trustworthy insurance provider that is easy to deal with.

- Customizable plans

- Very good reviews

- You can sign up while traveling

- You can choose to have zero deductible

- Only for UK and EU citizens

- Not super flexible if you want to cancel or pause your plan

👉 Check out True Traveller travel insurance for digital nomads here 👈

7. Insured Nomads (Best insurance for adventurous remote workers)

Insured Nomads offers a wide range of plans for digital nomads with varying needs. You can get coverage for entering a warzone! So if there are any digital nomads out there wanting to go off track then this is the insurance for you.

But the plan that most people will want is the World Explorer Plan which offers medical insurance for single trips from 7 to 364 days.

This plan offers the usual medical coverage that does not differ too much from other providers. But one thing that stood out to me was that if your flight is delayed you get free use of an airport lounge which is a great feature.

There is also a World Explorer Guardian Plan which includes cover for costs associated with having to cancel a trip . But this is only available to US citizens. However, it could be a good option if you are booking an expensive trip such as a safari, and are worried it may be canceled.

Insured Nomads Pricing

On the Insured Nomads website, they state that the typical cost for the World Explorer Plan is about $86 per month . But this price will vary depending on your age, nationality, etc.

- Medical expenses up to $2,000,000

- 24-hour emergency medical care

- Acute onset of a pre-existing condition

- Airport lounge access

Insured Nomads Reviews

Insured nomads have a score of 4.1 on Trustpilot from 90 reviews. So considering the number of reviews it is not the best score but also not highly representable. Room for improvement!

- Wide range of plans for specific needs

- You can sign up while abroad

- Not Flexible

- More expensive than other plans

- Newer company so might not be as reliable

👉 Check out Insured Nomads travel insurance for digital nomads here 👈

8. Passport Card (Medical treatment on a debit card)

Passport Card is a new insurance provider with a unique concept . When you sign up for Passport Card you receive a debit card.

If you need some medical treatment you call Passport Card and they will preload your card with money and then you pay directly with the card.

This is really convenient as you do not have to pay out of pocket and wait for a refund from the company. Passport Card is however a very new company without a proven record yet.

Passport Card Pricing

The pricing per month depends on what country you are traveling to and what deductible you choose. The plans seem very expensive: For a 35-year-old male (me) with worldwide coverage, it would cost $289 a month with zero deductible.

The zero deductible is great but you will pay much more in a year ($3,000) than for SafetyWing, Genki or Heymundo ($600). So you have to check if the coverage is worth it for what you need.

- 24/7 telemedicine services

- Medical care up to $1,000,000 on the basic plan

- Dental care up to $3,000 for pain relief

- Vaccinations up to $100

- Up to 5 physiotherapy visits per year

Passport Card Reviews

Passport Card has only a score of 3 on Trustpilot from less than 50 reviews. The pre-load concept is great but at this point in time, you may take a risk in being one of their first customers.

- Convenient system

- No out-of-pocket expenses

- 24/7 support line

- No deductible

- Very high monthly rates

- Not flexible

- Does not have the best reviews

- No coverage for lost baggage or missed flights. Only medical coverage

👉 Check out Passport Card travel insurance for digital nomads here 👈

9. World Nomads (Not recommended anymore)

World Nomads used to be well-respected with the best travel insurance for digital nomads. They have been operating for around 20 years but during Covid, they stopped accepting new customers.

They have started accepting new customers but from the recent reviews I have been reading, it seems like they are not doing a good job anymore.

For the last 6 months, every review that I read was a one-star. Customers claimed that they could not get in contact with World Nomads and that the customer service was terrible.

The reason that I have added it to this list is that I have seen many people still recommending World Nomads. It was also the insurance we initially wanted to sign up for before choosing SafetyWing .

One of the big benefits of World Nomads is that they cover you for a wide range of sporting activities. You are also covered for loss, damage, and theft of possessions in certain situations which is great.

Another great advantage is that you are covered if you have to cancel your trip . But based on all the negative reviews they have received recently, I do not think it is worth the risk to sign up with them.

World Nomads Pricing

I selected the standard plan for World Nomads and it came up to about $85 per month . You can choose the Explorer plan which gives you much more coverage for about $125 per month.

What is Covered?

- Medical expenses up to $5,000,000

- Dental care up to $1,000

- Cancellation of trip $5,000

World Nomads Reviews

3.6 on Trustpilot – Many negative reviews recently stated that customer service was terrible and claims were denied. It seems that recent changes have been made at World Nomads and customers are not happy. Hopefully this changes soon again!

- Extensive coverage for a small price

- Cover for theft or damage to possessions

- Coverage for a wide range of sporting activities

- Terrible reviews

- Seems like it is very hard to make claims

👉 Check out World Nomads travel insurance for digital nomads here 👈

Conclusion on the best travel insurance for digital nomads

Insurance is something that is easy to put off but you never know when you will need it. So it’s better to sort it out before an accident happens.

Being clear about what you need and expect from an insurance provider will help you narrow down the options. Because many insurers nowadays offer tailored plans for nomads. Yeah!

We went for SafetyWing because it fulfills all our needs and we can recommend it because we had a good claim experience .

To find the right plan for you make sure to consider the 7 factors we listed at the beginning of this blog post and voilá you will be an insured nomad soon.

I hope that this review helped you to find the best company to get nomad insurance. If so or if you have any questions let me know in the comments down below!

- Best cities in Mexico for digital nomads

- How to find housesits as a digital nomad

- How to stay fit while traveling full-time

- How to eat healthy and cheap while traveling

Hey there! Some of the links on this page are affiliate links. This means that if you choose to make a purchase we may get a small commission at no extra cost to you. These commissions help us to generate income and keep creating content for you. So we greatly appreciate your support! Thanks!

Hi, I am Allan, a travel, health and fitness fanatic from New Zealand. I'm a former lawyer who turned into a full-time nomad in 2020. For the last 4+ years I've been traveling the world. I'm always on a hunt for good food, activities on a budget and workouts on the go. I hope you find my tips helpful and get inspired to travel more!

You May Also Like

Peña de Bernal – Hike one of Mexico’s Natural Wonders

Condesa: A Guide to Mexico City’s Best Neighborhood 2024

Everything Playa del Carmen – Complete Travel Guide 2024

4 thoughts on “best digital nomad travel insurance 2024 (pros & cons)”.

You have made a wonderful compilation. Thank you.

Hi Gökçe, great to hear you found our review of insurances for nomads helpful. We will keep it updated 🙂

Best overview I have been able to find on this subject. Thanks so much for your effort putting together this compilation. Very appreciated!

Hi Cathy, thanks so much for your nice comment! We are really happy to hear that our blog post has helped you out 🙂

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail.

Hand-Picked Top-Read Stories

Choosing Document Management Solutions for Remote Workers

Remote Work Surge Contributing to Longer Commutes in the US, Study Reveals

FlexJobs Unveils Top 75 Companies for Remote Job Opportunities

Trending tags.

- Work From Home

- Virtual Teams

- travel guides

- Remote working Tools

- remote working news

- Remote Working

- Remote Workers

- Remote work with pets

- Remote Work Tips

- Remote Culture

- Travel Guides

- Work Online

Digital Nomad Insurance: Is It Worth It?

Why is Insurance Important For Digital Nomads?

- According to LuggageHero data and reports, a total of 2.8 million bags were mishandled by U.S. airlines in 2019 . You could be one among the 2.8 million in the coming years. These mishandled bags can also get lost. Having no travel insurance could mean the loss of not just your luggage but also extra time, money, and resources spent to buy everything that was in the bag, again. Also, if you have no insurance, get ready to bid adieu to the money you spent on a flight that never took off because of an emergency event like the pandemic.

- Hospital costs averaged $2,607 per day throughout the U.S. in 2020. Staying overnight can cost you a lot more. The average hospital stay runs $11,700. Those are exorbitant numbers, especially for those who don’t have insurance. 60%-65% of all bankruptcies are related to medical expenses. As a digital nomad, you travel often and are prone to catch sudden illnesses. The weather change, different pathogens, and new types of food can sometimes cause your health to suffer. It is best to have health insurance to avoid unforeseen medical expenditures.

Things to Consider Before Getting an Insurance as a Digital Nomad

- The annual limit

- Is evacuation covered?

- Are there any age restrictions?

- Does your digital nomad insurance cover sports and extreme sports?

What Kind of Insurance Should Digital Nomad’s Have?

1. digital nomad travel insurance .

- Travel medical coverage

- Emergency medical evacuation coverage

- Trip cancellation coverage

- Car and bike accident coverage

- Protection of lost or stolen items

- Third-Party Liability Coverage

- Leaving your personal belongings in an unsupervised place.

- Equipment used for work purposes.

- Failing to file a loss or theft complaint with the local authorities.

2. Digital Nomad Health Insurance

- Tests and vaccination

- Medical checkups

- Prescribed medication

- Psychiatric visits and care

- Cancer treatment

- Dental treatments and care

- Optical treatments and care

- Emergency treatments and ambulances

- Deductibles

- Excess or co-pays

- Exclusions of pre-existing conditions

- Coverage limits

3. Digital Nomad Gadget Insurance

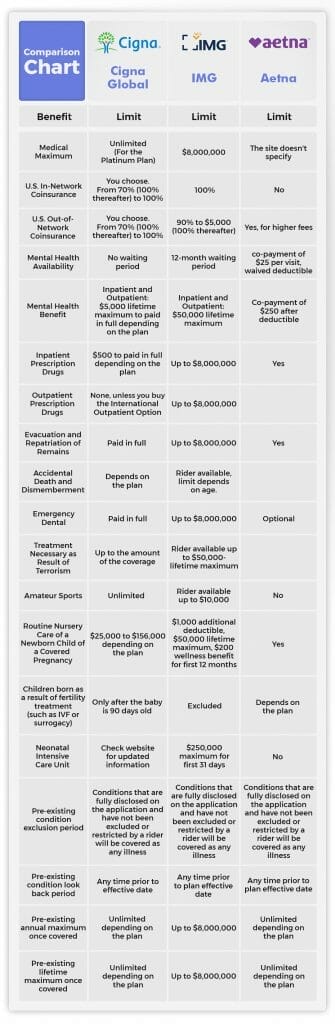

Best digital nomad insurance plans, health insurance.

- Flexible deductibles.

- Flexible payment options (monthly, trimester, or annual)

- The company pays your health provider directly so there’s no need to file a claim or reimbursement.

- 24-hour customer service, 7 days a week.

- Some Cigna plans include the transplanting and transportation of organs and kidney dialysis treatments.

- The company’s website provides you with information about the culture, financial system, and education system of the country you’re traveling to.

- Cigna covers all potential costs in the treatment of COVID, in compliance with the protocols recommended by the WHO .

- The basic plan doesn’t cover maternity costs.

- To get a personalized quote, you’ll need to enter way more personal information for this one than you will enter for other insurance companies.

- They offer personalized plans for digital nomads based on destinations and needs.

- They have offices in more than 15 countries and a 24-hour customer service, 7 days a week.

- Various magazines have named Aetna as the “Best International Private Health Insurance Provider” and “Health Insurer of the Year.’’

- Most of their plans cover for hospitalization, cancer treatment, and emergency evacuation

- IMG offers extensive coverage that includes 17,000 doctors and clinics across the globe.

- Using your IMG policy with a healthcare provider outside the United States will grant you a 50% reduction on your deductible.

- IMG has special health insurance plans for overseas missionaries.

- Their coverage options are available to all nationalities.

- IMG covers almost all costs for COVID-19 related tests and treatment.

- IMG plans have an age limit. There are no plans available for adults above 75 years of age.

- You get maternity care coverage only with the most expensive plans.

Travel Insurance

- Trip delays and interruptions.

- Emergency dental expenses.

- Emergency medical expenses.

- Emergency medical evacuation, accidental death and repatriation of remains.

- Return of minors and pets.

- Political evacuation and border entry protection.

- Lost visa/travel documents and lost checked luggage.

- Pre-existing medical conditions.

- Psychiatric visits and mental health disorders.

- Damages sustained under alcohol or drug influence.

- World Nomads

- The Standard Plan includes more than 200 sports but has lower coverage limits.

- The Explorer Plan adds 60 more sports and activities (dangerous ones too such as skydiving, paragliding, and shark cage diving).

- Trip interruptions, cancellations, and delays.

- Baggage delay and loss.

- Emergency medical expenses, evacuation and repatriation.

- Accidental death and dismemberment.

- Non Medical emergency transportation.

- Adventure sports and activities.

- Rental car damage (Explorer Plan).

- Pre-existing conditions.

- Self-harm or intoxication related accidents.

Gadget Insurance

- TCP Insurance

- Cameras, sound equipment, editing hardware and computers.

- Work related injuries, cancellations and theft (for photographers and filmmakers)

- TCP’s automotive insurance covers your vehicle + equipment left in your vehicle.

- Renters insurance that also covers your equipment if left at home or stolen.

- The biggest drawback with TCP insurance is that it covers only that equipment which is used for film and photography production.

- Laptops used for any other work that doesn’t include film production and photography will not be covered.

- They offer insurance plans only for mobile phones (especially iPhones) in case you need coverage only for your phone.

- Every kind of gadget is covered. This includes electronic items like television sets and stereos too.

- Worldwide coverage for up to 180 days.

- The insurance will not cover beyond 2 loss or theft claims within a 12-month period.

- Theft, loss, damage or breakdown where you have knowingly put your gadget at risk.

Get Insured To Get Going

Sign up for the ThinkRemote newsletter and stay up to date with the latest news and tips on remote work and WFH productivity.

Additionally, you’ll get a copy of our chairman’s best-selling remote leadership book for free (a $19.99 value).

Join us (We Have Cookies)

You're interested in news & tips about remote work? What luck! That's what we do! Better join our newsletter so we can hang out.

Privacy Overview

Travel Insurance for Digital Nomads: 20 Tips to Choose the Best Nomads Travel Insurance

In a world where remote work is becoming the norm, digital nomads have embraced a lifestyle that combines work and travel. Roaming the globe, exploring new cultures, cuisines, and adventures while staying connected to their careers. However, amidst the excitement of jet-setting from one destination to another, it’s essential for digital nomads to prioritize their well-being and financial security. That’s where travel insurance for nomads comes into play.

Nomads travel insurance is more than just a safety net; it’s a lifeline that protects against unexpected mishaps and provides peace of mind. From medical emergencies and lost belongings to trip cancellations and unforeseen delays, a comprehensive international travel insurance plan (designed for nomads) is a vital companion on your journey.

With so many options available, choosing the best travel insurance for nomads can be daunting. To help you make the right decision, we’ve compiled 20 essential tips to help you find a policy that aligns with your unique needs and circumstances. So, whether you’re a seasoned nomad or just starting your digital wanderlust, read on to discover the key factors that will help you navigate the world of travel insurance with confidence.

What is a Digital Nomad?

Imagine a life where your office is not a cubicle, but a breathtaking beach in Bali or a cozy cafe in Paris. . . Anywhere you want it to be.

This is the life of a digital nomad.

A digital nomad is an individual who works remotely while exploring the world.

They are adventurers with laptops and passports at the ready, breaking free from the traditional 9-to-5 to embrace a lifestyle of flexibility, curiosity, and unlimited possibilities.

Digital nomads seamlessly blend work and travel, embracing the wonders of new cultures, forging connections with like-minded individuals, and creating a lifestyle that knows no geographical boundaries.

What Is Nomad Travel Insurance?

Nomad travel insurance is a specialized form of insurance designed specifically for those leading a nomadic lifestyle. Unlike traditional travel insurance, which may cater to short-term vacations, travel insurance for nomads is tailored to the unique needs and circumstances of digital nomads, long-term travelers, and remote workers.

Nomads travel insurance provides coverage for a range of risks and incidents that can occur while on the go, like medical emergencies, trip cancellations or interruptions, lost or stolen belongings, and even liability protection. It offers a comprehensive safety net, ensuring that nomads can explore the world with confidence, knowing they have financial protection in case of unforeseen circumstances.

How Long Does Travel Insurance for Nomads Cover You For?

Travel insurance for nomads offers coverage for varying durations depending on the specific plan and insurance provider. The general coverage options available include: