- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Virgin Money credit card complimentary travel insurance

A virgin money credit card that offers complimentary travel insurance can help you save on the cost of overseas trips – so how much cover can you get.

In this guide

What Virgin Money cards have complimentary travel insurance?

What's covered by virgin money complimentary international travel insurance, what's not covered, what do i need to do to use virgin money credit card complimentary travel insurance, pre-existing medical conditions, how to make a claim, other types of virgin money complimentary credit card travel insurance, virgin money credit card complimentary insurance for shopping.

Virgin Money offers complimentary insurance on Virgin Australia Velocity High Flyer and Flyer credit cards, including complimentary international travel insurance on the Velocity High Flyer.

These policies are underwritten by Allianz Global Assistance (Allianz) and there are different conditions to get cover and make claims. That's why it's always best to read insurance policy documents. But if you just want an overview, here we have pulled out the key details for this cover.

Have a question or need to make a claim now? Call Allianz on 1800 072 791 (Australia) or +61 7 3305 7499 (overseas).

The Velocity High Flyer and Flyer credit cards offer different types of complimentary insurance. Here's a summary of what you can get with each card.

This insurance includes emergency medical cover, luggage and some cancellations. The actual cover you get is broken down into "benefits" based on what you can and can't claim. For some claims, you'll need to pay an excess before you'll get any money back if it's approved.

Here, we've broken down the key options for different types of benefits, with basic examples of when you might make a claim. But remember: you should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover

Cancellation, delays and transport, luggage and personal items cover, death, funerals and personal liability.

All insurance policies have details of when you will and won't get cover, so check the insurance booklet before you book a trip or make a claim. With Virgin Money credit card complimentary international travel insurance, some of the key situations that aren't covered include:

- If you don't follow advice from any government, official body or mass media announcements

- If the purpose of your trip includes getting medical treatment

- Participation in criminal or illegal acts

- Acts of war

- Dangerous activities, including rock climbing, white water rafting, bungee jumping, skydiving, water skiing, off-piste snow skiing or snowboarding, or for any professional sports

These are only a few examples of when you won't get cover under this policy. Check the Virgin Money credit card insurance policy booklet or call Allianz on 1800 072 791 for more details about the exclusions.

Does Virgin Money credit card international travel insurance cover COVID-19?

Yes, for claims made on or after 1 November 2023 there is some cover related to COVID-19. This includes:

- Overseas emergency assistance

- Overseas emergency medical

- Cancellation

- Additional expenses

To make a claim, you need to be positively diagnosed with COVID-19 (or another pandemic/epidemic disease) and meet all the other requirements for a claim. This also extends to an eligible spouse or dependants travelling with you – but won’t apply if you’re travelling against government advice. As there are lots of conditions to meet for this type of cover, make sure you read the policy booklet or call Allianz on 1800 072 791 before you travel.

If you need cover for a skiing trip, bungee jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions.

If you're planning a trip and want cover through your Virgin Money credit card, you'll need to meet the following requirements:

- Spend at least $500 on your prepaid travel costs using your Virgin Money Velocity High Flyer Card.

- Use Velocity Points to book your overseas travel ticket.

- Redeem a Virgin Australia Gift Voucher for the overseas travel ticket.

- Length of travel. This cover is available if your trip is for 6 consecutive months or less.

- Account status. You need to have an active, eligible Virgin Money credit card in your name at the time of your booking.

Does Virgin Money credit card travel insurance cover family members?

Yes, your spouse and eligible dependants (i.e. your children) can also get cover when you meet the eligibility requirements for international travel insurance. For them, the key requirements to get cover are:

- They need to be an Australian resident or a holder of a visa issued under the Migration Act 1958 (Cth)

- They need to travel with you for at least 50% of the trip that you've got cover for

- They need to have a return overseas travel ticket before leaving Australia

- They need to be under 81 years of age at the time they became eligible for the cover

They also need to meet the other conditions of the insurance policy. Keep in mind that some claims have different limits for a spouse or dependants compared to what you (as the primary cardholder) get.

A pre-existing medical condition can affect your travel insurance cover and usually refers to health conditions you've recently been treated for or manage on an ongoing basis.

With Virgin Money's complimentary international travel insurance, you can only get cover for a pre-existing medical condition if you apply and get written confirmation from Allianz Global Assistance.

You can do this online or by calling Allianz on 1800 072 791 before you go overseas. If your request is approved, you’ll need to pay a $75 administration fee and will then be sent written confirmation that your pre-existing condition is covered.

Pregnancy cover

This policy offers limited cover for pregnancies, but the amount and type of cover varies.

For example, if you become pregnant after booking your trip and meeting the eligibility requirements for this cover, you’ll be able to get cover for any complications of your pregnancy that arise from injury or sickness.

There is no cover for childbirth, except if it is the result of injury or sickness. If you are pregnant or planning for pregnancy, make sure you check the insurance policy or contact Allianz directly for full details on cover.

First, contact Allianz as soon as anything happens by calling +617 3305 7499 from overseas or 1800 072 791 from Australia. They will be able to advise you on the claim or claims you want to make at the time.

You can then submit a claim online by following these steps:

- Go to the Allianz online claim portal at https://claimmanager.com.au/aga/agreement

- Confirm you agree with the terms and conditions, then click "Create new claim"

- Select the "Credit card insurance" option and provide details of your card

- Fill in the details on the claim form and upload your supporting documentation

You will hear back about your claim within 10 business days.

What to include in your claim

With insurance claims, including as much detail as possible makes it easier for the insurer to consider the claim and your eligibility for a payout.

So when you're travelling with this cover, aim to get as much written or photo evidence as you can for any claims you need to make. This could include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Official medical reports

- Police reports

- Photos of damaged items

- Emails or letters from airlines that relate to a claim

- Receipts or other proof of purchase

Tip: Use a travel wallet or create an online folder to keep all your important documents together. This could include your passport, itinerary, printed tickets, a copy of the Virgin Money card insurance policy booklet – plus anything that could become supporting documentation for future claims.

Domestic travel insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. This can include costs relating to cancelled return flights, flight delays of 4 hours or more and delayed or lost luggage.

- When can I use it? You'll get cover for up to 28 days in a row if you have paid for the entire trip with your Virgin Australia Velocity High Flyer credit card, Velocity Points, a Virgin Australia Gift Voucher or a combination of these options. Your spouse and any dependants can also get cover if you use the same payment method for their return travel of 28 days or less and they will be with you for at least half the trip.

- Is there an excess cost? There is a $75 excess for claims that relate to additional expenses. There are no excess costs for other claims but there are maximum claim amounts, which vary depending on the type of claim.

Rental vehicle excess insurance in Australia

- What is it? Cover for damage or theft of a hire car, up to a maximum total of $10,000.

- When can I use it? When you’ve used your eligible Virgin Money credit card to pay for the full cost of the car hire.

- Is there an excess cost? $100 per claim.

To make a claim under one of these policies, download a claim form online at https://claims.agaassistance.com.au/ or call Allianz on 1800 072 791.

Virgin Money credit cards give you access to other types of insurance, which are also provided by Allianz. Here’s a basic explainer of each one:

- Purchase protection insurance: Offers cover for up to 90 days when you purchase new items with your eligible Virgin Money credit card and they are then stolen, accidentally damaged or lost. It covers household and personal items such as shoes, jewellery, glasses and new works of art.

- Extended warranty insurance: This cover doubles a manufacturer's warranty, up to a maximum period of 12 months, for eligible items bought with your card in Australia.

Don't have complimentary insurance on your credit card yet? Compare Virgin Money credit cards or check out other cards that offer insurance .

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald.

More guides on Finder

Get up to 60,000 bonus Velocity Points, a yearly $129 Virgin Australia gift voucher and points per $1 on all eligible spending.

The Virgin Australia Velocity High Flyer has a bonus Velocity Points offer, lounge passes and a yearly flight benefit. So is it worth the $329 annual fee?

This Virgin Australia Velocity Flyer offer gives you 0% interest on a balance transfer for 24 months and a $0 annual fee for the first year.

As well as a competitive variable purchase rate, the Virgin Money Low rate card has a balance transfer offer that can help you save on existing debts.

Take advantage of no annual fee and up to 55 interest-free days on purchases with the Virgin No Annual Fee Credit Card.

Earn Velocity Points as you spend and save with 0% interest on purchases and balance transfers for 14 months with the Virgin Australia Velocity Flyer Card.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

10 Responses

Two questions. I am planning on an overseas trip beginning in February 2024 with my companion , paid in full with my Virgin Credit Card , is she covered by my Card

Hi Anthony, Yes, if your companion is considered as your spouse, they would get access to this cover when you meet the eligibility requirements. Here’s the definition of “spouse” in the policy document booklet: “a partner of the cardholder who is permanently living with the cardholder at the time the journey or trip starts”. If you have further questions about eligibility for cover or any other details of the insurance, you can contact Allianz (the insurance provider) 1800 072 791. I hope this helps.

I have a High Flyer Card and have booked a one-way cruise ship trip. We used our Velicity points to book the flights to the embarkation port (Hawaii). Does my High Flyer Card complementary insurance cover us fully on the cruise ship?

Hi Steve, You can check your eligibility and cover with the insurance provider, Allianz, by calling 1800 072 791. For reference, booking an overseas travel ticket with Velocity Points is listed as an option in the eligibility section of the insurance policy document. But there are other requirements and details about cruises so it’s a good idea to double-check with the insurer. I hope this helps.

I have purchased an overseas holiday with full payment being made through a travel company. The travel company has made the flight bookings on our behalf so I need to know if the travel insurance on my credit card will provide my wife and I with cover

Hi Tony, According to the terms and conditions, if you have a current, valid Virgin Australia High Flyer credit card, “charging the cost of the overseas travel ticket to the account holder’s card account” is one way to get cover for a trip of up to 6 months. As there are other eligibility requirements and conditions around pre-existing conditions, you may want to call the insurance provider, Allianz, on 1800 072 791 for full details of the cover. I hope this helps.

I do not know what type my Velocity credit card is, and I am 81 years old, so can I get travel insurance on it?

Hi Wendy, You can call Virgin Money on 13 37 39 to find out what type of credit card you have and if it offers travel insurance. Alternatively, you can compare travel insurance for people aged over 80 , including prices and what’s covered. I hope this helps.

Could you please forward a copy of the policy for complimentary travel insurance for use with Virgin High Flyer credit card. I’m assuming it is with Alliance Insurance.

Hi Deborah,

Here’s a link to the complimentary insurance terms and conditions document (pdf) effective 1 June 2022. That’s the version currently available on the Virgin Money website (at the time of writing).

Just keep in mind that they do get updated periodically. So if you need to reference it in the future, check the Virgin Money credit card forms and T&Cs webpage for updates to it. Hope that helps!

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Travel Insurance You Can Trust.

Earn Velocity Points with Cover-More travel insurance

Earn Velocity Points when you cover your next trip with Cover-More travel insurance. As a member at every level of the Velocity Status program you can earn Bonus Points in addition to base Points earned 1 .

Earn double Points with Cover-More*

Purchase any Cover-More travel insurance policy through Virgin Australia by 31 May 2024 and earn 6 Velocity Points per $1 spent.

*T&Cs apply.

** Cover-More Travel Insurance - Australia

Limits, exclusions and conditions apply. This is general advice only. Velocity Frequent Flyer Pty Ltd (ACN 601 408 824, AR 1239355) is an Authorised Representative of Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) who arranges the insurance on behalf of the insurer, Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Please consider your own needs, financial situation and objectives and read the Combined FSG/PDS before deciding to buy this insurance. For information on the Target Market and Target Market Determination for these products, contact us on 1300 135 769 Money back guarantee available when you cancel your policy within 21 days of purchase provided you have not made a claim or departed on your journey. Please allow up to 14 days from travel start date for Points to appear in your Velocity account. Points may not be allocated where the policy is cancelled or refunded.

Cover-More Travel Insurance - New Zealand

Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More (NZ) Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. Consider the Policy Brochure and wording therein before deciding to buy this product. For further information see Zurich New Zealand’s financial strength rating. Money back guarantee available when you cancel your policy within 14 days of purchase provided you have not made a claim or departed on your journey. Please allow up to 14 days from travel start date for Points to appear in your Velocity account. Points may not be allocated where the policy is cancelled or refunded.

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Cover yourself, your family and any other travel companions with our comprehensive travel insurance policy..

Our travel insurance is available exclusively to UK residents with up to £15,000,000 cover for medical expenses and up to £5,000 per person for cancellations.

If you are a British national travelling to a country where the FCDO advise against travel at the time you are due to depart, then your insurance policy may be invalid. This could include destinations which Virgin Atlantic are flying to.

Please check here for up to date information: https://www.gov.uk/foreign-travel-advice

Covid-19 cover included

Covid-19 cover is included as standard with our travel insurance, to take care of the health and cancellation costs that arise should you fall ill or need to cancel due to Coronavirus.

Cruise cover included

Our policy includes additional benefits including cruise connection, missed port, cabin confinement and excursions cover.

Key policy terms

Providing peace of mind for your trip

- Covid-19 cover for medical expenses and cancellation if you become ill or have to quarantine due to Covid-19

- Up to £15,000,000 medical assistance cover in the event of illness or an accident while away

- Up to £5,000 cancellation cover or if you have to cut your trip short

- Up to £2,000 in the event of loss, theft or damage to your personal possessions

Please ensure this insurance is suitable for the country you're travelling to.

If you are a British national travelling to a country where the FCDO advise against travel at the time you are due to depart then your insurance policy may be invalid. This could include destinations which Virgin Atlantic are flying to.

Please check here for up to date information: https://www.gov.uk/foreign-travel-advice

Our partner, Allianz Assistance UK, is dedicated to providing answers to any questions, as well as claims information on +44 (0) 20 8239 4030 .

What’s covered by credit card travel accident and emergency evacuation insurance?

Editor's Note

Many perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance , delayed baggage insurance , lost baggage insurance , and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we'll explain a couple of lesser-known benefits that you hopefully won't have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you.

You can easily find the coverage and terms of any protection your travel credit card offers by doing a quick web search for the card's updated benefits guide. These benefits are not exclusive to travel credit cards , and many standard credit cards come with travel protection and insurance.

Travel accident insurance

Often called common carrier insurance , this policy pays in case of death, loss of eyesight or loss of limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you must typically pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance , not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don't compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start to look like you'll need assistance. You will not be reimbursed for anything that you decide to pay for on your own.

- Evacuation does not mean repatriation. If you're far overseas, you won't be evacuated back to the U.S. Most policies state you'll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider's expense being denied. Read your credit card's full terms and benefits guide to see which exclude these conditions and the credit card's definition of a preexisting condition.

- The coverage is only for the cost of evacuation and medical care during transportation. Once you're back on the ground, you still need medical insurance to pay the doctors and staff who provide care.

- Some cards have country exclusions, so don't expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, it still offers the most generous emergency evacuation insurance of any card.

There's no cost cap , and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don't even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*

Other American Express cards offer access to the Premium Global Assist Hotline. However, anything they coordinate will be at your expense. Make sure you read your Amex card's benefits guide carefully.

For more details, see our full review of the Amex Platinum .

Related: Your complete guide to Amex travel protections

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Apply here: Amex Platinum

Chase Sapphire Reserve® and Chase Sapphire Preferred® Cards

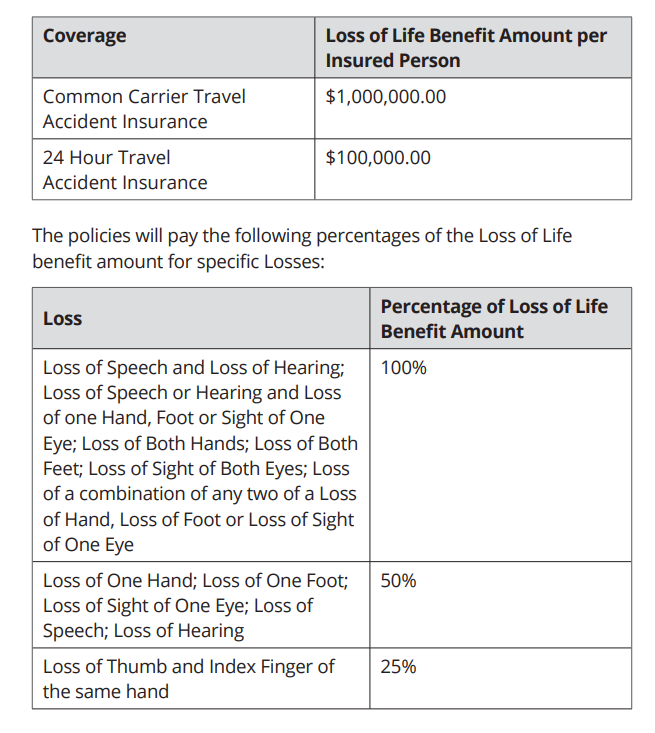

The Chase Sapphire Reserve ® offers two travel accident insurance benefits : common carrier travel accident insurance and 24-hour travel accident insurance. The former applies while riding as a passenger in, entering or exiting any common carrier. The latter applies any time during your trip — but you cannot be paid out on both the common carrier and 24-hour policies.

If you use your Chase Ultimate Rewards points to book your trip, you are covered under the card's benefits.

People eligible for coverage include "you, your spouse, your spouse's or domestic partner's children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews." Chase pays up to $1,000,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

Some interesting exclusions with Chase that would prevent a payout include the insured person participating in a motorized vehicular race or speed contest, the insured person participating in any professional sporting activity for which they received a salary or prize money or if the insured person traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket-launched aircraft.

The Chase Sapphire Reserve® also offers emergency evacuation insurance. If you or an immediate family member paid for at least a portion of your trip with the card, you're eligible for up to $100,000 in emergency medical evacuation.

Your covered trip must last between five and 60 days and be at least 100 miles from your residence. If you are hospitalized for more than eight days, the benefits administrator can arrange for a relative or friend to fly round-trip in economy class to your location. If your original ticket cannot be used, you can also be reimbursed for the cost of an economy ticket home. In a worst-case situation, the benefit also pays up to $1,000 to repatriate your remains.

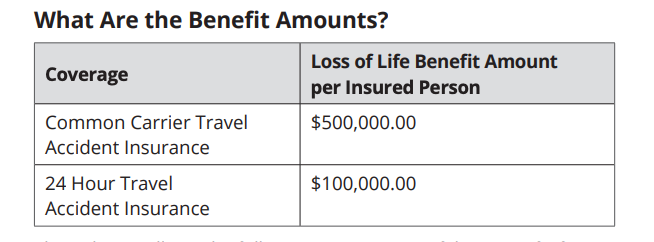

The Chase Sapphire Preferred Card offers the same travel accident insurance as the Reserve, except with lower payouts on the common carrier policy. The benefits pay up to $500,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

For more details, see our full reviews of the Chase Sapphire Reserve and Chase Sapphire Preferred .

Related: Your guide to Chase's trip insurance coverage

Apply here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Club℠ Infinite Card

The top-tier United Club℠ Infinite Card offers travel accident and emergency evacuation insurance. The travel accident insurance benefits pay up to $500,000 for a common carrier loss.

The card also carries the same benefit as the Chase Sapphire Reserve for emergency evacuation coverage, with up to $100,000 of coverage provided for evacuation.

For more details, see our full review of the United Club Infinite Card .

Apply here: United Club Infinite

Bottom line

We hope none of us perfectly ever have to worry about either of these policies, but it's nice to have peace of mind if you or your family need emergency assistance. This reassurance is one more reason to ensure one of these cards is always in your wallet when traveling.

The benefit guides of all cards are updated regularly, so make sure you don't toss them in the trash when updates show up in the mail and read the online guides for the latest terms and conditions.

Related: The best credit cards with travel insurance

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.

- Trip delay reimbursement: up to $500 per ticket if you're delayed more than six hours or require an overnight stay.

- Trip cancellation and interruption protection: up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Medical evacuation benefit: up to $100,000 for necessary emergency evacuation and transportation when on a trip of five to 60 days and traveling more than 100 miles from home.

- Travel accident insurance: accidental death or dismemberment coverage of up to $100,000 (up to $1,000,000 for common carrier travel).

- Emergency medical and dental benefits: up to $2,500 for medical expenses (subject to a $50 deductible) when on a trip arranged by a travel agency and traveling more than 100 miles from home.

- Rental car coverage: primary coverage for damages caused by theft or collision up to $75,000 on rentals of 31 days or fewer

More protections are included with cards with an annual fee, but there are exceptions. The no-annual-fee Chase Freedom Flex , for instance, includes up to $1,500 per person (and up to $6,000 per trip) in trip cancellation and trip interruption coverage.

However, there are some differences between credit card travel coverage and obtaining coverage from a third party.

"Credit card coverage does not typically provide travel medical benefits," Borden says. "For protection if you get sick or hurt while traveling, you'll want a travel insurance plan with medical coverage."

Whether you get your travel insurance in a standalone policy or through a credit card, it's important to review your plan details carefully. In either case, there may be exclusions and other requirements such as deadlines when filing a claim, Borden notes.

What travel insurance coverage do you need to pay more for?

Knowing what travel insurance doesn't cover is as important as knowing what it does cover.

"Travelers should understand that travel insurance benefits come into play only if a covered reason occurs," Borden says. Most standard travel insurance plans won't reimburse you for the following:

Cancel for any reason (CFAR)

Cancel-for-any-reason travel insurance covers a trip cancellation for any reason, not just a covered event. your standard benefits won't kick in unless it's a covered event. For instance, you'll be reimbursed simply for changing your mind about taking a trip.

That said, CFAR travel insurance is not without its downsides. For one, it's more expensive than traditional insurance, and most CFAR policies will only reimburse you for a percentage of your travel expenses. Additionally, CFAR policies aren't available for annual travel insurance .

You can find our guide on the best CFAR travel insurance here.

Foreseen weather events

Sudden storms or unforeseen weather events are typically covered by standard travel insurance plans. There are exceptions to be aware of. For example, an anticipated and named hurricane will not be covered.

Medical tourism

If you're going to travel internationally for a medical procedure or doctor's visit, your travel insurance plan will not cover the procedure itself. Most medical travel plans also won't cover you if something goes wrong with your procedure.

Pre-existing conditions and pregnancy

Those with specific pre-existing conditions, such as someone with diabetes and needing more insulin, will not be covered by most plans. In addition, pregnancy-related expenses will likely not be covered under most plans.

That said, you can obtain a pre-existing condition waiver for stable conditions. In order to obtain a wavier, you will need to purchase travel insurance within a certain time frame from when you booked your trip, usually two to three weeks, depending on your policy.

Extreme sports and activities

Accidents occurring while participating in extreme sports like skydiving and paragliding will typically not be covered under most plans. However, many plans offer the ability to upgrade to a higher-priced version with extended coverage.

Navigating claims and assistance

When a trip goes awry, the first thing you should do is document everything and be as specific as possible with documentation. This will make the claims process easier, as you can substantiate and quantify your financial losses due to the delay.

For example, your flight home has been delayed long enough to be covered under your policy, you'll want to keep any receipts from purchases made while waiting. For instances where your luggage is lost, you will need to file a report with local authorities and document all the items you packed.

Cancellation protection also requires meticulous attention to detail. If you're too sick to fly, you may need to see a doctor to prove your eligibility. If an airline cancels a flight, you'll also need to document any refunds you received as travel insurance isn't going to reimburse you for money you've already gotten back.

Part of the benefit of CFAR insurance is the reduced paperwork necessary to file a claim. You'll still need to document your nonrefundable losses, but you won't have to substantiate why you're canceling a trip.

Choosing the right travel insurance

Each plan should be personalized to meet the insured party's needs. Some travelers prefer to stick to the bare minimum (flight cancellation benefits through the airline). Others want a comprehensive plan with every coverage possible. Before you buy anything, set your destination. Are there any travel restrictions or changes pending? Does your destination country require emergency or other medical coverage?

If the destination airport is known for lost or delayed luggage, travelers should keep important items in carry-ons. Lost or delayed luggage coverage protects insured parties in the event of a significant delay or total loss.

Second, check current credit card travel benefits to avoid redundancies. Savvy travelers don't need to pay for the same coverage twice.

Finally, consider your individual needs. Do you have a chronic medical condition, or do you feel safe with emergency-only medical coverage? Keep in mind, this does not include coverage for cosmetic surgery or other medical tourism. Do you have a budget limit for travel insurance? Asking and answering these important questions will help every traveler find the right product.

Most travel insurance plans are simple, and Business Insider's guide to the best travel insurance companies outlines our top picks. Remember, read your policy and its specifics closely to ensure it includes the items you need coverage for.

No one likes to dwell on how a trip might not go as planned before even leaving. However, at its core, travel insurance provides peace of mind as you go about your trip. While the upfront cost may seem significant, when you compare it to the potential expenses of a canceled flight, emergency evacuation, or a hefty medical bill, it's a small price to pay in the grand scheme of things.

Get Travel Insurance Quotes Online

Protect your trip with the best travel insurance . Compare travel insurance quotes from multiple providers with Squaremouth.

What does travel insurance cover frequently asked questions

Does travel insurance cover trip cancellations due to a pandemic like covid-19.

Coverage for pandemics vary from policy to policy. Some travel insurance companies have specific provisions for pandemic-related cancellations, while others may exclude them entirely.

Are sports injuries covered under travel insurance?

Sports injuries are often covered under travel insurance, but high-risk or adventure sports might require additional coverage or a special policy.

Can travel insurance provide coverage for travel advisories or warnings?

Travel advisories have different effects on your travel insurance depending on your policy. Traveling to a country already under travel advisory may invalidate your coverage, but if you're already traveling when a travel advisory is announced, you may be covered.

How does travel insurance handle emergency medical evacuations?

Travel insurance usually covers the cost of emergency medical evacuations to the nearest suitable medical facility, and sometimes back to your home country, if necessary.

Are lost or stolen passports covered by travel insurance?

Many travel insurance policies provide coverage for the cost of replacing lost or stolen passports during a trip.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Green Card

Full List of Travel Insurance Benefits for the Amex Green Card [2023]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Stella Shon

News Managing Editor

92 Published Articles 648 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3211 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![virgin amex travel insurance Full List of Travel Insurance Benefits for the Amex Green Card [2023]](https://upgradedpoints.com/wp-content/uploads/2023/05/Amex-Green-Upgraded-Points-1c-1.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex green card — snapshot, amex green card — travel insurance benefits, travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

One of the most underestimated cards out there is the American Express ® Green Card , which is actually one of American Express’ first cards. It was the original charge card that was born in 1969, but it has fallen out of favor in recent years due to the meteoric growth of more premium options like the American Express ® Gold Card and The Platinum Card ® from American Express.

In fact, the money-colored card happens to be a good pick if you want travel perks and the ability to earn lots of points, all for a reasonable $150 annual fee.

In this guide, we’ll be walking you through its lesser-known travel insurance benefits that can come in handy if your trip goes awry.

This card can provide a great way to accumulate Membership Rewards points on eligible travel, transit, and at restaurants.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

The American Express ® Green Card is an excellent all-around travel rewards card thanks to earning 3x Membership Rewards ® points on eligible travel and transit purchases and at restaurants, access to American Express transfer partners, and a reasonable annual fee.

- 3x points per $1 spent at restaurants worldwide, on all eligible travel purchases, and transit purchases

- Up to $189 per calendar year in statement credits after you pay for a CLEAR ® Plus membership with the Card.

- Up to $100 in statement credits annually when you purchase airport lounge access through LoungeBuddy with the Card.

- $150 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 40,000 Membership Rewards ® Points after you spend $3,000 in eligible purchases on your American Express ® Green Card within the first 6 months of Card Membership.

- Earn 3X Membership Rewards ® points on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals.

- Earn 3X Membership Rewards ® Points on transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways.

- Earn 3X Membership Rewards ® points on eligible purchases at restaurants worldwide, including takeout and delivery in the US.

- $189 CLEAR Plus Credit: Receive up to $189 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express ® Green Card.

- $100 LoungeBuddy: No airport lounge membership? No problem! Purchase lounge access through the LoungeBuddy app using the American Express ® Green Card and receive up to $100 in statement credits annually.

- Payment Flexibility: When it comes to paying your bill, you have options. You can always pay in full. You also have the flexibility to carry a balance with interest or use Plan It ® to split up large purchases into monthly payments with a fixed fee, up to your Pay Over Time Limit. You may be able to keep spending beyond your limit – you’ll just need to pay for any new purchases in full when your bill is due.

- Trip Delay Insurance: If a round-trip is paid for entirely with your Eligible Card and a covered reason delays your trip more than 12 hours, Trip Delay Insurance can help reimburse certain additional expenses purchased on the same Eligible Card, up to $300 per trip, maximum 2 claims per eligible account per 12 consecutive month period. Terms, conditions and limitations apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- No Foreign Transaction Fees: No matter where you’re traveling, when you use your American Express ® Green Card there are no foreign transaction fees.

- $150 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Why the Amex Green Card Is Worth Considering

One of the crucial selling points of the Amex Green card is the ability to earn a valuable welcome bonus offer after meeting reasonable spending requirements within the first few months of being approved for a new account. Make sure to see what the current welcome offer is when applying, as it can change from time to time.

Although it’s not as popular compared to the Amex Gold card or Amex Platinum card , the Amex Green card is actually one of the most powerful Amex cards available for earning travel rewards. That’s because you’ll earn up to 3x Membership Rewards points on many popular spending categories.

The Amex Green card earns Membership Rewards points at the following rate:

- 3x points at restaurants worldwide, including takeout and delivery in the U.S.

- 3x points on travel , including airfare, hotels, cruises, tours, car rentals, and more

- 3x points on transit , including trains, buses, ferries, subways, and more

- 1x points on other purchases

The feature that sets apart the Amex Green card the most from its sister cards like the Amex Gold card and Amex Platinum card is the ability to earn 3x points on travel , which is defined very broadly.

For example, if you book a hotel through Booking.com , pay for a cruise with Norwegian Cruise Line , or order an Uber using your Amex Gold card or Amex Platinum card, you’d only earn 1x points on those purchases. Not so with the Amex Green card — you’ll earn 3x points on those same transactions!

The points earned on the Amex Green card are Membership Rewards points (just like you’d earn with the Amex Gold card and Amex Platinum card), which means you can transfer them to travel partners and book luxury award travel for pennies on the dollar!

If you want to learn more about how to maximize the value of Amex Membership Rewards points, read our guide on the best ways to redeem Membership Rewards points .

The Amex Green card also offers an annual CLEAR Plus membership credit of up to $189 and an annual LoungeBuddy credit of up to $100 to add even more value to your wallet. CLEAR gets you access to expedited security at airports and stadiums around the U.S. while the LoungeBuddy credit can cover the cost of 2 to 3 airport lounge visits a year.

Finally, the Amex Green card offers a number of travel insurance benefits, which we’ll dive into in detail below.

With the Amex Green card, you don’t get access to fancy Amex Centurion Lounges or perks like free breakfast and room upgrades when booking through Amex Fine Hotels & Resorts .

But you’ll still get a handful of useful travel protections and benefits that could save you thousands of dollars in the long run (though we hope you won’t ever have to use these benefits because that would mean an unfortunate incident has occurred).

Car Rental Loss and Damage Insurance

If you tend to rent cars while traveling, you might be surprised to discover that many credit cards offer insurance for your rental car. In this case, the Amex Green card comes with secondary rental car coverage (not to be confused with primary rental car coverage).

Secondary rental car insurance requires you to file a claim with any other insurance policies you have (including the one you use for your main car at home) before any of its coverage can apply.

Also, this particular rental car coverage policy covers rentals of up to 30 consecutive days and insures up to $50,000 per rental.

Premium Protection

With the Amex Green card, you also have the ability to purchase primary rental car coverage through Premium Protection , which comes at a low, fixed price of between $12.25 and $24.95 for the entire rental duration (eligible rentals can be up to 42 total days in length).

There’s no deductible, and this is a per-rental rate, not a per-day rate, which translates to much greater savings over other primary car rental insurance policies. The policy includes accidental death/dismemberment coverage, rental car damage, theft, and loss of use coverage.

Keep in mind that neither of these policies offers liability coverage — so if you are deemed at fault for the incident, you’ll be solely responsible for any costs and damages incurred regardless of whether you purchase Premium Protection or stick with the standard secondary car rental insurance. There’s also no disability coverage or uninsured/under-insured motorist coverage with Premium Protection.

Also, there is no coverage available when renting motor vehicles in these countries:

- New Zealand

- Any other countries subject to comprehensive sanctions administered by the Office of Foreign Assets Control (e.g. Iran, Cuba, etc.)

Filing a Claim

You can file a claim for a covered incident by calling 800-338-1670 within 30 days of the loss or as soon as reasonably possible. You can also file a claim at the American Express Claims Center .

After opening a claim, you’ll be sent additional forms within 15 days of reporting the incident to complete. These claims must be submitted, alongside any required documentation within 60 days after the incident.

Any claims that are fully substantiated will be paid within 30 days after your claim is approved.

Trip Delay Insurance

Another lovely benefit of the Amex Green card is trip delay insurance, which can cover you in the event that you’ve booked round-trip travel (which can consist of a combination of one-way tickets) entirely on your Amex Green card and there’s a covered delay of more than 12 hours. Coverage is also secondary to any primary coverage you may hold.

This insurance policy covers common carrier tickets, meaning any land, water, or air conveyance operating under a valid license for the transportation of passengers for hire and for which a ticket must be purchased prior to commencing travel.

Commercial airline tickets are eligible, as are high-speed train tickets and even cruises. However, some exclusions include taxis, limousine services, commuter rail or commuter bus lines, personal automobiles, or rental vehicles.

You, eligible family members, and traveling companions can get up to $300 in trip delay coverage towards the purchase of reasonably essential expenses like meals, lodging, toiletries, medication, and other personal use items if your trip is delayed more than 12 hours.

You can be approved for up to 2 trip delay claims every consecutive 12-month period.

Covered losses include:

- A common carrier’s equipment failure

- Inclement weather , which prevents a reasonable and prudent person from traveling or continuing (e.g. severe weather that delays the scheduled arrival or departure of a common carrier)

- Lost or stolen passports or travel documents

- Terrorist action or hijacking

Anything that falls outside of the categorization for covered losses is considered to be an exclusion for trip delay coverage.

For example, if the airline struggles to staff your aircraft with a crew, this would not be grounds for a covered trip delay because it doesn’t fall under the 4 bullet points above.

You can open a claim by calling your Benefits Administrator at 844-933-0648 within 60 days of the covered loss. The representative will provide instructions for submitting a completed claim and any required documentation which must be furnished within 180 days after the date of the covered loss.

Baggage Insurance Plan

Another great travel protection benefit of the Amex Green card is the baggage insurance plan. Simply pay for your common carrier ticket entirely using your Amex Green card (or using Membership Rewards points) to get baggage insurance coverage.

Coverage can apply to the cardmember, cardmember’s spouse or domestic partner, cardmember’s dependent children under 23 years of age, or dependent children because of a handicap condition that occurred before the attainment of the limited age of 23.

With the exception of war, acts of war, service in the armed forces or united auxiliary to it, acts of the customer or government authority, you can be eligible for the replacement cost of baggage and its contents subject to these coverage limits:

There’s also a sub-limit of $250 maximum per covered person per trip for all bags for high-risk items like jewelry, sporting equipment, photographic or electronic equipment, and more.

Lastly, for New York state cardmembers, there’s a maximum limit of $10,000 in aggregate per trip for all covered persons.

Here are the types of property that are excluded from coverage:

- Cash or its equivalent, notes, accounts, bills, currency, deeds, evidence of debt or intangible property, rare stamps or coins

- Credit cards and other travel documents including passports and visas

- Documents and tickets of any kind

- Eyeglasses, sunglasses, and contact lenses

- Food, consumable, and perishable items

- Hearing aids

- Living plants and animals

- Prescription or non-prescription drugs

- Property shipping as freight or shipped prior to the departure date

- Prosthetic devices

- Traveler’s checks and other negotiable instruments including gift certificates, gift cards, gift checks, food stamps

You can file a claim by visiting the A merican Express Online Claim Center or by calling 800-228-6855. You’ll need to provide notice of a claim within 30 days of the loss or as soon as reasonably possible.

Complete the claim form and submit any required or supplemental documentation within 60 days. This includes a list of the items lost, receipts, and other reports.

Approved claims will be paid within 30 days after satisfactory proof of loss evidence has been received.

Outside of travel insurance and protection, there are still a number of ways the Amex Green card can help when you’re traveling.

CLEAR Plus Credit