HelloSafe » Travel Insurance » PC Financial

Is PC Financial travel Insurance good? Review 2024

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Traveling without travel insurance can have severe financial consequences. Did you know that one night's hospital stay in the U.S. can be over $14,000 CAD? In some countries, you may even be denied medical assistance if you cannot prepay for treatment.

Travel insurance is an absolute necessity when you're away from home, providing coverage for healthcare expenses and ensuring you can access medical services when needed. It also offers assistance for flight disruptions, lost baggage, and other related issues.

One popular provider worth considering is the PC Financial Travel Insurance (from President's Choice). So we've done a comprehensive review outlining the coverage, costs, and the pros and cons of their service.

Additionally, you can also use our comparator to explore the best travel insurances in Canada and get quotes in seconds.

President's Choice Financial Travel Insurance: 5 Key takeaways

- PC Financial Travel Insurance protects against unexpected medical expenses and other issues like delays and cancelations.

- It offers comprehensive coverage, including trip cancellation, interruption, emergency medical, and baggage loss/delay.

- It is important to review the policy's terms and conditions to understand coverage limitations and exclusions.

- The policy offers flexibility and customisation, allowing travellers to tailor their coverage.

- It is advisable to compare other travel insurances using our comparator, considering factors like coverage, cost, and reviews.

Our 2024 review of PC Financial travel insurance

President's Choice has joined hands with Manulife Travel Insurance to provide Canadians with exceptional plans so they can travel and enjoy their business trips or vacations stress-free.

PC primarily offers 4 travel insurance options: Complete package, Package without medical care, Global medical care, and Unequaled Protection Insurance.

Before we dive into the coverage of each option, here's a quick look at the pros and cons of this insurance overall.

Pros of PC Financial Travel Insurance

- Diverse insurance options

- Partnership with Manulife

- Insurance for seniors

- No-fee master cards with travel insurance

- Quarantine expenses covered in case of COVID

Cons of PC Financial Travel Insurance

- Pre-existing medical condition exclusions

- Limited pricing information on website

You can also compare PC Financial Travel Insurance with other providers in Canada like Allianz Travel Insurance using our comparator below and also get quick quotes based on your unique needs.

Compare the best travel insurance plans on the market!

How is the PC Financial Travel Insurance Coverage?

PC Financial travel insurance offers a wide range of coverage from trip cancellation and medical emergency to flight delays and lost baggage and more to ensure you have the most stress-free travel. However the coverages vary based on the option you choose.

What does PC Financial Travel Insurance cover?

Your PC financial travel insurance may cover medical insurance alone or a combination of travel medical and trip protection, although the specific policy details, including coverage duration and limits, vary across different plans offered.

Generally, the PC Financial Travel covers a few or all of the following based on your plans:

- Trip cancellation and interruption coverage: Reimburses non-refundable expenses if a trip needs to be canceled or cut short due to covered reasons like illness, injury, or severe weather.

- Travel medical insurance: This provides coverage for medical expenses incurred while traveling, including emergency medical treatment, hospital stays, and sometimes even medical evacuation back to your home country.

- Lost or delayed baggage coverage: In the unfortunate event of lost, stolen, or delayed baggage, this coverage will provide reimbursement for the replacement of essential items.

- Trip delay coverage: If your flight or other transportation is delayed (for a specific period of time), this coverage can reimburse you for expenses such as meals, accommodations, and transportation during the delay.

- Travel accident insurance: Offers coverage for accidental death or dismemberment that occurs during travel on planes, trains, or buses.

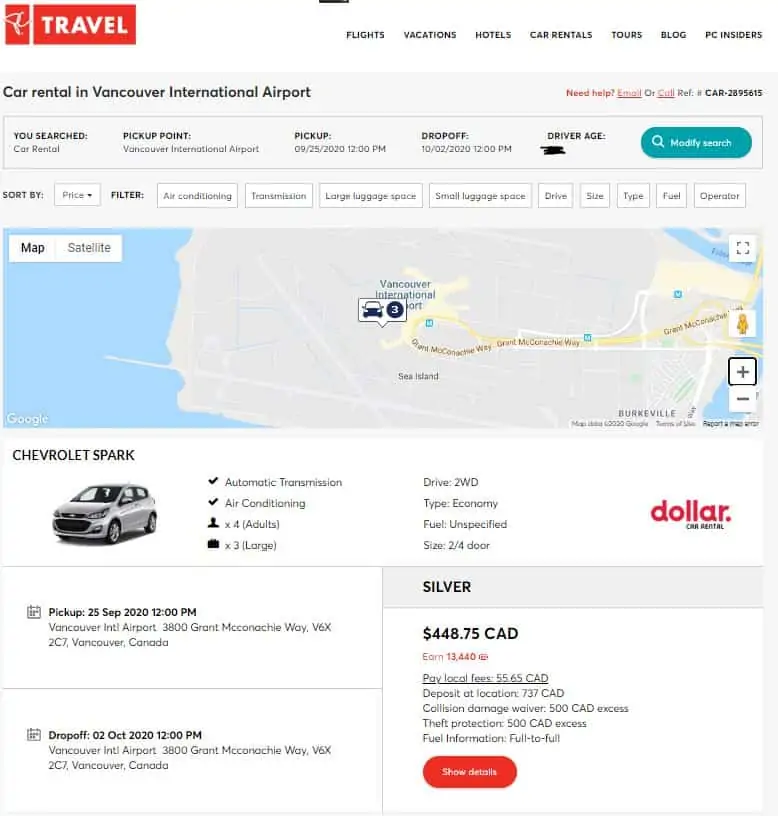

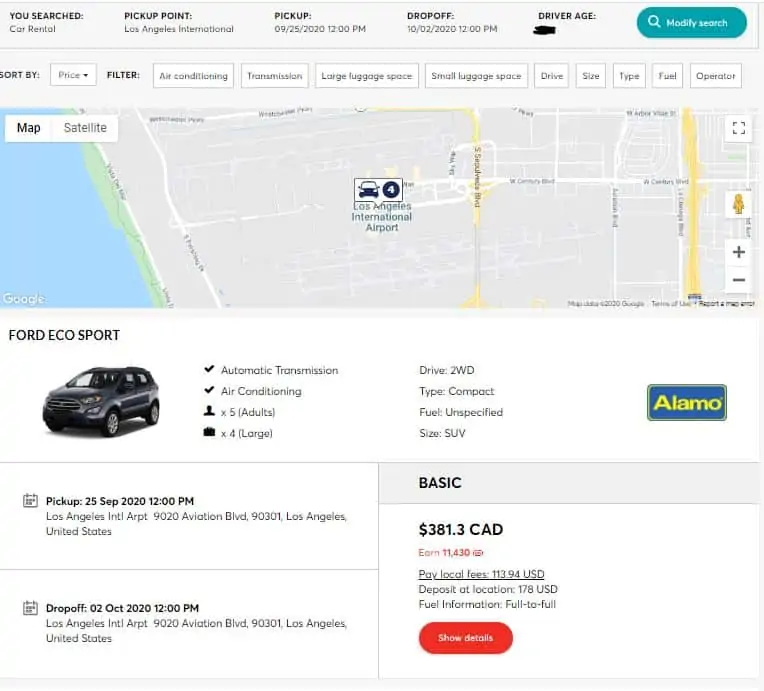

- Rental car insurance: Coverage for collision damage or theft of rental vehicles.

- Covid Travel Insurance : Covers Covid-related medical emergencies, repatriation and booking cancellations.

Here is a table to give you a quick overview of the coverage provided under the PC Financial Travel Insurance:

What does PC Financial Travel Insurance not cover?

PC Financial Travel Insurance, like other insurance policies in the market, has certain exclusions and limitations.

These may include coverage exclusions for pre-existing medical conditions, high-risk activities such as extreme sports, and incidents related to intoxication or drug use. Any claims arising from incidents related to being under the influence of alcohol or drugs may not be covered by the policy.

Additionally, travel to restricted or high-risk destinations may impact coverage eligibility. It's important to thoroughly review the policy's terms and conditions to fully understand the coverage limitations and exclusions that may apply.

If there are any uncertainties or specific concerns, it is advisable to contact PC Financial directly for further clarification.

How much does PC Financial travel insurance cost?

The price of PC Financial travel insurance depends on the following factors:

- Your desired coverage and respective policy

- Your deductible

- Your waiting period

- Your destination(s)

- The duration of your trip

You can compare coverages and prices of the best travel insurances in Canada using our comparator below and also get quick quotes based on your unique needs.

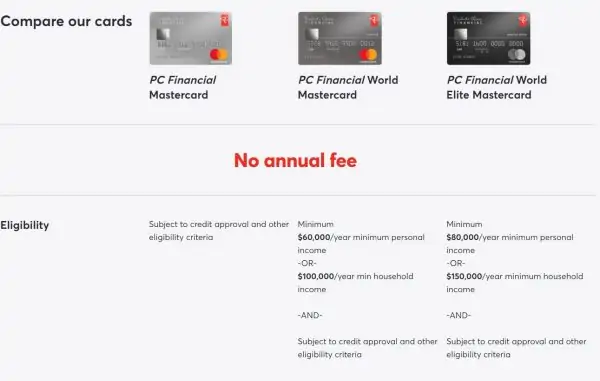

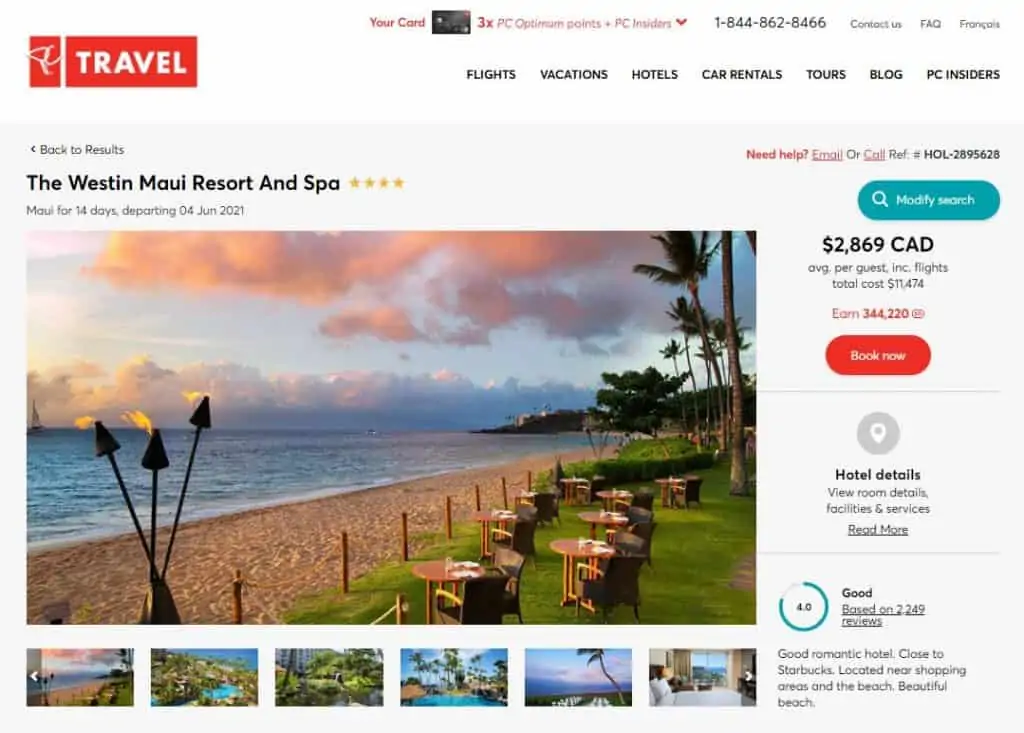

Is there a PC financial Mastercard travel insurance?

Yes, like other popular credit cards with travel insurance (to hyperlink later), President's Choice also offers this option. However, the extent of coverage and fee involved vary based on the type of credit card you choose.

PC has three primary credit cards. They are World Elite MasterCard MD , World MasterCard MD , and MasterCard MD .

PC Financial World Elite MasterCard travel insurance

PC World Elite MasterCard travel insurance provides up to $1,000,000 coverage for various emergency medical expenses during your travel including doctor charges, accidental dental care, return airfare, and more.

It also has car rental loss/damage and baggage coverage among others. It is important to read the offer documents of your card carefully.

To make insurance claims, it is highly important to ensure that your PC World Elite Mastercard account is in good standing at the time of the occurrence and the claim.

PC Financial World MasterCard travel insurance

The PC Financial World Mastercard does not offer any travel benefits, however, it does offer reward points for purchases made with respect to travel. It's best to check with your card provider to get accurate and up-to-date information.

PC Financial MasterCard travel insurance

The PC Financial MasterCard does not provide travel benefits by default. However, it might give you rewards and redeemable points that could prove beneficial for your trips and vacations. It would be best to get in touch with your provider for more information on this.

Good to know

In order to get these credit cards, you must satisfy certain eligibility criteria that also include a minimum yearly personal income or household income, apart from other credit approval criteria. Also, it's important that your travel purchases are made on your specific credit card to be eligible for claims after.

How do I contact PC travel insurance?

You can get in touch with the PC Financial travel insurance phone number: 1-844-862-8466 or 1-866-246-7262 . They are both toll-free numbers. You may have to wait a few seconds to minutes in queue when the lines are facing an unexpectedly high volume of enquiries.

The numbers are available only between 9:00 am and 5:00 pm (ET) from Monday to Friday. Weekends are closed for in-phone enquiries.

You could also fill up and submit a form on their website that is available under the contact us category and an agent will get in touch with you shortly after.

If you're an insurance holder, however, in the event of an emergency, however, you can call the toll free at 1-855-856-7569.

How do I file a claim for PC financial travel insurance?

To file a claim, you can get in touch with your provider directly on the phone and a customer service agent will guide you through the process.

You could also login on the PC Financial website to fill the claim form. It is extremely important to make sure you have all the supporting documents like invoices for purchases, bills, etc, at the time of claims process.

How do I cancel my PC financial travel insurance?

If you are looking for information and instructions to cancel PC Financial travel insurance at any time, please call 1-866-246-7262 to speak with a representative.

But canceling your travel insurance might mean putting yourself at the risk of financial stress should you be faced with unforeseen medical and other related issues during your travel. So, it's strongly recommended that you opt for a travel insurance that best suits your needs.

Now that you have a good idea about PC Financial Travel Insurance, you can compare it with the best travel insurances in Canada using our comparator below and also get quick quotes .

Nishadh Mohammed, an experienced news editor and writer, has been a member of the HelloSafe team since May 2023. With a robust nine-year background in journalism and content creation, he has transitioned from impactful roles at major Indian newspapers to steering the course of online content as the managing editor of The Daily Net. Possessing a proficiency in crafting content for diverse audiences, Nishadh also brings a deep understanding of data analytics tools such as SQL, Tableau, and Knime. His commitment goes beyond crafting engaging financial content for HelloSafe; he navigates the ever-changing SEO landscape, leveraging data-driven insights to make informed decisions. When he's not wrestling with SEO algorithms, Nishadh indulges in reading and passionately explores narratives on human rights, intersectionality, race, caste, and LGBTQIA+ issues.

- Forum Listing

- Advanced Search

- Money Topics

- General Personal Finance Talk

PC Financial Mastercard world elite travel insurance

- Add to quote

Topping up travel insurance offered by credit card

Here’s a start. https://assets.ctfassets.net/xqp30uh3quox/5bjnPXwVaaD7dwD792v0TY/917c718b945ffc1051abcccbaf5598c4/pcf_worldelite_coi_en.pdf i believe the answers are: 1. Yes, automatic, subject to conditions such as pre-existing conditions 2. that’s up to you. You may consider the coverage from PC MC isn’t enough. It doesn’t need to be one or the other. What I’m not clear about is how these credit card medical coverages work if you are driving out of country. You don’t have any airline tickets to prove entry/exit dates….how would you prove when you left rhe country? I assume you would need to prove it.

But already that's not good, if they aren't even internally coordinated to answer public's basic answer.

Did you try this number: 1-866-892-8683

This thread opened is just in a nick of time. Not trying to break your estatic balloon in getting covered/iinsured even with the top up ... try getting your claim paid or deemed approved is a nightmare. Just read yesterday from G&M(?) that a gentleman broke his back from sleep-walking off his hotel's balcony (weird or what?) whilst vacationing down south (somewhere). Boy did he get his money's worth ... of hassles. He was so closed to being a paralyzed from the waist down before he got approval for the emergency surgery from his "out of country cc covered insurer" some days later ... after calling like not hanging up at all. The insurer's 1800 # wasn't being picked up ... the usual "normal than higher volulme BS" so be prepared to wait ... hours ... if not days ... if not never. Holy jesus. Only if you're interested, I'll look for the link and p ost o/w it's not all that uncommon or unheard of ... these days. You pay and you take your chances.

From past experience, what matters is the terms of the insurance contract in effect when you enter into the contract. Suggest you download and read carefully to assess you are covered for the specific risks you are concerned about. Or post a link to it here and we can chime in. What the website or an agent say are at best only useful if you keep records and go to court months after the fact. In other words, if you have a claim someone will read the Terms in the Contract and pay based on that. Or not.

Tostig said: The benefits detail from the PC Financial website says includes "airfare". So I think it that means trip interruption. Click to expand...

Attachments

- pcf_worldelite_coi_en.pdf 537.2 KB Views: 67

I just found out that TD’s US dollar Visa offers some trip interruption coverage. Up to $5,000 of coverage per insured person, to a maximum of $25,000 for all insured persons on the same trip. To be eligible for this insurance, you must pay at least 75% of the entire cost of your trip, including taxes and fees of the Common Carrier fare, and any hotel or similar accommodations with your TD Credit Card.

- you must be under age 65

- you must be permanent residents of Canada with active provincial health insurance

- pre-existing conditions are excluded

- only the first 10 consecutive days of a trip are covered

James has provided a pretty good synopsis of how these plans work (as I understand it as well). Medical vs Trip Interruption & Cancellation are two very different things. Be sure to understand the difference and the one (or both) that you require. Be sure to fully understand the limited coverage of credit card plans and recognize it cannot be all that good considering how expensive such insurance coverages actually are. On a personal basis, I have ex-country health/medical coverage as a part of my annuitant heath benefit plans via Global Allianz which is ultimately the largest provider of this type of insurance. It is the same ex-country insurance active employees of the corporation have when they are traveling on company business. The part I have to cover on my own is Trip Interruption and Cancellation if I choose to do so. I bought this coverage back in 2015 when we were going for a Peru trip and I still had a very elderly parent alive. As it turned out, she died 5 days before we were to leave.We obviously had to cancel the trip. It took a lot of work but we were compensated for our non-refundable sunk costs because of that situation. We no longer buy TI&C because now that we are in our mid-70s, we have become higher risk of not being able to travel when scheduled and premiums have increased to about 10% of the value of the trip. We now self-insure on the premise that failure to follow through on 1 of 10 trips will pay for itself (like windshield coverage). We didn't buy TI&C for our recent trip to Costa Rica and we have not done so for our upcoming trip to Maui. Somewhere along the line, we may get caught exposed but we will take our chances.

AltaRed said: We no longer buy TI&C because now that we are in our mid-70s, we have become higher risk of not being able to travel when scheduled and premiums have increased to about 10% of the value of the trip. We now self-insure on the premise that failure to follow through on 1 of 10 trips will pay for itself (like windshield coverage). We didn't buy TI&C for our recent trip to Costa Rica and we have not done so for our upcoming trip to Maui. Somewhere along the line, we may get caught exposed but we will take our chances. Click to expand...

We also look for opportunities for refundable bookings, or relatively short lock-ins. Easy to do with airfare but more difficult with bookings in resort places, and even less easily with 'vacation packages'. Our Costa Rica package was not refundable at all about 30 days out from commencement. It is a calculated risk we take.

For packages, most tour operators sell a cancellation insurance that is not age-dependent. Runs usually $50 pp for the cheap coverage (gives you future vacation credit rather than your money back) or $100 pp for the better coverage (cancel for any reason, full refund, up to 24 hours before travel).

Lots of good advice given here. I will check the other thread again and call PC Financial about the possibility of topping up the insurance for an extra two days and trip cancellation and interruption.

Well my call to PC Financial's insurance administrator at the number on post #4, didn't get any results. No top ups are available. So I called CAA and got a quote for 2 extra days and for trip cancelation and interruption. It's over $500 for a $7000 trip for two people. Then my wife comes home and gets on the phone to talk to her pension administrator. It turns out we can register and pay an annual fee of something like $250 for the both of us to have trip cancellation and interruption as well as travel medical for all our trips. And for the trip we are booking, $35 per person. So, for us, problem solved.

Thank you. I was remiss in not saying that actually. In the case of WestJet vacations (our Costa Rica trip) it only covers up to 3? 5? days before travel, so there is a short window of real exposure. Anyways, your point is well taken.

We had/have Capital One world elite Mastercard. When we called to make a cancellation claim the C1 CSR had no information other than contact their insurer at this 1 800 number. We did, and had good service/good experience. The claim paid for more than 10 years of card fees. Our experience is that the credit card CSR’s only seem to have a data sheet with very general talking points. Anything else…call their insurance carrier. No surprise.

- ?

- 166.3K members

Top Contributors this Month

- Credit cards

What Are President’s Choice Financial Mastercards?

While most might recognize the Loblaw-owned President’s Choice brand for its various products, including coffee, cuts of meat, and even pet food, they also offer a mobile phone service, PC Mobile, and various financial services under the umbrella of President’s Choice Financial . In addition, through this offshoot of the company, they offer a trio of credit cards known as the PC Mastercards.

An Overview of President's Choice Financial Mastercard cards

There are a total of three types of PC Mastercards:

- PC Financial Mastercard ,

- PC Financial World Mastercard ,

- PC Financial World Elite Mastercard .

These cards allow you to earn PC Optimum points , which can be spent at Shoppers Drug Mart, Esso gas stations, and Loblaws stores. Cardholders can accumulate points not just at Loblaws-owned stores but also at various other retailers.

You can earn points from the following grocery stores:

- Atlantic Superstore

- Independent CityMarket

- Real Canadian Superstores

- The Independent Grocer

- Wholesale Club

You can also earn points shopping at Esso and Mobil gas stations, Shoppers Drug Mart and Pharmaprix pharmacies, and fashion brand/retail chain Joe Fresh.

The Benefits of Using a PC Financial Mastercard

The allure of the optimum points system.

First and foremost, the most popular draw of the PC Financial Mastercard is the Optimum points system . Reward programs are common these days, and it’s hard to find a card that offers nothing to its loyal users. PC Financial fulfills this need and more.

Obviously, shopping within the PC system will reap the most rewards. Not only will you earn more points, but they’ll go further on redemption when you put them towards approved products, services, and retailers. Stacking rewards with a PC Optimum credit card is a welcome feature, too.

In addition to the points you’ll be receiving and spending, there are a few extra bonuses, such as free PC Express pickup and 5% back on any PC Travel spending.

Common Advantages Across All PC Mastercards

While the three cards on offer vary in the details, such as how many PC Optimum points you earn while using each, certain benefits apply to all of them, such as the lack of an annual fee. In addition, none of the PC Financial Mastercards require a yearly payment to keep them active . All three cards also allow you to add up to four additional users for free.

Interest Rates and Balance Transfers

You’ll only pay 0.97% interest for the first six months on balance transfers. After that, purchase interest starts and remains at 20.97% for all three cards.

Exclusive Services and Travel and Insurance Benefits

The top two cards, PC Financial World Mastercard and PC Financial World Elite Mastercard , offer Mastercard Global Service Protection, 24/7 concierge service, purchase assurance, and extended warranties.

Finally, owners of a PC Financial World Elite Mastercard will also have access to travel emergency medical service and collision damage waiver insurance on owned and rented vehicles.

The Downsides of Using a PC Financial Mastercard

Limitations of pc mastercards.

No credit card is perfect, and that’s just as true for the PC Financial selection of Mastercards. As mentioned above, the biggest draw of these cards is the PC Optimum points system. If you regularly shop within the PC and Loblaw networks, the cards make for an excellent deal, especially the PC Financial World Elite Mastercard , which nets you the most points.

The Importance of the PC and Loblaw Network for Maximizing Points

However, that also points out the biggest downside to these cards. The cards lose most of their appeal if you don’t shop at PC partner stores or purchase PC products and services. You’ll earn points at a much slower rate – 1% on everyday purchases – and the points won’t be redeemable anywhere but PC Optimum retailers . Of course, one could make the argument that any points outside of their network are better than none, but these days, most cards offer points.

Lack of Cash Welcome Bonus: A Missed Opportunity?

Usually, the cards also don’t offer any sort of welcome bonus. While this may not be a big deal to some, it’s worth noting that, like rewards programs, welcome bonuses are increasingly common for new credit card owners. If various cards offer equally good plans, a welcome bonus might be enough of an incentive for someone to choose one card over another.

Limited-Time Welcome Bonus on PC Mastercard

To address the lack of a cash welcome bonus, PC Optimum is offering a limited-time opportunity to earn up to 100,000 welcome points until November 4, 2023. If you apply for a PC Mastercard on the PC Financial website, you can earn the following with your new PC Mastercard in Canada:

- 75,000 PC points when you spend $50 or more at partner stores within the first 60 days.

- 25,000 PC points when you spend $50 or more at Esso or Mobil within the first 60 days.

Comparing Travel Benefits with Competing Cards

Aside from the rewards, the cards generally don’t offer as many travel benefits as competitors’ cards. The lack of premium travel insurance makes this card less than ideal for people on the go. While it’s nice not having to pay an annual fee, some argue that this is why the card lacks many benefits that other cards carry.

Minimum Annual Income Requirements

On top of all that, the minimum annual income requirement for the PC Financial World Elite Mastercard is a whopping $80,000 for a single person and $150,000 for a household. In addition, if you qualify for the card, you have to charge a minimum of $15,000 every year to keep from being downgraded.

Is It Worth It?

Whether or not you should pick up a PC Financial Mastercard depends on a few factors. At the risk of sounding redundant, it only makes sense if you regularly shop within the Loblaw network. However, if you do happen to shop at those stores, especially if you purchase PC items, the card is an absolute must-have. If used properly, it’s possible to rack up many points in very little time.

If you don’t shop at those stores, take a hard look at some competing cards. The one exception is if this will be your first credit card. The lack of an annual fee is a huge incentive if you’re just starting out. And while the PC Financial World Elite Mastercard card might carry a hefty income requirement, the basic PC Financial Mastercard has no income requirement to speak of. Again, the benefits aren’t going to blow you away if you don’t shop within the network, but it’s a solid starter card regardless.

Alternative Cards to Consider

Here are three interesting alternatives to consider alongside PC Financial Mastercards:

Scotiabank Passport Visa Infinite Card

This card offers up to 35,000 Scene+ points and a first-year value of $747. It’s ideal for travelers and frequent shoppers at grocery stores like Sobeys and IGA, offering 3X Scene+ points on these purchases. Additionally, it has no fees for foreign currency transactions and offers free access to airport VIP lounges.

Walmart Rewards World Mastercard Card

With a first-year value of $274, this card offers a 3% cashback for online purchases on Walmart.ca and 1.25% in Walmart stores and on gas. It’s ideal for frequent Walmart shoppers and those looking to maximize cashback.

Tangerine World Mastercard

This card offers up to $100 cashback and a first-year value of $220. It’s perfect for those who want to customize their cashback, offering 2% cashback on two categories of your choice and 0.5% on all other purchases. It also offers several insurances, including mobile device and rental vehicle insurance.

Frequently Asked Questions

How can i access my president's choice mastercard account.

If you’re wondering how to manage your President’s Choice Mastercard account, you can easily access it online through the President’s Choice Financial Services website. You can log in using your mobile device, tablet, or computer.

Is it possible to manage my President's Choice Mastercard online?

Yes, you can manage your President’s Choice Mastercard online. This includes tracking your expenses, paying your bills, and checking your PC Optimum points balance. This feature makes it convenient for cardholders to stay on top of their financial activities.

How can I earn PC points with my Mastercard?

Earning PC Optimum points is straightforward with your President’s Choice Mastercard. You can accumulate points that can be redeemed for products and services at partner stores like Loblaws, Shoppers Drug Mart, and Esso gas stations. This is a great way to maximize your rewards while shopping.

How can I contact customer service for my President's Choice Mastercard?

If you need to reach customer service for your President’s Choice Mastercard, you can do so by calling the phone number listed on the back of your card. Alternatively, you can also contact them through the President’s Choice Financial Services website.

Does my President's Choice Mastercard offer travel insurance?

For those interested in travel benefits, the World Elite Mastercard from PC Finance offers emergency medical services while traveling, as well as collision damage waiver insurance for owned or rented vehicles. This makes it a suitable option for travelers.

What are the financing options with the President's Choice Mastercard?

When it comes to financing options, you’ll only pay 0.97% interest for the first six months on balance transfers with your President’s Choice Mastercard. After that, the purchase interest rate is 20.97%.

The President’s Choice World Mastercard offers additional services like Global Mastercard Protection Service, 24/7 concierge service, purchase insurance, and extended warranties. These extra features make it a compelling choice compared to other credit cards in the market.

Is it possible to get a cash advance with my President's Choice Mastercard?

Yes, you can get a cash advance with your President’s Choice Mastercard. However, be aware that higher fees and interest rates may apply for this service.

All posts by Audrey Voisine

Suggested Reading

- Bad Credit Loan

- Debt Consolidation

- Home Improvement Loan

- Installment Loan

- Private Loan

- Unsecured Loan

- Car Leasing

- Car Loan Refinance

- Secured Car Loan

- Car Title Loan

- Unsecured Car Loan

- Bridge Mortgage

- Commercial Mortgage

- First Time Homebuyer Mortgage

- Home Equity Loan

- Investment Property Mortgage

- Mortgage Refinancing

- Business Expansion Loan

- E-Commerce Business Loan

- Equipment Financing

- Merchant Cash Advance

- Start-Up Business Loan

- Working Capital Loan

- Critical Illness Insurance

- Disability Life Insurance

- Mortgage Life Insurance

- Senior Life Insurance

- Term Life Insurance

- Whole Life Insurance

- Apartment Insurance

- Basement Suite Insurance

- Condo Insurance

- Detached Home Insurance

- Rental Insurance

- Townhouse Insurance

- Errors and Omissions Insurance

- Office Insurance

- Personal Trainer Insurance

- Professional Liability Insurance

- Retail Insurance

- Yoga Insurance

- Holographic Wills

- Living Will

- Online Will

- Joint Wills

- Kitten Insurance

- Puppy Insurance

- Cat Insurance

- Dog Insurance

- More Services

- National Bank

- Apollo Insurance

- More Brands

- Best Simplii Chequing Accounts

- Best Coast Capital Chequing Accounts

- Best National Bank Chequing Accounts

- Best CIBC Chequing Accounts

- Best BMO Chequing Accounts

- Best Coast Capital Savings Accounts

- Best EQ Bank Savings Accounts

- Best National Bank Savings Accounts

- Best BMO Savings Account

- Best CIBC Savings Accounts

- EQ Bank Review

- Tangerine Bank Review

- Coast Capital Review

- CIBC Review

- National Bank Review

- More Accounts

- KOHO Prepaid Mastercard

- Neo Reward Card

- Tangerine Money-Back Credit Card

- AMEX Business Platinum Card

- Loop Corporate Card

- Jeeves Business Credit Card

- Balance Transfer

- Low Interest

- American Express

- Crypto Apps

- Crypto Exchanges

- Crypto Wallets

- CoinSmart Review

- Bitbuy Review

- Netcoins Review

- Binance Review

- Nexo Review

- More Crypto Reviews

- More Crypto

- The Motley Fool Canada

- CIBC Investor’s Edge Review

- Qtrade Review

- Addy Review

- Questrade Review

- Silver Gold Bull Review

- More Investments

- Personal Loan

- Business Loan

- Life Insurance

Home Insurance

Pc insurance review (june, 2024) – services, pricing, pros & cons.

If you’re currently searching for an insurance company, then chances are you’ve stumbled upon President’s Choice Insurance, also known as PC Insurance, which is one of the major players in the Canadian insurance industry.

Editorial Note: Comparewise is supported by our readers. When you find products and services through links on our site, we may earn commission.

PC Insurance

- Earn PC Optimum points on insurance

- Make claims 24/7

- Serves AB, ON, NB, PEI, NS and NL

Save up to 35% on insurance as a PC Optimum member - Claim this offer

The company promises to provide its customers with the best rates available in the market.

Most Canadian insurance companies pride themselves on offering the best and most affordable prices, along with top-notch services, while always prioritizing their customers’ needs.

However, these claims are becoming quite common and no longer seem newsworthy.

In this PC Insurance review, we will delve into PC Insurance’s products and services, and determine whether their claims are factual or mere hot air.

What is PC Auto Insurance?

PC Auto Insurance is an online insurance broker that compares your insurance alternatives side by side. You may obtain competitive coverage from up to nine different vehicle insurance carriers with only a few clicks.

All you need to do is provide your personal details to generate a quote that will display the cost of the insurance coverage you’re interested in.

It’s important to note that the quote may not be your final price, and it’s best to consult with a PC agent to negotiate the specifics of your contract before making any payments.

What types of insurance does PC provide?

PC Auto Insurance offers a variety of insurance packages from well-known providers to choose from.

Compulsory insurance

The insurance coverage that automatically comes with every quote includes the following:

- Liability insurance, which covers expenses that may arise if you cause an accident and someone sues you for damages.

- Accident benefits, which pay for medical expenses in the event of injury to you or your passengers during an accident.

- Uninsured motorist coverage, which helps you recover in case you encounter an uninsured driver or hit-and-run driver.

- Direct compensation, which pays for damages to your vehicle if you are not fully responsible for the accident (only available in Ontario).

Collision or Comprehensive Insurance

This insurance is more expensive, but it covers damages and repairs to your vehicle:

Collision insurance, which pays for repairs and maintenance following a collision, or replaces your vehicle if it is considered a write-off.

Comprehensive insurance protects your vehicle against damages caused by falling objects, vandalism, fire, theft, natural disasters, or civil unrest.

What do I need to know before applying?

Eligibility Requirements To qualify for PC Auto Insurance coverage, you must meet the following criteria:

- Be at least 16 years old.

- Hold a valid Canadian driver’s license.

- Own the vehicle you want to insure.

- You may also need to meet additional requirements based on the province you reside in.

How to Apply

If you want to apply for PC Auto Insurance, follow these simple steps:

- Visit the PC Auto Insurance website to request a quote online.

- Submit the required documents, such as a valid driver’s license and proof of vehicle purchase.

- If you meet the eligibility criteria, you will be verified and work with PC to negotiate the terms of your car insurance.

How to get in touch with PC Auto Insurance

You can contact PC Auto Insurance via their toll-free customer support number during regular business hours. Additionally, their claims hotline is available 24/7 to report accidents. For non-urgent inquiries, you can send an email or a letter to their business address in Ontario.

Pros of PC Pet Insurance

Free first month of pet insurance.

PC Pet Insurance offers a free first month of pet insurance, which could save you $50. You can try the service for a month before being charged, which is an excellent way to determine if it’s right for you.

Easy Sign-Up

The sign-up process for PC Pet Insurance is straightforward, and you can do it online after receiving a quote.

Coverage for Pets of Any Age

PC Pet Insurance covers pets of any age, including those that aren’t puppies. This means your pet can still be covered, regardless of their age.

Friendly Customer Service Representatives

PC Pet Insurance’s customer service representatives are friendly and eager to assist you, which is a refreshing change from the usual insurance company experience.

Discounts for Multiple Pets

PC Pet Insurance offers discounts for those with multiple pets. You can get a 10% discount if you have three to five pets, and a 15% discount if you have six or more pets.

Standard Coverage

PC Pet Insurance offers standard coverage, with accident coverage starting 48 hours after your policy, and illness coverage starting after 14 days.

Personalized Premium

Your premium is personalized based on your pet’s breed and location, taking into account varying veterinary costs.

Earn PC Points

If you pay with your PC Financial Mastercard, you can earn 20 PC points for every dollar of premium paid.

Affordable Rates

Accident coverage for dogs starts at $10.95 per month, and for cats, it starts at $9.95 per month.

Effortless Claims Approval

PC Pet Insurance approves claims without any trouble, making it easy to receive the coverage your pet needs.

PC Pet Insurance cons

Pre-existing condition coverage.

One downside of PC Pet Insurance is that it may not cover pre-existing conditions. When filing a claim, the underwriters will review your pet’s medical records to ensure that there are no pre-existing conditions.

It is also important to disclose any current or past conditions that your pet has experienced. For instance, if your pet has had food allergies, certain illnesses that arise from this condition, such as skin and gastrointestinal issues, may not be covered.

It is worth noting that other pet insurance providers have similar policies. Even Vet Insurance, which is renowned for being the “gold standard” in pet insurance, now requires a veterinary examination before approving a pet insurance application.

Delayed insurance documents

After being approved for pet insurance, customers may experience delays in receiving policy and member numbers from PC Pet Insurance.

This can cause confusion and inconvenience. While the policy package is comprehensive and easy to read once received, the wait time for delivery can be frustrating.

Claim Form Availability

In the past, finding claim forms on the PC Pet Insurance website may have been difficult.

However, it appears that the company has since made improvements to its website, making claim forms readily available as Adobe PDF files located on the right-hand side.

While the processing time for claims is faster than that of other pet insurance companies, it can still take some time to receive the results.

Changing Plans

If you need to change your pet insurance plan with PC Pet Insurance, you will need to submit a new application.

This is in sharp contrast to other pet insurance firms in Canada, where coverage may be updated with a simple phone call.

However, PC Pet Insurance suggests choosing a plan to cover your pet for the rest of its lifetime to eliminate the danger of pre-existing illnesses accumulating over time.

Overall, PC Pet Insurance has received positive feedback from customers with friendly customer service and transparent policies.

Their plans are straightforward compared to those of other providers, which may have more complicated plans with specific coverage limits.

PC Insurance: a brief overview of car insurance offerings

President’s Choice Insurance, regularly referred to as PC Insurance, is a famous Canadian insurance policy provider that serves clients across the country by providing a variety of insurance products.

This includes car insurance coverage, which is summarized below:

Car Insurance Coverage

PC Insurance provides various car insurance coverage options, including liability coverage, physical damage coverage, and accident benefits.

Optional coverage, such as legal protection, rental cars, and roadside assistance, is also available to customers.

Online Quotes

Customers can effortlessly obtain quotes for their insurance products online via PC Insurance’s website. This makes it convenient to compare coverage options and rates.

PC Insurance offers insurance premium discounts to customers for various factors, including having multiple policies with the company, having an excellent driving record, and driving a vehicle with safety features.

Claims Handling

PC I++++nsurance has a team dedicated to handling claims to help customers navigate the claims process quickly and fairly.

Customer Service: PC Insurance values excellent customer service and strives to maintain transparency, honesty, and open communication with its customers.

To assist people in locating the best insurance coverage for their unique needs, PC Insurance collaborates with a network of independent insurance brokers across Canada.

In general, PC Insurance is a respectable insurer that offers its clients a variety of insurance products, top-notch customer support, and openness.

PC Insurance market share

Although PC Insurance doesn’t publicly share its market share, it is a reputable insurance company in Canada with a long history, particularly in the areas of home and auto insurance.

Due to its affiliation with one of Canada’s largest merchants, Loblaw Companies Limited, PC Insurance has a significant market presence in that country.

PC Insurance is a well-known and reputable insurance company in Canada, despite the lack of precise market share data.

Other services offered by PC Insurance

PC Insurance offers a diverse range of insurance products to its customers in Canada, including:

- Car Insurance

PC Insurance provides liability coverage, accident benefits, and physical damage coverage for various car insurance products. Customers can opt for additional coverage, such as roadside assistance, rental cars, and legal protection, as well.

PC is one of the insurance companies in Canada that provides home insurance for houses, condominiums, and renters. Buyers of their policies can also add water damage, sewer backup, and home business insurance as options.

Insurance for Travel

Travel insurance from PC Insurance includes coverage for emergency medical bills, trip cancellations, and trip interruptions.

- Pet Insurance

Pet insurance options are offered by PC Insurance and cover boarding costs, prescription costs, and veterinarian costs.

PC Insurance provides life insurance policies such as term life insurance, full life insurance, and critical illness insurance.

Small Business Insurance

Business interruption insurance, property insurance, and liability insurance are all insurance options provided by PC Insurance for small companies.

PC Insurance’s car insurance coverage

PC Insurance is a subsidiary of Loblaw Companies and was founded in 1996. It provides home, auto, travel, and business insurance products to its customers.

PC Insurance offers car insurance coverage in select areas, such as

- New Brunswick

- Nova Scotia

- Newfoundland

- Prince Edward Island.

PC Insurance: making a claim or cancelling a policy

If you need to file a claim with PC Insurance, the process is hassle-free and straightforward.

You can easily call their phone lines and speak with an agent, who will ask for the necessary information and give you an estimated time frame for a response.

To make a claim, call 1-877-251-8656.

If you wish to cancel your policy, you can also use the same number to speak with an agent who will guide you through the process.

Keep in mind that cancelling your policy early may result in a cancellation fee, which is solely for administrative purposes.

Getting a quote from PC Insurance

To receive a quote from PC Insurance, you can contact them at 1866-660-9035 and speak with an insurance specialist during their weekday and Saturday hours of availability.

You can also obtain a quote online, but make sure to have all the necessary information on hand beforehand, such as your vehicle’s make and model, driver’s license, and driving record , among other details.

PC Insurance review final thoughts

PC Auto Insurance is a reputable car insurance broker that can provide access to competitive rates. However, keep in mind that they only compare rates from providers affiliated with their platform, so it’s essential to conduct your own research to ensure that you’re getting the best possible deal.

You might also like…

- TD Insurance Review

- Desjardins Insurance Review

- How To Get Car Insurance

Discover Investment Opportunities

Make your money do more.

Advertiser disclosure

Offers shown here are from third-party advertisers. We are not an agent, representative, or broker of any advertiser, and we don’t endorse or recommend any particular offer. Information is provided by the advertiser and is shown without any representation or warranty from us as to its accuracy or applicability. Each offer is subject to the advertiser’s review, approval, and terms. We receive compensation from companies whose offers are shown here, and that may impact how and where offers appear (and in what order). We don’t include all products or offers out there, but we hope what you see will give you some great options.

FAQs about our PC Insurance review

Yes, as long as you give them permission and they have a valid driver's license. All licensed drivers in your household should be listed on your policy, regardless of how frequently they use your vehicle.

There are various ways to qualify for discounts, such as parking your vehicle off-street, having winter tires, or installing a car alarm. Additionally, students and seniors may also qualify for discounts. Visit PC's website for a list of other available discounts.

Grow your finances today.

Most popular articles.

- How Many Toonies In A Roll

- How To Find an RBC Routing Number

- 7 Best Small Cars in Canada in 2024

- What is the Best Used SUV in Canada?

- Tesla Cybertruck in Canada: Full Buyers Guide 2024

- How to Prepare for the G License Test (June, 2024)

Browse by category

- Business Finance

- Business Insurance

- Car Finance

- Credit Cards

- Personal Finance

You may also like

Car loan? Personal Loan?

Top deals await you just a short application away!

Does PC MasterCard have trip cancellation insurance?

- Written by Mohamed Konate

- Published: January 16, 2024

Does PC MasterCard have trip cancellation insurance?

Does PC MasterCard have trip cancellation insurance – PC Financial offers travel emergency insurance but do not offer trip cancellation insurance.

Please review the certificate of insurance for details.

Our experts have compiled a list of the best cards in Canada in each major category , from cash back and low rate to balance transfers and more. Explore our top picks and find the best credit card for you.

Best Credit Cards in Canad a

Mohamed Konate is a personal finance expert, blogger, and marketing consultant based out of Toronto. He is a former financial services professional who worked for many years at major Canadian financial institutions where he managed the marketing strategy around various financial products ranging from credit cards to lines of credit. Mohamed is passionate about personal finance and holds a Bachelor in Business Administration from the University of Quebec (Montreal) and a Master in International Business from the University of Sherbrooke (Quebec).He is also the author of the Canadian Credit Card Guidebook. Read his full author bio

Credit Card Deals

Blog Categories

Best credit cards, popular content, latest articles, subscribe to our newsletter.

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

Credit Cards

By Keph Senett on March 15, 2022 Estimated reading time: 6 minutes

PC Financial Mastercard review

This no-fee card can be a good entrée into the PC Financial Mastercard family for avid PC Optimum points collectors. We break down what you need to know about this card, including the benefits and drawbacks.

With grocery costs expected to rise between 5% and 7% in 2022 , it’s natural to want a card that can earn you some points on that additional spending. If you’ve been collecting PC Optimum points for years, the PC Financial Mastercard could be a good choice for you. This card is designed to help you earn Optimum points, which can be redeemed for groceries and other products at stores like Shoppers Drug Mart and Loblaw banner stores. While it doesn’t offer much in the way of perks, the PC Financial Mastercard sets up cardholders for good rewards now along with the potential for a more premium credit card (and greater rewards) in the future. Plus, if you’re already an avid PC Optimum points collector, this card will help you maximize your earnings.

PC Financial Mastercard

- Annual fee: $0

- Earn rates: 25 points per $1 spent at Shoppers Drug Mart; at least 30 points per $1 at Esso and Mobil gas stations; 20 points per $1 at PC Travel; and 10 points per $1 on everything else

- Welcome offer: earn 100,000 PC Optimum points. Offer ends July 2, 2024.

- Annual income requirement: None

- Point value: 1 PC Optimum point is worth $0.001 (redeem 10,000 points for $10)

- Recommended credit score: 560 or higher

- Interest rates: 21.99% on purchases, 22.97% on cash advances and 22.97% on balance transfers

What you should know about the PC Financial Mastercard

How to collect pc optimum points .

When you shop using your PC Financial Mastercard, you’ll earn points for every dollar you spend, not just at PC-affiliated stores. This works out to 1% in points, which on its own is a perfectly respectable rate. In addition you’ll receive 30 points per litre on gas purchased at Esso and Mobil stations, plus 25 points per dollar at Shoppers Drug Mart—one of the best returns on gas and pharmacy purchases on any card. No matter how you look at it, these are competitive rewards made even more attractive when you consider that the PC Financial Mastercard carries no annual fee.

How to redeem PC Optimum points

Arguably the most flexible store credit card in Canada, the PC Financial Mastercard makes redeeming points as simple as earning them. Redemptions start at 10,000 points, which are worth $10 off at more than 2,500 PC-affiliated locations, including Loblaw banner stores like No-Frills or Fortinos and Shoppers Drug Mart. You can redeem points right at the checkout and the points will be used against the cost of whatever you’re purchasing.

Do you get a bonus for signing up ?

Who can qualify for a pc financial mastercard.

There is no specific income requirement for the PC Financial Mastercard, so it’s easy to qualify—even for students looking for their first card. And, if you fall into a higher earning category, you could be automatically considered for the higher-tier PC Financial World Mastercard ($60,000 income required) or PC Financial World Elite Mastercard ($80,000 income required) during the application process.

Can you get an upgrade to a higher-tier card?

Earning $60,000 to $80,000 annually may not be in reach right now, but if you spend at least $15,000 on your PC Financial Mastercard over the course of a year, you could be eligible to receive an upgrade to the mid-tier PC Financial World Mastercard. Spend $25,000 and be considered for PC Financial World Elite. All three options are no-fee.

How you can maximize your point earnings with the PC Financial Mastercard

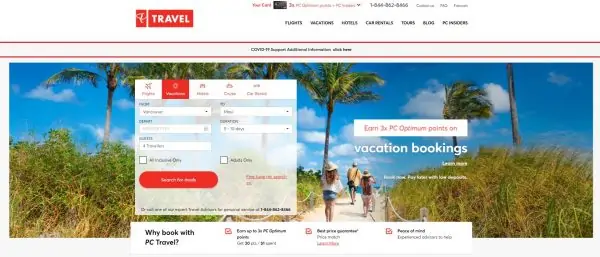

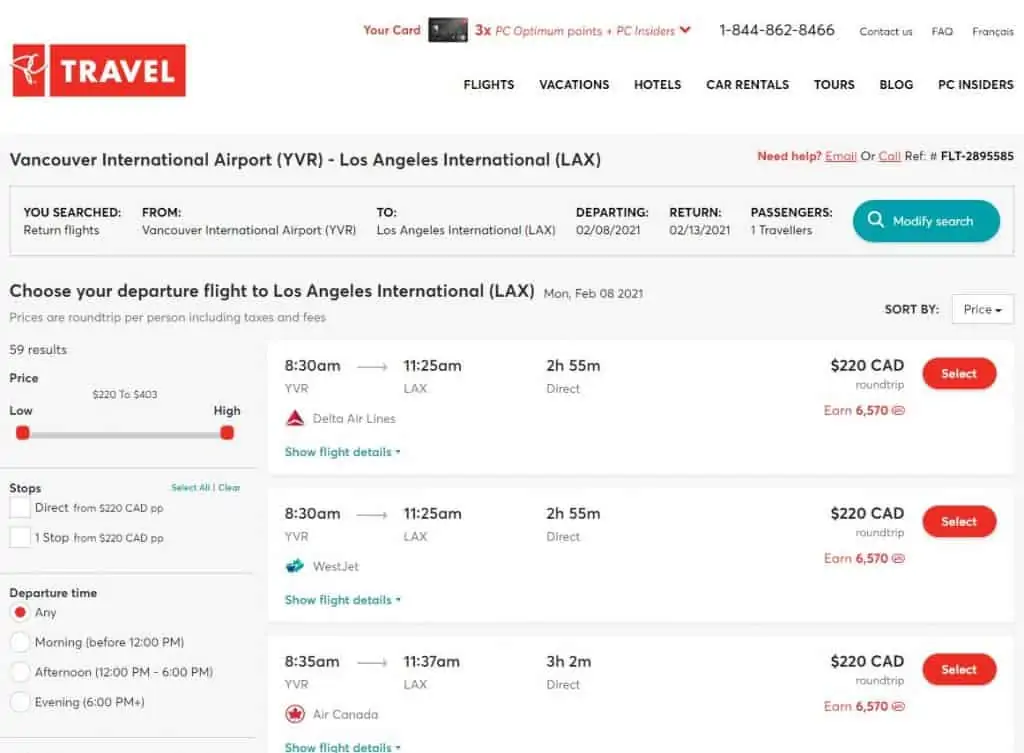

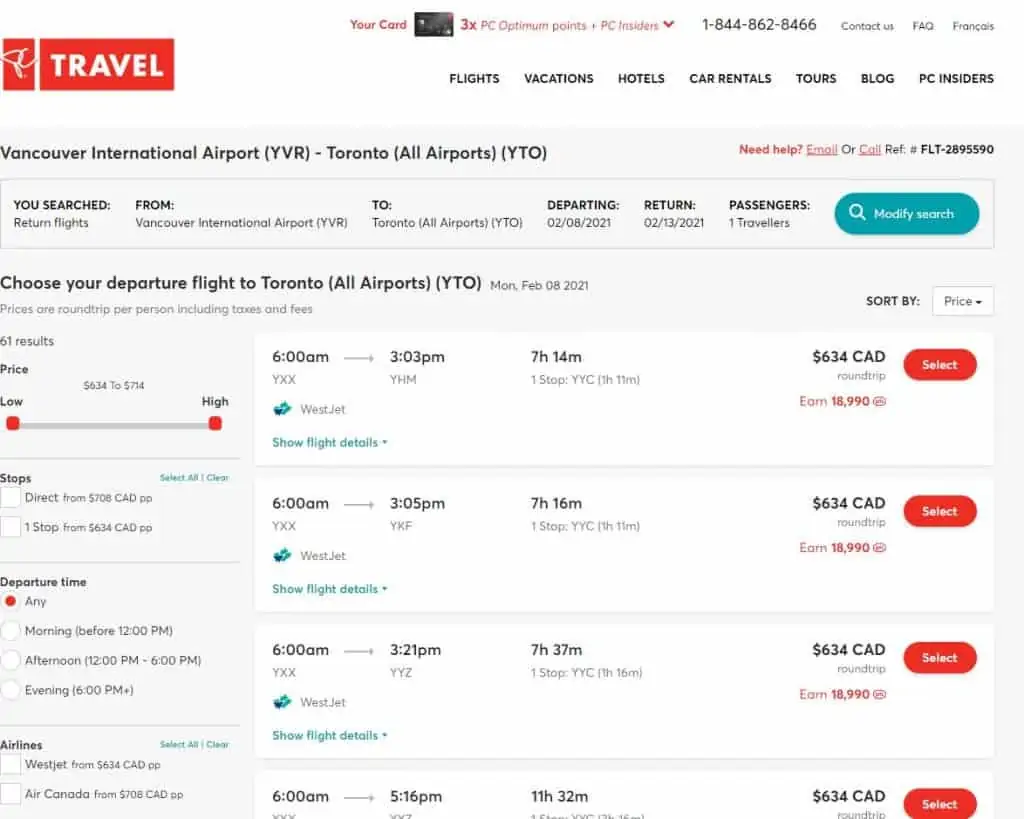

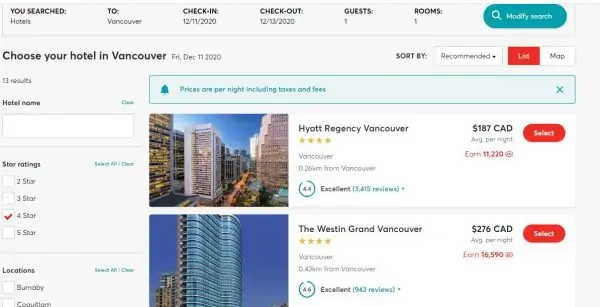

Everything you buy using your PC Financial Mastercard earns you valuable PC points, but to maximize your earnings, you’ll want to get strategic with your spending. As a PC Financial Mastercard cardholder you’ll have access to PC Travel—President’s Choice travel service agency, where you will collect two times the points on your travel spending, including flights, hotels, tours and car rentals. And, when you use your PC Optimum personalized offers available through the app or in-store, you’ll increase your earnings even more.

What other benefits does the PC Financial Mastercard offer?

The PC Financial Mastercard is a basic, no-fee card geared towards those who want to save big on everyday purchases like groceries or drugstore items; this is where the card shines. However, like most no-fee cards, it doesn’t offer much in the way of perks—though you will enjoy purchase and extended warranty protection when you shop.

How the PC Financial App works

The PC Financial mobile app is available for Apple and Android phones, and allows you to access valuable insights about your spending habits, balances and points accumulation. If you’re someone who misplaces or loses their credit cards, you’ll love the lock card feature. It allows you to temporarily lock down your credit card without reporting it stolen or missing, giving you time to find your card and avoid the hassle of getting a replacement. If you determine the card is really gone for good, you can notify the bank right from the app. The PC Financial app also allows you to use either Google Pay or Apple Pay with your card.

How Optimum Points Days work with the PC Financial Mastercard

Optimum Points Days is an annual PC promotion featuring bonus offers from partner stores including Shoppers Drug Mart, Loblaws, Real Canadian Superstore, Esso and Mobil locations. When you use the PC Financial Mastercard to make purchases that included bonus points, you can increase the amount you earn.

Who should get this card?

The PC Financial Mastercard offers an easy, no-annual-fee way to collect PC Optimum points, so it’s a must-have for those who frequently shop at partner stores and PC Optimum collectors. With no strict minimum income rules, it’s a solid choice for young adults.

Are there any drawbacks to the PC Financial Mastercard?

While the PC Financial Mastercard makes it easy to earn, the card does not allow you to collect points multipliers at Loblaw banner stores; that means you’ll receive only the base rate of 10 PC points per $1 (1%) on your grocery shopping there. As groceries are one of the biggest spending categories, this is a considerable shortcoming. Other no-fee cards, like the Tangerine Money-Back Card , offer double that rate, at up to 2% back on grocery purchases.

As a store credit card, the PC Financial Mastercard isn’t as flexible as a conventional cash back credit card. You can only redeem PC points on purchases from retailers affiliated with PC. For those who do a lot of shopping at PC stores, though, the earn rate and redemption policy make it a real contender.

The bottom line

The PC Financial Mastercard is a solid no-fee starter rewards card with easy qualifications, and it gives regular Canadians entry-level access to the PC points program. Cardholders can earn hefty rewards points at Shoppers Drug Mart and on gas (indeed, it’s one of the best credit cards for gas and drug store spending in Canada), but it falls a little short on grocery returns when compared to some other no-fee credit cards in Canada . However, the flexible points programs and easy redemption may make up for this shortfall. For those who shop regularly at PC-affiliated stores, the PC Financial Mastercard can boost your savings.

More on credit cards :

- The best rewards cards in Canada 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

About Keph Senett

Comments cancel reply.

Your email address will not be published. Required fields are marked *

There are 3 points for Loblaw’s + Shoppers, 1 point for other locations. This article is factually incorrect.

I love the PC Mastercard! I save the points and treat my daughter to a ‘free’ grocery shopping trip.

I presently have Capitol 1 and walmart rewards Mastercard would like a PC card as more flexibility

We stopped using it after it couldn’t sync to mint.com anymore

Note that there is interest charged on purchases from the day of purchase. There is no grace period. Make a payment to your credit card every day after you have use it to minimize interest charges.

This isnt completely true. The interest rate is actually about 25% and there is absolutely no customer service, not to mention false claims on your statements.

I used to absolutely love my PC card it was my go to card for the better part of 20 years… Then they stopped sinking with me and I had to manually put in my purchases… Over an hour a month I didn’t have time for. Argh. We switched to Tangerine MC.

I’ve been an Elite member for years. I spend more than double the required amount. While I love the points which is free groceries for our family, the Customer Service is pathetic. While the folks you talk to are nice without exception. They can’t solve a 16 month old problem with our cards though they’ve tried many times. It started with their new website in November 2018 and exists to this day.

After being denied cards and loans from banks, PC Mastercard was the only Credit card I was able to be approved for when I was deep in credit failure. Been with them for about 6 to 7 years, and thanks to them for helping me get my credit back to very good.

There’s no mention in this article that effective May 25th 2020, PC Financial MasterCard will be rounding down the total purchase amount to the nearest full dollar when calculating PC Optimum points for the purchase. So if the purchase amount is $5.99 it will be rounded down to $5.00 No surprises here as PC Financial has followed what many other credit card companies have been doing (shrinking point perks) when it comes to collecting points. I will not be using this card much more in the future and shame on you PC Financial for squeezing the consumer for your benefit.

Everything is milk and honey until you try to get to your account on line vey difficult to get to the account. Agent tells me it is set up this way for my protection, but if they don’t change the way it works I am going to cancel this account and the frustration that goes with it

Avoid PC, I’ve been trying for two weeks to call them urgently about fraudulent use on my account. At least one call a day, over an hour on hold each time before having to hang up. They are uncontactable, a big concern. I’m switching provider immediately.

I barely use mine. It’s my only CC. In the 10-odd years I’ve had it I’ve been hit by fraud at least 3 times. Each time I was issued a new card number and points accumulated were never transferred to the new card.

It’s scam!!! Paid off my PC master card and close account. Get later for closing account from them. After half month get statement I need to pay 12.75$ Don’t use theirs card.

The pc mastercard is pretty bad in rewards if you think about it. A/ has to be specific items when you grocer shop, B/ the points you earn is like 0.04%, compared toa 1% cash back credit card that is embarassing. c/ Points can be hacked… cash back does not… My gf recently lost all 540,000 points that she had on her account, and I doubt we are getting them back. esecially during covid-19 Customer Service. d/ i had issues with trying to get my money back from a company that sold me clothing that was nothing as what was advertised, and a missing jacket. They told me I had to send it back, which would of come from my costs, at 30$ and that was *IF* the shadey company decided they would tell em they received it. “The website was a hidden chinese company pretending to have American Standards. There was no money received back from the missing jacket even..

really bad credit card, good for beginners since it doesnt have an annual fee but not a professionals credit card. best to look else where.

I was victim of identity theft and someone is using this credit card on my name since January, it seems as a good entry level credit card for criminals

I have a pc MasterCard and I can’t use my points

Worst credit card company.I am a health care worker and was few days late in my payment and informed that due to my work time I was late but will pay out asap but was told by costomer service that they will not waive interest due being late.I also do have other cards but told me not to worry about being late and they will wave the interest.But PC will not do this.What a shame.I will pay out my card and cease PC card.No more.

I’m a happy customer. We very quickly qualified for the World Elite card, and use it for everything, gas, groceries, utilities, online purchase, a fridge, travel. The result is a big reduction in grocery costs every time we shop. Linking the credit card to the Optimum card took a couple of calls to customer service, but we’ve been happy with it now for about 5 years

I cancelled my PC Financial credit card after the two months due to poor customer service. PC Financial was absolutely aweful. Shortly after, someone from the credit department called to apologize. I have no faith in their integrity as a company.

I have had a credit with this company for 5 years and only missed one payment because everyone is just trying to get their shit together with all this covid stuff I said I could pay today and totally forgot they froze my account and refused to open it for a week for missing 1 payment in 5 years and she was very rude said sorry nothing we can do I was not told that my account was frozen instead I had to be embarrassed when my card didn’t got threw when it should have worked since I only owed 30% percent of the balance of 5500 I am paying off my account and never having anything to do with this company again if this how you treat your loyal customers count me out.

PC MasterCard Customer Care do not know their promotions. One has to haggle with them and provide them screenshots of promotions that are still in effect. PC MasterCard has a 5000 point bonus offer for purchase of 40 litres or more of fuel at Esso and Mobil stations up to a maximum of 20,000 points from August 27-September 26, 2020. I only got those points after I asked for them when I bought fuel on August 28. I got them on the same day. I bought more fuel with my PC Master Card on September 19. No 5000 points again. When I contacted their Customer Care I was asked by Pat to send them a screenshot of the promotion. I did. Employee named Kel informed me that the screenshot was received and that the missing points will be added to my PC Optimum account within 4-6 weeks. If I did not received them after that timeframe I should let them know. Outrageous. Award for excellence? For what? For lack of knowledge, for not being informed about their own promotions and for playing with customers like cats with a mouse. Sorry, but I find this outrageous. That promotion is still in effect today. Where do they operate from? From Calcutta or somewhere from South America? Who trains those people?

I have phoned four or five times trying to get them to fix my account “ACCOUNT LOCKED” I’ve paid my bill hopefully not paying interest. The last time I spoke with someone I asked them to send a paper copy. I definitely don’t have hours to spend on the phone with them as they try and fix my LOCKED ON LINE ACCOUNT THAT THEY SO FAR ARE UNABLE TO FIX.

Hello – because MoneySense is an online magazine, we are dedicated to offering information that will help people make good financial decisions. However, we are not a liaison between customers and providers of financial services.

For personal advice, we suggest consulting with your financial institution or a qualified advisor.

The dispute process sucks. I started a claim on a purchase in July and it appears that this may go on for several more months. I am so frustrated. You always hear, use your credit card to pay for things so that if you have issues you have recourse through your credit card company. Well I am finding this is not the case with MasterCard.

I have been a client of PC MasterCard for many years with excellent record. Never missed a payment. I have given thousands of dollars in business to PC. just called Customer Service and asked them to waive the interest rate of $96 as we are going through these strange times. The Customer service rep was so insensitive and kept repeating the same script over and over. He didn’t seem to care. I am very disappointed with PC and thinking to switch to other institutions.

PC Financial decreased my credit limit of 5000 to 1300, I always paid my bill every single month, I recently had paid it all off too and was continuing to use it, as I had done every month, I logged on today and noticed they decreased my credit limit drastically without any notice, no email, no letter, no phone call nothing. I was furious, I canceled the card instantly. Stay away from PC Financial at all costs

This is for anyone thinking of getting a basic PCF Mastercard. It does give 10 optimum points on every rounded down dollar spent almost anywhere on anything. There are bonuses and select locations will give even more points for each dollar. So far that includes booze, prescriptions, weed, and even taxes. So long as you have some kind of verifiable income you can get a basic PCF Mastercard. That’s the end of all the positives about the card. Now for the negatives. Transaction postings take 1 to 4 working days not including weekends. Posting the optimum points takes another day or 3 after the actual transaction is posted. I’ve also just recently discovered that even though my spending hasn’t changed, when I started to very quickly pay down my balance they cut my credit limit in half without any notice. When I phoned, they absolutely refused to restore it period!! They told me I could apply for an increase in 6 months. All summed up, I like the card for the points I get, but they treat their customers like crap.

Got 20,000 points after first use of pc mastercard spent 50.08 cad (need to spend over 50 on first purcase). Great points if you fill gas and accumulates point faster than other competitors

With this card can I us my points to by gas at esso

Go ahead and read the endless breathtaking nightmares on so many other sites about this horrible PC Choice credit card. RUN! Don’t walk!

There is a minimum 21 day grace period. You do not pay interest on purchases if you pay the balance before the due date. Like every other credit card.

I am a long time customer and have recently experienced the worst customer service from PC Financial. Locked card, declined transactions, long wait times for customer service. I would not recommend their cards.

I had the CC for 3 years, my credit limit was 12500, I used to spend about 100 a month, I was going on vacation, I spent 2000 on flight, they decreased my credit to 7500 and I paid for hotel and they reduced it again to 3500. I paid off the balance the same day. WTF PC. 0 stars

I think PC Financial has a great rewards program. Unfortunately, I have been trying to activate my card for 2 weeks. Sitting on hold for 30 -4 minutes at a time and no one answers the phone.

PC Financial has let it’s customers down. They believe your time waiting on hold for over 40 minutes to speak to a customer service representative is OK. Perhaps senior management should try wasting their time on hold each time they have a question or concern. We have tried numerous time to use the online support but finally got a bot that said the question was too complicated. All we have been trying to do is activate my replacement card. As my wife is the primary card holder it will not switch over to my card and allow me to update the access code. PC Financial must do a much better job with their customer service to ensure our ongoing business. Ps. Additionally we have had a very hard time understanding the accents of the service reps and are constantly asking them to repeat what they have said.

Harry Hawryshko applied for a mastercard, was approved (approx 3 weeks ago) still no card. what happened to the card?

I can’t believe how long I have been waiting to talk to a representative. I have been on hold an hour. Is there that many people wanting to talk to PC master card? I am sick of hearing a recording saying how important my call is to them after over a hour of waiting. What happen to good service in our world.

If I was to spend $1000.00 on locations other than pc affiliated what cash dollar amount would I receive back?

I would love to have gotten a PC Mastercard – but seems it might be because I have a lower income-senior- I have been disqualified. I have 800+ credit rating=excellent, own my home 24 yrs., no mortgage- but have been put through hoops trying to find out why I denied a credit card. Very disappointed in how I have been treated. Asked repeatedly to send the same information which has all been in emails and PM. A rep called me at home stating a bunch of information that did not mean anything. It was double talk thinking I was stupid. When I said to her I am old, not stupid, she went quiet and the conversation stopped. I just hung up the phone. Low income is the only reason I can come to to not receive this card. I meet all other requirements.

It appears there are real issues with the Master Card system in that it will remove your card from the system even when there is no issue with your account. This is done with no notification to the card holder. Solution is to issue a new card which will be mailed to you. There is no notification or check to see if the card is received, Digging into their system as much as a customer can that is the tip of the ice burg . Think carefully before getting this card. Like many other companies without enough resources hours of wait time is required to contact the company. Their chat system is virtual and only answers a few selected questions. Not a good choice.

NB. It is worth pointing out the Tangerine card mentioned doesn’t bring 2% on ALL grocery purchases, only SOME. Unless you do your grocery shopping at certain grocery stores the rate doesn’t apply. Yet again, it’s only in the small print, but I’m sure many customers get taken in by this policy.

Horrid and deplorable customer service. Don’t ! You will lose many hours of your life you cannot take back for nothing, just a lot of frustration.

They aren’t prepared for new customers. SHAME ON YOU!

I got a P/C Mastercard in the spring promising me and even an e-mail congratulating me on receiving the 100,000. points that was part of the deal when I applied for the card , and what signed up for .I charged more than the required amount @ gas stations and misc for the last 4 months. I had to buy .To date, (4 months later ) still only have points for purchases I made. (Rip of or scam)?

The pc master card is great. The customer service should you need help is terrible. Redeeming my points and moving on. Love me some rewards programs, but not more than customer service. Save your time and get a better card.

I made a mistake paying pc MasterCard. I paid my other MasterCard by mistake. Pc Financial froze my account as payment was not made to them for that month causing payments I make with my card not being made plus problems with credit bureau. I have been with them for years and I am not happy they would do this for one missed payment. I always make my payments on time.

I asked for an interest rate reduction, which I did receive from other companies at the same time. I am not in financial difficulty, thankfully, and have never been late in paying. Their rate is very high and I wanted it reduced. They declined to do so, and the next month they reduced my limit to a few hundred dollars over what I owe, and have done so subsequently several times. I stopped making purchases on the card when they refused to lower my interest rate, and now they are balance-chasing. My credit score is still good, but they are deliberately causing my utilisation rate to increase every month as I pay it down. Beware; if you ask for a reduction, or pay off your balance responsibly, they may balance-chase and cause a lowered credit score. Very shady. Like others here, I have been a responsible card holder with PC for over 5 yrs, but will close it out shortly and never recommend it.

Related Articles

Auto Insurance

Compare car insurance quotes from Canadian providers

Comparing auto insurance quotes online can help you find the best coverage at a low cost.

Making sense of the markets this week: June 23, 2024

Are lower housing prices on the way? Plus, CPI basket makeover, National Bank shareholders digest their rich meal, and...

The best no-fee credit cards in Canada for 2024

These cards have no annual fee and still boast perks like cash back, travel insurance and more.

The best student credit cards in Canada for 2024

As a student, it’s good to build a credit history while earning rewards for groceries, flights, movies and more....

The best credit cards for instant approval in Canada for 2024

Find out instantly if you’re approved for one of these credit cards. In some cases, you can use the...

How much income do I need to qualify for a mortgage in Canada?

The best credit cards for bad credit in Canada for 2024

If you want to improve your credit score you’ll have to show you can handle credit responsibly—and, used properly,...

Moving? Don’t miss these lucrative tax deductions on your moving expenses

You can ease the financial pain of a costly move by deducting those expenses from your employment, self-employment or...

The best credit cards for airport lounge access in Canada for 2024

If you want to make your travels a little more comfortable, airport lounge access is key. Here are the...

Buying your first home in Canada? Here’s what to look for in a home inspection

Sponsored By

National Bank of Canada

- Book Travel

- Credit Cards

PC Financial World Elite Mastercard

Signup bonus:

Annual fee:, earning rate:.

The PC Financial World Elite Mastercard is a fine choice for people who frequently shop at Loblaw’s brands, but otherwise has limited appeal.

Bonuses & Fees

The card currently has a welcome bonus of 20,000 PC Optimum points upon making their first purchase at a store that participates in the PC Optimum program.

Occasionally, new applicants can earn a welcome bonus of 100,000 PC Optimum points upon making their first purchase at a store that participates in the PC Optimum program. If you’re interested in the card, consider waiting for this offer to make an appearance before applying.

The card has no annual fee .

Earning Rewards

The card has category bonuses for shopping at specific stores:

- All Optimum members earn an additional 15 points per dollar spent at Shoppers Drug Mart and Pharmaprix, regardless of which credit card is used to pay

- Earn at least 30 Optimum points per litre at Esso and Mobil gas stations

- Earn 30 Optimum points per dollar spent at PC Travel

- Earn 10 Optimum points per dollar spent on all other purchases

While these rates cover a wide range of categories, they only apply at these particular merchants. So while the card may appear to have strong earning rates, it only benefits cardholders who already shop at those stores, or are willing to change their shopping habits.

Redeeming Rewards

PC Optimum points have a value of 0.1 cents per point , with occasional 50% bonus redemption events. Points can be redeemed at PC Optimum’s partner grocery stores and drugstores.

Perks & Benefits

The PC Financial World Elite Mastercard has no meaningful perks or benefits to speak of.

Insurance Coverage

The card has a modest insurance package, including emergency medical insurance for trips up to 10 days, and standard extended warranty and purchase protection .

It also includes rental car collision insurance for cars up to an MSRP of $65,000.

However, it doesn’t offer the specific provisions that are important to travellers, and the coverage it does provide can also be found on many other cards.

As a World Elite product, this credit card has a minimum annual income requirement of $80,000 (individual) or $150,000 (household). Follow the below link to the PC Financial website to learn more about this card and submit an application.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PC Travel Review: Is it worth using?