What are Round-Trip Transactions?

Complete Explanation of Round Tripping including Purpose, Example, & Risks

Home › Finance › Corporate Finance › What are Round-Trip Transactions?

In the complex world of financial markets and corporate accounting, the term “round-trip transactions” often surfaces amidst discussions of financial ethics, regulatory compliance, and corporate governance.

These transactions, while not inherently illicit, tread a fine line between strategic financial management and the murky waters of manipulative practices.

This comprehensive guide aims to unravel the intricacies of round-trip transactions, shedding light on their purposes, risks, and the legal and ethical considerations they entail.

- Round-Trip Transactions Meaning

Key Takeaways

The purpose of round-trip transactions, how is round tripping used, round tripping example, the risks and implications of round-trip transactions, legal and regulatory framework, ethical considerations of round trip transactions, detecting and preventing round-trip transactions, what exactly defines a round-trip transaction in financial terms, why might a company engage in round-trip transactions, what are the potential risks of engaging in round-trip transactions, how can round-trip transactions be identified or prevented.

Round-trip transactions refer to a series of transactions in which a company sells an asset to another party with the agreement that the asset will be bought back at a later date, usually at a similar or predetermined price.

This cycle creates the appearance of genuine business activity without any substantive change in the company’s financial position or the asset’s ownership. While round-trip transactions span various industries, they are notably prevalent in the energy sector and financial markets, where companies might engage in these deals to inflate revenue figures or to create a facade of heightened market activity.

The distinction between legitimate and manipulative uses of round-trip transactions hinges on intent and disclosure. Legitimate uses are typically transparent and aim to achieve lawful financial or operational objectives, such as hedging against price fluctuations. Conversely, manipulative practices are designed to deceive stakeholders or regulatory bodies about a company’s true financial health or market activity.

Manipulative Impact on Financial Statements : Round-tripping is primarily used to artificially inflate a company’s revenue and trading volume, misleading stakeholders about the company’s true financial performance and market activity.

Legal and Ethical Risks : Engaging in round-trip transactions carries significant legal and ethical risks, including regulatory penalties and reputational damage, as these practices can be considered deceptive and manipulative.

Importance of Transparency and Regulation : The detection and prevention of round-trip transactions highlight the importance of transparent accounting practices and stringent regulatory oversight to ensure the integrity of financial markets and protect investor interests.

Round tripping is often used to artificially inflate a company’s revenue and trading volume, creating the appearance of a higher level of business activity than actually exists.

This practice can be employed to meet financial targets, influence stock prices, or enhance the attractiveness of the company to investors by manipulating financial statements. By artificially inflating revenue, a company can appear more financially robust and liquid than it truly is, potentially influencing stock prices and investor perception.

The allure of round-trip transactions lies in their ability to temporarily enhance a company’s financial standing without necessitating actual business growth or operational improvements. This can make a company more attractive to investors, lenders, and analysts in the short term, albeit at significant risk.

Companies might engage in round-trip transactions in several different ways. Here are the most common round-trip transactions:

Inflating Revenue : A company may engage in round-tripping by selling an asset to another entity and buying it back at a similar price. These transactions can be recorded as legitimate sales and purchases, artificially inflating the company’s revenue and sales volume without any real change in its economic situation, misleading stakeholders about the company’s financial performance.

Boosting Asset Turnover : By repeatedly selling and repurchasing assets in round-trip transactions, a company can give the impression of higher asset turnover than is actually the case. This can make the company appear more efficient in its use of assets, potentially misleading investors about its operational effectiveness.

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company’s shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading information.

An example of round-tripping involves a company, Company A, selling an asset to Company B for $1 million. Shortly thereafter, Company B sells the same asset back to Company A for approximately the same price, say $1.01 million.

This sequence of transactions makes it appear as though Company A has engaged in $1 million worth of sales, thereby inflating its revenue figures, even though there has been no real change in the economic position of either company.

This practice can be used to manipulate financial statements and give an inflated impression of the company’s financial health and trading volume, potentially misleading investors and regulators.

The primary risk associated with round-trip transactions is the potential for legal repercussions and loss of investor trust. Regulatory bodies in many jurisdictions scrutinize such practices closely, and companies found guilty of using round-trip transactions to manipulate financial outcomes can face hefty fines, legal sanctions, and reputational damage.

Notable incidents, such as the Enron scandal, highlight the catastrophic impact that deceptive financial practices can have on stock prices, market stability, and investor confidence.

Moreover, round-trip transactions can distort market perceptions, leading to inefficient capital allocation and undermining the integrity of financial markets. The artificial inflation of activity or liquidity can mislead stakeholders about market demand, price stability, and the true value of assets involved.

The legal status of round-trip transactions varies by jurisdiction, but there is a growing trend towards stricter regulation and oversight. Financial regulatory bodies worldwide have implemented guidelines and reporting requirements to curb the abuse of such transactions.

The role of auditors and financial regulators is pivotal in detecting manipulative practices, necessitating rigorous examination of financial records, transaction trails, and disclosure statements.

Beyond legal implications, round-trip transactions pose significant ethical dilemmas. The fine line between creative accounting and outright fraud is often blurred, challenging companies to maintain integrity and transparency in their financial reporting.

Ethical business practices and robust corporate governance structures are crucial in mitigating the temptation to engage in deceptive financial maneuvers.

Companies must foster a culture of honesty and accountability, ensuring that all stakeholders can rely on the veracity of financial statements and market activities.

For investors and regulators, identifying potential round-trip transactions involves scrutinizing sudden spikes in revenue or trading volume without corresponding changes in market conditions or company operations. Vigilance and due diligence are essential in assessing the authenticity of reported financial health and operational activity.

Companies, on their part, can prevent misuse by adopting transparent accounting practices, regularly auditing financial records, and ensuring that all transactions are conducted at arm’s length and properly disclosed. As the financial landscape evolves, so too must the strategies for maintaining fairness and integrity in corporate reporting and market transactions.

Round-trip transactions, while a legitimate tool in certain contexts, present a complex challenge in the realm of financial ethics and regulation. As companies navigate the pressures of financial performance and market competitiveness, the temptation to engage in such practices underscores the importance of robust regulatory frameworks, corporate governance, and ethical leadership.

The future of round-trip transactions will undoubtedly be shaped by ongoing efforts to balance financial innovation with transparency and integrity, ensuring the stability and trustworthiness of markets and corporate institutions. In this ever-changing environment, the collective responsibility of companies, regulators, and investors to foster transparency and integrity has never been more critical.

Frequently Asked Questions

A round-trip transaction refers to a set of transactions where an asset is sold and subsequently repurchased by the original seller, often at a similar price, to artificially inflate volume or revenue without any real change in asset ownership.

Companies may use round-trip transactions to meet financial targets or create the illusion of increased business activity, thereby enhancing their financial statements or market valuation temporarily.

Round-trip transactions can lead to legal penalties, reputational damage, and a loss of investor trust if used to manipulate financial statements or deceive stakeholders.

Identifying round-trip transactions involves scrutinizing financial records for transactions that inflate company activity without real economic substance, while prevention requires transparent accounting practices and rigorous financial oversight.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Search Search Please fill out this field.

- Definitions O - Z

Round Trip Transaction Costs: Meaning, Profitability, Example

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

What Are Round Trip Transaction Costs?

Round trip transaction costs refer to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange fees, bid/ask spreads, market impact costs, and occasionally taxes. Since such transaction costs can erode a substantial portion of trading profits, traders and investors strive to keep them as low as possible. Round trip transaction costs are also known as round turn transaction costs.

Key Takeaways

- Round trip transaction costs refer to all the costs incurred in a financial transaction, such as commissions and exchange fees.

- Over the past two decades, round trip transaction costs have declined significantly due to the termination of fixed brokerage commissions, but still remain a factor to consider in purchasing a security.

- The concept of 'round trip transaction costs' is similar to that of the 'all-in cost,' which is every cost involved in a financial transaction.

How Round Trip Transaction Costs Work

The impact of round trip transaction costs depends on the asset involved in the transaction. Transaction costs in real estate investment, for instance, can be significantly higher as a percentage of the asset compared to securities transactions. This is because real estate transaction costs include registration fees, legal expenses, and transfer taxes, in addition to listing fees and agent's commission.

Round trip transaction costs have declined significantly over the past two decades due to the abolition of fixed brokerage commissions and the proliferation of discount brokerages . As a result, transaction costs are no longer the deterrent to active investing that they were in the past.

The concept of 'round trip transaction costs' is similar to that of the ' all-in cost ,' which is every cost involved in a financial transaction. The term 'all-in costs' is used to explain the total fees and interest included in a financial transaction, such as a loan or CD purchase, or in a securities trade.

Round Trip Transaction Costs and Profitability

When an investor buys or sells a security, they may enlist a financial advisor or broker to help them do so. That advisor or broker most likely will charge a fee for their services. In some cases, an advisor will enlist a broker to execute the transaction, which means the advisor, as well as the broker, will be able to charge a fee for their services in the purchase. Investors will have to factor in the cumulative costs to determine whether an investment was profitable or caused a loss.

Round Trip Transaction Costs Example

Shares of Main Street Public House Corp. have a bid price of $20 and an ask price of $20.10. There is a $10 brokerage commission . If you bought 100 shares, then quickly sell all of them at the bid and ask prices above, what would the round-trip transaction costs be?

Purchase: ($20.10 per share x 100 shares) + $10 brokerage commission = $2,020

Sale: ($20 per share x 100 shares) - $10 brokerage commission = $1,990

The round-trip transaction cost is: $2,020 - $1,990 = $30

Morningstar. " Morningstar's Annual Fund Fee Study Finds Investors Saved Nearly $6 Billion in Fund Fees in 2019 ."

:max_bytes(150000):strip_icc():format(webp)/PaymentforOrderFlow-blue-7af2b9aa04334d12b4ba77517dedec50.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Need Assistance? Con tact our support team

- Verify Certificates

- Anti-Financial Crime

- Anti-Money Laundering

- Fraud & Investigations

- Risk Management

- Certified Money Laundering Prevention Professional (CMLP)

- Certified Anti-Financial Crime Professional (CFCP)

- Certified Audit and Investigations Professional (CAIP)

- Certifications

- Online Courses

- Expert Webinars

- Learning Paths

- Completion Certificates

- Global Community

- Live Tutoring

- Resource Hub

- Interactive LMS

Dont Be Fooled: Key Red Flags in Round-Tripping Strategies

Understanding Round-Tripping in Financial Fraud

When it comes to financial fraud, one deceptive strategy that can be employed is round-tripping. Understanding the concept of round-tripping and its consequences is crucial for professionals working in compliance, risk management, anti-money laundering, and anti-financial crime.

What is Round-Tripping?

Round-tripping refers to a fraudulent practice where two entities engage in a series of transactions that create an appearance of legitimate business activity, while in reality, they are merely exchanging the same money or assets back and forth. This deceptive technique can be employed to inflate revenues, create fictitious transactions, or manipulate financial statements. By engaging in round-tripping, companies can present a misleading picture of their financial health to stakeholders, investors, and regulators.

Round-tripping can occur in various industries and sectors, including accounting, capital markets, and trading. In accounting, round-tripping involves inflating revenues or manipulating financial metrics through fictitious transactions. This practice can mislead investors and stakeholders about the company’s financial health. For example, a company involved in round-tripping might create fictitious sales or engage in circular transactions with related parties to artificially boost its revenue figures ( Small Business – Chron ).

Consequences of Round-Tripping

Engaging in round-tripping can have severe consequences for the companies involved. Regulatory authorities and law enforcement agencies closely monitor financial transactions to detect fraudulent activities. Companies found to be engaging in round-tripping may face legal and financial repercussions. These can include regulatory investigations, lawsuits, financial penalties, and significant damage to the company’s reputation and relationships with stakeholders.

Furthermore, round-tripping can result in misleading financial statements, which can lead to investment decisions based on false information. Investors may be deceived by inflated revenues and profits, potentially leading to financial losses. Once the truth behind the round-tripping scheme is uncovered, the company’s reputation and financial health may suffer, impacting its ability to attract investors and maintain business relationships.

To effectively combat round-tripping and other forms of financial fraud, it is crucial for professionals to be aware of the red flags and indicators associated with such activities. By recognizing these warning signs and implementing appropriate preventive measures, companies can safeguard themselves against the detrimental effects of round-tripping and maintain financial transparency and integrity.

Red Flags and Indicators of Round-Tripping

Round-tripping, a deceptive accounting practice, can be a red flag for financial statement fraud. It involves artificially inflating revenues or creating fictitious transactions to manipulate financial metrics, which can mislead investors and stakeholders about a company’s financial health ( Small Business – Chron ). Detecting round-tripping requires a keen eye for certain red flags and indicators. Here are some key signs to watch out for:

Unusually Consistent Revenue Growth

One red flag of round-tripping is unusually consistent revenue growth. While steady growth is expected in a healthy business, abnormally consistent revenue patterns might be an indication of artificial manipulation. Round-trippers may artificially inflate revenues to create an illusion of sustained growth.

High Volume of Sales with Minimal Change in Receivables

Another red flag is a high volume of sales with minimal change in receivables. In normal business operations, increased sales are typically accompanied by an increase in receivables. However, in round-tripping scenarios, sales may be artificially boosted without a corresponding increase in receivables. This discrepancy suggests potential fictitious transactions or the manipulation of sales figures.

Repeated or Cyclical Transactions with the Same Counterparty

Repeated or cyclical transactions with the same counterparty can also raise suspicions of round-tripping. Genuine business transactions often involve a variety of counterparties. However, if a company engages in a series of transactions with the same counterparty, especially in a repetitive or cyclical manner, it may be an attempt to inflate sales artificially.

Significant Increase in Sales Near the End of a Reporting Period

A significant increase in sales near the end of a reporting period can be a red flag for round-tripping. Companies engaging in this practice may try to manipulate financial statements to meet targets or impress investors. By recording a sudden surge in sales just before the reporting period ends, they create the appearance of strong performance.

Unusually High Inventory Levels

Unusually high inventory levels can be indicative of round-tripping. Companies involved in this fraudulent practice may artificially inflate their inventory levels to support fictitious sales transactions. By maintaining excessive inventory, they can create the illusion of high demand or robust business activity.

Low Gross Margins

Low gross margins can also raise suspicions. Round-tripping may involve selling products or services at lower prices, resulting in reduced profit margins. This strategy is used to generate higher sales volume and revenue figures, creating the appearance of a thriving business. However, it can be a red flag for potential financial statement fraud.

Cash Flow Inconsistencies

Inconsistent cash flows can be another red flag. Round-tripping transactions often involve the movement of funds between accounts to create the appearance of legitimate business activity. As a result, cash flows may exhibit irregularities or inconsistencies that warrant further scrutiny.

To detect round-tripping activities, auditors and investigators analyze sales patterns, review receivables and revenue, scrutinize transactions with related parties, assess inventory levels, and examine cash flow activities. By paying close attention to these red flags and conducting thorough investigations, companies can identify potential instances of round-tripping and take appropriate action to safeguard their financial integrity and reputation.

Detecting Round-Tripping Activities

To identify potential round-tripping activities and detect red flags associated with this deceptive practice, auditors and investigators must carefully analyze various aspects of a company’s financial records. By scrutinizing sales patterns, reviewing receivables and revenue, examining transactions with related parties, assessing inventory levels, and examining cash flow activities, professionals can uncover irregularities and signs of round-tripping.

Analyzing Sales Patterns

Analyzing sales patterns is a crucial step in detecting round-tripping activities. Auditors and investigators should look for unusual fluctuations or consistent growth in sales that may not align with the company’s industry norms or market conditions. Unusually consistent revenue growth, especially when accompanied by other red flags, can be indicative of potential round-tripping ( Small Business – Chron ).

Reviewing Receivables and Revenue

Reviewing receivables and revenue is essential to identify discrepancies and potential round-tripping schemes. Auditors should compare the amount of receivables to the reported revenue and assess whether there is a high volume of sales with minimal change in receivables. Significant inconsistencies between the two figures may raise suspicions of fictitious transactions or round-tripping ( My Accounting Course ).

Scrutinizing Transactions with Related Parties

Transactions with related parties can be an area where round-tripping occurs. Auditors should carefully review and scrutinize such transactions to identify any signs of round-tripping. Repeated or cyclical transactions with the same counterparty, especially when they lack a clear business purpose, can be regarded as red flags of potential round-tripping.

Assessing Inventory Levels

Assessing inventory levels in relation to sales can provide insights into potential round-tripping activities. Unusually high inventory levels, particularly when there is no corresponding increase in sales volume, can indicate the presence of fictitious or inflated transactions. Auditors should carefully examine the correlation between inventory levels and reported sales figures ( My Accounting Course ).

Examining Cash Flow Activities

Examining cash flow activities is crucial in detecting round-tripping. Auditors should pay close attention to cash flow inconsistencies, such as significant increases in sales near the end of a reporting period without a proportional increase in cash receipts. Discrepancies between reported cash flows and the underlying transactions can be indicative of round-tripping schemes ( SuperfastCPA ).

By thoroughly analyzing sales patterns, reviewing receivables and revenue, scrutinizing transactions with related parties, assessing inventory levels, and examining cash flow activities, professionals can identify potential round-tripping activities and take appropriate measures to address them. Implementing internal controls, conducting thorough audits, and performing due diligence are essential steps to prevent, detect, and mitigate the risks associated with round-tripping ( My Accounting Course ).

Round-Tripping in Capital Markets

Round-tripping in the capital markets is a form of financial fraud that involves various techniques to manipulate financial transactions and create the appearance of legitimate activity. Understanding the red flags associated with this practice is essential for regulatory and compliance professionals. In this section, we will explore some common red flags and indicators of round-tripping in capital markets.

Tax Evasion and Foreign Direct Investment

One of the most prevalent forms of round-tripping in capital markets is associated with tax evasion and Foreign Direct Investment (FDI). This scheme occurs when investments are channeled through a jurisdiction with low or no taxes before being reinvested in the originating economy. Mauritius, for example, has been highlighted as a destination where billions of dollars are round-tripped annually from India and emerging African nations ( Anti Money Laundering Law ). Detecting this type of round-tripping requires close scrutiny of cross-border transactions and the identification of unusual investment patterns.

Use of Shell Companies

The use of shell companies is another common tactic in round-tripping schemes. Shell companies are entities with no real business operations or assets, intentionally created to transfer funds between entities. This strategy makes it challenging for regulators or tax authorities to trace the origin or destination of funds, and can be utilized to inflate revenues or profits. It is crucial to thoroughly examine the relationships between entities and conduct enhanced due diligence to identify the involvement of shell companies ( LinkedIn ).

Falsified Invoices or Receipts

Falsified invoices or receipts are frequently employed in round-tripping schemes. This deceptive practice involves creating invoices or receipts for goods or services that were never actually purchased or sold. These fabricated documents are used to justify the transfer of funds, inflate revenues, overstate expenses, or evade taxes. The construction industry is particularly susceptible to this type of round-tripping activity, making it essential to scrutinize the authenticity of invoices and receipts.

Fictitious Loans or Investments

Another method of round-tripping in capital markets involves the creation of fictitious loans or investments. This scheme typically occurs when a company lends money to a shell company, which then lends it back to the original company. By creating the appearance of a legitimate loan or investment, round-trippers can manipulate financial statements, inflate assets, understate liabilities, or evade taxes. It is crucial to conduct thorough due diligence on loan agreements and investment transactions to detect this type of fraudulent activity ( LinkedIn ).

By being aware of these red flags and indicators of round-tripping in capital markets, compliance professionals can enhance their ability to detect and prevent financial fraud. Robust internal controls, thorough audits, and diligent scrutiny of financial records are essential to safeguard against these deceptive practices. Ongoing monitoring of financial performance and staying updated on the latest money laundering techniques are also crucial for effectively combating round-tripping in capital markets.

Preventing and Mitigating Round-Tripping

To combat the risks associated with round-tripping, it is crucial for organizations to implement robust preventive measures and mitigation strategies. By establishing internal controls, conducting thorough audits, segregating duties, performing due diligence, and establishing appropriate controls, financial professionals can significantly reduce the occurrence and impact of round-tripping.

Implementing Internal Controls

Implementing strong internal controls is a fundamental step in preventing and detecting round-tripping activities. Internal controls help establish a system of checks and balances, ensuring that transactions are properly authorized, recorded, and reviewed. By implementing internal control measures, organizations can mitigate the risk of fraudulent activities, including round-tripping.

Key internal control measures to consider include:

Segregation of Duties: Segregating duties is a critical control measure that helps prevent collusion or fraud. Different individuals should handle the initiation, approval, and recording of transactions. For example, those approving invoices should not have the authority to initiate payments. This segregation ensures that multiple individuals are involved in the transaction process, reducing the risk of fraudulent activities ( LinkedIn ).

Authorization and Approval Procedures: Implementing clear authorization and approval procedures is essential to ensure that all transactions undergo appropriate scrutiny. By establishing a hierarchical approval process and requiring proper documentation, organizations can reduce the likelihood of unauthorized or fraudulent transactions.

Regular Monitoring and Review: Ongoing monitoring and review of financial transactions and processes are crucial to detect any unusual patterns or discrepancies. Regular reviews of financial records, such as sales patterns, receivables, inventory levels, and cash flows, can help identify potential round-tripping activities ( LinkedIn ).

Conducting Thorough Audits

Thorough audits play a vital role in detecting and deterring round-tripping activities. Regular and comprehensive audits provide an independent assessment of an organization’s financial records, controls, and processes. Audits help identify any inconsistencies, errors, or potential fraudulent activities, including round-tripping.

During audits, financial professionals should:

Review Financial Transactions: Auditors should thoroughly review financial transactions, paying close attention to sales patterns, receivables, and revenue recognition. By examining the details of transactions, auditors can identify any irregularities or suspicious activities.

Scrutinize Related Party Transactions: Transactions involving related parties should receive additional scrutiny during audits. Auditors should thoroughly examine the terms, purpose, and nature of these transactions to ensure they are legitimate and not part of a round-tripping scheme.

Assess Internal Control Effectiveness: Auditors should assess the effectiveness of internal controls in preventing and detecting round-tripping activities. This includes reviewing the segregation of duties, authorization procedures, and monitoring mechanisms.

Segregating Duties

Segregation of duties is an essential control measure to reduce the risk of round-tripping. By separating the functions of initiating, approving, and recording transactions, organizations can minimize the potential for collusion or fraud. For example, individuals responsible for approving invoices should not have the authority to initiate payments. Segregating duties ensures that multiple individuals are involved in the transaction process, reducing the risk of fraudulent activities ( LinkedIn ).

Performing Due Diligence

Performing due diligence is a critical step in preventing round-tripping. Financial professionals should conduct thorough background checks, site visits, or other verification measures to ensure the legitimacy of entities involved in transactions. This includes verifying the identity, ownership, and business purpose of new entities before engaging in transactions with them. Due diligence helps identify any potential risks or red flags associated with round-tripping activities ( LinkedIn ).

Establishing Appropriate Controls

Establishing appropriate controls is essential in preventing and detecting round-tripping in financial transactions. This includes implementing measures such as:

Documenting Policies and Procedures: Clearly documenting policies and procedures related to financial transactions helps ensure consistency and transparency. These guidelines should address the identification and prevention of round-tripping activities.

Implementing Transaction Monitoring Systems: Utilizing advanced technology and software solutions, organizations can monitor financial transactions in real-time. These systems can identify suspicious patterns, flag potential round-tripping activities, and generate alerts for further investigation.

Conducting Regular Training and Awareness Programs: Organizations should provide regular training and awareness programs to employees, educating them about the risks associated with round-tripping and promoting a strong ethical culture. By fostering a culture of integrity and compliance, organizations can reduce the likelihood of round-tripping activities.

By implementing these preventive measures and mitigation strategies, financial professionals can protect their organizations from the detrimental impact of round-tripping. It is essential to remain vigilant, conduct regular assessments, and adapt controls as necessary to stay ahead of evolving financial fraud schemes.

Red Flags and Indicators of Round-Tripping in Trading Activities

When it comes to identifying potential round-tripping activities in trading, there are several red flags and indicators that professionals in compliance, risk management, anti-money laundering , and anti-financial crime should be aware of. These indicators can help in detecting potential market manipulation and fraudulent schemes. Here are some key red flags to watch out for:

Nonsensical Round-Trip Trading Volumes

Nonsensical round-trip trading volumes can be a significant red flag indicating potential market manipulation through wash trades. These trades involve buying and selling the same financial instrument at the same price or a very similar price, with the intention of creating false transaction volumes or influencing the market ( WallStreetMojo ). Unusually high trading volumes with no apparent economic purpose or justification should be thoroughly investigated.

Round-Tripping with Related Parties

Round-tripping with related parties is another red flag that deserves scrutiny. In such cases, trading activities occur between entities that have a close relationship, such as subsidiaries, affiliates, or entities under common control. This type of round-tripping can create false demand for a company’s stock and artificially inflate its value ( WallStreetMojo ). It is important to investigate the nature of these transactions and assess whether they are conducted arms-length or involve collusive activities.

High-Frequency Round-Tripping

High-frequency round-tripping, where a large number of trades are executed within a short period, can also be indicative of potential market manipulation. Rapid buying and selling of securities can artificially inflate trading volumes, create false market activity, and mislead investors. Monitoring and analyzing trading patterns can help identify such suspicious activities.

Frequent Round-Tripping by the Same Party

Another red flag is frequent round-tripping by the same party. This can be seen in cases where an individual or entity repeatedly engages in round-tripping transactions, potentially to manipulate stock prices or financial statements. Pump-and-dump schemes, where the price of a security is artificially inflated before being sold off, are examples of frequent round-tripping activities that require attention.

Non-Arms Length Round-Tripping

Non-arms length round-tripping, which occurs when parties collude to create misleading financial statements or engage in fraudulent activities, is another significant red flag. This type of round-tripping involves transactions between entities that have a close relationship and can be used to manipulate financial records or misrepresent the true nature of transactions. Proper due diligence and scrutiny of such transactions are crucial to identify and prevent such activities.

By being aware of these red flags and indicators, professionals can enhance their ability to detect potential round-tripping activities in trading. Thorough scrutiny of financial records, due diligence, and monitoring of financial performance are essential in identifying and mitigating the risks associated with round-tripping. Implementing robust internal controls, conducting regular audits, and establishing appropriate checks and balances are also crucial in safeguarding against these fraudulent practices.

Safeguarding Against Round-Tripping

To protect against the risks associated with round-tripping and other fraudulent schemes, it is essential to implement effective safeguards. Thorough scrutiny of financial records, conducting due diligence, and monitoring financial performance are crucial steps in preventing and detecting round-tripping activities.

Thorough Scrutiny of Financial Records

One of the key ways to safeguard against round-tripping is through a meticulous examination of financial records. By carefully analyzing financial statements, investors can identify red flags and patterns that may indicate fraudulent practices. This scrutiny involves reviewing financial data such as revenue, expenses, receivables, and cash flow activities.

By assessing the consistency and accuracy of these records, discrepancies or anomalies can be identified. Unusual revenue growth, low gross margins, cash flow inconsistencies, and significant increases in sales near the end of a reporting period are some red flags that may indicate potential round-tripping activities. For a comprehensive list of money laundering red flags, refer to our money laundering red flags checklist .

Conducting Due Diligence

Conducting thorough due diligence is another critical step in safeguarding against round-tripping. By researching and verifying the background, ownership, and business purpose of entities involved in transactions, investors can mitigate the risk of falling victim to fraudulent schemes. This includes performing background checks, site visits, and assessing the reputation and integrity of the parties involved.

Due diligence helps to ensure that the entities are legitimate and have a genuine business purpose. It also helps in identifying any related parties or connections that may raise suspicions. By diligently assessing the authenticity and credibility of the parties involved, investors can make informed decisions and reduce the risk of being involved in fraudulent activities. For more red flags and indicators related to customer behavior, refer to our article on red flags in customer behavior .

Monitoring Financial Performance

Regularly monitoring the financial performance of a company is crucial in detecting potential round-tripping activities. By closely analyzing revenue patterns, receivables, inventory levels, and cash flow activities, investors can identify inconsistencies or unusual patterns that may indicate fraudulent practices.

Unusually consistent revenue growth, high volumes of sales with minimal change in receivables, and repeated or cyclical transactions with the same counterparty are among the indicators of potential round-tripping. It is important to establish benchmarks and compare the financial performance of the company against industry standards and competitors. Any significant deviations should be thoroughly investigated. For more information on red flags in financial transactions, refer to our article on red flags in financial transactions .

By implementing these safeguards and maintaining a vigilant approach to financial transactions, individuals and organizations can protect themselves from falling victim to round-tripping and other fraudulent activities. It is important to stay informed about common money laundering techniques and be proactive in identifying and reporting suspicious transaction indicators to the relevant authorities.

Achieve AML Excellence: Unlocking the Power of Certification

Achieving AML Excellence: Following FATF Recommendations for Correspondent Banking

Cracking Down on Money Laundering: AML Regulations in Real Estate Exposed

Strengthening Financial Integrity: The Vital Role of Money Laundering Laws

Terrorist Financing Red Flags And Suspicion

From Aspirations to Reality: AML Job Openings for Ambitious Professionals

Privacy overview.

What Is round-Trip Trading?

Our promise to you.

Founded in 2002, our company has been a trusted resource for readers seeking informative and engaging content. Our dedication to quality remains unwavering—and will never change. We follow a strict editorial policy , ensuring that our content is authored by highly qualified professionals and edited by subject matter experts. This guarantees that everything we publish is objective, accurate, and trustworthy.

Over the years, we've refined our approach to cover a wide range of topics, providing readers with reliable and practical advice to enhance their knowledge and skills. That's why millions of readers turn to us each year. Join us in celebrating the joy of learning, guided by standards you can trust.

Editorial Standards

At SmartCapitalMind, we are committed to creating content that you can trust. Our editorial process is designed to ensure that every piece of content we publish is accurate, reliable, and informative.

Our team of experienced writers and editors follows a strict set of guidelines to ensure the highest quality content. We conduct thorough research, fact-check all information, and rely on credible sources to back up our claims. Our content is reviewed by subject-matter experts to ensure accuracy and clarity.

We believe in transparency and maintain editorial independence from our advertisers. Our team does not receive direct compensation from advertisers, allowing us to create unbiased content that prioritizes your interests.

Round-trip trading, in terms of individual investors, refers to the practice of buying and selling the same security in the same trading day. Since this is a risky practice, many markets have regulations in place that prevent this from taking place unless the investor has a significant amount of money in his or her trading account. In terms of companies, round-trip trading takes place when a company sells an asset to another company and then buys the same asset back from the second company for the same price. This practice inflates trading volume, which can boost stock prices in the process, and also can be used to artificially raise revenue totals for the companies involved.

Unfortunately, there are unscrupulous individuals and institutions that attempt to manipulate markets and investors in their favor. As a result, market regulatory bodies, like the Securities and Exchange Commission (SEC) in the United States, have instituted rules to try to dissuade these practices. One particular practice that has drawn the scrutiny of market regulators is the technique known as round-trip trading, which can deceive investors if left unchecked.

Day-traders, who are investors who make a significant number of market transactions in a single day in an attempt to time price movements, are the people most likely to use round-trip trading. Making a round-trip trade requires buying a security and then selling it in the same day. Since there are severe risks involved in making these kinds of trades on a constant basis, the SEC requires traders to have a significant minimum amount in their accounts to round-trip trade without limits.

Perhaps even more damaging to the overall economic picture is when companies indulge in round-trip trading. When it takes place on a corporate level, a round-trip trade involves two companies clandestinely agreeing to the sale of an asset. After a short time, the company that bought the asset simply resells it to the company that owned it originally.

There are two ways in which corporate round-trip trading is deceptive. First, the trades, if they are performed often enough and involve stocks or bonds, can boost trading volume. Investors often track volume as a way to measure interest in a company, so improved volume often leads to improved stock prices. The other way that a corporate round-trip trade is misleading is that it increases revenue totals for the companies involved. Even though there is no actual loss or gain involved, the higher revenue totals also can entice unsuspecting investors.

- https://seekingalpha.com/article/172797-the-global-oil-scam-50-times-bigger-than-madoff

Related Articles

- What is a Trading Unit?

Our latest articles, guides, and more, delivered daily.

The Meaning of "Round Tripping" in Accounting

- Small Business

- Accounting & Bookkeeping

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Does a Sales Discount Go on an Unadjusted Trial Balance?

Advantages and disadvantages of for-profit companies, accounting for an operating patent.

- What Does a Debit Balance in Manufacturing Overhead Do?

- How to Calculate Market Value of a Corporation

The accounting slang term "round tripping" refers to a series of transactions between companies that bolster the revenue of the companies involved but that, in the end, don't provide real economic benefit to either company. While not necessarily illegal, round tripping is at best disingenuous. It's important for a scrupulous businessperson to be able to recognize when a transaction may amount to round tripping – and, just as important, to know when a transaction that may look like round tripping is in fact legitimate.

Name Origins of "Round Tripping"

The name for the practice comes from "round trip" – a journey that takes you from one place to another and then back to your starting point. In essence, that's what's happening with financial round tripping: The companies involved start out in a certain financial position, and then they engage in a series of transactions. When all those transactions are settled, they're in the same financial position they were in when they started. They've made a "round trip." Such deals are also known as "lazy Susans."

Round Tripping: Meaning

A common round-tripping maneuver involves reciprocal sales of identical assets. Imagine you own an office supply store, and the owner of a stationery store comes to you with a proposal. He'll buy a pallet (40 cases) of copy paper from you at your retail price of $30 a case, for a total of $1,200. Meanwhile, you'll buy a pallet of the identical paper from him at the same price, $1,200. He's proposing a round-tripping deal. Other, more flagrant examples might include mutual payments for nonexistent "services," or one company "investing" in another, with the second company turning around and using the money to buy goods or services from the first.

Purpose of Round Tripping

According to Accounting Tools , the point of round tripping is to inflate revenue – to make a company look like it's doing more business than it really is. Although the bottom line for any company is profit, observers often judge a company's growth and size by its sales revenue. Round-trip deals generally don't inflate profit; after all, the $1,200 in revenue you would earn from selling paper to the stationery store would be offset by the $1,200 expense of buying an equal amount of paper. But each company gets that additional $1,200 in revenue, so it appears a little bigger and more active than it would without the round trip.

Legitimate Round Tripping Transactions

Say your office supply store has a delivery van whose tires are shot. You go to the tire shop next door and buy a new set of radials for $600. Three weeks later, the owner of the tire shop comes in and buys paper, printer ink, pens and other stuff worth $600 for his business. This would not be a round-trip situation. Each of you had a legitimate business purpose for these transactions; the fact that you both wound up with $600 in revenue and $600 in expenses, for a net profit of zero, is immaterial. Round tripping is about setting up reciprocal deals with no legitimate business purpose.

Legality of Round Tripping

The fact that legitimate deals can look like lazy Susans makes it hard to simply outlaw the practice. That said, WallStreet Mojo indicates that if a company is using self-canceling transactions to make its numbers look better to investors or lenders (which is the purpose of round tripping), it can be prosecuted for fraud. For instance, the Securities and Exchange Commission might charge several software companies relating to a round tripping fraud scheme for a series of transactions that an agency says provides no economic benefit and are intended only to boost the company's reported revenue.

- Accounting Tools: Round Tripping Definition

- WallStreet Mojo: Round Tripping

Related Articles

Why is the accrual basis of accounting accepted by gaap, difference between cash flow & sales revenue, is it ethical to record the transactions directly into the general ledger accounts, accounting definition of self balancing accounts, post-dump buyout strategy, difference in validate & verify in accounting, examples of aggressive accounting, examples of corporate malfeasance, what is a negative goodwill in accounting, most popular.

- 1 Why Is the Accrual Basis of Accounting Accepted by GAAP?

- 2 Difference Between Cash Flow & Sales Revenue

- 3 Is It Ethical to Record the Transactions Directly Into the General Ledger Accounts?

- 4 Accounting Definition of Self Balancing Accounts

- Forex Trading Education

- Forex Trading Glossary

What is a Round Trip?

Round Trip Definition. A Round Trip is the actual buying and selling of a specified amount of the same asset. In the context of the forex market, it pertains to a specific currency. This process has been used to inflate volume statistics through the continuous and frequent purchase and sale of a particular security, commodity or currency. Round-trip trading can also be employed by businesses to sell and buy back an asset at roughly equivalent pricing. This type of transaction is prevalent in the energy and telecom industries where excess capacity is sold back and forth between business partners with no apparent impact on profits. Unscrupulous business managers have used round-trip trading to artificially inflate transaction volumes and revenue, thereby manipulating markets in the process. Enron was a company that engaged in the nefarious practice of round-trip trading, and, by doing so, was able to increase revenues and expenses without changing its net income. Sarbanes-Oxley was the legislation that followed this financial debacle and was designed to tighten audit controls on all items that translate to revenue in a company’s financial statements.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

Privacy Overview

Financial Tips, Guides & Know-Hows

Home > Finance > Round Trip Transaction Costs Definition

Round Trip Transaction Costs Definition

Published: January 22, 2024

Learn the definition of round trip transaction costs in finance and understand how they impact investments. Find out how to calculate and minimize these costs for better financial management.

- Definition starting with R

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Understanding Round Trip Transaction Costs

When it comes to finance, there are various concepts and terms that can be confusing. Today, we’re going to dive deep into understanding round trip transaction costs. So, if you’re interested in learning more about this topic, you’ve come to the right place!

Key Takeaways:

- Round trip transaction costs refer to the total expenses associated with buying and selling an investment.

- These costs consist of brokerage fees, commissions, taxes, and other charges.

Now that we know the key takeaways, let’s delve into the definition and explanation of round trip transaction costs.

What are Round Trip Transaction Costs?

Round trip transaction costs can be defined as the total expenses incurred when an investor buys and sells an investment. It’s important to note that these costs go beyond the actual purchase and sale price of the investment.

When you decide to buy or sell securities such as stocks, bonds, or mutual funds, there are various additional expenses involved. These expenses include brokerage fees, commissions, taxes, and other charges. All these costs together make up the round trip transaction costs.

Calculating Round Trip Transaction Costs:

Calculating round trip transaction costs can be a bit tricky as it involves considering multiple factors. Here’s a general breakdown of the various costs to consider:

- Brokerage Fees and Commissions: These are charges imposed by the broker for executing the transaction on your behalf. They are usually a percentage of the trade value or a fixed fee per trade.

- Taxes: Depending on your country’s tax laws, you may need to pay taxes on the gains made from the investment. It’s essential to factor in these taxes when calculating the round trip transaction costs.

- Exchange Fees: If you’re trading on an exchange, there may be additional fees charged by the exchange itself. These fees vary from one exchange to another and can impact your overall round trip transaction costs.

- Spread: The spread is the difference between the buying and selling prices of an investment. It represents the cost the market maker charges for facilitating the transaction. It’s crucial to consider the spread when calculating round trip transaction costs, especially in highly liquid markets.

- Other Charges: Depending on the investment and the broker you’re using, there may be other charges associated with the transaction. These charges can include custody fees, wire transfer fees, or account maintenance fees. Always check the terms and conditions and the fee schedule provided by your broker to ensure you are aware of any hidden charges.

Why Are Round Trip Transaction Costs Important?

Round trip transaction costs are important because they directly impact your overall investment returns. These costs can eat into your profits or increase your losses. By understanding and minimizing these costs, you can improve your chances of achieving better investment results.

Moreover, being aware of round trip transaction costs can also help you evaluate the efficiency of your investment strategy. It allows you to compare the costs associated with different investments or trading strategies and choose the most cost-effective approach.

In Conclusion

Round trip transaction costs are a crucial aspect of investing. Understanding these costs and incorporating them into your investment strategy can help you make more informed decisions and maximize your returns. By considering factors such as brokerage fees, commissions, taxes, and other charges, you’ll have a clearer picture of the overall costs associated with buying and selling investments. So, next time you’re making an investment, remember to factor in the round trip transaction costs.

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

Do You Get A Grace Period For Car Insurance When Buying A Car?

What Is An Inefficient Market? Definition, Effects, And Example

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/round-trip-transaction-costs-definition/

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Round-tripping

By JX · 14 Oct 2020

Explore the Library

Round-tripping is the process where funds are returned after being transferred to an entity, shell company, financial instruments, location, or a person that have lower regulatory standards or obligations – giving the impression that the funds have derived from a clean source and thus completing a round trip.

Editor · Dip(AML)

Reader Interactions

23 Dec 2020 at 3:57 pm

Very interesting

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

One-Way vs. Round-Trip Flights: When Is It Worth Booking Separately?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is a round-trip flight?

What is a one-way flight, when booking cash tickets, when redeeming points and miles, consider booking open-jaw flights.

Are round-trip flights cheaper? The short answer is that it depends . Where you’re traveling to and if you’re paying with cash or miles are the biggest factors in the equation.

For instance, if you’re traveling between the U.S. and Europe and paying in cash, it's cheaper to book a round-trip flight. But if you’re paying for that same flight with miles, the price of two one-way tickets will most often be the same as a round-trip flight (though the taxes paid may vary).

There are other considerations besides just price when comparing round-trip versus one-way flights. Travelers might be surprised to find that booking a round-trip award flight could lead to issues if you have a change in plans mid-trip.

Here's a look at options to weigh when booking round-trip versus one-way flights and answers to some frequently asked questions.

» Learn more: The best travel credit cards right now

When you book a round-trip flight, it means you travel from Destination A to Destination B and you return back to Destination A from Destination B. Both flights are booked as one ticket.

So when you’re purchasing the ticket, you select your origin, destination, departure and return date. You make one payment, whether it's with cash or miles.

» Learn more: How to book a flight

A one-way flight, in contrast, is a ticket booked with no return. So you’re only booking a flight from Destination A to Destination B. You can purchase a second, separate ticket from Destination B back to Destination A (should you so choose). One-way flights can be booked with cash or miles.

These types of flights are a good option for those who don’t know their return date, are only traveling in one direction or booking an open-jaw itinerary .

» Learn more: The best days to book a flight and when to fly

When booking flights paid in cash, our recommendation is pretty simple: Book the option that's cheapest for your trip. If a round-trip flight is cheaper than two one-way flights, there's no reason to book two one-way flights.

If two one-way flights are the same price as a round-trip, it might make sense to book the one-way flight (as long as you don’t mind keeping track of the two separate reservations). Even though many airlines have eliminated change fees , it's much easier to change — or even cancel — a flight when there’s only one flight on the reservation to make a change to.

If you’re flying domestically in the U.S., the cost of two one-way flights will usually be the same as a round trip; however, when flying internationally, it can be much more expensive to book two one-way tickets.

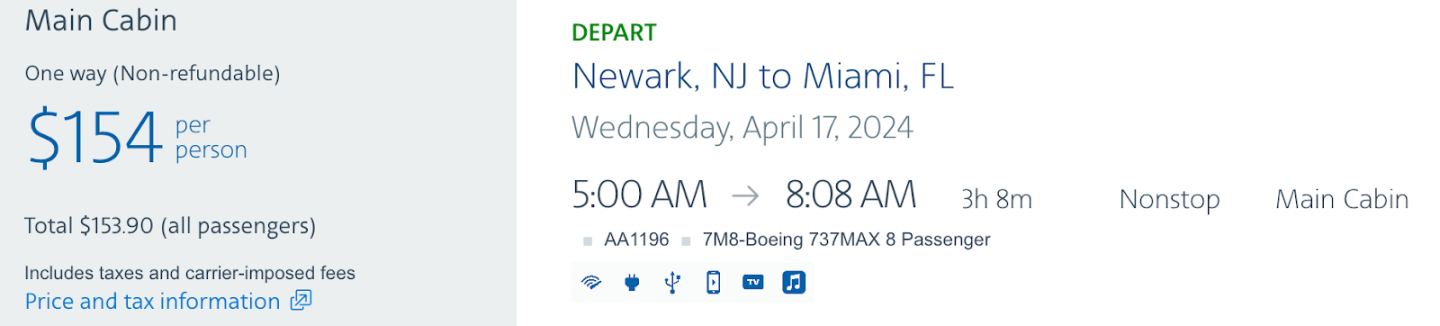

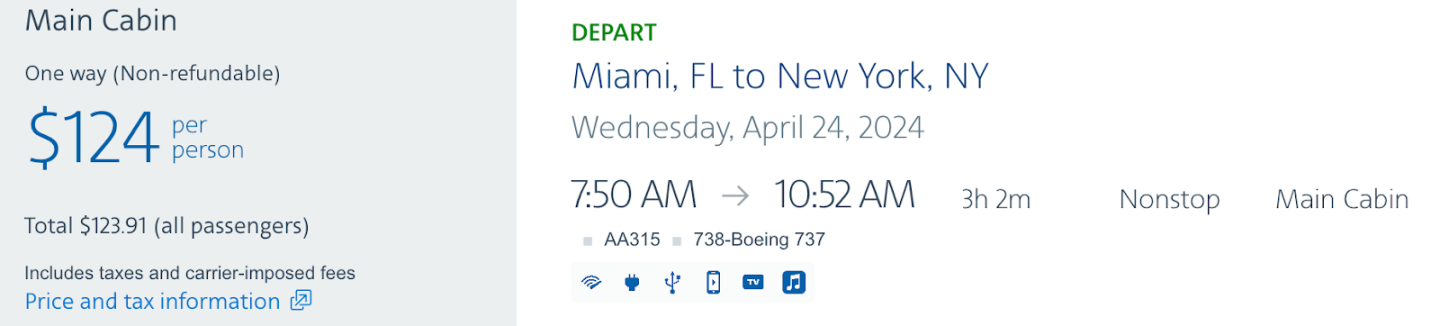

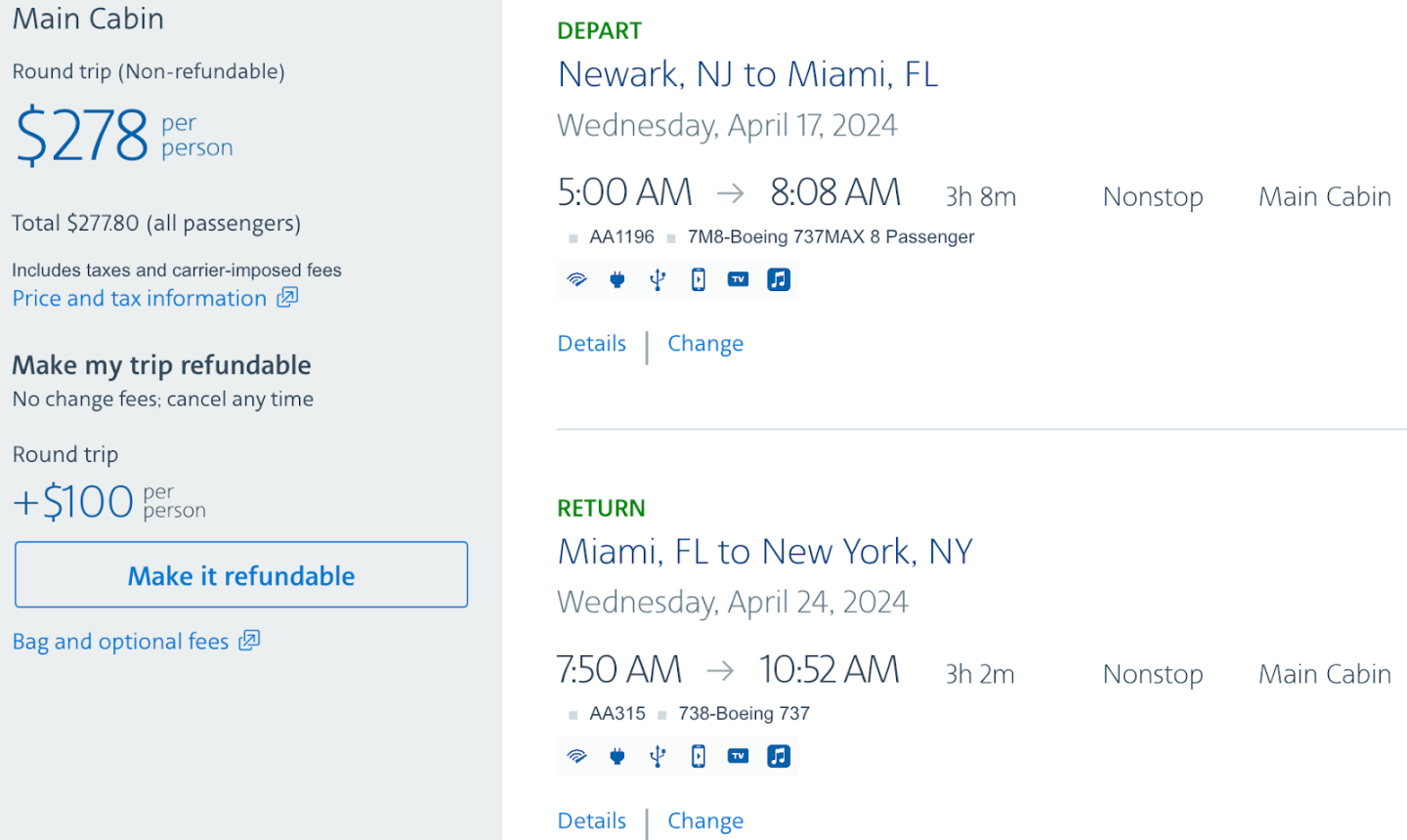

Sample flight within the U.S.

In this example flight search on American Airlines , booking two one-way tickets from Newark to Miami will cost $154 for the outgoing flight and $124 for the return, for a total of $278.

Outgoing flight

Return flight

If you were to book these two flights as a round-trip ticket, the price would be exactly the same at $278.

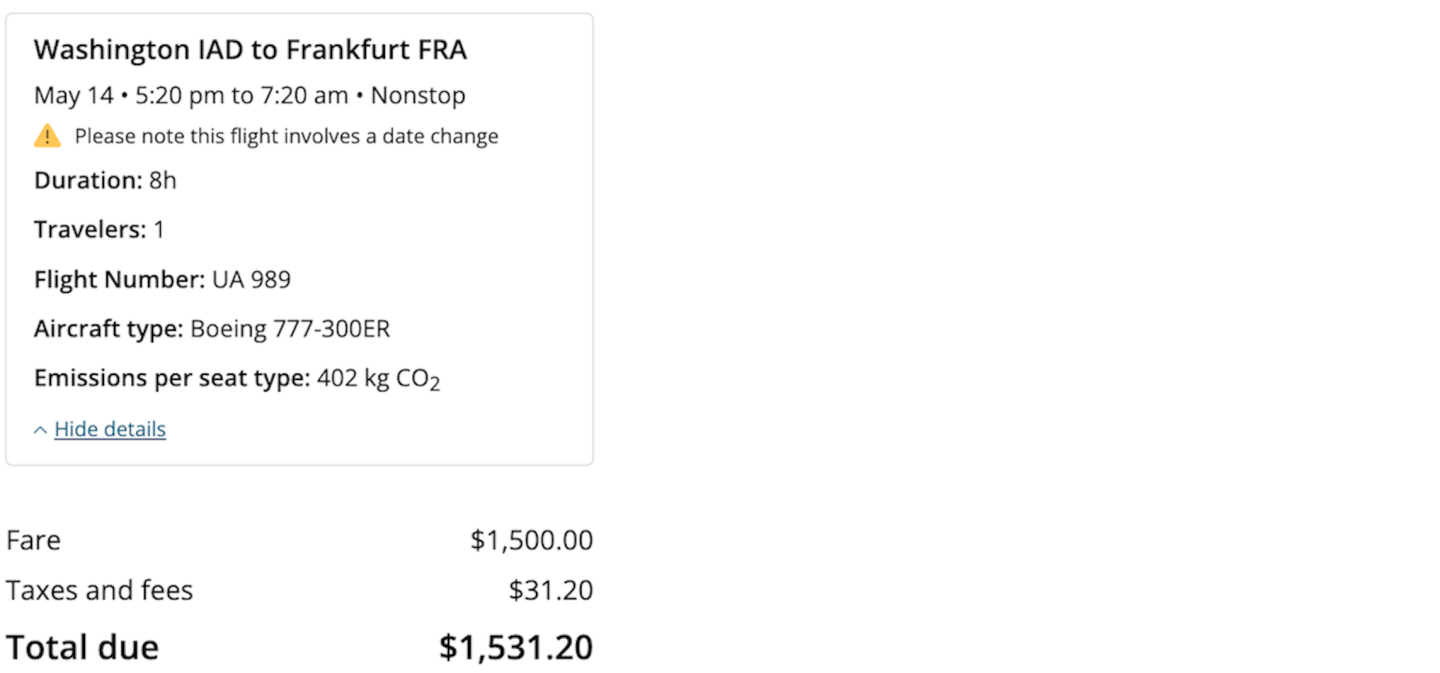

Sample international flight

It's a different ball game with international flights.

Take a look at this flight search from Washington-Dulles to Frankfurt, Germany, on United Airlines . If you were to book the flights as two one-way tickets, it would cost you $3,110.

However, if you book these same flights as part of a round-trip ticket, you’d have to pay $1,783, representing a significant savings over booking two one-way flights.

» Learn more: Should I be loyal to a single airline?

If you're planning on using points and miles to book award flights, you have a different set of factors to consider. In the case of award travel, it can make sense to book two one-way flights instead of a round-trip award.

Two one-way awards offer more flexibility

Most U.S. airlines have dropped change fees on both award and paid flights. So, if the price is the same, consider booking two one-way awards instead of a round-trip award to gain extra flexibility. Keep in mind that if you book a round trip, depending on the airline, you may have difficulty getting your miles redeposited if you need to change your award ticket after taking the first leg of the flight.

For example, if you cancel a United award flight midtrip, you'll retain the miles as a future flight credit. While the miles won't be refunded to your account, you'll have the chance to use them in the future.

Watch for higher taxes and fees when booking two one-way awards

When considering whether to book round-trip versus one-way awards, it's important to price out both options — particularly when flying overseas. Some airlines charge higher taxes and fees for awards that originate in certain regions of the world.

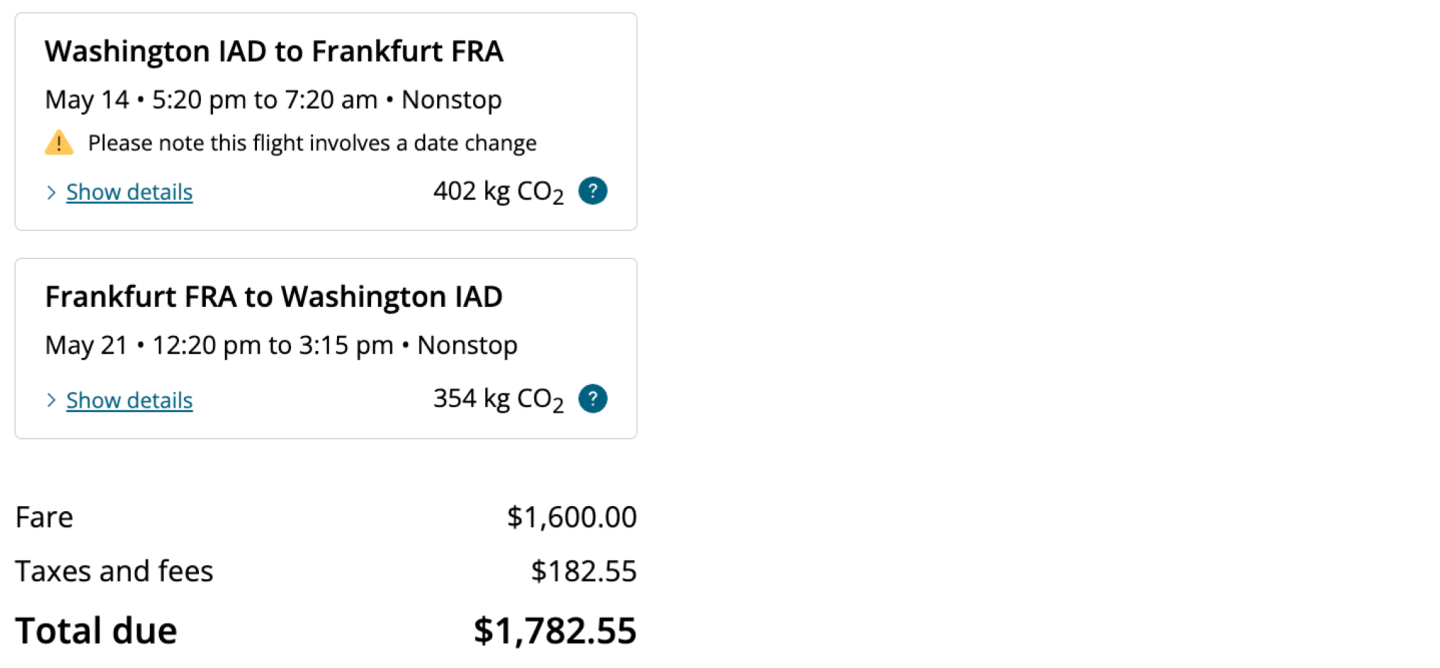

Delta SkyMiles is infamous for charging higher fees for award flights that originate in Europe. Also, particularly for international flights, Delta will often price round-trip award flights at less than the cost of two one-way awards.

For example, take a round-trip award from New York to Paris. Delta charges 50,000 SkyMiles plus $85 in taxes and fees for a round-trip main cabin award.

However, if you book the same flights as two one-way awards, you'll pay a total of 74,000 SkyMiles plus roughly $220 in taxes and fees. The outbound award costs 37,000 miles plus $6 in taxes and fees. Then, you'll need to pay another 37,000 SkyMiles plus around $220 to fly home.

In a situation like this, it makes sense to book a round-trip award. You'll save on miles and out-of-pocket costs.

Consider change fees on award flights

Most U.S. airlines have eliminated change fees on both paid flights and award tickets. However, that's not the case with all mileage programs. If you're booking through a mileage program that charges change fees, you may want to book a round-trip award to reduce the fees you could pay if you need to cancel the trip.

» Learn more: Booking flights with points or miles expands refund option

Say you're considering flying to Europe to take a cruise from Budapest to Munich. One might assume that your only options are to:

Book a round-trip flight into one of the cities plus book a one-way intra-Europe flight between them.

Book two one-way flights — one-way into Budapest and one-way back from Munich.

However, there's a third option: booking an "open-jaw" flight . Many airlines will let you book a flight into Budapest and a flight back from Munich on the same ticket. Rather than pricing these flights as two one-way flights, the airline generally prices the flights similar to a round-trip.

» Learn more: The guide to open-jaw flights with Chase points

If you're using airline miles to book these flights, check to see if it's cheaper to book two one-way awards or an open-jaw award. As outlined in the Delta example above, award flights originating in Europe can have much higher taxes and fees. So it might make sense to book the two award segments together as a multicity award.

In the past, airlines charged more for booking two one-way flights rather than a round-trip on the same route. However, this isn't the case anymore on most domestic flights and even some international flights — mostly thanks to competition from low-cost carriers.

In short, airlines charge more for one-way flights on the routes when they can get away with doing so. If only one airline is operating a particular route, it might increase the price of one-way flights to generate more revenue from business travelers and others that are willing to pay more for the nonstop flight.

However, when there's competition from other airlines, the cost of one-way flights often drops to compete with the other airlines serving that route.

Booking a round-trip flight can be cheaper than booking one-way tickets on the same flights. Before booking two one-way flights, check the round-trip price to see if it's cheaper. Even if you're flying out of a different city than you're flying into, booking a so-called "open-jaw" flight could be much cheaper than booking two one-way flights.

Most U.S. airline loyalty programs will charge the same number of miles whether you book round-trip or two one-way flights. Because of this, it can make sense to book two one-way flights instead of a round-trip award to get flexibility in case you need to change or cancel plans.

However, this isn't always the case. Some loyalty programs — such as Delta — charge fewer miles for booking a round-trip award instead of two one-way flights. We recommend pricing out award flights both ways just to be sure.

airline loyalty programs

will charge the same number of miles whether you book round-trip or two one-way flights. Because of this, it can make sense to book two one-way flights instead of a round-trip award to get flexibility in case you need to change or cancel plans.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of round trip

Examples of round trip in a sentence.

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'round trip.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

1837, in the meaning defined above

Dictionary Entries Near round trip

round-trip ticket

Cite this Entry

“Round trip.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/round%20trip. Accessed 10 Jun. 2024.

More from Merriam-Webster on round trip

Nglish: Translation of round trip for Spanish Speakers

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

What's the difference between 'fascism' and 'socialism', more commonly misspelled words, commonly misspelled words, how to use em dashes (—), en dashes (–) , and hyphens (-), absent letters that are heard anyway, popular in wordplay, the words of the week - june 7, 8 words for lesser-known musical instruments, 9 superb owl words, 10 words for lesser-known games and sports, your favorite band is in the dictionary, games & quizzes.

Why Do Individual Flights Sometimes Cost More On Their Own Than As Part Of A Round Trip?

- Not all airlines inflate one-way ticket prices; some like JetBlue and Southwest offer transparent pricing by summing up two one-way fares for the round-trip cost.

- Pricing discrepancy between one-way and round-trip fares is particularly evident in premium cabins, driven by the purchasing habits of business travelers who prioritize specific travel dates and times.

- Passengers can explore round-trip options, even if they don't use the return trip, as it may potentially save them from exorbitant one-way fares. Evaluating the value of redemptions against cash fares is also crucial for those using points and miles.

Airfare pricing involves a complex interplay of various factors that can confound travelers seeking consistency and transparency. The common notion that one-way tickets tend to be pricier than round-trip tickets isn't universally true, but there are valid reasons behind this perception. A closer look at the dynamics of airline pricing and passenger behaviors sheds light on this phenomenon.

Not always pricier

To begin with, not all airlines necessarily adhere to the practice of inflating one-way ticket prices. Some carriers, such as JetBlue and Southwest, often offer fairly transparent pricing by simply summing up two one-way fares to create the round-trip cost. Moreover, routes with frequent daily flights from a single airline can exhibit similar pricing symmetry due to increased capacity and a more consistent pricing structure.

Nevertheless, there are instances where the reverse occurs, where one-way tickets appear disproportionately costly compared to round-trip fares.

Driven by business travel

This discrepancy in pricing is particularly evident in premium cabins , attributed to the purchasing habits of business travelers. These passengers often prioritize specific travel dates and times, accommodating their rigid schedules without much sensitivity to cost. Such travelers, compelled by work-related commitments, are more likely to book one-way tickets, often covered by their companies. Although non-business travelers might also seek one-way options for emergencies, their urgency mitigates their price sensitivity.

In practice, actual pricing variations vary based on numerous factors including airline, route, and travel date, but the pronounced price difference between round trip and one-way fares is more observable on long international routes as opposed to on domestic flights. Premium cabins tend to accentuate this pricing differential, although it also occurs in economy class.

Alternate booking methods

To navigate this pricing structure, one strategy for travelers to consider is to explore round-trip options, even if they do not necessarily to utilize the return trip. While this will not always be cheaper than a one-way fare, it is worth looking into. This can lead to cost savings by potentially avoiding exorbitant one-way fares.

This pricing asymmetry presents another strategic challenge for passengers using points and miles for their flights. Evaluating the value of redemptions against cash fares is always crucial. Dividing the flight's cost by the miles or points required provides a simple metric, although there are diverse perspectives in the travel community about calculating this value accurately.

In any event, the rationale behind one-way tickets being consistently pricier than round-trip fares is deeply rooted in the dynamics of airline business and passenger behavior. Business travelers, who frequently require one-way bookings, form a market segment willing to pay for convenience.

Airlines, catering to this demand, capitalize on this by adjusting pricing structures. On the flip side, travelers seeking the flexibility of one-way travel bear the brunt of elevated fares due to the potential revenue loss airlines might incur if return flights aren't utilized. This complex interplay of factors shapes the airfare landscape, prompting travelers to carefully consider their options to optimize both cost and convenience.

What other strategies can passengers who only need a one-way fare utilize to save money? Let us know in the comments below.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products, hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

Membership & Benefits

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel