The Best Travel Insurance for Canada: IEC Working Holiday

The International Experience Canada (IEC) Working Holiday program offers young people the chance to live and work in Canada for up to two years. It is an amazing opportunity but there is a couple of rules to abide by when taking part in the IEC.

One of these is the program requirement to have comprehensive health insurance while in Canada.

This article will help you find the best travel insurance for Canada. I moved to Canada on the IEC program and I’ve helped thousands of people do the same since then.

Last updated November 2023 . This post includes some affiliate links – if you make a purchase via one of these, we may receive a small percentage of the sale.

The importance of travel insurance for Canada

As mentioned, it is a mandatory part of the IEC program to have health insurance for the length of your stay in Canada.

If you go to Canada without appropriate IEC travel insurance, you may receive a shortened work permit and/or be refused one altogether.

Those who do receive a shortened work permit are unable to extend or adjust the work permit later. This happens to more people than you would think!

As per the IEC rules , your health insurance for Canada must cover:

- medical care,

- hospitalization, and

- repatriation (returning you to your country in the event of severe illness, injury or death).

Be sure to buy the best travel insurance for Canada.

Taking part in the IEC program is a once-in-a-lifetime opportunity for most people – don’t waste this opportunity.

Thinking beyond the IEC requirement for insurance, you should also be aware that medical care in Canada can be very expensive.

Emergency room visits for relatively simple injuries can easily run up a bill of thousands of dollars.

Saving money on buying travel insurance for Canada can turn out to be an expensive mistake.

Options for IEC travel insurance

Read on for my research into the best IEC travel insurance for Canada.

Please research each company to ensure that the coverage is right for you. The specifics of the coverage can change at any time. Read the policy wording to make sure that you are covered.

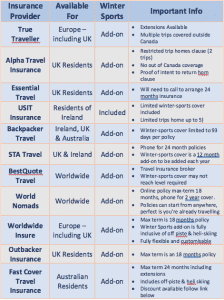

UK and EU citizens – True Traveller

I used True Traveller insurance for my working holiday in Canada.

Travel insurance policies with True Traveller are available up to 24 months in length. Policies can be started if you are already travelling.

Unlimited visits home are also allowed, with the insurance cover being suspended when in your home country. Winter sports coverage is available and there are no minimum residency requirements.

92 activities are covered as standard with True Traveller, including horse riding and bungee jumping. If you need coverage for more activities (such as rock climbing), an additional activity pack can be selected.

An alternative to True Traveller for UK citizens is Go Walkabout . Working Holiday cover is available for 2 years with 3 years available soon. Unlimited visits home are allowed with ski coverage available for an additional premium (Activity Pack 4).

Australian citizens – Fast Cover and HeyMondo

With Fast Cover , an initial IEC 12-month policy can be purchased and then extended for another 12 months on the departure date.

Optional winter sports coverage is available for an additional fee. Fast Cover policies cannot be started when already abroad.

HeyMondo offers single trip policies up to 12 months in length. Coverage for Covid-19 is included as standard as well as up to $10 million for emergency medical and dental expenses.

To have coverage for a full 24 month IEC working holiday, simply purchase 2 x one-year policies before leaving for Canada. For the second policy, you’ll need to tick the ‘already travelling’ box for it to be valid.

There is a 5% discount available for HeyMondo if you use the below link when purchasing. Note that HeyMondo does not offer winter sports coverage.

Alternatively, look at BestQuote (note lower medical coverage), Cover More (phone call required to buy a 2 year policy) or World Nomads.

New Zealand citizens – HeyMondo

HeyMondo includes coverage for Covid and up to $10 million of medical expenses. There is, however, no ski cover available.

For 23 months of coverage with HeyMondo, you’ll need to purchase a 12 month policy and then another 11 month policy. Make sure to tick the ‘already travelling’ box when purchasing the second policy.

Alternatively, look at BestQuote (note lower medical coverage) or World Nomads.

For citizens of 100+ countries – BestQuote

BestQuote are travel insurance specialists, partnered with some of the largest and most reputable insurance providers in Canada. Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims.

There are various medical coverage amounts available (most starting at $100,000), and adjustable excess levels as well. Please note that this medical coverage is lower than the other insurance providers mentioned on this page.

Buying the best IEC Travel Insurance

There is not one perfect working holiday travel insurance policy for Canada. Everyone has different requirements and circumstances.

The best working holiday travel insurance for Canada is the one that suits your own needs.

Before purchasing travel insurance for Canada, you may want to check factors such as:

- The type of activities that are covered. Climbing, kayaking and even hiking may have an additional premium

- Whether it is possible to return home for a short time and still have valid insurance coverage on return . Some policies become invalidated as soon as you reach home

- Residency requirements to purchase. Some IEC travel insurance policies require a minimum time spent resident in your home country before purchase

- Whether the policy can be started abroad if you are already travelling elsewhere. Most insurers are limited to only covering those who haven’t left home yet

- Winter sports coverage options. Even if you do not plan to work a ski season or live in a mountainous area, things can change

- The excess (deductible) on the policy. This is the amount you have to pay when making a claim

Finding Travel Insurance for Canada

Canada’s IEC program offers some of the longest working holiday options available in the world.

For this reason, one of the biggest problems with buying the best IEC travel insurance is finding a company that offers two-year travel insurance for Canada.

It can be such a rare occurrence that some working holiday companies advise their clients that there is no such thing. This is absolutely not true.

Another thing to remember is that the cheapest travel insurance for Canada may not be the best travel insurance for you. Be sure to look at the coverage limits and whether the policy is suitable for your travel plans.

Working Holiday Travel Insurance for Canada: The Small Print

Always read the policy wording to decide which IEC travel insurance provider and policy is right for you. As noted above, the best travel insurance for Canada isn’t necessarily perfect for everyone.

All details of IEC travel insurance providers mentioned above are correct at the time of writing but are subject to change.

The above companies also offer standard travel insurance for short-term holidays as well as working holiday insurance for Canada.

Found this post helpful? Subscribe to our IEC newsletter ! Working holiday advice and updates delivered straight to your inbox, with a FREE printable IEC packing list

Check out these other posts about working holidays in Canada

IEC Working Holiday Canada Extension Guide

IEC Working Holiday Canada: Arrival Checklist

Working Holiday Visa 2024 Canada IEC: Ultimate Application Guide

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Sunday 14th of May 2023

Hey Gemma, we are NZ residents coming to Canada on an IEC, coming through the US first. We have insurance confirmed for the first 12-months of our travel. Ideally we want to book the second year of our insurance, however, our current insurance company won't do that - they will only extend near the end of our current policy.. Do you know any options for us that would provide insurance for that second year (i.e., provide a policy so far in advance). Alternatively, do you know if it is doable/easy to get our visas extended/updated once we are able to confirm a further 12-months of travel insurance? Hope this makes sense!! Thank you :)

Sunday 21st of May 2023

Hi Annelise,

For your first question, I would look at World Nomads or BestQuote (the latter mentioned in this article). For your second question, you MUST have 23 months of insurance on entry into Canada to receive your full 23 month work permit. There is no way to extend your work permit if you did not have the appropriate insurance on arrival in Canada OR apply again. So make sure you have the full 23 months before you arrive in Canada!

Tuesday 5th of November 2019

Hi Gemma! Currently helping my British fiance figure out flights since he has been accepted for IEC. A little anxious that he will not receive his full 24 month permit if we buy return flights (since return flights only go aprox. 10 months ahead). Should we just splurge and buy the stupidley expensive one way ticket, or can we purchase a round trip ticket and just not use the return ticket? Do the border agents even ask for a return ticket or do they just expect that we won't have one since its an open 24 month work permit? Do you think he would just be able to tell the border agent, if asked, that he does have a return flight 3 days after his arrival flight but plans to cancel it because it's cheaper, then proceed to show the agent proof of funds for a return flight?

Monday 11th of November 2019

The good news is that you don't need a return ticket at all, just proof to be able to purchase one if needed. And for that, a credit card can be shown. Hope that helps!

Thursday 16th of May 2019

Hi Gemma, the question I have, do you have to pay the one year insurance all upfront or is it possible to pay monthly? My travel insurance offered it and I am wondering now if this would be accepted.

Saturday 18th of May 2019

Hi Jessica,

It needs to be upfront, not monthly. A monthly policy can be cancelled at any time so hence is not proof of insurance for the entire length of your trip.

Wednesday 14th of June 2017

Hi Gemma I am going to Canada from New Zealand and looking for travel insurance options...and a bit lost. The link for 'Down Under Insurance' under New Zealand doesn't seem to work, even when I searched it on Google. Would you please be able to recommend a travel insurance company / companies for someone going from New Zealand for the full 23 month period? Thank you :)

Thursday 15th of June 2017

The link to Down Under insurance goes directly to the booking page. As mentioned in the description on my page, you will need to call them to purchase the 23/24 month IEC policy. Alternatively, you could also book 2 x 1 year policies with World Nomads who are also linked on this page.

Saturday 14th of January 2017

Hi Gemma, I have been granted an IEC visa, I want it to be valid for the two years but I don't want to necessary stay there for two years. The idea is I go for 3/4 months say, before returning home. However, I would like to keep my options open and be able to return to Canada in the two year period. I also don't want to be paying for insurance for the full two years if I am not there. I assume It's possible to enter and leave Canada as many times as I like during the two year period?

I applied on my U.K. Passport but I have been living in Australia as a resident, and have become an Australian citizen since being granted my IEC Visa so will be travelling from oz(my Australian address and residency was on my IEC application). So another option I am looking at is if it's possible to reapply on an Australian passport now I can obtain one, even thought I have been granted the IEC on my uk passport. The reason being is I have to enter Canada by end of June 2017, however I am still in two minds financially as paying off debts and it would be more suitable for me to leave at a later date(I was granted my IEC a lot quicker then anticipated). I will be 31 in November 17 so would have to apply by then with Australian passport.

Otherwise 3rd option is to go on a holiday before end of June to validate and get the two years granted and then return later(rather then quitting my job and going for 3/4 months as per option one), but again that will go back to my intial question on insurance options to get a visa for two years to come and go as I please, and also if it's possible to enter and re-enter during the two years.

Thanks for any input or advice. Sorry it's long winded but wanted to include all the facts. You run a great site and I have been finding your ebook on whv in Canada most helpful. :-)

Tuesday 17th of January 2017

Wow, a lot of questions! OK, let's see if I don't miss anything. You can enter and re-enter Canada with the IEC subject to normal entry requirements (i.e. it is not technically a visa and as such does not guarantee entry). The usual problem with entering and leaving is with insurance. Most insurance policies do not allow you to return to your home country for 10 or more days. Some do not even allow you to return at all without invalidating the policy. To receive the full 2 year work permit on arrival it is necessary to have 2 years insurance - if you do not, then you risk being given a work permit to the length of your insurance (or no permit at all if you don't have any insurance).

Australian insurance by the way (as in, coverage for Australians) is VERY expensive, much more expensive than insurance for UK residents/citizens. Be aware though that you may not be eligible for many UK insurance policies as you have not been resident there for a while.

It seems like you have two options -

Go to Canada before your POE expires, activate your work permit with two years insurance. If you need to go home directly afterwards, that is OK, provided your insurance provider allows it (as mentioned, not many do and only for a short time). True Traveller allows you to return home for an indefinite time period without invalidating your policy is True Traveller. With your living situation, they are also one of the few UK insurers that you may be eligible to get a policy with.

Second option is to apply for the Australian quota. I would do this before September as the pools closed in early autumn last year. You must receive an invite before your 31st birthday to be eligible.

Best IEC Travel Insurance: Our Best Travel Insurance for Canada 2024

By: Author Sunset Travellers

Posted on Last updated: January 12, 2024

Categories Canada , Travel

In this post, we cover the Best IEC Travel Insurance: Our Best Travel Insurance for Canada – IEC Working Holiday Insurance.

If you’re moving to Canada under the International Experience Canada (IEC) program, you NEED to take out the right IEC health insurance policy.

After you receive your POE (point of entry) letter, it’s time to find the best travel insurance for Canada. Trust us, we spent a few weeks researching and trying to find the best one. So, having spent two years on our own IEC visa in Canada, we decided to share our travel insurance recommendations so you can pick the best option for you.

So, what is the best IEC Travel Insurance you recommend?

Loved these views in Vancouver!

You can read further down about why we chose these companies and what the guidelines are from the Canadian government. Based on all the important factors, we have found these companies to have the best travel insurance for Canada:

- True Traveller (for Europe and UK residents)

- Fast Cover insurance (for Australian residents)

- BestQuote Travel Insurance (for all nationalities, pre or post-departure)

There are a lot of companies out there which can make things quite hard when choosing the appropriate travel insurance for your Working Holiday Visa in Canada. Depending on the country you are from, your IEC visa might be approved for one or two years. For example, Steve has received a two-year work permit with an Irish passport. Sabina, with a Polish passport, was able to receive a work permit that was valid for one year only.

But thankfully, I have dual citizenship and got approved for a second IEC visa with my other passport. Otherwise, I was unable to stay for two years with Steve in Canada.

We have used these companies not only personally but also in our IEC Facebook group .

Navigating Insurance Requirements for the 2024 IEC Working Holiday:

Understanding the correct insurance for your 2024 IEC Working Holiday in Canada can be a bit perplexing. In the past, even the Canadian Government referred to the necessary coverage as ‘travel insurance’ in its communications with IEC applicants. This terminology led many insurance providers and information sources to promote travel insurance policies specifically for IEC participants.

However, the Government’s recent communications have shifted to a more precise term: IEC health insurance. This change aligns more closely with the actual requirements, as the essential coverage you need is health-related, not just general travel insurance. We’ll delve into the specifics of this coverage in the following section.

Despite this clarification, some insurance providers might still market their policies as IEC travel insurance. But, often, these policies are essentially health insurance. It’s crucial, therefore, to thoroughly examine any policy you’re considering to ensure it meets the specific health coverage requirements for your IEC Working Holiday.

This is why we worked hard to double-check with these companies that they are acceptable as the IEC travel insurance.

So, if you are coming from:

True Traveller Insurance

A favourite (and the one we used!) among Europeans for the International Experience Canada (IEC) program, including the Working Holiday initiative, True Traveller stands out for its comprehensive coverage. Our IEC-specific insurance not only meets but exceeds IRCC requirements, encompassing medical care, hospitalization, and repatriation. Trust True Traveller for your IEC journey – get your quote today!

BestQuote , a premier Canadian travel insurance broker, offers an extensive range of travel insurance options tailored for visitors to Canada. Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

Australia And New Zealand IEC insurance cover 🦘 :

Fast Cover(AUSTRALIA ONLY) is the go-to insurance provider for Australian participants in the International Experience Canada (IEC) program. Catering to your travel needs in Canada, we offer flexible policies for both 12 and 24 months. Our diverse range includes everything from basic medical to comprehensive coverage, as well as specialized options for snow sports and adventure activities. Travelling as a couple or with a friend? Our Duo policies offer a 5% discount for pairs. Start your Canadian adventure with confidence – get a quote from Fast Cover today.

BestQuote (NZ + AUSTRALIA) works for Australians as it is a premier Canadian travel insurance broker that offers an extensive range of travel insurance options tailored for visitors to Canada . Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

Rest of the world:

BestQuote is a premier Canadian travel insurance broker that offers an extensive range of travel insurance options tailored for visitors to Canada . Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

The International Experience Canada website states the following requirements:

For an iec working holiday visa in canada , you must have health insurance for the entire time you are in canada..

Therefore, we both needed 24-month insurance for Canada. If we were to get travel insurance for Canada for any shorter period than our intended stay, we would have received a work permit only valid until our insurance is.

This rule applies to everyone.

It is very important to get the appropriate travel insurance for Canada.

If you get asked at the border for proof of your travel insurance, make sure that it is valid for the entire duration of your intended stay.

Many people get only six months or one year of insurance and receive shortened work permits. When choosing the best travel insurance for your IEC visa in Canada, make sure that it also covers all the government requirements .

As per the IEC rules , health insurance must cover you for the following:

- medical care

- hospitalisation and

- repatriation (returning you to your country in the event of severe illness, injury or death).

If you go to Canada without appropriate IEC travel insurance, your work permit might be shortened and/or you might be refused one entirely.

A note from the government website :

“ We recommend you buy this insurance only after you receive your port of entry (POE) letter of introduction. We can’t recommend specific insurance companies or plans, but you can search online for something that meets your needs. You may be refused entry if you don’t have insurance. If your insurance policy is valid for less time than your expected stay in Canada, your work permit may expire at the same time as your insurance .”

Provincial Canadian healthcare or medical cover from your employment typically does not cover repatriation costs.

After you land your dream job, it takes time to get enrolled in the healthcare system, and there’s usually a cool-off period.

Therefore, you need to get separate 2-year travel insurance for Canada.

Don’t make the mistake of thinking you will be fine without one. We personally know a few people who decided to get the most basic insurance and ended up in a hospital with a broken bone and a huge medical bill to take care of. Many companies have policies built especially for the IEC visa, but it is essential to find the best travel insurance for Canada suitable for you.

We had to do our research based on several criteria and important inclusions.

What is the best IEC travel insurance?

That great feeling when you are fully insured!

Great question!

Depending on where you are travelling from and what you want to do in Canada, there will be certain criteria you might be looking for.

Based on all the important factors, we have found these companies to have the best travel insurance for Canada:

There are a lot of companies on the market, but based on our own experience and friends’ recommendations, these are the best companies to go with.

When choosing your coverage, there are a few important questions you need to ask the insurance company before buying your 24-month travel insurance for Canada.

Let’s face it: 24 months is a LONG time, and you don’t want to pick the wrong company!

Buying the best travel insurance for Canada

Along with the Canadian government rules, there are a few different things you might want to consider when choosing your insurance.

To put it simply, these are the most common things you want to check before buying IEC travel insurance:

- What is the level of my coverage?

If you are planning to hit the slopes or go hiking or kayaking, make sure that your insurance covers you. Most insurance companies will have an additional premium for covering you for extra activities. Who knew that cage shark diving isn’t included in the basic cover!?

- Am I covered for trips outside of Canada?

Travelling to the US, Central America, or any location outside of Canada might not be covered by some companies. If you are planning to explore the world, check if the places you are heading to while in Canada are covered. BestQuote has options to include trips outside of Canada to the USA, Mexico or elsewhere.

- What is your policy if you wish to take a trip back home for a holiday?

Some insurers have a limit on trips to your home country, others only allow a couple, and some enable unlimited trips back and forth. Whether you plan to stay in Canada or visit home regularly, find out how your insurer covers you for home visits.

True Traveller , for example, allows you to go home as many times as you like!

- Is there any excess?

You need to know how much you have to put out of your pocket to make a claim. The best coverages are no excess ones- but usually, you will have to pay a bit more for these.

- Are your items and luggage covered?

It is critical for the company to cover you in case of luggage delay, bags lost by the carrier in transit (it happens!), stolen luggage, stolen passports etc.

- Are you covered for activities like winter sports?

While we didn’t plan on snowboarding when we first landed in Vancouver, we were glad we opted for the additional cover when we decided to try snowboarding. We ended up doing a whole winter season in Whistler, and True Traveller completely covered us! You might also want to hike the Rocky Mountains , so make sure to get the right cover.

- Whether the policy can be started abroad if you are already travelling elsewhere.

Most insurers are limited to only covering those who haven’t left home yet.

- How do I contact the insurance company in case of an emergency in Canada and abroad?

Save the phone number on our phone as soon as you purchase your coverage.

So what are the best two-year IEC travel insurance options and why?

Relaxing again because kayaking is included in your policy.

Before you get overwhelmed with contacting every travel insurance company asking the above questions, we have done the hard work for you.

If you prefer to do your own research, remember that buying the cheapest travel insurance for Canada usually isn’t a good idea.

Cheap insurance will have a lot of coverage limits, and keep in mind this is the next two years of your life!

The best travel insurance options for Canada

Flying high over Toronto!

True Traveller – Available for EU citizens (including the UK)

These guys have been incredible, and we have continued to use them as we travel around the world. They offer you not only unlimited trips home but also fantastic coverage.

Travel insurance policies with True Traveller are available for up to 24 months, which covers you for the entire duration of your visa!

Winter sports coverage is available, and there are no minimum residency requirements.

You can claim while you’re still in Canada, as there is no need to wait to return home.

True Traveller covers you for over 92 activities on their standard cover.

These include bungee jumping, horse riding, safari touring, scuba diving to 18 meters and lots more activities you may end up doing on your trip.

For those extreme travellers out there, you can easily add more options at very reasonable prices.

We both used them for our 2-year IEC travel insurance and always recommended them to others.

We found True Traveller, the best and cheapest IEC insurance for Canada from Europe .

Get a quote here for your IEC travel insurance.

“Oh, so you went with Fast cover to!? Woo”

Fast Cover – Available for Australians

Our family, friends and many other people we met who have come from Australia went with Fast Cover.

They offer initial cover for 12 months but then it can be easily extended for another 12 months on the day of departure.

This totals the full 24 months needed for the IEC working holiday for Australians.

You simply purchase the first 12 months of travel insurance, and then you can log in and purchase the next 12 months.

Simply log in to the ‘Your Policy’ section of their website and extend it up to the full two years.

They also allow unlimited trips home, and it is not necessary to have a return ticket home in order to submit your claim.

Winter sports cover is also available, and their basic cover includes a whole host of activities!

Also worth noting is that their Ski & Snowboarding cover is one of the best we have ever seen!

They even include off-piste activities, which are often not included.

Fast Cover policies also include 24-hour overseas emergency assistance for IEC travellers.

Whale watching in Vancouver!

BestQuote Travel Insurance

With BestQuote , you can view and compare the best insurance options available for your IEC visa.

We really like them as their website is very clear and you can easily view and compare insurance prices, benefits, refund policies and much more.

Simply start your quote by:

- choosing the dates of your intended stay in Canada,

- adding any additional countries, you wish to visit

- indicating the number of travellers included in the cover

- adding dates of birth

- filling your email address

And your quote will appear instantly!

BestQuote Travel Insurance also offers several IEC policies that allow for up to two years of coverage.

Whether you are from Ireland, Australia, the UK, France, Portugal or New Zealand (max 23 months), you can get covered for the two years of your IEC visa.

The BestQuote policy is issued through Lloyd’s Underwriters and has been specifically designed for IEC travellers (which means peace of mind for you).

With BestQuote, you get the required health and repatriation benefits.

They also include basic skiing/snowboarding cover and allow unlimited trips outside of Canada for up to 35 days.

Final tips for Working Holiday Insurance for Canada ( th e small print)

Finding travel insurance for canada.

While we have used most of the companies above, it is always worth spending that little bit extra just to read the fine print.

It is important to pick the IEC travel insurance provider and policy that is right for you.

As we mentioned above, you will be with them for the next 12 to 24 months, so it is worth spending that little bit of extra time to read through everything.

Please always double-check cover details directly with your insurance policy provider, as any of the above information may change at any time.

Thank you so much for reading, and if you have any questions at all, please reach out to us!

You will also find a great selection of useful links and discounts on other services below:

Other useful links for your IEC visa:

Booking.com – This is the perfect alternative to Airbnb when you need a short place to stay.

Hostelworld – If you need a cheap place to stay where you can meet other travellers, Hostelworld is the best.

OFX – Another great money transfer company for larger transfers. We usually use them for larger sums. Follow the link for free transfers for life.

CurrencyFair – Our favourite money transfer company. They are 8x cheaper than banks. Follow the link for 10 free transfers with CurrencyFair.

Best Quote and TrueTraveller – The best travel insurance companies on the market! We personally used them both and can highly recommend them.

Taxback.com – Every time we have to do our taxes or claim Superannuation, we use these guys.

Sendmybag – The best company to ship your excess luggage to and from Australia. Follow our link for a 5% discount on your shipment.

If you need more info on moving to Canada, make sure to check out our Canada posts here .

Like what you are reading? Pin the image below!

Thanks for stopping by

Steve and Sabina

Notify me of follow-up comments by email.

Notify me of new posts by email.

Sunset Travellers

Sunday 13th of October 2019

Thanks a lot for letting us know!

Gerphil Galleto

Good day! I already found a travel insurance company they said that if something happens on me at work in canada they can't cover anything that happened to me because of my work. Is this reasonable from Insurance company?

Hi Gerphil,

Travel insurance is not a health insurance. It's designed for emergencies only. Once you are in Canada you most likely will be able to get health insurance via your employer. Best of luck!

IEC Travel Insurance

If you’re going to be travelling to Canada through International Experience Canada (IEC) then one of the requirements to be allowed to enter Canada is that you have IEC travel insurance (IEC health insurance).

But what exactly does the IEC travel insurance need to cover and how can you make sure to get the best deal?

We’ll cover everything you need to know in this article.

International Experience Canada

Iec travel insurance, iec travel insurance requirements, when do i need to purchase iec travel insurance, best iec travel insurance, what to look for in iec travel insurance, iec travel insurance cost, working in quebec.

If you’re figuring out what to do about IEC travel insurance, I’m sure you’re already familiar with what the International Experience Canada program is.

But just to confirm the context around the insurance:

IEC is what Canada calls its working holiday visas program for people aged between 18 and 35.

There are three different types of visa covered by IEC and which ones you can apply for depends on your country of citizenship.

The most common visa is the working holiday visa which is an open work permit. The working holiday visa lets you come to Canada without a job offer and work for almost any employer in Canada.

There are various requirements for each type of visa but, regardless of which visa you get, the IEC insurance requirements are the same.

If you get an IEC visa then one of the requirements you need to meet to be allowed to actually enter Canada on that visa is having IEC travel insurance, or IEC health insurance.

The IEC travel insurance that is required for entry into Canada on an IEC visa is insurance that covers you for medical matters, it’s not travel insurance that covers things like lost baggage.

So a more accurate term for the insurance you need is probably IEC health insurance.

There are a number of requirements that your IEC health insurance needs to cover, otherwise you might be denied entry to Canada.

In terms of the policy coverage, the IEC heath insurance must cover:

- Medical care

- Hospitalization

- Repatriation which includes getting you to a medical facility, and returning you or your remains to your home country

The insurance policy must be for the full duration of the time you plan to spend in Canada. So if you want to stay in Canada for the full two years (or three years for some countries), the policy will need to cover two (or three) years.

If the policy is shorter than two years, when you arrive in Canada the border agent will only give you a permit for the duration of the policy – so your work permit will expire on the day your health insurance does.

Keep in mind you won’t be able to extend your work permit at a later date. So if you want to have the option of staying in Canada for the full length that your visa allows, you need to already have insurance that covers that full time period when you land in Canada.

This is where it’s a good idea to buy insurance that allows you to do partial refunds. So if you leave Canada before you’ve used the whole duration of the policy you can get a refund for the unused duration.

Many of the Canadian insurers offered on the price comparison website we recommend offer partial refunds on time that’s not been used.

One last point on getting insurance to cover your full length of stay – if you can’t get one insurance policy that covers the full time, it’s acceptable to get two consecutive policies instead.

It’s important to note that having IEC travel insurance is not required to apply to IEC or to be approved for the visa. But it is required before you arrive in Canada.

So when you arrive in Canada the border agent will check your insurance and if everything isn’t in order you might be denied entry to Canada.

As with most insurance, there isn’t one insurer I can recommend that is always going to be the best or the cheapest.

What’s best for you will depend on your circumstances and what you want from a policy.

That’s why I recommend the best way of finding your insurance is to use a price comparison website .

The site I use for travel insurance when my family is visiting Canada is BestQuote .

It compares across a whole host of insurers and provides you with various options.

The results page also nicely displays the key components of each policy so you can quickly see which options look good for you.

You can then go ahead and purchase the policy through the BestQuite website.

You can check them out here .

When you’re comparing quotes, some of the key things to look out for are:

Coverage amount . What is the maximum amount the policy will pay out if you need to claim on it? Keep in mind the headline maximum figure will be further broken down into maximum amounts for individual things.

Coverage . What elements does the policy actually cover? Obviously you’ll want to make sure it covers the minimum requirements for IEC travel insurance as outlined above. But also make sure it covers anything else you think you might need and the coverage amount per item is sufficient. A big one here (with this being Canada!) is to consider if you want winter sports coverage.

The deductible . This is how much you’ll need to pay out your own pocket before the insurer will cover the rest. This can range from zero up to thousands, so pick which is right for you. Basically the higher the deductible the lower the insurance premium.

If you’re wanting some ballpark figures of what IEC health insurance might cost I’ve outlined a few ranges below.

I’ve given the costs for a 27 year old, but the insurance cost doesn’t really vary significantly for anyone in the visa age range.

Here’s what some typical IEC travel insurance policies will cost:

- $1,200. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $0 deductible. No pre-existing medical conditions and no winter sports.

- $2,700. Same criteria as above but with a stable pre-existing medical condition.

- $1,025. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible . No pre-existing medical conditions and no winter sports.

- $1,450. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible. No pre-existing medical conditions and winter sports included .

You can use a price comparison website to quickly get an idea of the cost of IEC health insurance for your circumstances.

Some countries have agreements with the province of Quebec that makes you eligible for health coverage. In which case you wouldn’t need IEC travel insurance that covers the medical care component of the requirements.

But the agreement doesn’t cover the repatriation part of the IEC travel insurance requirements so you’ll still need to buy separate insurance for that part. You can find out more if your country has agreements with Quebec here .

* All of the products and services I recommend on Canada for Newbies are independently selected based upon what I’ve personally found to be useful. I f you buy insurance through BestQuote using one of the links in this article, I might earn a small affiliate commission. Rest assured it won’t cost you anything and I would never recommend something I don’t believe in or use myself.

So that’s my overview of IEC health insurance. I hope you’ve found it useful.

Please feel free to drop me a comment on anything below.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Signup for new content and exclusive extras in your inbox.

IEC Travel Insurance Options

June 2016 Knowledge Base 1 minute read By Rik Dyson

Choosing an IEC Travel Insurance Policy

Essential requirements, choosing the right insurer, questions to ask, 24 month travel insurance providers.

Choosing a 2 year IEC Travel Insurance Policy

The IEC working holiday visa for Canada is 24 months for most countries, which means you need a 2 year IEC travel insurance policy. In this article, we’ll tell you what to look out for, the essential requirements of travel insurance, questions to ask, and at the very end, we list and link to the companies which offer 24-month travel insurance policies.

- The policy must cover the entire length of your stay. The immigration officer who issues your work permit on arrival will only issue a visa for the length of your travel insurance policy. So, if you’re trying to save money and only opt for a 1-year policy, be aware that you will only be issued a 1-year work permit, and it can’t be extended once it’s issued.

- Your IEC travel insurance policy must cover medical care, hospitalization and repatriation to your home country.

- Comprehensive winter sports cover is essential for all Winter Sports Company clients. We recommend taking a high level of winter sports cover, especially if you expect to ski or snowboard in the back-country or snow park.

- You are looking for a ‘long-stay’ or a ‘single trip’ policy. A multi-trip policy is standard travel insurance for holidays but usually, it only insures you for trips 30 days or less and is not suitable for IEC travel insurance.

- The added extras – consider everything! This insurance may save you tens of thousands of dollars in the long run.

Insurance companies all have different terms and conditions – before you commit to a policy, read the fine print. For example, some policies may include a clause of proof of intent to return to your home country at the end of your visa. If you can’t prove this, any claims you make may be rejected.

Trips home and further travelling – some companies have a condition written into their policies that you can only travel outside of Canada once or twice (this includes trips home). If you are planning further travel or may extend your stay after your visa expires, look for an IEC travel insurance policy with ‘extensions possible’.

Pre-existing medical conditions will need to be declared and checked to see if they are covered in your policy. If you need medical attention during travel, paying more for insurance to cover pre-existing conditions will be worthwhile.

Don’t forget, Travel Insurance companies are smart – and they will investigate. This can include checking your travel records and medical records to refuse pay-outs if you break the terms of your insurance.

What is the level of cover before I travel?

It is a good idea to opt for a policy with cancellation cover from the date you purchase insurance until the day you travel – most policies will include this as standard.

How are claims handled?

Some insurance companies require you to pay for things upfront and then claim reimbursement. Others deal with claims directly – be clear on this policy. It will cause you less stress if you have an unexpected trip to the hospital and you know what proof you need to make a claim.

Where can I view my documents?

You need a printed proof of insurance for IEC to enter the country. Most insurance companies offer digital proof of insurance – so save it to your computer.

Does the policy have financial failure protection?

This means you can claim if a company that is providing you with part of your trip goes into liquidation.

Is there a free-phone claims line, and what is the number for calling outside the country?

Put this number in your phone – then you have quick access to it in emergencies.

Am I covered for trips outside of Canada?

If you think you’ll take impromptu trips south of the border to the USA, or holidays further afield, make sure your insurance covers these.

What is your policy on trips home?

Some insurers do not allow trips home, others only allow a couple, and some allow unlimited trips back and forth. Be wise and realistic; returning to your home country may seem unlikely. However, you don’t want to void your insurance if you need to make a trip home for a family emergency.

Are luggage and personal items covered?

This includes ski and snowboard equipment – if you’ve got a lot of expensive stuff, find out if it’s covered and how much for.

Can I make changes to my policy?

Do you think you might extend your trip or want to add an extra level of cover at a later date? If so, check if this is possible – some insurance policies are iron clad after the initial cooling off period.

What is your policy on pre-existing medical conditions?

If you need cover for existing conditions, ask as many questions as possible about it, and get something in writing before you commit to the policy.

Is there an excess waiver, and how much is it?

Insurance companies usually offer an excess waiver which means if you need to claim, you don’t have to pay anything towards your claim.

Is this the best price you can do?

This is always worth an ask! Travel insurance can be expensive, but never be afraid to phone up. Ask if there is an active discount code or if you can have a discount for booking insurance well in advance.

True Traveller BigCat Travel insurance Fast Cover Travel Insurance

For short term travel and winter sports cover, check out our insurance page .

Canada , IEC , Insurance , Internships , Visa , Work Permit

Author: Rik Dyson

Rik first qualified as a water sports instructor in the late 90s before a successful career organising adventures on sea and snow for high-calibre clients worldwide. He's now returned to his first love of instruction and combined it with his passion for the mountains. With a wealth of knowledge and over 25yrs of experience in logistics, travel and adventure, he is ready to help you reach your goals.

Privacy Overview

- Trustpilot Reviews

- Instructor Courses

- Internships

- Career Break

- Progression

- Instructor courses

- All Mountain Experience

- Ski Patrol | Snowboard Patrol

- Knowledge Base

- Case Studies

- Snow Ready Fitness Program

- Sun Peaks – Canada

- Revelstoke – Canada

- Panorama- Canada

- Fairmont Hot Springs – Canada

- Hidden Valley-Canada

- Verbier- Switzerland

- Queenstown – New Zealand

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis dapibus rutrum vulputate. Mauris sed eros nec est vehicula mattis ac vitae ligula. Maecenas vitae tristique sapien, vitae pellentesque lectus.

Get a free one hour consultation

Compare Travel Insurance Canada

Quote and compare travel insurance in canada to get the best price plan.

There are various terms and phrases used to describe travel insurance in Canada. There's the must-have:

- Travel Medical Insurance, otherwise known as travel insurance or emergency medical travel insurance;

- and there's the nice-to-have: Trip Cancellation/Interruption, or Trip Interruption only as a stand alone plan.

- There's package plans called all-inclusive coverage that combine emergency medical with trip cancellation/interruption benefits as well as a bit of baggage coverage;

- We'll go through some of them here and link you to our other pages that contain more precise information:

If you need more questions answered, browse through our Canadian traveler blog page before your next holiday!

Travel Medical Insurance Referred to as either medical emergency travel insurance, emergency medical insurance, travel medical insurance, or travel health insurance. Medical insurance is a necessary form of travel insurance. It offers protection against certain financial losses arising from sudden, unexpected and unforeseeable circumstances. Some people might refer to this as trip insurance, but that would be oversimplifying a little. You may find, for example, that your credit card provides you with accidental travel insurance. Still, when you look closely, you may find that it only covers medical emergencies arising from accidental injury, not from an unexpected illness. See travel medical insurance for information on what is and isn't covered and your single-trip and multi-trip insurance options. Check out our Q&A pages. Get informed, get a quote, and get insured! Trip Cancellation Insurance Whether you are travelling away from Canada or out-of-province in Canada, trip cancellation insurance protects you against the risk of having to cancel your trip before it even gets started. Many events can sidetrack your travel plans. Sometimes, with cancellation penalties or non-refundable tickets, as well as reservations and tour expenses that might not be fully refundable, the costs of having to cancel a trip can add up to more than pocket change. For a fraction of those costs, you can rest assured that if you do need to cancel because of an insured risk, the only money that will be out-of-pocket is the cost of your insurance. See trip cancellation insurance for information on which types of risks are covered and how to save. Trip Interruption Insurance Trip interruption insurance helps prevent you from paying out-of-pocket costs that can occur if your trip is interrupted. This insurance would help insure things like a family emergency, a missed connection or flight due to any number of events such as weather, roadblocks, immigration/visa issues, accidents or sicknesses. See trip interruption insurance for Canadians to review an example list of covered risks. Travel Insurance Packages Travel insurance companies often package the three types of coverage mentioned above with baggage insurance as well as accidental flight insurance and offer everything at a price that's usually much lower than the sum of the parts. Baggage insurance covers certain types of baggage loss damage and delay, while accidental flight insurance would pay a lump sum benefit if an insured person is partially dismembered or dies in a flight accident. These package plans are usually referred to as all-inclusive plans and can be an excellent way to save insurance costs. See travel insurance packages for more details. Out-of-Province Insurance When Canadians travel outside their province or territory, they often believe that any medical emergencies will be covered the same way as in their home province. While that's perhaps 90-95% true, coverage differences exist between provinces (how much each province charges, and how much your home province covers), and not all costs will be coordinated between provinces upfront. You might be put in a position where you have to file a claim in your home province to recoup most costs (especially for Quebec). But out-of-province travel medical insurance covers non-medical costs related to emergencies that your provincial health provider doesn't. The insurance would include things like sending a loved one to your bedside, returning your vehicle home and more. Some companies offer this coverage at roughly half the price as out-of-country travel medical insurance. See out-of-province insurance for the list of unique benefits, and get covered for inter-provincial trips as well.

IMAGES

VIDEO

COMMENTS

Private IEC Health Insurance: Private (travel) health insurance plans for visitors to Canada — such as those required by IEC travellers — cover emergency medical expenses for accidental injuries or emergency illnesses. There are always certain restrictions and limitations when it comes to private insurance plans.

BestQuote has a wider group of policies than any other 'travel insurance specialist' in Canada. That means lower prices and better coverage. Get a free quote and buy online, or call us in Toronto (647-799-2032), Calgary (403-800-1582), Vancouver (604-259-2544) or toll-free from North America (1-888-888-0510). A wider group of policies than our ...

For citizens of 100+ countries - BestQuote BestQuote are travel insurance specialists, partnered with some of the largest and most reputable insurance providers in Canada. Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

BestQuote Travel Insurance has the ultimate guide to IEC visa insurance. Looking to visit Canada for up to two years? Click here to see how we can help!

We advise working with BestQuote Travel Insurance Agency for your IEC travel insurance in 2023. They're a skilled insurance agency in their own right, but what's better is that they also allow you to compare plans from different insurance providers. This helps you feel confident you're getting the best policy available.

The International Experience Canada (IEC) program allows young people between the ages of 18 to 35 to temporarily work in Canada for up to two years. Citizens from more than 30 countries are eligible to apply. Among the IEC program's eligibility requirements is proof of health insurance that provides coverage for medical care, hospitalization ...

BestQuote Travel Insurance also offers several IEC policies that allow for up to two years of coverage. Whether you are from Ireland, Australia, the UK, France, Portugal or New Zealand (max 23 months), you can get covered for the two years of your IEC visa.

No pre-existing medical conditions and no winter sports. $1,450. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible. No pre-existing medical conditions and winter sports included. You can use a price comparison website to quickly get an idea of the cost of IEC health insurance for your circumstances.

This is the insurance you need for the 2024 IEC Working Holiday. You have heard or read that you need travel insurance before arriving in Canada under the IEC program. This is confusing. Once upon a time, the Government of Canada actually used the term 'travel insurance' in some communications to IEC candidates.

Canadians Travelling on a Working Holiday Visa. If you are a Canadian citizen between the ages of 18 and 35, you may be eligible for a Working Holiday visa.

The IEC working holiday visa for Canada is 24 months for most countries, which means you need a 2 year IEC travel insurance policy. In this article, we'll tell you what to look out for, the essential requirements of travel insurance, questions to ask, and at the very end, we list and link to the companies which offer 24-month travel insurance policies.

BestQuote provides a competitive range of travel insurance policies from leading providers across Canada. Looking for travel insurance? You can use our comparison tool to get quotes for: • Super Visa Insurance • Visitors to Canada Insurance • IEC (International Experience Canada) Insurance • Snowbird Insurance • Expatriate Insurance • Canadian Traveller Insurance • Student Insurance

Travel Insurance Packages. Travel insurance companies often package the three types of coverage mentioned above with baggage insurance as well as accidental flight insurance and offer everything at a price that's usually much lower than the sum of the parts. Baggage insurance covers certain types of baggage loss damage and delay, while accidental flight insurance would pay a lump sum benefit ...

Why use BestQuote to compare travel insurance prices? Because no single travel insurance company is always going to have the best policy at the best price for every traveller all the time. For each traveller, any travel insurance company can swing from being the best policy with the lowest price one year to being completely uncompetitive and ...