- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

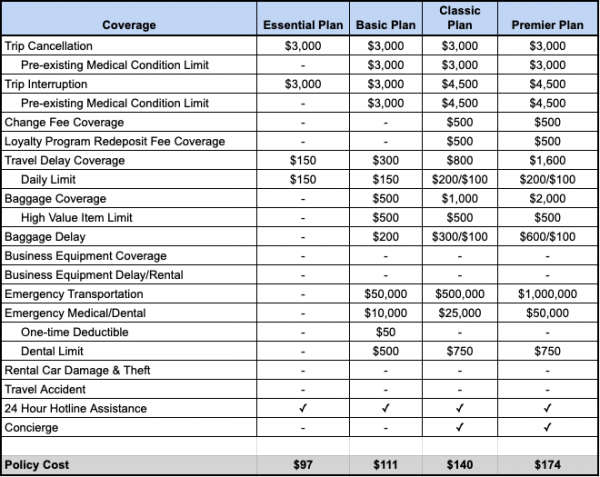

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

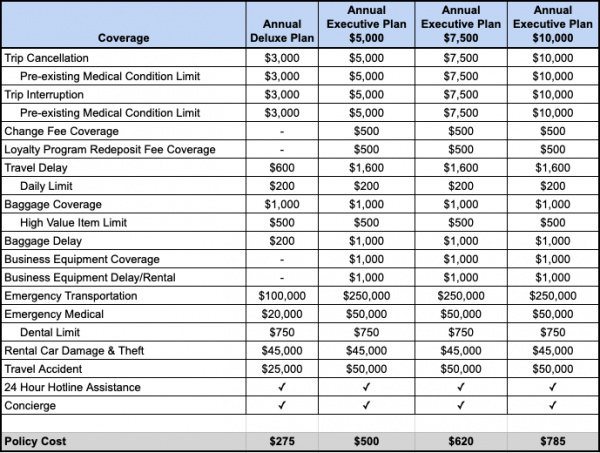

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

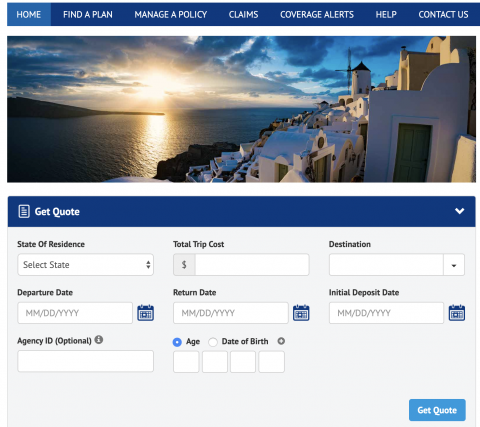

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Five Ways Travel Insurance Can Clear Your Path for Your Vacation

Updated : January 11, 2024

Table of Contents

- Worry less about nonrefundable trip investments

- Know you’re protected with emergency benefits

- Benefits can help make unexpected travel delays easier

- Relax knowing you have 24/7 access to professional, multilingual assistance

- Epidemic-related covered reasons are now included

As a AAA member, you understand the importance of being prepared for the unexpected. That’s why AAA offers Allianz Travel Insurance to help you secure your investments, belongings and yourself with plans that feature exclusive AAA benefits. That means whatever your vacation looks like, you can make the most of it with greater reassurance. Read on for five ways that Allianz Travel Insurance can secure peace of mind the next time you travel.

1. Worry less about nonrefundable trip investments

For some of us, the term “nonrefundable” can cause hesitation or concern. The “what-ifs” that have the potential to derail our plans can seem infinite. What if something like a hurricane causes a change in plans? Or what if there’s a family emergency back home while you’re away?

Luckily, putting your concerns to rest over many of these hypotheticals can be simple. Allianz Travel Insurance plans offered by AAA offer a broad range of covered reasons for trip cancellation and interruption to reimburse your prepaid, nonrefundable vacation expenses, so you can spend your vacation (and the weeks leading up to it), with your mind at ease.

2. Know you’re protected with emergency benefits

Plenty of travelers often forget that U.S. government medical plans and many personal health insurance plans don’t work outside their country. The U.S. State Department even cautions you in your passport to look into this before leaving the country. A trip protection plan provides important coverage benefits for emergency medical/dental and emergency medical transportation, plus services to help ensure you get the care you need away from home. You can also access Allianz's travel insurance partner’s network of pre-screened medical providers to help ensure the quality of your care.

3. Benefits can help make unexpected travel delays easier

If, for example, inclement weather keeps your flight from boarding on time, then it could be even more disappointing to have to pay extra for meals, lodging and transportation that were never part of your plans.

Fortunately, with benefits for covered travel delays, you can get reimbursed for additional qualifying trip costs if this happens. Plus, with plans including SmartBenefits SM *, you can automatically receive a fixed payment for each person named on your plan whenever a qualifying delay is tracked—without ever having to submit a claim.

4. Relax knowing you have 24/7 access to professional, multilingual assistance

Whenever an issue arises away from home, it can be all the more challenging to work through it if you’re not completely familiar with local emergency facilities and other nearby services.

Let’s say you lose your passport. One call to your assistance team can help you reach local authorities and the nearest U.S. government office, so you can report the loss and replace your passport as quickly as possible. If you have a medical emergency while traveling, access to these services can help save you or your travel companions critical minutes by locating your nearest appropriate facility and making any necessary transportation arrangements to get there.

5. Epidemic-related covered reasons are now included

Now you can worry less about what would happen if you came down with COVID-19 before

or during your trip. For example, depending on your plan, benefits for trip cancellation, trip interruption or emergency medical care and transportation could apply if you become ill. Ask your travel advisor and be sure to read your plan details for more information.

______________________________________________

Terms, conditions, and exclusions apply. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance (AGA) or its affiliates. AGA compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

*When you opt in and provide flight information, we’ll monitor flights and send flight status and benefit alerts, including about flight delays that qualify for automated travel delay payment. Standard message/data rates apply to SMS alerts. SmartBenefits SM automated claims system and payment availability is not guaranteed and is subject to our sole discretion. All claims subject to policy terms, conditions, and exclusions.

More Articles

Travel like an expert with aaa and trip canvas, get ideas from the pros.

As one of the largest travel agencies in North America, we have a wealth of recommendations to share! Browse our articles and videos for inspiration, or dive right in with preplanned AAA Road Trips, cruises and vacation tours.

Build and Research Your Options

Save and organize every aspect of your trip including cruises, hotels, activities, transportation and more. Book hotels confidently using our AAA Diamond Designations and verified reviews.

Book Everything in One Place

From cruises to day tours, buy all parts of your vacation in one transaction, or work with our nationwide network of AAA Travel Agents to secure the trip of your dreams!

- Travel Advice

- General Information

A Quick & Easy Guide to AAA Travel Insurance

Last Updated: May 24, 2024 May 24, 2024

American Automobile Association — commonly called AAA or Triple A — is probably best known as the organization that provides roadside assistance to its members. However, their members also benefit from AAA’s long standing partnership with Allianz Global Assistance, a leading travel insurance provider .

The good news? You don’t have to be a member to get trip coverage from Triple A, so let’s take a closer look at what you can expect from AAA travel insurance .

What Does Travel Insurance from AAA Cover?

AAA trip insurance coverage options can vary depending on your location and travel destination . The plan you choose also influences what coverage is available. That said, travel insurance from AAA often includes coverage for:

- Trip cancellations

- Trip interruptions

- Travel delays

- Trip changes

- Emergency medical and dental care

- Emergency evacuations

- Baggage loss, theft, damage, or delay

Additionally, AAA travel insurance policies also provide 24-hour assistance to help you with emergencies, ranging from lost passports to ongoing medical monitoring.

Members will also enjoy travel benefits through AAA. These may include:

- Discounts on car rentals and hotels

- Special vacation packages

- A reloadable, prepared credit card

- Assistance with visas, passport photos, and international driving permits

What’s Not Covered by AAA Travel Insurance?

AAA trip insurance policies, like most insurance policies, may exclude coverage for certain perils. For example, your injury likely won’t be covered if it occurred while taking part in criminal or high-risk activities. Intoxication and drug use might also curtail your coverage.

Moreover, your policy may not cover cancellations for some events. This often includes events that were public knowledge when you booked your trip, so check the Coverage Alerts page before you purchase travel insurance from AAA.

Finally, AAA travel insurance only covers named insured — that is, individuals specifically mentioned in the plan. That means your family members or travel companions are only covered if you name them in your policy.

Coverage details can vary, so be sure to review your policy documents before you leave for your trip.

AAA Trip Insurance Plans

AAA offers single-trip insurance plans that depend on your state of residence and destination. Requesting a quote generally returns three plan levels with various coverage options and premiums: TripProtect Deluxe II, TripProtect Select II, and TripProtect Cancel Anytime.

Each of these plans included coverage for:

- Lost document fees.

- Flight changes for covered events.

- Changes to or a missed port of call.

- Required vaccinations.

- Trip cancellations, delays, or interruptions.

- Emergency medical and dental care.

- Emergency transportation.

None of the travel plans covered rental cars, but AAA does offer an add-on to cover that cost if your trip is interrupted as well as the cost of damage or theft of your rental car.

TripProtect Deluxes has the highest coverage limits. However, the TripProtect Cancel Anytime plan is a cancel for any reason policy , which may be attractive for some trip planners.

How to Get AAA Trip Insurance Quotes

Getting a quote from AAA for travel insurance is easy. You simply go to the AAA’s travel insurance page and click the “Get your quote now” button. From there, you enter your state of residence, total trip cost, destination, departure and return dates, initial deposit date, and the ages of every traveler. Once you do this, you’ll receive information about the available plans. Be sure to click the View Plan Comparison button. This will give you a side-by-side comparison coveages and amounts.

How Much Does AAA Travel Insurance Cost?

Your travel insurance premium depends on the cost of your trip and the plan you choose. To give you an idea of what travel insurance from AAA might cost, we plugged in information for a 7-day, $12,000 trip for one traveler leaving from Illinois. Prices ranged between $505 for the TripProtect Select II plan to $704 for the TripProtect Cancel Anytime plan.

The prices for the same trip for a family of three were between $377 and $534.

Frequently Asked Questions About AAA Trip Insurance

Here are answers to some of the more frequently asked questions about travel insurance from AAA.

Does AAA Offer Overseas Travel Insurance?

AAA offers coverage for both domestic and international travel. Cancel for any reason trip insurance may be more difficult or even unavailable or some overseas travel.

Does AAA Cover Flight Cancellation?

AAA can cover flight delays and cancellations. How and when these events are covered depend on your specific policy, but travel insurance from AAA often reimburses you for meals, transportation, and accommodations if a covered event delays your flight for a minimum number of consecutive hours.

Is Allianz Part of AAA?

Allianz has been a travel insurance partner of AAA for over 30 years. The insurer holds an A+ rating from AM Best and has been accredited with the Better Business Bureau since 1991.

Is AAA Travel Insurance Worth It?

Travel insurance is almost always worth the cost, if only because it brings you peace of mind that your vacation is protected should something go wrong. But is travel insurance from AAA worth it? That depends on your particular situation.The best way to decide if travel insurance from AAA is the right coverage for you is to compare policies.

Get quotes from several trip insurance providers, and take a good look at the coverage and cost. When you find the policy that gives you the protection you need at a premium you can afford, you’ve found the right one.

Written by Virginia Hamill

How AAA Members Can Save Big Money When Traveling

I f you're a frequent traveler, you're no stranger to all the ways you can save money so you can travel more often. From travel credit card perks to airfare booking strategies , you've probably got it all figured out. However, you might be surprised when we say that if you're not a AAA (American Automobile Association) member, you might be missing out on amazing deals.

AAA is a non-profit organization -- technically a federation of motor clubs -- that is dedicated to enhancing its members' travel experiences throughout the U.S.A. It offers a range of benefits that can significantly contribute to cost savings for your trips while also providing peace of mind while on the road.

Perks range from 24/7 roadside assistance to exclusive discounts on car rentals and hotel stays. However, you won't just get perks for road trips -- AAA will also take to the skies with you with deals on airfare and travel abroad with all-inclusive trips to Mexico , the Caribbean , and beyond.

AAA 'S Membership Tiers Offer Great Value For Travelers

Since it was established in 1902, AAA has reliably served travelers across the United States. Now, with a century of experience, it has become a trusted organization best known for its comprehensive travel services.

AAA offers three main membership levels: Classic, Plus, and Premier, all with incredible perks. The Classic membership is the basic tier, but there's nothing simple about it. This tier still provides all the essential services, such as roadside assistance, $60 dollars toward locksmith services, and access to travel resources. However, it also includes discounts on rental cars, identity theft protection, and expedited passport and travel visa services.

The second-tier Plus membership includes all of that but simply in greater amounts. For example, you get 100 miles of towing (whereas Classic provides 7), emergency fuel delivery that is completely free (including the fuel), along with 50% off European travel guides.

The Premier membership offers the highest level of coverage and benefits and includes everything from the Plus and Classic tiers with even greater discounts. Premier members can expect to receive amazing extras like one-day free car rentals and concierge services for those bougie budget-conscious travelers.

Membership costs will vary depending on your zip code and the level chosen. For example, the Classic tier in California costs around $36 per year but in neighboring Arizona goes up to $65. No matter the cost, considering the potential savings and benefits, the value received should make it worth your while.

Get Great Discounts On Travel With AAA

Through its extensive network of partnerships, AAA members can save a trunkload of money. As a member, you will gain access to a wide range of discounted travel options, including all-inclusive resort or cruise packages or piecemeal -- if you like to book things separately -- hotel accommodations, car rentals, and airfare.

For example, when booking hotel accommodations, AAA members often receive discounted rates that can range from 5 to 10% off the regular prices for hotels chains like Hilton, Best Western, and MGM. This means significant savings on popular hotels and resorts located both in the U.S. and worldwide. You'll even earn loyalty points when you book through AAA , which can be applied towards your next membership renewal.

Similarly, when renting a car, AAA members can benefit from discounted rates (up to 35% on electric vehicles ), free upgrades, and additional perks like fuel discounts with their main partner Hertz or budget car rental companies like Thrifty and Dollar. AAA will even waive the additional driver and young renters fees if you're between the ages of 20 to 24.

AAA Offers Members Expert Travel Planning Support

While all the roadside assistance is great for long road trips, what really makes the organization stand out is that it's actually the largest travel agency in the U.S. Their advisors are available to chat with you in-person or virtually. AAA travel agents won't just help you plan an amazing trip but they can also find you the best deals through their exclusive discounts.

If you're thinking about planning a road trip , AAA also offers their own travel app called TripTik. This is an interactive road trip planning tool that can help you plan out stops along your route for gas and rest stops, restaurants, hotels, and attractions. If you need some inspiration, the app also has 600 pre-planned scenic drives including recommended stops.

For those who enjoy the analog versions of things, AAA is one of the few organizations that still offer paper maps to its members for free. However, if you prefer digital, they haven't forgotten you. You can grab AAA's digital TourBooks which provide access to information about destinations across North America and the Caribbean.

Get Everything You Need To Travel In One Place

Now that you know where you want to go, you just have to get there. Luckily, AAA offices can be your one-stop-shop for (almost) all your official documents.

If you know you have air travel planned soon, and you don't have a passport or need to renew it quickly and/or you need a travel visa, head to your nearest AAA office instead of the post office or passport office. With AAA , you can take your passport photos (at a discount for AAA members) and get your passport and visa application expedited through AAA 's connections with RushMyPassport.

If you're planning to drive while abroad, you may also want to consider grabbing an International Driving Permit (IDP). Since a U.S. Driver's License is not accepted in all countries, an IDP is a surefire way to avoid issues. An IDP can also reduce issues with language barriers and it may be required to rent a car. The best part is that with AAA you can get an IDP the same day you apply for only $20, plus additional (but still discounted) fees for the passport photos required for the document.

Lastly, to be prepared for any eventuality that may occur on your trip, you can also purchase automotive and travel insurance through AAA . They partner with Allianz Global Assistance so members can take advantage of insurance policies that cover trip cancellation, trip interruption, and emergency medical coverage.

Read this next: Safety Items You Should Pack For Your Next Road Trip

What you need to know about rental car reimbursement coverage

By AAA staff

May 30, 2024

If your car is damaged in an incident covered by insurance, there's a good chance you'll need to rent a vehicle to get around while your car is being repaired or replaced.

Renting a car can be costly, adding up to hundreds or even thousands of dollars depending on how long you need it for.

The good news? Auto insurance offers rental car reimbursement coverage specifically to take this financial burden off your shoulders. What exactly is rental car reimbursement coverage , how does it work, and what does it cover? Let's dive in.

What is rental car reimbursement coverage?

While coverage can vary from one policy or insurance company to the next, the basic idea is that you are compensated for the expense of renting a car when your personal vehicle is being repaired or replaced for a loss covered by your insurance.

Most insurers require you to carry comprehensive and collision coverage before you can add rental car reimbursement coverage. If you already have those coverages, however, rental car reimbursement coverage is typically a small additional expense for added peace of mind and convenience if your vehicle is damaged in a covered incident.

Many insurance companies allow you to arrange your rental directly through them, and this is usually the most convenient way to use your coverage, as your insurer can monitor and pay for the rental directly, up to the limits on your coverage. In some situations, you may need to pay for the rental out of your own pocket initially and submit receipts to your insurance company for reimbursement instead.

What kind of car can you rent under this coverage?

Typically, rental car reimbursement coverage will come with limits on the daily rate of the rental car and the maximum number of days that are covered. For example, your insurer might cover a $40/day rental for up to 30 days. If you need or want a rental that costs more than that, you’ll pay the difference out of pocket.

There isn't usually a limit on the type of car you can rent with rental reimbursement coverage so long as it falls within your daily limit. Some policies, however, may designate that the rental vehicle needs to be a similar make and/or model as the vehicle involved in the insurance claim. If you have questions about what's included with your rental car reimbursement coverage, be sure to consult with your insurance agent.

How long will your rental car expenses be covered?

Check your auto insurance policy paperwork to find out exactly how long your rental may be covered, as this can vary from one policy to the next. Some rental car reimbursement policies max out at 30 days, while others may include coverage for as long as it takes to repair or replace your car.

What if another party is at fault?

The nice thing about rental car reimbursement coverage is that it can typically be used to cover the costs of a rental car following a covered claim no matter who is at fault, or if fault has not yet been determined.

If you don’t have rental car reimbursement coverage and another driver is determined to be at fault for the damage to your vehicle, you may be able to pursue reimbursement for your rental expenses directly from the at-fault driver's insurance.

What's covered vs. what might not be covered?

The best way to find out exactly what's covered by your rental car reimbursement policy is to read your own policy paperwork and declarations carefully, being sure to reach out to your insurance agent with any questions or concerns you may have.

In general, however, rental reimbursement coverage is designed to cover the daily rate of a rental vehicle while your own car is unavailable because of a covered claim, such as a crash. That typically includes taxes and fees as long as they don’t exceed the daily limit on your coverage, but not refueling charges or the tax on refueling charges, or optional add-on insurance you might be offered by the rental car company.

Rental car reimbursement coverage isn’t designed to pay for costs related to renting a car for a vacation or leisure. Likewise, this coverage can’t be used if your vehicle is in the shop for routine maintenance or repairs unrelated to a covered claim.

Is rental car reimbursement coverage the same thing as rental car insurance?

It’s easy to confuse rental car reimbursement coverage with the add-on rental car insurance that car rental companies offer when you rent a car, such as collision damage waivers and excess liability insurance. These are separate types of coverage:

- Rental car reimbursement is a coverage you can elect to carry on your own auto insurance policy in case you need to rent a car while getting your own car fixed or replaced.

- Add-on rental car insurance refers to 4 types of optional coverage you can accept or turn down when you rent a car: collision damage waiver, supplemental liability insurance, personal accident insurance, and personal effects coverage. If you opt for any of them, these short-term coverages only cover you in your rental car for the length of the rental.

Reporting an auto claim to AAA is fast & easy

Contact us to file a claim on your auto insurance policy through AAA.

With AAA, you could save hundreds on auto insurance

Enjoy auto insurance savings, service, and security. Our policyholders have counted on AAA for years to provide the legendary service we’re known for.

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Area, Altitude, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

Elektrostal Demography

Information on the people and the population of Elektrostal.

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal weather.

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

Explore Elektrostal

Essential elektrostal.

Elektrostal Is Great For

Eat & drink.

- Apelsin Hotel

- Elektrostal Hotel

- Apart Hotel Yantar

- Mini Hotel Banifatsiy

- Restaurant Globus

- Amsterdam Moments

- Cafe Antresole

- Viki Cinema

- Statue of Lenin

- Park of Culture and Leisure

Explore Zheleznodorozhny

Essential zheleznodorozhny.

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Peter the Great Military Academy

- Central Museum of the Air Forces at Monino

- History of Russian Scarfs and Shawls Museum

- Ramenskii History and Art Museum

- Balashikha Museum of History and Local Lore

- Pekhorka Park

- Balashikha Arena

- Drama Theatre BOOM

- Bykovo Manor

- Malenky Puppet Theater

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Church of Vladimir

- Likino Dulevo Museum of Local Lore

- Orekhovo Zuevsky City Exhibition Hall

- Noginsk Museum and Exhibition Center

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Malakhovka Museum of History and Culture

IMAGES

COMMENTS

Stay protected on your travels with AAA Travel Insurance. Get comprehensive coverage for trip cancellations, medical emergencies, and more. Join AAA now!

AAA offers several different travel insurance plans that can help you cover trip delays or medical emergencies. Check out our full AAA travel insurance review.

AAA's TripAssist Choice Basic plan offers some protection while you're traveling, but it has the least amount of coverage out of AAA's three travel insurance plans.

Whether you're traveling internationally or within the United States, AAA members have access to travel insurance which could help with non-refundable costs if you have to cancel your trip.

Allianz Partners, a world leader in travel insurance and assistance services and AAA partner of over 30 years, offers many reasons to protect yourself and your family with travel insurance — helping travelers every year through unanticipated travel delays, bad weather, lost luggage and medical emergencies in foreign countries.

Allianz plans offer generous protection for all domestic and international travel. Most plans feature trip cancellation and primary emergency medical benefits, 24-hour travel assistance, and optional benefits to tailor the plan to your travel needs. Allianz is the perfect companion for your perfect vacation. Kids Are Free.

Allianz Travel Insurance plans offered by AAA offer a broad range of covered reasons for trip cancellation and interruption to reimburse your prepaid, nonrefundable vacation expenses, so you can spend your vacation (and the weeks leading up to it), with your mind at ease.

When planning your vacation, you imagine everything going perfectly. But reality can often derail your plans—from losing a suitcase to missing your cruise because of a delayed connecting flight to having a medical emergency overseas. Travel insurance helps protect your financial investment in the wake of unforeseeable events like these—and many more.

Check out travel articles and tips, travel guides, vacation packages, and more. Discover all the ways AAA Travel is your one-stop source for your next worry-free vacation.

Even careful vacation plans can be disrupted by an illness, family emergency, natural disaster or other events beyond your control. Travel insurance covers cancellation penalties, trip interruption, some medical costs and expenses related to lost or delayed baggage.

AAA's Travel Protection Services. Travel with Peace of Mind with Travel Insurance and more!

Your travel insurance premium depends on the cost of your trip and the plan you choose. To give you an idea of what travel insurance from AAA might cost, we plugged in information for a 7-day, $12,000 trip for one traveler leaving from Illinois. Prices ranged between $505 for the TripProtect Select II plan to $704 for the TripProtect Cancel ...

Most travel protection plans exclude losses caused directly or indirectly by an epidemic, as in the case of COVID-19. Like storms, once a health alert is issued it is considered a "known event" and excluded from coverage.

AAA is a non-profit organization -- technically a federation of motor clubs -- that is dedicated to enhancing its members' travel experiences throughout the U.S.A. It offers a range of benefits ...

The average cost of Covid travel insurance is $733 per trip, based on Forbes Advisor's analysis of 23 pandemic travel insurance plans that include "cancel for any reason" travel insurance ...

Rental car reimbursement is a coverage you can elect to carry on your own auto insurance policy in case you need to rent a car while getting your own car fixed or replaced. Add-on rental car insurance refers to 4 types of optional coverage you can accept or turn down when you rent a car: collision damage waiver, supplemental liability insurance ...

Domestic travel insurance is just as important as the travel insurance you'd purchase for an international journey. Discover how a policy can protect your trip.

Elektrostal : Elektrostal Localisation : Country Russia, Oblast Moscow Oblast. Available Information : Geographical coordinates, Population, Area, Altitude, Weather and Hotel. Nearby cities and villages : Noginsk, Pavlovsky Posad and Staraya Kupavna. - City, Town and Village of the world

Elektrostal Tourism: Tripadvisor has 801 reviews of Elektrostal Hotels, Attractions, and Restaurants making it your best Elektrostal resource.

Zheleznodorozhny Tourism: Tripadvisor has 1,133 reviews of Zheleznodorozhny Hotels, Attractions, and Restaurants making it your best Zheleznodorozhny resource.

Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right.