Is AAA membership worth it?

I've been a AAA member for more than 15 years, and I can confidently say that the perks and benefits have come in handy — especially the well-known roadside assistance benefit.

Over the years, AAA has opened up its network to provide vast options and money-saving discounts for travelers beyond roadside assistance.

I'm also partial to the regional magazine AAA produces six times a year; Arizona's is called Via and California's is called Westways. Each issue is full of travel inspiration and valuable tips. AAA even has a travel service you can use to book vacations.

How I've used AAA benefits

Living in Arizona, you can expect that your car battery will not survive more than two years due to the heat. In my case, the two-year timing always seemed to happen in August — the hottest month of the year. I have called AAA on more than one occasion to take advantage of its mobile battery service , and workers have come to my location with a new car battery.

Usually, they will test your current battery power and sell you a new one on the spot if needed. Members receive a $25 discount on batteries purchased during the on-the-spot installation. They even offer a battery warranty, so there's a chance if you purchased your last battery from AAA, your replacement might be free.

It has been a fantastic time saver and more convenient than getting jumper cables and making it to the nearest auto shop. Additionally, AAA membership covers the individual, not just the vehicle. So, you can use your membership for a service call even if you're a passenger in a stalled car.

To request 24/7 roadside assistance , use the AAA online assistance tool, call 800-AAA-HELP (800-222-4357) or you can text HELP to that same phone number and follow the prompts from there.

According to the AAA website, response time varies depending on several factors including time of day, breakdown location, and severity of the issue, and that AAA strives to provide the fastest and most efficient service possible. If you make your request online, you can track the progress of your request and the location of your technician.

What does AAA membership cost?

Membership rates are determined by the local club and may vary, a AAA spokesperson confirmed. The pricing below is provided as an example and is based on Arizona's current club pricing.

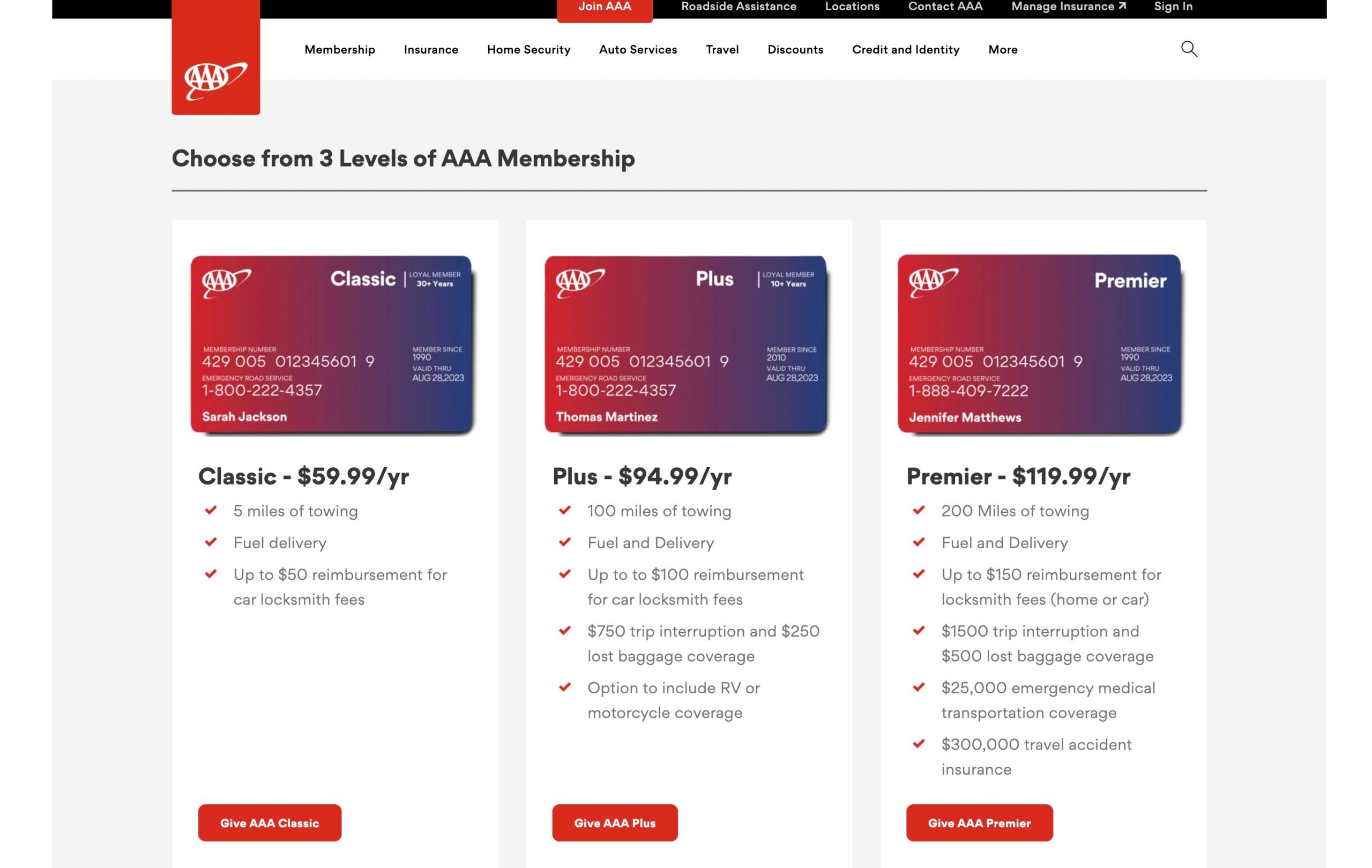

There are three AAA membership levels based on the types of services included.

The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees.

The next membership level is called "Plus" and is $94.99 annually. This level will more than pay for itself if you had to use just the locksmith option which is up to $100 reimbursement. This option also includes 100 miles of towing, fuel and delivery, $750 trip interruption, $250 lost baggage coverage and an option to include RV or motorcycle coverage.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance.

Does AAA offer discounts and perks?

AAA can help you save on everything from theme park tickets to car insurance and car repair. AAA membership offers a vast network of discounts and perks when you show your card or make online reservations with certain companies that provide AAA member discounts.

Guide: 6+ unexpected travel discounts to save you money.

A quick look at the AAA merchant list for attractions, zoos, museums and tours reveals discounts for CityPass for some major U.S. cities, Legoland Discovery Centers, Busch Gardens, Six Flags Theme Parks, AMC Theatres and Regal Cinemas, to name a few. You can search by city on the website to narrow down your results.

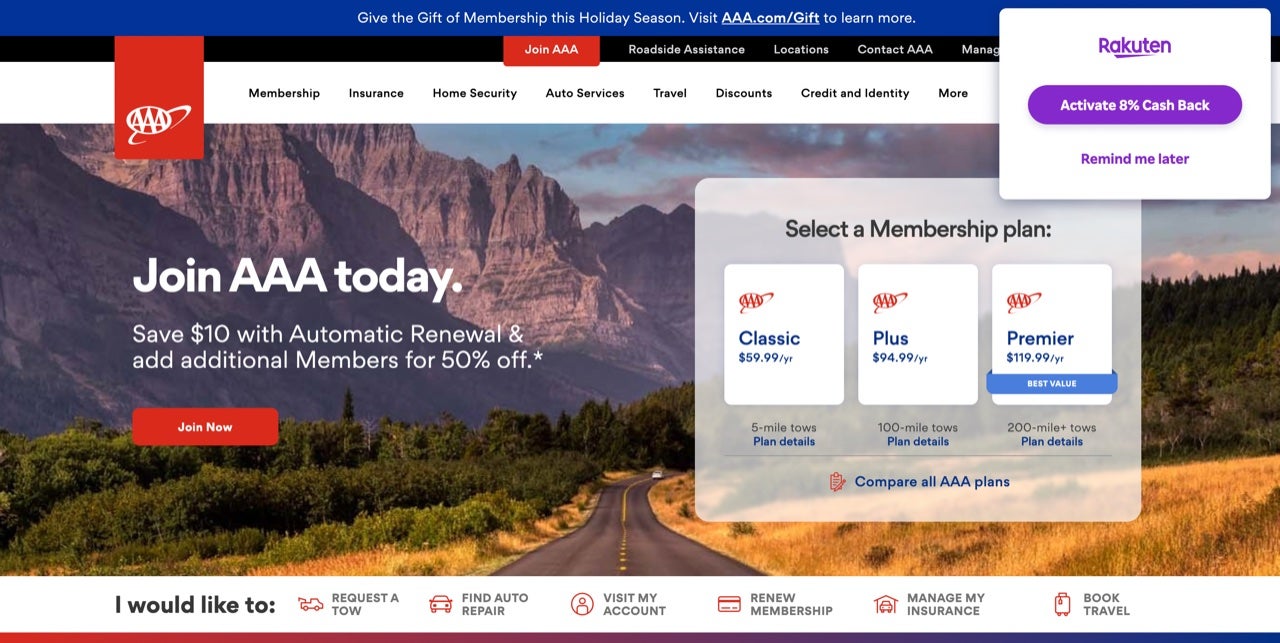

As I navigated to the AAA website, my Rakuten browser extension popped up and offered me 8% back, so there are ways to stack offers while using your AAA membership.

AAA is a trusted name in the auto industry and not just for its roadside assistance. Auto repair shops can be AAA trust-certified which means as a consumer which means you can access this network and receive discounts on regular automotive service or repairs; the work carries a warranty for 24 months/24,000 miles. You will also get access to priority service and a minimum of 10% off labor costs.

Through AAA Smart Home you can save money on items for your home such as a home security system, smart door locks, energy-efficient thermostats and even home automation.

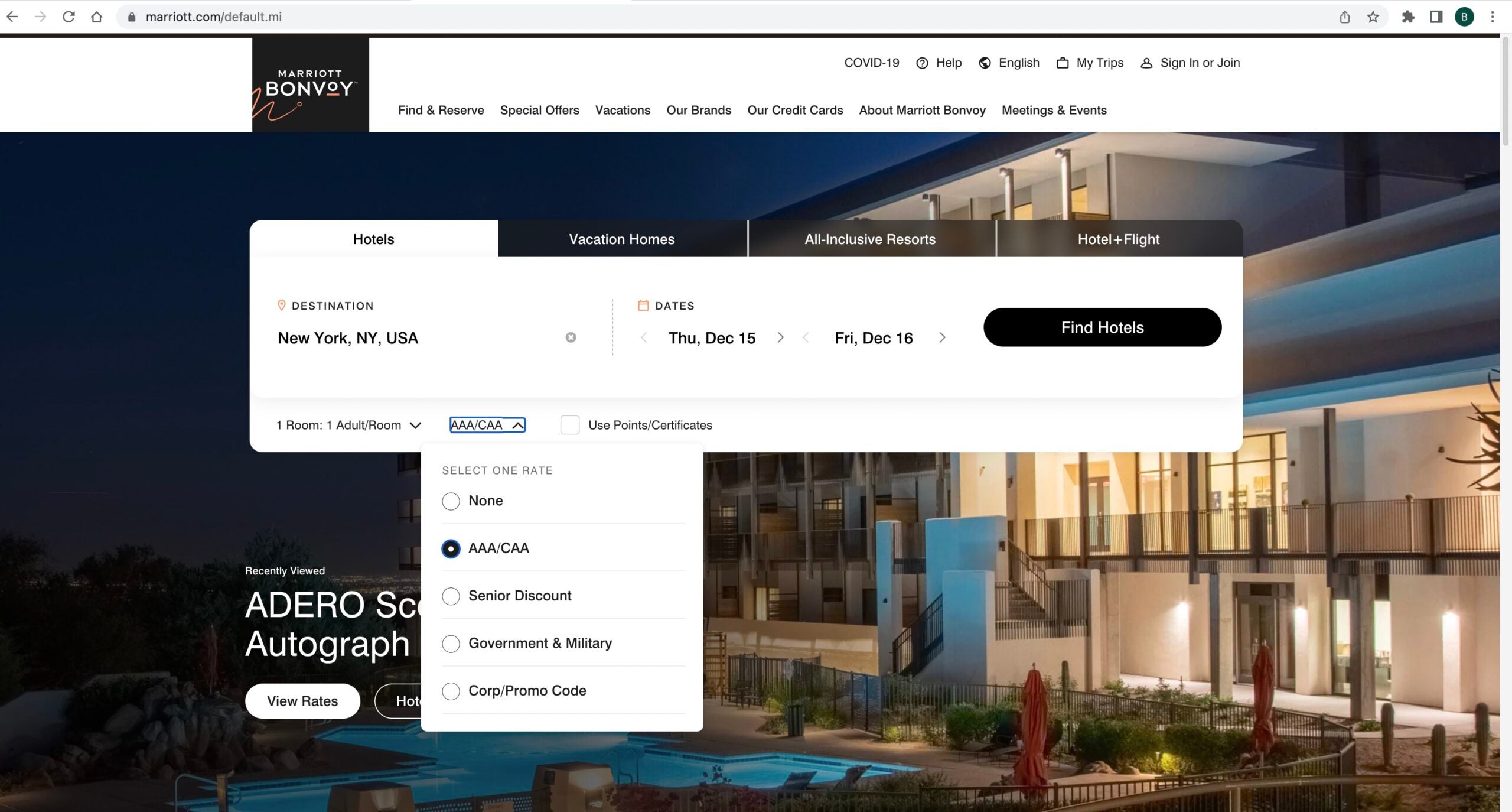

Many hotel companies offer AAA discounted rates which usually hover around 10% off the best available rate. If you click for rate options, you'll see a AAA rate option on many hotel booking websites.

Another way to utilize AAA perks is for car rentals — many rental companies offer AAA corporate rates which you can find using the AAA travel portal. If you are a renter under 25 , you can rent through Hertz, which specifically honors the AAA discount for younger drivers.

Can I gift AAA membership to a friend or family member?

According to the AAA website, gift memberships are available for purchase in some regions of the country: Northern California, Nevada, Utah, Arizona, Montana, Wyoming and Alaska. If the person you want to gift membership to lives in another region, you can search by zip code to find the local AAA club where they live.

Is AAA worth it?

If you enjoy saving money and getting additional home and travel perks, I recommend checking out AAA to see if it is a program you can benefit from. If you are a T-Mobile customer, see if your plan includes the Coverage Beyond program — this includes AAA membership free for customers (a $60 value).

Related: AAA tests program to allow California users to get Real ID

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

12 AAA Travel Benefits You Probably Never Considered

Ashley Rossi

Ashley Rossi is always ready for her next trip. Follow her on Twitter and Instagram for travel tips, destination ideas, and off the beaten path spots.

After interning at SmarterTravel, Ashley joined the team full time in 2015. She's lived on three continents, but still never knows where her next adventure will take her. She's always searching for upcoming destination hotspots, secluded retreats, and hidden gems to share with the world.

Ashley's stories have been featured online on USA Today, Business Insider, TripAdvisor, Huffington Post, Jetsetter, and Yahoo! Travel, as well as other publications.

The Handy Item I Always Pack : "A reusable filtered water bottle—it saves you money, keeps you hydrated, and eliminates waste—win-win."

Ultimate Bucket List Experience : "A week in a bamboo beach hut on India's Andaman Islands."

Travel Motto : "Travel light, often, and in good company."

Aisle, Window, or Middle Seat : "Window—best view in the house."

Travel Smarter! Sign up for our free newsletter.

If, like me, you thought AAA travel benefits only cover roadside assistance, you’ll be pleasantly surprised to find that they offer much more. With plans starting at $52 annually, you can save a lot on travel with an AAA membership—here’s how.

Free or Discounted Passport Photos

Depending on membership level, some AAA subscribers are entitled to a free set of passport photos per year. They’re discounted ($8) for basic members. You can also get a passport application at your AAA branch—although AAA doesn’t process passports.

International Driving Permits (IDP)

Renting a car overseas? You can get an international driving permit ( IDP ) at any AAA location, or you can mail in your application. An IDP is a necessary form of driver identification abroad, is valid in over 150 countries, and comes printed in 10 languages. To get an IDP through AAA you’ll need a valid U.S. license, the $20 fee, and two passport-sized photos on a white background.

Travel Money: Money Cards and Foreign Currency

For foreign currency, AAA travel benefits afford members a few different options to choose from: The Visa TravelMoney card is a pre-paid and reloadable card not attached to your personal bank account. AAA members get a discount on the card activation fee ($4.95 per card) and it can be reloaded online, by direct deposit, or at an AAA branch.

AAA members can also order over 90 types of foreign currency. Getting cash ahead of time can be a great way to avoid high fees and unfavorable exchange rates at airports and hotels. AAA currency must be ordered in person, and purchases are shipped to the branch location in about three business days. Plus, orders over $200 are shipped free.

Car Rental Plans

AAA has its own rental car search engine and offers coupons with Hertz for additional savings. Some highlights include a waived young renter fee (for those between 20 and 25) as well as up to a 20 percent discount on daily, weekend, weekly, and monthly rentals.

Travel Insurance

AAA offers members Allianz Global Assistance as well as travel protection plans by region. According to its website , the AAA Northeast Travel Protection Plan offers trip cancellation and interruption coverage.

Theme Park & Ticket Discounts

AAA offers small to significant discounts on parks like Universal Studios and Walt Disney World, as well as at movie theatre chains like Showcase and AMC. For families, check out AAA’s special Orlando Vacations packages for even more savings.

Additionally, AAA members get special discounts on cruising and Rail Europe .

Road Trips & Planning

The traditional AAA roadside benefits include towing, flat tire assistance, vehicle lockout service, fuel delivery, and more, but there are other AAA travel benefits when it comes to hitting the road.

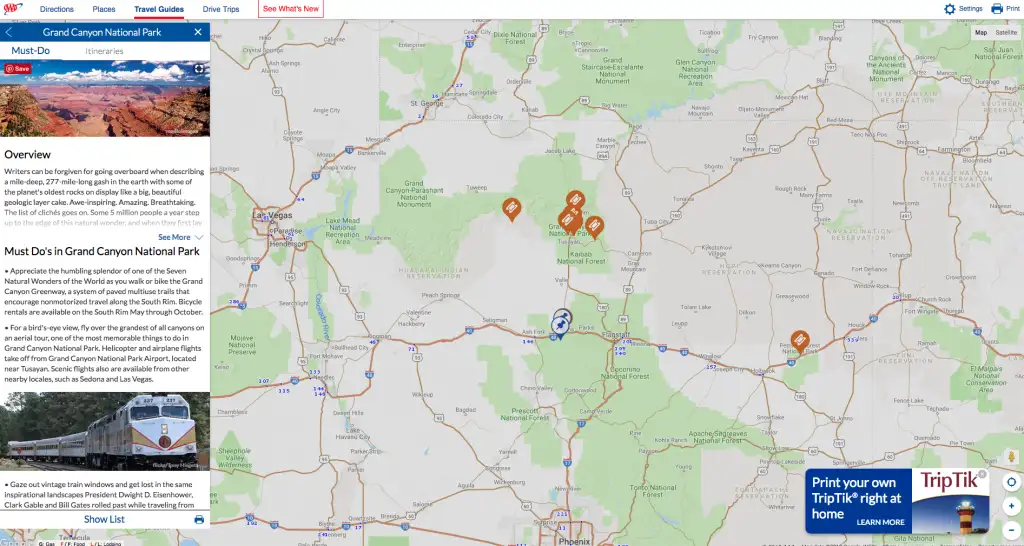

AAA also offers online travel guides , free guidebooks and maps at branch locations (or you can place an order online ), and even a handy map planning feature called TripTik . TripTik helps you plan your ideal road trip and plots rest areas, pit stops, scenic sights, and reports construction and traffic conditions.

Lodging Discounts

Search for hotels via AAA’s hotel search engine for the best member rates. Preferred partners include Best Western, Hilton, Hyatt, Marriott, and MGM Resorts. AAA rates are also eligible for partner loyalty point credits, too.

Travel Planning

The AAA website is also a booking website for hotels, flights, cars, cruises, and vacations. AAA agents at branch offices and over the phone will help you plan and book group trips and destination weddings and honeymoons using its bookings services and member savings. For group travel, you can even fill out an online form ahead of time stating your group’s interests and requirements.

Avoid the DMV

Most AAA branches also have registry services, which is a huge time saver and avoids trips to the DMV. This is even more beneficial now since you can renew your license to a REAL ID, which will be necessary for domestic air travel by 2020.

Notary Service

If you need forms notarized for travel purposes (or other reasons), AAA also provides this service for free.

Identity Theft Protection

With any AAA membership you get basic ProtectMyID coverage which includes credit monitoring, lost wallet protection, and fraud resolutions support, other levels of membership get even more benefits.

“Identity theft is a growing problem worldwide—especially for travelers, who are very vulnerable, forced as they are to use unsecured Internet connections, carry extensive personal documentation with them at all times, and share their credit cards with merchants …” says SmarterTravel’s Ed Hewitt.

More from SmarterTravel:

- Best AARP Travel Benefits to Use in 2018

- 11 Ways to Prevent Identity Theft While Traveling

- Do AAA Travel Discounts Really Save You Money?

Don't Miss a Trip, Tip, or Deal!

Let us do the legwork! Sign up for our free newsletter now.

Editor’s Note: All information is based on research done on the AAA website using a Boston area code. Services, pricing, and benefits vary based on location.

Ashley Rossi is always ready for her next trip. Follow her on Twitter and Instagram for travel tips, destination ideas, and off the beaten path spots.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

Oslo to Bergen: 6-Night Norway Fjords...

Luxe, 7-Night Caribbean & Mexico Cruise...

Regent Seven Seas Cruises

Ohio: Daily Car Rentals from Cincinnati

Trending on SmarterTravel

Is AAA Membership Worth It? Costs, Benefits & Pros & Cons

You’re cruising down the freeway without a care in the world on a Friday afternoon. The weekends here, and you’re ready to relax after a hard week at the office. All of a sudden, your engine light turns on, and the car comes stuttering to a halt. The steam coming from under the hood and the wheel wells suggests this is a severe problem.

Now what? You’re stuck on the side of the highway during peak rush hour, with a broken car. It’s not like you’re a mechanic, and if someone had to ask you to identify a fuel pump from a crankshaft, chances are you would have no idea what you’re looking at.

You need to call someone, but what do you do with your car? You’ll have to have it towed, and you know that that’s going to cost you a fortune. So much for an excellent start to a relaxing weekend.

Is an AAA Membership Worth It?

Table of Contents

With the above scenario in mind, let’s examine if the costs of owning an annual AAA membership are worth the money. We’ve all heard about AAA, but how many of us use the service? When it comes to the world of motoring, most of us have more concern about meeting our insurance and lease payments at the end of the month. AAA membership is one more transportation cost that we don’t want to add to our budget.

However, there are plenty of benefits to joining AAA. Motorists can utilize a bouquet of services that actually save them on their motoring costs. However, are the discounts and perks worth the price of the membership? Do you think you’ll ever end up using the perks, or will they remain on the shelf?

In this article, we’ll unpack the AAA membership, and clearly explain the advantages and drawbacks of using this service.

The Top Benefits of an AAA Membership

We all know there are perks and benefits to taking a AAA membership. However, not many of us know what these perks are or if they offer us any practical benefit. AAA offers both emergency roadside assistance services, and they offer you discounts and perks at retailers.

Let’s examine the retailer discounts available with your AAA membership.

Timely Response in Auto Emergencies

With AAA membership, you get 24-hour roadside assistance, seven days a week. This perk is probably the main reason why all of us want a AAA membership in the first place. However, AAA takes its service offering to another level when you consider all of the other perks involved with subscribing.

Replacement of Your Car Battery

If you’re stuck at home, and your car won’t start, it could be due to a flat battery. Under normal circumstances, you’d have to take an Uber to a battery center and get them to either charge or replace the battery. Then it’s back in the Uber to your home, and you’ll have to fit the battery yourself.

With AAA, a service technician visits your premises with a new battery and fits it for you. As a result, you are on your way to work in minutes, rather than wasting the morning running around.

AAA Travel Services

The AAA offers you a wide variety of reduced or free travel services in the United States. You get personalized trip planning, along with discounts on admission to many attractions, and group travel arrangements, cruise planning, and international travel assistance as well. The chances are that if you book your next family vacation using these services, it will more than cover the cost of your annual AAA membership.

Issuing International Driving Licenses

If you’re traveling to a foreign country, then you’ll need an international driver’s license to drive a car around. Failure to produce this license could result in your arrest in a foreign country. Without an international driver’s license, you’ll also find it challenging to get a car hire in most countries. As a AAA member, you get deep discounts on this service.

Discounts for Hertz Car Rental

Hertz collaborated with AAA to bring you discounted car rental services. You could save up to 20-percent on your car rental on selected models. All AAA members get a complimentary Hertz Gold Plus membership, with a value of $60. As a gold Hertz Member, you get expedited checkout, as well as free vehicle changes, and a host of other benefits.

Discounts with Participating Merchants

AAA members get to take advantage of discounts at participating merchants. Whether you’re looking for a discount on services, a new set of tires, or even cellphone contract discounts, look at what’s available with your AAA membership. Some merchants may offer you discounts for as much as 50-percent off of the purchase price.

Complimentary AAA Travel Guides

With an AAA membership, you get access to free road maps, guides, and travel planners within America for premier members, with Classic members paying 50-percent off the sticker price. AAA also offers these services for select regions of Europe as well, so check out the website if you’re planning a European vacation that involves some driving. You can order your free domestic travel materials online.

Discounts on Affiliated Insurance Policies

Some AAA clubs offer discounts with insurers on monthly premiums. Most insurers view drivers that sign up with AAA as reliable and safe behind the wheel. Insurance is all about calculating the risk involved with your driving, and what it would cost if you had to make a claim.

By signing up with AAA, you mitigate the risk of your driving unsafely. Affiliated insurers in the AAA membership include; Family Insurance Company Auto Club, The Automobile Club Inter-Insurance Exchange, and the AAA Life Insurance Company.

Discounts with Participating AAA-Approved Auto Shops and Dealers

As an AAA member, you get 10-percent off at participating auto repair shops across America. This saving applies to both parts and labor, and it can save you a bundle when it comes time to service your vehicle.

Look for the AAA membership logo at your local service shop to see if they participate in the program. However, AAA cap this saving at a maximum of 50-percent on the service or repair. Some auto shops may not offer you the discount unless you ask for it, so always make sure that you enquire before you book your service.

All AAA-approved auto repair providers must guarantee any work or repairs for at least 24,000-miles or 2-years. Leaving your vehicle with a AAA shop does not always mean that you’re getting good value for your money for your servicing and repair needs. Always remember to shop around with other vendors before booking a service with the AAA member.

Monitoring Identity Theft

AAS provides its members with complimentary identify theft monitoring services. You also get daily Experian credit checks to ensure that no-ones been applying for credit on your behalf. If you are a victim of identity theft, you have $10,000 in insurance coverage paid out to you by AAA. These services come offered by ProtectMyID, a subsidiary of the Experian credit bureau.

Travel Concierge

While you’re on the road, AAA offers premier members access to dedicated teams of travel concierges to make your journey that little bit more pleasant. Concierge services on offer include reservation assistance, local weather reports, entertainment bookings, car rentals, and even tee-off times at local country clubs near where you’re visiting.

AAA also offers emergency travel assistance, as well. This service provides premier members translation, prescription refills, cash transfers, medical assistance, document replacement, and bookings for doctors’ appointments as well.

Variability with Local Clubs

You need to understand that each AAA club offers a different experience and different levels of service. Call your local club and ask for assistance in understanding their offering. You can always look them up online and read the terms and conditions of membership, as well as the benefits on offer.

The Downside to AAA Membership

Believe it or not, after mentioning all of these fantastic membership perks, there is still a downside to AAA membership. AAA isn’t for everyone, and read on to find out if AAA suits your lifestyle.

Don’t Get a Membership If You Don’t Intend on Using It

All of the perks mentioned in this article are great if you ever plan on using them. Before you jump head-first into your membership agreement, step back and cool off for a second. Ask yourself when the last time one of these AAA services would have come in handy for you in your life.

The chances are that you can’t think of many instances where you’ll be using these perks. Sure, the servicing and repairs discount is nice, but your car probably already comes with a service plan if it’s a new vehicle. Many life insurance companies and credit card lenders also provide similar perks on the accounts you already have with them.

Therefore, it’s a prudent strategy to do an audit of your rewards from financial institutions before you sign up with AAA. Make a list of all the perks you get already, and cross reference them to the benefits mentioned on this list. If you find that you already have 90-percent of them with your current financial providers, then don’t bother with AAA membership.

Basic and Classic Memberships Don’t Have as Many Perks as the Premium

One of the most frequent gripes we hear from people that have a AAA membership, is that the Basic and Classic plans don’t have as many perks as the Premium version. Why this would come as a surprise to anyone is a mystery. You get what you pay for in this world. Therefore, you should expect more perks with the Premium subscription.

However, if you take a step back and look at the situation, you’ll wonder why anyone would go with a Classic or Basic package in the first place. Both of these options seem like an opportunity to upsell you to the premium option anyway.

If you do decide to go with a Basic or Classic subscription, then you can expect to give up some perks. However, many of them might not even apply to you. If you have a lockout far from a nearby locksmith service, then the $60 discount fee from AAA won’t go very far to covering this expense. The Classic and Basic models also lack complimentary battery replacement, which has a value of more than $100, and that’s a service that comes in handy for many AAA subscribers.

Your Membership Fees Vary by Your Local Club

It’s important to note that your local AAA club plays by its own set of rules. Your club sets the membership pricing, as well as the perks on offer in your membership. It’s for this reason that it’s vital to check with your local club for membership details.

Think About Using Insurance Companies

If your current life insurance or home insurance policy doesn’t already come with most of these services, then consider asking them if they offer any similar plans with similar roadside assistance and lifestyle perks. Most insurers provide identical packages with the same perks, for a more affordable price.

For example, Allstate’s Allstate Motor Club will cost you $99 for a one-year first-time membership. This membership includes a host of benefits and complimentary services, as well as discounts and coverage that far exceeds what’s available at any AAA membership price-point.

The Final Thought – Is AAA Membership Worth It?

Before you jump into taking AAA membership at Premium level, ask yourself if it’s a good deal for you. Do you already get most of the services on offer from your insurer or another financial services provider? Do you drive a new leased car, or do you drive an older model that you paid for with cash?

It’s paramount to ask yourself these questions before you decide on your AAA membership. If you already receive most of the benefits, then why spend $60 or more on an annual AAA membership?

However, if you don’t have any of these benefits and perks available through your existing policies, and you drive an older model car, then AAA membership could be the ideal choice for your situation.

- X (Twitter)

Oliver Dale is Editor-in-Chief of MoneyCheck and founder of Kooc Media Ltd, A UK-Based Online Publishing company. A Technology Entrepreneur with over 15 years of professional experience in Investing and UK Business.His writing has been quoted by Nasdaq, Dow Jones, Investopedia, The New Yorker, Forbes, Techcrunch & More.He built Money Check to bring the highest level of education about personal finance to the general public with clear and unbiased [email protected]

Related Posts

Hometree review: boiler home & heating care plans, safetywing remote health review: global health insurance for nomads, safetywing review: medical & travel insurance for long-term travelers, best boiler cover uk: we compare all the top options.

do you cover taxi as my car is one

Type above and press Enter to search. Press Esc to cancel.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is AAA Worth It?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Understanding AAA auto clubs

Aaa discounts and extras, aaa auto insurance, is aaa worth it.

Responding to more than 33 million calls a year, AAA has become the standard in roadside assistance. And its popularity spans the generations, with millennials making up almost a third of its new memberships in 2019.

AAA membership not only provides assistance for stranded motorists but also offers discounts on car rentals, vacation packages, cellular service and more. Depending on where you live and the level of coverage you choose, annual AAA memberships can range from about $38-$164 for one driver.

To determine whether the cost of AAA membership is worth it, consider how you might use it, decide if you need the services and see how it could save you money when it comes to the total cost of owning a car .

AAA, often referred to as "Triple A," is a national company, but it offers coverage based on location. Each region has its own auto club, which provides assistance to members living in specific areas.

When you look into a AAA membership, you’ll use your ZIP code to determine which auto club covers your location. That auto club will determine the options available for you and rates for services like roadside assistance and insurance coverage.

AAA has a three-tiered membership structure. The pricing depends on where you live and which plan you choose.

Membership plan benefits

Each plan offers different services or call-outs for a type of service. The table below is an example of the benefits for members in Texas.

* Extrication of snowbound or flooded vehicles isn't covered by these plans.

Additional fees

While AAA will cover all drivers in your family, each driver must be individually enrolled in your plan. And each enrollment comes with a small jump in price.

The primary driver — the person first enrolled — is covered for the advertised base price. An additional adult, known as an associate member, can be added to a plan. Dependents who are younger than 26 and live with you or are full-time students can be added as dependent associate members. The rate you're charged for additional members will depend on your location and plan.

You might be charged an admission fee as a new member for your first year. This is on top of your annual dues.

Auto loans from our partners

5.29 - 21.99%

on MyAutoloan

5.24 - 29.9%

on Auto Credit Express

Auto Credit Express

5.95 - 28.55%

6.24 - 34.9%

6.29 - 29.9%

7.95 - 27.95%

on Consumers Credit Union

Consumers Credit Union

6.24 - 17.54%

on Gravity Lending

Gravity Lending

4.99 - 17.99%

on LightStream

LightStream

7.74 - 15.69%

6.93 - 18.54%

5.9 - 29.9%

4.99 - 14.99%

A perk that draws many members to AAA is the discounts with national companies. The discounts vary, but examples include:

Services at Napa Auto Parts, LensCrafters, Penske Truck Rental and The UPS Store.

Restaurants such as Hard Rock Cafe, Bubba Gump Shrimp Co. and Joe’s Crab Shack.

Food delivery services such as Blue Apron, Freshly and Home Chef.

Entertainment venues such as AMC Theatres, Busch Gardens, Cinemark, Disneyland, SeaWorld.

Technology such as from Dell, HP, Samsung and T-Mobile.

Auto-related discounts

AAA works with certified auto repair shops that meet Automotive Service Excellence standards and have undergone AAA inspections for equipment, customer satisfaction and technician expertise. Members get 10% off repairs, up to $50, at these AAA-approved locations. Most repairs are guaranteed for two years or 24,000 miles, whichever comes first.

AAA members can also get additional car-related benefits, depending on their location. For example, a Texas AAA membership comes with:

A free 40-point inspection or discounted 86-point inspection at a AAA-approved repair facility.

Discounted Carfax report.

Free online vehicle pricing report.

Travel discounts

AAA is also known for its discounts on travel services. These include discounts with car rental companies like Hertz , Thrifty Car Rentals, Dollar Rent A Car and The Parking Spot .

» MORE: Which rental car company usually has the lowest prices?

You can also save on hotels around the world. While AAA has a few preferred partners — including Best Western Hotels & Resorts , Hilton , Hyatt , Marriott and MGM Resorts International — you can search AAA’s hotel-specific website to find deals on international stays as well.

But note that you might not be able to combine discounts or promotions offered to AAA members with other offers.

» MORE: The best hotel promotions

Other perks

AAA membership also includes additional perks, some of which are available in the higher-tiered plans and in certain locations only:

A free personal notary service.

Discounted passport photos.

Discounts on international AAA maps.

24-hour travel assistance on eligible trips.

Credit toward home locksmith services.

Want to refinance your auto loan? See if you pre-qualify.

Just answer a few questions to get personalized results from our lending partners.

on NerdWallet

Membership is required to purchase AAA insurance.

Most AAA clubs offer insurance, but the type of insurance and individual rates vary by location. AAA’s insurance agents will look over any of your existing policies and provide advice as part of the membership. Across the board, AAA offers a variety of auto, home, renters, life and small-business insurance.

» MORE: AAA auto insurance review

It depends on the math and how protected you want to be. Like auto insurance, AAA is set up so that you pay for coverage in advance that you hope you don’t have to use. In some cases, it can be more expensive to go without coverage if you do need roadside assistance.

Do the math

To see if AAA coverage is worth the investment, consider the potential costs of having and not having coverage for a certain situation. For example, let’s say a family of four in Texas is comparing the cost of AAA coverage with what they would pay for towing services directly from an auto shop.

How much the family pays for the AAA coverage depends on how many drivers are enrolled in their chosen plan. The family of four in Texas would pay $91 a year for the first driver and $55 for each additional driver.

However, if they decide to pay an auto shop for towing services directly, the rate they pay could vary depending on the company. Based on a quote from a Houston-based towing service, the family would pay $109 for a hook-up fee and $6 per mile to have their car towed 20 miles.

With AAA, they know in advance how much they’ll pay only as long as they have their car towed 100 miles or less. However, that money will be spent on unused coverage if they don’t need assistance during the year. And if they limit coverage to one or two drivers who aren’t in the car when it breaks down, they can’t use their AAA coverage for that tow.

If they hire a tow service instead, they might pay less that year if they only need a single tow, regardless of which driver is in the seat when the car breaks down. But if they require two tows that year, the expense could be higher than if they had covered all four drivers with AAA.

*The estimated prices for hiring a tow service directly are based on a quote provided in September 2022.

Drivers who can probably skip it

If you fit any of these descriptions, you might be able to skip AAA coverage:

You rarely drive your car.

You already have coverage through a different company, such with your vehicle's warranty.

You’re financially secure and can comfortably cover the cost of roadside services without assistance.

Also check your car insurance company’s coverage, which could be as little as $10 a year for basic roadside assistance that might be more fitting for your driving habits.

Drivers who might benefit

If you fall into any of these categories, you might benefit from considering a AAA membership:

Your financial situation makes it difficult to pay for roadside services without assistance.

You are more comfortable paying a monthly membership price than an out-of-pocket cost all at once.

You are on the road frequently.

You tend to drive long distances.

Alternatives to AAA

For those who aren’t worried about having constant roadside assistance coverage, AAA’s plans might be more than what you need. There are other roadside assistance options available to help you find the coverage you want that will fit your budget. In addition to other organizations, consider asking your car insurance provider, car manufacturer, credit card company or cell phone provider if they have roadside assistance plans available.

MORE: Roadside assistance: Where to get it, what to ask

There are also apps that offer on-demand roadside assistance. For example, using Honk, Driver Roadside and Mach 1 could be a better option if you want to avoid a membership fee. You pay when you need assistance only.

However, the services could cost you more out of pocket than a AAA membership, depending on your location and the service you need. And some drivers have said using these apps isn’t any easier than calling a tow truck or auto service center directly.

On a similar note...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best AAA Discounts for Travelers — Are They Worth It?

Jarrod West

Senior Content Contributor

442 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3245 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

What is aaa, how much does a aaa membership cost, what travel benefits does aaa offer, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

With the emergence of flight search engines like Google Flights and Skyscanner , and OTAs like Expedia or Orbitz , the idea of needing to book through travel agency might like AAA Travel might seem like a thing of the past.

But you might be surprised to know that travel agencies like AAA Travel can have access to discounted travel rates that are not available to the public. Not only that, but a AAA membership can provide travelers with quite a few ways to save on their travel expenses.

The American Automobile Association (AAA – pronounced “Triple-A”) began as a roadside assistance company over 100 years ago. While AAA is still, at its core, a roadside assistance company, its membership program offers many other services as well, including discounts, travel services, vacation planning, and assistance with financial products for its members.

AAA offers 3 membership packages: Classic, Plus, and Premier.

The prices for each package range between $40 -$160 depending on your location and the level of roadside assistance services you would like.

All membership plans include AAA’s popular roadside assistance benefit that makes you eligible for free towing, spare tire replacement, jumpstarting a dead battery, and fuel delivery for your personal or rental vehicles. The benefit levels increase as you upgrade to a higher plan, like a free 100-mile tow instead of a 5-mile tow, for example.

As an AAA member , you’ll receive access to dozens of travel discounts, and full access to AAA travel agents for in-person service. So what sort of discounts are available through AAA Travel?

Members can search for hotels via AAA Travel’s hotel search engine for the best member rates. AAA Travel partners with more than 3 dozen hotel brands to bring its members discounted nightly rates, lower than you might see via an OTA like Expedia .

AAA Travel’s preferred partners include Best Western , Hilton , Hyatt , and Marriott . You’ll need your AAA member number handy when you book and may be asked to present your card at check-in.

Hot Tip: When booking an AAA rate, you are still eligible for hotel loyalty points and elite night credits!

Rental Cars

AAA Travel has its own rental car search engine so you can compare prices between companies , and it offers coupons to provide additional savings. AAA discounts can include a waived young renter fee (for those between 20 and 25) as well as up to a 20% discount on daily, weekend, weekly, and monthly rentals.

Example rental car discounts that AAA Travel frequently offers are 20% off with Hertz rentals, 10% off Dollar rentals, and 8% off Thrifty rentals.

International Driving Permits

Planning to rent a car on your trip overseas? You can get an international driving permit (IDP) at your local AAA location. An IDP is a required form of driver identification abroad, is valid in over 150 countries, and comes printed in 10 languages. To get an IDP through AAA you’ll need to present a valid U.S. driver’s license and pay a $20 fee, along with 2 passport-sized photos on a white background.

Everyone wants to save money when dining out on vacation. With an AAA membership , you can purchase discounted gift cards with your favorite restaurants at Restaurant.com at a rate of $10 for a $25 certificate.

AAA also offers instant discounts at select merchants; just show your AAA card to the waitstaff when you ask for your bill. Some popular restaurants include:

- 10% off food and non-alcoholic beverages at Hard Rock Cafe, Rainforest Cafe, and Bubba Gump Shrimp Company

- 10% off your total bill at Dave & Buster’s

- Up to 30% off select pizzas and appetizers at Papa John’s

Hot Tip: Want to extend your dining savings even further? Consider adding a rewards card to your wallet that offers restaurants as a bonus category .

Planning a cruise soon ? Don’t book without checking offers at AAA Travel first! Discounts can vary greatly, depending on which local AAA club you’re a member with, but it’s always worth having a look!

For example, at the Ohio Valley AAA Club, a cruise booking with Royal Caribbean comes with $150 to spend at sea, plus 60% off your second guest.

Travel Insurance

When things go wrong on your trip, having some travel insurance coverage can really come in handy. Fortunately, if you have an AAA membership you will automatically receive travel insurance for all of your trips, though the level of coverage will vary based on which membership you have.

Members with the Classic membership receive trip interruption protection, up to $100 per individual or $500 per family, plus travel accident coverage up to $100,000 per member (including the covered individual’s traveling party).

Members with the Plus membership receive trip interruption protection, up to $200 per individual or $1,000 per family, plus travel accident coverage up to $200,000 per traveling party.

Members with the Premier membership receive trip interruption protection, up to $300 per individual or $1,500 per family, plus travel accident coverage up to $300,000 per traveling party.

Entertainment

Why should you only save money when getting to your destination? AAA offers discounted tickets and admission packages to a variety of other events and institutions, including live musical performances, theatrical performances, theme parks , and museums , so you cave even save on experiences that help make your trip memorable.

Here are some examples of experiences you can save money on with an AAA membership:

- Universal Orlando Resort: visit 3 parks from $50 per day (promotional pricing available on select 3, 4 and 5-day tickets)

- Seaworld Orlando: save up to 60% on Seaworld ticket when you purchase through AAA

- Six Flags America: save up to 35% on Six Flags America tickets when you purchase through AAA

Hot Tip: Vendors that offer discounts, and their amounts, can vary based on your local AAA club, so be certain to visit their booking website for the most up to date discounts and deals.

Save on Currency Conversion

Heading overseas and need to change your dollars for the local currency? AAA members can order over 90 types of foreign currency. Taking care of this ahead of time is a great way to avoid high fees and unfavorable exchange rates at airports, hotels, or currency exchange stores in heavily-trafficked tourist areas.

AAA requires that you order the currency in person, and purchases are shipped to the branch location in about 3 business days. Plus, orders of $200 or more are shipped free.

Travel Planning

As one of the largest travel agencies in the nation, one of the biggest benefits of an AAA membership for travelers is access to their personal vacation planning assistance.

AAA Travel staffs a team of professional travel planners, so if you don’t have the time or desire to plan your own trip, or if you’re visiting an area unfamiliar to you, the AAA travel planners will put together the trip for you.

This means they will take care of everything from your flight to hotel rooms, and any prepaid excursions, at their best price possible, including any AAA discounts and benefits your trip will be eligible for.

Hot Tip: The AAA travel planning service isn’t limited to personal travel. You can also book group trips, destination weddings, and honeymoons. For group trips, you can even fill out an online form ahead of time stating your group’s interests and requirements and the AAA travel agents will build a trip around those requirements.

An AAA membership is a great option for vacation planning assistance and roadside assistance, and to receive great discounts on items like hotels, rental cars, and experiences. So is an AAA membership worth it for travelers? It definitely can be!

If you’re someone who knows you will be able to take advantage of the discounts on items you were planning to purchase anyway, you can easily offset the cost of your annual membership. Do some math for yourself and your travel needs — if you find that the AAA savings exceed the cost of the membership fee, then it’s likely worth it to join AAA.

Frequently Asked Questions

What travel benefits does aaa offer.

An AAA membership can save you money on a wide variety of travel purchases, including hotels, rental cars, travel insurance, entertainment tickets, and cruises.

Members are also able to take advantage of benefits like travel planning services and currency conversion.

How much does a AAA membership cost?

AAA offers 3 membership packages: Classic, Plus, and Premier. The prices for each package range between $40-$160 depending on your location and the level of roadside assistance services you would like.

Do you have to purchase a AAA membership to use the travel benefits?

If you simply want to book your travel, be it flights or hotels, through the AAA Travel portal, you can do that for no charge and you are not required to have a membership.

However, if you want to take advantage of their travel discounts, benefits, and personal booking service, you must have an AAA membership to do so.

Is it cheaper to book your travel through AAA?

It depends! AAA Travel can offer some excellent travel deals to its members, but you should not assume that whatever deal offered is automatically the best deal. Always compare multiple resources before booking so you can be certain you’re getting the best deal possible.

Do you have to have the Premier AAA membership to access the travel discounts?

You do not. You can access all of the travel benefits and discounts offered to AAA members even if you just have the Classic membership package.

Does AAA help plan trips?

Yes, AAA Travel is one of the largest travel agencies in the nation and members can receive all sorts of assistance when it comes to booking their vacations.

AAA travel agents will help you with your airline reservations, cruise discounts, tour packages, hotel bookings, and even assist you with any incidental items like event tickets.

What does AAA travel insurance cover?

Your amount of travel insurance with AAA depends on your membership level.

Members with a Classic membership receive trip interruption protection up to $100 per individual or $500 per family, plus travel accident coverage up to $100,000 per member (including the covered individual’s traveling party).

Members with the Plus membership receive trip interruption protection up to $200 per individual or $1,000 per family, plus travel accident coverage up to $200,000 per traveling party.

Was this page helpful?

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Which Organization Offers Better Benefits, AARP or AAA?

Money expert Clark Howard, Team Clark and our audience all love discounts.

Whether it’s a membership to Costco , Clark’s favorite store, fast food apps that offer loyalty rewards or holiday discounts on Chromebooks , we’re all about it.

But what about the deals and discounts you can get by being a member of two of the most engrained, nationwide programs in the United States: AARP and AAA ? Which one doles out more attractive benefits?

That’s what a listener of the Clark Howard Podcast recently asked.

AARP vs. AAA: Which Membership Offers Better Benefits?

Which benefits package is better, AARP or AAA? That’s what a Clark listener essentially asked on the Dec. 5 podcast episode .

Judith in Florida asked: “I just read about ‘younger’ people joining AARP for the discounts. Do you think this is worth it and a better deal than the discounts provided by AAA?”

As Judith alluded to, you can become an AARP member for as little as $12 per year … at any age . That’s something that many people don’t realize.

Clark got a family member to join AARP before those younger than 50 could officially join.

“I did something really terrible to my wife. When she turned 25, I signed her up for AARP as a joke. Nobody verified anything. She started at a really young age getting all these solicitations for senior living and all that,” Clark says.

As for the membership benefits, AAA starts at $59.99 a year ($5 a month) and offers emergency roadside assistance.

A cursory check of the national benefits for AARP vs. AAA shows that AARP offers a much higher volume of discounts. For example, AARP offers 21 restaurant discounts vs. two listings at AAA.

However, once you’re in your 60s, some of the senior discounts are redundant.

“If you’re in your 60s, you don’t have to be an AARP member anymore,” Clark says. “I’ve noticed a bunch of hotel chains now, they don’t want to have to pay commissions. So they’re just offering senior discounts with the presentation of an ID. But if you’re not in your 60s yet, or you’re in your 40s, then having an AARP card will save you.”

While you may gravitate to one over the other — perhaps you’re really interested in the on-call roadside assistance that AAA provides or some of the great deals AARP offers — there’s nothing wrong with getting both. Especially if you’re going to consistently save good money each year.

“The rates are not necessarily the same. So having both is an advantage if you travel regularly ,” Clark says. “Or just [join] AARP if you don’t need the roadside assistance from AAA because it’s much cheaper.”

Final Thoughts

AARP vs. AAA isn’t apples to apples. The former, open to any age, originally provided deals catered to seniors. It’s still “dedicated to people over 50.” The latter stands for American Automobile Association and has always been focused on automotive services and travel first and foremost.

However, each membership offers some unique benefits and discounts. With a combined price of as low as $17 for both memberships, it’s possible that both can offer you value.

- Amelia Island, Florida escapes from $119 per night

- British Airways: ATL-Vienna from $580 for Christmas markets

- Sandals Saint Vincent: Up to $1,000 in air & resort credits

- Frontier Go Wild! all-you-can-fly pass for $399 for a limited time

Our Daily Newsletter

Join more than 330,000 people who get our must-have money tips every day

Watch / Listen

Check out our top-rated money podcast.

Need money help? Call us for free advice . You can also email us .

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Garden Road Trips Member News AAA's Take Good Question Car Reviews AAA Traveler Worldwise Foodie Finds Minute Escapes

- Public Affairs

- Information

Are Travel Agents Worth It?

Traveling isn’t cheap. There’s transportation—be that plane or bus tickets, a couple of tanks of gas, or all of the above—lodging, meals, admission to various attractions and museums, and more. Adding a travel agent to that list of expenses might seem like a waste of money to some. Others, however, swear by working with travel agents to organize trips and would say their fees pay for themselves in convenience and peace of mind.

So is a travel agent worth it? Here are some pros and cons to consider.

1. Pro: Travel agents know the industry

There was a time when travelers would buy plane tickets in person at the airport and arrange for a hotel once they’d arrived at their destination. Those days are gone. As technology has become more powerful and accessible the travel industry has exploded and consumers’ travel options have multiplied along with it.

On the one hand, this has made some elements of traveling more convenient. On the other, with the advent of things like airline loyalty programs, credit card points, frequent flight delays and blackout days—and even Airbnb and other technologies that have disrupted the hospitality industry—it can feel like there’s suddenly an entire game of four-dimensional chess involved in arranging a relaxing getaway. One survey of American travelers found that 68% considered booking travel these days “ more complex ” than ever before.

Travel agents know that complexity inside and out. They have the expertise, insider industry knowledge, and anecdotal data that come with having planned zillions of flights and booked zillions of hotels on behalf of their customers. They know what days are the best to book, how to get a seat upgrade, which airlines have fees you can get around (and which don’t), and more. On top of that, they learn of flight cancellations and other disruptions well before the greater public, and they’re skilled in troubleshooting those issues. They may be able to offer you travel alternatives before you even know you need them.

2. Con: Finding the right advisor will take research

Though booking with a travel agent can save time when it comes to finding the best, fastest, quickest means of travel, or if you want to avoid poring over guidebooks, it’s not as if there’s no time investment at all. That’s because it’s important to find a representative who won’t just take care of the “lowest-hanging fruit” concerns, and instead understands your specific needs and goals. For example, if you’re a young person traveling solo looking to go off the beaten path and you don’t mind some less-than-luxurious accommodations, you’re unlikely to find a lot of help from a travel advisor who has experience planning travel for families with small children.

What’s more, it’s important to find an advisor you trust. Some travel agents are paid a commission by hotels when they book them, so they’re incentivized to book you with that franchise regardless of whether it makes sense for your trip. So while one of the draws of booking with a travel agent is saving time, it’s worth investing time in finding the right one.

3. Pro: Travel agents have local insights

Travel agents and advisors are there for more than helping with the complicated and tedious world of purchasing airline tickets and booking hotels. It’s also their job to know your destination inside and out. That means you avoid the awkwardness that can come with not knowing local customs like tipping and other forms of etiquette. They can tell you how (or whether) to haggle on prices such that you don’t come across as rude.

Moreover, they know what attractions are worth braving the crowds for, whether it makes sense to stay in the tourist area or outside the city center, and other insider tips. A great travel agent will likely know of small, “hidden gem” restaurants that are actually worth the hype, and not just tourist traps.

Finally, not only do they have that advice, they can make all the necessary reservations and arrangements to ensure your days are smooth and enjoyable. All you have to do is show up.

4: Con: There’s less room for flexibility

…but you do have to show up. Travel advisors are unparalleled when it comes to planning the perfect day, but they can’t see into the future. It’s impossible to plan for every eventuality. Say you visit the snorkeling school your travel agent booked for you and unlock a passion you never knew you had. You’re not going to be able to spend another couple of hours there without expensive changes to your itinerary. Want to order a second dessert at lunch? You’ll have to cancel the next activity—which your travel agent can certainly help with. For people who like to be spontaneous, it’s better to book fewer activities and instead arrive armed with a list of suggestions from your travel agent.

So are travel agents worth it? The answer is really: It depends. If you’re booking a fairly simple trip from Chicago to Tampa, you might save money taking care of it yourself. If you’re planning an extravagant adventure with several destinations, the right advisor can ensure it’s a magical experience. Even if you’ve got a smaller budget and a simpler itinerary in mind, a travel agent can help ensure you don’t miss out on the “must-see” items without spending more than needed.

Are you interested in booking with an agent? AAA members have access to local reliable travel agents across the country. Find one here .

Limited Time Offer!

Please wait....

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

American Express Platinum rental car benefits guide 2024

Lee Huffman

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:44 a.m. UTC June 3, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Nuttawan Jayawan, Getty Images

Frequent travelers know that The Platinum Card® from American Express (terms apply, rates & fees ) is loaded with premium travel benefits and annual statement credits that can justify its large annual fee. The Amex Platinum’s car rental benefits include protection against theft or damage¹ and elite status perks with Avis, Hertz and National Car Rental (enrollment required).

The card’s secondary rental car coverage¹ puts it at a distinct disadvantage to other luxury travel cards that include primary rental car insurance. However, Amex cardholders can also opt for primary rental car protection for a flat fee under $25 that’s only charged once per rental period (price varies depending on coverage selection and location).

When the annual fee can be worth it: Here’s how this card holder gets every penny back from the annual fee on their Amex Platinum

Amex Platinum Card overview

The American Express Platinum Card includes a variety of premium travel benefits for luxury travelers. In exchange for its $695 annual fee, you receive more than $1,500 in value, such as annual statement credits, airport lounge access, complimentary elite status and more. Here are a few of the major perks included with this card:

- Welcome bonus: 80,000 Membership Rewards® Points after spending $8,000 on eligible purchases in the first six months of card membership.

- Earn high rewards in several areas: 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases.

- Flexible redemption options: Membership Rewards points have numerous redemption options, including booking travel, cash back (via statement credit), gift cards, online shopping and more. Plus, Amex partners with nearly two dozen airlines and hotels, so you can transfer points to book award reservations through those loyalty programs.

- Global Lounge Collection: Complimentary access to more than 1,400 airport lounges from American Express, Priority Pass (enrollment required) and more.

- Travel protections: Your trips are covered against delay², cancellation and interruption³ when using your Amex Platinum to book your reservations.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

The Platinum Card® from American Express

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

How does Amex Platinum car rental insurance work?

To receive Amex Platinum car rental insurance¹ on your reservation, you must use your card to pay for the entire rental and decline the rental company’s coverage options. This coverage also applies when redeeming Membership Rewards points to pay for some or all of the reservation.

Rental car protection¹ covers Amex Platinum cardholders, their spouse or domestic partner and any authorized drivers.

Rental car elite status

As an Amex Platinum cardholder, you and your authorized Platinum Card users receive complimentary elite status from three major rental car companies. Each program requires manual activation of these benefits, and you must use the special code when booking a rental car to receive benefits like free upgrades and discounts.

Avis Preferred

When you enroll with Avis Preferred, you’ll receive Avis Preferred Plus status. This status level includes a complimentary upgrade (when available) and additional Avis Preferred points on your reservations. To receive discounts on your rental, use your Platinum AWD discount code “A756900” and pay with your Amex Platinum Card.

Plus, you’ll receive a free weekend offer after completing two qualifying Avis rentals in the U.S., Puerto Rico or the U.S. Virgin Islands within the following promotional period: January 1 – June 30 or July 1 – December 31. Terms and conditions apply.

Hertz Gold Plus Rewards

Amex cardholders receive complimentary Hertz President’s Circle status with Hertz Gold Plus Rewards. As a President’s Circle member, you’ll receive a discount on the base rate, a 4-hour grace period on returns within the U.S. and guaranteed car-class upgrades on certain classes of vehicles (with at least a 24-hour advance reservation).

You’ll receive these benefits when paying with your Amex Platinum Card and using the Amex Corporate Discount Code (CDP) “211762” on your reservation.

National Car Rental Emerald Club

When you activate benefits with National Car Rental Emerald Club, you’ll receive complimentary Executive tier status. You can choose any car within the Executive Selection area and receive automatic upgrades when a full-size through luxury car is reserved. Plus, after six qualifying rentals, you’ll receive a complimentary rental day. You can also choose to receive airline miles or hotel points from one of National’s partners on your reservations.

What does Amex car rental insurance cover?

When using your Amex Platinum car rental benefits, your rental car is insured for up to 30 consecutive days per rental agreement. Eligible vehicles are covered up to $75,000 against damage or theft of the vehicle.¹

Additionally, this protection covers you for other charges beyond vehicle damage. Rental car companies may charge drivers for loss of rental vehicle use, towing charges, appraisal fees, storage, administrative fees and more. The American Express Platinum card covers all of these costs.¹

These benefits also include accidental death and dismemberment coverage up to $300,000, accidental injury coverage up to $300,000 and personal property coverage up to $2,000.¹

What it doesn’t cover

Although the most exclusive cards, like American Express, are known for excellent customer service and generous benefits, the Amex Platinum car rental insurance¹ doesn’t cover every situation or claim. There are numerous exceptions where you won’t be covered against loss. Here are a few of the situations not covered by your Amex car rental coverage that may apply to your next rental car reservation.

- Vehicles rented in Australia, Italy or New Zealand.

- Illegal activity by the renter.

- Driving while intoxicated or under the influence of drugs.

- Off-road operation of the vehicle.

- Intentional damage by the renter.

- Normal wear and tear.

- Theft or damage to an unlocked vehicle.

- Cargo vans, box trucks or vans with seating capacity for more than eight passengers.

- Using the vehicle for commercial or “for hire” purposes.

- Off-road vehicles, motorcycles, mopeds or recreational vehicles.

Additionally, these car rental benefits only apply to theft or damage to the rental car. This insurance does not cover damage to other vehicles or property. Nor does it cover injuries to passengers, other drivers or pedestrians.¹

How to file a claim for Amex Platinum rental car insurance