Travelers Insurance

A new jersey travelers insurance agency.

Travelers takes on the risk and provides the coverage you need to protect the things that are important to you — your home, your car, your valuables and your business — so you don’t have to worry. They have been around for more than 160 years and have earned a reputation as one of the best property casualty insurers in the industry.

Why Travelers?

- Travelers works hard to make things easier for you. You can pay your bill the way you prefer: by check, electronically (via credit card, checking account or savings account), by phone or online.

- Claim service trusted for generations. In a natural disaster or homeowner nightmare, how does Travelers handle claims? They are fast, fair, and ready, 24/7. Travelers can respond with exceptional speed: They have more than 13,000 claims professionals across the country.

Homeowners Insurance

Basic coverage in a Travelers home.

- Your home and other buildings on your property

- The contents of your home

- Additional living expenses if you have to move out during certain repairs

- Liability protection for you and your household, protecting you if someone is accidentally injured or their property is damaged

Trust Us to Find You Savings

You may qualify for special savings like:

- Loss-free Savings , a reward for having no claims

- Protective-Device Savings if your home has smoke alarms and a fire extinguisher

- Extra Savings for insuring both your home and car with Travelers

High Value Homeowners Insurance

Travelers High Value homeowners policy helps you guard against inflation because they adjust the limits of coverage at the beginning of each renewal policy term to reflect increases in the cost of rebuilding your home. And, most of your personal property has full replacement cost coverage, with no deduction for depreciation.

Travelers High Value homeowners policy is broader in coverage than a standard homeowners policy. Both your home and your personal property are insured for all losses, except for those specifically excluded in your policy.

With the broad coverage Travelers High Value homeowners policy can give you, you’d think it would be expensive. It isn’t. The policy is competitively priced with other policies on the market that are designed to meet your coverage needs.

Co-op Insurance

A master policy purchased by your cooperative corporation covers your unit’s building, the common areas, and shareholders’ collective liability. But that policy does not cover damage to your personal belongings or property within your unit that is caused by vandalism, theft or fire. Nor does it cover your personal liability in the event of a lawsuit.

The Travelers Co-op Unit Owner Protection Program can provide the protection you need at a price you can afford. To give you the maximum in flexibility and affordability, Travelers offers solid, basic coverage and lets you add special options to fit your needs.

Condominium Insurance

When you own a condo, Travelers has you protected in more ways than one.

Travelers Condominium Protection Program policy can cover:

- household appliances

- many other personal belongings

- covered items you take while traveling

- additional living expenses if you have to move out during repairs after a covered loss

Auto Insurance

When you insure your vehicles with Travelers, you can rest easier knowing that they will be there to smooth out any bumps in the road.

Valuable coverage options Right from the start, you can count on Travelers to give you more flexibility to customize an insurance program that’s right for you. Just a few of our options include:

- Responsible Driver Plans that cost-effectively bundle such key features as Accident Forgiveness and Decreasing Deductible®

- Premier New Car Replacement® plan that will replace your totaled car with a brand-new one in the first five years

- Premier Roadside Assistance® plan that gives you access to roadside service for just a few dollars a month

Boat Insurance

Travelers boat program provides comprehensive basic coverage with personalized enhancements designed to match your individual needs. Specialized marine claim representatives are available to get you back on the water quickly. You’ve worked hard to acquire your boat. Make sure that you have the right protection for it.

Exceptional coverage

- Physical Damage coverage

- Liability coverage

- Personal Property coverage

- Towing and Assistance coverage

- Custom coverage options available

Travelers Insurance Keeps Pace With Your Life

Travelers is committed to bringing you innovative insurance solutions that keep up with your ever-changing life. It’s a commitment built on their more than 150-year heritage of industry-leading firsts – from issuing the first auto and flight insurance, to pioneering identity fraud protection and discounts on hybrid vehicles.

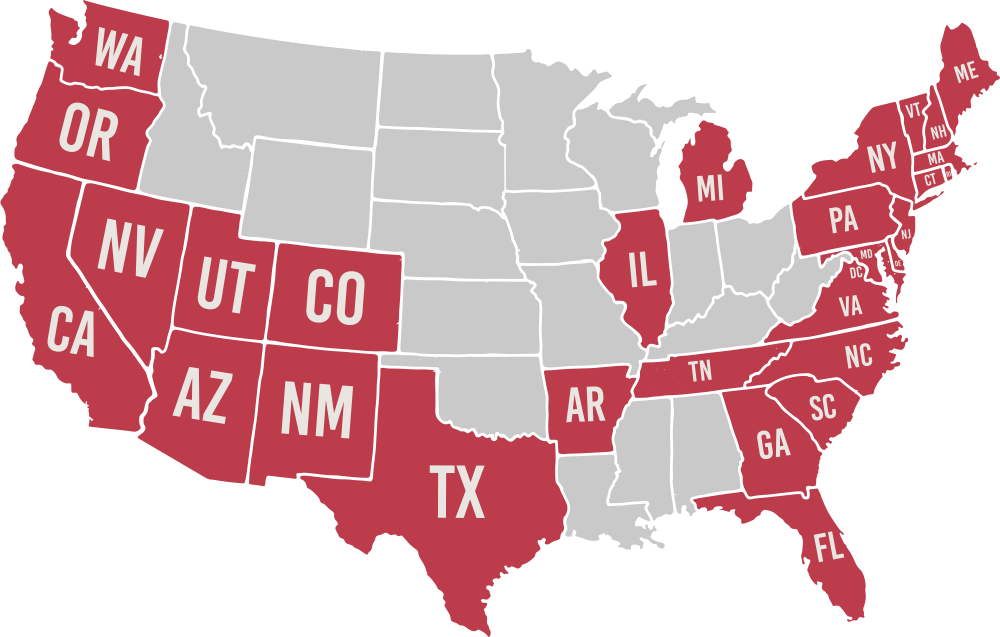

Licensed in Over 30 States

Call Us Today

We are here for all of your insurance needs.

1-201-659-2403

Accreditation

Travel Insurance

Business travel insurance, executive assistance services.

Emergency Medical and Travel Assistance services while traveling — anytime, anywhere. In addition to the insurance protection provided by your insurance plan, Chubb Accident & Health has arranged with AXA, our Assistance Provider, to provide you with access to its travel assistance services around the world.

Executive Assistance Services - for CHUBB Travel Smart online and/or mobile access to these services using policy number #PHFD3839115A 006

ACE American Insurance Company - Services Executive Assistance® Services are designed to provide covered employees, volunteers, or students with pre-trip security information, as well as emergency assistance, emergency medical and political evacuation, or concierge services while they are traveling on covered trips worldwide.

Executive Assistance Toll-Free Inside U.S. and Canada: 1 (800) 766-8206 / Executive Assistance Toll-Free Outside U.S. and Canada IDD+800-0200-8888 (available from 40 countries)

Access your BTA Insurance Plan & Travel Assistance Services

Business travel accident only.

While traveling on business authorized by or at the direction of the College, employees of the College are covered by accident insurance protection (accidental death, dismemberment, or paralysis). Hamilton College Policy #GTP 9156848 is effective September 28, 2022, to September 28, 2025.

Your safety and security are very important to us, especially while traveling on company business. With that in mind, we are pleased to provide you with Business Travel Accident (BTA) insurance from an AIG member company. With this coverage, you have access to AIG’s business travel insurance plan if you experience any travel inconveniences, security issues, or medical emergencies while traveling anywhere in the world.

As part of this coverage, you are also provided with travel assistance services from AIG Travel. Services available to you include: To get started with your BTA coverage, please take the time to review these links:

- Travel Guard Group Services Description

- Travel Security Assistance

- Travel Medical Assistance

- Concierge Services

- Guide to Reporting Claims

- Assistance Services ID Card

- Videos to help you get started with the AIG Travel Assistance app and website

If you have questions, please get in touch with Amber Denny, Administrative Services, at 315-859-4974, [email protected] .

For Hamilton’s health insurance questions while traveling in the U.S. or aboard, contact Kim Hatzinger, Benefits Manager, 315-859-4689 [email protected] or Samantha Campione, CEBS, 315-859-4042 [email protected] .

Global Advantage Package with Executive Assistance Services

While traveling globally on business authorized by or at the direction of the College, employees can access Executive Assistance Services under the Global Companion Policy, which includes various Emergency Response, Security, and Travel Assistance Services, subject to certain limitations. Travelers should register with CHUBB at www.ExecutiveAssistance.com for CHUBB Travel Smart online and/or mobile access to these services using policy #PHFD3839115A 006 .

Available services include trip planning (embassy locations, visa/passport requirements, country risk levels); Emergency Assistance (medical transport, doctor dispatch, medical evacuation/repatriation, repatriation of remains); Travel Alerts (political instability, natural disasters, terrorism, disease outbreaks); Security Services (political evacuation, natural disaster evacuation, legal assistance, emergency travel); Concierge Services (hotel, car and airline reservations, restaurant referrals).

Executive Assistance Collect Calls Outside the U.S. and Canada: 1 (202) 659-7777/ Where Toll-Free or Collect Calls are not available, Executive Assistance Outside the U.S. and Canada: IDD 1 (202) 659-7777.

For further details regarding the Business Travel Accident Insurance, Executive Assistance Services under the Global Companion Policy, or the Travel Assistance Services affiliated with the policy, please contact Amber Denny in Administrative Services at 315-859-4974.

Contact Name

Administrative Services

Help us provide an accessible education, offer innovative resources and programs, and foster intellectual exploration.

Site Search

- Small Business

- Private Client Advice

- British Columbia

- New Brunswick

- Newfoundland Labrador

- Northwest Territories

- Nova Scotia

- Prince Edward Island

- Saskatchewan

- English Selected

- secure Login

Get a quote

Home/ Condo/ Tenant

Travel with confidence

Spring into holiday travels

Get ready for your trip with travel insurance from TD Insurance.

TD Insurance Travel Insurance

Why it can be important to have travel insurance.

Travelling can be expensive enough on its own, but a medical emergency could cost you much more. It’s also important to note that your credit card might not include travel insurance or may have limited coverage. Whether you’re planning a trip for yourself or your entire family, TD Insurance Travel Insurance can help provide protection from certain unexpected events.

Explore TD Insurance Travel Insurance Plans

TD Insurance Multi-Trip All-Inclusive Plan

This is the most comprehensive plan we offer. It provides you with multiple benefits, including up to $5 million in emergency travel medical coverage, trip cancellation and interruption and more, for multiple covered trips up to the maximum trip duration selected within one year. 1

Sample Insurance Policy - Multi-Trip All-Inclusive Plan

TD Insurance Single-Trip Medical Plan

This plan provides up to $5 million in emergency travel medical insurance coverage for one trip. 2

Sample Insurance Policy - Single-Trip Medical Plan

TD Insurance Multi-Trip Medical Plan

If you travel often, then this multi-trip plan could be more cost-effective than buying a single-trip plan each time. This plan provides you with up to $5 million in emergency travel medical coverage for each covered trip up to the maximum trip duration selected within one year. 3

Sample Insurance Policy - Multi-Trip Medical Plan

TD Insurance Trip Cancellation & Interruption Plan

This plan could be right for you if you do not need emergency medical coverage but want financial protection for eligible non-medical expenses like your trip being cancelled or interrupted due to a covered event. 4

Sample Insurance Policy - Trip Cancellation & Interruption Plan

Compare plans

Please refer to the Sample Policy for defined terms and a full description of features, benefits, limitations and exclusions.

Ready to choose a plan?

Why choose td insurance travel insurance.

- Up to $5 million in emergency travel medical coverage Feel good about your next trip with medical coverage up to $5 million on eligible costs.

- 24/7 emergency assistance by phone worldwide Call our administrator anytime if you have an emergency during your trip.

- Travel medical coverage for dependent child(ren) included with two paying travellers On select plans that have the family coverage 5,6 option, your dependent child(ren)’s travel medical coverage is included at no additional charge.

- Convenient online quotes and claims servicing Available 24/7 when submitted online.

How to apply online

Get a quote in minutes

No obligation to purchase.

Decide whether you want to purchase

After reviewing the details, you can proceed to purchase.

Pay and submit

Review and confirm your purchase.

Submit a travel insurance claim

Start the claims process by visiting our Online Claims Portal.

Let’s connect

Our administrator is ready to answer your questions and help you on your way.

- For 24/7 emergency assistance: 1-833-962-1140 (Canada and the U.S., toll free) or + 1-519-988-7629 (worldwide, collect).

- For quotes, to purchase a policy or any general inquiries: 1-833-962-1143 . Mon-Fri 8am to 8pm ET Saturday 9am to 5pm ET

- For claims: 1-833-962-1140 .

Check your TD credit card travel insurance benefits.

Are you an existing TD Credit Cardholder and dreaming of future travels? Learn about what travel insurance benefits are available on your TD credit card with our Credit Card Travel Insurance Verification Tool.

Information for Quebec Residents – TD and MBNA Credit Card Product Summaries

Below are the Travel Insurance Summaries and Credit Card Insurance Summaries for TD and MBNA credit cards. These summaries provide an overview of the features and benefits of the insurance coverages included with TD and MBNA credit cards.

TD Personal Credit Cards:

- TD Cash Back Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Cash Back Visa * Card Credit Card Insurance Summary

- TD® Aeroplan® Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD® Aeroplan® Visa Platinum * Card Travel Insurance Summary Credit Card Insurance Summary

- TD® Aeroplan® Visa Infinite * Privilege Card Travel Insurance Summary Credit Card Insurance Summary

- TD First Class Travel® Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Platinum Travel Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Rewards Visa * Card Credit Card Insurance Summary

- TD Emerald Flex Rate Visa * Card Credit Card Insurance Summary

- TD U.S. Dollar Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Low Rate Visa Card Credit Card Insurance Summary

TD Business Credit Cards:

- TD Business Travel Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Business Cash Back Visa * Card Credit Card Insurance Summary

- TD Business Select Rate TM Visa * Card Credit Card Insurance Summary

- TD® Aeroplan® Visa Business Credit Card Travel Insurance Summary Credit Card Insurance Summary

MBNA Credit Cards:

- MBNA Gold Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA Platinum Plus or True Line Mastercard® Credit Card Insurance Summary

- MBNA Rewards Platinum Plus® Mastercard® Credit Card Insurance Summary

- MBNA Rewards World Elite® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA World Elite® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA World Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA Platinum Plus® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

Other Products and Services You May Want To Consider For Your Trip

TD offers banking solutions, credit cards and competitive exchange rates for your travel needs. Explore our products to learn how TD can enhance your trip.

TD Travel Credit Cards

Earn travel reward points on everyday purchases to redeem for flights, hotels and more.

Foreign Exchange Services

We have over 50 foreign currencies available at competitive rates.

Cross Border Banking

Canadian-based U.S. dollar products with TD Canada Trust can help you avoid foreign exchange fees by allowing you to save and spend in U.S. dollars.

TD Insurance Travel Insurance plans (TD Insurance Multi-Trip All-Inclusive Plan, TD Insurance Single-Trip Medical Plan, TD Insurance Multi-Trip Medical Plan and TD Insurance Trip Cancellation & Interruption Plan) are individual insurance plans administered by Global Excel Management Inc. and its subsidiary, CanAm Insurance Services (2018) Ltd. TD Insurance Multi-Trip All-Inclusive Plan and TD Insurance Trip Cancellation & Interruption Plan are underwritten by TD Life Insurance Company (medical covered causes) and TD Home and Auto Insurance Company (non-medical covered causes). TD Insurance Single-Trip Medical Plan and TD Insurance Multi-Trip Medical Plan are underwritten by TD Life Insurance Company. Medical and claims assistance, claims payment and administrative services are provided by the administrator described in the insurance policies. Coverages and benefits are subject to eligibility conditions, limitations, and exclusions, including pre-existing medical condition exclusions. Please refer to the policy for full details. 1. The TD Insurance Multi-Trip All-Inclusive Plan will provide coverage for each covered trip taken within 1 year up to the maximum trip duration you selected when the policy was purchased. If the oldest person on the insurance policy is 15 days old to 59 years old, the maximum trip duration is 60 consecutive days. If you are 60 years and older, the available maximum trip durations are 22 or 30 consecutive days. Coverage may be subject to conditions, exclusions, and limitations. Refer to your Policy of Insurance for full details of coverage for the TD Insurance Multi-Trip All-Inclusive Plan. 2.Coverage may be subject to conditions, exclusions and limitations. Answering a Medical Questionnaire is required for those 60 years of age or older to determine eligibility for the TD Insurance Single-Trip Medical Plan. Refer to your Policy of Insurance for full details of coverage. 3. The TD Insurance Multi-Trip Medical Plan will provide emergency travel medical coverage for each covered trip taken within 1 year up to the maximum trip duration you selected when the policy was purchased. If the oldest person on the insurance policy is 15 days old to 79 years old, the available maximum trip durations are 4, 9, 16 or 30 consecutive days. If you are 80 years and older, the available maximum trip durations are 4, 9 or 16 consecutive days. Coverage may be subject to conditions, exclusions and limitations. Answering a Medical Questionnaire is required for those 60 years of age or older to determine eligibility for the TD Insurance Multi-Trip Medical Plan. Refer to your Policy of Insurance for full details of coverage. 4.Coverage may be subject to conditions, exclusions and limitations. Refer to your Policy of Insurance for full details of coverage for the TD Insurance Trip Cancellation & Interruption Plan. 5. The TD Insurance Multi-Trip All-Inclusive Plan has family coverage and provides coverage for you, your Spouse and unmarried Dependent Child(ren) if you name them in your application. Spouse means the person to whom you are legally married to; or the person you have lived for at least 1 year and publicly refers to as your domestic partner Dependent Child(ren) means your natural, adopted, or step-children who are: a) unmarried; and b) dependent on you for financial maintenance and support; and i. under 22 years of age, or ii. under 26 years of age and attending an institution of higher learning, full-time, in Canada; or iii. mentally or physically handicapped. All insured persons may travel independently of one another. All covered travellers must be a Canadian resident and be covered by the government health insurance plan of your Canadian province or territory of residence for the entire duration of your trip and at the time you incur a claim. If any of the travellers do not meet these criteria, that traveller will need to complete a separate application for their own policy. Up to 6 travellers including yourself are permitted to be under a policy through our online application. To purchase additional coverage for groups of more than 6 people, please call our administrator at 1-833-962-1143 . 6. Family Coverage is available on the TD Insurance Single-Trip Medical Plan and the TD Insurance Multi-Trip Medical Plan for you, your Spouse and unmarried Dependent Child(ren) if you name them in your application. Spouse means the person to whom you are legally married to; or the person you have lived for at least 1 year and publicly refers to as your domestic partner. Dependent Child(ren) means your natural, adopted, or step-children who are: c) unmarried; and d) dependent on you for financial maintenance and support; and i. under 22 years of age, or ii. under 26 years of age and attending an institution of higher learning, full-time, in Canada; or iii. mentally or physically handicapped. Your Dependent Child(ren) must be travelling with you or your spouse. All covered travellers must be a Canadian resident and be covered by the government health insurance plan of your Canadian province or territory of residence for the entire duration of your trip. Family Coverage is not available when a medical questionnaire is required for any of the travellers. If any of the travellers do not meet these criteria, that traveller will need to complete a separate application for their own policy. Up to 6 travellers including yourself are permitted to be under a policy through our online application. To purchase additional coverage for groups of more than 6 people, please call our administrator at 1-833-962-1143 . Mailing Address: TD Life Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2 TD Home and Auto Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Sorry, we do not offer this product in the selected province

Please visit our homepage to see products available in your province.

100 Drumlin Circle, Suite 101

1-905-660-9740

1-866-CLAIM-20

24/7 Claims Assist

Travel Insurance Hamilton

We’ve got you covered, hamilton travel insurance with oracle rms, looking for travel insurance in hamilton we’ve got you covered, as you think about getting travel insurance in hamilton, there are at least a couple of insurance options that you may want to discuss with your oracle rms broker:, baggage coverage and delay:, rental car coverage:, the right coverage for you, at the best price, travel facts in hamilton.

Our mission at Oracle RMS is to do all we can to make sure you receive exactly the coverage you require. We understand every situation is unique and requires a tailored approach to receive the best results. That's why our customers come back satisfied and seek out our services time and time again. Where else can you find an insurance company that truly puts your needs first? Visit our products pages to start the process to finding your free quote, or contact us directly with any questions you may have on how we at Oracle RMS can help you.

Insurance Products

- Automobile Insurance

- Home Insurance

- Commercial Insurance

- Travel Insurance

- Motorcycle Insurance

- Landlord Protection

- Bonding Insurance

- Life Insurance

- Ride / Car / Home Sharing

- Group Home and Auto Insurance

- Snowmobile Clubs

- Snow Removal Insurance

- Muskoka Lakes Chamber of Commerce

- CAA Membership

- Manufacturer’s Insurance

- Contractors & Construction Insurance

- Landscaping Insurance

- Peel District School Board

- Bus Insurance

- Pool & Spa Insurance

- Tenant Insurance

- Rented Dwelling Insurance

- Cottage Insurance

- Directors and Officers Liability Insurance

- Manufactured Home & Mobile Home Insurance

- Condo Insurance

- Cyber Insurance

- Report a Claim

- Legal Information

- Privacy Policy

- Broker Compensation

- CAA Customer Portal

- RIBO Fact Sheet

- CISRO Principles of Conduct for Insurance Intermediaries

- Accessibility

STAY CONNECTED

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Single Trip Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How single trip travel insurance works

How to choose between travel insurance companies, best plans for single trip travel insurance, other tips for travel insurance for a single trip, travel cards that come with complimentary travel insurance, single travel insurance for a trip recapped.

There are many types of travel insurance, including plans that’ll reimburse you for emergency medical expenses or unexpected travel delays. Along with coverage types, there are also different durations of travel insurance.

Single trip travel insurance will cover you during one vacation, while multitrip or annual travel insurance can last for multiple outings. Let’s take a look at single trip travel insurance, what kind of coverage you can expect and how to choose a plan that works for you.

Purchasing a travel insurance plan is fairly simple, as is making a claim. It generally goes like this:

You gather a few quotes from travel insurance companies.

You pick a plan that suits your needs and customize it to your liking.

You purchase your plan and include a date for it to start.

You go on your trip.

If something happens (such as a flight delay), keep the proof.

You make a claim with your travel insurance company.

The travel insurance company reimburses you.

There are a few variations in how this can work (for instance, some travel insurance plans can pay a medical provider directly), but for the most part, this is how the process will go. This is the case whether you have one-trip travel insurance or multitrip travel insurance.

» Learn more: How to find the best travel insurance

There are several travel insurance companies out there, which can make choosing a plan difficult.

NerdWallet analysis found that some travel insurance providers rise above the rest in terms of breadth and depth of coverage, cost, customizability, and overall customer satisfaction. Jump to see our findings on the bets plans for single trip travel insurance.

However, before choosing a company and purchasing a plan, consider these questions:

How much am I willing to pay?

Do I want trip protection, emergency medical coverage or both?

Do I already have coverage somewhere?

How much customizability does my plan need?

Do I need coverage for preexisting conditions?

Will I be doing any sort of adventure activities?

Once you’ve answered these questions, do your due diligence and get quotes from multiple sources. Different providers will offer differing levels of coverage at varying prices, so it’s in your best interest to generate as many quotes as possible and read the fine print.

To make it simple, travel insurance aggregators such as Squaremouth (a NerdWallet partner) will provide you with multiple quotes at a time.

» Learn more: The best travel credit cards right now

We considered a wide variety of factors when it comes to selecting the best insurance for your trip. These factors include cost, customizability, coverage maximums, whether preexisting conditions are included and the type of coverage the policy offers.

World Nomads

World Nomads is great for active travelers because of its standard coverage of adventure activities. With just two plans from which to choose, it’s also simple to decide which one you’d like.

Covers 200-plus activities as standard.

Simple plan options.

Emergency medical coverage included.

Only two choices for policies.

Riskier activities are covered only by the more expensive Explorer plan.

Fixed-rate reimbursement for trip protection.

» Learn more: Read our full review of World Nomads

With eight plans on offer, Tin Leg has a policy for every type of traveler. Along with standard trip protections, Tin Leg also offers Cancel For Any Reason (CFAR) add-ons.

Plenty of plans from which to choose.

Preexisting conditions included in most plans.

Primary and secondary medical coverage options.

Cheapest plan doesn’t cover preexisting medical conditions.

Rental car coverage add-on available only on Luxury plan.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

Seven Corners

Seven Corners is an excellent option for those who really want to customize their plans. Whether you’re looking for medical-only insurance or a more comprehensive policy, Seven Corners has options available.

Preexisting condition coverage available.

Medical-only plans on offer.

Covers missed tours and cruise connections.

Inexpensive plan offers secondary medical insurance.

Event ticket registration coverage only for expensive plan.

» Learn more: Is Seven Corners coverage worth the cost?

Our last company on the list is unique in that it covers those who use travel rewards, like purchasing flights or hotels with points and miles . This is fairly uncommon among travel insurance providers and can be really helpful when things go awry during award travel.

Plan options include accidental death and dismemberment (AD&D) travel life insurance.

Covers up to $300 in frequent traveler reward costs.

Worldwide travel assistance included on every policy.

Cancel For Any Reason insurance available only on most expensive plan.

Just $35,000 in emergency medical for basic plan (low compared to similar policies at other companies).

» Learn more: Our full TravelSafe review

If you’re interested in getting travel insurance, do yourself a favor and consider these tips before making any purchases:

Consult your medical insurance provider to see whether it offers coverage out of country .

Consider an annual plan to save money if you make multiple trips per year.

Check your credit card for complimentary travel insurance . Many offer this benefit, and if its limits are satisfactory, you can book your travels with it and avoid buying a separate policy out-of-pocket altogether. More on this in the next section.

If you're looking to get coverage for a one-off trip, among your best options is to simply pay for your travel with a card that includes travel insurance as a benefit.

Most travel cards will include coverage for things like trip interruption , trip delays and lost luggage .

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

If you’re in the market for single trip travel insurance, there are plenty of options available to you. Before purchasing a plan, grab quotes from multiple companies because the types of coverage and costs are going to vary.

Beyond this, be sure to check whether your credit card offers complimentary travel insurance and reach out to your medical insurance provider to see what type of coverage it offers overseas.

American Express insurance disclosures

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES

COMMENTS

Hamilton, New Jersey. 3812 Quakerbridge Rd. Hamilton, New Jersey 08619. US. Get Directions. Main Number (609) 586-7474 (609) 586-7474. EMAIL US. Agency Website . ... Travelers has been an insurance leader, committed to keeping pace with the ever changing needs of our customers, for over 160 years. As one of the nation's largest property and ...

The Travelers Companies, Inc., commonly known as Travelers, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. [3] [4] [citation needed] Travelers is incorporated in Minnesota, with headquarters in ...

InsuraMatch is a Travelers-owned insurance agency that sells insurance policies for various insurance companies. It receives commissions on the insurance policies it sells from these insurers and may receive other performance, profitability or volume-based compensation from the insurers. This compensation may vary by insurance company.

Travelers is committed to providing you with the highest level of service. If you have questions or any concerns regarding the service you have received from us, please call us at 1.866.336.2077. We are here for you 24 hours a day. Company Directory. 1.800.328.2189.

957 RT 33. (716) 373-5511. Get Directions. Request A Quote. Browse all Travelers Insurance agencies in Hamilton Square, NJ to learn more about home, auto, business and renters insurance.

Travelers Insurance 2022-07-31T18:58:21-04:00. A New Jersey Travelers Insurance Agency. Travelers takes on the risk and provides the coverage you need to protect the things that are important to you — your home, your car, your valuables and your business — so you don't have to worry. They have been around for more than 160 years and have ...

1 Insurance Agency in Hamilton, IL. Travelers Insurance . Find an Agent. All Insurance Agencies / IL / Hamilton; 1 Insurance Agency in IL, Hamilton. Koehler Froman Insurance Services. 1026 Broadway St. Hamilton, IL 62341. US. phone (217) 847-9061 (217) 847-9061.

With the ongoing development of technology in cars to help us drive safely, there is an opportunity to help raise awareness of your driving behaviors. Car insurance helps protect you from costs related to auto accidents and other losses, such as theft. Get a free car insurance quote with Travelers insurance.

Terms & Conditions. 1 CAA Travel Insurance, an Orion Travel Insurance product, is underwritten by Echelon Insurance. Certain exclusions, limitations and restrictions apply. Subject to change without notice. A Medical Questionnaire may be required if you are 60 years of age and older. Quotes are valid for 30 days. Subject to change without notice.

A homeowners policy is recommended for anyone who owns a home or condo and may be required by your mortgage lender. You will need separate coverages to help protect your home and personal belongings against damage due to floods or earthquakes. If the unexpected happens, home property insurance can help you restore your life back to normal.

For Agents and Brokers. Placing domestic and international business insurance with one carrier offers many advantages. Explore the benefits of having one carrier, including one insurer to contact and an easier claim process. 5 minutes.

Welcome to Travelers. Log in to securely access and manage your account. USER ID . Password

The best travel insurance companies are PrimeCover, Travel Insured International and WorldTrips, based on our analysis of 42 policies. Travel insurance policies package together valuable benefits ...

Hamilton College Policy #GTP 9156848 is effective September 28, 2022, to September 28, 2025. ... With this coverage, you have access to AIG's business travel insurance plan if you experience any travel inconveniences, security issues, or medical emergencies while traveling anywhere in the world.

At Travelers Canada, we know how important it is to have people and services you can rely on when something unexpected happens. That's why we're committed to providing quality coverages, claim services and risk control resources that help protect you when you need it most. It's been our mission here in Canada for over 135 years.

Pay your business insurance bill, monitor your account and sign up for automatic recurring payments - all online. Make a one-time payment with Express Pay. Make a payment without logging in. Other payment options. Mailing address, pay by phone, etc.

TD Insurance Multi-Trip All-Inclusive Plan. This is the most comprehensive plan we offer. It provides you with multiple benefits, including up to $5 million in emergency travel medical coverage, trip cancellation and interruption and more, for multiple covered trips up to the maximum trip duration selected within one year. 1. Get Started ...

WorldTrips and IMG are the best travel medical insurance companies for visitors to the U.S., based on our analysis. If you're going to have family or friends from another country visit you, they ...

Best travel insurance category. Company winner. Best overall. Berkshire Hathaway Travel Protection. Best for emergency medical coverage. Allianz Global Assistance. Best for travelers with pre ...

Get expert advice from an insurance broker near you. Postal Code. Search. Français. Travelers Canada has trusted personal insurance and business insurance brokers available across Canada. Find a broker near you.

Contact Oracle RMS to explore your travel insurance options in Hamilton today. Oracle RMS. 100 Drumlin Circle, Suite 101 . 1-905-660-9740. [email protected] . 1-866-CLAIM-20. 24/7 Claims Assist. Home; Company Profile. About Us; Why Oracle; Industry Partners; Community; Careers; Insurance. Automobile Insurance;

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus ...

Zillow has 41 photos of this $259,000 1 bed, 1 bath, 900 Square Feet apartment home located at 36 Hamilton Ave APT 2U, Staten Island, NY 10301 built in 1963. MLS #1165959.