- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Family Travel Insurance

- Schengen Travel Insurance

- International Health For Individuals

- International Health for SME

- Travel Insurance Promotion

- COVID-19 Alerts

Travel Insurance

Travel Insurance Singapore

With Allianz 24/7 Global Assistance and Support , you'll get the help you need while overseas. From Covid-19 and other epidemics or pandemics, to injury, illness, flight cancellations and baggage delays, we will be with you.

50% off Travel Insurance Plan

Save 50% on the normal cost of single trip, annual multi trip, or family travel insurance from Allianz Travel.

Refund within 14 days - Get your money back if you change your mind after purchasing of policy*

Travel Insurance with Selected Covid-19 Coverage*

- Our Travel Insurance will cover you against medical costs, cancellations and curtailments due to COVID-19*

- Discover scenarios where Covid-19 has impacted the travel plans of people covered by Allianz Travel insurance policies here

Travel Insurance Catered to Different Needs

- For Frequent Travellers: Get covered for an unlimited number of trips (up to 90 days’ duration each trip). Discover our Annual Plan Travel Insurance here

- For One-off Trips: Single trip plan is suitable for an occasional traveller or those who are looking for a short getaway. Discover our Single Trip Travel Insurance here

- For Family: Family plan provides cover for you and the members of your family who travel with you on your journey (maximum of 2 adults) . Discover our Family Travel Insurance here

24/7 Assistance And Support - For Your Safety, Health And Security

- Our team will help organise emergency medical assistance around the clock.

Identify closest hospitals & arrange and pay for transport*

Advance payment for in-patient services, where accepted*

Provision of medical escort if needed, subject to availability*

Arrange payment to return home*

Allianz Partners Group prides itself on providing individuals and their families with assistance and travel insurance solutions specific to their needs. This travel insurance is underwritten by Tokio Marine Insurance Singapore Ltd, with services provided by Allianz Travel, trading as AWP Services Singapore Pte Ltd.

*Subject to the terms, conditions, exclusions and benefits limits of the policy wording. For more information please click on the Policy Wording to read the Allianz Travel Policy Wording.

^Terms & Conditions.

50% Off All Plans (Single Trip, Family and Annual Plans)

The promotional code 'flash50'

1. is valid until 28 May 2024

2. ‘flash50’ code is applicable to Allianz Travel insurance

3. is applicable only on the website of Allianz Assistance Singapore - https://www.allianz-assistance.com.sg/

4. All benefits, limits, terms and conditions of the travel insurance plan purchased under this promotion are subject to the terms and conditions of the Policy Wording. By purchasing our travel insurance with the discount codes above, you are deemed to have read the Policy Wording and agreed to all terms and conditions and policy exclusions

5. Allianz Travel reserves the right to end such promotion at any time as it deems fit

Allianz Assistance Singapore

"i got my luggage delayed during my trip in thailand in 2018, allianz travel insurance have been helpful when i inquiry before buying the insurance, during the luggage delayed happen, and afterwards to claim. response have been very fast and accurate. claim is also very fast. i would give 5 stars plus plus plus if possible", benefits highlights.

Swipe to view more

Designed for essential travel and medical coverages only

From S$ 17.50

Well-balanced coverages for most type of travels

Inclusive of an extensive scope of travel protection

Core Benefits

- Selected COVID-19 Cover*

- Overseas medical expenses

- Trip Cancellation, Baggage delay and emergency transportation benefits

- Travel inconveniences including trip curtailment and travel delay, medical expenses, and emergency transportation benefits

- Travel personal accident, rental car excess, and lost travel documents benefits

- Personal liability and sports benefits

You have to pay for emergency medical or dental treatment while on your trip.

With Selected Covid-19 Coverage*

You have to pay for emergency medical care (including Covid-19-related) or dental treatment while on your trip.

Any medical expenses incurred in Singapore will not be payable under this plan.

Up to S$ 200,000

Dental care maximum sublimit: S$ 250

Traditional Chinese Medicine sublimit: S$ 200

Up to S$ 500,000

Hospical cash: Up to S$ 1,000

Traditional Chinese Medicine sublimit: S$ 250

Up to S$ 1,000,000

Hospital cash: Up To S$ 2,000

Traditional Chinese Medicine sublimit: S$ 300

You have to cancel your trip before you depart.

With Selected Covid-19 coverage*

You have to cancel your trip before you depart because you or your travelling companion are diagnosed with Covid-19 and/or are required to quarantine; or a family member is diagnosed with Covid-19 (or other covered reason)

Your travel plans are delayed while you are on your trip.

Your travel plans are delayed while you are on your trip because you or your travelling companion are diagnosed with Covid-19 and are required to quarantine (or other covered reason) - sublimits apply - please refer to the policy wording

Transportation is needed following a medical emergency while on your trip.

With Selected Covid-19 Coverage

Transportation is needed following a medical emergency (including Covid-19 diagnosis, or other pandemic or epidemic) while on your trip. This includes emergency local emergency transportation and medical repatriation to Singapore if needed.

Search and Rescue: S$ 10,000

More Benefits

You have to end your trip early and need to recover unused trip costs.

Trip Curtailment: You have to end your trip early and need to recover unused trip costs.

Trip Incident include

- Early Return (You have to end your trip early and need to recover transportation cost for return home.)

- Trip Continuation (Your travel plans are interrupted, but you continue your trip.)

- Extended Stay (Your travel plans are interrupted and you need to recover additional accommodation and transportation costs you have incurred. (Maximum of SGD$300 per day for 5 days)

Subject to the terms, conditions, exclusions and benefits limits of the policy wording. For more information please click on the Policy Wording to read the Allianz Travel Policy Wording.

*There is no cover for lockdowns, changes in government alert levels, quarantine or mandatory isolation applying to a population or part of a population.

For one-off trips

Single trip plan is suitable for an occasional traveller or those who are looking for a short getaway

For family trips

Family plan provides cover for you and the members of your family who travel with you on your journey (maximum of 2 adults)

For frequent travellers

Cover for every trip in entire year (max 90 days per trip). More practical and hassle-free for those who are planning for more than 3 trips a year.

Travel Insurance Singapore: Protecting Your Journeys with Peace of Mind

With Allianz Travel insurance, you can enjoy the freedom to choose your coverage based on your travel plans. Whether you're a frequent traveller, a family going on vacation, or an individual on a business trip, we have a range of different options to cater to your varied requirements.

As a trusted Singapore travel insurance provider, we provide coverage that goes beyond borders. Allianz Travel insurance policies are designed to protect you against unforeseen circumstances such as trip cancellations, medical emergencies, lost luggage, flight delays, and more.

Ready to secure your peace of mind? Buying travel insurance in Singapore is just a few clicks away. Our user-friendly online platform allows you to easily compare coverage options, receive instant quotes, and purchase your policy hassle-free. Take advantage of our Singapore travel insurance promotion to enjoy discounts and special offers on selected policies.

Choose Allianz Travel as your trusted partner in travel insurance. Safeguard your adventures and embark on worry-free journeys. Purchase your travel insurance today and let us be your shield against unexpected financial costs.

Selected Covid-19 Cover* Travel Insurance

Emergency medical / transportation, trip cancellation, trip curtailment / incident, travel delay, benefits by product plans.

Emergency Medical

Coverage for Covid-19 medical costs if you are diagnosed with Covid-19 while overseas

Emergency Transportation

Search & Rescue sublimit: S$ 10,000

Emergency Transportation is needed following a medical emergency (including Covid-19 diagnosis, or other pandemic or epidemic) while on your trip. This includes emergency local emergency transportation and medical repatriation to Singapore if needed.

Up to S$ 1,500

If you or a travelling companion fall ill with Covid-19 before your trip begins

Up to S$ 5,000

Trip Curtailment

Up to S$ 1,200

If you or a travelling companion are required to quarantine during your trip. Part of Delay coverage. Limit per 24-hour period S$ 400 (with receipts)

Up to S$ 10,000

Trip Incident

If you or a travelling companion fall ill with Covid-19 before

Up to S$ 1,600

No cover is provided for claims arising from lockdowns, changes in government alert levels, quarantine, or mandatory isolation that applies generally or broadly to some or all of a population, vessel or geographical area, or that applies based on where You are travelling to, from, or through.

No cover is provided for claims directly or indirectly arising from or caused by you commencing travel against the Singapore Government’s advice, or against local government advice at your overseas destination.

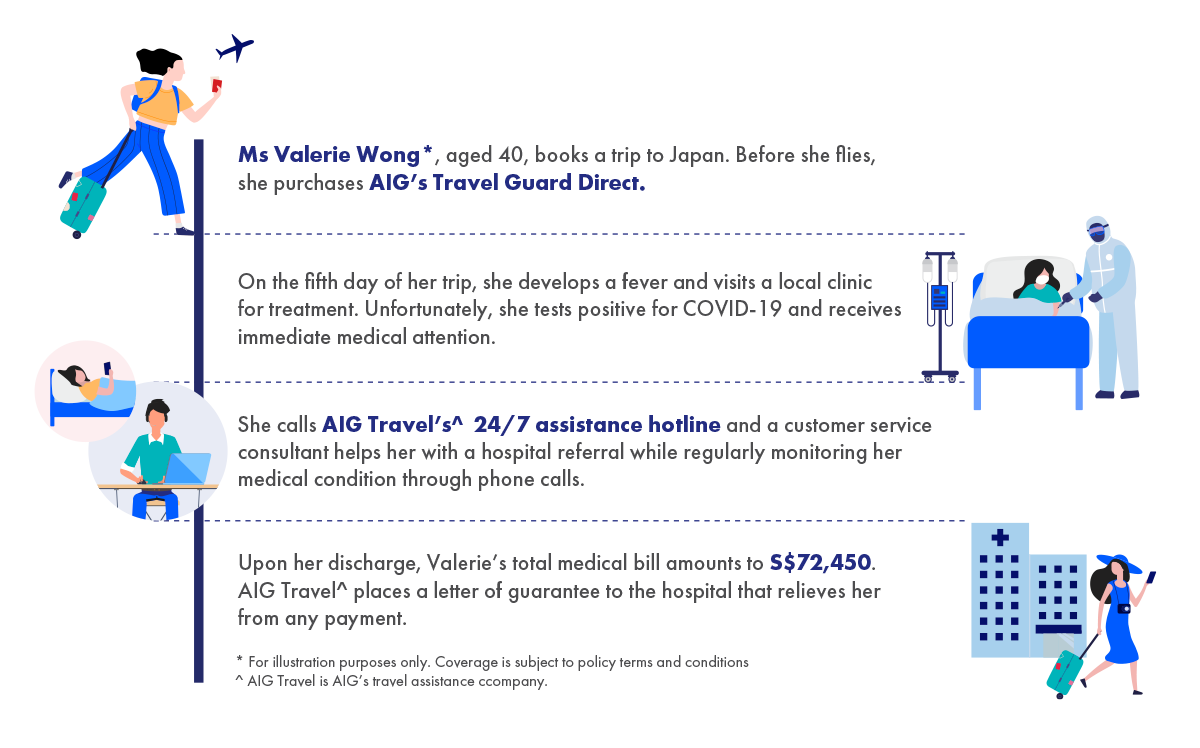

Here are scenarios where Covid-19 has impacted the travel plans of people covered by Allianz Travel insurance policies. Disclaimer: They are not based on real people but illustrate the challenges you and your travelling companions might face during the pandemic.

Covid-19 example scenarios, covid-19 diagnosis before travel mr jimmy tan, mr jimmy tan, aged 39, booked a trip to thailand, then he bought an allianz travel comprehensive platinum single-trip plan., unfortunately, before departure mr tan took a pcr test and was diagnosed positive for covid-19., he contacted allianz travel’s 24/7 medical assistance and asked for help.. they directed him to make a paperless online claim for trip cancellation. , during claims processing the pcr test was confirmed as being in mr jimmy tan’s name. allianz travel agreed to pay mr tan s$935 for the parts of his trip that were not refundable, including flight and hotel, along with other costs covered., covid-19 diagnosis during travel the wang family, mr & mrs wang & 2 kids booked a month-long trip to australia they then bought an allianz travel comprehensive platinum family plan., on day 4 of their trip mrs wang developed a heavy fever. she tested positive for covid-19., mr wang called allianz travel’s 24/7 assistance about his wife. they contacted the hospital & organised advance payments for covid-19 medical care., the wang family’s final medical costs were s$69,500, which were covered by their allianz travel policy.. they were able to continue their family trip after mrs wang recovered..

Paperless Online Claim

24/7 medical assistance and support .

24/7 Medical Assistance during your trip

COVID-19: 8 Ways Travel Insurance for Singaporeans Got Smarter

Discover Our Travel News & Tips

Are you always worrying on too many things about your travels?

Travel should be peaceful… worry-free… pleasant… and any great adjectives that you can think of right now.

Pre-Travel Checklist for a Worry-Free Trip

From thorough research and planning to buying travel insurance, each aspect of your pre-travel checklist contributes to a seamless travel experience.

Understanding Travel Insurance Terms and Exclusions

Travel insurance encompasses a range of coverage options. Understanding these terms will help you navigate policy documents and make informed decisions.

Travelling to EU Countries with Allianz Travel Singapore

Allianz Travel Singapore, a reputable travel insurance provider, offers coverage that ensures you're prepared for the unexpected while exploring EU countries.

Tips for Planning a Budget-Friendly Travel Adventure

Budget-friendly travel doesn't mean compromising on safety. Travel insurance plays a crucial role in ensuring a stress-free travel experience.

Solo Travel Safety Tips for Adventurous Solo Explorers

Prioritise safety through pre-trip planning, personal safety practices, and travel insurance protection to ensure your adventures are thrilling and secure.

Family Travel Insurance for Your Loved Ones

When selecting family travel insurance in Singapore, it's essential to consider various factors to ensure you have the right coverage for your specific needs.

Travelling to Australia with Singapore Travel Insurance

As you set your sights on this destination, Allianz Travel Singapore travel insurance becomes your steadfast companion to safeguard your journey.

Single Trip vs Annual Multi-Trip Travel Insurance

Allianz Travel Insurance steps in to offer a safety net that ensures your travels remain as enjoyable and worry-free as possible.

Annual Travel Insurance for Frequent Flyers

By selecting the right annual travel insurance for frequent flyers, adventurers can embark on their journeys with a profound sense of peace.

How Travel Insurance Saves You Unexpected Medical Expenses

Travel insurance plans are designed to provide financial protection and assistance in the event of unforeseen medical emergencies while travelling.

The Importance of Travel Insurance Protection

Allianz Travel Insurance offers extensive coverage that protects you during your travels. Get your Singapore travel insurance quote today.

Essential Tips for Choosing the Right Travel Insurance Plan

By considering these tips, you can make an informed decision and select the right travel insurance plan that offers the necessary protection for your journey.

What to Expect After Submitting Travel Insurance Claims

Learn what to expect after submitting travel insurance claims: from the processing timeline to handling claim rejections. Be prepare for every step of the journey.

Can I Participate in Risky Activities While Travelling

Explore the extend of travel insurance coverage for high-risk activities such as skydiving or paragliding, and more. Find out if accidents and mishaps are included in your policy.

What Documents Do I Need to Claim Travel Insurance?

Ensure a seamless travel insurance claim with our guide on required documents. Discover what you need to protect your trip. Get expert tips now!

Help is just a phone call away

For 24/7 Emergency Assistance during your trip

Please call +65 6995 1118

For claims enquiries

Call: +65 6327 2215

Mon – Fri, 9:00 - 17:30 Singapore Time

e-mail: [email protected]

For customer service

call: +65 6327 2210

Allianz Travel: How Can We Help?

24 hour emergency assistance.

MoneySmart Financial is an Exempt Financial Adviser and Registered Insurance Broker licensed by Monetary Authority of Singapore ("MAS").

Get the Best Annual Travel Insurance in Singapore 2024

Compare Travel Insurance prices on MoneySmart to get the best deal to cover you against coronavirus (COVID-19), lost baggage, medical emergencies, flight delays, pre-existing conditions, pregnancy claims and more.

- Korea, Republic of

- United States

- Afghanistan

- Aland Islands

- American Samoa

- Antigua and Barbuda

- Bonaire, Sint Eustatius and Saba

- Bosnia and Herzegovina

- Bouvet Island

- British Indian Ocean Territory

- Brunei Darussalam

- Burkina Faso

- Cayman Islands

- Central African Republic

- Christmas Island

- Cocos (Keeling) Islands

- Congo, The Democratic Republic Of The

- Cook Islands

- Czech Republic

- Côte D'Ivoire

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Falkland Islands (Malvinas)

- Faroe Islands

- French Guiana

- French Polynesia

- French Southern Territories

- Guinea-Bissau

- Heard and McDonald Islands

- Holy See (Vatican City State)

- Iran, Islamic Republic Of

- Isle of Man

- Korea, Democratic People's Republic Of

- Lao People's Democratic Republic

- Liechtenstein

- Macedonia, the Former Yugoslav Republic Of

- Marshall Islands

- Micronesia, Federated States Of

- Moldova, Republic of

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Norfolk Island

- Northern Mariana Islands

- Palestine, State of

- Papua New Guinea

- Philippines

- Puerto Rico

- Russian Federation

- Saint Barthélemy

- Saint Helena

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre And Miquelon

- Saint Vincent And The Grenedines

- Sao Tome and Principe

- Saudi Arabia

- Sierra Leone

- Sint Maarten

- Solomon Islands

- South Africa

- South Georgia and the South Sandwich Islands

- South Sudan

- Svalbard And Jan Mayen

- Switzerland

- Syrian Arab Republic

- Tanzania, United Republic of

- Timor-Leste

- Trinidad and Tobago

- Turkmenistan

- Turks and Caicos Islands

- United Arab Emirates

- United Kingdom

- United States Minor Outlying Islands

- Venezuela, Bolivarian Republic of

- Virgin Islands, British

- Virgin Islands, U.S.

- Wallis and Futuna

- Western Sahara

- No matches found! Please try another search.

Refine Your Results

Total Premium

Starr TraveLead Comprehensive Silver

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy an exclusive 58% off your policy premium for a limited time only ! Valid till 20 May 2024. • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

Are your trip details correct?

Destination: Thailand

Duration: 18 May 2024 - 20 May 2024

.png)

FWD Premium

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy 25% off your policy premium • Get S$20 iShopChangi e-voucher and Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

Great Eastern TravelSmart Premier Classic

[MoneySmart Exclusive] • Enjoy up to 40% off your policy premiums • Get S$10 iShopChangi e-voucher with every policy purchased. T&Cs apply.

DirectAsia Voyager 1000 Annual Plan

[ Win a Rolex, Samsonite Luggage & More! | FLASH DEAL] • Enjoy 40% off your policy premium • Receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

Singlife Travel Plus

[Receive your cash as fast as 30 days*] • Enjoy up to 28% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$30 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

Allianz Travel Basic

[Receive your cash as fast as 30 days*] • Enjoy an exclusive 57% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$40 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

Starr TraveLead Comprehensive Bronze

AIG Travel Guard® Direct - Supreme

[Receive your cash as fast as 30 days*] • Get up to S$220 worth of cash and rewards with eligible premiums spent. • Additionally, receive an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply.

Total Premium*

The Wise Traveller Premium

Great Eastern TravelSmart Premier Elite

.png)

[MoneySmart Exclusive | FLASH SALE] • Enjoy 45% off your Single Trip policy premium and 60% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$10 iShopChangi e-voucher with every policy purchased. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Allianz Travel Platinum

DirectAsia Voyager 250 Annual Plan

The Wise Traveller Secure

FWD Business

AIG Travel Guard® Direct - Enhanced

Starr TraveLead Comprehensive Gold

Allianz Travel Silver

.png)

Singlife Travel Lite

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

What Customers Say about their Travel Insurance Purchase

Review by doreenngsk ng.

"Purchased travel insurance on Moneysmart with cash rebate deal. Great value after discount. MS is good platform to peruse available travel policies to choose from, giving us choices to consider appropriate for our requirements."

As seen on Google

Review by Ron Tay

"I always use MoneySmart when i need a travel insurance..... It easy and convenient to use, let me easy to compare each travel insurance package..... Highly recommended!"

Review by Jodel Tan

"Purchasing travel insurance was easy, fast and smooth... had a good deal of getting cashback by purchasing the insurance. Steps from claiming to receiving the cashback was simple too. A good experience overall."

Best Travel Insurance Plan in Singapore 2024

What do travel insurance plans cover.

While pricing is a an important factor when comparing travel insurance plans, other features such as overseas medical coverage, trip cancellation coverage and many other related aspects are as important. These benefits and the extent of coverage for each type of benefit usually varies from insurer to insurer. Here are a few aspects you’ll want to look out for when it comes to choosing a suitable travel insurance with adequate coverage .

Overseas medical expenses

In the event you get diagnosed with some sort of unexpected disease, you’ll be able to claim for the necessary and reasonable overseas medical costs incurred within a certain number of days of your trip (usually 90 days) up to the limit as specified according to your selected plan. For some plans there are also tiered coverage limits for different age groups.

In-hospital cash overseas or allowance

Reimbursements for in terms of cash for hospital stays is another benefit that many insurers include in their plans now, especially after the Covid-19 pandemic.

Emergency medical evacuation and emergency medical repatriation

This is one of the fundamental aspects of every coverage plan. Any costs incurred for emergency medical evacuation and repatriation (including repatriation of mortal remains back to Singapore) that are related to your severe injury/illness diagnosis will be covered.

Keep in mind to have someone on your behalf to contact the insurer’s emergency service to provide your full name, dates of trip, NRIC/FIN number, policy number, name of the place and the telephone number that your insurance provider can reach you, as well as the nature of help required during the emergency, in case you are unable to do so during the emergency.

Trip cancellation/alteration/interruption/delay

Trip cancellations, postponements, delays, and interruptions are often covered if you as the traveller or you relatives travelling with you are diagnosed with a severe illness/get severely injured before the date of departure, subject to terms and conditions.

Pre-existing conditions

This benefit is not commonly included in most travel insurance plans, but currently there are several insurers providing such plans and they include MSIG TravelEasy® Pre-Ex, Income Insurance Enhanced PreX® (formally known as Income) and Etiqa Pre-Ex. The premiums are higher than regular plans, but they provide overseas medical expenses that cover pre-existing conditions.

Does Travel Insurance Cover Cancelled Flights?

Not always! While all travel insurance policies have a "Trip Cancellation" benefit, you can only claim for this if it's for an insured event, such as a serious illness or accident, or unforeseen events such as riots or natural disasters. However, different insurers exclude different scenarios, so it's best to read the policy wording carefully. The following are types of flight cancellations that are NOT covered by travel insurance.

Flight Cancellation Due to Known Event

Flight cancellations due to events which are already made known as public knowledge are not covered by travel insurance, as you are expected to have known about these at the point of buying your tickets. However, if you bought your flights and activated your travel insurance before they became public knowledge, you might still be able to make a claim.

Flight Cancellation with Refund / Replacement

If your flight was cancelled but you were put on a replacement flight, or your fare was refunded, you will not be able to make a travel insurance claim under the trip cancellation benefit. In general, travel insurance is only for unrecoverable costs. However, you may claim for trip delay benefits, such as an extra night's accommodation or extra meals.

You Cancelled Your Own Flight / Trip

Travel insurance typically covers insured events that are beyond your control. If you are the one who changed your mind about your trip, you generally won't be able to claim anything - unless your insurer offers a "Cancellation for Any Reason" benefit. However, in public health emergencies like the COVID-19 outbreak, airlines usually waive the usual penalties for flight cancellations, out of goodwill.

Different Types Of Travel Insurance Coverage

Single trip plans.

If you’re thinking of only taking one or two trips in a year, single-trip travel insurance is probably more suitable for you. As the name suggests, single-trip insurance plans are made for individual travellers, and those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

It makes more economic sense for those who don't travel very often, plus, single-trip insurance plans can be purchased easily online, with less time in planning and consideration as compared to annual multi-trip plans. But on the flip side, you’ll face the hassle of getting a new travel insurance policy every time you go on an overseas trip. For some, a single-trip insurance plan can get relatively expensive if the trips are short.

Annual Multi-trip plans

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, are designed for those who travel several times in a year. The great thing about this kind of travel insurance is that you only need to do the purchase once, and you’re covered for the next 12 months. It is a good option if you’re a frequent traveller who intends to make many long trips or short weekend getaways abroad in a year.

Individual plans

Going solo as an occasional traveller or frequent traveller means that you’ll most likely need a single-trip individual travel insurance plan or an annual multi-trip travel insurance plan, depending on the frequency of travel.

Family plans

Family travel insurance plans usually cover you and the members of your family who travel with you on your trip, with a maximum number of adults and children to be insured per policy purchased. The people who are insured under a family travel insurance plan may comprise of you and your spouse, and/or your children or grandchildren.

You may want to consider purchasing a family travel insurance plan if you are travelling with your family and thinking of getting a single policy for your family members who are travelling with you, as getting a family travel insurance plan can be more cost-effective than getting separate single trip plans for each family member. What if you and your loved ones are travelling very often as a family? Some travel insurers also offer annual multi-trip travel insurance for families who are frequent travellers.

Single-trip or Annual multi-trip plan - Which one should you pick?

Now that we've detailed out what the different types of travel insurance plans are, it’ll be easier for you to make a decision. If not, here are some examples to help you understand better.

Joshua flies frequently in and out of the country for his business trips. As he works as a legal advisor, his job requires him to travel between Singapore and Thailand twice or once a month. Each trip will last for about a week. In this case, multi-trip travel insurance works best for him as he wouldn't have to keep getting travel insurance before every trip.

Lisa and Amanda are university friends planning to take a long post-graduation trip to Australia. They seldom travel and even if they did, they go on overseas vacations once a year with their own families. For them, the single travel insurance policy is a more suitable choice Australia .

How Do I Choose The Best Travel Insurance?

When choosing travel insurance plans for your holiday or business trips, there are several factors to consider, depending on your priorities. Here are four simple steps to pick a suitable travel insurance plan.

Check general coverage

Instead of deciding solely by price, you should compare the benefits and reimbursement limits for common claims like medical expenses, trip cancellations, flight delays and baggage theft and/or damage.

Compare policy premiums

How much your travel insurance costs depends on your destination and length of stay. Most travel insurance companies have 2 to 3 tiers of plans at different price points, with varying comprehensiveness and reimbursement limits.

Special activities coverage

The breadth of coverage needed largely depends on your itinerary. For instance, if you’re planning to go skydiving, make sure you get a policy that covers aerial sports like MSIG’s TravelEasy® Standard, Elite and Premier plans. Or if you’re going golfing overseas, pick a policy that insures your equipment.

Consider the trip duration

This is one of the important determining factors of which kind of travel insurance you get. Single trip travel insurance plans are usually for short trips. If you’re the kind who travels far and for months, it might be worthwhile to consider buying annual travel insurance.

Unlike single trip travel insurance, annual travel insurance often charges a flat premium and insures you for an entire year of travel. It usually costs about $200 to $300 per year, which is more suitable for a frequent traveller who is probably going to travel overseas more than 7 or 8 times a year, at least.

Best Travel Insurance Plans in Singapore Benefits Coverage

Travel insurance recommendations.

- Best Travel Insurance with Pre-Existing Coverage

- Best Pregnancy Travel Insurance for Expecting Mothers

- Best Covid-19 Coverage Travel Insurance

- Best Travel Insurance For Flight Cancellation Coverage

- Best Extreme Sports/ Adventure Sports Travel Insurance

- Best Cruise Travel Insurance

- Best Travel Insurance for Seniors and Elderly

- Best Travel Insurance For Phones, Laptops, Tablets

- Best Travel Insurance For Roadtrips

- Best Bali Travel Insurance (Indonesia): Top 7 Value Plans

- Best Malaysia Travel Insurance: JB, KL, Penang & more

- Best Japan Travel Insurance – Best Value, Cheap Plan s

- Best Thailand Travel Insurance– What To Look Out For

- Best Australia Travel Insurance– Plan Benefits, Travel Tips

- Best Korea Travel Insurance To Get– Most Affordable

- Best Travel Insurance To Buy Travelling To The UK: Top 5 Plans

- Best Taiwan Travel Insurance– Cost, Coverage, Compare

- Best Vietnam Travel Insurance

- Batam Travel Guide: What To Do, Where To Go

Travel Tips

- Travel Essential Packing List 101

- How To Renew Your Singapore Passport

- Top Travel Hacks To Save Money

- 15 Rookie Mistakes To Avoid While Travelling in Europe

- 10 Cost Savings Tips For Your Year End Holiday

- Travel Safety: Tips for Women, LGBTQ+, and Persons with Disabilities

- Best Travel Insurance Plans For Female Solo Travellers

- Should I get travel insurance from all-in travel agency packages?

- Moneysmart's Travel Insurance Promotion

- Starter Guide :How To Claim Travel Insurance

- Top 5 Reasons Why Travel Insurance Claims Are Rejected

- Are Travel Aggregators Harder to Claim From?

Travel Surveys

- Top 12 Airlines With Most Cancellations and Delays

Travel Insurance Claims

How do travel claims work.

Before you make a claim from your travel insurance provider, there are several important things to take note of, whether it is for claims related to your COVID-19 diagnosis, loss of baggage, trip cancellation, or other reasons. These include knowing what type of plan you purchased, when did the incident/illness occur (pre-trip, during-trip or post-trip), what belongings or items to claim for, and who are involved.

Here are 3 simple steps to submit your travel insurance claim

Get your supporting documents ready.

Most travel insurers require claims within 30 days. Submit via mail, WhatsApp, their app, or online portal to avoid policy breaches. Keep originals for 6 months in the event the travel insurance provider needs to sight them. Required documents often include personal info, medical reports, ownership proof, trip records, and reports (e.g., police, airline).

Fill in your details and attach your supporting documents in your submission

Log in to your insurer's claims app or portal. Fill in your info, and the necessary details for the claims (email address. policy number, departure date or policy purchase date), upload soft copies of your documents and submit. Alternatively, mail hard copies of your original documents.

Receive an acknowledgement email and await for settlement

After submitting, you'll receive an acknowledgment email. Your claim will be reviewed. For COVID-19-related claims, contact the provided hotline or email. Upon approval, your insurer will coordinate payments, often offering cashless reimbursement through PayNow or iBanking for speed and convenience.

Frequently Asked Questions

What is travel insurance and how does it help me, what's the difference between single-trip or annual multi-trip travel insurance.

When you buy travel insurance you can choose from 2 types of policies, either the single trip or annual multi-trip travel insurance plan. Single trip travel insurance covers you for a single trip and is usually for individual travellers, or those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, cover you for all trips starting and ending in Singapore, and are designed for those who travel several times in a year, each trip lasting for about less than 180 days. You should consider buying Annual Travel Insurance if you travel frequently (more than 10 times a year). You will enjoy significant savings, and you won't have to worry about purchasing travel insurance every single time as you’ll be covered for the entire year.

Are family travel insurance plans cheaper?

Can i buy travel insurance once i'm overseas, how do i compare travel insurance policies, what are the best travel insurance for east and southeast asia countries.

We have written a quick guide on buying the best travel insurance to the nearby countries whether you are travelling to Malaysia , taking a weekend trip to Thailand , holidaying in Bali , planning a trip to Japan or a getaway to South Korea . Before jetting off, here are the 5 must have list of travel essentials that you will need when on holiday.

Does travel insurance cover flight cancellation due to illness?

Is there a difference between family travel insurance plans and group travel insurance plans, we asked singaporeans about flight disruptions, and they answered..

Find out the worst airlines with delays and cancellations according to Singaporean travellers.

- Car Insurance

- Corporate Employee Insurance

- Critical Illness Protect360

- Early Critical Illness Insurance

- Fire Insurance

- Home Protect360

- Home ProtectLite

- Hospital Income Insurance

- Maid Insurance

- Mobile Phone Insurance

- Accident Protect360

- Family Protect360

- Singapore Travel Pass

- Travel Insurance

- Business Packages

- Casualty Insurance

- Corporate Travel360

- Engineering Insurance

- Keyman Insurance

- Property Insurance

- Agent Recruitment

- Intermediary Login

- Our Corporate Profile

- Ethics Policy

- News and Media Releases

- HLAH Background and Regional Subsidiaries

- Check Claim Status

- Claim Forms

- Guide To Claims Process

- REGIONAL SERVICES

SAFE TRAVELS START WITH SINGAPORE'S BEST COVID-19 TRAVEL INSURANCE

Protect Yourself with Singapore’s Best COVID-19 Travel Insurance

Important Notice

The Ministry of Foreign Affairs has put up travel advisories against non-essential travel to Israel and Palestinian Territories. Please click here if you intend to or have purchased a travel plan to these areas.

current promotion

Purchase your travel insurance policy with HL Assurance and you’ll have the chance to win a flight ticket of your choice to your dream destination. The more you purchase, the more points you earn and the more chances of winning! Terms apply.

How to participate.

Get your dream holiday!

Protect you and your family with our COVIDSafe Travel Protect360.

Stand a chance to WIN a flight ticket of your choice

Single Trip

Travel insurance promotion 45% discount, ncd th customer + 1 buddy + ncd-->.

Be protected from COVID-19 with the new travel insurance offer in Singapore – COVIDSafe Travel Protect360! Not only will you be covered for Overseas Medical Expenses and Trip Cancellation due to COVID-19 under our travel protection plan, but we are also now rewarding you with No Claim Discount. *Terms apply.

Please refer to below Single Trip Travel Insurance Promotion Terms and Conditions for more redemption details.

Annual Unlimited

Annual travel insurance promotion 50% discount, ncd.

Travelling more than twice in a year? Get our annual multi-trip insurance policy and additional travel perks at just $0.52 / day. This travel insurance annual promotion in Singapore could be better value than buying single trip insurance for each holiday! Take advantage of our best annual travel insurance promotion and discounts today!

Please refer to below Annual Multi Trip Travel Insurance Promotion Terms and Conditions for details.

COVIDSafe Travel Protect360.

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

Enhanced Benefits with COVID-19 Cover

*NEW FEATURE* Making your vacation safe even during a pandemic

Get a peace of mind when you are travelling during the pandemic with our new COVID-19 benefits for Travel Protect360! Even if you require medical assistance or trip cancellation due to COVID-19, you can be assured that you are well covered!

Travel No Claims Discount

Get Rewarded for Safe Travels

We want to celebrate your safe travels with you! If you do not make any claims from your travel insurance, you get additional up to 10% off your next travel insurance purchase on top of our promotions.

Travel Inconvenience Protection

Be protected with comprehensive Travel Inconvenience cover

No traveller will wish for travel cancellations and travel interruptions and we are here to protect you from these inconveniences! No matter if it is the loss of baggage or insolvency of travel agencies, be assured that you are well protected!

Why You Should Choose Our COVID-19 Travel Insurance in Singapore?

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that offer secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

24/7 COVID-19 Travel Concierge

With regional alarm centres available 24/7, you can travel with peace of mind, knowing support is #OneClickAway. Connect with Global Teleconsultation via your communication method of choice. Click here to find out more.

Best COVID-19 Travel Insurance Coverage

Travelling during a pandemic can be stressful, not knowing if your insurance plans provide proper coverage. With our enhanced COVIDSafe Travel Protect360 Insurance, you can travel knowing that you are covered up to $200,000 in overseas medical expenses incurred due to COVID-19.

COVID-19 Quarantine Allowance

Be reimbursed with up to $1,500 even when you are quarantined overseas as part of our many COVID-19 travel insurance coverage benefits.

Enjoy No Claim Discount

If you do not make any claims from your travel insurance, you get up to 10% off your next travel insurance purchase with HL Assurance.

Greater Flexible Coverage

If you have to make changes to your trip due to the COVID-19 pandemic, COVIDSafe Travel Protect360 allows you to make adjustments to your policies. When your family is protected by COVIDSafe Travel Protect360 insurance, we are happy to make adjustments even when the trip needs to be cancelled because of one person in the family.

Stay Protected From Travel Inconvenience

Be it loss of baggage or insolvency of travel agencies, our comprehensive COVID-19 travel insurance cover ensures that you are well protected from travel cancellations, travel interruptions and other inconveniences! Buy your travel insurance online today.

Enhanced Benefits of our Travel Insurance

With our enhanced travel insurance, you can now be ready for all your adventures and travel with peace of mind. COVIDSafe Travel Protect360 insurance provides the comprehensive travel insurance coverage you need for your holiday.

COVID-19 Cover

Overseas Medical Expenses

Extensive Travel Inconvenience Benefits

What Our Customers Have To Say About Us

preferred travel insurance in singapore.

Customer Review by Lee Meng Tong

Thank you so much for your efforts in processing and finalising my travel claims. My wife and I are very appreciative of the care and excellent service provided by you and your staff. Rest assured that HL Assurance would be our preferred insurance for all our travels.

Hassle-Free Claims

Customer Review by Jack Wong

For my annual travel insurance, I always go with HLAS, their price is most reasonable with good enough coverage and the claim process is hassle-free. I always recommend my friends and colleagues to them.

Prompt And Excellent Service

Customer Review by H L

What professionalism! Prompt and excellent service for travel insurance as well as car insurance. I had immediate attention and was certainly impressed! 😀👌🏻

Seamlessly Easy And Convenient

Customer Review by Rasidah Maya

We get our travel insurance regularly from HL Assurance. Seamlessly easy and convenient online purchase. Thank you Jerry He for assisting me with the changes I needed and the advice given for my queries.

Good Choice For Travel Insurance

Customer Review by Choon Xiang

I am really inspired with HLAS travel NCD. You get rewarded for Safe Travels which everyone wishes. No doubt is your good choice for travel insurance.

No Claim Travel Insurance Discount Programme Terms and Conditions

Promotion terms and conditions.

- The promotion is held from now until 30 June 2024, customers who purchase any Travel Insurance policy (COVIDSafe Travel Protect360 Single Trip or Travel Protect360 Annual Trip) will automatically be enrolled into COVIDSafe Travel Protect360 No Claim Discount programme.

- For COVIDSafe Travel Protect360 Single Trip Policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for a 5% discount promotion code.

- For subsequent travel purchases with the utilising the 5% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for an additional 10% discount promotion code.

- Thereafter for subsequent travel purchases utilising the 10% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be capped at 10% discount promotion code.

- For COVIDSafe Travel Protect360 Annual Plan Policyholder(s) who has completed the policy period of one (1) year and has no claims during the policy period and within stipulated timeframe of 30 days from the policy end date, will be eligible for a 10% discount promotion code refund upon the next Travel Protect360 Annual Plan renewal.

- Promotional codes provided for the Single Trip can only be utilised for the next Single Trip purchase and can only be used once.

- The promotional codes are not transferable.

- Should there be any claims incurred, the No-claims discount promotion code will no longer be applicable.

- Each policy is only eligible for one promotion code.

Note: Swipe left or right to view the full table on your mobile screen.

- HL Assurance, at any time, at its sole discretion and without prior notice, can vary, modify, delete or add to these terms and conditions. Please refer to the policy wording for full details.

- In the event of any dispute, HL Assurance management’s decision is final.

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2021 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- “HL Assurance” means HL Assurance Private Limited.

- HL Assurance’s Travel Insurance is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites (www.gia.org.sg or www.sdic.org.sg). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Single Trip)

- The promotion is held from now until 30 June 2024.

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Single Trip policies during the Promotion Period will be entitled to 45% discount.

- This promotion is only applicable for new purchases made via HL Assurance website at www.hlas.com.sg/personalinsurance/travelinsurance.

- New purchases refer to purchases via HL Assurance website (as per stated above), and are not applicable to any purchase from HL Assurance’s agency partner.

- This promotion is not valid with any ongoing travel discounts, schemes or privileges.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Mid-Year Deal Promotion (Single Trip)

- The Mid-Year Deal Promotion is held from now until 29 May 2024.

- Eligible customers who successfully use the promo code ‘MIDYEAR5’ to purchase any COVIDSafe Travel Protect360 Single Trip policies during this Promotion Period will be entitled to an additional 5% off the base discount.

- This promotion is only applicable for new purchases made via HL Assurance website at www.hlas.com.sg/personal-insurance/travelinsurance .

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2024 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- HL Assurance’s Travel Insurance is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Annual Trip)

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Annual Trip policies during the Promotion Period will be entitled to a 50% discount, provided that the policy is not subsequently cancelled.

- New purchases refer to purchases via HL Assurance website (as per stated above), and is not applicable to any purchase from HL Assurance’s agency partner.

Terms and Conditions for COVIDSafe Travel Protect360 Get eSIM (Single/Annual Trip)

Please click the link for terms and conditions: COVIDSafe Travel Protect360 Get eSIM Terms and Conditions

What our Travel Insurance in Singapore Covers

Read the full terms and conditions

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ).

Frequently Asked Questions for COVIDSafe Travel Protect360 Insurance

Q: can i continue my medical treatment for injury or sickness sustained overseas when i return to singapore.

A: Yes. We pay for the medical expenses, up to the Sub-limit, reasonably incurred by you in Singapore within 30 days after your return from the trip.

Q: If I was injured or sick overseas but did not seek medical treatment, can I do so upon my return to Singapore?

A: Yes. The Company will indemnify you up to the Benefits Payable under the Policy for the treatment sought within three (3) days after your return from the Journey where initial treatment for Bodily Injury or Sickness was not sought overseas, up to a maximum of thirty (30) days from the date of first treatment in Singapore.

Q: What is the time frame for submitting a travel claim when I return to Singapore?

A: You will need to submit a claim within thirty (30) days upon returning to Singapore.

Q: What should I do if I lose my money or travel documents during my trip?

A: If your loss arises out of robbery, burglary or theft, you should report the loss to the local police within 24 hours after the loss / incident and obtain a written statement from the police to substantiate your travel insurance claim.

Q: What should I do if I need assistance while overseas?

A: One of the benefits of our travel insurance is the 24 hours Travel, Emergency Medical and Evacuation Assistance which provides for loss of travel documents and baggage, air ticket arrangements, emergency medical evacuation, referral services for interpreters / translators, legal, embassy, hospital admission and other medical facilities etc. These services are available 24/7 by calling our Hotline at (65) 6922 6009.

Q: I am currently under medication for some medical conditions. Can I claim for medical expenses related to these medical conditions during the trip?

A: No. Our Travel Insurance Policy excludes all pre-existing medical conditions prior to the trip.

Q: If I am pregnant, am I covered for any medical treatment incurred overseas?

A: No. Our travel insurance policy does not cover any pregnancy-related issues.

Q: Is dental treatment covered while I am overseas?

A: Yes, dental treatment is covered (as a result of Bodily Injury only).

Q: Will I be covered if I am going overseas to receive medical treatment?

A: No. The travel insurance plan does not cover you if you are travelling contrary to the advice of any Qualified Medical Practitioner or for the purpose of obtaining medical treatment.

Q: Are adventure activities and indoor / outdoor sports covered by COVIDSafe Travel Protect360 insurance?

A: No. Our travel insurance does not cover adventure activities. You can find the list of exclusions in our policy wordings .

Q: Is there a waiting period for COVIDSafe Travel Protect360 Insurance coverage to take effect?

A: A 3-day waiting period applies only to trip cancellation, postponement, and curtailment due to COVID-19 in Enhanced Travel Inconvenience (for COVID-19).

Q: How to buy travel insurance from HL Assurance?

A: Buying your travel insurance from HL Assurance is a straightforward process. You can purchase your desired policy online. Simply visit our travel insurance section, select the plan that suits your needs, and follow the steps for a hassle-free purchase experience.

Q: Can I extend my travel insurance coverage if my trip is extended?

A: Yes. This is subject to our underwriter’s approval. You can call or email us before the policy expires. If you’re wondering where to buy travel insurance for extended trips, you can easily do so through our website or contact our customer support at 6702 0202 for assistance.

Q: Can I buy travel insurance after departure?

A: Generally, travel insurance should be purchased before your trip commences.

Q: Can I cancel my travel insurance policy if my plans change?

A: You may cancel the Policy before the start of your trip with administrative charges applicable.

Q: Annual Trip Insurance vs Single Trip Insurance - Which is better?

A: Single Trip Travel Insurance provides coverage for the destination you’ve indicated. Meanwhile, an Annual Trip Travel Insurance gives better value should you have already planned to go on more than two trips in the year.

Q: Does COVIDSafe Travel Protect360 Insurance cover me if I travel to multiple countries?

A: Please indicate the countries you will be travelling to when you buy your travel insurance online. If you’re wondering where to buy travel insurance online, simply visit our website’s travel insurance section for a seamless online purchase experience.

Q: What are the Terms and Conditions for COVIDSafe Travel Protect360 Insurance?

A: You can find out more about our Terms and Conditions for COVIDSafe Travel Protect360 here .

Q: What does COVIDSafe Travel Protect360 Insurance cover?

A: We provide comprehensive travel insurance coverage of four (4) levels with diverse limits: Basic, Enhanced, Superior and Premier. Though the limits vary, the coverage is broad and has everything you’re looking for in a travel insurance plan.

All plans cover the following travel benefits:

- Overseas Medical Expenses (Child, Adult, Senior / Elderly)

- Medical Expenses in Singapore

- Personal Accident: Accidental Death & Permanent Disablement

- Travel Inconvenience

- Travel Postponement

- Travel Misconnections

- Insolvency of Travel Agency (Excluding Basic Plan)

- Trip Disruption

- Flight Inconvenience and Diversion

- Hijack of Common Carrier

- Kidnap & Hostage (Excluding Basic Plan)

- Personal Liability

- Loss of Home Contents

- Credit Card Protections (Excluding Basic Plan)

- Rental Car Excess

- Enhanced Medical Benefits due to COVID-19 (Excluding Basic Plan)

- Enhanced Travel Inconvenience, Cancellation, Postponement or Curtailment due to COVID-19 (Excluding Basic Plan)

Chat with us if you have any questions via WhatsApp and we will be happy to answer your queries!

For 24-Hour Emergency Travel Assistance Service, please contact 6922 6009 .

File a travel insurance claim, claims procedure and documentation.

Please submit your claim to us with the original Claim form and supporting documents within 30 days upon returning from your trip.

Common documents required for all Travel Insurance Claims:

- Copy of flight itinerary

- Proof of travel, i.e. original boarding pass, air tickets, copy of passport, etc.

Supporting documents needed when making a claim for:

- Medical Report and Medical Certificate

- Original Medical bills / receipts

- Death Certificate, autopsy report, coroner’s findings, if applicable (for death claim)

- Documentary proof of relationship between deceased and claimant (for death claim)

- Motor accident report / police report (for injury / death resulting from a traffic accident)

- Baggage loss or damage report / Property irregularity report from the carrier / airline

- Baggage tag(s) issued from the carrier / airline during check-in

- Written confirmation of carrier / airline’s settlement / rejection of claim for damage / loss of property

- Photographs of damaged items

- Original purchase receipts of damaged/lost items

- Copy of police report lodged at place of loss within 24 hours

- Receipts for replacement of passport / visa

- Transportation and / or hotel bills / receipts incurred for replacement of document

- Baggage delay report

- Written confirmation from carrier / airline on reason and duration of delay

- Acknowledgement receipt of baggage received

- Medical Report and other medical documents / Death Certificate

- Proof of relationship (if due to sickness, injury or death of related person)

- Written advice or medical certificate from a Registered Medical Practitioner to cancel / curtail trip

- Original tour booking invoice / receipt

- Travel agent and / or airline’s confirmation of the refund amount

- Original invoice / receipt for charges incurred in amending or purchasing additional air ticket (for trip curtailment)

- Written confirmation from carrier / airline on reason and duration of delay, overbooked flight, travel misconnection, and / or diversion

- Air ticket and Boarding pass

- Copy of police report lodged within 24 hours upon discovery

- Invoice of damaged items / quotations

- Original photographs of damaged items

- Do not admit any liability or make any offer, promise or payment without our prior consent

- Forward all correspondence / documents from third parties concerning the accident to us immediately

- Copy of police report lodged (if applicable)

We will contact you for any additional documents that may be required.

You may submit your claims online . Kindly note that it may take longer to process a claim if we require additional information or documents from you. For any claims enquiry, amendment of details or submission of supporting or original documents, please email our friendly claims officers at [email protected] with our acknowledgement reference number – MTC/YYYY/000000.

We will keep you updated on your claim(s) by email. You can also call our Hotline at 6922 6003 to check on your claim(s).

Thank you for insuring with us.

Discover more about Travel Insurance in Singapore

Travel Essentials: Must-See Cities and Insurance Insights for Japan

Japan is an archipelago stretching along the eastern coast of Asia, made up of four main islands: Honshu, Hokkaido, Kyushu, and Shikoku. This geographic diversity brings a range of climates and landscapes, from the snowy mountains of Hokkaido to the tropical beaches of Okinawa. Whether you’re a first-time traveller or a yearly visitor, Japan continually…

Travel to Bali: Essential Insurance Tips for a Tropical Escape

Bali, Indonesia’s famed island paradise, beckons travellers with its enchanting blend of lush landscapes, friendly people, and serene beaches. Known for its majestic temples, vibrant arts scene, and world-renowned surf spots, Bali offers a myriad of experiences for every type of holiday-goer. As you plan to bask in the island’s natural beauty and dive into…

Travel Smart in Taiwan: Key Insurance Insights and Tips for Your Journey

Taiwan is a land of stunning contrasts, delightful food and friendly people. The island boasts a landscape as diverse as its cultural heritage, from the soaring peaks of the Central Mountain Range to the serene beaches of Kenting. Prefer food to scenery? Taiwanese cuisine, a delightful blend of local flavours and foreign influences, offers foodies…

- Flash Deal! Get up to 40% off

With no additional premium needed, get up to $150,000 coverage 1 expenses and emergency medical evacuation if you are diagnosed with COVID-19 during your travels. Read more

Embark on your travels with financial protection. Yes now you can – whether it’s a much-deserved holiday, that overdue adventure tour, a quick weekend getaway or essential work travel.

Now you can be fully immersed in your travel experiences, knowing that TravelSmart Premier is providing you the protection against unexpected events –from travel delays to leisure adventurous activities accidents.

For existing customers, we will pre-fill your details to simplify your purchase. Use the Great Eastern App to make a faster purchase today.

Key benefits

Extended coverage for travel inconveniences due to covid-19.

Whether you, your relative or travel companion on the same trip is diagnosed with COVID-19, you can be assured that your coverage is extended to support cancellations and postponements. Get complete peace of mind with an automatic extension of coverage up to 30 days, without extra premium, if you are hospitalised or quarantined overseas due to COVID-19.

Comprehensive worldwide protection with extensive medical coverage

Travel with ease as you are supported with our 24-hour international emergency assistance services including up to $1 million emergency medical evacuation coverage.

Our plan also extends to cover medical expenses that includes Emergency Dental Treatment 2 , Traditional Chinese Medical (TCM) and Chiropractor treatments.

Protect against unexpected travel cancellation and inconveniences

Up to $15,000 coverage against flight cancellations and includes coverage for other travel inconveniences, like loss of baggage, non-recoverable accommodation expenses and trip disruptions due to unforeseen events.

Complimentary benefits at no extra premium 2

Indulge in action-packed adventures like mountaineering, snowboarding and skydiving, knowing you are covered at no additional premium.

Your questions answered

(Applicable for Elite and Classic single trip 2-way plans and annual multi-trip plans, each trip must not exceed 90 days.)

If you are purchasing a new policy, we have extended the TravelSmart Premier policy to cover certain situations pertaining to COVID-19. This means that for some benefits, cover is expanded to include losses occurring after COVID-19 was a known event and could reasonably have been expected to lead to a claim. For a detailed summary of what is covered or not covered for COVID-19, please refer to the policy wording.

Before purchasing the policy, please note that: • Your Trip is under the latest permitted travel arrangement as per Singapore Government travel advisory. • For single-trip policies and annual multi-trip policies, the extension only applies if the trip is no longer than 90 days in a row. • The extension is applicable to Elite and Classic plans only. • You are not serving stay home notice or quarantined due to COVID-19 or traveled to any countries other than the list of countries permitted as per Singapore Government travel advisory within 14 days before your trip started. • If required by authorities, you must take a COVID-19 Polymerase Chain Reaction (PCR) test or any COVID-19 equivalent test approved by Singapore authorities within 72 hours before the start of your trip and you must be tested negative. Otherwise, there is no cover under section 38a - Medical expenses while overseas, section 38b - Emergency medical evacuation, section 38c - Repatriation, section 38g - Automatic extension of cover, section 38h – Overseas quarantine allowance and section 38i - Overseas hospital allowance of this extension. • We will not cover if you, a relative, or a travel companion is diagnosed (or suspected of being infected) with Covid-19 at the point of purchase of this policy or trip.

Q1: What are the benefits provided for COVID-19 cover?

Please refer to the table below for COVID-19 coverage:

Q2: Where can I find details on the latest permitted travel arrangements issued by the Singapore government?

For the latest permitted travel arrangements issued by the Singapore government, please visit ICA Safe Travel website at https://safetravel.ica.gov.sg/ .

Q3: If the destination that I am going to has been suspended from the latest permitted travel arrangement as per the Singapore authorities, will I still be covered for the COVID-19 extension if I proceed with the trip?

No, the COVID-19 extension is only applicable if your trip is under the permitted travel arrangements as per the Singapore Government travel advisory at the point of your trip commencement.

Q4: If I have already departed for my trip before the permitted travel arrangement was suspended by the Singapore authorities, will I still be covered for the COVID-19 extension?

Yes, you will still be covered under the COVID-19 extension in view that the permitted travel arrangement was suspended after you have departed for your trip.

Q5: Will the policy cover my loss if I need to cancel my trip due to being diagnosed with COVID-19?

We will pay for any non-recoverable travel, accommodation expenses and/or cost of entertainment tickets that were paid in advance due to the cancellation of your trip if you are diagnosed with COVID-19 in Singapore within 30 days prior to the scheduled departure date of your trip. Please note that reimbursement of any travel and/or accommodation expenses redeemed using mileage points, holiday points or any reward schemes is excluded. If the policy is purchased less than seven days before your departure date, the Trip Cancellation benefit will only apply upon death due to COVID-19.

Q6: Will the policy cover my loss if I need to postpone my trip due to being diagnosed with COVID-19?

We will pay for any non-recoverable administrative charges arising from your travel and accommodation expenses that were paid in advance due to the postponement of your trip if you are diagnosed with COVID-19 in Singapore within 30 days prior to the scheduled departure date of your trip. Please note that reimbursement of any travel and/or accommodation expenses redeemed using mileage points, holiday points or any reward schemes is excluded.

Q7: I want to cancel my travel plans because I'm afraid to travel due to COVID-19. Am I covered?

Trip cancellation due to concern or fear of travel because of COVID-19, is not covered under the policy.

Q8: Can I claim for compensation if my flight is delayed by airline following instruction or recommendation by the government due to COVID-19 situation?

Flight delay by airline following instruction or recommendation of the government due to COVID-19 situation does not fall under the policy coverage.

Q9: If I contracted COVID-19 while traveling overseas, can I claim for medical expenses incurred?

We will reimburse the overseas medical expenses incurred up to 90 consecutive days from the date you are diagnosed with COVID-19. Please note that the policy will not cover your overseas medical expenses incurred if you are travelling against the advice of the Government or any local authority at the destination.

Q10: Will the policy cover my loss if I am diagnosed with COVID-19 during my trip and as a result, I am unable to continue with the trip?

We will pay up to the sub-limit that applies to your selected plan for the reasonable extra travel expenses or the cost of the unused portion of non-recoverable travel expenses (economy class), accommodation costs and entertainment tickets (for admission to theme parks, musicals, plays, theatre or drama performances, concerts or sports events) that you paid in advance if you are forced to change any part of your trip as a direct result of you, a relative on the same trip, or a travel companion being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q11: Will my policy be automatically extended in the event that I am hospitalised overseas or quarantined due to COVID-19?

We will automatically extend your period of insurance with no extra premium for up to 30 days if you are hospitalized or quarantined overseas as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q12: If I am quarantined overseas, am I entitled to any overseas quarantine allowance under my travel insurance

We will pay you a cash benefit up to the limit that applies to your selected plan for each full 24-hour period of quarantine, if you are placed under mandatory quarantine by the local authorities as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas. Quarantine benefit is payable for quarantine at designated facility which is legally recognized by respective countries’ legislation.

Q13: If I am hospitalised overseas, am I entitled to any hospital allowance under my travel insurance?

We will pay you a cash benefit that applies to your selected plan for each full 24-hour period that you are in hospital overseas as an inpatient as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q14: If I contracted COVID-19 upon my return to Singapore, can I claim for medical reimbursement?

The policy is designed to protect you during your overseas journey. If you are diagnosed with COVID-19 within Singapore, after your journey, your policy will not cover the costs of any medical expenses incurred locally.

Q15: Who can purchase TravelSmart Premier?

In order to qualify for travel insurance from Great Eastern, you must meet the following criteria: • You are a Singaporean or Singapore Permanent Resident; or foreigner with a valid Employment Pass, Work Permit, Dependant’s Pass, Student’s Pass or Long Term Social Visit Pass residing in Singapore. • You are at least 18 years old at the time of purchase (only required if you are the applicant). • You are not travelling contrary to the advice of a qualified medical practitioner or for the purpose of obtaining medical treatment. • You bought the policy before you leave Singapore on your trip.

Q16: What is the difference between TravelSmart Premier Basic, Classic and Elite Plans?

The differences are in the policy features and maximum amounts payable per person per trip in the event of a claim. For the best cover and highest protection, we suggest you choose Elite plan. You can view the travel policy document and compare the amounts payable for each of the policy features, to help you choose a suitable plan.

Q17: Who is considered Family under TravelSmart Premier?

For Single Trip Policies, Family means: • An adult and/or his/her spouse and unlimited number of biological or legally adopted children; or • One (1) or two (2) adults who are not related by marriage and a maximum of four (4) children who must be at least family related (i.e. biological or legally adopted child or ward, sibling, grandchild, niece, nephew or cousin) to any one of the adults; and All insured persons under the Single Trip Family Cover must depart from and return back to Singapore together at the same time as a Family.

For Annual Multi-Trip Policies, Family means: • An adult and/or his/her spouse and unlimited number of biological or legally adopted children; and • The insured persons under the family cover are not required to travel together on a journey. However, child insured person under the age of ten (10) years must be accompanied by a parent or adult guardian for any trip made during the period of insurance.

Q18: What do I indicate as the Period of Insurance?

You will need to indicate the start date and end date of your trip for the Period of Insurance. The start and end date will be based on Singapore time. • Start date: The date you are departing from Singapore (e.g. If you are departing from Singapore on 04 Dec 2020 23:50, you should indicate the Start Date as 04 Dec 2020). • End date: The date you are arriving in Singapore (e.g. If you are arriving in Singapore on 05 Dec 2020 00:30, you should indicate the End Date as 05 Dec 2020).

Q19: Can I purchase TravelSmart Premier for my child who is traveling on a student exchange program or field trip?

Yes, child below 18 years old can apply for any plans under an individual cover, provided the proposal is made in the parent or adult guardian's name. Child below 10 years old must be accompanied by an adult (parent or guardian) for the entire trip. Please note that child benefits apply.

Q20: Can I purchase travel insurance if I am already overseas?

No, you will need to purchase your travel insurance before setting off for your overseas trip from Singapore. We strongly encourage you to purchase early before departure as our travel insurance provides pre-journey coverage as well.

Q21: If I have pre-existing illness, can I still purchase travel insurance?

Yes, you may still buy the policy. However, please note that the policy does not cover any loss, damage or liability directly or indirectly arising as a result of any pre-existing medical condition. For more information, please refer to your policy documents.

Q22: I will be travelling to more than two countries and will be back to Singapore before flying to the next country (e.g. Singapore > Bangkok > Singapore > Seoul> Singapore). Can I purchase one single trip policy for the entire journey in this case?

Sounds like a great trip! In this case, you will need to buy 2 separate single trip policies because the coverage for a single trip policy ends when you return to Singapore. Alternatively if you travel more than 3 times a year, an annual policy would be recommended as your insurance costs will be considerably cheaper compared to buying a single trip travel policy each and every time.

Q23: I’m travelling to more than one country during my trip. Can I still get a policy?

Yes, please select all destinations on your itinerary.

Q24: If I am travelling overseas to seek medical treatment, can I take up travel insurance?

Our policy covers people who are travelling overseas for business or for holiday. It is not intended to cover people who are travelling to seek medical treatment.