IELTS Mentor "IELTS Preparation & Sample Answer"

- Skip to content

- Jump to main navigation and login

Nav view search

- IELTS Sample

IELTS Writing Task 2/ Essay Topics with sample answer.

Ielts essay # 1161 - today’s food travels thousands of miles before it reaches customers, ielts writing task 2/ ielts essay:, today’s food travels thousands of miles before it reaches customers., why is this so is this a positive or negative development.

- IELTS Essay

- Writing Task 2

- IELTS Essay Sample

- Positive or Negative Development

IELTS Materials

- IELTS Bar Graph

- IELTS Line Graph

- IELTS Table Chart

- IELTS Flow Chart

- IELTS Pie Chart

- IELTS Letter Writing

- Academic Reading

Useful Links

- IELTS Secrets

- Band Score Calculator

- Exam Specific Tips

- Useful Websites

- IELTS Preparation Tips

- Academic Reading Tips

- Academic Writing Tips

- GT Writing Tips

- Listening Tips

- Speaking Tips

- IELTS Grammar Review

- IELTS Vocabulary

- IELTS Cue Cards

- IELTS Life Skills

- Letter Types

- Privacy Policy

- Cookie Policy

- Copyright Notice

- HTML Sitemap

Welcome Guest!

- IELTS Listening

- IELTS Reading

- IELTS Writing

- IELTS Writing Task 1

- IELTS Writing Task 2

- IELTS Speaking

- IELTS Speaking Part 1

- IELTS Speaking Part 2

- IELTS Speaking Part 3

- IELTS Practice Tests

- IELTS Listening Practice Tests

- IELTS Reading Practice Tests

- IELTS Writing Practice Tests

- IELTS Speaking Practice Tests

- All Courses

- IELTS Online Classes

- OET Online Classes

- PTE Online Classes

- CELPIP Online Classes

- Free Live Classes

- Australia PR

- Germany Job Seeker Visa

- Austria Job Seeker Visa

- Sweden Job Seeker Visa

- Study Abroad

- Student Testimonials

- Our Trainers

- IELTS Webinar

- Immigration Webinar

IELTS Writing 2 Topic: Food

Updated On Oct 25, 2021

Share on Whatsapp

Share on Email

Share on Linkedin

Limited-Time Offer : Access a FREE 10-Day IELTS Study Plan!

Today’s fresh food like vegetables or fruits travels thousands of miles from the rural areas or farms before it reaches customers in cities or urban areas. Why is this? Is this a positive or negative trend?

Get Evaluated for FREE:

Do you have an essay on this topic? Please post it in the comments section. One of our IELTS trainers will evaluate your essay from an examiner’s point of view and reply to the comment. This service is completely FREE of cost.

Direct Question Essay

Introduction

- Paraphrase the topic of the essay.

- Paragraph 1 – The spread of food to far-away places is cost-ineffective. Such fees related to gasoline, transportation delivery, staff management and other types of insurance are way beyond the pocket of suppliers. However, economically, it bestows upon both producers and consumers more noticeable benefits.

- Paragraph 2 – The second disadvantage of this trend is believed to trigger the inability to control the quality of food and growing dependence of each nation. The past has shown that Roman, as a consequence of relying on food chain supply of other nations, ever saw its power going into steep decline whereas the task of far-distance distribution can hardly ensure the thorough examination between suppliers and buyers, and trigger unwanted virus damaging the food.

- Conclude the essay by summarizing the topic and providing an inference.

Sample Essay

We all need food to survive. It is thought that with the domination of cutting-edge technology, such as airplane, food is accessible to everywhere while others see it as a danger, rather than a boon . I totally support the mobile trend in food distribution .

First of all, opponents of this tendency argue that the spread of food to far-away places is cost-ineffective . Such fees related to gasoline, transportation delivery, staff management and other types of insurance are way beyond the pocket of suppliers. However, economically, it bestows upon both producers and consumers more noticeable benefits. Due to scarcity of food in some areas, as a result of frozen or extremely scorching weather, crop failures are predictable, leading to a skyrocketing price . Hence, with the in-time delivery from other zones which are available in this type of needed food, the prices can be curbed and their taste is fully satisfied while businessmen who truly prioritize the demand of customers over others gain a huge amount of profit. Besides, as living standards of human escalates non-stop, their need for varied food, from eastern to western, is more urgent than ever, especially in times of globalization. As there goes a saying “ variety is the spice of life ”, food transported from thousands of miles away from its farm is inevitable.

The second disadvantage of this trend is believed to trigger the inability to control the quality of food and growing dependence of each nation. The past has shown that Roman, as a consequence of relying on food chain supply of other nations, ever saw its power going into steep decline whereas the task of far-distance distribution can hardly ensure the thorough examination between suppliers and buyers, and trigger unwanted virus damaging the food. Nevertheless, gone are the days that food was easily ruined by external factors when refrigerators and other types of modern innovations are employed to keep food fresh and pasteurize it effectively. Another point is that Roman might have seen a quick economic recovery if successfully developing other industries to compensate for their lack of food supply . Geographically, each nation is born to be in a location which could be either suitable or hostile to food production, but by focusing on their inherent strengths and exchanging their products, food supply and other types of products are readily accessible to both, and at the same time, this is conducive to heightening the specialization in their production and maximizing their output in general. Moreover, with this trend growing ever-prevalent , procedures of supervising food set up by food experts are internationalized. Entering the market of Wal-mart in America, customers are able to choose the lowest price dishes, while still feeling satisfied with their quality by dint of clear markings of out-of-date and usage attached to each item. Equally important, this tendency is a contributor to pressuring local food companies to continuously enhance their quality; otherwise, customers will turn to other markets for better ones with less cost.

All things considered , I strongly hold onto the view that more gains than pains are realized in this scenario for its cost-effective, motivational, win-win benefits for customers, producers and governments.

Domination (noun) control or power over other people or things

Cutting-edge (adj) extremely modern and advanced

Boon (noun) something useful that brings great benefits or makes your life easier

Bestow something on someone (verb) to give valuable property or an important right or honour to someone

Scorching (adj) extremely hot

Skyrocket (verb) rising quickly to a very high level

Variety is the spice of life (Cliché) You should try many different kinds of experiences, because trying different things keeps life interesting.

Band 9 Sample Essay

Unlock Essay

Signup/login to unlock band 9 essay and ace the IELTS

The system followed by grocery traders and merchants for procurement of fresh supplies is quite sophisticated in this day and age. Since the production of farm products is restricted to rural areas, transportation is the only avenue for obtaining fruits and vegetables for the urban market. Although there are various underlying reasons for this trend and there is a debate on whether such a system is feasible or not, this has been the conventional method followed by businesses across the globe. In the following paragraphs, I will explore and provide answers to the questions posed by the topic.

To begin with, we are all aware of the fact that agricultural activities are most prevalent in the countryside. Since rural areas are less polluted and the land is rich in nutrients, farming activities are abundant in such places. Thus, the primary supply of products like fruits and vegetables comes from rural areas. Moreover, due to the abundance of free land, the establishment of huge farms and plantations is easier in the country.

On the other hand, the demand for such farm products is greater in urban areas due to cities and towns being more densely populated. Consequently, traders have to bear enormous expenses on transportation so that these products are made available to the urban population in supermarkets and grocery stores. Although such expenses can be managed by large scale organizations with economies of scale, the same is not possible for small-time businesses. Furthermore, there are other costs like proper storage of these products as they are perishable in nature. All these limitations make this current approach costly and impractical for new and small-scale vendors.

In conclusion, I would like to say that even though the framework of procuring farm products through long-distance transportation is widely practised, it is not suitable for various reasons. As the integrity and the quality of such products become questionable when travelling huge distances from rural to urban areas, an improved process that is both efficient and cost-effective has to be implemented.

More Writing Task 2 Essay Topics

- I t Is Better For College Students To Live In Schools Than Live At Home With Their Parents

- Many Students Have To Study Subjects Which They Do Not Like

- Some People Argue That We Should Do Research Into Their Family History

- Some People Believe That Excessive Use Of Modern Technologies

- Parents Often Give Children Everything They Ask For And Do What They Like

Also check:

- IELTS Essay Topics

- Tips to write introduction in IELTS Writing Task 2

- Tips to write great writing essay

- IELTS Sample essays

- IELTS Writing task 2 Preparation Tips

- Tips to Improve IELTS Writing Skills

- How to get band 8 in IELTS Writing Task 2

- IELTS Writing recent actual test

- IELTS Direct question essay

- IELTS Band 9 essays

- Advantage and Disadvantage Essays

- IELTS Writing Answer sheet

- IELTS map vocabulary

- IELTS Writing Task 1 Connectors

Practice IELTS Writing Task 2 based on Essay types

Start Preparing for IELTS: Get Your 10-Day Study Plan Today!

Courtney Miller

Courtney is one of our star content writers as she plays multiple roles. She is a phenomenal researcher and provides extensive articles to students. She is also an IELTS Trainer and an extremely good content writer. Courtney completed her English Masters at Kings College London, and has been a part of our team for more than 3 years. She has worked with the British Council and knows the tricks and tips of IELTS.

Explore other Opinion Essays

Nehasri Ravishenbagam

Janice Thompson

Whitney Houston

Post your Comments

Posted on Nov 3, 2021

Band score : 5

Concentrate on the structure of the essay. This is a direct question essay which means you have to answer both parts of the question : one in each body paragraph. Also, in conclusion, you just restate points. You will not answer the second part of the question in conclusion.

Recent Articles

Kasturika Samanta

Raajdeep Saha

Our Offices

Gurgaon city scape, gurgaon bptp.

Please enter Email ID

Please enter phone number

Application

Please select any one

Already Registered?

Select a date

Please select a date

Select a time (IST Time Zone)

Please select a time

Mark Your Calendar: Free Session with Expert on

Which exam are you preparing?

Great Going!

Get a free session from trainer

Write better, score higher.

IELTS Writing Task 2

You should spend about 40 minutes on this task.

Today’s food travels thousands of miles before it reaches customers. Why is this? Is this a positive or negative trend? Give reasons for your answer and include any relevant examples from your own knowledge or experience.

Write at least 250 words.

😩 Feeling stuck? View sample answers below ⬇️ or get another random Task 2 topic.

🤩 Sample answers

Model essay #1:, today’s food travels thousands of miles before it reaches customers. why is this.

In today's globalized world, food often travels long distances before it reaches consumers. This phenomenon can be attributed to several factors. Firstly, advancements in transportation and refrigeration technology have made it easier and more economical to transport perishable goods across continents. Additionally, the demand for out-of-season produce and exotic food items has led to an increase in international food trade. As a result, consumers have access to a wide variety of food products throughout the year.

The trend of food traveling thousands of miles has both positive and negative implications. On the positive side, it allows consumers to enjoy a diverse range of food options that may not be locally available. This can contribute to cultural exchange and culinary exploration, enriching people's dining experiences. Moreover, it supports global food security by enabling the distribution of food from regions with surplus to those facing shortages.

However, there are also negative aspects to consider. The extensive transportation of food contributes to carbon emissions and environmental degradation. Furthermore, it can lead to the loss of freshness and nutritional value in the products, as extended travel times may result in reduced quality. Additionally, the reliance on long-distance food transport can undermine local agriculture and traditional food systems, impacting the livelihoods of small-scale farmers.

In conclusion, while the extensive travel of food has facilitated culinary diversity and global food accessibility, it also comes with environmental and socio-economic drawbacks. It is essential to strike a balance between the benefits of international food trade and the need for sustainable, local food systems. Consumers can play a role in supporting local producers and making informed choices to minimize the negative impacts of long-distance food transport.

Model Essay #2:

In today's interconnected world, the journey of food from farm to table often involves covering thousands of miles. This trend can be attributed to various reasons. Firstly, global trade agreements and economic incentives have encouraged the international exchange of food products. Additionally, consumers' preferences for diverse and exotic foods have driven the demand for imported goods. Furthermore, advancements in logistics and refrigeration technology have made it feasible to transport perishable items across long distances.

From a positive perspective, the extensive transportation of food results in a wider variety of options for consumers. It allows individuals to enjoy seasonal produce and specialty items from different parts of the world, enriching their culinary experiences. Moreover, it supports the livelihoods of farmers and food producers in various countries by providing access to international markets. Additionally, it contributes to cultural exchange and global interconnectedness through the sharing of traditional cuisines and food practices.

However, there are also negative implications associated with the long-distance travel of food. The environmental impact of carbon emissions from transportation and the use of packaging materials raises concerns about sustainability. Furthermore, the reliance on imported food may lead to a loss of connection to local food systems and agricultural traditions. Additionally, it can create dependency on foreign sources, potentially impacting food security in the long run.

In conclusion, while the extensive transport of food offers consumers diverse choices and supports global trade, it is crucial to consider its environmental and cultural ramifications. Finding a balance between international food trade and supporting local agriculture can contribute to sustainable and diverse food systems. Consumers can make informed decisions to minimize the negative impacts of long-distance food transport, such as choosing locally sourced products and advocating for sustainable food practices.

✍️ Evaluate your essay for free

You can submit your essay for free evaluation. We will provide you with your score and give you feedback on how to improve your essay.

🤓 More IELTS Writing Task 2 topics

- People find it very difficult to speak in public or to give a prese...

- Some people prefer to eat at restaurants while others prefer to pre...

- Some people think that politicians have the greatest influence on t...

- The number of overweight people in many countries is increasing ala...

- There are many different types of music in the world today. Why do ...

- Nowadays, many people like to spend their free time and meet others...

Or view the list of all tasks .

IELTS Practice.Org

IELTS Practice Tests and Preparation Tips

- Band 9 IELTS Essays

Foods Travels Thousands Of Miles From Producers To Consumers

by Manjusha Nambiar · Published February 3, 2019 · Updated April 20, 2024

Need help with writing? Get your writing samples corrected by me .

Sample essay

Food is crucial for our survival. These days, many consumers eat food that has traveled thousands of miles away from their producers. Some people opine that it will be good for the environment if people only eat locally produced food. I agree with this view to a certain extent. In my opinion, consumption of local food will create jobs in the local economy and help the environment, but if people eat only locally produced food, they will have fewer choices.

Environmental problems are a highly debated topic these days. Huge amounts of fossil fuels have to be burned to transport food to distant places. This causes considerable damage to the environment. There will be a massive reduction in the consumption of oil if people start preferring locally grown food and hence it is good for the planet. Another argument in favour of eating locally produced food is its nutrient value. Locally grown food is nutritious because it is free of preservatives. Also, locally grown fruits and vegetables are plucked when they ripen and this retains their nutritional content. By contrast, when they are transported from a distant place, they are plucked when they are still raw and then ripened with the help of chemicals. Regular consumption of such food items will lead to health problems in people.

Even so, in my opinion, eating locally produced food alone is not a viable option because there is a limit to the kind of food that can be grown in each place. For example, fruits like apples and grapes can only be grown in cold climates. Likewise, some fruits and vegetables only grow in hot climates. There are also many regions that are not suitable for cultivation. If people eat only what is available in their region, they choices will be limited. Hence, in my opinion, locally grown food should be given preference. However, it should not be the only food available to people.

To conclude, if people give preference to the local produce, it will certainly benefit their health, the environment and the local economy. Even so, in my opinion, eating locally cultivated food alone is not a viable option because it will seriously limit the food choices people have.

Sample essay 2

Nowadays, food items travel from one country to another country to fulfill consumer demand. According to some people, consuming locally grown food is better than importing it. I agree with this view to a great extent.

Consumption of local produce is good for the environment because food does not have to be transported over long distances. It is good for the local economy and local producers as well. Imported food is usually cheaper. That is why it is imported in the first place. If locally grown apples are cheaper than foreign apples, they will not be imported. When cheap imported foods flood the local market, local producers will not get good prices for their produce. This hurts them. Also, locally grown food tends to be fresher and healthier. Since they reach consumers within hours of leaving the farm, they are unlikely to be laced with preservatives or other harmful chemicals. Imported food, on the other hand, may contain dangerously high levels of chemicals used to enhance their shelf life.

On the other hand, there are also some disadvantages to consuming only locally produced food. If people get to eat only locally grown items, their choice will be pretty limited. Also, if food is not imported local producers will have a monopoly over the market and they may artificially drive up the prices. This is bad for the consumers. In some cases, importing is essential to control prices in the local market and sometimes importing is the only option to deal with shortage of food.

To conclude, if people consume locally grown fruits, vegetables and other foods, it is largely beneficial for the environment and the economy. However, there are downsides too. Personally, I believe that people should favour local food as much as possible. However, in some cases, importing may be necessary to control prices or to ensure availability.

Tags: band 9 essay band 9 essay sample band 9 ielts essay models ielts writing samples

Manjusha Nambiar

Hi, I'm Manjusha. This is my blog where I give IELTS preparation tips.

- Next story Academic IELTS Writing Task 1 | Goods Transported In The UK

- Previous story Some People Think That Allowing Children To Make Their Own Choices Is Likely To Result In A Society Of Individuals Who Only Think About Their Own Wishes

Leave a Reply Cancel reply

You must be logged in to post a comment.

- Academic Writing Task 1

- Agree Or Disagree

- Band 7 essay samples

- Band 8 Essay Samples

- Band 8 letter samples

- Discuss Both Views

- Grammar exercises

- IELTS Writing

- Learn English

- OET Letters

- Sample Essays

- Sample Letters

- Writing Tips

Enter your email address:

Delivered by FeedBurner

IELTS Practice

food travel thousands of miles before it reaches the customer

Today’s food travel thousands of miles before it reaches the customer. is this a positive or negative trend.

We are living in globalization era so that’s why there are no barriers to communication and transportation. Nowadays, food import and export to other area become popular without any restriction as compared to past. It has some pros and cons.

First of all, when food travels to long journey then people receive the variety of food and also help to taste the different cuisine. All in all, people can know about another cuisine. For instance, in India, there are some food and fruits which are imported from other countries and states such as whole wheat pieces of bread, noodles and so on. Moreover, it also increases competition. As a result of it, local farmers produce high-quality products to survive in the competitive market. Apart from it, when in world some emergency situations occur such as war, natural disasters that food is very helpful at that time.

However, every coin has two sides there is some negative impact also. Due to traveling food reduce the quality as well as nutrition value. Furthermore, when food reaches its destination after long travel then it loses its freshness. In addition to it, if one country import food then it put an extra burden on the pocket of the common person. For example, transport charges are included in food price that made it very costly .

To put in a nutshell, I pen down saying that imported food is beneficial as well as harmful also.It gives a chance to taste variety but some preservatives are used to preserve the food that is detrimental to health.

https://www.facebook.com/ieltsfever

Today’s food travel thousands of miles before it reaches the customer

- Click to share on WhatsApp (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to print (Opens in new window)

About The Author

IELTS FEVER

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Search This Blog

Gracia Maria Academy offers free IELTS Task 1 and Task 2 sample answers to help you prepare for the IELTS Test. Admissions are open for Online and Offline IELTS sessions. Call +91 9846 9746 95 to book your slot for a free demo class.

- Writing Task 2 Essay Sample Answer

IELTS Task 2 Sample Answer 28 - The food travels thousands of miles from farm to consumer. Some people think it would be better for our environment and economy if people ate only locally produced food. Do you think the advantages outweigh the disadvantages?

Excellently written essay with 100% task response

brilliant work.

The structure of the essay is always perfect here...plus 100% task achievement👍🏻

Post a Comment

Popular posts.

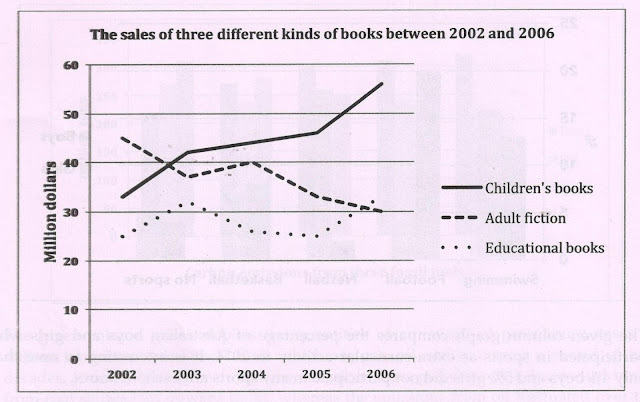

Task 1 (Graph) - The graph below shows the sales of children’s books, adult fiction and educational books between 2002 and 2006 in one country.

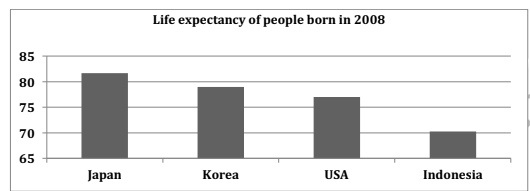

Task 1 (Graph) - The bar chart gives us the information about the life expectancy in Japan, Korea, United States and Indonesia and the table shows us the change in the life expectancy between 1953 and 2008.Summarise the information by selecting and reporting the main features and make comparisons where relevant.

- Listening Tests

- Reading Tests

- IELTS Writing Checker

- IELTS Writing Samples

- Free IELTS Speaking Test Online

- Speaking Club

- Vocabularying

- 2024 © IELTSing

- free ielts Listening test practice 2024 with answers

- free ielts Reading tests online 2024 with answers

- Free IELTS Writing Checker

- Check IELTS Speaking Test

Today, some food travels travel thousands of miles from farms to consumers, Some people think it would be better to our environment and economy if people only eat local food. To what extent do the advantages outweigh the advantages?

IELTS essay Today, some food travels travel thousands of miles from farms to consumers, Some people think it would be better to our environment and economy if people only eat local food.

- The chart below show the information about changes in the house prices in five different countries between 1990 and 2002 compared with average house prices in 1989. . ? The specified bar graph illustrates proportion of average house rate in five various countries from 1990 to 2002, which was compared with price in 1989. Overall, it can be seen that, a most downward trend was witnessed from 1990 to 1995, the highest an upward in 1996 to 2002 over given period. Hav ...

- Some people claim that it is acceptable to use animals in medical research for the benefit of human beings, while others argue that it is wrong. Directed medical studies designed to test the effect of medications or treatments are necessary to measure the ability to use them in humans. However, methods that are used for conducting medical research cause a lot of ethical controversies if animal testing is deemed acceptable. In my opinion, ani ...

- It is generally belived that some people are born with certain talents for instance, stort of music and others are not. However, it is sometimes claimed that any can be taught to be become a good sports person or musician. It is totally trusted that most humans are birthed escorted manifest power, for examples, by of athletics and melody and or anothers are not Nevertheless, it is often provided that some child can not be studied to be become a intense sports human of wonderful musician. firstly, there is reason for ...

- You recently visited a store to repair your computer, but they couldn’t fix it. Write a letter to the store manager and say – What was the problem with your computer? – What happened in the store? – What do you want them to do about it? Dear Sir/Mam I am writing to express my dissatisfaction about your poor customer service which i experienced during my last visit in you service store where i came for servicing of my laptop. I am hoping that you would take appropriate action in this regards after receiving this latter. As per my ...

- The line graph below shows the population size, brith and death rate of England and Wales from 1700 to 2000. In the beginning of this period, population size started at 2 or 3 million in the England while this period. The population size dramatically dropped to 1750 and 1800. Even so after 50 years residence rate again increased to 10 millon. In 1850 the residence rate experienced highly increase to from 1 ...

- International tourism and international trade are two important aspects of the development of the economy of a country and a country can get numerous benefits from the close relationship it maintains with foreign countries. It is true that most countries are cooperating to improve their economy and business. International tourism and trade are an essential factor to develop the country, and they can also gain various benefits from it. I extremely agree with this statement which will be described in detail. It is unden ...

- The charts below show the number of magazines sold per person in five countries in 2000 and 2010, with projected sales for 2020. The figure gives information about quantity of newspapers sold per folks in five countries every 10 years from 2000 to 2020. I must admit, the biggest percentage was in country B. On the contrary, the lowest proportion was in country E. Moreover, I can draw the little conclusion that society in cou ...

- People have different hobbies ranging from reading books to mountain hiking. According to some, hobbies must be difficult to be enjoyable while other oppose the idea. What is your viewpoint on this? Science ancient times, many thinkers and philosophers considered that a person should always have something to do. They said, "A rolling stone gathers no moss". People come up with certain leisure time activities. Some opine that hobbies should be difficult to be enjoyable while others support the o ...

- The table below shows the cinema viewing figures for films by country, in millions. The table compares four countries in terms of the number of people who watch four different genres of film at the cinema: Action, Romance, Comedy and Horror. The table indicates that more Indian people watch films at the cinema than the other three nationalities. In all four countries, Action is th ...

- Banks should receive billions of dollars in assistance from their governments during a financial crisis that was in large part their fault. with this statement? During a financial crisis, the government should save banks even though they are the main suspects in this event. In my opinion, these institutions must be kept afloat for sake of the people. Banks are long considered to be a safe haven where one can store their money in order it grow or take loans ...

- The table below shows the sales at a small restaurant in a downtown business district. The tabular chart demonstrates the amount of money earned by a resutrant which is located in downtown business district. The data has been calibrated in dollars. Overall, the sales of returant was maximum during weekdays except weekands on which earing was minimum. Turing to details, resturant ear ...

- You would like a job working in a summer camp which runs sports and outdoor activities for children and young people. Write a letter to the organizers of the summer camp Dear Sir or Madam, Perhaps there is a position at your Sunshine summer camp for an experienced coach My name is John Miller and I am 30 years old. I consider myself an organized, dedicated, approachable and confident person. Furthermore, I have a good communication skills. I have had 3 years expe ...

Interactive visualization requires JavaScript

Related research and data

- Very little of global food is transported by air; this greatly reduces the climate benefits of eating local

- You want to reduce the carbon footprint of your food? Focus on what you eat, not whether your food is local

- Agri-environmental policies weighted by their intensity

- Carbon opportunity costs per kilogram of food

- Environmental footprints of dairy and plant-based milks

- Eutrophying emissions per 100 grams of protein

- Eutrophying emissions per 1000 kilocalories

- Eutrophying emissions per kilogram of food product

- Excess nitrogen from croplands

- Excess nitrogen per hectare of cropland

- Food loss index

- Food waste per capita

- Food: emissions from production and the supply chain

- Food: greenhouse gas emissions across the supply chain

- Freshwater use per kilogram of farmed seafood

- Freshwater withdrawals of foods per 1000 kilocalories

- Freshwater withdrawals per 100 grams of protein

- Freshwater withdrawals per kilogram of food product

- Global emissions from food by life-cycle stage

- Greenhouse emissions per unit of food transported

- Greenhouse gas emissions from food systems

- Greenhouse gas emissions per 100 grams of protein

- Greenhouse gas emissions per 1000 kilocalories

- Greenhouse gas emissions per kilogram of food product

- Greenhouse gas emissions per kilogram of seafood

- Land use of foods per 1000 kilocalories

- Land use per 100 grams of protein

- Land use per kilogram of farmed seafood

- Land use per kilogram of food product

- Nitrogen emissions per tonne of farmed seafood

- Number of agri-environmental policies in place

- Number of agri-environmental policies vs. GDP per capita

- Phosphorous emissions per tonne of farmed seafood

- Scarcity-weighted water use of foods per 1000 kilocalories

- Scarcity-weighted water use per 100 grams of protein

- Scarcity-weighted water use per kilogram of food product

- Self-reported dietary choices by age, United Kingdom

- Share of calories in each food group that are lost or wasted

- Share of food lost in post-harvest processes

- Share of food lost in post-harvest processes by region

- Share of global excess nitrogen from croplands

- Share of global excess phosphorus from croplands

- Share of global food loss and waste by region

- Share of global food miles by transport method

- Share of global greenhouse gas emissions from food

- Share of national greenhouse gas emissions that come from food

- Share of total energy used in agriculture and forestry

- Transport's share of global greenhouse gas emissions from food

- Vegans, vegetarians and meat-eaters: self-reported dietary choices, United Kingdom

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- IELTS Scores

- Life Skills Test

- Find a Test Centre

- Alternatives to IELTS

- General Training

- Academic Word List

- Topic Vocabulary

- Collocation

- Phrasal Verbs

- Writing eBooks

- Reading eBook

- All eBooks & Courses

Task 2: Importing Food

Today’s food travels thousands of miles before it reaches customers. Why is this? Is this a positive or negative trend? Nowadays, an increasing number of food items offered in supermarkets are imported. Sometimes even quite ordinary food has travelled huge distances. I will explore the reasons for this tendency and discuss its benefits and drawbacks. While delicacy and spices have been internationally traded for centuries, today’s global trade with low transportation costs and fewer trade barriers has encouraged the importing of food in large quantities. In some places even everyday items and inexpensive food like pasta or vinegar can be imported cheaper more cheaply than being produced locally. Consequently, supermarkets take advantage of this development. However, imported food comes at a high price for consumers, the local agriculture and the environment. First of all, some food will lose flavour and freshness when travelling by ship for weeks. For example , (comma here) fruit has to be shipped before fully ripe or additional preservatives have to be added to food. Secondly, local farmers may not be able to compete with the low cost of imported food. They will go out of business or stop growing local fruit or vegetable species at all. This can lead to less local variety in food offered. Additionally, the transportation itself is harmful to the environment as it uses fossil fuels. For all of these reasons a quite vocal “local food” movement has formed in recent years trying to promote and preserve food quality and local grown food. (I would not include this last sentence – it detracts from your essay as it is not answering the question i.e. it is not an advantage or disadvantage). It can be argued, (no comma here) that imported food benefits consumers with low prices and more choice. Supermarkets can choose the least expensive supplier worldwide and offer food at a lower price to their customers. Importing food also enables them to offer more choices, like exotic fruits and international food, to their customers. For example, in some countries it would be impossible to sell most kind of fresh fruits and vegetables in winter at all if they were not imported. All in all I think it is worth preserving local food and one should restrict importing foods to products unavailable like delicacy and unseasonable fruits. It will not be easy to reverse this trend, but if consumers choose local food over imported, it can help making to make supermarkets decide to offer more local food again. ================================================== IELTS buddy Feedback: It's an excellent answer so there is little I can add to it. Just be careful to keep on topic as per the sentence I identified in body paragraph 2.

Click here to add your own comments

Return to Writing Submissions - Task 2.

Would you prefer to share this page with others by linking to it?

- Click on the HTML link code below.

- Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

Band 7+ eBooks

"I think these eBooks are FANTASTIC!!! I know that's not academic language, but it's the truth!"

Linda, from Italy, Scored Band 7.5

All 4 Writing eBooks for just $25.86 30% Discount Find out more >>

IELTS Modules:

Other resources:.

- All Lessons

- Band Score Calculator

- Writing Feedback

- Speaking Feedback

- Teacher Resources

- Free Downloads

- Recent Essay Exam Questions

- Books for IELTS Prep

- Useful Links

Recent Articles

IELTS Bundle Writing eBooks: 30% Off

Jun 01, 24 09:55 AM

House Sitting

May 31, 24 03:59 AM

Key Phrases for IELTS Speaking: Fluency and Coherence

May 26, 24 06:52 AM

Important pages

IELTS Writing IELTS Speaking IELTS Listening IELTS Reading All Lessons Vocabulary Academic Task 1 Academic Task 2 Practice Tests

Connect with us

Before you go...

Check out the ielts buddy band 7+ ebooks & courses.

Copyright © 2022- IELTSbuddy All Rights Reserved

IELTS is a registered trademark of University of Cambridge, the British Council, and IDP Education Australia. This site and its owners are not affiliated, approved or endorsed by the University of Cambridge ESOL, the British Council, and IDP Education Australia.

The Food Travels Thousands of Miles From Farm

The food travels thousands of miles from farm to consumer. Some people think it would be better for our environment and economy if people only ate locally produced food. To what extent do the advantages outweigh the disadvantages?

Sample Answer of The Food Travels Thousands of Miles From Farm to Consumer

Introduction.

Nowadays, supermarkets are stocked with food products from around the world. Some individuals are of Nowadays, supermarkets are stocked with food products from around the world. Some individuals believe that this imported food has a detrimental effect on our economy and culture and it would be better if people ate only the local produce. Certainly, the disadvantages of imported food outweigh the advantages.

Body Paragraph 1

On the positive side, transporting food over a long distance gives us a lot of choices. We can taste a variety of fruits and vegetables from all parts of the world. For example, about ten years ago, we hardly saw kiwi fruit from New Zealand. But, now it has a place on every fruit stand. Secondly, many people get employment in this field. Small farmers have a chance to expand globally, and it increases the overall economy of the country. Finally, it helps in developing good relations between countries, which helps in international cooperation and peace. If countries are dependent upon one another’s economic success, then the armed conflict would be less likely.

Body Paragraph 2

On the other hand, importing food can hurt local culture. This can be seen in Japan, where imported food has become more popular than traditional, local produce, eroding people’s understanding of their own food traditions. Although some would claim that this is a natural part of economic development, I feel strongly that any loss of regional culture would be detrimental in an increasingly global world.

Body Paragraph 3

A second major reason to reduce imports is the environmental cost. Many food imports, such as fruit, are transported thousands of miles by road, sea and air, making the product more expensive to buy and increasing pollution from exhaust fumes. Even though trade in food exports has existed for many years, I am convinced that a reduction would bring significant financial and environmental gains.

In conclusion, I am certain that it would have environmental benefits if people ate locally produced food. It would also benefit the local economy because, in time, people would prosper commercially as the demand for local and regional produce would remain high, resisting the competition from overseas.

Follow Us on IELTSDATA Twitter

Share this:

Table of Contents

- 1.1 Introduction

- 1.2 Body Paragraph 1

- 1.3 Body Paragraph 2

- 1.4 Body Paragraph 3

- 1.5 conclusion

- 1.6 Share this:

Manpreet Singh

Hello, I'm Manpreet Singh, and it's my pleasure to welcome you to IELTSdata.org. For over a decade, I have had the privilege of guiding thousands of students and professionals like you on their journey to achieve their desired scores in the IELTS exam. My passion for teaching and my dedication to the English language have been the driving forces behind our platform, and it's an honor to share this journey with you.

1 thought on “The Food Travels Thousands of Miles From Farm”

- Pingback: Academic test 55 Scratching the Surface THE ANDERTON BOAT LIFT

Leave a Comment Cancel reply

Notify me of follow-up comments by email.

Notify me of new posts by email.

Today food travels thousands of miles from the farm to the consumers Why does this happen Is it a positive or a negative trend

Today, food travels thousands of miles from the farm to the consumers. Why does this happen? Is it a positive or a negative trend?

In this day and age, the physical distance for foods to be delivered from agricultural areas to consumers is thousands of miles. There are many reasons that propel farmers to transport foods from their production sites to shops and from an educational perspective, this trend would bring negativity entirely. The primary reason for this trend is the location of the production sites. This is because crops require fertile land and spacious location to grow as well as animals which demand different sources of food that farms can only be the provider. Therefore, those living in the suburbs or downtowns tend to purchase more agricultural products which help to generate more profits for sellers. Another reason is related to geological factors and weather conditions. In some regions, it may be possible for certain types of crops to be fully grown. Taking Canada as an example, tropical fruits such as durians or watermelons are unable to be planted as the weather conditions there tend to be dry or cold throughout the year.

However, this trend would bring negative impacts to the economy and the consumers. First and foremost, transporting foods for a long distance may cause an economic imbalance. In particular, costs related to transportations such as terminal costs, linehaul costs and capital costs, they could be added up to the final price of the productions causing customers have to bear the price. Moreover, it also negatively influences the health of consumers as too much chemicals are used. In order to preserve the products, certain additives and preservants are added to food making them to be edible for a longer time as well as guaranteeing its quality when delivered to buyers. However, if they are not washed in caution, retained residue will be the roots of health-related issues including cancer, allergy or obesity. Taking everything into consideration, this reinforces my perspective that there are numerous roots for food to be transported for a long distance which can lead to the abovementioned consequences.

- Log in or register to post comments

Essay evaluations by e-grader

Grammar and spelling errors: Line 4, column 456, Rule ID: MUCH_COUNTABLE[1] Message: Use 'many' with countable nouns. Suggestion: many ...fluences the health of consumers as too much chemicals are used. In order to preserv... ^^^^

Transition Words or Phrases used: also, first, however, if, may, moreover, so, therefore, well, as to, in particular, such as, as well as

Attributes: Values AverageValues Percentages(Values/AverageValues)% => Comments

Performance on Part of Speech: To be verbs : 20.0 13.1623246493 152% => OK Auxiliary verbs: 8.0 7.85571142285 102% => OK Conjunction : 12.0 10.4138276553 115% => OK Relative clauses : 7.0 7.30460921844 96% => OK Pronoun: 18.0 24.0651302605 75% => OK Preposition: 40.0 41.998997996 95% => OK Nominalization: 10.0 8.3376753507 120% => OK

Performance on vocabulary words: No of characters: 1719.0 1615.20841683 106% => OK No of words: 330.0 315.596192385 105% => OK Chars per words: 5.20909090909 5.12529762239 102% => OK Fourth root words length: 4.26214759535 4.20363070211 101% => OK Word Length SD: 2.91519088992 2.80592935109 104% => OK Unique words: 189.0 176.041082164 107% => OK Unique words percentage: 0.572727272727 0.561755894193 102% => OK syllable_count: 535.5 506.74238477 106% => OK avg_syllables_per_word: 1.6 1.60771543086 100% => OK

A sentence (or a clause, phrase) starts by: Pronoun: 8.0 5.43587174349 147% => OK Article: 2.0 2.52805611222 79% => OK Subordination: 1.0 2.10420841683 48% => OK Conjunction: 0.0 0.809619238477 0% => OK Preposition: 4.0 4.76152304609 84% => OK

Performance on sentences: How many sentences: 15.0 16.0721442886 93% => OK Sentence length: 22.0 20.2975951904 108% => OK Sentence length SD: 47.6591602481 49.4020404114 96% => OK Chars per sentence: 114.6 106.682146367 107% => OK Words per sentence: 22.0 20.7667163134 106% => OK Discourse Markers: 6.86666666667 7.06120827912 97% => OK Paragraphs: 4.0 4.38176352705 91% => OK Language errors: 1.0 5.01903807615 20% => OK Sentences with positive sentiment : 4.0 8.67935871743 46% => More positive sentences wanted. Sentences with negative sentiment : 3.0 3.9879759519 75% => OK Sentences with neutral sentiment: 8.0 3.4128256513 234% => Less facts, knowledge or examples wanted. What are sentences with positive/Negative/neutral sentiment?

Coherence and Cohesion: Essay topic to essay body coherence: 0.167582765147 0.244688304435 68% => OK Sentence topic coherence: 0.0638627234857 0.084324248473 76% => OK Sentence topic coherence SD: 0.0701061546681 0.0667982634062 105% => OK Paragraph topic coherence: 0.121087277465 0.151304729494 80% => OK Paragraph topic coherence SD: 0.0895613365321 0.056905535591 157% => OK

Essay readability: automated_readability_index: 14.1 13.0946893788 108% => OK flesch_reading_ease: 49.15 50.2224549098 98% => OK smog_index: 8.8 7.44779559118 118% => OK flesch_kincaid_grade: 11.9 11.3001002004 105% => OK coleman_liau_index: 12.94 12.4159519038 104% => OK dale_chall_readability_score: 9.56 8.58950901804 111% => OK difficult_words: 101.0 78.4519038076 129% => OK linsear_write_formula: 11.0 9.78957915832 112% => OK gunning_fog: 10.8 10.1190380762 107% => OK text_standard: 11.0 10.7795591182 102% => OK What are above readability scores?

--------------------- Rates: 78.6516853933 out of 100 Scores by essay e-grader: 7.0 Out of 9 --------------------- Note: the e-grader does NOT examine the meaning of words and ideas. VIP users will receive further evaluations by advanced module of e-grader and human graders.

How Far Does Your Food Travel to Get to Your Plate?

On the Hawaiian island of Maui is a sugar museum. It is next door to a sugar processing plant, and surrounded by acres of sugarcane growing. The museum tells the story of the history of sugarcane production on the island, and it is a fascinating testament to the power of one crop to shape the cultural makeup of a place.

The sugarcane growing on those fields is processed in the plant across the street, but only to the “raw sugar” stage. It is then shipped to the C & H Sugar Refinery in Contra Costa County, not far from San Francisco. C & H stands for “California and Hawai’i.” Here, it is refined into the white sugar that is such a ubiquitous part of our American diet.

But that’s not the end of its journey: the sugar is then shipped cross-country to New York, where it is packaged into little individual paper packages of sugar to go on tabletops, which are then distributed all across the country—including Hawai’i.

So if you drive a mile away from that sugarcane field and sit in a café, the sugar packets on your table have traveled about 10,000 miles: to California, to New York, and back again to Hawai’i, instead of the one mile you have between the field and the café.

How Far Does an Apple Travel?

Long-distrance travel is not the exception, but rather the rule, in our current food system. Shipping foodstuffs long distances for processing and packaging, importing,and exporting foods that don’t need to be imported or exported—these are standard practices in the food industry.

In 1996, it was reported that Britain imported more than 114,000 metric tons of milk. Was this because British dairy farmers did not produce enough milk for the nation’s consumers? No, since the UK exported almost the same amount of milk that year, 119,000 tons. Does this make sense?

Nowadays, it is not only tropical foodstuffs, such as sugar, coffee, chocolate, tea, and bananas, that are shipped long distances to come to our tables. It also fruits and vegetables that once grew locally, in household gardens and on small farms. An apple imported to California from New Zealand is often less expensive than an apple from the historic apple-growing county of Sebastopol, just an hour away from San Francisco. But is it really less expensive in the long run?

The True Cost of Food Miles

It is estimated that the meals in the United States travel about 1,500 miles to get from farm to plate. Why is this cause for concern? There are many reasons:

- This long-distance, large-scale transportation of food consumes large quantities of fossil fuels. It is estimated that we currently put almost 10 kcal of fossil fuel energy into our food system for every 1 kcal of energy we get as food.

- Transporting food over long distances also generates great quantities of carbon dioxide emissions. Some forms of transport are more polluting than others. Airfreight generates 50 times more CO2 than sea shipping. But sea shipping is slow, and in our increasing demand for fresh food, food is increasingly being shipped by faster—and more polluting—means.

- In order to transport food long distances, much of it is picked while still unripe and then gassed to “ripen” it after transport, or it is highly processed in factories using preservatives, irradiation, and other means to keep it stable for transport and sale. Scientists are experimenting with genetic modification to produce longer-lasting, less perishable produce.

Those of us who shop at farmers markets have begun to make the transition to supporting a local food system. At the Ferry Plaza Farmers Market in San Francisco, you are able to buy fruits, vegetables, meat, dairy products, eggs, honey, beans, and potatoes that are all grown within a couple of hundred miles of where you live.

An amazing array of foods can be grown here in California, with the Bay Area’s Mediterranean climate, the heat of the Central Valley, and the fog of the coast. We can eat locally and seasonally with very little sacrifice. Still, some crops simply aren’t appropriate for our climate. But we can begin to look at imported foods as things that supplement our local foods, rather than supplant them. We can make a coconut milk curry filled with local seasonal vegetables; we can put local cream into our imported coffee; we can dip local strawberries into melted, fair trade chocolate from cacao grown in the tropics.

Rebuilding a local food system doesn’t mean you never eat anything that has flown overseas, it just means that you start with what is fresh, local, and seasonal. Shopping at the farmers market, maintaining a home garden, or participating in a CSA are wonderful ways to support a local food system. At the same time we help build food security for future generations, feed ourselves and our families food that is delicious and nutritious, and support small-scale local farmers as they work each day to steward our land.

Food Mile Comparisons

A study called “Food, Fuel, and Freeways” put out by the Leopold Center for Sustainable Agriculture in Iowa compiled data from the U.S. Department of Agriculture to find out how far produce traveled to a Chicago “terminal market,” where brokers and wholesalers buy produce to sell to grocery stores and restaurants. We compared these figures to our Ferry Plaza Farmers Market to give you an idea of the difference.

Average Distances from Farm to Market

Terminal Market vs. Ferry Plaza Farmers Market

Apples: 1,555 miles vs. 77 miles

Tomatoes: 1,369 miles vs. 117 miles

Grapes: 2,143 miles vs. 134 miles

Beans: 766 miles vs. 101 miles

Peaches: 1,674 miles vs. 173 miles

Winter Squash: 781 miles vs. 98 miles

Greens: 889 miles vs. 99 miles

Lettuce: 2,055 miles vs. 102 miles

Not-so-happy meal: As fast food prices surge, many Americans say it's become a luxury

Is fast food becoming a luxury?

Yes, say four-fifths of Americans in a new survey about fast-food inflation.

Fast food prices are up 4.8% since last year and 47% since 2014, according to the Bureau of Labor Statistics.

In a new survey of more than 2,000 consumers, the personal finance site LendingTree found that many diners are wincing at their restaurant receipts. Among the findings:

◾ 78% of consumers said they view fast food as a luxury because of its cost.

Protect your assets: Best high-yield savings accounts of 2023

◾ 62% said they are eating less fast food because of rising prices.

◾ 65% said they’ve been shocked by a fast-food bill in the last six months.

◾ 75% said it’s cheaper to eat at home.

The LendingTree survey, conducted in April, was published May 20.

“For generations, American families have looked at fast food as a relatively cheap, inexpensive option for nights where you don’t want to cook after work, or you’re bringing the kids home from soccer practice,” said Matt Schulz, chief credit analyst at LendingTree.

Want a cheap meal? Make it yourself, consumers say

Yet, as prices rise, opinions are changing. When the LendingTree survey asked consumers to name their typical go-to choice for an easy, inexpensive meal, 56% chose “making food at home.” Only 28% picked fast food.

The fast-food price surge inspired a recent USA TODAY analysis of combo-meal prices at five major burger chains. The report found that a Big Mac combo now costs nearly $15 in Seattle. It tracked rising prices across the board, topping out at $20 for a meal at Five Guys.

Earlier this year, a Five Guys receipt totaling $24.10 for one meal went viral , sparking a heated debate about runaway fast-food prices.

"It's so upsetting because it goes against what we are expecting and what we have grown to love about fast food," which is its affordability, said Kimberly Palmer , personal finance expert at NerdWallet.

On top of the sticker shock, rumors circulated recently that Wendy’s and other chains were experimenting with “ surge pricing ,” the technique of charging customers more at peak hours.

Officials at Wendy’s assured customers they had no surge-pricing plans. Nonetheless, in the LendingTree survey, 78% of Americans said they are concerned about surge pricing.

“There’s kind of the perception or the feeling that some businesses are bumping up prices more than they need to because of inflation,” Schulz said.

Fast-food sticker shock: Diners may be retreating from the drive-thru

Industry data suggest diners may be retreating from the drive-thru.

Several fast-food chains, including McDonald’s and Wendy’s, charted a decline in business in the last quarter “as low-income customers have pulled back from spending,” according to the industry journal Restaurant Dive .

In response, “many operators are planning value-oriented offerings this year to bring customers back,” the report said.

$15 Big Macs: As inflation drives up fast food prices, map shows how they differ nationwide

Burger King unveiled a trove of deals and discounts this week for members of its loyalty program, one of several promotions loosely tied to Tuesday’s National Hamburger Day. Wendy’s recently rolled out a 1-cent cheeseburger. McDonald’s reportedly plans a series of $5 meal deals .

“McDonald’s, Wendy’s, Burger King and Jack in the Box are all preparing bundled value meals this summer in a bid to regain customer traffic,” according to Restaurant Business , another industry journal.

High prices aside, most Americans still make at least the occasional McDonald’s run. In the LendingTree survey, three-quarters of consumers said they eat fast food at least once a week.

Daniel de Visé covers personal finance for USA TODAY

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Best travel credit cards of June 2024

- • Credit card strategy

- • Credit card comparisons

Bankrate expert Garrett Yarbrough strives to make navigating credit cards and credit building smooth sailing for his readers. After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor.com, he joined the CreditCards.com and Bankrate teams as a staff writer to develop product reviews and comprehensive credit card guides focused on cash back, credit scores and card offers.

- • Rewards credit cards

- • Travel credit cards

Nouri Zarrugh is a writer and editor for CreditCards.com and Bankrate, focusing on product news, guides and reviews. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Through his thorough card reviews and product comparisons, Nouri strives to demystify personal finance topics and credit card terms and conditions to help readers save money and protect their credit score.

- • Credit cards

- • Personal finance

Stephanie Zito is a professional traveler, self-employed humanitarian consultant and collector of credit card points. She shares savvy travel tips that she’s learned firsthand circling the globe for more than 25 years. She’s a backpacker, expect and premium traveler who’s visited more than 130 countries and all seven continents. Her life motto is “See the world, change the world, have fun doing it!” and her mission is to inspire others along the journey.

The listings that appear on the website are from credit card companies from which Bankrate receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Here's an explanation for how we make money.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Travel credit cards help you earn valuable points and miles on your purchases. For maximum value, some cards earn rewards not only on travel, but also everyday purchases like dining, groceries and gas. You can redeem these rewards for free or discounted flights, hotel stays or to cover other travel-related expenses.

The best travel cards also come with additional features. Even no-annual-fee travel cards are likely to offer perks like sign-up bonuses, intro APR offers and travel insurance. But for top-of-the-line benefits like airport lounge access, elite status and travel credits, expect to pay an annual fee.

View card list

Table of contents

Why choose bankrate.

We helped over 150,000 users compare travel cards in 2023

We evaluated and compared over 40 travel rewards perks

Over 47 years of experience helping people make smart financial decisions

The Bankrate Promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards .

Bankrate's Best Travel Credit Cards of June 2024

- Best starter travel card: Chase Sapphire Preferred® Card

- Best for flat-rate rewards: Capital One Venture Rewards Credit Card

- Best for luxury travel: The Platinum Card® from American Express

- Best for no annual fee: Capital One VentureOne Rewards Credit Card ( See Rates & Fees )

- Best for foodies: American Express® Gold Card

- Best for everyday spending: Citi Strata Premier℠ Card

- Best for intro APR: Bank of America® Travel Rewards credit card

- Best for point values: Chase Sapphire Reserve®

- Best for practical perks: Capital One Venture X Rewards Credit Card

- Best for pairing: Chase Freedom Unlimited®

- Best for hotel bookings: Wells Fargo Autograph Journey℠ Card

- Best no-annual-fee hotel card: Hilton Honors American Express Card

- Best luxury hotel card: Marriott Bonvoy Brilliant® American Express® Card

- Best for transfer partners: Bilt Mastercard®

- Best for gas: Wells Fargo Autograph℠ Card

- Best for companion tickets: Delta SkyMiles® Platinum American Express Card

- Best starter airline card: Southwest Rapid Rewards® Plus Credit Card

- Best for expedited security screening: Bank of America® Premium Rewards® credit card

- Best for first-year value: Discover it® Miles

- Best for fair credit: Credit One Bank Wander® Card

- What to know about travel credit cards

- Tips for choosing the best travel card

Travel credit card perks

How do credit card points and miles work.

- Expert advice on travel cards

How we assess the best travel credit cards

- Frequently asked questions

- Ask the experts

Credit range

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

0 ? 'Showing ' + filterMatchedProductTiles + ' results' : ' '">

Sorry, no cards match these filters

You can still get a personalized list of cards that fit your credit profile in just a few minutes.

You might also consider these cards

Card categories

Best starter travel card

Chase Sapphire Preferred® Card

Bankrate score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Intro offer

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

We calculate this number by multiplying the card's intro offer by Bankrate's valuation of this issuer's rewards program , showing you how much your points or miles are worth in dollars.

Rewards rate

5x on travel purchased through Chase Travel℠. 3x on dining, select streaming services and online groceries. 2x on all other travel purchases. 1x on all other purchases.

Regular APR

- 5x 5x on travel purchased through Chase Travel℠.

- 3x 3x on dining, select streaming services and online groceries.

- 2x 2x on all other travel purchases.

- 1x 1x on all other purchases.

What we love: This popular card comes loaded with features that can make it easy even for occasional travelers to offset the modest $95 annual fee without eating into hard-earned rewards. Plus, its rewards program is one of the best, giving you some of the most valuable travel redemptions — through both Chase and transfer partners — and Chase card pairing opportunities if you want to build your card portfolio eventually. Learn more: Why expert Margaret Weck loves using the Chase Sapphire Preferred Alternatives: If you’re looking for an even simpler travel card, the Capital One Venture Rewards Credit Card is a terrific option. Its flat rewards rate makes it easy to know exactly how much you’ll earn with every purchase and though it can’t match the Sapphire Preferred’s redemption flexibility, it offers more redemption options than the typical travel rewards card.

- You earn Ultimate Rewards points with this card — some of the most valuable and flexible rewards around, especially if you pair it with Chase’s cash back cards in the future.

- The card touts significant long-term benefits like anniversary bonus points and travel credits, as well as travel protections like trip cancellation insurance and a car rental collision damage waiver.

- Doesn’t offer airline- or hotel-specific perks like free checked bags, elite status or free night stays.

- The sign-up bonus is decent, but the card has previously offered higher, chart-topping bonus points.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Best for flat-rate rewards

Capital One Venture Rewards Credit Card

New Venture cardholders can earn 75,000 miles once they spend $4,000 on purchases within 3 months from account opening

5 Miles per dollar on hotels and rental cars booked through Capital One Travel 2 Miles per dollar on every purchase, every day

2 Miles - 5 Miles

- 5 Miles 5 Miles per dollar on hotels and rental cars booked through Capital One Travel

- 2 Miles 2 Miles per dollar on every purchase, every day

What we love: It’s a great option for travelers looking for a straightforward rewards program and flexible redemption options. You'll earn unlimited miles on all eligible spending and can redeem not only for travel bookings, but also as a statement credit to cover travel purchases made in the past 90 days. Learn more: Why expert Jacqueline DeMarco loves the Capital One Venture Rewards Credit Card Alternatives: The Chase Sapphire Preferred® Card offers a higher rewards rate in some everyday spending categories and potentially more valuable points. Chase points are worth 1.25 cents each if you redeem for travel through Chase, while Capital One miles are only worth 1 cent each when you redeem for travel. Plus, Chase rewards are more helpful for occasional travelers since you can redeem as cash back at 1-cent-per-point value.

- Carries solid perks given its low annual fee, including expedited airport purchase security and hotel experience credits, lost luggage reimbursement and more.

- Zero foreign transaction fees make this an excellent choice for international travelers.

- You can’t offset the annual fee with annual travel credits or bonuses alone as you can with some rival cards.

- The card’s sign-up bonus carries a high spending requirement, so it may be tough to earn if you don’t have large purchases on the horizon.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Best for luxury travel

The Platinum Card® from American Express

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- 5X Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year.

- 5X Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

What we love: Luxury travelers and big spenders will appreciate the bevy of travel benefits, including annual statement credits worth around $1,700, elite hotel loyalty status and access to perhaps the most comprehensive airport lounge access available with a credit card. Learn more: Why expert Holly Johnson loves the Platinum Card® from American Express Alternatives: The Capital One Venture X Rewards Credit Card offers a taste of luxury at a lower cost than many premium travel cards. You can unlock a generous rewards rate on both travel and general purchases, complimentary access to popular airport lounge memberships and valuable annual travel credits and anniversary miles.

- Comes with a generous welcome offer and a longer time period to earn it compared to most rewards cards.

- A robust line-up of airline and hotel partners and related perks make this card truly valuable for travelers.

- The $695 annual fee may not be worth it if you don’t spend much on travel frequently or can’t take full advantage of the card’s luxury — and often niche — perks.

- Redeeming and maximizing the card’s credit and benefits requires some legwork and can be a bit confusing.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.