- Small Business

- Private Client Advice

- British Columbia

- New Brunswick

- Newfoundland Labrador

- Northwest Territories

- Nova Scotia

- Prince Edward Island

- Saskatchewan

- English Selected

- secure Login

Get a quote

Home/ Condo/ Tenant

Summer's here and so are travel plans

Get ready for your trip with travel insurance from TD Insurance.

Travel Insurance Plans from TD Insurance

Why it can be important to have travel insurance.

Travelling can be expensive enough on its own, but a medical emergency could cost you much more. It’s also important to note that your credit card might not include travel insurance or may have limited coverage. Whether you’re planning a trip for yourself or your entire family, TD Insurance Travel Insurance can help provide protection from certain unexpected events.

Explore TD Insurance Travel Insurance Plans

TD Insurance Multi-Trip All-Inclusive Plan

This is the most comprehensive plan we offer. It provides you with multiple benefits, including up to $5 million in emergency travel medical coverage, trip cancellation and interruption and more, for multiple covered trips up to the maximum trip duration selected within one year. 1

Sample Insurance Policy - Multi-Trip All-Inclusive Plan

TD Insurance Single-Trip Medical Plan

This plan provides up to $5 million in emergency travel medical insurance coverage for one trip. 2

Sample Insurance Policy - Single-Trip Medical Plan

TD Insurance Multi-Trip Medical Plan

If you travel often, then this multi-trip plan could be more cost-effective than buying a single-trip plan each time. This plan provides you with up to $5 million in emergency travel medical coverage for each covered trip up to the maximum trip duration selected within one year. 3

Sample Insurance Policy - Multi-Trip Medical Plan

TD Insurance Trip Cancellation & Interruption Plan

This plan could be right for you if you do not need emergency medical coverage but want financial protection for eligible non-medical expenses like your trip being cancelled or interrupted due to a covered event. 4

Sample Insurance Policy - Trip Cancellation & Interruption Plan

Compare plans

Please refer to the Sample Policy for defined terms and a full description of features, benefits, limitations and exclusions.

Ready to choose a plan?

Why choose td insurance travel insurance.

- Up to $5 million in emergency travel medical coverage Feel good about your next trip with medical coverage up to $5 million on eligible costs.

- 24/7 emergency assistance by phone worldwide Call our administrator anytime if you have an emergency during your trip.

- Travel medical coverage for dependent child(ren) included with two paying travellers On select plans that have the family coverage 5,6 option, your dependent child(ren)’s travel medical coverage is included at no additional charge.

- Convenient online quotes and claims servicing Available 24/7 when submitted online.

How to apply online

Get a quote in minutes

No obligation to purchase.

Decide whether you want to purchase

After reviewing the details, you can proceed to purchase.

Pay and submit

Review and confirm your purchase.

Submit a travel insurance claim

Start the claims process by visiting our Online Claims Portal.

Let’s connect

Our administrator is ready to answer your questions and help you on your way.

- For 24/7 emergency assistance: 1-833-962-1140 (Canada and the U.S., toll free) or + 1-519-988-7629 (worldwide, collect).

- For quotes, to purchase a policy or any general inquiries: 1-833-962-1143 . Mon-Fri 8am to 8pm ET Saturday 9am to 5pm ET

- For claims: 1-833-962-1140 .

Check your TD credit card travel insurance benefits.

Are you an existing TD Credit Cardholder and dreaming of future travels? Learn about what travel insurance benefits are available on your TD credit card with our Credit Card Travel Insurance Verification Tool.

Information for Quebec Residents – TD and MBNA Credit Card Product Summaries

Below are the Travel Insurance Summaries and Credit Card Insurance Summaries for TD and MBNA credit cards. These summaries provide an overview of the features and benefits of the insurance coverages included with TD and MBNA credit cards.

TD Personal Credit Cards:

- TD Cash Back Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Cash Back Visa * Card Credit Card Insurance Summary

- TD® Aeroplan® Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD® Aeroplan® Visa Platinum * Card Travel Insurance Summary Credit Card Insurance Summary

- TD® Aeroplan® Visa Infinite * Privilege Card Travel Insurance Summary Credit Card Insurance Summary

- TD First Class Travel® Visa Infinite * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Platinum Travel Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Rewards Visa * Card Credit Card Insurance Summary

- TD Emerald Flex Rate Visa * Card Credit Card Insurance Summary

- TD U.S. Dollar Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Low Rate Visa Card Credit Card Insurance Summary

TD Business Credit Cards:

- TD Business Travel Visa * Card Travel Insurance Summary Credit Card Insurance Summary

- TD Business Cash Back Visa * Card Credit Card Insurance Summary

- TD Business Select Rate TM Visa * Card Credit Card Insurance Summary

- TD® Aeroplan® Visa Business Credit Card Travel Insurance Summary Credit Card Insurance Summary

MBNA Credit Cards:

- MBNA Gold Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA Platinum Plus or True Line Mastercard® Credit Card Insurance Summary

- MBNA Rewards Platinum Plus® Mastercard® Credit Card Insurance Summary

- MBNA Rewards World Elite® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA World Elite® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA World Mastercard® Travel Insurance Summary Credit Card Insurance Summary

- MBNA Platinum Plus® Mastercard® Travel Insurance Summary Credit Card Insurance Summary

Other Products and Services You May Want To Consider For Your Trip

TD offers banking solutions, credit cards and competitive exchange rates for your travel needs. Explore our products to learn how TD can enhance your trip.

TD Travel Credit Cards

Earn travel reward points on everyday purchases to redeem for flights, hotels and more.

Foreign Exchange Services

We have over 50 foreign currencies available at competitive rates.

Cross Border Banking

Canadian-based U.S. dollar products with TD Canada Trust can help you avoid foreign exchange fees by allowing you to save and spend in U.S. dollars.

TD Insurance Travel Insurance plans (TD Insurance Multi-Trip All-Inclusive Plan, TD Insurance Single-Trip Medical Plan, TD Insurance Multi-Trip Medical Plan and TD Insurance Trip Cancellation & Interruption Plan) are individual insurance plans administered by Global Excel Management Inc. and its subsidiary, CanAm Insurance Services (2018) Ltd. TD Insurance Multi-Trip All-Inclusive Plan and TD Insurance Trip Cancellation & Interruption Plan are underwritten by TD Life Insurance Company (medical covered causes) and TD Home and Auto Insurance Company (non-medical covered causes). TD Insurance Single-Trip Medical Plan and TD Insurance Multi-Trip Medical Plan are underwritten by TD Life Insurance Company. Medical and claims assistance, claims payment and administrative services are provided by the administrator described in the insurance policies. Coverages and benefits are subject to eligibility conditions, limitations, and exclusions, including pre-existing medical condition exclusions. Please refer to the policy for full details. 1. The TD Insurance Multi-Trip All-Inclusive Plan will provide coverage for each covered trip taken within 1 year up to the maximum trip duration you selected when the policy was purchased. If the oldest person on the insurance policy is 15 days old to 59 years old, the maximum trip duration is 60 consecutive days. If you are 60 years and older, the available maximum trip durations are 22 or 30 consecutive days. Coverage may be subject to conditions, exclusions, and limitations. Refer to your Policy of Insurance for full details of coverage for the TD Insurance Multi-Trip All-Inclusive Plan. 2.Coverage may be subject to conditions, exclusions and limitations. Answering a Medical Questionnaire is required for those 60 years of age or older to determine eligibility for the TD Insurance Single-Trip Medical Plan. Refer to your Policy of Insurance for full details of coverage. 3. The TD Insurance Multi-Trip Medical Plan will provide emergency travel medical coverage for each covered trip taken within 1 year up to the maximum trip duration you selected when the policy was purchased. If the oldest person on the insurance policy is 15 days old to 79 years old, the available maximum trip durations are 4, 9, 16 or 30 consecutive days. If you are 80 years and older, the available maximum trip durations are 4, 9 or 16 consecutive days. Coverage may be subject to conditions, exclusions and limitations. Answering a Medical Questionnaire is required for those 60 years of age or older to determine eligibility for the TD Insurance Multi-Trip Medical Plan. Refer to your Policy of Insurance for full details of coverage. 4.Coverage may be subject to conditions, exclusions and limitations. Refer to your Policy of Insurance for full details of coverage for the TD Insurance Trip Cancellation & Interruption Plan. 5. The TD Insurance Multi-Trip All-Inclusive Plan has family coverage and provides coverage for you, your Spouse and unmarried Dependent Child(ren) if you name them in your application. Spouse means the person to whom you are legally married to; or the person you have lived for at least 1 year and publicly refers to as your domestic partner Dependent Child(ren) means your natural, adopted, or step-children who are: a) unmarried; and b) dependent on you for financial maintenance and support; and i. under 22 years of age, or ii. under 26 years of age and attending an institution of higher learning, full-time, in Canada; or iii. mentally or physically handicapped. All insured persons may travel independently of one another. All covered travellers must be a Canadian resident and be covered by the government health insurance plan of your Canadian province or territory of residence for the entire duration of your trip and at the time you incur a claim. If any of the travellers do not meet these criteria, that traveller will need to complete a separate application for their own policy. Up to 6 travellers including yourself are permitted to be under a policy through our online application. To purchase additional coverage for groups of more than 6 people, please call our administrator at 1-833-962-1143 . 6. Family Coverage is available on the TD Insurance Single-Trip Medical Plan and the TD Insurance Multi-Trip Medical Plan for you, your Spouse and unmarried Dependent Child(ren) if you name them in your application. Spouse means the person to whom you are legally married to; or the person you have lived for at least 1 year and publicly refers to as your domestic partner. Dependent Child(ren) means your natural, adopted, or step-children who are: c) unmarried; and d) dependent on you for financial maintenance and support; and i. under 22 years of age, or ii. under 26 years of age and attending an institution of higher learning, full-time, in Canada; or iii. mentally or physically handicapped. Your Dependent Child(ren) must be travelling with you or your spouse. All covered travellers must be a Canadian resident and be covered by the government health insurance plan of your Canadian province or territory of residence for the entire duration of your trip. Family Coverage is not available when a medical questionnaire is required for any of the travellers. If any of the travellers do not meet these criteria, that traveller will need to complete a separate application for their own policy. Up to 6 travellers including yourself are permitted to be under a policy through our online application. To purchase additional coverage for groups of more than 6 people, please call our administrator at 1-833-962-1143 . Mailing Address: TD Life Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2 TD Home and Auto Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Sorry, we do not offer this product in the selected province

Please visit our homepage to see products available in your province.

- Personal Finance

The TD First Class Travel Visa Infinite Card and its travel insurance benefits

Insurance Coverage

First, it is very important to read the most recent version of the TD First Class Travel Visa Infinite Card Benefits Coverage Guide .

They can change at any time and it is your responsibility to be aware of these insurance benefits .

If you have any questions, please contact TD Customer Service at 1-866-374-1129 . It is strongly recommended that you call them before booking travel with your card and before you leave on your trip.

Eligibility

Travel insurance coverage is only available to :

- Primary cardholder

- Spouse and dependent children of the primary cardholder

- Additional cardholder

- Spouse and dependent children of the additional holder

In addition, the card account must be in good standing . This means:

- The Primary Cardholder has not asked TD to close the Account

- TD has not suspended and revoked credit privileges or closed the account

Eligibility Tool

To make it easier to understand the insurance coverage of its credit cards, TD has put together an interactive tool on travel insurance . In 6 questions, you can quickly find out if you qualify or not, when you pay in full for the trip in cash.

TD First Class Travel Visa Infinite Card Description

Travel medical insurance.

The maximum benefit for emergency medical care is $2,000,000. To be eligible, you only need to have the card, as per the Eligibility section above. This includes the following inclusions:

- Hospitalization

- Physician’s fees

- Private nursing

- Diagnostic services

- Ambulance and air ambulance services

- Prescription drugs

- Accidental dental and emergency relief of dental pain

- Medical Appliances

- Emergency return home

- Transportation to the bedside and compensation for the bedside companion

- Compensation for the travel companion

- Meals and accommodation

- Incidental hospital expenses

- Vehicle return

- Repatriation of deceased

- Baggage return

Trip cancellation and trip interruption insurance

To receive the benefits of this insurance coverage, the full cost of your trip must be paid with your ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card and/or TD Rewards points.

A trip cancellation occurs before departure .

A trip interruption occurs on or after the departure date when the trip has begun .

Eligible reasons may be:

- The death of an insured person or an immediate family member

- A sudden, unexpected illness or accidental injury to a person or a member of his or her immediate family

- A natural disaster at the insured person’s principal residence

- Weather conditions during the trip

Common Carrier Travel Accident Insurance

To be eligible for this insurance, you must:

- Privileges under your account have not ceased or been suspended

- The account is not more than 90 days past due

- And the TD credit card must be in good standing

A common carrier is a land, air or water conveyance that is authorized to carry passengers for compensation. This can be a :

- Ferry or Cruise ship

- Bus or Train

- Cab or Limousine

If there is an accidental death or dismemberment, the maximum benefit is $500,000 .

Delayed and Lost Baggage Insurance

In order to benefit from this insurance, the credit card must have been used to pay 100% of the airfare .

Flight and travel delay insurance

To benefit from this insurance, at least 75% of the cost of your trip must be charged to the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card .

The reason for the delay may be due to weather, an outage or a strike for example.

This flight or travel delay insurance can be up to $500 , for a delay of 4 hours or more .

Hotel/Motel Burglary Insurance

This is for hotel and motel reservations in Canada and the United States only. At least 75% of the total cost of the stay must be charged to the card. The use of TD Rewards points is also valid under certain conditions.

The maximum amount is $2,500 .

Collision and damage insurance for rental vehicles

- Pay for the car rental at the rental agency with the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card MD (payment with TD Rewards points is accepted, under certain conditions).

- Refuse to purchase the Collision Damage Waiver (CDW ) or an equivalent coverage from the rental agency and have it written into the contract

The car rental covers up to 48 consecutive days and the manufacturer’s suggested retail price (MSRP) of the car must be under $65,000 . Some types of vehicles are not insured.

Purchase Assurance and Extended Warranty Protection

Purchase insurance covers items purchased with the ® Visa Infinite* Card" href="https://milesopedia.com/en/credit-cards/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card for 90 days from the date of purchase . If the item is lost, stolen or damaged, it will be replaced or repaired with this insurance.

Extended warranty protection extends the manufacturer’s warranty up to one year . It begins after the manufacturer’s warranty expires and the item must be purchased with the Card.

Mobile Device Insurance

Did your new smartphone or tablet have a major accident and stop working? Mobile device insurance can come to the rescue, up to a maximum of $1,000 in reimbursement!

To qualify, at least 75% of the total cost of the device must be charged to the TD First Class Travel Visa Infinite Card. Under certain conditions, insurance is also eligible if the total cost of the device is financed through a plan with monthly payments .

Emergency travel assistance services

It is not really an insurance, but rather a help to solve a problem during a trip in unknown land. They do not offer payment or refunds. They are more of a medical second opinion or will tell you what to do if you don’t know what to do when you are in total panic.

The phone number is 1-800-871-8334 for Canada or the United States. Or if you are in another country: 1-416-977-8297 (collect).

This phone line can be useful for the following situations:

- Medical consultation and follow-up

- Medical emergency travel and medical referrals

- Payment to medical service providers

- Assistance in case of lost luggage

- Legal assistance

- Replacement of lost tickets and documents

- Translation Services

- Emergency transfer of funds

What to do if you have an insurance claim with the TD First Class Travel Visa Infinite Card

You must call 1-866-374-1129 , within the time frame following the date the event occurred.

In summary, here are the various insurance coverages of the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card :

Bottom Line

In addition to all this insurance to prevent inconvenience, the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card has a very profitable welcome offer from TD Bank .

With all these points, you can afford to get a stay that will not cost much. This is in addition to his annual TD Travel Credit of $100 for Expedia for TD bookings of $500 or more.

To save on travel and insurance, this is a secret card to have in your wallet!

All posts by Caroline Tremblay

Suggested Reading

TD Platinum Travel Visa* Card review

Welcome Offer Ends Jan 6, 2025

Earn up to $370 in value†, including up to 50,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by January 6, 2025.

- Rates & Fees

- Eligibility

6 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

4.5 TD Rewards Points for every $1 you spend on Groceries and Restaurants†.

3 TD Rewards Points for every $1 you spend on regularly recurring bill payments set up on your Account†.

1.5 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

20.99% Purchase APR

22.99% Cash Advance APR

$89 Annual Fee First year Annual Fee Rebate† ; Additional cardholder† $35 ; $0 for subsequent Additional Cardholders

2.50% Foreign Transaction Fee 2.5% of the transaction in CND

Good Recommended Credit Score

$0 Required Annual Personal Income

$0 Required Annual Household Income

By Tyler Wade & Cory Santos

Updated: September 04, 2024

- TD® Aeroplan® Visa Infinite Privilege*

- TD® Aeroplan® Visa Infinite* Card

- TD First Class Travel® Visa Infinite*

- TD Cash Back Visa Infinite* Card

- TD Rewards Visa* Card

- Best travel credit cards

- American Express® Aeroplan®* Card

- BMO Ascend™ World Elite®* Mastercard®*

- Rogers™ World Elite® Mastercard®

Quick overview of the TD Platinum Travel Visa*

The TD Platinum Travel Visa* Card is best for TD Bank users who frequently book their travels through Expedia and want to earn rewards on their everyday spending like bills and groceries.

However, like all credit cards, it comes with its own set of pros and cons. In this comprehensive review, we'll delve into the card's features, benefits, and how it stacks up against other TD offerings and plan programs, helping you decide if it's the right fit for your wallet.

Who is the TD Platinum Travel Visa* Card for?

The TD Platinum Travel Visa* Card is designed for TD Bank users who frequently book their travels through Expedia and want to earn rewards on their everyday spending. It offers a generous welcome bonus, high earn rate on dining, groceries, and Expedia bookings, making it a valuable option for frequent travelers. However, if you're looking for more premium travel perks like airport lounge access, consider other cards in the market, including TD's Aeroplan® Visa Infinite Privilege*

TD Platinum Travel Visa* Card: pros and cons

Generous welcome bonus: Get up to 50,000 TD Rewards Points† when you make your first card purchase and spend $1,000 within 90 days of opening your account.

High earn rate: Earn up to six TD Rewards Points for every $1 spent on Expedia® for TD, 4.5 points on dining and groceries, and three points on recurring bill payments.†

No travel restrictions: No blackouts, seat restrictions, and your points never expire as long as your account is in good standing.

First year fee rebate: Get an Annual Fee Rebate for the first year†.

Limited travel perks: Unlike some premium cards, it doesn't offer perks like airport lounge access.

Not ideal for non-Expedia users: The highest rewards rate is tied to Expedia bookings.

TD® Platinum Travel Visa credit card welcome bonus

New cardholders with the TD Platinum Travel Visa* Card can earn up to $370 in value†, including up to 50,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions apply. Account must be approved by January 6, 2025:

- 15,000 TD Rewards Points after your first purchase with the card †

- 35,000 TD rewards points after you spent $1,000 within 90 days of opening your account †

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by January 6, 2025.

How to earn TD Rewards points with the TD® Platinum Travel Visa

The TD Platinum Travel Visa Card offers an impressive earning rate on several keys categories:

- Earn 6 TD Rewards Points† for every $1 spent when you book travel through Expedia for TD†

- Earn 4.5 TD Rewards Points for every $1 spent on groceries and dining out†

- Earn 3 TD Rewards Points for every $1 spent on recurring bill payments†

- Earn 1.5 TD Rewards points for every $1 spent on everything else†

How to redeem points

The average dollar value of one TD Reward point is $0.005. To make this math easier, let’s crank up the points.

The best way to redeem your points is by travelling through Expedia for TD portal, where 200 points equal 1 dollar.

You can also book travel through any provider where the value goes down a little for the first $1,200 in spending—250 TD Rewards points are worth $1. Redeeming merchandise is not as valuable, where, depending on the retailer, you’ll get, at best, half and at worth a tenth of the value out of your points.

You can also apply your points as a statement credit if you’re trying to pay down a balance.

Key Benefits of the TD Rewards Card

- Expedia benefits: If you frequently book through Expedia, this card offers one of the best rewards rates for your bookings.

- Dining and groceries: Earn a high rate of 4.5 points for every dollar spent at restaurants and grocery stores, making your night out on the town or grocery run even more rewarding.

- Travel insurance: The card includes decent travel insurance coverage, ensuring peace of mind during your travels. However, you can upgrade your coverage for an additional fee to unlock emergency medical insurance.

TD Platinum Travel Visa* Card insurance coverage

The Platinum Travel Visa credit card from TD provides an impressive selection of travel insurance and everyday protection benefits for cardholders, including:

- Flight delay insurance† of up to $500 if your trip is delayed more than 4 hours.

- Delayed and lost baggage insurance† up to $1,000 per insurance person if delayed more than 6 hours.

- Travel accident insurance† up to $500,000 (while travelling on a common carrier like a plane, train, or bus).

- Rental car insurance† for up to 48 consecutive days up to a maximum MSRP of $65,000.

- Mobile device insurance† up to $1,000 in the event of loss, theft, or accidental damage.

- Extended warranty insurance† that doubles the manufacturer’s warranty up to an additional 12 months.

- Hotel burglary insurance† up to $2,500.

- [Optional] Apply for travel medical insurance in case of medical emergencies abroad.

- [Optional] Apply for Trip cancellation insurance to help recover trip expenses or the cost of a trip home.

- [Optional] Apply for TD Auto Club Membership for roadside emergencies.

Rewards Visa cardholders also receive peace of mind thanks to instant fraud alerts; TD Fraud Alerts continuously monitors your TD account registered mobile phone and automatically alerts you if suspicious activity is suspected.

Extra Benefits of the TD Bank Platinum Travel Visa* credit card

- Additional rental car savings: At Avis and Budget locations, you can save a minimum of 10% off the lowest base rate fares in Canada and 5% in the U.S.

- No restrictions: There are no travel blackouts or seat restrictions, and your TD Rewards Points never expire as long as your account is open and in good standing.

- Earn more stars at Starbucks: Link the TD Rewards card to your Starbucks account and earn 50% more TD Rewards points and Stars. Conditions apply.

- Mobile wallet compatibility: Use Apple Pay, Google Pay or Samsung Pay wherever contactless payments are accepted.

- TD mobile app: The app allows you to manage your account, view transactions, block international purchases, and more. It's available in the Apple App Store and Google Play.

- Added payment security: Chip and pin technology for an added layer of security.

What people are saying about the Platinum Travel Visa credit card from TD

- "I've had the TD Visa Platinum Travel card for years and have never complained about the rewards, using the rewards or the use of the card... Redeeming for travel, etc, is very easy through TD for Expedia. A high fee has always been credited back due to my bank portfolio level with TD Bank...so I have no complaints at all, I would highly recommend this card and TD Bank! Satisfied card holder!" - Drmoy1

- "It is a great card with great rates, and we never had any real issues with it. The interest rate is also very good, so yes all is good with this card" - Joshua M

How does the TD Platinum Travel Visa* Compare?

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025.

TD Platinum Travel Visa* vs. TD First Class Travel ® Visa Infinite* Card

The TD Platinum Travel Visa* Card and the TD First Class Travel ® Visa Infinite* Card are both tailored for travel enthusiasts, but they cater to slightly different needs. While any card you choose ultimately depends on your individual travel and spending habits, the TD First Class Travel ® Visa Infinite* Card shines with better earn rates and insurance (including emergency medical).

Yes, the TD First Class Travel ® Visa Infinite* Card charges $50 more in its annual fee, but just like the TD Platinum Travel Visa Card, that fee is rebated in the first year. Also, the First Class card gives you an annual TD Travel Credit† of $100 with Expedia For TD.

For frequent travellers, especially those who prefer to book through Expedia, the TD First Class Travel® Visa Infinite* Card offers more value and benefits.

TD Platinum Travel Visa* Card vs. TD Aeroplan ® Visa Platinum Card

Both cards charge the same annual fee which are both rebated in the first year. They both feature the same travel insurance (and sadly both miss emergency medical travel insurance), purchase security, extended warranty and mobile device insurance.

These cards are virtually identical, except for one crucial difference: the points.

You either earn TD Rewards Points or Aeroplan ® points. With TD, you can book your travel through Expedia or use the “book-any-way” redemption method which reduces your point value, but you can fly anywhere on any airline. With TD’s Aeroplan ® card, you get Aeroplan ® points allowing you to book with Air Canada and its partner airlines.

Essentially, if you bank with TD and love their rewards program, be sure to take advantage of bundle discounts on their chequing, saving, insurance and mortgage. If you’re not loyal to a bank, and love the Aeroplan ® program, go with the TD Aeroplan ® Visa Platinum Card.

Is the TD® Platinum Travel Visa Card worth it?

The TD Platinum Travel Visa* Card is best suited for those who frequently use Expedia for their travel bookings. With its generous welcome bonus, high earn rate on dining, groceries, and Expedia bookings, it offers significant value. However, if you're looking for more comprehensive travel perks, there might be other cards in the market that better suit your needs. The biggest benefits of this card are its earn rate and flexibility in point redemption. The main drawback is the lack of premium travel perks like airport lounge access.

Eligibility requirements of the TD® Platinum Travel Visa Card from TD Bank

To qualify for the TD Platinum Travel Visa* Card, you need to meet the following criteria:

- You must be a Canadian resident.

- You must be at least the age of majority in your province or territory.

There is no minimum income requirement for this card. However, it is important to have a credit score in the good to excellent range.

This offer is not available for residents of Quebec. For Quebec residents, please click here .

The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button. Sponsored Content.

† Terms and conditions apply.

Is the TD Platinum Travel Visa* worth it?

The TD Platinum Travel Visa* Card offers value for frequent Expedia users with its high earn rate on bookings, dining and groceries. Its comprehensive travel insurance and flexible point redemption enhance its appeal. However, its worth depends on individual spending habits and the annual fee's perceived value.

Is the first-year annual fee really rebated for the TD Platinum Travel Visa* Card?

Yes, the TD Platinum Travel Visa* Card often offers promotions where the annual fee is rebated for the first year, providing immediate savings for new cardholders.

How do I earn the maximum welcome bonus for the TD Platinum Travel Visa* Card?

To earn the maximum welcome bonus, you have to make a purchase within the first 90 days of activating the card, plus spend at least $1,000 in that same time period.

How does the TD Platinum Travel Visa* Card's rewards program benefit frequent Expedia customers?

The card offers a higher earn rate for travel bookings made through ExpediaForTD.com, groceries and recurring bill payments allowing frequent Expedia users to accumulate TD Points faster.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Cory Santos is a finance writer, editor and credit card expert with nearly a decade of experience in personal finance. Cory joined Wise Publishing from BestCards, with bylines in numerous print and digital publications across North America, including the Miami Herald, St. Louis Post-Dispatch, Debt.ca, AOL, MSN and Medium as well as financial podcasts like KOFE Talk.

Compare other TD credit cards

Compare other travel credit cards, latest articles, inflation makes holidays hard for small businesses, fixed or variable mortgage when rates are falling, 5 smart things wealthy baby boomers do with money, one third of canadians manage their finances well, what can you do if you can’t afford your mortgage, short-term rentals are costing ontarians billions.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

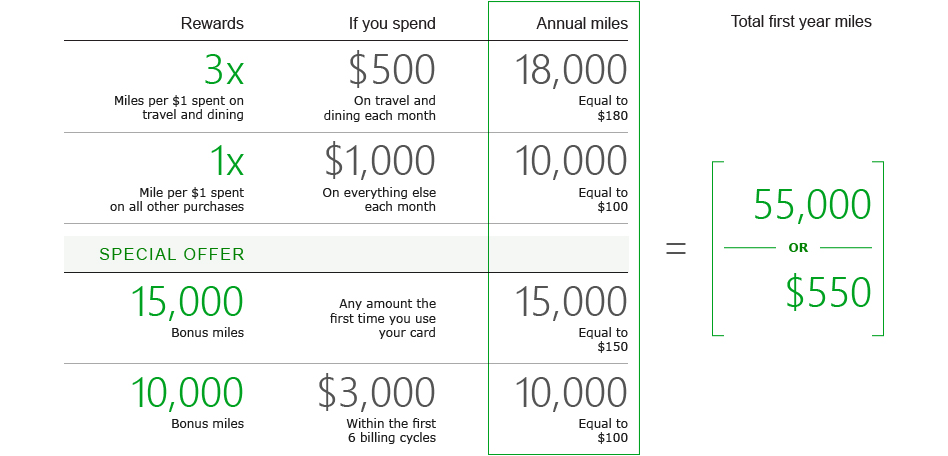

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

TD Platinum Travel Visa Card Review

Earn td rewards points with every purchase and get travel perks with the td platinum travel visa card..

In this guide

30-second take

What to watch out for, td platinum travel visa card interest rates, what should i know before i apply, bottom line, frequently asked questions about the td platinum travel visa card.

- Consider getting this card if you travel frequently and want comprehensive insurance coverage and the ability to earn reward points on all purchases.

- Choose something else if you don’t want to pay an annual fee of $89.

- You must be a Canadian resident and the age of majority in your province. There is no minimum income requirement for this card.

If you’re a travel enthusiast and want a travel card with a boosted rewards program, then the TD Platinum Travel Visa Card could be the right choice for you. This card saves you money for your next trip and lets you use your travel points on all your daily purchases.

This card has no minimum annual income requirement to apply and that makes it an extremely accessible card for everyone.

- Welcome bonus. Earn up to 50,000 TD Rewards Points (a travel value of $370). Plus, get the first year annual fee waived. Conditions Apply. Apply by January 6, 2025.

- Earn reward points. Earn 6 TD Rewards Points per $1 spent on travel booked online through Expedia for TD, earn 4.5 TD Rewards Points per $1 spent on eligible grocery purchases, 3 TD Rewards Points per $1 spent on regularly recurring bill payments, and earn 1.5 TD Rewards Points for every $1 you spend on all other eligible purchases.

- Flexible rewards. TD Rewards Points never expire and can be redeemed for travel discounts, gift cards, merchandise or as a statement of credit.

- Travel insurance coverage. Get a comprehensive travel insurance package including up to $500 coverage for delayed flights and up to $1,000 coverage per person for delayed and lost baggage.

- Common carrier insurance. Get up to $500,000 Commom Carrier Travel Accident Insurance on accident-insured losses while traveling on common transport like buses, planes, ferries and trains.

- Purchase security. Get extended warranty and insurance coverage for your latest purchases in case they’re stolen or damaged.

- Rental car excess coverage. Get a minimum 10% discount in Canada and the US, and a minimum 5% discount internationally with Avis, Budget and other participating car rental agencies.

- Fraud protection. Visa’s Zero Liability insurance offers protection in case of illegal, unauthorized or fraudulent activities detected on your account.

- Cardless payments. You can save time by checking out with Visa payWave technology on Google Pay for Android and Apple Pay for iOS users.

- Annual fee. The annual fee is $89 – but the fee is waived in the first year.

- High interest rate. You will be charged 20.99% interest on outstanding purchase balances and 22.99% for cash advances.

- Additional card fee. Additional cards cost $35 each.

- Medical insurance. You won’t be covered for any medical emergencies with this card.

Eligibility requirements

- Be a Canadian citizen or permanent resident

- Be the age of majority in your province/territory of residence

- There is no minimum income requirement

Required documents and information

- Your name, residential status and contact information

- Your social insurance number and date of birth

- Your email address and phone number

The TD Platinum Travel Visa Card offers a welcome bonus, the ability to earn reward points on all purchases and comprehensive travel insurance. The card comes with seven different insurance coverages such as common carrier insurance, car rental insurance, purchase security insurance, lost baggage insurance and fraud protection, with other extra benefits. This card is not for you if you don’t want to pay an annual fee of $89 or don’t travel frequently.

Do I need to set up a travel notification before my trip?

Do i need to pay extra when i use my card abroad.

Picture : td.com/ca

More guides on Finder

Earn Aeroplan points for business purchases and enjoy a suite of travel benefits with this premium travel card.

Are you looking for credit card rewards with no annual fee? See what the TD Bank Rewards Visa card has to offer.

Get cash back, travel insurance and more with the TD Bank Cash Back Visa Infinite Card.

Earn more Aeroplan points on every dollar with the TD Aeroplan Visa Infinite Privilege Card.

Earn Aeroplan points and other travel benefits with the TD Aeroplan Visa Platinum Card.

Looking for a no-fee card? Save money and get cash back on everyday purchases with the TD Bank Cash Back Visa* Card.

Avoid foreign currency conversion fees when you shop in the US with the TD Bank U.S. Dollar Visa Card.

Get points, travel insurance and more with the TD First Class Travel Visa Infinite card.

Get Aeroplan points, travel benefits and comprehensive insurance with this premium Aeroplan card.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Credit Cards

- TD Rewards Visa* Card Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD Rewards Visa Card Review 2024

Updated: Sep 3, 2024, 3:55am

Fact Checked

The TD Rewards Visa* Card is a card with no annual fee that mainly benefits those loyal to ExpediaForTD. While it does include a few solid perks, like mobile device insurance , rental car discounts and extended warranty protection on purchases, it’s really only a solid option if you’re looking to bank with TD, travel using ExpediaForTD and want to pay no annual fee.

- No annual fee

- Mediocre travel and consumer protection plan

Table of Contents

Introduction, quick facts, td rewards visa* card rewards, td rewards visa* card benefits, how the td rewards visa* card stacks up, methodology, is the td rewards visa* card right for you.

- Advertiser's Disclosure

- Earn 15,152 TD Rewards Points† (a value of $50 on Amazon.ca†) when you spend $500 within 90 days of Account opening†, plus no Annual Fee. Account must be approved by January 6, 2025.

- Earn TD Reward Points on all the things you normally do, whether you use your card for groceries, dining or paying bills. The rewards will add up quickly so you can enhance your everyday experiences and enjoy a wide variety of rewards.

- Flexibility to redeem your TD Rewards Points on a wide variety of rewards at Expedia ® For TD, Starbucks ® and more.

- Mobile device insurance of up to $1000 if you lose or damage your phone.

- Booking your travel through Expedia ® for TD† to maximize the TD Rewards points you can earn on your travel purchases

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop Points. Conditions Apply.

- This offer is not available to residents of Quebec.

- † Terms and conditions apply.

The TD Rewards Visa* Card is a no-annual-fee travel rewards card with a decent welcome bonus. New applicants can earn 15,152 TD Rewards Points for keeping their accounts open and active for the first 90 days.

Beyond that, this card shines on purchases and redemptions through ExpediaForTD. You’ll earn 4 points per dollar spent booking through their travel portal. Redeeming through this platform is also the best way to maximize the value of your points, earning 0.5 cents per point. This translates to a maximum value of 2% on your purchases through ExpediaForTD.

You’ll also earn 2 points per dollar on recurring bills, along with 3 points per dollar on dining and groceries. However, these earn rates drop to 1 point per dollar after exceeding $5,000 in annual spending per category. The remainder of your purchase categories will earn 1 point per dollar spent.

Other no-annual-fee cards , like other cash back and rewards cards , offer higher earnings and more flexibility to redeem where you want—without losing potential value. This card restricts earning potential by imposing $5,000 spending caps on groceries , restaurants and recurring bills. Your earn rate drops to 1 point per dollar after exceeding these limits.

Overall, this is a decent starter card for those new to credit cards or students looking to earn travel rewards without paying an annual fee. But cards with higher earn rates and more perks may be preferable for big spenders despite their annual fees. The TD Rewards Visa Card best suits low-volume spenders who use ExpediaForTD as their go-to travel booking site.

- Maximum earn rate of 2% when spending and redeeming through ExpediaForTD.

- $5,000 annual caps on groceries, dining and bills, 1 point per dollar afterward.

Earning rewards

Earning rewards with the TD Rewards Visa Card is straightforward—you simply use the card for everyday purchases and the points automatically accumulate in your account. You’ll earn:

- 4 points per dollar spent booking travel through ExpediaForTD

- 3 points per dollar on groceries and dining (up to a limit of $5,000 per year per category)

- 2 points per dollar on recurring bills (up to a limit of $5,000 per year)

- 1 point per dollar on all other eligible purchases

- Earn 50% more TD Rewards points at Starbucks when you link your card to your Starbucks Rewards account

The earn rates are decent but nothing extraordinary. TD Rewards generally carry a maximum redemption value of 0.5 cents per point. This translates to a maximum earn rate of 0.2% to 2% on spending.

Redeeming Rewards

Redeeming TD Rewards points is done through the TD Rewards website or app. You have various redemption options, including travel, shopping and financial rewards.

- ExpediaForTD travel: Use your points to book travel directly through ExpediaForTD. Booking with this offers the best value for points redemption, as you’ll get a fixed 0.5% per point. There are also no blackout dates and you can apply points to airline taxes and fees.

- Book Any Way: You can use your points to book your trip through any other travel agency or website. Points can be applied to various travel expenses including within 90 days of your purchase.

- Amazon Shop with Points: Use your points to pay for your purchases on Amazon.ca.

- Starbucks Rewards: Convert your points into Stars at Starbucks when you link your card to your Starbucks Rewards account.

- Merchandise and gift cards: You can cash in TD Rewards Points for merchandise and gift cards.

Financial Rewards

- Pay With Rewards: Use your points to help pay down your credit card balance.

- Education Credits from HigherEdPoints: Redeem your points towards tuition (for yourself or someone else) at over 100 institutions for higher education.

Rewards Potential

The earning potential with the TD Rewards Visa* Card is decent but not market-leading. Forbes Advisor estimates that an average Canadian will earn $263.25 in rewards annually. This is calculated using average spending trends. You’ll need to purchase and redeem through ExpediaForTD to maximize rewards potential, achieving an effective 2% return.

Your rewards potential is limited by spending caps, which apply to grocery/dining and recurring bill categories. Although you’ll earn 2 to 3 points per dollar on these categories, they’ll drop to 1 point per dollar after exceeding $5,000 in annual spending. For example, you will only receive 1 point per dollar on groceries after exceeding the annual spending limit. Note that the spending caps apply to each individual spending category, meaning exceeding the grocery limit won’t reduce your recurring bills earn rate.

Aside from earning on your everyday spending, this card offers some other benefits. That said, it doesn’t have as much to offer as many other rewards cards on the market.

- Mobile Device Insurance: Get up to $1,000 in the event of loss, theft, damage or breakdown of your mobile device.

- Purchase Security: This will repair, replace or reimburse you if your item is lost, stolen or damaged within 90 days of purchase.

- Extended Warranty: Double the manufacturer’s warranty up to 12 additional months.

- Optional Travel Insurance: This card offers the option of travel emergency medical insurance, trip cancellation insurance and trip interruption insurance.

Other Perks

- Discounts on Car Rentals: Save at least 10% off the lowest available base rates in Canada and the U.S. and a minimum of 5% off the lowest available base rates internationally at participating Avis and Budget locations.

- Starbucks Rewards: Earn 50% more TD Rewards points at Starbucks when you link your card to your Starbucks Rewards account.

Interest Rates

- Regular APR: 19.99%

- Cash Advance APR: 22.99%

- Foreign Transaction Fee: 2.5%

- Annual Fee: $0

- Any other fees: Additional cardholder $0

TD Rewards Visa* Card vs. RBC ION+ Visa Card

Those willing to pay a $4 monthly fee can benefit from the enhanced earning potential of the RBC ION+ Visa Card. This card earns 3 Avion points per dollar on groceries, restaurants, gas, ride shares, EV charging, streaming, subscriptions and digital gaming. Every other category (including travel) earns 1 point per dollar spent.

Notably, RBC Avion points carry a value of up to 2.33 cents per point. As such, you’ll receive a maximum 2.33% to 6.99% earn rate on your purchases, eclipsing the 0.2% to 2% offered through the TD Rewards Visa* Card. Furthermore, the RBC ION+ Visa Card doesn’t have the spending cap as seen with the TD counterpart.

Overall, the RBC ION+ Visa Card is better for high-spenders looking to earn more points on everyday purchases. However, the TD Rewards Visa Card is best for frequent travellers looking to enhance points through ExpediaForTD.

TD Rewards Visa* Card vs. MBNA Rewards Platinum Plus Mastercard

The MBNA Rewards Platinum Plus Mastercard provides shocking rewards for a no-annual-fee credit card. Forbes Advisor estimates that an average Canadian will earn $439.59 in annual rewards value from this card. This is contrasted with the $263.25 in rewards expected from the TD Rewards Visa* Card. Both calculations are based on the same average spending habits of Canadians.

The elevated earning potential is due to the higher spending caps and earning rate. The MBNA card earns a base rate of 2 points per dollar spent on restaurant, grocery, digital media, membership and household utility purchases, up to $10,000 in spend per category. This cap is double that of the TD card, which sees many categories evaporate after $5,000 in spend.

Assuming a maximum point value of 1 cent per point, the MBNA Rewards Platinum Plus Mastercard earns up to 2% on its top spending categories. Meanwhile, the TD Rewards Visa Card only earns this rate on ExpediaForTD purchases.

As such, the MBNA Rewards Platinum Plus Mastercard is better for those who want increased rewards on everyday purchases.

TD Rewards Visa* Card vs. HSBC +Rewards Mastercard

The HSBC +Rewards Mastercard is not great for those who want to maximize rewards. Instead, it’s best for those who want to carry a balance. This is because of the exceptionally low interest rate offered by the HSBC Card. Most credit cards—-including the TD Rewards Visa* Card—charge almost double.

However, anyone looking to optimize rewards earning potential should skip this card. Although it has a $25 annual fee, Forbes Advisor estimates that the average Canadian will only earn $152.15 in annual net earnings. This is lower than the mid-market estimation of $263.25 for the TD Rewards Visa Card.

Overall, the TD Rewards Visa* Card is better if you want to earn more points. Meanwhile, the HSBC +Rewards Mastercard is best if you plan to carry a balance and want to reduce your interest payments.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With this card, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses and other benefits and features. Keep in mind. what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The TD Rewards Visa Card is a solid option for occasional travellers who want to earn rewards without paying an annual fee and frequently use ExpediaForTD to book flights and hotels. This card is also a good choice for beginners starting with credit cards or students looking for a no-fee card.

However, a cash-back card like the no-annual-fee Tangerine Money-Back Card provides better returns thanks to their ability to earn up to 2% on 2 to 3 categories of your choosing. The TD Rewards Visa* Card also lacks premium travel perks and insurance coverage, so it’s not ideal if you want luxury benefits and security.

Additionally, a cash-back card would be a smarter pick over this travel-focused TD option if you prefer earning flexible cash back over rigid travel points. Overall, the TD Rewards Visa Card suits budget-minded travellers happy with ExpediaForTD and its straightforward rewards structure.

Related: Best Credit Cards To Use in Canada

Frequently Asked Questions (FAQs)

Does td rewards visa* have travel insurance.

No, the TD Rewards Visa Card does not have travel insurance coverage . It only includes more basic protections like purchase protection, extended warranty and mobile device insurance. You’d need to upgrade to the TD First Class Travel Visa Infinite Card for a TD card with travel insurance.

What is a rewards Visa card?

The TD Rewards Visa Card is an entry-level, no annual fee travel rewards card issued by TD Bank. It earns TD Rewards points that can be redeemed for travel booked through ExpediaForTD, cash back, gift cards, statement credits and more.

Its key features include no annual fee, a 15,152 point welcome bonus, 4 points per dollar on ExpediaForTD purchases and 2 to 3 points per dollar on groceries, dining and bills.

How to redeem TD Visa Reward points?

There are a few different ways to redeem TD Rewards points earned with the TD Rewards Visa Card:

- Book travel through ExpediaForTD (get 0.5 cents per point value)

- Redeem for any travel (0.4 to 0.5 cents per point)

- Utilize education credits (0.4 cents per point)

- Shop on Amazon.ca (0.33 cents per point)

- Get statement credits and gift cards (0.25 cents per point)

- Purchase merchandise (0.20 cents per point)

To maximize value, points should be redeemed for travel booked through ExpediaForTD where possible. You can redeem by logging into your TD Rewards account.

Why should you get a rewards credit card?

Rewards credit cards are an easy way to earn points on everyday spending. With most programs, you can use the points for travel, merchandise, gift cards and statement credits.

How do you earn TD Rewards Points on your credit card?

You earn TD Rewards Points on your credit card by using it for your everyday spending. With this card, you’ll earn points on all your purchases, but you’ll earn more points when spending with ExpediaForTD or on groceries, restaurants, bill payments and at Starbucks.

Advertiser's Disclosure

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Daniel is an expert on travel, finance, and SEO. He grew up in Toronto, receiving an Honours BBA (Finance) from Wilfrid Laurier University. Today, Daniel is based in Lisbon, Portugal, but some of his most adventurous destinations include Cairo, Rio, and Istanbul.

Courtney Reilly-Larke is the deputy editor of Forbes Advisor Canada. Previously, she was the associate editor of personal finance at MoneySense. She was also managing editor of Best Health Magazine and has contributed to publications such as Cottage Life and Blog TO. She currently lives in Toronto.

- Best Credit Cards

- Best Travel Credit Cards

- Best Cash Back Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Aeroplan Credit Cards

- Best Student Credit Cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Credit Cards for Bad Credit

- Best Business Credit Cards

- Most Exclusive Credit Cards In Canada

- Best Prepaid Credit Cards

- Best TD Credit Cards

- Best Low-Interest Credit Cards

- Best Visa Cards

- Best RBC Credit Cards

- Best of Instant Approval Credit Cards

- Best Cash Back Credit Cards With No Annual Fee

- Best Secured Credit Cards in Canada

- American Express Cobalt Review

- KOHO Prepaid Mastercard Review

- EQ Bank Card Review

- Neo Standard Mastercard Review

- TD Aeroplan Visa Infinite Privilege Review

- TD First Class Travel Visa Infinite Card

- RBC Avion Visa Infinite Review

- Simplii Financial Cash Back Visa Review

- MBNA Rewards World Elite Mastercard

- Scotiabank Passport Visa Infinite Review

- Neo Secured Credit Card Review

- MBNA True Line Mastercard Review

- TD Aeroplan Visa Platinum Card Review

- TD Cash Back Visa Infinite Review

- BMO CashBack World Elite Mastercard Review

- Platinum Card From American Express Review

- TD Platinum Travel Visa Card Review

- TD® Aeroplan® Visa Infinite* Card Review

- American Express Aeroplan Card Review

- American Express Green Card Review

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- American Express Cobalt vs. Scotiabank Gold American Express Card

- TD First Class Travel Vs. TD Aeroplan

- What's The Best Day & Time To Book Flights

- Air Canada Aeroplan: The Ultimate Guide

- Guide To American Express Credit Card Levels

- What Credit Cards Does Costco Accept In Canada?

- Is American Express Better Than Visa Or Mastercard?

- How To Get The Apple Card In Canada

- What Happens If You Overpay Your Credit Card?

- How To Redeem Aeroplan Points

- Foreign Transaction Fees: How To Avoid Them

- How To Spot A Credit Card Skimmer

- What Is The Highest Limit Credit Card In Canada?

- Benefits And Perks Of Amex Platinum Card

- How Much Is The Amex Platinum Foreign Transaction Fee?

- Negative Balance On A Credit Card: What To Do?

- Fee Increases Here For Both Platinum Cards From Amex

More from

Capital one smart rewards mastercard review 2024, rogers red world elite mastercard review 2024, rogers red mastercard review 2024, bmo ascend world elite mastercard review 2024, home trust preferred visa card review 2024, float secured business credit card review 2024: canada’s only secured business credit card.

- Small Business

- English Selected

Help make trips a little smoother

TD Trip Cancellation & Trip Interruption Insurance can help provide financial protection for your eligible trip expenses.

TD Trip Cancellation & Trip Interruption Insurance

This plan is ideal if you are an occasional traveler who doesn’t need medical coverage but wants coverage for eligible travel expenses in case your trip is cancelled or interrupted for a covered reason.

Coverage Highlights

Eligibility

You are eligible to apply if you meet the following conditions:

You are a Canadian resident.

At least 18 years old on the effective date of your Trip Cancellation and Trip Interruption Insurance (and if you are under 18 years old, a parent or guardian can provide authorization).

You purchased the plan while in Canada and you purchased the plan before you depart on your trip.

You are a TD Bank Group customer, or the spouse or dependent child of a TD Bank Group customer.

Exclusions and Limitations

It’s important to know that benefits will only be paid for eligible expenses and only up to the maximum amount. A complete list of exclusions that apply to your plan will appear in your certificate, but here are some examples.

Pre-existing medical conditions. 1

Committing or attempting to commit an illegal or criminal act.

Intentional self-inflicted injuries.

Travel to destinations under a travel advisory by the Canadian government.

The birth of a child during your trip.

Refer to the Sample Certificate of Insurance for a full description of eligibility requirements, defined terms, benefits, limitations and exclusions.

View Product Summary and Fact Sheet (for residents of Quebec only)

Why TD Trip Cancellation & Interruption Insurance can be a smart choice?

You can select the coverage amount

This plan lets you choose – and only pay for – the amount of coverage you select, to a maximum of $20,000.

Claims and contact Info

Let’s connect.

Our administrator is ready to answer your questions and help you on your way. For quotes, to purchase a plan or any general inquiries: 1-888-992-9163 Mon-Fri 8am to 8pm ET Saturday 9am to 5pm ET For 24/7 emergency assistance: 1-800-359-6704 (Canada and the U.S., toll free) or + 1-416-977-5040 (worldwide, collect). For claims: 1-800-359-6704

Submit a travel insurance claim

Start the claims process by visiting the Online Claims Portal .

Explore more TD Travel Insurance plans

Looking for more options? We offer other travel insurance plans.

TD Trip Cancellation & Trip Interruption Insurance is administered by Global Excel Management Inc. and its subsidiary, CanAm Insurance Services (2018) Ltd.

TD Trip Cancellation & Trip Interruption Insurance is a group plan underwritten by TD Life Insurance Company (medical covered causes) and TD Home and Auto Insurance Company (non-medical covered causes), designed exclusively for the clients of TD Bank Group and is distributed by The Toronto-Dominion Bank. Medical and claims assistance, claims payment and administrative services are provided by the administrator described in the Certificate of Insurance.

Coverages and benefits are subject to eligibility conditions, limitations, and exclusions, including pre-existing medical condition exclusions. Please refer to the Sample Certificate of Insurance for full details.

1 Claims related to Pre-existing medical conditions may not be covered. Pre-existing medical condition means any sickness, injury or medical condition (other than a minor ailment) that was not stable during the time period specified in the certificate. Refer to the Sample Certificate of Insurance to determine how this exclusion may affect your coverage. Mailing Address: TD Life Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2 TD Home and Auto Insurance Company P.O. Box 1 TD Centre Toronto, Ontario M5K 1A2 The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

VIDEO

COMMENTS

Depending on the TD credit card, travel benefits could include: Travel Medical Insurance 1. Trip Cancellation / Trip Interruption Insurance 2. Delayed and Lost Baggage Insurance 3. Flight/Trip Delay Insurance 3. Common Carrier Travel Accident Insurance 4. Auto Rental Collision / Lost Damage Insurance 5. Emergency Travel Assistance Services 6.

travel Italicized and capitalized terms are defined in . Your Certificate • Travel insurance covers claims arising from sudden and unexpected situations (e g , accidents and emergencies) • To qualify for this insurance, You. must meet all the eligibility requirements • This insurance contains limitations and exclusions (e g ,

5000 Yonge Street, Suite 2000, Toronto, Ontario M2N 7E9 Phone: 1‐800‐859‐0694. This Certificate of Insurance contains a clause which may limit the amount payable. The coverage outlined in this Certificate of Insurance is efective October 30, 2022, and is provided to eligible TD Rewards Visa Cardholders Refer to the Definitions Section ...

Here, we're comparing three popular cards that offer travel insurance: The TD®Aeroplan® Visa Infinite Privilege Card, the Scotiabank Gold American Express Card and the BMO AIR MILES World ...

If you're using Aeroplan or TD Points to pay for travel, call us to speak with an advisor at 1-866-374-1129. Results will be calculated based on the accuracy and completeness of the information you enter and will provide an estimate only. The results are calculated and generated based on the accuracy and completeness of the data and information ...

The TD First Class Travel Visa Infinite Card is considered to be one of Canada's higher-end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential ...

TD Insurance Multi-Trip All-Inclusive Plan. This is the most comprehensive plan we offer. It provides you with multiple benefits, including up to $5 million in emergency travel medical coverage, trip cancellation and interruption and more, for multiple covered trips up to the maximum trip duration selected within one year. 1. Get Started.

Here are the key types of travel insurance coverage offered by TD Bank: Emergency medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency ...

Flight and travel delay insurance. To benefit from this insurance, at least 75% of the cost of your trip must be charged to the TD First Class Travel ® Visa Infinite* Card. The reason for the delay may be due to weather, an outage or a strike for example. This flight or travel delay insurance can be up to $500, for a delay of 4 hours or more.

The TD Platinum Travel Visa Card offers an impressive earning rate on several keys categories: Earn 6 TD Rewards Points† for every $1 spent when you book travel through Expedia for TD†. Earn 4 ...

Visa Signature Card Benefits 1. Visa Signature Card Benefits. 1. In addition to your TD Bank Credit Card rewards, as a Signature cardholder you'll get all the Visa benefits of a Platinum card, plus a range of security and travel benefits: Fraud and protection benefits. Travel benefits. Entertainment and lifestyle benefits.

Travel Medical Insurance is a group insurance plan underwritten by TD Life Insurance Company, is designed exclusively for clients of The Toronto-Dominion Bank, and is distributed by The Toronto-Dominion Bank.Trip Cancellation and Trip Interruption Insurance is underwritten by TD Life Insurance Company (medical covered causes) and TD Home and ...

Welcome Bonus†† (applies only in the first year) 15,000. Groceries and Regularly Recurring Bill Payments (yearly spend cap of $500 18,000 $15,000 for each) Other Purchases $1,000 24,000. Total TD Rewards Points in Your First Year. 57,000. e†††† of $285 in travel through Exped.

There are two ways to view your points online: 1. At Credit Card Account Access - once you receive and activate your card, register here and get your confirmation. You will then be able to view points. 2. Rewards site - you can register to view points plus rewards. View First Class rewards. 5.

Jumping into the rewards scene Collecting rewards with the TD Platinum Travel Visa Card can feel like striking gold. Each bite at a restaurant or grocery run puts 4.5 TD Rewards Points in your pocket.

Before you begin. You must meet the following requirements: You must be a Canadian resident. You are covered by a valid government health plan of your Canadian province or territory for the entire duration of your trip (i.e., OHIP, AHCIP, etc.). You are a TD Bank Group customer, or the Spouse or Dependent Child of a TD Bank Group customer. You ...

The TD Platinum Travel Visa Card offers a welcome bonus, the ability to earn reward points on all purchases and comprehensive travel insurance. The card comes with seven different insurance coverages such as common carrier insurance, car rental insurance, purchase security insurance, lost baggage insurance and fraud protection, with other extra ...

Certificate of Insurance. Claims administration and adjudication services are provided by Global Excel Management Inc The . Certificate. applies to the TD Platinum Travel Visa Card, which will be referred to as a "TD Credit Card" throughout the . Certificate TD Life Insurance Company ("TD Life") provides the insurance for this . Certificate

The TD Rewards Visa* Card is a card with no annual fee that mainly benefits those loyal to ExpediaForTD. While it does include a few solid perks, like mobile device insurance, rental car discounts ...

Annual Plan 1. Ideal for frequent travelers, our annual plan offers a more convenient and cost-effective option than buying a single plan each time you travel. You'll get up to $5 million in emergency travel medical coverage for an unlimited number of covered trips, up to your chosen maximum trip duration, for one year. View details.

Cancellation and interruption coverage usually require you to pay for the transportation charges with your card, but it's all in the specific insurance contract. You should read through this and become familiar with the coverage, there's often tons of things people miss out on because they didn't even realize they're covered. 4. Reply.

Covers costs of meals and accommodation if a covered event interrupts or delays your scheduled return date. Up to $350 per day, per insured person, up to a maximum of $700 per insured person, per covered trip. Transportation. Covers cost of transportation, subject to pre-approval if a covered event causes your trip to be unexpectedly interrupted.