Mandatory Visitors’ Health Insurance for Qatar

Select policy dates to get started

from 27 May 2024 till 25 June 2024

Mandatory for all visitors

Starting from 2023, everybody arriving to Qatar must have this policy. Get yours now and enjoy a hassle-free trip

Protects in emergencies

Our insurance protects you against medical emergencies while traveling, allowing you to keep your peace of mind

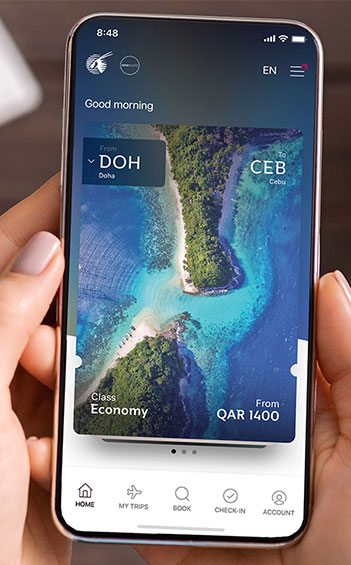

Get insured immediately

Buy a policy in a few steps for a worry-free stay in Qatar. Fully digital, instant, and paperless

Visitors Insurance includes

Emergency medical assistance.

Visitors health cover will compensate the emergency medical assistance, for example, if you get in an accident

Compensation within Qatar

You can get compensation only if the accident happens within the State of Qatar

10,000+ medical providers in Qatar

Hospitals, private medical practitioners, diagnostic centers, and pharmacies

If you get ill with COVID-19, we’ll cover the cost of your treatment, quarantine, hospitalization, and medications

Emergency evacuation

We’ll cover emergency evacuation to your home country if your health condition requires it

Zero waiting period

There is no waiting period. You get full coverage the moment you buy insurance

Keeping you safe since 1964

Customers in GCC region as of 2023

Best Insurance Company Digital Transformation in Qatar

S&P Global Ratings, November 2023

Trusted by over 200,000 customers in Qatar

Afnaz Mohamed

Ahmad Abouisteite

Justin Houtan

Hassan Aldarbesti

Convenient policy download

From our website, from your email.

Search your inbox, we usually send a PDF file after the purchase

DohaGuides YouTube Channel

How To Get Health Insurance For Visitors To Qatar (2024)

Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 16 January 2024.

According to a recent announcement by Qatar’s Ministry of Public Health (MoPH), visitors to Qatar are required to have a health insurance policy starting from 1 February 2023.

Qatar’s Law No. (22) of 2021 regulating healthcare services in Qatar stipulates that visitors must be covered by a mandatory health insurance scheme. The mandatory health insurance scheme will be implemented in phases, and the first phase has started on 1 February 2023 .

This article will discuss everything you need to know about health insurance for visitors to Qatar , including the cost, coverage, authorised providers and how visitors can buy health insurance.

Is Health Insurance For Visitors To Qatar Mandatory?

Why is qatar introducing a health insurance policy, how to get visitors’ health insurance, moph approved health insurance.

- Cost of Visitor's Health Insurance Policy:

Validity Period of Health Insurance For Visitors To Qatar

- Coverage Under Visitor's Health Insurance Policy

Criteria for Accepting International Health Policy

Moph helpline, frequently asked questions.

Starting 1 February 2023, all visitors to Qatar applying for a visitor’s visa are required to have health insurance policies. This is mandatory for all types of visit visas including Family Visit Visa , GCC Residents Visit Visa , and Visa On Arrival .

AUGUST 2023 UPDATE: According to Qatar Government’s Hukoomi helpline, visitors traveling on an instant visa and staying in Qatar for less than 30 days do not need to obtain Health insurance . However it is highly recommended to have insurance as it can be helpful in case of an emergency.

GCC citizens are exempted from the mandatory health insurance while entering Qatar.

According to MOPH, the health and well-being of visitors are of paramount importance. Therefore the Government has established the necessary regulations to ensure that visitors are protected against accidents and medical emergency-related conditions during their stay.

By implementing a sustainable and effective healthcare system, and by regulating healthcare expenditures, the scheme aims to regulate health insurance and ensure continuous improvements.

Visitors Applying For Visit Visa Online

- Visitors applying for a visit visa online via the Metrash App will be directed to the MOPH website.

- There, they can select one of the insurance companies registered with the Ministry to purchase the visitors’ policy after completion of all other relevant visa requirements.

- Once the insurance policy is issued by the selected insurance company, the Ministry of Interior will issue the appropriate visit visa.

The Visitor will receive the Health Insurance Policy from the website of the Insurance companies. The policy can be printed, kept and shown when needed.

Visitors Eligible For Visa On Arrival

To ensure speedy completion of your procedures upon arrival at the various border crossings (airport, land and seaports), visitors are advised to purchase a visitor insurance policy before arriving at these ports from the MOPH link provided below and follow the same procedures mentioned.

The registered insurance companies are listed on the Ministry of Public Health’s website. Visitors can choose any one of the listed insurance companies through the links available on MOPH website:

Here is the link to the page on the MOPH website.

The registered insurance companies (in alphabetical order) are:

- Al Khaleej Takaful Insurance

- Beema Damaan Islamic Insurance Company

- Doha Insurance Group

- Doha Takaful

- General Takaful

- Islamic Insurance

- Qatar General Insurance & Reinsurance Co. Q.P.S.C.

- Qatar Insurance Company

- QLM Life & Medical Insurance Company

MoPH has indicated that for visitors who hold international health insurance, the insurance policy must include Qatar, be valid during their stay in the country and be issued by one of the insurance companies approved in Qatar.

Cost of Visitor’s Health Insurance Policy:

The standard premium for a single insurance policy will be QAR 50 for 30 days (USD 13.73). For the extension of a visit visa beyond 30 days, the visitor will have to buy an additional policy.

In addition, visitors can obtain additional health insurance policies, and the premiums for these policies will vary depending on the insurance company’s prices.

Health insurance premiums cannot be refunded after the purchase of the policy if the stay duration is less than the period of the visa.

The effective date of coverage is the date of entry of the visitor at any border.

If the visitor wishes to extend his/her stay in the State of Qatar, then he/she must purchase a new health insurance policy. The minimum duration of the visitor’s insurance policy is 30 days, it is not possible to purchase a policy with less than this duration.

The basic visitor insurance policy in case of a single-entry visa expires upon leaving the State of Qatar through any air, sea or land ports.

There is an insurance policy for multiple-entry visas and it remains valid from the date of entry until the policy expires.

Coverage Under Visitor’s Health Insurance Policy

The mandatory health insurance for visitors will only cover emergency medical treatments and accidents .

Emergency Medical Treatment:

- Up to QAR 150,000 for the policy period and within the State of Qatar.

- Emergency medical assistance with a sub-limit of QAR 35,000, includes:

- Emergency ambulance transportation within the State of Qatar, and where necessary.

COVID-19 and Quarantine:

- Sub-limit up to QAR 50,000.

- Covid-19 treatment for positive cases.

- Quarantine expenses (for confirmed cases) are up to QAR 300 per day.

Repatriation:

In the event of the visitor’s death within the State of Qatar, the cost of repatriation is covered up to an amount of QAR 10,000.

Is there a waiting period for this policy to be active?

No, there will be no waiting period for the visitor’s health insurance policy.

Does the policy require any copayment or deductible?

No copayment or deductible will be required for any covered services as per the terms and conditions stipulated in the visitor’s health insurance policy.

In addition to the listed insurance companies, Qatar MOI may accept some international health insurance companies, subject to the fulfilment of the following conditions and requirements set by the Ministry of Public Health to be accepted for entry visa issuance:

- To be issued by one of the insurance companies included in the approved list by the Ministry of Public Health.

- Its geographical coverage includes the State of Qatar.

- To be valid and cover the period of stay in the country.

- To cover emergency services and accidents with an annual limit of 150,000 Riyals or more, without deductibles or excesses.

- To include a QR code.

The policy can be uploaded to the website of the Ministry of Interior or a paper copy to be submitted to the competent officer at the border crossing.

In case of any queries about the mandatory health insurance policy, you can call the MOPH Helpline on 16000 (inside Qatar) . Extension number 1 is dedicated to health insurance. International visitors can call 00974-44069963. For complaints, you can email: [email protected]

Is travel insurance mandatory for Qatar visit visa?

Yes, travel insurance is mandatory for all visitors to Qatar with effect from 1 February 2023.

How much is the travel insurance fee for Qatar visit visa?

The premium for the Mandatory Visitors’ Health Insurance policy is QAR 50 per month.

Does the Visitor Health Insurance Policy cover me in GCC or other countries?

No. The Visitor Health Insurance coverage is limited to the State of Qatar only.

What documents are needed in case of emergency treatment?

Passport & Insurance Policy Documents will be required for emergency treatment.

Does the basic insurance policy for visitors cover emergencies during travel?

The basic visitor insurance policy coverage begins upon the visitor entering the State of Qatar.

Related Articles:

- How Hayya Card Holders Can Visit Qatar in 2023

- Qatar Visa On Arrival For Indians: Complete Guide

- GCC Residents Visit Visa (With List of Professions)

- Qatar Family Visit Visa: Requirements and Procedure

- Qatar Family Residence Visa Procedure

Copyright © DohaGuides.com – Full or partial reproduction of this article is prohibited.

97 thoughts on “How To Get Health Insurance For Visitors To Qatar (2024)”

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

In addition to the below, please note that I am unable to pay the visa fee to issue the visa without buying the insurance (Again). Unfortunately I was unaware that the insurance policy needs to be purchased after the visa approval and not before.

please help me in this.

Dear DG, I purchased the QIC Insurance policy while submitting the request for family visit visa. I got the message that my visa request is approved and there is a link to purchase the insurance policy. My concern how do I upload the insurance copy which I already purchased before visa request was approved? The insurance policy starts from 24th April 24 and it is for 3 months. Do I have to buy the insurance policy again or is there a way to upload the policy online in Metrash?

Your prompt response is much appreciated.

Thanks and regards Habeeb

Start typing and press enter to search

We’re sorry, this site is currently experiencing technical difficulties. Please try again in a few moments. Exception: request blocked

Qatar is welcoming 102 countries visa-free, check your visa status here .

Visit Qatar App Explore things to do in Qatar!

Select your language

Get eVisa info

Health insurance policy

Travellers entering the State of Qatar for a stay of over 30 days are required to obtain health insurance with any insurance company that is registered with the Ministry of Public Health. You can get your health insurance on arrival. However, we strongly advise securing health insurance before travelling.

Here’s a list of other registered insurance companies in the State of Qatar that can help you obtain a travel insurance policy hassle-free. Please note that you need to be covered by any of the below:

1. Qatar General Insurance & Reinsurance Co.

3. General Takaful Co.

4. Doha Takaful

5. AlKhaleej Takaful Insurance

6. Doha Insurance Group

7. QLM Life & Medical Insurance Company

8. Qatar Islamic Insurance Group

9. Qatar Insurance Co

10. Damaan Islamic Insurance Company – Beema

11. Al Arabia Insurance Company

12. Libano-Suisse Insurance

13. GIG Gulf Axa Insurance Qatar

14. American Life Insurance Company (“ALICO”) t/a MetLife

15. Medgulf Takaful – QFC Branch

16. Seib Insurance & Reinsurance Company LLC

17. AWP Health & Life S.A (Allianz)

18. Sharq Insurance Company

19. Al Koot Insurance

Healthcare facilities

The State of Qatar offers a high standard of medical care with state-of-the-art facilities and is developing to be one of the world's best public health systems. The healthcare systems in Qatar has been ranked among the world's top five in terms of quality of care.

Things to know before travelling

Want to travel visa-free? Check if you qualify here.

Getting here

Planning your trip to Qatar? Check how to get here.

Travel tips

Make the most of your visit with our handy travel guide.

Getting around

From a dhow boat to our world-class metro, here’s how to easily explore Qatar.

- Latest edition

- Media Centre

- Terms & conditions

- Privacy notice

- Corporate website

- Amiri Diwan

- Cookie policy

- Qatar Tourism brand logos

- Subscribe to our newsletter

- Cookie settings

© 2024 Qatar Tourism | All rights reserved

- Provider Search

- Download Centre

- Media Center

- Toll Free: 44444 756 (QLM)

- CEO Message

- QLM History

- Our Board Members

- Our Management Team

- Official Documents

Life Insurance

Medical insurance.

- Financial Information

- Corporate Governance

- Board of Director

Investor Relations

Information center, ">get a quote.

- Media Centre

Modal title

Login to your account.

Membership Registration Forgot Password?

Reset your account Password

Membership registration login.

In Safe Hands

Qlm life & medical insurance company q.p.s.c.

is among the biggest insurers in the MENA region. QLM Health Insurance protects you from unexpected high medical costs and from financial losses. Secure your life with affordable premiums. We bring to you innovative and tailor-made insurance solutions coupled with world class level of service. Our core strengths lie in a strong financial base, in-house 24/7 operations, highly qualified workforce, in-depth knowledge of the local and international markets and a diversified product range designed to provide premiere services furnished through a worldwide network of providers and patronized by millions over decades.

Visitors Mandatory Health Insurance

The Ministry of Public Health (MoPH) has announced that the implementation of the first phase of the mandatory Health Insurance scheme in Qatar, started from February 01, 2023. Its mandatory for all the visitors to Qatar required to have a health insurance policy. This is in accordance with the Law No. (22) of 2021, regarding the regulation of healthcare services within the State of Qatar, which stipulates that all the visitors shall be covered by the mandatory Health Insurance Scheme. On February 1st, Ministry of Public Health started the implementation of the mandatory health insurance law. The first phase covers all types of visitors (except GCC residents). The scope of cover is mainly emergency & accidents with some additional benefits.

Our Products

The power of our global network in a policy customised around you.

Group Medical Insurance

Individual Medical Insurance

Senior Citizens Insurance

QLM for life

Secure your family’s financial future by insuring your career and theirs.

Group Life Insurance

is a type of life insurance that provides coverage to a group of individuals, typically employees of a company or members of an organization. In group life insurance, the policyholder is the employer or organization, and the insured individuals are the employees or members.

Individual Life Insurance

insurance is a type of life insurance policy that provides financial protection for an individual in the event of their death. In an individual life insurance policy, the policyholder is the individual, and the beneficiary is typically a family member or loved one.

SeQure Retirement Series

The SeQure Retirement Series is designed around today’s global workforce. With an option to start saving in one currency and continue in another, you can focus on making other plans whilst we take care of Life.

SeQure Education Series

A SeQcure insurance plan is a type of insurance policy that provides financial protection for a child in the event of an unexpected event. Child insurance plans can provide various types of coverage, including life insurance, health insurance, education savings, and other benefits. The policy can be purchased by the child's parent or guardian, and the coverage typically continues until the child reaches a certain age. Child health insurance plans provide coverage for medical expenses related to the child's health. These plans can cover a variety of expenses, including doctor visits, hospitalization, prescription drugs, and other healthcare-related costs. Child education savings plans provide a way for parents to save for their child's education expenses, such as college tuition and fees. These plans can be designed to provide a guaranteed amount of money at a certain age or to provide a set rate of return on the investment. It's important to carefully review the policy details and investment options before purchasing an insurance plan to ensure that it meets your retirement income needs and investment goals.

QLM on the move

Download our mobile app.

Check your coverage, find a hospital and track your claims, all from the QLM app

Featured Videos

SeQure Child Plan

SeQure Retirement Plan

- +974 3019 1237

Visitors’ Health Insurance Now Required to Enter Qatar

Embarking on an adventure to Qatar? Safeguard your journey with the power of visitor health insurance. From the vibrant markets of Souq Waqif to the awe-inspiring dunes of the desert, Qatar offers an array of captivating experiences. However, unforeseen circumstances can disrupt even the most meticulously planned trips. That’s why having comprehensive health insurance has become paramount and the Qatari Government has made it mandatory for everyone to get health insurance before entering the country.

In a recent development, the government of Qatar has implemented a new regulation requiring visitors to have health insurance coverage in order to enter the country. This measure aims to ensure the well-being and safety of both tourists and residents alike. With this new requirement, Qatar is taking proactive steps to address healthcare concerns and provide visitors with peace of mind during their stay. Let’s first discuss the importance of visitor health insurance Qatar.

Why Does Travel Insurance Matters?

In the midst of excitement and anticipation, it’s easy to overlook the potential risks and uncertainties that can arise during your Qatar trip. Travel Health insurance acts as a shield against the unexpected, providing financial protection and peace of mind. Whether it’s a sudden illness, or emergency, having health insurance ensures you’re prepared for the unexpected twists and turns of your journey.

Benefits of Visitor Health Insurance in Qatar

With visitor health insurance in Qatar, you can explore this fascinating destination with confidence. Medical coverage ensures that you receive the necessary care without worrying about hefty bills.

By prioritizing health insurance, you can fully immerse yourself in the wonders of Qatar, knowing that you have a safety net should any unexpected situations arise.

Key Benefits of Health Insurance:

- Emergency Medical Coverage: Health insurance provides visitors with financial protection in case of unexpected medical emergencies. It covers expenses such as hospitalization, surgeries, consultations, and prescription medications, thereby offering peace of mind to travelers.

- Access to Quality Healthcare: Having health insurance ensures that visitors have access to a wide network of medical facilities and healthcare providers. In the event of illness or injury, travelers can seek timely medical attention from qualified professionals.

- Travel Assistance Services: Health insurance plans often include additional benefits such as travel assistance services. These services can help travelers navigate the local healthcare system, arrange medical appointments, provide translation services, and offer support during unforeseen circumstances.

- Financial Security: Health insurance coverage safeguards visitors from the financial burden of medical expenses. By having a comprehensive insurance plan, travelers can avoid unexpected costs and focus on enjoying their time in Qatar.

Understanding Visitor Health Insurance Qatar

Travel insurance coverage:.

Travel insurance in Qatar offers a comprehensive range of coverage, ensuring you are protected throughout your journey. This includes vital elements such as medical expenses, and access to 24/7 emergency assistance. With travel insurance, you can have peace of mind knowing that unforeseen circumstances won’t derail your Qatar adventure.

Understanding the New Regulation:

The decision to mandate health insurance coverage for visitors to Qatar comes as part of the country’s commitment to maintaining high standards of healthcare and ensuring the accessibility of medical services. According to the official announcement by the Qatari government, the new regulation applies to all visitors, regardless of the purpose or duration of their stay. This includes tourists, business travelers, and individuals visiting friends or family members in Qatar.

Complying with the Health Insurance Requirement:

To comply with the new regulation, visitors must provide proof of health insurance coverage before their arrival in Qatar. The insurance policy should meet the minimum requirements set by the Qatari government. These requirements typically include coverage for emergency medical treatment, hospitalization, and a minimum coverage limit.

Visitors can obtain health insurance coverage from international insurance providers or choose from the options offered by Qatari insurance companies. It is advisable to purchase insurance that specifically caters to travel-related medical needs, ensuring comprehensive coverage for the duration of the stay.

Implications for Travelers:

While the new health insurance requirement may add an additional step to the travel planning process, it ultimately benefits visitors. By having health insurance, travelers can mitigate potential financial risks associated with unforeseen medical emergencies. Moreover, access to quality healthcare services and travel assistance can contribute to a more positive and secure travel experience in Qatar.

It is essential for visitors to familiarize themselves with the specific requirements and regulations concerning health insurance coverage before their trip. This will help ensure a smooth entry into Qatar and avoid any last-minute complications.

Key Considerations When Buying Visitor Health Insurance:

When selecting travel insurance for your Qatar trip, several factors deserve careful consideration.

- Review the coverage limits to ensure they align with your anticipated expenses. Take note of any exclusions to understand what situations may not be covered.

- If you have pre-existing medical conditions, explore options that provide coverage or consider purchasing additional coverage.

- Consider the flexibility of policy extensions to accommodate any changes in your travel dates or itinerary.

By evaluating these key considerations, you can select the most suitable travel insurance plan for a worry-free and protected journey in Qatar.

Exploring Travel Insurance Options in Qatar

Top travel insurance provider in qatar.

To acquire the Health Insurance Policy, you have the option to purchase it from any of the insurance companies that are registered with or approved by the Ministry of Public Health. You can access the list of these approved companies via the following link . Or you can ask your booking specialist from Experience Qatar to book it for you.

Comparing Coverage and Costs

The cost of visitor health insurance is just 50 QR for everyone.

Medical Expenses and Emergency Medical Evacuation

Travel insurance in Qatar provides coverage for unforeseen medical expenses that may arise during your trip. This includes costs associated with hospitalization, doctor visits, and necessary medications. Additionally, in the event of a medical emergency that requires transportation to a different medical facility, travel insurance offers coverage for emergency medical evacuation, ensuring you receive the necessary care without financial burden.

Health Insurance Tips and Advice for Visitors to Qatar

- Before embarking on your journey to Qatar, it’s essential to ensure you have appropriate travel insurance coverage.

- Familiarize yourself with the policy terms, including any exclusions and limitations. Additionally, consider any pre-existing medical conditions you may have and whether they are covered by your chosen insurance plan.

- By adequately preparing with the right travel insurance, you can enjoy peace of mind throughout your trip.

- While having travel insurance provides financial protection, it’s also important to take necessary precautions to stay safe during your travels in Qatar.

- Familiarize yourself with local laws, customs, and emergency contact information. Keep your travel insurance details easily accessible in case of an emergency.

- Take necessary steps to safeguard your belongings, be mindful of your surroundings, and follow any travel advisories or guidelines issued by the relevant authorities.

By combining travel insurance with responsible travel practices, you can ensure a safe and protected experience in Qatar. So, don’t let uncertainties hinder your journey; embrace the beauty of Qatar with the assurance that health insurance brings.

FREQUENTLY ASKED QUESTIONS

Can i purchase insurance after arriving in qatar.

Ideally, it’s recommended to purchase insurance before you begin your journey to ensure you are covered from the start. However, in some cases, it may be possible to purchase health insurance after arriving in Qatar, depending on the insurance provider’s terms and conditions.

Can I use my existing health insurance from my home country?

Some international health insurance policies may provide coverage in Qatar. However, it is important to check with your insurance provider to ensure that your policy meets the specific requirements set by the Qatari government.

What happens if I don’t have health insurance when entering Qatar?

Without health insurance, you may not be granted entry into Qatar. It is crucial to obtain health insurance coverage before your arrival to comply with the new regulation.

How can I ensure that my health insurance policy meets the requirements?

To meet the requirements, it is essential to review the specific guidelines provided by the Qatari government. Ensure that your health insurance policy covers emergency medical treatment, hospitalization, and meets the minimum coverage limit specified by the government.

Who does the health insurance requirement apply to?

The health insurance requirement applies to all visitors, regardless of the purpose or duration of their stay. This includes tourists, business travelers, and individuals visiting friends or family members in Qatar.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- February 2024

- January 2024

- December 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2022

- Best Places to Visit in Qatar

- Best Places to Visit in Qatar|Dine & Wine in Qatar

- Best Places to Visit in Qatar|Dine & Wine in Qatar|Unique Experiences in Qatar

- Best Places to Visit in Qatar|Unique Experiences in Qatar

- Doha vs Dubai | Best Experience in Qatar

- Eid celebration Qatar 2024

- Female Travelers in Doha

- Ramadan in Qatar

- Unique Experiences in Qatar

Experience Qatar: Redefining travel through excellence, authenticity, and personalized service, creating unforgettable moments in Qatar’s captivating wonders while promoting sustainability and supporting local communities.

Office # 315, 3rd Floor, Ace Business Center, Building # 8, Al Rawabi Street, Doha, Qatar

[email protected]

All Tours are Operated by Experience Tours for Tourism Services LLC, Licensed by Qatar Tourism

- Privacy Policy

- Refund Policy

WhatsApp us

Download Our Tour Book

Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in

+ 844 1755 – 444 11

- Personal Corporate Investor Relation

- Salvage Auctions

Follow us on:

Download app:, medical insurance.

Your health matters. We’ll make sure that you and your loved ones get the treatment they need, whenever they need it.

- Our Promise

- Submit Claim

Our Medical Plans:

Balsam Visitors

The Visitors plan is one of our insurance policies that we created specifically for your visitors coming to the Qatar. The policy is designed to cover any visitor’s health insurance worries and can be purchased before departure from any worldwide country.

Balsam General

Covering all your adequate medical needs. Balsam Standard medical insurance plan covers most of the medical services provided as an outpatient as well as an inpatient, including the expenses incurred in diagnosis, medical treatment & medicines.

Balsam Bronze

The Bronze plan is a decently designed and reasonably priced plan. The plan offers a range of options to select what suits you most. The plan also has the flexibility to opt for routine dental cover if required.

Balsam Silver

The Silver plan offers comprehensive coverage for inpatient and outpatient services. This health insurance plan has range of options to select that suits the member the most. Routine dental care and major dental care can be selected. Vision care is also offered as an option that can be selected if required.

Balsam Gold

The Gold plan is an exclusive health insurance plan designed for members who do not like to compromise on benefits. This plan offers coverage for inpatient and outpatient services. Routine dental care and major dental care can be selected. Vision care is also offered as an option that can be selected if required.

What is covered:

Emergency Medical Assistance Emergency Medical Assistance, Covid Coverage

Hospitalization Benefit Hospital charges, Cancer and kidney dialysis treatment , Pre/post hospitalization treatment, Home nursing

Outpatient Benefit GP Doctor Consultation, Prescribed medicines, Health check-ups, Vaccinations

Optional Dental Benefit Routine dental checks, Extractions, Implants, Crowns

Optional Vision Benefit Eye checks, Eyeglasses or contact lenses

Our Promise to you:

Best Treatment

Our large network will give you quick access to the best medical professionals.

Flexible Plans

Flexibility to choose benefits according to your needs rather than buying a preset plan

Health is wealth

All our policies are tailored to your medical needs to keep you happy and healthy.

Total Protection

Total protection to complete your coverage

Smart questions you may be asking: View all

Our health insurance policy will not provide coverage for the following- • Cosmetic or Obesity treatment • Pregnancy-related conditions • Injuries caused due to self-harm or suicide attempt • Injuries suffered due to adventure sport, war, nuclear explosion, defense operations

Getting cashless claims is extremely simple. All you have to do is seek treatment in one of the network hospitals covered under your medi-claim policy. Upon completion of the treatment, the hospital files a claim with the insurer, and the insurance company settles the bill directly with the hospital. Policyholders need not pay a single penny for cashless claims.

Your health insurance policy offers cover against medical expenses. If a person meets with a medical emergency, then they can file for a claim with health insurance. However, a policyholder will not get such benefits when the health insurance policy has expired. The person must pay the medical expenses out of their pocket. Therefore, it is extremely important that you remember the expiry date of your medical insurance policy and renew your health insurance plan on time to enjoy interrupted protection.

Under health insurance, the age and the amount of cover are two main factors that decide the premium. Usually, younger people are considered healthier and thus pay lower annual premiums. Older, people pay a higher health insurance premium as their risk of health problems or illness is higher. Similarly, smokers and those who consume alcohol have higher premiums. Even the nature of your job and where you stay can influence the premium of your medical insurance policy.

Yes, you can have more than one medical insurance policy. In case of a claim, you can choose which policy to use to cover your costs. The benefit of having 2 health insurance plans is that, once the Sum Insured of one policy is exhausted, the remaining medical expenses, if any, can be claimed through the second health insurance policy.

TPA is short for Third Party Administrator. TPAs are IRDAI authorized entities that act as intermediaries between the general insurance company & the policyholder. They provide policyholders with numerous services such as claim guidance, issuance of photo identity cards, providing approval for cashless claims, guidance for rejected claims, and so on.

Claims Services

No need to visit a Claims Office to file your claims! Our Online system is ready to help round the clock, call 44658888 or WhatsApp 44658899 for all inquiries related to your claims.

Step 1: Direct billing within network If you are getting medical treatment within our network, no claim is needed. All you need to do is present your medical insurance card and we will cover the cost of treatment outside of the deductible.

Step 2: Reimbursement outside network If you get medical treatment outside our network or overseas, then you will need to submit a claim for reimbursement.

Step 3: Claim settlement If you submit a medical claim because you need us to reimburse you, we will do this by transferring the amount directly into your bank account. You will receive an email/SMS notification when the transfer is complete.

First thing’s first. Make sure you have all of the right details and documents ready, so you can submit your claim as smoothly as possible.

To submit your medical claim, you will need: •Policy number •Medical report •Detailed bill •Payment receipt •Insured personal banking details •Claim form*

If you are an Individual Medical Insurance cardholder, you can submit your claim to our medical insurance department at QIIG main office with original documents.

To get in touch with us about any medical claims questions, email us at [email protected] and we will be happy to help you

Phone: 44658888

Whatsapp: 4465 8899

Online: Submit your medical claim online .

How To Get Travel Health Insurance For Visitors To Qatar?

Are you planning a trip to Qatar? Starting from February 1, 2023, visitors to Qatar are required to have Travel Health Insurance. If you are applying for a visitor’s visa, you must have health insurance. This applies to all types of visit visas, like the Family Visit Visa or the GCC Residents Visit Visa. Even if you are staying less than 30 days, it’s highly recommended to have travel insurance.

The goal of this mandatory scheme is to regulate healthcare costs and improve the healthcare system. It protects you in case of accidents or medical emergencies during your stay. This insurance covers just emergency and accident services and has a monthly payment of QR50 once the visitor’s visa is issued or when extended.

In this article, we’ll cover how to get mandatory health insurance for visitors to Qatar, the approved companies, the cost, exemptions, and recommendations. So, let’s make sure you’re prepared for your upcoming visit to Qatar.

Law No. 22 of 2021 on Health Insurance

- Qatar’s Law No. (22) of 2021 regulating healthcare services in Gytar stipulates the requirement of Health insurance to travel to Qatar.

- The law requires Qatari companies to give health insurance coverage to their foreign national workers who live and work in the country through private insurance companies. (Art. 11.)

- Foreign nationals’ work permits cannot be extended or renewed without proof of health insurance coverage. (Art. 10.)

- In contrast to foreign nationals, Qatari citizens are not forced to use services provided by commercial health insurance firms under Law No. 22 but are entitled to free healthcare services from the Qatari government. (Art. 6.)

Mandatory Health Insurance for Qatar Requirement

All travellers to Qatar who applied for a visitor’s visa after 1 February 2023 are obliged to purchase health insurance. This is required for all types of visit visas, including the Family Visit Visa, the GCC Residents Visit Visa , and the Visa On Arrival. While GCC citizens are spared from the health insurance requirement during their visit to Qatar.

Why is Qatar implementing a health insurance scheme?

The health and well-being of tourists are of the utmost concern, according to MOPH. As a result, the government has put in place the essential measures to safeguard visitors from accidents and medical emergencies during their stay. The program intends to control health insurance and assure continual improvements by developing a sustainable and effective healthcare system and managing healthcare expenses.

How to Obtain Visitor Health Insurance for Qatar

To obtain health insurance for your visit to Qatar, you will need to go through an additional step in the visitor visa application or extension process.

Visitors Applying for a Visit Visa Online

- Visitors using the Metrash App to apply for a visit visa will be forwarded to the MOPH website.

- After completing all other applicable visa procedures, they can choose one of the insurance providers registered with the Ministry to acquire the visitor’s medical insurance.

- The Ministry of Interior will grant the relevant visit visa after the insurance coverage is issued by the chosen insurance company.

- The visitor will obtain the Health Insurance Policy from the insurance providers’ websites. The policy can be printed, saved, and presented as needed.

Visitors Who Are Eligible for a Visa On Arrival

To guarantee a rapid completion of your processes upon arrival at all of the border crossings (airport, land, and seaports), tourists are requested to obtain visitor insurance coverage through the MOPH website before arriving at these ports and following the same protocols described.

Health Insurance Approved by the MOPH

The registered insurance firms are published on the website of the Ministry of Public Health. Visitors can select any of the mentioned insurance firms by using the links on the MOPH website :

The following insurance firms are registered:

- Al Khaleej Takaful Insurance

- Beema Damaan Islamic Insurance Company

- Doha Insurance Group

- Doha Takaful

- General Takaful

- Insurance that is Islamic

- Qatar General Insurance and Reinsurance Co.Q.P.S.C

- Qatar Insurance Company

- QLM Life & Medical Insurance Company

The Ministry of Public Health stated that tourists who have foreign health insurance must also include Qatar, must be valid throughout their stay in the country, and must be supplied by one of the insurance firms permitted in Qatar.

Prices of Visitor’s Health Insurance Policy:

- The regular price for a single health insurance policy for 30 days (about 4 and a half weeks) will be QAR 50.

- A traveller must purchase extra health insurance to extend a visit visa beyond 30 days.

- Travellers can also purchase extra health insurance plans, with varying rates based on the insurance company’s costs.

- If the duration of the stay is shorter than the duration of the visa, health insurance premiums cannot be repaid.

Exemptions and Recommendations

Visitors to Qatar may be exempt from the mandatory health insurance requirement if their stay is less than 30 days. However, it is highly recommended to purchase health insurance even for short trips as some airline staff may ask for it. If insisted, insurance can be purchased for QR 50. Australian citizens, who can get a visa on arrival, usually do not need health insurance for short-duration trips. To provide a clearer understanding, here is a table that summarizes the exemptions and recommendations for Qatar visit visa insurance:

Please note that this table is for reference purposes only, and visitors should always check the latest updates and requirements on the Government of Qatar’s website and Envoy’s website.

Health Insurance Validity Period

- Health Insurance Validity Period for Visitors to Qatar

- The visitor’s entrance date at any border is the date of commencement of insurance.

- If the tourist chooses to prolong his or her stay in the State of Qatar, a new health insurance coverage must be purchased.

- The tourist’s insurance coverage has a minimum period of 30 days (about 4 and a half weeks); a policy with a shorter duration cannot be purchased.

- In the situation of a single-entry visa , the basic visitor insurance package expires upon exiting the State of Qatar whether it’s air, sea, or land port.

- For multiple-entry visas , there is insurance coverage that is effective from the date of entrance until the policy expires

Hayya Cardholders and their Companions:

Hayya cardholders and their companions must get visitors’ insurance plans that cover the remaining duration of the Hayya card entrance permit, which expires on January 24, 2024. For example, if a Hayya Cardholder intends to join the State of Qatar on March 1, 2023, he or she should buy an insurance plan for 11 months, and if intends to enter Qatar on April 1, 2023, he or she needs to purchase an insurance policy for 10 months, and so on.

Visitors from Abu Samra:

In addition to the mandatory Health Insurance, visitors from Abu Samra must get automobile insurance. Vehicle insurance may be purchased online.

Coverage under the Visitor’s Health Insurance Policy

Visitors’ compulsory health insurance is limited to covering emergency medical procedures and accidents.

Emergency Medical Assistance:

• Up to QAR 150,000 throughout the policy and inside the State of Qatar.

• Emergency medical care with a sub-limit of QAR 35,000 includes Emergency ambulance transportation inside Qatar and anywhere necessary.

COVID-19 and Quarantine:

• Sub-limit up to QAR 50,000.

• Treatment of Covid-19 in positive cases.

• The cost of quarantine (for confirmed illnesses) could exceed QAR 300 per day.

Repatriation:

If a tourist dies within the State of Qatar, the expense of repatriation will be covered up to a maximum of QAR 10,000.

Is there a waiting time before this policy is activated?

No, the visitor’s health insurance coverage will not have a waiting period.

Is there a copayment or deductible related to this policy?

According to the terms and conditions of the tourist’s health insurance policy, no copayment or deductible will be paid for any covered services.

In the event of an emergency, what should I do?

You can go to a service provider who is part of the insurance company’s network. The policyholder can contact the registered insurance company for assistance in locating the nearest treatment centre that can offer the necessary care.

Acceptance Criteria for International Health Insurance Companies:

Besides the above insurance providers, Qatar MOl may accept some foreign health insurance companies if the following rules and regulations established by the Ministry of Public Health are met:

1. Must be granted by one of the insurance providers on the Ministry of Public Health’s authorized list.

2. The State of Qatar is included in its geographical coverage.

3. It must be valid and cover the duration of the visitor’s stay in the country.

4. To pay for emergency services and accidents up to 150,000 Qatari Riyals per year, with no deductibles or surcharges.

5. Must Include a QR code.

The policy can be posted to the Ministry of Interior’s website or printed and shown to the designated officer at the point of entry.

Helpline for MOPH

If you have any questions concerning the required health insurance coverage, please call the MOPH Helpline at 16000 (from inside Qatar). The first extension is for health insurance.

International tourists can contact the hotel at 00974-44069963.

Email your complaint to [email protected] .

We hope you found this information useful! Please contact us if you have any more queries concerning health insurance for tourists to Qatar. We’d be delighted to assist you!

Frequently Asked Questions

Are there any exceptions to the mandatory health insurance requirement for visitors to qatar.

There are no exceptions to the mandatory health insurance requirement for visitors to Qatar. All visitors applying for a visa must have health insurance policies, regardless of the duration of their stay.

Can Visitors Purchase Health Insurance From Any Insurance Company, or Are There Specific Approved Companies They Must Choose From?

You must purchase health insurance from specific approved companies listed by the Ministry of Public Health. It is not possible to buy insurance from any company. Ensure you choose from the approved list.

Is the Cost of the Health Insurance Policy the Same for All Visitors, Regardless of Their Duration of Stay?

The cost of the health insurance policy may vary depending on the insurance company’s prices. Whether you stay for a short period or longer, the premium for a single policy is QAR 50 (USD 13.73) for 30 days.

What Happens if a Visitor’s Stay in Qatar Exceeds 30 Days? Are They Required to Purchase Additional Health Insurance?

If your stay in Qatar exceeds 30 days, you will need to purchase an additional health insurance policy. This ensures that you are covered for the entire duration of your visit and comply with the mandatory health insurance requirement.

Are There Any Specific Recommendations or Guidelines for Visitors Regarding the Health Insurance Requirement?

It is highly recommended that you obtain health insurance when visiting Qatar, even if your stay is less than 30 days. This will protect against accidents and medical emergencies during your time in the country.

In conclusion, if you’re planning a visit to Qatar starting from February 1, 2023, it’s important to be aware of the new requirement for health insurance.

This mandatory health insurance scheme aims to regulate healthcare expenditures and ensure continuous improvements in the healthcare system. It’s designed to protect against accidents and medical emergencies during your stay in Qatar.

Make sure to obtain visitors’ health insurance from approved insurance companies to comply with the regulations and ensure a safe and secure visit.

Similar Posts

How to Apply for Hayya Card Qatar 2024?

The Hayya Card, which was established during the 2022 FIFA World Cup in Qatar, has been reissued in a new format that makes applying for visas to Qatar easier than ever. It is now available on smartphones, allows individuals to apply for all kinds of visas to Qatar, which includes visas for tourists, GCC citizens,…

Hayya Entry Permit: FAQ for Qatar visa and Hayya Permit 2024

The Hayya Entry Permit is a mandatory requirement for all visitors to Qatar during the 2022 FIFA World Cup. It is an electronic identification and travel document that will allow you to enter, exit, and move around Qatar during the tournament. This FAQ will answer your questions about the Hayya Entry Permit, including how to…

How To Invite Family and Friends On Hayya Card Qatar

In our fast-paced world, staying connected with our loved ones can sometimes be a challenge. Fortunately, with the Hayya Card, you have a powerful tool at your disposal to invite family and friends on Hayya Card and bring your loved ones closer together. In this comprehensive guide, I will walk you through the process of…

Free Qatar Visa on Arrival Eligibility, Cost & Stay Period

Are you planning a trip to Qatar? Wondering about the requirements and costs for obtaining a Qatar visa on arrival? The answer depends on your nationality. Citizens of many countries can obtain a visa on arrival which allows you to visit Qatar during your layover or extended stay. Welcome to our comprehensive guide on Qatar…

Qatar Visa Types For Filipinos: Visa Requirements & Fee 2024

With an increasing number of Filipino visitors in Qatar, Qatar Guides has decided to write a comprehensive article about the “Qatar Visa Types for Filipinos along with its types, requirements and fees. Philippine employees are Qatar’s 4th largest group of foreign workers. In addition to the quarter hundred thousand Filipino expats that live here, hundreds…

How To Confirm Your Hayya Card Pending Accommodation (2024)

You must be worried about Hayya Card Pending Accommodation status. Are you an International traveller who submitted the Hayya card application but facing Hayya Card Pending Accommodation notification? Their Hayya Card application won’t be fully accepted until all the information about their accommodation is submitted and authenticated. Here I will discuss the various alternatives for…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- KQIC Kuwait

- QIC Europe Limited

- QIC Real Estate

- Antares Group

- Travel Insurance

Travel Insurance is more than a piece of paper

We’ve got you protected, covers that protects you and your family.

- Travel without Trouble – pay for where you travel

Buying your travel insurance

In case of a claim, get quote today.

Get a Quote

Buying your travel insurance should be more than just having the papers required for visiting Schengen countries – it is about providing the feeling of security for you and your family if things go wrong

Travel insurance with QIC gives you the security of knowing you and your family are in good hands, should something happen

Get Travel insurance with covid-19 cover and enjoy a safe trip

If you contract COVID-19 while on a covered trip, we will pay the cost of the medical treatment , and you may be covered for trip cancellation in the event of confirmed infection with Covid-19, 14 days prior to your departure

Refer for covid 19- extension wordings for a detailed description of covers

Click here for policy wordings

If you lost your baggage

If your bags don’t show up when you do – or they are damaged – we will compensate you for the things you need in order to enjoy your travels uninterrupted

If your trip is cancelled or shortened

Do you have to cancel because you’re sick or for another reason beyond your control? No worries! We will reimburse a fixed amount to cover your incurred travel expenses

If you have Medical expenses

Need to go to the hospital while traveling? We’ll cover your expenses caused by accidents, illness

From lost or damaged luggage to accidents caused by terrorism and more – QIC has got you covered!

Medical Expenses

Treatments and hospitalization in case of illness while travelling

Personal Accidents

Accidents during your trip, including injuries, disability, and death

Third-Party Damage

Damages you might cause to others or to their properties

Loss of Passport

Reimbursement for getting a replacement travel document

Covid-19 Cover

Medical, hospitalization, quarantine and trip cancelation fees in case of a COVID-19 infection

Loss of Baggage

Compensation for lost luggage in airports or transit areas

Trip Cancelation

Covers non-refundable expenses in case your trip got canceled

Terrorism Attacks

Damages and injuries due to terrorism acts in abroad

Optional Extra: Winter Sports Extension

Covers you in case of accidents occurring while skiing and guarantees you a memorable, hassle-free winter vacation Click here for policy wordings

Get a quote today and get 20% discount on your travel insurance .

Travel without trouble – pay for where you travel.

Travelcare Plus covers you for travel destinations across the world including USA, Canada as well as Schengen countries. All you have to do is select the travel destination (as categorized below) and pay the premium accordingly.

- Regional – includes GCC, Arab countries, India, Pakistan, Sri Lanka, Bangladesh, Korea, Philippines, Indonesia, Nepal and Bhutan.

- Worldwide excluding USA and Canada- With this extensive cover, travellers could be covered for loss of baggage or any other travel related inconveniences like loss of Passport.

- Worldwide- This cover has been designed for travellers who will be visiting the USA/Canada.

- Fly Europe – This cover has been specially designed for travellers who are required to buy insurance to avail a visa for Schengen countries. This policy only covers for Medical Expenses up to USD 50,000.

TravelCare Plus policy wordings

*Annual Policy is for mutiple trips for maximum of 90 days

At QIC, our customers’ convenience and the quality of services we provide at an equitable cost are of utmost importance

We understand the hassle one goes through when visiting a branch to manage insurances or make calls for subscriptions etc.

We are, therefore, proud to offer you qic.online , where you can purchase your travel insurance at the click of a button

To make it even simpler, you can download our QIC App manage your insurances easily from your smartphone

Android App

QIC Call Center: 8000 742 – open Sunday through Thursday from 7 AM – 8 PM, Saturday from 9 AM – 5 PM

Product Manager: Rayane Malak QIC Retail Department Email: rayane.malak@qic.com.qa

Having a claim to register – is always a hassle; we know this. We have therefore done our utmost to make registering and managing claims with us as easy and fast as possible

You can read much more about our Travel Insurance claims process here and you can always call us on 8000 742 for assistance or email us at personal.claims@qic.com.qa

Brilliance. Excellence. Success.

Qatar Insurance Company Q.S.P.C. Tamin Street, West Bay, PO Box: 666, Doha, Qatar

A.M. Best Europe assigned financial strength rating of A- (Excellent) and issuer credit rating of “a-” (Excellent) to QIC and its subsidiary Anteres-Re Read More

Standard & Poor's (S&P) confirmed its ‘A-’ issuer credit and financial strength ratings on QIC, with a stable outlook. Read More

Get Connected

Personal Insurance /Retail Life & Medical Media Careers Customer Service

- Destinations

Qatar Travel Insurance Requirements

Last updated: 03/07/2024

As of February 1, 2023, all foreign visitors are required to have an approved and recognized medical insurance policy in order to gain entry into Qatar. The policy must be effective for the duration of their stay, and can be purchased in advance or on arrival at a cost of 50 Qatari Riyal, roughly $14.

According to authorities, travelers with international health insurance must have a policy that’s valid in Qatar, covers their entire stay in the country, and was issued by one of the recognized insurance providers. Be sure to visit the official Visit Qatar website for a full list of recognized insurance providers.

Squaremouth’s Travel Insurance Recommendations

All foreigners visiting Qatar must purchase a policy from a insurance provider that’s been recognized by the Qatari government in order to gain entry into the country. With that said, there’s a possibility that the coverage options available from those recognized providers won’t meet the needs of some travelers. If additional coverage is needed, Squaremouth recommends supplementing the required coverage with a comprehensive travel insurance plan.

For travel to Qatar, Squaremouth recommends a policy with at least $50,000 in Emergency Medical coverage and $100,000 in Medical Evacuation coverage. This is in line with Squaremouth’s general international medical recommendations, due to the potential for high medical expenses overseas.

Emergency Medical coverage can offer reimbursement for expenses due to an unforeseen illness or injury. Covid-19 treatment can also be covered under most policies. The Medical Evacuation benefit can provide reimbursement for costs associated with transportation for a traveler to get to the nearest adequate medical facility.

Travelers visiting Qatar may have extensive travel arrangements, pre-paid trips costs, and non-refundable expenses, such as airfare, accommodations, tours, sports tickets, or excursions. For these travelers, Squaremouth recommends a comprehensive plan that offers the Trip Cancellation benefit. This benefit can reimburse up to 100% of these prepaid and non-refundable insured trip costs if a traveler has to cancel for a covered reason.

The most common covered reasons typically include contracting Covid-19 or another unforeseen illness, an injury, inclement weather, or terrorism.

Policies with Trip Cancellation are comprehensive. This means these policies often include coverage for other major traveler concerns, such as delayed baggage, missed connections, or a trip that gets interrupted after the departure.

Click here to begin your search for Qatar Travel Insurance.

Qatar Travel Insurance Trends and Data

Qatar is an Arabian peninsula surrounded on three sides by the Persian Gulf. It also boasts miles of sand dunes. The capital, Doha, is famous for its ultra-modern architecture and impressive skyscrapers. Qatar is also home to the 2022 FIFA World Cup.

Destination Rank: 138

Percentage of Squaremouth Sales: 0.02%

Average Premium: $249.07

Average Trip Cost: $3,402.75

Helpful Resources

- Department of State Travel Information

- US Embassy in Qatar

Available Topic Experts for Media:

Squaremouth's destination information is free and available for use within your reporting. Please credit Squaremouth.com for any information used.

Squaremouth's topic experts are on hand to answer your questions. Contact a member of our team for media inquiries about Squaremouth Analytics or to schedule an interview.

Steven Benna, Lead Data Analyst: [email protected]

We're here to help!

Have questions about travel insurance coverage? Call us! 1-800-240-0369 Our Customer Service Team is available everyday from 8AM to 10PM ET.

fb.success.share

Does your current profile name match the name in your passport?

- qmiles.portalprofcard.mobilenumbererror

I agree to the terms and conditions of the Privilege Club Programme. I also agree to receiving communications by email, post, SMS or social media about my membership account, offers and news from Qatar Airways and Privilege Club, Privilege Club partner offers and market research from time to time.

Your perfect travel companion

Middle East GCC

- Bahrain English

- Iran English

- Iraq English

- Jordan English

- Kuwait English

- Lebanon English

- Oman English

- Qatar English

- Saudi Arabia English

- United Arab Emirates English

About Trade Portal

- Oryx Connect (NDC)

- Destination Qatar

- Sports Travel

- Discover Qatar

- Study & Fly

- Business Solutions

- Inflight Entertainment

- Onboard Cuisine

- Onboard Experience

- Oryx Inflight Magazine

- Self-services

- Name correction

- Qsuite Quad Access

- Carriage of Pets

- Young Solo Traveler

- STPC Request

- Popular searches

- Schedule Change Policy

- Booking & Ticketing Guidelines

Choose your region

Get more on our app.

- Dashboard My profile Sign out

Please accept the Qatar Airways Partner Agency Policies(QAPAP)

What is QAPAP?

- All of Qatar Airways policies in one place

- Defines legal framework of Agency enagagement

- Enables Agencies to obtain QR content via NDC

- Protects mutual Agency-Airline data

- Reduces unwanted and unexpected ADMs

To know more, please click here

Placeholder

Your session is about to expire

Essential travel health insurance, mandatory health insurance.

If your clients are planning to visit Qatar for an extended stay, work trip or using your Hayya Fan Entry Permit they may need to get travel health insurance to meet the requirements of the Ministry of Public Health.

For more information on how to obtain a visitor’s health insurance please visit Ministry of Public Health - Mandatory Health Insurance Scheme (moph.gov.qa) or the VisitQatar Health Insurance page

One-time pin

Add an extra layer of security to your account with a one-time pin (OTP).

Secure your account with an OTP:

Receive your otp via:.

Enter a mobile number

login.otp.mobile.calling.code.emptyerrormessage

Please enter email address

Mobile number and email address should not be empty

Please enter valid email address

Placeholder for service error message

Your account is less secure without an OTP

Your OTP preferences have been updated.

A verification link will be sent to your newly amended email address. You will now logged out of your Privilege Club account. Do you wish to continue

Please enter the one-time pin (OTP) sent to your registered mobile number {0}.

A new OTP was sent successfully.

Please enter the one-time password received in your registered email, {0}.

one-time password has been re-sent. Please enter the one-time password received in your registered email, {0}.

Please enter the one-time pin (OTP) sent to your registered email address {1} and mobile number {0}.

A new OTP has been sent to your registered email address {1} and mobile number {0}. Please enter it below.

Please enter the valid one-time password

OTP should not be empty

Your account has been temporarily locked as the maximum number of daily attempts has been reached. Please try again by resetting your password after 24 hours. Back

The OTP has been successfully verified.

Your contact details have been successfully changed..

Lounge Pass Allocate

Tier status allocate, qrbb lounge pass allocate.

- Lounge Pass Allocated: 0 |

- Tier Status Allocated: 0 |

Please provide any of the input details

No results found

Place holder for service error

The requested benefits allocated successfully

Program Admin Details

Cannot add more than 2 program admins

IMAGES

COMMENTS

Trusted by over 200,000 customers in Qatar. Very quick response, fast services, and customer-friendly. Afnaz Mohamed. Professional services, friendly staff and very reasonable prices. Ahmad Abouisteite. The best online insurance solutions in Qatar. Insurance is made easy for real.

In case of any queries about the mandatory health insurance policy, you can call the MOPH Helpline on 16000 (inside Qatar). Extension number 1 is dedicated to health insurance. International visitors can call 00974-44069963 . For complaints, you can email: [email protected].

Health Insurance Premium . The premium for the Mandatory Visitors' Health Insurance policy is QAR 50 per month. The visitor can purchase additional coverage (Top-ups) as desired provided extra premium determined by the insurance companies. Holders of a Hayya card must obtain health insurance for the remaining period of their Hayya card.

February 22, 2023. U.S. Embassy Doha. Message for U.S. Citizens. Visitors' Health Insurance Now Required to Enter Qatar. Visitors to Qatar are now required to have a health insurance policy. This insurance covers emergency and accident services only, with a premium of QR50 per month at the initial issuance and upon extension of the visitor ...

The premium for the Mandatory Visitors' Health Insurance policy is QR 50 per month. This is the single insurance policy premium for a period of 30 days (minimum duration), and the premium for other visas varies according to the duration and type of visas. The visitor can purchase additional coverage (top-ups) for extra premiums.

Travellers entering the State of Qatar for a stay of over 30 days are required to obtain health insurance with any insurance company that is registered with the Ministry of Public Health. You can get your health insurance on arrival. However, we strongly advise securing health insurance before travelling.

The Mandatory Visitor Health Insurance protects you in case of accidents, medical emergencies and COVID 19 related conditions. As per Ministry of Public Health guidelines, all visitors coming to Qatar require a mandatory visitor health insurance to be able to enter the country. QLM's visitor's health insurance offers comprehensive coverage ...

The Ministry of Public Health (MoPH) has announced that the implementation of the first phase of the mandatory Health Insurance scheme in Qatar, started from February 01, 2023. Its mandatory for all the visitors to Qatar required to have a health insurance policy. This is in accordance with the Law No. (22) of 2021, regarding the regulation of ...

International visitors can get a fully-digital visitors' health insurance policy in less than 2 minutes on qic.online and from anywhere in the world before their trip into the country. QIC's online platform also offers visitors the possibility of adding up to 5 friends, relatives, or travel companions under their mandatory health insurance policy.

The Ministry of Public Health (MoPH) has announced that the implementation of the first phase of the mandatory Health Insurance Scheme in the State of Qatar will begin on 1 February 2023, with all visitors to the State of Qatar required to have a health insurance policy. This is in accordance with Law No. (22) of 2021 regarding the regulation ...

The Peninsula. Doha: The Ministry of Public Health (MoPH) has announced that the implementation of the first phase of the mandatory Health Insurance Scheme in Qatar will begin on February 1, 2023 ...

Step 1: Report incident. You report the incident, with the required documents. Step 2: Claim assessment. Once you report the claim and submit your documents, we can start your claim process. We record details of the incident, assess your case and email you with guidance on the next steps. Depending on the loss, we might need to come to review ...

Understanding Visitor Health Insurance Qatar Travel Insurance Coverage: Travel insurance in Qatar offers a comprehensive range of coverage, ensuring you are protected throughout your journey. This includes vital elements such as medical expenses, and access to 24/7 emergency assistance. With travel insurance, you can have peace of mind knowing ...

What to expect when you submit a medical claim-click to expand. Step 1: Direct billing within network. If you are getting medical treatment within our network, no claim is needed. All you need to do is present your medical insurance card and we will cover the cost of treatment outside of the deductible. Step 2: Reimbursement outside network.

by Dianne Apen-Sadler October 3, 2022. Visitors to Qatar will now have to pay QR50 for a health insurance premium, according to the Official Gazette. Published yesterday (Sunday October 2), the health insurance premium for entry visas will be priced at QR50 per month, and will cost the same if the visa is extended.

If you have any questions concerning the required health insurance coverage, please call the MOPH Helpline at 16000 (from inside Qatar). The first extension is for health insurance. International tourists can contact the hotel at 00974-44069963. Email your complaint to [email protected].

Contact: QIC Call Center: 8000 742 - open Sunday through Thursday from 7 AM - 8 PM, Saturday from 9 AM - 5 PM. Product Manager: Rayane Malak. QIC Retail Department. Email: [email protected].

Essential travel health insurance. 08 March 2023. Updates. If your clients are planning to visit Qatar for an extended stay, work trip or using your Hayya Fan Entry Permit they may need to get travel health insurance to meet the requirements of the Ministry of Public Health. For more information on how to obtain a visitor's health insurance ...

For travel to Qatar, Squaremouth recommends a policy with at least $50,000 in Emergency Medical coverage and $100,000 in Medical Evacuation coverage. This is in line with Squaremouth's general international medical recommendations, due to the potential for high medical expenses overseas. Emergency Medical coverage can offer reimbursement for ...

Whether you are travelling to Qatar or a Qatar resident and inviting your family to visit, buy your mandatory health visitor insurance online in 1 minute from GIG Gulf and secure your travel plans prior to travelling. TRAVELLING TO QATAR TRAVELLING FROM QATAR. *Terms and conditions apply.

Welcome. We bring to you innovative and tailor-made insurance solutions coupled with world class level of service. Our core strengths lie in a strong financial base, in-house 24/7 operations, highly qualified workforce, in-depth knowledge of the local and international markets and a diversified product range designed to provide premiere ...

Tel: +971 4 5096111. Email: [email protected]. Important information. Insurance terms and conditions. Our travel insurance booking service acts as a third party to enable you to get travel insurance cover with convenience on our website. Payments will be processed by Qatar Airways upon selection of the travel insurance product in the ...

Essential travel health insurance. 08 March 2023. Updates. If your clients are planning to visit Qatar for an extended stay, work trip or using your Hayya Fan Entry Permit they may need to get travel health insurance to meet the requirements of the Ministry of Public Health. For more information on how to obtain a visitor's health insurance ...