- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for medical-only coverage

- Best for family coverage

- Best for long trips

- Why You Should Trust Us

Best International Travel Insurance for June 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best International Travel Insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the Best International Travel Insurance Companies

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allianz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue Travel Insurance offers policies that covers emergency medical treatments when you're abroad. While GeoBlue lacks trip cancellation coverage, that allows it to charge lower premiums than the other companies on this list.

GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs.

Read our GeoBlue Travel Insurance review here.

Best for family coverage: Travelex Travel Insurance

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex Travel Insurance review here.

Best for long trips: Seven Corners

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners Travel Insurance review here.

How to Find the Right International Travel Insurance Company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

Your needs for travel insurance will depend on the type of trip you're taking. You'll need to consider your destination and what you'll be doing there, either business, leisure, or adventure traveling. Policies covering adventure sports and activities will cost more. Longer, more expensive trips will also cost more.

Research the reputation of the company

When researching a company, you'll want to closely review the description of services. You'll want to see how claims are handled, any exceptions, and limitations.

You'll also want to look at the company's customer reviews on sites like Trustpilot, BBB, and Squaremouth, as this will provide insight on the quality of customer service and the claims process. You should also take note of whether companies respond to customer reviews.

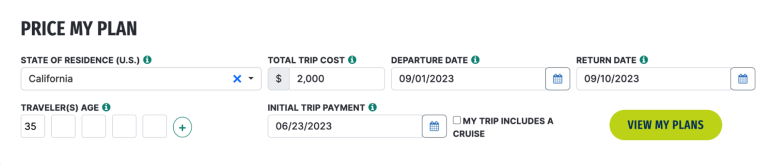

Compare prices

You can get quotes through a company's website or travel insurance aggregators like InsureMyTrip and VisitorsCoverage. You'll need to be prepared to provide the following information about your trip:

- Trip destination(s)

- Travel dates

- Number of travelers

- Traveler(s) age/birthday

- State of residence

- Total trip cost

For companies that offer travel medical insurance, you'll also want to play around with the deductible options, as they can affect your policy premium.

Understanding International Travel Insurance Coverage Options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the Best Price for International Travel Insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

Why You Should Trust Us: How We Reviewed International Travel Insurance Companies

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

Read more about how Business Insider rates insurance products here.

International Travel Insurance FAQs

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

You should pay attention to any limitations regarding covered cancellations, pre-existing conditions, and adventure activities. For example, if you're worried you may have to cancel a trip for work reasons, ensure that you've worked at your company long enough to qualify for cancellation coverage, as that is a condition with some insurers. You should also see if your destination has any travel advisories, as that can affect your policy.

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

You should purchase travel insurance as soon as possible after making payment on your trip. This makes you eligible for add-ons like coverage for pre-existing conditions and CFAR. It also mitigates the chance of any losses in the days leading up to your trip.

- Main content

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

We've helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Easy to compare

"I liked the comparison tool to see how the different policies stack up."

Robyn from MD 05/31/2024

Stress free!

"I was so thankful to find this website. Appreciated being able to talk to a real person. Very helpful!"

Susan from GA 05/27/2024

Comprehensive comparison

"Nice to have a large selection of policies and to be able to easily compare them."

Jeffrey from MD 05/14/2024

Great resource for travel insurance

"Website was easy to navigate. Numerous options for insurance. Excellent filter opportunities."

Rosemary from WA 05/05/2024

Rosemary from WA 5/5/2024

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

10 Ways to Get Great Coverage For Less

When it comes to travel insurance, more expensive does not necessarily mean better. We uncover 10 proven tactics you can use during your search to lower premiums without sacrificing protection.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

Travel insurance is not typically required when traveling overseas. The majority of travel insurance customers purchase their plans voluntarily for peace of mind and financial protection. With that said, some destinations or organized tours may require proof of international health insurance that lasts for the duration of your trip.

What Does Travel Insurance Cover?

Comprehensive travel insurance coverage is designed to protect against common disruptions that may impact a trip. Most travel insurance plans will provide coverage for trip cancellations, medical emergencies, travel delays, missed connections, accidental death and dismemberment, and lost luggage.

How Much Does Travel Insurance Cost?

In general, comprehensive travel insurance coverage costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without cancellation coverage will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: The situations and expenses that are covered by a travel insurance policy.

- Coverage Limits: The maximum dollar amount that will be reimbursed within each benefit.

- Exclusions: Specific activities, expenses, and scenarios that are not covered in the event of a claim.

- Premium: The cost of the policy for your specific trip.

- Provider Reputation: Based on past customer reviews regarding interactions with assistance services and the claims experience.

Does Travel Medical Insurance Cover International Trips?

Yes, travel medical insurance provides coverage for unexpected medical expenses that you may experience during a trip. This can include ambulance rides, hospital stays, doctor visits, and emergency medical evacuations.

Medical coverage is the most popular benefit among travelers because most primary health care plans, such as Medicare or an employer-sponsored plan, don’t offer coverage overseas. Traveling without proper health insurance could lead to thousands of dollars in out-of-pocket expenses.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing medical conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance plans cover cancellations under specified circumstances, such as sudden illness, injury, or death of a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Choosing the right travel insurance company can take time. We recommend comparing plans from at least 3-5 providers before buying.

Deals of the Week Mediterranean Magic Up to 50% OFF

Travel Insurance

Travel can sometimes be unpredictable, but with travel insurance from XCover via Cover Genius, you’re supported no matter what happens. It’s time to focus less on the what-ifs and more on your organized adventure

6192 reviews on

Your trusted travel companion

On an organized adventure, you’re looking for unique experiences, not unwelcome surprises! Travel insurance is your safety net, costing only pennies a day but saving you thousands in case of an accident or other misfortune. Imagine your flight gets canceled, an emergency requires you to return home, or you need to visit the hospital at your destination. Those are just a few examples of where XCover by Cover Genius would step in to help you recover your financial losses. They find solutions to your unique situation and help you with the associated costs. Most health plans don’t cover you overseas, and credit card coverage is limited, so purchasing good travel insurance is a no-brainer. Customized packages offered by companies such as Cover Genius are tailored to fit your needs and make the ideal travel companion for your adventures—from beginning to end!

More information

- Travel Insurance Myths Busted!

Travel insurance designed for the times

Cancelations, medical emergencies, baggage loss or theft.

Adding insurance to your TourRadar booking

Step 1: Choose your adventure and departure date

Step 2: Purchase your insurance at checkout

Step 3: Enjoy your adventure knowing you're fully covered

TourRadar proudly partners with Cover Genius

Travel insurance from our award-winning partner, Cover Genius, means you and your travel companions can book a tour on TourRadar with complete peace of mind knowing that you’re covered in case your adventure doesn’t go according to plan, something unforeseen happens while on tour or you are prevented from participating. XCover is one of Cover Genius’ global insurance distribution platforms that deliver personalized insurance in any country, language, and currency. Here are just a few things that are included with the XCover policy:

Tailored policy

Instant claims handling

Comprehensive Coverage

Xcover constituents for your consideration, trip cancelations.

No worries! With XCover you have coverage for airline cancelations due to illness or injury

If your items get stolen, lost, or damaged, your losses or expenses while you wait for the return of your items may be covered

Trip interruptions and Delays

Get reimbursed for unused travel if your trip is shortened due to injury or illness sustained by your or your travel companion as well as costs associated with trip delays

Get reimbursed for medical and dental treatment due to injury or illness sustained by you or your travel companion

Your travel insurance questions, answered

Do i need travel insurance.

In short–yes! Travel insurance is mandatory for most of the adventures on TourRadar and must be purchased before you start your travels. It covers trip cancellations, medical emergencies, lost or stolen baggage, and more.

Why is travel insurance important?

Aside from covering medical expenses while on an adventure, stolen personal items, and trip cancellations, travel insurance is there for you to reduce financial stress in case something unforeseen pops up and changes your vacation plans. Some things can be quite costly, so ensuring you have the appropriate travel coverage can save you a lot of money!

Are there age limits for travel insurance?

Most travel insurance providers have an age limit, so it’s best to double-check with your insurance provider to see if you’re eligible

How do I make a claim?

It depends on your travel insurance provider. It’s a good idea to familiarize yourself with your policy’s Product Disclosure Statement (PDS) to ensure you understand all inclusions, exclusions, and limitations before leaving for your trip. Make a note of your insurance provider’s 24-hour emergency phone number and how to make a claim in case the unforeseen happens.

About XCover Travel Protection via Cover Genius

Who is tourradar’s travel protection partner.

XCover is a global insurance distribution platform owned and managed by Cover Genius. It delivers peace-of-mind insurance with its stress-free claims process and quick claim payment into USD, CAD, AUD, NZD, EUR, and GBP, with policies backed by some of the world’s largest insurance companies, including Lloyds, Munich Re, Collinson, Generali, and Zurich.

How do I purchase XCover Travel Protection through TourRadar?

Adding insurance is available in the booking process as long as your country is included. Simply select your preferred departure date and proceed to the booking page, where you can view and customize the insurance policies for your trip before making your payment. If you’ve already booked your tour and want to add insurance, simply click the “Get Travel Insurance” button on your booking conversation page and follow the instructions. You can add travel insurance up until one day before departure.

What does XCover’s Travel Protection cover?

Common benefits include: Trip Cancellation: reimbursement if you or your travel companions need to cancel due to illness or injury, including an emergency at home Emergency Medical and Expenses: for emergency medical treatment, hospital visits, and evacuations/repatriations Baggage Loss/Theft: for reimbursement for personal items damaged, lost, or stolen while traveling Accidental Death

Who is covered by XCover’s Travel Protection?

XCover Travel Protection covers the travelers listed on your booking at the time of purchase. Please note that once your policy is booked and active, we cannot add extra travelers. For more information about your coverage, you can view your policy wording anytime by logging in to your XCover account with the email you used to book your tour.

How can I check my coverage?

When you obtain a quote, be sure to check the policy details to see your policy limits, exclusions, and inclusions, as they may differ depending on your home country, state, or destination. If you have already purchased a policy, you can check your policy wording anytime by logging in to your XCover account with the email you used to book your tour.

Does XCover Travel Protection cover pre-existing medical conditions?

Like many travel insurance policies, claims arising from pre-existing medical conditions are generally not covered. You can view your policy wording at any time from your XCover account . To log in, use the email you used to book your tour.

What is not covered by XCover Travel Protection?

In most countries, XCover’s policies don’t cover pre-existing illnesses. You also wouldn’t be covered if you don’t wish to travel or change your mind about your trip. Instead, you can check your rescheduling options on the booking conversation page of your tour. To see what’s included in your specific policy, you can check the policy wording on the insurance booking block when you book a tour and/or on the confirmation emails sent to you by our partner XCover.com .

Am I covered for my flights and other services booked outside of TourRadar?

Any travel services booked outside of TourRadar will not be covered when adding insurance to your TourRadar booking. You will need to look into a supplemental insurance plan to cover these travel services (flights, transport to and from the airport, etc.).

Which countries are covered by XCover Travel Protection?

Insurance with XCover is currently only available in the following countries: USA (except residents of New York and Hawaii) Canada (except residents of Quebec and Saskatchewan) Australia New Zealand Europe/UK → Austria → Belgium → Denmark → England → France → Germany → Ireland → Italy → Malta → Netherlands → Northern Ireland → Norway → Portugal → Scotland → Spain → Sweden → Wales

Your policy

How do i access my policy purchased through tourradar.

You can view your policy wording for your TourRadar Travel Protection at any time, either by checking your emails from our partner XCover.com or logging in to your XCover account using the email address you used when booking your tour on TourRadar.

My TourRadar booking has changed. Will my XCover Protection update as well?

If you make changes to your TourRadar booking, your insurance will be updated automatically, and you’ll be notified by email. You can always message us from your booking conversation page if you’re unsure whether your insurance has been updated.

Claims & medical emergencies

How do i make a claim with xcover.

To make a claim, head to the XCover website and select “Make a Claim.” If you’re not already logged into your account, you’ll be prompted to do so. Log in using the email address you used when booking your tour on TourRadar. Once logged in, fill out the online claim form to submit your claim. You should receive a claim confirmation and further instructions from XCover (or their third-party claims partners) via email within a few days.

I have a medical emergency. Who do I contact?

If your coverage includes medical emergency assistance, please contact XCover Assist or, for U.S. residents, your assigned emergency medical service provider. Please note that contact numbers vary by country of residence, so you’ll need to log in to your XCover account and view your policy wording to find the contact details relevant to you.

My booking was canceled. What now?

We’re sorry the operator canceled your booking—we understand how disappointing this can be. It’s important to note that insurance policies are typically non-refundable because they are designed to provide coverage for unexpected events, and the premiums paid are used to secure that coverage. Once the cooling-off period (when you can cancel your insurance policy) has passed, refunds are generally not possible.

Sign up for our newsletter

Get the best travel deals delivered straight to your inbox.

By submitting this form, I agree to the TourRadar T&Cs and Privacy policy .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Best travel insurance companies of June 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 2:16 p.m. UTC June 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

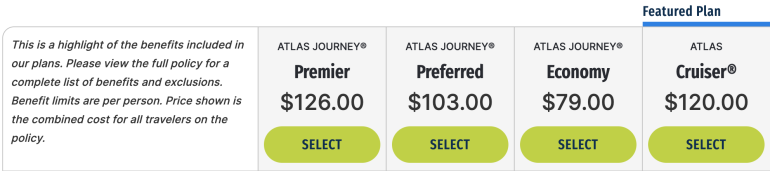

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Elevate plan gets the top score in our rating because of the extensive coverage it provides for the price. It offers best-in-class emergency medical and evacuation benefits, as well as high limits for baggage insurance.

Best travel insurance of 2024

- WorldTrips : Best travel insurance.

- Travel Insured International : Best for emergency evacuation.

- TravelSafe : Best for missed connections.

- Aegis : Cheapest travel insurance.

- Travelex : Best for families.

- AIG : Best for add-on coverage options.

- Nationwide : Best for cruise itinerary changes.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel , WorldTrips’ Atlas Journey Elevate plan gives you $250,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

See our full WorldTrips travel insurance review .

Pros and cons

- $250,000 in primary medical coverage.

- $1 million per person in medical evacuation coverage.

- Primary damage or loss baggage coverage of $500 per item, up to $2,500.

- 5 optional upgrades, including pet care, adventure sports and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 428 reviews of policies purchased through the travel insurance comparison site since 2008.

Heidi’s expert take: “WorldTrips offers primary coverage for emergency medical expense and for baggage damage or loss. This means the insurer will pay for your claim first and then seek recovery from any responsible third party, such as your health insurance provider, airline or homeowners insurance company (if your belongings are stolen). Travel insurance with secondary medical coverage might be cheaper, but then you’d have to file claims with third parties yourself, before you could turn to your travel insurance for help.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “The Worldwide Trip Protector plan provides rare non-medical evacuation benefits of up to $150,000. If you’re traveling to an area at risk of a political, security or national disaster, this emergency evacuation coverage could help get you back to safety.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for missed connections

TravelSafe offers good travel insurance for missed connections , with $2,500 in missed connection coverage for each person on the plan.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you miss out on prepaid vacation plans because you didn’t make a connecting flight, you’ll be glad for the $2,500 missed connection coverage. Some policies only provide missed connection coverage for cruises and tours, but TravelSafe Classic doesn’t impose that restriction.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Cheapest travel insurance

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. This is based on the average cost of seven international trips of varying lengths and values for travelers of different ages.

See our full Aegis travel insurance review .

- Cheapest of our best trip insurance plans.

- Pet care benefit of $500 under travel delay benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Heidi’s expert take: “If you’re looking for a budget travel insurance policy , Go Ready Choice may fit the bill. It has comparably low coverage limits, but if you have health insurance that will cover you on your trip, its $50,000 in secondary medical coverage may be sufficient.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

See our full Travelex travel insurance review .

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you’re traveling with kids, a Travelex policy will cover them, too. The number of children you can add to your policy is unlimited and they’ll get travel protection at no additional cost.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review .

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Heidi’s expert take: “You can add riders to your AIG travel insurance policy to maximize your coverage. Choose from these bundles: adventure sports, medical, pet, quarantine, security and wedding. You may also want to add “cancel for any reason” coverage and rental vehicle damage coverage.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for cruise itinerary changes

Nationwide’s Choice Cruise is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Choice Cruise also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

See our full Nationwide travel insurance review .

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

Heidi’s expert take: “This plan has protections for cruisers when it comes to prepaid expenses. But its emergency medical coverage is secondary, which means you’d have to file medical claims with your health insurance company first. Since U.S. health insurance won’t help you at sea, you may want to look for cruise travel insurance with primary medical coverage instead.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Compare the best travel insurance plans

Via Compare Coverage’s website

Heidi’s expert take: “Here are my tips on how to buy travel insurance that gets you the most coverage for the lowest price: Buy early . Getting travel insurance within two weeks of making your first trip deposit may qualify you for coverage of pre-existing medical conditions, and it won’t cost you any extra. Look for primary emergency medical coverage . If you buy a plan with secondary coverage, you’ll have to file a claim with your health insurance first, even if you know it will be denied. Don’t overinsure . Calculate the value of only your prepaid, nonrefundable trip expenses that are not already covered by other insurance (like credit card travel insurance or health insurance, if your coverage extends to where you are traveling). Even if this value is $0, you can still buy travel insurance for the travel medical insurance benefits, and you’ll only be paying for the insurance you need. Understand exclusions . If you are planning to go scuba diving, for instance, make sure this adventure activity is not excluded from a policy’s coverage. If so, you may need to pay for a rider or shop for another plan that offers the coverage you need.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from April 28 to May 28, 2024.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

If you’d like to dig in deeper, head over to our travel insurance ratings methodology page.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Explore and Atlas Journey Elevate — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- 'Just a parade of incompetency': Spirit Airlines passengers with 'nightmare' stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected