- Help Center

- 1-866-921-7925

Start Searching

- Packages

- Hotels

- Cruises

- Rental Cars

* Indicates required fields

Rental Period:

pickUpDate - dropOffDate

Pick-Up: pickUpTime - Drop-Off: dropOffTime

Pick-Up Location:

pickUpAddress

pickUpAgencyName

pickUpAgencyAddress

Drop-Off Location:

Same as Pick-Up Location

dropOffAddress

dropOffAgencyName

dropOffAgencyAddress

Coupon Override

Please call.

For drivers under the age of 25, additional fees and/or restrictions may apply.

For information and assistance in completing your reservation, please call:

We're unable to find your location.

Alaska Cruise Tours:

A cruise tour is a voyage and land tour combination, with the land tour occurring before or after the voyage. Unless otherwise noted, optional services such as airfare, airport transfers, shore excursions, land tour excursions, etc. are not included and are available for an additional cost.

Compare. Book. Go!

Costco travel's, low price finder™.

- Compare Up to Four Brands

- Shop All Discounts and Coupons

Sailings Departing Soon

Last-minute cruises.

- Summer Sailings Still Available

- Digital Costco Shop Card with Every Sailing

Entertainment Capital

Las vegas getaway deals.

- Member Savings, Resort Credit or More

- Choose from Popular Resorts

Luxury Resort

The ritz-carlton, aruba package.

- $100 Resort Credit

- Daily Buffet Breakfast for Two

Beachfront Resort

Outrigger waikiki beach resort package.

- Daily Breakfast or Lunch for Two

- Digital Costco Shop Card

Immersive Itineraries

Kirkland signature cruises.

- Exclusive Costco Member Savings

Discover the Beauty of Hawaii

Included Extras or a Digital Costco Shop Card Additional Savings on Rental Car and Airfare

London, England

Daily Breakfast with Every Package $400 London Tour Credit

Limited-Time Deals

Book Before They're Gone These Deals Won't Last

Bahamas: The Royal at Atlantis Package

Family Friendly Complimentary Access to AQUAVENTURE

Fiji: Koro Sun Resort Meal Inclusive Package

Daily Breakfast, Lunch and Dinner Executive Member Benefit

7 Nights with Airfare from $3,269 Per Person*

Riviera Maya: Hotel Xcaret Arte Package

All-Fun Inclusive™ Resort Digital Costco Shop Card Welcomes 16 Years and Older

Featured Travel

New orleans: higgins hotel new orleans, curio collection by hilton package.

Admission to National WWII Museum for Two

Last-Minute Summer Travel

It's Not Too Late To Book! Member Value in Every Package

Maui: Sheraton Maui Resort & Spa Package

Room Upgrade Daily Resort Fee Included Family-Friendly Resort

Tahiti: Hilton Moorea Buyer's Choice Package

Daily Breakfast and Nightly Dinner Resort Credit

5 Nights with Airfare from $2,869 Per Person*

Vacations of a Lifetime

For an Experience as Unique as You Are Exclusively for Costco Members

Best of Italy: Your Way

Daily Breakfast Private Airport Transfers and Rail Tickets

Featured Destinations

Boston, massachusetts.

Rich History and Culture

Washington D.C.

Monuments, Memorials and Museums

Myrtle Beach, South Carolina

Over 60 Miles of Atlantic Coastline

Featured Cruises

Greece, turkey and italy cruise.

Celebrity Cruises | Celebrity Ascent℠ Digital Costco Shop Card, Rome to Athens/Piraeus

7 Nights from $899*

Eastern Caribbean and Perfect Day Cruise

Royal Caribbean | Icon of the Seas℠ Digital Costco Shop Card, Round-Trip Miami

7 Nights from $1,549*

Connoisseur Escorted Cruisetour - Tour #RA5

Princess Cruises | Sapphire Princess® Digital Costco Shop Card, Vancouver to Anchorage

12 Nights from $2,258*

Great Barrier Reef Cruise

Celebrity Cruises | Celebrity Edge® Digital Costco Shop Card, Round-Trip Sydney

11 Nights from $1,455*

Mexican Riviera Cruise

Princess Cruises | Discovery Princess® Digital Costco Shop Card, Round-Trip Los Angeles

7 Nights from $448*

Hawaii Inter-Island Cruise

Norwegian Cruise Line | Pride of America Digital Costco Shop Card, Round-Trip Honolulu

7 Nights from $1,499*

Hidden Gems

Trending now, maximize your rewards, costco anywhere visa® card by citi.

3% Cash Back Rewards on Costco Travel Learn More

Executive Members Get More

Executive Members Earn an Annual 2% Reward on Costco Travel

Costco Executive Membership

Upgrade Online Today

Explore More Travel

Walt disney world® resort.

Packages Include Theme Park Tickets,

Benefits and More

Condo Resorts

Studios to Three-Bedroom Suites

Great for Large Groups or Long Stays

Oahu: AULANI, A Disney Resort & Spa

Family-Friendly, Beachfront Resort

No Resort Fee, Digital Costco Shop Card

Travel Items on Costco.com

Shop costco wholesale.

Visit Costco.com

Crossbody Bag

Headphones & earbuds.

We are processing your payment.

Do not refresh your browser or exit this page.

- Twitter / X

- Readers' Choice

- Food & Drink

- Arts & Culture

- Travel Guides

USA TODAY 10Best

10 travel memberships that are worth the money

November 11, 2021 // By Leila Najafi

By Leila Najafi November 11, 2021

We live in a subscription-obsessed world and there’s a subscription for everything you can imagine, from razors to clothing and even hot sauces. Travel memberships are on the rise, providing new ways to ease some of the stress that comes with traveling these days and help make the journey more seamless.

Whether you’re willing to pay a premium for exclusive travel experiences that provide a little more privacy or you're more budget-conscious and want to find the best travel deals, there’s a membership for every type of traveler. Here are 10 travel memberships that are worth considering.

Wheels Up offers private jet charter memberships so travelers can access a fleet of aircrafts, including a King Air 350i, an 8-passenger Citation Excel/XLS, and one of the fastest aircrafts, the Citation X. Wheels Up uses a dynamic pricing model offering competitive rates, so members can book flights on-demand with the flexibility to pay as they go.

Advertisement Advertisement

Additional m embership benefits include invites to signature events, President’s Circle status with Hertz, a complimentary trial of Inspirato Club subscription for 12 months (Core members only), certain perks at select Waldorf Astoria hotels across North America, a partnership with Delta SkyMiles, dedicated partnership rates with Porsche and more.

Membership cost: Three membership options are available – Connect, Core and Business. The Connect membership requires a one-time initiation fee of $2,995 and annual dues of $2,495 which begin on year two. The Core membership has an initiation fee of $17,500 and annual dues of $8,500 which begin on year two. The Business membership requires an initiation fee of $29,500 and $14,500 for subsequent years and includes up to six lead passengers.

Getting through airport security lines can be a drag, especially during holiday weekends and a pandemic that has increased the demand for more seclusion when traveling. PS (formerly known as Private Suite) is designed for first and business class travelers who are seeking privacy and convenience, allowing them to bypass LAX altogether.

Travelers check into a private terminal where they can relax in a fully-stocked luxury private suite that includes complimentary in-suite meals catered by h.wood Group , as well as additional services upon request such as in-suite massages, manicures and detailing services for personal cars. PS also provides a designated on-site TSA and Customs agent for expedited screening.

Upon boarding, travelers are transported across the tarmac directly to their aircraft in a BMW 7 Series sedan. Earlier this year, the Salon at PS launched, which features a new full-service lounge at the terminal for travelers who want the same benefits of PS but seek a more social experience.

Membership cost: Annual membership costs $4,500, which gives members access to a preferred rate of $3,250 for a one-way Suite experience for up to four travelers. The Salon is available to members and non-members for $695 per use per person.

Inspirato is a subscription-based luxury travel service that gives members exclusive access to over 150,000 luxury vacation homes and resorts around the world that are staffed by Inspirato. There are two membership types: Inspirato Club and Inspirato Pass. The former gives you access to the luxury residences and hotels around the world, on-site concierge and daily housekeeping with additional benefits such as late check-in and check-out, room upgrades, spa credits and more. However, members also pay nightly room rates.

With the Inspirato Pass, you automatically get the benefits of Inspirato Club plus nightly rates are already factored into the price of membership, so you can book as many vacations as possible in one month with one active reservation at a time. There is also no long-term commitment, so you can cancel the membership at any time.

Membership cost: Inspirato Club membership is $600/month plus a $600 enrollment fee and you pay nightly rates as you go. Inspirato Pass is a flat rate of $2,500/month which includes all hotel stays.

Scott’s Cheap Flights

A membership to Scott’s Cheap Flights includes flight deals and “Mistake Fares” accidentally published by airlines sent straight to your inbox. The team scours the internet for the lowest published airfare rates to popular destinations and shares them with members.

Subscribers can also track deals from a specific airport close to home or destinations of interest. A membership to Scott’s Cheap Flights is best for travelers who have flexibility on the destination and dates and are willing to fly based on low airfare rates. Flight deals don’t last long so you’ll have to act fast.

Membership cost: There are three membership tiers including Limited which is free, Premium costs $49/year and Elite $199/year.

PRIOR was started by a former travel editor who saw a gap in the market for travelers wanting a more immersive experience during their vacation. A team of experienced travel editors and local tastemakers on the ground design itineraries for curious travelers.

A PRIOR WORLD membership includes access to curated destination guides, unique local experiences in cities around the world, pre-planned group trips led by experts and for an additional fee, the team can create a custom itinerary based on your interests.

If you're a frequent traveler, PRIOR BESPOKE might be the membership better suited for you. For a flat fee per year, members get unlimited trip planning by their expert team of travel editors and membership managers.

Membership cost: PRIOR WORLD membership costs $249 per annum. PRIOR BESPOKE is $5,000 per annum.

Priority Pass

Airport terminals may have come a long way in the last decade, but killing time for a three-hour layover in a crowded airport isn’t exactly on anyone’s list of things to do, especially on vacation. Trade the busy terminals for private lounge access with Priority Pass and enjoy guaranteed Wi-Fi and snacks.

Members of Priority Pass receive access to over 1,300 airport lounges globally, including several airline lounges such as Virgin Atlantic, Air France and Turkish Airlines. Several credit cards like the Chase Sapphire Reserve, American Express Platinum and Marriott Bonvoy Brilliant American Express offer free Priority Pass memberships as part of their member benefits.

Membership cost: Choose from three membership tiers which start at $99/year for the Standard membership plus $32 per visit and go up to $429/year for the Prestige membership which includes unlimited lounge visits.

TSA Pre-Check and Global Entry are services that allow travelers to expedite the security screening process upon departure and arrival. With CLEAR Plus, enrolled members get escorted to the front of the security line once they’ve been verified using facial recognition or fingerprint scans, so they no longer have to verify identification at security. However, for expedited clearance through security screenings, TSA Pre-Check or Global Entry are still required.

CLEAR uses biometric identifiers to create a unique ID assigned to each member that is used for verification at stations across airports, stadiums and other major venues nationwide.

Membership cost: A CLEAR Plus membership is $179 per year. American Express Platinum Card Members receive a $179 statement credit and United MileagePlus members receive a discounted membership rate.

Well Traveled

Well Traveled is a members-only social and booking platform that allows members to connect with friends to find and share travel recommendations. The community-driven platform is intended to make travel planning easier by allowing you to follow people in your network that you trust, in addition to other like-minded travelers who share similar budgets and travel preferences.

Members can also take advantage of the personalized booking service that includes perks like exclusive rates, room upgrades, food & beverage credits, complimentary breakfast and more. Currently, membership is invite-only but you can also apply to be considered.

Membership cost: $150 per year.

Travel + Leisure Club

Travel + Leisure Club is a new travel subscription service offered by Travel + Leisure Group. Members can pay a monthly fee for access to preferred pricing on curated itineraries and an average of 25% savings on hotels, resorts, car rentals and activities that are listed on Travel + Leisure GO, the online travel booking site. Plus, members get a subscription to the glossy print magazine.

Members also get access to a personal concierge that can assist with travel planning, scoring tickets to sold-out events, making dinner reservations and more.

Membership cost: Travel + Leisure Club is currently offering an introductory rate of $9.95/month.

Exclusive Resorts

Designed for families who value privacy, Exclusive Resorts is a small community of members (only 150 new members accepted each year) that get access to over 350 luxury residences around the world including the Amalfi Coast, Barcelona, Deer Valley, Kaua’i, Los Cabos, St. Barts and more.

Guests enjoy a more personalized experience with a dedicated on-site team who can assist with pre-trip planning details such as stocking the fridge with your favorite snacks, booking a massage or private chef, and housekeeping services.

Membership cost: There is a one-time, non-refundable initiation fee of $150,000 for a 10-year membership. Annual dues are $1,395/night and members travel 15-30 nights per year.

About Leila Najafi

Leila Najafi is a luxury travel writer based in LA who is a member of more subscription services than she'd like to admit.

Read more about Leila Najafi here.

Connect with Leila via: Website | Facebook | Instagram | Twitter | TikTok

Member Brochure

Bringing the best Value on all Things Travel

Congratulations, you have joined an exclusive club where our number one goal is to help you build Amazing Vacation Memories. For 20 years our travel professionals have been helping put smiles on our members faces.

As a member of Voyager One Travel, you'll never have to worry about not getting the absolutely best price on every trip you take. In fact, WE GUARANTEE IT. So, go to bed tonight and rest easy. You've just ensured your family will be vacationing in style for the rest of their lives. As if that's not enough, you have a member's only travel team that guarantees to bring you specially negotiated 'member only' rates; rates that are so good, they cannot be shown to the general public.

Take a vacation...and make a memory with those you love the most.

Have any questions? Contact us.

Processing...

It will take just a moment. Please, wait.

Password reminder

Please, enter valid username OR email associated with your account. We will send you password. If you do not remember either, please contact us for assistance 828-220-6176.

Account Issue

It looks like there is an issue with your account. Please use the link below to verify that your renewal is up to date.

Suggested companies

Inteletravel.com, inteletravel.

One Travel Club Reviews

In the Travel agent category

Visit this website

Company activity See all

Write a review

Reviews 5.0.

Most relevant

Blissful holidays

Kirsty booked this holidays for us and it ticked all the boxes. From the moment we were at the airport to last day of our holidays, everything went really smoothly. Kirsty made the whole process of booking super convenient, basically, we just had to check in - everything else was taken care of for us. Great hotel, lots of entertainment for children, great facilities, lovely and very convenient location. Definitely recommend and we will definitely use Kirsty's services again. Thank you Kirsty!

Date of experience : 24 May 2024

So pleased with our holiday .

So pleased with all areas of our booking ,hotel room was just perfect better than expected . We’re so happy with our experience and holiday we’re booking again !😎 Thankyou Sandy for making our hoilday a stress free.

Date of experience : 18 May 2024

We’ve booked our summer holiday to…

We’ve booked our summer holiday to Rhodes with Lisa. She was very helpful and got everything booked super quickly with no fuss. Would highly recommend using her and we would definitely book through her again.

Date of experience : 11 April 2024

Emma Ross - absolute holiday booking legend - thank you!

In the last 4 months I have booked two holidays with Emma Ross and can't recommend her highly enough. She booked a trip to Disneyland Paris for my son and I, and everything possible was catered for or advised. Booking process so easy and she was super fast to respond to queries or little changes. We are both so excited to go in August! I then asked her to book a grown ups holiday and gave her a fairly loose set of criteria for what we would like. She came back quickly with 5 options we really liked the look of, and was patient with us during a busy week when we couldn't nail down our choice. We finally settled on our decision and despite a little hiccup with the dynamic pricing (not Emma's fault at all, and it settled down anyway), we were booked for Ibiza - again, Emma was so helpful with our several queries and request. Wouldn't hesitate to recommend her and will absolutely use her services again. Worth mentioning too that for both holidays I sense checked the pricing against booking.com and the like, as well as booking direct, and her quote was ALWAYS cheaper. Thank you Emma!

Date of experience : 03 June 2024

Always 5 star treatment

Always 5 star treatment! Customer service is the best James is always able to help with literally anything, booked around 5 holidays through him and got 1 coming up! Recommend to anyone!

Date of experience : 04 June 2024

Fantastic service and recommendations

Fantastic service and recommendations. Lyndsay was of great help to us and provided great support and availability in our quest for a relaxing holiday.

Date of experience : 27 May 2024

Fab holiday in Majorca

Just back from a fantastic holiday in Alcudia, Majorca, organised by Louise at One Travel Club. Wish we could do it all over again!!! Louise was amazing and so helpful throughout the booking process and the lead up to the holiday. She made it so easy!! Nothing was too much bother and she was there to answer any questions or requests we had. She found us a fab holiday package which met our needs so well, it was exactly what we had asked for. The holiday was amazing from the flight and transfers to the service at our accommodation. For anyone looking to book a holiday I can’t recommend Louise highly enough! Thank you!!

Date of experience : 19 May 2024

Nikki sorted out a lovely break away to…

Nikki sorted out a lovely break away to Sicily for us. Great hotel, great location, ticked all boxes we asked her to do! Very responsive to questions. So much easier than when we booked our holiday ourselves last year, spending hours looking!!! Thank you very much Nikki!

Date of experience : 22 April 2024

Wonderful Family Holiday via One Travel Club

Fantastic experience booking our family holiday with One Travel Club, everything went perfectly & they couldn't of been more helpful to our needs. Booking through them was such a smooth, simply process. I would definitely recommend them & be using them again.

Lisa is your woman!

Lisa was so, so helpful and sent me so many holiday ideas including places I’d never even thought of! Highly recommend her!

Date of experience : 09 May 2024

Lisa Baker, amazing 1000% recommend

Lisa Baker was amazing, I had already booked some flights to Italy and she helped with the booking of the hotel and transfers, which is something I thought she wouldn’t be able to do as I thought it would be package holidays. We spoke on the phone we said we had plans to visit Sorrento and the amalfi coast. After talking to Lisa she suggested just visiting the amalfi coast due to our short time frame there and to get the most out of it. She suggested a location to stay which was great and easy to get around. Lisa provided so many suggestions of where to visit and restaurants to go to, how to book bus and ferry journeys and the apps to use. To be honest I would have been lost with out her knowledge and help. We also booked transfers through Lisa which were great, both were on time, clean cars and felt very safe. I had some trouble booking a restaurant, I messaged Lisa and she sorted straight away for me and got it booked. Finally, when I returned, I found that I had left something in the hotel, i messaged Lisa and once again she was so helpful and promt and to my surprise they had it and we are currently arranging it to be shipped back to the U.K. All in all the best experience I have had booking a hotel and transfer. I was a little nervous as first as I found Lisa through Instagram but as soon as I spoke to her I felt I trusted her. I would 100% recommend and would definitely be using Lisa again. Once again thank you so much

Date of experience : 05 June 2024

Planning our family holiday to the…

Planning our family holiday to the Maldives was my idea this time, and I decided to take the lead instead of my wife, who usually handles our trips. With not much time on my hands, choosing Remi as our travel agent was an easy decision. She really listened to what we wanted, came up with several great options, and was super patient as she adjusted the itinerary multiple times to fit my long list of needs. Remi got us an amazing deal and made the whole process a breeze. Most importantly, we had an incredible holiday. I can't recommend Remi enough for anyone planning their next trip!

Date of experience : 10 April 2024

Amazing trip to Dubai booked by Charleigh Gaze

Charleigh was super helpful from the moment I reached out. I was quite particular with flight times and location, and she delivered on both. She was also amazing whilst we were out there, despite being on holiday herself. Would definitely book via Charleigh again. It saves you so much time.

Date of experience : 26 February 2024

Trip to Madrid booked by Michelle

My partner and I recently visited Madrid to celebrate his birthday; Michelle advised on flights and activities, as well as booked our hotel. We had a fabulous time and were truly surprised to arrive to a bottle of bubbles in our room, along with a note from Michelle. The booking process was a pleasure, made simple from start to finish, which relieved the pressure of researching and booking ourselves. The hotel was stunning, in a great location, and full of attentive, helpful staff. Michelle’s knowledge of travel is unmatched - I would book a holiday in her capable hands one hundred times over! Thank you so much.

Japan trip booked by Michelle Vanlint

Michelle Vanlint helped us book our trip to Japan. Having travelled and lived there herself, she was a great source of information. She offered excellent advice on our international flights and did all the booking for our domestic flights and accommodation. The hotels in Kyoto and Tokyo were amazing! She went out of her way to make sure we had a wonderful time. We did! Thank you Michelle!

Date of experience : 29 March 2024

Holiday planned by Gabrielle

Recently had a Beautiful holiday to Larnaca all planned by Gabrielle She was incredibly helpful and made sure she was available in case of any issues whilst checking in, she went above and beyond to ensure we had everything we needed. Thank-you Gabrielle will definitely be returning to you for our next holiday.

Excellent !!!!One Travel club

Excellent !!!!One Travel club Our holiday was all fantastic bec. of this company. It was very smooth transaction. :) We got a great deal .I can high recommend !!

I cannot recommend Ella Thatcher highly enough…

I cannot recommend Ella Thatcher@ One Travel Club highly enough. She is warm, friendly and very well researched. She listened to our specifications and with her knowledge, was able to offer additional options which enhanced our original plan. We had a fantastic holiday and will definitely use Ella for further bookings. Thankyou Ella🥰

Date of experience : 03 May 2024

Booked our holiday through Kirsty.

Booked our holiday through Kirsty.. fantastic experience with no problems at all. Kirsty was on hand to answer any questions we had. We look forward to booking through her again next holiday. Highly recommend.

Date of experience : 08 May 2024

Booked my trip to Disney Paris with…

Booked my trip to Disney Paris with Kirsty and she could not have done more . She was patient in finding us the best price from the best airport to save us as much as she could and also gave us 3 holiday options depending on our lowest and highest budget. Kirsty was able to give us all tip and tricks for our trip and honestly without them we would not have been able to complete so much within the time . Before our trip Kirsty also went above and beyond and sent us a personalised gift for our Disney trip for all our important documents which I thorght was such a lovely and personal touch. Thanks again Kirsty I look forward to booking my summer holiday through you also. Kind regards Hayley

New to TTG?

New agency plots growth after recruiting 100 agents in four months.

A new homeworking agency – which has recruited nearly 100 agents just four months after launching – has set its sights on bringing in up to an additional 400 "eager" new members.

"There is a massive array of experience when it comes to homeworkers, some are very new and some are very knowledgeable. We realised there is a huge market of people that are so willing to learn and develop their skills, but they haven’t got that support network above them to do so."

One Travel Club offers new members a one-hour consultation before joining to see if the move would be a right fit for both them and the firm. If accepted, a mentor is assigned to help guide new members.

The agency will also offer members a bespoke onboarding guide, tailored to the specific needs of the agent depending on what product they usually sell and what areas they wish to improve in.

Data and technology are also unique selling points for One Travel Club, Evans explained, which forms part of the training and onboarding process for new agents.

"We wanted to incorporate tech into selling holidays and make it as easy as possible for agents to be confident in what they do," he continued.

"We have built our own hub which enables each agent to source information based on the enquiry they have, ranging from skill byte sessions, how to guides on specific subjects and special assistance."

The hub will be a space where agents can book sessions with the company’s in-house support team or watch the latest webinars from its partners. They will also be able to access One Travel Club’s bookable website.

Future growth

As the group edges closer to the 100 member-mark, Evans said he is aware the bigger the association grows, the harder it will be to maintain the "personal touch" and "family-feel" the brand strives for.

"This is why we are capping at 500 people," he explained, "as I don’t think the personal feel we offer is sustainable above that level, we want to keep up expectations and our promises."

One Travel Club is a member of the Travel Trust Association (TTA), which Evans praised for "playing a key role in our vision".

Rising water levels force Tui River Cruises to evacuate ship

Fti touristik failure: the story so far and knock-on effects for the uk travel trade, if travel is to be a go-to growth sector for the next government, it must learn to tell its story better, air india names bengaluru its fifth direct route from gatwick airport, martin bamford rejoins africa collection as sales manager, “our hotel guests are our sales and marketing team”.

Read TTG June 2024

Supplier directory.

Find contacts for 260+ travel suppliers. Type name, company or destination.

Editor's pick

Lusso recruits Travelopia's Kevin Gaddes for new trade role

Cunard reveals ‘icons’ to represent queen anne's ‘godparent’ at naming, jet2holidays reassures clients over fti hotel concerns, fti touristik files for insolvency despite €125 million investment, why canada is taking inspiration from finland, sweden, tuscany – and ireland, the 7 steps to creating a seamless online booking journey, sign up for weekday travel news and analysis straight to your inbox, recommended for you.

Barrhead Travel parent promotes agency's president Jacqueline Dobson

Travelopia launches 'virtual passport’ agent incentive

How to actually reduce travel's carbon emissions

Latest travel jobs.

Travel sales consultant

Assistant Manager - Belfast

Assistant Manager - Birkenhead & Liverpool

Competitions.

Win a spot on a fantastic fam trip to Quebec City

Win a place on the Brand USA MegaFam 2024

Win one of three spa vouchers or a goody bag with Visit Greater Palm Springs

Win a four-night stay for two in Turkey with Barut Hotels

Ttg luxury journey.

TTG Agenda 2024

TTG VV Fest 2024

Fairer Travel Month 2024 by TTG

TTG Fairer Travel Festival 2024

- If outside US 001-954-239-2242

866-408-8482

The simplest way to book your perfect cruise.

Email Address

Forgot password.

By signing in you agree to our terms and conditions and privacy policy

Need an account?

Viva vip sign in.

Why Sign In?

Access to unpublished secret discounted Viva member pricing.

Live real time pricing & availability for agreeing to receive marketing emails (opt out at anytime).

VIP private sales and promotions sent via email and text messages.

NEED HELP FAST? call 866-408-8482

By signing in or creating an account, you agree to receive marketing emails. In addition, you agree to our terms and conditions and privacy policy. You may opt out at anytime. You are not required to join if you prefer to book over the phone.

Phone number (recommended)

Create a password, already have an account, viva vip sign up.

Welcome to Viva Voyage! My name is Geoff Silvers and I am the founder of Viva Voyage. Viva Voyage’s mission is to become the best seller of vacations by redefining the way they are sold.

It has been my lifelong dream to help people get the best value for their vacation. Viva Voyage was designed to work harder than other travel agencies to make sure that our customers are purchasing the right vacation to match their needs. Our goal is to provide vacation solutions that provide the highest possible value for your vacation dollar.

Your Viva Voyage experience is just beginning when you purchase your vacation with us. We make ourselves available to answer any questions you may have to make sure your vacation goes smoothly.

Viva cruise managers are trained to make sure your experience is so good that you will want to recommend our company to your family and friends. Our Cruise managers are not compensated with commission. Therefore, their goals are aligned with making sure that you are completely satisfied. If you are not 100% satisfied with your Viva experience, please email me at [email protected] .

Geoffrey B. Silvers, CEO/President, Viva Voyage As a leader in the travel industry, Geoff Silvers founded Viva Voyage to redefine the way travel is sold. Silvers was previously at Orbitz. Silvers has appeared on CNNfn, WBBM-TV, and ABC News Now. In addition, his advice and tips have been quoted repeatedly in The Wall Street Journal, USA Today, Los Angeles Times and Chicago Tribune. He has also done numerous radio interviews including WSJ Radio and CBS Radio Network.

Prior to Orbitz, Silvers pioneered effective customer programs and online marketing for Fortune 100 companies and created innovative interactive experiences and promotions with leading companies such as General Motors, Pillsbury, Motorola, Maytag, Jenn-Air, United Airlines, Britannica.com, AT&T, Unilever, and Seagram’s. Silvers holds a Bachelor of Science degree in Business Administration with a major in Management and Marketing from Babson College in Wellesley, MA.

* Viva Voyage guarantees that it can match any cruise line’s price that is available directly to the public at the time of booking. Any offers that clients have received must be verified by Viva Voyage in order to match the offer price. This guarantee only applies to new reservations and does not apply to group rates or rates that are not available to the general public direct from the cruise line.

Seller of Travel Numbers: FL ST-36496, CA 2077353-40, HI TAR-7367, WA 604-393-149

©2024 Viva Voyage, LLC

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

HSBC TravelOne Card adds 8 new airline and hotel partners, including Aeroplan

HSBC TravelOne Cardholders can now redeem miles for Aeroplan, Qatar Privilege Club, Turkish Miles&Smiles, JAL MileageBank and more. The catch: very poor conversion ratios.

Back in May 2023, HSBC launched the TravelOne Card, its first-ever mass market miles card. This had a lot of things going for it: a 20,000 miles welcome offer for both new and existing customers, eight lounge visits in the first membership year, instant transfers with no conversion fees, and conversion blocks of just two miles after the first 10,000 miles.

But the thing that intrigued me the most were the transfer partners. At the time of launch, HSBC TravelOne Cardholders could transfer points to 12 different airlines and hotels, snatching away Citi’s “most transfer partners” crown. And HSBC made it clear that they weren’t done yet, because the plan was to have more than 20 airline and hotel partners by the end of 2023.

HSBC has now made good on their word by adding eight new airline and hotel partners to the TravelOne’s stable, including a Singapore debut for Air Canada Aeroplan and Japan Airlines Mileage Bank , as well as miles community favourites Qatar Privilege Club and Turkish Airlines Miles&Smiles.

Unfortunately, it’s not all good news. While I always welcome new transfer partners, the conversion ratios at which many of these are being offered threaten to nerf any potential value.

Let’s dive into the details.

HSBC TravelOne Card new partners

Effective immediately, HSBC TravelOne Cardholders can transfer their points to 16 airlines and 4 hotel programmes.

Conversions can be made at the following ratios.

Airlines (16)

All HSBC TravelOne Card partner transfers are processed instantly , with the exception of the following:

- Accor Live Limitless: Within 5 business days

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Qatar Privilege Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 21 business days

All transfers are currently processed free of charge until 24 January 2024. Following this, HSBC will impose an (absurdly) expensive fee of 10,000 points per transfer, which I’ve talked about in the post below.

HSBC TravelOne Card adds hefty 10,000 points conversion fee

My thoughts on the new transfer partners

Let’s ignore transfer ratios for a minute and just talk about the new partners.

For me, the biggest excitement is undoubtedly Air Canada Aeroplan. This is the first time it’s been available through a Singapore credit card, and it’s well-loved by the miles and points community, for good reason.

- No fuel surcharges

- More airline partners than any programme (including non-Star Alliance partners like Air Mauritius, Azul, Gulf Air and Oman Air)

- Stopovers can be added on one-way awards for just 5,000 points

- Virtually all partner awards can be booked online

- Access to Singapore Airlines award space can be better than KrisFlyer even

Japan Airlines Mileage Bank is another first for Singapore. This used to be an excellent programme for redeeming Emirates First Class awards, but that’s no longer been possible since September 2021. You can still redeem Emirates Business Class awards, but you’ll have to pay some very hefty fuel surcharges. Domestic Japan awards start from 6,000 miles.

Qatar Privilege Club offers competitive Business Class redemption rates between Singapore and Europe (70,000-75,000 miles) and North America (95,000 miles), and the best part is that Qatar does not impose fuel surcharges for redemptions on its own flights. This can save you hundreds of dollars compared to booking through Asia Miles or another oneworld programme.

However, this shouldn’t be seen as a new addition per se, since HSBC TravelOne Cardholders already have access to British Airways Executive Club, and Avios can be transferred between the programmes at a 1:1 ratio.

Turkish Miles&Smiles offers great value Business Class awards between Singapore and Japan/Europe, which cost just 35,000 miles/45,000 miles respectively.

Club Vistara is an odd addition, particularly since Vistara is living on borrowed time. It’s already been announced that Air India will discontinue the brand once the merger with Tata SIA Airlines is completed. This presumably means that Club Vistara members will become part of Air India’s Flying Returns programme.

From what I know, there isn’t really anything to get excited about Hainan Fortune Wings or THAI Royal Orchid Plus, so I wouldn’t waste time studying their award programmes if I were you.

Transfer ratios

If you were waiting for the other shoe to drop, here it is: the transfer ratios are poor.

The seven new airline partners have ratios ranging from 30,000 to 50,000 points to 10,000 miles , 20%-100% more than the 25,000 points to 10,000 miles that was the standard for all nine airline partners prior to this.

To put it another way, HSBC TravelOne Card cardholders currently earn:

- 3X HSBC points per S$1 on local spend

- 6X HSBC points per S$1 on foreign currency spend

That works out to 1.2 mpd/2.4 mpd, but only if you’re choosing a partner with a 25,000 points to 10,000 miles ratio.

Otherwise, the earn rates can fall as low as 0.6 mpd/1.2 mpd respectively.

This problem is compounded by the fact that it’s not easy to accrue HSBC TravelOne points:

- HSBC points don’t pool — the bank says they’re working on adding this, but it won’t be coming in 2023 — so you can’t tap the 4 mpd earning power of the HSBC Revolution

- HSBC does not have an equivalent of Citi PayAll; in fact, they ended their income tax payment facility for credit cards in January this year

- HSBC does not allow cardholders to earn points on CardUp/ipaymy transactions

Therefore, it’d take a significant amount of spending to reach the critical mass required for a long-haul Business Class award, let alone several, let alone if you’re looking at a frequent flyer programme with a 30,000-50,000 points : 10,000 miles ratio!

The Aeroplan silver lining

Now, all that having been said, I want to spend a little time talking about Aeroplan specifically, because that can be the potential silver lining here.

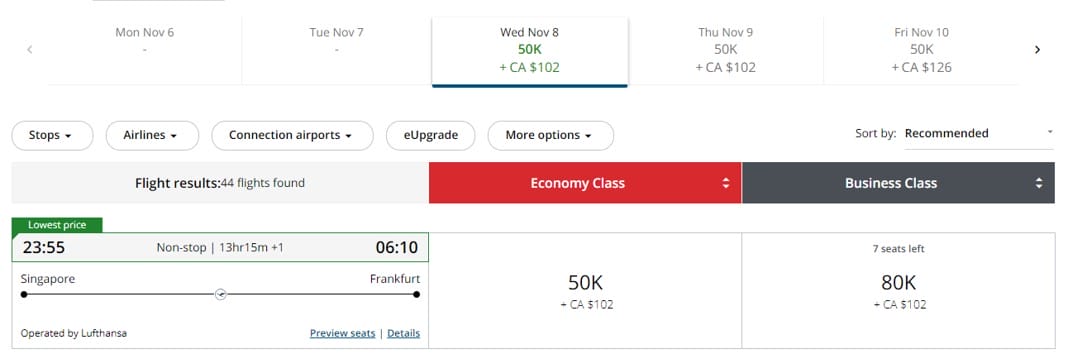

This probably deserves a separate post on its own, but here’s a quick idea of how Aeroplan’s award pricing for one-way Business Class flights compares to KrisFlyer.

Now, this would be phenomenal if you could earn Aeroplan and KrisFlyer miles at the same rate. But you can’t, and since Aeroplan is 3.5:1 versus KrisFlyer 2.5:1, we need to increase the Aeroplan figures by 40%.

This narrows the use cases significantly, though it doesn’t destroy them altogether.

Look at Australia, for example. Not only is Aeroplan cheaper than KrisFlyer, it sometimes has better access to Singapore Airlines award space than KrisFlyer! Yes, you read that right: Aeroplan members can sometimes see Singapore Airlines award space that KrisFlyer members can’t.

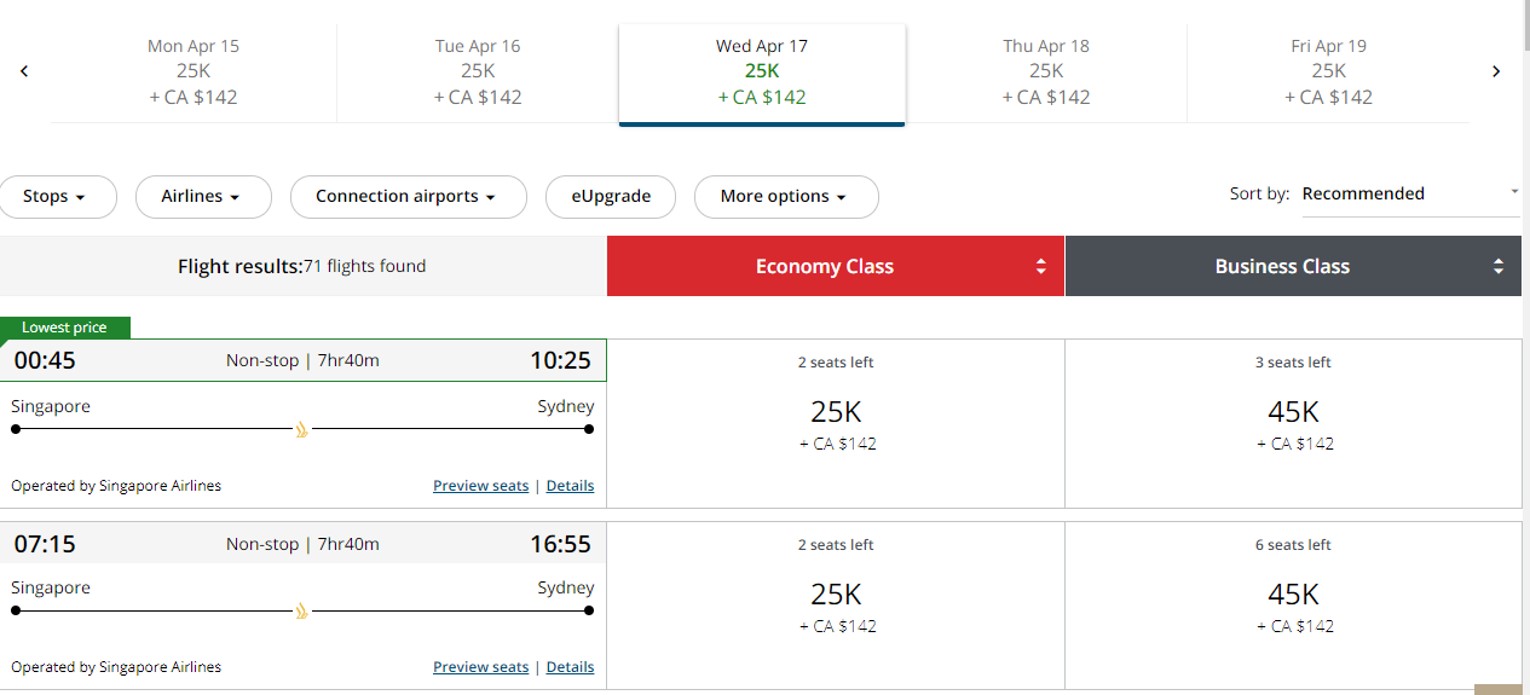

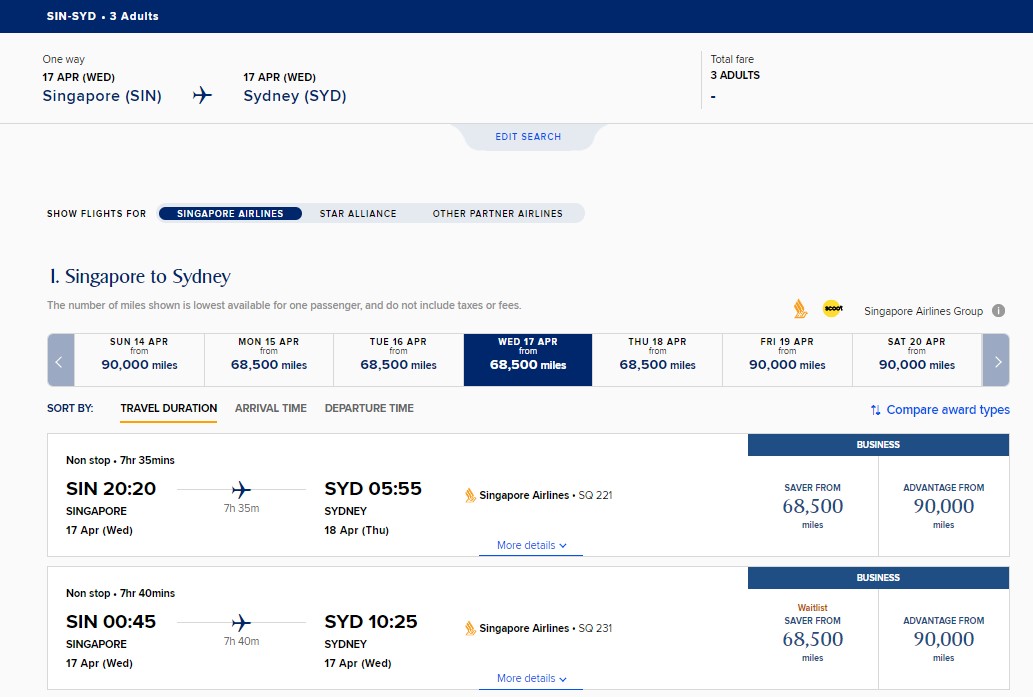

Here’s an example from April 2024. Notice how Aeroplan can see three Business Class seats on the 0045 SQ231 flight from SIN-SYD.

If you try to book three Business Class seats on the 0045 SQ231 flight from SIN-SYD via KrisFlyer, you’ll have to waitlist.

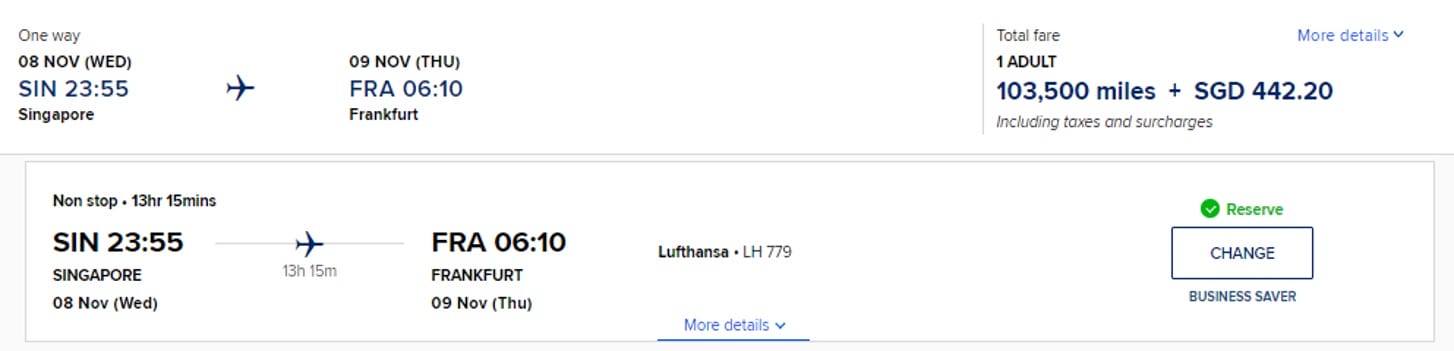

And that’s not even taking into account fuel surcharges. Singapore Airlines does not impose these on its own flights anymore, but if you’re redeeming KrisFlyer miles for Star Alliance partners like ANA, Lufthansa or Turkish, you still need to pay.

For example, it will cost 103,500 miles + S$442 to redeem a one-way Business Class award from Singapore to Europe on Lufthansa.

With Aeroplan, the equivalent cost is 112,000 miles (80,000 + 40%) + S$100.

I think it says quite a bit about how good Aeroplan is that even with a 40% handicap, it can still be competitive with KrisFlyer!

The HSBC TravelOne Card has added eight new airline and hotel partners, bringing its total options to 20.

As excited as I am to see new faces like Air Canada Aeroplan and Japan Airlines Mileage Bank, the transfer ratios make them relatively unattractive. There could still be some cases for transfers to Aeroplan, but otherwise most people would do better by sticking with 25,000 pts: 10,000 miles partners like KrisFlyer, Asia Miles, British Airways, Flying Blue and EVA Infinity MileageLands.

What do you make of the new TravelOne partners?

- credit cards

Similar Articles

Dbs adds cardup and ipaymy to rewards exclusion list (update: exclusion removed), complete faqs: uob lady’s savings account.

Should revolution be given this redemption list, it will change the environment of redemptions in Singapore quite a bit with Aeroplane. SQ should be concerned about this.

How is HSBC able to transfer miles instantly when others take up to X days. What’s the barrier preventing others from doing the same? More fees for the bank?

This is made possible via api integration provided by ascenda loyalty. Ocbc and scb use the same platform too (though not for krisflyer miles, which is why those still require a few days)

Oh, interesting! I’m not sure if there’s value in it for the site, but I would love to read a Milelion article on how the backend points/miles system works today (ie APIs, banks, third parties, airlines, etc).

I would be interested to know how things work too! But you are right that it might not of value for this site.

try this: https://milelion.com/2023/01/30/behind-the-scenes-how-do-airlines-tie-up-with-credit-cards/

Thanks, but the miles earn rate is extremely slow. With UOB PP or citibank rewards card, I can easily earn 4mpd.

when will the HSBC point pools ready? Do you have any information?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

0161 222 0822

Experiences

COVID-19: Visit our FAQ Page for latest updates

Travel just got easier

1000's of amazing destinations to choose from..

Lowest Prices

Jet2 Holidays

Low Deposits and

easy monthly payments

Disney Holidays

Holidays with your

own private pool

Villa Holidays

extraordina ry adventures

Etihad Holidays

Book with confidence.

Fully Protected

Peace of mind on and before your holiday

Low Deposits

Secure your dream holiday from £69pp

Unbeatable Prices

Our Lowest Prices - Guaranteed

Spread the Cost

Pay monthly with our budget friendly instalment plans

R elax, Unmatched Ease

Find your perfect holiday in minutes

L oved By Our Customers

95% of our customers recommend us

Recently Booked

Popular holidays.

The CaribbeaN

The Caribbean, where azure waters meet sun-kissed shores, is a paradise of relaxation and vibrant culture waiting to be explored

Find Out More >

Greek Islands

The Greek Islands, where ancient myths meet sun-kissed shores, offer an enchanting escape into Mediterranean bliss.

From the neon lights of bustling cities to the serene beauty of its national parks, the USA offers a vast tapestry of unforgettable holiday experiences.

Where futuristic skyline meets ancient desert, sparkles as an oasis of luxury and innovation under the Arabian sun.

All Inclusive Holidays

Family holidays, luxury holidays, deals and travel, inspiration.

Weekly in your inbox, daily in your feed

Email Subscribe

City skyline

Birthday Sparks

Fashion Magazine

Blurred Lines

Talk to the experts, we are on hand 7 days a week - call today, 0161 222 0822.

YOU'RE IN GOOD COMPANY

Discover partners who share our journey

Destinations

Holiday types

Useful Information

4 Spark Road, Manchester M23 1DR

Staff Login

100% Financially Protected

The Best No-Fee Travel Credit Cards

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.

One of the easiest ways to save money traveling is by using credit cards (responsibly) to collect points and miles . This essentially transforms your everyday spending into free flights, free hotel stays, and other awesome travel perks.

Not only does this stretch your travel budget but it levels up your travel experience, providing free upgrades, lounge access, and much, much more.

Whether you want to be on the road for longer, take more trips, or simply save money on your next vacation, points and miles can get you there.

However, most of the best travel credit cards have annual fees (sometimes huge ones).

While annual fees are usually worth it for frequent travelers (you can get much more value out of a card than its annual fee), if you’re new to all of this or don’t travel that much, you may want to get a no-fee card first.

And there are a lot of no-fee cards out there. Which one do you pick?

Here is my list of the best no-fee travel credit cards so you can start earning points toward free travel today:

Table of Contents

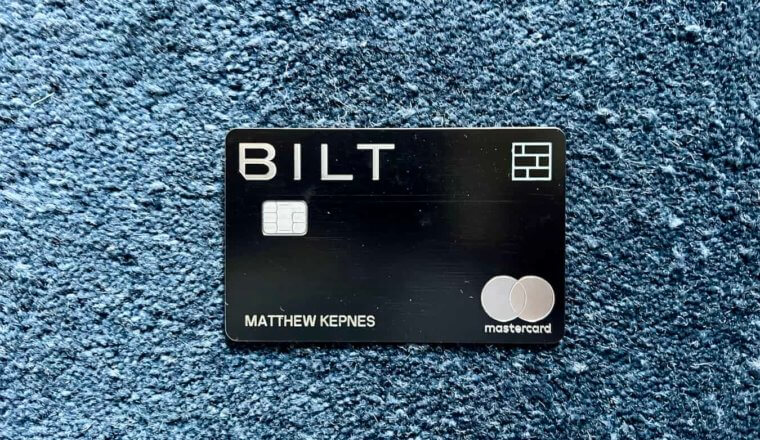

1. The Bilt Rewards Mastercard

2. capital one ventureone rewards credit card, 3. chase freedom unlimited®, cards with low fees.

You can transfer points 1:1 to travel partners, including American Airlines, Alaska Airlines, United, Emirates, Hawaiian, Virgin Atlantic, Air Canada, Air France/KLM, Hyatt, and IHG. The fact that you can transfer Bilt points to American Airlines and Alaska Airlines really sets this card apart as no other card’s points transfer to these airlines. Amassing Bilt points is the only way to get these points without having an American or Alaska card.

Bilt also integrates with point.me , a handy search and booking engine for award flights.

This card offers:

- 1x points on rental payments

- 2x points on travel

- 3x points on dining

- American Airlines and Alaska Airlines as transfer partners (it’s the only card that does)

- Rent Day benefits: monthly giveaways and challenges as well as 6x points on dining, 4x points on travel, and 2x on spending on the 1st of the month

- Access to the Bilt Milestone Rewards program (where you get more perks and earning power the more points you accumulate)

- Trip Cancellation and Interruption Protection and Trip Delay Reimbursement

- No foreign transaction fees

The Bilt card is absolutely a no-brainer for renters who love to travel. To learn more, read my full Bilt Review . It is the card I use the most right now (especially on rent days).

—> LEARN MORE

- Earn 20,000 miles once you spend $500 on purchases within 3 months from account opening

- 1.25x points on all purchases

- 5x points on hotels and rental cars booked through Capital One Travel

- Travel accident and car rental insurance

LEARN MORE —> LEARN MORE

- bonus_miles_full

- 1.5% cash back on all purchases

- 5% cash back on travel purchased through Chase Travel

- 3% cash back on restaurants and drugstores

If the cards above are a little too basic for your needs and you want something more intermediate, here’s a quick list of travel credit cards with affordable fees:

card_name ($95 annual fee) – 3x points on dining, online grocery purchases, and select streaming services, 2x points on travel (5x when booked through Chase Travel (SM) , travel protections, and a $50 annual hotel credit when you book and prepay through Chase Travel (SM) .

card_name ($95 annual fee) – 2x points on all purchases, 5x points on hotels/rental cars booked on Capital One travel, $100 Global Entry/TSA pre-check credit, 2 airport lounge visits per year.

card_name ($95 annual fee) – If you’re a business owner, this card offers 3x points per dollar on the first $150,000 spent each year on shipping, internet, phone, travel, and online advertising. It also offers free cards for employees.

While fee-based cards have better earning structures and travel benefits , if you’re new to the points and miles game, the idea of forking out for an annual fee might put you off from travel cards entirely. But if you love to travel (or want to travel more), not collecting points and miles is the biggest mistake you could make .

No-fee cards are a great place to start so that you can begin to work towards free flights and hotel stays today, without having to think about whether you’re getting enough value out of the card to justify the annual fee.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Advertiser Disclosure: “Nomadic Matt has partnered with CardRatings for our coverage of credit card products. Some or all of the card offers on this page are from advertisers and compensation may impact how and where card products appear on the site. Nomadic Matt and CardRatings may receive a commission from card issuers.”

Editorial Disclosure: “Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.”

Hi, I’m Nomadic Matt, the New York Times best-selling author of How to Travel the World on $50 a Day and Ten Years a Nomad, as well as the founder of this website! And I’m here to help you save money on your next trip.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

GET YOUR FREE TRAVEL STARTER KIT

Enter your email and get planning cheatsheets including a step by step checklist, packing list, tips cheat sheet, and more so you can plan like a pro!

- +7 (903) 682 38 24

- [email protected]

- Find on map

At Excellent Travel Club, we create unique travel itineraries according to your requests.

About the company

Excellent Travel Club proudly invites you to discover the magnificent Russian nature and its rich culture and heritage. Our dedicated team has been hosting guests in Russia since 2002. We provide exclusive services for business and leisure travelers and offer tailor-made experiences for the most discerning clients.

14 best travel credit cards of June 2024

The best travel credit cards offer an array of premium perks and benefits . For both occasional travelers and frequent flyers, adding a travel credit card to your wallet is a great way to earn rewards and save money on every trip you take. At The Points Guy, our team has done the legwork and curated a selection of the best travel credit cards for any globe-trotter, whether you prefer to backpack through mountains or settle into a luxury villa for some relaxation. From generous travel credits to premium lounge access, we’ve chosen the cards packed with the best benefits to elevate your next travel experience.

Check out our list below and discover which travel credit card from our partners makes the best addition to your wallet for all of your adventures.

- Chase Sapphire Preferred® Card : Best for beginner travelers

- Capital One Venture Rewards Credit Card : Best for earning miles

- Capital One Venture X Rewards Credit Card : Best for premium travel

- Ink Business Preferred® Credit Card : Best for maximizing business purchases

- The Platinum Card® from American Express : Best for lounge access

- American Express® Gold Card : Best for dining at restaurants

- Capital One VentureOne Rewards Credit Card : Best for no annual fee

- The Business Platinum Card® from American Express : Best for business travel

- Wells Fargo Autograph Journey℠ Card : Best for unlimited point earning

- Chase Sapphire Reserve® : Best for travel credits

- Wells Fargo Autograph℠ Card : Best for variety of bonus categories

- American Express® Business Gold Card : Best for flexible rewards earning

- Bank of America® Travel Rewards credit card : Best for travel rewards beginners

- Alaska Airlines Visa Signature® credit card : Best for Alaska Airlines miles

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, credit pointers with brian kelly, what is a travel credit card, helpful tools, how we rate cards, how to maximize travel credit cards, how to choose the best travel credit card, ask our experts, pros + cons of travel credit cards, frequently asked questions.

- Airport Lounge Access

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase’s 14 valuable airline and hotel partners. Read our full review of the Chase Sapphire Preferred Card .

- You’ll earn 5 points per dollar on travel purchased through Chase Travel, 3 points per dollar on dining, select streaming services and online grocery store purchases, 2 points per dollar on all other travel and 1 point per dollar on everything else.

- Annual $50 Chase Travel Hotel Credit

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance.

- The card comes with a $95 annual fee.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Capital One Venture Rewards Credit Card

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. You’ll earn earns 2 miles per dollar on every purchase with no bonus categories to memorize, making it an ideal card for those with busy lives. Read our full review of the Capital One Venture Rewards Credit Card .

- This flexible rewards card delivers a solid sign-up bonus of 75,000 miles, worth $1,388 based on TPG valuations and not provided by the issuer.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories.

- Rewards earned are versatile as they can be redeemed for any hotel or airline purchase for a statement credit or transferred to 15+ travel partners.

- Highest bonus-earning categories only on travel booked via Capital One Travel

- Capital One airline partners do not include any large U.S. airlines.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Capital One Venture X Rewards Credit Card

If you can maximize the $300 credit toward Capital One Travel, the Venture X’s annual fee effectively comes down to $95, the same annual fee pegged to the Capital One Venture Rewards Credit Card (see rates and fees ). Add in a 10,000-mile bonus every account anniversary (worth $185, according to TPG valuations ) and lounge access, and the card may become the strongest option out there for a lot of travelers. Read our full review of the Capital One Venture X Rewards Credit Card .

- 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- 10,000 bonus miles every account anniversary

- $395 annual fee

- $300 credit annually, only applicable for bookings made through Capital One Travel portal

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card’s sign-up bonus is among the highest we’ve seen from Chase. Plus earn points across the four bonus categories (travel, shipping, advertising and telecommunication providers) that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. Read our full review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening.

- Access to the Chase Ultimate Rewards portal for points redemption.

- Reasonable $95 annual fee.

- Bonus categories that are most relevant to business owners; primary car insurance.

- Perks including cellphone and purchase protection; extended warranty; trip cancellation/interruption insurance; trip delay reimbursement.

- Yearly cap on bonus categories.

- No travel perks.

- Subject to Chase's 5/24 rule on card applications.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative. TPG values it at $1,600.

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and more than $1,400 in assorted annual statement credits and so much more. (enrollment required)

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway.

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost.

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories.

- The annual airline fee credit and other monthly statement credits can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- See Rates & Fees

American Express® Gold Card

This isn’t just a card that’s nice to look at. It packs a real punch, offering 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar). There’s also an up to $120 annual dining credit at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar, and select Shake Shack locations, plus it added an up to $120 annually ($10 per month) in Uber Cash, which can be used on Uber Eats orders or Uber rides in the U.S. All this make it a very strong contender for all food purchases, which has become a popular spending category. Enrollment is required for select benefits. Read our full review of the Amex Gold .

- 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar)

- 3 points per dollar on flights booked directly with the airline or with Amex Travel.

- Welcome bonus of 60,000 points after spending $6,000 in the first six months of account opening.

- Weak on travel and everyday spending bonus categories.

- Not as effective for those living outside the U.S.

- Some may have trouble using Uber/food credits.

- Few travel perks and protections.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Capital One VentureOne Rewards Credit Card

If you’re looking to dip your toes into the world of travel rewards, the Capital One VentureOne Rewards Credit Card is a great way to get started. With no annual fee and a simple 1.25 miles per dollar on all your purchases, you won’t have to keep up with multiple bonus categories — just earn rewards on everything you purchase! Coupled with the 20,000-mile sign-up bonus, you can use your rewards to book travel, transfer to Capital One’s loyalty partners and more. Read our full review of the Capital One VentureOne Rewards Credit Card .

- No annual fee.

- Earn a bonus of 20,000 bonus miles once you spend $500 within the first three months from account opening.

- Use your miles to book or pay for travel at a 1-cent value, or transfer your miles to loyalty programs to gain potentially even greater value for your rewards.

- Earn 1.25 miles per dollar on all purchases.

- No foreign transaction fees.

- Other credit cards can offer you higher rewards for your common purchase categories.

- Capital One airline transfer partners do not include any large U.S. airlines.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. While the card does come with a high annual fee, you’re also getting a ton of valuable benefits in return. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review on The Business Platinum Card from American Express .

- Up to $100 statement credit for Global Entry every 4 years or $85 TSA PreCheck credit every 4.5 years (enrollment is required)

- Up to $400 annual statement credit for U.S. Dell purchases (enrollment required)

- Gold status at Marriott and Hilton hotels; access to the Fine Hotels & Resorts program and Hotel Collection (enrollment required)

- Steep $695 annual fee.

- High spend needed for welcome offer.

- Limited high bonus categories outside of travel.

- Welcome Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card®. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card®, here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

Wells Fargo Autograph Journey℠ Card

The Wells Fargo Autograph Journey credit card offers healthy reward earning rates on top of uncapped point-earning meaning the sky's the limit — especially if you strategize and spend in popular categories.

- No foreign transaction fees

- Uncapped earning potential

- $50 annual statement credit

- Solid point earning rates in popular categories

- This card features an annual fee

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

- $95 annual fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, bonus points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve card .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access to Chase Ultimate Rewards hotel and airline travel partners.

- 10 points per dollar on hotels, car rentals and Chase Dining purchases through the Ultimate Rewards portal, 5 points per dollar on flights booked through the Chase Travel portal, 3 points per dollar on all other travel and dining, 1 point per dollar on everything else

- 50% more value when you redeem your points for travel directly through Chase Travel

- Steep initial $550 annual fee.