TRAVEL INSURANCE

Wherever Their Destination …

We’ve got your customers covered.

As a tour operator, your customers value your meticulous planning and attention to detail to help ensure they have the trip of a lifetime. Let us help you take care of their travel protection needs – wherever their travels may take them.

Supporting Travelers

No matter what the market brings, C&F has shown that we will be there to support our customers and partners. During the COVID-19 pandemic, we were one of only a few carriers to honor Cancel For Any Reason (CFAR) coverage for travelers.

Most recently, through C&F Services and other assistance companies, we helped travelers in Israel and the surrounding region by providing them with on-the-ground logistics and arranging travel out of the country.

Why Choose Us

Crum & Forster (C&F) is “A” (Excellent) rated by AM Best and offers a broad portfolio of specialty insurance products. We have developed and provided travel insurance for over 20 years. Leading tour operators choose to partner with us for our reliability, commitment to our customers, collaborative approach, and flexible and innovative solutions.

Collaborative Underwriting Support

Our underwriters collaborate with you to build a flexible, custom travel protection program designed for your business needs.

24/7 Customer Care & Claims Handling

API system integrations and connections make it easy to partner with any of our TPAs

Flexible Profit and/or Risk Sharing

Plus, get access to our captive facility for more cost-effective, flexible underwriting on special risks.

Our Travel Products Can Include

Travel Cancellation

Travelers with prepaid and non-refundable trip payments can insure their expenses with Trip Cancellation. This benefit provides 100% of trip cost protection.

Trip Interruption

Offers coverage for travelers who need to cut their trip short for a covered reason, such as an illness or injury, or severe weather at their destination.

Travel Delay

If a traveler’s trip is unexpectedly delayed for a significant period of time, the Travel Delay benefit can reimburse their meal and accommodation expenses.

Medical Evacuation

Medical evacuation can provide transportation of a traveler to the nearest adequate hospital in the event of an emergency during their trip.

Emergency Medical Expenses

The Emergency Medical benefit of travel insurance can cover travelers in the event of a medical emergency that occurs during their trip, such as an illness or injury.

Delayed or Lost Baggage

Proud Supporter of the Following:

Ready to Learn More?

We’d love to talk with you. Contact the Accident & Health team today!

C&F’s admitted travel insurance is underwritten by United States Fire Insurance Company (USF). Non-insurance product features, including Travel Assistance, can be provided by C&F Services and/or by external partner companies.

20231106-3198643

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Travel Insured International Review: Is it Worth The Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Travel Insured International cover?

Travel insured international single trip plan costs, can you buy travel insured international online, what’s isn't covered by travel insured international, is a travel insured international policy worth it.

Travel Insured International

- Annual or single-trip policies are available.

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

When thinking about your next vacation, giving some thought to travel insurance can make a lot of sense. It can protect you in case something goes wrong, not to mention give you peace of mind. One travel insurance provider to consider is Travel Insured International, a company with over 25 years in this space. In 2015, it was acquired by Crum & Forster, a 200-year-old specialty and standard insurance provider.

Here’s what you need to know about Travel Insured International.

» Learn more: See why Travel Insured International is one of the best options out there

Travel Insured International offers four plans to choose from: Worldwide Trip Protector Plus, Worldwide Trip Protector, Worldwide Trip Protector Lite and Travel Medical Protector.

The plans include trip cancellation, trip interruption/delay, medical protection, baggage protection, rental car coverage and cancel-for-any-reason coverage.

Travel Insured International also allows you to upgrade certain elements of your policy through add-ons including: cancel for work reason, flight accident, medical, rental car damage, primary coverage and travel benefits.

» Learn more: Everything you need to know before buying travel insurance

To see how the policies shake out, we input a $3,000, three-week trip to Mexico by a 45-year-old resident of Alaska:

The Worldwide Trip Protector Plus plan ($216) and the Worldwide Trip Protector plan ($144) are nearly identical in the benefits offered, with both providing 100% trip cancellation , 150% trip interruption , $1,000 travel delay, $1 million in medical evacuation, $100,000 for medical expenses and many other benefits.

The primary difference between the two plans is that the more expensive option includes CFAR coverage and interrupt-for-any-reason coverage.

CFAR allows you to cancel a trip for nearly any reason and receive up to 75% of your nonrefundable deposit back (so long as you cancel within 48 hours before departure and you add all of your travel arrangements to your trip within 21 days of payment). This is a great option for those who have nonrefundable reservations and want the flexibility to cancel a trip on the fly.

IFAR allows you to interrupt your trip for any reason as long as it is 72 hours or more after you’ve departed. If you use this benefit, you will receive a refund of up to 75% of your nonrefundable and unused land or water travel arrangements. This could be useful coverage if you decide to cut your trip short and the reason for interruption is not considered a covered reason as per the policy.

If you value these two benefits, you’d want to go with the more expensive Worldwide Trip Protector Plus plan.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

The Worldwide Trip Protector Lite plan ($109) offers 100% trip cancellation coverage, 100% trip interruption, $300 travel delay, $100,000 medical evacuation and repatriation and $10,000 for medical expenses and other benefits.

The limits offered by this plan are lower; however, if you’re only looking for trip cancellation benefits and the medical coverage is sufficient for you, this policy could make sense.

The Travel Medical Protector plan ($73.50) focuses mostly on providing benefits surrounding medical care, with $1 million for medical evacuation and repatriation, $50,000 for medical expenses, $150,000 for non-medical evacuation and $5,000 for trip interruption.

This policy could be a good choice for someone who doesn't need trip cancellation benefits. Additionally, if you have a premium travel card that offers trip cancellation insurance (like the Chase Sapphire Reserve® or The Platinum Card® from American Express ) and the limits are sufficient, a standalone medical plan might be enough to provide adequate coverage for your trip.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Additional options and add-ons

These add-ons are a great way to improve limits on specific items of coverage. For example, for $35 per person, the Worldwide Trip Protector Plus plan and the Worldwide Trip Protector plan let you double your trip delay, missed connection, baggage delay and baggage and personal effects limits.

For $24 per person, the Worldwide Trip Protector Lite plan allows you to add a cancel-for-work-reason benefit. Cancel for work reason would permit you to cancel a trip if it's related to work. The reason will need to satisfy the conditions of the policy, but if this is a benefit you’d like to have, it's good to know it's available.

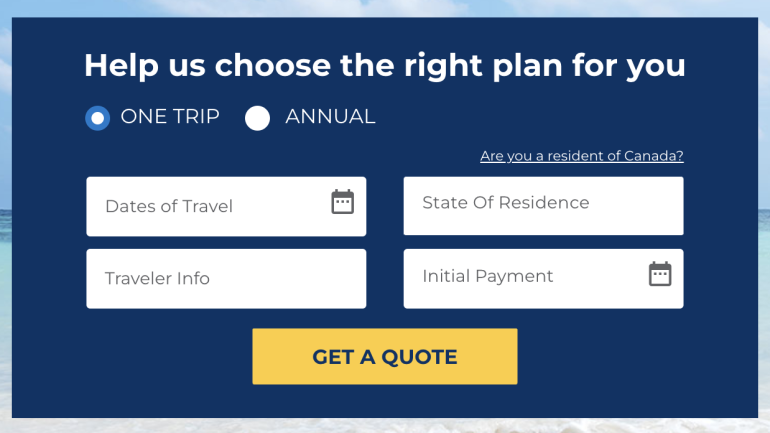

To see which policies are available in your state, head over to the Travel Insured International website . You will need to input your destination, your residence, your trip dates and the number of travelers. Then click “Get a Quote.”

Once you select “View Quote,” you will see a list of plans to choose from based on your state of residence and trip details.

Though all of the above plans offer varying levels of coverage, not everything will be covered, including:

Being scared to travel. Unless you have the CFAR add-on, you can only cancel your trip for a covered reason under the policy. Being nervous about your travels is not a covered reason, so if you’d like ultimate flexibility, you’d want to choose the Worldwide Trip Protector Plus plan.

Baggage loss for eyeglasses, contact lenses, hearing aids or orthodontic devices. Keep these items with you in a carry-on or backpack because a Travel Insured International policy won’t cover them.

Certain events. General exclusions not usually covered by insurers won't be covered here either. Example events include self-harm, war, participating in dangerous activities (e.g., skydiving), committing a felony or getting into an accident while intoxicated. You’ll need to review the policy's fine print to know exactly what is and isn’t covered.

Travel Insured International has been offering insurance for over 25 years. They're owned by Crum & Forster, a stand insurance provider that has been in business for 200 years. Travel Insured International is well established and offers four plans to fit many different needs.

Plan benefits offered by Travel Insured International include trip cancellation or interruption, mileage or rewards reimbursement, Cancel For Any Reason (CFAR) or Interrupt For Any Reason, travel delay, missed connection, change fee coverage, itinerary change, accident & sickness medical expense, baggage delay, rental car damage and more. Each plan is different and has the option for add-ons.

Yes, the Worldwide Trip Protector Plus plan covers Cancel For Any Reason (CFAR). You receive up to 75% of your nonrefundable deposit back as long as you cancel within 48 hours before departure and you add all of your travel arrangements to your trip within 21 days of payment.

Most often, you will need to file a claim after you’ve incurred costs. Travel Insured International strongly recommends filing online. You can then check the status of your claim in your portal. If your claim is approved, you will receive a reimbursement. In some instances, the insurer pays a fixed fee for any claims.

The cost of travel insurance through Travel Insured International will vary depending on a variety of factors. This can include:

Your trip length.

What state you live in.

Where you’re going.

What type of activities you’re engaging in.

How old you are.

The coverage levels that you select.

Yes. Travel Insured International can provide you with either a single-trip policy or an annual insurance plan for international or domestic travel. You also have the option to add on customized per-trip benefits to your selected policy.

Travel insurance can provide peace of mind while you’re on vacation, especially if you’re worried about changes, cancellations or other mishaps occurring. However, before you go in on a policy, you’ll want to double check if you already have coverage through your credit card .

You can also find travel insurance from multiple providers by getting a quote from insurance aggregators like Squaremouth or InsureMyTrip. This will allow you to compare different coverage levels and pricing from a variety of companies.

cost of travel insurance

through Travel Insured International will vary depending on a variety of factors. This can include:

Travel insurance can provide peace of mind while you’re on vacation, especially if you’re worried about changes, cancellations or other mishaps occurring. However, before you go in on a policy, you’ll want to double check if you already have

coverage through your credit card

If you’re heading on a major international vacation and you don’t have a premium travel credit card with sufficient limits, considering a Travel Insured International insurance policy could be a good bet.

The CFAR and IFAR options are solid benefits for those who want ultimate flexibility — especially since you can add coverages like these a la carte. If you’re looking for fewer benefits with lower limits, the Worldwide Trip Protector Lite plan is a good choice. Those seeking medical coverage can consider the Travel Medical Protector plan.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our Allyz ® TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

The Top Travel Apps That You Need This Summer

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Take your adventures further with the Allyz® TravelSmart app, and get features like real-time safety alerts, trip organizer, hospital finder, and more.

Get the app »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

Travel Insured International Review and Pricing (2024)

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Anna Douglas is a journalist and editor with over a decade of experience in newspapers and digital publishing.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

- Average cost: $199

- Better Business Bureau (BBB) rating: A+

- AM Best score: A

- Medical expense max: $100,000

- Emergency evacuation max: $1 million

Our Thoughts on Travel Insured International

We gave Travel Insured International 4.4 out of 5 stars and named it our pick for well-rounded coverage. While it only offers two standard plans for single trips and one annual policy for multi-trip travelers, its coverage is comprehensive and may be worth it for many travelers . Unique coverages include $50 per day for pet kennel costs, emergency evacuation in the event of political unrest, security issues or natural disasters, and more.

Travel Insured International offers 24/7 customer assistance and concierge services with every plan. While its strengths include its variety of add-ons and flat-rate costs for annual and multi-trip plans, Travel Insured International may offer lower coverage limits than some competitors. Its most basic single-trip plan, Worldwide Trip Protector Edge, offers just $10,000 in medical expense coverage and $300 in trip delay protection to cover costs such as hotels or meals. However, the provider’s higher-tier plan, Worldwide Trip Protector, ups medical coverage to $100,000.

While we appreciate how well-rounded Travel Insured International’s coverage plans are, customers may want to look elsewhere for higher limits on both medical and trip interruption or delay coverage. For example, some competitors, such as Seven Corners , offer medical expense maximums upwards of $500,000.

Pros and Cons

- Has both single-trip and annual multi-trip policies

- Provides unique coverages as standard, such as pet kennel coverage

- Single-trip plans last up to 180 days

- Offers a variety of optional add-on coverages

- Coverage limits are lower than many competitors, according to our research

- Pre-existing medical conditions coverage is not available on multi-trip policies

- Some policies aren’t available in every U.S. state

Why Trust Us?

How travel insured international scored in our methodology.

After analyzing Travel Insured International using our in-depth travel insurance ratings methodology, the company earned an overall score of 4.4 out of 5 stars .

Travel Insured International earned high marks for cost, coverage features, claim eligibility windows, and trip cancellation and interruption coverage. It also earned bonus points in our customer service and reviews rating category. Despite this, the provider lost points in all categories except for its add-on CFAR coverage , which gives travelers substantial flexibility for reimbursement if trip plans change.

Rating is based off of MarketWatch Methodology Guidelines

When asked for comment regarding the company’s lower score regarding coverage extras, a representative said: “Travel Insured offers a variety of additional coverages and packages to meet travelers’ needs, including jewelry (subject to special limitations), and optional coverage for electronic equipment.”

Compare Travel Insured International to the Competition

See the table below for a direct comparison of Travel Insured International to our other top-rated providers in the travel insurance industry.

Travel Insured International vs. Faye

Travel Insured International and Faye’s comparable plans have more differences than similarities. The two offer identical coverage amounts for trip cancellations and interruptions but Travel Insured International has the upper hand in emergency evacuation coverage limits, offering twice as much as Faye. It’s also cheaper, on average, than Faye and provides a higher reimbursement limit for baggage delays.

However, Faye’s coverage for emergency medical expenses comes with a maximum of $250,000 per person — more than double that of Travel Insured International. Similarly, if your trip is delayed for a covered reason, Faye’s trip delay benefit is triple the amount Travel Insured International offers. Faye also provides double the amount of coverage if your luggage or bags are lost or stolen. While Faye’s Travel Protection plan is more expensive, it has higher overall protection limits than Travel Insured International’s Worldwide Trip Protector plan.

Read more in our Faye Travel Insurance Review .

Travel Insured International vs. Travelex

Customers will find similar pricing with Travel Insured International’s Worldwide Trip Protector and Travelex’s Travel Select plans but certain features may add value for individual travelers. For example, Travelex offers half of the amount of travel medical insurance and emergency evacuation coverage that Travel Insured International does in its Worldwide Trip Protector plan. Travelex also offers lower reimbursement for baggage delays compared to Travel Insured International. However, Travelex’s trip delay protection is $500 higher, which helps cover costs like hotels and meals if your travel is delayed.

Both companies offer the exact same coverage amounts for trip cancellations, trip interruptions and lost baggage.

Learn more in our Travelex Travel Insurance Review .

What Does Travel Insured International Cover?

Travel Insured International offers two single-trip travel insurance policies with coverage lasting up to 180 days. If you’re looking for annual coverage for multiple trips, Travel Insured International offers separate plans for adults and children, starting at $94 and $64 per year, respectively. However, multi-trip plans aren’t available to Missouri, Montana, New York, Pennsylvania and Washington residents.

Single-trip policies carry maximum coverage limits with no deductible and provide benefits for trip cancellation , trip interruption, trip delay coverage , baggage coverage, medical expense and evacuation coverage, pet kennel costs and more. Travel Insured International’s multi-trip plans offer much of the same coverage as its single-trip plans.

If you’re not satisfied with your coverage, Travel Insured International allows you to cancel your policy for a full refund within 14 days of the policy’s effective date. Note that this provider is a Crum and Forster (C&F) company, which is rated “Excellent” with an A score from AM Best. Learn more about Travel Insured International’s two single-trip policies and its annual, multi-trip coverage options in the section below.

Travel Insured International Policy Options

While secret shopping, we found it was easy to get a quote and plan information for Travel Insured International’s policies. Online, you can compare plan details and coverage and access sample policies without inputting any personal information. To get a quote, you’ll need to provide some general information about your exact travel plans and your email address.

If you plan to take a single trip lasting less than 180 days, you’ll have your pick of two plans from Travel Insured International: Worldwide Trip Protector and Worldwide Trip Protector Edge. Trip Protector Edge is the cheaper of the two plans but doesn’t include coverage for pet kennel costs, accidental death and dismemberment (AD&D) benefits or the additional security evacuation coverages that Worldwide Trip Protector offers.

All other coverages offered remain the same between the two single-trip plans. However, it’s important to note that limits for medical evacuations, medical expenses, baggage coverage, and more are lower with the Worldwide Trip Protector Edge plan. To better understand the differences between these two plans, see the table below to compare single-trip options offered by Travel Insured International.

Based on quotes our team gathered using eight unique sample traveler profiles, the average cost of a Worldwide Trip Protector Edge plan is $168, with a Worldwide Trip Protector plan costing $229. The average price of a standard travel insurance plan is $204, based on calculations made using quotes gathered by our team from two dozen different providers.

Travel Insured International Annual Multi-Trip Plans

If you’re looking for an annual, multi-trip plan, Travel Insured International offers one plan for adults and one for children — the only difference between these plans is the price. Base plans offer the following coverages on a per-trip basis, and start at a flat rate of $94 per year for adults and $64 for children.

Optional protections you can purchase on a per-trip basis with an annual multi-trip plan include:

- Trip cancellation coverage

- Trip interruption coverage

- CFAR coverage

- Rental car damage and theft coverage

- Additional medical evacuation coverage

Travel Insured International Optional Add-On Coverages

Travel Insured International offers several add-on options with its single-trip plans, but availability depends on your chosen plan. Coverages include the following:

- Rental car damage and theft coverage: You’ll receive $50,000 of coverage with Worldwide Trip Protector and $25,000 with Worldwide Trip Protector Edge if you experience damage to a rental car.

- CFAR coverage: This reimburses up to 75% of your prepaid, non-refundable trip expenses if you cancel your trip for virtually any reason.

- IFAR coverage: An add-on that reimburses you up to 75% of your non-refundable trip expenses if your trip is cut short for virtually any reason.

- Cancel for work reasons: If you need to cancel your trip due to unforeseen circumstances at work, Travel Insured International will reimburse you up to 100% of your non-refundable, insured trip costs.

- Event ticket registration fee protection: This add-on reimburses you the cost of registration fees in the event of cancellation of a covered event during your travels.

- Travel inconvenience: This provides coverage for inconveniences such as closed attractions, beach closures, rental car breakdowns, hotel infestations and more.

How Much Does Travel Insured International Cost?

After gathering quotes for Travel Insured International’s Worldwide Trip Protector and Worldwide Trip Protector Edge plans, we determined average costs of $229 and $168 , respectively. The cost of a Worldwide Trip Protector plan is 12% more than the average cost of travel insurance , which is $204. However, the cost of a Worldwide Trip Protector Edge plan is around 21% less than the average. Our team analyzed pricing across two dozen travel insurance providers to calculate average costs.

To show you what you might expect to pay for travel insurance, we used eight unique traveler profiles to gather estimates for Worldwide Trip Protector and Worldwide Trip Protector Edge plans.

We used a range of traveler ages, itineraries and trip costs to gather quotes, but your exact plan cost from Travel Insured International will likely vary. Costs depend on factors such as your trip’s total price, destination, coverage limits, your age and more.

When mystery shopping for quotes, we found that Travel Insured International offers annual multi-trip plans for a flat rate of $94 per year for adults and $64 for children. However, coverage is more limited than the provider’s single-trip policies unless you pay for optional protections.

Does Travel Insured International Offer 24/7 Travel Assistance?

Our research found that Travel Insured International offers 24/7 travel assistance to all policyholders. The insurer supplies two numbers through its website — one for emergency calls within the U.S. and Canada and one if you’re traveling abroad. Travel Insured International’s website provides the phone numbers but no further details about what the assistance line offers. We had to dig through sample contracts to better understand this benefit.

After reading sample contracts, we found Travel Insured International’s 24/7 travel assistance benefit includes medical or legal referrals, translation services, prescription drug replacements, eyeglass replacements, identity theft resolution services, concierge services and more. We encourage you to read through a sample contract before purchase to ensure you fully understand the benefits of this offering.

How To Buy a Policy From Travel Insured International

To understand the purchasing process with Travel Insured International, we gathered quotes using the provider’s web portal for eight different sample traveler profiles. Getting a quote was a relatively standard experience and similar to other providers we’ve rated using our travel insurance methodology.

The insurer’s homepage, travelinsured.com , features a quote tool for inputting your trip details. You’ll need to provide your travel dates, state of residence, trip type, date of initial trip deposit, and personal information such as your date of birth and email address.

Once you’ve entered the required information, you’ll be taken to a screen where you’re presented with your plan options. Our team was able to easily access plan information and sample contracts, and Travel Insured International provided a base cost before offering several add-on coverages for an additional cost.

After choosing your plan and any desired add-on protections, you’ll need to provide more in-depth information on each traveler seeking coverage. This includes your address and phone number. If you want, you can designate beneficiaries to whom Travel Insured International will pay your loss of life benefits in the event of your death on a covered trip. You’ll then choose whether to have your plan documents emailed or provided as a download. From here, you’ll finalize payment and receive your plan.

If you need assistance with your purchase or have questions about coverage, you can call Travel Insured International’s customer care line or visit its online help center to read frequently asked questions about policies and claims.

While our experience with the sign-up process was positive, we turned to reviews from policyholders like you to learn how real customers felt about their experience. We found many reviews through Trustpilot, such as this one , that mentioned an easy sign-up process. We found no recent reviews indicating problems with Travel Insured International’s sign-up process.

Travel Insured International Customer Reviews

As previously mentioned, our research team carefully reads customer reviews to better understand the quality of service that travel insurers provide policyholders. We used the BBB and Trustpilot, two third-party review sites, to learn more about Travel Insured International’s reputation amongst customers.

At the time of writing, Travel Insured International held a 1 out of 5-star customer review rating on the BBB and 4.1 out of 5 stars on Trustpilot. Learn more about what customers like and dislike about their experiences with the company in the sections below.

What Customers Like

- Helpful customer representatives: Several recent travelers, such as this one , noted that Travel Insured International’s representatives were knowledgeable and helpful.

- Easy claims process: Many customers, such as this traveler , were pleased with the company’s easy process when filing a claim.

- Reasonable prices: A few policyholders felt that they received great coverage for the price with their Travel Insured International plan.

What Customers Don’t Like

- Unfairly denied claims: Some policyholders felt they had a legitimate claim that was denied for unfair reasons.

- Difficulty with emergency services: This traveler was unable to reach a representative through Travel Insured International’s 24/7 helpline when they needed assistance.

- Long claims process: Several customers, such as this one , reported waiting for months for their claim approval and reimbursement.

Our team reached out to Travel Insured International for comment on its negative reviews and received the following response.

“Travel insurance is regulated by state, and we abide by state laws, ensuring we adhere to regulations related to claims and customer service. Claims received are reviewed in accordance with the terms, conditions and limitations of approved policies. Claims and benefits differ by state and plan design. Different benefit options are available for consumer choice based on their needs. Our standard practice is to respond promptly to inquiries upon receipt of the necessary information.”

How To File a Claim With Travel Insured International

As we conducted our research on Travel Insured International, we noticed that the provider offers detailed information on its claims process on its website in addition to a frequently asked questions (FAQ) section.

To start your claim with the company, head online to Travel Insured International’s website and log into the account you created when you signed up for a policy — the provider doesn’t have a mobile app. From there, you’ll notify the company of your loss or claim and receive the proper forms to complete depending on your circumstance. Travel Insured International notes that it sends out a step-by-step list of items it will need to properly review your claim.

Once you’ve submitted your claim with the requested documentation, a claims supervisor will review it. If approved, you’ll receive a check by mail that includes an explanation of your payment on the check stub. A claims representative from Travel Insured International will also contact you to let you know you’ll be receiving the payment. You can also choose reimbursement by electronic payment.

If Travel Insured International denies your claim, a claims analyst will contact you to explain the findings and reasons for denial. From there, the company will allow you to appeal the decision and provide additional information relevant to your claim.

We read through Travel Insured International customer reviews to better understand experiences with the company’s claims process. Many reviewers, such as this one , noted that submitting the proper receipts and documentation was the key to getting your claim approved. Others, such as this policyholder , felt that the company made it difficult to file a claim and that the amount of information requested was unreasonable. While customer reviews help assess a company’s services, note that your individual experience will likely vary.

Is Travel Insured International Worth It?

Travel Insured International provides single-trip and multi-trip policies for travelers seeking well-rounded coverage. The company offers unique features as standard coverages — such as pet kennel coverage and missed connection coverage — in addition to various optional add-on protections. While we found that Travel Insured International costs less than the average travel insurance plan, its coverage limits are markedly less than the limits we’ve discovered other providers offering through comparable plans.

Whether a travel insurance policy from Travel Insured International is worth it is up to you. However, as a best practice when shopping for a plan, we encourage you to gather quotes and research plans from at least two other travel insurance providers. This can help ensure you find the best coverage for your travel needs at a price that fits your budget.

Frequently Asked Questions About Travel Insured International

Where is travel insured international located.

According to its BBB profile, Travel Insured International is headquartered in Glastonbury, Conn.

When should I buy international travel insurance?

Our research has found that if you plan to purchase an international travel insurance plan, it’s best to buy it as soon as possible. Many travel insurance companies will limit certain benefits if you don’t purchase your plan within a certain time period from your first trip deposit. For example, some only allow you to purchase a pre-existing conditions waiver if you buy coverage within a specific period.

What does Travel Insured International travel insurance cover?

Travel Insured International’s travel insurance plans offer both trip cancellation or interruption benefits and medical expense protections. However, limits vary by plan, so read through the provider’s sample contracts to fully understand what is and isn’t covered by a specific policy.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed.

Why Travel Insurance?

Cancellation policies from travel providers like hotels and airlines may not have the comprehensive coverage you need. It's tough to make plans if you're not guaranteed to get your money back - What if you eventually need to cancel?

Expect More With Worldwide Trip Protector

Plan your trip with confidence knowing there are 30 covered reasons for trip cancellation for which you can be reimbursed up to 100% of your insured trip cost.

Our most comprehensive travel protection product also includes benefits for trip interruption, accident and sickness, baggage, optional rental car and more. Optional coverages include travel inconvenience and Cancel for Any Reason .

Uncertainty shouldn't keep you from planning your trip.

If you can’t travel or hit a snag after departure, we can help.

Cancel for Any Reason (CFAR)

If you must cancel your trip for a reason not stated in your Worldwide Trip Protector plan, CFAR reimburses 75% of your trip cost.

Travel secure with this optional benefit knowing that you're covered for unforeseen events beyond your control.

Travel Inconvenience

This optional coverage includes a fixed benefit amount per stated travel inconvenience. Travel inconveniences include, but are not limited to:

- Rainy Vacation

- Beach Closure

- Closed Attractions

- Flight Delay

- Missing Work

- Cruise Disablement

Trip Cancellation & Trip Interruption

30 Covered Reasons

Cancelling for a covered reason can reimburse up to 100% of your total trip cost. Interrupting your trip for a covered reason can reimburse up to 150% of your trip cost. Flight related covered reasons include:

- Inclement weather

- Natural disaster

- Airport strike

Interested in year-round travel protection?

Cover a full year of trips with the Annual Multi-Trip Protector.

This website contains highlights of the plans developed by Travel Insured International, which include travel insurance coverages underwritten by United States Fire Insurance Company, Principal Office located in Morristown, New Jersey, under form series T7000 et al, T210 et al and TP-401 et al, and non-insurance Travel Assistance Services provided by C&F Services and for WTP Cruise only, AwayCare and Blue Ribbon Bags. The terms of insurance coverages in the plans may vary by jurisdiction and not all insurance coverages are available in all jurisdictions. Insurance coverages in these plans are subject to terms, limitations and exclusions including an exclusion for pre-existing medical conditions. In most states, your travel retailer is not a licensed insurance producer/agent, and is not qualified or authorized to answer technical questions about the terms, benefits, exclusions and conditions of the insurance offered or to evaluate the adequacy of your existing insurance coverage. Your travel retailer may be compensated for the purchase of a plan and may provide general information about the plans offered, including a description of the coverage and price. The purchase of travel insurance is not required in order to purchase any other product or service from your travel retailer. CA DOI toll free number is 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured International. P.O. Box 6503, Glastonbury, CT 06033; 855-752-8303; [email protected] ; California license #0I13223. While Travel Insured International markets the travel insurance in these plans on behalf of USF, non-insurance components of the plans were added to the plans by Travel Insured and Travel Insured does not receive compensation from USF for providing the non-insurance components of the plans.

What can we help you with?

At this time, plan and benefit related information in our Help Center does not apply to:

- Travelers who purchased one of our plans before March 1, 2021; and

- Residents of the following states: Montana, New York, Pennsylvania, and Washington.

Top Articles

Account help for usaa members opens in new window.

- How to Modify Your Travel Dates

- How to Increase or Decrease Your Trip Cost

- Determining Trip Cost

- Logging Into Your Account

- Travel Insured App Sign In for USAA Members

FAQs USAA Members Opens in new window

- How Far in Advance Can I Purchase a Plan?

- Time-Sensitive Benefits for USAA Members

- Visiting More than One Destination

- How to View Your Plan Documents

Benefits & Coverages USAA Members Opens in new window

- 14 Day Free Look Period

- What is Trip Cost?

Trending Articles

Can't find what you're looking for? Please contact us for further assistance.

USAA means United Services Automobile Association and its affiliates. Use of the term "member" or "membership" refers to membership in USAA Membership Services and does not convey any legal or ownership rights in USAA. Restrictions apply and are subject to change. The USAA Perks program is provided through USAA Alliance Services LLC, a wholly owned subsidiary of USAA. USAA Alliance Services contracts with companies not affiliated with USAA to offer their products and services to members and customers. USAA Alliance Services receives compensation from these companies based on the sale of these products or services. When you purchase a product or service from one of these companies, that company is responsible for protecting your data and its processes and procedures may differ from those of USAA. These companies have sole financial responsibility for their products and services. The trademarks, logos and names of other companies, products and services are the property of their respective owners. 240485-0223 This website contains highlights of the plans developed by Travel Insured International, which include travel insurance coverages underwritten by United States Fire Insurance Company, Principal Office located in Morristown, New Jersey, under form series T7000 et al, T210 et al and TP-401 et al, and non-insurance Travel Assistance Services provided by C&F Services and for WTP Cruise only, AwayCare and Blue Ribbon Bags. The terms of insurance coverages in the plans may vary by jurisdiction and not all insurance coverages are available in all jurisdictions. Insurance coverages in these plans are subject to terms, limitations and exclusions including an exclusion for pre-existing medical conditions. In most states, your travel retailer is not a licensed insurance producer/agent, and is not qualified or authorized to answer technical questions about the terms, benefits, exclusions and conditions of the insurance offered or to evaluate the adequacy of your existing insurance coverage. Your travel retailer may be compensated for the purchase of a plan and may provide general information about the plans offered, including a description of the coverage and price. The purchase of travel insurance is not required in order to purchase any other product or service from your travel retailer. CA DOI toll free number is 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured International. P.O. Box 6503, Glastonbury, CT 06033; 877-771-1189; [email protected] ; California license #0I13223. While Travel Insured International markets the travel insurance in these plans on behalf of USF, non-insurance components of the plans were added to the plans by C&F Services and for WTP Cruise only, AwayCare and Blue Ribbon Bags, and C&F Services, AwayCare and Blue Ribbon Bags does not receive compensation from USF for providing the non-insurance components of the plans.

© 2023 Travel Insured International

COMMENTS

Travel Insured offers domestic and international trip protection products and services. To access your account, click on the login button at the top right corner of the web page.

Learn how to access your Travel Insured account where you can manage your travel protection plans, file claims, and more. Follow the steps to sign in with your email and password or create a new account if needed.

P.O. Box 6503, Glastonbury, CT 06033; 855-752-8303; [email protected]; California license #0I13223. While Travel Insured International markets the travel insurance in these plans on behalf of USF, non-insurance components of the plans were added to the plans by Travel Insured and Travel Insured does not receive compensation from ...

Consumer Customer Secure Login Page. Login to your Consumer Customer Account.

This help center contains highlights of the plans developed by Travel Insured International, which include travel insurance coverages underwritten by United States Fire Insurance Company, Principal Office located in Morristown, New Jersey, under form series T7000 et al, T210 et al and TP-401 et al, and non-insurance Travel Assistance Services provided by C&F Services and for WTP Cruise only ...

Enter your USAA login credentials and select "log on" ... please contact Travel Insured International. P.O. Box 6503, Glastonbury, CT 06033; 877-771-1189; [email protected]; California license #0I13223. While Travel Insured International markets the travel insurance in these plans on behalf of USF, non-insurance components of the plans were ...

Pros. "Cancel for any reason" and "interruption for any reason" upgrades available. "Travel inconvenience" upgrade available, for mishaps such as canceled events and closed attractions ...

Travel Insured International P.O. Box 6503 Glastonbury, CT 06033-6503 Phone: 1-800-243-2440 (Weekdays 8:00 a.m. - 5:30 p.m. EST) Fax: 1-860-528-8005 Email: [email protected] . For Emergency Assistance. There may be times when circumstances beyond the Assistance Company's control hinder their endeavors to provide travel assistance ...

To access your plan documents, start by signing into your Travel Insured account, then take the following steps. 1. Select your name in the top, right corner. Then select "My Account". 2. Under your name on the account page, select "Trips". 3. Locate and select the trip associated with the plan documents you need. 4.

Why Choose Us. Crum & Forster (C&F) is "A" (Excellent) rated by AM Best and offers a broad portfolio of specialty insurance products. We have developed and provided travel insurance for over 20 years. Leading tour operators choose to partner with us for our reliability, commitment to our customers, collaborative approach, and flexible and ...

CA DOI toll free number is 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured International.

One travel insurance provider to consider is Travel Insured International, a company with over 25 years in this space. In 2015, it was acquired by Crum & Forster, a 200-year-old specialty and ...

Follow the steps to access your Travel Insured account where you can add trips, modify your travel protection plan, file claims, and more. 1. On the homepage, click the word "Login" in the top right corner. 2. A box will present with two options, select "I am a Traveler". 3. Enter the email address associated with your account and your password.

TAP is a new agent dashboard developed by Travel Insured International to assist travel agents in selling insurance policies with ease. It offers multiple email quote options, detailed analytics, and integration with GDS and Clientbase systems.

Prime Cover, Travel Insured International and WorldTrips are among the best travel insurance companies, based on our analysis of 42 policies. We evaluated costs and a variety of coverage features ...

USAA Customer Secure Login Page. Login to your USAA Customer Account.

CA DOI toll free number is 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured International.

Meet your new favorite travel companion. Take your adventures further with the Allyz® TravelSmart app, and get features like real-time safety alerts, trip organizer, hospital finder, and more. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold.

Travel Insured International is a travel insurance company that offers two comprehensive plans that include trip and medical coverage, with several optional add-ons to enhance protection. Based on ...

Access your travel insurance account with igoinsured.com. Enter your agency code, user ID and password to sign in.

If you aren't able to find what you're looking for, please contact us. Customer Care. 1-855-752-8303. Emergency Travel Assistance. 1-800-494-9907 (toll-free in the U.S. and Canada) 1-603-328-1707 (collect outside of the U.S. and Canada) This help center contains highlights of the plans developed by Travel Insured International, which include ...

CA DOI toll free number is 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured International.

On the Travel Insured homepage, click the word "login" in the upper right corner. 2. A box will appear with two options, select "I am a Traveler". ... This help center contains highlights of the plans developed by Travel Insured International, which include travel insurance coverages underwritten by United States Fire Insurance Company ...

P.O. Box 6503, Glastonbury, CT 06033; 877-771-1189; [email protected]; California license #0I13223. While Travel Insured International markets the travel insurance in these plans on behalf of USF, non-insurance components of the plans were added to the plans by C&F Services and for WTP Cruise only, AwayCare and Blue Ribbon Bags ...