US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Report: 2022 year in review.

ANNUAL REPORT January 24, 2023

Two themes dominated the state of the industry in 2022: Pent-up travel demand and ongoing recession fears coupled with economic concerns.

Pent-up demand continued to soar, and travelers’ desire to make up for lost travel experiences helped to largely recover the domestic leisure sector to pre-pandemic levels. The summer and holiday travel periods showed that inflationary concerns and high travel prices did not dissuade travelers but instead shifted behaviors, such as cutting back on travel distance, trip duration and staying with friends and family instead of paid accommodations.

There was also evidence of pent-up demand for business travel—specifically meetings and events—as the sector began rescheduling postponed events which helped to make gains toward 2019 figures. The industry sees potential for growth in this sector, especially as a ‘new normal’ continues to shape travel patterns (i.e. hybrid work, more flexibility, fewer peak months and the blend of business and leisure travel).

However, the recovery has been uneven. Transient business travel and international travel were sluggish throughout 2022. Business travel and international travel are not expected to return to pre-pandemic levels until 2027 and 2025, respectively.

But there is optimism as we head into 2023. U.S. Travel’s latest forecast indicated that despite the ongoing headwinds—economic concerns, recession fears, a strong U.S. dollar, unstable global economies and long U.S. visitor visa wait times—travel industry growth is expected to remain robust as we head into 2023.

- Skip to main content

- Skip to "About this site"

Language selection

- Français

- Search and menus

Search The Daily

National tourism indicators, first quarter 2022.

Released: 2022-07-06

$15.7 billion

First quarter 2022

(quarterly change)

$13.5 billion

$2.2 billion

Tourism spending in Canada grew 1.3% in the first quarter of 2022, a fourth consecutive quarterly increase. Tourism gross domestic product ( GDP ) (+0.9%) and jobs attributable to tourism (+0.8%) also rose in the first quarter.

Tourism spending in Canada increased 50.7% over the last four quarters but was 34.2% below the pre-pandemic levels of the fourth quarter of 2019.

Growth in the first quarter of 2022 was driven by an increase in tourism spending by Canadians in Canada (+2.9%). Tourism spending by international visitors fell 6.9%, as overnight travel to Canada declined in the first quarter following a large increase in the fourth quarter of 2021.

New travel restrictions were set in late 2021 in response to COVID -1 9's Omicron variant. Phased easing and lifting of these restrictions did not come into effect until February 28 . As of that date, travellers arriving to Canada from any country who qualified as fully vaccinated were being randomly selected for arrival testing and were not required to quarantine while awaiting their test results. Furthermore, travellers would then have the option of using a COVID -1 9 rapid antigen test result or a molecular test result to meet pre-entry requirements. Recommendations to avoid non-essential travel were also lifted on that date.

Chart 1 Tourism spending increases

Tourism GDP grew 0.9% in the first quarter of 2022, following an 11.9% increase in the fourth quarter of 2021. Transportation services (+2.9%) were the greatest contributor to the growth in tourism GDP . Despite this increase, tourism GDP was 34.2% below its pre-pandemic level. With economy-wide GDP up 0.8% in the first quarter of 2022, tourism's share of GDP remained the same as the fourth quarter of 2021, at 1.3%.

Employment attributable to tourism rose in the first quarter of 2022, up 0.8%, following a 4.8% increase in the fourth quarter of 2021. Travel services (+10.2%), non-tourism industries (+1.3%) and air transportation services (+2.6%) were the largest contributors to the first quarter's growth.

Chart 2 Tourism gross domestic product and jobs attributable to tourism rise

Tourism spending in Canada by Canadians increases

Tourism spending in Canada by Canadians increased 2.9% in the first quarter of 2022. Increased spending on passenger air transport (+10.5%) and pre-trip expenses (+6.0%), such as recreational vehicles, pleasure crafts and camping equipment, were the main contributors. Tourism spending in Canada by Canadians accounted for 85.8% of total tourism spending in the first quarter of 2022, up slightly from the fourth quarter of 2021 (84.5%).

Spending by international visitors decreases

Tourism spending by international visitors fell 6.9% in the first quarter of 2022, following a 116.4% increase in the fourth quarter of 2021. Passenger air transport ( -1 1.4%) followed by accommodation services ( -4 .8%) and non-tourism products ( -8 .5%) were the main contributors to the quarter's decline.

Chart 3 Share of tourism spending by international visitors decreases

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development , the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The national tourism indicators are an example of how Statistics Canada supports the reporting on the global goals for sustainable development. This release will be used in helping to measure the following goal:

Note to readers

Growth rates for tourism spending and gross domestic product ( GDP ) are expressed in real terms (that is, adjusted for price changes), using reference year 2012, as well as adjusted for seasonal variations, unless otherwise indicated.

Employment data are also seasonally adjusted.

Tourism's share of economy-wide employment is calculated using seasonally adjusted values.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions .

Associated percentage changes are presented at quarterly rates unless otherwise noted.

Economy-wide GDP is obtained from table 36-10-0104-01 .

Non-tourism industries , also referred to as other industries, are industries that would continue to exist in the absence of tourism. For example, the crop production and petroleum refineries industries produce products purchased by tourists. However, neither would cease to exist in the absence of tourism. Tourism GDP takes into account the production of these products purchased by tourists.

Non tourism products , also referred to as other products, are products for which a significant part of its total demand in Canada does not come from visitors, such as groceries, clothing and alcohol bought in stores.

With the first quarter of 2022 release of the national tourism indicators, all data from the first quarter of 2021 to the fourth quarter of 2021 has been revised.

Revisions over the 2020 to 2021 period are expected to be higher than normal due to the volatile economic situation, particularly for the tourism sector.

The national tourism indicators are funded by Destination Canada.

Next release

Data on the national tourism indicators for the second quarter of 2022 will be released on September 28, 2022.

The data visualization product " Provincial and Territorial Tourism Satellite Account ," which is part of Statistics Canada – Data Visualization Products ( Catalogue number 71-607-X ), is available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts ( Catalogue number 13-605-X ) is available.

The User Guide: Canadian System of Macroeconomic Accounts ( Catalogue number 13-606-G ) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts ( Catalogue number 13-607-X ) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136 ; 514-283-8300 ; [email protected] ) or Media Relations ( [email protected] ).

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Further recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

The state of the Hospitality and Tourism Industry in 2022

Summer 2022 season will soon be upon us, and many destinations are preparing to soon open their doors to welcome tourists. But a big question remains. Will this year be any better for the hospitality and tourism industry, considering COVID-19 is still around than the previous two years?

The pandemic has had a significant impact on the industry and affected tourism professionals . Booking cancellations saw tourism businesses’ revenues plummet, while many were left unemployed.

Based on the current epidemiological data and bookings, what do experts say about the hospitality and tourism industry 2022 performance? Let’s find out.

What experts initially believed

Since the beginning of the pandemic, tourism experts were not so optimistic about the sector’s recovery. Only 1% of tourism experts thought a recovery to pre-pandemic levels was possible in 2021. At the same time, 15% believed that the sector would recover in 2022. The majority (43%) sided with 2023, and 41% felt 2024 or later sounded more likely.

Hospitality and tourism industry statistics

Tourism arrivals went up by 4% in 2021 compared to 2020 levels, but they remained 72% below the pre-pandemic levels in 2019. This drop in tourist arrivals meant a $1.3 trillion loss in export revenue, to put this in numbers.

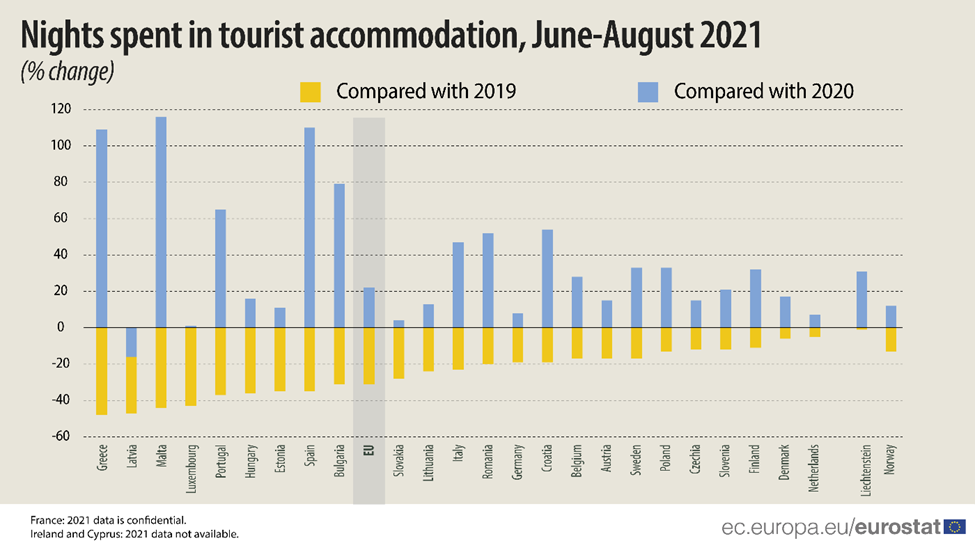

To illustrate this, in the following graph, you see that tourists spent fewer nights in tourist accommodation during the three summers months from June to August 2021.

In 2022, global international tourist arrivals more than doubled (+ 130%) in January 2022 compared to 2021. Particularly, this is an increase of 18 million more visitors worldwide in the first month of the year, which equals the total rise in visitors for the whole of 2021. However, despite this significant increase for the global hospitality and tourism industry in January 2022, the numbers remained 67% lower than the pre-pandemic levels.

The positive growth of tourist arrivals in early 2022 set the course for a record-breaking year since the pandemic’s start. Unfortunately, this positive outlook seems to worsen due to additional challenges.

Hospitality and tourism industry challenges in 2022

The war in ukraine.

While countries worldwide were loosening up their covid-related restrictions, the war in Ukraine came to impose new ones.

The war between Russia and Ukraine, which started on 24 February 2022, hampered global travel and tourism as many European countries closed their airspace to Russian carriers.

Russians and Ukrainians together accounted for a combined 3% of global spending on international tourism in 2020, that are expected to be lost in 2022. At the same time, experts are afraid that a prolonged conflict would have a further cost of $ 14 billion in global tourism.

The hospitality and tourism industries that will suffer the most from this conflict are neighbouring east European countries and various other Mediterranean destinations.

Soaring prices

The Russo-Ukrainian conflict came on top of the existing high inflation raising prices and reducing consumer purchasing power further.

The recent spike in oil and natural gas prices and rising electrical bills make accommodation and transportation significantly more expensive. That adds more pressure on businesses as their profit margins decrease. At the same time, many people will either decide not to travel or spend less during their travels.

The Organisation for Economic Co-operation and Development (OECD) projects that this year’s economic growth will be lower than expected. Specifically, OECD reports that global economic growth will be about 1% lower and inflation 2.5% higher than initially expected.

2022 began with the best possible way for tourism as there were signs of significant improvements in global travel exceeding expectations. Nevertheless, this positive feeling did not last long, as the war in Ukraine later shadowed these positive trends. As the summer season of 2022 is almost upon us, it remains to be seen how the global tourism and hospitality industry will cope with this new uncertainty.

Get to Know HOSTVET

While the world is preparing for the upcoming Summer 2022 season, the HOSTVET project works in the background. It prepares the next generation of tourism professionals and improves the management of existing organizations in the hospitality and tourism industry.

HOSTVET is an Erasmus+ EU project focused on sharing best practices. It develops new strategies for managing hosting organizations for internship programs in tourism and cultural and creative business sectors. It uses Sardinia as an example since it has a low number of businesses involved in EU projects. Tourism and the cultural sectors are essential resources for the area’s economy and need to improve.

The purpose of HOSTVET is the following:

- construct a standard model of rules and processes to be used in international training and apprenticeship initiatives devoted to the heads of the entities concerned,

- identify and disseminate the best approaches for assisting enterprises in participating in the ERASMUS + project,

- increase awareness and knowledge of the ERASMUS + program to facilitate the participation of companies and qualified organizations that will host vocational training students in Europe,

- work on sharing best practices on the management of sending / hospitality organizations that will involve VET learners in mobility projects,

- share best practices that could also have an impact at the ERASMUS + level.

To learn more about HOSTVET EU Project, visit the project’s official website .

Vasilis Bouronikos

Content & Communication Manager

Do you want to write for us? Read our guest post guidelines here !

Privacy Overview

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

Now boarding: Faces, places, and trends shaping tourism in 2024

After falling by 75 percent in 2020, travel is on its way to a full recovery by the end of 2024. Domestic travel is expected to grow 3 percent annually and reach 19 billion lodging nights per year by 2030. 1 Unless otherwise noted, the source for all data and projections is Oxford Economics. Over the same time frame, international travel should likewise ramp up to its historical average of nine billion nights. Spending on travel is expected to follow a similar trajectory, with an estimated $8.6 trillion in traveler outlays in 2024, representing roughly 9 percent of this year’s global GDP.

About the authors

This article is a collaborative effort by Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann , with Ivan Gladstone and Jasperina de Vries, representing views from McKinsey’s Travel, Logistics & Infrastructure Practice.

There’s no doubt people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go? We developed a snapshot of current traveler flows, along with estimates for growth through 2030. For the purposes of this report, we have divided the world into four regions—the Americas, Asia, Europe, and the Middle East and Africa.

Our analysis identifies three major themes for industry stakeholders to consider:

- The bulk of travel spending is close to home. Stakeholders should ensure they capture the full potential of domestic travel before shifting their focus to international travelers. And they should start with international travelers who visit nearby countries—as intraregional trips represent the largest travel segment after domestic trips.

- Source markets are shifting. Although established source markets continue to anchor global travel, Eastern Europe, India, and Southeast Asia are all becoming fast-growing sources of outbound tourism.

- The destinations of the future may not be the ones you imagine. Alongside enduring favorites, places that weren’t on many tourists’ maps are finding clever ways to lure international travelers and establish themselves as desirable destinations.

The bulk of travel spending is close to home

International travel might feel more glamorous, but tourism players should not forget that domestic travel still represents the bulk of the market, accounting for 75 percent of global travel spending (Exhibit 1). Domestic travel recovered from the COVID-19 pandemic faster than international travel, as is typical coming out of downturns. And although there has been a recent boom in “revenge travel,” with travelers prioritizing international trips that were delayed by the pandemic, a return to prepandemic norms, in which domestic travel represents 70 percent of spending, is expected by 2030.

The United States is the world’s largest domestic travel market at $1 trillion in annual spending. Sixty-eight percent of all trips that start in the United States remain within its borders. Domestic demand has softened slightly, as American travelers return abroad. 2 Dawit Habtemariam, “Domestic U.S. tourism growth levels off as Americans head overseas,” Skift, August 18, 2023. But tourism players with the right offerings are still thriving: five national parks broke attendance records in 2023 (including Joshua Tree National Park, which capitalized on growing interest from stargazers indulging in “dark sky” tourism 3 Scott McConkey, “5 national parks set attendance records in 2023, and the reasons may surprise you,” Wealth of Geeks, April 16, 2024. ).

China’s $744 billion domestic travel market is currently the world’s second largest. Chinese travelers spent the pandemic learning to appreciate the diversity of experiences on offer within their own country. Even as borders open back up, Chinese travelers are staying close to home. And domestic destinations are benefiting: for example, Changchun (home to the Changchun Ice and Snow Festival) realized 160 percent year-on-year growth in visitors in 2023. 4 Shi Xiaoji, “Why don’t Chinese people like to travel abroad anymore? The global tourism industry has lost 900 billion yuan. What is the situation?,” NetEase, February 12, 2024. In 2024, domestic travel during Lunar New Year exceeded prepandemic levels by 19 percent.

China’s domestic travel market is expected to grow 12 percent annually and overtake the United States’ to become the world’s largest by 2030. Hotel construction reflects this expectation: 30 percent of the global hotel construction pipeline is currently concentrated in China. The pipeline is heavily skewed toward luxury properties, with more than twice as many luxury hotels under construction in China as in the United States.

India, currently the world’s sixth-largest domestic travel market by spending, is another thriving area for domestic travel. With the subcontinent’s growing middle class powering travel spending growth of roughly 9 percent per year, India’s domestic market could overtake Japan’s and Mexico’s to become the world’s fourth largest by 2030. Domestic air passenger traffic in India is projected to double by 2030, 5 Murali Krishnan, “Can India’s airports cope with rapid passenger growth?,” Deutsche Welle, February 7, 2024. boosted in part by a state-subsidized initiative that aims to connect underserved domestic airports. 6 “India is seeing a massive aviation boom,” Economist , November 23, 2023.

When travelers do go abroad, they often stay close to home (Exhibit 2).

Europe and Asia, in particular, demonstrate strong and growing intraregional travel markets.

Recognizing this general trend, stakeholders have been funneling investment toward regional tourism destinations. An Emirati wealth fund, for instance, has announced its intent to invest roughly $35 billion into established hospitality properties and development opportunities in Egypt. 7 Michael Gunn and Mirette Magdy, “UAE’s $35 billion Egypt deal marks Gulf powers’ buying spree,” Bloomberg, April 27, 2024.

Europe has long played host to a high share of intraregional travel. Seventy percent of its travelers’ international trips stay within the region. Europe’s most popular destinations for intraregional travelers are perennial warm-weather favorites—Spain (18 percent), Italy (10 percent), and France (8 percent)—with limited change to these preferences expected between now and 2030.

Despite longer travel distances between Asian countries, Asia’s intraregional travel market is beginning to resemble Europe’s. Intraregional travel currently accounts for about 60 percent of international trips in Asia—a share expected to climb to 64 percent by 2030. As in Europe in past decades, Asian intraregional travel is benefiting from diminishing visa barriers and the development of a low-cost, regional flight network.

Thailand is projected to enjoy continued, growing popularity with Asian travelers. Thailand waived visa requirements for Chinese tourists in 2023 and plans to do the same for Indian tourists starting in 2024. It has aggressively targeted the fast-growing Indian traveler segment, launching more than 50 marketing campaigns directed at Indians over the past decade. The investment may be paying off: Bangkok recently overtook Dubai as the most popular city destination for Indian tourists. 8 “Bangkok overtakes Dubai as top destination for Indians post visa relaxation, reveals Agoda,” PR Newswire, January 18, 2024.

A McKinsey ConsumerWise survey on consumer sentiment, conducted in February 2024, suggests that Chinese travelers are also exhibiting high interest in international travel, with 36 percent of survey respondents indicating that they intend to spend more on international travel in the next three months. 9 Daniel Zipser, “ China brief: Consumers are spending again (outside of China) ,” McKinsey, April 8, 2024. Much of this interest is directed toward regional destinations such as Southeast Asia and Japan, with interest in travel to Europe down from previous years. 10 Guang Chen, Zi Chen, Steve Saxon, and Jackey Yu, “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Given travelers’ preference for proximity, how can tourism stakeholders further capitalize on domestic and intraregional travel demand? Here are a few strategies:

- Craft offerings that encourage domestic tourists to rediscover local gems. Destinations, hotels, and transportation providers can encourage domestic tourists to integrate lesser-known cultural landmarks into their trips to visit friends and relatives. In France, the upscale hotel chain Relais & Châteaux markets historic properties that lie far from classic tourist sights—such as Château Saint-Jean in rural Auvergne—as a welcome escape from the bustle of Paris. In Mexico, the Pueblos Mágicos program has successfully boosted domestic tourist visits to a set of “magical towns” that showcase Mexican heritage.

- Fold one-off domestic destinations into fuller itineraries. Route 66 in the United States is a classic road trip pathway, which spurs visits to attractions all along the highway’s length. Tourism stakeholders can collaborate to create similar types of domestic itineraries around the world. For instance, Mexico has expanded on its Pueblos Mágicos concept by branding coordinated visits to multiple villages as “magical routes.” In France, local tourism boards and vineyards have collaborated to promote bucket list “wine routes” around the country.

- Make crossing borders into neighboring countries seamless. Removing logistical barriers to travel can nudge tourists to upgrade a one-off trip to a single attraction into a bucket list journey across multiple, less-trodden destinations. In Africa, for example, Ethiopian Airlines is facilitating cross-border travel to major regional tourist sites through improved air connectivity. In Asia, Thailand has announced its intent to create a joint visa easing travel among Cambodia, Laos, Malaysia, Myanmar, Thailand, and Vietnam.

Source markets are shifting

The United States, Germany, the United Kingdom, China, and France remain the world’s five largest sources of travelers, in that order. These countries collectively accounted for 38 percent of international travel spending in 2023 and are expected to remain the top five source markets through 2030. But interest in travel is blossoming in other parts of the world—causing a shift in the balance of outbound travel flows (Exhibit 3).

North Americans’ travel spending is projected to hold steady at roughly 3 percent annual growth. US consumers voice growing concerns about inflation, and the most cost-constrained traveler segments are reducing travel, which is affecting ultra-low-cost airlines and budget hotels. Most travelers, however, plan to continue traveling: McKinsey research suggests that American consumers rank international and domestic travel as their highest-priority areas for discretionary spending. Instead of canceling their trips, these consumers are adapting their behavior by traveling during off-peak periods or booking travel further in advance. Travel spending by Europeans paints a slightly rosier picture, with roughly 5 percent projected annual growth. Meanwhile, the projected 12 percent annual growth in Chinese travelers’ spending should anchor substantial increases in travel spending across Northeast Asia.

Alongside these enduring traveler segments, new groups of travelers are emerging. Eastern Europe, India, and Southeast Asia are still comparatively small source markets, but they are developing fast-growing pools of first-time tourists (Exhibit 4).

India’s breakneck GDP growth of 6 percent year over year is bolstering a new generation of travelers, 11 Benjamin Laker, “India will grow to become the world’s third-largest economy by 2027,” Forbes , February 23, 2024. resulting in a projected annual growth in travel spending of 9 percent between now and 2030. Indian air carriers and lodging companies are making substantial investments to meet projected demand. Budget airline IndiGo placed the largest aircraft order in commercial aviation history in 2023, when it pledged to buy 500 Airbus A320 planes 12 Anna Cooban, “Biggest plane deal in history: Airbus clinches massive order from India’s IndiGo,” CNN, June 19, 2023. ; that same week, Air India nearly equaled IndiGo’s order size with purchase agreements for 250 Airbus and 220 Boeing jets. IndiGo later added an order for 30 additional Airbus A350 planes, well suited to serving both domestic and international routes. 13 “Airbus confirms IndiGo's A350 aircraft order,” Economic Times , May 6, 2024. The Indian Hotels Company Limited is ramping up its hotel pipeline, aiming to open two new hotels per month in the near future. International players are not sitting on the sidelines: seven hotel chains are launching new brands in India in 2024, 14 Peden Doma Bhutia, “Indian Hotels expansion plans: 2 new brands launching, 2 hotels opening every month,” Skift, February 2, 2024. including Marriott’s first Moxy- and Tribute-branded hotels in India and entrants from Hilton’s Curio and Tapestry brands. 15 Forum Gandhi, “Check-in frenzy: International hotel giants unleash fresh brands in India’s booming hospitality landscape,” Hindu Businessline , February 13, 2024. Development focus has shifted away from major metropolises such as Mumbai and Delhi and toward fast-developing, smaller cities such as Chandigarh and Hyderabad.

Southeast Asian travel spending is projected to grow at roughly 7 percent per year. Pockets of particularly high growth exist in Cambodia, Malaysia, and the Philippines. To capitalize on this blossoming source market, neighboring countries are rolling out attractive visa arrangements: for example, China has agreed to reciprocal visa waivers for short-term travelers from Malaysia, Singapore, and Thailand. 16 Julienna Law, “China launches ‘visa-free era’ with Southeast Asia. Will travel retail boom?,” Jing Daily , January 30, 2024.

Travel spending by Eastern Europeans is expected to grow at 7 percent per year until 2030—two percentage points higher than spending by Western Europeans. Areas of especially high growth include the Czech Republic, Hungary, and Poland, where middle-class travelers are increasingly venturing farther afield. Major tourism players, including the TUI Group, have tapped into these new source markets by offering charter flights to warm-weather destinations such as Egypt. 17 Hildbrandt von Klaus, “TUI develops Czech Republic as a new source market,” FVW, December 22, 2023.

Although the number of travelers from these new source markets is growing, their purchasing power remains relatively limited. Compared with Western European travelers (who average $159 per night in total travel spending), South Asians spend 20 percent less, Eastern Europeans spend 40 percent less, and Southeast Asians spend 55 percent less. Only 3 percent of the current Asian hotel construction pipeline caters to economy travelers, suggesting a potential supply gap of rooms that could appeal to budget-constrained tourists.

While acknowledging that historical source markets will continue to constitute the bulk of travel spending, tourism players can consider actions such as these to capitalize on growing travel demand from newer markets:

- Reduce obstacles to travel. Countries can look for ways to strategically invest in simplifying travel for visitors from growing source markets. In 2017, for example, Azerbaijan introduced express processing of electronic visas for Indian visitors; annual arrivals from India increased fivefold in two years. Requirements regarding passport photocopies or in-person check-ins can similarly be assessed with an eye toward reducing red tape for travelers.

- Use culturally relevant marketing channels to reach new demographics. Unique, thoughtful marketing strategies can help destinations place themselves on first-time travelers’ bucket lists. For example, after the release of Zindagi Na Milegi Dobara , a popular Bollywood movie shot in Spain with support from the Spanish Ministry of Tourism, Indian tourism to Spain increased by 65 percent. 18 “ Zindagi Na Milegi Dobara part of syllabus in Spain colleges,” India Today , June 6, 2004.

- Give new travelers the tech they expect. Travelers from newer source markets often have access to tech-forward travel offerings. For example, Indian travelers can travel anywhere within their country without physical identification, thanks to the Digi Yatra app. The Southeast Asian rideshare app Grab has several helpful travel features that competitors lack, such as automated menu translation and currency conversion. Tourism stakeholders should consider how to adapt to the tech expectations of newer travelers, integrating relevant offerings that ease journeys.

- Create vibrant experiences tailored to different price points. Crafting lower-budget offerings for more cost-constrained travelers doesn’t need to result in giving them a subpar experience. Capsule hotels, in which guests sleep in small cubbies, began as a response to the high cost of accommodations in Japan, but they have become an attraction in their own right—appearing on many must-do lists. 19 Philip Tang, “24 of the best experiences in Japan,” Lonely Planet, March 23, 2024.

The places you’ll go: The destinations of the future may not be the ones you imagine

The world’s top ten destination countries (the United States, Spain, China, France, Saudi Arabia, Türkiye, Italy, Thailand, Japan, and India, in that order) currently receive 45 percent of all travel spending, including for domestic travel. But some new locales are gaining traction (Exhibit 5).

A significant number of travelers are expanding their horizons, booking journeys to less visited countries that are near to old standbys. For instance, Laos and Malaysia, which both border Thailand—an established destination that is home to Bangkok, the world’s most visited city 20 Katherine LaGrave, “This is the world’s most visited city,” AFAR , January 31, 2024. —are up a respective 20 percent and 17 percent, respectively, in year-over-year international travel spending.

The world’s top ten destination countries currently receive 45 percent of all travel spending, including domestic-travel spending. But some new locales are gaining traction.

Several other countries that have crafted thoughtful tourism demand generation strategies—such as Peru, the Philippines, Rwanda, and Vietnam—are also expected to reap benefits in the coming years. Vietnam logged a remarkable 40 percent increase in tourism spending in the five years before the pandemic. Postpandemic, it has rebounded in part by waiving visa requirements for European travelers (while indicating intent to offer similar exemptions in the future for Chinese and Indian travelers). 21 Ashvita Singh, “Vietnam looks to offer visa-free entry to Indians: India report,” Skift, November 20, 2023. The Philippines has made a concerted effort to shift its sun-and-beach branding toward a more well-rounded image, replacing its long-standing “It’s more fun in the Philippines” tourism slogan with “Love the Philippines.” Peru is highlighting less visited archeological sites while also marketing itself as a top-notch culinary destination through the promotion of Peruvian restaurants abroad. Rwanda is investing in infrastructure to become a major African transit hub, facilitated by Qatar Airways’ purchase of a 60 percent stake in the country’s major airport. 22 Dylan Cresswell, “Rwanda plots ambitious tourism recovery,” African Business , July 28, 2022. Rwanda has also successfully capitalized on sustainable tourism: by charging $1,500 per gorilla trekking permit, for instance, it has maximized revenue while reducing environmental impact.

Tourism players might consider taking some of these actions to lure tourists to less familiar destinations:

- Collaborate across the tourism ecosystem. Promotion is not solely the domain of destination marketing organizations. Accommodation, transportation, and experience providers can also play important roles. In Singapore, for instance, the luxury resort Marina Bay Sands partners extensively with Singapore Airlines and the Singapore Tourism Board to offer compelling tourism offerings. Past collaborations have included flight and stay packages built around culinary festivals and a Lunar New Year drone show. 23 “Singapore Tourism Board, Marina Bay Sands & UOB partner to enliven Marina Bay precinct,” Singapore Tourism Board news release, January 25, 2024.

- Use infrastructure linkage to promote new destinations. By extending route options, transportation providers can encourage visitors to create itineraries that combine familiar destinations with new attractions. In Asia, Thailand’s tourism authority has attempted to nudge visitors away from the most heavily trafficked parts of the country, such as Bangkok and Phuket, and toward less popular destinations.

- Deploy social media to reach different demographics. Innovative social media campaigns can help put a destination on the map. Australia launched its “Ruby the kangaroo” campaign in China to coincide with the return of postpandemic air capacity between the two places. A video adapted for Chinese context (with appropriate gestures and a hashtag in Mandarin) garnered more than 20 million views in a single day on one of China’s largest social media platforms. 24 Nicole Gong, “Can Ruby the kangaroo bring Chinese tourists hopping back to Australia?,” SBS, June 5, 2023.

- Embrace unknown status. “Off the beaten path” messaging can appeal to widely traveled tourists seeking fresh experiences. Saudi Arabia’s “#WhereInTheWorld” campaign promoted the country’s tourist spots by acknowledging that they are less familiar to travelers, using a series of images that compared these spots with better-known destinations.

As tourism stakeholders look to the future, they can take steps to ensure that they continue to delight existing travelers while also embracing new ones. Domestic and intraregional tourism remain major opportunities—catering to local tourists’ preferences while building infrastructure that makes travel more seamless within a region could help capture them. Creative collaboration among tourism stakeholders can help put lesser-known destinations on the map. Travel tides are shifting. Expertly navigating these currents could yield rich rewards.

Caroline Tufft is a senior partner in McKinsey’s London office, Margaux Constantin is a partner in the Dubai office, Matteo Pacca is a senior partner in the Paris office, Ryan Mann is a partner in the Chicago office, Ivan Gladstone is an associate partner in the Riyadh office, and Jasperina de Vries is an associate partner in the Amsterdam office.

The authors wish to thank Abdulhadi Alghamdi, Alessandra Powell, Alex Dichter, Cedric Tsai, Diane Vu, Elisa Wallwitz, Lily Miller, Maggie Coffey, Nadya Snezhkova, Nick Meronyk, Paulina Baum, Peimin Suo, Rebecca Stone, Sarah Fellay, Sarah Sahel, Steffen Fuchs, Steffen Köpke, Steve Saxon, Sophia Wang, and Urs Binggeli for their contributions to this article.

This article was edited by Seth Stevenson, a senior editor in the New York office.

Explore a career with us

Related articles.

The future of tourism: Bridging the labor gap, enhancing customer experience

The promise of travel in the age of AI

From India to the world: Unleashing the potential of India’s tourists

- Main menu News

- Crypto News

- Main menu Statistics

- Business and Workplace Statistics

- Crypto Statistics

- Cybersecurity Statistics

- Entertainment Statistics

- Finance and Marketing Statistics

- Hardware and Gadgets Statistics

- Science Statistics

- Software & Web Statistics

- Main menu Software

- Main menu Spy Apps

- Main menu Best Spy Apps

- Best Phone Spy Apps

- Best Spy Apps for iPhone

- Best Spy Apps for Android

- Main menu Social Media Spy Apps

- Best Facebook Spy Apps

- Best WhatsApp Spy Apps

- Best Instagram Spy Apps

- Best Tinder Spy Apps

- Best Telegram Spy Apps

- Best TikTok Spy Apps

- Best Snapchat Spy Apps

- Best Text Message Spy Apps

- Main menu Catch Cheater

- Best Cheating Spouse Tracker Apps

- Top Boyfriend Spy Apps

- Best Girlfiend Spy Apps

- Signs Your Girlfriend is Cheating

- Main menu Parent Control

- Best Parental Control Apps

- Best Parental Control Apps in the UK

- Best Parental Control Apps in Australia

- Best Parental Control Apps in Germany

- Facebook Parental Controls

- Best Parental Control Apps for iPhone and iPad

- Best Parental Control Apps for Android Devices

- Main menu Track Location

- Best Geofencing Apps

- Best Secret GPS Trackers

- Best Boyfriend Phone Trackers

- Main menu Keyloggers / Recording

- Best Keylogger Apps

- Best Keylogger Software For Windows PC

- The Best Android Keylogger Apps

- The Best iPhone Keylogger Apps

- Best Secret Screen Recorder Apps

- Main menu Spy App Reviews

- mSpy Review

- Spynger Review

- uMobix Review

- GEOfinder Review

- Phonsee Review

- EyeZy Review

- XNSPY Review

- Spyic Review

- Spyera Review

- Main menu Spy Tips and Tricks

- Is It Illegal to Spy on Someone Without Their Knowledge?

- How to Spy on Devices Connected to Your Wi-Fi

- Main menu VPNs

- What is a VPN?

- How to Hide IP Address

- Best VPN Service

- Best VPN for Business

- Main menu Best VPN Apps

- Best VPN for Android

- Best VPN for iPhone

- Best Linux VPN

- Best VPN for Firestick

- Fastest VPN Providers

- Best Cheap VPNs

- Main menu Free VPN

- Best Free VPN Services

- Best Free VPNs According to Reddit

- Free VPNs for Android

- Free VPNs for iPhone

- Free VPNs for Netflix

- Free VPNs for Torrenting

- Free VPNs Chrome Extensions

- Free VPNs for Firestick

- VPNs with Free Trials

- Best Netflix VPN

- Best Gaming VPN

- Best Gambling VPNs

- Best VPN Reddit

- The Best VPN for Streaming

- Best Twitter VPN

- Best Betfair VPNs

- Best Porn VPN

- Main menu VPN Reviews

- NordVPN Review

- ExpressVPN Review

- Surfshark VPN Review

- CyberGhost VPN Review

- Ivacy VPN Review

- PureVPN Review

- VyprVPN Review

- Proton VPN Review

- ExpressVPN Vs NordVPN

- Main menu Best VPN by Country

- Best VPNs for UK

- Best VPNs for Canada

- Best VPNs for Australia

- Best VPNs for Singapore

- Best VPNs for UAE

- Best VPNs in China

- Main menu Guides

- How Do I Hide My IP Address?

- How to Watch DStv online

- How To Watch NRL 2023 Online

- Main menu VoIP Services

- What is VoIP? The Definitive Guide to VoIP

- Main menu Wiki

- VoIP vs Landline – Everything You Need to Know

- What is a VoIP Number & How Does it Work?

- What is a Virtual Phone System & How Does It Work?

- How to Get a VoIP Number

- How to Choose a VoIP Provider

- What is ISDN?

- Call Center Technology 101

- VoIP Security Guide

- VoIP Hacking: How to Protect Your VoIP Phone

- VoIP Statistics and Trends

- Best VoIP Services

- Best VoIP Service for Home

- Cheapest VoIP Phone Service Providers

- Free VoIP Phone Number Solutions

- Best VoIP Mobile Apps

- Main menu VoIP for Business

- Best Virtual Phone Service Providers for Business

- Best VoIP for Small Business

- Best VoIP Business Phone Systems

- Best Hosted VoIP Providers

- Main menu By Country

- Best US Virtual Phone Number Provider

- Best Unlimited VoIP UK

- Best VoIP Providers in Canada

- Best VoIP Australia

- The Best VoIP Apps for Iran

- Main menu Password Managers

- Best Password Managers

- Best Password Managers for Business

- Best Password Manager in the UK

- Best Password Managers in India

- The Best Password Manager for iPhone

- The Best Password Manager Reddit Users Recommend

- The Best Password Manager for Windows

- Keeper Password Manager Review

- Main menu Business Software

- Main menu Accounting Software

- Best Accounting Software

- Best Self-Employment Accounting Software

- Best Cloud-Based Accounting Software

- Best Accounting Software to Integrate with WooCommerce

- Best Mac Accounting Software

- The Best Payroll Software for the UK

- Best Accounting Software Australia

- Main menu Project Management

- The Best Resource Management Software – Top 10 Compared for 2024

- The Best Gantt Chart Software Solutions

- The Best Workflow Management Software

- Best Project Management Software

- The Best Free Project Management Software

- Monday.com Review

- Zoho Projects Review — Best Use Cases & Testing in 2024

- ResourceGuru Review with Tests — Is It a Good Software in 2024?

- Main menu Employee Monitoring

- Best Employee Tracking Software

- Best Employee Monitoring Software For Mac

- Best Employee Time Tracking Software

- Best Employee Time Tracking Software for Windows

- Main menu Hosting

- The Best WordPress Hosting Services

- The Fastest WordPress Hosting You Can Get

- Best Cheap WordPress Hosting Services

- The Best Website Hosting Services

- Main menu CRM

- What is CRM?

- Best CRM Software

- CRM for Small Businesses in the UK

- CRM Marketing Automation Software

- Real Estate CRM Software

- CRM for Startups

- Recruitment CRM Software

- Best Free CRM Software

- Best CRM for Non Profits

- Construction CRM Software

- Automotive CRM Software

- Best CRM Insurance Software

- Best CRMs for E-Commerce Reviewed

- Best Free CRMs for Startups

- Main menu Background Check Services

- Best Background Check Software

- Best Tenant Background Check Sites

- Main menu Hiring Software

- The Best HR Software: Top 10 for 2024 Compared

- Best EOR Services for International Hiring

- Best Applicant Tracking Systems

- The Best Applicant Tracking Systems for Small Businesses

- The Best Recruitment Software

- Teamtailor Review

- ClearCompany Review

- Zoho Recruit Review

- Monday.com Recruitment Review

- Main menu Employer of Record

- Deel Review

- Multiplier Review

- Main menu Antivirus

- Best Antivirus Software

- Best Antivirus for Windows

- Best Antivirus for Mac

- Best Antivirus for Android

- Best Antivirus for Servers

- Best Lightweight Antivirus – Good Protection for Low-End PCs and Light RAM Usage

- How to Remove Spyware

- Best Spyware Detectors

- Main menu Best by Country

- Best Antivirus in Singapore

- Best Antivirus in Indonesia

- Best Antivirus in Philippines

- Best Antivirus in UK

- Best Antivirus in Canada

- Best Antivirus in Australia

- Main menu Artificial Intelligence

- A Full Jasper.ai Review

- An In-Depth Copy AI Review

- Best AI Writing Tools

- Best AI Copywriting Tools

- The 10 Best Copy.ai Alternatives Reviewed for 2024

- Main menu Crypto

- Main menu Best Crypto to Buy Now

- Best Crypto Presales

- Best Meme Coins

- Best Crypto to Buy Now

- Best Altcoins to Buy

- Next Crypto to Explode

- Best Crypto to Hold Long Term

- Main menu New Cryptos

- New Cryptocurrencies to Invest

- Best Crypto ICOs

- New Upcoming Binance Listings

- New Upcoming Coinbase Listings

- Main menu Crypto Robots

- Best Bitcoin Robots

- Bitcode Method Review

- Bitcoin 360 AI Review

- Qumas AI Review

- BitiCodes Review

- Immediate Connect Review

- Immediate Edge Review

- Immediate Fortune Review

- Ultimate Crypto Glossary in Simple Words

- Main menu Gambling

- Main menu Crypto Gambling

- Best Crypto Casino Sites

- Best Bitcoin Betting Sites

- Best Bitcoin Gambling Sites

- Best Bitcoin Slot Sites

- Best Ethereum Casino Sites

- Best Solana Casinos

- Main menu Sports Betting

- Best Sportsbooks

- Best Offshore Sportsbooks

- Best AI Sports Betting Prediction Sites

- Best Sports Betting Bots

- Main menu Casino

- Best Offshore Casinos

- Best Anonymous Casinos

- Best Casino Apps for Real Money

- Best Online Blackjack Casinos

- Best Roulette Casinos

- No-KYC Casinos

- VPN Friendly Casinos

- New Casinos

- Safe Online Casinos

- Best No ID Verification Casinos

- Telegram Casinos

- Top Plinko Gambling Sites

- Inclave Casinos

- Credit Card Casinos

- Best Payout Casinos

- Best Cash App Casinos

- Main menu USA

- Best Anonymous Online Casinos

- Best Casino Apps For Real Money

- Best Live Blackjack Online Casinos

- Reddit Sportsbooks

- California Sports Betting

- Florida Sports Betting

- Florida Online Gambling

- Missouri Online Casinos

- North Carolina Sports Betting

- California Online Casinos

- New York Online Casinos

- Main menu UK

- Betting Sites Not On Gamstop

- Casinos Not on Gamstop

- Main menu Canada

- Crypto Casinos

- Main menu Malaysia

- Online Casino Malaysia

- Malaysia Online Gambling Sites

- Malaysia Sports Betting Sites

- Main menu Indonesia

- Indonesia Online Gambling Sites

- Online Casino Indonesia

- Indonesia Sports Betting Sites

- Main menu Singapore

- Singapore Online Gamblling Sites

- Singapore Online Casinos

- Singapore Sports Betting

- Main menu Sweden

- Casino Utan Svensk Licens

- Main menu Philippines

- Online Gambling Sites Philippines

- Philippines Online Casino

- Philippines Sports Betting

- Main menu South Korea

- South Korea Online Gambling Sites

- Online Casino South Korea

- Main menu India

- India Online Gambling Sites

- Online Casino India

- India Sports Betting Sites

- Main menu Australia

- Bitcoin Casinos in Australia

- Main menu Gambling Guides

- How To Gamble Online

- How to Play Baccarat

- Blackjack Strategy

- How to Play Bingo

- How To Play Craps

- Craps Strategy

- How to Play Keno

- How To Play Poker

- Poker Cheat Sheet

- Poker Strategy

- How To Play Roulette

- Roulette Odds

- Roulette Strategy

- Main menu Gadgets

- Gadget digest

- Main menu Hardware

- Motherboards

- Main menu About

- Editorial Policy

- Why Trust Tech Report

- Meet the Tech Report Team

- Our Writers and Editors

Tourism Industry Statistics Showing COVID-19’s Impact – 2023 Numbers

Global Impact in 2020

United states tourism, lodging and hotel sector, beverage and food, attractions and tour, business travel, international tourism prospect in 2023.

Tourism has been an essential revenue-generating sector, providing over 320 million jobs globally. According to statistics, the Tourism industry employs many women, representing 54% of the workforce. But the industry was greatly affected by the Covid-19 pandemic.

Countries dependent on tourism felt the impact longer than other nations with diverse sources of revenue. In countries like Barbados, the pandemic halted the sector, significantly affecting the country’s income. This article provides adequate information on the impact of Covid- 19 on the tourism industry.

Let’s take a look.

The pandemic affected the tourism industry negatively, and the unemployment rate increased.

1. Globally, the travel and tourism industry generated $396.37 billion in revenue in 2020. This was a 42.1% decline in growth from 2019. 2. In 2020, there was a decline in the patronage of tourist accommodations in the European Union by 51%.

3. In 2019, 243 million Europeans made at least one tourism trip , but this reduced by 21% to 193 million in the preceding year.

4. The travel and tourism industry lost a minimum of $1.2 trillion of gross domestic product globally after 4 months of being shut down during the pandemic.

5. UNCTAD estimated that for every $1 million lost in international revenue , there is a reduction by a minimum of $2 million in a country’s national income.

6. Travel and tourism are responsible for 1 in 10 jobs. This implies 330 million jobs and a contribution of 10.3% to the global gross domestic product.

7. International tourism had a projection to decrease in 2020 by 60 to 80 percent. Tourism revenue generation will likely not return to how it was before the pandemic until 2024. This puts 120 million jobs in the sector at risk.

8. Tourists in 2020 took about 1 billion international trips globally. This is 30% less than the estimated 1.46% of trips for the year due to travel restrictions during the Covid-19 pandemic.

9. Women make up 54% of the tourism workforce.

10. Tourism represents over 20% of the gross domestic product for some countries.

11. In 2019, tourism made up 7% of global trade .

12. The travel and tourism industry provides 15.8 million American Jobs . The tourism and travel sector gives jobs to one in every 10 Americans.

13. There was an increase of 3.5% in the unemployment rate due to Covid-19. Retrenchment of employees caused the United States unemployment rate to increase from 3.5% to 7.1% in barely two months during the pandemic.

14. The United States was projected to lose revenue above every other country.

15. The US lost more than other countries in dollars , twice China, which stands in second place.

16. Tourism represents 21% of Hawaii’s economy. Visitors in 2012 spent over $14 billion in Hawaii. This industry fell by 95% during the Covid-19 pandemic as residents of states were mandated to stay home.

17. In the first quarter of 2020, Florida experienced a decline in tourism activities by 10.7%. This decline in Florida’s tourism sector caused a loss of $ 67 billion in its economy.

18. Hotels in Austin had a 3% booking in April 2020. Hotels in Austin-Texas experienced a significant reduction in the number of rooms booked from 10,777 in 2019 to 342 in 2020.

19. There was a reduction in US spending on tourism by 31%. Due to the pandemic, the United States experienced a 31% reduction in travel expenses. This means a decline in travel expenses to $355 billion in 2020.

20. 217 countries imposed travel restrictions to limit the spread of the coronavirus. Lockdown measures were imposed by many governments when the pandemic was at its peak.

21. The travel and tourism industry had the most significant casualty. The pandemic greatly affected the travel and tourism industry.

22. Passenger airlines revenue declined by 55% from 2019 . According to the International Air transport association, the tourism industry fell by $314 billion.

23. 97 countries representing 45% of destinations , implemented partial or total border closure.

24. 39 countries representing 18% of destinations, implemented border closure to specific goals .

25. 65 countries representing 30% of destinations, suspended flights partially or totally.

26. 16 countries representing 7% of destinations, required visitors to follow quarantine measures .

27. R eport from Flightrader reveals a decline in the average number of commercial flights . In January and February 2020, commercial flights were reduced by over 100,000. The sector experienced a further reduction to 78,500 in March and 29,400 flights in April.

28. Passenger revenue was projected to decline by $314 billion in 2020. According to the air travel report, 2020 experienced a 55% reduction in revenue generation from its 2019 record.

29. International flights were reduced by 80%. On May 4, 2020, there was a reduction of 80% in the number of international flights. The majority of airlines closed operations due to borders closure.

30. In June 2020, International Air Transport Association reported a loss of $84.3 billion globally by airlines. Income in the aviation sector was projected to be negative throughout 2021 as countries are recuperating and slowly lifting barrier bans.

31. International Air Transport Association predicts a 50% increase in the price of plane tickets . The cost of plane tickets with social distancing measures was expected to increase by 50% globally.

32. Airline ticket fares rose by 13.75% and 10.9% yearly. At the height of the Covid -19 pandemic , the price of airline tickets of a company increased by 13.7% and 10.9% between April 13 and May 4.

33. Hotels in the United States have lost over $46 billion in room revenue . Hotel experts state a loss of $400 million daily due to low patronage of hotel rooms.

34. AHLA speculates room occupancy to be below 20%. For most hotel business owners , an occupancy rate of 35% and below means closing up business.

35. According to McKinsey analysis, the pandemic is most likely to cause a shift to digital bookings. Travelers will be more flexible on booking options and likely make last-minute changes . For instance, in China, over 90% of trip bookings were made within seven days of the trip.

36. Revenue per available room was projected to fall by 20% in 2023. In the worst-case situation, RevPAR is estimated at 20% in 2023.

37. Luxury room Revenue per available room is the slowest to return . The RevPAR of the luxury room is the slowest to return as it involves higher semi-fixed costs and variable costs.

38. 51% of Americans are likely to frequent a hotel. According to the Ipsos survey, 51% of Americans will likely keep a lodge in the same hotel. The hospitality sector has been experiencing an improvement in the rate at which customers frequent their service.

39. Airbnb has been experiencing some challenges. 64% indicated concerns and were unsure of undergoing their intended booking due to the pandemic.

40. 47% of hosts felt unsafe renting out lodges to guests.

41. 70% of guests had concerns about staying at Airbnb .

42. 44% of hosts predicted a reduction in revenue from June to August.

43. Daily rates decline to $90.

44. $236 million was reportedly lost by Hyatt in the second quarter; this indicates a 376% reduction in income from 2019.

45. Full-service restaurants in the United States saw a decline in reservations in March by 41% across the country during the pandemic. Open table reservations crash to 41% across the US as coronavirus spreads.

46. Working hours in local restaurants dropped by 40%. There was a decline in the number of working hours on March 17 by 40% in local restaurants and bars and an overall reduction of hourly workers by 45%.

47. O ut of 3 restaurants lose their jobs. National Restaurant Association reports that the pandemic has incredibly hit workers.

48. 91% of the hourly workforce was laid off. James beard foundation discovered that 91% of the hourly workforce in restaurants was laid off, with 70% of salaried employees due to Covid-19.

49. Dining industry to lose$240 billion in 2020. National Restaurant Association forecasted the dining industry to lose $240 billion at the end of 2020.

50. The restaurant’s biggest challenge was reopening. According to a James Beard Foundation survey conducted during the epidemic, 41% of restaurants had gradual consumer returns, 35% needed money for vendors, and 16% needed new personnel.

51. 33% of consumers increase takeout. The rate of takeout by consumers reached 33% after the pandemic.

52. 90% of cultural institutions closed business doors. Due to the pandemic, about 90% of cultural institutions shut their doors, and about 13% may never resume activity.

53. Metropolitan Opera lost $60 million. The New York giant had to cancel its season show at the end of March, thereby incurring an estimated loss of $60 million in revenue.

54. Safari experienced a decline in bookings by 75%. The pandemic greatly impacted the revenue of Africa’s US$12.4 billion safari industry. Due to the restriction policy, it experienced a 75% decline in bookings.

55. 80% of ships had cases of covid-19 on board. The CDC issued a standing order that ships within the United States jurisdiction should not set sail between March and October.

56. Master cards experienced a 45% reduction in travel-related transactions. The credit company had a 45% decline in its usage for travel-related transactions.

57. 77% of the America Society of Travel Advisors (ASTA) predicted no business activity for six months. Members of ASTA forecasted nonexistent business for about 6 months due to the pandemic.

58. Watt Disney lost about $5 billion. During April, May, and June, the theme parks of Watt Disney Co were closed, causing a loss of revenue.

59. Global business travel was predicted to lose $810.7 billion in revenue in 2020. According to estimates, the pandemic will hit worldwide sales by $810.7 billion, with China’s travel spending predicting a $404.21 billion drop.

60. The US travel economy lost $250 billion. Due to the pandemic, the United States lost $250 billion at the beginning of March.

61. 5 to 10 business travels lost due to remote work tools. Experts predicted increased loss of business travel due to a shift to virtual meetings.

62. 89% reduction in business travel occurred due to the pandemic. The decline in business travel was far more significant than during the great recession and 9/11 losses. Half of all businesses canceled travel arrangements due to the pandemic.

63. Tourism travel to reach 80% to 95% of pre-pandemic. According to UNWTO research, the travel industry may return to 80 to 95 percent of pre-pandemic levels by 2023, with the Middle East and Europe expected to play critical roles in the recovery.

The third-largest export industry in the world economy is tourism. Some nations’ gross domestic product is 20% of it . Millions of individuals in developed and developing economies are employed in this sector. The tourist sector employs one person for every ten employees. However, one of the Covid-19 epidemic areas was most badly damaged, hurting opportunities, public services, and lifestyles in various countries.

How many travelers were there in 2020?

Worldwide, 1 billion foreign travels were done in 2020. This was down from the estimated 1.46 billion trips for the year by 30%.

What proportion of tourists decreased in 2020?

International tourism suffered significant losses due to the pandemic. Revenue dropped from 20% to 70% from 2019 to 2018.

What are the key challenges facing the travel and tourism sector?

The issues are Infrastructure, taxation, safety, and tourism promotion.

- Safari Bookings

- Restaurant Business Online

- RESTAURANTS NEED MORE SUPPORT TO

- Seven Rooms