Travel Insurance for Italy (What You NEED to Know Before You Go)

From who needs it to where to get italy travel insurance, here's what to should look out for.

Planning a dream trip to Italy? You may need travel insurance. I know, I know, the last thing you want to do is think about something going wrong. But when dealing with so many variables: flights, car rental, hotels, and tours, anything can happen. Accidents, theft, and cancellations have the potential to ruin what was supposed to be a well-deserved getaway. This is why many people choose to purchase travel insurance when traveling to Italy, Europe, and beyond!

Do you need travel insurance to visit Italy?

If you require a Schengen Visa to enter Italy, it is mandatory to have valid travel insurance to apply for an Italian visa. If you can travel to Italy without a visa, travel insurance is not required, but can provide added peace of mind. However, if you’re applying for a long-term visa, such as a Work or Student visa, international health insurance may be required instead of travel insurance.

Insurance requirements for Italy travel visas

Since Italy is a member of the Schengen, your insurance policy needs to meet the Schengen travel insurance requirements. This means it must be valid throughout the entire Schengen Zone and cover at least €30,000 in medical expenses. Additional coverage can be purchased for further protection.

Where can you get travel insurance for Italy?

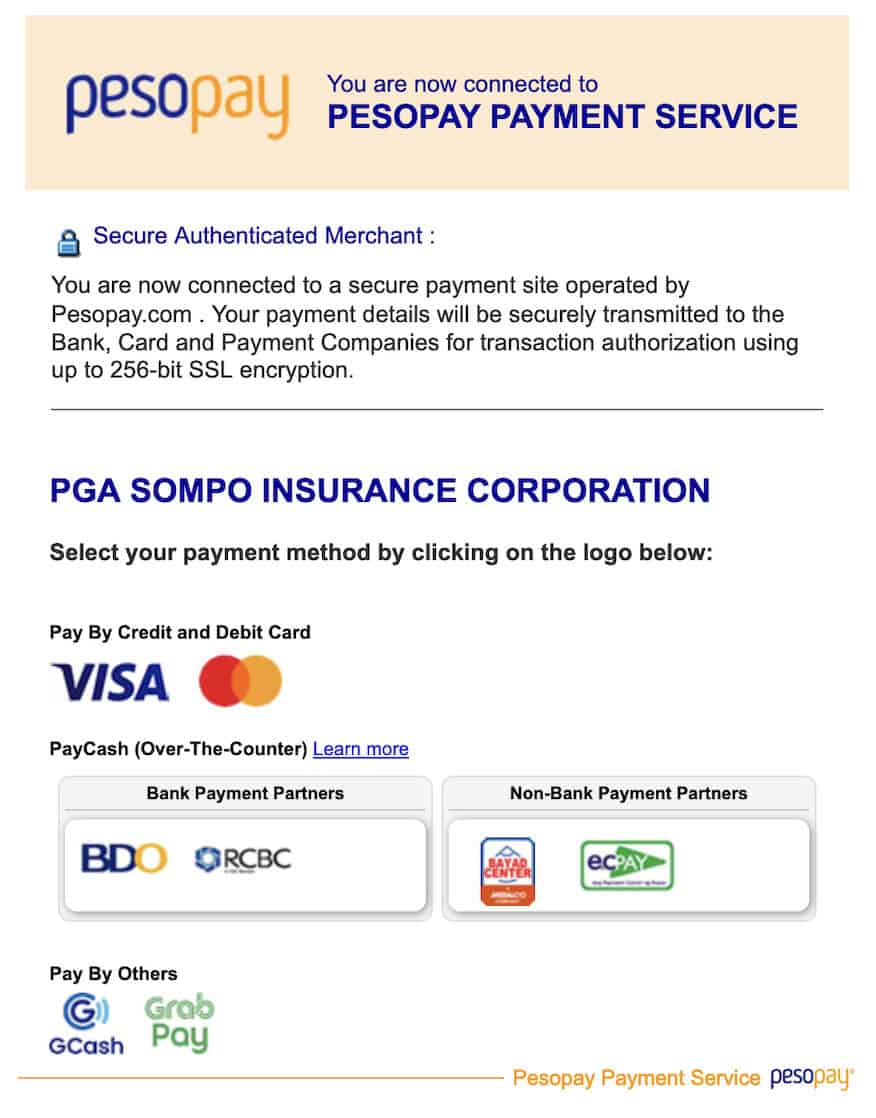

You can purchase travel insurance for Italy by:

- Going directly to a travel insurance company – this is the popular option, as most companies operate online, allowing you to choose and purchase a plan from the comfort of your own home. World Nomads offers Schengen travel insurance that is accepted by Italian Embassies and Consulates.

- Travel insurance brokers – there are many online services that offer plans from various insurance companies where you can compare prices and choose travel insurance that meets your requirements.

- Tour agency – some tour companies offer complimentary travel insurance plans, but be sure to read the policy carefully before signing up to ensure you are adequately covered.

How to provide proof of Italy travel visa insurance?

When you purchase a Schengen travel insurance plan from World Nomads , you will receive an Insurance Certificate or Letter that you can download and print out. You must send this, along with the other required documents, to the Italian Embassy or Consulate.

Is having travel insurance important when traveling to Italy?

Travel insurance adds a safety net, protecting you from unexpected costs that could arise during your trip. For example, if you have an accident that requires medical attention while in Italy, travel insurance will reimburse your medical bills. Additionally, if you have trip disruption coverage and need to cancel or cut your trip short due to circumstances beyond your control, travel insurance could reimburse a portion of your prepaid expenses such as hotel and flight tickets.

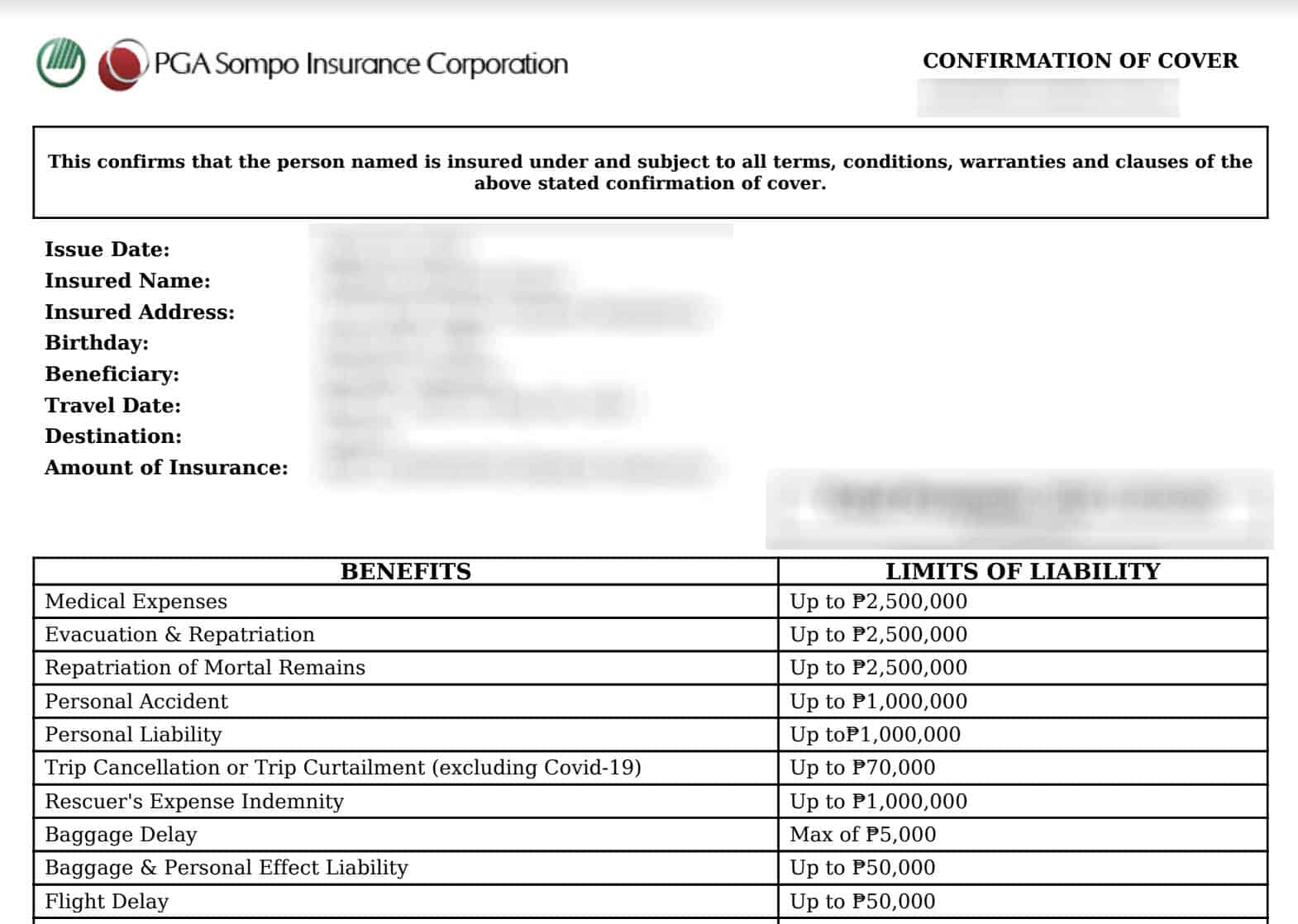

What can Italy travel insurance cover?

Italy travel insurance plans can provide coverage for the following:

- Medical emergencies: If you encounter an accident or suddenly fall ill while in Italy, travel health insurance can cover the cost of medical treatment. However, you’re only covered for emergencies and accidents, not treatment for pre-existing conditions.

- Evacuation or repatriation: If you become seriously ill while in Italy and require evacuation out to your home country or elsewhere, evacuation coverage will cover the cost of the air ambulance. Repatriation coverage, on the other hand, refers to the transport of remains in the event of death.

- Optional coverage: In addition to travel health insurance, many insurance companies offer additional coverage, such as reimbursement for trip disruption, loss or damage of personal belongings, and liability insurance. However, these additional services come at an extra cost.

What are some things should you consider when choosing travel insurance for Italy?

When selecting the best travel insurance plan for Italy, consider the following factors:

- Policy maximum: This refers to the maximum amount of money that an insurance company will cover for medical expenses during your trip. In order to obtain a Schengen visa, you need insurance with a policy maximum that’s at least €30,000 or more.

- Coverage details: Most insurance companies provide detailed explanations of their plans on their website. Ensure you read about how much they will cover for each item and under what circumstances.

- Exclusions: Be aware of what the company will not cover, such as accidents resulting from driving under the influence and injuries due to adventurous activities.

- Schengen requirements: If you need a visa to visit Italy, make sure you choose travel insurance that meets all Schengen requirements. Otherwise, it may result in the Italian Embassy/Consulate rejecting your visa application.

- Claims process: Ensure you understand the claims process before leaving, including how to file a claim, the required documents, and whom to contact.

- 24/7 assistance: Confirm if your insurance company has a 24/7 customer service line or if you have someone to reach out to during your stay in Italy.

What is the cost of travel insurance for Italy?

The cost of travel insurance for Italy varies as it depends on a few factors.

- The type and amount of coverage you choose will affect the cost, for example, policies that over coverage up to €30,000 will cost less than those with a maximum of €50,000 or €100,000.

- Your age is also a contributing factor. If you’re over 60, you will pay more due to increased risk.

- Additionally, the duration of your trip impacts the cost, with longer trips resulting in higher health insurance policy prices.

- On average, for a seven-day trip, you can expect to pay between €20 and €30 for travel health insurance for one person.

World Nomads provides travel medical insurance premiums for different durations of travel in the Schengen area and beyond. For more information, visit World Nomad’s website and create a free quote for your trip.

How to file a travel insurance claim

There are two methods for filing a travel insurance claim:

- Direct billing: In Italy, some hospitals will charge the travel insurance company directly for medical treatment without you having to pay anything. However, not all hospitals offer this option, and insurance companies typically have a network of hospitals that can bill them directly. Before you travel, it’s a good idea to confirm which hospitals are included in this scheme before receiving treatment.

- Reimbursement: You can choose to pay for your medical treatment upfront and then submit the bill to the insurance company for reimbursement. Remember, it’s essential that you keep all your receipts and prescriptions for medication, police reports for lost or stolen belongings, and proof of canceled flights.

Do US, Canadian, and Australian Citizens need travel insurance for Italy?

Although it’s not mandatory for US, Canadian, and Australian citizens to have travel health insurance for Italy, it can offer an extra layer of protection. Schengen Plus, Universal by Mutuaide, and Gold/Platinum by AXA are some of the travel health insurance plans that offer not only the mandatory insurance certificate required for an Italian visa but also extended coverage for Italy, all Schengen area members, EU countries, and the UK.

Is healthcare expensive for tourists in Italy?

Tourists without travel health insurance in Italy will have to bear the full cost of treatment themselves. While minor emergencies may not be too expensive, significant treatments like surgeries can quickly become costly.

It’s important to note that emergency services are not free of charge. There have been anecdotal reports of tourists not being charged anything for emergency services, but this is more likely because the incident was minor, and the clinic or hospital was not equipped to charge a tourist.

In any case, it’s always better to assume that you will have to pay for any medical treatment you receive in Italy. Italian citizens pay taxes that fund the country’s healthcare system and receive medical treatment mostly free of charge, but tourists do not benefit from this system and are subject to full costs.

Who should you call in an emergency situation in Italy?

In Italy, the following emergency numbers can be used:

- 118 for medical emergencies

- 113 for general emergencies (similar to 911 in the USA),

- 112 for national police (Carabinieri)

- 115 for the fire department

It’s also a good idea to note down the contact details of your country’s Embassy or Consulate in Italy.

Using EHIC vs. Getting travel insurance in Italy

Although an EHIC can provide medical attention in Italy for EU nationals in the same way as Italian citizens, it is not a substitute for travel insurance. The charges and co-pays for medical attention will still apply unless the individual has travel health insurance. Additionally, EHIC does not cover private healthcare, evacuation, trip disruption, liability, etc. It should also be noted that many Italian citizens have private health insurance.

Climate and health precautions in Italy

Italy is hot and very dry during the summers while winters can get quite cold and wet. Temperatures in Southern Italy reach 40°C in the peak of summer, making sightseeing exhausting so make sure you stick to the shade or spend that hottest part of the day indoors at a museum or poolside. During winter, do as the Italians do and ‘ vestirsi a cipolla ’ (dress like an onion), wearing several warm layers of clothing means you can stay comfortable when you’re going indoors and outdoors.

Get my complete guide to the best times to visit Italy which includes money-saving tips and ways to avoid crowds.

Car insurance for driving in Italy

A separate international car insurance plan is needed to cover Italy and other Schengen countries when driving to Italy. It’s important to note that regular travel insurance does not include car insurance. Your car insurance from your home country is also not valid in Italy either, unless you are from an EU Member State. It’s also essential to check if your driving license and license plates are valid and accepted in Italy.

7 things to know before traveling to Italy

- Restaurants located near tourist attractions and popular landmarks tend to be overpriced, crowded, and offer poor-quality food.

- Italians tend to eat dinner late, so many restaurants will not open before 7 pm.

- A Coperto charge is paid when sitting down for a meal at a restaurant, usually ranging from €1 to €5 per person.

- Tickets for trains or buses should be validated at one of the machines at the station to avoid a fine.

- Carrying both cash and a card is advisable for smaller purchases.

- Electronic devices from the USA will need adapters and converters due to different plug shapes and voltages.

- Finally, booking tickets for landmarks in advance can save time and avoid long queues.

Don’t miss my complete guide to Italy travel tips that will save you time, money, and disappointment.

Like it? Pin it for later!

Over to you!

Did you find this guide helpful? Let me know using the comments section below or join me on social media to start a conversation.

Thanks for reading and I hope you enjoyed this post.

Like what you see? Subscribe using the form below to have all of my posts delivered directly to your email.

Success! Now check your email to confirm your subscription.

There was an error submitting your subscription. Please try again.

Get my best language and travel tips FREE by email...

Subscribe to my newsletter to receive detailed travel guides, exclusive travel and language learning tips, priority access to giveaways and more!

I will never give away, trade or sell your email address. You can unsubscribe at any time.

Michele creates language learning guides and courses for travel. What separates her from other instructors is her ability to explain complex grammar in a no-nonsense, straightforward manner using her unique 80/20 method. Get her free guide 9 reasons you’re not fluent…YET & how to fix it! Planning a trip? Learn the local language with her 80/20 method for less than the cost of eating at a tourist trap restaurant Start learning today!

ESSERE and STARE: What is the Difference? (Includes FREE Quiz)

9 beautiful wine windows in florence and where to find them (map included), leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

If you don't know where you are , how do you know where you're going? Find out how well you know Italian grammar today!

GET A QUOTE

Europe travel insurance for Schengen visa

From €33 / week

- Up to 100,000 € coverage in medical expenses

- Repatriation

- Medical teleconsultation 24/7

- 24H assistance

- Up to 180 days of coverage

- All Schengen, E.U countries and the U.K.

- Certificate issued immediately and approved by the embassies

Europe Travel, the travel insurance for Europe

AXA’s Europe Travel insurance offers extensive protection, covering medical expenses up to €100,000 in the following European countries: Austria, Belgium, Croatia, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, as well as the United Kingdom , Bulgaria, Cyprus, Ireland, Romania, San Marino, Andorra, Monaco and the Vatican .

It also allows you to obtain the travel insurance certificate required with your Schengen Visa application .

Europe Travel insurance:

- guarantees a coverage of up to € 100,000 (about US$ 111,000)

- covers travellers for up to 180 days

- bears the expenses linked to emergency medical care**, hospitalisation**, sanitary repatriation** or death**

- offers the refund of your subscribed travel insurance if your Schengen visa application is denied (under certain conditions)

- no age restriction, 0 deductible

Do you cover emergency medical costs related to Coronavirus?

We will cover your medical costs related to Coronavirus provided you haven't travelled against World Health Organisation 's advice, medical advice, or any other government body’s advice in your home country or the country you are travelling to. Emergency and additional travel costs are also covered providing you have stuck to this advice.

Do I need an insurance certificate with Covid protection?

All issued electronic certificates purchased on the axa-schengen site include this disclaimer: “ Medical fees related to COVID-19 are covered in the terms, conditions & exclusions established in the insurance policy ”.

Travel insurance for the European Union and the Schengen area

If you wish to travel to Europe and you do not yet know the details of your itinerary, our AXA Europe Travel insurance is the best choice for you as it will give you the possibility to continue your journey if you decide to visit Ireland or the U.K. for example.

Visit this page to discover all our Schengen visa Insurance warranties .

Will AXA Schengen travel insurance be accepted with my visa application?

Yes ! For over 10 years AXA has been delivering insurance certificates which meet EU countries’ requirements to obtain a Schengen visa.

Is the digital travel insurance certificate valid to submit my visa application?

Yes. All you have to do is print it and enclose it with your visa application file. Each AXA Schengen insurance policy is individualized and bears a number that is verifiable on our website.

I don’t need a Schengen visa to visit Europe. Can I still purchase your insurance to cover my possible health expenses?

As the saying goes " Better safe than sorry ". If the Schengen travel insurance is not mandatory for some travelers, the troubles they might face are still very real. A broken wrist or nasty infection can happen to anyone! We thus strongly recommend that you subscribe to our insurance for travelers visiting Europe to make sure your trip is as safe and peaceful as possible.

How much does Europe Travel, AXA Schengen visa travel insurance cost?

Great news ! Our travel insurance which will allow you to enjoy a peaceful visit to Europe is cheap. For a one week stay, it starts at €33 ($36).

How many days will I be covered by my travel insurance?

Europe Travel insurance covers travellers for up to 180 days (around 6 months).

The Schengen Europe travel insurance, an extensive coverage

You are not quite sure of your European itinerary but you need to be covered everywhere , wherever your travels take you for business or pleasure ? AXA Europe Travel is the Europe visa insurance you need to stay anywhere in the Schengen area as well as in any country of the European Union.

After subscribing to your Europe Travel insurance on line, you will receive a certificate by email . You must enclose it with your Schengen visa application: it meets all the requirements of the countries of the Schengen area.

It offers the basic warranties required for your medical and repatriation expense coverage. If you do not provide this travel insurance certificate, your application will not be examined and your visa request will be denied.

Warranties of Europe Travel, AXA’s travel insurance for Europe

Europe Travel also offers 4 essential advantages:

- Immediate coverage. Your insurance covers you from the first day you need it.

- No age restriction

- No price variation because of nationality or age

- No health questionnaire

If your Schengen visa application is denied , you can ask for your Europe Travel insurance to be refunded.

** Before paying any medical expenses, travellers must first contact AXA Assistance medical service.

This insurance does not cover the country of residence

Ready to subscribe?

Features at Glance

U.K., Schengen, U.E. countries

AXA #1 Global Insurance Brand

Extended protection

Meets all visas requirements from the European regulation

Medical expenses covered up to 100.000€

Assistance 24 / 7 - Emergency helpline

Cover details

See the Insurance Product sheet and our Terms & Conditions for full details. Please read these before signing the contract. Schengen Low Cost Travel Insurance is developed by Inter Partner Assistance SA, an insurance company governed by Belgian law.

Visit our Low Cost insurance page and our Schengen insurance for 1 year page to see the full benefits offered by AXA Schengen.

***This insurance does not cover the country of residence

Get Schengen insurance

Copyright AXA Assistance 2023 © AXA Assistance is represented by INTER PARTNER ASSISTANCE SA/NV, a public limited liability company governed by Belgian law with registered office at Regentlaan 7, 1000 Brussel, Belgium – Insurance company authorized by the National Bank of Belgium under number 0487 and registered with the Crossroads Bank for Enterprises under number 0415 591 055 – RPR Brussels- VAT BE0415 591 055

AXA Travel Insurance Global | AXA Assicurazione Viaggio | AXA Assurance Voyage | AXA Seguros y asistencia en viajes | AXA Seguro de viagem

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, which are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

licensed agents available

Schengen Travel Insurance Italy

Traveling to Italy, or any other Schengen country, requires careful planning, including obtaining the necessary travel insurance. In this article, we will delve into the intricacies of Schengen travel insurance for Italy and why it is essential for anyone planning a trip to the country. Understanding the specific requirements and benefits of this type of insurance will ensure a smooth and worry-free travel experience.

When traveling to Italy, having the right Schengen travel insurance is crucial to meet visa requirements and ensure coverage for any unforeseen events during your stay. Understanding what this type of insurance entails, its importance, specific requirements for Italy, and how to choose the best plan are all essential aspects that travelers need to consider before embarking on their journey.

In the following sections, we will explore why Schengen travel insurance is vital for traveling to Italy and discuss specific requirements and different plans available. Additionally, we will provide tips for choosing the right plan, outline the application process, address common misconceptions, and present some of the best providers for Schengen travel insurance in Italy.

Whether you are a first-time traveler or a seasoned explorer, having comprehensive knowledge about Schengen travel insurance for Italy will undoubtedly enhance your travel experience.

Table of Contents

Why Schengen Travel Insurance Is Important for Traveling to Italy

When planning a trip to Italy, it is essential to understand the importance of having Schengen travel insurance. This type of insurance is necessary for travelers entering the Schengen Area, which includes Italy, as it provides medical and emergency coverage during their stay. The Schengen travel insurance italy is specifically designed to meet the requirements set by the Schengen visa regulations, ensuring that travelers are financially protected in case of unexpected events.

One of the main reasons why Schengen travel insurance is important for traveling to Italy is that it is a mandatory requirement for obtaining a Schengen visa. The visa application process for Italy and other countries within the Schengen Area requires proof of adequate travel insurance coverage.

Without this documentation, travelers may face challenges or even be denied entry into Italy. Therefore, having the right Schengen travel insurance plan in place is crucial for a smooth and hassle-free travel experience.

Additionally, when traveling to Italy, it’s important to consider the specific requirements for Schengen travel insurance. These requirements often include minimum coverage amounts for medical expenses, emergency evacuation, and repatriation. It’s essential to carefully review and compare different Schengen travel insurance plans to ensure they meet these specific requirements for traveling to Italy. By doing so, travelers can enjoy their trip with peace of mind knowing that they are adequately covered in case of any unforeseen circumstances.

The Specific Requirements for Schengen Travel Insurance for Italy

When planning a trip to Italy, it is essential to understand the specific requirements for Schengen travel insurance. The Schengen Area encompasses 26 European countries, including Italy, and requires visitors to have valid travel insurance with specific coverage in order to enter. Here are the specific requirements for Schengen travel insurance for Italy:

- Medical coverage of at least €30,000: Your Schengen travel insurance must provide coverage for medical emergencies and expenses up to a minimum of €30,000. This is crucial as it ensures that you are financially protected in the event of illness or injury during your stay in Italy.

- Coverage for repatriation and evacuation: In addition to medical coverage, your travel insurance policy should also include provisions for emergency medical evacuation and repatriation of remains. This means that if you need to be transported back to your home country due to a serious medical condition or in the event of death, the costs will be covered by your insurance.

- Validity throughout the entire Schengen Area: When purchasing travel insurance for Italy, it is important to ensure that the policy is valid in all 26 countries within the Schengen Area. This guarantees that you will be covered no matter where your travels within Europe may take you.

Meeting these specific requirements for Schengen travel insurance for Italy is essential for ensuring a smooth and worry-free trip. By choosing a comprehensive plan that meets these criteria, travelers can enjoy their time in Italy with peace of mind knowing that they are financially protected against unforeseen circumstances.

By understanding and adhering to these specific requirements, travelers can ensure that they meet the necessary criteria for Schengen travel insurance when visiting Italy and other countries within the Schengen Area. It is important to carefully compare different insurance plans and select one that not only meets these requirements but also provides additional benefits such as trip cancellation coverage or baggage loss protection. Prioritizing comprehensive coverage will ultimately contribute to a more enjoyable and stress-free travel experience in Italy.

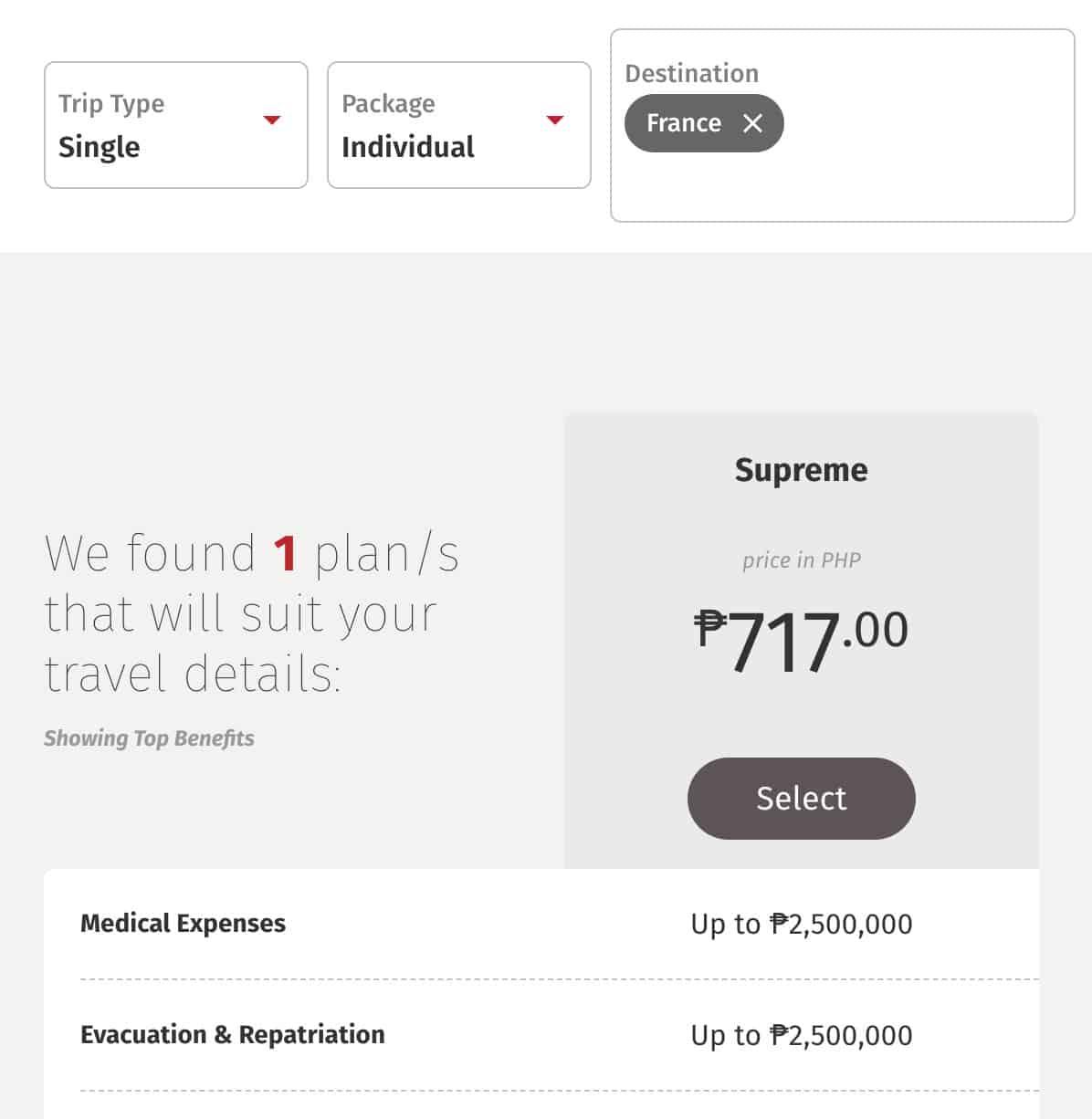

Comparing Different Schengen Travel Insurance Plans for Italy

When planning a trip to Italy, it is essential to have the right Schengen travel insurance to provide coverage in case of any unexpected events. There are various insurance providers offering different plans, so it’s crucial to compare them before making a decision. One important aspect to consider when comparing different Schengen travel insurance plans for Italy is the coverage they provide. This includes medical emergencies, trip cancellations, lost baggage, and other unforeseen circumstances.

Another factor to consider when comparing Schengen travel insurance plans for Italy is the cost. While it’s important not to compromise on coverage, it’s also essential to find a plan that fits within your budget. Some insurance providers offer customizable plans that allow travelers to tailor their coverage based on their specific needs and budget.

In addition to coverage and cost, it’s important to consider the reputation and reliability of the insurance provider. Reading reviews from other travelers and checking ratings from independent agencies can help in making an informed decision when comparing different Schengen travel insurance plans for Italy.

Tips for Choosing the Right Schengen Travel Insurance Plan for Italy

When it comes to choosing the right Schengen travel insurance plan for Italy, there are several factors to consider in order to ensure that you have the best coverage for your trip. One of the most important tips for choosing the right plan is to carefully review the coverage limits and benefits offered by each policy. Look for plans that offer comprehensive coverage for medical expenses, emergency medical evacuation, trip cancellation or interruption, and baggage loss or delay.

Another important tip is to consider the duration of your trip. Some Schengen travel insurance plans have a maximum trip duration limit, so make sure that the plan you choose will cover the entire length of your stay in Italy. Additionally, if you plan to engage in any high-risk activities such as skiing or extreme sports during your trip, make sure that these activities are covered by your chosen insurance plan.

It’s also crucial to consider the cost of the insurance plan and compare different options to find one that fits within your budget while still providing adequate coverage. Keep in mind that the cheapest option may not always be the best choice if it doesn’t offer sufficient protection.

Finally, take into account any pre-existing medical conditions you may have and check if they are covered by the insurance plan you’re considering. By carefully considering these tips when choosing a Schengen travel insurance plan for Italy, you can ensure that you have peace of mind and protection during your travels.

The Benefits of Having Schengen Travel Insurance for Italy

When traveling to Italy, having Schengen travel insurance is essential to ensure peace of mind and financial protection in case of unforeseen circumstances. This type of insurance provides coverage for medical expenses, trip cancellation, and other emergencies during your stay in the Schengen Area. The benefits of having Schengen travel insurance for Italy are numerous and can make a significant difference in your travel experience.

Medical Coverage

One of the primary benefits of having Schengen travel insurance for Italy is access to medical coverage. In the event of an illness or injury during your stay, the insurance will cover medical expenses, including hospitalization, doctor’s visits, and prescription medications. This can be especially valuable when traveling abroad, as healthcare costs in a foreign country can be extremely high.

Trip Cancellation and Interruption

Schengen travel insurance also provides coverage for trip cancellation or interruption due to unforeseen events such as a family emergency or natural disaster. This can help recoup non-refundable expenses such as flights, accommodations, and tour reservations, offering peace of mind when planning your trip to Italy.

Emergency Assistance Services

In addition to medical coverage and trip protection, Schengen travel insurance offers access to emergency assistance services such as 24/7 hotline for medical emergencies or help with lost documents. This can be invaluable when facing unexpected challenges while traveling in Italy. With these benefits in mind, investing in quality Schengen travel insurance for Italy is a smart decision for anyone planning a trip to this stunning European destination.

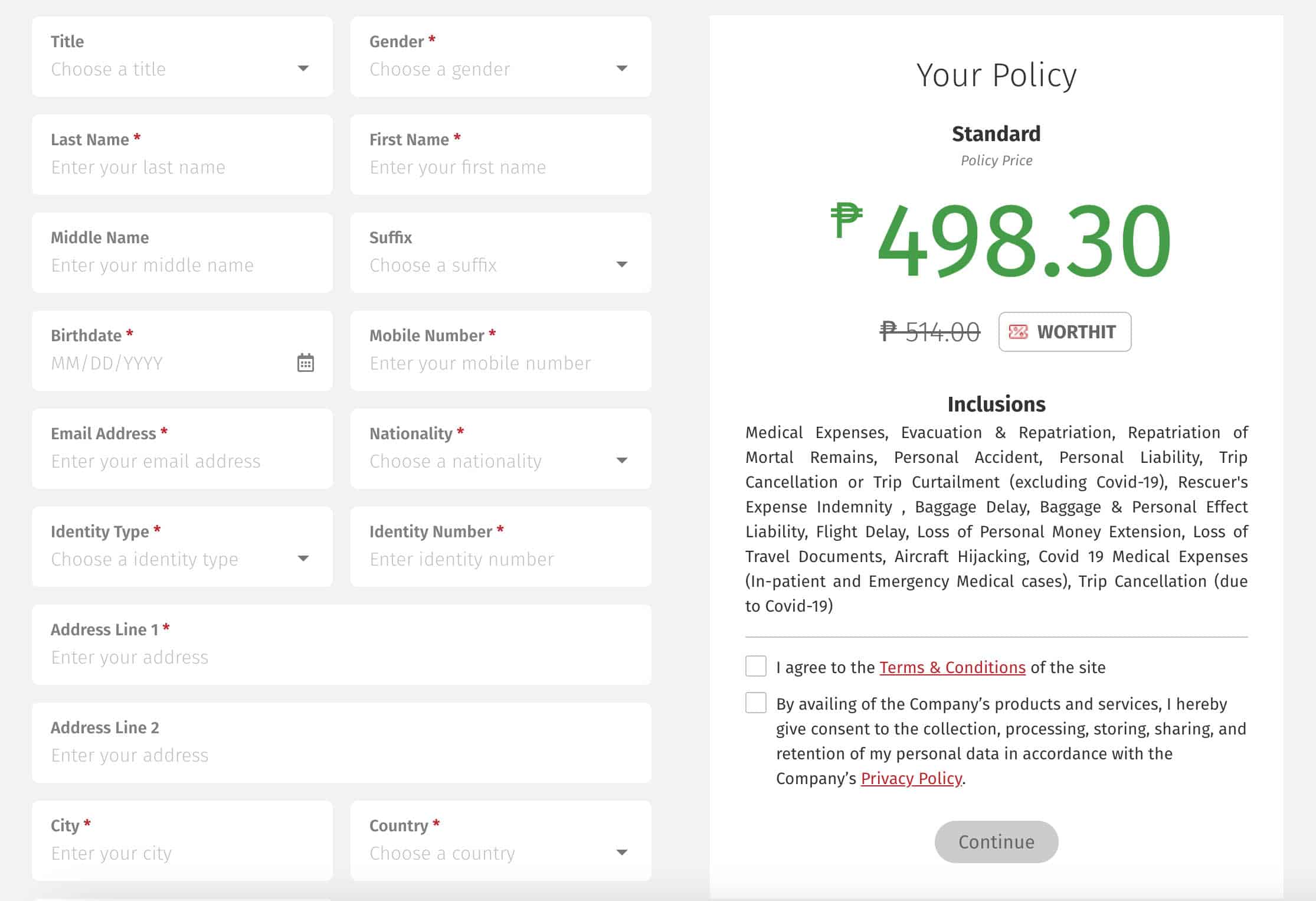

How to Apply for Schengen Travel Insurance for Italy

Applying for Schengen Travel Insurance for Italy is a straightforward process, but it’s important to ensure that you have the right coverage for your trip. Whether you’re traveling for leisure, business, or study, having comprehensive travel insurance will give you peace of mind and protect you from unexpected expenses.

To apply for Schengen Travel Insurance for Italy, follow these simple steps:

- Research different insurance providers: Take the time to compare different insurance plans and providers to find the best coverage for your needs. Look for a plan that includes medical coverage, emergency assistance, trip cancellation/interruption, and baggage loss/delay.

- Check the specific requirements: Make sure the insurance plan meets the specific requirements set by the Italian consulate or embassy. This may include minimum coverage amounts and validities.

- Submit your application: Once you’ve chosen a provider and plan, submit your application online or through an authorized agent. Be sure to provide all required information accurately to avoid delays in processing.

It’s important to note that when applying for Schengen Travel Insurance for Italy, it’s necessary to provide proof of coverage when applying for a visa. The insurance policy should meet the minimum requirements set by the Schengen area countries, including Italy. Additionally.

travelers should ensure that their insurance provider has a good reputation for handling claims efficiently and providing reliable customer service. By taking these steps in advance of your trip, you can enjoy peace of mind knowing that you’re protected with the right Schengen Travel Insurance for Italy.

Benefits of Having Schengen Travel Insurance

- Medical Coverage: Guaranteeing access to quality healthcare services during your stay in Italy.

- Emergency Assistance: Providing round-the-clock support in case of unexpected events.

- Trip Cancellation/Interruption: Reimbursing non-refundable trip expenses if your journey is canceled or cut short due to covered reasons.

- Baggage Loss/Delay: Offering compensation in case of lost or delayed baggage during your travels.

Common Misconceptions About Schengen Travel Insurance for Italy

When it comes to traveling to Italy within the Schengen Area, there are several misconceptions about the requirements for travel insurance. One common misconception is that any travel insurance policy will suffice for a trip to Italy, but this is not the case.

In order to obtain a Schengen Visa for Italy, travelers must have specific Schengen travel insurance that meets the requirements set forth by the Italian consulate. This type of insurance provides coverage for medical emergencies and repatriation, among other things.

Another misconception is that all Schengen travel insurance plans for Italy offer the same coverage and benefits. In reality, there are various options available from different providers, each with their own set of terms and conditions. It’s important for travelers to carefully compare different plans in order to choose one that best suits their needs and budget.

Some travelers mistakenly believe that they do not need Schengen travel insurance if they already have a European Health Insurance Card (EHIC). While the EHIC can provide some coverage in certain situations, it does not replace the need for comprehensive travel insurance. It’s recommended to have both the EHIC and a valid Schengen travel insurance plan when visiting Italy or any other country within the Schengen Area.

The Best Schengen Travel Insurance Providers for Italy

When traveling to Italy, it is crucial to have the right Schengen travel insurance. This type of insurance provides coverage for medical emergencies, repatriation, and even trip cancellations. However, with so many providers out there, it can be overwhelming to choose the best one for your trip.

Factors to Consider When Choosing a Provider

When looking for the best Schengen travel insurance provider for Italy, there are several factors to consider. Firstly, it is essential to review the coverage offered by each provider. Look for a plan that includes a minimum coverage of 30,000 euros for medical expenses and repatriation. Additionally, consider whether the plan covers trip cancellations and delays.

Another important factor to consider is the cost of the insurance plan. Compare quotes from different providers and ensure that you are getting good value for your money. It’s also advisable to check if there are any age restrictions or pre-existing condition limitations.

Top Schengen Travel Insurance Providers for Italy

There are several reputable Schengen travel insurance providers that offer comprehensive coverage for travel to Italy. One such provider is AXA Schengen, which offers various plans tailored to different types of travelers. Another top provider is Europ Assistance, known for its extensive network of healthcare providers throughout Europe.

Allianz Global Assistance is another popular choice among travelers heading to Italy. The company provides 24/7 multilingual assistance and has a solid reputation in the industry.

In conclusion, it is evident that having Schengen travel insurance is crucial for anyone traveling to Italy. The specific requirements and benefits make it a wise investment for any traveler. By understanding the importance of Schengen travel insurance and comparing different plans, individuals can ensure they have the coverage they need during their time in Italy.

It is important to remember that not all Schengen travel insurance plans are created equal, and careful consideration should be given to choosing the right plan. Tips such as considering the coverage limits, medical benefits, and additional perks can help travelers make an informed decision. Additionally, applying for Schengen travel insurance should be done well in advance of the trip to ensure there are no issues with coverage while in Italy.

Despite common misconceptions about Schengen travel insurance, it remains a valuable asset for travelers visiting Italy. With the variety of providers available, individuals can find a plan that meets their needs and budget. Ultimately, by recognizing the significance of having Schengen travel insurance for Italy, travelers can embark on their journey with peace of mind knowing they are covered in the event of unforeseen circumstances.

Frequently Asked Questions

Which insurance provider is best for schengen visa.

The best insurance provider for Schengen Visa would be one that offers comprehensive coverage for medical expenses, emergency medical evacuation, repatriation of remains, and a minimum coverage of €30,000.

Which Is the Best Travel Insurance for Schengen?

The best travel insurance for Schengen would be one that meets the requirements set by the Schengen area countries, including coverage for emergency medical expenses, hospitalization, and repatriation. It should also cover the entire duration of your trip.

Do I Need Schengen Travel Insurance?

Yes, Schengen travel insurance is a requirement for obtaining a Schengen Visa. It is mandatory to have travel insurance that provides coverage for medical emergencies and repatriation while traveling within the Schengen area. This requirement helps ensure that travelers are protected in case of unforeseen circumstances.

I’m a passionate traveler, writer, and Italophile. My fascination with Italy’s history, art, and culture has led me on countless adventures across the Italian landscape. Through “I Live Italy,” I share my love for this extraordinary country and aims to inspire others to explore its boundless beauty.

Related Posts:

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

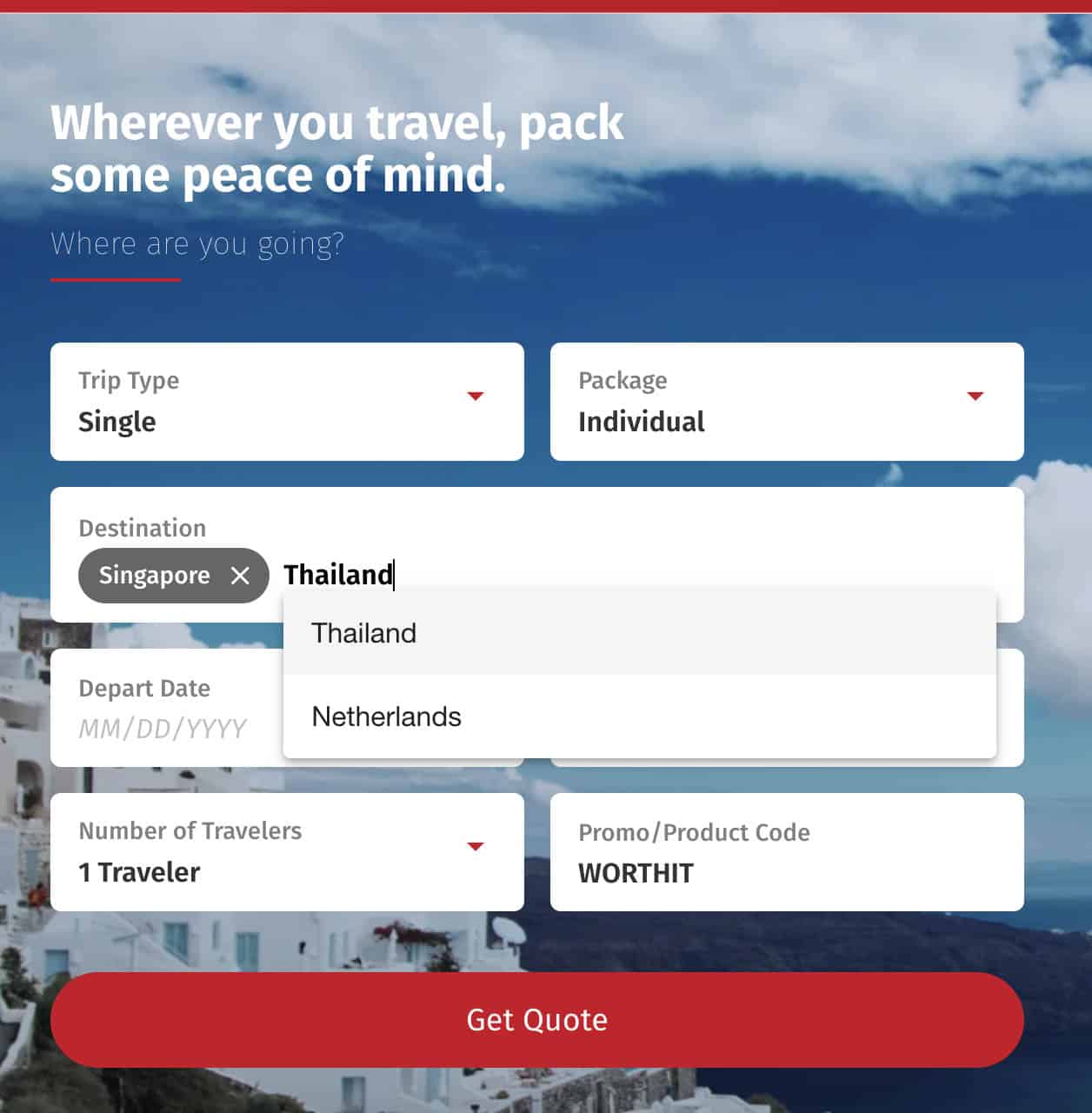

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

- International Travel Insurance Dubai

- Single Trip

- Schengen product

- Annual Multi-Trip

- Hajj & Umrah

- Inbound to UAE

- Sports Cover

- Policy Document

- Travel Tips

- Glossary of Terms

- Privacy Notice

- Health declaration & health exclusions

- Blogs & Newsletters

- BUY ALLIANZ TRAVEL

SCHENGEN TRAVEL INSURANCE

Our schengen travel insurance offers essential coverage for your trip, including the required insurance certificate for schengen visa applications, why is it crucial to have schengen insurance while travelling in europe.

Schengen Visa, which allows for travel within 26 European countries, comes with specific insurance requirements, as Schengen Visa Info outlines. Travellers must meet these requirements, which include coverage for emergency medical expenses, repatriation of remains, and a minimum coverage of €30,000.

Medical costs in some European countries can be excessive. For instance, according to the World Health Organization, a single day's hospitalisation in Switzerland can cost around US$1,000. Having Schengen insurance is a must to avoid unexpected financial burdens.

This insurance isn't limited to a particular demographic; it's designed to offer coverage for global travellers, including

- Senior citizens up to the age of 85

- Individuals traveling for work

- Children between the ages of 1-18 and

Not every traveller needs a Schengen Visa for Schengen Area visits, given that countries such as the U.S.A., Mexico, Brazil, and Canada maintain visa-free agreements with the Schengen Zone. Nevertheless, it is highly advisable to secure insurance since your medical expenses, or any potential costs arising from unexpected incidents during your journey, may lack coverage without proper travel insurance. Opting for travel insurance is particularly beneficial if you intend to explore multiple Schengen countries or desire flexibility in your itinerary, offering comprehensive coverage across most European nations.

Why Choose Allianz Schengen Travel Insurance?

Our Schengen travel insurance will help you get your Schengen visa and offer protection while travelling in Europe. You’ll receive the mandatory insurance certificate for your Schengen visa application.

Different benefits are available within this travel insurance product:

- Up to US$50,000 in emergency medical expenses in case of accident, sickness, illness or injury.

- Up to US$200 if your baggage is delayed.

- Up to US$2,000 in case of trip cancellation.

Insure your next European holiday, starting from AED 56 per person.

Schengen Product

This is my 3rd consecutive time, i am purchasing your annual travel insurance . last year, i had issues with my travel in australia and allianz were very fast in paying my claims . i have never seen such an excellent service anywhere else. superfast responses and payment, well done , schengen travel visa insurance requirements – europe travel insurance.

Swipe to view more

Schengen Travel Insurance

Travel Schengen Single Trip

From 56 AED

Everything you need to know about Schengen Travel Insurance

What does a schengen insurance policy usually cover .

A Schengen insurance policy is a specific type of travel insurance designed to fulfil the visa requirements for individuals travelling to the Schengen Area. The Schengen Area comprises 26 European countries that have abolished passport control at their mutual borders, allowing for easier travel within the region. A Schengen insurance policy typically covers the following:

1. Medical expenses: Coverage for emergency medical expenses, including hospitalisation, surgery, and outpatient treatment. As Schengen visa regulations require, the policy usually covers a minimum amount, such as €30,000.

2. Emergency evacuation and repatriation : Coverage for the cost of emergency evacuation and repatriation to your home country in case of a medical emergency.

3. Repatriation of mortal remains: Coverage for the cost of repatriating the insured person's remains in the unfortunate event of death during the trip.

4. Travel assistance services : Access to 24/7 emergency assistance services, including a helpline for medical advice, travel assistance, and coordination of medical services.

5. Coverage for multiple Schengen countries : The policy should cover the entire itinerary if you plan to visit multiple Schengen countries.

6. Minimum coverage amount : Schengen insurance policies must meet minimum coverage amounts as specified by the Schengen visa requirements. As of my last knowledge update in January 2022, the minimum coverage is €30,000.

7. Emergency dental treatment : Coverage for emergency dental treatment due to an accident.

It's important to carefully review the terms and conditions of the Schengen insurance policy to ensure that it meets the specific requirements of the Schengen visa application. Additionally, check if the policy covers additional features or optional add-ons that may benefit your travel needs.

When considering a Schengen insurance policy, opt for a reputable and globally recognised insurance provider like Allianz Travel that offers comprehensive coverage for individuals travelling to the Schengen Area. You can benefit from a range of features designed to meet the specific requirements of Schengen visa applications. Schengen travel insurance from Allianz Travel includes coverage for medical expenses, emergency evacuation, repatriation, travel assistance services, personal liability, and more.

All Outbound travel insurance products from Allianz Travel UAE are schengen-compliant meaning all products meets the Schengen visa requirements. The Extra and Gold products however go beyond the basic Schenge coverages to offer maximum peace of mind.

Does my Schengen travel insurance need to cover all Schengen are countries?

Yes, your Schengen travel insurance should typically cover all Schengen Area countries you plan to visit. When you apply for a Schengen visa, one of the visa requirements is proof of travel insurance that meets specific criteria. The insurance coverage is expected to be valid for your stay in the Schengen Area and should include coverage for medical emergencies and repatriation.

Key points regarding Schengen travel insurance coverage for multiple countries:

1. Coverage for the entire itinerary : The insurance policy should cover the entire duration of your stay in the Schengen Area, from entry to exit.

2. Minimum coverage amount: The insurance coverage must meet the minimum amount specified by the Schengen visa requirements. As of our last knowledge update in January 2022, the minimum coverage amount is €30,000.

3. Coverage for all countries : The policy should explicitly mention coverage for all Schengen Area countries you plan to visit. When purchasing the insurance, it's important to list the countries you intend to travel to.

4. Insurance certificate : The provider typically issues a certificate or confirmation letter specifying the coverage details, including the countries covered. This certificate is submitted as part of your Schengen visa application.

When obtaining Schengen travel insurance, communicate your travel itinerary and ensure the policy explicitly mentions coverage for all the Schengen space. This is crucial for meeting the visa requirements and ensuring adequate travel coverage within the Schengen Area. Always check the latest visa requirements and guidelines from the consulate or embassy of the country you are applying to, as they may be subject to change.

When obtaining Schengen travel insurance that covers all your needs across multiple countries, Allianz Travel emerges as a reliable choice. Allianz Travel offers comprehensive Schengen insurance coverage that aligns with the specific criteria set by Schengen visa requirements. Whether you're planning to explore the enchanting cities of Europe or embark on a multi-country journey within the Schengen Area, Allianz Travel provides policies that cater to your travel itinerary

What is excluded from a Schengen travel insurance policy ?

- Exclusions in a Schengen travel insurance policy can vary depending on the insurance provider and your specific policy. However, there are common exclusions often found in Schengen travel insurance policies. It's essential to carefully review the terms and conditions of your policy to understand what is excluded. Here are some common exclusions:

- 1. Pre-existing medical conditions : Many Schengen travel insurance policies exclude coverage for pre-existing medical conditions. Any medical condition you had before purchasing the insurance may not be covered.

- 2. Medical treatment not deemed necessary : Expenses for medical treatments not considered necessary by the attending physician or that can be postponed until your return to your home country may be excluded.

- 3. Medical treatment resulting from intentional acts : Medical treatment resulting from self-inflicted injuries, suicide attempts, or participation in risky activities may be excluded.

- 4. War and terrorism : Injuries, damages, or losses resulting from war, acts of terrorism, or participation in military activities may be excluded.

- 5. Alcohol and drug-related incidents : Incidents related to the consumption of alcohol or drugs that a licensed medical professional does not prescribe may be excluded.

- 6. Participation in hazardous activities : Injuries or incidents resulting from participation in high-risk or hazardous activities such as extreme sports or adventure activities may be excluded.

- 7. Nonmedical coverage exclusions: Non-medical coverage exclusions may include events such as trip cancellations for reasons not specified in the policy, lost or stolen belongings, and other nonmedical incidents.

- 8. Failure to follow medical advice : Expenses incurred due to your failure to follow the prescribed medical advice or treatment plan may be excluded.

- 9. Excess/deductibles : Some policies may have deductibles or excess amounts, meaning you are responsible for a certain portion of the expenses before the insurance coverage takes effect.

- 10. Pregnancy and childbirth : Some policies may exclude coverage related to pregnancy and childbirth, especially within a certain period before the expected due date.

- It's crucial to carefully read the policy documentation and ask your insurance provider for clarification. Understanding the exclusions will help you make informed decisions about your coverage and ensure that you have appropriate protection for your travels within the Schengen Area.

- When navigating the intricacies of Schengen travel insurance exclusions, choosing a reliable insurance provider prioritising transparency and comprehensive coverage is imperative. Allianz Travel stands out as a reputable and globally recognised option, offering policies that address the specific needs of Schengen visa applications while minimising uncertainties related to exclusions.

How long do I need Schengen travel insurance?

The duration you need Schengen travel insurance depends on your planned stay in the Schengen Area. Schengen travel insurance is typically required for your intended stay, including the entry and exit dates specified in your travel itinerary.

Here are some key points to consider regarding the duration of Schengen travel insurance:

1. Coverage period : The insurance coverage should be valid for the entire duration of your stay in the Schengen Area, starting from your entry date until your planned exit date.

2. Non-Flexible coverage : You cannot change the dates of your travel insurance once it is issued. That is why you need to make sure you have your final trip dates before you puchase your travel insurance. You will not be able to renew your Schengen travel insurance while your trip has started : it is therefore important to know your dates before your purchase your policy..

3. Return to home country : The insurance coverage should lastuntil your planned return to your home country.

When securing Schengen travel insurance that aligns seamlessly with the duration of your stay, Allianz emerges as a dependable choice. Allianz Travel offers policies designed to cater to the unique needs of your travel itinerary, ensuring comprehensive coverage for the entirety of your visit to the Schengen Area.

Is there an age limit for Schengen travel insurance?

Schengen travel insurance has no strict universal age limit, as insurance providers' eligibility criteria vary. However, certain insurance companies may have age-related restrictions or considerations for travel insurance policies.

Here are some points to remember regarding age and Schengen travel insurance:

1. Age categories : Some insurance providers categorise age groups differently, offering specific policies for adults, seniors, and children. The terms and conditions, as well as coverage options, may differ based on these categories.

2. Elderly travellers : While many insurance providers offer coverage for elderly travellers, there might be age limits for certain policy features or types of coverage. It's essential to check with the insurer to understand any age-related restrictions.

3. Premiums and coverage options : Premiums for Schengen travel insurance may vary based on age. Elderly travellers may experience higher premiums due to potential health risks and the likelihood of medical expenses.

At Allianz Travel, we made it easy, you just need to follow our online booking funnel to see if you are eligible to purchase our Schengen Travel insurance.

Can I get a Schengen visa without travel insurance?

Travel insurance is mandatory for obtaining a Schengen visa. The Schengen visa application process requires applicants to provide proof of travel insurance that meets certain criteria. Travel insurance is considered an essential part of the visa application, and failing to provide adequate insurance may result in rejection.

Key points regarding Schengen visa and travel insurance:

1. Mandatory requirement : Schengen visa applicants must provide proof of travel insurance as part of the visa application process.

2. Minimum coverage requirements : The insurance coverage should meet specific minimum requirements, including a minimum coverage amount (commonly €30,000) and coverage for the entire duration of the intended stay.

3. Insurance certificate : Applicants must submit an insurance certificate or confirmation letter issued by the insurance provider, clearly stating the coverage details, including the coverage amount, coverage period, and countries covered.

Failing to provide the required travel insurance or submitting insurance that does not meet the criteria may lead to the rejection of the visa application.

At Allianz Travel, we provide the required Certificate of Insurance by email after you pruchased your travel insurance online.

Selecting a dependable travel insurance provider is crucial when dealing with Schengen visa prerequisites. Allianz Travel distinguishes itself as a reputable and internationally acclaimed choice, presenting customised solutions that effortlessly adhere to the obligatory criteria set for Schengen visa applications.

Can I purchase Schengen travel insurance after arriving in the Schengen Area?

Can i get a refund on my travel insurance if my schengen visa application is refused.

Whether you can get a refund on your travel insurance after a Schengen visa application is refused depends on the terms and conditions of the insurance policy you purchased. In general, travel insurance policies have different refund policies, and it's essential to review the specific terms outlined in your policy documentation or contact your insurance provider for clarification. Here are some factors to consider:

1. Refund policies: Some travel insurance policies may have a refund provision in case of a visa refusal. This could be subject to certain conditions outlined in the policy.

2. Reasons for refusal: The refund eligibility may depend on the visa refusal. Some policies may only offer refunds in specific situations, such as visa denials due to unforeseen circumstances beyond the applicant's control.

3. Documentation requirements: You may need documentation confirming the visa refusal to request a refund. This could include the visa rejection letter issued by the consulate or embassy.

4. Cancellation period: Policies often have a specific period during which you can cancel and seek a refund. This period may vary among insurance providers.

5. Administrative fees: Some insurance providers may charge administrative fees for processing a refund request. Be aware of any associated fees that may apply.

6. Policy exclusions: Check the policy exclusions to understand if visa refusal is explicitly addressed as a covered event for refund purposes.

7. Communication with insurance provider: If you find yourself in a situation where your Schengen visa application is refused, promptly communicate with your insurance provider. They can provide guidance on the refund process and any applicable terms.

It's crucial to thoroughly review your insurance policy and contact your provider to understand the specific refund conditions and requirements. Remember that each insurance provider may have different policies, so that the refund process can vary. Additionally, check the policy's cancellation period and act within the specified timeframe if you decide to pursue a refund.

When facing the intricacies of obtaining a travel insurance refund post-Schengen visa application refusal, reviewing your policy's terms carefully is crucial. Allianz Travel emerges as a dependable and transparent insurance provider, offering a customer-friendly approach to the refund process. With a commitment to transparency, flexibility, and customer satisfaction, reaching out to Allianz Travel ensures reliable support during challenging situations. For a trustworthy solution, consider Allianz Travel as your go-to provider for confidently navigating the refund process.

Do I need Schengen travel insurance as a passport-holding UAE resident?

The need to apply for a Schengen visa if you want to visit the Schengen space does NOT depend on your country of residence but on your nationality.

For example: if you are an American citizen living in the UAE, you do not need to apply to a Schengen visa before your trip. You will get a visa on arrival. However, if your are an Indian citizen living in the UAE, you will need to apply for a Schengen visa before your trip.

Therefore, you need to check what the requirements are for your nationality - if you plan to travel with friends, you may not need to follow the same steps even if you are travelling together on the same dates.

If you need a Schengen visa, then the visa requirements are the same for all when it comes to travel insurance:

1. Mandatory requirement : Schengen visa regulations typically mandate that applicants provide proof of travel insurance coverage as part of the visa application.

2. Minimum coverage requirements : The insurance coverage should meet specific requirements, including a minimum amount (commonly €30,000) and coverage for your intended stay in the Schengen Area.

3. Insurance certificate : You must submit an insurance certificate or confirmation letter from the insurance provider along with your visa application. This document should clearly outline the coverage details, including the coverage amount, coverage period, and countries covered.

4. Coverage for medical emergencies : The insurance should cover medical emergencies and repatriation, ensuring you have financial coverage in case of unexpected medical expenses during your stay in the Schengen Area.

Failure to provide the required travel insurance or submitting insurance that does not meet the specified criteria may result in rejection of your Schengen visa application.

Before securing Schengen travel insurance, it's advisable to carefully review the consulate or embassy requirements of the Schengen country you plan to visit. Allianz Travel's commitment to compliance, comprehensive coverage, and clear documentation makes them a trusted choice for meeting Schengen travel insurance requirements.

Do I need COVID protection for my Schengen travel insurance?

COVID-19 travel insurance depends on each country - therefore there is not any specific requirement that covers all Schengen space countries. You need to check the particular country or countries you are planning to visit.

Once you have checked what the COVID-19 requirements are for the country of destination, you can then check what the insurance provider covers - if somehting is unclear to oyu, do not hesitate to contact the travel insurance company who will be able to help you.

Remember that travel regulations and insurance coverage related to COVID-19 may evolve, so it's essential to stay informed and check for any updates or changes in requirements before your trip.

Given the evolving nature of travel regulations and COVID-19 coverage. Allianz Travel's proactive approach, comprehensive coverage, and customer-focused communication make them reliable for addressing your COVID-19-related travel insurance needs.

How do I make a claim?

Claiming your Schengen travel insurance involves a series of steps, and it's important to follow the process outlined by your insurance provider. Below is a general guide on how to make a claim:

1. Review policy documents : Carefully review your policy documents to understand the coverage details, terms, and conditions. Take note of the specific events and situations covered and any exclusions.

2. Contact your insurance provider : Notify your insurance provider immediately after an event that may lead to a claim. Most insurance companies have a helpline or a claims department that you can contact for guidance.

3. Obtain claim form s: Request claim forms from your insurance provider. At Allianz Trave, you can submit your claim online here

4. Complete claim forms : Fill out the claim forms accurately and provide all the required information. Include supporting documents, such as medical reports, police reports (if applicable), receipts, and other relevant documentation.

5. Submit claim documents : Submit the completed claim forms and supporting documents to the insurance company per their instructions. Some insurers may allow you to submit claims online or via email, while others may require physical documentation.

6. Claim processing : The insurance company will review your claim and assess whether it meets the criteria outlined in the policy. This process may involve verifying the details of the incident and checking the documentation provided.

7. Follow-up and communication : Stay in communication with the claims department. Be responsive to any requests for additional information or documentation. You may also receive updates on the status of your claim during the processing period.

8. Claim approval or denial : Once the insurance company completes its assessment, you will be informed of the claim decision. If the claim is approved, the insurer will provide details on the amount to be reimbursed. If the claim is denied, the insurer will provide reasons for the denial.

9. Reimbursement or payment : If your claim is approved, the insurer will arrange for reimbursement or payment per the policy terms.

It's important to initiate the claims process promptly and provide accurate and complete information to expedite the assessment. Keep copies of all documentation for your records, and maintain open communication with the insurance provider. Always refer to your specific policy documents for detailed instructions on the claims process, as procedures can vary among insurance providers. If you have any questions or concerns, don't hesitate to contact your insurance provider for guidance.

For a hassle-free claims process and reliable support, choose Allianz Travel. Their customer-focused approach, efficient communication, and commitment to transparency make them a trusted partner for addressing your Schengen travel insurance claims.

Is Allianz Travel Insurance safe?

Allianz is a well-established and reputable insurance company whose travel insurance products are generally considered reliable and trustworthy. Allianz is one of the largest and most recognised insurance providers globally, offering a range of insurance products, including travel insurance, to individuals and businesses.

Key points regarding the safety and reliability of Allianz Travel Insurance:

1. Financial stability : Allianz is known for its financial strength and stability. It is a leading global insurer with a strong financial standing, which is an important factor in evaluating the reliability of an insurance provider.

2 . Global presence : Allianz operates in many countries worldwide, and its global presence often contributes to its reputation for reliability and customer service.

3. Customer reviews : While individual experiences may vary, you can look at customer reviews and ratings to gain insights into the satisfaction of other travellers who have used Allianz Travel Insurance. Online reviews can provide valuable perspectives on the quality of service and claims processing.

4. Coverage options : Allianz offers a variety of travel insurance plans with different coverage options, allowing travellers to choose plans that suit their needs. The flexibility in coverage options is a positive aspect for many travellers.

5. Claims process : The efficiency and transparency of the claims process are crucial indicators of the reliability of an insurance provider. Allianz generally has a well-structured claims process, and it's important to follow the specific procedures outlined in your policy when making a claim.

6. Industry recognition : Allianz has received industry recognition and awards for its insurance products and services, further affirming its standing in the insurance sector.