National Safety Month promotion: Save 25% on the AARP Smart Driver online course. You could even save on auto insurance!

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products, hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Find how much you can save in a year with a membership. Learn more.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel

AARP National Park Guide

Discover Canyonlands National Park

History & Culture

8 Amazing American Pilgrimages

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

Movies for Grownups

Summer Movie Preview

Jon Bon Jovi’s Long Journey Back

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Friends & Family

How to Host a Fabulous Dessert Party

Home Technology

Caregiver’s Guide to Smart Home Tech

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Solves 25 of Your Problems

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Clean Your Car

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

How does Medicare cover emergency room costs?

Kimberly Lankford,

The type of Medicare you have determines how it pays for emergency department services.

Original Medicare covers emergency services under Medicare Part B at any U.S. hospital or medical facility that accepts Medicare. However, that care is subject to a deductible and 20 percent copayment. Supplemental insurance, such as a Medigap policy or a retiree plan from your former employer, may cover these out-of-pocket expenses.

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Find out how much you could save in a year with a membership. Learn more.

Medicare defines an emergency as an injury, sudden illness or an illness that gets much worse.

If you’re admitted to the same hospital for a related condition within three days, you won’t have to pay the copayment because the visit is considered part of your inpatient hospital stay, covered through Medicare Part A .

Medicare Part B also covers urgent care visits needed to treat a sudden illness or injury that isn’t a medical emergency. Urgent care visits are also subject to a deductible and 20 percent copayment.

How does Medicare Advantage cover emergency services?

Medicare Advantage plans typically have provider networks and generally charge higher copayments and deductibles or don’t cover out-of-network care at all. But the rules are different for emergency services.

In this case, Medicare Advantage plans must cover emergency care as an in-network service, even if the hospital or facility isn’t in the provider’s network. But copayments may be different from under original Medicare.

For example, you may need to pay as much as a $135 copayment for each emergency room visit, whether it’s at an in-network or out-of-network facility. You can compare emergency care copayments for each Medicare Advantage plan in your area using the Medicare Plan Finder . Click on the Plan Details blue button at the bottom of an Advantage plan’s description.

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

ARTICLE CONTINUES AFTER ADVERTISEMENT

A different definition of emergencies. For Advantage plans, the Centers for Medicare & Medicaid Services (CMS) considers an emergency medical condition one that, if not treated, could result in:

- Serious jeopardy to the health of the individual or, in the case of a pregnant woman, the health of the woman or her unborn child.

- Serious impairment to bodily functions.

- Serious dysfunction of any bodily organ or part.

Your emergency medical condition status is not affected if a later medical review found no actual emergency, CMS says. The plan can’t require prior authorization for emergency services.

AARP® Vision Plans from VSP™

Exclusive vision insurance plans designed for members and their families

With some MA plans, if you’re admitted to the hospital within 24 hours, you may not need to pay the copayment for the emergency room visit. Instead, it becomes part of your hospital stay.

How to find the details. Specifics vary by plan. See the plan summary on the website of each private plan or evidence of coverage. You can get to these documents through Medicare’s Plan Finder even if you’re not shopping for new coverage.

Log in if you have an account to see a summary of your current coverage. Or navigate through the Plan Finder by entering your zip code, choosing your coverage year, hitting the Continue button, clicking Medicare Advantage Plan (Part C) , tapping the Find Plans button and going though the questions. You don’t need to compare your drug costs, but you do want to get to the list of plans for your area and find your specific plan.

Click the Plan Details button, and on the next page the Plan website link. From there, your provider’s website will walk you through steps to learn information about your plan on its website. You’ll generally see a link to View plan summary or View plan documents within the plan information. Both documents are very detailed but often let you search within for “emergency” so you can find what’s relevant to your situation.

Urgent care also possible. Your Medicare Advantage plan may cover urgent care visits from out-of-network providers. These are nonemergency situations that require immediate medical attention when a network provider is not available, such as when you have a severe sore throat on a weekend and your doctor is off or if you’re traveling outside the plan’s service area.

You’ll have the same copayment as in-network urgent care, which could be around $50.

LEARN MORE ABOUT AARP MEMBERSHIP.

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

How does Medicare cover emergency ambulance services?

Medicare Part B covers emergency ambulance services , but they’re subject to a deductible and 20 percent coinsurance. A supplemental policy should help cover those.

Part B will pay for ambulance transportation to a hospital or skilled nursing facility if traveling in any other vehicle could endanger your health. This applies to emergency transport in an airplane or helicopter if you need immediate and rapid transport that a ground service can’t provide.

Medicare Advantage, too, covers emergency ambulance services, but like its emergency room coverage, its copay rates can be high. You may have a $300 copay for each one-way trip. See the plan’s evidence of coverage for details.

Keep in mind

Medicare covers emergency room visits throughout the United States, but it typically doesn’t cover emergency care outside the U.S., except in limited circumstances .

Some Medigap policies cover foreign travel emergency care with a lifetime limit of $50,000. Some Medicare Advantage plans provide limited coverage for foreign travel emergencies. Specifics vary a lot by plan.

Another option is buying travel insurance , which may provide more coverage for emergency care and medical evacuation when traveling.

Return to Medicare Q&A main page

Kimberly Lankford is a contributing writer who covers Medicare and personal finance. She wrote about insurance, Medicare, retirement and taxes for more than 20 years at Kiplinger’s Personal Finance and has written for The Washington Post and Boston Globe . She received the personal finance Best in Business award from the Society of American Business Editors and Writers and the New York State Society of CPAs’ excellence in financial journalism award for her guide to Medicare.

Discover AARP Members Only Access

Already a Member? Login

More on Medicare

How to Navigate the Emergency Department With an Older Adult

Care Tips to Keep Dementia Patients Safe at Home

What Forms Do I Need to Help With a Parent’s Health Care?

Caregivers should get signatures on these key documents

Recommended for You

AARP Value & Member Benefits

Learn, earn and redeem points for rewards with our free loyalty program

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

The National Hearing Test

Members can take a free hearing test by phone

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

Does Medicare Cover Emergency Room Visits?

- by Christian Worstell

- January 12, 2024

- Reviewed by John Krahnert

Yes, emergency room visits are typically covered by Medicare .

Most outpatient emergency room services are covered by Medicare Part B, and inpatient hospital stays are covered by Medicare Part A.

Medicare Advantage plans (Part C) also cover ER visits . Many Medicare Advantage plans also offer benefits not found in Original Medicare.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

By clicking "Sign me up!” you are agreeing to receive emails from MedicareAdvantage.com.

Compare plans today.

Speak with a licensed insurance agent

1-800-557-6059 | TTY 711, 24/7

What Medicare Part A covers

Medicare Part A hospital insurance helps cover:

- Inpatient care in a hospital

- Skilled nursing facility care

- Hospice care

- Some home health care services

Medicare Part A is typically premium-free, as long as you or your spouse paid sufficient Medicare taxes while working.

If you go to the emergency room and are admitted as an inpatient , Medicare Part A helps cover some of the costs related to your hospital stay once your Part A deductible is met .

In 2024, the Medicare Part A deductible is $1,632 per benefit period .

What Medicare Part B covers

Medicare Part B is known as medical insurance and helps cover medically necessary services and preventive services, which can include:

- Doctor’s office visits

- Clinical research

- Ambulance services

- Durable medical equipment

- Mental health services

Medicare Part B may also cover services you receive when you visit the emergency room as an outpatient.

Medicare Part B is optional, and if you enroll in Part B you must also enroll in Part A. Unlike Medicare Part A, which is premium-free for most people, you must pay a monthly premium for Medicare Part B.

The standard Part B premium in 2024 is $174.70 per month.

Emergency room copayments and coinsurance

Even if your emergency room visit is covered by Medicare, you are typically responsible for paying a portion of the costs, known as copayments or coinsurance.

Typically, you pay a Medicare emergency room copayment for the visit itself and a copayment for each hospital service.

How you are charged depends on several factors, including which part of Medicare covers your visit (Medicare Part A, Medicare Part B or both) and whether or not you have met your Part A and Part B deductibles.

In 2024, the Part A deductible is $1,632 per benefit period, and the Part B deductible is $240 per year.

Medicare Part A coinsurance

Generally, if you go to the emergency room and are admitted as an inpatient, Medicare Part A will cover a portion of the costs, and in 2024 you pay:

- $0 coinsurance for each benefit period for days 1-60 spent in the hospital

- $408 coinsurance for days 61-90 in each benefit period

- $816 coinsurance per each “lifetime reserve day” beyond day 90 in each benefit period

- All costs beyond lifetime reserve days

Remember, you must meet your Part A deductible before Medicare will pay its share for covered services.

Medicare Part B copayments

If you go to the emergency room and receive care from a doctor but are not admitted as an inpatient, Medicare Part B will typically cover a portion of your medical costs.

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most services, and Medicare pays the rest.

Medicare Advantage plans cover emergency room visits

Medicare Advantage (Medicare Part C) is an alternative to Original Medicare (Medicare Part A and Part B) that provides the same hospital and medical benefits as Original Medicare. This means that Medicare Advantage plans, like Original Medicare, will cover at least some of your emergency room costs.

Most Medicare Advantage plans may also cover benefits not included in Medicare Part A or Part B.

To learn more about Medicare Advantage plans that may be available in your area and to find out about the emergency room coverage they offer, speak with a licensed insurance agent today.

Explore Medicare Advantage plan benefits in your area

Or call 1-800-557-6059 (TTY: 711) to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

Christian’s work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christian’s passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism.

If you’re a member of the media looking to connect with Christian, please don’t hesitate to email our public relations team at [email protected] .

Related articles

Original Medicare (Parts A and B) doesn’t cover routine dental or vision care. 2024 Medicare Advantage (Part C) plans can cover benefits Original Medicare doesn’t cover, but dental and/or hearing benefits may not be available where you live. Learn more and find out how to compare the plans and benefits available in your area. Read more

Medicare Part B may cover emergency ambulance services, and some Medicare Advantage plans may offer non-emergency transportation to plan-approved locations. Learn more about Medicare transportation coverage. Read more

Medicare Advantage plans can offer gym memberships and fitness benefits that Original Medicare doesn’t cover, such as SilverSneakers. Learn how to compare your local plan options and how to find a Medicare Advantage plan that covers fitness benefits. Read more

While Original Medicare (Parts A and B) doesn’t cover hearing aids, Medicare Advantage (Part C) plans can cover hearing benefits Original Medicare doesn’t cover. Hearing benefits can be limited and may not be available where you live, so learn how to find out if Medicare Advantage plans that help pay for hearing aids are available in your area. Read more

Medicare Part B covers annual wellness visits. Medicare Advantage plans also cover annual wellness visits, and many Medicare Advantage plans also offer other wellness benefits not found in Original Medicare. Read more

Medicare Part A does not cover outpatient surgery, but Part B covers medically necessary outpatient surgery. Medicare Advantage plans may also cover outpatient surgery and include an annual out-of-pocket spending limit, which Original Medicare doesn’t offer. Read more

Original Medicare and Medicare Advantage plans can cover chiropractic care, but some plans may cover services more than others. Learn about what’s covered, what’s excluded and how much your Medicare costs could be. Read more

Medicare covers many telehealth services, and those benefits expanded during the coronavirus pandemic. Beneficiaries can use telehealth to access their doctor while also staying safe during COVID-19. Read more

Original Medicare (Medicare Parts A and B) doesn’t cover bathroom grab bars or other bathroom safety devices. Medicare Advantage plans can cover bathroom safety devices, but only in limited situations and only for beneficiaries who qualify. Read more

Join our email series to receive your Medicare guide and the latest information about Medicare.

Please enter your information to get your free quote.

Thanks for signing up for our emails!

Your Medicare guide will arrive in your email inbox shortly. You can also look forward to informative email updates about Medicare and Medicare Advantage.

If you'd like to speak with an agent right away, we're standing by for that as well. Give us a call!

Enter ZIP code

You're on your way to finding a Medicare Supplement plan!

Compare your Medigap plan options by visiting MedicareSupplement.com

Does Medicare Cover Emergency Room Visits?

Written by: Rachael Zimlich, RN, BSN

Reviewed by: Selah Lee, Licensed Insurance Agent

Key Takeaways

Original Medicare Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). will cover at least a portion of your visit to the emergency room.

The part of Medicare that covers your visit will depend on if you are admitted or not.

If you are admitted to the hospital for at least two nights after an ER visit, Medicare Part A covers it.

If you are not admitted after an ER visit, Medicare Part B will cover it.

How Much Does Medicare Pay for an Emergency Room Visit?

Original Medicare will cover a portion of your visits to the emergency room, but whether or not you are admitted will determine if Part A or Part B coverage is used. In either case, you pay a portion of your cost for services, but Medicare pays the majority.

If you have a Medicare Advantage plan, your ER visit will be covered and the plan you choose will determine your out-of-pocket costs. You may also have to pay more for visiting doctors or facilities that are outside your plan’s network.

Does Medicare Part A or B Cover Emergency Room Visits?

Both Medicare Part A and B offer some coverage of emergency services depending on how long you need to stay in the hospital. If your ER visit leads to a hospital stay, Medicare Part A covers the costs, plus any services that were provided in the three days before your admission. If your visit is one where you are discharged from the emergency room or after just one night of observation, Medicare Part B will provide coverage.

Will Medicare Part A Cover Emergency Room Visits?

Medicare Part A only covers emergency room services when you are admitted by a doctor for at least two nights in the hospital. The “Two-Midnight” rule is important, because in some cases your doctor may just keep you one night for observation. These visits are considered outpatient care even though you spent the night in the hospital, and Medicare Part B will provide coverage.

Medicare Part B covers most emergency visits, especially if you are seen and sent home the same day, or spend one night for observation. Even if you are admitted, Part B will pay the portion of your bill that covers doctor’s services while Part A will pay inpatient hospital costs.

Can I bundle multiple benefits into one plan?

Does Medicare Have a Copay for ER Visits?

Original Medicare does not have an established copay for emergency room visits. Instead, you will pay a share of the costs based on your Part A or Part B coverage, and which part of Medicare is applied to your visit.

If you are admitted for at least two nights after and ER visit and Part A is used, in 2024 you will pay:

- A $1,632 deductible for each inpatient stay for each benefit period. Benefit periods reset every 60 days you spend outside of a hospital or skilled nursing facility.

- If you were recently admitted and already paid this deductible for your benefit period, you will not have to pay it again for the same benefit period.

- Coinsurance applies, also, but only after 60 days of hospitalization.

If you visit the emergency room and are sent home right away or are admitted for just one night of observation, Part B coverage applies. This will cost you:

- Your annual deductible — $240 for 2024 — if you haven’t already met it for the year.

- Twenty percent of the remainder of the Medicare-approved costs associated with the visit.

How Much of a Hospital Bill Does Medicare Pay?

When Medicare Part A is applied for emergency department visits that turn into an inpatient stay, your costs will be covered after you pay your deductible and coinsurance.

When Medicare Part B is used for an ER visit where you are not admitted or kept only one night for observation, Medicare pays for 80% of the approved cost after your deductible is met.

Can I Get Help Paying?

If you need help paying for your share of your emergency department bill — regardless of whether Medicare Part A or B was applied — you may be able to use additional coverage if you’ve signed up for a Medicare supplement plan . Medicare supplement plans can only be purchased if you have Original Medicare (Parts A and B). If you have a Medicare Advantage plan, you will need to leave that policy.

Costs of Medicare supplement plans vary based on which plan you choose. Medicare supplement plans can be used to cover costs such as deductibles, copayments and coinsurance that are not covered by Original Medicare.

How Many ER Visits Does Medicare Cover?

There is no limit to how many ER visits Medicare covers, but you may have to start a new benefit period if it’s been awhile since your last admission. If you are admitted to the hospital and it’s been more than 60 days since your last admission, you will have to start a new benefit period and pay your Part A deductible. If you were admitted within the last 60 days, you will not have to pay this deductible again since you are in the same benefit period.

Find the Medicare Advantage plan that meets your needs.

Who Covers Ambulance Transportation?

Regardless of whether you are admitted or not following an ER visit, Medicare Part B is used to pay for ambulance services. If you’ve already met your Part B deductible for the year, you will be responsible for 20% of the cost of these services.

What About Medications?

Medications that you are given while admitted in the hospital are covered under Part A. If you are given a prescription in the emergency room and sent home, you will have to pay for this medication unless you have Medicare Part D coverage (prescription drug plans). Costs for prescription coverage vary based on the Medicare Part D plan you choose.

Let’s find your ideal Medicare Advantage plan.

Inpatient or outpatient hospital status affects your costs TRUSTED & VERIFIED medicare.gov . Medicare.gov.

Medicare costs at a glance TRUSTED & VERIFIED medicare.gov . Medicare.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

Skilled Nursing Facility

Medicare Skilled Nursing Facility (SNF) Coverage

Weight Loss (Bariatric) Surgery

Does Medicare Cover Weight Loss or Bariatric Surgery?

Chemotherapy

Does Medicare Cover Chemotherapy? Understanding the Costs

Does Medicare Cover Surgery?

Palliative Care

Does Medicare Cover Palliative Care?

Hospitals & Hospital Beds

Medicare Hospital Coverage

Does Medicare cover Hospice?

Home Health Care

Does Medicare Cover Home Health Care?

Let’s see if you qualify for Medicare savings today!

Medicare Interactive Medicare answers at your fingertips -->

Emergency room services, outpatient hospital services.

You must be logged in to bookmark pages.

Email Address * Required

Password * Required

Lost your password?

If you have Original Medicare , Part B covers emergency room services anywhere in the U.S. Medicare Advantage Plans also must cover emergency room services anywhere in the country. Emergency room services are typically provided when you have a medical condition that requires immediate action, such as an injury or sudden illness.

If you have a Medicare Advantage Plan, be aware that:

- Your plan cannot require you to see an in-network provider .

- You do not need a referral .

- There are limits on how much your plan can bill you if you receive emergency care while out of your plan’s network , Specifically, you will be billed either $50 or your plan’s in-network cost for emergency services, whichever is less.

- Your plan must cover medically necessary follow-up care related to the medical emergency if delaying care would endanger your health.

- You have the right to appeal if your plan does not cover your emergency care.

If your condition was not an emergency but appeared to be an emergency, Original Medicare or your Medicare Advantage Plan must still cover your care. For example, let’s say you have chest pain and think you are having a heart attack. If you go to the emergency room and doctors discover that your pain is heartburn, your care should still be covered because the situation appeared to be an emergency.

Even if you do not have health insurance or the ability to pay, you still have the right under federal law to receive medical care in the case of an emergency.

Update your browser to view this website correctly. Update my browser now

How Much Does an ER Visit Cost? Free Local Cost Calculator

It’s true that you can’t plan for a medical emergency, but that doesn’t mean you have to be surprised when it’s time to pay your hospital bill. In 2021, the U.S. government enacted price transparency rules for hospitals in order to demystify health care costs. That means it should be easier to get answers to questions like how much an ER visit costs.

While the question seems pretty straightforward, the answer is more complicated. Your cost will vary based on factors such as if you’re insured, whether you’ve met your deductible, the type of plan you have, and what your plan covers.

There is a lot to consider. This guide will take you through specific scenarios and answer questions about insurance plans, deductibles, co-payments, and discuss scenarios such as how much it costs if you go to the ER when it isn’t an emergency.

You’ll learn a few industry secrets too. Did you know that if you don’t have insurance you might see a higher bill? According to the Wall Street Journal , it’s common for hospitals to charge uninsured and self-pay patients higher rates than insured patients for the same services. So, where can you go if you can’t afford to go to the ER?

Keep reading for all this plus real-life examples and cost-saving tips.

How Much Does an ER Visit Cost Without Insurance?

Everything is more expensive in the ER. According to UnitedHealth, a trip to the emergency department can cost 12 times more than a typical doctor’s office visit. The average ER visit is $2,200, and doesn’t include procedures or medications.

If you want to get a better idea of what an ER visit will cost in your area, check out our medical price comparison tool that analyzes data from thousands of hospitals.

Compare Procedure Costs Near You

Other out-of-pocket expenses you may incur include bills from third parties. A growing number of emergency departments in the United States have become business entities separate from the hospital. So, third-party providers may bill you too, like:

- EMS services, like an ambulance or helicopter

- ER physicians

- Attending physician

- Consulting physicians

- Advanced practice nurses (CRNA, NP)

- Physician assistants (PA)

- Physical therapists (PT)

And if your insurance company fails to pay, you may have to pay these expenses out-of-pocket.

How Much Does an ER Visit Cost With Insurance?

The easiest way to estimate out-of-pocket expenses for an ER visit (or any other health care service) is to read your insurance policy. You’ll want to look for information around these terms:

- Deductible: The amount you have to pay out-of-pocket before your insurance kicks in .

- Copay: A set fee you pay upfront before a covered medical service or procedure.

- Coinsurance: The percentage you pay for a service or a procedure once you’ve met the deductible.

- Out-of-pocket maximum: The most you will pay for covered services in a rolling year. Once met, your insurance company will pay 100% of covered expenses for the rest of the year.

Closely related to out-of-pocket expenses like deductibles and co-insurance are premiums. A premium is the monthly fee you (or your sponsor) pay to the insurance company for coverage. If you pay a higher premium, you’ll have a lower deductible and fewer out-of-pocket costs whenever you use your insurance to pay for services such as a visit to the ER. The opposite is also true — high deductible health plans (HDHP) offer lower monthly payments but much higher deductibles.

Sample ER Visit Cost

Using a few examples from plans available on the Marketplace on Healthcare.gov (current as of November 2021), here’s how this might play out in real life:

Rob is a young, healthy, single guy. He knows he needs health insurance but he feels reasonably sure that the only time he’d ever use it is in case of an emergency. Here’s the plan he chooses:

Plan: Blue Cross/Blue Shield Bronze Monthly premium: $394 Deductible: $7,000 Out-of-pocket maximum: $7,000 ER coverage: 100% after meeting the deductible

Rob does the math and considers the worst case scenario. If he does go to the ER, he’ll pay full price if he hasn’t yet met his deductible. But since both his deductible and his maximum out-of-pocket are the same, $7,000 is the most he’ll have to pay before his insurance kicks in at 100%.

Now imagine that Rob gets married and is about to start a family. He might need a different insurance plan to account for more hospital bills, doctors appointments, and inevitable emergency room visits.

Since Rob knows he’ll be using his insurance more often, he picks a plan with a lower deductible that covers more things.

Plan: Bright HealthCare Gold Monthly premium: $643 Deductible: $0 Out-of-pocket maximum: $6,500 ER coverage: $500 Vision: $0 Generic prescription: $0 Primary care: $0 Specialist: $40

This time Rob goes with a zero deductible plan with a higher monthly premium. It’s more out-of-pocket each month, but since his plan covers doctor’s visits, prescription drugs, and vision, he feels more prepared as his lifestyle shifts into family mode.

If he has to go to the ER for any reason, all he’ll pay is $500 and his insurance pays the rest. And worse case scenario, the most he’ll pay out-of-pocket in a year is $6,500.

How Much Does an ER Visit Cost if You Have Medicare?

Medicare Part A only covers an emergency room visit if you’re admitted to the hospital. Medicare Part B covers 100% of most ER costs for most injuries, or if you become suddenly ill. Unlike private insurance and insurance purchased on the Affordable Care Act (ACA) Marketplace, Medicare rarely covers ER visits that happen while you’re outside of the United States.

To learn more, read: How to Use the Healthcare Marketplace to Buy Insurance

How Much Does an ER Visit Cost for Non-Emergencies?

When you have a sick child but lack insurance, haven’t met your deductible, or if you’re between paychecks, just knowing you can go to the ER without being hassled for money feels like such a relief. ER staff won’t demand payment upfront, and they usually don’t ask about insurance or assess your ability to pay until after discharge.

There are other reasons, too. You might be tempted to go to the ER for situations that are less than emergent because emergency departments provide easy access to health services 24/7, including holidays and the odd hours when your primary care physician isn’t available. If you’re one of the 61 million Americans who are uninsured or underinsured , you might go to the ER because you don’t know where else to go.

What you may not understand is the cost of an ER visit without insurance can total thousands of dollars. Consumers with ER bills that get sent to collections face some of the most aggressive debt collection practices of any industry. Collection accounts and charge-offs could affect your credit score for the better part of a decade.

Did you know that charges begin racking up as soon as you give the clerk your name and Social Security number? There are tons of horror stories out there about people receiving medical bills after waiting, some for many hours, and leaving without treatment.

4 ER Alternatives Ranked by Level of Care

First and foremost, if you’re experiencing a medical emergency, call 911 or go to the closest emergency room. Do not rely on this or any other website for advice or communication.

If you’re not sure whether your condition warrants immediate, high-level emergency care, you can always call your local ER and ask to speak to their triage nurse. They can quickly assess how urgent the situation is.

If you are looking for a lower-cost alternative to the ER, this list provides a few options. Each option is ranked by their ability to provide you with a certain level of care from emergent care to the lowest level, which is similar to the routine care you would receive at a doctor’s office.

1. Charitable Hospitals

There are around 1,400 charity hospitals , clinics, and pharmacies dedicated to serving low-income families, including the uninsured. Most charitable, not-for-profit medical centers provide emergency room services, making it a good option if you’re uninsured and worried about accruing substantial medical debt.

ERs at charitable hospitals provide the same type of medical care for conditions like trauma, broken bones, and life-threatening issues like chest pain and difficulty breathing. The major difference is the price tag. Emergency room fees at a charity hospital are usually flexible and almost always based on your income.

2. Urgent Care Centers

Urgent care centers are free-standing facilities designed to treat patients with serious but not life-threatening conditions. Also called “doc in a box,” these ambulatory care centers are a good choice for treating stable but chronic health issues, fever, urinary tract infections, back pain, abdominal pain, and moderately high blood pressure, to name a few.

Urgent care clinics usually have a medical doctor on-site. Some clinics offer point-of-care diagnostic tests like ultrasound and X-rays, as well as basic lab work. The average cost for an urgent care visit is around $180, according to UnitedHealth.

3. Retail Health Clinics

You may have noticed small retail health clinics (RHC) popping up in national drugstore chains like CVS, Walgreens, and in big-box stores like Target and Walmart. The Little Clinic is an example of an RHC that offers walk-in health care services at 190 supermarkets across the United States.

RHCs help low-acuity patients with minor medical problems like sore throat, cough, flu-like symptoms, and other conditions normally treated in a doctor’s office. If you think you’ll need lab tests or other procedures, an RHC may not be the best choice. Data from UnitedHealth puts the average cost for an RHC visit at $100.

4. Telehealth Visits

Telehealth, in some form, has been around for decades. Until recently, it was mostly used to provide access to care for patients living in the most remote or rural areas. Since 2020, telehealth visits over the phone, via chat, or through videoconferencing have become a legitimate and extremely cost-effective alternative to in-person office visits.

Telehealth is perfect for some types of mental health therapies, follow-up appointments, and triage. For self-pay, a telehealth visit only costs around $50, according to UnitedHealth.

Tips for Taking Control of Your Health Care

- Don’t procrastinate. Delaying the care you need for too long will end up costing you more in the end.

- Switch your focus from reactive care to proactive care. Figuring out how to pay for an ER visit is a lot harder (and costlier) than preventing an ER visit in the first place. Data show that preventive health care measures lead to fewer illnesses and better outcomes.

- Plan for the unknown. It’s inevitable that at some point in your life you’ll need health care. Start a savings account fund or better yet, enroll in a health savings account (HSA). If you’re employed (even part-time) you already qualify for an HSA. A contribution of just $9 a paycheck could add up to $468 tax-free dollars for you to spend on health care every year. Unlike the use-it-or-lose-it savings plans of the past, modern plans don’t expire. You can use HSA dollars to pay for out-of-pocket costs like copayments, deductibles, and for services that your health insurance may not cover, like dental and vision services.

- Advocate for yourself. There is nothing more empowering than taking charge of your health. Shop around for services and compare prices on procedures to make sure you’re getting the best prices possible.

- If you are uninsured or doing self-pay, negotiate your bill and ask for a cash discount.

Estimate the Cost of the ER Before You Need It

It’s stressful to think about money when you’re facing an emergency. Research the costs of your nearest ER before you actually need to go with Compare.com’s procedure cost comparison tool .

All you have to do is enter your ZIP code and you’ll immediately see out-of-pocket costs for ER visits at your local emergency rooms. It works for other medical services too, like MRIs, routine screenings, outpatient procedures, and more. Find the treatment you need at a price you can afford.

Disclaimer: Compare.com does not offer medical advice and is in no way a substitute for any medical advice received from health professionals. Compare.com is unable to offer any advice on any medical procedure you may need.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

Does Medicare Cover Emergency Room Visits?

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our editorial standards and how we make money.

If you’re new to Medicare, you’re probably wondering how much coverage the federal health program offers Medicare beneficiaries for emergency medical care and emergency room visits.

While urgent and life-saving medical treatment in the ER can cost a lot of money, you’ll be glad to know that Medicare will cover most of the costs of your visit to the emergency room.

Read our guide to find out what parts of Medicare will cover your treatment and care in the emergency room, and find out what costs you’ll be liable for if you ever need to visit the ER.

What Is Medicare?

The federal Medicare program is a health care program for people over the age of 65, those with certain disabilities, and individuals who suffer from ESRD (End-stage Renal Disease) and ALS (Lou Gehrig’s).

If you are in good health, you qualify for Medicare three months before you turn 65. However, you can enroll at any age after 65.

When you join Medicare, you can either enroll in Original Medicare or Medicare Advantage. Original Medicare consists of Part A and Part B coverage and Medicare Advantage is private health coverage for Part A and B.

Medicare Coverage Explained

There are three parts to Medicare that will cover you for different types of medical expenses.

Part A is hospital coverage and pays for medical costs related to an inpatient hospital stay and hospital treatment.

Part B is outpatient or general medical coverage which covers expenses such as doctors’ visits, routine exams, and outpatient procedures.

Part D is prescription drug coverage for self-administered medication. Original Medicare doesn’t cover this; however, there are private health plans that you can join to pay for these costs.

Medicare Advantage used to be known as Medicare Part C. It covers Part A, Part B, and Part D in some cases.

Source: Pexels

Medicare will cover ER visits and trips to the emergency room under either Medicare Part A or Part B.

If you are treated as an outpatient and are up to date with your Part B premiums, you will first need to pay your Medicare Part B deductible to have your treatment covered.

Medicare Part B will cover 80% of the cost of your treatment and you will be liable for the remaining 20% of the cost.

For example, let’s say you are admitted to hospital as an outpatient after a car accident. You receive treatment in the ER and are sent a bill for $12,000. Medicare Part B will pay $9,600 and you will need to pay $2,400.

If you are admitted to hospital as an inpatient, you will be covered for all expenses. However, if you are in hospital for more than 60 days, you will need to pay a coinsurance amount for each day of care.

Costs to Keep in Mind

Remember that there are emergency room costs you’ll have to pay regardless of your Medicare coverage when you visit the ER. This includes your monthly premiums, your deductibles, coinsurance amounts, and co-pays.

Besides these costs, there are expenses that aren’t covered by Medicare. For example, ambulance rides aren’t typically covered by Medicare and if you need to be airlifted to the hospital, this can cost you thousands of dollars.

Another expense that isn't covered by Medicare is the cost of blood units. The price per pint of blood can range between $150-$350, so if you need four or five blood units, this can end up costing you a lot of money.

If you’re on Original Medicare, it’s a good idea to plan for these expenses and set aside some money to ensure that you can cover these costs if you need them.

You can also look at other insurance coverage options, such as Medicare Supplement Insurance, to help you pay for these uncovered costs.

What Is the Medicare Deductible for an Emergency Room Visit?

Deductibles are a fee that you’ll need to pay before you’re covered by your health insurance.

For Medicare Part A you’ll need to pay a deductible of $1,556 in 2022.

For Medicare Part B, you’ll need to pay a deductible of $233 in 2022.

How Much Does an ER Visit Cost?

If you’re ever admitted to the ER, the cost of treatment will depend on the care you require and how long you are in there.

The cost of lifesaving care in the ER can run into thousands of dollars. One thing to note is that you can be treated as an outpatient under Medicare Part B if your injuries aren’t that severe.

However, if you are admitted to hospital, your medical costs will change to inpatient treatment. This means you’ll likely have to pay more than you would as an outpatient, as outpatient treatments have different fee structures.

For example, if you need stitches as an outpatient, you may pay $200. However, if you are an admitted patient, the same procedure may cost you around $400.

If you are admitted to the ER as an outpatient by the emergency department services and at a later point need to be admitted as an inpatient, your outpatient rates will be converted into inpatient rates and you will need to cover the Medicare Part A deductible ($1,556).

Example of ER Costs: Meet George

George is a 68 year-old retiree who experiences chest pain, tingling, and light-headedness while having lunch with his family.

He has Medicare Part A and Part B coverage.

He is rushed to the ER, is diagnosed with a pulmonary embolism, and receives urgent medical care to save his life.

Upon arrival he is given outpatient treatment, but the doctors later decide to admit him to hospital as he needs surgery to clear a blockage in his arteries.

In this case, George’s costs will be converted to Medicare Part A and he will need to pay the Part A deductible to be covered by Medicare.

The Part A deductible for 2022 is $1,556 and once he pays this, he gets up to 60 days of hospital treatment and does not have to pay a coinsurance amount.

If he didn’t have Medicare coverage, he’d have to pay for the entire cost of his treatment as an outpatient and inpatient from his own pocket.

Does Medicare Advantage Cover ER Visits?

Yes, Medicare Advantage Plans are required by law to offer the same or equivalent level of coverage as Original Medicare.

This means that if you are a member of a Medicare Advantage Plan, you’ll get the same care, treatment, and services that a person on Original Medicare receives.

However, most Medicare Advantage Plans usually offer more benefits and perks to their members. Some of these include SilverSneakers, telehealth, and home health care benefits.

In terms of emergency care and emergency room visits, Medicare Advantage Plans offer their members more coverage for added costs not covered by the government Medicare program.

For example, many Medicare Advantage Plans cover the costs of an ambulance ride to and from the hospital, as this trip will be provided by an in-network provider.

They may also not charge their member the 20% coinsurance rate or the per-day Medicare Part A coinsurance rate if they are treated at an in-network hospital or medical facility.

What If I Need ER Treatment While I’m Overseas?

If you’re traveling or on holiday and need to visit the ER, Medicare won’t cover your costs. Our recommendation is to get additional coverage while you’re overseas to ensure that you can get the same level of care as you would in the U.S.

Source: Pixabay

What Other Coverage Options Are There for Emergency Room Visits?

If you’re a member of another type of private health plan, such as Medigap or Part D cover, you may get assistance with the costs of hospital services and treatment in the ER.

Medicare Supplement Insurance

If you have Medicare Supplement Insurance, this can help pay for some of the costs of your emergency room visit or treatment by emergency services.

For example, Medigap Plan F, G, and H all cover the costs of blood transfusions.

Want to find out more about Medicare Supplement Insurance? Read our guides to Medigap cover and Medicare Supplement Insurance Plans.

Medicare Part D (Prescription Drug Coverage)

Medicare Part D may be useful to cover some of the costs of medication after you leave the ER. However, it won’t really help with the costs of treatment while you are in the ER.

If you’d like to learn more about both Medigap and Medicare Part D, be sure to read our guides.

Does Medicare Cover Emergency Room Visits - FAQs

Does medicare part a cover emergencies.

Yes, Medicare Part A will cover visits to the ER and medical emergencies if you are admitted to hospital. However, you will need to pay the Part A deductible ($1,556) before you are covered.

What does Medicare Part A pay for?

Medicare Part A covers all inpatient care and treatment on a per-day basis—including emergency room visits. You will be covered for 60 days without having to pay a coinsurance amount. After 60 days, you will need to pay $389 for the next 30 days. After 90 days, you’ll need to pay $778 per day.

Where Can I Learn More about Medicare Coverage and Related Topics?

If you have Original Medicare or a Medicare Advantage Plan, you can rest assured that you’ll be covered in case you need to go to the ER.

However, keep in mind that there are costs that Original Medicare won't cover, such as ambulance services and blood transfusions.

If you’re interested in learning more about Medicare topics such as costs, coverage, and enrollments, be sure to visit our Medicare hub.

If you’d like to speak to someone about your health insurance, speak to one of our Medicare agents to discuss your options and find health coverage in your state.

Compare plans today.

Medicare emergency room copay.

Original Medicare pays for emergency room visits, but there is usually a copay for emergency room visits that the beneficiary needs to pay.

by Christian Worstell | Published October 25, 2023 | Reviewed by John Krahnert

Original Medicare is a federal health insurance program for seniors and people with certain disabilities. So does Medicare cover emergency room visits? When a Medicare recipient requires emergency care, Medicare does cover emergency room visits for the most part, and the recipient pays a copayment .

Read on to learn more about emergency room costs and how a Medicare Supplement Insurance plan can help reduce what you pay out of pocket for Medicare emergency room coverage.

What is the Copay for Medicare Emergency Room Coverage?

A copay is the fixed amount that you pay for covered health services after your deductible is met. In most cases, a copay is required for doctor’s visits, hospital outpatient visits, doctor’s and hospital outpatients services, and prescription drugs. Medicare copays differ from coinsurance in that they're usually a specific amount, rather than a percentage of the total cost of your care.

Medicare does cover emergency room visits. You'll pay a Medicare emergency room copay for the visit itself and a copay for each hospital service. It is important to remember, however, that your actual Medicare urgent care copay amount can vary widely, depending on the services you require and where you receive care.

If you are admitted for inpatient hospital services after an emergency room visit, Medicare Part A does help cover costs for your hospital stay. Medicare Part A does not cover emergency room visits that don't result in admission for an inpatient hospital stay.

What Does Medicare Pay for Emergency Room Visits?

Medicare Part A emergency room coverage is specifically for inpatient hospital stays. If your emergency room visit requires you to be admitted for inpatient care, your Medicare Part A benefits would kick in but are subject to the Part A deductible and coinsurance.

Most ER services are considered hospital outpatient services, which are covered by Medicare Part B . They include, but are not limited to:

- Emergency and observation services, including overnight stays in a hospital

- Diagnostic and laboratory tests

- X-rays and other radiology services

- Some medically necessary surgical procedures

- Medical supplies and equipment, like splints, crutches and casts

- Preventive and screening services

- Certain drugs that you wouldn't administer yourself

NOTE: There's an important distinction to be made between inpatient and outpatient hospital statuses. Your hospital status affects how much you pay for services. Unless your doctor has written an order to admit you as an inpatient, you're an outpatient, even if you spend the night in the hospital.

How Medicare Part B Pays For Outpatient Services

Medicare Part B pays for outpatient services like the ones listed above, under the Outpatient Prospective Payment System (OPPS). The OPPS pays hospitals a set amount of money (or payment rate) for the services they provide to Medicare beneficiaries.

The payment rate varies from hospital to hospital based on the costs associated with providing services in that area, and are adjusted for geographic wage variations.

Other Medicare Costs

Aside from Medicare ER copays, there are other outpatient hospital costs that you should be aware of when visiting the emergency room, such as deductibles and coinsurance . In most cases, if you receive care in a hospital emergency department and are covered by Medicare Part B, you'll also be responsible for:

- An annual Part B deductible of $240 (in 2024).

- A coinsurance payment of 20% of the Medicare-approved amount for most doctor’s services and medical equipment.

How You Pay For Outpatient Services

In order for your Medicare Part B coverage to kick in, you must pay the yearly Part B deductible. Once your deductible is met, Medicare pays its share and you pay yours in the form of a copay or coinsurance.

Get Help Covering Your Emergency Room Copay

If you're worried about a trip to the emergency room adding expensive and unpredictable costs to your health care budget, consider joining a Medicare Supplement Insurance (or Medigap) Plan .

Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays. All Medigap plans cover at least a percentage of your Medicare Part B coinsurance or ER copay costs.

To find a Medigap plan in your area, call 1-800-995-4219 to connect with a licensed insurance agent.

Does medicare part a cover emergency room visits.

If you opted out of Medicare Part B, and only have Part A, you may be wondering if you can get coverage for an emergency room visit. Medicare Part A is designed for hospital insurance, meaning that it's benefits are generally used once admitted to the hospital. If your emergency room visit results in an inpatient admission, your Medicare Part A coverage would then kick in.

How Much is an Emergency Room Visit?

The average cost of an emergency room visit is around $1,150, although the average cost of an emergency room visit for those age 65 and over is just $849. ¹

Compare Medigap plans in your area.

Or call now to speak with a licensed insurance agent:

1-800-995-4219

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox , MSN , and The Washington Post , and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism. He currently lives in Raleigh, NC.

https://consumerhealthratings.com/healthcare_category/emergency-room-typical-average-cost-of-hospital-ed-visit/

Resource Center

Compare 2024 medigap plans | medicaresupplement.com, how to choose between medigap and medicare advantage, medicare part d plans 2024 | guide to medicare rx prescription drug coverage, medicare eligibility requirements, medicare supplement insurance for people under 65 with disabilities, medicare eligibility and enrollment guide, average cost of medicare supplement insurance by age | medigap 2023, state-specific medicare supplement information, medicare out-of-pocket costs.

Get a Free Medicare Guide!

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance, as well as important Medicare news and tips. We promise to never send you spam – just helpful content!

By clicking "Get your guide" you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 11 years.

Ready to find your plan?

Or chat about my options with an agent

Thanks for signing up for our emails!

Your free Medicare guide will arrive in your email inbox shortly. You can also look forward to informative email updates about Medicare and Medicare Supplement Insurance.

If you'd like to speak with an agent right away, we're standing by for that as well. Give us a call!

Call now 1-800-995-4219 TTY 711, 24/7 LICENSED AGENTS AVAILABLE NOW

Under 65 Years Old?

Call a Licensed Insurance Agent to check your eligibility

877-822-4889

Under 64 Years Old?

800-298-2106

- For Medicare

- For Providers

- For Brokers

- For Employers

- For Individuals & Families:

Shop for Plans

Shop for your own coverage.

- Other Supplemental

Plans through your employer

- Learn about the medical, dental, pharmacy, behavioral, and voluntary benefits your employer may offer.

- Explore coverage through work

- How to Buy Health Insurance

- Types of Dental Insurance

- Open Enrollment vs. Special Enrollment

- See all topics

Looking for Medicare coverage?

- Shop for Medicare plans

- Member Guide

- Find a Doctor

- Log in to myCigna

Emergency Room Visit: When to Go, What to Expect, Wait Times, and Cost

Knowing when and why to go for an emergency room visit can help you plan for care in the event of a medical emergency.

How much does it cost to go to an emergency room?

Emergency Room (ER) costs can vary greatly depending on what type of medical care you need. How much you pay for the visit depends on your health insurance plan. Most health plans may require you to pay something out-of-pocket for an emergency room visit. A visit to the ER may cost more if you have a High-Deductible Health Plan (HDHP) and you have not met your plan’s annual deductible. HDHP's typically offer lower monthly premiums and higher deductibles than traditional health plans. Your plan will start paying for eligible medical expenses once you’ve met the plan’s annual deductible. Here are some tips to pay less out of pocket .

When should I go to an emergency room?

Emergency rooms are often very busy because many people don’t know what type of care they need, so they immediately go to the ER when they are sick or hurt. You should make an emergency room visit for any condition that’s considered life-threatening.

Life-threatening conditions include, but are not limited to, things like a serious allergic reaction, trouble breathing or speaking, disorientation, a loss of consciousness, or any physical trauma.

If you need to be treated for problems that are considered non-life threatening, such as an earache, fever and flu symptoms, minor animal bites, mild asthma, or a mild urinary tract infection, consider seeing your doctor or visiting an urgent care center or convenience care clinic.

What is the cost of an emergency room visit without insurance?

Emergency room costs with or without health insurance can be very high. If you have health insurance, review your plan documents for details on the costs associated with your plan, including your plan deductible, coinsurance, and copay requirements.

If you don’t have insurance, you may be required to pay the full cost of your treatment, which can vary by facility and the type of treatment required. Always plan ahead for sudden sickness, injury, or other medical needs, so you know where to go and how much it could cost. If you need medical care, but it’s not life-threatening you may not have to go to the ER—there are other more affordable options:

- Urgent care center: Staffed by doctors, nurses, and other medical staff who can treat things like earaches, urinary tract infections, minor cuts, nausea, vomiting, etc. Wait times may be shorter and using an urgent care center could save you hundreds of dollars when compared to an ER.

- Convenience care clinic: Walk-in clinics are typically located in a pharmacy (CVS, Walgreens, etc.) or supermarket/retail store (Target, Walmart, etc.). These clinics are staffed with physician assistants and nurse practitioners who can provide care for minor cold, fever, flu, rashes and bruises, head lice, allergies, sinus/ear infections, urinary tract infections, even flu and shingles shots. No appointments are needed, wait times are usually minimal, and a convenience care clinic costs much less than an ER.

Plan ahead for when you need medical care. You may not need an emergency room visit and the bill that could come with it.

What are common emergency room wait times?

Emergency room wait times vary according to hospital and location. Patients in the ER are seen based on how serious their condition is. This means that the patients with life-threatening conditions are treated first, and those with non-life threatening conditions have to wait.

To help reduce ER wait times, health care facilities encourage you to plan ahead for care, so when you’re sick or hurt, you know if the ER is right for your medical condition.

An emergency room visit can take up time and money if your problem is not life-threatening. Consider other care options, such as an urgent care center, convenience care clinic, your doctor, or a virtual doctor visit (video chat/telehealth)—all of which could be faster and save you money out of your own pocket if the medical problem is non-life threatening.

If you have health insurance, be sure to check your plan documents to see what types of care options are eligible for coverage under your plan, including whether or not you need to stay in your plan’s network.

Is taking an ambulance to the emergency room free?

An ambulance ride is not free, but your insurance may cover some of the costs for the ride, as well as the emergency room visit. Check your plan benefits to see what out-of-pocket expenses you are responsible for when it comes to an ambulance ride and a visit to the ER.

Plan ahead for times you may need immediate medical care. Review the details of your health plan so you know the costs for an ER visit should you ever need it. Know when it’s best to go to the emergency room and when going somewhere else, like an urgent care center, convenience care clinic, your doctor, or even a virtual doctor visit (video chat/telehealth), is the right option that may save you time and money.

- Emergency Care

- What is Inpatient vs. Outpatient Care?

- Urgent Care vs. Emergency Room

- Shop Around for MRIs, CTs, and PET Scans

Explore Our Plans and Policies

- Health Insurance

- Dental Insurance

- Supplemental Insurance

Back to Knowledge Center

The information provided here is for educational purposes only. It does not constitute medical advice and is not a substitute for proper medical care provided by a physician. Cigna Healthcare SM assumes no responsibility for any circumstances arising out of the use, misuse, interpretation or application of this information. Always consult your doctor for appropriate examinations, treatment, testing, and care recommendations. In an emergency, dial 911 or visit the nearest emergency room.

I want to...

- Get an ID card

- File a claim

- View my claims and EOBs

- Check coverage under my plan

- See prescription drug list

- Find an in-network doctor, dentist, or facility

- Find a form

- Find 1095-B tax form information

- View the Cigna Healthcare Glossary

- Contact Cigna Healthcare

- Individuals and Families

Secure Member Sites

- myCigna member portal

- Health Care Provider portal

- Cigna for Employers

- Client Resource Portal

- Cigna for Brokers

The Cigna Group Information

- About Cigna Healthcare

- The Cigna Group

- Third Party Administrators

- International

- Evernorth Health Services

- Terms of Use

- Product Disclosures

- Company Names

- Customer Rights

- Accessibility

- Non-Discrimination Notice

- Language Assistance [PDF]

- Report Fraud

- Washington Consumer Health Data Privacy Notice

- Cookie Preferences

Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company (CHLIC), Cigna HealthCare of Arizona, Inc., Cigna HealthCare of Illinois, Inc., Cigna HealthCare of Georgia, Inc., Cigna HealthCare of North Carolina, Inc., Cigna HealthCare of South Carolina, Inc., and Cigna HealthCare of Texas, Inc. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company (CGLIC), or their affiliates (see a listing of the legal entities that insure or administer group HMO, dental HMO, and other products or services in your state). Accidental Injury, Critical Illness, and Hospital Care plans or insurance policies are distributed exclusively by or through operating subsidiaries of The Cigna Group Corporation, are administered by Cigna Health and Life Insurance Company, and are insured by either (i) Cigna Health and Life Insurance Company (Bloomfield, CT). The Cigna Healthcare name, logo, and other Cigna Healthcare marks are owned by The Cigna Group Intellectual Property, Inc.

All insurance policies and group benefit plans contain exclusions and limitations. For availability, costs and complete details of coverage, contact a licensed agent or Cigna Healthcare sales representative. This website is not intended for residents of Arizona and New Mexico.

Selecting these links will take you away from Cigna.com to another website, which may be a non-Cigna Healthcare website. Cigna Healthcare may not control the content or links of non-Cigna Healthcare websites. Details

- Shop for Medicare plans

- Estimate costs

- Medicare Supplement plan costs

Medicare Supplement insurance plan costs

Get help with some of the costs Medicare Parts A and B (Original Medicare) won't pay for, with a Medicare Supplement insurance plan.

UnitedHealthcare offers a variety of Medicare Supplement plans with different costs and levels of coverage. When choosing a Medicare Supplement plan, it's a good idea to think about things like premiums, your out-of-pocket medical expenses and what Original Medicare will and will not cover.

What costs are associated with medicare and medicare supplement plans.

Your costs can include:

- Monthly premium

A monthly premium is the fee you pay to the plan in exchange for coverage. Each Medicare Supplement plan has a different monthly premium.

A deductible is the amount you pay out-of-pocket for covered services before Medicare and/or your Medicare Supplement plan begins to pay. It’s a preset, fixed cost. Most Medicare Supplement plans provide coverage for your Part A hospital deductible. In most cases, you’re responsible for your Medicare Part B deductible, which is an annual cost of $240 in 2024.

Copayment (copay)/coinsurance

Copayment (also known as a copay) and coinsurance are a kind of cost sharing. A copay is a set, flat amount paid each time, such as a $20 copay for each in-office doctor visit. Coinsurance requires you to pay a percentage of the Medicare-approved amount each time.

Out-of-pocket limit/maximum

This is a maximum amount of out-of-pocket costs you pay per calendar year. Since Medicare Parts A and B don’t have an out-of-pocket maximum, your out-of-pocket medical expenses can add up to hundreds or thousands per year. Medicare Supplement plans are designed to help cover some of these costs.

Shop plans in your area

See AARP Medicare Supplement Insurance plans where you live, and compare costs and benefits side-by-side.

How do Medicare Supplement plans provide more coverage than Original Medicare alone?

Pays its share of your health care costs

- Inpatient hospital stays

- Skilled nursing facility

- Home health care

- Doctor's services

- Hospital outpatient care

- Durable medical equipment

- Some preventive services

Out-of-pocket costs

- Deductibles

- Coinsurance

- Annual deductible

Helps fill in some of the gaps of Medicare

Medicare Supplement plans are designed to help you pay some of the out-of-pocket costs associated with Original Medicare. Benefits and costs vary depending upon the plan selected.

How do I decide which Medicare Supplement plan is right for me?

Your health needs and budget will help you decide which Medicare Supplement plan might be best for you.

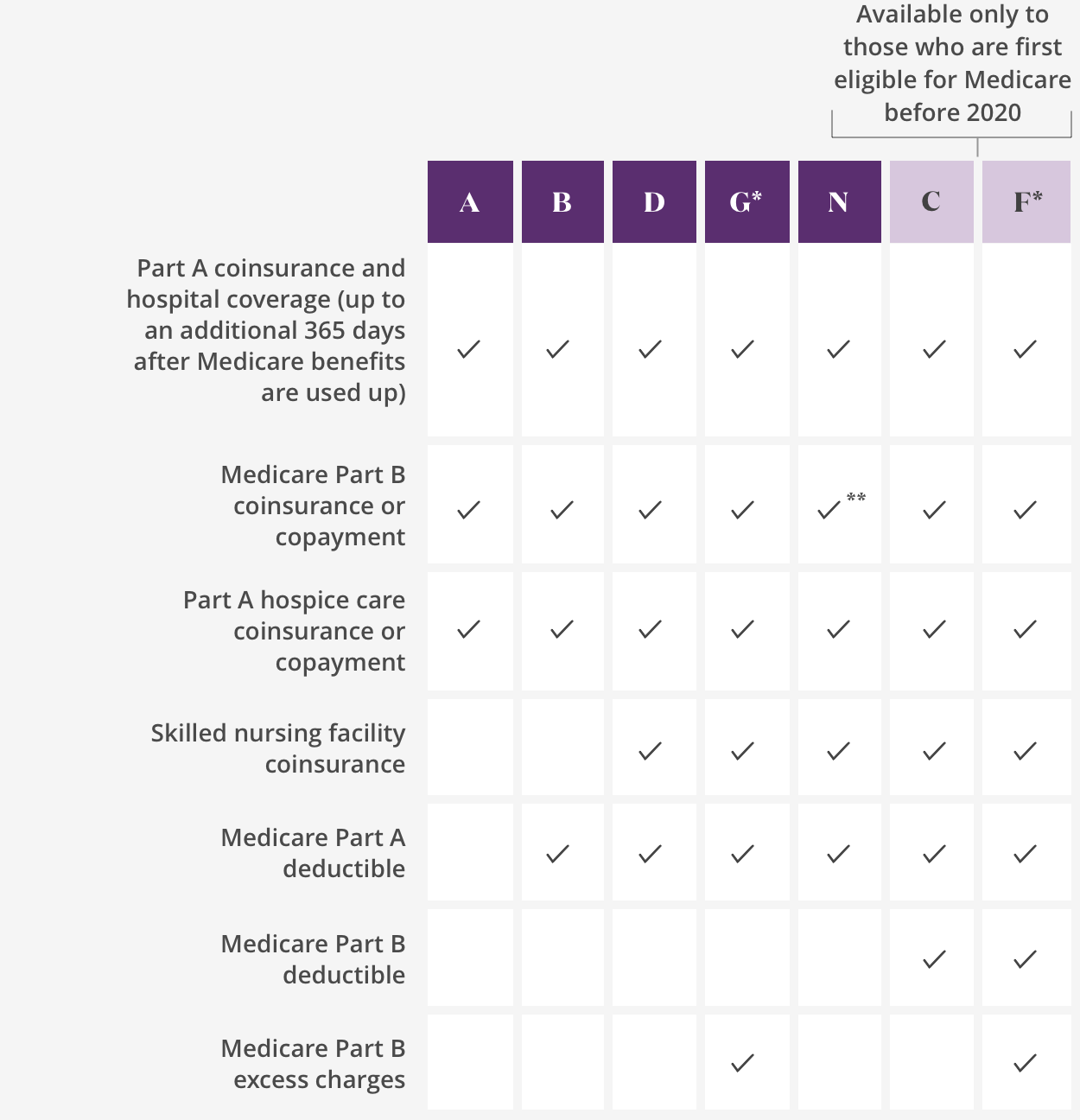

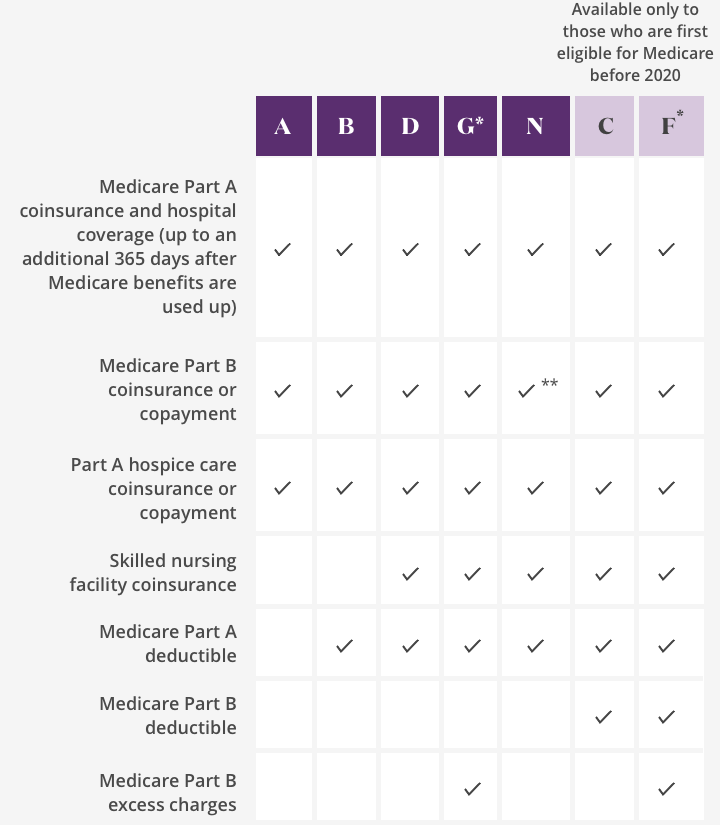

Prefer to have more coverage and less out-of-pocket expense?

If yes, then plans G, C 1 , or F 1 may be right for you. These plans typically have a higher premium and offer the most supplemental coverage, paying up to 100% of your out-of-pocket costs for many Medicare-approved services (depending on the plan).

Prefer to have a lower monthly premium with out-of-pocket expenses based on your need?

If yes, then another Medicare Supplement plan may be right for you.

Plans A and B

Medicare Supplement Plan A offers just the Basic Benefits, while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible, which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.

Plans C 1 , F 1 and G

These plans offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. These plans generally have higher monthly premiums but lower out-of-pocket costs.

Plans K and L

Plans K & L are cost sharing plans with lower monthly premiums. They pay a percentage of the coinsurance instead of the full amount, and you are responsible for the rest. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

Plan N covers Medicare Part B coinsurance once the Part B deductible is met, but you pay copayments for covered doctor office and emergency room visits in exchange for a mid-level premium .

1 Only applicants first eligible for Medicare before 2020 may purchase Plans C and F

Already a member?

Go to the member site to see more personalized benefits.

Find a plan

Meet with us.

Make an appointment with a licensed insurance agent/producer in your area.

Call UnitedHealthcare at FED TFN / TTY 711, 8 a.m. to 8 p.m. 7 days a week

Get a Free Decision Guide

The Decision Guide provides you with information about AARP Medicare Supplement Plans.

View Important Disclosures Below

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company.

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Insured by UnitedHealthcare Insurance Company, Hartford, CT (UnitedHealthcare Insurance Company of New York, Islandia, NY for New York residents). Policy Form No. GRP 79171 GPS-1 (G-36000-4).

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Not connected with or endorsed by the U.S. Government or the federal Medicare program.

This is a solicitation of insurance. A licensed insurance agent/producer may contact you.

THESE PLANS HAVE ELIGIBILITY REQUIREMENTS, EXCLUSIONS AND LIMITATIONS. FOR COSTS AND COMPLETE DETAILS (INCLUDING OUTLINES OF COVERAGE), CALL A LICENSED INSURANCE AGENT/PRODUCER AT THE TOLL-FREE NUMBER SHOWN/1-844-775-1729.

What Does Medicare Not Cover? Seven Things You Should Know

Medicare Part A and Part B leave gaps in your health care coverage. But Medicare Advantage has problems, too.

- Newsletter sign up Newsletter

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn 65. Part A (hospital insurance) helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B (medical insurance) helps pay for doctors' visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It's important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. This is why increasing numbers of Medicare beneficiaries choose to go with Medicare Advantage, which purports to fill some of those gaps.

A private plan through Medicare Advantage can offer more benefits and lower premiums. But a recent report from the Office of Inspector General found that some beneficiaries of Medicare Advantage are denied necessary care.

Here's a closer look at what isn't covered by traditional Medicare, plus information about supplemental insurance policies, Medicare Advantage and strategies that can help cover the additional costs, so you don't end up with unexpected medical bills in retirement.

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

1. Does Medicare cover prescription drugs?