Tourist Tax Refund Counter at KLIA

undo Facilities and Services at KLIA

Kuala Lumpur International Airport Terminal 2 (klia2) Info Site

GST Guidelines on Tourist Refund Scheme

Greetings! Are you looking for information on GST guidelines for Tourist Refund Scheme?

The Goods and Services Tax (GST) is a value added tax in Malaysia. GST is levied on most transactions in the production process, but is refunded with exception of Blocked Input Tax, to all parties in the chain of production other than the final consumer.

The existing standard rate for GST effective from 1 April 2015 is 6.0%. However, the GST rate was reset to 0% effective from June 1, 2018.

Read more about GST zero rated from June 1 .

- GST refund at KLIA / klia2 airport

- Overview of Goods and Services Tax

- Overview Of Tourist Refund Scheme

- Conditions for fefund

- Goods not eligible for GST refund

- GST refund by a tourist at an approved outlet

1. Introduction

This Industry Guide is prepared to assist you in understanding the Goods and Services Tax (GST) and the related Tourist Refund Scheme (TRS). This guide will explain to you:

- As a tourist visiting Malaysia, how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet

- As a business, the conditions and eligibility requirements to become an Approved Outlet

2. Overview of Goods and Services Tax (GST)

GST is a multi-stage tax on domestic consumption. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. GST is also charged on the importation of goods and services into Malaysia.

Payment of GST is made in stages by the intermediaries in the production and distribution process. Although the tax is paid throughout the production and distribution chain, it is ultimately passed on to the final consumer. Therefore, the tax itself is not a cost to the intermediaries and does not appear as an expense item in their financial statements.

In Malaysia, a person who is registered under the Goods and Services Tax Act 2014 is known as a GST registered person. A GST registered person is required to charge output tax on his taxable supply of goods and services made to his customers. He is allowed to claim input tax credit on any GST incurred on his purchases which are inputs to his business. Thus, this mechanism would avoid double taxation and only the value added at each stage is taxed.

3. Overview Of Tourist Refund Scheme (TRS)

Common features and the main key players under the TRS are:

- TRS is a scheme that allows tourists to claim GST paid on eligible goods purchased in Malaysia. The tourist can then claim a GST refund from an Approved Refund Agent on the eligible goods purchased from an Approved Outlet when the tourist leaves Malaysia by air mode from one of the 8 international airports in the scope of the TRS.

- Tourists classified under the TRS are foreign tourists who are eligible to claim GST refunds and who hold a valid international passport.

- An Approved Refund Agent is an agent appointed by the Malaysian Government through tender, who processes and refunds GST refund claims made by outbound tourists.

- The Approved Refund Agent may charge an administrative fee for processing the GST refund. Any fee chargeable will be made known to the tourist when they purchase eligible goods from an Approved Outlet. The GST treatment on services of the Approved Refund Agent are zero rated because the services are considered as export services.

- The Approved Refund Agent will then recover refunds made and fee charged to tourists under TRS from the Royal Malaysian Customs Department (RMCD)

- Approved Outlets are approved retailers who are GST registered person selling standard rated goods to foreign tourists

- The Approved Outlets are retailers who are GST registered persons, approved by RMCD and selling standard rated eligible goods to foreign tourists.

- All Approved Outlets are to display TRS logos / signage at their outlets. These logos / signage will be provided by the Approved Refund Agent. When in doubt, the tourist should check with Approved Outlet whether it is participating in the TRS or otherwise.

4. Conditions For Refund of GST Under Tourist Refund Scheme

A tourist shall be entitled to the refund of GST under the TRS if s/he satisfies the following conditions:

- S/he is neither a citizen nor a permanent resident of Malaysia and holds a valid international passport.

- S/he is a foreign diplomat leaving the country after completion of service in Malaysia and is in possession of a document from the relevant diplomatic or consular mission stating that s/he is permanently leaving Malaysia.

- S/he is not nor has been employed in Malaysia at any time in the 3 months preceding the date of purchase of the eligible goods.

- S/he departs Malaysia by means of air transportation from one of the 8 international airports in the scope of the TRS.

- S/he is not a member of the cabin or flight crew of the aircraft on which s/he is departing out of Malaysia

- S/he must have purchased the eligible goods within 3 months prior to the date of departure.

- S/he must spend at least three-hundred Malaysian Ringgit (MYR300) (GST inclusive) at the same Approved Outlet. Accumulation of purchases is allowed if purchases are made from the same Approved Outlet on different days.

- S/he must take the eligible goods out of Malaysia to another country as accompanied (hand carried) or unaccompanied (checked-in) luggage.

- If s/he is entering or staying in Malaysia on a student pass, your entitlement under the TRS is like any other foreign tourist.

- S/he must be at least 18 years of age.

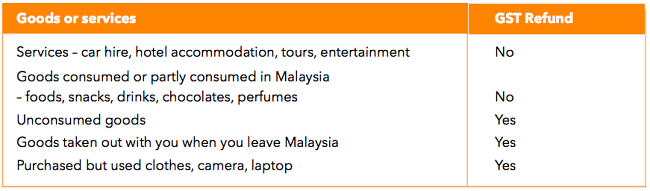

5. Goods Not Eligible for GST Refund under the Tourist Refund Scheme

You may claim refund on the GST charged and paid on goods purchased from an Approved Outlet, except for the following:

- Wine, spirits, beer and malt liquor

- Tobacco and tobacco products

- Precious metal and gem stones

- Goods wholly or partially consumed in Malaysia (except for clothing/tax invoices to be maintained)

- Goods which are absolutely prohibited from export under the written law

- Goods which are not taken out as accompanied (hand carried) or unaccompanied (checked-in) luggage

6. Manner/ Procedure for Claiming a GST Refund by a Tourist at an Approved Outlet

A tourist claiming a GST refund under the TRS must comply with the following requirements at the time of purchase of the eligible goods at the Approved Outlet:

- Show the tourist’s own original valid international passport to the sales assistant/cashier at the Approved Outlet to prove eligibility for a GST refund under the TRS.

- Get an original tax invoice or receipt for the eligible goods purchased.

- Tourist’s name

- Tourist’s passport number

- Tourist’s country of residence

- Date of arrival in Malaysia

- Intended date of departure from Malaysia

- Date of purchase of the eligible goods

- Tax invoice or receipt number for the eligible goods

- Description and quantity of the eligible goods purchased

- The total amount paid for the eligible goods, inclusive of GST, the total amount of GST refundable, the amount of the administrative/processing charge/fee and the net amount of GST refundable to the tourist.

- in cash up to three-hundred Malaysian Ringgit (MYR300);

- to a credit card account; or

- through a bank cheque if neither of the previous refund options is feasible.

- The tourist must keep the original copy of the tax invoice or receipt and the completed original refund form and produce these documents together with the purchased goods to an RMCD Customs Officer (GST Refund Verification Counter) at the airport prior to departure.

- The Tourist can only receive a refund form from the Approved Outlet where the eligible goods have been bought. A refund form cannot be issued by RMCD at the airport.

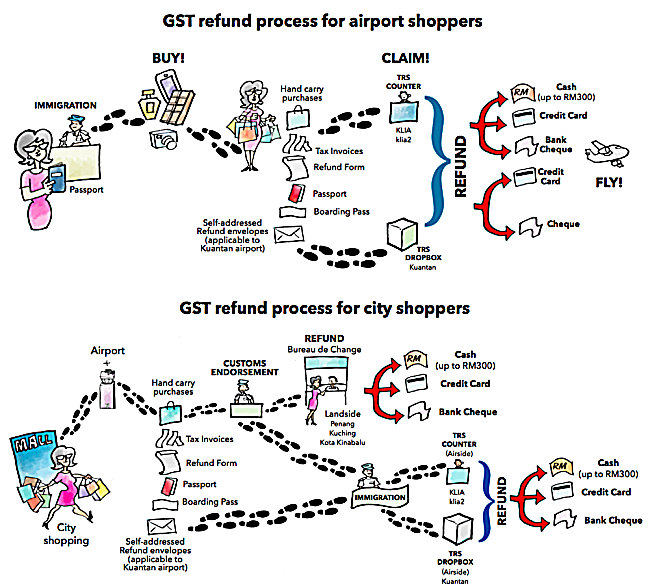

7. Manner/ Procedure for Claiming GST Refund at a Malaysian International Airport

The tourist should be ready to present the tax invoice or receipt, the completed original refund form and the eligible goods for export to an RMCD Officer for verification at the GST Customs Refund Verification Counters prior to departure from Malaysia.

The GST Customs Refund Verification Counters are located landside (before check in for unaccompanied luggage) and airside (after immigration control for accompanied luggage) at each of the 8 international airports in scope of the TRS. The tourist should also provide the RMCD Officer with:

- The Tourist’s original international passport; and

- The Tourists Boarding pass or confirmed air ticket (as proof of departure)

- The goods purchases (if jewellery in sealed plastic bag)

- The tax invoice

GST The Approved Refund Agent’s counters will be located either landside or airside, or both, at each airport. Where there is no Approved Refund Agent counter airside, a mailbox will be provided to allow the tourist to post their GST Refund Forms for processing by the Approved Refund Agent using stamped addressed envelopes provided by the Approved Outlet.

After the original refund form has been endorsed/verified by the RMCD Officer, the tourist shall not part with the goods or give them to another person, except to the counter staff for checking in.

The goods shall not be taken out of the International Airport Departure Hall after the original refund form has been endorsed by the RMCD Officer unless otherwise approved by RMCD.

The refund form that has been endorsed by the RMCD Officer shall be provided to the Approved Refund Agent either personally at the Approved Refund Agent’s counter or by post within two months from the date of RMCD endorsement. The endorsed refund form can also be put into a TRS mail box before departing. The TRS mail box shall be located airside close to the GST Customs Refund Verification Counter.

The refund must be made by the following mode of payment :

For flights departing from any terminal at a Malaysian International Airport, if the tourists are carrying:

- Accompanied luggage – tourists are required to present the goods and the original refund form(s) at the GST Refund Verification Counter located at the landside departure hall/lounge of all international airports in scope of the TRS. The GST Customs Refund Verification Counter for accompanied luggage shall be located airside after Immigration Control. Accompanied luggage should not weigh more than 7kg

- Unaccompanied luggage – tourists are required to declare bulky items/goods such as DVD / CD players / television sets or goods the tourists have packed into their luggage together with relevant documents (invoice/receipt/refund form/international passport)/confirmed air ticket/boarding pass at the GST Customs Refund Verification Counter before checking in the goods at the airport. The GST refund transaction must be validated by RMCD before the goods are checked in as unaccompanied luggage.

- For flights departing from the Budget Terminal (LCCT), irrespective of whether the tourist is going to carry their goods on board the aircraft (accompanied goods) or check them in (unaccompanied goods), the tourist is required to present the goods together with relevant documents and confirmed air ticket to the RMCD Officer at the GST Customs Refund Inspection Counter located landside before check in at the LCCT Terminal (unaccompanied luggage) and in the Departure Hall for hand carried (accompanied) luggage.

- Tourists who have hand carried luggage (accompanied) which do not meet the allowable airline size and weight limits are allowed to take the goods out and check in the goods as unaccompanied luggage.

- Proceed to the Approved Refund Agent’s Counter to obtain the GST refund; or

- Seal the validated original refund form in an envelope (given to the tourist at the Approved Outlet) and post it to the Approved Refund Agent to process the GST refund within 2 months of RMCD’s endorsement or drop the refund form in the mail box located near the GST Customs Verification Counter airside before departing from Malaysia by air mode. GST Refund Forms sent by ordinary post or dropped in the TRS mailbox must reach the Approved Refund Agent in time for processing before the limit of 2 months from RMCD’s endorsement has expired.

8. Conditions And Eligibility Of Approved Outlet Under Tourist Refund Scheme

In order to participate in the Tourist Refund Scheme in Malaysia, a Merchant must:-

- Be registered for GST under section 20 GST Act 2014 and hold a valid GST registration number

- Be approved by the Royal Malaysian Customs Department to participate in the scheme

- Be affiliated by the Approved Refund Agent

- Be equipped by the Approved Refund Agent with the solution to issue TRS transactions to eligible tourists

- Provide a GST Refund Form to eligible tourists who wish to claim refund of GST under Tourist Refund Scheme using the solutions provided by the Approved Refund Agent

- Account for tax on a monthly period

- Sell eligible goods

- Not sell non-taxable goods/non tax refundable goods like liquor, cigarettes, tobaccos, tobacco products, gems stone and precious metal under the scheme

- Charge GST at standard rate on taxable goods sold to foreign tourists

- Issue tax invoices which indicate the cost of the goods as well as the amount of GST charged

9. Appointment of Approved Outlet

In order to be appointed as Approved Outlets the merchant will have to undergo the following procedure:

- Merchant/Outlet- Register Outlet Details via Outlet Registration Portal

- IGB (Iris Global Blue) Outlet Registration Portal/ IGB Sales Staff- Capture Outlet Details and send to GenTax Portal For Approval. If Outlet Approved will install and activate issuing solution at outlet.

- GenTax Portal/Royal Malaysian Customs Department Officer (RMCD) –Review Outlet Details and approve or reject. Send approved/reject response to Outlet Registration Portal.

Further information regarding Outlet Registration and Approval process is available on this webpage: http://business.globalblue.com/my_en/

For registration of Outlets/Merchants to become Approved Outlet under Tourist Refund Scheme please use the following link: https://iris-globalblue.com/register-trs-outlet/

10. Mechanism For Jewellery/Article of Jewellery Under TRS

Jewellery merchants who become Approved Outlet under TRS will have to adopt the following mechanism:

- Minimum purchase of jewellery (gold, platinum, silver) of RM300 (GST inclusive) is eligible to claim refund of GST under TRS

- All Approved Outlets selling jewellery will be provided with custom approved security bag with serial number. Security bag to be provided by Federation of Goldsmiths And Jewellers Association of Malaysia (FGJAM)

- Every purchase made by tourist will be sealed in security bag with serial number together with the tax invoice clearly showing weight, quantity, density, amount and serial number of the bag before tourist leave the Approved Outlet

- Approved Outlet will charge GST to the tourist and tourist will later claim refund of GST under TRS from the Approved Refund Agent

- Tourist departing from all Malaysian Airport (Second Schedule- Regulation 81 (GST Regulations 2014) will show the security bag to RMCD at the GST Refund Verification Counter. RMCD will inspect the bag and reserved the right to open the bag for weighing and confirming the density of the jewellery

- RMCD weighs and check the density of jewellery (gold, platinum, silver) using a special kind of machinery for jewellery

- After completion of weighing and confirming the density and verification by RMCD, tourist to proceed to Approved Refund Agent to claim refund of GST under TRS

For more information, please visit http://gst.customs.gov.my/ .

Site Search

Did you find what you are looking for? Try out the enhanced Google Search:

- Our Awards and Milestones

- Our Business Continuity Policy

- Our International Network

- Our Digital Master Plan

- Our Mobile App

- Corporate Social Responsibility

- Switch to 3E Accounting Malaysia

- Client Testimonial

- Robotics Accounting Firm

- Penang Corporate Services Provider

- Malaysia Company Incorporation Services

- Venture to Malaysia with 3E Accounting Singapore

- Why 3E Accounting’s Company Incorporation Package is the best in Malaysia

- Malaysia Company Registration Packages

- Nominee Director Services

- Appointing the Right Person as your Nominee Director in Malaysia

- Setting Up Foreign Owned Company in Malaysia

- Key Considerations Before a Foreigner Starts a Business in Malaysia

- Foreign Company Setup Options

- Liberalisation of the Services Sector in Malaysia

- Equity Policy in the Manufacturing Sector

- An Expatriate Guide to Starting a Business in Malaysia as Foreigner

- An Expat’s Guide: Commonly Faced Problems by Foreigner When Doing Business in Malaysia

- Standard Procedures for Incorporation in Malaysia

- Guide to Malaysia Company Registration

- Guide to Start Business in Malaysia

- Guide to Select Your Malaysia Company Names

- Free Malaysia Company Name Check

- Incorporation FAQ

- Determining Financial Year End

- Sole Proprietor vs LLP vs General Partnership vs Company

- Online Incorporation Form

- Limited Liability Partnership Setup

- Conversion into LLP

- Annual LLP Services

- Taxation for Limited Liability Partnership LLP

- Limited Liability Partnership LLP FAQ

- Guide to LLP Setup

- Limited Liability Partnership (LLP/PLT) Compliance Requirements

- Key Issues And Ambiguities

- Name Search for Limited Liability Partnership (LLP)

- Limited Liability Partnership LLP Setup Form

- Overview of SST in Malaysia

- Goods and Person Exempted from Sales Tax

- SST Return Submission and Payment

- SST Registration in Malaysia

- SST Penalties and Offences in Malaysia

- How to Check SST Registration Status for A Business in Malaysia

- Malaysia Sales Tax 2018

- Malaysia Service Tax 2018

- SST Treatment in Designated Area and Special Area

- SST Deregistration Process

- Guide to Imported Services for Service Tax

- Digital Service Tax in Malaysia

- Ways To Pay For Sales And Services Tax (SST) In Malaysia

- Sales Tax on Low Value Goods (LVG)

- Transitional Rules for SST Rate Change

- Start a Malaysia Company

- Corporate Secretarial

- Human Resource

- Business Setup

- Business Advisory

- Start a LLP

- Immigration

- Associate Business

- Other Jurisdictions Setup

- Virtual Office

- Stamp/Seal Makers

- Software Sale and Development

- Latest News in Malaysia

- Malaysia Public Holidays

- Guide to Setup Malaysia Business

- Malaysia Taxation

- Corporate Compliance Requirement

- Malaysia Budget

- Goods and Services Tax (GST)

- Industry Guide

- Expatriates

- Human Resources & Immigration

- Sales and Service Tax (SST) in Malaysia

- Miscellaneous Topics

- Finances and Grants

- E-Newsletter

- Feedback to 3E Accounting Malaysia

- Book an Appointment With 3E Accounting

- Malaysia Tourist Refund Scheme

Malaysia Tourist Refund Scheme in Malaysia

A tourist shall be entitled to the refund of GST under TRS if he satisfies the following conditions: (a) he is neither a citizen nor a permanent resident of Malaysia not less than eighteen years of age and holding a valid international passport; (b) he is a foreign diplomat leaving the country after completion of service in Malaysia and is in possession of a document from the relevant diplomatic or consular mission stating that you are departing from Malaysia; (c) he is not, in the 3 months preceding the date of purchase of the goods, been at any time employed in Malaysia; (d) he departs Malaysia by air mode; (e) he is not a cabin or flight crew of the aircraft on which is departing out of Malaysia; (f) he must purchase the goods within 3 months before the date of departure; (g) he has spent at least three hundred Ringgit Malaysia (GST inclusive) or more at the same Approved Outlet. Accumulation of purchases are allowed if purchases are made from the same store on different days; and (h) he must bring the goods out of Malaysia to another country as accompanied (hand carried) or unaccompanied (check in) luggage.

The following goods are not eligible for refund under TRS: (a) precious metal and gems stone; (b) goods which are wholly or partially consumed in Malaysia; (c) goods which are absolutely prohibited from export under any written law; and (d) goods which are not taken out as an accompanied (hand carried) or unaccompanied (check in) luggage. (e) wine, spirits, beer and malt liquor; and (f) tobacco and tobacco products.

Non consumable goods such as clothing, cameras and watches can be used before leaving Malaysia. Consumable goods such as drinks, perfume and chocolates are not eligible for GST refund if already partly/wholly used or consumed in Malaysia.

Claim of refund under TRS can be made at the following airports: (a) Kuala Lumpur International Airport, Sepang (KLIA); (b) Kuala Lumpur International Airport 2, Sepang (KLIA 2); (c) Senai International Airport, Johor (d) Kota Kinabalu International Airport, Sabah; (e) Kuching International Airport, Sarawak; (f) Penang International Airport, Bayan Lepas; (g) Sultan Haji Ahmad Shah Airport, Pahang; (h) Sultan Abdul Aziz Shah Airport, Subang, Selangor; and (i) Langkawi International Airport, Kedah.

For all the Approved Malaysian Airports, the GST Refund Verification Counters will be located before check in into the airport for unaccompanied (check in) luggage and at the Departure Hall for accompanied (hand carried) luggage.

After the original refund claim form has been verified and endorsed (digitally/manually stamped) by the officer of customs, the tourist shall not part with the possession of the goods or give it to another person, except to the counter staff for checking in. The goods shall not be brought out of the premises of the Departure Hall of the Approved Airports after the refund application form has been endorsed by the officer of Customs unless otherwise approved by the senior officer of customs due to some unavoidable circumstances.

For the detail process of claiming refund, please see guide on Tourist Refund Scheme .

Related Links:

Overview of Goods and Services Tax (GST) in Malaysia Overview of Specific GST Guide in Malaysia Do I Need to Register For GST in Malaysia? Goods And Services Tax (GST) Offences and Penalties in Malaysia GST List of Zero-Rated Supply, Exempted Supply and Relief in Malaysia

KPMG Personalization

Tourism Tax Policy and Amendments to Service Tax Policy

- Home ›

- Insights ›

Useful resources

- MyTTx Portal – TTx Policy No. 1/2021

- MySST Portal – Service Tax Policy

The Royal Malaysian Customs Department (“RMCD”) has uploaded a Tourism Tax Policy to recap the exemption of Tourism Tax announced by the Government earlier as well as amendments to two Service Tax Policies on its official portal. Please click on the above header links for a copy each of the policies.

Set out below are the salient points:-

Tourism Tax Policy No. 1/2021

- The exemption of Tourism Tax for the period from 1 July 2020 to 30 June 2021 has been further extended until 31 December 2021.

- Accommodation operators are still liable to submit TTx-03 Return to account and pay the Tourism Tax received from foreign tourists for accommodation provided before the exemption period or any Tourism Tax where payment has not been received from tourists within twelve calendar months that become due in the taxable period.

- The amount of Tourism Tax exempted must be stated in Column 7 of the TTx-03 Return i.e. the amount exempted for each night per room.

- During the exemption period, Tourism Tax should be recorded as “exempt” or “NIL” or “RM0.00” in the invoice issued to foreign tourists.

Amendment (No.2) to Service Tax Policy No. 9/2020

- Registered accommodation premise operators are exempted from charging Service Tax from 1 March 2020 to 31 December 2021.

- Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022.

Amendment to Service Tax Policy No. 2/2019

- Subject to meeting conditions, Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021.

Our highlights are intended to provide a general overview of the key proposed tax changes and should not be used or relied upon as a substitute for detailed advice or as a basis for formulating business decisions.

Should you have any questions or require further clarification, please do not hesitate to email or contact any of our Executive Directors, Directors, Associate Directors or Managers whom you are accustomed to dealing with or who are responsible for the tax affairs of your organization.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

RECENTLY PUBLISHED

Popular articles.

- e-Invoicing in Malaysia: A Complete Guide For Your Business

- Malaysia e-Invoicing FAQs: Everything You Need to Know

- Important Terms in Malaysia e-Invoicing

- Reasons for Rejection and Cancellation of e-Invoice in Malaysia

- e-Invoice Exemptions in Malaysia: A Comprehensive Guide

- e-invoice Model in Malaysia: Benefits, Requirements and How to Get Started

- Data Security and Privacy Monitoring in Malaysia: How IRBM Leads the Way

- Transaction Types of e-Invoicing in Malaysia: A Comprehensive Guide

- Steps for submission, validation, and issuance of e-invoices in Malaysia

Malaysia Tourism Tax: What You Need to Know in 2024

Updated on : May 2nd, 2024

The Malaysian Tourism Tax Bill was passed in the Senate on 27 April 2017 and t he TTx has been in effect since 1 September 2017. All accommodation providers have to collect TTx from tourists staying at their premises. The tax at a rate of MYR10 per room, per night has been required to be collected by the accommodation operator and then paid to the Royal Malaysian Customs Department (RMCD).

The ambit of the law has been significantly widened under the new amendments which were effective from Jan 1, 2023 and now any digital platform whether located in Malaysia or outside Malaysia, on providing services relating to online booking of accommodation in Malaysia shall be liable to be registered for Tourism Tax in Malaysia.

What is the Tourism Tax in Malaysia?

The Tourism Tax in Malaysia, also known as TTx, is a tax charged for all foreign passport holders staying at accommodation premises in Malaysia. It is collected by the operators of these premises and is charged at a fixed rate of RM10.00 per room per night.

Malaysian nationals and permanent residents are excluded from the tax

Who is responsible for collecting and remitting tourism tax in Malaysia?

As per the policy update issued by the Malaysian government, the responsibility for charging, collecting, accounting, and remitting tourism lies on Digital Platform Service Providers (DPSPs) like Agoda and Booking.com for all online bookings, irrespective of whether the DPSP or the hotel operator receives the payment.

The hotel operators are liable to collect and remit TTx only for offline bookings

However, the policy has granted a grace period from 1 April 2023 TO 31 December 2025. During the grace period, the policy eases the compliance burden on DPSPs based on the booking and payment nature. Here's how it works:

- If a booking is made online, but payment goes directly to the hotel operator: The responsibility for collecting and remitting TTx falls on the operator.

- If both booking and payment are done online through the DPSP: Only, then does the responsibility to collect and remit tourism tax lie with the DPSP.

Who has to pay Tourism Tax?

The tourism tax is a consumption-based tax. Foreign tourists staying at accommodation premises in Malaysia are ultimately liable to bear the burden of Tourism tax in Malaysia. However, it is collected by the accommodation operation or digital platform service provider (DPSP) and remitted to the government on behalf of the tourist.

How to Pay?

- Tourists, upon payment to DPSPs (Digital Platform Service Providers) submit proof of TTx payment. In cases where proof is provided, registered operators are relieved from collecting TTx directly from tourists. However, if tourists fail to provide proof, DPSPs must collect the TTx amount and account for it to the RMCD.

- From 2023, DPSPs that facilitate the online booking of accommodations in Malaysia (“online travel platform operators e.g. Airbnb, OYO, etc.”) to collect tourism tax (TTx) and remit the tax to the RMCD.

- The deposit of Tourism tax in Malaysia is completely digital using their customer website MyTTx.

Key Highlights:

- MyTTx is an online submission and payment system for tourism tax (TTx).

- It is available 24 hours daily and accessible anywhere.

- The system can be accessed through any latest browser and is best viewed at 1024 x 768 resolution or higher.

When to Pay?

- Operators have to file a return every three months to account for the tourism tax (“TTX”) received. Note: If the operator is GST registered, the operator must file a tourism tax return in the same taxable period in which the operator files his/her GST returns (i.e. monthly or quarterly).

- The deadline to make payments of tax is clarified by stating that payment is due “not later than” the last day of the month following the end of each taxable period.

Benefits of Malaysian Tourism Tax

Tourism Tax comes with several advantages that contribute to the sustainable development of the tourism industry and the overall growth of local economy.

- Revenue Generation: The primary purpose of the Tourism Tax is to generate revenue for the Government to develop and enhance tourism-related infrastructure and services. This includes the development of tourist attractions, accommodation facilities, transportation networks, and other amenities that enhance the overall visitor experience.

- Promotion of Tourism: The funds from the Tourism Tax can be allocated to marketing and promotional activities aimed at attracting more tourists to Malaysia. This helps in boosting the country's image as a desirable tourist destination on a global scale.

- Cultural Preservation: Tourism Tax revenue can be invested in projects aimed at preserving and promoting Malaysia's rich cultural heritage. This may involve the restoration of historical sites, supporting traditional arts and crafts, and organizing cultural events that showcase the country's diverse cultural tapestry.

- Job Creation: A thriving tourism industry leads to increased demand for services, creating job opportunities across various sectors. The revenue generated from the Tourism Tax indirectly contributes to employment generation, benefiting local communities and individuals.

- Balance Over Tourism: The tax is becoming popular as a tool to battle the pressing issue of over-tourism in countries where both, indigenous nature and culture is at risk. It allows the government to monitor and manage the tourism sector effectively, ensuring compliance with standards and regulations set to maintain the industry's integrity.

TTx is here to stay

As Malaysia continues to position itself as a premier tourist destination, the Tourism Tax plays a pivotal role in sustaining its ecosystem. Navigating TTx is a necessity for a primarily tourist driver economy. It needs involvement of all stakeholders DPSPs, tourists, and the RMCD to make the system better and smoother every day.

What is Tourist Refund Scheme (TRS)

Notice The Malaysian Ministry of Finance has reduced the standard GST Rate to 0% effective 1 June 2018. The Tourist Refund Scheme ends on 1 June 2018. TRS Forms will have until 31 August 2018 to obtain Customs validation and claim the tax refund which will be paid via credit card or cheque. For more information please visit Malaysian Customs website at http://gst.customs.gov.my A Tourist Refund Scheme (TRS) is a scheme that allows any tourist who qualifies to claim a refund of Goods and Services Tax (GST) paid on certain goods purchased in Malaysia from approved outlets. The key players under the TRS are: (a) Foreign tourists; (b) Foreign diplomats after completion of duty in Malaysia; (c) Approved Refund Agent (ARA) appointed by the Minister to process the GST refund claim; (d) Approved Outlet which is a business establishment operated by a registered person under GST and appointed by the ARA (Iris Global Blue) for the purpose of TRS. The approved outlets will have to display visibly the Tax Refund Logo at their premise. Sources: http://gst.customs.gov.my

- Travel & Living

- 17 Questions You Might Have About GST Refund For Tourist In Malaysia

17 QUESTIONS YOU MIGHT HAVE ABOUT GST REFUND FOR TOURIST IN MALAYSIA

With effect from 1 st April 2015, Goods & Service Tax (GST) will be implemented throughout Malaysia. Thus, tourist to Malaysia can apply for GST Refund on eligible goods purchased in Malaysia when they leave the country. Here are 17 commonly asked questions about the Tourist Refund Scheme (TRS) .

#1 What is TRS?

TRS allows tourist to claim a refund of the GST they paid on eligible goods purchased from Approved Outlets (shops that participate in the TRS) if the goods are taken out internationally from Malaysia by air from one of the airports in Malaysia managed by Malaysia Airports. If you buy in shops that do not participate in TRS, you’ll not get any tax refund.

#2 How do I know which outlets is an Approved Outlet for TRS?

Retailers participating in the TRS will display a “TRS logo” at their retail shop. Tourist can look out for the logo or check with the retailer if their purchases are eligible for GST refund.

#3 Who are eligible for TRS?

To be eligible for a GST refund, you must satisfy all of the following criteria:

- You’re NOT a Malaysian citizen or permanent resident of Malaysia

- You hold a valid international passport

- You’re not a member of the crew of the aircraft on which you’re departing Malaysia

- You must take the goods out of Malaysia by air within 3 months of purchase

#4 What if I’m here on a student pass? Am I entitled?

Yes, provided that you’re non-Malaysian and is not a permanent resident of Malaysia. Student pass holders are treated as normal foreign tourist and are eligible for GST refund if you fulfil all the criteria.

#5 Are Malaysians eligible for a refund under TRS?

Are you kidding? Obviously not. Please re-read #3.

#6 Can I claim tax refund for everything I buy? If not, what are the goods that are exempted for a refund?

GST refund is only applicable to Approved Outlets bearing the “TRS logo” and applies to only eligible goods. You may claim refund on the GST charged and paid on goods purchased from an Approved Outlet, except for the following:

- Wine, spirits, beer and malt liquor

- Tabacco and tabacoo products

- Precious metal and gem stones

- Goods wholly or partially consumed in Malaysia (except for clothing/tax invoices to be maintained)

- Goods which are absolutely prohibited from export under the writer law

- Goods which are not taken out as accompanied (hand carried) or unaccompanied (checked-in) luggage

#7 Can refund be claimed for services such as accommodation, car rental and entertainment?

GST refund is not applicable for consumable goods and services such as hotel accommodation, entertainment, car rental, etc.

#8 Can tourist use the purchases before applying for TRS?

Purchases that have been used, wholly or partly, will not be eligible for GST Refund – except for non-consumable goods such as clothing, camera and laptops. Tax invoices for non-consumable goods must be maintained.

#9 What must I do at the Approved Outlet?

- You must show your valid international passport to prove your eligibility

- Inform the outlet that you intend to leave Malaysia via air within 3 months from date of purchase

- Obtain and keep the original tax invoice/receipt for your eligible purchases

- Get an original Refund Form from the sales assistant/cashier at the Approved Outlet and ensure that the refund form is completed correctly

- Complete the Refund Form, which is in triplicate. The Form must be completed by you personally and NOT by a representative

- The tourist must keep the original copy of the tax invoice or receipt and the completed original Refund Form and produce these documents together with the purchased goods to a Customs Officer at the airport prior to departure

- If you want to mail in your Refund Form, get a self-addressed envelope with pre-paid postage from the Approved Outlet

#10 Is there a minimum amount for the refund?

You must spend at least RM300 (including GST) to be eligible for refund. You claim for tax refund must be supported by the relevant tax invoices or receipts and Refund Forms.

#11 Is there a time limit on the purchases under the TRS?

Yes, as mentioned, your purchase should not be more than 3 months from your date of departure in order to be eligible under TRS.

#12 Where do I get my Refund Form?

You can get it from the Approved Outlet where the eligible goods have been bought. A Refund Form cannot be issued by the Customs at the airport.

#13 What information do I need to provide on the Refund Form?

The refund form should contain the following particulars:

- Tourist’s name

- Tourist’s passport number

- Tourist’s country of residence

- Date of arrival in Malaysia

- Intended date of departure from Malaysia

- Date of purchase of the eligible goods

- Tax invoice or receipt number for the eligible goods

- Description and quantity of the eligible goods purchased

- The total amount paid for the eligible goods, inclusive of GST, the total amount of GST refundable, the amount of the administrative/processing charge/fee and the net amount of GST refundable to the toutist.

#14 What documents must be presented during a refund?

- You must show your valid international passport

- Your boarding pass or confirmed air ticket as proof of departure

- The goods purchased (jewellery must be in sealed plastic bags)

- Your completed Refund Form for your purchases

- Your tax invoices/receipts

#15 Where do I obtain my refund at the airport?

Once you have completed your Refund Form(s) and the form(s) are endorsed by the Customs, you can apply for your GST refund at the TRS counters located at the respective airports before you check-in your purchases. It’s important for you to arrive at the airport early to allow sufficient time for processing of your GST Refund and inspection of goods.

#16 Will I be charged a handling fee?

Yes, you’ll be charged a handling fee and it’ll be deducted from the GST amount due to you. It means that you’ll not receive the full amount of GST as refund. GST Refund is made in Ringgit Malaysia at the prevailing exchange rates.

#17 What’s the currency used for GST Refund and what are the payment methods?

Your refund will be made in Ringgit Malaysia (minus the Agent handling fee). You may choose to have your refund in cash (up to RM300) or to a credit card account or through a bank cheque if neither of the previous refund options is feasible.

(Content sources: Malaysia Airports and GST Customs )

JQ Lee talks and writes for a living. That's because she loves sharing interesting things to the world. With a Degree in Communication and Media Management, this petite Gen-Y will not stop chasing her passion in writing and broadcasting. She dreams to host a travel show and be a radio announcer someday, hopefully soon.

Stalk this wacky fair Asian girl at www.jqtalks.com , Instagram and Twitter

READ RELATED

SWITZERLAND: WHERE STUNNING ALPINE VIEWS, RICH HISTORY, VIBRANT CITIES, AND ENDLESS ADVENTURES PROMISE UNFORGETTABLE EXPERIENCES AND JOYFUL DISCOVERIES!

【AUSTRALIA】WHY YOU SHOULD TRAVEL TO AUSTRALIA: A WORLD OF ADVENTURE AWAITS

【AZERBAIJAN】ETERNAL FLAME: HOW AZERBAIJAN BECAME THE LAND OF FIRE

【CHINA】SHANGHAI ISSUES PREPAID TRAVEL CARDS FOR INBOUND TRAVELERS' CONVENIENCE

【MALAYSIA MOVEMENT CONTROL ORDER EXTENDED】COMPANY CLOSURE FROM 18 MARCH - 14 APRIL 2020

【MALAYSIA MOVEMENT CONTROL ORDER】COMPANY CLOSURE FROM 18 - 31 MARCH 2020

【DENMARK】WILL CLOSE ITS BORDERS TO ALL FOREIGN VISITORS

【NEW ZEALAND】EVERYONE TRAVELLING TO NZ FROM OVERSEAS TO SELF-ISOLATE

- Terms & Conditions

- Privacy Policy

- Flight Booking Guideline

- Google Plus

12FLY Sales Office

No.21, Jalan Tong Shin, 50200 Kuala Lumpur, Malaysia

- Contact Information

Guide To Tax Refund In Malaysia

Updated on: March 17, 2019

What is GST?

Who are eligible to apply for Tax Refund?

Minimum purchase, time limit for customs approval, how to claim tax refund in malaysia, a step by step instruction.

- Cash: The GST refund can be paid in cash but only to maximum 300 MYR (equivalent to $70 USD).

- Credit card: The refund will be paid back to your credit card within 5 days.

GST refund overview in Malaysia

You might also like:.

Guide To Tax Refund In Canada

Guide To Tax Refund In Czech Republic

Leave a comment cancel reply.

Louis Vuitton

Chanel Bag Prices

Louis Vuiton Bag Prices

Dior Bag Prices

Hermes Bag Prices

Goyard Bag Prices

Celine Bag Prices

Chanel Wallet Prices

Chanel Bag Collections

Hermes Wallet Prices

Tax-Refund Guide

Shopping Guide in Airports

Heathrow airport guide.

Leather Guides

© 2024 Bragmybag.com. All Rights Reserved.

Louis Vuitton Bag Prices

Chanel Collection Prices

Shopping Guide In Airports

Heathrow Airport Guide

PH +1 000 000 0000

24 M Drive East Hampton, NY 11937

© 2024 INFO

Chinese (CN) / 简体中文

Chinese (HK) / 繁體中文(香港)

Chinese (TW) / 繁體中文(台灣)

Japanese / 日本語

Korean / 한국어(대한민국)

Malaysian Tourism Tax FAQs

Home > Partner Help > Your reservations > Malaysian Tourism Tax FAQs

Last updated: 1 year ago | 8 min read time

Malaysian Tourism Tax FAQs (CN)/简体中文

Malaysian Tourism Tax FAQs (HK)/中文 (香港)

Malaysian Tourism Tax FAQs (TW)/繁體中文

Malaysian Tourism Tax FAQs Japanese/日本語

Malaysian Tourism Tax FAQs Korean /한국어(대한민국)

Malaysian Tourism Tax FAQs Thai/ไทย

Malaysian Tourism Tax FAQs (MY)/Malay

This article will explain the Malaysian Tourism Tax and answer FAQs.

- Effective 1st Jan 2023 – 31 Dec 2025, Digital Platform Service Providers (DPSPs or Platform) are liable to collect and charge TTx from any tourists for reservations that are i) made through the DPSP’s platform and ii) where payment is made to a DPSP (such as Agoda) and remit such TTx to the Malaysian Customs Department. If payment of TTx has been made to the platform, then the accommodation premises should not collect the TTx again, provided proof of payment of TTx can be furnished; otherwise the accommodation premises shall collect TTx. For bookings where payment is made to accommodation premises in Malaysia directly (pay at property), it is the accommodation premise’s obligation as a registered operator to collect and remit TTx to Malaysian Customs Department.

- Starting on 1 Jan 2026, the government may choose to alter or continue with these rules.

- For more information, please visit myttx.customs.gov.my .

- a) Malaysian nationals (holders of a MyKad card)

- b) Permanent residents of Malaysia (holders of a MyPR card).

- If the property is listed and booked as one unit, then the Tourism Tax of RM10/room/night will be imposed to the unit only, so for 1 night, the applicable TTx = RM 10.

- If the property is listed on platform as three separate units (one bedroom per listing), then TTx shall be imposed on each of the rooms. So, if three rooms are booked for 1 night, the TTx would be RM 10/room/night x 3= RM 30.

- Q: Will this affect existing bookings, especially for Pay at Hotel existing bookings? A: Guests who are tourists have been subject to pay TTx since September 2017 when staying at any accommodation premises in Malaysia; this is normally collected by the operator i.e. accommodation premises operator. However, starting from 1 Jan 2023 and continuing until 31 Dec 2025, bookings made through platforms providing reservation services such as Agoda are liable to collect and charge TTx for any bookings made on the platform in which the platform collects the payment from bookers. If a traveler has made a booking on Agoda before 1 Jan 2023, and where TTx is applicable, the TTx must be collected by the property and remitted to the RMCD. For bookings of Malaysian properties made on Agoda on and after 1 Jan 2023 and continuing until 31 Dec 2025, Agoda as the platform is required to collect TTx if the payment for the booking is collected by Agoda. Agoda will endeavor to collect TTx on most bookings and issue a document as proof of TTx payment to the booker. However, for Pay Property bookings, TTx needs to be collected by the property from the booked guest at check-in.

- If the payment model “Pay to Agoda”, “Merchant Commission” and TTx applies – TTx is INCLUDED in the price and is collected by Agoda.

- If the payment model is “Pay to Agoda”, “Merchant Commission” and TTx doesn’t apply — TTx is NOT collected.

- If the payment model is “Pay at Hotel” and TTx applies — Malaysia Tourism Tax is INCLUDED in the price and collected by the property.

- If the payment model is “Pay at Hotel” and TTx doesn’t apply — Malaysia Tourism Tax is NOT collected.

- Q: How do I verify that TTx has been collected by Agoda? A: Agoda will issue to bookers proof of TTx collection (if collected by Agoda), unless TTx needs to be collected by the property as explained above.

- Q: My property did not register for Tourism Tax, does this apply to me? A: To determine whether you should be registered for TTx or not, please consult your business advisor or seek RMCD’s further guidance. The exemption from TTx for certain property types (Item 3, Tourism Tax Exemption Order 2017) e.g. homestay/kampungstay operator, operator with 4 accommodation rooms or less, does not apply when the reservation is made through a DPSP’s platform. Even if you are exempt from TTx, TTx would still be applicable when a booking of your property is made on Agoda by a qualified tourist.

- Q: If a tourist books accommodation through Agoda then subsequently extends their stay directly with the accommodation premise operator, who is liable to collect the TTx for the additional stay period? A: For tourists who book accommodation through a platform and extend their stay, the accommodation premise operator will collect any TTx for the additional stay. Platforms such as Agoda should not be liable to collect the TTx for the additional stay period, unless the additional stay period is booked using the online platform. Source: GUIDE ON TOURISM TAX (DIGITAL PLATFORM SERVICE PROVIDER) as of 13 Aug 2021.

- Q: If I have other questions on the Malaysian Tourism Tax, who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: In case of a dispute by a customer, what should I do and who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: Upon check in, I found that the guest is a foreign tourist, but the booking was made by a local. In this case, what should I do? Should I collect the tax and remit to RMCD? A: Yes. You should collect the applicable TTx in such case and remit to RMCD.

- Q: Is the guest still entitled to a TTx refund if the booking is non-refundable, but it is a no-show? A: TTx will in all cases be refunded to the booker if the stay at the premise does not take place. For more specific cases see below:

- If a full refund is triggered (cancellation on refundable booking) => Agoda refunds the entire amount. TTx will be refunded in full.

- If a booking is cancelled with 100% charge (cancellation on non-refundable booking) => Agoda keeps the original amount not related to TTx. Payment to the property should not be affected. However, TTx should be refunded to the booker.

- If a booking is cancelled with partial charges=> TTx will be refunded to the booker.

- If the booking is amended => Applicable tourism tax will be recalculated based on the new room nights of the amended booking. The amendment voucher should indicate the new value of tourism tax that has been paid.

Was this article helpful?

Thanks for your feedback!

Your reservations

Managing your reservations

How do I collect earnings from my bookings?

What is the Analytics Center?

YCS Availability Center

How do I respond to booking inquires?

What should I do if I can’t accommodate a Property Collect booking?

What is Acknowledge Booking and how can I Acknowledge Booking?

How to handle guest requested changes?

How do I receive confirmation on my reservation?

How do I respond to a special request?

Can I make changes to a reservation?

What should I do if I can’t accommodate a guest?

Where can I see details of my reservations?

Recommended reads

Agoda’s Eco Deals Survey: 4 in 5 travelers care about more sustainable travel

Agoda’s eco deals survey: 4 in 5 travelers ....

Agoda’s Eco Deals Survey: 4 in 5 travelers care about more sustainable travel As travelers venture to explore new horizons, they are increasingly mindful of the potential impact of their choices. According to a survey conducted by digital travel platform Agoda, 77% of travelers care about more sustainable travel. Respondents highlighted that financial incentives, the […]

Agoda’s Eco Deals Survey: 4 in 5 travelers care about more sustainable travel As travelers venture ...

27-Jun-2024

Agoda, United States Agency for International Development (USAID), and Global Sustainable Tourism Council (GSTC) collaborate for Hotel Sustainability Training in Jaipur

Agoda, united states agency for international ....

Agoda, United States Agency for International Development (USAID), and Global Sustainable Tourism Council (GSTC) collaborate for Hotel Sustainability Training in Jaipur Digital travel platform Agoda collaborated with the United States Agency for International Development (USAID) and the Global Sustainable Tourism Council (GSTC) to organize a Hotel Sustainability Training for industry professionals from 28 […]

Agoda, United States Agency for International Development (USAID), and Global Sustainable Tourism Co ...

26-Jun-2024

Agoda, GSTC, and USAID partner to champion sustainability education for hotels in Asia

Agoda, gstc, and usaid partner to champion su ....

Agoda, GSTC, and USAID partner to champion sustainability education for hotels in Asia (left to right): Dr. Bryan Byrne, USAID/India Development Partnerships and Innovations Office, Director; Mr. Omri Morgenshtern, CEO, Agoda; Mr. CB Ramkumar, Vice Chair, GSTC. Digital travel platform Agoda, the Global Sustainable Tourism Council (GSTC), and the United States Agency for International Development […]

Agoda, GSTC, and USAID partner to champion sustainability education for hotels in Asia (left to righ ...

21-Mar-2024

Agoda celebrates Golden Circle Awards across Asia

Agoda celebrates golden circle awards across ....

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuket, Hong Kong, Seoul and Tokyo

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuke ...

11-Mar-2024

Agoda Partner Appreciation Night – Livestream

Agoda partner appreciation night – live ....

Thank you for joining us for industry insights from Agoda’s leaders!

20-Feb-2024

Protected: Agoda Partner Appreciation Night – Livestream

Protected: agoda partner appreciation night & ....

There is no excerpt because this is a protected post.

14-Feb-2024

Agoda Manila hosts ‘Coffee Session’ for Growth Team

Agoda manila hosts ‘coffee session̵ ....

Agoda Manila hosts 'Coffee Session' for Growth Team Partners

Agoda launches the 3rd edition Eco Deals Program at the ASEAN Tourism – Forum

Agoda launches the 3rd edition eco deals prog ....

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has broadened its collaboration with World Wide Fund for Nature (WWF), expanding its Eco Deals Program to support eight conservation projects across Southeast Asia.

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has br ...

More questions?

More support articles available!

Agoda Homes Support

Set up your property with Agoda

Agoda API Documentation

Yield Control System (YCS) Extranet

Policy and terms of use

Content Terms

Cookie policy

Terms of use

Agoda Business Partners Privacy Policy

Agoda NHA Host Privacy Policy

Advertise with us

Agoda Media Solutions

All Languages

This site uses cookies to offer you a better browsing experience and understand how you interact with our Site. Find out more on how we use cookies and how you can change your settings here Cookie Policy .

Learn To Legally Lower Your Taxes, Watch Video🎥

Malaysia Tax Refund: All You Need To Know

Navigating the Malaysian tax refund system can feel like exploring a rainforest without a guide—thrilling yet slightly bewildering.

But fear not, intrepid explorer ! This guide is your trusty compass, pointing you towards the treasure trove of tax refunds awaiting savvy travelers and residents alike.

We’ll cut through the underbrush of regulations and forms, lighting the way to your rightful returns with clarity and a hint of humor.

Let’s dive in!

Understanding Tax Refunds In Malaysia: What Exactly Triggers A Refund?

A tax refund refers to the excess amount of taxes you’ve paid compared to what you owe. This often occurs when taxes are deducted from your monthly income (MTD) , and your total deductions exceed the amount you must pay based on your income bracket.

This surplus typically arises because the monthly deductions don’t consider various tax reliefs you might be eligible for, such as medical expenses or specific purchases that qualify for tax relief, like personal computers, gym memberships, or educational materials.

If your deductions don’t fully account for these additional deductions and credits, you might overpay taxes, leading to a refund from the Inland Revenue Board of Malaysia (LHDN) .

Critical Oversights in Monthly Tax Deductions: What Factors Might Lead to Overpayment of Taxes?

Factors Overlooked by Monthly Tax Deductions:

The essential point is that monthly tax deductions (MTD) fail to consider various tax reliefs. This often results in individuals subjected to MTD paying more income tax than necessary. Here are crucial elements that MTD overlooks:

- Additional Tax Reliefs

- Unforeseen expenses, such as medical costs.

How To Manage Income Tax Refunds In Malaysia: How Do You Make Sure That The Refund Is Received Promptly?

To receive your income tax refund, ensure your bank account details are accurately provided when filing taxes online. Refunds are typically credited directly into your bank account within 30 days after filing.

Since the 2013 tax year , there has been a significant change in refund processing. You’re entitled to compensation if you don’t receive your refund within 30 days.

If eligibility criteria are met, you could receive a 2% compensation. There’s an update for those who opt for cheque refunds but still need to provide their bank details.

Cheque payments are being phased out in favor of a new voucher system, the income tax refund voucher system (BBBC).

These vouchers can only be deposited or cashed at Malaysia’s CIMB and CIMB Islamic branches.

Tracking Your Tax Refund: How Can You Monitor Your Income Tax Refund Status in Malaysia?

To check the status of your tax refund:

- Access your LHDN online e-filing account.

- Navigate to the ‘Services’ tab and select ‘Refund Status.

- Enter your income tax reference number and identity card (IC) number to view your refund status.

Once LHDN has processed your tax refund, you’ll see payment details, including the refund date and amount.

It’s crucial to double-check that the bank account details you’ve provided to LHDN are accurate to prevent any delays or issues with the refund process.

Navigating Malaysia’s Taxable Period: Understanding the Calendar Year for Income Assessment and Tax Refunds

Taxable Period in Malaysia: The period in Malaysia corresponds to the calendar year, from January 1st to December 31st. Income and deductions are assessed based on activity occurring within this timeframe for tax purposes.

Understanding this taxable period is essential when navigating Malaysia’s tax refund process, ensuring taxpayers know the timeframe for evaluating their income and tax liabilities.

Tax Filing Procedures In Malaysia

In Malaysia, tax returns are issued separately to spouses and filed individually. Even if living together, a wife’s income is assessed separately unless she chooses to be taxed jointly with her husband, an option available to residents or Malaysian citizens.

Similarly, a husband without income can opt for joint assessment under his wife’s name.

Individuals in Malaysia adhere to a self-assessment system, where taxpayers are responsible for calculating their own chargeable income and tax liabilities. This includes computing tax payable and settling any outstanding balances.

Tax returns must be submitted by April 30th (for individuals without business income) or June 30th (for those with business income ) of the following calendar year.

E-filing, or online submission of tax returns, is available for convenience. Those who opt for e-filing in a particular assessment year won’t receive a physical tax return form for subsequent years.

Furthermore, individuals whose total income tax matches the amount deducted under the PAYE system may choose not to submit a tax return, provided certain conditions are met.

Understanding these filing procedures is essential when considering eligibility for tax refunds in Malaysia.

Tax Payment Process In Malaysia

In Malaysia, taxes are collected from employees through mandatory salary deductions, following a Pay-As-You-Earn (PAYE) system.

If an individual’s assessed tax exceeds the total amount deducted from their salary upon filing their tax return, they must settle the difference by the submission deadline.

Tax payments for a specific assessment year are due on the following dates in the subsequent year:

- April 30th for individuals earning non-business income.

- June 30th for those with business income.

Understanding this tax payment schedule is crucial when considering the potential eligibility for tax refunds in Malaysia.

✅ Financial Relief: Tax refunds offer individuals a significant opportunity to obtain relief from overpaid taxes.

By reclaiming excess amounts, taxpayers can effectively lighten their financial burden, providing a welcomed respite for budgetary concerns or unforeseen expenses.

✅ Increased Cash Flow: Receiving a tax refund injects additional liquidity into the taxpayer’s finances.

This surge in cash flow can facilitate a range of financial activities, from covering immediate expenses to making investments or bolstering savings for future endeavors.

✅ Incentive for Compliance: The prospect of a tax refund is a compelling incentive for taxpayers to comply with tax regulations diligently.

By accurately reporting income and diligently claiming eligible deductions, individuals enhance their chances of securing a refund and contribute to the integrity and fairness of the tax system.

✅ Support for Taxpayers: A tax refund can provide invaluable support when individuals may have encountered unexpected financial hardships or incurred unanticipated expenses.

Whether offsetting medical bills, addressing home repairs, or covering educational costs, the additional funds can help alleviate financial strain and promote stability.

✅ Stimulus for Economic Activity: Tax refunds have the potential to serve as a catalyst for economic activity.

As recipients utilize their refunds to make purchases, investments, or repay debts, they contribute to the circulation of money within the economy, fueling consumption, investment, and overall economic growth.

Understanding and leveraging the benefits of tax refunds empowers taxpayers to navigate tax exemptions effectively, optimize their financial resources, and contribute to broader economic vitality.

And just like that, we’ve charted a course through the dense jungle of Malaysia’s tax refund system, emerging into the clearing with knowledge and confidence.

Armed with this guide, claiming your tax refund is no longer a daunting expedition but a rewarding journey.

Remember, every ringgit returned is a victory in understanding and navigating the financial landscape of Malaysia.

Happy reclaiming!

But wait, there’s more! You might also be interested in the following:

- Malaysia Tax System: How it works

- Tax Consulting in Malaysia: An Expats Guide

- Tax Number in Malaysia: An Expats Guide

- Make A Complaint

- Registration

- Introduction

- Airline information disclosure

- Automatic add-ons

- Communication of changes in flight status

- Persons with Disability

- Post-purchase price increase

- Price disclosure

- Advertisements

- Terms and conditions

- Denied boarding and Offloaded

- Flight Delays and Cancellations

- Damage of mobility equipment

- Refund Request

- Lost, damaged and delayed baggage

- Introduction and procedure

- Airline and airport contacts

- Make a complaint / Check Status

- Flight Disruptions – COVID-19 FAQs

Consumer / After Your Flight / Refund request

Refund request

Consumers may be unable to fly for any number of reasons, including medical reasons, death and other emergencies or travel disruptions. Consumers may request for a refund due to not being able to travel, however the refund value depends on whether the ticket is a refundable ticket or a non-refundable ticket.

In many cases for non-refundable tickets, the ticket will lose its value with the exception of the airport tax or government-imposed taxes. Consumers may claim a refund of the airport tax or government-imposed taxes since the airport facilities were not used. Airlines may however charge a processing fee of up to 5 per cent based on the airport tax or government-imposed taxes. The refund shall also be reimbursed via the original mode of payment.

As for refundable tickets, airlines are not allowed to charge an additional five per cent refund processing fee. The Terms and Conditions for a refundable ticket will apply.

The refund must be remitted to the consumer within 30 days from the initial request date.

For tickets purchased with a travel agent or through an online travel website, the airline must remit the refund to the travel agent within 30 days from the submission date by the travel agent.

Illustration 1

Lee purchased a ticket to Brussels from ABC Airline’s website for RM9,500. Unfortunately, due to the passing of a family member, he is unable to travel. The ticket has a refund value, however the airline charges a refund fee of RM500.

What should the refund value be?

As the refund is based on the Terms and Conditions of the ticket, the refund fee would be applicable. Lee will be entitled for a refund of RM9,000.

ABC Airline is not be allowed to charge an additional five per cent based on the airport tax or government-imposed taxes.

Illustration 2

Logan purchased a ticket to Langkawi from ABC Airline’s website for RM500. One day before his flight, he fell sick and his doctor advised him not to travel. The ticket purchased is a non-refundable ticket.

As Logan purchased a non-refundable ticket, he would be entitled to a refund of the airport tax minus the processing fee (up to five per cent). The passenger service charge or airport tax should be refunded via the original mode of payment.

Illustration 3

Ali purchased a ticket to Bali from an Online Travel Agent. He missed his flight with ABC Airline due to a medical reason and is requesting for a refund of the ticket from the airline.

Is Ali entitled for a refund?

Ali must first contact the Online Travel Agent for the refund request. The Terms and Conditions and refund policy set between the Online Travel Agent and the consumer will apply. Should a refund be applicable, ABC Airline will remit the money to the Online Travel Agent within 30 days.

Pendaftaran HANYA untuk syarikat yang telah diperbadankan di Malaysia

1. Sila gunakan pelayar Chrome (Incognito mode) atau Firefox ( Private mode) untuk memastikan kelancaran aplikasi ini.

2. Pastikan dokumen sokongan dikepilkan bersama permohonan.

3. Sekiranya permohonan anda berjaya dihantar, halaman Terima Kasih akan terpapar serta merta dan e-mel pengesahan akan diterima daripada MAVCOM.

4. Sekiranya ralat “ Authentication Required ” terpapar ketika anda mengisi permohonan, borang online ini mungkin telah disekat oleh ‘ firewall’ syarikat anda. Anda dinasihatkan untuk menggunakan kaedah lain untuk melayari internet (contoh: ‘hotspot’ telefon bimbit anda).

Terus ke pendaftaran

Registration is ONLY Applicable to companies incorporated in Malaysia

1. Use Chrome’s Incognito or Firefox’s Private modes for improved browsing experience.

2. Attach the required supporting documentation to ensure efficient processing.

3. After successfully submitting the form, you will see the Thank You page and receive an acknowledgement email from MAVCOM.

4. If, during the registration, you receive an “ Authentication Required ” error message, your corporate firewall may be blocking the registration form. You are advised to use alternate connectivity means e.g (mobile data ( tethering )).

Continue to registration

Anda akan ditujukan ke laman web www.flysmart.my untuk membuat aduan.

You will now be redirected to www.flysmart.my for your complaint submission.

Terima kasih kerana melawat laman web Suruhanjaya Penerbangan Malaysia (MAVCOM). Laman web Bahasa Malaysia sedang dikemaskini.

Untuk membuat aduan, sila klik pada butang ‘Buat Aduan’. Jika anda ada sebarang pertanyaan, sila hubungi kami di [email protected] .

Selamat melayari laman web kami.

Hal Ehwal Pengguna , Pengurus Kanan

- Su-N merupakan Felo Persatuan Akauntan Bertauliah (ACCA). Beliau mempunyai pengalaman melangkaui 11 tahun dalam bidang perundingan pengurusan, pengurusan projek, tadbir urus serta peningkatan prestasi.

- Semasa beliau di MAVCOM, beliau telah mengetuai pembangunan dan implementasi Kod Perlindungan Pengguna Penerbangan Malaysia 2016 (MACPC), iaitu kod perlindungan pengguna pertama yang khusus untuk industri penerbangan Malaysia. MACPC menggariskan hak-hak pengguna penerbangan dengan jelas.

- Su-N juga telah mengetuai unit pembangunan rangka kerja untuk meningkatkan tahap perkhidmatan dan kualiti lapangan terbang. Rangka kerja kualiti perkhidmatan ini sedang diperkenalkan dan dilaksanakan di lapangan-lapangan terbang Malaysia.

Su-N adalah Alumni MAVCOM yang bekerja di Suruhanjaya sehingga Ogos 2018.

Prof. Dr. Jae Woon (June) Lee

Assistant professor, faculty of law, chinese university of hong kong (cuhk).

Dr. Jae Woon Lee is an Assistant Professor in the Faculty of Law at The Chinese University of Hong Kong. He has been working, teaching and researching in the field of aviation law and policy since 2004. Born in Seoul and educated there as well as at McGill University (LLM) and National University of Singapore (PhD), his main research and teaching interests are aviation law and competition law. Prof. Lee has seven years of legal affairs experience in the airline industry, advising the company on issues relating to company liability, government regulation and competition law matters. He has acted as legal advisor to the Korean Government on aviation law issues and regularly attended the International Civil Aviation Organization (ICAO) Legal Committee as a Korean delegate. He is a member of ICAO Secretariat Study Group on Legal Issues related to Pilotless Aircraft (SSG-LIPA) Prof. Lee has published on various aviation legal issues in both major air law journals and other leading journals. He serves on the editorial board of the Annals of Air and Space Law and is the editor of the book: Aviation Law and Policy in Asia: Smart Regulation in Liberalized Markets (2021). Prof. Lee has served as a consultant/expert to government and international agencies, including the European Union Aviation Safety Agency, International Air Transport Association and the Hong Kong Competition Commission. He frequently presents at academic and aviation industry conferences and regularly comments in the media.

Dato’ Mah Weng Kwai

Former commissioner, malaysian aviation commission.

YBhg. Dato’ Mah Weng Kwai is a former judge of the High Court of Malaya and the Court of Appeal. Upon retirement, he was appointed as Commissioner of the Human Rights Commission of Malaysia (SUHAKAM) from 2016 to 2022, a member of the Judicial Appointments Commission and a Commissioner of the Malaysian Aviation Commission (MAVCOM). In 2021, he was appointed an independent Director and Chairman of the Securities Industry Dispute Resolution Centre. YBhg. Dato’ Mah was President of Malaysian Bar (2001 – 2003) and President of Law Association for Asia and the Pacific (LAWASIA) (2006 -2008) and is presently a consultant in the law firm of MahWengKwai & Associates. He is an Arbitrator on the panel of the Asian International Arbitration Centre (AIAC).

Amna Arshad

Head of u.s. aviation regulatory practice, special counsel, freshfields bruckhaus deringer.

Tan Sri Bashir Ahmad

Asia-pacific regional advisor of airports council international (aci) world governing board.

Mohideen Abdul Kader

President, consumer association penang (cap).

Elected as president of CAP since 2019, superseding CAP’s former president, S.M. Mohamed Idris. CAP is a grassroots non-profit, civil society organisation based in Malaysia, established in 1969 to promote critical awareness and action among consumers in order to uphold their rights and interests. CAP’s activities are conducted from its office in Penang, engaging in education, community mobilisation, research, advocacy, training and publication. Mohideen is a passionate and outspoken leader of CAP who is often pro-active in urging the government, policy makers and corporations and agencies to respond to the needs of consumers. He has written numerous opinion pieces in the media to express his views on various matters pertaining to consumers’ rights and needs.

Professor Emeritus Dato’ Dr. Sothi Rachagan

Mavcom consumer protection committee member.

Michael Gill

Director of legal bureau, international civil aviation organisation (icao).

Mr. Michael Gill is a UK and French national. He was appointed as Director, Legal Affairs & External Relations Bureau at ICAO in September 2021. From 2013 until this year, he served in the dual roles of Director, Aviation Environment at the International Air Transport Association (IATA) and Executive Director of the Air Transport Action Group (ATAG) in Geneva. From 2007-2013, he was Senior Legal Counsel in IATA, supporting its external affairs portfolio. Before joining IATA, Michael was an aviation lawyer in private practice in London and Paris, acting for airlines and their insurers. He holds law degrees from King’s College, London and the Sorbonne University in Paris, as well as a Master’s degree from the University of Edinburgh. He is admitted as a Solicitor in England & Wales and an Avocat in France. Michael is a Fellow of the Royal Aeronautical Society and former Chairman of its Air Law Group.

Peter Alawani

Chief economic regulatory framework section, air transport bureau, international civil aviation organisation (icao).

Broadcast Journalist

Stefano Baronci

Director general of airports council international (aci) asia-pacific.

Ridha Aditya Nugraha

Air and space law studies, universitas prasetiya mulya indonesia.

Ridha Aditya Nugraha teaches Air and Space Law Studies at International Business Law Program, Universitas Prasetiya Mulya, Indonesia. In 2019-2020, he was engaged as ASEAN Passenger Protection Support Expert at the EU-EASA ARISE Plus Civil Aviation Project in ASEAN. Before joining academia, he worked with a Jakarta-based law firm, a Dutch low-fare airline, and a Danish international consulting firm. He has also an experience with a Singapore-based aviation consultant. He holds graduate degree from International Institute of Air and Space Law, Universiteit Leiden; and undergraduate degree from Faculty of Law, Universitas Indonesia.

Vinoop Goel

Asia-pacific regional director of airports & external relations, international air transport association (iata).

Vinoop Goel is the Asia-Pacific Regional Director of Airports & External Relations for the International Air Transport Association (IATA). He is based at their Asia-Pacific regional office in Singapore. Vinoop leads a team that is responsible for all IATA’s activities in the Asia-Pacific region relating to Airports including Infrastructure development, Passenger Facilitation, Cargo and Security. In addition to this, Vinoop also heads the Member and External Relations department for the region that is responsible for Sustainability, Government Regulations and Aviation policy matters. Vinoop has a degree in Computer Science and Engineering from India Institute of Technology (IIT), Delhi in India. He has more than 3 decades of aviation industry experience including a 14-year stint in Japan and has been with IATA since 2005.

Soukkhongthong Voraphet

Director of air transport division, department of civil aviation of laos pdr.

Mr. Voraphet has 10 years working experience in the aviation industry. In 2019, he earned his Advanced Master in Air Transport Management and Specialised Executive Master of Air Transport Management having completed his thesis on ‘Challenges and Opportunities to develop Air Transport in the Lao PDR’.

Pushpalatha Subramaniam

Director of consumer affairs, malaysian aviation commission (mavcom).

Mdm. Pushpalatha Subramaniam heads the Consumer Affairs Department in MAVCOM. In 2015, Pushpa was part of the establishment on the Malaysian Aviation Commission for Malaysia. She has been instrumental in establishing the first Malaysian Aviation Consumer Protection Code (MACPC) in 2016 in Malaysia, a regulation to protect travellers in the civil aviation industry. Under her leadership, she had led the implementation of various consumer awareness and education initiatives, empowering travellers with information on their travel rights under the MACPC. In addition, her team has consistently achieved more than 90 per cent resolution of consumer complaints since the first year of MAVCOM’s operation. Pushpa also leads the development of the Airports Quality of Service (QoS) Framework and oversees the implementation of the Framework with the aim of enhancing passenger’s convenience and comfort, more importantly ensuring efficiencies at airports in Malaysia. The QoS has been implemented at both the terminals at KLIA and work is still in progress for other airports in Malaysia. Prior to this, she was the Senior Vice President in charge of customer experience in Malaysia Airlines (MAS) and later, Head of Customer Experience with Standard Chartered Malaysia. Pushpa has more than 27 years of experience in the airline industry with niche expertise in managing consumer affairs. Pushpa holds a Bachelor’s in Business Administration (BBA) degree from the Royal Melbourne Institute of Technology (RMIT), Australia. She also spent five years on the Board of the Worldwide Airline Customer Relations Association (WACRA) and is a member of the International Aviation Women’s Association (IAWA).

Olivier Waldner

Deputy head of unit passenger rights, directorate general for mobility and transport european commission (eu).

Saravanan Thambirajah

Chief executive officer, federation of malaysian consumers associations (fomca).