Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

What is a known traveler number on a global entry card.

You've been approved for Global Entry and are now wondering how to use your Global Entry card when traveling. You may also be wondering about the Known Traveler Number (KTN) that appears on your Global Entry card and how it works.

Your Known Traveler Number (KTN)

Global Entry helps expedite United States entry for travelers and provides TSA PreCheck as part of its membership benefits. TSA PreCheck provides expedited security checks at about 200 select U.S. airports.

If you have a Global Entry or TSA PreCheck membership (or both), the nine-digit Known Traveler Number is used to identify you when booking travel. When you enter a participating entry point, this number can help you pass through the expedited security lane. That's why you may want to include your KTN when filling out your profile for frequent flyer travel accounts and buying plane tickets.

Where is the known traveler number on your Global Entry card?

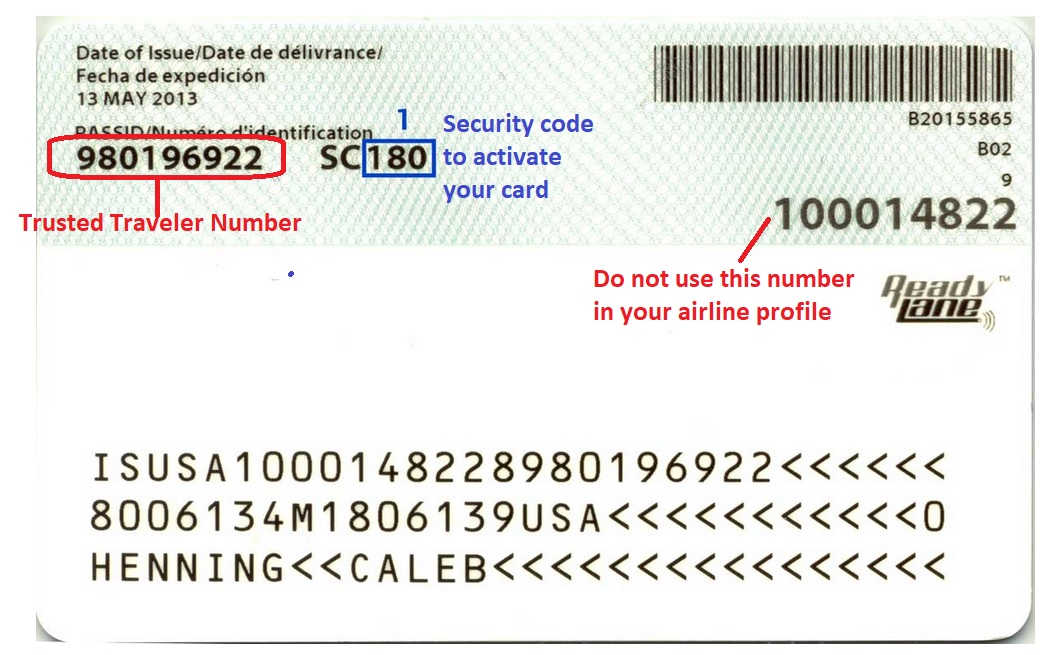

You'll likely want to know where to locate your KTN when it's time to book a flight. If you have a physical Global Entry card, you can find your Known Traveler Number on the back. It's designated as a PASSID number, made up of nine digits.

You can usually find your KTN on the TSA or Trusted Traveler Program (TTP) websites as well. If you've used your Known Traveler Number to travel before, you can check your account with the airline you used for that trip should you have one. Airlines maintain a record of when KTNs are used, so this can sometimes work as a backup.

How do I get my Known Traveler Number?

Applying for Global Entry membership is one way to get a Known Traveler Number, but it's subject to approval and there's a fee. Here's how to apply:

- Join the Trusted Traveler Program on the Department of Homeland Security website.

- Complete the application for Global Entry once logged in to your account.

- Pay the application fee of $100 for a 5-year membership (as of May 2024).

- Set up an interview at an enrollment center.

- Bring along your government-issued ID and complete the in-person interview.

Can you add a Known Traveler Number after booking?

Yes, you can add your Known Traveler Number after booking a flight. At any point up to the travel date, and sometimes even that same day, you can contact the airline to add your KTN.

You can call a customer service representative for your airline. Once your Known Traveler Number is linked to your airline account, it will appear on plane tickets purchased through that account.

When does my Known Traveler Number expire?

Your Known Traveler Number expires five years after your application is approved. Many recommend starting the renewal process about six months prior to that expiration date. It's possible you'll be called for an interview as part of the renewal process. Note your membership extends from the expiration date regardless of when you renew.

The renewal process follows the same process as applying, including the current fee of $100. After finishing the renewal application, make sure to click on the option to certify your account renewal. Then you can check your Trusted Traveler Program (TTP) account periodically for any updates.

If you're required to do another interview, you'll receive an email informing you of this. Once your renewal is approved, you will get an email and your former Global Entry account expiration date will become the start date for your new annual membership.

The Known Traveler Number on your Global Entry card can come in handy when it's time to fly. That's because your KTN identifies you for expedited entry in participating airports. This could grant you more time for dining or shopping with credit cards like Chase Sapphire Reserve ® .

You can find your Known Traveler Number either on the back of your Global Entry card or by accessing your Trusted Traveler online account. You can input these nine digits when you purchase tickets, and/or set up or sign into your associated airline accounts, so your Known Traveler Number can help expedite your next trip across the globe and back.

- card travel tips

What to read next

Frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

UponArriving

Known Traveler Number Guide: (How to Lookup, Global Entry, Pre-Check) [2023]

This comprehensive article will tell you everything you need to know about your Known Traveler Number.

I’ll cover how you can get one and the best way to do that with programs like TSA Pre-Check and Global Entry. I’ll show you how to look-up your Known Traveler Number and add it to your travel itineraries with airlines like United, Southwest, and Delta.

Finally, I’ll explain the differences between a Known Traveler Number and a Redress Number.

Table of Contents

What is a Known Traveler Number?

A Known Traveler Number, also called your “KTN,” is a 9-digit number used to link your TSA Pre-Check enrollment to your travel itinerary in order to ensure that you can receive TSA Pre-Check benefits like expedited security screening.

This is the same number used for other trusted traveler programs, such as Global Entry, NEXUS, and SENTRI . However, for these latter programs, this number is known as your “PASSID.”

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Why do you want a Known Traveler Number?

With a Known Traveler Number, you can participate in TSA Pre-Check, which means you’ll be able to breeze through security at airports.

How do you get a Known Traveler Number?

You can get a Known Traveler Number by signing up, getting approved, and paying the fees for any of the following programs:

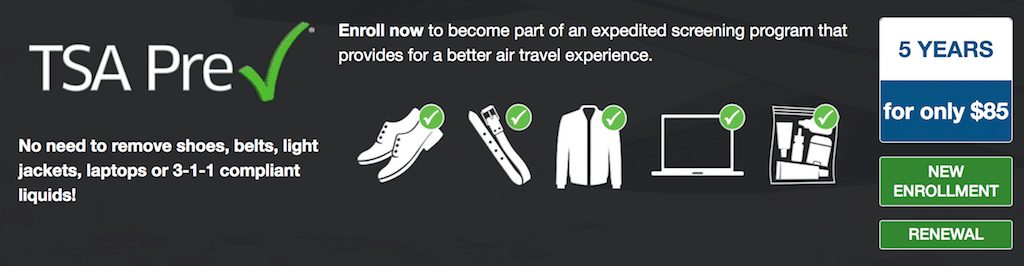

TSA Pre-Check

Global entry.

As already discussed, TSA Pre-Check will usually get you through airport security in a breeze.

You’ll usually get access to a priority security line which is often much shorter than the standard security line (though not always, unfortunately).

You’ll also be able to go through a less restrictive and invasive screening process. You often only have to pass through a traditional metal detector (as opposed to the full-body scanners) and you also get to enjoy the following benefits:

- Shoes can stay on

- Belt can stay on

- Light jackets can stay on

- Laptops allowed to stay in bag

- Liquids ( 3-1-1 Rule ) can stay in bag

This program costs $78 to enroll for five years and it does not require the extensive interview process that Global Entry requires. There are multiple ways to get TSA Pre-Check for free and you can read about those here.

Global Entry would be my preferred method for obtaining a Known Traveler Number. That’s because not only will you get TSA Pre-Check, but you’ll also get expedited entry at Customs and Immigration when making your way back into the US.

This program does require you to attend an interview to be approved but the interview process is not difficult at all . If you’ve got a clean criminal history and come prepared with your documents then you should pass the background check and interview without any issues at all.

In some cases this “interview” process will only take about five minutes total.

You might get asked some very basic questions like what countries you have visited and whether or not you have traveled for business or pleasure. It’s hardly anything close to an interrogation in most cases.

The hardest part is often scheduling the interview because availability can be limited and in some cases it might take weeks (or even months) to find an open slot.

Luckily, some airports offer interviews upon arriving from international locations. So if you have some international travel coming up, this can be one of the easiest ways to get approved for Global Entry.

There are many credit cards that come with a $100 statement credit for your Global Entry application fee, so it’s very easy to get this program for free. My personal recommendations for getting a $100 statement credit for your Global Entry/TSA Pre-Check is to go with the United Explorer Card. It has great perks and a low annual fee and you can read more about it here!

Since you’ll get both TSA Pre-Check and expedited entry back into the US, I think Global Entry is the way to go for many people.

NEXUS is a joint program between the US and Canada that will grant pre-approved, low-risk travelers expedited entry into both Canada and the US. Specifically, membership in the NEXUS program allows you to reduce your wait times at designated ports of entry by:

- Using dedicated processing lanes at land border crossings

- Using NEXUS kiosks when entering Canada

- Using their card in dedicated SENTRI lanes along the U.S.-Mexico border

- Using Global Entry kioks when entering the United States, and

- Calling a marine telephone reporting center to report your arrival into the United States and Canada

You may also be granted access to the Canadian Air Transport Security Authority (CATSA) Security Line at some Canadian airports to expedite airport pre-boarding security screening. (This is like a Canadian version of TSA Pre-Check.)

Just like Global Entry, NEXUS will require you to clear a background check. The difference is that this background check also is submitted to Canadian authorities, such as the Canadian Security Intelligence Service (CSIS), Royal Canadian Mounted Police (RCMP).

One of the major draws to the NEXUS program is that the application fee is only $50 . This is surprising since NEXUS comes with both Global Entry and TSA Pre-Check, which cost $100 and $85 respectively. For people who live near or travel between the US/Canada border, NEXUS is an especially attractive bargain.

The Secure Electronic Network for Travelers Rapid Inspection (SENTRI) is a U.S. Customs and Border Protection (CBP) program that allows expedited clearance for pre-approved, low-risk travelers upon arrival in the United States.

You can enter the United States by using dedicated primary lanes into the United States at Southern land border ports so this is a program you might be interested in if you’re traveling between the US and Mexico a lot.

You might be a little overwhelmed with all of the different Trusted Traveler programs and perhaps you’re not sure which program you should sign-up for.

If that’s the case you can check out this TSA tool which can help you narrow down what program is most ideal for you based on your citizenship, number of flights, and travel destinations.

Other related travel programs

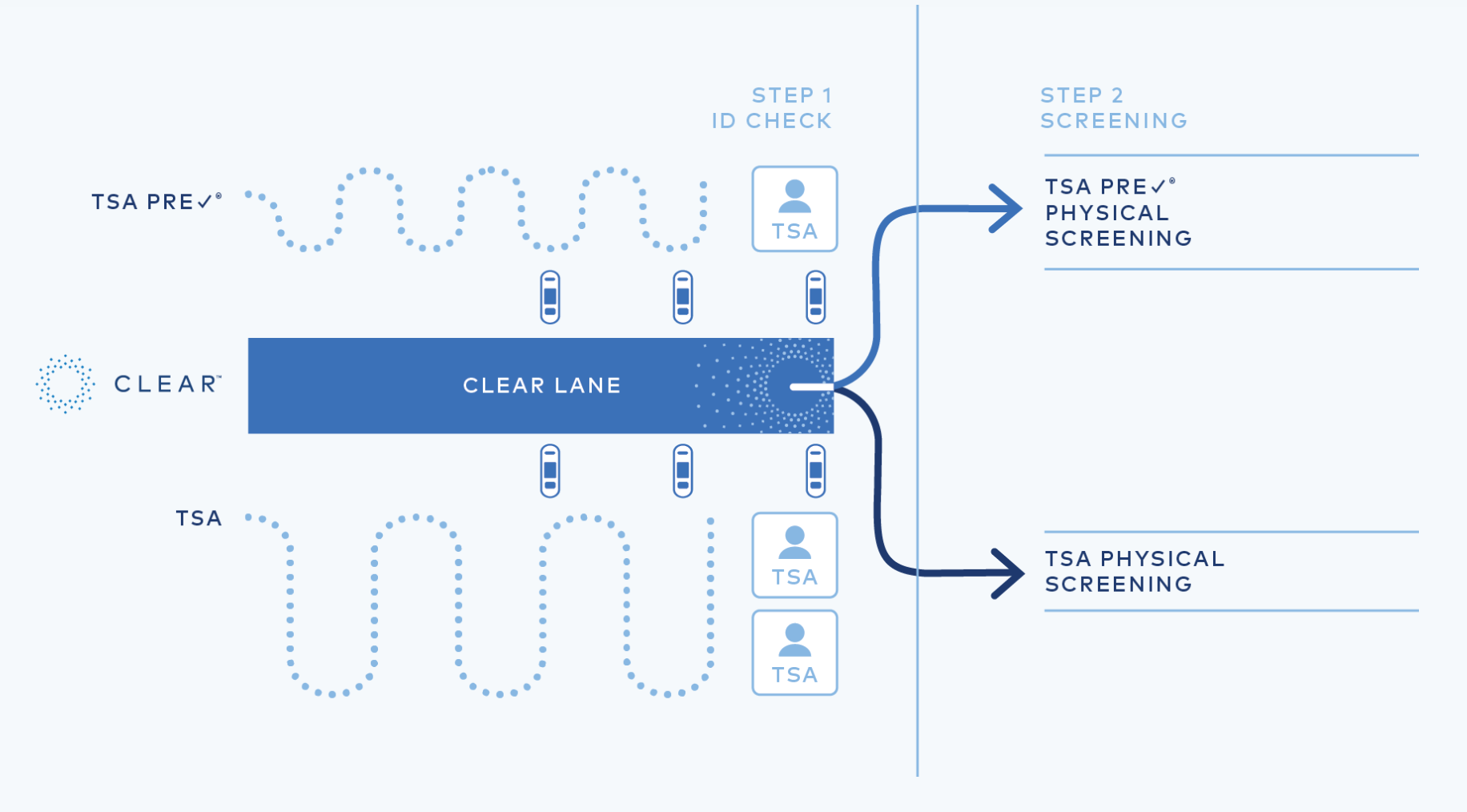

CLEAR is a privately owned service offered to passengers that allows them to bypass the lines going into airport security, whether you are going into the standard security line or the TSA Pre-Check line.

In order to use it you find the CLEAR line leading to security which should have little to no line and then you simply scan your boarding pass and biometric data and then you’re off to the races and able to skip whatever line you would have been waiting on. You don’t even have to show your ID.

CLEAR can be great for frequent flyers in busy airports but it’s not cheap at $179 per year (though cheaper promos are often available). This program does not require you to have a Known Traveler Number.

Mobile Passport

Launched in the fall of 2014, Mobile Passport Control is an app, developed by Airside Mobile and Airports Council International-North America in partnerships with CBP, that you can download to use in order to expedite your entry into the US. It’s available in the Apple App Store and Google Play .

It’s free to use and can be just about as good as Global Entry at some airports, though I’d still take Global Entry over Mobile Passport.

That’s because Global Entry gets you Pre-Check and also allows you to get through customs AND immigration while Mobile Passport often only get your priority access through immigration. This program also does not require you to have a Known Traveler Number.

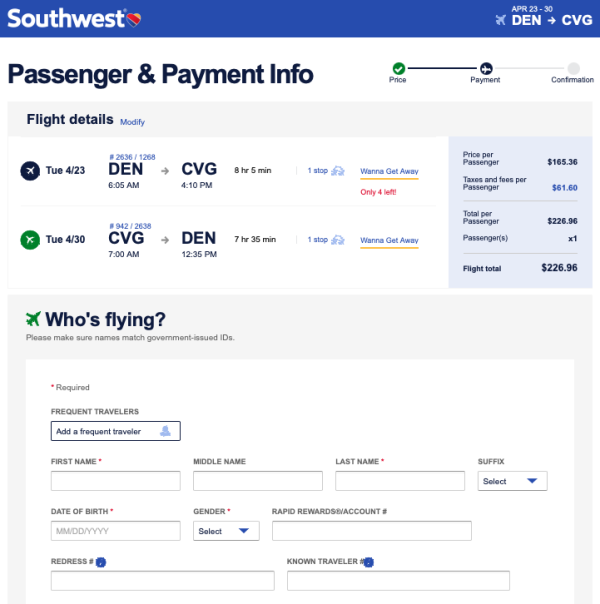

Adding a Known Traveler Number

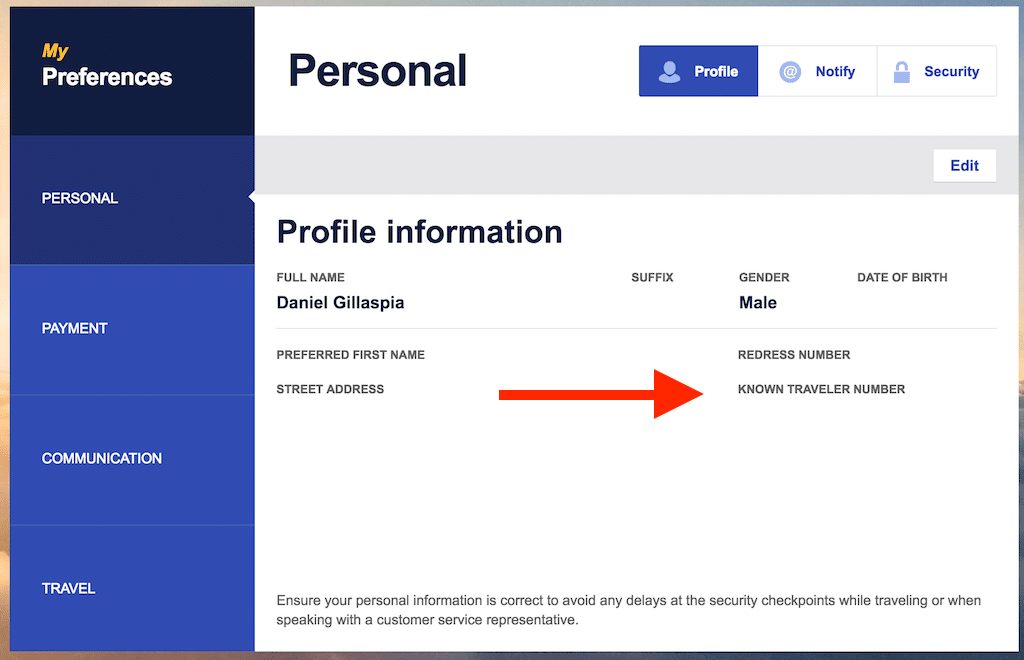

Once you have your Known Traveler Number, you’re going to need to add that number to your travel profiles for the various airlines so that your Known Traveler Number will automatically show up in your itineraries.

However, you should note that your Known Traveler Number will NOT automatically show up in all of your travel itineraries.

Many people assume that once they add their Known Traveler Number to their profile, it will always show up but that’s not the case. So you always need to double check that your KTN was added.

Below, you can see how to add your Known Traveler Number to some of the major airlines. For whatever reason, it is not always the easiest thing to do since you often have to click around a lot.

Usually you can find where to input it if you just look for your profile and a button allowing you to edit your profile, but the steps below should help you locate this.

American Airlines

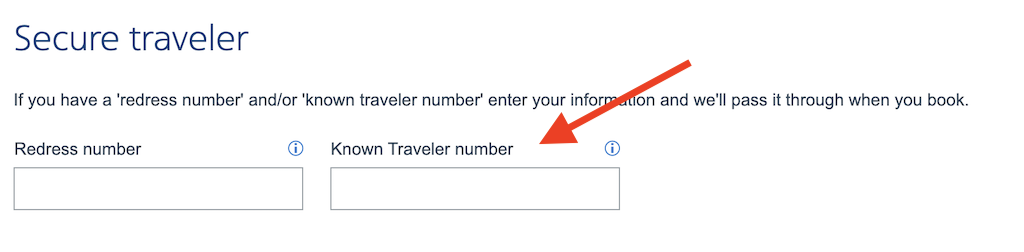

Sign in to your American Airlines account and then click on your name at the top of the page. Then click on “your account.” Next, click on “edit account” and then click on “Information and password.” Scroll down and then under “Secure traveler,” you will see where to input your Known Traveler Number.

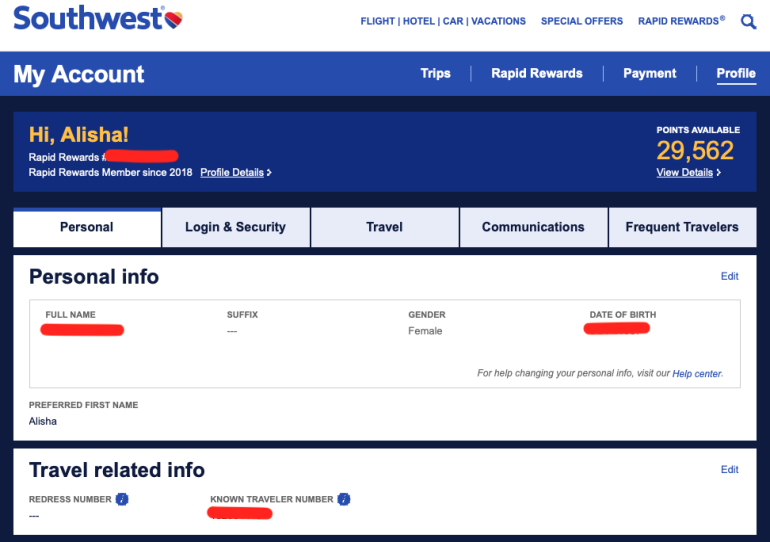

Sign in and click on “My Account” and then scroll to “My Preferences” to change your personal details within your profile information.

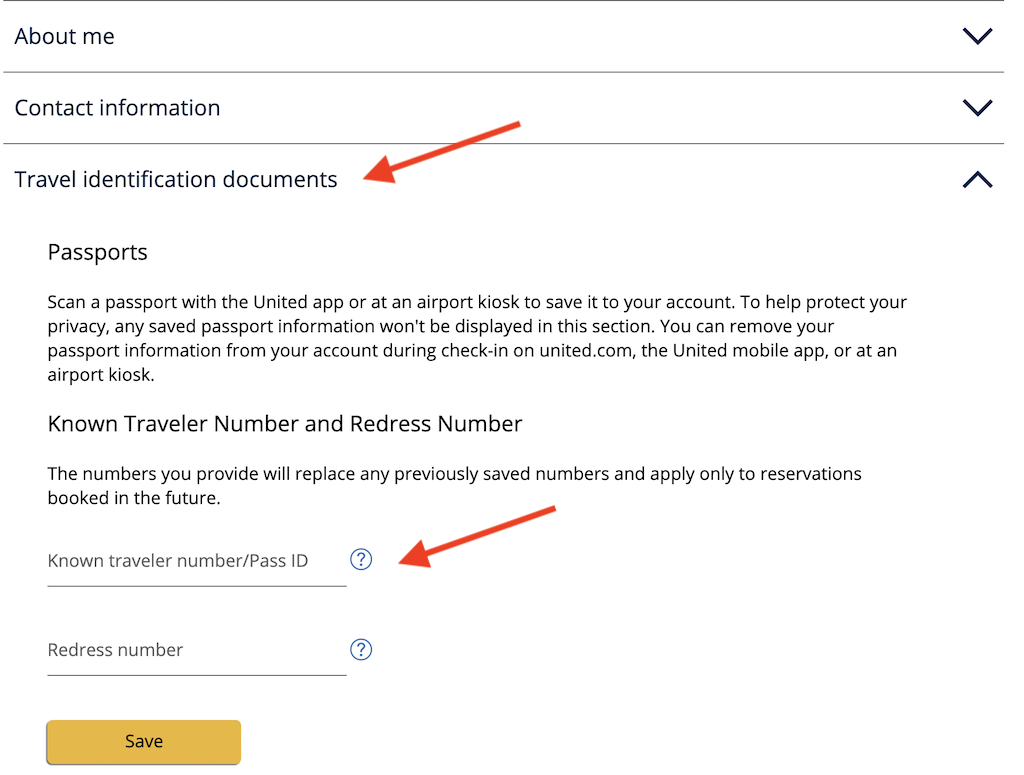

Sign in and click on Profile and Preferences and then click on “Travel identification documents” and then you’ll see the area to enter it in below.

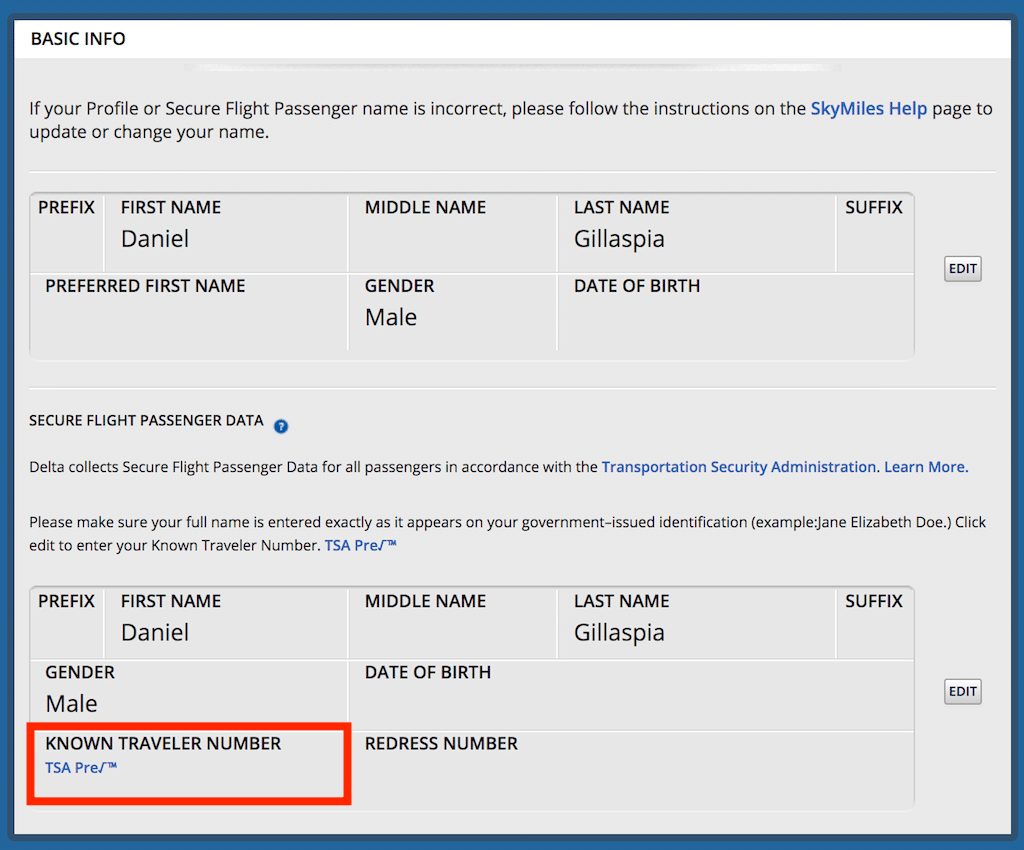

Go to the Delta website and log-in and then proceed to My Delta -> My Profile -> Basic Info. You’ll then see a field where you can input your Known Traveler Number.

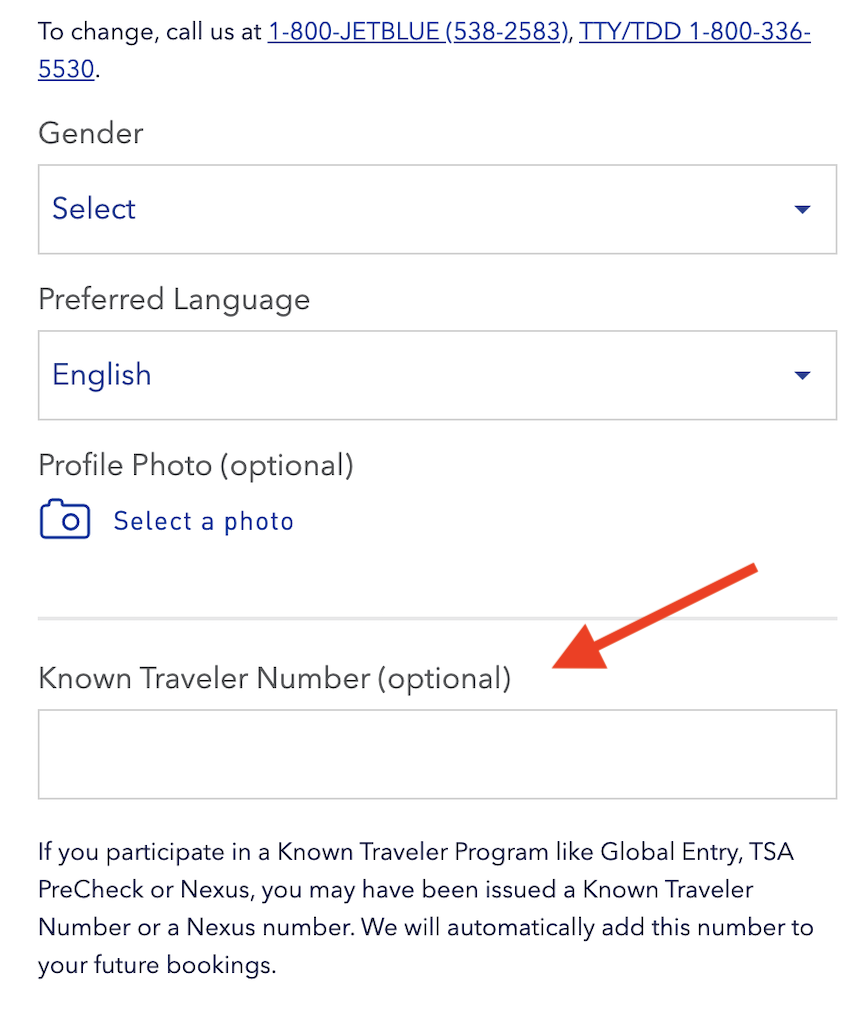

First, sign in to your JetBlue account. Click on the arrow in the upper right corner by your name and then click on “Edit profile.” Scroll down and you will see where to input your information.

Hawaiian Airlines

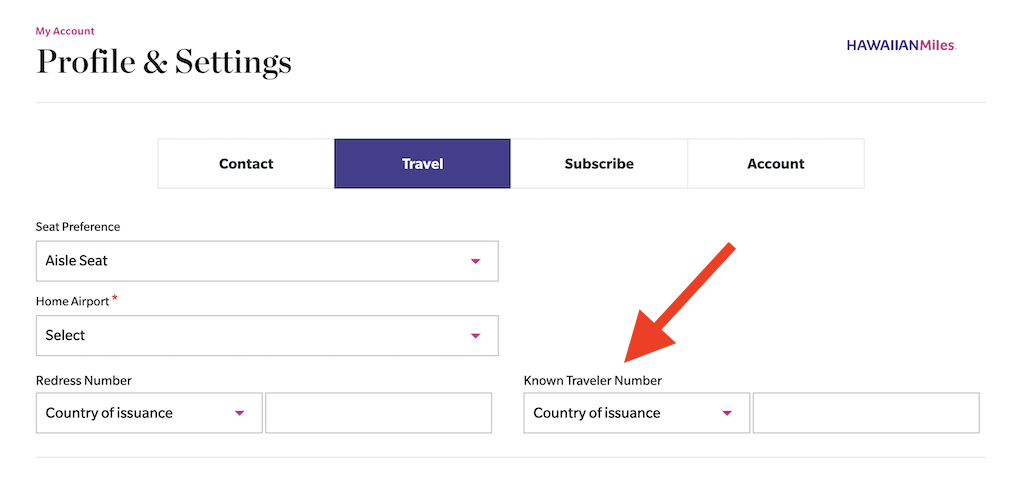

First, sign in to your Hawaiian Airlines account. Go to My Account and under that click on “Profile & Settings.” Click on the travel tab and you will see where to input your information.

Travel portals and OTAs

Most online travel agencies (like Expedia) will allow you to enter in your Known Traveler Number into your profile which should populate into your itinerary when you make a booking.

But since you’re dealing with a third party, you should always verify that your number was properly included in your booking.

Add Known Traveler Number after booking?

If you add your Known Traveler Number to your profile after you make a flight reservation, there’s a good chance that your flight itinerary is not linked to your Known Traveler Number and you won’t get TSA Pre-Check.

In that case, you should be able to call up the airline and request for them to input your number into your itinerary.

You could also just wait until you arrive at the check-in desk for baggage and request for your Known Traveler Number to be added to your boarding pass.

Also, sometimes you’ll have to re-add your Known Traveler Number to specific itineraries. It’s not always clear why this happens but sometimes you’ll just have to do it.

If you ever are given a boarding pass without TSA Pre-Check on it and you know you have a TSA Pre-Check membership, simply approach an agent at the check-in desk and tell them you would like to add your Known Traveler Number.

It’s usually no problem for them to do this and they can re-issue you a boarding pass in a couple of seconds that has TSA Pre-Check.

For the reasons above, I highly recommend that you keep your Known Traveler Number somewhere easily retrievable like in your smart phone in a folder or app that you won’t forget about and can quickly pull up.

Where can I look up and find my Known Traveler Number?

If you are a member of the TSA Pre-Check Application Program you can, look up your KTN online .

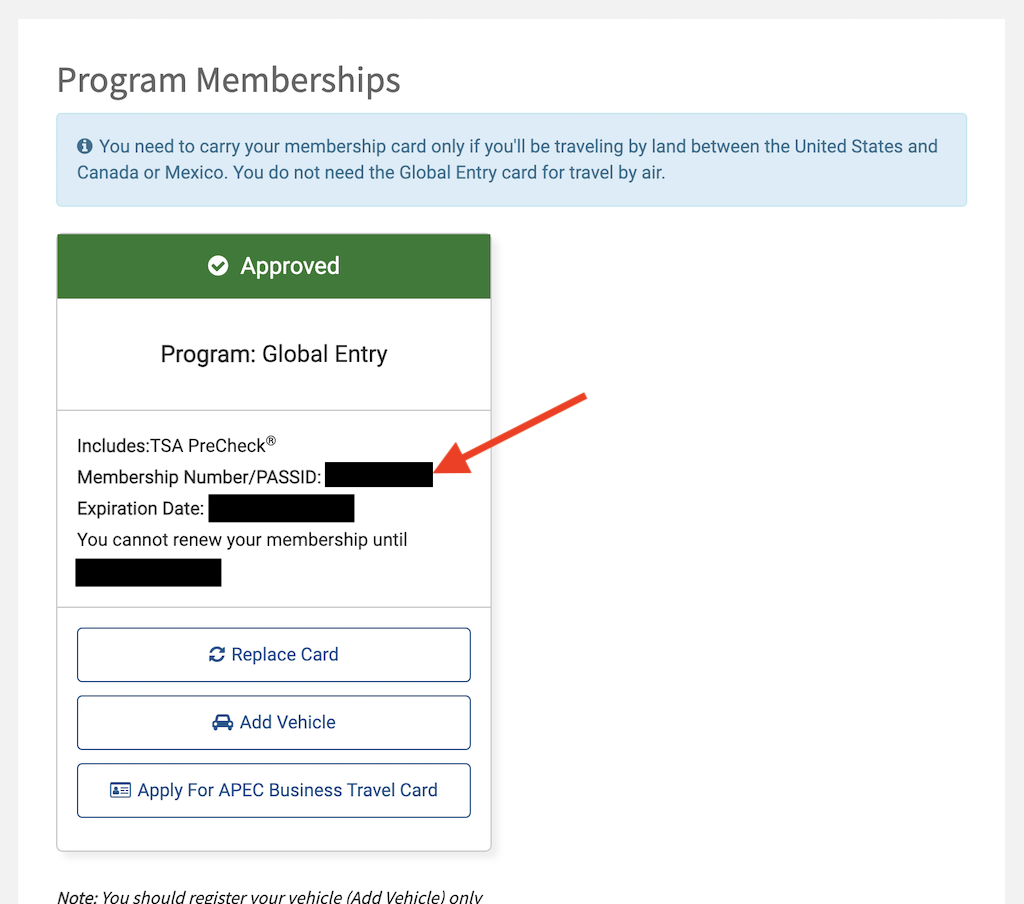

If you are a member of another trusted traveler program, such as Global Entry, NEXUS, or SENTRI, log on to the Trusted Traveler Program website to obtain your PASSID, which once again is the same as your KTN.

You’ll find it right under “Program Memberships.”

You can also check the back of your trusted traveler cards for your PASSID. Note that TSA does not issue an ID card like Global Entry, NEXUS, and SENTRI do.

Related: Can You Get Through TSA and Fly with No ID?

.jpg)

What is a redress number?

You might also be wondering about a redress number since that field often shows up near where you input your Known Traveler Number.

A redress number is the record identifier for people who apply for redress through the DHS Travel Redress Inquiry Program (DHS TRIP) .

“DHS TRIP is for travelers who have been repeatedly identified for additional screening and who want to file an inquiry to have erroneous information corrected in DHS systems.”

For example, someone might share the same name as another person on a no-fly list and that might bring up a red flag every single time this unfortunate traveler attempts to board a plane.

The redress number will help those people avoid additional searches, pat downs, and questioning in the future.

So in case you were wondering a redress number really has nothing to do with your Known Traveler Number.

Known Traveler Number for Military members

If you are a member of the military, you can utilize TSA Pre-Check for free.

Members of the U.S. Armed Forces can get expedited screening including those serving in the U.S. Coast Guard, Reserves, and National Guard.

This can be done by using the official Department of Defense (DoD) identification number when making flight reservations. Your 10-digit DoD ID number is located on the back of your Combined Access Card ID and it is not the same as your SSN. Read more about how to utilize this benefit here.

TSA Pre-Check vs Global Entry

Now that you’re aware of all of the benefits you might be wondering whether or not you should choose TSA Pre-Check or Global Entry.

The answer to this question depends a lot on your personal preferences.

If you are only going to be traveling within the US then your need for Global Entry will be nearly zero.

In that case, getting TSA Pre-Check should be just fine. The only drawback to that is that if an unexpected trip comes up you’ll lose out on the benefit you could have had with Global Entry.

On the other hand, if you’re going to be traveling internationally then you might want to think about Global Entry since it will save you a lot of time getting back into the country.

The two drawbacks to Global Entry are that it requires you to attend an interview and that the background check can be tough to clear if you have anything on your record like a DWI, DUI, etc.

Known Traveler Number FAQ

The easiest way would be to get approved for TSA Pre-Check .

No, you do not need a Known Traveler Number for CLEAR?

At the time of booking, you will typically see a field where you can enter your Known Traveler Number. In addition, you can add your Known Traveler Number to your frequent flyer profile. If you are at the airport, you can also ask an agent to add your Known Traveler Number to your boarding pass.

There is no practical difference and these are essentially the same.

As you can see, getting a Known Traveler Number can be very easy and can even be done for free with the right credit card.

I recommend going with a program like Global Entry to get your PASSID/Known Traveler Number and using a credit card with a $100 credit for Global Entry.

If you always keep your Known Traveler Number with you at all times you’ll be able to add it to your boarding pass when needed and there shouldn’t be any major issues.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

I only travel to the States. Which one should I apply. I read and I see so many type to apply. Quite confusing. Truly appreciate if you can advise . Thank you Regards Teresa

If you don’t travel outside the US, TSA Pre-Check is a solid option.

Can we get KTNs at West Palm Beach International Airport or a post office in Boynton Beach Florida?

Comments are closed.

Privacy Overview

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

I forgot my Known Traveler Number (KTN). How do I find it?

If you are a member of the TSA PreCheck® Application Program, look up your Known Traveler Number (KTN) here .

If you are a member of another trusted traveler program, such as Global Entry, NEXUS, or SENTRI, log on to the Trusted Traveler Program website to obtain your PASSID, which is your KTN.

If your TSA PreCheck® benefits come through HME, TWIC®, or DoD, please visit these respective links for additional information: HME , TWIC® , DoD .

If your TSA PreCheck® benefit comes through TSA PreCheck® for DHS employees, please visit TSA PreCheck® for DHS Employees | TSA PreCheck® for additional information.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- At the airport

- Security checkpoints

Global Entry

Breeze through u.s. customs with global entry.

Global Entry is a program from U.S. Customs and Border Protection (CBP) that allows low-risk, pre-screened international travelers to expedite entry into the U.S.

If you have Global Entry, upon arrival in the U.S. you can bypass passport control lines and paper customs declarations by going directly to a Global Entry kiosk.

To use Global Entry, you must first be approved for the program and go through a rigorous background check and in-person interview. Once you’re approved, you’ll also receive TSA PreCheck ® .

- Apply for Global Entry Opens another site in a new window that may not meet accessibility guidelines

- TSA PreCheck

Global Entry and application fee credits

Citi ® / AAdvantage ® Executive Mastercard ® cardmembers receive application fee credit for Global Entry or TSA PreCheck, up to $100 every 4 years. To receive reimbursement, you must charge the application fee to your Citi ® / AAdvantage ® Executive Mastercard ® .

More about the Citi ® / AAdvantage ® Executive Mastercard ® Opens another site in a new window that may not meet accessibility guidelines.

AAdvantage ® Aviator ® Silver Mastercard ® cardmembers receive application fee credit for Global Entry, up to $100 every 4 years. To receive reimbursement, you must charge the application fee to your AAdvantage ® Aviator ® Silver Mastercard ® .

More about the AAdvantage ® Aviator ® Silver Mastercard ® Opens another site in a new window that may not meet accessibility guidelines.

Travel with Global Entry

With Global Entry, your CPB PASS ID is your Known Traveler Number (KTN). Update your KTN in your AAdvantage ® account before you travel so your information is saved for every trip. If you’re not an AAdvantage ® member, you must add your KTN to each reservation when you book.

If you can’t find your PASS ID, you can get it online.

Find your PASS ID Opens another site in a new window that may not meet accessibility guidelines.

Update your AAdvantage® profile

- Log in to your AAdvantage ® account

- Add your KTN in the ‘Secure traveler’ section

- Save your changes

- Update your profile

- Not an AAdvantage ® member? Join for free

Update an existing trip

- Find your trip on aa.com or the American app

- Select ‘Edit’ in the passenger information section

- Go to ‘Security information’

- Add your KTN

Find your trip

Global Entry kiosk

When you arrive in U.S. Customs, at the Global Entry kiosk:

- Scan your passport or other travel document

- Place your fingerprints on the scanner

- Make a customs declaration.

- The kiosk will then issue you a transaction receipt and direct you to baggage claim and the exit.

Global Entry is available at select airports in the U.S. including:

- Charlotte (CLT)

- Chicago O’Hare (ORD)

- Dallas Fort Worth (DFW)

- Los Angeles (LAX)

- Miami (MIA)

- New York Kennedy (JFK)

- Phoenix (PHX)

- Philadelphia (PHL)

Other airports with Global Entry Opens another site in a new window that may not meet accessibility guidelines.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Known Traveler Number: Here’s What You Need To Know [2024]

Spencer Howard

Former Content Contributor

51 Published Articles

Countries Visited: 21 U.S. States Visited:

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3293 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1180 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![global entry card travel number Known Traveler Number: Here’s What You Need To Know [2024]](https://upgradedpoints.com/wp-content/uploads/2022/08/Passengers-go-through-TSA-security-check.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

What is a known traveler number, how to get a known traveler number, credit cards that reimburse for global entry, tsa precheck, and/or nexus application fees, how to find your known traveler number, how to add your known traveler number to bookings, global entry or tsa precheck: which one is right for you, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’re new to TSA PreCheck or Global Entry, you may be wondering what a Known Traveler Number (KTN) is, how it works, and why there’s a KTN box when booking flights, but there isn’t one for your TSA PreCheck or Global Entry number. Here’s what you should know about your KTN.

Your Known Traveler Number is your membership number with a Trusted Traveler Program. This number is what allows you to access TSA PreCheck security lanes and Global Entry lanes (depending on which Trusted Traveler Program you join).

To acquire a Known Traveler Number, you must participate in one of the Trusted Traveler Programs. These are:

- Global Entry

- TSA PreCheck

Global Entry and TSA PreCheck are by far the most popular options in the U.S. The NEXUS and SENTRI programs also provide a Known Traveler Number, though these programs are much less commonly used in the U.S.

Many premium credit cards will reimburse you for the application fee for either Global Entry or TSA PreCheck (including American Express, Capital One, Chase, and Citi, which all provide cards that offer an application fee reimbursement).

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

This card is ideal for business travelers who enjoy luxury travel and are looking for a card loaded with benefits!

The Business Platinum Card ® from American Express is a premium travel rewards card tailored toward business owners who are frequent travelers with a high number of annual expenses.

When you factor in the large number of perks that the card offers like the best airport lounge access at over 1,400 lounges , along with tons of annual credits, it’s easy to see why this card can is a top option for frequent traveling business owners.

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

- 5x Membership Rewards points per $1 on flights and prepaid hotels at Amex Travel

- Access to over 1,400 worldwide airport lounges as part of the American Express Global Lounge Collection

- Get 50% more Membership Rewards points (1.5 points per $1) on eligible purchases in key business categories, as well as on purchases of $5,000 or more (cap applies)

- High annual fee of $695 ( rates & fees )

- Airline fee credit does not cover airfare, only incidentals like checked bags

- Welcome Offer: Earn 150,000 Membership Rewards ® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards ® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card ® . Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card ® , here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR ® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR ® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card ® .

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

- APR: 19.49% - 28.49% Variable

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

Chase Ultimate Rewards

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- 2x miles per $1 on all other purchases

- Global Entry or TSA PreCheck application fee credit

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

Since several cards offer this benefit, consider the other benefits of your credit card options before you choose one. Look at the points they earn, trip delay protection, purchase protection, elite status, or airport lounge access.

If your priority is earning tons of valuable (and transferable!) points, you might choose the Chase Sapphire Reserve card . It earns 5x points on air travel and 10x points on hotels and car rentals when you purchase travel through Chase Travel, 10x points on Lyft (through March 2025), 3x points on all other travel, and it comes with a Priority Pass Select membership for lounge access. You’ll also receive a $300 travel credit that is automatically applied to your first $300 in travel purchases each cardmember year (this includes taxis, Uber , Lyft , train tickets, flights, hotels, and more).

If airport lounge access and elite status are your top priorities, the Amex Platinum card and Amex Business Platinum card provide world-class lounge access , including Centurion Lounges and Delta Sky Clubs (when flying Delta), on top of a Priority Pass Select membership upon enrollment. Cardholders also receive elite status with both Hilton Honors and Marriott Bonvoy upon enrollment. To top it off, you’ll earn 5x Membership Rewards points when booking flights directly with an airline.

And for travelers who value simplicity in earning and redeeming their rewards along with a reasonable annual fee, consider the Capital One Venture X card . It earns 2x Capital One miles on all purchases and comes with the lowest annual fee among the most popular premium credit cards.

Whichever card you choose, all you have to do is use it to pay for the Global Entry or TSA PreCheck application fee, and you’ll automatically be reimbursed.

Hot Tip: You can find your PASSID (also known as your Known Traveler Number) on the back of your Global Entry, NEXUS, or SENTRI card.

If you only have TSA PreCheck, log in to the Trusted Traveler Program website to access your PASSID/Known Traveler Number. If you lose your Global Entry, NEXUS, or SENTRI card, you can use the Trusted Traveler Program site to find the number.

While it might not be apparent at first, you’ll be happy to know that your TSA PreCheck or Global Entry number is, in fact, your Known Traveler Number. Simply enter your Known Traveler Number in the appropriate field when booking your flight. This can also be done later — even at the check-in desk at the airport.

The vast majority of the time, you do not need to carry your Global Entry card to access the airport’s TSA PreCheck or Global Entry lanes. That said, there have been some recent reports of travelers being asked to show their physical card. This appears to happen most at airports that allow travelers with Global Entry to preclear security, especially for flights departing from Canada. It also may happen when entering the U.S. by car via NEXUS or SENTRI lanes.

Hot Tip: Unlike when returning from most countries, if you want to access Global Entry lanes when returning from Canada, you will need your physical Global Entry card with you.

As anyone who’s been through airport security knows, it can be a frustrating hassle. To expedite the screening process at many U.S. airports, TSA PreCheck access provides a much better experience. If you are returning to the U.S. from an international destination, Global Entry can make getting through customs a breeze.

If you mainly travel within the U.S., you might think that you only need to get TSA PreCheck — this is understandable, considering the fee is $78 compared to $100 for Global Entry.

However, a Global Entry membership also provides access to TSA PreCheck. When you account for the application fee reimbursement offered by several credit cards, why wouldn’t you go ahead and get Global Entry? With the right card, the impact on your wallet is the same — neither should cost you a dime!

By getting Global Entry, you can enjoy a quicker security experience when boarding flights in the U.S. If you decide to travel abroad, you can take comfort in the fact that returning to the U.S. will be easy.

Hot Tip: If you have additional questions, don’t miss our piece on the top Global Entry FAQs and TSA PreCheck FAQs .

Airports are becoming busier by the year, so having access to TSA PreCheck and Global Entry is vital for quicker and smoother security screenings. With so many credit cards offering to reimburse you for the application fee, there is no excuse not to have a Known Traveler Number.

Whether you get TSA PreCheck or Global Entry, you’ll be all set for a better airport experience — just enter your PASSID/Known Traveler Number when booking your flight.

Like this Post? Pin it on Pinterest!

The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

How do i know if i have a known traveler number.

If you have applied for and been approved for Global Entry, NEXUS, SENTRI, or TSA PreCheck, you have a Known Traveler Number. It is your membership number from one of these Trusted Traveler Programs.

Can you add a Known Traveler Number after booking your flight?

Yes. If you forget to add your Known Traveler Number at the time of booking, you can add it later. This can be done online or at the check-in desk at the airport. We recommend doing it online before checking in.

Why isn't my Known Traveler Number working?

If your Known Traveler Number isn’t working, the likely causes are:

- You, a travel agent, or reservations agent entered the number incorrectly

- Your name doesn’t match what is on your Trusted Traveler Program profile

Where do I find my Known Traveler Number on my Global Entry card?

Your Known Traveler Number can be found on the back of your Global Entry card. It is your PASSID number.

If you have NEXUS or SENTRI, your PASSID number will also be found on the back of your card.

How long is a Known Traveler Number good for?

Your membership with a Trusted Traveler Program lasts 5 years. At that point, you will need to renew your membership and pay another fee. Don’t forget to use a credit card that will reimburse you for the fee!

Was this page helpful?

About Spencer Howard

Always a fan of flying, it was only natural that Spencer was drawn to finding a way to improve the travel experience.

Like many, he started this journey searching for cheap flights to take him around the world. This was fun for a while, but Spencer was intrigued by the idea of flying in business and first class!

Throwing himself into what became an extensive research project, Spencer spent 3-4 hours per night learning everything he could about frequent flyer miles over the course of several months (he thinks this is normal). He runs Straight to the Points, an award-seat alert platform.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!).

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Redress Number vs. Known Traveler Number: What’s the Difference?

Alisha is a freelance writer and photographer. She is the creator of travel and adventure site Terradrift.com and has written about travel and rewards for many publications, including American Way and Johnny Jet.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Every time you book a flight, two little boxes loom large on the passenger information page: redress number and Known Traveler Number (KTN).

Even if you travel often, you may not know the difference. Here's how these two numbers differ, where to find them and how to know if you need either.

The main differences between redress and KTN numbers

Not every traveler will have a redress number or a KTN. In fact, the majority of travelers won’t have either. And if you do, you’ll know, because you will have gone through a lengthy application and approval process.

A redress number is exclusively for travelers who have experienced (sometimes often or repeated) difficulty or delays during security screening, whether traveling domestically or internationally, and who have started a redress inquiry with the Department of Homeland Security to resolve a misidentification issue.

A KTN, on the other hand, is granted to travelers who have applied and paid for Global Entry or TSA PreCheck in order to enjoy expedited security screenings at airports in the U.S.

» Learn more: TSA PreCheck vs. Clear: What to know

What is a redress number?

A redress control number, more frequently known as a redress number , is an identifier given to individuals who were falsely identified as posing a threat to transportation security or public safety when flying. If you believe you have been incorrectly added to a watchlist or run into frequent screening problems and delays at border control — often as a result of having the same name as someone on the Transportation Security Administration's (TSA) watchlist — you might open a redress case to get your name cleared.

When you start a case with the Department of Homeland Security Traveler Redress Inquiry Program (DHS TRIP), you receive a seven-digit redress number, which essentially links you with your redress case.

Most travelers don’t have, nor will ever need, a redress number.

» Learn more: What ‘SSSS’ on your boarding pass means

What is a Known Traveler Number?

If you’ve applied and been approved for TSA PreCheck or Global Entry, an expedited security screening program at airports across the U.S., you’ll receive a Known Traveler Number.

The nine-digit number is linked to your Trusted Traveler account and must be shared with airlines when booking in order to gain access to the dedicated TSA PreCheck line at security. You’ll know if you entered it correctly if there’s a TSA PreCheck logo, complete with green check mark, on your boarding pass.

Your Known Traveler Number can be found by logging into the Trusted Traveler Programs website. It’s also printed on the back of your Trusted Traveler card.

» Learn more: How to get TSA PreCheck

Do you need a redress number or Known Traveler Number?

If you’re traveling soon or in the midst of booking a flight and are wondering if you need either number, the answer is likely “no.”

KTNs are entirely optional, though are often worth the expense for frequent travelers. Plus, there's a way to get a KTN for free as part of the benefits of your travel credit card. Some credit cards offer statement credits that will reimburse you for TSA PreCheck or Global Entry application fees.

If you don’t have a KTN, don’t sweat it; you can leave that box empty.

Likewise, if you’ve never experienced delays or difficulties other than the occasional pat-down or random selection for bag screening at security or ports of entry, you probably don’t need a redress number, either, and can also leave that field empty.

» Learn more: What Chase cards come with TSA PreCheck?

Where do I enter a redress number or Known Traveler Number?

If you do happen to have either number, you can add them during booking on airline websites. After you’ve selected your preferred flights, when you come to a page that prompts you to enter the details of each traveler, you’ll find boxes for both a redress number and Known Traveler Number.

Enter either if you have them (or neither if you don’t) and they'll be linked to your booking.

You can also add either number to your frequent flyer account so they’ll be automatically entered during every booking and you don’t have to go searching for your number each time you travel.

The process for each program may look a bit different, but log into your profile, find the page where you can update personal information and enter your number in the corresponding text box. It will be saved for future bookings.

» Learn more: How to add TSA PreCheck to your airline ticket

The bottom line

Whether you have a redress number or KTN depends entirely on you as an individual traveler. While a KTN is entirely optional and offers a way to move more quickly and easily through security, a redress number is reserved for those who regularly experience unnecessary delays or difficulties at checkpoints, often due to mistaken identity.

If you do have either, just make sure to include your number on your travel booking to help ensure a seamless and hassle-free trip through security.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Travel Tips

- Customs + Immigration

Why You Should Get Global Entry and How It's Different From TSA PreCheck

Plus, how to get it, how much it costs, and which airports use it.

:max_bytes(150000):strip_icc():format(webp)/maya-kachroo-levine-author-pic-1-2000-1209fcfd315444719a7906644a920183.jpg)

What Is Global Entry?

How does global entry help you, how is global entry different from tsa precheck, how much does global entry cost, do credit cards pay for global entry, how to get global entry, what do i need for the global entry interview, how long does it take to get global entry, how to use global entry, which airports have global entry.

- What If the Person You're Traveling With Doesn’t Have Global Entry?

How Long Does Global Entry Last?

If you've ever arrived on an international flight carrying 500 passengers, you know that the customs line can be brutally long. And after you've endured many hours of traveling, perhaps even a couple layovers, waiting in line to reenter your own country is the last thing you want. This is where Global Entry comes in handy.

The Global Entry line is guaranteed to be shorter, if there's one at all, and instead of meeting with a customs agent, Global Entry holders simply scan their documents at an automated kiosk that typically takes a fraction of the time. Ready to have your homecoming expedited for all your future travels? Here's everything you need to know about the U.S. Global Entry program.

Global Entry is a program run by U.S. Customs and Border Protection that helps Americans avoid the customs line when coming back into the country and when entering other countries where a Global Entry kiosk is available. Travelers who have gone through the application and screening process are able to reenter the U.S. by just checking in at an electronic kiosk. There is no paperwork to mail in and rarely a line at the airport, so Global Entry holders often end up reunited with their luggage and loved ones faster as a result of their membership.

Travelers approved for Global Entry also get TSA PreCheck . So, in addition to getting back into the country (and into other select countries) faster, you'll gain access to shorter security lines and streamlined screening before your flight. Once you're approved for the program, you'll receive a nine-digit Known Traveler Number or "PASSID" (the Known Traveler Number is for TSA PreCheck, and it becomes a PASSID when the member has Global Entry and PreCheck). You can then add your PASSID to your frequent flier profiles to use when booking flights.

TSA PreCheck expedites your security process when entering the airport, whereas Global Entry eases your customs experience when returning to the U.S. However, Global Entry travelers qualify for PreCheck as a perk of their Global Entry status. Global Entry essentially gets you PreCheck and then some — and it costs just $22 more than TSA PreCheck alone.

It costs $100 (nonrefundable, even if you're denied) to apply for Global Entry, and that fee covers you for five years. However, you may be able to get Global Entry for free, or even help a friend or family member do so, just by using a certain credit card.

Some credit cards — such as several by American Express, Capital One, Bank of America, and Chase — will reimburse you if you use them to pay for the Global Entry application fee. Furthermore, you can sometimes use a credit card to pay for someone else's Global Entry and still receive the rebate (though you usually have to choose whether to use the benefit for yourself or someone else, not both).

The first step is to create a Trusted Traveler Programs account on the U.S. Customs and Border Protection website. Once you're logged in, fill out the Global Entry application and pay the fee. U.S. Customs and Border Protection will review your application and conduct a background check, and if it's conditionally approved, you'll make an appointment for an in-person interview at a U.S. Global Entry Enrollment Center.

First off, applying for U.S. Global Entry doesn't mean your interview is going to happen in the following days or even the following weeks. In fact, it could take a few months. However, if you don't want to wait, you can try your luck as a walk-in. Whether you walk in or show up for a scheduled appointment, you'll need to bring a printed copy of your conditional letter of approval, your passport or permanent resident card, and proof of residency (your driver's license works).

For super-expedited approval , you can opt for Enrollment on Arrival (EoA), which allows applicants "who are conditionally approved to complete their interviews upon arrival into the United States," Customs and Border Control says. "The EoA program eliminates the need for a Global Entry applicant to schedule an interview at an enrollment center to complete the application process." The EoA interview could take 10 minutes or less.

The entire process, from applying for Global Entry to getting your card, could take as little as three weeks or as long as six months. You should prepare for the latter. Wait times depend on the number of Global Entry applicants Customs and Border Control is fielding at a time. Of course, you can try to expedite the process with a walk-in interview or Enrollment on Arrival.

When you're given a Known Traveler Number after getting approved for Global Entry, you'll want to start providing that number when booking flights. Then, when heading to customs to get back into the U.S., follow signs for Global Entry and wait in the (wonderfully short) kiosk line. You'll scan your passport or permanent resident card at the kiosk, verify your fingerprints, and declare any items you're bringing back into the country. You'll then get a receipt, and you won't have to fill out the infamous blue-and-white paper customs form flight attendants hand out on international flights.

There are currently Global Entry kiosks at about 80 airports in the U.S. and abroad. In the U.S., major travel hubs like Los Angeles International Airport, John F. Kennedy International Airport, Hartsfield-Jackson Atlanta International Airport, Chicago O'Hare International Airport, Miami International Airport, San Francisco International Airport, Dulles International Airport, and Newark Liberty International Airport have the kiosks, as do smaller airports like Ohio's Toledo Express Airport and Vermont's Burlington International Airport. Alaska has them in Fairbanks and Anchorage, and Hawaii has them in Honolulu. Keep in mind that some of the locations do not offer Enrollment on Arrival.

Abroad, you'll find Global Entry kiosks at Abu Dhabi International Airport, throughout the Caribbean and Canada, and in the North Pacific and Ireland.

What If the Person You're Traveling With Doesn’t Have Global Entry?

You can't take any travel companions who don't have Global Entry with you through the kiosks because the system is automated and requires proof of membership. That also goes for young children, so if you want your four-year-old to enter the U.S. with Global Entry, they would need to undergo the same application and screening process to enroll.

Global Entry lasts five years starting on your first birthday after receiving a card and expiring on your birthday in the fifth year (the expiration date can be found on your card). Members become eligible to renew their Global Entry status one year prior to that expiration date and can do so by logging into their Trusted Traveler Programs account and submitting a renewal application, which requires another $100 fee. If you submit the renewal application before your membership expires and it isn't approved before the expiration date, you will be able to continue using your benefits for 24 months after the expiration.

Related Articles

Known Traveler Number on Global Entry Card (Unlimited Guides)

If you are a frequent traveler who often enters or exits the US, you’re likely to be interested in any schemes that allow you to skip the security line to gain expedited access to the US territory – and several such schemes exist.

One of these is the highly popular Global Entry scheme, which allows those who have been accepted to pass through security a whole lot quicker than non-members. But what exactly is it?

To answer this and other similar questions, in this post, we have all the info you need to know about Global Entry and the all-important Known Traveler Number on the Global Entry card.

What is Global Entry?

Global Entry is a system that entitles members to expedited entry into the US at participating airports and some seaports.

Applicants for the scheme are assessed, and those deemed low risk may be accepted. Members of the scheme then gain access to expedited security clearance via automated control lanes on arrival in the US.

Who is eligible?

US nationals and US lawful permanent residents are eligible to apply for the scheme, as are nationals of the following countries:

- Dominican Republic

- Netherlands

- South Korea

- Switzerland

- UK (British citizens only)

In addition, Israel, Japan, Qatar, Saudi Arabia, Australia and Costa Rica are also in the process of joining the scheme.

However, applications to the scheme may be refused. Reasons for this include criminal convictions, providing false information on the application and customs-related offences, among others.

How do you apply?

Applications to the scheme are filed with US Customs and Border Protection. Following this, applicants are called to an in-person interview. Prior to the interview, all applicants undergo a rigorous background check to assess their eligibility for the scheme.

The fee for joining the scheme is currently $100 – and this is non-refundable in the case of an application being rejected.

Further details of the application process are available on the CBP website .

How do you know if you’ve been accepted?

After completing the interview, you may be notified of your acceptance into the scheme very quickly, sometimes almost immediately or within around 15 minutes – or sometimes within a couple of hours.

Once you are accepted, you will receive an email – and you will subsequently also receive notification by post, which will also contain your membership card if you have requested one.

What is your Known Traveler Number (KTN)?

So what is the all-important Known Traveler Number (KTN) – and where can you find it?

Your KTN is a nine-digit number that you need to communicate to airlines when booking flights and that will then grant you access to expedited security clearance.

This number will be communicated to you in the email you receive when you are accepted into the scheme, and it can also be found on the back of your membership card under PASSID.

You will also be able to find your number on TSA or Trusted Traveler Program websites, and airlines usually save the number when you use it with them for the first time, so you won’t need to find it again the next time you book with the same airline.

Once you have your number, you don’t need to carry or use the physical membership card for air travel – and the membership card isn’t usually issued unless you specifically request it.

What’s the procedure for using Global Entry?

When booking a flight, you should notify the airline of your KTN when you fill in the rest of your details.

However, if you don’t do this when booking your flight, you can notify the airline of your number later, sometimes right up until the day of your flight.

On arrival at a participating airport, Global Entry members proceed to designated Global Entry kiosks. These kiosks then scan the traveler’s machine-readable passport, and the traveler is required to fill out an online customs declaration form.

After this, the machine will produce a receipt that tells the traveler to proceed to baggage reclaim – which means the security check has been completed – or they will be told to proceed to an inspection booth to go through the regular entry procedures.

This means that once you have provided your KTN to the airline, the Global Entry kiosk will already have your number, so you won’t need to remember it or enter it again.

Note that Global Entry is only available at selected airports, and not all international airports in the US are part of the scheme.

How about for land and sea borders?

When entering the US via land and sea borders, Global Entry can also help expedite your passage through security clearance – but the procedure might be slightly different.

In this case, the Global Entry membership card is used at special “Ready Lanes” to skip regular security checks.

When entering from Canada or Mexico via land or sea, the membership card alone is sufficient, and you don’t need to carry a passport.

However, note that a valid passport is required to enter Canada, and the Global Entry card will not allow you to cross the border in that direction.

Where can you find your Known Traveler Number?

Once you have been accepted to the Global Entry scheme, you will be notified by email, and your nine-digit KTN number will be communicated to you in the email. You can then begin using it immediately.

If you have requested a membership card, this will later be mailed to you, and the number will be written on the back.

You will also be able to find your number on TSA or Trusted Traveler Program websites.

Can you use a Global Entry card instead of a passport?

No. Your Global Entry card doesn’t replace your passport, so you should always carry your passport when you travel internationally.

The exception to this is that the membership card may be used as a valid form of ID when entering the US via land or sea (but not air) from Canada or Mexico.

Do you need to carry the membership card with you?

No. You don’t need to carry the physical membership card, you just need to know your nine-digit KTN and communicate it to the airline before traveling.

Are membership cards issued automatically?

No. Membership cards are only issued upon request since the KTN is all you need to take advantage of the benefits of Global Entry when flying into participating airports in the US.

What are the advantages of requesting a Global Entry membership card?

Although you don’t need a membership card to enjoy the benefits of Global Entry when flying, you will need the card to use the scheme when entering the US overland or by sea from Mexico or Canada.

You can also use the card as a valid form of photo ID in certain places, so for many people, it’s still worth having – especially since it doesn’t cost anything extra to ask for it.

Does Global Entry guarantee expedited entry?

No. Sometimes even members of the Global Entry scheme are selected for standard or enhanced screening and will have to go through the necessary procedures instead of enjoying expedited entry into the US.

Can you add the number after reserving a flight?

Yes. Even if you don’t add your KTN during the booking process, you can still contact the airline before flying, sometimes even on the same day as your flight, to add the number to your reservation.

How long is Global Entry valid?

Global Entry is valid until five years after your next birthday on being accepted into the program. This means, for example, if you are accepted in January 2024 and your birthday is May 1 st , your membership will be valid until May 1 st , 2029.

How do you reapply?

The reapplication is the same as the initial application procedure, and the fee is also the same. However, not all those reapplying are required to go for an in-person interview – although in some cases, this can be necessary.

When can you reapply?

It is recommended that you reapply early since if your application hasn’t been accepted by the time your membership runs out, you may find yourself traveling while ineligible to enjoy the benefits of Global Entry.

It’s best to reapply at least six months before the expiry of your previous membership – but you can apply up to one year before, which effectively means on your birthday the year before your membership is due to expire.

How much is the fee for signing up for Global Entry?

The application fee is currently $100, and this is non-refundable, even in the case of a rejected application. The fee for reapplication is the same.

A valuable scheme for those who enter and exit the US frequently

As we’ve seen, Global Entry offers some valuable benefits to members of the scheme, and if you travel into and out of the US frequently, the $100 fee for a five-year membership will probably seem like money well spent.

Applying for the scheme is easy, and once you’ve been accepted, you can begin enjoying the benefits immediately, making use of expedited security clearance instead of wasting lots of time standing in line with everyone else.

Jennifer Morris is an avid solo travel adventurer who founded Solo Traveller after many years of journeying on her own around the world. She has backpacked through over 50 countries across 6 continents over the past decade, striking up conversations with locals along railway platforms, learning to cook regional dishes in home kitchens, and absorbing a global perspective while volunteering with various community initiatives.

With a Masters in Tourism and Hospitality, Jennifer is passionate about responsible and meaningful travel that fosters cultural exchange. Whether trekking through the Atlas Mountains, sailing to Komodo National Park, or taking an overnight train across Eastern Europe - she is always seeking her next epic destination.

When not globetrotting, Jennifer calls Vancouver, Canada home. There she enjoys kayaking local waters, curling up with books on faraway places, and gearing up for her next solo backpacking trip. As the founder of SoloTraveller, she hopes to motivate and inform fellow solo explorers from all walks of life to take the leap into their own adventures.

Similar Posts

Is Travellergram Legit or Not?

Most people enjoy traveling, and everybody enjoys getting a great deal – and as a result, the internet is now full of websites promising to help you find the cheapest rates. Unfortunately, that also means there are plenty of scam sites that are just designed to separate you from your money without providing the services…

Is Travelcation Legit or Not?

Nowadays, when you want to book a flight, there are many websites to turn to that can compare the various options and propose the best prices – but while many of them are well-established and highly reputable, others can’t be trusted. One site that claims to be able to offer some of the cheapest prices…

Is Traveluro Legit or Not?

The internet is a jungle that’s full of scams and cheats, and often, when you find a great deal, you find it hard to believe. One site that poses this problem is Traveluro, so to help you decide if you want to book through them, here we answer the question, is Traveluro legit? What is…

5 Different Types of Travel Document Number

Many people love traveling to visit new places, sample delicious local cuisines, experience vibrant cultures and see stunning sights. However, there’s also the admin side of travel, which can be less fun – and in some cases, even downright stressful. Part of this can involve filling out lots of forms and worrying about getting things…

Knowledge Article

How to renew Trusted Traveler Program (Global Entry, NEXUS, SENTRI, or FAST) membership

- Log in to the TTP website (click https://ttp.dhs.gov ).

- If you don't have a login.gov account, you will be directed to login.gov to create an account first then you will be prompted to setup your TTP account profile. On the profile page, you will need to associate the account with your PASSID (membership number). See the back of your Trusted Traveler card or your approval letter.

- From your Dashboard, select the Renew button on your Global Entry, NEXUS, SENTRI or FAST program membership section.

- You must declare your citizenship (if you are a US Citizen, you declare "U.S.").

- Select the program that you wish to renew. You may select to renew another program for which you are eligible. However, remember that depending on the program you choose, your benefits may change. On the next page, acknowledge the program requirements.

- Follow the guidelines provided on the Membership Renewal page.

- When you have updated all information in the application, on the Final Review page, click Confirm and Continue in each section. At the bottom of the page, click Save and Continue .

- On the Certify page, answer Yes or No to "Do you certify?"

- Select Next . The Purchase Summary page will display.

- Fees are for application processing and are non-refundable. Check the box under the total application fee to agree and proceed.

- Select Pay Now . The online payment page displays.

- After payment, you will be returned to your TTP Dashboard.

Article Number

Date Published

Ask a Question

Submit a Complaint

Submit a Compliment

Report Illegal Activities

Additional Information

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance