- Money Transfer

- Rate Alerts

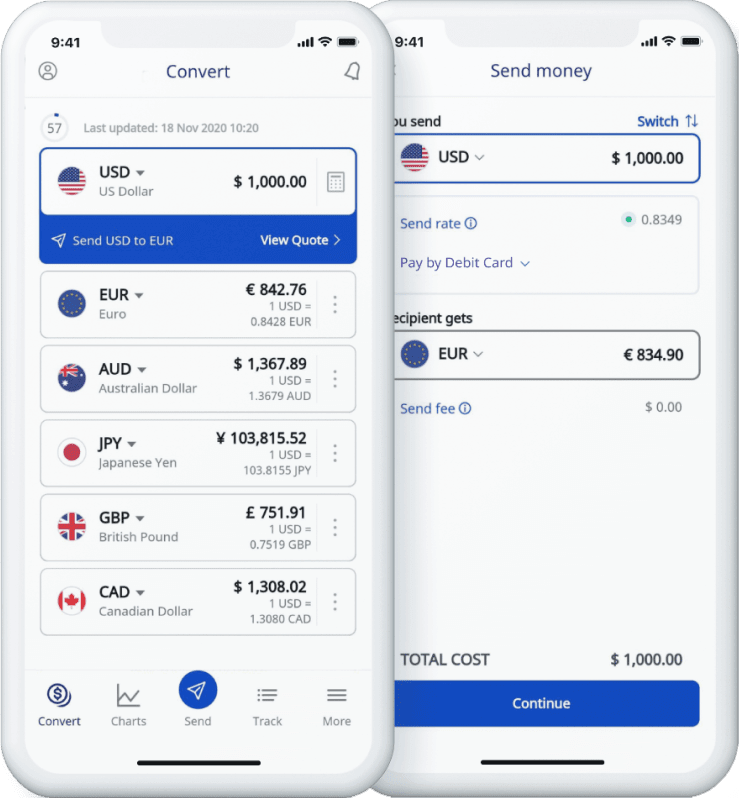

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Best Places To Exchange Money [Best Rates, Fees, and Convenience]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Senior Editor & Content Contributor

108 Published Articles 709 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![best tourist exchange rates Best Places To Exchange Money [Best Rates, Fees, and Convenience]](https://upgradedpoints.com/wp-content/uploads/2023/09/Person-putting-euros-in-wallet-at-money-exchange.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

How does currency exchange work, exchanging money before you leave, exchanging money while you’re abroad, exchanging money when you get home, best tips to tackle international spending, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When planning a trip abroad, being able to pay for expenses is bound to be a primary concern. While using a credit card for your purchases can give you the best rate, we know it’s not always possible to pay with a credit card everywhere you go.

So, where is the best place to exchange money? Should you exchange money before you leave or while you’re on vacation? And what do you do with leftover currency when your trip is over? We’ll answer all these questions and give you some great tips for exchanging money on your next trip.

An exchange rate is the value at which one currency can be exchanged for another. Frequently, this value is variable and dependent on the market, but sometimes the value can be fixed, or pegged, to another currency.

Banks and currency exchange stores tack on some sort of charge in addition to the market rate, and these fees can vary significantly.

What does this mean for you? Your spending power on your vacation depends on the value of the U.S. dollar and the currency of the country you’ll be visiting. As these values fluctuate over time, planning a trip when the dollar is favorable can benefit you. Also, where you choose to exchange your money matters!

You have the best opportunity to get the best exchange rates before you ever leave home.

The best place to exchange money is at your local bank or credit union. You will get the best currency exchange rates as rates will closely resemble the market rates, with only minimal added costs added on.

You’ll obviously need to do this before you leave unless your bank has an international presence in the country you’ll be visiting, so plan ahead!

Before you head over to the bank, give them a call to see if they have your desired currency on hand. Depending on the currency you need, you may have to order it in advance. If it’s a common currency, sometimes banks will have it available immediately.

The pro of exchanging money before you leave is that you can hit the ground running when you arrive. You can also generally save some money if you get the money from your bank or credit union.

Knowing your destination’s currency conversion in relation to U.S. dollars is important! We recommend using an offline currency conversion app, such as Currency ( iOS ) or Currency Converter Plus ( Android ). You can also just plug it into Google, but it is helpful to have access abroad even if you don’t have an internet connection.

What Not To Do

You might be tempted to exchange money at the airport before you leave, but we generally recommend against this. Airport exchange kiosks and stores are convenient but also tack on big fees and unfavorable rates . This can end up costing you!

You might not need as much cash as you think. Most places accept credit cards, and then you could be stuck carrying excess cash around (and exchanging it back). Try not to take out more than you need.

Regarding traveler’s checks , while they have been popular in the past, they have fallen out of favor. It is increasingly difficult to find a place that will cash them — if your bank even offers them. We don’t recommend exchanging money for traveler’s checks as credit cards (and even debit cards) offer a level of security once only provided by traveler’s checks.

If you’ve already left home and need some tips on exchanging currency, we’ve got you covered!

If you’re wondering how to get local currency when traveling, the easiest way is by using your debit card at an ATM. It’s best to use your bank’s ATM network in order to avoid fees, but any ATM will work. These fees generally range from 1% to 3%. There are cards that will waive (or reimburse) international ATM withdrawal fees, though!

Try to limit your withdrawals and take out the maximum you think you’ll need each time, as there are per-transaction fees as well (generally about $5). In addition, if you’re planning to get money out abroad, knowing your ATM limit is important. You can call your bank to request an increase if it is low.

Also, consider using your credit card when you travel abroad. Most stores and restaurants accept credit cards, which is the easiest and most convenient way to get the best currency exchange rate! Just be sure to select “local currency” and not “pay in U.S. Dollars.”

If you’re looking for a card with no foreign transaction fees , consider popular rewards cards like the American Express ® Gold Card or the Chase Sapphire Preferred ® Card . Both cards also offer a ton of other valuable travel-related benefits!

Whatever you do, don’t get money from a foreign ATM using your credit card. This is considered a cash advance — the fees can be high, and the interest begins to accrue immediately.

Also, we don’t recommend using those currency exchange stores and kiosks (i.e. Travelex) you see at the airport, hotels, and other major tourist destinations. While they might seem convenient, the rates are not favorable, and the fees are much higher than other options.

For example, let’s say you have $100 to exchange for euros and the current market rate for the exchange is €92.64. Your bank might offer you €92, while a currency conversion kiosk might offer €87. Extra fees could also be tacked on that eat away further at your exchange’s value.

If you have some leftover cash, you’ll likely want to convert it back into U.S. dollars. The best way to exchange foreign currency for U.S. dollars will be at your bank or credit union. Unfortunately, they may not buy back all types of currency.

Those currency exchange stores and kiosks we advised against before might be a good option for less-common currencies. The fees are higher, but at least you won’t be stuck with currency you won’t use again!

Another option might be to donate currency to UNICEF’s Change for Good . American Airlines offers envelopes on its planes and at its Admirals Club and Flagship Lounge locations, but you can also mail currency to the following address:

Change for Good UNICEF USA 125 Maiden Lane New York, NY 10038

While exchanging money for cash is a good start, having a good plan in place for all your international spending is important. That’s because it’s just not feasible to pay for all your large expenses (such as hotels, train travel, etc.) with cash. Here is what we recommend:

- Use your debit card to get out cash from an ATM when you’re abroad or bring money from home.

- Bring along a credit card that has no foreign transaction fees and don’t use your credit card to get out cash from an ATM.

- When using your credit card, be sure you choose to pay in local currency.

- Avoid currency stores and kiosks if possible.

- Be aware of the current currency exchange rate to avoid any surprises!

Where you choose to exchange your currency can have an impact on how much money you’ll receive. The best rates are found at banks and credit unions. Even if you exchange money when you’re abroad, you can save money by using your debit card to take cash out of an ATM. Be sure to bring cards that are meant for international travel and you’ll be sure to save!

For rates and fees of the American Express ® Gold Card, click here .

Frequently Asked Questions

What is the best method of currency exchange.

The best method of currency exchange is using a credit card with no foreign transaction fees to pay in local currency. If you want to use cash, exchanging cash at a bank or credit union will be your best option.

How can I exchange currency without fees?

There is no way to exchange currency without fees. Banks will always charge some marginal rate to process your transaction. The best way to exchange currency by limiting your fees is at your bank or credit union.

Is it better to exchange currency at home or abroad?

While it can be cheaper to exchange money at your bank before you leave, you might be tempted to exchange too much cash. In this case, it might be better to use your debit card to take out cash from an ATM while you are abroad as you need it.

How can I exchange currency without losing money?

Unfortunately, when it comes to exchanging currency, it will always cost some money. There are ways to limit how much it costs, including exchanging the currency at your bank or using a credit card with no foreign transaction fees.

Is it better to exchange money or use a credit card?

Using a credit card will get you the best possible exchange rate, so we recommend using a credit card when you can. There are some instances that it is just more convenient to have cash (such as a small purchase with a local vendor). Having a good way to access both methods of payment is important when traveling.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- United States Australia Canada France --> Germany --> Holland --> India Japan --> Ireland --> Malaysia --> Mexico --> New Zealand Philippines --> Singapore Spain --> UAE United Kingdom Other countries Global

- Profile -->

- My Rates -->

- Search Rates

USD to GBP Travel Money Rates Today

The best USD to GBP rate is 0.7857. We help you save money by comparing USD to GBP exchange rates to the latest market rate and those offered by leading FX providers.

Compare Exchange Rates

Loading exchange rates...

You Can Save Money when you Compare Exchange Rate Margins & Fees

The above comparison table makes it easy to calculate the Total Cost you are being charged on your currency transaction by banks and providers versus the market mid-rate. It is easy to calculate any savings available from popular market-leading FX providers.

Is US dollar (USD) expected to go up or down?

This is always a difficult question as exchange rates are influenced by many factors, so a good method to consider the US dollar current value is to look the USD performance against a range of other currencies over various time periods.

The following table looks at the performance of the USD exchange rate against selections of other currencies over time periods from the previous 2 days back to the last 5 years.

USD Currency Country Guides

How is the expat life in the uk.

Expat life in the UK can be a positive experience, as the country is known for its rich history, culture, and diverse society. It also offers a high standard of living and a strong economy. However, as with any move to a new country, there can be challenges to overcome.

One of the biggest challenges for expats in the UK is the weather, as it can be unpredictable and quite damp, especially in the winter. Additionally, the cost of living in the UK, particularly in the larger cities such as London, can be high.

Read more at our United Kingdom (GBP) country guide

BER partners are among the best & most trusted FX brands

- Best Rate Calculator

- Foreign Transfers

- Currency Exchange

- Large Transfers

- Cross Rate Matrix

- Who We Compare

- Rate Tracker

- Market Update

- Currency Forecasts

- Country guides

- Content Hub

- How-to-Save Guides

- User Forums

- Log in to BER

- Country Sites

- BER.me Profile

- Transfers - Quote

BER is operated by Best Exchange Rates Pty Ltd, a company incorporated under the laws of Australia with company number ABN 68082714841. BER is a comparison website only and not a currency trading platform. BestExchangeRates.com uses cookies. Disclaimer & Terms of Service Privacy

Compare Currency

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

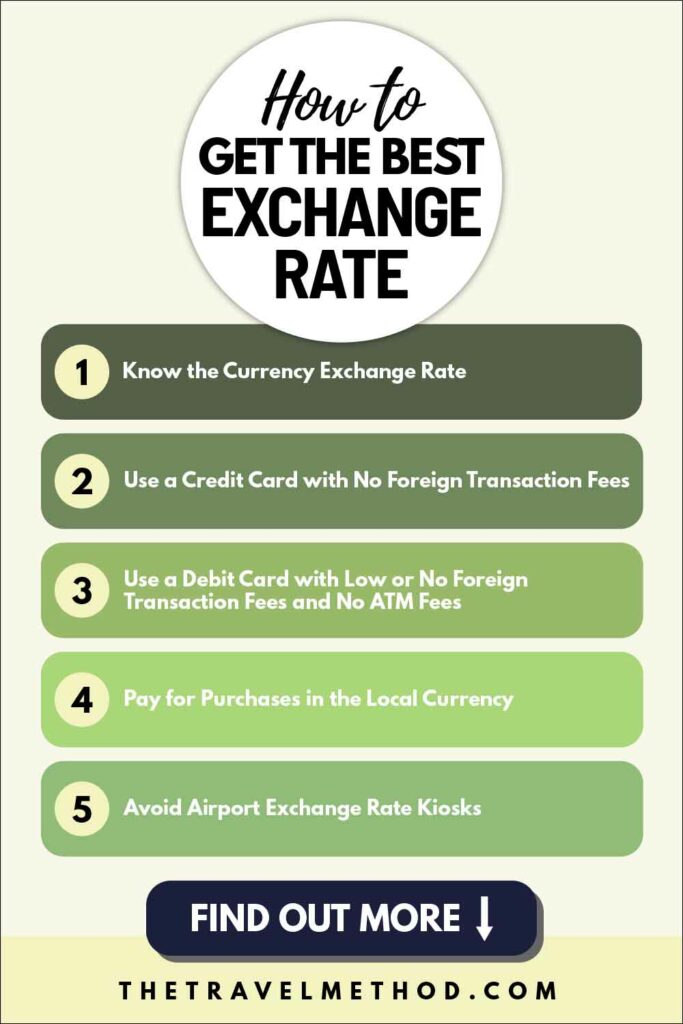

How to Get the Best Exchange Rate While Traveling

This post may contain affiliate links and advertising. Learn more

This article was originally published on our site Nomad Paradise. As part of a rebrand, we are publishing all our travel packing and tips content in one place for you to enjoy - The Travel Method. For world cuisine and recipes, you can keep visiting Nomad Paradise.

Use these tips to help you get the best exchange rate while traveling and make your money go further when abroad.

Getting a fair rate for your money isn’t too complicated if you know where to look and what red flags to ignore. With some planning and smart thinking, you can save yourself tens, maybe even hundreds, of dollars, both before and during your trip.

- Know the Currency Exchange Rate

Look up the exchange rate before you leave the country. Being informed is the first step in getting a good rate. It will prevent you from exchanging the money at a very unfavorable rate.

So, find this information before you set off on your trip and check the rate occasionally to stay informed about any major changes.

Our favorite currency app for checking the exchange rate is XE Currency . You can look up the live currency exchange rates on the app.

When you check the rates, the app actually saves the rates so that you can access this information offline. Even if you don’t have internet access, you can still have a good idea of the exchange rate based on the last saved rates.

- Use a Credit Card with No Foreign Transaction Fees

If you have a credit card with no foreign transaction fees, use it whenever possible. If you don’t have one, you should look into getting one if you travel quite a bit. In the U.S., there are many such options.

Before paying by credit card, though, take into account a few factors and see if they apply to your situation:

- Local shops and restaurants may add a fee for transactions made with credit cards.

- Some credit card companies charge fees for transactions made in foreign currencies. That’s true especially if you’re based outside of the U.S.

- Use a Debit Card with Low or No Foreign Transaction Fees and No ATM Fees

When using your debit card to withdraw money from ATMs, you may have to pay additional fees, including the following:

- a currency exchange fee,

- a fee from the local bank’s ATM, and

- a fee from your bank back home for using an ATM abroad.

In the U.S., UK, and many countries in mainland Europe, you can generally find some debit cards that waive most or all of these fees. If you travel quite a bit, you can save hundreds of dollars in ATM fees annually using no-fee debit cards.

Regardless of the card, always stay informed on what you’ll get charged abroad. Go over your bank agreement and make sure you know exactly how much you get charged on foreign transactions. The goal is to find the best deal possible, but you have to do this before you set out on your trip.

If you can’t avoid the ATM fees, keep in mind the ATM fees are often set per transaction so you can save money by making a larger withdrawal rather than multiple smaller ones.

Another tip to remember is that some ATMs will offer to do the conversion for you. That means they will charge your card in your home currency (for example, USD if you’re from the United States or GBP if you’re from the United Kingdom) instead of the local currency.

The first time I encountered this was in Porto, Portugal. Letting the ATM charge me in US dollars rather than euros would have meant losing about $20 on a $200 withdrawal. As you can see, that’s an atrocious charge. Please do not fall for it.

- Pay for Purchases in the Local Currency

Along those same lines, many merchants now offer to charge your card not in the local currency but in your home currency. A lot of tourists fall into this trap. Don’t agree to this offer, as they often add fees to the already poor exchange rate.

At the pay terminal, pay for the purchase in the local currency and allow your credit card company to convert at a better exchange rate.

- Avoid Airport Exchange Rate Kiosks

You’ve probably already seen many money exchange kiosks at airports. They may promise “zero commission,” but in return, they have a poor exchange rate. Even though their airport location is convenient, you pay a very high price for this ‘convenience’ – a price that can be as high as 15%.

Although airport exchange rate kiosks are a terrible option, there are occasionally legitimate exchange rate kiosks that offer good rates once you’re at your destination. For example, in Moldova, Eastern Europe, there is practically an exchange kiosk at every corner that offers a very good exchange rate.

If you have USD, you can sometimes get better rates at the local exchange kiosk (not the airport exchange kiosk) than by withdrawing money from the ATM.

These are just a few tips for how to get the best exchange rates when traveling. Good luck, and remember to take your time. Don’t rush to get your money just because you want it done.

Spending a little time getting the right cards or exchanging at the right place can save you tens, even hundreds of dollars.

Save and Pin for Later

Traveling internationally soon? Save this article to one of your trip planning boards so that you can revisit these top tips when you want to exchange money.

Author: Dale

Dale Johnson is a content creator from the UK. He has traveled full-time for over three years and to over 30 countries and writes on a number of travel-themed topics, including travel packing tips and the latest gear.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Cheap Holiday Money At Your Fingertips

Best GBP to USD Rates

The USA is always a lucrative destination for British travellers. Orlando’s Disney World is among the most popular holiday destinations for families, while cities like New York or Vegas are great for couples or singles. Travelling to English-speaking countries is always fun, especially when it’s balmy.

Travellers can find the best cash exchange deals for Pounds to USD using the table below. This way, you can find the best holiday money provider and buy USD in advance.

Compare the best travel money providers to find the right one to buy US dollars from.

Best Pound to US Dollar Exchange Rates Provider:

Wise multi-currency card for travelers, using wise’s multi-currency card is better than cash..

- Excellent Rates: Get real-time exchange rates with no hidden fees.

- Convenient: Spend in multiple currencies and make free international ATM withdrawals.

- No Need for Cash: Use your Wise card worldwide, safer and easier than carrying cash.

- Great Exchange Rates : Get the Wise exchange rates .

💳 Learn More & Apply Now

Additional providers:, buy us dollars for 1,000 pounds; travel money – more providers.

Are these rates always accurate and precise?

Although we gave our utmost efforts to reflect the true USD exchange rates proposed by each travel money provider, we cannot promise 100% accuracy. In spite of the fact that our GBP to USD exchange rate comparison system is automatic, we, again, can’t “guarantee” that indeed the company on top offers the best USD rate at the moment. That is due to the following facts:

- The rates can suddenly fluctuate and our comparison table only updates on an hourly basis.

- Some travel money providers can change their pricing without us knowing that.

- Some companies make it trickier to compare by applying other fees which are not embedded into the exchange rate.

- Technical errors can always occur. Please bear with us.

Travelling to The USA – Gov.UK’s Recommendation

Read the recommendation here: https://www.gov.uk/foreign-travel-advice/usa

UK embassy in the USA:

Embassy of the United Kingdom, Washington, D.C.

- Address: 3100 Massachusetts Ave NW, Washington, DC 20008, USA

- Phone: +1 202-588-6500

Travelling to The USA – Cost Comparison

- An inexpensive meal at a restaurant costs less than £15.25 (compared to £15 in the UK).

- A can of Coke or a McMeal at McDonald’s would cost you almost the same, maybe a bit higher than in the UK.

- Buy yourself a new pair of jeans, since 1 pair of jeans (Levis 501 Or Similar) is going to cost you 40% less than in the UK.

- If you plan to rent a car, don’t worry about the gasoline since it costs almost 52% less than in the UK!

In general, the USA is usually less expensive than the UK and one of the easiest countries to travel to.

Data from Numbeo , and various travel sites.

Travelling to The USA – Popular Destinations

These are the most popular destinations in the USA:

- New York City – one of the best cities in the world for tourists. Plenty of famous sites across the city like Times Square, the Statue of Liberty, the Met, Central Park, and many more. A Perfect place for shopping and restless night clubs.

- Maui’s extraordinary beaches, hiking trails, opportunities to climb a volcano, experience amazing waterfalls, and, of course, surfing make this place a paradise for everyone.

- The Big Island of Hawaii- you can have it all – snow-capped mountains, deserts, rainforests, and volcanoes, all in one island. Be sure to spend a couple of days over there to enjoy the desired activities.

- Las Vegas is a 24/7 nonstop city with casinos, nightclubs, and terrific shows. There are also some outdoor activities near the city, like the Grand Canyon and the Hoover Dam.

Based on Trip Advisor

Exchanging Large Sums Via Bank

If you are looking to exchange significant amounts you could be better off simply making an international wire transfer from UK to USA. This is especially useful when paying for a hotel where high card costs incur. Some providers will even offer multi-currency accounts so that you could use the funds for travel.

US Dollars Rate Comparison

Thank you for reading our guide for travellers to the US who want to find the best Pound to US Dollar exchange rates. We are dedicated to improving our website’s content and quality and we would be glad to see you again in the future. Do not forget, the best travel money provider today does not have to be the cheapest at any given time. Compare you results every time you want to buy US Dollars in order to get the best GBP to USD exchange rates.

Enjoy your amazing trip to the United States!

Argentina Adds Another Exchange Rate—for Tourists Only

The argentinian government implemented a new regulation on november 4, 2022, allowing visitors using credit and debit cards to obtain a more favorable exchange rate than the official rate..

- Copy Link copied

The government hopes the new rule for credit and debit cards will discourage all-cash transactions that leave cash-laden tourists more vulnerable to robbers.

AP Photo/Natacha Pisarenko

In recent years, a moment often came when a visitor to Argentina suddenly grasped they could have gotten a lot more bang for their bucks if only they had brought cash to buy pesos on the unofficial market.

A dollar sometimes would buy twice as many pesos in informal cash trading as the amount in pesos it would get in purchases using a credit or debit card covered by the official exchange rate.

“You can almost hear the blood drain out of their voice when they realize this,” said Jed Rothenberg, owner of a travel agency that specializes in trips to Argentina.

That should, at least in theory, be a thing of the past as of Friday. The government has implemented a new regulation allowing visitors using credit and debit cards to get more pesos than the official rate gives.

On Friday, one dollar was officially worth 157 Argentine pesos. But in the unofficial market, commonly referred to as the “blue dollar,” it could be worth as much as 285 pesos. And in the system that will now be used by credit card operators, it was at 292.

The informal foreign currency traders became more ubiquitous after strict capital controls were put in place in 2019 in an effort to protect the local currency from a sharp devaluation amid the country’s high inflation.

Why the new rule?

The government hopes the new rule for credit and debit cards will discourage all-cash transactions that leave cash-laden tourists more vulnerable to robbers—and also often deprive the government of sales taxes that are frequently ignored if there is no electronic trail.

Rothenberg sought for years to explain Argentina’s different exchange rates and the difficulties that tourists faced in using credit and debit cards. He wasn’t always successful.

“The vast majority of people are just confused: ‘You mean there’s more than one exchange rate and that one of these can be as much as a double- or even triple-digit difference?’,” Rothenberg said.

The new rule won’t do much to reduce confusing complexities. It adds yet another exchange rate to the more than 10 that already exist in Argentina—a system that makes it impossible to say simply what a peso is worth.

The government also imposes different taxes on converting foreign currency depending on what it will be used for, leading to rates that have colloquial names like the “Qatar dollar” for travelers (a reference to the World Cup), the “Netflix dollar” for streaming services, and the “Coldplay dollar” to book foreign artists to play in the country.

The reason why no one can really answer how much a peso is worth is because “it’s worth something different for each person,” said Martín Kalos, an economist who is a director at Epyca Consultores, a local consultancy.

“The government has been segmenting the market. There is no one value, there are multiple prices depending on who you are or what operation you want to do,” he said.

The government’s goal is to have a stronger peso to pay for the country’s imports in hopes of keeping price rises from worsening. The economy registered an annual inflation rate of 83 percent in September.

President Alberto Fernández’s administration “is implementing palliative measures, or patches, because it has elections a year from now” and any efforts to correct these distortions would likely cause economic pain that would be costly at the ballot box, Kalos said.

Argentina has gone through so many financial crises in recent decades that its citizens are distrustful of their currency, so those who earn enough to save usually do so in dollars or euros.

Even economically savvy Argentines are often confused.

Anyone who has not received subsidies from the state or who operates in certain financial markets can buy as much as $200 a month but must add an additional 65 percent tax to the official exchange rate.

Argentines who pay for foreign currency purchases on their credit cards pay a surplus of 75 percent over the official rate. But that is as long as they spend less than $300. If they spend more than that a month, the surplus increases to 100 percent.

Argentines can also buy dollars through the financial markets via operations through bonds or stocks but pay a peso price similar to that in the informal market. That is the system made available to credit card processing companies Friday.

Experts said they have to see how the new system for visitors is implemented before knowing whether it will be successful.

But if implemented well, Rothenberg said the change could be a boon for tourists.

“They’re just using their credit card, they don’t care about the details,” he said. “If they actually make this work, Argentina could be one of the top tourist destinations within the next couple of years, especially with how expensive the U.S. and Europe are right now.”

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Betting Sites

- Online Casinos

- Wine Offers

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Holiday destinations where your money will go further with the current exchange rate

These are the places to go if you want your money to do more this summer, article bookmarked.

Find your bookmarks in your Independent Premium section, under my profile

Sign up to Simon Calder’s free travel email for expert advice and money-saving discounts

Get simon calder’s travel email, thanks for signing up to the simon calder’s travel email.

Holiday season is fast approaching, with warm weather on the way with the bank holiday at the end of this month welcoming the start of summer in the UK.

The end of the school year will soon follow, with plenty of people taking an opportunity to explore Europe.

Foreign holidays don’t have to be the expensive luxury they might seem. Much of Europe remains accessible on a budget , and there are countries where your money will go further this summer due to exchange rate fluctuations.

While the pound has had a tumultuous year, its value has strengthened against the currencies of some European countries, including Turkey and Sweden, with potential for affordable summer city breaks.

Using data and information given by Jack Mitchell, head of travel money at FairFX , we’ve unearthed some of the best destinations where your money will go further this summer.

Istanbul, Turkey

- Exchange rates: £500 can currently buy you 12,062.95 Turkish lira, compared to 9,519.25 at this time last year

- Accommodation prices: Double rooms in three-star, city centre hotels available from £50 per night

- Flights: Return flights from Gatwick for £190

Famously the only city in the world to straddle two continents, Istanbul is also the largest city in Europe. Steeped in history, the city has been the centre of three historic empires (the Roman, Byzantine and Ottoman empires) and many of its monuments and much of its architecture reflecting this. The main sites include the Hagia Sophia and the Blue Mosque, two neighbouring mosques built in the 6th and 17th centuries, respectively. Both are in the Sultanahmet district, known as the Old City, where many shops, restaurants and hotels line the streets.

Certainly a destination for exploring , other sights include the Topkapi Palace (once the centre of Ottoman rule), the ancient Galata Tower, and cruises along the Bosphorus Strait, where Europe meets Asia.

Bergen, Norway

- Exchange rates: For £500 you will get approximately 6,583.7 Norwegian Krone; last year you’d have got NOK 5,759.95

- Accommodation prices: Double rooms in thecity centre for £80 per night

- Flights: Return flights from Gatwick available for £154

Norway’s second city is small by city standards, with a population of just under 280,000 (roughly half the size of Manchester’s), giving it the feel of a small town rather than a busy metropolitan centre. However, this is part of the appeal. Surrounded by mountains and a section of the North Sea, nature is an important part of the city, from outdoor activities (think hiking and kayaking) to a fish market that traces its roots back to the 1200s.

Bryggen, the historic area around the harbour, is a colourful Unesco World Heritage Site where tourists flock for bars and restaurants, while other neighbourhoods such as Vaskerelven and Nygardsgaten offer a less crowded experience. Whatever your fancy, make sure to take a fjord tour for a half-day boat trip to see dramatic waterfalls and steep mountains.

Read more on Europe travel :

- How to see the Northern Lights in Iceland

- Turkey travel guide: Everything you need to know before you go

- Italy’s 1 euro houses: who can buy one and how does it work?

Gothenburg, Sweden

- Exchange rates: This year, £500 buys you 6,398.35 Swedish Krona, in comparison to 6,182.55 last year

- Accommodation prices: Double rooms in central hotels from £71 per night

- Flights: Return flights from Heathrow are currently priced around £112

Named as the most sustainable city in the world in last year’s Global Destination Sustainability Index (Bergen was named in second place), Gothenburg is Sweden’s second city, with a city-wide focus on environmentally friendly living. The focus on sustainability means that cycling has become a great way to navigate the city.

Many of the most popular activities consist of exploring different sites and areas, from the Botanical Gardens or Slottsskogen Park to the Haga district, one of the oldest neighbourhoods in the city. Nevertheless, the city still has its fair share of cultural activities, including a natural history museum, a science museum and the Museum of Fine Art.

Reykjavik, Iceland

- Exchange rates: The current rate will get you 84,930 Icelandic Krona for £500, an increase of 1,260 ISK

- Accommodation prices: Double rooms from £100 per night

- Flights: Multiple airlines fly from Heathrow, Gatwick, Stansted and Luton, starting at £90 for return flights with easyJet

Reykjavik is the capital city of a country with a population of around 330,000 people, and 120,000 of them live here. It’s the world’s most northerly capital, a city of many opportunities for budding tourists. It’s a great base for exploring many of the country’s main natural sites, with drives of under two hours to Thingvellir National Park, Gullfoss Falls and the Kerid Crater (among other areas of natural beauty).

It also acts as a base for numerous Northern Lights trips, while most visitors will also go to Iceland’s famous Blue Lagoon, a manmade geothermal spa located in a lava field around 50 minutes’ drive from the capital . Despite all the amazing nature, it’s worth remembering that the city itself also has some interesting attractions, including the Reykjavik Art Museum and the National Archives of Iceland.

Nairobi, Kenya

- Exchange rates: £500 will buy you 83,395 KES in 2023, up from 74,760 KES last year

- Accommodation prices: Hotels near the city centre start at under £30 per night

- Flights: Return flights vary in price but can be found for as little as £480

The Kenyan capital is a gateway to the country’s many world-famous safari destinations, such as the Maasai Mara National Reserve or the Tsavo East National Park, both offering excellent opportunities to see the Big Five. Nevertheless, for those not wanting to venture too far, the city has Nairobi National Park, where you can see over 100 different animals including black rhinos, lions, buffalo and giraffe.

Within the city itself, Nairobi National Museum is the best place to learn about Kenyan history, while the Maasai Market is one of the best places to go to immerse yourself in the local art and crafts scene. In the south of the city, the Bomas of Kenya showcase traditional villages that belong to local tribes, with dozens of cultural performances including music and dance.

Toronto, Canada

- Exchange rates: Last year, £500 would buy you 817.40 CAD; now, it gets you 850.45

- Accommodation prices: Central hotels are available from roughly £140 per night

- Flights: Return flights available from £285

Toronto is Canada’s largest city, a busy metropolis of almost three million people with a wide array of different neighbourhoods and districts to explore. The Entertainment District is home to many of the city’s theatres, performance venues and nightclubs, while the Distillery District is a pedestrian zone that contains several 19th-century red-brick buildings and various shops, bars and restaurants. West Queen West is one of the more trendy areas, with a mix of street art and varied shops, and there are plenty of cultural enclaves across the city, such as Little India, Chinatown, Greektown or Little Italy.

Meanwhile, anyone looking to escape the buzz of the city can visit some of its green spaces . High Park is a 399-acre park in the middle of the city, while the Botanical Gardens are a series of 17 gardens that aim to “educate and inspire” with learning experiences for all ages. For a longer day out, The Toronto Islands are a small island chain, just a 13-minute ferry from downtown, with beaches, woodland and opportunities for cycling, hiking, canoeing, paddling boarding and more.

Mumbai, India

- Exchange rates: At the current rate, £500 buys you 51,005 INR, compared to 49,304.90 last year

- Accommodation prices: Double rooms available starting at £38 per night

- Flights: Return flights from £468

Home to 12 million people, Mumbai is renowned for bustling markets, street food, buzzing nightlife and crowded roads and streets. While movie buffs might want to visit Film City to learn what goes on behind the scenes in Bollywood, architecture aficionados will want to see the Gateway of India and two of the city’s Unesco sites, the Chhatrapati Shivaji railway terminus and The Victorian and Art Deco Ensemble of Mumbai (a group of 19- and 20th-century buildings, including the University Library and Rajabai Clock Tower).

Other highlights include the Chhatrapati Shivaji Maharaj Vastu Sangrahalaya, which documents Indian history from pre-historic times, or the Kala Ghoda Art Precinct, an artistic district offering several galleries and museums. Shopping can range from the high-end (in neighborhoods like Bandra and Colaba) to traditional (in markets such as Crawford Market and Chor Bazaar). Alternatively, head to one of the city’s various beaches (Juhu Beach and Girgaum Chowpatty are popular) for sunsets, swimming, street food and relaxation.

Bodrum, Turkey

- Exchange rates: £500 now buys you 12, 062.95 Turkish lira, far more than the 9,519.25 it would have bought last year

- Accommodation prices: Prices vary depending on area, but good hotels can be found for as little as £40 per night

- Flights: EasyJet and Tui offer return flights for as little as £182

A popular tourist destinations with Britons, the Bodrum Peninsula (including the eponymous city) sits on the Aegean Sea in the southwest of Turkey . The city itself is built on the ancient ruins of Halicarnassus (once home to the Mausoleum, one of the Seven Wonders of the Ancient World), and is steeped in history. This includes Bodrum Castle and the Museum of Underwater Archaeology.

With average temperature highs well into the 30s between June and September, this part of the country is an excellent choice for warmth and sun during your summer holiday, with dozens of picturesque beaches and warm, turquoise waters. Other outdoor activities include hiking, sailing and exploring some of the charming surrounding towns, such as Bitez.

Read more of our reviews of the best hotels in Europe

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Want an ad-free experience?

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

- Compare Rates

- Compare Exchange Rates

- Currency Exchange Rates

- Currency Rates Cross Table

- Exchange Rates Today

- Country Codes

- Currency Symbols

- Todays Top Movers

- Pounds to Euros

- Pounds to Dollars

- Pounds to NZ Dollars

- Pounds to AUS Dollars

- Pounds to CAD Dollars

- Pounds to Yen

- Pounds to Rands

- Euros to Pounds

- Dollars to Pounds

- Euros to Dollars

- Currency Calculator

- Historical Currency Converter

- Exchange Rate Calculator

- Market Updates (Email)

- Currency Converter App

- British Pounds

- Swiss Franc

- Australian Dollars

- Canadian Dollars

- South African Rands

- Euro Exchange

- Emigrating Overseas

- Buying Property Abroad

- Regular Overseas Payments

- International Money Transfers

- Importing High Value Assets

- Sending Money Home

- Foreign Exchange Brokers

- Money Transfer Options

- ...more in this section

- Money Transfer to Spain

- Money Transfer to Australia

- Money Transfer to Hong Kong

- Money Transfer to New Zealand

- Money Transfer to Canada

- Money Transfer to US

- Money Transfer to UK

- Money Transfer to South Africa

- Money Transfer to Germany

- Foreign Currency

- Travel Money Card

- Travellers Cheques

- Crypto Currencies

- Live Gold Prices

- Live Silver Prices

- Live Oil Prices

- Currency Affiliate Program

- Live Forex Rates and Charts

- Rates Table Live

- Money Transfer To Table

- Exchange Rate Converter

- Exchange Rates Table

- Exchange Rates Table Deluxe

- Currency Charts

- Live Currency Converter

- Live Currency Rates Ticker

- Live Forex Rates Ticker

- Live Currency Toolbar

Today's Best British Pound / Costa Rica Colon exchange rate: 1 GBP = 672.6636 CRC

Latest gbp/crc exchange rate data, converter, calculator tools and fx history, currency menu.

- Currency Rates

- GBP CRC Rate Alert?

- CRC GBP (Invert)

- GBP CRC History, Charts

- Compare Cash Rates

Welcome to the Pounds to Costa Rica Colon page, updated every minute.

Compare today's best British Pound to Costa Rica Colon exchange rates

The live Pound to Costa Rica Colon exchange rate (GBP CRC) as of 8 Jun 2024 at 2:01 AM.

GBP/CRC Live Chart & Data

Below you can see the chart for the Costa Rica Colon rate today compared to the Pound.

Historical Charts & Data for Pounds to Costa-Rica-Colon

The GBP to CRC rate over a historical period can be determined using the history chart and data below:

For full history please visit GBP/CRC exchange rate history page

To convert Pounds to Costa Rica Colon or determine the Pound Costa Rica Colon exchange rate simply use the currency converter on the right of this page, which offers fast live exchange rate conversions today!

Compare Travel Money: Best CRC Tourist Exchange Rates

The best CRC exchange rate right now is 637.9900 from Best Foreign Exchange. This is based on a comparison of 25+ currency suppliers and if you were buying £500 worth of CRC for home delivery. Today's best UK deal for £500 will get you 318995 CRC plus delivery. Check the table of travel money rates below to see more competitive deals than the high street/airport bureau de change.

Your Trust and Safety: Exchange Rates UK ONLY works with foreign exchange payment companies that are registered with the FCA .

Accuracy: The travel/tourist exchange rates were valid at Saturday 8th of June 2024 02:01:12 AM, however, please check with relevant currency exchange broker for live travel money rate. Note: You may need to refresh this page.

Click here for the full best exchange rates comparison table.

Compare Today's GBP to CRC Exchange Rate with Past Historical Rates

Some Common Questions

Handy Conversion Data Table

Pound Sterling Today: Strong Employment Data Keeps Pressure on BoE, Lifts GBP

Pound to dollar rate retreats to 1.4050, pound sterling news.

Pound to Euro: No ECB Shockwaves, Sterling Held Below Key Resistance

Pound to Dollar Rate Unable to Regain 1.28 as US Services Data Blocks Pound Advance

Pound Sterling: Inflation Data Increases Chances of August BoE Rate Cut

Pound to Dollar Outlook: GBP/USD Below 1.28, Fragile Risk Appetite Offsets Weaker US Data

Pound to Dollar Rate Tests 10-Week Best as Sterling Bounces

Read all our latest exchange rate forecasts with live FX news updates as they happen!

MOST VISITED CURRENCY PAGES

GBP CRC Converter

Live currency calculator, get a free rate alert:, currency conversions.

- Copyright © 2006 - 2024 Exchange Rates UK

- Editorial and Ethics Guidelines

- Ownership/Advertising/Funding Disclosure

- Legal Disclaimer

- Language: English

- Français

- Español

- Português

- Netherlands

- Credit Cards

- Best Travel Credit Cards

19 Best Travel Credit Cards Of June 2024

Expert Reviewed

Updated: Jun 6, 2024, 11:02am

For anyone who travels enough to have a travel savings account, like I do, credit cards are a valuable resource toward booking and paying for your trip. The rewards can offset a huge portion of your out-of-pocket expenses, and the best cards often pay for themselves both in savings and avoided headaches.

Why you can trust Forbes Advisor

Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below.

- 113 countries visited

- 5,500 hotel nights spent

- 93,000,000 miles and points redeemed

- 29 loyalty programs covered

Best Travel Rewards Credit Cards

- Chase Sapphire Preferred® Card : Best Travel Credit Card for Beginners

- Capital One Venture Rewards Credit Card : Best Flat-Rate Rewards Credit Card for Travel

- Wells Fargo Autograph Journey℠ Card * : Best Travel Earnings Without a Portal

- Bank of America® Premium Rewards® credit card : Best Card for Bank of America Preferred Rewards Members

- Chase Freedom Flex℠ : Best Intro APR Travel Card

- American Express® Green Card * : Best Travel Card for Varied Spending

- Capital One Venture X Rewards Credit Card : Best Premium Travel Rewards Card

- Chase Sapphire Reserve® : Best Travel Credit Card for International Travel

- The Platinum Card® from American Express : Best Travel Rewards Credit Card for Lounge Access

- American Express® Gold Card : Best Travel Rewards Earning for Foodies

- Aeroplan® Credit Card : Best Airline Rewards Program for International Travel

- British Airways Visa Signature® Card : Best for British Airways Passengers

- United Quest℠ Card : Best United Credit Card

- United Club℠ Infinite Card : Best Premium Airline Card

- IHG One Rewards Premier Credit Card : Best Midrange Hotel Card

- The World of Hyatt Credit Card : Best Travel Credit Card for Hyatt Loyalists

- Wyndham Rewards Earner® Plus Card * : Best for Road Warriors

- Marriott Bonvoy Boundless® Credit Card * : Best for Marriott Customers

- Hilton Honors American Express Surpass® Card : Best Credit Card for Hilton Travelers

- Best Credit Cards Of 2024

- Credit Cards With Travel Insurance

- Best Hotel Credit Cards

- Best Credit Card For Lounge Access

- Best No-Annual-Fee Cards For Travel

- Best Airline Credit Cards

OFFER ENDING SOON: EARN 75K WELCOME BONUS POINTS

Chase sapphire preferred® card.

Up to 5x Reward Rate

Earn 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all Read More

Welcome Bonus

75,000 bonus points

Regular APR

21.49%-28.49% Variable

Credit Score

Excellent, Good (700 - 749)

Offering a rare mix of high rewards rates and redemption flexibility, this card is a dream for frequent spenders on travel & dining – while charging a modest annual fee.

- Earn high rewards on several areas of spending

- Transfer points to travel partners at 1:1 rate

- Many travel and shopping protections

- No intro APR offer

- Best travel earning rates are only for bookings through the Chase Travel portal

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Best Travel Cards with a Low Annual Fee

Best travel credit card for beginners.

I jumped at the chance to get the Chase Sapphire Preferred® Card when it was first launched. More than a decade later, I’m still a loyal cardholder. It’s the ideal starter card for someone dipping their toe into travel rewards and I’m living proof you may never need to upgrade. Cardholders earn valuable Chase Ultimate Rewards® points for access to transfer partners or for easy, no-strings-attached redemptions through Chase Travel℠. There’s no foreign transaction fee and a wide selection of travel insurances.

Why We Like It

For a modest annual fee of $95 (which can be partially offset with an annual $50 hotel credit) you get a rare mix of high rewards rates and redemption flexibility.

What We Don’t Like

The highest earning rate requires making reservations through Chase Travel℠, which doesn’t include direct bookings or online travel agencies.

Who It’s Best For

Travelers who want to earn transferable points without a steep annual fee.

It’s the granddaddy of travel credit cards, but it still earns its reputation as one of the best around with solid bonus categories, strong travel protections, a great set of domestic and international transfer partners and a reasonable annual fee to boot. You can’t go wrong with it as your first travel credit card.

Best Flat-Rate Rewards Credit Card for Travel

Capital one venture rewards credit card.

Up to 5X Reward Rate

Earn 5X miles on hotels and rental cars booked through Capital One Travel. Earn 5X miles on Capital One Entertainment Read More

Earn 75,000 bonus miles

19.99% - 29.99% (Variable)

Casual travelers who don’t plan to carry a balance will find good value in the Capital One Venture Rewards Credit Card‘s earnings rates ( rates & fees ). And if you appreciate the skip-the-line perks of TSA PreCheck® and Global Entry as much as I do, you’ll be grateful for the up to $100 credit toward program fees.

You can earn double miles on every purchase and can access transfer partners without ponying up a triple-digit annual fee.

Expect dialed-back benefits compared to more premium travel cards. You’ll still enjoy select trip protections along with no foreign transaction fee. Keep in mind that you’ll want to redeem for travel bookings or transfers to partner programs (cash back redemptions are often not the best value).

Cardholders who want to earn travel rewards at a flat rate.

The Capital One Venture Rewards card is extremely low maintenance as far as travel reward cards go. It provides consistent value and flexibility when it comes to earning and redeeming points for travel and is an excellent alternative for anyone a bit leery of the high Venture X annual fee ( rates & fees ).

- Solid rewards rate

- Global Entry or TSA PreCheck® statement credit (up to $100)

- No foreign transaction fees

- Miles are easy to redeem either via partner transfers or by applying against travel purchases

- $95 annual fee

- No introductory APR on purchases or transfers

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Best Travel Earnings Without a Portal

Wells fargo autograph journey℠ card *.

Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points Read More

60,000 bonus points

21.24%, 26.24% or 29.99% variable APR

We love that the Wells Fargo Autograph Journey℠ Card * bestows you with strong earning rates on travel without requiring you to book through a card’s portal. Go ahead and book directly with your preferred airline and hotel: You’ll earn 5 points per dollar on hotels, 4 points per dollar on airlines, 3 points per dollar on other travel and restaurants and 1 point per dollar on other purchases.

There’s a minimal annual fee for this card and it comes with the opportunity to earn a $50 statement credit each year when you spend $50 or more on airline purchases. That’s a bargain travelers will love.

For now, there’s a limited number of transfer partners, which means you’ll have fewer redemption options than what some other issuers provide.

We think this card is a perfect fit for travelers who like to book trips directly, especially if they’re looking for cash-back rewards rather than travel transfers.

Wells Fargo has entered the premium card market with its highly anticipated Autograph Journey card which offers accelerated points earnings on airfare, hotels and restaurants. It’s also the newest card to offer the option to redeem points by transferring them to travel partners.

- Solid welcome bonus

- High rewards rates on travel and restaurants

- Annual statement credit for airfare

- Limited everyday bonus rewards

- Few transfer partners

- Charges an annual fee

- Earn 60,000 bonus points after spending $4,000 in purchases in the first 3 months of account opening – worth up to $600 toward your next trip

- Earn unlimited 5 points per dollar spent on hotels, 4 points on airlines, 3 points on other travel and restaurants and 1 point on other purchases

- Earn a $50 annual credit with $50 minimum airline purchase

- Cell phone protection against damage or theft, subject to a $25 deductible

- Complimentary 24/7 Visa Signature® Concierge

Best Card for Bank of America Preferred Rewards Members

Bank of america® premium rewards® credit card.

Up to 2X Reward Rate

Earn unlimited 2 points for every $1 you spend on travel and dining purchases. Earn 1.5 points for every $1 Read More

60,000 points

21.24% - 29.24% Variable APR on purchases and balance transfers

Good, Excellent (700 - 749)

The Bank of America® Premium Rewards® credit card won’t turn heads unless you’re a Preferred Rewards member with substantial account balances at Bank of America. But if you are, watch your rewards grow at amazing rates.

I have no problem earning $100 in statement credits annually for airline incidental charges, my favorite perk of the card. And while it won’t be relevant to everyone, some Bank of America account holders could earn an incredible 25-75% more in rewards on every purchase.

The standard earning rate on this card isn’t notable. You’ll earn 2 points per dollar on travel and dining purchases and 1.5 points per dollar on all other purchases.

This card stands out for someone who already qualifies for Preferred Rewards, or is willing to move banking balances to Bank of America and their partners accordingly.

The best travel credit cards make it easy to earn back the annual fee every year, and the Premium Rewards credit card is one of those. It’s also a rewards powerhouse for Bank of America Preferred Rewards customers.

- No foreign transaction fee

- TSA PreCheck® or Global Entry fee credit

- Visa Signature concierge benefit

- Flexible reward redemption options

- High penalty APR

- High balance transfer fee

- High standard APR and cash advance APR

- No airport lounge perks

- Low $95 annual fee.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.