- |

CENTRAL CIVIL SERVICES - TRAVELLING ALLOWANCE RULES

Ta/da rules - government of india's orders.

F.No.19030/3/2008-E.IV Government of India Ministry of Finance Department of Expenditure

New Delhi, the 23rd September, 2008

OFFICE MEMORANDUM

Subject: Travelling Allowance Rules - Implementation of the Sixth Central Pay Commission.

The undersigned is directed to say that in pursuance of the decisions taken by the Government on the recommendations of the Sixth Central Pay Commission relating to Travelling Allowance entitlements, sanction of the President is conveyed to the modifications in the Travelling Allowance Rules as set out in the Annexure to this Office Memorandum in so far as they apply to civilian employees of the Central Government. Separate orders will be issued by the Ministries of Defence and Railways in respect of their personnel.

2. The 'Grade Pay' for determining the TA/DA entitlement is as indicated in Central Civil Service (Revised Pay) Rules, 2008.

3. The term 'pay' for the purpose of these Orders refer to basic pay as defined in Rule 3(8) of Central Civil Services (Revised Pay) Rules, 2008 and includes the revised non-practicing allowance, if any, admissible in addition.

4. In respect of those employees who opt to continue in their pre-revised scales of pay, the corresponding Grade Pay of the pay scales of the post occupied on 1/1/2006 would determine the TA/DA entitlements under these orders. However, for determining the Composite Transfer Grant for such employees, the term pay shall also include, in addition to the basic pay in the pre-revised Scales, stagnation increments, Dearness Pay and NPA as per orders in force on 1/1/2006.

5. These orders shall take effect from 1st September, 2008. However, if the Travelling Allowance entitlements in terms of the revised entitlements now prescribed result in a lowering of the existing entitlements in the case of any individual, groups or classes of employees, the entitlements, particularly in respect of mode of travel, class of accommodation, etc., shall not be lowered. They will instead continue to be governed by the earlier orders on the subject till such time as they become eligible, in the normal course, for the higher entitlements.

6. The claims submitted in respect of journey made on or after 1st September, 2008, may be regulated in accordance with these orders.

7. It may be noted that no additional funds will be provided on account of revision in TA/DA entitlements. It may therefore be ensured that permission to official travel is given judiciously and restricted only to absolutely essential official requirements.

8. In so far as the persons serving in the Indian Audit & Accounts Department are concerned, these orders issue in consultation with the Comptroller & Auditor General of India.

9. Hindi version will follow.

(MADHULIKA P. SUKUL) Joint Secretary to the Government of India

Annexure to Ministry of Finance, Department of Expenditure O.M.No.19030/3/2008-E.IV dated 23rd September, 2008.

In supersession of S.R. 17 and G.O.I., M.F. No. 10/2/98-1C & 19030/2/97-E.IV dated 17/4/1998; the following provisions will be applicable with effect from 1.9.2008.

2. Entitlements for Journeys on Tour:

A. Travel Entitlements within the Country:

The revised Travel entitlements are subject to following: -

(i) In case of places not connected by rail, travel by AC bus for all those entitled to travel by AC II Tier and above by train and by Deluxe/ordinary bus for others is allowed.

(ii) In case of road travel between places connected by rail, travel by any means of public transport is allowed provided the total fare does not exceed the train fare by the entitled class.

(iii) Henceforth, all mileage points earned by Government employees on tickets purchased for official travel shall be utilized by the concerned department for other official travel by their officers. Any usage of these mileage points for purposes of private travel by an officer will attract departmental action. This is to ensure that the benefits out of official travel, which is funded by the Government, should accrue to the Government.

(iv) All Government servants are allowed to travel below their entitled class of travel.

B. International Travel Entitlement:

C. Entitlement for journeys by Sea or by River Steamer (SR. 40):

(ii) Accommodation entitlements for travel between the mainland and the A&N Group of Islands and Lakshadweep Group of Island by ships operated by the Shipping Corporation of India Limited will be as follows:

D. Mileage Allowance for Journeys by Road:

In supersession of S.R.46 and the Government of India's order thereunder, the grade pay ranges for travel by public/bus/auto/rickshaw/scooter/motor cycle, full taxi/taxi/own car is revised as indicated below:

(b) Mileage allowance for road journeys shall be regulated at the following rates in places where no specific rates have been prescribed either by the Director of Transport of the concerned State or of the neighbouring States:

(i) For journeys performed in own car/taxi: Rs. 16 per km.

(ii) For journeys performed by auto rickshaw own scooter, etc.: Rs. 8 per km.

(c) The rate of Mileage Allowance for journeys on bicycle on tour and transfer, is revised from 60 paise to Rs 1.20 per kilometer.

3. Daily Allowance on Tour:

In case of stay/journey on Government ships, boats etc. or journey to remote places on foot/mules etc., for scientific/data collection purposes in organization like FSI, Survey of India, GSI etc., daily allowance will be paid at rate equivalent to that provided tor reimbursement of food bill. However, in this case the amount will be sanctioned irrespective of the actual expenditure incurred on this account with the approval of the Head of Department/controlling officer. For journeys on foot, an allowance of Rs. 5 per kilometer travelled on foot shall be payable additionally.

4. TA on Transfer:

A. Accommodation and Mileage Allowance Entitlements:

(i) Accommodation and Mileage Allowance entitlements as prescribed at para 2 above, except for International Travel, for journey on tour by different modes will also be applicable in case of journeys on transfer. The general conditions of admissibility prescribed in S.R. 114 will, however, continue to be applicable.

(ii) The provisions relating to small family norms as contained in para 4(A) of Annexure to M/o Finance O.M. F. No. 10/2/98-IC & F. No. 19030/2/97-EIV dt. 17th April 1998, shall continue to be applicable.

B. Transfer Grant and Packing Allowance:

(i) The Composite Transfer Grant shall be equal to one month's pay as defined in para 3 of this O.M. in case of transfer involving a change of station located at a distance of or more than 20 km from each other.

(ii) In cases of transfer to stations which are at a distance of less than 20 kms from the old station and of transfer within the same city, one third of the composite transfer grant will be admissible, provided a change of residence is actually involved.

(iii) At present, only one transfer grant is permitted if the transfer of husband and wife takes place within 6 months of each other from the same place to the same place. With effect from the date of implementation of these orders, in cases where the transfer take place within six months, but after 60 days of the transfer of the spouse, fifty percent of the transfer grant on transfer shall be allowed to the spouse transferred later. No transfer grant shall be admissible to the spouse transferred later in case both the transfers are ordered within 60 days. The existing provisions shall continue to be applicable in case of transfers after a period or six months or more. Other rules precluding transfer grant in case of transfer at own request or transfer other than in public interest, shall continue to apply unchanged in their case.

C. Transportation of Personal Effects:

The rates for transporting the entitled weight by Steamer will be equal to the prevailing rates prescribed by such transport in ships operated by Shipping Corporation of India.

D. Transportation of Conveyance:

5. T.A. Entitlement of Retiring employees:

A. Transportation of Conveyance:

In partial modification of S.R. 147 the expenditure on transportation of conveyance by government servants on their retirement shall be reimbursed without insisting on the requirement that the possession of the conveyance by them while in service at their last place of duty should have been in public interest.

B. Lumpsum Transfer Grant and Packing Allowance:

(i) The composite transfer grant equal to a month’s pay last drawn as defined in para 3 of this O.M. may be granted in the case of those employees who, on retirement, settle down at places other than the last station(s) of their duty located at a distance of or more than 20 kms. The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc. at the old and new station, presently admissible are subsumed in the composite transfer grant and will not be separately admissible.

(ii) As in the case of serving employees, government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 kms may be paid one third of the composite transfer grant subject to the condition that a change of residence is actually involved.

6. The TA/DA rates mentioned in para 2 D(b) and (c) (mileage for road journey by/taxi/own car/auto rickshaw/ own scooter/bicycle etc.), para (3) (all components of dally allowance on tour including rate of DA for journey on foot) and para 4(c) (rates of transportation of personal effects) of this Annexure, shall automatically increase by 25% whenever Dearness Allowance payable on the revised pay structure goes up by 50%.

Acts and Rules

- Customs Act, 1962

- Central Excise Act, 1944

- Finance Act, 1994

- CGST, IGST, UGST Acts, 2017

- CBIC Notifications

- CBIC Circulars & Instructions

- Local Standing Orders

- CBIC Recruitment Rules

- CBIC Reward Rules

Allied Acts and Rules

- F.E.M.A. 1999

- FEMA Rules & Regulations

- Circulars under FEMA

- RBI - Master Circulars

- Other Allied Acts & Rules

Budgets & Finance Acts

- Finance Acts from 1953

- Union Budget from 1999

- Budget Speeches from 1947

Directories and Codes

- All India CHA Directory

- Country, Airport, Port Codes

- SEZ, ICD, CFS Codes

- Guest Houses, Holiday Homes

- Currency Exchange Rates

- Import duty on Gold & Silver

- Gold Price from 1925

- Foreign Trade Policy

- Handbook of Procedures

- HP - Appendices

- ITC (HS) Schedules

Manuals and Galleries

- Manuals - Customs, Excise

- e-Learning Quizzes

- Cadre Review in CBIC

- CBIC ICE Magazines

- CBIC Surakshit & Vidhi Vartha

- News, Views & Articles

- Picture & Video Gallery

Promotions & Transfers

- Promotion, Transfer Orders

- Transfer, Placement Policy

Seniority Lists

- Commissioners Seniority Lists

- Gr. 'A' Officers Seniority Lists

- Gr. 'B' Officers Seniority Lists

- IRS (C & CE) Civil Lists

- CBIC Sampark from 2006

- CBIC List of Retiring Officers

Service Case Laws

- Supreme Court - Judgements

- RTI - CIC Orders

Tariffs & Schedules

- Customs Import & Export Tariff

- Customs Duty Calculator

- CGST, IGST Tariff

- Central Excise Tariff

- Drawback Schedules

- DEPB Schedules

Baggage and Passengers

- Baggage Rules 2016

Directories & Codes

- STD Codes Directory

- ISD Codes Directory

- PIN Codes Directory

- Speed Post Directory

Favourite Site Links

- Govt. & Other Websites

- International Organizations

General Information

- CBIC - What is CBIC?

- C B Revenue Act, 1963

- Customs & Excise Overview

- Customs Duty Introduction

- Customs Duty Collections

- Central Excise Duty

- Service Tax - An Outline

- GST - UGST and IGST

- Income Tax Rates

Pay Commissions

- 7th CPC OM Pay Fixation

- 7th CPC Revised Pay Rules

- 7th CPC Govt.'s Acceptance

- 7th CPC Pension Calculator

- 7th CPC Pay Calculator

- 7th Pay Commission Report

- 6th Pay Commission Report

- 6th CPC - GOI Decisions

Recruitment & Promotion

- Recruitment of Staff

- UPSC CS Examinations

- SSC CGL Examinations

- SSC Physical Standards

- Departmental Examinations

- Confirmation Syllabus

- Confirmation Examinations

- Promotion Syllabus

- Promotion Examinations

Service Rules

- AIS (Conduct) Rules, 1968

- AIS (D&A) Rules, 1969

- AIS (MA) Rules, 1954

- CCS (Conduct) Rules, 1964

- CCS (CCA) Rules, 1965

- CCS (LTC) Rules, 1988

- CCS (Leave) Rules, 1972

- Travelling Allowance Rules

- PS (Inquiries) Act, 1850

- Disciplinary Proceedings

Trade Facilitation

- ACES - What is ACES?

- CAAP - What is CAAP?

- ICEGATE - What is ICEGATE?

- ICES - What is ICES?

- NIDB - What is NIDB?

- ECDB - What is ECDB?

- RMS - What is RMS?

- SWIFT - What is SWIFT?

- eSANCHIT - What is eSANCHIT?

- GSTN - What is GSTN?

FIXING OF RATE PER KILOMETRE IN RESPECT OF MOTOR VEHICLES FOR THE PURPOSES OF SECTION 8(1)(b)(ii) AND (iii) OF THE INCOME TAX ACT, 1962

Prescribed rate per kilometre:

The prescribed rate per kilometre used for reimbursive travel allowance for 2022/2023 has increased from R3.82 to R4.18

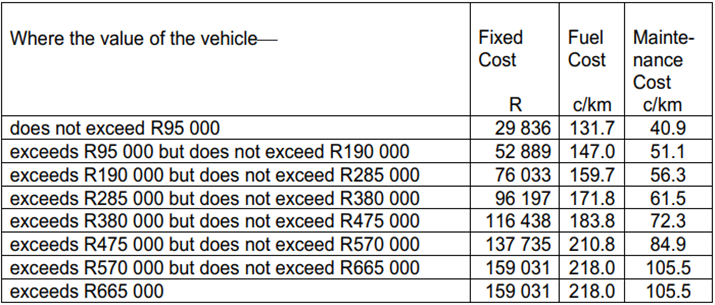

Vehicle lookup table for the purpose of calculating a travel allowance (deemed cost rate per kilometre on assessment):

Click here to read the Gazette: Government Gazette 46015

Central Government Employees Latest News

7th Pay Commission Latest News Today 2023, 7th Pay Matrix Table PDF, Expected DA Calculation, DA Rates Table, 8th Pay Commission Latest News

7th CPC Mileage Allowance for Journeys by Road

“7th cpc mileage allowance for road journeys”.

The 7th Central Pay Commission (CPC) has introduced a new policy for Mileage Allowance for Journeys by Road. Under this policy, specific rates have been prescribed for places where employees are required to travel for work purposes. This policy aims to provide fair compensation to employees for the expenses incurred during their travels, while also ensuring that the rates are reasonable and in line with market standards. By implementing this policy, the 7th CPC hopes to improve the job satisfaction of government employees and promote a culture of fairness and transparency in the workplace.

What is the 7th CPC Mileage Allowance for Journeys by Road?

The 7th CPC Mileage Allowance for Journeys by Road is a daily allowance for journeys taken by ordinary public bus or at prescribed rates for auto rickshaw, own scooter, motor cycle, moped, etc.

What do levels 1-5 cover?

Levels 1-5 cover actual fare by ordinary public bus or at prescribed rates for auto rickshaw, own scooter, motor cycle, moped, etc.

What do levels 6-13a cover?

Levels 6-13a cover the same as levels 1-5, with the exception that journeys by AC taxi will not be permissible.

What does level 14 (GP 10000) cover?

Level 14 covers actual fare by any type of bus including AC bus or at prescribed rates for AC taxi when the journey is actually performed by AC taxi or at prescribed rates for auto rickshaw, own car, scooter, motor cycle, moped, etc.

How much is the allowance for journeys performed in own car/taxi?

The allowance for journeys performed in own car/taxi is Rs. 24/- per Km.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

CSD AFD Canteen Price List

7th CPC Travelling Allowance Rates

7th pay commission travelling allowance rules for central government employees.

Travelling Allowance is not a regular allowance for all employees! Travelling Allowance is that the permission to avail reimbursement of the expenses incurred by an employee while on duty in outstation! Travelling Allowance is a package of various allowances. Travelling Allowance and Daily Allowance (TA-DA), Hotel Charges, Travelling Charges, Food Charges, Mileage Allowance, Reservation Charges, Internet and E-Ticketing Charges, Cancellation Charges, Conveyance Charges, TA on Deputation, TA on Transfer and TA on Retirement.

Compilation of TA/DA Rules for CG Employees

New Revised Rate and Entitlements of Travelling allowance as per 7th pay commission with effect from 1st July 2017: For Armed Forces Defence Personnel and Railway employees, the concerned department will issue separate orders on this subject respectively. Supersession of all orders issued earlier, particularly DoE Office Memorandum No.19030/3/2008-E.IV dated 23.9.2008, in respect of Travelling Allowance rules.

Travelling Allowance (TA) on Retirement

Time-limit for submission of claims for TA on Retirement is modified from 60 days to 180 days (six months), succeeding the date of completion of the journey – Finance Ministry Orders on 15th June 2021.

TA/DA Rules for Central Govt Employees

What is TA/DA?

TA/DA stands for Travelling Allowance and Daily Allowance (not Dearness allowance ). TA means the travel expenses as per entitlement on official duty. DA means the food and accommodation charges as per the entitlement. Travelling allowance and Daily allowance are fixed amounts as per the pay matrix level after the 7th pay commission.

What is Travelling Allowance?

A reimbursement system for travelling expenses while on duty (official duty or temporary duty). And any kind of travelling expenses is permissible as per entitlements of TA/DA Rules. Other than travel expenses, accommodation, food and other related expenses are also eligible for reimbursement under Daily Allowance. The revised rates of TA and DA allowances after the 7th pay commission are given below in detail.

- 7th Pay Commission Travel Entitlement

- 7th Pay Commission Rate of Travelling Allowance

- 7th Pay Commission Orders on Travelling Allowance

Travelling Allowance Rates 7th Pay Commission – Travel Entitlement as per Pay Level in Pay Matrix

Entitlement of Daily Allowance and Travelling Allowance as per Pay Level in Pay Matrix Table

Travel Entitlement for Tour and Training (within the Country)

Entitlement of Premium Trains, Premium Tatkal, Suvidha, Shatabdi, Rajdhani and Duronto Trains

International Travel Entitlement

Entitlement for journeys by Sea or by River Steamer

(i) For places other than A&N Group of Islands and Lakshadweep Group of Islands:-

For travel between the mainland and the A&N Group of Islands and Lakshadweep Group of Islands by ships operated by the Shipping Corporation of India Limited

Mileage Allowance for Journeys by Road

(i) At places where specific rates have been prescribed:-

Daily Allowance as per Pay Level in Pay Matrix

Rate of Daily Allowance Travelling Allowance as per Pay Level in Pay Matrix Table

Note: The Rates of Accommodation Charges, Travelling Charges, and Lump sum amount will further increase by 25% whenever DA increases by 50%.

Clarification on accommodation charges for stay in Hotels as per CCS (TA) Rules – Dated: 18.6.2018

Claiming of hotel charges procedure for CG Staff and Officers with effect from 1st July 2017 as per the recommendations of the 7th pay commission.

For levels 8 and below, the amount of claim (up to the ceiling) may be paid without the production of vouchers against self-certified claims only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. Additionally, for a stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be Rs. 1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers.

Reimbursement of Travelling charges

Reimbursement of TA for Central Government Officers and Staff from 1st July 2017.

Similar to Reimbursement of staying accommodation charges, for level 8 and below, the claim (up to the ceiling) may be paid without the production of vouchers against self-certified claim only.

The self-certified claim should clearly indicate the period of travel, vehicle number, etc. the ceiling for levels 11 and below will further rise by 25 per cent whenever DA increases by 50 per cent. For journeys on foot, an allowance of Rs.12/- per kilometre travelled on foot shall be payable additionally.

Reimbursement of Food charges Procedure

Reimbursement of food bills procedure for CG Employees after 7th pay commission.

There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table E (i) above and, depending on the length of absence from headquarters, would be regulated as per Table (v) below.

Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates). i.e. Lump sum amount payable.

Timing restrictions – Absence from Headquarter

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per-day basis.

If absence from headquarters is less than 6 hours = 30% of the Lumpsum amount

If absence from headquarters is between 6 -12 hours = 70% of the Lumpsum amount

If absence from headquarters is more than 12 hours = 100% of the Lumpsum amount

Travelling Allowance Rules – Implementation of the Seventh Central Pay Commission

Transportation Rules for Personal Effects

Transportation of personal effects on transfer by road calculation. Transportation entitlement for Central Government employees with effect from 1.7.2017

Transportation Rules for Conveyance

Reimbursement for transportation of conveyance charges for CG employees effective from 1.7.2017.

Classification of pay level for Travelling allowance

Rate of transportation of conveyance on transfer

TA-DA Allowance Rules for Central Government Employees

Sr 116 of ta rules pdf.

The travelling allowance referred to will be admissible in respect of the journey of the Government servant and members of his family from the last station of his duty to his home town or to the place where he and his family is to settle down permanently even if it is other than his declared home town and in respect of the transportation of his personal effects between the same places.

SR 147 of TA Rules PDF

S.R. 147 the expenditure on transportation of conveyance by government servants on their retirement shall be reimbursed without insisting on the requirement that the possession of the conveyance by them while in service at their last place of duty should have been in the public interest. Finance Ministry issued an important clarification order on Travelling Allowances rules and rates as per 7th Pay Commission on 13.7.2017.

TA/DA Rules for Retiring Employees

TA on Retirement includes 4 components:-

- Travel entitlement for self and family

- Composite Transfer and packing grant (CTG)

- Reimbursement of charges on transportation of personal effects

- Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements

Travel entitlements as prescribed for tour/transfer in Para 2 above, except for International Travel, will be applicable in case of journeys on retirement. The general conditions of admissibility prescribed in S.R. 147 will, however, continue to be applicable.

(ii) Composite Transfer Grant (CTG)

(a) The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of those employees, who on retirement, settled down at places other than the last station(s) of their duty located at a distance of or more than 20 km.

However, in case of settlement to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay.

Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG.

The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc., at the old and new station, are already subsumed in the composite transfer grant and will not be separately admissible.

(b) As in the case of serving employees, Government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 km may be paid one-third of the CTG subject to the condition that a change of residence is actually involved.

(iii) Transportation of Personal Effects:- Same as Para 3(iii) above.

(iv) Transportation of Conveyance:- Same as Para 3(iv) above.

The general conditions of admissibility of TA on Retirement as prescribed in S.R. 147 will, however, continue to be applicable.

Who is eligible for Travelling Allowance?

7th CPC Travel Entitlements

Travelling Allowance and Related matters | Finmin Orders

Transfer Travelling Allowance Form for Central Government employee

Travelling Allowance Bill For Transfer

- Part-A (To be filled by the Government Servant)

Particulars of an employee

Part-B (To be filled in the Bills Section)

- Expenditure Details

Note: This bill should be prepared in duplicate-one for payment and the other as an office copy

Time limit for submission of claims for Travelling Allowance (TA) on retirement regarding

The time limit for submission of TA claim in all other cases i.e. on tour, transfer and training etc. will remain 60 days.

Travelling Allowance (TA/DA) Chart

Travelling Allowance on transfer to/from the North-Eastern Region, Union Territories of Andaman & Nicobar, Lakshadweep Island and Ladakh

If the family of the Railway employee does not accompany him. transfer to from these areas, the employee is entitled to carry personal effects up to 1/3rd of his entitlement and production of receipt/voucher is not mandatory to claim 1/3rd of his entitlement of transportation of personal effects.

If the family of the Railway employee accompanies him on transfer to/from these areas, the employee is entitled to the admissible cost of transportation of personal effects and production of receipt/voucher is mandatory to claim the admissible amount as per his entitlement for transportation of personal effects.

Related Updates

- 7th CPC Briefcase Allowance Rates

- 7th CPC Transport Allowance Rates

- Indian Railways Train Numbers 2022

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Are you claiming the correct rate for business kilometres travelled?

https://www.crs.co.za/wp-content/uploads/2022/07/CRS-News-Flash-20-July-2022-PAKISTAN-Revised-tax-rates-published-in-the-Finance-Act-2022.pdf

Contact our legislation team at [email protected] if you require any additional information.

© 2022 C RS Technologies (Pty)Ltd. All Rights Reserved.

- AA rate per kilometre

- business kilometres

Engage™ Europe, Middle East, Africa distributor.

Quick links

- Participate

- CRS HR Services

- CRS Tax Advisory

- CRS Payroll Bureau

- Engage™ Software

- Engage™ Europe

- Enstruct e-learning portal

- Testimonials

- Partner Portal

- Partner Application

- SCARF Philosophy

- Hipe Agreement

Inspired, Engaged and Rewarded Employees

2024/2025 Tax Guide

2024/2025 Tax Guide download

Download your copy of the CRS 2024/2025 Tax Guide

This will close in 0 seconds

We use cookies to ensure that we give you the best experience on our website.

Your choices on cookies

This website uses cookies that are necessary to make the website work. You can also choose to set optional analytics cookies that are described below.

You can find more information on how we use our cookies in our Cookie Statement . You can change your cookie preferences at any time by clicking the Cookie preferences link in the footer of every page on this website.

Necessary Cookies and Preferences Cookies

Necessary cookies are used so that the basic functions of this website work. They are limited to only those that are strictly necessary. For example, we set a session cookie on your device to store a session's status in between http requests to enable better performance.

You can disable these cookies by changing your browser settings but this may affect how this website functions for you.

Preferences cookies allow a website to remember the choices you have made when you save your cookie preferences.

Analytics cookies

These cookies are used to help us understand how website visitors use this website. They are set by a third-party service provided by Google. The service collects and reports information to us in a way that does not directly identify you as a website user. For example, the service provides summary reports to us that help us to understand which pages our website visitors access most often. This enables us to keep improving the website.

You can help us to continue to improve our website by turning analytics cookies on. You can change your mind and turn them off at any point in the future by clicking the Cookie Statement quick link in the footer of every page on this website. When you save your analytics cookies choice below, a cookie will be saved on your device to remember your choice.

This website uses cookies in order for our feedback functionality to work. You can choose to set these optional survey cookies that are described below.

Survey cookies

Survey cookies are set by a third-party service provided by Qualtrics. These cookies are required in order for our feedback functionality to work.

The survey cookies collect information about the page you are providing feedback from. When you save your survey cookies choice below, a cookie will be saved on your device to remember your choice. These cookies are set as session cookies and will be deleted once you close this browsing session.

We welcome your feedback and you can help us to continue to improve our website by turning survey cookies on.

This website uses cookies in order for our video functionality to work. You can choose to set these optional video cookies that are described below.

YouTube cookies

YouTube cookies are set by a third-party service provided by YouTube, a company owned by Google. These cookies are required in order for our video functionality to work.

When you save your YouTube cookies choice below, Revenue will save a cookie on your device to remember your choice. This Revenue cookie is set as a session cookie and will be deleted once you close this browsing session. YouTube may set cookies directly according to YouTube's own cookies policy .

Tá an chuid seo den suíomh idirlín ar fáil i mBéarla amháin i láthair na huaire.

Travel and subsistence

- Normal place of work

- Business journeys

- Reimbursement rates

Civil service rates

- Emergency travel

- Site-based employees

- Voluntary work

Civil service motoring and bicycle rates

Cars (rate per kilometre).

The kilometres accumulated by an employee between 1 January 2022 and 31 August 2022 will not be altered by the introduction of these new rates. Actual kilometres driven to date will, however, count towards total kilometres for the year.

You have claimed 1,400km by 31 August 2022. You would move to the new rate applicable to Band 1 for the remaining 100km in that band.

Mileage claims made in respect of journeys carried out in electric vehicles should use the rates applicable to engine capacity 1201cc-1500cc. Please see the above table.

Reduced mileage rates apply for journeys associated with an official’s job but not solely related to the performance of those duties. Examples include necessary travel in relation to:

- attendance at confirmed promotion competitions

- attendance at approved courses of education or conferences.

Motorcycles (rate per kilometre)

Civil service subsistence rates, rates for assignments within the state, overnight allowance.

Overnight allowance covers an overnight assignment of up to 24 hours. This must be at least 100km from the employee's home and their normal place of work.

The rate category depends on the period of an assignment:

- normal rate is for up to 14 nights

- reduced rate covers the next 14 nights

- detention rate covers each of the next 28 nights.

For assignments over 56 nights, you must make an application to Revenue to confirm subsistence is still available.

The period of subsistence at any one location is limited to six months.

Day allowances

The assignment must be outside eight kilometres of the employee's home and normal place of work.

You can only claim both a day and overnight allowance if you work five hours or more the next day.

Rates for assignments outside the State

Short term assignment.

These rates can be used for a single temporary assignment of up to six months where your employee is working abroad.

Long term assignment

A long term assignment will be more than six months.

For the first month of the assignment, you can allow subsistence for the overnight rate. This is to facilitate the employee to find self-catering accommodation.

For the remainder of the assignment you can allow subsistence costs and a portion of the ten-hour day rate. The subsistence cost can cover the cost of reasonable accommodation. You can allow 50% of the day rate (ten-hour) for the location.

Historic civil service rates

The historic rates are available in Part 05-01-06 of the Tax and Duty Manuals.

Next: Emergency travel

Published: 18 December 2023 Please rate how useful this page was to you Print this page

- Circular 16 2022: Motor travel rates Revised motor travel rates circular 16 2022

- Circular 17 2022: Domestic subsistence allowances Domestic subsistence allowances circular 17 2022

- Circular 19 2023: Domestic subsistence allowances Circular 19 2023: Domestic subsistence allowances

- Part 05-01-06 Tax treatment of the reimbursement of Expenses of Travel and Subsistence to Office Holders and Employees

- Part 42-04-35A The Employers' Guide to PAYE with effect from January 2019

- Part 42-04-35 Employers' Guide to PAYE. This guide remains applicable up to and including 31 December 2018.

- Information about Revenue

- Role of Revenue

- Customer service commitments

- Press office

- Statistics on income, tax and duties

- Revenue museum

- Revenue centenary

- Using revenue.ie

- Accessibility statement

- Re-use of public sector information

- Cookie preferences

- COVID-19 Information

- Statutory obligations

- Freedom of Information

- Data protection

- Protected disclosures

- Procurement

- Regulation of Lobbying Act

- Official Languages Act

- Child Safeguarding Statement

- Gender pay gap

- Reporting tax evasion (shadow economy activity)

- Drug and tobacco smuggling

- Consultations and submissions

- Submission to the Commission on Taxation and Welfare

- Modernising Ireland's administration of Value-Added Tax (VAT)

- Communications

- Our X policy

- Fraudulent emails and SMS (text messages)

- Website feedback

- Tax education

- Central Register of Beneficial Ownership of Trusts (CRBOT)

- External Links

- WhoDoesWhat

- WhoDoesWhat (Irish)

7th Pay Commission TA DA – Travelling and Daily Allowance – Recommendation and decision by Govt

7th Pay Commission TA DA – List of Allowances Covered while on Travel and cadre-wise eligibility – Committee’s recommendation and Government approval.

7th Pay Commission TA DA – Allowances allowed relating to Travel.

7th Pay Commission TA DA – Travelling and Daily Allowance are payable to Government Employees who are on official tour subject to certain conditions.

The analysis and recommendations of 7th Pay Commission as far as this reimbursement is concerned is as follows.

Daily Allowance

8.15.12 Daily allowance is meant to cover living expenses when employees travel out of their headquarters for work. Presently it is in the form of reimbursement of staying accommodation expenses, travelling charges (for travel within the city) and food bills, payable at the following rates:

For journeys on foot, undertaken in organizations like FSI, Survey of India, GSI, etc. for data collection purposes, an additional allowance of ₹7.5 per km travelled on foot shall be payable.

8.15.13 The existing dispensation is different for Railway employees who are paid a flat sum because they are currently not entitled to stay in any accommodation other than Railway rest houses. The lump-sum rates for Railway personnel are as follows:

8.15.14 Representations received regarding this allowance primarily deal with the reimbursement procedure, as it is claimed that getting hotel bills (in small towns) and food bills is not always practical.

Analysis and Recommendations

8.15.15 The Commission considered the present model of this allowance, followed both in Railways and in other ministries. It is proposed to adopt the best from both of them so that the administration of the allowance can be simplified. Accordingly the following is recommended :

a) Reimbursement of staying accommodation charges ( ₹ per day)

For levels 8 and below, the amount of claim (up to the ceiling) may be paid without production of vouchers against self-certified claim only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. The ceiling for reimbursement will further rise by 25 percent whenever DA increases by 50 percent. Additionally, it is also provided that for stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be ₹1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers.

b) Reimbursement of travelling charges

Similar to Reimbursement of staying accommodation charges, for levels 8 and below, the claim (up to the ceiling) should be paid without production of vouchers against self- certified claim only. The self-certified claim should clearly indicate the period of travel, vehicle number, etc. The ceiling for levels 11 and below will further rise by 25 percent whenever DA increases by 50 percent. The rate of allowance for foot journeys shall be enhanced from the current rate of ₹7.5 per km to ₹12 per km travelled on foot. This rate also shall further rise by 25 percent whenever DA increases by 50 percent. c) There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table 1 below and, depending on the length of absence from headquarters, would be regulated as per Table 2 below. Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates). i. Lump sum amount payable

( ₹ per day)

The Lump sum amount will increase by 25 percent whenever DA increases by 50 percent.

ii. Timing restrictions

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per day basis.

8.15.16 All the above provisions will apply to Railway personnel also .

Daily Allowance on Foreign Travel

8.15.17 This allowance is granted to employees when they undertake foreign travel. The rate of the allowance varies from $60 to $100 per day, depending upon the country involved. No demands have been received regarding this allowance.

8.15.18 Ministry of External Affairs and Ministry of Finance decide the rate of this allowance from time to time. Hence, the rates may be kept unchanged .

M ileage Allowance for Journeys by Road

8.15.35 It is more in the nature of entitlement for road journeys performed by different levels of employees. No demands have been received for any change.

8.15.36 The Commission is of the view that present provisions are adequate. Hence, status quo may be maintained except at places where no specific rates have been prescribed. There the rates should be enhanced by 50 percent. Accordingly, the following is recommended :

8.15.37 At places where no specific rates have been prescribed, the rate per km will go up by 25 percent each time DA rises by 50 percent.

Travelling Allowance

8.15.55 This allowance is in the nature of travel entitlements for different ranks of government employees. No demands have been received regarding this allowance.

8.15.56 The Commission opines that the present provisions are adequate. Hence, status quo is recommended with the present system of differentiation based on Grade Pay duly substituted by the Levels of the Pay Matrix:

8.15.57 It is suggested that Indian Railways reconsider its position regarding air travel to its employees, in light of the possible savings in terms of cost and man-hours, particularly after the pay revision as recommended by the Commission. The fact that additional seats will be released in trains for the public will be an added advantage. 7th Pay Commission TA DA – Travelling and Daily Allowance – Recommendation and decision by Govt

Here are the decisions of Govt with respect to Travelling Allowance and Daily Allowance which are effective from 1st July 2017

Daily Allowance:

- Level 6 to 8 of Pay Matrix to be entitled for Air Travel

2. Travelling Charges for Level -12 – 13 revised from ‘Non-AC Taxi charges up to 50 km to ‘AC taxi charges upto 50 Kms.’ and for level 14 and above to be revised from ‘AC Taxi charges up to 50 km’ to ‘AC taxi charges as per actual expenditure commensurate with official engagements’.Existing system of Daily allowance in the Ministry of Railways to continue.

Accepted as such.

Travelling Allowance:

Modifications accepted by the Government:

Level 6 to 8 of Pay Matrix to be entitled for Air travel. Level 5 A of Defence Forces to be clubbed with Level 6 for travelling entitlements. Existing system to continue in Ministry of Railways.

Mileage Allowance for journeys by road:

Click here to check the decision of Govt on all 197 Allowances applicable to Central Government Employees, Railway Employees and Defence Personnel

- Skip to navigation

- Skip to main content

Tax-free travel allowance increases

On this page, what has changed.

Are you an employer or self-employed professional without staff ( zzp'er )? The tax-free travel allowance ( reiskostenvergoeding ) has increased from €0.21 per kilometre to €0.23 per kilometre from 1 January 2024.

Are you self-employed ( zzp'er) ? If you are an entrepreneur for income tax purposes , you can deduct the amount per kilometre from your profit.

Employers can refund their employees’ travel costs free of tax. This also applies to public transport costs. And for taxi, boat, or airplane costs, within reason.

Employers may also choose to refund more than the tax-free kilometre allowance of €0.23. The surplus counts as wages and you have to pay wage tax over this. You can also make use of the discretionary scope in the work-related cost scheme (WKR) for the surplus. This way, the extra travel allowance remains untaxed.

The tax-free travel allowance does not apply to employers who offer their employees a company car or bicycle.

- employers who refund their employees’ travel costs

- self-employed professionals without staff ( zzp’ers ) who deduct travel expenses from their profit

The change in law has entered into effect on 1 January 2024.

This article is related to:

Related articles.

- Work-related costs scheme: staff allowances

- Company use of a private car

External links

- 2024 Tax Plan: essential steps for society and for the tax system (Dutch government)

Questions relating to this article?

Please contact the Netherlands Enterprise Agency, RVO

- 7th Pay Commission

- Privacy Policy

- Post office

- Seventh Pay Commission

- 4th to 7th CPC

- Implementation of 7th CPC

- 7th CPC Recommendation

- Seventh Pay Commission Report

- 7th CPC Notification

- CGHS Clarification

- cghs empanelment

- CSD – FAQ

- Latest Price List and Contact Details

- CSD Purchasing Process

- AFD Dealer Contact Details for 4/2 wheeler prices

- Four Wheelers Available

- 2 Wheelers – Availability List

- List of Holidays

Revised Rates of various 7th CPC Allowances – Existing and Revised rates: RBE No. 51/2024

Revised Rates of various 7th CPC Allowances upon Dearness Allowance being raised to 50% – Existing and Revised rates: Railway Board Order RBE No. 51/2024 dated 05.06.2024

GOVERNMENT OF INDIA (BHARAT SARKAR) MINISTRY OF RAILWAYS (RAIL MANTRALAYA) (RAILWAY BOARD)

RBE No. 51/2024

No. F(E)l/2024/AL-28/34

New Delhi, Dated: 05.06.2024

The General Managers/Principal Financial Advisers, All Zonal Railways & Production Units etc, DGs of RDSO and NAIR.

Sub: Revised Rates of various Allowances upon Dearness Allowance being raised to 50%.

Ref: Board’s letter No. PC-VII/2016/117/2/l(RBE No. 26/2024) dated 15.03.2024.

Vide Board ‘s letter referred above, the rate of Dearness Allowance was raised to 50%. Consequently, multiple references have been received regarding revision in the rates of various allowances whose rates were slated to be revised upon DA reaching 50%.

2. In view of the same, a list of such allowances whose rates shall be revised with DA reaching 50%, along with the revised rates is enclosed as Annexure-I.

3.The revised rates of these allowances shall be applicable with effect from 1st January, 2024. Hindi version will follow.

(Sanjay Prashar) Jt Director Finance (Estt.)

REVISED RATES OF VARIOUS ALLOWANCES UPON DEARNESS ALLOWANCE BEING RAISED TO 50%

(i) Conveyance Allowance : In partial modification to Board’s letter No. F(E)I/2017/AL-4/3, dated 10.08.2017 (RBE No. 89/2017) & dated 11.01.2024 (RBE No. 04/2024), the revised rates will be as following:-

(ii) Conveyance Allowance to Railway Medical Officers : ln partial modification to Board’s letter No F(E)l/2020/AL-7/1, dated 10.01.2022 (RBE No. 03/2022), the revised rates will be as following:-

(iii) Daily Allowance : In partial modification to Board’s letter No. F(E)l/2017/AL-28/40, dated 08.08.2017 (RBE No. 84/2017), the revised rates will be as following:-

(iv) Special Compensatory Allowances (Subsumed in Tough Location Allowance) : In partial modification to Board’s letter No.F(E)l/2017/AL-4/5, dated 11.08.2017 (RBE No. 91/2017), the revised rates will be as following:

(v) Mileage Allowance for journeys by road : In partial modification to Board ‘s letter No. F(E)l/201 7IAL-28/41 , dated 24.08.2017 (RBE No. 103/2017), the revised rates of Mileage Allowance at places where no specific rates have been prescribed either by the Directorate of Transport of the concerned State or of the neighboring States, will be as following:-

(vi) Transportation of Personal effects on Transfer/Retirement : In partial modification to Board ‘s letter No. F(E)l/2017/AL-28/4 l , dated 24.08.2017 (RBE No. 103/2017), the revised rates will be as following:-

RECOMMENDED FOR YOU

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This article is free to read if you register or sign in.

Simply register at no cost.

Questions or problems? Email [email protected] or call 0711 046 000 .

INDISCRIMINATE PAY

Why city mps could soon earn mileage perks, lawmakers seek law change to allow psc to set their benefits.

- Only MPs making 350-km round-trip are eligible for mileage claims

- MPs say the PSC and JSC are independent bodies that should be allowed to function as such

MPs from within the Nairobi metropolitan area could soon get mileage allowances if a proposed law gives the Parliamentary Service Commission powers to determine lawmakers’ perks.

Only MPs making a round trip of 350 kilometres to their constituencies are entitled to reimbursement for monies they spend on their travel.

“A Member of Parliament shall be reimbursed a claimable mileage of one return journey per week from the National Assembly (Nairobi) to his/her constituency office at the rate of Sh116.63 per kilometre, based on a car of engine capacity not exceeding 3,000cc,” the Salaries and Remuneration Commission said in a gazette notice setting perks for MPs.

Those who cover a maximum of 700 kilometres are entitled to a monthly claim of up to Sh353,778, while those who go beyond 351 kilometres are paid based on the actual distance – at Sh116.63 per kilometre.

“The Parliamentary Service Commission shall ensure that Members of Parliament are reimbursed within the maximum actual distance from the National Assembly (Nairobi) to respective constituency offices,” SRC instructed.

As a result of the limitations, MPs [about 42] representing constituencies in Nairobi, Kiambu, parts of Kajiado, Machakos, and parts of Muranga counties have been unable to draw mileage claims.

The MPs now want the law changed to grant the PSC power to determine their perks.

While the agency is in charge of the parliamentary service, MPs’ pay, being state officers, is set by the SRC, a situation that has occasioned a push and shove for years.

Some of the affected MPs highlighted discrimination in the payment of mileage, saying they equally spend when going about activities in their constituencies.

A government-sponsored bill provides that the PSC can determine the transport reimbursements for MPs.

Plenary sitting allowance is another bone of contention with SRC, which MPs seek to address using the proposed law. SRC banned plenary sitting allowances.

“The Commission shall review and determine the rates of reimbursement for travel by motor vehicle for Members, in accordance with international best practice,” the proposed law reads.

“The Commission shall review and determine the rates of reimbursement of the daily subsistence costs expended by members and staff of Parliament in the performance of their duties.”

The omnibus bill is extending the powers to the Judicial Service Commission as well, to determine travel reimbursements and subsistence allowances for judges.

“The Commission (JSC) shall review and determine the nature of transport facilitation and the rates of reimbursement the daily subsistence costs expended by judges, judicial officers and staff of the Judiciary in the performance of their duties,” the Statute Law (Miscellaneous Amendments) Bill (No67) of 2023 reads.

Kilifi North MP Owen Baya said, “Initially, these rates were set by the Ministry of Roads, Transport and Public Works, Salaries and Remuneration Commission (SRC), and other bodies. However, we will bring back this function to PSC.”

“JSC should now look at transport facilitation and rates of daily subsistence allowance, which the SRC had taken away. We want to restore this to the JSC.”

For the MPs, the PSC and JSC are independent bodies that should be allowed to function as such “without necessarily having interference from SRC.”

The lawmakers hold that SRC has been wrongfully interpreting Article 230(4) of the Constitution to say it has the mandate to facilitate Parliament and the Judiciary.

The Supreme Court made a pronouncement that Article 230 “must be read alongside other provisions that provide the same powers to PSC and JSC.”

“We have conflict with SRC every time because it wants to set limits for Parliament and JSC. This Bill will give these two bodies an opportunity to run away from the conflict with SRC all the time,” Baya explained.

Samburu West MP Naisula Lesuuda said she had heard of complaints by her colleagues about the lack of equity in the payment of mileage.

“I agree that those who come from areas near Nairobi should benefit. It should not be an issue of some people benefiting while others do not. We should look at this matter objectively, so that those who have not been benefiting can benefit,” she said.

Majority leader Kimani Ichung’wah said it was time MPs in the city and its neighbourhood were equally compensated.

He said MPs, especially those in Nairobi, make several trips to their constituencies even on the days Parliament has scheduled business.

Using the example of Dagoretti North MP Beatrice Elachi, Ichung’wah said it was possible the lawmaker was making trips in between parliamentary sittings.

He argued that Parliament is an independent arm of government “just like the Judiciary.’

“Therefore, we must not be treated any differently. If the Judicial Service Commission takes care of the well-being of the members of the Judiciary and their staff, we also need to align our Parliamentary Service Act so that our own Commission takes care of our well-being.

"You need not have any apologies having a Commission to take care of your well-being even those who benefit from mileage,” Ichung’wah said.

Elachi backed the sentiments.

“The work we do in Nairobi is not a joke. In Nairobi we do not sleep. We are 24/7 in our constituencies day and night. When we were hit by floods, we had to be in the constituency all the time.”

Ol Jorok MP Michael Muchira said, “There is no way you would have a commission and then again purport to regulate the sittings of Parliament.”

Tharaka MP Gitonga Murugara said the change, if adopted, would help better the welfare of MPs and staff.

“Some [of us] have to travel long distances from their constituencies to the central House of Parliament here in Nairobi. They encounter hardships. They do not know where to sleep or put up. Possibly, they do not know where to spend their evenings. This is where the Parliamentary Service Commission comes in,” he said.

“It is now being empowered to ensure that, away from other bodies, it is able to take care of members’ welfare. This is very important. The same applies to judges and members of staff of the Judiciary,” Murugara, who is also Justice Committee chairman, said.

The bill is at the second reading stage and is lined up for a decision of the whole House by the end of this month.

MPs shun Sh9bn Bunge Tower, still splash millions in fancy hotels

Mps weigh in on omtatah's finance bill case, seek dismissal, mps have powers to amend finance bill 2024 and save kenyans - maungu, most popular, mp baya launches 10-day activism against muguka, sell produce through cooperatives to weed out brokers, ..., kariminu ii dam pipe leaks, destroys farms in gatundu ..., sacked county workers in migori demand reinstatement, mcas used as guns for hire in theft of county cash, latest videos, details of fbi director christopher wray's 5-day visit to kenya, we are crushing wash wash gangs, dci says, sign up for the free star email newsletter and receive the latest kenya news daily..

IMAGES

VIDEO

COMMENTS

29 February 2024 - The Minister of Finance has approved the new table of rates per kilometre for motor vehicles in respect of the 2025 year of assessment, for purposes of Section 8(1) of the Income Tax Act No. 58 of 1962. ... 80% of the travelling allowance must be included in the employee's remuneration for the purposes of calculating PAYE ...

New Revised Rate and Entitlements of Travelling allowance as per 7th pay commission with effect from 1st July 2017: ... an allowance of Rs.12/- per kilometre travelled on foot shall be payable additionally. ... Finance Ministry issued an important clarification order on Travelling Allowances rules and rates as per 7th Pay Commission on 13.7.2017.

Subject: Travelling Allowance Rules - Implementation of the Sixth Central Pay Commission. ... For journeys performed by auto rickshaw own scooter, etc.: Rs. 8 per km. (c) The rate of Mileage Allowance for journeys on bicycle on tour and transfer, is revised from 60 paise to Rs 1.20 per kilometer. 3. Daily Allowance on Tour: Grade Pay.

DISTANCE in KM (One Way ) CONSOLIDATED CHARGES FROM TO 1 2 Rs. 30 3 8 Rs. 90 9 15 Rs. 15 0 16 20 Rs. 18 0 3. DAILY ALLOWANCE 3.1 When the employee either stays in a hotel or makes his own arrangement during tour, the daily allowances shall be paid as per following rates: Employee Group A-I Class Cities A-Class Cities B1-Class

REVISION OF RATES OF DAILY ALLOWANCES ON OFFICIAL ... REVISION OF TRAVEL-LING AND MILEAGE ALLOWANCE The President has been pleased to sanction revision of mileage ... Rs. 0.02 per kg per km Revised Rates (w.e.f st 1 Jul , 2023 Rs. Rs. 7.5/- per k.m Rs. 3.75/- er k.m. Rs. 15/-

The prescribed rate per kilometre used for reimbursive travel allowance for 2022/2023 has increased from R3.82 to R4.18. Vehicle lookup table for the purpose of calculating a travel allowance (deemed cost rate per kilometre on assessment): Click here to read the Gazette: Government Gazette 46015.

Kilometre rates (mileage) remain unchanged as set out below: Full Upkeep Commuted Upkeep Motor Cycle Casual kilometre rates payable to non-travelling officer in accordance with Staff Order 11.3.5 Existing 40.00 40.00 14.50 47.00 19.00 New Rates w.e.f. April 1, 2018 $ p.a. 46 46 20 53 25 a) b) Passengers: Motor Car Motor Cycle Kilometre rate per ...

The allowance for journeys performed in own car/taxi is Rs. 24/- per Km. Get official 7th CPC Mileage Allowance when traveling by road. All information about journey allowance rates and calculations provided.

1s pleased to decide the revision in the rates of Travelling Allowance as set out n the Annexure to this Office Memorandum. 2. The 'Pay Level' for determining the TA/DA entitlement is as indicated in Central Civil Service (Revised Pay) ... km per day for travel within the city, Reimbursement of food bills not exceeding . f1000/-per day . 9i011 .

updated instructions regarding the Travelling Allowance and relevant rules. It may point out that the last edition of "A Manual of Travelling Allowance Rules" was published in October, 1995. 3. We are confident that this new edition of T.A. Rules will highly facilitate the Government officials in drawing up their T.A. claims and shall ...

Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are determined by using the following table: Where the value of the vehicle ¾ Fixed cost (R) Fuel cost (c/km) Maintenance cost (c/km) does not exceed R95 000

Rs. 50 Per Km: 6 To 11: 6000 Kg By Goods Train/4 Wheeler Wagon/1 Single Container: Rs. 50 Per Km: 5: 3000 Kg: Rs. 25/- Per Km: 4 And Below: 1500 Kg: ... Finance Ministry issued an important clarification order on Travelling Allowances rules and rates as per 7th Pay Commission on 13.7.2017. TA/DA Rules for Retiring Employees.

Reimbursive travel cost at the prescribed rate is non-taxable. However, where the reimbursed rate exceeds the prescribed rate of R4.18 per kilometre, irrespective of the business kilometres travelled, there is an inclusion in remuneration for PAYE purposes. The full inclusion amount is subject to PAYE, unlike the fixed travel allowance where ...

At prescribed rates for auto-rickshaw/own scooter/ motorcycle/ moped etc. (b) The rates of Road Mileage per km for journey performed by own car/taxi/jeep will be Rs. 10/- per km. subject to prior approval for travel by car/taxi/jeep from competent authority.

Reduced Motor Travel Rates per kilometre; Engine Capacity up to 1200cc: Engine Capacity 1201cc to 1500cc: Engine Capacity 1501cc and over: 21.23 cent: 23.80 cent ... Overnight allowance. Domestic overnight subsistence rates (from 14 December 2023) Rate category Rate; Normal rate. €195.00. Reduced rate. €175.50. Detention rate.

Rates are reviewed regularly. The rate is: 85 cents per kilometre for 2023-24. 78 cents per kilometre for 2022-23. 72 cents per kilometre for 2020-21 and 2021-22. 68 cents per kilometre for 2018-19 and 2019-20. 66 cents per kilometre for 2017-18.

8.15.37 At places where no specific rates have been prescribed, the rate per km will go up by 25 percent each time DA rises by 50 percent. Travelling Allowance. 8.15.55 This allowance is in the nature of travel entitlements for different ranks of government employees. No demands have been received regarding this allowance. Analysis and ...

70¢ per kilometre for the first 5,000 kilometres driven. 64¢ per kilometre driven after that. In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometer allowed for travel. For prior-year rates, see Automobile allowance rates. Example: Employee who is paid an allowance at the prescribed rate.

•The rates of per diem and other allowances for official travel shall be determined by the President •The rates may be changed from time to time upon recommendation of the Travel Rates Committee (TRC) 2 President's Authority to Set Travel Rates PAGBA 2019 3rd Quarter Seminar L'Fisher Hotel, Bacolod City August 28-31, 2019

1.50 per kilometre. (ii) For distance beyond 500 kilometres, but up to 1,200 kilometres. Rs. 1.20 per kilometre. (iii) For distance covered beyond 1,200 kilometres in a month. ... Fractions of a kilometre will be ignored in the total of a bill for travelling allowance at mileage rate, but not in the various items of the bill. (4) Government ...

process on reimbursive travel allowances, if they are reimbursed at a higher rate, rather than only paying tax on assessment of the ITR12. The prescribed rate per kilometre is currently R3.61 per kilometre. In order to accommodate the new dispensation, new payroll codes have been allocated by the South

We do provide travel allowance besides mileage reimbursement; travel allowance is to help the employees meet the cost of commuting to work while the mileage reimbursement is to compensate the staff for the use of their personal vehicles in carrying out their official work. Presently our rates: Car - RM0.60/km + parking & toll charges incurred.

The tax-free travel allowance (reiskostenvergoeding) has increased from €0.21 per kilometre to €0.23 per kilometre from 1 January 2024. Are you self-employed (zzp'er)? If you are an entrepreneur for income tax purposes, you can deduct the amount per kilometre from your profit.

Revised Rates of various 7th CPC Allowances upon Dearness Allowance being raised to 50% - Existing and Revised rates: Railway Board Order RBE No. 51/2024 ... Average Monthly Travel on Official Duty: For Journey by Own Motor Car: ... Revised rates: 6 and above: Rs. 50/- per Km: Rs. 63/- per Km: 5: Rs. 25/- per Km: Rs. 31/- per Km: 4 and below ...

Revised Rates of various Allowances upon Dearness Allowance being. raised to 50%. A copy of Ministry of Railways (Railway Board) letter no.F(E)l/2024/AL-28/34, dated 05/06/2024 (RBE No. 51/2024) is circulated herewith along with its enclosure for information, guidance and further necessary action. Board's earlier letter dated.

The fixed rate method for calculating your deduction for working from home expenses has been revised. This revised method is available from 1 July 2022. The fixed rate method has been revised to: increase the rate per work hour that you can claim when you work from home. change the expenses the rate covers. change the records you need to keep.

(iv) Special Compensatory Allowances (Subsumed in Tough Location Allowance): In partial modification to Board's letter No.F(E)I/2017/AL-4/5, dated 11.08.2017 (RBE No. 91/2017), the revised rates will be as following: S.N0 (11) (111) Existing Rate per month (in Rs.) 5300 4100 3400 2700 1200 1200 1200 1000 1200 1000 Revised Rate per month (in Rs.)

Those who cover a maximum of 700 kilometres are entitled to a monthly claim of up to Sh353,778, while those who go beyond 351 kilometres are paid based on the actual distance - at Sh116.63 per ...