What's the Best Way to Bring Spending Money to the UK?

A Look at the Pros and Cons for Convenience, Value and Spending Power

:max_bytes(150000):strip_icc():format(webp)/FerneArfin-5b6f00c446e0fb0050324e74.jpg)

Yagi Studio/Getty Images

The pound Sterling (£), sometimes just called " Sterling ", is the official currency of the UK . You can change your money into pounds in different ways, but you can't actually spend your own national currency, not even Euros , without exchanging it first.

As soon as you start planning your trip, start thinking about how you'll handle your spending money in the UK. Leave yourself enough time to consider the convenience, security and value of various options and to open new bank or credit card accounts if necessary.

These are the choices:

1. credit and debit cards - the easiest and the cheapest.

These are, hands down, the cheapest and most convenient way to pay for things and to get cash in the UK as long as you use them correctly. Consider the pros and cons.

- Credit card companies apply a wholesale/interbank exchange rate in effect when your payment is processed. The rate will go up and down but it will always be a commercial rate, available to banks and large organizations—much better than the retail currency exchange rates available over the counter to consumers. So you get more for your money.

- Most card companies do not add additional transaction fees on purchases of goods (though they do when you buy cash).

- If you pay your credit card bills before interest is added on, or make sure you have enough money in your debit account to cover your spending, you won't be subject to any extra charges.

- They're widely accepted—You can pay for just about anything with a debit card in the UK, from a carton of milk and the day's newspapers or beer in a pub, to large expensive goods. In the UK, people can even pay their taxes and electricity bills with a debit card.

- Cash machines, or ATMs are everywhere. Most village high streets will have a selection of automated teller machines. They're available at petrol (gas) stations, in cinemas, at banks and in some shops. This makes getting some cash at any hour of day or night very easy.

- Some cards are not recognized or widely accepted in the UK. You may have difficulty using Diners Club and Discover cards. American Express cards are sometimes refused. Stick with the big two—VISA and MasterCharge—and you shouldn't have any problems.

- Some merchants may require a minimum purchase to accept a credit card. This is especially true in small, local Mom and Pop stores.

- Bank charges may apply. Bank, building society and post office cash machines in the UK (which is most of them) do not apply an extra charge or commission getting cash. But your own bank or card company probably will. It's worth shopping around for the lowest currency transaction charge because this varies from card to card and between issuing banks. You might be charged anywhere from $1.50 to $3.00 or more per foreign currency cash transaction.

- A small number of cash machines do charge for withdrawals and are worth avoiding. Cash machines in small convenience stores and at some motorway rest stops may be part of commercial networks that add extra fees—a minimum of about £1.50 but sometimes a percentage of your transaction. Try to avoid using these machines except in an emergency. Instead look for ATMs associated with the UK's big banks, with building societies (like savings banks) or with leading shops (Harrods, Marks & Spencer ) and supermarkets.

- You may need to get a new card to comply with European chip-and-pin standards (more on that below).

- One word to the wise —Use your credit card to buy things but use a debit or ATM card for getting cash from ATMs. When you use a credit card for shopping, interest is not charged until after the payment deadline (usually 30 days or the end of the month). But, when you use a credit card at a cash machine, interest starts accruing immediately. With a debit card, as long as you have money in the bank to cover your spending, no interest is charged.

The Chip-and-Pin Issue

The UK, along with most of the rest of the world, has been using chip-and-pin cards for more than a decade. The cards have an embedded microchip and customers are issued a unique, 4-digit PIN number they have to enter in ATMs or at point of sale machines to use their cards.

The USA has been the one holdout, relying instead on cards with magnetic stripes that usually require a signature. All that is finally beginning to change. The EMV (Europay Mastercard VISA) group, who developed the global, open chip and pin smart card technology, have been trying to persuade American merchants and card issuers to change to chip and pin for a long time. In October 2015, to force the issue, they changed their rules. Since then, if a card is used fraudulently, merchants or card issuers who do not participate in the chip and pin protocol will be held liable for the cost of the fraud.

Because of this, EMV chip-and-pin smart cards are becoming more widely available in the USA and older style cards are gradually being replaced to meet the global standard.

What This Means for You

If you already have a chip-and-pin smart card, you won't run into any difficulty using it where your brand of card is accepted. The card reading machines used in shops, banks and post offices will still have a magnetic stripe reader so you can swipe your card on the top or side of the device.

But if your card requires a signature (either mag stripe and signature or chip and signature cards) you will have problems—especially when no human cashier is present to accept your signature. Without a chip, your card will be rejected by ticket machines (at train stations, for example) and by automated petrol (gasoline) pumps. And even with a chip, you will need a PIN number to use your card with these machines.

To avoid hassles:

- All bank cards and credit cards have a 4-digit PIN number, even if your bank or card issuer has not given it to you. Ask for one for each of your cards before traveling. Then you'll be able to use your card in an ATM or swipe it at a point-of-sale terminal and authorise the transaction with your PIN number.

- Get yourself a chip-and-pin card. Most of the bigger American banks are now offering them or replacing their customers' existing chip and signature cards with chip and pin cards. If your bank does not yet have them available, open an account at a bank that can give you one.

And the Contactless Issue

Most debit and credit cards issued to UK consumers have a contactless payment feature. If the card has it, there is a symbol that looks like sound waves printed on the card, as pictured above. These cards can be used for payments simply by tapping them on terminals similarly equipped. Very conveniently, these cards can be used just like Oyster Cards for access to London Underground, London buses. London Overground and Docklands Light Railway. Some mobile phone apps that display the contactless logo can also be used to pay small amounts.

If you are visiting the UK from Canada, Australia or a number of European countries, you may already have one of these contactless cards and you can use them in the UK wherever the contactless symbol is displayed on the payment terminal. As of 2018, US banks began to offer contactless credit and debit cards in partnership with international card issuers. Chase, for example, has offered this form of payment to its customers since February 2018. If you can, get your hands on one of these as its the most convenient way to pay small amounts. If you are able to use a contactless card, keep in mind though, that your transaction will still be subject to whatever foreign exchange transaction fees your bank or card issuer charges.

If you have an iPhone, you may be able to use Apple Pay wherever contactless payments are accepted and for more than the £30 contactless limit. The Apple Pay UK site has a list of some of the main businesses that accept this form of payment at point of sale.

Traveler's checks.

Traveler's checks were once the gold standard when it came to carrying travel money. And perhaps, in some parts of the world they may still be a safe option, but they are currently the most expensive and most inconvenient option for the UK.

- They are very secure—As long as you keep a record of the check numbers (separate from the checks themselves), and as long as you keep track of the emergency number to call in the country you are visiting, you can get lost or stolen checks replaced quickly, at no extra cost.

- They are available in several currencies including dollars, Euros and pounds sterling.

- They are expensive, possibly the most expensive way to take money abroad in fact. First off, you will usually be charged a fee of one percent of the total value of the checks you buy. If you buy them in a foreign currency—in other words you spend dollars to buy travelers checks in pounds sterling—the seller's retail exchange rate will apply and you may also pay a commission for the currency conversion. If you buy them in dollars, planning to exchange them for local currency when you arrive, you will still be stuck with accepting a retail exchange rate (usually much less advantageous than the interbank rate for the day) and probably a foreign currency commission too.

- They are very inconvenient. In the UK, with the exception of tourist magnets like Harrods , and very expensive hotels, almost none of the shops, restaurants and hotels accept them. In fact, very few stores in the UK accept any kind of check at all. So you will have to seek out bureaux de changes, banks and post offices—during weekday working hours, to cash them. Bureau de change outlets, the European name for commercial currency exchanges, are profit making businesses and usually offer the worst exchange rates. And banks will only cash traveler's checks if they have what is known as a correspondent relationship with the bank that issued them.

3. Prepaid Currency Cards

One way around the chip-and-pin issue is to buy yourself a prepaid currency card, such as the Travelex Cash Passport or the Virgin Money Prepaid MasterCard. These are cards you prepay in either your own currency or the currency you want to spend. Some can be charged up with several currencies at once. The cards are associated with one of the major international card organizations—usually VISA or MasterCard, are embedded with chip-and-pin technology and can be used wherever those credit cards are normally accepted.

- An easy way to chip-and-pin

- Easier to control your spending. You charge up the card with exactly what you want to spend and then use it up like cash.

- Security is assured as long as you protect your PIN number.

- Up front purchase price and higher than average ATM cash fees can add to costs

- Some can only be charged up with additional funds in person in a branch of the business that sold it to you, in your own country.

- Hidden charges—if you leave a balance on the card, planning to use it for another trip abroad or other special purchases, you may find that balance nibbled away by monthly "inactivity" charges. Read the fine print.

And one last warning about prepaid cards:

Whatever you do, DO NOT USE these cards to guarantee your hotel or rental car bill or to buy petrol from automated pumps. In these situations, an amount - which can be £200 or £300—will be put on hold to guarantee that you will pay your bill. The problem is, even if you don't spend that much money, it can take as long as 30 days for those funds to be released. Meanwhile, you can't use the money you've put on the card for the rest of your trip. Use your credit card for the guarantees, then settle the bills with the prepaid card.

Then, of course, there's always good old cash—or at least there used to be (see below). You'll want to have some local currency in your wallet for tips , cab fares and small purchases. How much you carry depends on your own spending habits and confidence in carrying cash. As a rule of thumb, plan on carrying about as much in pounds sterling as you might carry in your own currency when at home.

There is a catch. In the UK, espcially the big cities, a small but growing number of businesses—notably cafes and bars—are refusing to accept cash and will only accept card payments. This is still pretty rare, but we were shocked in November, 2018, to offer a £10 note to pay for a coffee and croissant only to be shown a sign that said the restaurant did not accept cash. These days, an internationally accepted credit card is still the safest kind of travel money to have.

Currency in Egypt: Everything You Need to Know

Know Before You Go: A Traveler's Guide to UK Currency

Currency Converters

A Traveler's Guide to the Yen

The Currencies of Ireland

Caribbean Currency for Travelers

Whether to Use Cash, Credit, or Debit While Traveling

Can You Use Euros in England and Around the UK?

Money in Germany

How to Exchange Money in China

Your Trip to the Czech Republic: The Complete Guide

9 Tips for Using Your ATM card in Europe

Exchanging Currency in London and the UK

Tips for Changing Your Money Abroad

Tips for Using Debit and Credit Cards in Canada

Driving in France

Best Prepaid Travel Money Cards

Explore the best prepaid travel money cards.

Matt Crabtree

Rebecca Goodman

Prepaid travel cards have various names, such as travel money cards or multi-currency prepaid cards, but they all work in the same way to make spending abroad easier.

Using your debit card or usual bank account on holiday can accrue fees, and spending more than you have may be tempting, like dipping into your overdraft or savings accounts.

With a prepaid card, you can stick to your budget and be aware of all the fees involved before spending.

In this article, I'll discuss everything you need to know about prepaid cards to use when you're abroad, and I've picked a list of the best prepaid travel cards on the market to help you decide.

What are multi-currency prepaid cards?

A prepaid card works much like a debit card in terms of how you use it to make purchases and withdraw cash from an ATM. The only difference is that a prepaid card isn't attached to a bank account; you must top it up to use it.

Anyone can sign up for a prepaid card and use it for travelling. There are no credit checks, so even if you’ve got a history of bad credit, you can still apply for a prepaid travel card.

A prepaid multi-currency card is like a gift card in the same way you top it up and use it. With multi-currency prepaid cards, you use them as an alternative to carrying cash or traveller's cheques when travelling . You top the card up in the currency of your choice and then use it as you need it.

You can top-up prepaid cards on the go, usually by an app, and you can use them in most places worldwide. You’ll have to check with your prepaid card provider to see what currencies you can use on the card and where you can use it.

The pros and cons

Like any financial product, there are benefits and drawbacks to using a prepaid card.

✔️ Budgeting: You can preload all of your spending money on the card, and as you can only spend what's there, it's much easier to stick with a budget and not overspend.

✔️ Safer than cash : If you lose your prepaid card, or if it's stolen, you can get a replacement card sent to you. A prepaid card isn’t attached to a bank account , so you don’t have to worry too much about anyone potentially accessing your everyday banking.

✔️ No foreign exchange fees: Most travel money cards are made for spending abroad, so there are usually no foreign exchange fees.

✔️ Accepted in most places: Most countries accept prepaid cards. Double-check with your prepaid card provider if your card is accepted before you fly out to your destination.

✔️ Different foreign currency: You can spend money in your chosen currency.

✔️ Top-up on the go: Most prepaid cards have an app that allows you to add money, exchange multiple currencies and view transaction history in one place.

✔️ Good credit not required: Anyone can apply and use a prepaid multi-currency card and there are no credit checks .

❌️ Fees to cash withdrawals: Some prepaid cards charge you for cash withdrawals.

❌️ Other fees: Fees will vary between prepaid card providers, but there may be administration fees, monthly charges or other additional fees.

❌️ Limits: Some travel prepaid cards limit how much money you can hold on your prepaid card, and some cards have a minimum amount to deposit to use the card.

Best prepaid travel cards

Here are the best prepaid travel money cards:

1. Wise: Digital and physical cards available

- Application fees: One-time fee of £7

- Conversion Fees: Fixed fee + 1.75% after free allowance

- Minimum loading amount: No limit

- Cash withdrawal fee: Fee-free cash withdrawals up to £200 monthly

With the Wise Travel Money Card, you can use it straight away as a digital card.

If you want a physical card, there is a £7 delivery fee, but you can use a digital card instantly with Google Pay or Apple Pay. You can create up to three free digital cards.

With the mid-market rate, you can top up your currency card from the Wise app . On the app, you can check your balance and transactions and receive spending notifications to see how much you spend to help you stay within your budget.

You can manage your Wise account from the mobile app or their website. You can exchange money for over 40 other currencies in real time. If you have leftover money from your holiday or your plans have changed, you can spend the money at home in the UK with a small conversion fee.

You can use your currency card to withdraw cash from over 3 million ATMs worldwide. You can use your currency card in more than 160 countries. The Wise prepaid travel money card is eco-friendly, biodegradable, reloadable, and has no subscription fee. There are no fees if you choose not to use the Wise travel card.

2. Asda Money Travel Money Card: Apply online or in store

- Application fees: None

- Conversion Fees: 5.75%

- Minimum loading amount: £50

- Cash withdrawal fee: Fee-free

You can apply for an Asda Money Travel Money Card online or in-store.

You can load up to 15 currencies and use your card contactless worldwide. You don't have to worry about cash withdrawal fees when you use this prepaid currency card; you can manage it on the go with the app. You can exchange 16 currencies with a fixed conversion fee.

You can top up via the app, online, or over the phone. You can top up while abroad, so you don't have to worry about running short of money. There are no fees when you spend in a currency preloaded to your card.

There is a £2 inactivity fee per month after 12 months. With this card, you can withdraw £500 a day, but the maximum it can hold is £5,000. This card has no link to your bank account for fraud protection.

Asda Travel Money Card is issued by PrePay Technologies Limited pursuant to a licence by Mastercard International. The Financial Conduct Authority authorises PrePay Technologies Limited under the Electronic Money Regulations 2011 .

3. Caxton Currency Card: Up to £12,000 on a card

- Conversion Fees: Live exchange rates

- Minimum loading amount: £10

- Cash withdrawal fee: Fee-free abroad, £1.50 for domestic ATM withdrawals and transactions

The daily cash withdrawal limit for the Caxton Currency Card is £300, and you can hold up to £12,000 on the prepaid card.

When you use this currency card abroad, you can make purchases fee-free with no worries. You can convert your money into 15 currencies with live exchange rates and hold multiple simultaneously.

You can use your Caxton prepaid card anywhere that accepts Mastercard; watch for the Mastercard Acceptance Mark. You can manage your finances from the mobile app as it allows you to check your card balance, top up, and block the card if you misplace it.

Caxton offers customer service that is live 24/7 to help with any of your issues or concerns. Caxton also runs an international trading online platform.

4. Easy FX Currency Card: Fee-free international cash withdrawals

- Conversion Fees: Exchange rate plus 1.8% for up to £1,000

- Cash withdrawal fee: International cash withdrawals are free

There are zero international fees when you use the EasyFX Personal Currency Card.

There is a £1.50 withdrawal fee for using a cash machine in the UK. You can benefit from highly competitive exchange rates and store multiple currencies on one account.

There are conversion fees with this currency card. However, the more money you convert, the lower the cost. You'll pay 1.8% on top of the exchange rate for conversion up to £1,000. The conversion fee lowers to 1.2% for up to £4,000.

As well as a currency card, you'll gain access to risk management tools provided by VFX Financial. You can manage your balances in real time on any device using the smart app or EasyFx website. If you don't use your card for 12 months, you'll be charged £2 monthly for inactivity.

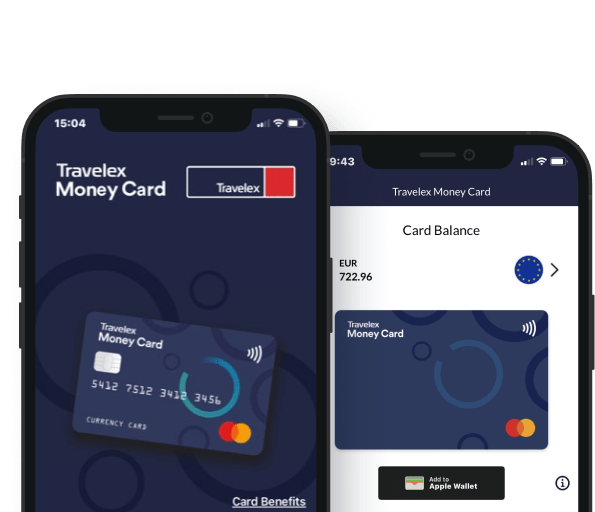

5. Travelex Money Card: Use in millions of locations

- Application fees: One-time fee of £15

- Minimum loading amount: £50 in person and £100 online

- Cash withdrawal fee: None

The Travelex Travel Money Card allows you to use your card across millions of locations that accept Mastercard Prepaid. Look for the Mastercard International Incorporated logo when you're travelling, and you can use the Travelex Travel Money Card at those locations.

With the Travelex Money Card, you'll get free WiFi worldwide without worrying about roaming fees. There are no charges for withdrawing cash from an ATM overseas. You can exchange GBP into 15 other currencies with fixed exchange rates.

There is a monthly £2 inactivity fee. There is currently a giveaway running with Mastercard that's open until 30 September, where all you need to do is load £220 or more onto a Travelex Money Card. You'll enter into a prize draw to win a dream holiday.

6. Post Office Travel Money Card: No fee for spending abroad

- Cash withdrawal fee: Fees vary between locations

Carry up to 22 currencies with the Post Office Travel Money Card. Wherever you see the Mastercard Acceptance Mark , you can use this travel money card, including millions of shops, restaurants, and bars in over 200 countries.

There are cross-border fees of 3% when you use your currency in other countries than what the Post Office offers. There is also a load commission fee of 1.5%.

Use the Post Office accessible Travel app to top up, manage your prepaid card, transfer funds between currencies and more. You can connect your prepaid card to Apple Pay and Google Pay. If you return from your holiday with money left on your card in another currency, you can use the wallet-to-wallet feature and transfer it to a new currency you choose.

7. Sainsbury's Bank Prepaid Travel Money Card: Lower exchange rate for Nectar cardholders

You may get better exchange rates than a non-card holder if you're a Nectar cardholder and want to apply for Sainsbury's Prepaid Travel Money Card. If you hold a Nectar card, you can earn 500 bonus Nectar points when you load at least £250 onto your travel money card.

You can load money onto your card in 15 currencies at once. You can use your prepaid travel card to make purchases worldwide and withdraw cash without worrying about ATM fees.

You can check out all your transactions and load money onto the card with the Sainsbury's Bank travel money card app. There is no direct link to the prepaid card to your bank account, so you don't have to worry about security.

There is a 2% fee for loads and reloading into GBP purses. Additionally, if you don't use your card for 18 months, you may be charged a £2 inactivity fee.

8. FairFX Prepaid Card: Earn cashback in select retailers

- Application fees: Free

- Conversion Fees: 1.12%

- Cash withdrawal fee: £2 flat rate + 3.75% of the transaction amount

The FairFX Prepaid Card holds 20 major currencies, including GBP, Euros, US dollar, Japanese yen, Australian dollar, and more.

You can use this free multi-currency card in over 190 countries worldwide. You can top up on the go, either before you travel or whilst you're travelling.

Travel smarter with FairFX; when you become a customer, you can access offers and deals from partners to help your money take you further, for example, discounts on lounge access and more. You can earn 3.5% cashback in-store or online at select UK retailers.

If your car expires with a leftover balance, there will be a monthly £2 charge. Card renewal is free so that you can avoid expiration. There are no subscription fees or monthly fees.

Tips for looking after your money as you travel

Money is a massive element of travelling; it pays for your trips, food, and all the fun activities you get up to. A prepaid currency card can make your journey much more accessible.

We've compiled a list of further tips to help manage your finances a little more easily while you travel:

- Check the expiry date on the card: For any cards you take with you on your travels, ensure they're within the expiry date. Otherwise, you may be stuck without access to money. If your cards are close to expiring, consider contacting your provider and getting a new one sent out before you fly out.

- Travel insurance: Always travel with travel insurance to protect yourself and your belongings. Travel insurance can cover your medical costs if you become ill or have an accident.

- Check exchange rate: If you choose a prepaid card provider that uses live exchange rates, keep an eye on the exchange rates at specific types of the day.

- Top up your card online: If you're running low on holiday money, choose a prepaid travel card that allows you to top up online to add money to the card quickly.

- Check foreign exchange fee: Most prepaid travel cards offer minimum foreign exchange fees, but always check with the card provider for potential fees before you travel.

- Have card provider details at hand: If any issues occur, you should have the contact number or support team access to contact prepaid providers. If your card is stolen or you find fraudulent transactions on it, contact your provider, and it's worth alerting local police, too.

The verdict

A prepaid card is the ideal companion if you're someone who travels regularly and wants to be on control of tour cash.

They allow you to stay within budget, control your account from an app on your phone, and spend abroad without worrying too much about fees. With one of the prepaid currency cards from our best list, you can spend abroad securely and confidently.

Related Guides:

- 7 Cheapest Ways to Spend Money Abroad

- Best Avios Credit Cards

- Best Air Miles Credit Cards

- What Is Holiday Let Insurance?

Is it Worth Getting a Prepaid Travel Card?

Using your debit card or usual bank account can accrue many travelling fees. With a prepaid card, you can stick to your budget with no credit options available and know all the fees involved before spending. You can spend without worrying about security, as your prepaid card has no direct link to your bank accounts. Prepaid cards are safer than cash and are accepted in most places. You can spend money in your chosen currency and top up on the go.

How Does a Prepaid Card Work?

You can top-up prepaid cards on the go, usually by an app, and you can use it in most places worldwide. It works similarly to a debit card, like how you use it to spend, but a prepaid card isn’t attached to a bank account, and anyone can use one.

What is the Best Travel Money Card?

The Wise Travel Money Card is at the top of our best travel money card list. There is no minimum loading fee; you make free monthly cash withdrawals of up to £200. While waiting for your card to be delivered, you can use your balance immediately as a digital card with Google Pay or Apple Pay. You can create up to three free digital cards. You can use your currency card to withdraw cash from over 3 million ATMs worldwide.

Related Articles

Mentioned banks.

Get Bank Deals & More

Sign up for our email updates on the best bank deals, money savings tips and more.

- Travel Money Card

The Travelex Money Card is the quick, easy and secure way to spend abroad

- Top Up Card

- Our best rates

- No commission or hidden charges

- Free Click and Collect

- Next day home delivery

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

- Manage your balance 24/7 through the Travelex Money App

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Already have a card?

Travel money card benefits, safe & secure, find the right balance for your trip.

With our multi-currency prepaid card, you can reduce the amount of cash you need to carry on holiday and find the right balance for your trip. Plus, your card is not linked to your bank account, providing an extra layer of security against potential financial threats, and reducing the risk that comes with carrying cash.

Control at your fingertips

Manage your travel funds effortlessly with the Travelex Money App . Along with the essential features of freezing/unfreezing your card for enhanced security, the app provides seamless options to top up your card on-the-go. Always have secure access to your PIN and stay in full command of your travel money, ensuring a worry-free experience.

Peace of mind

Lock in your rates.

No more fluctuating exchange rates causing stress during your travels. With our multi-currency prepaid card, you can lock in your exchange rates 1 , shielding your budget from unexpected currency fluctuations.

Free and secure cash access

Forget about ATM fees eating into your travel budget. Our card provides free cash access with no overseas ATM charges 2 , allowing you to withdraw funds wherever you are. And in case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you. We aim to replace your card swiftly or provide emergency cash to keep your journey on track.

Easy to use

Effortless transactions.

Experience the ease of secure contactless payments – no signature or PIN required. Streamline your transactions and enjoy the convenience of a smooth payment process at millions of locations worldwide, wherever Mastercard Prepaid is accepted.

Easy money management

Enhance your travel experience with the flexibility to top up in 22 different currencies, including EUR, USD and AUD, and the convenience of transferring funds between your currency wallets in our app all through one versatile card, making international spending more seamless and efficient.

Seamless spending

You can easily add our card to your Apple Pay or Google Pay Wallet, making your payments smooth frictionless.

How does a Travelex Money Card work?

It’s fast and easy to get a Travelex Money Card.

1 | Order your Card

Order your Travelex Money Card online or in-store. Enjoy the flexibility of free delivery or convenient in-store collection.

2 | Register

Use the Travelex Money App to effortlessly register your card, granting you complete control over your account

Explore the world of hassle-free spending! Use your card at millions of locations globally, wherever Mastercard Prepaid is accepted.

Currencies and Rates

Explore the 22 currencies available to you on our prepaid travel card.

Fees and Limits

Free atm withdrawals worldwide.

Access your money without the hassle of ATM fees 2 , whether you're in the UK or exploring abroad.

Free Replacement Card

Enjoy peace of mind with our free replacement card service, available if your card is lost, stolen, or damaged while you're away or access to emergency cash.

Low Minimum Load/Top-up

Get started with a minimum load of just £50.00 GBP.

Generous Spending Limits

Spend up to £3,000.00 GBP at retailers and merchants within a 24-hour period

With our flexible fees and limits our Travelex Money Card is your perfect travel companion.

Download the Travelex Money App

- Top-up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

What our customers say

Find out why our community trust in Travelex

Common questions about the Travelex Money Card

What is a travel money card.

A travel money card (sometimes referred to as a prepaid currency card) is a global multi-currency card that’s not linked to a bank account. Like a debit or credit card, travel money cards can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling.

Do you get charged for using a travel money card?

Some providers may charge you for using your card abroad, but we do not charge spending fees 3 on our Travelex Money Card.

How do I get a Travel Money Card?

You can get a Travelex Money Card by purchasing currency online or in-store. Find our full list of stores here.

Where can I use my Travel Money Card?

You can use the Travelex Money Card in most countries across the world, wherever Mastercard Prepaid is accepted. Choose from 22 available currencies: British pounds, euros, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Swiss franc, UAE dirham, Mexican peso, Polish zloty, Czech koruna, Swedish krona, Japanese yen, Thai Baht, Hong Kong dollars, Singapore dollars, Danish kroner, Norwegian krone, Hungarian forint and Icelandic krona.

Can I withdraw money from my Travel Money Card?

Like most bank accounts, you can withdraw money from your travel money card at ATMs worldwide. The maximum withdrawal amount is 500.00 GBP within a 24-hour period. Please bear in mind Travelex does not charge ATM fees but some operators may do so, check before you withdraw cash. Travelex Money Card T&Cs can be found here.

- Travelex Money Card Terms & Conditions can be found here.

- 1 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

- 2 Although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. We advise to check with the ATM operator before using.

- 3 No charges when you spend abroad using an available balance of a local currency supported by the Travelex Money Card.

- Travelex Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International.

- PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

- Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Store Finder

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

- Prepaid Cards >

- Travel Prepaid Cards

Compare our best prepaid travel cards

Simplify your spending abroad with a prepaid travel card, find a prepaid travel card, what is a prepaid travel card.

A prepaid travel card , also known as a 'travel money card', is a debit card that you preload with money and take on holiday. It's a good way to stick to your holiday budget and avoid carrying a lot of cash.

Prepaid travel cards can be used at cashpoints, in shops and restaurants , or anywhere that accepts Mastercard or Visa debit or credit cards.

However, a prepaid travel card is not the same as a credit card for two key reasons:

You can only spend the amount you have put on the card; the pre-loaded limit prevents you overspending and getting into debt

You can choose which currency to preload your travel money card with depending on where you're going, which often means you can secure a better exchange rate

Pick a card with fees that suit how you plan to use it, e.g. choose one with no withdrawal fees if you'll be withdrawing cash often while travelling.”

What are the different types of prepaid travel cards?

Multi-currency prepaid cards.

These can be loaded with several different currencies , making them ideal for both frequent travellers and those taking trips to multiple destinations. For example, you holiday in Europe but often visit the US on business, you could use a prepaid travel card to cover your everyday spending wherever you are by topping it up with say £600 then exchanging £200 into euros and £200 into US dollars. The different currencies will then be stored in separate “wallets” , allowing you to switch currencies when you like.

Sterling prepaid cards

These can be used at home and abroad , making them even more flexible than the best travel cards offering multiple currencies. You don’t need to worry about setting up a wallet for the currency you want to use; the card provider simply converts your pounds to the required currency each time you make a purchase . However, this can make holiday budgeting harder and may increase your costs, depending on the charging structure.

Euro prepaid cards

As well as multi-currency cards, you can take out prepaid cards designed to hold a specific currency . This can work out excellently if you're trying to lock in a good rate now by loading your euro prepaid card, but if you then use the card to buy things in a country that isn't in the eurozone. That's because if you spend in a country that does not use the euro, it converts to the local currency each time you make a purchase, which can work out more expensive.

Prepaid US dollar cards

These keep your balance in dollars . If you spend in countries that use a different currency, the card will exchange your dollars to the local currency, and you might well be charged a fee. The currency exchange takes place as soon as you load your card . If the pound strengthens afterwards, you won’t be getting the best value for money, but it if weakens you'll do well.

How to get a prepaid travel card

Compare cards.

Use our table below to find prepaid travel card that offers the features you need with the lowest fees

Check your eligibility

Make sure you fit the eligibility criteria for your chosen travel money card and can provide the required proof of ID

Apply for the card

Click 'view deal' below and fill out the application form on the provider's website with your personal details

What are the eligibility requirements?

Anyone can get a prepaid travel card. There's no need to have a bank account, and no credit checks are required . Some providers have a minimum age of 18, but many will let you have a prepaid card from the age of 13 with parental consent.

Sometimes parents like to use travel money cards to give their children a set amount of holiday money , and to help teach them about budgeting and financial responsibility.

Pros and Cons

What exchange rate do you get.

Exchange rates vary over time depending on what is happening in the wider economy. That means the exchange rate you get on a US dollar travel card today, for example, might not be the same as you get tomorrow or next week.

What prepaid cards offer is the ability to lock in today's rate to use later on. That could see you better off if the pound weakens, but might also mean you get a poor deal if the pound strengthens.

That offers is certainty - you'll know exactly how many dollars, euros, lira or whichever currency you load onto the card you have to spend on holiday.

Today’s best exchange rates

At what point is the currency exchanged with prepaid travel cards.

Some prepaid travel cards hold the balance in pounds sterling. These convert the required amount to the local currency every time you spend on them .

The exchange rate isn’t fixed, so you’ll only know how many pounds you have on the card - not what it will buy you while overseas.

But the cards in our comparison table convert your money when you add it onto the card. This means you know the exchange rate used and your card's exact balance before you go away.

Compare the rates before you choose a prepaid card. Although rates can change several times a day, some travel cards will be more competitive than others.

Using a card with competitive exchange rates will mean you get more local currency for your pound.

You also need to watch out for fees as well as withdrawal limits when choosing a card, as these can vary between providers.

What are the alternatives to prepaid travel cards?

Travel credit card.

A travel credit card works just like a regular credit card, with which you can make purchases by borrowing money. The main difference is that travel credit cards don't charge foreign transaction fees for spending abroad.

Travel money

For many people, cash is the most comfortable form of payment when travelling. It's hassle-free and universally accepted. But it’s riskier, as you'll lose out if it’s lost or stolen and you’ll need to budget carefully to ensure your foreign currency lasts the length of your trip.

Travel debit card

These days, there are plenty of specialist banks and providers that offer bank accounts that don't charge foreign transaction fees when used abroad. This offers you a chance to take advantage of the best exchange rates. And if it's your main current account, you won't have to worry about topping up your account before you go.

What other costs or fees are there with prepaid travel cards?

As well as the exchange rate, you might have to pay several other charges on your prepaid travel card.

These could include:

A fee to buy the card

A monthly or annual fee for keeping the account open

Cash withdrawal fees

Transaction fees when you pay for anything on the card

Inactivity fees

Loading fees when you add money onto the card

Some cards also charge fees for withdrawing cash or making purchases inside the UK .

But some of the cards in this comparison do not charge fees in countries that use currencies loaded on the card - just make sure the right one is selected before spending on them.

Check carefully for fees before you pick one.

Read our full guide on how much it costs to use a travel prepaid card and how to choose one .

"With multi-currency cards, check you've selected the right currency before you arrive."

How long does it take to get a prepaid travel card?

You can apply online and get a decision immediately. However, it can take up to two weeks before your card arrives in the post.

Can I use any prepaid card abroad?

Yes, you can use prepaid Visa or Mastercard cards in most destinations worldwide. Travel prepaid cards are usually cheaper to use overseas than a standard credit or debit card.

Can I withdraw cash abroad?

Yes, you can use a travel money card in a cash machine outside the UK. Some cards charge fees for this, so always check if you want to use your prepaid travel card to make cash withdrawals.

What currencies can my card hold?

All the travel money cards in our comparison can hold a balance in popular currencies such as euros or dollars, while some support more than 50 different currencies.

Can I make international payments?

Yes, some providers let you send or receive money from abroad by logging into your online account, which works in the same way as standard internet banking.

Who sets the exchange rate?

This depends on the company that processes the transactions. Typically, it’s down to Visa or Mastercard , as well as your card provider, which may take an additional cut.

Can I use my prepaid card in the UK?

You can use prepaid cards to withdraw cash or buy things in the UK or online. However, you may pay fees or even an exchange rate if your card is loaded with a foreign currency.

Explore our prepaid card guides

About the author

Didn't find what you were looking for?

Our most popular prepaid card deals

Other products that you might need for your trip

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Hays Travel Money Card

The Hays Travel Mastercard® is free to use in millions of locations worldwide where Mastercard® Prepaid is accepted when you spend in a currency loaded on the card: including restaurants, bars, and shops. This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals, and also 24/7 phone support. Take your currency card with you on every holiday, simply top up and go! Just call into your local Hays Travel branch today to purchase your Hays Travel Prepaid Travel Money Card. *The Hays Travel Mastercard is only available to UK residents aged 18 or over. A valid Passport or Drivers Licence must be presented in the branch at the time of purchase.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

- BUY IN BRANCH

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

The Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad. The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

Download our app here

Manage the card on the go via Hays Travel Currency Card App

My Account Portal

Available currencies.

- British Pounds

- Australian Dollar

- Canadian Dollar

- Czech Koruna

- Japanese Yen

- Mexican Peso

- New Zealand Dollar

- Polish Zloty

- Swedish Krona

- South African Rand

- Swiss Franc

- Turkish Lira

Useful links

- Card Services Support Numbers

- Terms and Conditions

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel money card

Planning a trip overseas? Our prepaid travel money card lets you load your chosen currency and lock in a top rate before you go. Spend safely abroad with a Sainsbury’s Bank Travel Money Card.

Wherever you go, we’ve got your back

With a Sainsbury's Bank Travel Money Card, spending money abroad has never been easier – or safer. Once you’ve experienced the benefits of a travel money card, it’ll be your first choice every time. Our prepaid money travel card allows you to:

Load up to 15 currencies at any one time. No more worrying if your currency will be in stock at the bureau de change

Make secure, contactless payments. Just look for the contactless symbol when eating out or shopping abroad. Contactless payment is subject to merchant acceptance, and there may be a maximum limit when paying this way

Manage your account on the go. Use the Sainsbury’s Bank travel money card app to manage your currency card wherever you are

Put security first. Travel with confidence knowing your card is chip and PIN protected and there’s no direct link to your bank account

Live like a local. Use your travel money card to withdraw local currencies at ATMs worldwide for free. Remember to check whether the ATMs charge their own fee

Enjoy rates you can rely on. Fix the exchange rate any time you load or move money between currencies

Enter a world of convenience. Whenever you use your travel card, it automatically knows where you are and which currency to use

It’s free to get. And it won’t cost you a penny – or a cent – to load with foreign currency

Your adventure awaits. To get your travel money card next day from your local instore bureau click 'order for collection'. Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days).

What is a travel money card?

Travel cards are a hassle-free alternative to taking cash on holiday. And a handy way of taking multiple currencies if you’re travelling to a few different destinations.

Use it like a debit card – without worrying about overseas bank fees when you spend in a currency loaded on the travel card. Pay contactless, pay with your PIN or withdraw at a local ATM. You can even use it to make online purchases.

Since it’s a prepaid travel money card, it’s also a great way to keep an eye on your holiday spending – just load your money before you jet off. And if you need a little extra you can even easily top up your card from the beach. Download the Sainsbury’s Bank travel money card app or find out more .

Which currencies can I load?

The world’s your oyster when you get a Sainsbury’s Bank Travel Money Card. Pick up to 15 currencies at any one time. Along with the Great British Pound, you can choose from:

- Euros

- US Dollars

- Australian Dollars

- NZ Dollars

- Canadian Dollars

- South African Rand

- Turkish Lira

- Swiss Francs

- UAE Dirham

- Mexican Peso

- Polish Zloty

- Czech Koruna

- Swedish Krona

- Japanese Yen

When you use your travel money card abroad, it will automatically pick up where you are and know which currency to use.

And as soon as you load money onto your prepaid travel money card, you’ll get a fixed exchange rate for the currency, or currencies loaded. So you know exactly how much you’ll have to spend even if rates change while you’re away.

Ready to get your travel money card?

It's easy. To get your travel money card next day from your local instore bureau click 'order for collection'.

Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days). When it arrives, remember to sign the back of the card.

To start using your card, simply load it with a minimum of £50. All that's left to do is decide where you’re going.

Fees, limits and terms and conditions

Get to know our Sainsbury’s Bank travel money card fees and limits. It’ll help you understand whether it’s the right option for you.

For a full description of fees, limits and terms and conditions, please click here .

± If the currency of your transaction does not match any of the currencies on your card, or there are insufficient funds on your card in a currency to cover the whole transaction, the (remainder of the) transaction amount will be exchanged to another currency (-ies) on the card in the order of priority, at an exchange rate determined by Mastercard® on the day the transaction is processed, increased by 5.75% (the foreign exchange fee).

‡ A foreign exchange rate will apply if transferring funds to another currency. The currency exchange rate is selected from the range of rates available in wholesale currency markets (which vary each day), together with a margin.

+ If, following the debit of any monthly inactivity fee, the card fund balance is less than the fee, we will waive the difference.

^^ The amount that can be loaded/reloaded will vary depending on which channel you choose, i.e. online, in store, telephone or internet banking.

^^^ If you’ve forgotten your travel money card PIN, you can contact us for a replacement.

Already got a card?

If you’ve already got a travel money card with us, login online or use the app to top up and manage your account.

Prefer to take foreign currency?

We can help with that too. With travel money bureaux all over the UK, it’s easy to find one near you . You can also order online for home delivery. There’s 0% commission, plus, if you’re a Nectar member, you’ll get better rates. ±

Travel tools and guides

Going on holiday.

Read our holiday checklist to help you create the perfect travel plan

Keeping your valuables safe abroad

Helpful tips on how to protect your valuables while you’re on holiday

Currency converter

Use our calculator to find out how much foreign currency you could get

Frequently Asked Questions

How does a sainsbury's bank travel money card work.

Sainsbury’s Bank Travel Money Card is a chip and PIN protected prepaid Mastercard® currency card.

You can load multiple currencies onto it before you travel and then use it in millions of ATMs around the world displaying the Mastercard Acceptance Mark, to access your money quickly and safely. You can also pay for goods and services online and in-store.

Where can I use a Sainsbury's Bank Travel Money Card?

Your Sainsbury’s Bank Travel Money Card can be used to withdraw money from ATMs worldwide~ displaying the Mastercard® Acceptance Mark. All you need to do is to find your nearest ATM.

Alternatively, you can use the card to pay online and in stores around the world~.

You can use your Sainsbury’s Bank Travel Money Card in countries or areas with a different currency to those on your Card. The system will automatically convert your stored currency (-ies) to the local one. Please note that for any transactions in a currency different from the Currencies loaded on your Card, the funds available on the Card will be used in the following order of priority: GBP, EUR, USD, AUD, CAD, NZD, ZAR, TRY, CHF, AED, MXN, PLN, CZK, SEK and JPY at an exchange rate determined by Mastercard on the day the transaction is processed, increased by a percentage determined by us (see the Fees and Limits section for more details).

How do I download the Sainsbury’s Bank Travel Money Card app?

Search Sainsbury’s Bank Travel Money Card app in the Apple App Store or on Google Play.

How do I top up my Sainsbury's Bank Travel Money Card?

Even with a zero balance, your card is still valid (up to the expiry date printed on the front of the card), and you can reload it any time before your next trip##.

For information on how to reload your Sainsbury’s Bank Travel Money Card, please see the 'top up' section.

## Until card expiry and subject to reload limits (see Fees and Limits section).

What if an ATM asks for a six-digit PIN?

In some countries, you may be asked for a six-digit PIN when using an ATM.

Sainsbury’s Travel Money Card uses a standard four-digit PIN, which will still be accepted as normal if the ATM has been set up correctly in compliance with Mastercard regulations.

If you need assistance with any PIN issues, please call Card Services.

Can I get cash back with my Sainsbury's Bank Travel Money Card?

No, cash back is not available on a Sainsbury’s Bank Travel Money Card.

Terms and conditions

Sainsbury’s Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

* Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy in store or online. You need to tell us your Nectar card number at the time of your transaction. We reserve the right to change or cancel this offer without notice.

Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Our website doesn't support your browser so please upgrade .

Global Money

Access the world with one account

Spend, send and manage your currencies in one place using the HSBC UK Mobile Banking app.

Join the many customers who are benefitting from HSBC UK's best exchange rates, and access to more than 200 countries and regions worldwide.

Spend money at home or abroad using your Global Money debit card, or simply add it to your digital wallet for spending free from HSBC fees. Non-HSBC fees may apply.

Your currency balances are protected up to £85,000 by the Financial Services Compensation Scheme.

Available exclusively via the latest version of the HSBC Mobile Banking app.

Here's what you get with a Global Money Account

Send money internationally without any HSBC or intermediary fees

- Send money abroad via the HSBC UK Mobile Banking app with a Global Money Account with no HSBC or intermediary bank fees

- Send money free from HSBC fees in more than 50 currencies to 200 countries and regions with Global Money transfers. You can also hold up to 18 currencies securely to use at any time

- Live exchange rates during market hours so you know exactly how much you're sending

- Send up to GBP50,000 per day (or currency equivalent)

- See the estimated arrival time on screen when you send a payment

More than just a travel money card

- Order your Global Money multi-currency debit card when you apply at no extra cost and add it immediately to your digital wallet. It can be used at home, abroad and online

- With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines

- Use your card abroad and spend like a local. We'll debit the payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance

HSBC UK's best exchange rates

- Benefit straight away from our competitive live exchange rates

- You can view these rates in the HSBC UK Mobile Banking app before you convert

- You can add or convert currency at any time, storing it until you need it. Convert on the go or when the rate is right for you

- When you're using your card abroad and have the funds in the currency balance you are spending in, there won't be a conversion

- If there aren't enough funds in the right currency balance, but you have funds in GBP and spend in one of the currencies you can hold with us, the conversion will be done using the HSBC Global Money Exchange Rate. Any other currencies will be converted using the VISA exchange rate

Before you apply

Who can apply.

You can apply for an HSBC Global Money Account if you have:

- an active HSBC UK current account (excluding Basic Bank Account, Amanah, Appointee and MyAccount)

- a valid email address that's on our records

- the HSBC UK Mobile Banking app (Global Money is only available via the app)

Find out how to add or update your email address .

You must also read the important documents.

Important documents

- HSBC Global Money Account Terms and Conditions (PDF, 582 KB) HSBC Global Money Account Terms and Conditions (PDF, 582 KB) Download

- HSBC Global Money Account fee information document (PDF, 181 KB) HSBC Global Money Account fee information document (PDF, 181 KB) Download

- UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) Download

- Privacy notice (PDF, 498 KB) Privacy notice (PDF, 498 KB) Download

Apply for a Global Money Account

Already an hsbc customer.

On your mobile and have our app?

New to HSBC?

If you're not yet an HSBC customer with an eligible current account, find out more about our current accounts and how to apply.

Not on your mobile?

Scan the code to get started.

Frequently asked questions

What is an hsbc global money account .

It's a digital account you can use to hold money in different currencies. It's also an easy-to-use instant payment service that lets you manage, send and spend money in different currencies securely. It's free from HSBC fees. Non-HSBC fees may apply. If a payment is sent to your Global Money Account in a non-GBP currency it will be received, but will be converted into GBP. In the future you’ll be able to receive foreign currency into your account without it being converted to GBP.

What currencies can I hold and use with an HSBC Global Money Account?

You can send and spend payments more than 50 currencies to 200 countries and regions. If you don't hold a balance in the currency you are spending in, simply ensure funds are available in your GBP wallet.

You can hold balances in these currencies:

- GBP - pound sterling

- USD - US dollar

- AUD - Australian dollar

- ZAR - South African rand

- PLN - Polish zloty

- CAD - Canadian dollar

- NZD - New Zealand dollar

- CHF - Swiss franc

- SEK - Swedish krona

- HKD - Hong Kong dollar

- AED - UAE dirham

- CZK - Czech koruna

- NOK - Norwegian krone

- DKK - Danish krone

- SGD - Singapore dollar

- JPY - Japanese yen

- CNY* - Chinese yuan renminbi

*Whilst you can hold a CNY balance, there are are regulatory restrictions that prevent you being able to send or spend inside or outside China. Chinese regulations only allow for payments in GBP, USD or EUR, so you will need to ensure you have funds available in these currencies.

How do I use my Global Money card?

Simply add GBP or any supported currency to your HSBC Global Money Account. Use your debit card as you would at home. We'll debit payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and not your USD balance.

Please bear in mind spending limits may apply.

Is a Global Money debit card the same as a travel money card?

Global Money is more than just a travel card. You can convert currency as and when you need to, even on the go. You can use your Global Money debit card like a local, at home or abroad with no HSBC fees including at cash machines. Non-HSBC fees may apply. We'll debit payments from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and NOT your USD balance.

Are my balances in Global Money protected?

Yes, they're covered up to £85,000 by the Financial Services Compensation Scheme. You can find the UK FSCS Information Sheet and Exclusions List under Important documents on this page where you can, view, print and download the document.

What exchange rate will I get when I use my Global Money Account?

The HSBC Global Money Exchange Rate is made up of the cost to HSBC and a foreign currency conversion margin that we include.

Sending money - international payments

The HSBC Global Money Exchange Rate is a live rate updated by the second during market hours. This means we can always offer our most up-to-date rate. This provides you with visibility and certainty of how much you're sending. The exchange rate will be displayed in the mobile app before you confirm your payment and will be valid for 40 seconds before refreshing. This rate is quoted to you before you complete any foreign currency transaction using Global Money.

Spending - card transactions

If you have enough funds in the currency of the transaction, no exchange rate will apply. If you don't have any or enough funds in the currency of the transaction, but have funds available in GBP, we will auto convert the funds to cover the transaction using HSBC Global Money Exchange Rate.

Is the Global Money debit card a prepaid debit card?

No, but you can convert currency before you go, and hold it in your currency balance ready to use at any time. This can help you control your budget by choosing how much you want to spend. Alternatively, you could choose to convert currency as and when you need it.

Are there any fees for using a Global Money Account?

You can send money internationally without any HSBC or Intermediary fees. However, other banks may charge to receive a payment.

With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines.

You might also be interested in

Using your card abroad vs travel money , using your card outside the uk , starting a new journey , customer support.

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

- Tips for travel

- Managing your money abroad

Travel wallet

Buy foreign currency in the Barclays app and use your debit card as a travel money card

Our travel wallet lets you buy foreign currency to spend on your debit card, so you don’t have to carry travel money around. It’s a great way to travel light and gives you security, convenience and control while you recharge your batteries.

With a travel wallet you can:

Buy US dollars and euros and spend them with your debit card 1

Track your spending and get balance alerts

Convert any unused currency back into pounds

What is a travel wallet?

It’s a simple way to get your travel money. Instead of queueing at a currency exchange, you can buy foreign currency in your Barclays app, then use your debit card as a travel money card when you’re abroad. It’s more secure than carrying foreign currency around, and there are no transaction fees.

Why create a travel wallet?

All in your app.

• Create a travel wallet instantly in your Barclays app • Load it up in a few taps: before you travel, at the airport or on the beach • Convert and transfer unused travel money back into your account in a click

Use your normal debit card

• Lose the stress of carrying around lots of travel money in cash • No need to get a separate travel money card • Avoid fees on purchases in euros and US dollars 2

Control your spending

• Buy foreign currency at a fixed exchange rate • Check your balance in the app and get alerts when it’s running low • Keep track of when and where you’re spending your travel money

How to create a travel wallet in your Barclays app

• Download, register and open the Barclays app 3 • Tap ‘Your cards’ on the home screen in your app to get started • Select ‘Create a travel wallet’ 4

Enjoy spending abroad with your travel wallet

Things to consider.

Using your debit card abroad

A secure and convenient way to pay when you’re away

If you’re currently abroad and need to use your debit card, here’s what it’ll cost you to withdraw cash and make purchases.

Foreign currency

Bureau de change

If you need foreign currency, you can order it online and we’ll deliver it for free to your home address in the UK, or you can collect it from one of our branches.

Getting cash in an emergency

We’re here to help if you need cash in an emergency while you’re on holiday, including if your debit card has been lost or stolen.

- Important information

Fees conditions apply. Some UK-based cash machines dispense foreign currency but will charge in pounds sterling and this will be taken from your current account. Return to reference

No transaction fees apply when paying with euros and US dollars from your travel wallet. If you pay in British pounds on your debit card whilst abroad, a transaction fee will still apply. Return to reference

You need to be 16 or over to access this product or service using the app. T&Cs apply . Return to reference

T&Cs apply when you create and use a travel wallet in your Barclays app. Return to reference

Our products

- Current accounts

- Credit cards

- Help & FAQs

- Money worries

- Report fraud or a scam

- Report card lost or stolen

Site information

- Accessibility

- Privacy policy

- Cookies policy

- Find Barclays

- Service status

Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority.

Registered office for all: 1 Churchill Place, London E14 5HP

Travel money card

Spend like a local and explore the globe with a travel debit card. Whether it's a virtual or a physical card, we've got all your travel money needs covered.

Need an international travel card? Take us all around the world

Exchange currencies, send money abroad, and keep 36 local currencies in-app. These are just some of the reasons why our customers love their travel debit cards.

Built-in security features

Set spending limits, get payment notifications, and freeze or unfreeze your card in-app.

Add it to Google Pay or Apple Pay

No need to wait for your physical card to arrive — spend instantly with a virtual card.

Withdraw without ATM fees

Get fee-free ATM withdrawals, up to £2,000 per rolling month, depending on your plan type.¹

Manage travel money in-app

Manage everything for your holiday money card in the Revolut app, from top-ups to transfers.

¹No ATM withdrawal fees within plan limits on a rolling monthly basis. Third-party providers may charge a withdrawal fee. Currency and ATM fair-usage fees apply. Currency exchange fees may apply. Weekend markups on currency exchange will apply. Plan fees and T&Cs apply.

Spend like a local in 150+ currencies

No ATM fees up to £2,000 per month²

²No ATM withdrawals fees within plan limits on a rolling monthly basis. Third-party providers may charge a withdrawal fee and ATM fair-usage fees. Weekend markups will apply.

Spend right away with Apple Pay or Google Pay

How to get your travel money card in the UK

Get your currency debit card in 3 steps

Get revolut.

Join 40+ million people worldwide saving when they spend abroad with Revolut.

Order your card

Order your free travel money card to spend in 150+ currencies. Delivery fees may apply.

Spend like a local

Start spending around the world. That's your travel money, sorted.

Get instant payment notifications

Spend with confidence

Built-in security measures

How to save money with travel currency cards

Tips for saving with a money travel card

Don't exchange at airports or at home.

Don’t exchange cash before you travel. Use your travel money card to spend or withdraw money from an ATM (just watch out for ATM fees).

Always choose the local currency

Choose the local currency when spending with your card in shops and restaurants.

Save on travel spending with a Revolut card

Spend in the local currency at competitive rates on your next trip from the UK.

For life, not just for holidays

This is not a prepaid card you just throw away after your trip. Trust us, you’ll want to use Revolut for future adventures and everyday spending.

Rating as of 20 May 2024

713K Reviews

2.8M Reviews

Spend your holiday money in 150+ currencies

Need a little more help?

Holiday money card FAQs

What is a travel money card, what currencies can i spend in when i use a travel money card, what are the limits for spending with a travel card, how can i manage my travel money card, is a travel money card safe and secure, how can i order a travel money card.

- Download the Revolut app : find it in the Apple or Google Play Store.

- Sign up for Revolut : apply for an account and verify your identity.

- Add a debit card : go to Cards and follow the instructions to start your order.

- Set your PIN : choose a PIN that you'll remember.

- Arrange delivery : enter your delivery address and select your delivery method before proceeding to checkout (delivery fees may apply).

Don’t worry, there's no need to wait for your physical card to arrive — you can also use virtual travel cards with Revolut. Just connect your card to Google Pay or Apple Pay, and use it immediately.

Is a travel money card better than travel money?

- Don’t exchange cash at the airport. It’s much cheaper to withdraw money from an ATM with your travel money card.

- Don't carry more cash than you need. When you return home from your trip, you’ll need to re-convert this cash back to GBP, which can take time and cost you in fees.

- Always choose the local currency when spending with your card in shops and restaurants.

- Sign up for Revolut so you can manage your balance and get instant notifications on what you spend.

What is the best bank to use when travelling abroad?

- exchanging currencies before you go or while you're there

- withdrawing money from ATMs

- using your card in shops, restaurants, and more

Traditional banks aren't your only option. Financial apps often have similar features to traditional banks without the hassle.

With Revolut, you can do everything in-app and save on your transactions and withdrawals abroad. You get ultimate flexibility and control over your money.

What's the difference between using prepaid travel cards and travel debit cards for spending abroad?

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

Travel money sale now on!

Click & Collect sale on euro, US dollar and Turkish lira available until 4 June.

Click & Collect available on selected currencies from selected stores. £150 minimum order, cancellation fee and full T&Cs apply. Exchange rates will still fluctuate daily during the sale period, but you'll receive the best rate applicable on the date the order is placed. Rates shown when placing your order are sale rates. Sale T&Cs apply.

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store